OTCQX: TGEN THIRD QUARTER 2021 EARNINGS CALL NOV 11, 2021 1

MANAGEMENT Benjamin Locke - CEO Robert Panora – COO and President Abinand Rangesh – CFO Jack Whiting – General Counsel & Secretary 2

SAFE HARBOR STATEMENT This presentation and accompanying documents contain “forward-looking statements” which may describe strategies, goals, outlooks or other non- historical matters, or projected revenues, income, returns or other financial measures, that may include words such as "believe," "expect," "anticipate," "intend," "plan," "estimate," "project," "target," "potential," "will," "should," "could," "likely," or "may" and similar expressions intended to identify forward-looking statements. These statements are only predictions and involve known and unknown risks, uncertainties, and other factors that may cause our actual results to differ materially from those expressed or implied by such forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Forward-looking statements speak only as of the date on which they are made, and we undertake no obligation to update or revise any forward-looking statements. In addition to those factors described in our Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q under “Risk Factors”, among the factors that could cause actual results to differ materially from past and projected future results are the following: fluctuations in demand for our products and services, competing technological developments, issues relating to research and development, the availability of incentives, rebates, and tax benefits relating to our products and services, changes in the regulatory environment relating to our products and services, integration of acquired business operations, and the ability to obtain financing on favorable terms to fund existing operations and anticipated growth. In addition to GAAP financial measures, this presentation includes certain non-GAAP financial measures, including adjusted EBITDA which excludes certain expenses as described in the presentation. We use Adjusted EBITDA as an internal measure of business operating performance and believe that the presentation of non-GAAP financial measures provides a meaningful perspective of the underlying operating performance of our current business and enables investors to better understand and evaluate our historical and prospective operating performance by eliminating items that vary from period to period without correlation to our core operating performance and highlights trends in our business that may not otherwise be apparent when relying solely on GAAP financial measures. 3

AGENDA Tecogen Overview 3Q 2021 Results Earnings Takeaways Q&A 4

Providing resiliency and energy savings with a cleaner environmental footprint 3,000+ Units Shipped 5

DISTRIBUTED GENERATION CLEAN COOLING Chillers with lower operating cost and lower greenhouse gas footprint compared to an equivalent electric chiller EMISSIONS 3rd in number of microgrids installed in North America Near zero NOx and CO emissions systems for gasoline, propane and natural gas engines 6

PRODUCT RUN HOURS DISTRIBUTED GENERATION AND CHILLERS SHIPPED 52M+3,000+ KWH GENERATED 2.1M+ METRIC TONS OF CO2 SAVED 200,000+ FACTS ABOUT US 7

REVENUE SEGMENTS We service most purchased Tecogen equipment in operation through long term maintenance agreements through 11 service centers in North America and perform certain equipment installation work. SERVICES CLEAN, GREEN POWER, COOLING AND HEAT Sales of combined heat and power, and clean cooling systems to building owners. Key market segments include multifamily residential, health care and indoor cultivation. PRODUCT SALES We sell electrical energy and thermal energy produced by our equipment onsite at customer facilities. ENERGY SALES 8

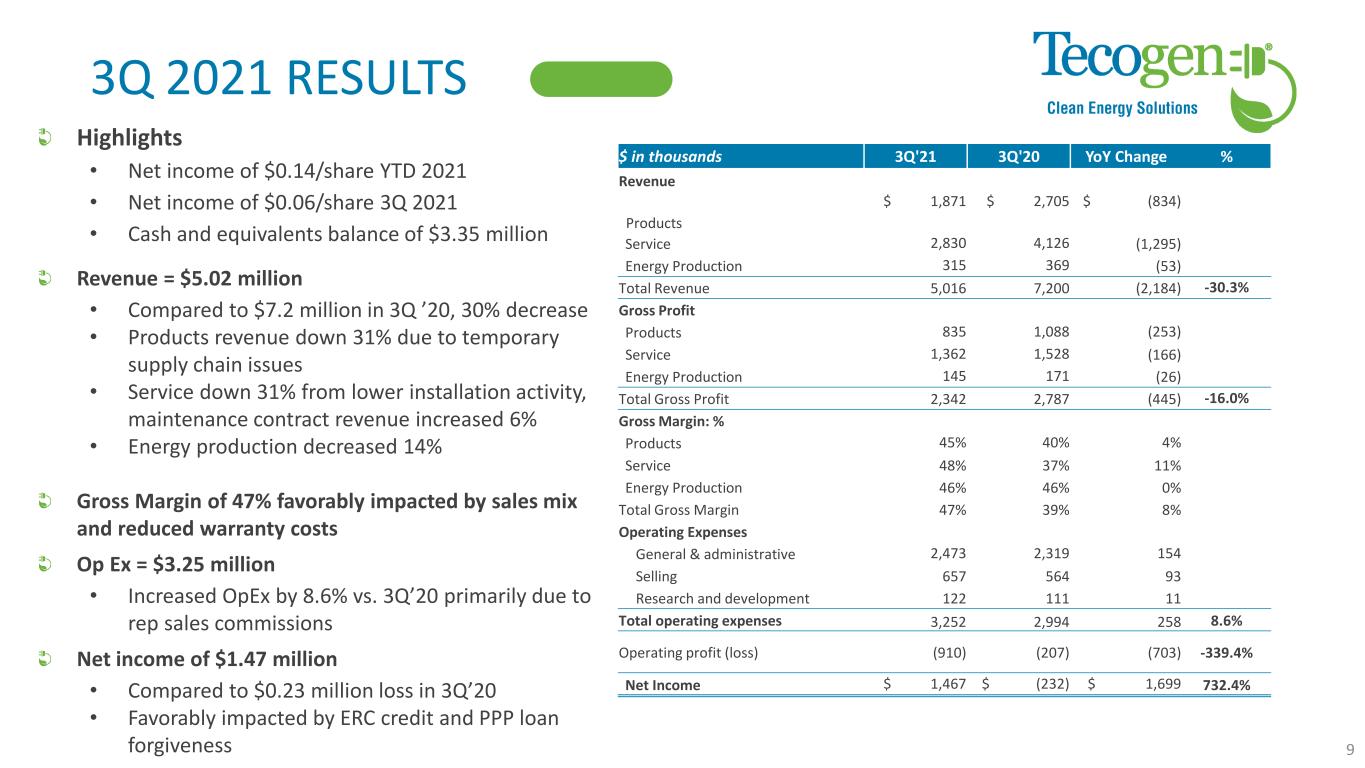

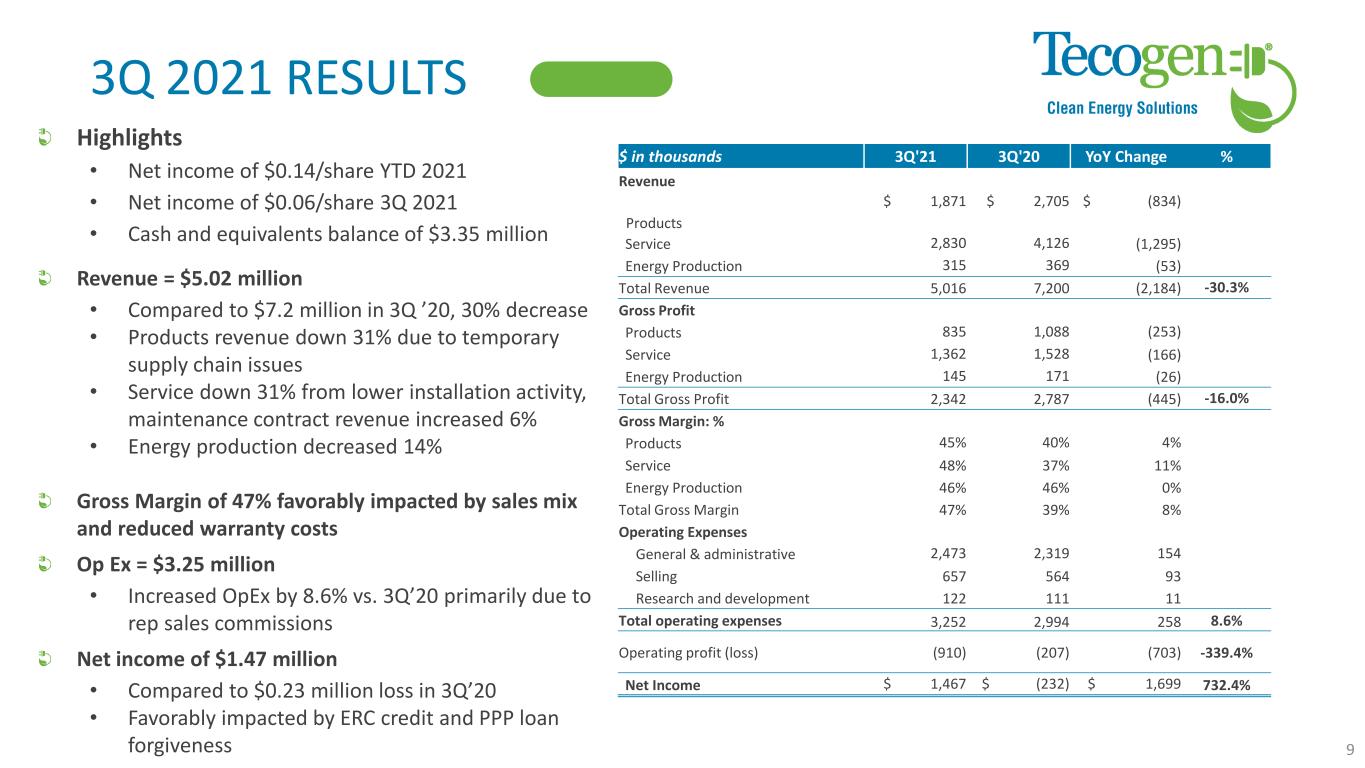

3Q 2021 RESULTS Highlights • Net income of $0.14/share YTD 2021 • Net income of $0.06/share 3Q 2021 • Cash and equivalents balance of $3.35 million Revenue = $5.02 million • Compared to $7.2 million in 3Q ’20, 30% decrease • Products revenue down 31% due to temporary supply chain issues • Service down 31% from lower installation activity, maintenance contract revenue increased 6% • Energy production decreased 14% Gross Margin of 47% favorably impacted by sales mix and reduced warranty costs Op Ex = $3.25 million • Increased OpEx by 8.6% vs. 3Q’20 primarily due to rep sales commissions Net income of $1.47 million • Compared to $0.23 million loss in 3Q’20 • Favorably impacted by ERC credit and PPP loan forgiveness 9 $ in thousands 3Q'21 3Q'20 YoY Change % Revenue Products $ 1,871 $ 2,705 $ (834) Service 2,830 4,126 (1,295) Energy Production 315 369 (53) Total Revenue 5,016 7,200 (2,184) -30.3% Gross Profit Products 835 1,088 (253) Service 1,362 1,528 (166) Energy Production 145 171 (26) Total Gross Profit 2,342 2,787 (445) -16.0% Gross Margin: % Products 45% 40% 4% Service 48% 37% 11% Energy Production 46% 46% 0% Total Gross Margin 47% 39% 8% Operating Expenses General & administrative 2,473 2,319 154 Selling 657 564 93 Research and development 122 111 11 Total operating expenses 3,252 2,994 258 8.6% Operating profit (loss) (910) (207) (703) -339.4% Net Income $ 1,467 $ (232) $ 1,699 732.4%

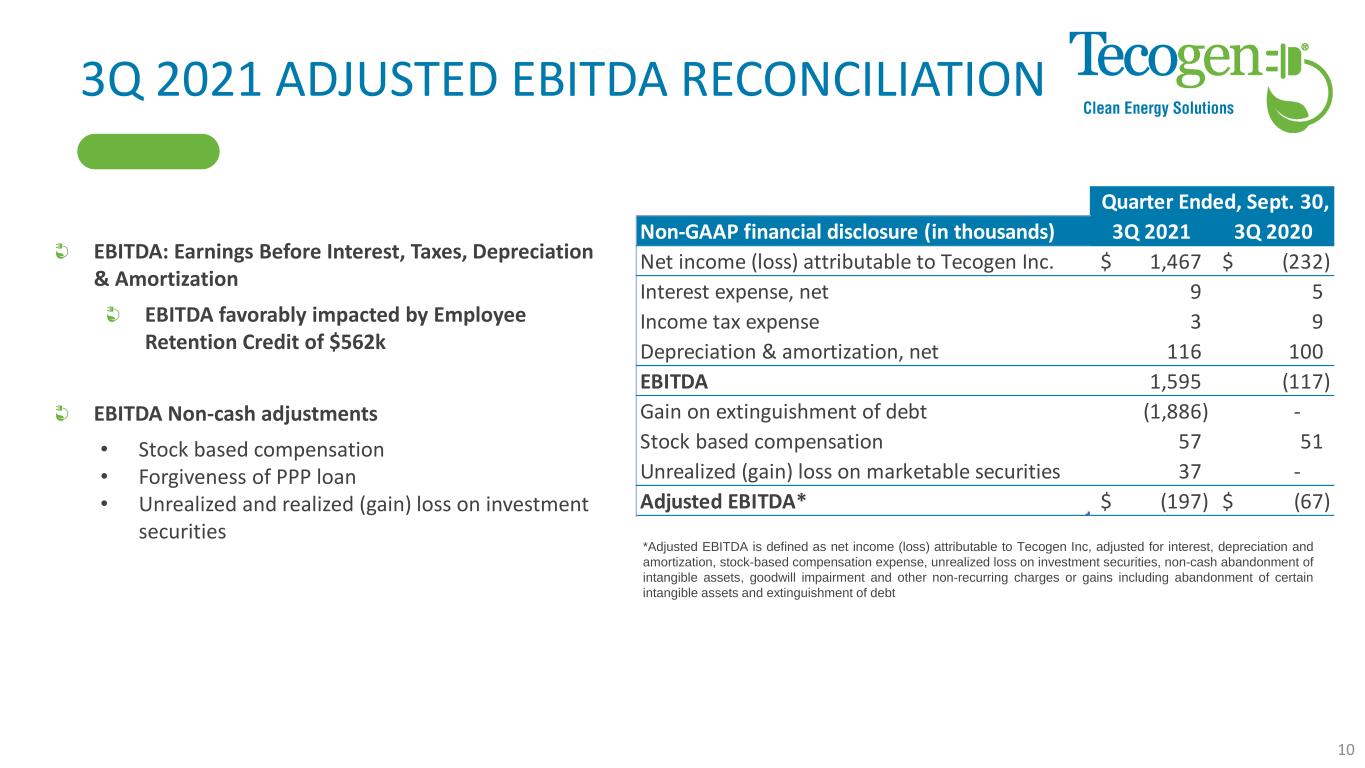

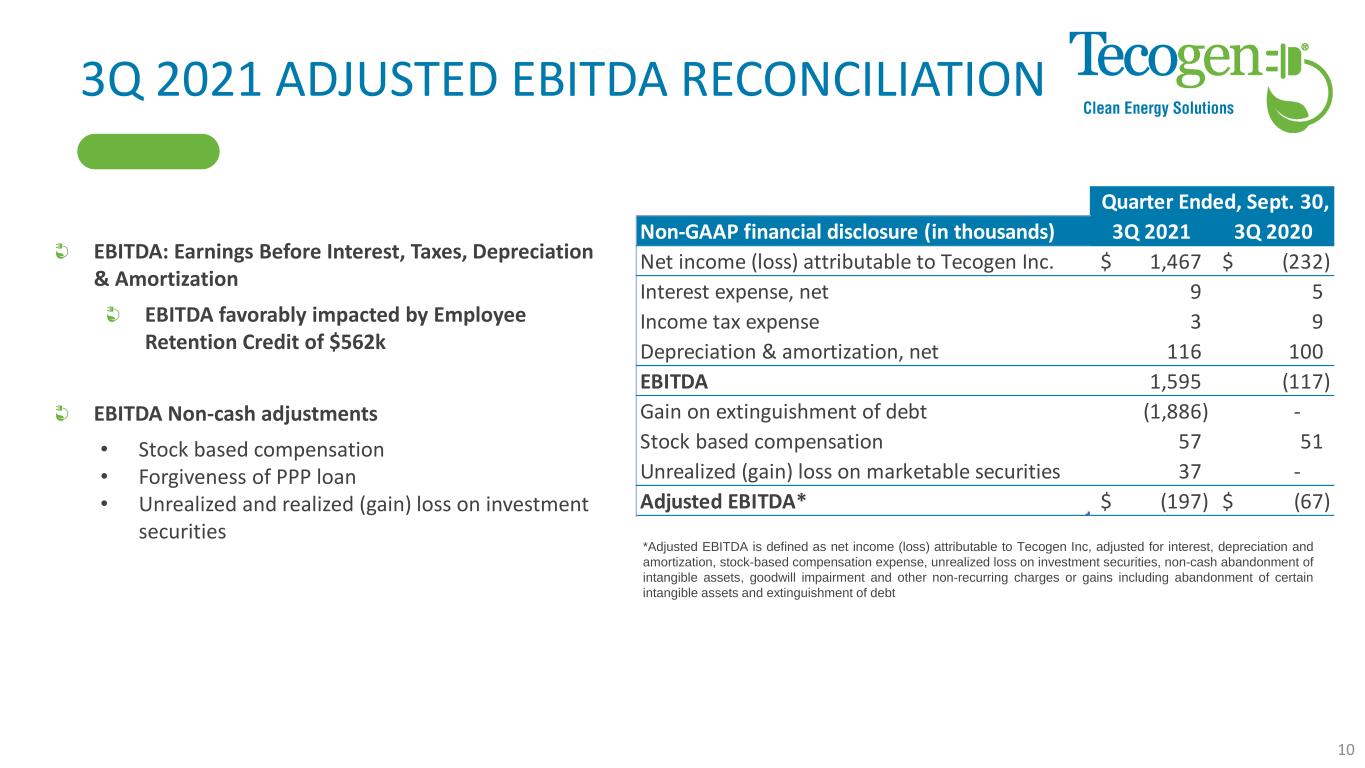

3Q 2021 ADJUSTED EBITDA RECONCILIATION EBITDA: Earnings Before Interest, Taxes, Depreciation & Amortization EBITDA favorably impacted by Employee Retention Credit of $562k EBITDA Non-cash adjustments • Stock based compensation • Forgiveness of PPP loan • Unrealized and realized (gain) loss on investment securities *Adjusted EBITDA is defined as net income (loss) attributable to Tecogen Inc, adjusted for interest, depreciation and amortization, stock-based compensation expense, unrealized loss on investment securities, non-cash abandonment of intangible assets, goodwill impairment and other non-recurring charges or gains including abandonment of certain intangible assets and extinguishment of debt 10 Non-GAAP financial disclosure (in thousands) 3Q 2021 3Q 2020 Net income (loss) attributable to Tecogen Inc. 1,467$ (232)$ Interest expense, net 9 5 Income tax expense 3 9 Depreciation & amortization, net 116 100 EBITDA 1,595 (117) Gain on extinguishment of debt (1,886) - Stock based compensation 57 51 Unrealized (gain) loss on marketable securities 37 - Adjusted EBITDA* (197)$ (67)$ Quarter Ended, Sept. 30,

PERFORMANCE BY SEGMENT Product revenue decreased 31% QoQ • All products faced some supply chain constraints • One $1.5m order of chillers was unable to ship in Q3 and will be shipped in Q4 • Product backlog improving with outlook for 1Q and 2Q 22 positive Service revenue declined 31% QoQ • Installation services down 96% QoQ • Service contracts/parts up 6% QoQ • Services Gross Margin increased to 48% Energy Production decreased 14% QoQ Gross Margin 47% 11 3Q Revenue ($ thousands) 2021 2020 YoY Growth Revenue Cogeneration $ 1,446 $ 1,890 -23% Chiller 383 769 -50% Engineered accessories 42 46 -8% Total Product Revenue 1,871 2,705 -31% Service Contracts 2,767 2,612 6% Installation Services 63 1,514 -96% Total Service Revenue 2,830 4,126 -31% Energy Production 315 369 -14% Total Revenue 5,016 7,200 -30% Cost of Sales Products 1,036 1,617 -36% Services 1,467 2,598 -44% Energy Production 171 198 -14% Total Cost of Sales 2,674 4,413 -39% Gross Profit 2,342 2,787 -16% Net income (loss) $ 1,467 $ (232) Gross Margin Products 45% 40% Services 48% 37% Aggregate Products and Services 47% 38% Energy Production 46% 46% Overall 47% 39% QTD Gross Margin 2021 2020 Target Overall 47% 39% >40%

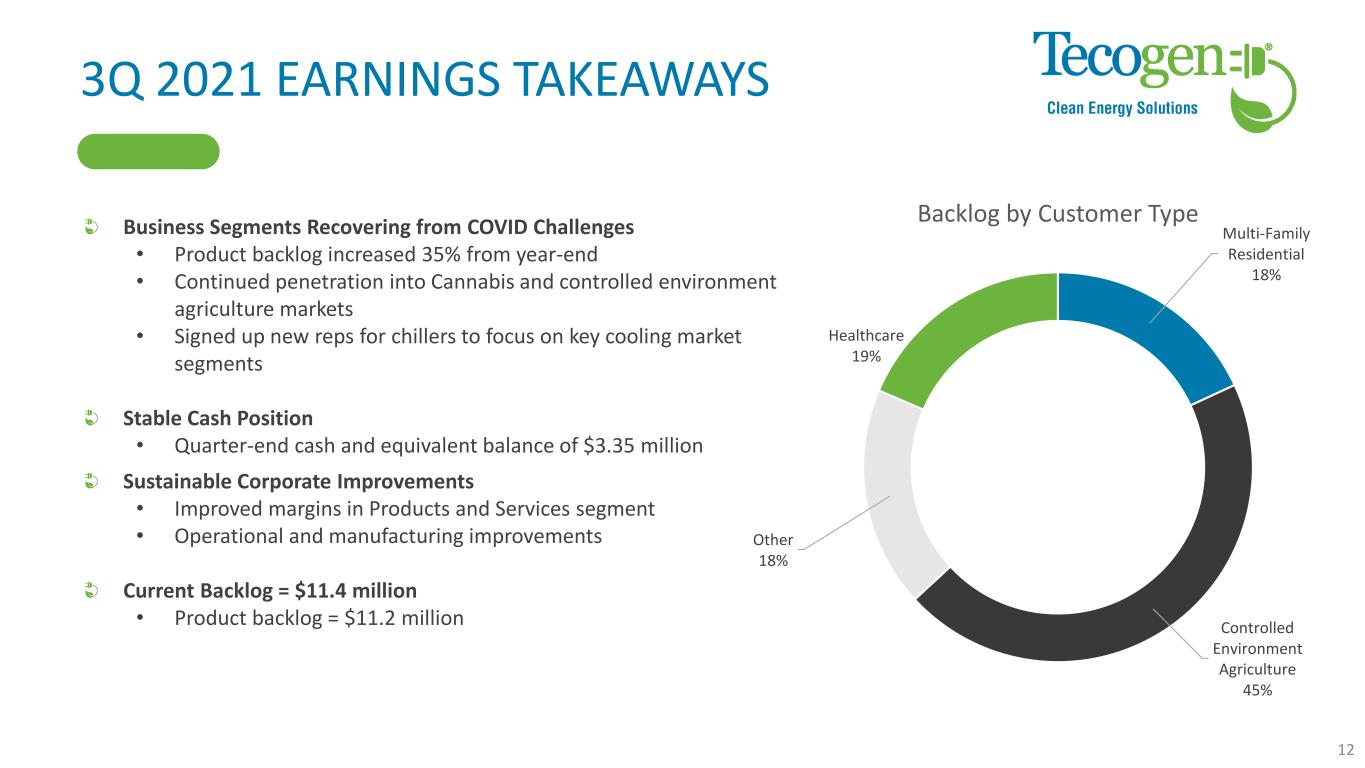

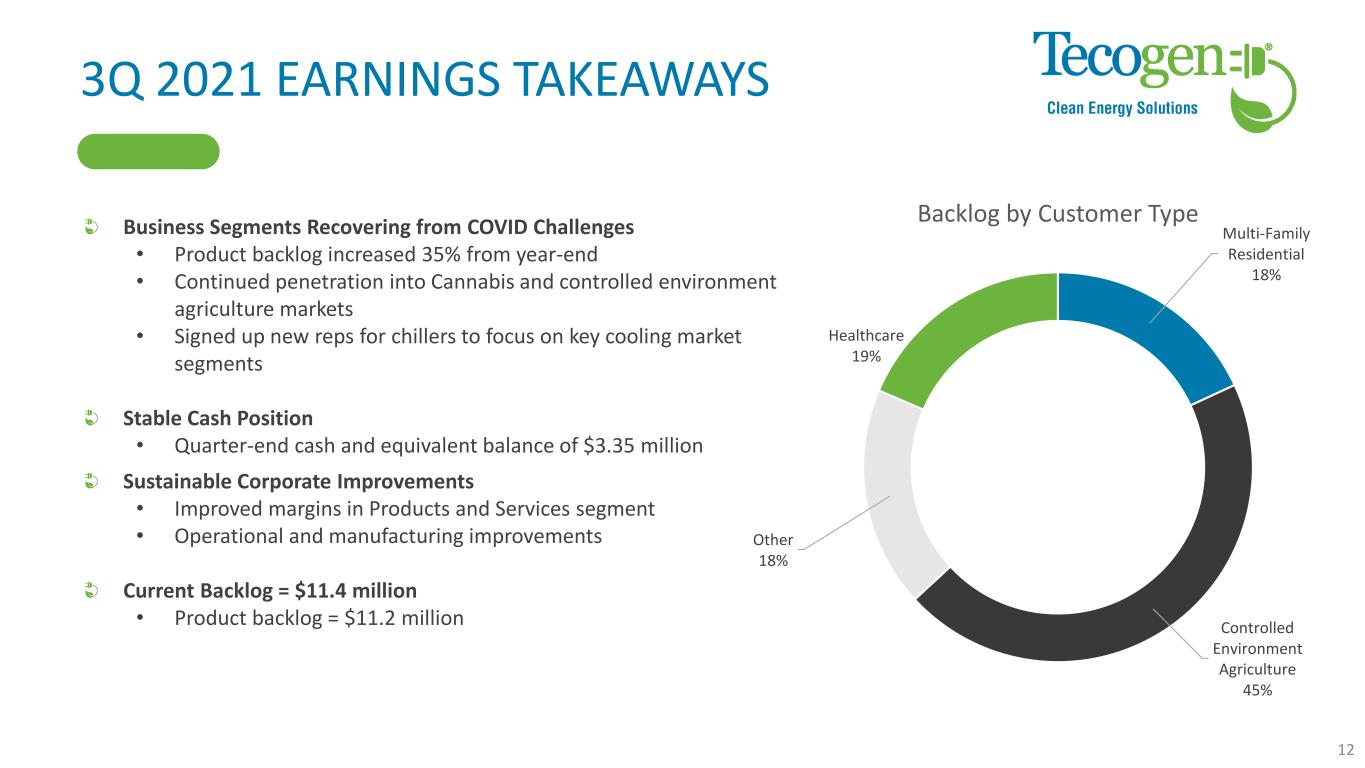

3Q 2021 EARNINGS TAKEAWAYS Business Segments Recovering from COVID Challenges • Product backlog increased 35% from year-end • Continued penetration into Cannabis and controlled environment agriculture markets • Signed up new reps for chillers to focus on key cooling market segments Stable Cash Position • Quarter-end cash and equivalent balance of $3.35 million Sustainable Corporate Improvements • Improved margins in Products and Services segment • Operational and manufacturing improvements Current Backlog = $11.4 million • Product backlog = $11.2 million Multi-Family Residential 18% Controlled Environment Agriculture 45% Other 18% Healthcare 19% Backlog by Customer Type 12

PATHWAY TO GROWTH Anticipate Introduction of Tecochill Air Cooled Chillers that incorporate the Tecogen hybrid drive technology by Q4 2022. This addresses a gap in our Tecochill offering as air cooled chillers are typically sold in larger volumes compared to water cooled chillers in our size range. Focus on Clean Cooling applications where there is a simultaneous cooling and dehumidification load. Continue to increase market share in regional cannabis markets including New England, Mid-Atlantic and Florida with a goal to have a minimum of 30% market share per state in facilities > 10,000 sq feet. Clean Microgrids using CHP in combination with other energy technologies including solar and battery 2022 13

Q&A Company Information Tecogen, Inc 45 First Ave Waltham, MA 02451 www.Tecogen.com Contact information Benjamin Locke, CEO 781.466.6402 Benjamin.Locke@Tecogen.com 14