OCTQX: TGEN THIRD QUARTER 2020 Earnings Call November 12, 2020

Participants Benjamin Locke Chief Executive Officer President & Chief Operating Robert Panora Officer Jack Whiting General Counsel & Secretary 2

Safe Harbor Statement This presentation and accompanying documents contain “forward-looking statements” which may describe strategies, goals, outlooks or other non- historical matters, or projected revenues, income, returns or other financial measures, that may include words such as "believe," "expect," "anticipate," "intend," "plan," "estimate," "project," "target," "potential," "will," "should," "could," "likely," or "may" and similar expressions intended to identify forward-looking statements. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause our actual results to differ materially from those expressed or implied by such forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Forward-looking statements speak only as of the date on which they are made, and we undertake no obligation to update or revise any forward-looking statements. In addition to those factors described in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q under “Risk Factors”, among the factors that could cause actual results to differ materially from past and projected future results are the following: fluctuations in demand for our products and services, competing technological developments, issues relating to research and development, the availability of incentives, rebates, and tax benefits relating to our products and services, changes in the regulatory environment relating to our products and services, integration of acquired business operations, and the ability to obtain financing on favorable terms to fund existing operations and anticipated growth. In addition to GAAP financial measures, this presentation includes certain non-GAAP financial measures, including adjusted EBITDA which excludes certain expenses as described in the presentation. We use Adjusted EBITDA as an internal measure of business operating performance and believe that the presentation of non-GAAP financial measures provides a meaningful perspective of the underlying operating performance of our current business and enables investors to better understand and evaluate our historical and prospective operating performance by eliminating items that vary from period to period without correlation to our core operating performance and highlights trends in our business that may not otherwise be apparent when relying solely on GAAP financial measures. 3

Earnings Call Agenda Agenda: Tecogen Overview 3Q 2020 Results 3Q 2020 Performance by Segment 3Q 2020 Earnings Takeaways Ultera Emissions Update Q&A 4

Tecogen Overview Clean and Efficient Energy Systems Leader in Distributed Generation Technology • Unmatched efficiency of air-conditioning and cooling systems • Ultera technology ensures emissions compliance in most stringent US districts • Enable black-start and off-grid power generation • Ranked 3rd in quantity of microgrids deployed in US Positioned For Low Carbon Future • High efficiency enables significant carbon reductions compared to heating and cooling systems dependent on grid Proprietary Ultera Emissions Technology • Demonstrated success across range of engine brands and sizes • Considering options to expand commercialization 5

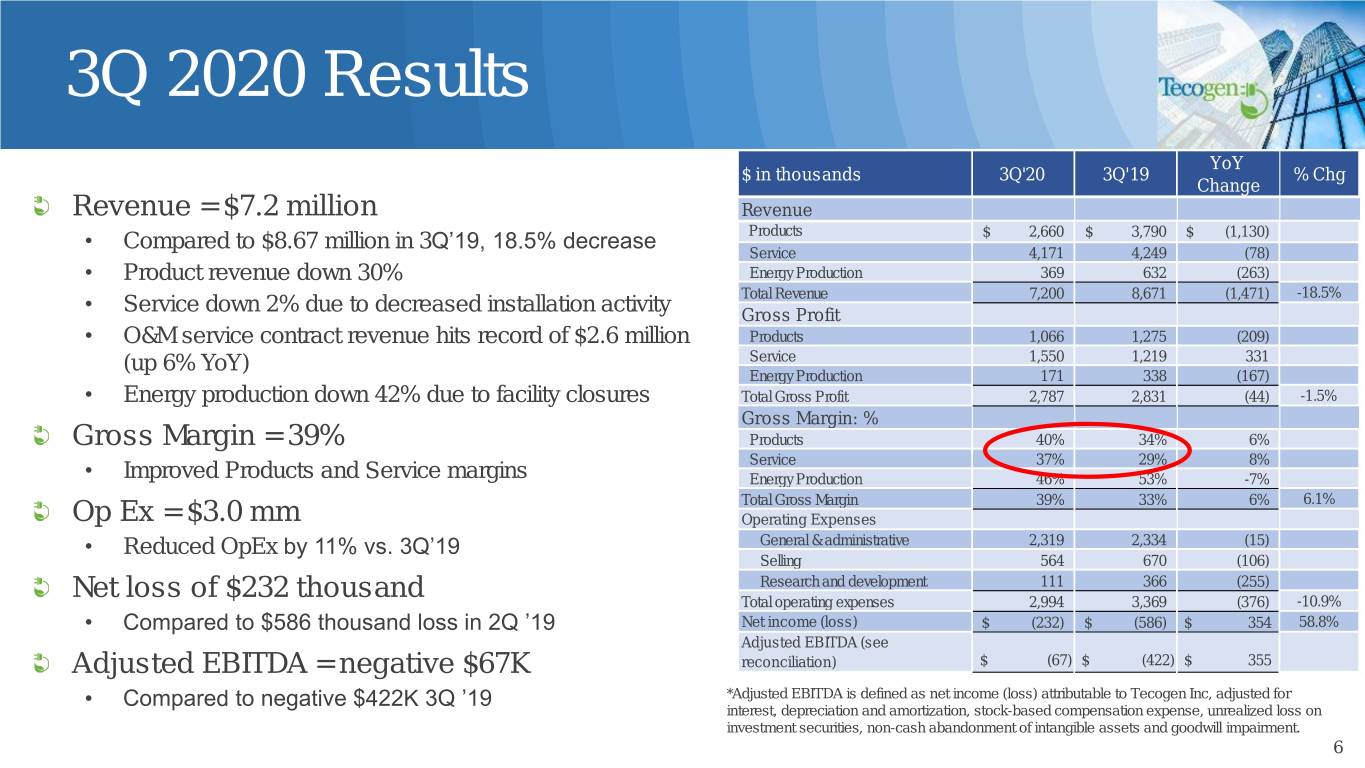

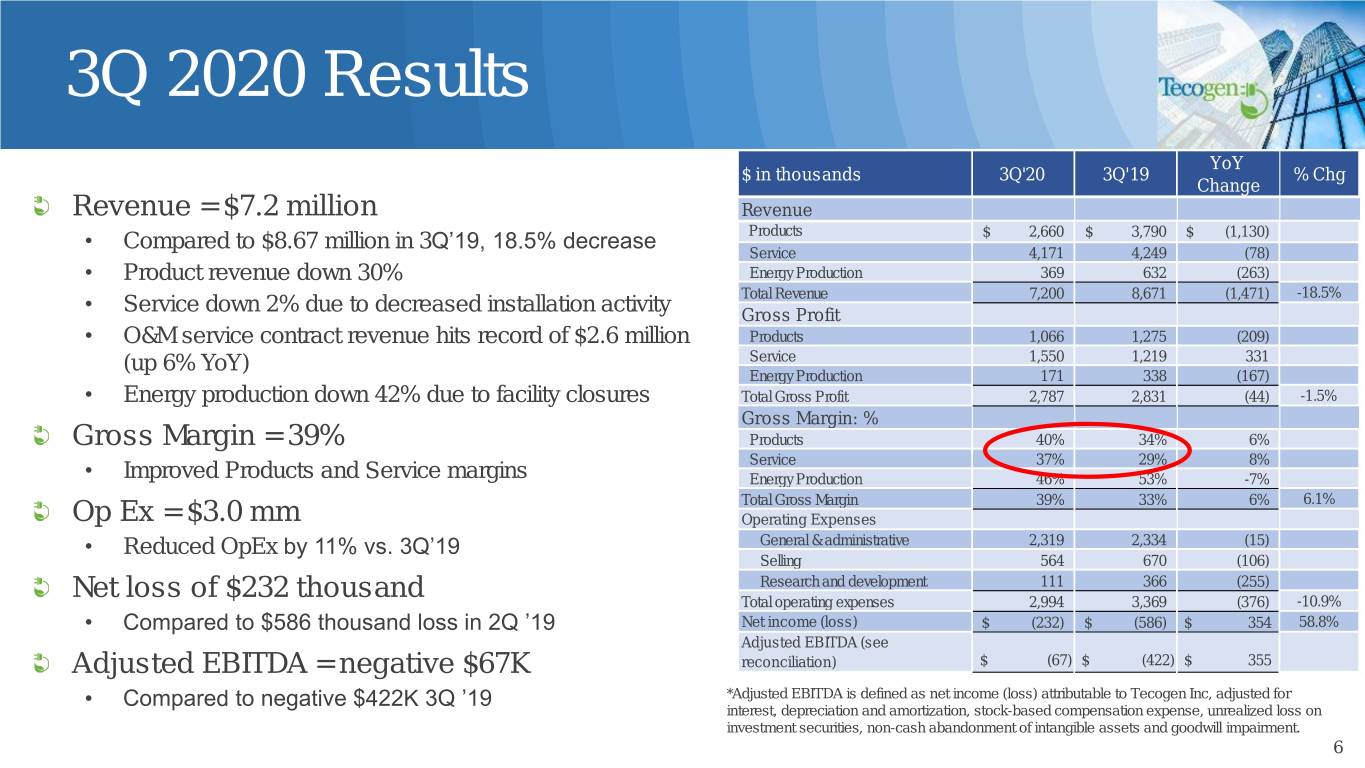

3Q 2020 Results YoY $ in thousands 3Q'20 3Q'19 % Chg Change Revenue = $7.2 million Revenue • Compared to $8.67 million in 3Q’19, 18.5% decrease Products $ 2,660 $ 3,790 $ (1,130) Service 4,171 4,249 (78) • Product revenue down 30% Energy Production 369 632 (263) Total Revenue 7,200 8,671 (1,471) -18.5% • Service down 2% due to decreased installation activity Gross Profit • O&M service contract revenue hits record of $2.6 million Products 1,066 1,275 (209) (up 6% YoY) Service 1,550 1,219 331 Energy Production 171 338 (167) • Energy production down 42% due to facility closures Total Gross Profit 2,787 2,831 (44) -1.5% Gross Margin: % Gross Margin = 39% Products 40% 34% 6% Service 37% 29% 8% • Improved Products and Service margins Energy Production 46% 53% -7% Total Gross Margin 39% 33% 6% 6.1% Op Ex = $3.0 mm Operating Expenses • Reduced OpEx by 11% vs. 3Q’19 General & administrative 2,319 2,334 (15) Selling 564 670 (106) Research and development 111 366 (255) Net loss of $232 thousand Total operating expenses 2,994 3,369 (376) -10.9% • Compared to $586 thousand loss in 2Q ’19 Net income (loss) $ (232) $ (586) $ 354 58.8% Adjusted EBITDA (see Adjusted EBITDA = negative $67K reconciliation) $ (67) $ (422) $ 355 • Compared to negative $422K 3Q ’19 *Adjusted EBITDA is defined as net income (loss) attributable to Tecogen Inc, adjusted for interest, depreciation and amortization, stock-based compensation expense, unrealized loss on investment securities, non-cash abandonment of intangible assets and goodwill impairment. 6

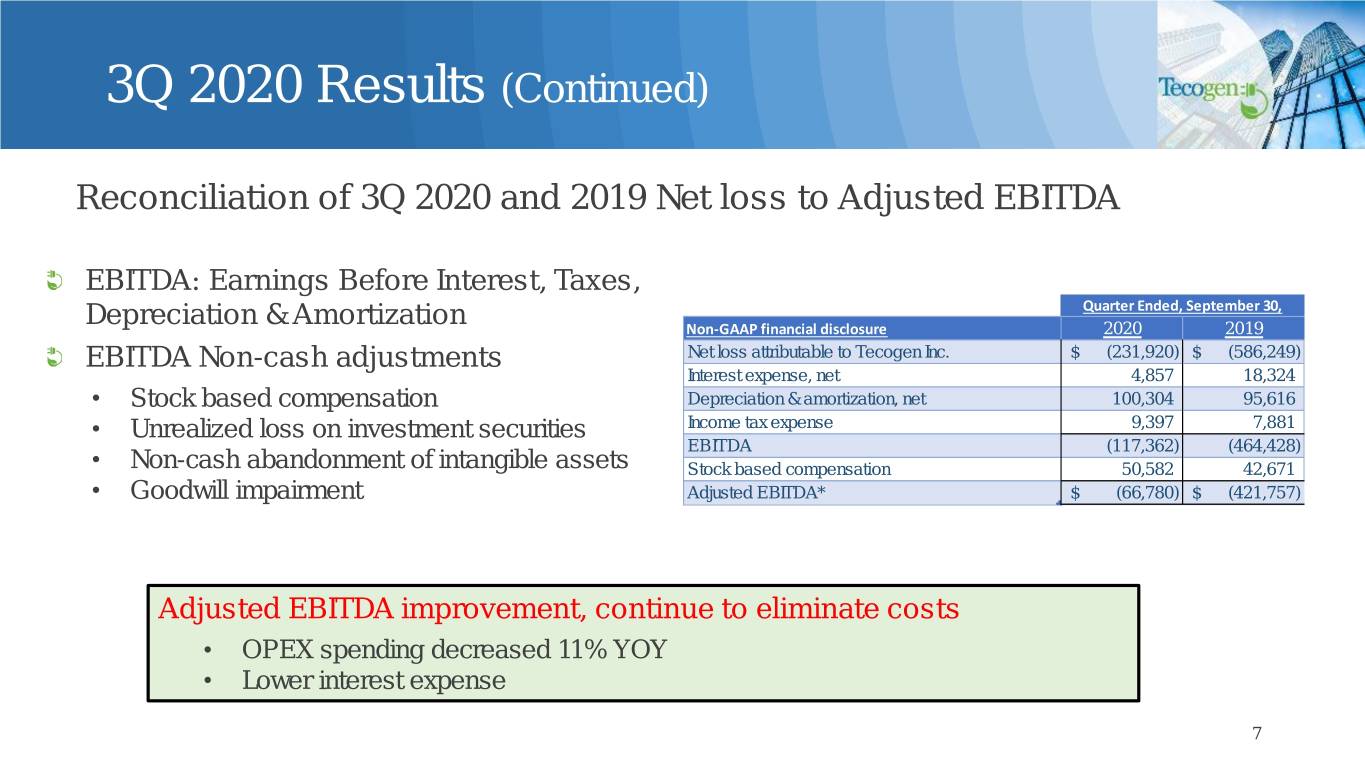

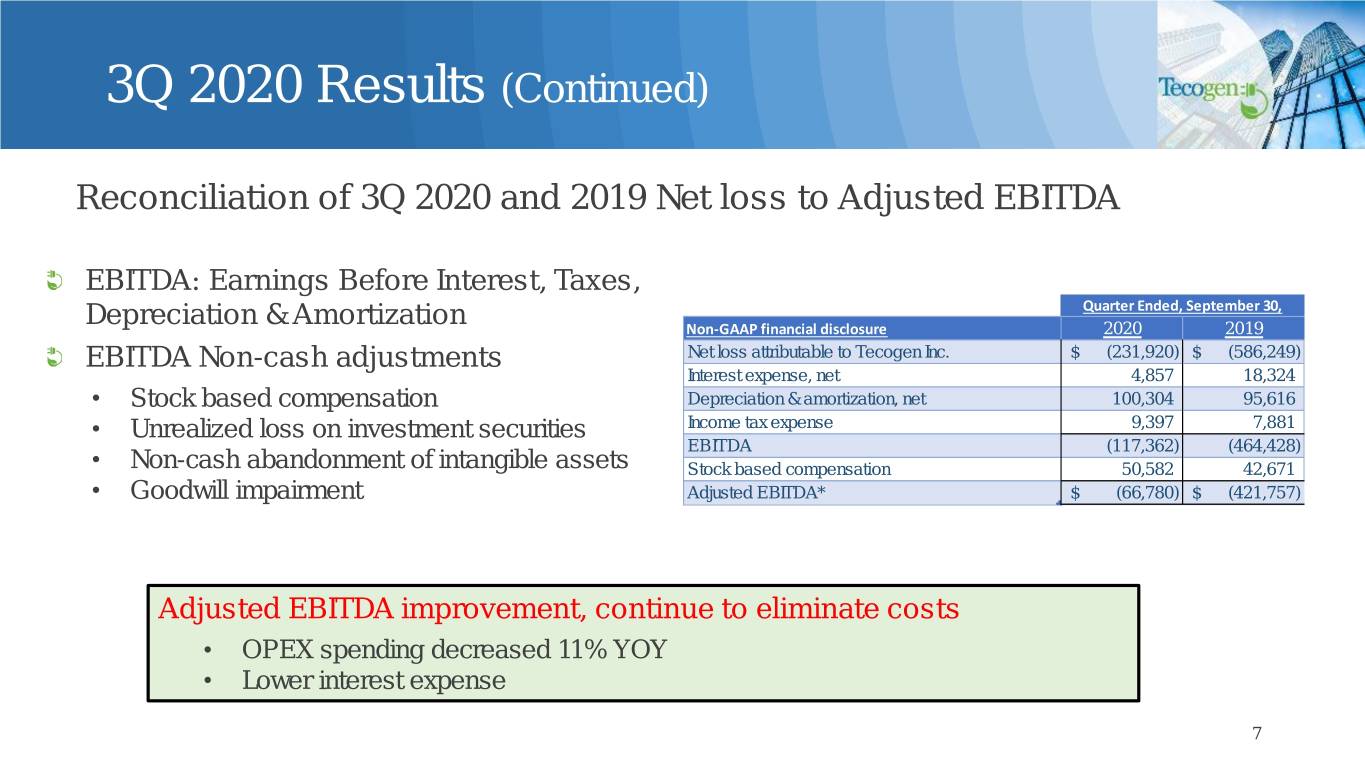

3Q 2020 Results (Continued) Reconciliation of 3Q 2020 and 2019 Net loss to Adjusted EBITDA EBITDA: Earnings Before Interest, Taxes, Depreciation & Amortization Quarter Ended, September 30, Non-GAAP financial disclosure 2020 2019 EBITDA Non-cash adjustments Net loss attributable to Tecogen Inc. $ (231,920) $ (586,249) Interest expense, net 4,857 18,324 • Stock based compensation Depreciation & amortization, net 100,304 95,616 • Unrealized loss on investment securities Income tax expense 9,397 7,881 EBITDA (117,362) (464,428) • Non-cash abandonment of intangible assets Stock based compensation 50,582 42,671 • Goodwill impairment Adjusted EBITDA* $ (66,780) $ (421,757) Adjusted EBITDA improvement, continue to eliminate costs • OPEX spending decreased 11% YOY • Lower interest expense 7

3Q ’20 Performance by Segment Product Sales Slowed by Service Contracts/Parts Energy Production Project Delays Recovered in 3Q Revenue Slowed by COVID YoY % of Q3 Revenue ($k) 2020 2019 Growth Total Rev Revenue Cogeneration $ 1,890 $ 1,656 14% 26% Chiller 770 2,135 -64% 11% Total Product Revenue 2,660 3,790 -30% 37% Service Contracts and Parts 2,612 2,454 6% 36% Installation Services 1,559 1,795 -13% 22% Total Service Revenue 4,171 4,249 -2% 58% Energy Production 369 632 -42% 5% Total Revenue $ 7,200 $ 8,671 -17% 100% Q3 Gross Margin 2020 2019 Target Overall 39% 33% 35-40% 8

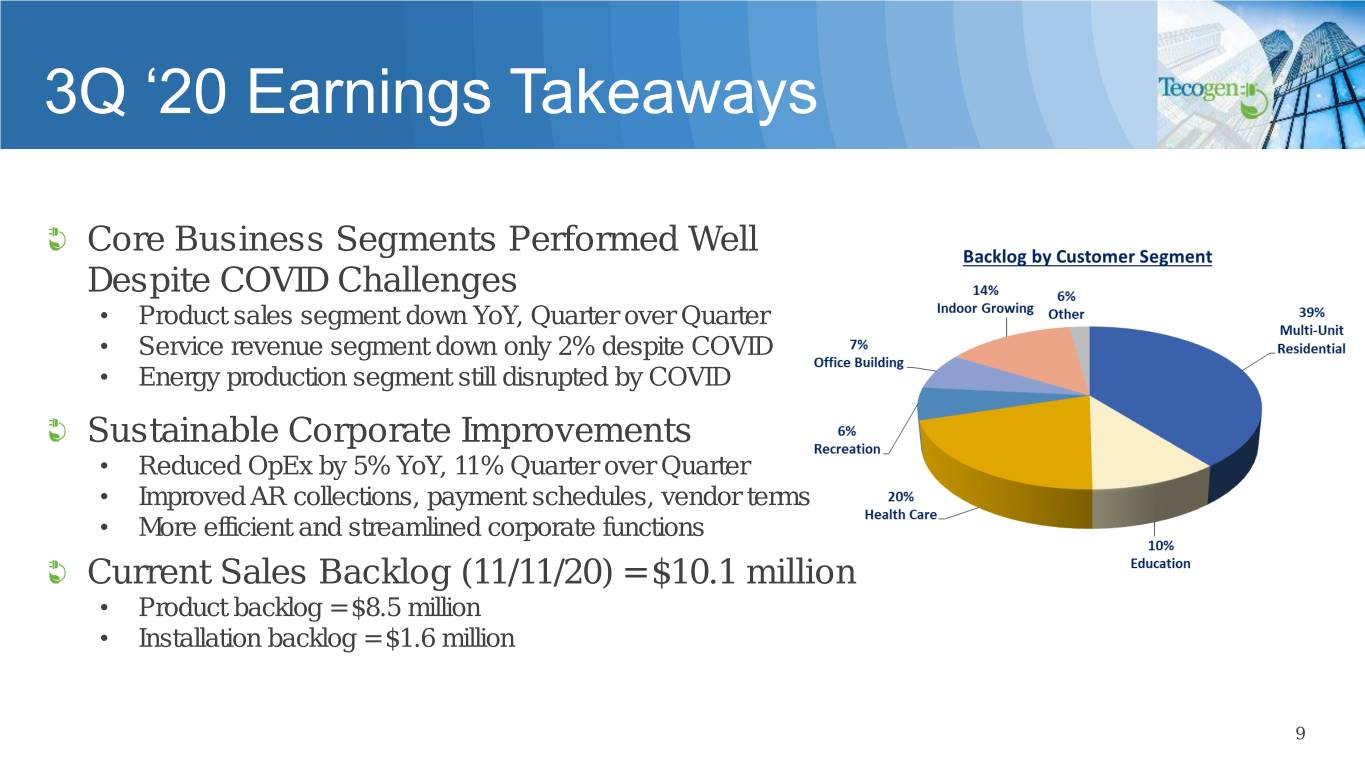

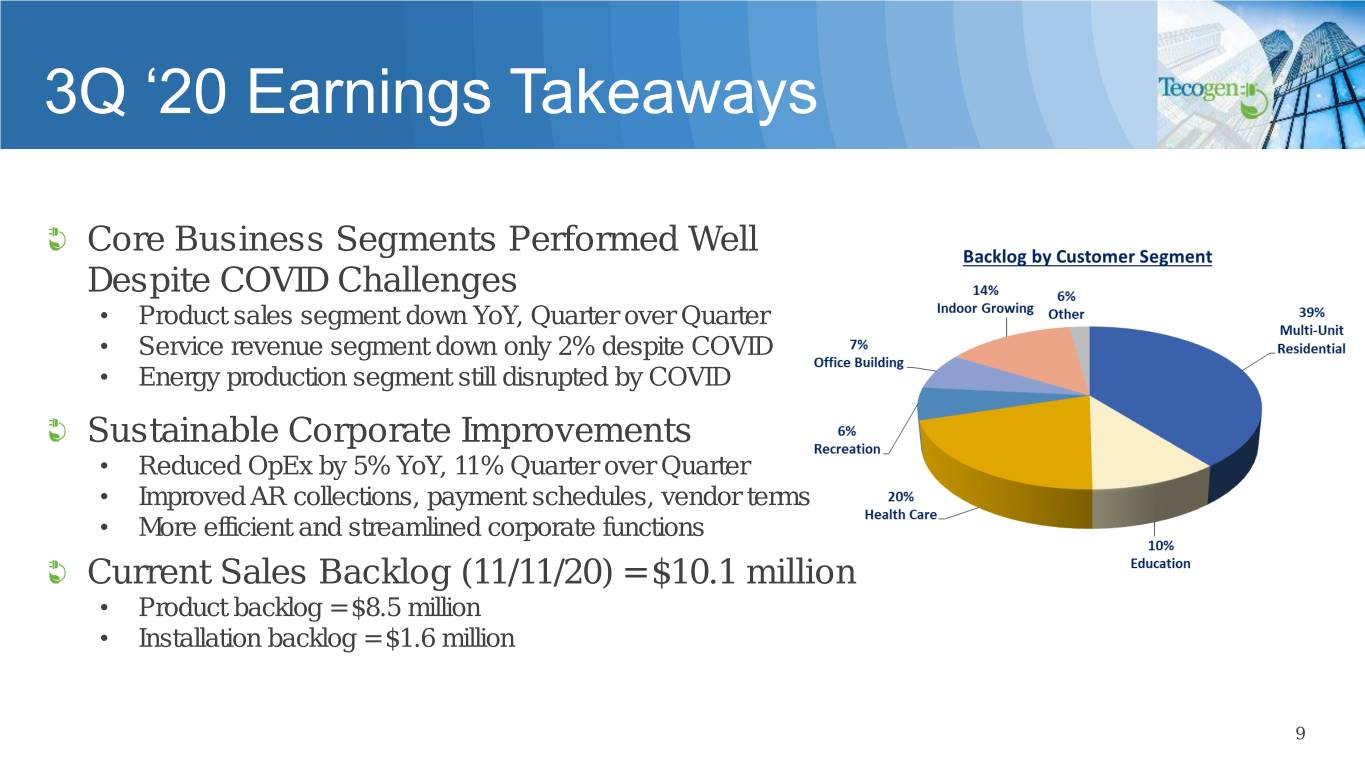

3Q ‘20 Earnings Takeaways Core Business Segments Performed Well Despite COVID Challenges • Product sales segment down YoY, Quarter over Quarter • Service revenue segment down only 2% despite COVID • Energy production segment still disrupted by COVID Sustainable Corporate Improvements • Reduced OpEx by 5% YoY, 11% Quarter over Quarter • Improved AR collections, payment schedules, vendor terms • More efficient and streamlined corporate functions Current Sales Backlog (11/11/20) = $10.1 million • Product backlog = $8.5 million • Installation backlog = $1.6 million 9

Ultera Emissions Update Completed Licensing Agreement With Origin Engines Co. OEM engine supplier to multiple natural gas and propane markets Including forklifts, generators, and water pumps Significantly expands Ultera commercial potential California water district large engine Ultera kit order In process, components being fabricated Catalyst Development Highly promising formulation identified Pursuing further development with research partner MCFA program On hold pending lifting of COVID travel restrictions 10

Q&A Company Information Tecogen, Inc 45 First Ave Waltham, MA 02451 www.Tecogen.com Contact information Benjamin Locke, CEO 781.466.6402 Benjamin.Locke@Tecogen.com 11