- SRAX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

S-1 Filing

SRAX (SRAX) S-1IPO registration

Filed: 24 Jan 12, 12:00am

As filed with the Securities and Exchange Commission on January 24, 2012

Registration No. [________]

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

SOCIAL REALITY, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 7311 | 45-2925231 | ||

(State or jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

479 Rodeo Drive

Beverly Hills, CA 90210

(323) 229-0297

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Christopher Miglino

Chief Executive Officer

479 Rodeo Drive

Beverly Hills, CA 90210

(323) 229-0297

(Name, address, including zip code, and telephone number,

including area code, of agent for service)

Copy to:

Raul Silvestre

Silvestre Law Group, P.C.

31200 Via Colinas, Suite 200

Westlake Village, CA 91362

(818) 597-7552

Fax (818) 597-7551

Approximate date of commencement of proposed sale to the public: From time to time after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box. x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ¨ | Accelerated filer | ¨ | |||

| Non-accelerated filer | ¨ (Do not check if smaller reporting company) | Smaller reporting company | x |

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Amount to be Registered(1) | Proposed Maximum Offering Price | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | ||||||||||||

| Common Stock, par value $0.001 per share | 1,447,107 | $ | .8111 | (2) | $ | 1,173,749 | $ | 134.51 | ||||||||

| 1,447,107 | $ | 1,173,749 | $ | 134.51 | ||||||||||||

(1) Pursuant to SEC Rule 416, also covers additional common shares that may be offered to prevent dilution as a result of stock splits or stock dividends.

(2) Estimated solely for the purpose of calculating the registration fee in accordance with Rule 457 of the Securities Act based upon a per share amount of $.8111, based on the price on which the securities were previously sold pursuant to the Company's January of 2012 private placements. There is currently no trading market for the Registrant's common stock. The price of $.8111 is a fixed price at which the selling stockholders identified herein may sell their shares until the Registrant's common stock is quoted, if ever, at which time the shares may be sold at prevailing market prices or privately negotiated prices.

THE REGISTRANT HEREBY AMENDS THIS REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT WHICH SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933, AS AMENDED, OR UNTIL THE REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SUCH SECTION 8(a), MAY DETERMINE.

The information in this preliminary prospectus is not complete and may be changed. These securities may not be sold until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell nor does it seek an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | SUBJECT TO COMPLETION | JANUARY 24, 2012 |

Social Reality, Inc.

1,447,107 Shares of Common Stock

This prospectus relates to the resale of 1,447,107 shares of our Class A common stock, by the selling stockholders identified on page 10 of this prospectus. We will not receive any proceeds from the sale of these shares by the selling stockholders. We have two classes of authorized common stock, Class A common stock and Class B common stock. The rights of the holders of Class A common stock and Class B common stock are identical, except with respect to voting and conversion. Each share of Class A common stock is entitled to one vote per share. Each share of Class B common stock is entitled to ten votes per share and is convertible at any time into one share of Class A common stock. As of the date of this prospectus, outstanding shares of Class A common stock will represent approximately 4% of the voting power of our outstanding capital stock, and outstanding shares of Class B common stock held by our founders, will represent approximately 96% of the voting power of our outstanding capital stock.

Our common stock is not presently traded on any market or securities exchange, and we have not applied for listing or quotation on any public market. We anticipate seeking sponsorship for the trading of our Class A common stock on the National Association of Securities Dealers OTC Bulletin Board upon the effectiveness of the registration statement of which this prospectus forms a part. However, we can provide no assurance that our shares will be traded on the OTC Bulletin Board or, if traded, that a public market will materialize. The Selling Stockholders will sell at a price of $0.8111 per share until our shares are quoted, if ever, on a stock exchange in which a market develops or trading facility on which the shares are traded, and thereafter, at prevailing market prices or privately negotiated prices.

Our principal executive offices are located at 479 Rodeo Drive Beverly Hills, CA 90210, telephone number (323) 229-0297.

Investing in our common stock is highly speculative and involves a high degree of risk. You should consider carefully the risks and uncertainties in the section entitled “Risk Factors” on page 4 of this prospectus.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR PASSED UPON THE ADEQUACY OR ACCURACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this Prospectus is [_________]

| 2 |

TABLE OF CONTENTS

| Page | ||

| FORWARD LOOKING STATEMENTS | ||

| RISK FACTORS | 4 | |

| USE OF PROCEEDS | 10 | |

| DIVIDEND POLICY | 10 | |

| DETERMINATION OF OFFERING PRICE | 10 | |

| SELLING SECURITY HOLDERS | 10 | |

| PLAN OF DISTRIBUTION | 10 | |

| DESCRIPTION OF CAPITAL STOCK | 11 | |

| INTERESTS OF NAMED EXPERTS AND COUNSEL | 14 | |

| EXPERTS | 14 | |

| OUR BUSINESS | 14 | |

| PROPERTIES | 19 | |

| LEGAL PROCEEDINGS | 19 | |

| MARKET FOR COMMON EQUITY & RELATED STOCKHOLDER MATTERS | 19 | |

| SHARES ELIGIBLE FOR FUTURE SALE | 19 | |

| EQUITY COMPENSATION PLAN INFORMATION | 21 | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 22 | |

| MANAGEMENT | 24 | |

| CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS | 27 | |

| PRINCIPAL STOCKHOLDERS | 27 | |

| INDEMNIFICATION OF DIRECTORS AND OFFICERS | 29 | |

| WHERE YOU CAN FIND MORE INFORMATION | 29 | |

| FINANCIAL STATEMENTS | 30 |

You may rely only on the information contained in this prospectus. We have not authorized anyone to provide information or to make representations not contained in this prospectus. This prospectus is neither an offer to sell nor a solicitation of an offer to buy any securities other than those registered by this prospectus, nor is it an offer to sell or a solicitation of an offer to buy securities where an offer or solicitation would be unlawful. Neither the delivery of this prospectus, nor any sale made under this prospectus, means that the information contained in this prospectus is correct as of any time after the date of this prospectus.

| 3 |

RISK FACTORS

Investing in our Class A common stock involves a high degree of risk. You should carefully consider the following risk factors and all other information contained in this prospectus before purchasing our Class A common stock. If any of the following events were to occur, our business, financial condition or results of operations could be materially and adversely affected. In these circumstances, the market price of our common stock could decline, and you could lose some or all of your investment

General Risks Relating To Our Business And Business Model

We have a limited operating history.

Our limited operating history means that there is a high degree of uncertainty in our ability to: (i) execute our business plan; (ii) obtain customers and create new products and services; (iii) respond to competition; or (iv) operate the business, as management has not previously undertaken such actions as a company. Our inability to achieve any of the foregoing, could materially and adversely affect our business.

We will require additional financing to expand our business.

Although we are currently profitable, we will require additional financing in the future to grow our business. The issuance of common or preferred stock in connection with a future financing will result in a decrease of stockholders percentage ownership of the Company. The Company has the authority to issue additional shares of common stock and preferred stock, as well as additional classes or series of ownership interests or debt obligations which may be convertible into any one or more classes or series of ownership interests. The Company is authorized to issue 250,000,000 shares of Class A and 9,000,000 shares of Class B common stock and 50,000,000 shares of preferred stock. Currently we have 3,775,874 shares of Class A common stock, 9,000,000 shares of Class B common stock and 0 shares of preferred stock issued and outstanding. Accordingly, we can issue an additional 246,224,126 shares of Class A common stock and 50,000,000 shares of preferred stock without the approval or consent of the Company's stockholders.

If we are unable to maintain a good relationship with Facebook, our business will suffer.

Facebook is the primary medium on which we undertake our marketing campaigns and promotions for our clients. We generate substantially all of our revenue through marketing campaigns on the Facebook platform and expect to continue to do so for the foreseeable future. Any deterioration in our relationship with Facebook would harm our business and adversely affect the value of our Class A common stock.

We are subject to Facebook’s standard terms and conditions for application developers, which govern the promotion, distribution and operation of applications on the Facebook platform. Our business would be harmed if:

| · | Facebook discontinues or limits access to its platform by us and other application developers; | |

| · | Facebook modifies its terms of service or other policies, including fees charged to, or other restrictions on, us or other application developers, or Facebook changes how the personal information of its users is made available to application developers on the Facebook platform or shared by users; | |

| · | Facebook establishes more favorable relationships with one or more of our competitors; or | |

| · | Facebook develops its own competitive offerings. |

We have benefited from Facebook’s strong brand recognition and large user base. If Facebook loses its market position or otherwise falls out of favor with Internet users, we would need to identify alternative channels for our marketing and promotional campaigns, which would consume substantial resources and may not be effective. In addition, Facebook has broad discretion to change its terms of service and other policies with respect to us and other developers, and those changes may be unfavorable to us. Facebook may also change its fee structure, add fees associated with access to and use of the Facebook platform, change how the personal information of its users is made available to application developers on the Facebook platform or restrict how Facebook users can share information with friends on their platform. Beginning in early 2010, Facebook changed its policies for application developers regarding use of its communication channels. These changes limited the level of communication among users about applications on the Facebook platform. As a result, our campaigns and promotions may be less effective. Any such changes in the future could significantly alter the value of our products and services and harm our business.

| 4 |

A small number of customers have generated a majority of our revenue.

The creation and management of social media marketing campaigns is relatively new. As a result, a majority of our revenue has come from test marketing campaigns or one off promotions. Our growth depends on our ability to develop and manage ongoing and recurring marketing and promotional campaigns. If we do not successfully attract and retain a significant number of recurring customers, our market share, reputation and financial results will be harmed.

Our profitability may not remain at current levels.

We face risks that could prevent us from achieving our current profitability levels in future periods. These risks include, but are not limited to, our ability to:

| • | adapt our products, services and cost structure to changing macroeconomic conditions; | |

| • | maintain and increase our inventory of advertising space on publisher websites, ad exchanges and other sources; | |

| • | maintain and increase the number of customers that use our products and services; | |

| • | continue to expand the number of products and services we offer and the capacity of our systems; | |

| • | adapt to changes in Web advertisers' promotional needs and policies, and the technologies used to satisfy such needs; | |

| • | respond to challenges presented by the large and increasing number of competitors in the industry; | |

| • | adapt to changes in legislation, taxation or regulation regarding Internet usage, advertising and e-commerce; and | |

| • | adapt to changes in technology related to online advertising. |

If we are unsuccessful in addressing these or other risks and uncertainties, our business, results of operations and financial condition could be materially and adversely affected.

If advertising on the internet loses its appeal, our revenue could decline.

Our business models may not continue to be effective in the future for a number of reasons, including the following: decline in the rates we can charge for advertising and our promotional activities; our inability to create applications for our customers; Internet advertisements and promotions are, by their nature, limited in content relative to other media; companies may be reluctant or slow to adopt online advertising and promotional activities that replace, limit or compete with their existing direct marketing efforts; companies may prefer other forms of Internet advertising and promotions that we do not offer; and, regulatory actions may negatively impact our business practices. If the number of companies who purchase online advertising and promotional services from us does not grow, we may experience difficulty in attracting publishers, and our revenue could decline.

Our revenue could decline if we fail to effectively manage our media inventory.

Our success depends, in part, on our ability to effectively manage our existing advertising space and content, the acquisition of additional content publishers and our creation of custom applications. If a publisher decides not to make content from its websites available to us, we may not be able to replace this content with content from other publishers that have comparable traffic patterns and user demographics quickly enough to fulfill our customers’ requests. This would result in lost revenue.

We expect that our customers' requirements will become more sophisticated as the Web continues to mature as an advertising medium. If we fail to manage our existing media inventory, applications and publishers effectively to meet our customers' changing requirements, our revenue could decline. Our growth depends, in part, on our ability to expand our media inventory within our networks and to have access to new sources of advertising inventory such as new partner websites. To attract new customers, we must maintain a consistent supply of attractive advertising space and media as well as applications with increased functionality. Our success relies, in part, on expanding our media inventory by selectively adding new Web publishers to our networks that offer attractive demographics, innovative and quality content and growing Web user traffic volume. Our ability to attract new Web publishers to our networks and to retain Web publishers currently in our networks will depend on various factors, some of which are beyond our control. These factors include, but are not limited to, our ability to introduce new and innovative products and services, our ability to efficiently manage our existing inventory, our pricing policies, and the cost-efficiency to Web publishers of outsourcing their advertising sales. In addition, the number of competing intermediaries that purchase advertising inventory from Web publishers continues to increase. We cannot assure you that the size of our inventory will increase or remain constant in the future.

We may face intellectual property actions that are costly or could hinder or prevent our ability to deliver our products and services.

We may be subject to legal actions alleging intellectual property infringement (including patent infringement), unfair competition or similar claims against us. Companies may apply for or be awarded patents or have other intellectual property rights covering aspects of our technologies or businesses. Defending ourselves against intellectual property infringement or similar claims is expensive and diverts management's attention.

| 5 |

If we fail to compete effectively against other Internet advertising companies, we could lose customers or advertising inventory and our revenue and results of operations could decline.

The Internet advertising markets are characterized by rapidly changing technologies, evolving industry standards, frequent new product and service introductions, and changing customer demands. The introduction of new products and services embodying new technologies and the emergence of new industry standards and practices could render our existing products and services obsolete and unmarketable or require unanticipated technology or other investments. Our failure to adapt successfully to these changes could harm our business, results of operations and financial condition.

The market for Internet advertising and related products and services is highly competitive. We expect this competition to continue to increase, in part because there are no significant barriers to entry to our industry. Increased competition may result in price reductions for our products and services, reduced margins and loss of market share. Our principal competitors include other companies that provide advertisers with performance-based Internet advertising solutions and companies that offer Cost Per Thousand, pay-per-click and Cost Per Engagement services. We compete in the performance-based marketing segment with CPE and CPA performance-based companies, and with other large Internet display advertising networks. Competition for advertising placements among current and future suppliers of Internet navigational and informational services, high-traffic websites and Internet service providers ("ISPs"), as well as competition with other media for advertising placements, could result in significant price competition, declining margins and reductions in advertising revenue. In addition, as we continue our efforts to expand the scope of our services, we may compete with a greater number of publishers and other media companies across an increasing range of different services, including vertical markets where competitors may have advantages in expertise, brand recognition and other areas. If existing or future competitors develop or offer products or services that provide significant performance, price, creative or other advantages over those offered by us, our business, results of operations and financial condition could be negatively affected. We also compete with traditional advertising media, such as direct mail, television, radio, cable, and print, for a share of advertisers' total advertising budgets. Many current and potential competitors enjoy competitive advantages over us, such as longer operating histories, greater name recognition, larger customer bases, greater access to advertising space on high-traffic websites, and significantly greater financial, technical, sales, and marketing resources. As a result, we may not be able to compete successfully. If we fail to compete successfully, we could lose customers or advertising inventory and our revenue and results of operations could decline.

We depend on key personnel, the loss of whom could harm our business.

Our success depends in part on the retention of personnel critical to our combined business operations due to, for example, unique technical skills, management expertise or key business relationships. We may be unable to retain existing management, finance, engineering, sales, customer support, and operations personnel that are critical to the success of the Company, which may result in disruption of operations, loss of key business relationships, information, expertise or know-how, unanticipated additional recruitment and training costs, and diminished anticipated benefits of acquisitions, including loss of revenue and profitability. Although we have entered into employment agreements with key management, there can be no assurance that these individuals will continue to provide services to us. Generally, a voluntary or involuntary termination of employment could have a materially adverse effect on our business.

We may be required to make significant payments to members of our management in the event their employment with us is terminated or if we experience a change of control.

We are a party to employment agreements with certain members of our management. In the event we terminate their employment, have a change in control or, in certain other cases, if such executive terminates his employment with us, such executive will be entitled to receive certain severance and related payments. Additionally, in such instances, certain securities held by these executives will become immediately vested and exercisable. Upon the occurrence of any such event, our obligation to make such payments could significantly impact our working capital and, accordingly, our ability to execute our business plan, which could have a materially adverse effect to our business. Also, these provisions may discourage potential takeover attempts.

Delaware law contains anti-takeover provisions that could deter takeover attempts that could be beneficial to our stockholders.

Provisions of Delaware law could make it more difficult for a third-party to acquire us, even if doing so would be beneficial to our stockholders. Section 203 of the Delaware General Corporation Law may make the acquisition of our company and the removal of incumbent officers and directors more difficult by prohibiting stockholders holding 15% or more of our outstanding voting stock from acquiring us, without our board of directors' consent, for at least three years from the date they first hold 15% or more of the voting stock.

System failures could significantly disrupt our operations, which could cause us to lose customers or advertising inventory.

Our success depends on the continuing and uninterrupted performance of our systems. Sustained or repeated system failures that interrupt our ability to provide services to customers, including failures affecting our ability to deliver advertisements quickly and accurately and failures of our applications, would reduce significantly the attractiveness of our solutions to our customers and Web publishers. Our business, results of operations and financial condition could also be materially and adversely affected by any systems damage or failure that impacts data integrity or interrupts or delays our operations. Our computer systems are vulnerable to damage from a variety of sources, including telecommunications failures, power outages, malicious or accidental human acts, and natural disasters. Therefore, any of the above factors affecting any of these could substantially harm our business. Moreover, despite network security measures, our servers are potentially vulnerable to physical or electronic break-ins, computer viruses and similar disruptive problems. Despite the precautions taken, unanticipated problems affecting our systems could cause interruptions in the delivery of our solutions in the future and our ability to provide a record of past transactions. Our insurance policies may not adequately compensate us for any losses that may occur due to any failures in our systems.

| 6 |

It may be difficult to predict our financial performance because our quarterly operating results may fluctuate.

Our revenue and operating results may vary significantly from quarter to quarter due to a variety of factors, many of which are beyond our control. You should not rely on period-to-period comparisons of our results of operations as an indication of our future performance. The factors that may affect our quarterly operating results include, but are not limited to, the following:

| • | macroeconomic conditions; | |

| • | fluctuations in demand for our advertising solutions or changes in customer contracts; | |

| • | fluctuations in the amount of available advertising space, or views, on our networks; | |

| • | the timing and amount of sales and marketing expenses incurred to attract new advertisers; | |

| • | fluctuations in sales of different types of advertising and services; for example, the amount of advertising and services sold at higher rates rather than lower rates; | |

| • | fluctuations in the cost of online advertising; | |

| • | seasonal patterns in Internet advertisers' spending; | |

| • | changes in our pricing and publisher compensation policies, the pricing and publisher compensation policies of our competitors, the pricing and publisher compensation policies of our advertiser customers, or the pricing policies for advertising on the Internet generally; | |

| • | changes in the regulatory environment, including regulation of advertising on the Internet, that may negatively impact our marketing practices; | |

| • | fluctuations in levels of professional services fees or the incurrence of non-recurring costs; | |

| • | deterioration in the credit quality of our accounts receivable and an increase in the related provision; |

Expenditures by advertisers also tend to be cyclical, reflecting overall economic conditions as well as budgeting and buying patterns. Any decline in the economic prospects of advertisers or the economy generally may alter advertisers' current or prospective spending priorities, or may increase the time it takes us to close sales with advertisers, and could materially and adversely affect our business, results of operations, cash flows, and financial condition.

We may not be able to protect our intellectual property from unauthorized use, which could diminish the value of our products and services, weaken our competitive position and reduce our revenue.

Our success depends on our ability to create and protect our proprietary technologies relating to our services and custom applications. We may be required to spend significant resources to monitor and police our intellectual property rights. If we fail to successfully enforce our intellectual property rights, the value of our products and services could be diminished and our competitive position may suffer.

We currently rely on a combination of trade secret laws, confidentiality procedures and licensing arrangements to establish and protect our proprietary rights. Third-party software providers could copy or otherwise obtain and use our technologies without authorization or develop similar technologies independently, which may infringe upon our proprietary rights. We may not be able to detect infringement and may lose competitive position in the market before we do so. In addition, competitors may design around our technologies or develop competing technologies. Intellectual property protection may also be unavailable or limited in some foreign countries.

We generally enter into confidentiality or license agreements with our employees, consultants, vendors, customers, and corporate partners, and generally control access to and distribution of our technologies, documentation and other proprietary information. Despite these efforts, unauthorized parties may attempt to disclose, obtain or use our products and services or technologies. Our precautions may not prevent misappropriation of our products, services or technologies, particularly in foreign countries where laws or law enforcement practices may not protect our proprietary rights as fully as in the United States.

| 7 |

Government enforcement actions, changes in government regulation, technical proposals and industry standards could decrease demand for our products and services and increase our costs of doing business.

Laws and regulations that apply to Internet communications, commerce and advertising are becoming more prevalent. These regulations could affect the costs of communicating on the Web and could adversely affect the demand for our advertising solutions or otherwise harm our business, results of operations and financial condition. The United States Congress has enacted Internet legislation regarding children's privacy, copyrights, sending of commercial email (e.g., the Federal CAN-SPAM Act of 2003), and taxation. The United States Congress has passed legislation regarding spyware (i.e., H.R. 964, the "Spy Act of 2007") and the New York Attorney General's office has also pursued enforcement actions against companies in this industry. In addition, on December 1, 2010, the FTC issued its long-awaited staff report criticizing industry self-regulatory efforts as too slow and lacking adequate protections for consumers and emphasizing a need for simplified notice, choice and transparency to the consumer of the collection, use and sharing of their data. The FTC suggests various methods and measures, including an implementation of a "Do Not Track" mechanism—likely a persistent setting on consumers' browsers—that consumers can choose whether to allow the tracking of their online searching and browsing activities. As a result of the report, some of the browser makers have been working on their own do-not-track technical solutions, notably Microsoft Internet Explorer, Mozilla Firefox and Google Chrome. Microsoft's Internet Explorer 9 offers a tracking protection feature that doesn't allow for tracking by allowing internet users to download tracking protection block lists which consequently block any third-party domain included in such block lists from serving content. This content-blocking feature, depending on the adoption by internet users, may adversely affect our ability to grow our company, maintain our current revenues and profitability, serve and monetize content and utilize our behavioral targeting platform. Legislatively, Congressman Bobby Rush is working to reintroduce his bill from last year (H.R. 5777—Best Practices Act) and others within the House and the Senate are looking to introduce bills regarding the privacy of online and offline data. Other laws and regulations have been adopted and may be adopted in the future, and may address issues such as user privacy, spyware, "do not email" lists, pricing, intellectual property ownership and infringement, copyright, trademark, trade secret, export of encryption technology, acceptable content, search terms, lead generation, behavioral targeting, taxation, and quality of products and services. This legislation could hinder growth in the use of the Web generally and adversely affect our business. Moreover, it could decrease the acceptance of the Web as a communications, commercial and advertising medium. We do not use any form of spam or spyware and has policies to prohibit abusive Internet behavior, including prohibiting the use of spam and spyware by our Web publisher partners.

We could be subject to legal claims, government enforcement actions and damage to our reputation and held liable for our or our customers' failure to comply with federal, state and foreign laws, regulations or policies governing consumer privacy, which could materially harm our business.

Recent growing public concern regarding privacy and the collection, distribution and use of information about Internet users has led to increased federal, state and foreign scrutiny and legislative and regulatory activity concerning data collection and use practices. The United States Congress currently has pending legislation regarding privacy and data security measures, such as S. 495, the "Personal Data Privacy and Security Act of 2007", and H.R. 5777, the Best Practices Act, introduced by Congressman Bobby Rush. Any failure by us to comply with applicable federal, state and foreign laws and the requirements of regulatory authorities may result in, among other things, indemnification liability to our customers and the advertising agencies we work with, administrative enforcement actions and fines, class action lawsuits, cease and desist orders, and civil and criminal liability. Recently, class action lawsuits have been filed alleging violations of privacy laws by ISPs. The European Union's directive addressing data privacy limits our ability to collect and use information regarding Internet users. These restrictions may limit our ability to target advertising in most European countries. Our failure to comply with these or other federal, state or foreign laws could result in liability and materially harm our business.

In addition to government activity, privacy advocacy groups and the technology and direct marketing industries are considering various new, additional or different self-regulatory standards. This focus, and any legislation, regulations or standards promulgated, may impact us adversely. Governments, trade associations and industry self-regulatory groups may enact more burdensome laws, regulations and guidelines, including consumer privacy laws, affecting our customers and us. Since many of the proposed laws or regulations are just being developed, and a consensus on privacy and data usage has not been reached, we cannot yet determine the impact these proposed laws or regulations may have on our business. However, if the gathering of profiling information were to be curtailed, Internet advertising would be less effective, which would reduce demand for Internet advertising and harm our business.

Third parties may bring class action lawsuits against us relating to online privacy and data collection. We disclose our information collection and dissemination policies, and we may be subject to claims if we act or are perceived to act inconsistently with these published policies. Any claims or inquiries could be costly and divert management's attention, and the outcome of such claims could harm our reputation and our business.

Our customers are also subject to various federal and state laws concerning the collection and use of information regarding individuals. These laws include the Children's Online Privacy Protection Act, the Federal Drivers Privacy Protection Act of 1994, the privacy provisions of the Gramm-Leach-Bliley Act, the Federal CAN-SPAM Act of 2003, as well as other laws that govern the collection and use of consumer credit information. We cannot assure you that our customers are currently in compliance, or will remain in compliance, with these laws and their own privacy policies. We may be held liable if our customers use our technologies in a manner that is not in compliance with these laws or their own stated privacy policies.

The two class structure of our common stock has the effect of concentrating voting control with our founders; this will limit your ability to influence corporate matters.

Our Class B common stock has 10 votes per share and our Class A common stock, which is the stock being registered in this prospectus, has one vote per share. The holders of Class B common stock collectively hold approximately 96% of the voting power of our outstanding capital stock. As a result, the holders of our Class B common stock will have significant influence over the management and affairs of the company and control over matters requiring stockholder approval, including the election of directors and significant corporate transactions, such as a merger or other sale of our Company or its assets, for the foreseeable future. This concentrated voting control will limit your ability to influence corporate matters and could adversely affect the price of our Class A common stock.

| 8 |

If we are unable to implement and maintain effective internal control over financial reporting in the future, the accuracy and timeliness of our financial reporting may be adversely affected.

If we are unable to maintain adequate internal controls for financial reporting in the future, or if our auditors are unable to express an opinion as to the effectiveness of our internal controls as will be required pursuant to the Sarbanes-Oxley Act, investor confidence in the accuracy of our financial reports may be impacted or the market price of our Class A common stock could be negatively impacted.

The requirements of being a public company may strain our resources, divert management’s attention and affect our ability to attract and retain qualified board members.

As a public company, we will be subject to the reporting requirements of the Securities Exchange Act of 1934, as amended, or the “Exchange Act”, the Sarbanes-Oxley Act, the Dodd-Frank Act, and other applicable securities rules and regulations. Compliance with these rules and regulations will increase our legal and financial compliance costs, make some activities more difficult, time-consuming or costly and increase demand on our systems and resources. The Exchange Act requires, among other things, that we file annual, quarterly and current reports with respect to our business and operating results.

We also expect that being a public company will make it more expensive for us to obtain director and officer liability insurance, and we may be required to accept reduced coverage or incur substantially higher costs to obtain coverage. These factors could also make it more difficult for us to attract and retain qualified members of our board of directors, particularly to serve on our audit committee and compensation committee, and qualified executive officers.

As a result of disclosure of information in this prospectus and in filings required of a public company, our business and financial condition will become more visible, which we believe may result in threatened or actual litigation, including by competitors and other third parties. If such claims are successful, our business and operating results could be harmed, and even if the claims do not result in litigation or are resolved in our favor, these claims, and the time and resources necessary to resolve them, could divert the resources of our management and harm our business and operating results.

There is no public market for the company’s securities and no assurance can be given that one will ever develop.

The Company is a private company and this registration statement is its initial registration. Our stock is not traded on an exchange or on the OTC Bulletin Board. Without a market for our shares, there is only a limited ability of a security holder to sell their securities, if any, as those transfers or sales would be made privately. Therefore, an investment in our common stock should be considered as totally illiquid, and investors are cautioned that they may not be able to liquidate their investment readily, or at all, when the need or desire to sell arises. Moreover, no assurances can be given that a public market for our securities will ever materialize. Additionally, even if a public market for our securities develops and our securities become traded, the trading volume may be limited, making it difficult for an investor to sell their shares.

When and if the company becomes a public company, the company faces risks related to compliance with corporate governance laws and financial reporting standards.

We anticipate that costs associated with becoming public will add $150,000 of annual expenses in connection with professional, legal and accounting fees. Additionally, the Sarbanes-Oxley Act of 2002, as well as related new rules and regulations implemented by the United States Securities and Exchange Commission (“SEC”) and the Public Company Accounting Oversight Board, require changes in the corporate governance practices and financial reporting standards for public companies. These new laws, rules and regulations, including compliance with Section 404 of the Sarbanes-Oxley Act of 2002 relating to internal control over financial reporting (“Section 404”), will materially increase the Company's legal and financial compliance costs and make some activities more time-consuming and more burdensome. Presently we qualify as a non-accelerated filer and, accordingly, are exempt from the requirements of 404b and our independent registered public accounting firm is not required to audit the design and operating effectiveness of our internal controls and management's assessment of the design and the operating effectiveness of such internal controls. In the event we become an accelerated filer, we will be required to expend substantial capital in connection with compliance.

Because of our limited resources, management has concluded that our internal control over financial reporting may not be effective in providing reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with U.S. generally accepted accounting principles. To mitigate the current limited resources and limited number of employees, we rely heavily on direct management oversight of transactions, along with the use of legal and accounting professionals. As we grow, we expect to increase our number of employees, which will enable us to implement adequate segregation of duties within the Committee of Sponsoring Organizations of the Treadway Commission internal control framework.

| 9 |

The company does not intend to pay cash dividends on its common stock in the foreseeable future.

Any payment of cash dividends will depend upon the Company's financial condition, results of operations, and capital requirements and will be at the discretion of the Board of Directors. The Company does not anticipate paying cash dividends on its Class A common stock in the foreseeable future. Furthermore, the Company may incur additional indebtedness that may severely restrict or prohibit the payment of dividends. Since we do not anticipate paying dividends, any gains on an investment will need to come through an increase in the price of our Class A common stock.

USE OF PROCEEDS

We will not receive any of the proceeds from the sale of the shares by any of the selling stockholders,

DIVIDEND POLICY

We have never paid or declared cash dividends on our common stock, and we do not intend to pay or declare cash dividends on either of our classes of common stock in the foreseeable future.

DETERMINATION OF OFFERING PRICE

The Selling Stockholders will initially offer their shares at $.8111 per share until such time as a trading market for outstanding shares develops, if ever. Once a trading market develops, the shares will be offered at prevailing market prices, privately negotiated prices, or in any other fashion as described in the section of this Prospectus entitled “Plan of Distribution.” The selling price has no relationship to any established criteria of value, such as book value or earnings per share. The price was chosen arbitrarily.

SELLING SECURITY HOLDERS

This prospectus relates to the offering and sale, from time to time, of up to 1,447,107 Class A common shares which are held by the stockholders named in the table below (“Selling Stockholders”). Set forth below is information, to the extent known to us, the name of each Selling Shareholder and the amount and percentage of Class A common stock owned by each (including shares that can be acquired on the exercise of outstanding securities, if any) prior to the offering, the shares to be sold in the offering, and the amount and percentage of Class A common stock to be owned by each (including shares that can be acquired on the exercise of outstanding securities, if any) after the offering assuming all shares are sold. The footnotes provide information about persons who have investment voting power for the Selling Shareholders and about material transactions between the Selling Shareholders and the Company.

The Selling Stockholders may sell all or some of the shares of common stock they are offering, and may sell shares of our common stock otherwise than pursuant to this prospectus. The tables below assumes that each selling stockholder sells all of the shares offered by it in offerings pursuant to this prospectus, and does not acquire any additional shares. We are unable to determine the exact number of shares that will actually be sold or when or if these sales will occur.

The Selling Stockholders may sell all, some or none of their shares in this offering. See “Plan of Distribution.”

The total number of Class A common shares sold under this prospectus may be adjusted to reflect adjustments due to stock dividends, stock distributions, splits, combinations or recapitalizations with regard to the common stock and warrants. Unless otherwise stated below in the footnotes, to our knowledge, no Selling Stockholder nor any affiliate of such stockholder: (i) has held any position or office with, been employed by or otherwise has had any material relationship with us or our affiliates during the three years prior to the date of this prospectus; or (ii) is a broker-dealer, or an affiliate of a broker-dealer. We may amend or supplement this prospectus from time to time in the future to update or change this list and shares which may be resold.

The Class A common shares being sold under this prospectus were originally issued by us in connection with our January 2012 offering. The shares were originally sold at $.8111 per share. The offering resulted in us receiving gross proceeds of approximately $362,642.

| Common Shares Owned Before Sale (1) | Common Shares Owned After Sale (2) | |||||||||||||||||||||||

| Name | Amount | % of class | Shares being registered | Amount | % of Class | Total Voting % | ||||||||||||||||||

| Cary Sucoff | 1,500 | * | 1,500 | - | — | — | ||||||||||||||||||

| James B. Edwards | 2,500 | * | 2,500 | - | — | — | ||||||||||||||||||

| Marta L. Knutson | 100,000 | 2.65 | % | 100,000 | - | — | — | |||||||||||||||||

| Matthew O. Knutson | 13,000 | * | 13,000 | - | — | — | ||||||||||||||||||

| Rachel Pettit | 8,700 | * | 8,700 | - | — | — | ||||||||||||||||||

| Robert O. Knutson | 25,000 | * | 25,000 | - | — | — | ||||||||||||||||||

| Ronit Sucoff | 1,500 | * | 1,500 | - | — | — | ||||||||||||||||||

| Windermer Insurance Co.(3) | 61,645 | 1.63 | % | 61,645 | - | — | — | |||||||||||||||||

| Barry Goss, TTEE GOSS FAMILY TRUST EST. 12/16/1999 | 2,000 | * | 2,000 | - | — | — | ||||||||||||||||||

| Robert Scherne | 1,542 | * | 1,542 | - | — | — | ||||||||||||||||||

| Lindsay Scherne | 1,542 | * | 1,542 | - | — | — | ||||||||||||||||||

| Robin Scherne | 1,542 | * | 1,542 | - | — | — | ||||||||||||||||||

| Theresa Scherne | 1,542 | * | 1,542 | - | — | — | ||||||||||||||||||

| Mark R Bell MD Retirement Trust | 43,152 | 1.14 | % | 43,152 | - | — | — | |||||||||||||||||

| Brandon Hill(4) | 4,000 | * | 4,000 | - | — | — | ||||||||||||||||||

| Benjamin Hill(4) | 4,000 | * | 4,000 | - | — | — | ||||||||||||||||||

| Irv Edwards MD Inc. Retirement Trust | 43,152 | 1.14 | % | 43,152 | - | — | — | |||||||||||||||||

| Paul Darin | 5,000 | * | 5,000 | - | — | — | ||||||||||||||||||

| Brodie Munro | 2,500 | * | 2,500 | - | — | — | ||||||||||||||||||

| Daniel Rodriquez | 123,290 | 3.27 | % | 123,290 | - | — | — | |||||||||||||||||

| Moises Investment Group(5) | 2,095,890 | 55.51 | % | 1,000,000 | 1,095,890 | 29 | % | 1.17 | % | |||||||||||||||

| Total | 2,542,997 | 1,447,107 | 1,095,890 | |||||||||||||||||||||

| * | Less than 1%. |

| (1) | Pursuant to Rules 13d-3 and 13d-5 of the Exchange Act, beneficial ownership includes any common shares as to which a shareholder has sole or shared voting power or investment power, and also any common shares which the shareholder has the right to acquire within 60 days, including upon exercise of common shares purchase options or warrants. There were 3,775,874 Class A and 9,000,000 Class B common shares outstanding as of January 20, 2011. |

| (2) | Assumes the sale of all common shares listed as being registered in this selling shareholder table. |

| (3) | John Scardino has voting and dispositive control of the shares being offered. |

| (4) | Associated person of Galt Financial, Inc., a Broker-Dealer. Galt has not received any compensation from the Company in connection with this offering. |

| (5) | Edwardo M. Moises Serio has voting and dispositive control of the shares being offered. |

PLAN OF DISTRIBUTION

The Selling Stockholders (“Selling Stockholders”) will sell at a price of $0.8111 per share until our shares are quoted, if ever, on a stock exchange in which a market develops or trading facility on which the shares are traded. Thereafter, the Selling Stockholders and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their shares of common stock on any stock exchange in which a market develops or trading facility on which the shares are traded or in private transactions. These sales may be at fixed or negotiated prices. A Selling Stockholder may use any one or more of the following methods when selling shares:

| · | ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; | |

| · | block trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; | |

| · | purchases by a broker-dealer as principal and resale by the broker-dealer for its account; | |

| · | an exchange distribution in accordance with the rules of the applicable exchange; | |

| · | privately negotiated transactions; | |

| · | settlement of short sales entered into after the effective date of the registration statement of which this prospectus is a part; | |

| · | broker-dealers may agree with the Selling Stockholders to sell a specified number of such shares at a stipulated price per share; | |

| · | through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; | |

| · | a combination of any such methods of sale; or | |

| · | any other method permitted pursuant to applicable law. |

The Selling Stockholders may also sell shares under Rule 144 under the Securities Act of 1933, as amended (the “Securities Act”), if available, rather than under this prospectus.

Broker-dealers engaged by the selling stockholders may arrange for other broker-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling stockholders (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in excess of a customary brokerage commission in compliance with FINRA Rule 2440; and in the case of a principal transaction a markup or markdown in compliance with FINRA IM-2440.

| 10 |

In connection with the sale of the common stock or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the common stock in the course of hedging the positions they assume. The selling stockholders may also sell shares of the common stock short and deliver these securities to close out their short positions, or loan or pledge the common stock to broker-dealers that in turn may sell these securities. The selling stockholders may also enter into option or other transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The selling stockholders and any broker-dealers or agents that are involved in selling the shares may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended, in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any profit on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act of 1933, as amended. In no event shall any broker-dealer receive fees, commissions and markups which, in the aggregate, would exceed eight percent (8%).

We are required to pay certain fees and expenses incurred by us incident to the registration of the shares. We have agreed to indemnify the selling stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act of 1933, as amended.

Because selling stockholders may be deemed to be “underwriters” within the meaning of the Securities Act of 1933, as amended, they will be subject to the prospectus delivery requirements of the Securities Act of 1933, as amended, including Rule 172 thereunder. In addition, any securities covered by this prospectus which qualify for sale pursuant to Rule 144 under the Securities Act of 1933, as amended may be sold under Rule 144 rather than under this prospectus. There is no underwriter or coordinating broker acting in connection with the proposed sale of the resale shares by the selling stockholders.

Under applicable rules and regulations under the Securities Exchange Act of 1934, as amended, any person engaged in the distribution of the resale shares may not simultaneously engage in market making activities with respect to the common stock for the applicable restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, the selling stockholders will be subject to applicable provisions of the Securities Exchange Act of 1934, as amended, and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of shares of the common stock by the selling stockholders or any other person. We will make copies of this prospectus available to the selling stockholders and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule 172 under the Securities Act of 1933, as amended).

DESCRIPTION OF CAPITAL STOCK

General

The following is a summary of the rights of our common stock and preferred stock and related provisions of our certificate of incorporation and bylaws. For more detailed information, please see our certificate of incorporation and bylaws, which are filed as exhibits to the registration statement of which this prospectus is a part.

Our certificate of incorporation provides that we will have two classes of common stock: Class A common stock, which has one vote per share, and Class B common stock, which has ten votes per share. Any holder of Class B common stock may convert his or her shares at any time into shares of Class A common stock on a share-for-share basis. Otherwise the rights of the two classes of common stock will be identical. The rights of these classes of common stock are discussed in greater detail below.

Our authorized capital stock consists of 309,000,000 shares, each with a par value of $0.001 per share, of which:

| · | 250,000,000 shares are designated as Class A common stock. | |

| · | 9,000,000 shares are designated as Class B common stock. | |

| · | 50,000,000 shares are designated as preferred stock. |

At January 20, 2012, we had outstanding 3,775,874 shares of Class A common stock, held of record by 24 stockholders and 9,000,000 shares of Class B common stock, held of record by 2 stockholders and no preferred shares outstanding.

| 11 |

Common Stock

Voting Rights

Holders of our Class A and Class B common stock have identical rights, except that holders of our Class A common stock are entitled to one vote per share and holders of our Class B common stock are entitled to ten votes per share. Holders of shares of Class A common stock and Class B common stock will vote together as a single class on all matters (including the election of directors) submitted to a vote of stockholders, unless otherwise required by law. Delaware law could require either our Class A common stock or Class B common stock to vote separately as a single class in the following circumstances:

| · | If we amended our certificate of incorporation to increase the authorized shares of a class of stock, or to increase or decrease the par value of a class of stock, then that class would be required to vote separately to approve the proposed amendment. | |

| · | If we amended our certificate of incorporation in a manner that altered or changed the powers, preferences or special rights of a class of stock in a manner that affects them adversely then that class would be required to vote separately to approve the proposed amendment. |

We have not provided for cumulative voting for the election of directors in our certificate of incorporation.

Dividends

Subject to preferences that may apply to any shares of preferred stock outstanding at the time, the holders of Class A common stock and Class B common stock shall be entitled to share equally in any dividends that our board of directors may determine to issue from time to time. In the event a dividend is paid in the form of shares of common stock or rights to acquire shares of common stock, the holders of Class A common stock shall receive Class A common stock, or rights to acquire Class A common stock, as the case may be, and the holders of Class B common stock shall receive Class B common stock, or rights to acquire Class B common stock, as the case may be.

Liquidation Rights

Upon our liquidation, dissolution or winding-up, the holders of Class A common stock and Class B common stock shall be entitled to share equally all assets remaining after the payment of any liabilities and the liquidation preferences on any outstanding preferred stock.

Subdivision or Combinations.

Upon the subdivision or combination of the outstanding shares of one class of Common Stock, the outstanding shares of the other class of Common Stock will be subdivided or combined in the same manner.

Conversion

Our Class A common stock is not convertible into any other shares of our capital stock.

Each share of Class B common stock is convertible at any time at the option of the holder into one share of Class A common stock. In addition, each share of Class B common stock shall convert automatically into one share of Class A common stock upon any transfer, whether or not for value, except for certain transfers described in our certificate of incorporation, including the following:

| · | Transfers between one Class B Stockholder to another Class B Stockholder. | |

| · | Transfers for tax and estate planning purposes, including to trusts, corporations and partnerships controlled by a holder of Class B common stock. |

The death of any holder of Class B common stock who is a natural person will result in the conversion of his or her shares of Class B common stock to Class A common stock. Once transferred and converted into Class A common stock, the Class B common stock shall not be reissued. No class of common stock may be subdivided or combined unless the other class of common stock concurrently is subdivided or combined in the same proportion and in the same manner.

Preferred Stock

Our board of directors will have the authority, without approval by the stockholders, to issue up to a total of 50,000,000 shares of preferred stock in one or more series. Our board of directors may establish the number of shares to be included in each such series and may fix the designations, preferences, powers and other rights of the shares of a series of preferred stock. Our board could authorize the issuance of preferred stock with voting or conversion rights that could dilute the voting power or rights of the holders of common stock. The issuance of preferred stock, while providing flexibility in connection with possible acquisitions and other corporate purposes, could, among other things, have the effect of delaying, deferring or preventing a change in control of Social Reality. We have no current plans to issue any shares of preferred stock.

| 12 |

Anti-Takeover Effects of Delaware Law and Our Certificate of Incorporation and Bylaws

Certain provisions of Delaware law, our certificate of incorporation and our bylaws contain provisions that could have the effect of delaying, deferring or discouraging another party from acquiring control of us. In particular, our dual class common stock structure will concentrate ownership of our voting stock in the hands of our founders, board members, and employees. These provisions, which are summarized below, are expected to discourage coercive takeover practices and inadequate takeover bids. These provisions are also designed to encourage persons seeking to acquire control of us to first negotiate with our board of directors. We believe that the benefits of increased protection of our potential ability to negotiate with an unfriendly or unsolicited acquirer outweigh the disadvantages of discouraging a proposal to acquire us because negotiation of these proposals could result in an improvement of their terms.

Dual Class Structure

As discussed above, our Class B common stock has ten votes per share, while our Class A common stock, which is the class of stock the Selling Stockholders are selling pursuant to this prospectus and which will be the only class of stock which is publicly traded, has one vote per share. Our Class B common stock is 100% controlled by our founders, executive officers and employees, representing 96% of the voting power of our outstanding capital stock. Because of our dual class structure, our founders, executives and employees will continue to be able to control all matters submitted to our stockholders for approval even if they come to own significantly less than 50% of the shares of our outstanding common stock. This concentrated control could discourage others from initiating any potential merger, takeover or other change of control transaction that other stockholders may view as beneficial.

Special Approval for Change in Control Transactions

In the event a person seeks to acquire us by means of a merger or consolidation transaction, a purchase of all or substantially all of our assets, or an issuance of stock which constitutes 2% or more of our outstanding shares at the time of issuance and which results in any person or group owning more than 50% of our outstanding voting power, then these types of acquisition transactions must be approved by our stockholders at an annual or special meeting. At this meeting, we must obtain the approval of stockholders representing the greater of:

| · | A majority of the voting power of our outstanding capital stock; and | |

| · | 60% of the voting power of the shares of capital stock present in person or represented by proxy at the stockholder meeting and entitled to vote. |

Undesignated Preferred Stock

The ability to authorize undesignated preferred stock makes it possible for our board of directors to issue preferred stock with voting or other rights or preferences that could impede the success of any attempt to acquire us. These and other provisions may have the effect of deferring hostile takeovers or delaying changes in control or management of our company.

Requirements for Advance Notification of Stockholder Nominations and Proposals

Our bylaws establish advance notice procedures with respect to stockholder proposals and the nomination of candidates for election as directors, other than nominations made by or at the direction of the board of directors or a committee of the board of directors. The bylaws do not give the board of directors the power to approve or disapprove stockholder nominations of candidates or proposals regarding business to be conducted at a special or annual meeting of the stockholders. However, our bylaws may have the effect of precluding the conduct of certain business at a meeting if the proper procedures are not followed. These provisions may also discourage or deter a potential acquiror from conducting a solicitation of proxies to elect the acquirer’s own slate of directors or otherwise attempting to obtain control of our company.

Delaware Anti-Takeover Statute

We will be subject to the provisions of Section 203 of the Delaware General Corporation Law regulating corporate takeovers. In general, Section 203 prohibits a publicly-held Delaware corporation from engaging under certain circumstances, in a business combination with an interested stockholder for a period of three years following the date the person became an interested stockholder unless:

| · | Prior to the date of the transaction, the board of directors of the corporation approved either the business combination or the transaction which resulted in the stockholder becoming an interested stockholder. | |

| · | Upon completion of the transaction that resulted in the stockholder becoming an interested stockholder, the stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding for purposes of determining the number of shares outstanding (1) shares owned by persons who are directors and also officers and (2) shares owned by employee stock plans in which employee participants do not have the right to determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer. |

| 13 |

| · | On or subsequent to the date of the transaction, the business combination is approved by the board and authorized at an annual or special meeting of stockholders, and not by written consent, by the affirmative vote of at least 66 2/3% of the outstanding voting stock which is not owned by the interested stockholder. |

Generally, a business combination includes a merger, asset or stock sale, or other transaction resulting in a financial benefit to the interested stockholder. An interested stockholder is a person who, together with affiliates and associates, owns or, within three years prior to the determination of interested stockholder status, did own 15% or more of a corporation’s outstanding voting securities. We expect the existence of this provision to have an anti-takeover effect with respect to transactions our board of directors does not approve in advance. We also anticipate that Section 203 may also discourage attempts that might result in a premium over the market price for the shares of common stock held by stockholders.

The provisions of Delaware law, our certificate of incorporation and our bylaws could have the effect of discouraging others from attempting hostile takeovers and, as a consequence, they may also inhibit temporary fluctuations in the market price of our common stock that often result from actual or rumored hostile takeover attempts. These provisions may also have the effect of preventing changes in our management. It is possible that these provisions could make it more difficult to accomplish transactions that stockholders may otherwise deem to be in their best interests.

Transfer Agent and Registrar

The transfer agent and registrar for our Class A common stock is Transfer Online, Inc. 512 SE Salmon Street, Portland, OR 97214, 503-595-2982.

INTERESTS OF NAMED EXPERTS AND COUNSEL

The Silvestre Law Group, P.C. has given us an opinion relating to the issuance of the common stock being registered. The Silvestre Law Group, P.C. or its various principals and/or affiliates, own 410,959 shares of our Class A common stock.

EXPERTS

The financial statements as of December 31, 2010 included in this prospectus and in the registration statement of which it forms a part, have been so included in reliance on the report of RBSM LLP, our independent registered public accounting firm, appearing elsewhere in this prospectus and the registration statement of which it forms a part, given on the authority of said firm as experts in auditing and accounting.

OUR BUSINESS

Our Business

Social Reality, Inc. develops and sells targeted and measurable social media advertising campaigns and programs to brand advertisers and digital advertising agencies. Social Reality delivers these programs across multiple third party Facebook applications and high traffic, targeted websites. These programs generate quantifiable engagement for clients, thereby driving revenue and increased brand recognition. We also develop custom Facebook applications to help grow our customer’s social media presence and drive engagement for their brands.

How We Derive Revenues

We derive our revenue from: (i) the development and management of social media marketing campaigns and programs; (ii) the sales of media on our partner websites and applications, and (iii) building custom applications for our partners in connection with such campaigns. We offer our customers a number of pricing options including cost-per-thousand-impression ("CPM"), whereby our customers pay based on the number of times the target audience is exposed to the advertisement and cost-per-engagement ("CPE"), whereby payment is triggered only when an individual takes a specific activity. We also generate revenue from the creation and management of custom social media applications, marketing campaigns and programs.

| 14 |

Our Campaigns

Our campaigns use pre-existingsocial networks, reaching a portion of those networks’ more than 500 million monthly average users (Facebook applications, select websites), to increasebrand awareness or to achieve other marketing objectives (such as product sales, Facebook “likes,” or sweepstakes entries) through a self-replicatingviral processes. Our media is targeted across one of three channels: social good (Facebook applications and sites focused around causes and philanthropy), social gaming (leading social game apps and websites) and lifestyle (music & entertainment properties.) In connection with these campaigns, we develop and sell pop-ups, custom and standard Interactive Advertising Bureau (“IAB”) unit advertising to further enhance the impact and viral nature of these campaigns. We feel that these campaigns and programs provide better results to our customers through the creation of brand ambassadors. A brand ambassador is a participant in our customer’s target demographic who, instead of merely being a passive observer of the campaign, actually becomes involved and furthers the campaign or programs goals.

How We Market our Products and Services

We market our services through our in house sales team, which is divided into two distinct activities. One group is responsible for brand advertisers and the other is responsible for publisher acquisition and management. We market our services on industry related websites and blogs. We also have an in house public relations team that is focused on social media, PR, industry events and the creation of white papers.

Our Customers

We service two distinct customer bases, online publishers and direct marketers, brand advertisers and advertising agencies that service these brands.

The value propositions that we offer direct marketers, brand advertisers and the advertising agencies is the creation of social media programs that leverage the power of engagement through peer to peer referral to drive tangible results. We connect brands and nonprofits in the social space to further incentivize activity completion and viral sharing, by rewarding a nonprofit with a donation per completed activity. We accomplish this through arranging and facilitating partnerships with large Facebook applications, other social media applications and websites and thru the development of custom applications utilizing our proprietary technologies. Our marketing campaigns and programs are centered on the premise of creating brand ambassadors for our customers from participants in these campaign and programs. In short, our campaigns are designed to have participants “spread the word”, thereby creating a social engagement resulting in increases in brand recognition by driving traffic to our customer’s fan pages or achieving other marketing initiatives.

Our publisher partners enjoy higher monetization of their online advertising inventory through integration into our online advertising campaigns and programs. Through this integration, users of our publishing partner’s applications are encouraged to share their participation in these campaigns with individuals in their own unique social networks. This sharing thereby increases the awareness of both the publisher and brand advertiser. As we do not primarily compete directly with our publisher partners for online consumers, we act as a trusted partner in helping online publishers monetize their online audience and advertising inventorywith both banner advertising and engagement based programs.

The following examples illustrate some of our services, marketing campaigns and programs:

Traditional banner

Traditional banner advertising living within a Facebook application:

| 15 |

Social Engagement Ads

Social Reality creates social engagement ads that drive traffic and engagement for brand advertisers. We work with large advertising agencies and brands to strategize on the programs and their implementation. We have created a number of social engagement ads for our clients. These ads typically include some form of activity that the user needs to take in order to make a donation or get some form of benefit, such as virtual currencies.

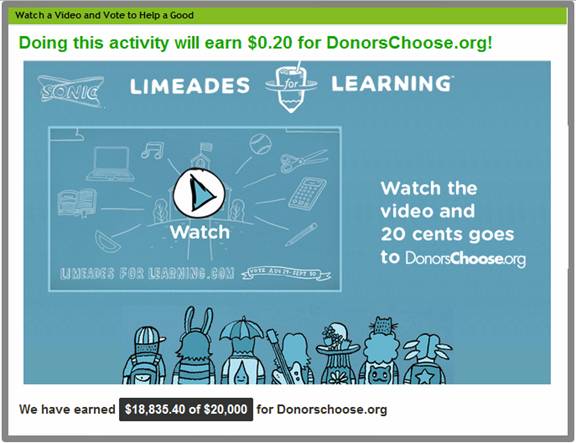

Video

In the fall of 2011 we created a viral video pop-up campaign for a well-known fast food retailer. The call to action asked users to “watch a video, which resulted in a 20 cent donation to a nonprofit organization.” After two weeks, the video received more than 100,000 views. The brand was able to drive a significant amount of traffic to their Facebook and web properties as a result, seed their video content, and support a trusted charity partner in the process.

| 16 |

Voting and taking activities

Other engagement ads go beyond just watching a video and ask users to participate in some form of activity such as voting, selecting or engaging in a game activity. In the fall of 2011 we launched a program for Seventh Generation that was intended to engage users around the idea of selecting a bright idea. We worked closely with the brand and their agency to develop the program and launched the program on multiple partner sites resulting in a significant increase in traffic and brand recognition for Seventh Generation.

| 17 |

Custom Build

Our services in this area include: social engagement strategy, graphical development, development, nonprofit or charity reward incentives, moderation and management of the app build or program. We work with both brands and advertising agencies on these custom projects.