As filed with the Securities and Exchange Commission on August 17, 2012

Registration No. 000-54576

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 4

to

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

Pursuant to Section 12(b) or (g) of the Securities Exchange Act of 1934

RICHFIELD OIL & GAS COMPANY

(Exact name of registrant as specified in its charter)

| Nevada | 35-2407100 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) |

15 W. South Temple, Suite 1050

Salt Lake City, Utah 84101

(801) 519-8500

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Copies to:

Reed W. Topham, Esq.

Robbie G. Yates, Esq.

Stoel Rives LLP

201 S. Main Street, Suite 1100

Salt Lake City, Utah 84111

(801) 328-3131

Securities to be registered pursuant to Section 12(b) of the Act: None

Securities to be registered pursuant to Section 12(g) of the Act:

Common Stock, $0.001 par value

(Title of class)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of "large accelerated filer," "accelerated filer" and "smaller reporting company" in Rule 12b-2 of the Exchange Act.

| Large accelerated filer ¨ | Accelerated filer ¨ | Non-accelerated filer ¨ | Smaller reporting company x | |||

| (Do not check if a smaller reporting company) |

Table of Contents

| Page | |

| Explanatory Note | 1 |

| Forward-Looking Statements | 1 |

| Glossary of Terms | 3 |

| Item 1. Business | 6 |

| Item 1A. Risk Factors | 25 |

| Item 2. Financial Information | 37 |

| Item 3. Properties | 48 |

| Item 4. Security Ownership of Certain Beneficial Owners and Management | 48 |

| Item 5. Directors and Executive Officers | 49 |

| Item 6. Executive Compensation | 51 |

| Item 7. Certain Relationships and Related Transactions, and Director Independence | 56 |

| Item 8. Legal Proceedings | 62 |

| Item 9. Market Price of and Dividends on the Registrant’s Common Equity and Related Stockholder Matters | 63 |

| Item 10. Recent Sales of Unregistered Securities | 63 |

| Item 11. Description of Registrant’s Securities to be Registered | 79 |

| Item 12. Indemnification of Directors and Officers | 80 |

| Item 13. Financial Statements and Supplementary Data | 82 |

| Item 14. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure | 82 |

| Item 15. Financial Statements and Exhibits | 83 |

| Index to Financial Statements | F-1 |

EXPLANATORY NOTE

We are filing this Amendment No. 4 to our General Form for Registration of Securities on Form 10 to register our common stock, par value $0.001 per share (the “Common Stock”), pursuant to Section 12(g) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

This registration statement became effective automatically on February 27, 2012, 60 days from the date of the original filing, pursuant to Section 12(g)(1) of the Exchange Act. As of the effective date we are subject to the requirements of Regulation 13(a) under the Exchange Act and are required to file annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K, and we are required to comply with all other obligations of the Exchange Act applicable to issuers filing registration statements pursuant to Section 12(g) of the Exchange Act.

Unless otherwise noted, references in this registration statement to the “Registrant,” the “Company,” “we,” “our” or “us” means Richfield Oil & Gas Company. Our principal place of business is located at 15 W. South Temple, Suite 1050, Salt Lake City, Utah 84101. Our telephone number is (801) 519-8500.

FORWARD-LOOKING STATEMENTS

This registration statement may contain forward-looking statements. These statements include, but are not limited to, any statement that may predict, forecast, indicate or imply future results, performance, achievements or events. These forward-looking statements address matters that involve risks and uncertainties. Accordingly, there are or will be important factors that could cause our actual results to differ materially from those indicated in these statements. We believe that these factors include but are not limited to the following:

| · | questions on the part of our auditors regarding our ability to continue as a going concern; |

| · | our limited operating history and negative operating cash flows; |

| · | our substantial capital requirements that, if not met, may hinder our growth and operations; |

| · | loss of our directors or key management and technical personnel or our ability to attract and retain experienced technical personnel; |

| · | our ability to acquire or develop additional reserves; |

| · | our dependence on drilling partners for successful development and exploitation of certain oil properties in which we hold an interest; |

| · | lack of insurance against all of the operating hazards to which our business is exposed; |

| · | title claims to which our properties may be subject; |

| · | our exposure to third-party credit risk and defaults by third parties; |

| · | our issuance of additional indebtedness in the future; |

| · | our ability to realize anticipated benefits of acquisitions and dispositions; |

| · | our ability to adequately manage growth; |

| · | unforeseen economic events and the state of the global economy; |

| · | concentration of our producing properties in two major geographic areas; |

| · | uncertainties involved in drilling for and producing oil and gas; |

| · | our election, as an emerging growth company, to delay the adoption of new or revised accounting standards; | |

| · | market conditions or operational impediments that may hinder our access to oil and gas markets or delay production; |

| · | the effect of the market price of oil and gas on our profitability and cash flow; |

| · | shortages of rigs, equipment, supplies and personnel and any resulting delays in our production; |

| · | our ability to manage our costs of production, as estimated in the Pinnacle Reserve Report; | |

| · | uncertainty relating to estimates of our reserves; |

| · | complex laws and regulations, including environmental regulations, that can materially increase the cost, manner and feasibility of doing business; |

| · | intense competition in the oil and gas industry; |

| · | delays in business operations that could reduce cash flows and subject us to credit risk; |

| 1 |

| · | recently proposed legislation relating to changes in income taxation of independent producers; |

| · | seasonal weather conditions and other factors affecting our drilling operations; |

| · | proposals to increase U.S. federal income taxation of independent producers; |

| · | proposed legislation related to climate changes and global warming; |

| · | loss of leases or increases in lease renewal costs due to failure to drill acreage prior to lease expiration; and |

| · | alternatives to and changing demand for petroleum products. |

You can often identify these and other forward-looking statements by the use of words such as “may,” “will,” “could,” “would,” “should,” “expects,” “plans,” “anticipates,” “estimates,” “intends,” “potential,” “projected,” “continue,” or the negative of such terms, or other comparable terminology. Forward-looking statements also include the assumptions underlying or relating to any of the foregoing statements.

These statements are based on current expectations and assumptions regarding future events and business performance and involve known and unknown risks, uncertainties and other factors that may cause industry trends or our actual results, level of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these statements.

The foregoing factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this registration statement. For a more detailed discussion of the principal factors that could cause actual results to be materially different, you should read our risk factors included below under “Item 1A. Risk Factors.”

Although we believe that expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. We will assume no obligation to update any of the forward-looking statements after the effective date of this registration statement to conform these statements to actual results or changes in our expectations, except as required by law. You should not place undue reliance on these forward-looking statements, which apply only as of the effective date of this registration statement.

Emerging Growth Company Status

We qualify as an “emerging growth company,” as defined in Section 2(a) of the Securities Act of 1933 (the “Securities Act”), as modified by the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As such, we are permitted to rely on exemptions from various reporting requirements including, but not limited to, the requirement to comply with the auditor attestation requirements of Section 404(b) of the Sarbanes-Oxley Act of 2002, and the requirement to submit certain executive compensation matters to shareholder advisory votes such as “say on pay” and “say on frequency.”

In addition, Section 107 of the JOBS Act also provides that an emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for complying with new or revised accounting standards. In other words, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. We have elected to take advantage of the benefits of this extended transition period. Our financial statements may therefore not be comparable to those of companies that comply with such new or revised accounting standards.

We will remain an emerging growth company up to the fifth anniversary of our first registered sale of common equity securities, or until the earliest of (a) the last day of the first fiscal year in which our annual gross revenues exceed $1 billion, (b) the date that we become a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act, which would occur if the market value of our common stock held by non-affiliates exceeds $700 million as of the last business day of our most recently completed second fiscal quarter, or (c) the date on which we have issued more than $1 billion in non-convertible debt during the preceding three-year period.

| 2 |

GLOSSARY OF TERMS

The following definitions shall apply to the technical terms used in this report.

“Anticlinal structure or fold” are geological formations where layers of rock have been folded into an arch shape, which can include favorable formations for oil and gas drilling, such as doubly plunging or faulted anticlines, culminations, and structural domes.

“Bbl” means barrel or barrels.

“BLS” means barrel or barrels.

“BOE” means barrels of crude oil equivalent.

“Boepd” means barrels of crude oil equivalent per day.

“Bopd” means barrels of crude oil per day.

“Condensates” are hydrocarbons that exist in a gaseous state within the native reservoir environment, but condense to a liquid state due to pressure and/or temperature changes caused during the drilling, completion, or production stages of well development.

“Development well” is a well drilled within the proved area of an oil or gas reservoir to the depth of a stratigraphic horizon known to be productive.

“Dry hole” is an exploratory or development well found to be incapable of producing either crude oil or natural gas in sufficient quantities to justify completion as a crude oil or natural gas well.

“Farm-in” is a contractual relationship where a company acquires an interest in an operation owned by another operator.

“Gross acres” refer to the number of acres in which we own a working interest.

“Gross well” is a well in which we own a working interest.

“MBbls ” means thousand barrels.

“MCF ” means thousand cubic feet of gas.

“MMBbls ” means million barrels.

“MMcf” means million cubic feet of gas.

“Mud-log report” is a report which sets forth data regarding geological structure and hydrocarbon presence maintained at the time a well is drilled.

“Net acres” represent the Company���s percentage ownership of gross acreage. Net acres are deemed to exist when the sum of fractional ownership working interests in gross acres equals one (e.g., a 10% working interest in a lease covering 640 gross acres is equivalent to 64 net acres).

“Net well” represents the Company’s percentage ownership of a gross well. A net well is deemed to exist when the sum of fractional ownership working interests in gross wells equals one.

| 3 |

“Probable reserves” are those additional reserves that are less certain to be recovered than proved reserves but which, together with proved reserves, are as likely as not to be recovered.

“Productive well” is an exploratory or a development well that is not a dry hole.

“Proved developed reserves (PDPs)” are proved reserves that can be expected to be recovered:

| i. | Through existing wells with existing equipment and operating methods or in which the cost of the required equipment is relatively minor compared with the cost of a new well; or |

| ii. | Through installed extraction equipment and infrastructure operational at the time of the reserves estimate if the extraction is by means not involving a well. |

“Proved reserves” or “reserves” are the estimated quantities of crude oil, natural gas, and natural gas liquids which geological and engineering data demonstrate with reasonable certainty to be recoverable in future years from known reservoirs under existing economic and operating conditions, i.e., prices and costs as of the date the estimate is made. Prices include consideration of changes in existing prices provided only by contractual arrangements, but not on escalations based upon future conditions.

| i. | Reservoirs are considered proved if economic producibility is supported by either actual production or conclusive formation test. The area of a reservoir considered proved includes (A) that portion delineated by drilling and defined by gas-oil and/or oil-water contacts, if any, and (B) the immediately adjoining portions not yet drilled, but which can be reasonably judged as economically productive on the basis of available geological and engineering data. In the absence of information on fluid contacts, the lowest known structural occurrence of hydrocarbons controls the lower proved limit of the reservoir. |

| ii. | Reserves which can be produced economically through application of improved recovery techniques (such as fluid injection) are included in the proved classification when successful testing by a pilot project, or the operation of an installed program in the reservoir, provides support for the engineering analysis on which the project or program was based. |

| iii. | Estimates of proved reserves do not include the following: (A) oil that may become available from known reservoirs but is classified separately as indicated additional reserves; (B) crude oil, natural gas, and natural gas liquids, the recovery of which is subject to reasonable doubt because of uncertainty as to geology, reservoir characteristics, or economic factors; (C) crude oil, natural gas, and natural gas liquids, that may occur in undrilled prospects; and (D) crude oil, natural gas, and natural gas liquids, that may be recovered from oil shales, coal, gilsonite and other such sources. |

“Proved undeveloped reserves (PUDs)” are proved reserves that are expected to be recovered from new wells on undrilled acreage, or from existing wells where a relatively major expenditure is required for recompletion.

Reserves on undrilled acreage shall be limited to those directly offsetting development spacing areas that are reasonably certain of production when drilled, unless evidence using reliable technology exists that establishes reasonable certainty of economic producibility at greater distances.

Undrilled locations can be classified as having undeveloped reserves only if a development plan has been adopted indicating that they are scheduled to be drilled within five years, unless the specific circumstances justify a longer time.

Under no circumstances shall estimates for proved undeveloped reserves be attributable to any acreage for which an application of fluid injection or other improved recovery technique is contemplated, unless such techniques have been proved effective by actual projects in the same reservoir or an analogous reservoir, or by other evidence using reliable technology establishing reasonable certainty.

| 4 |

“Seismic imaging” is a tool that bounces sound waves off underground rock structures to reveal possible oil- and gas-bearing formations. Seismologists use ultrasensitive devices called geophones to record the sound waves' echoes within the earth. By studying the echoes, petroleum geologists seek to calculate the depth and structures of buried geologic formations. This analysis may help them identify oil- and gas-bearing reservoirs hidden beneath the earth's surface.

“Sidetrack” is a process using a whipstock, turbodrill, or other mud motor to drill around broken drill pipe or casing that has become lodged permanently in the hole, or is used to bypass other formation damage.

“SWD” means saltwater disposal well.

| 5 |

ITEM 1. BUSINESS

Our History

Our Predecessor

Our predecessor company, Hewitt Petroleum, Inc., a Delaware corporation, (“HPI”) was incorporated on May 18, 2008. On January 1, 2009, HPI entered into a Purchase and Sale Agreement with Hewitt Energy Group, LLC (“HEGLLC”) for the acquisition of certain subsidiaries, other assets and liabilities including Hewitt Energy Group, Inc., a Texas corporation (“HEGINC”), and its subsidiary Hewitt Operating, Inc., a Utah corporation (“HOPIN”), certain oil and gas leases, well equipment, and certain liabilities (the “Subsidiary Acquisition”). At the time of the Subsidiary Acquisition, HEGLLC was owned and controlled by Douglas C. Hewitt, Sr., our Executive Chairman, President and Chief Executive Officer.

On March 4, 2011, HPI entered into a Stock Exchange Agreement with Freedom Oil & Gas, Inc., a Nevada corporation (“Freedom”), which called for the exchange of stock in HPI for all of the outstanding stock of Freedom (the “Freedom Acquisition”). The Freedom Acquisition was approved by HPI’s Board of Directors and a majority of the stockholders of Freedom as required by Nevada law, and the exchange took place effective March 31, 2011. As a result of the Freedom Acquisition, Freedom became a wholly owned subsidiary of HPI. The Freedom Acquisition allowed for the consolidation of working interests held by HPI and Freedom in several Utah exploration projects, as well as the acquisition by HPI of the remaining assets and liabilities of Freedom.

Neither the Company nor any of its predecessors, subsidiaries or affiliates has been affiliated with or in any way related to Richfield Oil Corporation, an oil company based in California that was merged out of existence in 1966, or its successor, Atlantic Richfield Company.

Transactions Relating to Our Formation

Richfield Oil & Gas Company (the “Company”) was incorporated in Nevada on April 8, 2011. Contemporaneously with the incorporation, we merged with our predecessor company, HPI (the “HPI Merger”). In connection with the HPI Merger, HPI was merged out of existence and the Company assumed all of the assets and liabilities of HPI. The HPI Merger was approved by our Board of Directors and a majority of the stockholders of HPI as required by Delaware law.

Following the HPI Merger, Freedom was a wholly-owned subsidiary of the Company until June 20, 2011. On June 20, 2011, Freedom was merged with and into our Company (the “Freedom Merger”). In connection with the Freedom Merger, Freedom was merged out of existence and the Company assumed all of the assets and liabilities of Freedom. We refer to the Subsidiary Acquisition, the Freedom Acquisition, the HPI Merger and the Freedom Merger as the “Consolidation.”

Our Business Strategy

We are an oil and gas exploration and production company with ten projects in Utah, Kansas, Oklahoma and Wyoming. We are currently producing oil from four projects in Kansas. We are currently completing one well in Juab County, Utah which we refer to as the “Liberty #1 Well,” and is in the completion stage of development. The focus of our business is acquiring, retrofitting, and operating or selling oil and gas production. We have two strategic directions:

| a) | We used our research technology to identify properties in Kansas that were initially developed between the 1920s and 1950s. We identified significant oil and gas reserves from these early exploration properties, which were previously underdeveloped due to inefficient and antiquated exploration and production methods and low commodity prices. In most cases these wells were developed and left fallow by major oil and gas companies. Using current technology and methodologies, we successfully developed both production and proved reserves within these fields and others, and we intend to continue to develop our Kansas properties, where we are participating in approximately 3,000 acres. |

| 6 |

| b) | We have conducted a limited amount of exploration for oil and gas reserves in the Central Utah Overthrust region, where we are participating in over 30,000 acres. Of the 30,000 acres, we are currently the operator of approximately 10,000 acres. We lease or own 100% of the mineral rights on these properties. We intend to conduct drilling operations on some of our Utah properties, and to conduct additional exploration activities. |

We use a systematic approach for the acquisition of leases and development of drilling programs. Our approach focuses on three areas of development planning:

| a) | Activities involving the identification, acquisition and development of leases of property in which oil or gas is known to exist. This represents approximately 20% of our development planning. |

| b) | Activities involving low or moderate exploration and development risk. These include leases of property where oil and gas has been produced in the past but there are no existing wells. This represents approximately 20% of our development planning. |

| c) | Activities involving the acquisition of properties where it is reasonably believed that potential hydrocarbon values exist based on analysis involving geochemical, radiometric, gravitational and supportable seismic data. This may include projects that have never been drilled or tested for oil and gas in the past. This represents approximately 60% of our development planning. |

We have developed a database to evaluate every well on record in our Kansas areas of operation. The database contains extensive well records, including information on historic production, seismic data, geological data, well depth, well logs and drilling records, and where available, handwritten driller notes concerning rock formation depths and other relevant information. This system has been developed internally from data obtained from appropriate state agencies and private organizations. The database enables us to identify potential bypassed hydrocarbons throughout the state of Kansas.

Through statistical modeling and data evaluation, we believe greater oil and gas reserves exist and can be found, measured and produced in areas where initial reserves were previously found but abandoned prior to full development. We believe that with our current technologies and systems, acquiring and developing older fields mitigates exploration risk and is a safe and predictable method of managing our business.

Properties

We maintain our headquarters at 15 West South Temple, Suite 1050, Salt Lake City, Utah 84101 and have temporary operational facilities in Russell County, Kansas and Juab County, Utah. The Kansas facilities include a storage yard for equipment and the Utah facilities include a trailer located on the current Liberty #1 Well site in Juab County, Utah.

The Company has been involved in leasing, exploring and drilling activities in Kansas, Oklahoma, Utah and Wyoming since its formation. The Company is participating in over 33,000 acres of leasehold interests, and has been involved in conducting seismic surveys, and numerous drilling projects in these states. As of August 16, 2012, we have 13 producing wells; 22 shut-in wells; and one well we are currently in the process of completing, the Liberty #1 Well. In addition, we operate seven saltwater disposal wells. As set forth in our Reserves and Engineering Evaluation, dated January 18, 2012, and effective as of January 1, 2012 and as amended from time to time and most recently on August 13, 2012 (the “Pinnacle Reserve Report”), prepared by Pinnacle Energy Services L.L.C. (“Pinnacle”), we had 8 producing wells and 2 non-producing wells as of January 1, 2012. See Third Amendment to Report of Pinnacle Energy Services, L.L.C., dated August 13, 2012, filed herewith as Exhibit 99.5.

| 7 |

Kansas/Oklahoma

In 2009, we began development of our leases in Kansas and Oklahoma by selling working interests to a foreign publicly held company to provide development funding. Over the following two years we purchased and sold working interests in our Kansas and Oklahoma properties. As of August 16, 2012, we have three Kansas projects, the Gorham Project, the South Haven Project and the Trapp Project, in which we own a 100% working interest and which contain 30 total wells, including eight producing wells, 18 shut-in wells, and four saltwater disposal wells. We have two other Kansas projects, the Perth Project, in which we own a 85% working interest and which contains four total wells, including two producing wells, one shut-in well, and one saltwater disposal well, and the Koelsch Project, in which we own a 73.50% working interest, with the exception of the Prescott Lease in which we own a 52.50% working interest and the Koelsch #25-1 Well in which we own a 71.50% working interest. The Koelsch Project contains five total wells including three producing wells; one shut-in well and one saltwater disposal well. We have one project in Oklahoma, the Bull Project, in which we own a 95% working interest and which contains a total of two wells, including one shut-in well and one saltwater disposal well. Our total acreage position in Kansas and Oklahoma is 2,946 gross acres with respect to which we lease 100% of mineral rights.

Utah/Wyoming

In Utah and Wyoming, we have four projects—the Liberty Project, the Fountain Green Project, the Independence Project and the Spring Valley Project. We are the operator of all the projects, except the Independence Project, through our subsidiary HOPIN. The Liberty Project incorporates approximately 1,184 acres, in which we own a 58% working interest after payout. We began drilling the Liberty #1 Well in April 2010, which is currently in the completion stage of development. We own a 28.40% working interest before payout (return of capital) and a 25.00% working interest after payout in the Liberty #1 Well. The Fountain Green Project incorporates approximately 9,405 acres, in which we own a 75.50% working interest in the deep zones and a 37.75% working interest in the shallow zones. The Independence Project incorporates approximately 20,000 acres, in which we own a 5% working interest and which contains one shut-in well we refer to as the “Moroni #1-AXZH Well”. We have one project in Wyoming, the Spring Valley Project, located in Fremont County. We own 100% of the mineral rights on a 160 acre parcel of land.

Business Opportunity

Our development plan is designed to generate production increases in the initial phase of the development of both our Kansas and Utah projects. We will continue to develop our Kansas properties where the reserves are proven and drilling costs are modest. For example, all drilling objectives in Kansas are shallow in nature, with depths ranging from 3,100 to 4,300 feet, and are supported by geological and engineering studies. In contrast, the Utah projects entail greater exploration risk. The Fountain Green Project will require drilling down to depths in the 6,000 to 15,000 feet range. The Liberty Project will require drilling in the 3,000 to 12,000 feet range. The Independence Project will require drilling in the 8,000 to 15,000 feet range. We believe that the Utah wells, while expensive and risky, have the greatest potential return of any projects in our inventory. With the information gained from drilling and completing the Liberty #1 Well and the shut-in Moroni #1-AXZH Well, we will be able to better define our drilling objectives within our Utah projects.

Project Methodology

Each of the Kansas and Oklahoma projects acquired, contain old wells that previously produced only a few barrels of oil a day or were shut-in. When these wells were originally developed, they had initial production rates of 200 to over 4,000 barrels of oil per day—an indication of superior reservoir permeability. Reservoirs with these characteristics are typically good candidates for hydrostatic reduction/hydrocarbon expansion methodologies, which are often used to obtain higher production rates. These methodologies aim to increase oil production by reducing hydrostatic pressure. Hydrostatic pressure is reduced by pumping fluid out of a well at very high rates. The decrease in hydrostatic pressure allows oil that was trapped by water to enter the well in greater proportions. We refer to the proportion of oil to water contained in extracted fluid as the “oil cut rate.” With continued production, the oil cut rate increases as the amount of water contained in extracted fluid decreases. We plan to equip many of our Kansas wells with submersible pumps and saltwater disposal systems. These pumps are expected to allow for a high rate of fluid extraction, and therefore higher oil production. The submersible pumps should also allow the water pressure in the reservoir to be reduced at a significantly increased rate than is possible using traditional pumps.

| 8 |

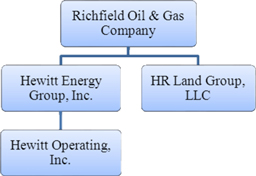

Corporate Structure

The following chart shows the current corporate structure of the Company and its subsidiaries.

Richfield Oil & Gas Company, a Nevada corporation, is the successor corporation to Hewitt Petroleum, Inc., a Delaware corporation. Hewitt Energy Group, Inc., a Texas corporation was formed in 1989 and is licensed and bonded as a Kansas operator. HOPIN was formed in 2005 and is licensed and bonded as a Utah operator. Both Hewitt Energy Group, Inc. and its subsidiary HOPIN were acquired by Hewitt Petroleum, Inc. from Hewitt Energy Group, LLC effective on January 1, 2009. On July 27, 2012, the Company formed a new 100% owned subsidiary, HR Land Group, LLC, a Utah limited liability company, (“HR Land”). HR Land’s purpose is to acquire oil and gas leases in Utah and to operate as a land bank.

General Development of the Business

We have raised capital through private placements of equity and debt financings. During the six months ended June 30, 2012, we raised $2,011,865 in cash from the private placements of common stock and warrants and $100,000 in cash from debt financing. During the twelve-month periods ended December 31, 2011, 2010 and 2009, we raised $1,108,744, $471,221 and $556,000 in cash from the private placements of common stock and $739,984, $17,500 and $355,500 in cash from debt financings, respectively. In 2008, we did not raise any cash either from the private placement of common stock or from debt financing, but we raised $424,000 from the private placements of preferred stock.

We acquired oil and gas properties, including wells and related equipment, for consideration totaling $1,901,173 during the six months ended June 30, 2012. During the twelve-month periods ended December 31, 2011, 2010, 2009 and 2008, we acquired oil and gas properties, including wells and related equipment, for consideration totaling $9,064,387, $4,134,916, $5,331,579 and $585,940, respectively. Included in these numbers are two significant acquisitions. On January 1, 2009, we acquired oil and gas properties, including wells and related equipment, from HEGLLC valued at $2,976,077 in exchange for common stock and assumption of debt. On March 31, 2011, we acquired additional oil and gas properties from Freedom valued at $6,904,067 in exchange for common stock and assumption of debt. See “Item 10. Recent Sales of Unregistered Securities” for additional information relating to these offerings.

We have eight full-time employees and four consultants providing services for the Company, and we expect to increase the number of our employees in 2012 as field operations expand. Our technical staff focuses on the development and exploration of oil drilling projects, and evaluating the probability of encountering economically recoverable hydrocarbons.

| 9 |

We employ integrated analysis including geology, geophysics and reservoir engineering to determine the viability of a drilling project. We prefer to drill in areas where there are multiple zones potentially containing hydrocarbons rather than a single target, which we refer to as “stacked pay.” Although we cannot be certain whether any of the zones contain hydrocarbons, the stacked pay approach reduces the risk of a dry hole. Additionally, we look for projects with access to existing infrastructure to transport and process the products produced. Once we have conducted a full review of these factors and confirmed the viability of a project, we proceed with acquiring rights to the lands and resources. These lands may be acquired through direct acquisition of existing oil and gas production, leasehold acquisitions or farm-ins.

Projects

We have initiated the development of four oil-producing projects. Our development plans may be delayed and are dependent on certain conditions, including the receipt of necessary permits, the ability to obtain adequate financing and weather conditions. Uncertainties associated with these factors could result in unexpected delays. In addition, the feasibility of a number of the projects described below is still subject to further geological testing and/or drilling to determine whether commercial quantities of hydrocarbons are present.

In addition to the projects currently under development, we intend to initiate the development of additional projects from time to time. However, the number of projects we initiate each year will depend on a number of factors, including the availability of adequate financing, the availability of mineral leases, the demand for oil and gas, the number of projects we have under development, and our available resources to devote to our project development efforts.

The current status of each of our projects is described below:

Kansas/Oklahoma

We hold rights with respect to five projects in Kansas and one project in Oklahoma. These projects are described below:

Bull Project

The Bull Project is located in Kay County, Oklahoma, an area where oil and gas has been produced since the 1920s. The Bull Project consists of 40 acres, situated between two fields that have each produced more than 25 million barrels of oil according to data maintained by the Oklahoma Corporation Commission. Several different formations on this 40-acre project have produced oil in the past and are still capable of producing today. The Bull Project contains one shut-in well and one saltwater disposal well. We own a 95% working interest in the Bull Project.

Based upon recent engineering evaluations, we have determined that the Bull #2-16 Wilcox reservoirs have good probable reserves.

Perth Project

The Perth Project is located in Sumner County, Kansas. The Perth Project was discovered in 1945, and has produced a total of 1.84 million barrels of oil from the Wilcox Formation based on information maintained by the Kansas Corporation Commission (the “KCC”). The field was mostly abandoned in the 1980s. Our research indicates that this field has high water content that is compatible with our production methodology and has the potential of producing a significant amount of additional oil. There are also other zones in this field, which have not been fully tested, that we believe could contain additional reserves. These zones include Lansing/Kansas City, Mississippi, and Arbuckle.

| 10 |

We have drilled and completed two production wells in the Wilcox Formation and equipped the wells with submersible pumps. We have also drilled a high-capacity saltwater disposal well, in the lower portions of the Arbuckle zone, to facilitate the production of the Wilcox Formation. We own a 85% working interest in the Perth Project, which incorporates 480 acres. For our next phase of operations, we intend to convert the saltwater disposal well into a new production well, and reconfigure the AJ Dowis #1 Well into a saltwater disposal well, The AJ Dowis #1 Well was originally drilled in 1945, and is currently shut-in.

South Haven Project

The South Haven Project is located in Sumner County, Kansas. The South Haven Field was discovered in 1954 and produced over 600,000 barrels of oil through 1977, when the field was abandoned, according to data maintained by the KCC. All of the oil production came from the Wilcox Formation. Our research indicates that this field has high water content compatible with our production methodology. We believe that the South Haven Project has the capability of producing substantially more oil than has been produced in the past. There has been evidence of petrochemicals present during testing of the project. However we have not conducted any operations in the Layton, Cleveland, or Mississippi Chat Formations. We own a 100% working interest in the South Haven Project, which incorporates 406 acres. The project currently contains one shut-in well, and our drilling plans call for drilling four new production wells and a saltwater disposal well.

Koelsch Project

The Koelsch Project consists of the Koelsch Leases and the Prescott Lease, which are located in Stafford County, Kansas. The Koelsch Leases consists of 560 acres of which we own a 73.50% working interest, with the exception of the Koelsch #25-1 Well of which we own 71.50% working interest. The Prescott Lease consists of 80 acres of which we own a 52.50% working interest. This field was discovered in 1952 and has produced over 500,000 barrels of oil with some reported gas production, according to data maintained by the KCC. The Arbuckle reservoir in this field has been largely abandoned since 1957. We believe that the Koelsch Project has the capability of producing substantially more oil than has been produced in the past. In January 2012, we drilled the Koelsch #25-1 Well which went into production in April 2012. In June 2012, we put the Prescott #25-6 Well into production and in August 2012, we put the Prescott #2 Well into production. Our plans relating to the Koelsch Project include: i) drilling two new production wells in the Arbuckle reservoir zone; ii) reconfiguring one existing shut-in well in the Arbuckle reservoir zone; iii) drilling two new production wells in the Mississippi zone; iv) reconfiguring an existing saltwater disposal well; and v) drilling an additional saltwater disposal well.

Additionally, we have reviewed mud-log reports that indicate the presence of at least 22 shallow gas zones in the Koelsch Project, which exhibit low British Thermal Unit (“BTU”) content gas. The low BTU gas content of these wells is due in large part to significant Helium deposits together with nitrogen. Helium by itself is a valuable gas and if we desire to produce gas, the wells will require the installation of portable separation plants to extract Helium and waste nitrogen from the natural gas. This process is expected to increase the BTU content of the natural gas and create additional value from the sale of Helium.

Gorham Project

The Gorham Project is located in Russell County, Kansas. We currently have a 100% working interest in a total of 1,218 acres. The project was discovered in 1926 and has produced approximately 98,000,000 barrels of oil for former producers, 67% of which has come from the Upper Arbuckle and Reagan Reservoirs, and 25% of which has come from the Lansing/Kansas City formation, according to data maintained by the KCC. Our research indicates that this field has high water content compatible with our production methods and has the potential to produce more oil than has previously been produced. Other formations with potential for future production include the Lansing/Kansas City, Tarkio, Topeka, Lower Arbuckle, Gorham Sand and the weathered granite basement rocks. The field currently contains seven producing wells. We intend to drill seven new wells, reconfigure the 15 existing shut-in wells in the Arbuckle Reservoir, reconfigure one of the three existing saltwater disposal wells, and drill two new saltwater disposal wells. Extended plans call for the drilling of as many as 33 new Arbuckle/Reagan or Gorham Sand wells, and as many as seven new saltwater disposal wells.

| 11 |

Trapp Project

The Trapp Project is located in Russell and Barton Counties in Kansas. The Trapp Project is the largest producing oil field in Kansas and has produced approximately 299,000,000 barrels of oil with very little reported gas production for previous producers, according to data maintained by the KCC. This oil has been obtained almost exclusively from the upper two to 15 feet of the Arbuckle formation. Our research indicates that this field has high water content which is compatible with our production methodology. As a result of our water extraction capabilities, we have the potential to produce additional oil and add reserves relating to the Trapp Project. We believe that substantially more productive area exists within the Arbuckle zone, previously categorized as PUD.

The Hoffman lease is located in a portion of the Trapp Project. We own a 100% working interest in the Hoffman lease. This project consists of 160 acres with respect to which we lease 100% of the mineral rights. The Hoffman lease contains four wells, including one producing well, two shut-in wells, and one saltwater disposal well. We plan to drill two new wells on the Hoffman lease.

Utah/Wyoming

Fountain Green Project – Central Utah Overthrust

The Fountain Green Project is currently owned by Hewitt Utah Overthrust Partners (“HUOP”). Ownership in the Fountain Green Project has been split stratigraphically into two groups, deep rights and shallow rights. The working interest owners of the Fountain Green Project have defined deep rights as all stratigraphic intervals located below the Jurassic Twin Creek Formation, including the Jurassic Twin Creek Formation, and have defined shallow rights as all stratigraphic intervals located above, but not including, the Jurassic Twin Creek Formation. With respect to the Fountain Green Project, we currently own a 75.50% working interest in the deep rights, and a 37.75% working interest in the shallow rights for each well, with the exception of the first well we drill on the project. We will own a 34.75% working interest in the shallow rights of the first well in the Fountain Green Project.

The Fountain Green Project consists of 9,405 acres along the Central Utah Overthrust in Sanpete County, Utah, with respect to which we lease 100% of the mineral rights. The Fountain Green Project has attractive oil and gas potential relating to multiple large subsurface anticlinal structures near Fountain Green, Utah indicated by surface geology, gravity data, geochemical evidence and seismic surveys. We believe this data suggests structural closure over several square miles with a high possibility of the presence of oil and gas under the acres leased by HUOP. This evidence is bolstered by discoveries southwest of Fountain Green, Utah and traces of oil in wells surrounding the project. The main productive zones of the Fountain Green Project are the Twin Creek and Navajo zones which are each repeated as three separate structures throughout the project, at approximate depths of 6,000, 9,000, and 12,000 feet, in separate locations on acres leased by us.

There are also shallow targets within the anticlinal fold on the eastern edge of Fountain Green Project’s leases at depths of 4,000 to 10,000 feet range. We believe the Entrada Sandstone and the Cretaceous zones of the Emery, Ferron, Tununk and Dakota formations could hold reserves. We have identified several drilling locations where these zones could be tested simultaneously by drilling one well. These zones are accessible through conventional drilling techniques.

There are no wells currently on the Fountain Green Project. We plan to drill wells so that three overlapping Navajo layers in three different structures can be tested in one well, all within project boundaries. Our long-term development plans for the Fountain Green Project include drilling on 80-acre spacing in multiple reservoirs.

Liberty Project – Central Utah Overthrust

The Liberty Project is owned by multiple parties. We own a 28.40% working interest before payout (return of capital) and a 25% working interest after payout in the Liberty #1 Well, and a 58% working interest after payout in the remaining Liberty Project acreage. The Liberty #1 Well is currently in the completion stage of development.

| 12 |

The Liberty Project incorporates 1,184 acres in which we lease, or own, 100% of the mineral rights. The Liberty Project is on the Paxton Thrust in the northernmost part of the Central Utah Overthrust in Juab County, Utah. We drilled the Liberty #1 Well in 2010, and as a result, we have discovered about 1,700 feet of hydrocarbon charged zone in the Twin Creek Limestone and the Navajo Sandstone, including oil, gas and condensates. These formations are naturally fractured, resulting in excellent permeability and enhanced secondary porosity. Petrographic analysis confirms the presence of gas and oil throughout the hydrocarbon charged zone, as well as 15% to 20% primary porosity in the Navajo Sandstone. The oil is similar to that of the Covenant Field and has been classified as coming from a Mississippian-aged source rock.

While the Liberty #1 Well was spud in April 2010, it remains in the completion stage of development. The initial drilling of the well resulted in formation damage. We have made four attempts at remediating this damage, but these attempts have so far been unsuccessful. Recently, we have evaluated our geological samples and our test results to determine optimal completion methods. We are planning to drill a sidetrack as a potential method of completing the Liberty #1 Well. After consultation and third-party analysis with industry experts, we believe this last phase of drilling in the Liberty #1 Well will prevent formation damage that had occurred previously.

Independence Project – Central Utah Overthrust

The Independence Project lies directly east of the Gunnison Thrust of the Central Utah Overthrust belt, in Sanpete County, Utah. Prior to June 28, 2012, we owned a 49.50% working interest in the Moroni #1-AXZH Well, which is presently shut-in, and the surrounding 320 acre leasehold and a 20% working interest in approximately 4,680 leased acres surrounding the well. On June 28, 2012, the Company entered into an agreement (the “Skyline Oil Agreement”) with Skyline Oil, LLC (“Skyline Oil”), whereby the Company gave Skyline Oil (i) all of its interest in the Chad Wood Lease, located in Central Utah; (ii) a 44.5% working interest in the Moroni #1-AXZH Well plus 320 surrounding acres; and (iii) a 15% working interest in 4,680 acres of the Independence Project, and in exchange, Skyline Oil gave the Company (i) $1.6 million cash; (ii) 2,000,000 of the Company’s common stock valued at $500,000 or $0.25 per share; and (iii) a 5% working interest in an additional 15,000 acres in a new Independence Project. Following this transaction, the Company now owns a 5% working interest in 19,680 acres in the new Independence Project and a 5% working interest in the Moroni #1-AXZH Well plus 320 surrounding acres.

In 1976, Hanson Oil Co., Inc. and True Oil, LLC drilled the Moroni #1-AXZH Well to a total depth of 21,260 feet looking for a Mississippian zone. During the drilling process, mud circulation was lost in the Tununk Shale at 11,551 feet. It took four months to drill past the Tununk Shale zone and install steel casing in the well. The well was later plugged. While lost circulation is a problem when drilling, it is also an indication that the reservoir has good porosity and permeability. During the four months of drilling in the Tununk Shale, oil flowed to the surface, which is an indication that a significant amount of hydrocarbons are likely present.

In 1996, Cimarron Energy, Inc. re-entered the Moroni #1-AXZH Well and drilled a vertical sidetrack in the well. During drilling, Cimarron measured a gas flare of 20,800 units in the Tununk Shale, in addition to oil flowing to the surface.

In 1998, Cimarron Energy, Inc. drilled five horizontal sidetracks in the Tununk Shale in the Moroni #1-AXZH Well. On Cimarron’s final failed attempt, its drill pipe became stuck. Limited perforations through the drill pipe in the Tununk Shale have tested as much as 720 Bopd, but such rates were only sustained for one to two hours at a time. Severe mechanical constrictions and formation damage have combined to make it uneconomical in its current mechanical configuration and have led to the well being shut-in. We plan to participate in the development of the field by funding our 5% working interest requirement when work progresses on the Independence Project.

Spring Valley Project –Utah-Wyoming Overthrust

The Spring Valley project lies between the Anschutz Ranch and Pinedale Fields in Southwestern Wyoming, along the Utah-Wyoming Overthrust. We currently own 100% of the mineral rights in a 160 acre parcel of land, containing an active oil seep. Geological research into the project is ongoing. Plans to drill in this project have not yet been determined as we are awaiting the results of the geological research.

| 13 |

Trends and Cycles

Over the past several years, the prices for oil and gas have been volatile. We expect this volatility to continue. Prolonged increases or decreases in the price of oil and gas could have a significant impact on our results of operations and our ability to execute our business plan. There is a strong relationship between energy commodity prices and access to both equipment and personnel. High commodity prices also affect the cost structure of services which may impact our ability to accomplish drilling, completion and equipping goals in a timely fashion. In addition, weather patterns are unpredictable and can cause delays in implementing and completing projects.

The oil and gas business is cyclical by nature, due to the volatility of oil and gas commodity pricing as described above. Additionally, seasonal interruptions in drilling and construction operations can occur but are expected and accounted for in the budgeting and forecasting process.

Competitive Conditions

We actively compete for reserve acquisitions, exploration leases, licenses and concessions and skilled industry personnel with a substantial number of competitors in the oil and gas industry, many of whom have significantly greater financial resources than our Company. Competitors include major integrated oil and gas companies, numerous other independent oil and gas companies and individual producers and operators.

The oil industry is highly competitive. Our competitors for the acquisition, exploration, production and development of oil and gas properties, and for capital to finance such activities, include companies that have greater financial and personnel resources than our Company.

Certain of our customers and potential customers are also exploring for oil and gas, and the results of such exploration efforts could affect our ability to sell or supply oil to these customers in the future. Our ability to successfully bid on and acquire additional property rights, to discover reserves, to participate in drilling opportunities and to identify and enter into commercial arrangements with customers will be dependent upon developing and maintaining close working relationships with our future industry partners and joint operators, our ability to select and evaluate suitable properties and to consummate transactions in a highly competitive environment. Hiring and retaining technical and administrative personnel continues to be a competitive process. We believe our distinct competitive advantage is through our unique projects, our use of innovative scientific and engineering methods, and our integrated approach to generating and implementing drilling projects.

Regulation of the Oil and Gas Industry

Our operations are substantially impacted by U.S. federal, state and local laws and regulations. In particular, oil and gas production and related operations are, or have been, subject to price controls, taxes and numerous other laws and regulations. All of the jurisdictions in which we plan to own or operate properties for oil and gas production have statutory provisions regulating the exploration for and production of oil and gas, including provisions related to permits for the drilling of wells, bonding requirements to drill or operate wells, the location of wells, the method of drilling and casing wells, the surface use and restoration of properties upon which wells are drilled, sourcing and disposal of water used in the drilling and completion process, and the abandonment of wells. Our operations are also subject to various conservation laws and regulations. These include regulation of the size of drilling and spacing units or proration units, the number of wells which may be drilled in an area, and the unitization or pooling of oil and gas wells, as well as regulations that generally prohibit the venting or flaring of gas and that impose certain requirements regarding the ratability or fair appointment of production from fields and individual wells.

Failure to comply with applicable laws and regulations can result in substantial penalties and the regulatory burden on the industry in the U.S. and increases the cost of doing business and affects profitability. Additional proposals and proceedings that affect the oil and gas industry are regularly considered by Congress, states within the U.S., the Federal Energy Regulatory Commission (“FERC”), and U.S. federal and state courts. We cannot predict when or whether any such proposals may become effective or the costs of complying therewith.

| 14 |

Regulation of Transportation and Sales of Oil

Sales of crude oil, condensate and gas liquids are not currently regulated and are made at negotiated prices. Nevertheless, Congress could re-enact price controls in the future.

Sales of crude oil will be affected by the availability, terms and cost of transportation. The transportation of oil in common carrier pipelines is also subject to rate and access regulation. The FERC regulates interstate oil pipeline transportation rates under the Interstate Commerce Act. In general, interstate oil pipeline rates must be cost-based, although settlement rates agreed to by all shippers are permitted and market based rates may be permitted in certain circumstances. Effective January 1, 1995, the FERC implemented regulations establishing an indexing system (based on inflation) for transportation rates for oil that allowed for an increase or decrease in the cost of transporting oil to the purchaser. A review of these regulations by the FERC in 2000 was successfully challenged on appeal by an association of oil pipelines. On remand, the FERC in February 2003 increased the index ceiling slightly, effective July 2001. Following the FERC’s five-year review of the indexing methodology, the FERC issued an order in 2006 increasing the index ceiling.

Intrastate oil pipeline transportation rates are subject to regulation by state regulatory commissions. The basis for intrastate oil pipeline regulation, and the degree of regulatory oversight and scrutiny given to intrastate oil pipeline rates, varies from state to state. Insofar as effective interstate and intrastate rates are equally applicable to all comparable shippers, we believe that the regulation of oil transportation rates will not affect operations in any way that is of material difference from those of competitors who are similarly situated.

Further, interstate and intrastate common carrier oil pipelines must provide service on a non-discriminatory basis. Under this open access standard, common carriers must offer service to all similarly situated shippers requesting service on the same terms and under the same rates. When oil pipelines operate at full capacity, access is governed by pro-rationing provisions set forth in the pipelines’ published tariffs. Accordingly, we believe that access to oil pipeline transportation services generally will be available to us to the same extent as to similarly situated competitors.

Regulation of Transportation and Sales of Natural Gas

Historically, the transportation and sale for resale of natural gas in interstate commerce has been regulated by the FERC under the Natural Gas Act of 1938 (“NGA”), the Natural Gas Policy Act of 1978 (the “NGPA”), and regulations issued under those statutes. In the past, the federal government has regulated the prices at which natural gas could be sold. While sales by producers of natural gas can currently be made at market prices, Congress could re-enact price controls in the future. Deregulation of wellhead natural gas sales began with the enactment of the NGPA and culminated in adoption of the Natural Gas Wellhead Decontrol Act which removed all price controls affecting wellhead sales of natural gas effective January 1, 1993.

Regulation of Production

The production of oil and gas is subject to regulation under a wide range of local, state and federal statutes, rules, orders and regulations. Federal, state and local statutes and regulations require permits for drilling operations, drilling bonds and reports concerning operations. The jurisdictions in which we anticipate operating have regulations governing conservation matters, including provisions for the unitization or pooling of oil and gas properties, the establishment of maximum allowable rates of production from oil and gas wells, the regulation of well spacing, and plugging and abandonment of wells. The effect of these regulations is to limit the amount of oil and gas that we can produce from and to limit the number of wells or the locations at which we can drill, although we can apply for exceptions to such regulations or to have reductions in well spacing. Moreover, each jurisdiction generally imposes a production or severance tax with respect to the production and sale of oil, natural gas and natural gas liquids.

The failure to comply with these rules and regulations can result in substantial penalties. Competitors in the oil and gas industry are subject to the same regulatory requirements and restrictions that affect our operations.

| 15 |

Other Federal Laws and Regulations Affecting the Industry

The Energy Policy Act of 2005 (the “EPAct2005”) is a comprehensive compilation of tax incentives, authorized appropriations for grants and guaranteed loans, and significant changes to the statutory policy that affects all segments of the U.S. energy industry. Among other matters, EPAct2005 amends the NGA to add an anti-manipulation provision which makes it unlawful for any entity to engage in prohibited behavior to be prescribed by FERC, and furthermore provides FERC with additional civil penalty authority. EPAct2005 provides the FERC with the power to assess civil penalties of up to $1,000,000 per day for violations of the NGA and increases the FERC’s civil penalty authority under the NGPA from $5,000 per violation per day to $1,000,000 per violation per day. The civil penalty provisions are applicable to entities that engage in the sale of natural gas for resale in interstate commerce. On January 19, 2006, FERC issued Order No. 670, a rule implementing the anti-manipulation provision of EPAct2005, and subsequently denied rehearing. The rule makes it unlawful for any entity, directly or indirectly, in connection with the purchase or sale of natural gas subject to the jurisdiction of FERC, or the purchase or sale of transportation services subject to the jurisdiction of FERC, (1) to use or employ any device, scheme or artifice to defraud; (2) to make any untrue statement of material fact or omit to make any such statement necessary to make the statements made not misleading; or (3) to engage in any act, practice, or course of business that operates as a fraud or deceit upon any person. The new anti-manipulation rules do not apply to activities that relate only to intrastate or other non-jurisdictional sales or gathering, but do apply to activities of gas pipelines and storage companies that provide interstate services, such as Section 311 service, as well as otherwise non-jurisdictional entities to the extent the activities are conducted “in connection with” gas sales, purchases or transportation subject to FERC jurisdiction, which now includes the annual reporting requirements under Order 704. The anti-manipulation rules and enhanced civil penalty authority reflect an expansion of FERC’s NGA enforcement authority. Should we fail to comply with applicable FERC administered statutes, rules, regulations, and orders, we could be subject to substantial penalties and fines.

FERC Market Transparency Rules

On December 26, 2007, FERC issued a final rule on the annual natural gas transaction reporting requirements, as amended by subsequent orders on rehearing, or Order No. 704. Under Order No. 704, wholesale buyers and sellers of more than 2.5 Million British Thermal Units (“MMBTU”) of physical natural gas in the previous calendar year, including interstate and intrastate natural gas pipelines, natural gas gatherers, natural gas processors, natural gas marketers and natural gas producers, are required to report, on May 1 of each year beginning in 2009, aggregate volumes of natural gas purchased or sold at wholesale in the prior calendar year to the extent such transactions utilize, contribute to or may contribute to the formation of price indices. In order to provide respondents time to implement new regulations to Order No. 704, the FERC extended the deadline for calendar year 2009 until October 1, 2010. The report for calendar year 2010 and subsequent years remains May 1 of the following calendar year. It is the responsibility of the reporting entity to determine which individual transactions should be reported based on the guidance of Order No. 704. Order No. 704 also requires market participants to indicate whether they report prices to any index publishers and, if so, whether their reporting complies with FERC’s policy statement on price reporting.

Additional proposals and proceedings that might affect the natural gas industry are pending before Congress, FERC and the courts. We cannot predict the ultimate impact of these or the above regulatory changes to our natural gas operations. We do not believe that we would be affected by any such action materially differently than similarly situated competitors.

Environmental, Health and Safety Regulation

Exploration, development and production operations will be subject to various federal, state and local laws and regulations governing health and safety, the discharge of materials into the environment or otherwise relating to environmental protection. These laws and regulations may, among other things, require the acquisition of permits to conduct exploration, drilling and production operations; govern the amounts and types of substances that may be released into the environment in connection with oil and gas drilling and production; restrict the way we handle or dispose of wastes; limit or prohibit construction or drilling activities in sensitive areas such as wetlands, wilderness areas or areas inhabited by endangered or threatened species; require investigatory and remedial actions to mitigate pollution conditions caused by operations or attributable to former operations; and impose obligations to reclaim and abandon well sites and pits. Failure to comply with these laws and regulations may result in the assessment of administrative, civil and criminal penalties, the imposition of remedial obligations and the issuance of orders enjoining some or all operations in affected areas.

| 16 |

These laws and regulations may also restrict the rate of oil and gas production below the rate that would otherwise be possible. The complexity and comprehensive nature of the environmental laws and regulations affecting the oil and gas industry increases the cost of doing business in the industry and consequently affects profitability. Additionally, the Congress and federal and state agencies frequently revise environmental, health and safety laws and regulations, and any changes that result in more stringent and costly waste handling, disposal, cleanup and remediation requirements for the oil and gas industry could have a significant impact on operating costs.

The trend in environmental regulation is to place more restrictions and limitations on activities that may affect the environment, particularly under air quality and water quality laws and standards, and thus, any changes in environmental laws and regulations or re-interpretation of enforcement policies that result in more stringent and costly waste handling, storage, transport, disposal, or remediation requirements, could have a material adverse effect on operations and financial position. Of particular note, the U.S. Environmental Protection Agency (“EPA”) has recently made the enforcement of environmental laws in the oil and gas exploration and production sector a formal enforcement priority. Increased compliance costs may not be able to be passed on to purchasers or customers. Moreover, accidental releases or spills may occur in the course of operations, and we cannot assure prospective investors that we will not incur significant costs and liabilities as a result of such releases or spills, including any third-party claims for damage to property, natural resources or persons.

Hazardous Substances and Waste

The Comprehensive Environmental Response, Compensation, and Liability Act, as amended, (“CERCLA”), also known as the Superfund law, and comparable state laws impose liability without regard to fault or the legality of the original conduct on certain classes of persons who are considered to be responsible for the release of a “hazardous substance” into the environment. These persons include current and prior owners or operators of the site where a release occurred and entities that disposed or arranged for the disposal for the hazardous substances found at the site. Under CERCLA, these “responsible persons” may be subject to joint and several, strict liability for the costs of cleaning up hazardous substances that have been released into the environment, for damages to natural resources, and for the cost of certain health studies. CERCLA also authorizes the EPA and, in some instances, third parties to act in respect to threats to the public health or the environment and to seek to recover from the responsible classes of persons the costs they incur. It is not uncommon for neighboring landowners and other third parties to file claims for personal injury and property damage allegedly caused by the release of hazardous substances or other pollutants into the environment. The Company’s operations will generate materials that may be regulated as hazardous substances.

We anticipate that the operations will also generate solid and hazardous wastes that are subject to the requirements of the Resource Conservation and Recovery Act, as amended (the “RCRA”), and comparable state statutes. RCRA imposes strict requirements on the generation, storage, treatment, transportation and disposal of hazardous wastes. We anticipate that our operations will generate petroleum hydrocarbon wastes and ordinary industrial wastes that may be regulated as hazardous wastes.

We own or lease and, in connection with future acquisitions, we anticipate that we will acquire, properties that have been used for numerous years to explore and produce oil and gas. Hydrocarbons and wastes may have been disposed of or released on or under the properties owned or leased by us or on or under other locations where these hydrocarbons and wastes have been taken for treatment or disposal. In addition, certain of these properties may have been operated by third parties whose treatment and disposal or release of hydrocarbons and wastes was not under our control. These properties and wastes disposed thereon may be subject to CERCLA, RCRA and analogous state laws. Under these laws, we could be required to remove or remediate previously disposed wastes (including wastes disposed of or released by prior owners or operators), to clean up contaminated property (including contaminated groundwater) and to perform remedial operations to prevent future contamination.

| 17 |

Air Emissions

The Clean Air Act, as amended, and comparable state laws and regulations restrict the emission of air pollutants from many sources and also impose various monitoring and reporting requirements. These laws and regulations may require us to obtain pre-approval for the construction or modification of certain projects or facilities expected to produce or significantly increase air emissions, obtain and strictly comply with stringent air permit requirements or utilize specific equipment or technologies to control emissions. Obtaining permits has the potential to delay the development of oil and gas projects. In addition, the EPA and state regulators are developing a number of regulatory changes (including the EPA’s new compressor engine emissions standards and the potential aggregation of exploration and production-related emissions sources to make what have historically been multiple “minor” sources into larger “major” sources) that may significantly increase the regulatory burdens and costs of U.S. oil and gas exploration.

Climate Change

In response to certain scientific studies suggesting that emissions of certain gases, commonly referred to as “greenhouse gases” and including carbon dioxide and methane, are contributing to the warming of the Earth’s atmosphere and other climatic changes, the U.S. Congress has been actively considering legislation to reduce such emissions. On June 26, 2009, the U.S. House of Representatives passed the American Clean Energy and Security Act of 2009 (the “ACESA”), which would establish an economy-wide cap-and-trade program to reduce U.S. emissions of “greenhouse gases” including carbon dioxide and methane that may contribute to warming of the Earth’s atmosphere and other climatic changes. ACESA would require a 17% reduction in greenhouse gas emissions from 2005 levels by 2020 and just over an 80% reduction of such emissions by 2050. Under this legislation, the EPA would issue a capped and steadily declining number of tradable emissions allowances to major sources of greenhouse gas emissions so that such sources could continue to emit greenhouse gases into the atmosphere. These allowances would be expected to escalate significantly in cost over time. The U.S. Senate considered pursuing its own legislation for restricting domestic greenhouse gas emissions and President Obama has indicated his support of legislation to reduce greenhouse gas emissions through an emission allowance system. Although it is not possible at this time to predict when the Senate may act on climate change legislation or how any bill passed by the Senate would be reconciled with ACESA, any future federal laws or implementing regulations that may be adopted to address greenhouse gas emissions could require us to incur increased operating costs and could adversely affect demand for the oil and gas produced.

In addition, on December 15, 2009, the EPA published its finding that emissions of greenhouse gases presented an endangerment to human health and the environment. These findings by the EPA allow the agency to proceed with the adoption and implementation of regulations that would restrict emissions of greenhouse gases under existing provisions of the federal Clean Air Act. Consequently, the EPA proposed two sets of regulations that would require a reduction in emissions of greenhouse gases from motor vehicles and could trigger permit review for greenhouse gas emissions from certain stationary sources. On October 30, 2009, the EPA also published a final rule requiring the reporting of greenhouse gas emissions from specified large greenhouse gas emission sources in the U.S. beginning in 2011 for emissions occurring in 2010. On March 23, 2010, the EPA announced a proposal to expand its final rule on greenhouse gas emissions reporting to include owners and operators of onshore oil and gas production. If the proposed rule is finalized in its current form, reporting of greenhouse gas emissions from such onshore production would be required on an annual basis beginning in 2012 for emissions occurring in 2011. The adoption and implementation of any regulations imposing reporting obligations on, or limiting emissions of greenhouse gases from, equipment and operations could require us to incur costs to reduce emissions of greenhouse gases associated with operations or could adversely affect demand for the oil and gas produced.

Even if such legislation is not adopted at the national level, more than one-third of the states have begun taking actions to control and/or reduce emissions of greenhouse gases, primarily through the planned development of greenhouse gas emission inventories and/or regional greenhouse gas cap and trade programs. Although most of the state-level initiatives have to date focused on large sources of greenhouse gas emissions, such as coal-fired electric plants, it is possible that smaller sources of emissions could become subject to greenhouse gas emission limitations or allowance purchase requirements in the future. Any one of these climate change regulatory and legislative initiatives could have a material adverse effect on our business, financial condition and results of operations.

| 18 |

Water Discharges

The Federal Water Pollution Control Act, as amended, or the Clean Water Act, and analogous state laws impose restrictions and strict controls regarding the discharge of pollutants into navigable waters. Pursuant to the Clean Water Act and analogous state laws, permits must be obtained to discharge pollutants into state waters or waters of the U.S. Any such discharge of pollutants into regulated waters must be performed in accordance with the terms of the permit issued by the EPA or the analogous state agency. Spill prevention, control and countermeasure requirements under federal law require appropriate containment berms and similar structures to help prevent the contamination of navigable waters in the event of a petroleum hydrocarbon tank spill, rupture or leak. In addition, the Clean Water Act and analogous state laws require individual permits or coverage under general permits for discharges of storm water runoff from certain types of facilities.

The Oil Pollution Act of 1990, as amended, (the “OPA”), which amends the Clean Water Act, establishes strict liability for owners and operators of facilities that are the site of a release of oil into waters of the U.S. The OPA and its associated regulations impose a variety of requirements on responsible parties related to the prevention of oil spills and liability for damages resulting from such spills. A “responsible party” under the OPA includes owners and operators of certain onshore facilities from which a release may affect waters of the U.S.

Employee Health and Safety

We are subject to a number of federal and state laws and regulations, including the federal Occupational Safety and Health Act, as amended (the “OSHA”), and comparable state statutes, whose purpose is to protect the health and safety of workers. In addition, the OSHA hazard communication standard, the EPA community right-to-know regulations under Title III of the federal Superfund Amendment and Reauthorization Act and comparable state statutes require that information be maintained concerning hazardous materials used or produced in operations and that this information be provided to employees, state and local government authorities and citizens.

We are committed to conducting our activities in a manner that will safeguard the health and safety of our employees, contractors and the general public. Our management is responsible for providing and maintaining a safe work environment with proper procedures, training, equipment and programs to ensure that work is performed in compliance with accepted and legislated standards. Employees share the responsibility to work in a manner which safeguards themselves with equal concern for co-workers, contractors and the general public. We will administer a comprehensive health and safety program, which will include corporate commitment, risk assessment and monitoring, capability, development, emergency response plans and systems for incident reporting, tracking and investigation.

| 19 |

Summary of Oil and Gas Reserves

The following table summarizes our estimated quantities of proved and probable reserves as of January 1, 2012. See “Preparation of Reserves Estimates" on page 22 of this registration statement and Exhibit 99.5 attached hereto for additional information regarding our estimated proved reserves.