SECURITIES AND EXCHANGE COMMISSION

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

Delaware | 80-0786663 | 333-229783 | 0001537805 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | (Commission File Number) | (Central Index Key Number) |

Delaware | 20-7458816 | 333-229783-01 | 0001537806 |

| (State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification Number) | (Commission File Number) | (Central Index Key Number) |

��

| Dale W. Lum | Siegfried Knopf |

| Sidley Austin LLP | Sidley Austin LLP |

| 555 California Street | 787 7th Avenue |

| San Francisco, California 94104 | New York, New York 10019 |

| (415) 772-1200 | (212) 839-5334 |

| Title of Each Class of Securities to be Registered | Amount to be Registered | Proposed Maximum Offering Price Per Unit(1) | Proposed Maximum Aggregate Offering Price(1) | Amount of Registration Fee |

| Asset Backed Notes | (2) | 100% | (2) | (2) |

| Exchange Notes(3) | (4) | (4) | (4) | (4) |

| (1) | Estimated solely for the purpose of calculating the registration fee. |

| (2) | An unspecified amount of Asset Backed Notes for which payment of the registration fee is deferred is hereby registered in reliance on Rules 456(c) and 457(s) of the Rules and Regulations under the Securities Act of 1933. Filing fees in the amount of $31,313.44 that were paid by the depositor under registration statement No. 333-208533 filed by the registrants on December 14, 2015 are carried forward and included on this registration statement. |

| (3) | Each exchange note (“Exchange Note”) issued by Daimler Trust will be backed by a reference pool of leases and leased vehicles owned by Daimler Trust. Each Exchange Note will be sold to the depositor, and will then be sold by the depositor to one of the issuers of the Asset Backed Notes. The Exchange Notes are not being offered to investors hereunder. |

| (4) | Not applicable. |

PROSPECTUS

| $[●] | [●]% | Class A-1 Asset Backed Notes | |

| $[●] | [●]% | Class A-2[A] Asset Backed Notes(1) | |

| [$[●] | [●]% | Class A-2B Asset Backed Notes(1)] | |

| $[●] | [●]% | Class A-3 Asset Backed Notes | |

| $[●] | [●]% | Class A-4 Asset Backed Notes | |

| [$[●] | [●]% | Class B Asset Backed Notes] |

[(1) | The aggregate principal amount of the Class A-2A and Class A-2B Notes will be $_________ but the allocation of such aggregate principal amount between the Class A-2A and Class A-2B notes will be determined no later than the day of pricing.] [The Class [__] notes are not being offered by this prospectus.] |

Daimler Trust Leasing LLC Depositor (CIK: 0001537805) | Mercedes-Benz Financial Services USA LLC Sponsor, Servicer and Administrator (CIK: 0001540252) |

Price to Public | Underwriting Discounts and Commissions | Net Proceeds to the Depositor(1) | |||||||

| Class A-1 Asset Backed Notes | $ [___________] | ([________]%) | $ [___________] | ([________]%) | $ [___________] | ([________]%) | |||

| Class A-2[A] Asset Backed Notes | $ [___________] | ([________]%) | $ [___________] | ([________]%) | $ [___________] | ([________]%) | |||

| [Class A-2B Asset Backed Notes | $ [___________] | ([________]%) | $ [___________] | ([________]%) | $ [___________] | ([________]%)] | |||

| Class A-3 Asset Backed Notes | $ [___________] | ([________]%) | $ [___________] | ([________]%) | $ [___________] | ([________]%) | |||

| Class A-4 Asset Backed Notes | $ [___________] | ([________]%) | $ [___________] | ([________]%) | $ [___________] | ([________]%) | |||

| [Class B Asset Backed Notes | $ [___________] | ([________]%) | $ [___________] | ([________]%) | $ [___________] | ([________]%)] | |||

| Total | $[_____________] | $[____________] | $[____________] | ||||||

| (1) | The net proceeds to the Depositor exclude expenses, estimated at $[●]. |

| Title of Each Class of Securities to be Registered | Amount to be Registered | Proposed Maximum Offering Price Per Unit(1) | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee(2) | ||||

| Asset Backed Notes | $________ | 100% | $________ | $________ | ||||

Exchange Note(3) | (4) | (4) | (4) | (4) |

| (1) | Estimated solely for the purpose of calculating the registration fee. |

| (2) | [Description of calculation of registration fee to be included pursuant to Rule 456(c), including any fee offsets from prior offerings.] |

| (3) | The exchange note [will be issued by Daimler Trust and will be backed by the reference pool of leases and leased vehicles. The exchange note will be sold to the Depositor, and will then be sold by the Depositor to the issuer, as further described in this prospectus. The exchange note] is not offered under this prospectus or the registration statement. |

(4) | Not applicable. |

| Page | |

| 2 | |

| 6 | |

| 7 | |

| 8 | |

| 9 | |

| 10 | |

| 21 | |

| 40 | |

| 40 | |

| 41 | |

| 41 | |

| 42 | |

| 42 | |

| 43 | |

| 43 | |

| 44 | |

| 44 | |

| 45 | |

| 45 | |

| 46 | |

| 49 | |

| 50 | |

| 50 | |

| 51 | |

| 51 | |

| 53 | |

| 53 | |

| 54 | |

| 55 | |

| 55 | |

| 55 | |

| 56 | |

| 58 | |

| 59 | |

| 59 | |

| 59 | |

| 60 | |

| 61 | |

| 61 |

| Page | |

| 61 | |

| 62 | |

| 62 | |

| 63 | |

| 63 | |

| 64 | |

| 64 | |

| 67 | |

| 68 | |

| 68 | |

| 68 | |

| 69 | |

| 69 | |

| 70 | |

| 71 | |

| 71 | |

| 73 | |

| 73 | |

| 74 | |

| 75 | |

| 80 | |

| 81 | |

| 82 | |

| 82 | |

| 83 | |

| 83 | |

| 83 | |

| 84 | |

| 86 | |

| 87 | |

| 88 | |

| 93 | |

| 93 | |

| 93 | |

| 94 | |

| 95 |

| Page | |

| 96 | |

| 97 | |

| 98 | |

| 98 | |

| 98 | |

| 99 | |

| 99 | |

| 101 | |

| 101 | |

| 101 | |

| 102 | |

| 104 | |

| 104 | |

| 104 | |

| 106 | |

| 107 | |

| 108 | |

| 109 | |

| 110 | |

| 110 | |

| 111 | |

| 111 | |

| 111 | |

| 112 | |

| 112 | |

| 113 | |

| 113 | |

| 113 | |

| 114 | |

| 116 | |

| 116 | |

| 117 | |

| 117 | |

| 117 | |

| 118 | |

| 118 | |

| 119 | |

| 122 | |

| 122 | |

| 123 |

| Page | |

| 123 | |

| 124 | |

| 124 | |

| 124 | |

| 124 | |

| 125 | |

| 127 | |

| 129 | |

| 129 | |

| 130 | |

| 130 | |

| 130 | |

| 132 | |

| 132 | |

| 132 | |

| 133 | |

| 134 | |

| 138 | |

| 139 | |

| 139 | |

| 142 | |

| 142 | |

| 144 | |

| 145 | |

| 145 | |

| 146 | |

| 147 | |

| 147 | |

| 148 | |

| 148 | |

| 148 | |

| 149 | |

| A-1 | |

| B-1 | |

| A-I-1 |

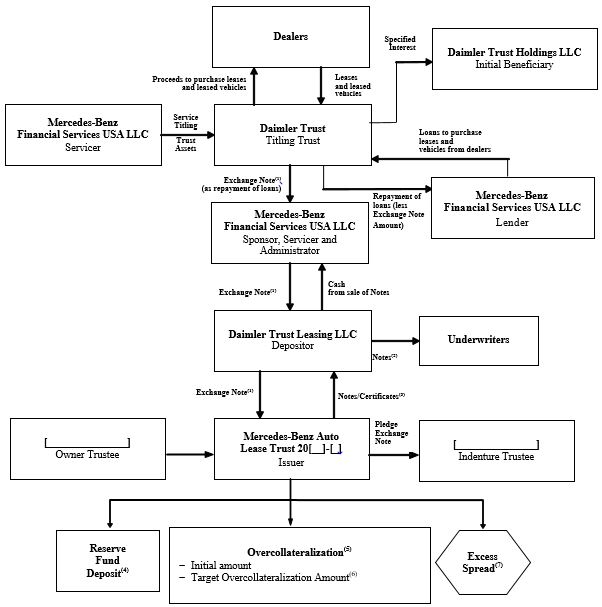

| (1) | The Exchange Note will be backed by the Reference Pool. |

| (2) | Some or all of one or more classes of Notes may be initially retained by the Depositor or its affiliates. |

| (3) | The Certificates represent the residual interest that will be held initially by the Depositor and represent the right to all funds not needed to make required payments on the Notes, pay fees and expenses of the Issuer or make deposits in the Reserve Fund. [The Depositor will hold the Certificates as described under “Credit Risk Retention”.] |

| (4) | The Reserve Fund will be funded on the Closing Date at [●]% of the Cutoff Date Aggregate Securitization Value. |

| (5) | Overcollateralization is the amount by which the Aggregate Securitization Value of the Leases exceeds the Note Balance of the Notes. Initially, the overcollateralization for the Notes will be approximately [●]% of the Cutoff Date Aggregate Securitization Value. |

| (6) | The Target Overcollateralization Amount is calculated as described under “Description of the Notes — Credit Enhancement — Overcollateralization”. |

| (7) | Excess spread is available, as a portion of Available Funds, to make required principal payments on the Notes and, as a result, provides a source of funds to absorb losses on the Leases and related Leased Vehicles and to increase overcollateralization until the Target Overcollateralization Amount is reached, as further described under “Description of the Notes — Credit Enhancement — Excess Spread”. |

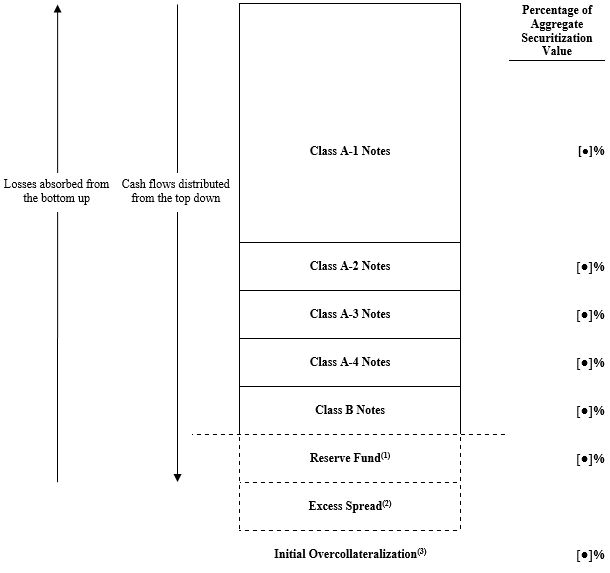

| (1) | On the Closing Date, the Reserve Fund will be funded at [●]% of the Cutoff Date Aggregate Securitization Value. |

| (2) | Excess spread is available as a portion of Available Funds to make required principal payments on the Notes and, as a result, provides a source of funds to absorb losses on the Leases and related Leased Vehicles and to increase overcollateralization until the Target Overcollateralization Amount is reached. |

| (3) | Overcollateralization is the amount by which the Aggregate Securitization Value of the Leases exceeds the Note Balance of the Notes. Initially, the overcollateralization for the Notes will be approximately [●]% of the Cutoff Date Aggregate Securitization Value. |

This summary describes the main terms of the issuance of and payments on the notes, the assets of the issuer, the cash flows in this securitization transaction and the credit enhancement available for the notes. This summary does not contain all of the information that may be important to you. To fully understand the terms of the offering of the notes, you will need to read this prospectus in its entirety.

Administrative Agent

U.S. Bank Trust National Association, a national banking association.

Asset Representations Reviewer

[____________], a [____________].

Terms of the Securities

The Notes

The following classes of notes, referred to herein as the “notes”, are being offered pursuant to this prospectus:

Note Class | Initial Note Balance | Interest Rate Per Annum | ||

| A-1 | $___________ | _.___% | ||

A-2[A][(1)] | $___________ | _.___% | ||

[A-2B(1) | $___________ | One-month LIBOR + _.___%] | ||

| A-3 | $___________ | _.___% | ||

A-4[] | $___________ | _.___% | ||

| B | $___________ | _.___% |

[(1) | The allocation of the principal amount between the Class A-2A and Class A-2B notes will be determined on or before the day of pricing.] |

[(_) | The Class [__] notes are not being offered by this prospectus.] |

[The class A-2A notes and the class A-2B notes are referred to as the “class A-2 notes.” The class A-2B notes are sometimes referred to as the “floating rate notes”. [The class A-2A notes and the class A-2B notes have equal rights to payments of principal and interest, which will be made on pro rata basis.]]

The notes will bear interest at the rates set forth above and interest will be calculated in the manner described under “Interest Accrual”.

The notes will be issued in book-entry form in minimum denominations of $1,000 and integral multiples of $1,000 in excess thereof.

The depositor [may initially retain some or all of the notes and] will initial retain [__% of each class of notes and] the residual interest in the issuer.

The Certificates

The issuer will issue Mercedes-Benz Auto Lease Trust 20[__]-[_] certificates to the depositor. The certificates, which reflect the residual interest in the issuer, are not being offered by this prospectus. [The depositor will initially retain the certificates in satisfaction of the risk retention obligations of the sponsor. See “Credit Risk Retention” for more information.] The certificates will not have a principal balance and will not bear interest. All distributions in respect of the certificates will be subordinated to payments on the notes. Any information in this prospectus relating to the certificates is presented solely to provide you with a better understanding of the notes.

Note Class | Final Scheduled Payment Date | |

| A-1 | [_________], 20[__] | |

| A-2[A] | [_________], 20[__] | |

| [A-2B | [_________], 20[__]] | |

| A-3 | [_________], 20[__] | |

| A-4 | [_________], 20[__] | |

| B | [_________], 20[__] |

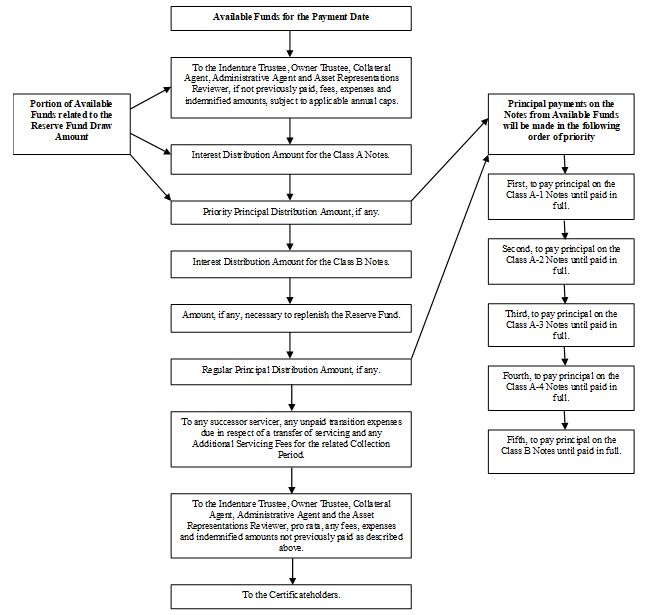

| (1) | to the class A-1 notes until they have been paid in full; |

| (2) | to the class A-2[A] notes [and the class A-2B notes, pro rata], until they have been paid in full; |

| (3) | to the class A-3 notes until they have been paid in full; |

| (4) | to the class A-4 notes until they have been paid in full; and |

| [(5) | to the class B notes until they have been paid in full]. |

| (1) | to the class A-1 notes until they have been paid in full; |

| (2) | to the class A-2[A] notes, [the class A-2B notes,] the class A-3 notes and the class A-4 notes, pro rata, until all classes of notes have been paid in full; and |

| [(3) | to the class B notes until they have been paid in full]. |

| (1) | pro rata, if not previously paid, the fees, if any, expenses and indemnified amounts due to the indenture trustee, the owner trustee, the collateral agent, the administrative agent and the asset representations reviewer for the related collection period, plus any overdue fees, expenses and indemnified amounts of such parties for one or more prior collection periods to each such party; provided, however, that the aggregate amount to be paid pursuant to this clause for such fees, expenses and indemnified amounts shall not exceed $[●] in any given calendar year; |

| [(2) | the interest distributable amount for the class A notes, to the distribution account, for payment ratably to the holders of the class A notes; |

| (3) | principal of the notes in an amount equal to the excess, if any, of (a) the aggregate principal amount of the class A notes (before giving effect to any payments made to the holders of the notes on the related payment date) over (b) the aggregate securitization value as of the last day of the related collection period, to the distribution account for payment to the holders of the notes; |

| (4) | [the interest distributable amount for the class B notes, to the distribution account, for payment to the holders of the class B notes;] |

| (5) | the amount, if any, necessary to fund the reserve fund up to the required reserve amount, which will be [●]% of the aggregate securitization value of the leases as of the cutoff date or, on any payment date occurring on or after the date on which the aggregate principal amount of the notes has been reduced to zero, zero, into the reserve fund; |

| (6) | principal of the notes in an amount equal to (a) the excess, if any, of (i) the aggregate principal amount of the notes (before giving effect to any payments made to the holders of the notes on the related payment date) over (ii) the aggregate securitization value as of the last day of the related collection period minus the target overcollateralization amount described under “Description of the Notes—Credit Enhancement—Overcollateralization” less (b) any amounts allocated to pay principal as described in clause (3) above, to the distribution account for payment to the holders of the notes;] |

| (7) | if a successor servicer has replaced the servicer, any unpaid transition expenses due in respect of the transfer of servicing and any additional servicing fees for the related collection period to the successor servicer; |

| (8) | any fees, expenses and indemnified amounts due to the owner trustee, indenture trustee, collateral agent, administrative agent and asset representations reviewer, pro rata, that have not been paid as described in clause (1) above; and |

| (9) | any remaining amounts to the certificateholders. |

| (1) | pro rata, the fees, expenses and indemnified amounts of the owner trustee, the indenture trustee, the collateral agent, the administrative agent and the asset representations reviewer due to each of them, without limitation; |

| (2) | [the interest distributable amount for the class A notes, ratably to the holders of the class A notes; |

| (3) | principal of the class A-1 notes, to the holders of the class A-1 notes, until the class A-1 notes have been paid in full; |

| (4) | principal of the class A-2[A] notes, [the class A-2B notes,] the class A-3 notes and the class A-4 notes, pro rata, to the holders of the class A-2[A] notes, [the class A-2B notes,] the class A-3 notes and the class A-4 notes, until all such classes of notes have been paid in full; |

| (5) | [the interest distributable amount for the class B notes, ratably to the holders of the class B notes; |

| (6) | principal of the class B notes, to the holders of the class B notes, until the class B notes have been paid in full;]] |

| (7) | if any entity has replaced the servicer, any unpaid transition expenses due in respect of a transfer of servicing and any additional servicing fees for the related collection period to the successor servicer; and |

| (8) | any remaining amounts to the certificateholders. |

| • | [for so long as the class [__] notes are outstanding, [●]%; and |

| • | on and after the payment date on which the class [__] notes are paid in full, [●]%.] |

| (1) | pro rata, if not previously paid, to the indenture trustee, the owner trustee, the collateral agent, the asset representations reviewer and the administrative agent, the fees, if any, expenses and indemnified amounts due to such parties for the related collection period plus any overdue fees, expenses and indemnified amounts of such parties for one or more prior collection periods to each such party; provided, however, that the aggregate amount to be paid pursuant to this clause for such fees, expenses and indemnified amounts shall not exceed $[●] in any given calendar year; |

| (2) | to the class A noteholders, monthly interest described in clause (2) and the amounts allocated to pay principal described in clause (3) under “Priority of Distributions”, if any, required to be paid on the notes on that payment date plus any overdue monthly interest due to any class of notes for the previous payment date; |

| (3) | to the class B noteholders, monthly interest described in clause (4) under “Priority of Distributions” plus any overdue monthly interest due to such class for the previous payment date; and |

| (4) | to the noteholders, principal payments required to reduce the principal amount of a class of notes to zero on or after its final scheduled payment date. |

| • | no interest will be paid on the class B notes until all interest due, and certain principal payments due, on each class of class A notes has been paid in full; and |

| • | no principal will be paid on the class B notes until all principal due on each class of class A notes has been paid in full. |

| • | a default for five days or more in payment of interest on the notes [of the controlling class] when due; |

| • | a default in the payment of principal of any note on its final scheduled payment date; |

| • | a default in the observance or performance of any other covenant or agreement of the issuer made in the indenture, which default is materially adverse to the holders of the notes and has not been cured for a period of 60 days after written notice thereof has been given to the issuer by the depositor or the indenture trustee or to the issuer, the depositor and the indenture trustee by the holders of notes evidencing not less than 25% of the aggregate principal amount of the notes [of the controlling class]; |

| • | any representation or warranty made by the issuer in the indenture or in any certificate delivered pursuant thereto or in connection therewith having been incorrect in any material adverse respect as of the time made and such incorrectness not having been cured for a period of 30 days after written notice thereof has been given to the issuer by the depositor or the indenture trustee or to the issuer, the depositor and the indenture trustee by the holders of notes evidencing not less than 25% of the aggregate principal amount of the notes [of the controlling class]; or |

| • | an insolvency or a bankruptcy with respect to the issuer (which, if involuntary, is not dismissed within 90 days); |

| • | the proceeds of the sale or liquidation of the issuer’s assets would be sufficient to repay the noteholders in full; |

| • | 100% of the holders of the notes [of the controlling class] consent to such sale or liquidation; or |

| • | the indenture trustee has determined pursuant to the provisions of the indenture that the assets of the issuer will be insufficient to continue to make all required payments of principal and interest on the notes when due and payable, and the holders of notes evidencing at least 66 2/3% of the aggregate principal amount of the notes [of the controlling class] consent to such sale or liquidation. |

| • | an exchange note secured by the leases and the related leased vehicles allocated to the reference pool; |

| • | amounts on deposit in the accounts owned by the issuer and permitted investments of those accounts; |

| • | rights under certain transaction documents; and |

| • | the proceeds of any and all of the above. |

| • | the aggregate securitization value, based on the securitization rate, of the leases and leased vehicles was $[●]; |

| • | the total number of leases was [●]; |

| • | the discounted aggregate residual value of the leases being financed was approximately [●]% of the aggregate securitization value; |

| • | the weighted average original number of monthly payments of the leases was [●] months; and |

| • | the weighted average remaining number of monthly payments of the leases was [●] months. |

| The notes are not suitable | |

| investments for all investors | The notes are not a suitable investment for any investor that requires a regular or predictable schedule of payments or payment on specific dates. The notes are complex investments that should be considered only by sophisticated investors. We suggest that only investors who, either alone or with their financial, tax and legal advisors, have the expertise to analyze the prepayment, reinvestment and default risks, the tax consequences of an investment and the interaction of these factors should consider investing in the notes. |

You may have difficulty selling your notes and/or obtaining | |

| your desired price | There may be no secondary market for the notes. The underwriters may participate in making a secondary market in the notes, but are under no obligation to do so. We cannot assure you that a secondary market will develop or, if it does develop, that such market will provide noteholders with sufficient liquidity of investment at any time during the period for which your notes are outstanding. Any investor in the notes must be prepared to hold its notes for an indefinite period of time or until the related final scheduled payment date or alternatively such investor may only be able to sell its notes at a discount to the original purchase price of those notes. In addition, there have been times in the past where there have been very few buyers of asset backed notes and thus there has been a lack of liquidity in the secondary market. There may be a similar lack of liquidity in the secondary market in the future. As a result, you may not be able to sell your notes when you want to do so, or you may not be able to obtain the price that you wish to receive |

The issuer’s assets are limited, only the assets of the issuer are available to make payments on your notes and you may experience a loss if defaults on the leases or residual value losses exceed the available | |

| credit enhancement | The notes represent indebtedness of the issuer and will not be insured or guaranteed by MBFS USA, the depositor, the servicer, any of their respective affiliates or any other person or entity. The only source of payment on your notes will be payments received on the leases and the related leased vehicles in the reference pool and the other credit enhancement described herein. The notes and the leases will not be insured or guaranteed, in whole or in part, by the United States or any governmental entity. Therefore, you must rely solely on the assets of the issuer for repayment of your notes. If these assets are insufficient, you may suffer losses on your notes. The residual values are future projections that are based on projections by Automotive Lease Guide, as described herein. There is no guarantee that the assumptions regarding future events that are used to determine residual values will prove to be correct. |

| If the residual values of the leased vehicles are substantially higher than the sales proceeds actually realized upon the sale of the leased vehicles, you may suffer losses if the available credit enhancement is exceeded. | |

Amounts on deposit in the reserve fund will be limited and | |

| subject to depletion | The amount on deposit in the reserve fund will be used to fund certain payments of monthly interest and certain distributions of principal to noteholders on each payment date if payments received on or in respect of the leases and leased vehicles allocated to the reference pool, including amounts recovered in connection with the repossession and sale of leased vehicles that secure defaulted leases, are not sufficient to make such payments. There can be no assurances, however, that the amount on deposit in the reserve fund will be sufficient on any payment date to assure payment of your notes. If the leases experience higher losses than were projected in determining the amount required to be on deposit in the reserve fund on the closing date, the actual amount on deposit in the reserve fund on a payment date may be less than projected. If, on any payment date, available collections and amounts in the reserve fund are not sufficient to pay in full the monthly interest and distributions of principal due on the notes, you may experience payment delays with respect to your notes. If on subsequent payment dates the amount of that insufficiency is not offset by excess collections on or in respect of the leases and leased vehicles allocated to the reference pool and amounts recovered in connection with the repossession and sale of leased vehicles that secure defaulted leases, you will experience losses with respect to your notes. |

[Subordination of the class B notes may reduce payments to | |

| those notes | Investors in the class B notes may suffer a loss on their investment because payments of interest on and principal of the class B notes are subordinated to the class A notes subject to the following priorities: · no interest will be paid on the class B notes until all interest due, and certain principal payments due, on that distribution date on each class of class A notes has been paid in full; and · no principal will be paid on the class B notes until all principal of the class A notes has been paid in full; In addition, for so long as the class A notes are outstanding, the class A notes will be the controlling class of notes, and will have the authority when acting in that regard to take actions that will affect, and may adversely affect, the class B notes without the consent of the class B noteholders. You may experience losses on your investment in the class B notes if available collections and amounts on deposit in the reserve fund, after making required payments on the class A notes are insufficient to protect your notes from losses.] |

| Overcollateralization may not | |

| increase as expected | The overcollateralization is expected to increase to the target overcollateralization amount as excess spread is used to pay principal of the notes in an amount greater than the decrease in the aggregate securitization value of the reference pool from the amortization of the leases and related leased vehicles. It is not certain, however, that the target overcollateralization amount will be reached or maintained, or that the leases will generate sufficient collections to pay your notes in full. |

For more information about overcollateralization as a form of credit enhancement for your notes, see “Description of the Notes — Credit Enhancement — Overcollateralization”. | |

Failure to pay principal on your notes will not constitute an event of default until | |

| maturity | The amount of principal required to be paid to noteholders will be limited to amounts available for that purpose in the exchange note collection account and amounts in the reserve fund. Therefore, the failure to pay principal on a class of notes generally will not result in the occurrence of an event of default until the final scheduled payment date for that class of notes. |

The return on your notes may be reduced by application of the Servicemembers Civil Relief | |

| Act | Under the Servicemembers Civil Relief Act, members of the military on active duty, including reservists, who have entered into an obligation, such as a lease contract for a lease of a vehicle, before entering into military service may be entitled to protections that state the lessor may not terminate the lease contract for breach of the terms of the contract, including non-payment. Furthermore, under the Servicemembers Civil Relief Act, a lessee may, under certain circumstances, terminate a lease of a vehicle at any time after the lessee’s entry into military service or the date of the lessee’s military orders. No early termination charges may be imposed on the lessee for such termination. No information can be provided as to the number of leases that may be affected by these laws. The foregoing laws may impose limitations that would impair the ability of the servicer to repossess a vehicle under a defaulted lease during the related lessee’s period of active duty and, in some cases, may require the servicer to extend the lease termination date of the related lease, lower the monthly payments and adjust the payment schedule for a period of time after the completion of the lessee’s military service. It is not clear that the Servicemembers Civil Relief Act would apply to leases such as the leases allocated to the reference pool or how many leases would be affected by it. If a lessee’s obligation to make lease payments is reduced, adjusted or extended, or if the lease is terminated early and no early termination charge is imposed, the servicer will not be required to advance those amounts. Any resulting shortfalls in interest or principal will reduce the amount available for distribution on the notes. |

| Turn-in rates may increase | |

| losses | Under each lease, the lessee may elect to purchase the related vehicle during the related lease term or at the expiration of the lease for an amount generally equal to the stated residual value established at the inception of the lease, subject to certain concessions MBFS USA may offer to such lessee. Lessees who decide not to purchase their leased vehicles will expose the issuer to possible losses if the sale prices of such vehicles in the used car market are less than their respective stated residual values. The level of turn-ins at lease termination could be adversely affected by lessee views on vehicle quality, the relative attractiveness of new models available to the lessees, sales and lease incentives offered with respect to other vehicles (including those offered by MBFS USA), the level of purchase option prices for the related leased vehicles compared to new and pre-owned vehicle prices and economic conditions generally. The grant of extensions[, including extension in connection with hurricanes Florence and Michael,] and the early termination of leases allocated to the reference pool may affect the number of turn-ins in a particular month. If lessees purchase the related leased vehicles for less than their stated residual values or if lessees opt to not purchase the related leased vehicles and such vehicles are then re-sold in the used car market at prices below their related stated residual values, and such residual losses related to these turn-ins exceed the credit enhancement available, you may suffer a loss on your investment. |

Prepayments, including prepayments on the leases and the related leased vehicles, may adversely affect the average life of, and rate of return on, your | |

| notes | You may not be able to reinvest the principal repaid to you at a rate of return that is equal to or greater than the rate of return on your notes. Faster than expected prepayments on the leases may cause the issuer to make payments on its notes earlier than expected. A variety of economic, social and other factors will influence both the rate of optional prepayments on the leases and the level of defaults. We cannot predict the effect of prepayments on the average lives of your notes. All leases, by their terms, may be prepaid at any time. Prepayments include: · prepayments in whole or in part by the lessee; · prepayments in whole or in part resulting from damages to a leased vehicle and the related insurance proceeds received; · liquidations due to default; · partial payments with proceeds from amounts received as a result of rebates, insurance premiums and physical damage, theft, credit life and disability insurance policies; · payments due to a required repurchase from the reference pool of leases and the related leased vehicles by the servicer for specified breaches of certain servicing obligations or representations, warranties and covenants, to the extent such breach materially and adversely affects the interest of the issuer and such breach is not timely cured; and · an optional repurchase of the issuer’s assets by the servicer, as described under “Description of the Transaction Documents—Optional Purchase”. You will bear any reinvestment risks resulting from prepayments and the corresponding acceleration of payments on the notes. |

| As a result of prepayments, the final payment of each class of notes is expected to occur prior to its final scheduled payment date. If sufficient funds are not available to pay any class of notes in full on its final scheduled payment date, an event of default will occur and final payment of that class of notes will occur later than scheduled. | |

Proceeds of the liquidation of the assets of the issuer may not be sufficient to pay your notes | |

| in full | If so directed by the holders of the requisite percentage of the notes [of the controlling class], following an acceleration of the notes upon an event of default, the indenture trustee will liquidate the assets of the issuer only in limited circumstances. The noteholders will suffer losses if the indenture trustee sells the assets of the issuer for less than the total amount due on its notes. We cannot assure you that sufficient funds would be available to repay those noteholders in full. |

Federal bankruptcy or state debtor relief laws may impede collection efforts or alter the timing and amount of collections, which may result in acceleration of or reduction in | |

| payment on your notes | If a lessee sought protection under federal bankruptcy or state debtor relief laws, a court could reduce or discharge completely the lessee’s obligations to repay amounts due on its lease. As a result, that lease would be written off as uncollectible. You could suffer a loss if no funds are available from credit enhancement or other sources and amounts allocated to the notes are insufficient to cover the applicable default amount. |

Leases that fail to comply with consumer protection laws may be unenforceable, which may result in losses on your | |

| investment | Numerous federal and state consumer protection laws, including the federal Consumer Leasing Act of 1976 and Regulation M promulgated by the Consumer Financial Protection Bureau, impose requirements on retail lease contracts. California has enacted comprehensive vehicle leasing statutes that, among other things, regulate the disclosures to be made at the time a vehicle is leased. The failure by the titling trust to comply with these requirements may give rise to liabilities on the part of the titling trust (as lessor under the leases) or the issuer (as owner of the exchange note). Further, many states have adopted “lemon laws” that provide vehicle users certain rights in respect of substandard vehicles. A successful claim under a lemon law could result in, among other things, the termination of the related lease and/or the requirement that all or a portion of payment previously paid by the lessee be refunded. MBFS USA will make representations and warranties that each lease complies with all requirements of applicable law in all material respects. If any such representation and warranty proves incorrect, has a material and adverse effect on the interest of the issuer and is not timely cured, MBFS USA will be required to make a repurchase payment in respect of the related lease and leased vehicle and reallocate the related lease and related leased vehicle out of the reference pool. To the extent that MBFS USA fails to make such repurchase, or to the extent that a court holds the titling trust or the issuer liable for violating consumer protection laws regardless of such a repurchase, a failure to comply with consumer protection laws could result in required payments by the titling trust or the issuer. If sufficient funds are not available to make both payments to lessees and on your notes, you may suffer a loss on your investment in the notes. |

| Vicarious tort liability may | |

| result in a loss | Some states allow a party that incurs an injury involving a leased vehicle to sue the owner of the vehicle merely because of that ownership. Most states, however, either prohibit these vicarious liability suits or limit the lessor’s liability to the amount of liability insurance that the lessee was required to carry under applicable law but failed to maintain. The Transportation Act, more fully described under “Certain Legal Aspects of the Leases and Leased Vehicles—Vicarious Tort Liability” provides that, absent negligence or criminal wrongdoing on its part, an owner (or an affiliate of an owner) of a motor vehicle that rents or leases the vehicle to a person shall not be liable under the law of a state or political subdivision by reason of being the owner of the vehicle, for harm to persons or property that results or arises out of the use, operation, or possession of the vehicle during the period of the rental or lease. The Transportation Act is intended to preempt state and local laws that impose possible vicarious tort liability on entities owning motor vehicles that are rented or leased and it is expected that the Transportation Act should reduce the likelihood of vicarious liability being imposed on the titling trust. State and federal courts considering whether the Transportation Act preempts state laws permitting vicarious liability have generally concluded that such laws are preempted with respect to cases commenced on or after the effective date of the Transportation Act. While the outcome in these cases have thus far upheld federal preemption under the Transportation Act, there are no assurances that future cases will reach the same conclusion. MBFS USA maintains primary and excess liability insurance policies on behalf of the titling trust and contingent liability insurance coverage against third party claims against the titling trust. If vicarious liability imposed on the titling trust exceeds this coverage, or if lawsuits are brought against either the titling trust or MBFS USA involving the negligent use or operation of a leased vehicle, you could experience delays in payments due to you or you may ultimately suffer a loss on your investment. |

Paying the servicer a fee based on a percentage of the securitization value of the leases may result in the inability to | |

| obtain a successor servicer | Because the servicer will be paid its base servicing fee based on a percentage of the aggregate securitization value of the leases, the fee the servicer receives each month will be reduced as the size of the pool decreases over time. At some point, if the need arises to obtain a successor servicer, the fee that such successor servicer would earn might not be sufficient to induce a potential successor servicer to agree to assume the duties of the servicer with respect to the remaining leases and leased vehicles. If there is a delay in obtaining a successor servicer, it is possible that normal servicing activities could be disrupted during this period which could delay payments and reports to noteholders, adversely impact collections and ultimately lead to losses or delays in payments on your notes. |

Commingling by the servicer may result in delays and reductions in payments on your | |

| notes | The servicer, if it satisfies certain requirements, will be permitted to hold with its own funds collections it receives from lessees on the leases (and an amount equal to sales proceeds that are deposited under MBFS USA’s like-kind exchange program) and the repurchase payment for any leases and related leased vehicles required to be reallocated from the reference pool until the day prior to the date on which the distributions are made on the notes. During this time, the servicer may invest those amounts at its own risk and for its own benefit and need not segregate them from its own funds. If the servicer is unable to pay these amounts to the issuer on or before the related payment date, you might incur a delay in payment or a loss on your notes. |

A servicer default may result in additional costs or a diminution in servicing performance, any of which may have an adverse | |

| effect on your notes | If a servicer default occurs, the exchange noteholder (which shall be the indenture trustee acting on behalf of the holders of notes evidencing at least 66 2/3% of the aggregate principal amount of the notes [of the controlling class]) may direct the titling trustee to remove the servicer, without the consent of the owner trustee or the holders of any securities subordinate to the notes [of the controlling class], including certificateholders. In the event of the removal of the servicer and the appointment of a successor servicer, we cannot predict: · the cost of the transfer of servicing to the successor servicer; or · the ability of the successor servicer to perform the obligations and duties of the servicer under the servicing agreement. Furthermore, the indenture trustee or the noteholders may experience difficulties in appointing a successor servicer and during any transition phase it is possible that normal servicing activities could be disrupted. |

[Daimler AG and/or its subsidiaries are subject to legal risks relating to pending legal proceedings, claims, governmental investigations and administrative orders and proceedings, and the SEC is investigating, among other things, nondisclosure in prior asset backed security issuances in the U.S. of alleged diesel vehicle noncompliance with | |

| emission standards | Daimler AG and its subsidiaries, which include MBFS USA, are confronted with various legal proceedings, claims, government investigations and administrative orders and proceedings (collectively, legal proceedings) on a large number of topics, including vehicle safety, emissions, fuel economy, financial services, dealer, supplier and other contractual relationships, intellectual property rights, warranty claims, environmental matters, antitrust matters (including actions for damages) and shareholder litigation. |

The automotive industry is subject to extensive governmental regulations worldwide. Laws in various jurisdictions regulate occupant safety and the environmental impact of vehicles, including emission levels, fuel economy and noise, as well as the emissions of the plants where vehicles or parts thereof are produced. Noncompliance with regulations applicable in the different regions could result in significant penalties and reputational harm, the inability to sell vehicles (including used vehicles) in the relevant markets or an adverse effect on the residual values of vehicles. The cost of compliance with these regulations is significant, and in this context, Daimler AG and/or its subsidiaries expect a significant increase in such costs. Currently, Daimler AG and/or its subsidiaries are subject to governmental information requests, inquiries, investigations, administrative orders and proceedings as well as litigation relating to environmental, securities, criminal, antitrust and other laws and regulations in connection with diesel exhaust emissions. Several federal and state authorities and other institutions worldwide have inquired about and/or are conducting investigations and/or administrative proceedings, and/or have issued administrative orders. These particularly relate to test results, the emission control systems used in Mercedes-Benz diesel vehicles and/or Daimler AG’s and/or its subsidiaries’ interaction with the relevant federal and state authorities as well as related legal issues and implications, including, but not limited to, under applicable environmental, securities, criminal and antitrust laws. These authorities include, among others, the U.S. Department of Justice, which has requested that Daimler AG conduct an internal investigation, the U.S. Environmental Protection Agency, the California Air Resources Board and other U.S. state authorities as well as other authorities of various foreign countries and the European Union. The SEC has requested information regarding potential violations of securities laws, including in connection with issuances of asset-backed securities sponsored by MBFS USA, as a result of nondisclosure of certain Mercedes-Benz diesel vehicles’ alleged noncompliance with emission standards. In January 2017, the SEC informed MBFS USA that it had issued a formal order of investigation; the investigation is ongoing. MBFS USA continues to fully cooperate with the SEC. In the second and third quarter of 2018, the German Federal Motor Transport Authority (“KBA”) issued administrative orders holding that certain calibrations of specified functionalities in certain Mercedes-Benz Diesel vehicles are to be qualified as impermissible defeat devices and ordered subsequent auxiliary provisions for the respective EU type approvals in this respect, including a stop of the first registration and mandatory recall. Daimler AG filed timely objections against such administrative orders in order to have the open legal issues resolved, if necessary by a court of law. In the course of its regular market supervision, KBA routinely conducts further reviews of Mercedes-Benz vehicles. It cannot be ruled out that in the course of further investigations KBA will issue further administrative orders making similar findings. Daimler AG has implemented a temporary delivery and registration stop with respect to certain models and reviews constantly whether it can lift this delivery and registration stop in whole or in part. The new calibration requested by KBA in its administrative order of the second quarter of 2018 has meanwhile been completed and the related software has been approved by KBA; the related recall has in the meantime been initiated. It cannot be ruled out, however, that further delivery and registration stops may be ordered or resolved by Daimler AG and/or its subsidiaries as a precautionary measure under the relevant circumstances. Daimler AG and/or its subsidiaries have initiated further investigations and otherwise continues to fully cooperate with the authorities and institutions. Further, in 2017, US environmental authorities issued notices of violation to another vehicle manufacturer, and the United States filed a related complaint against such manufacturer. In such notices of violation and court complaint, functionalities were identified, apparently including functionalities that are common in diesel vehicles, as undisclosed Auxiliary Emission Control Devices (AECDs) and, in some unspecified cases, as impermissible. |

In light of these matters and in light of the ongoing governmental information requests, inquiries, investigations, administrative orders and proceedings, and Daimler AG’s own internal investigations, as well as the technical Compliance Management System (tCMS), which is and continues to be implemented to address the specific risks associated with the product development process throughout Daimler AG and its subsidiaries and is designed particularly to also provide guidance – taking into account technical and legal aspects – with regard to the complex interpretation of regulations, it cannot be ruled out that authorities will reach the conclusion that other passenger cars and/or commercial vehicles with the brand name Mercedes-Benz or other brand names of Daimler AG and its subsidiaries also have impermissible functionalities and/or calibrations. Furthermore, the authorities have increased scrutiny of Daimler AG’s and/or its subsidiaries’ processes regarding running change, field fix and defect reporting as well as other compliance issues. The inquiries, investigations, legal actions and proceedings as well as the replies to the governmental information requests, the objection proceedings against KBA’s administrative orders and Daimler AG’s internal investigations are still ongoing and open; hence, Daimler AG and/or its subsidiaries cannot predict the outcome at this time. If these or other inquiries, investigations, legal actions and/or proceedings result in unfavorable findings, an unfavorable outcome, or otherwise develop unfavorably, Daimler AG and/or its subsidiaries could be subject to significant monetary penalties, fines, remediation requirements, further vehicle recalls, further registration and delivery stops, process improvements, mitigation measures and/or other sanctions, measures and actions, including further investigations and/or administrative orders by these or other authorities and additional litigation. The occurrence of the aforementioned events in whole or in part could cause significant collateral damage including reputational harm. Further, due to negative determinations or findings with respect to technical or legal issues by one of the various governmental agencies, other agencies could also adopt such determinations or findings, even if such determinations or findings are not within the scope of such authority’s responsibility or jurisdiction. Thus, a negative determination or finding in one proceeding carries the risk of having an adverse effect on other proceedings, also potentially leading to new or expanded investigations or proceedings. In particular, any remediation requirements, recalls or delivery and registration stops of Mercedes-Benz diesel vehicles, or reputational harm to the Mercedes-Benz brand, could adversely affect the sales prices of used Mercedes-Benz passenger cars and sport utility vehicles [and smart automobiles] and the residual values of Mercedes-Benz passenger cars and sport utility vehicles [and smart automobiles] that are leased, including those that are allocated to the reference pool securing the exchange note that will collateralize the notes. None of the leased vehicles that will be allocated to the reference pool will be diesel vehicles. |

| Notwithstanding the foregoing, MBFS USA does not believe that the outcome of the SEC investigation nor any of the inquiries and investigations in the United States pertaining to Daimler AG and/or its subsidiaries will have a material adverse effect on the financial condition of MBFS USA or on the ability of MBFS USA to perform its obligations under the transaction documents relating to the issuance of the notes.] | |

The bankruptcy of MBFS USA or the depositor could result in losses or delays in payments on your notes and could delay the appointment of a successor | |

| servicer | Following a bankruptcy or insolvency of MBFS USA or the depositor, a court could conclude that the exchange note is owned by MBFS USA or the depositor, instead of the issuer. This conclusion could be reached either because the court concluded that the transfer of the exchange note from the depositor to the issuer was a pledge of the exchange note and not a “true sale” or because the court concluded that the depositor or the issuer should be consolidated with MBFS USA or the depositor for bankruptcy purposes. If this were to occur, you could experience delays in payments due to you, or you may not ultimately receive all amounts due to you as a result of: · the “automatic stay”, which prevents a secured creditor from exercising remedies against a debtor in bankruptcy without permission from the court, and provisions of the United States bankruptcy code that permit substitution of collateral in limited circumstances; · tax or government liens on MBFS USA’s or the depositor’s property (that arose prior to the transfer of the exchange note to the issuer) having a prior claim on collections before the collections are used to make payments on the notes; and · the fact that neither the issuer nor the indenture trustee has a perfected security interest in the leased vehicles allocated to the reference pool and may not have a perfected security interest in any cash collections of the leases and leased vehicles allocated to the reference pool held by MBFS USA at the time that a bankruptcy proceeding begins. The depositor will take steps in structuring the transaction described in this prospectus to minimize the risk that a court would consolidate the depositor with MBFS USA for bankruptcy purposes or conclude that the transfer of the exchange note was not a “true sale”. In addition, in the event of a servicer default by MBFS USA resulting solely from certain events of insolvency or the bankruptcy of MBFS USA, a court, conservator, receiver or liquidator may have the power to prevent either the indenture trustee or the holders of notes [of the controlling class] from appointing a successor servicer or prevent MBFS USA from appointing a sub-servicer, as the case may be, and delays in the collection of payments on the leases may occur. Any delay in the collection of payments on the leases may delay or reduce payments to noteholders. |

Adverse events with respect to MBFS USA, its affiliates or third party servicers to whom MBFS USA outsources its activities may affect the timing of payments on your notes or have other adverse effects on | |

| your notes | Adverse events with respect to MBFS USA, its affiliates or a third party servicer to whom MBFS USA outsources its activities may result in servicing disruptions or reduce the market value of your notes. MBFS USA currently outsources some of its activities as servicer to third party servicers with respect to delinquent leases. In the event of a termination and replacement of MBFS USA as the servicer, or if any of the third party servicers cannot perform its activities, there may be some disruption of the collection activity with respect to delinquent leases and therefore delinquencies and credit losses could increase. As servicer, MBFS USA will be required to repurchase certain leases that do not comply with representations and warranties made by MBFS USA (for example, representations relating to the compliance of the lease contracts with applicable laws). If MBFS USA becomes unable to repurchase any of those leases or make the related payment to the issuer, investors could suffer losses. In addition, adverse corporate developments with respect to servicers of asset-backed securities or their affiliates have in some cases also resulted in a reduction in the market value of the related asset-backed securities. For example, MBFS USA is an indirect wholly-owned subsidiary of Daimler AG. Although Daimler AG is not guaranteeing the obligations of the issuer, if Daimler AG ceased to manufacture vehicles or support the sale of vehicles or if Daimler AG faced financial or operational difficulties, those events may reduce the market value of Mercedes-Benz [and smart]automobiles, and ultimately the amount realized on any Mercedes-Benz [or smart] leased vehicle, including the leased vehicles allocated to the reference pool. |

Interests of other persons in the leases and the leased vehicles could be superior to the issuer’s interest, which may result in delayed or reduced payment on | |

| your notes | Because the exchange note will be secured by the leases and leased vehicles allocated to the reference pool, you will be dependent on payments made on these leases and proceeds received in connection with the sale or other disposition of the leased vehicles for payments on your notes. The issuer will not have an ownership interest in the leases or an ownership interest or perfected security interest in the leased vehicles, which will be titled in the name of the titling trust or the titling trustee on behalf of the titling trust. It is therefore possible that a claim against or lien on the leased vehicles or the other assets of the titling trust could limit the amounts payable in respect of the exchange note to less than the amounts received from the lessees of the leased vehicles or received from the sale or other disposition of the leased vehicles. Further, although unlikely, liens in favor of and/or enforceable by the Pension Benefit Guaranty Corporation could attach to the leases and leased vehicles owned by the titling trust. |

To the extent a third-party makes a claim against, or files a lien on, the assets of the titling trust, including the leased vehicles allocated to the reference pool, it may delay the disposition of those leased vehicles or reduce the amount paid to the holder of the exchange note. If any of the foregoing events occurs, you may experience delays in payment or losses on your investment in the notes. | |

If ERISA liens are placed on the titling trust assets, you could suffer a loss on your | |

| Investment | Liens in favor of and/or enforceable by the Pension Benefit Guaranty Corporation could attach to the leases and leased vehicles owned by the titling trust and could be used to satisfy unfunded ERISA obligations of any member of a controlled group that includes MBFS USA and its affiliates. Because the collateral agent in connection with the exchange note has a prior perfected security interest in the leases and leased vehicles (other than for leased vehicles in [Kansas, Missouri, Nebraska, Nevada and South Dakota]), these liens would not, however, have priority over the interest of the collateral agent in the assets securing the exchange note. While MBFS USA believes that the likelihood of this liability being asserted against the assets of the titling trust or, if so asserted, being successfully pursued, is remote, you cannot be sure the leases and leased vehicles will not become subject to an ERISA liability. |

Financial market disruptions and a lack of liquidity in the secondary market could adversely affect the market value of your notes and/or limit your ability to resell your | |

| notes | For several years after the 2008 financial crisis, events in the global financial markets, including the failure, acquisition or government seizure of several major financial institutions, the establishment of government initiatives such as the government bailout programs for financial institutions and assistance programs designed to increase credit availability, support economic activity and facilitate renewed consumer lending, problems related to subprime mortgages and other financial assets, the devaluation of various assets in secondary markets, the forced sale of asset-backed and other securities as a result of the deleveraging of structured investment vehicles, hedge funds, financial institutions and other entities and the lowering of ratings on certain asset-backed securities, caused a significant reduction in liquidity in the secondary market for these asset-backed securities. While conditions in the financial markets and the secondary markets have improved, there can be no assurance that future events will not occur that could have a similar adverse effect on liquidity of the secondary market for asset-backed securities. The recurrence of such events or the occurrence of similar events could adversely affect the market value of your notes and/or limit your ability to resell your notes. Furthermore, over the past several years, the global financial markets have experienced increased volatility due to uncertainty surrounding the level and sustainability of the sovereign debt of various countries. Concerns regarding sovereign debt may spread to other countries at any time. There can be no assurance that this uncertainty relating to the sovereign debt of various countries will not lead to further disruption of the financial and credit markets in the United States, which could adversely affect the market value of your notes. |

Federal financial regulatory reform could have an adverse impact on the sponsor, the | |

| depositor or the issuer | The Dodd–Frank Wall Street Reform and Consumer Protection Act (Pub.L. 111-203) provides for enhanced regulation of financial institutions and non-bank financial companies, derivatives and asset-backed securities offerings and enhanced oversight of credit rating agencies. The Dodd-Frank Act also created the Consumer Financial Protection Bureau, an agency responsible for administering and enforcing the laws and regulations for consumer financial products and services. In 2015, the CFPB issued a final rule expanding its authority to larger participants in the automobile financing market, including MBFS USA and, as a result, MBFS USA is subject to the supervisory and examination authority of the CFPB to assess compliance with federal consumer financial laws. Compliance with the implementing regulations under the Dodd-Frank Act or the oversight of the SEC or CFPB may impose costs on, create operational constraints for, or place limits on pricing with respect to finance companies such as MBFS USA or its affiliates. No assurance can be given that the Dodd-Frank Act and their implementing regulations, or the imposition of additional regulations including new standards, will not have an adverse impact on the marketability of asset-backed securities such as the notes, the servicing of the leases and leased vehicles allocated to the reference pool, MBFS USA’s securitization program or the regulation or supervision of MBFS USA. The Dodd-Frank Act also creates a liquidation framework under which the FDIC may be appointed as receiver following a “systemic risk determination” by the Secretary of Treasury (in consultation with the President) for the resolution of certain nonbank financial companies and other entities, defined as “covered financial companies”, and commonly referred to as “systemically important entities”, in the event such a company is in default or in danger of default and the resolution of such a company under other applicable law would have serious adverse effects on financial stability in the United States, and also for the resolution of certain of their subsidiaries. With respect to the new liquidation framework for systemically important entities, no assurances can be given that such framework would not apply to the sponsor or its subsidiaries, including the issuer and the depositor, although the expectation embedded in the Dodd-Frank Act is that the framework will be invoked only very rarely. Guidance from the FDIC indicates that such new framework will in certain cases be exercised in a manner consistent with the existing bankruptcy laws, which is the insolvency regime which would otherwise apply to the sponsor, the depositor and the issuer. The provisions of the new framework, however, provide the FDIC with certain powers not possessed by a trustee in bankruptcy under existing bankruptcy laws. Under some applications of these and other provisions of the new framework, payments on the notes could be reduced, delayed or otherwise negatively impacted. |

[Investigations by the U.S. Department of Justice into auto finance companies could have a material adverse effect on your | |

| notes | Certain auto finance companies involved in the origination and securitization of auto loans have recently received subpoenas from the U.S. Department of Justice as part of an industry-wide investigation relating to possible civil proceedings for potential violations of the Financial Institutions Reform, Recovery, and Enforcement Act of 1989. If MBFS USA were to receive a subpoena from the Department of Justice, no assurances could be given that the ultimate outcome of the investigation or any resulting proceeding would not have a material adverse effect on MBFS USA or any of its subsidiaries or affiliates, the ability of MBFS USA to service leases or the ability of MBFS USA to perform its duties under the transaction documents. Additionally, any such outcome could adversely affect the ratings, marketability or liquidity of your notes.] |

The residual value of leased vehicles may be adversely affected by discount pricing incentives, marketing incentive | |

| programs and other factors | Historical residual value loss experience on leased vehicles is partially attributable to new vehicle pricing policies of all manufacturers. Discount pricing incentives or other marketing incentive programs on new vehicles introduced by MBFS USA, its affiliates or its competitors that effectively reduce the prices of new vehicles may have the effect of reducing demand by consumers for pre-owned vehicles. The reduced demand for pre-owned vehicles resulting from discount pricing incentives or other marketing incentive programs may reduce the prices consumers will be willing to pay for pre-owned vehicles, including leased vehicles included in the reference pool at the end of the related leases and thus reduce the residual value of such leased vehicles. In addition, the pricing of pre-owned vehicles is affected by supply and demand for such vehicles, which in turn is affected by consumer tastes, general economic factors and conditions, fuel costs, the introduction and pricing of new vehicle models, legislation relating to emissions and fuel efficiency, possible vehicle recalls and other factors that are beyond the control of the issuer, the depositor or the servicer. Significant increases in the inventory of pre-owned automobiles during periods of economic slowdown or recession may also depress the prices at which off-lease automobiles may be sold or delay the timing of these sales. Additionally, if a lessee fails to maintain appropriate insurance with respect to a leased vehicle, insurance coverage with respect to a damaged leased vehicle may be unavailable or be exhausted and no third-party reimbursement for the damage may be obtained. Although each lease contract and applicable state law require that appropriate insurance with respect to leased vehicles be maintained by the lessees, MBFS USA is not obligated to, and does not, monitor whether the lessees are in fact maintaining such insurance. As a result of any of these factors, the proceeds received by the titling trust upon disposition of leased vehicles may be reduced. If the resulting residual value losses exceed the credit enhancement available for the notes, you may suffer a loss on your investment. |

Vehicle recalls could adversely affect the performance of the | |

| pool assets | Lessees of leased vehicles affected by a vehicle recall may be more likely to be delinquent in, or default on, payments on their leases. Significant increases in the inventory of pre-owned vehicles subject to a recall may also depress the prices at which repossessed vehicles may be sold or delay the timing of those sales. If the default rate on the leases allocated to the reference pool increases and the price at which the related leased vehicles may be sold declines, you may experience losses with respect to your notes. If any of these events materially affect collections on the leases allocated to the reference pool, you may experience delays in payments or losses on your investment. |

Losses on the leased vehicles may be affected disproportionately because of geographic concentration of the | |

| leases | The servicer’s records indicate that, as of the cutoff date, [●]%,[●]%,[●]%,[●]% and [●]% of the aggregate securitization value of the leases and leased vehicles allocated to the reference pool are related to lessees with mailing addresses in [California, Florida, New York, New Jersey and Texas], respectively. No other state accounted for more than 5.00% of the aggregate securitization value as of the cutoff date. If any such states experience adverse economic changes, such as an increase in the unemployment rate or an increase in the rate of inflation, lessees in those states may be unable to make timely payments on their leases which may affect the rate of prepayment and defaults on such leases and the ability to sell or dispose of the related leased vehicles for an amount at least equal to their residual values and you may experience payment delays or losses on your notes. Extreme weather conditions, including wildfires, hurricanes and floods, or other natural disasters could cause substantial business disruptions, economic losses, unemployment and an economic downturn. As a result, the related lessees’ ability to make timely payments could be adversely affected. Particularly if any of these adverse events occurs in a state where there is a concentration of leased vehicles, the issuer’s ability to make payments on the notes could be adversely affected. For a discussion of the breakdown of the leases and leased vehicles by state, see “The Leases – Characteristics of the Leases”. |

The concentration of leased vehicles to particular models could negatively affect the | |

| reference pool assets | The [C, E, GLK/GLC, ML/GLE, S and GL/GLS Class] models represent approximately [●]%,[●]%,[●]%,[●]%,[●]% and [●]%, respectively, of the aggregate securitization value as of the cutoff date of the leases and leased vehicles allocated to the reference pool. No other model accounted for more than 5.00% of the aggregate securitization value as of the cutoff date. Any adverse change in the value of a specific model type would reduce the proceeds received at disposition of a related leased vehicle. As a result, you may incur a loss on your investment. |

Payment priorities and changes in the order of the priority of distributions following an indenture event of default increase risk of loss or delay in payment to certain classes of | |

| notes | Classes of notes that receive principal payments before other classes will be repaid more rapidly than the other classes. In addition, because the principal of each class of notes generally will be paid sequentially, classes of notes that have higher numerical class designations generally are expected to be outstanding longer and therefore will be exposed to the risk of losses on the leases during periods after other classes of notes have been receiving most or all amounts payable on their notes, and after which a disproportionate amount of credit enhancement may have been applied and not replenished. If an event of default under the indenture has occurred and the notes have been accelerated, note principal payments and amounts that would otherwise be payable to the holders of the certificates will be paid first to the class A-1 notes until they have been paid in full, then pro rata to the other classes of notes based upon the principal amount of each such class. As a result, in relation to the class A-1 notes, the yields of the class A-2 notes, the class A-3 notes and the class A-4 notes will be relatively more sensitive to losses on the leases and the related leased vehicles and the timing of such losses. [The class B notes will bear greater risk than the class A notes because no interest will be paid on the class B notes until all interest on the class A notes are paid in full, and no principal will be paid on the class B notes until the principal amount of the class A notes is paid in full.] If available credit enhancement is insufficient to cover the resulting shortfalls, the yield to maturity on your notes may be lower than anticipated and you could suffer a loss. In addition, the notes are subject to risk because payments of principal and interest on the notes on each payment date are subordinated to the servicing fee and the related servicer advance reimbursement amount due to the servicer and certain capped fees, expenses and indemnities due to the owner trustee, the indenture trustee, the collateral agent, the asset representations reviewer and the administrative agent (or, after the occurrence of an event of default and the acceleration of the notes, uncapped fees, expenses and indemnities due to the owner trustee, the indenture trustee, the collateral agent, the asset representations reviewer and the administrative agent). This subordination could result in reduced or delayed payments of principal and interest on the notes. For more information on interest and principal payments, see “Description of the Notes—Payments of Interest” and “—Payments of Principal”. |

Withdrawal or downgrade of the initial ratings of the notes, or the issuance of unsolicited ratings on the notes, will affect the prices for the notes upon resale, and the payment of rating agency fees by the sponsor or the issuer may | |

| present a conflict of interest | The sponsor has hired two rating agencies and will pay them a fee to assign ratings on the notes. A rating is not a recommendation to purchase, hold or sell notes, and it does not comment as to market price or suitability for a particular investor. The ratings of the notes address the assigning rating agency’s assessment of the likelihood of the payment of principal and interest on the notes according to their terms. We cannot assure you that a rating will remain for any given period of time or that a rating agency will not lower, withdraw or qualify its rating if, in its judgment, circumstances in the future so warrant, or that one or more additional rating agencies, not hired by the sponsor or the depositor to rate the notes, may nonetheless provide a rating for the notes that will be lower than any rating assigned by a hired rating agency. In addition, in the event that a rating with respect to any notes is qualified, reduced or withdrawn, no person or entity will be obligated to provide any additional credit enhancement with respect to such notes. A reduction, withdrawal or qualification of a note’s rating would adversely affect its value. |

The sponsor will not hire any other nationally recognized statistical rating organization, or “NRSRO”, to assign ratings on the notes and is not aware that any other NRSRO has assigned ratings on the notes. Under SEC rules, however, information provided to a hired rating agency for the purpose of assigning or monitoring the ratings on the notes is required to be made available to each qualified NRSRO in order to make it possible for such non-hired NRSROs to assign unsolicited ratings on the notes. An unsolicited rating could be assigned at any time, including prior to the closing date, and none of the depositor, the sponsor, the underwriters or any of their respective affiliates will have any obligation to inform you of any unsolicited ratings assigned on or after the date of this prospectus. NRSROs, including the hired rating agencies, have different methodologies, criteria, models and requirements. If any non-hired NRSRO assigns an unsolicited rating on the notes, there can be no assurance that such rating will not be lower than the ratings provided by the hired rating agencies, which could adversely affect the market value of your notes and/or limit your ability to resell your notes. In addition, if the sponsor fails to make available to the non-hired NRSROs any information provided to any hired rating agency for the purpose of assigning or monitoring the ratings on the notes, a hired rating agency could withdraw its ratings on the notes, which could adversely affect the market value of your notes and/or limit your ability to resell your notes. None of the sponsor, the depositor, the owner trustee, the indenture trustee, the collateral agent or any of their respective affiliates will be required to monitor any changes to the ratings on these notes. Potential investors in the notes are urged to make their own evaluation of the creditworthiness of the leases and leased vehicles allocated to the reference pool and the credit enhancement on the notes, and not to rely solely on the ratings on the notes. Additionally, we note that it may be perceived that a rating agency has a conflict of interest where, as is the industry standard and the case with the ratings of the notes, the sponsor or the issuer pays the fee charged by the rating agency for its rating services. | |

[The issuer will issue floating rate notes, but the issuer will not enter into any interest rate swaps and you may suffer losses on your notes if interest rates | |

| rise | The leases allocated to the issuer on the closing date will provide for level monthly payments and the exchange note will bear interest at a fixed rate, while the floating rate notes will bear interest at a floating rate based on LIBOR plus an applicable spread. Interest rates have generally been at historically low levels in recent years and economic or other conditions could cause short term interest rates including LIBOR to rise materially after the issuance of the notes. Even though the issuer will issue floating rate notes, it will not enter into any interest rate swaps or interest rate caps in connection with the issuance of the notes, which could mitigate this interest rate risk. |

| The issuer will make payments on the floating rate notes out of its generally available funds and not from funds that are dedicated solely to the floating rate notes. Therefore, if the floating rate payable by the issuer increases to the point where the amount of interest and principal due on the notes, together with other fees and expenses payable by the issuer, exceeds the amount of collections and other funds available to the issuer to make such payments, the issuer will not have sufficient funds to make payments on the notes, not just the holders of the floating rate notes. If the issuer does not have sufficient funds to make payments on the notes, you would experience delays or reductions in the interest and principal payments on your notes.] | |