UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

| | | | | |

| ☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _________ to _________

Commission File Number: 001-42018

IBOTTA, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware (State or other jurisdiction of incorporation or organization) | | 35-2426358 (I.R.S. Employer Identification Number) |

| | |

| 1801 California Street, Suite 400 Denver, Colorado 80202 (Address of principal executive offices, including zip code) |

|

| | |

| (303) 593-1633 (Registrant’s telephone number, including area code) | |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common stock, par value $0.00001 per share | IBTA | New York Stock Exchange |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☐ |

| | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the registrant’s common equity held by non-affiliates of the registrant as of June 28, 2024, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $1.1 billion based upon the closing price of the registrant’s Class A common stock reported for such date on the New York Stock Exchange (“NYSE”).

As of January 31, 2025, the registrant had outstanding 27,884,964 shares of Class A common stock and 3,137,424 shares of Class B common stock, each with a par value of $0.00001 per share.

DOCUMENTS INCORPORATED BY REFERENCE

Part III incorporates certain information by reference from the registrant’s definitive proxy statement for the 2025 Annual Meeting of Stockholders, which will be filed no later than 120 days after the registrant’s fiscal year ended December 31, 2024.

TABLE OF CONTENTS

| | | | | | | | |

| | Page |

| |

| |

| | |

| PART I | | |

| Item 1. | | |

| Item 1A. | | |

| Item 1B. | | |

| Item 1C. | | |

| Item 2. | | |

| Item 3. | | |

| Item 4. | | |

| PART II | | |

| Item 5. | | |

| Item 6. | | |

| Item 7. | | |

| Item 7A. | | |

| Item 8. | | |

| Item 9. | | |

| Item 9A. | | |

| Item 9B. | | |

| Item 9C. | | |

| PART III | | |

| Item 10. | | |

| Item 11. | | |

| Item 12. | | |

| Item 13. | | |

| Item 14. | | |

| PART IV | | |

| Item 15. | | |

| Item 16. | | |

| | |

| | |

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the federal securities laws, which involve substantial risks and uncertainties. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “would,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential,” “seek,” “aim,” “look,” “wish,” “hope,” “pursue,” “propose,” “design,” “forecast,” “try,” “continue,” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, plans, or intentions. Forward-looking statements contained in this Annual Report on Form 10-K include, but are not limited to, statements about:

•our expectations regarding financial results and performance, including our operational and financial targets, key metrics, and our ability to maintain profitability and generate profitable growth over time;

•our ability to successfully execute our business and growth strategy;

•our expectations regarding the capabilities of our platform and technology;

•the sufficiency of our cash, cash equivalents, restricted cash, and marketable securities to meet our liquidity needs;

•the demand for the Ibotta Performance Network (IPN) including the size of our addressable market, market share, and market trends;

•our ability to renew, maintain, and expand our relationships with publishers, specific products or groups of products identified by particular names and owned by a company that sells consumer packaged goods, including in the grocery and general merchandise categories (CPG brands), and retailers;

•our ability to grow the number of consumers that use our platform and the amount redeemed by our redeemers;

•our expectations regarding the macroeconomic environment, including rising inflation and interest rates, and uncertainty in the global banking and financial services markets;

•our ability to develop and protect our brand;

•our ability to effectively manage costs;

•our ability to develop new offerings, services, and features, bring them to market in a timely manner, and make enhancements to our platform;

•our ability to compete with existing and new competitors in existing and new markets and offerings;

•our ability to successfully expand our AI and machine learning (AIML) capabilities;

•our expectations regarding outstanding litigation and legal and regulatory matters;

•our expectations regarding the effects of existing and developing laws and regulations, and our ability to comply with such laws and regulations, including privacy matters;

•our ability to collect, receive, store, process, generate, use, transfer, disclose, make accessible, protect, secure, dispose of, and share data about publishers, CPG brands, retailers, and consumers;

•our ability to manage and insure operations-related risk associated with our business;

•our expectations regarding our market opportunity and new and evolving markets;

•our ability to maintain the security and availability of the IPN;

•our expectations and management of future growth;

•our expectations concerning relationships with third parties, including with Walmart Inc. and our other publishers on the IPN;

•our ability to expand into new verticals;

•our ability to maintain, protect, and enhance our intellectual property;

•the need to hire additional personnel and our ability to attract and retain such personnel;

•our ability to obtain additional capital and maintain cash flow or obtain adequate financing or financing on terms satisfactory to us;

•our expectations that we will not rely on the “controlled company” exemption under the listing standards of the New York Stock Exchange;

•our expectations regarding our Share Repurchase Program;

•the increased expenses associated with being a public company; and

•the impact of escalating tariff and non-tariff trade measures imposed by the U.S. and other countries, any U.S. federal government shutdown, the COVID-19 pandemic, or a similar public health threat, or the ongoing conflicts between Russia and Ukraine and Hamas and Israel, on global capital and financial markets, political events, general economic conditions in the United States, and our business and operations.

We have based these forward-looking statements largely on our current expectations and projections about our business, the industry in which we operate, and financial trends that we believe could materially adversely affect our business, financial condition, results of operations, and prospects, and these forward-looking statements are not guarantees of future performance or development. These forward-looking statements speak only as of the date of this Annual Report on Form 10-K and are subject to a number of risks, uncertainties, and assumptions described in the section titled, “Risk Factors” and elsewhere in this Annual Report on Form 10-K. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained in this Annual Report on Form 10-K, whether as a result of any new information, future events, or otherwise.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Annual Report on Form 10-K. While we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and you are cautioned not to unduly rely upon these statements.

We announce material information to the public through filings with the U.S. Securities and Exchange Commission, the investor relations page on our website (www.ibotta.com), press releases, public

conference calls, and public webcasts. The information disclosed through the foregoing channels could be deemed to be material information. As such, we encourage investors, the media, and others to follow the channels listed above and to review the information disclosed through such channels. Any updates to the list of disclosure channels through which we will announce information will be posted on the investor relations page on our website.

GLOSSARY OF KEY TERMS

The following definitions apply to these key terms as used in this Annual Report on Form 10-K:

Ad products. Paid digital advertisements such as display ads, tiles, sponsored offers, newsletters, and feature placements bought by clients to raise awareness of their offers and/or communicate their brand messages.

Application Programming Interface (API). A set of functions and procedures allowing the creation of apps that access the features or data of an operating system, app, or other service.

Artificial Intelligence (AI). Capabilities that leverage machine learning, deep learning, generative AI, and natural language processing on Ibotta’s technology platform.

Campaign. An organized course of action that clients undertake to promote a product or service on the IPN. A campaign may include one or more offers and related ad products.

Cash back. A form of reward that gives consumers a cash rebate after they purchase a product that qualifies for the reward.

Client. A company that pays Ibotta for the use of its IPN with the goal of influencing consumer purchase behaviors.

Consumer. An individual who uses the IPN (including both Ibotta properties and publisher properties). If a consumer has accessed the website or downloaded an app of one or more publishers or visited a store of a publisher, such consumer may be counted as multiple consumers.

Consumer Packaged Goods (CPG) brand (or brand). A CPG brand is an identifying name of a specific product or group of products owned by a company that sells consumer packaged goods, including in the grocery and general merchandise categories.

Digital promotions. Offers, discounts, and cash-back rewards that are marketed through online-based digital technologies such as a website, mobile app, mobile web interface, or other digital media.

Ibotta Direct-to-Consumer (D2C). Ibotta’s direct-to-consumer products include a free mobile app, website, and browser extension that are branded through Ibotta and allow CPG brands to deliver digital promotions to consumers on a fee-per-sale basis and consumers to earn cash back rewards for everyday purchases.

Ibotta Performance Network (IPN). An AI-enabled technology platform that allows CPG brands to deliver digital promotions to consumers via a network of publishers, in a coordinated fashion and on a fee-per-sale basis.

Ibotta Portal. A single interface that centralizes our clients’ experience with Ibotta, starting from setting up a campaign to analyzing its performance. Ibotta employees also use the Ibotta Portal to create and manage campaigns for our clients.

Integrated retailer. A retailer that sends item-level purchase data to Ibotta (either directly or via the IPN) so that offers can be seamlessly redeemed in its stores or on its apps or websites.

Offer. A digital promotion that encourages consumers to purchase one or more CPG products or shop at a specific retailer in exchange for a reward or discount.

Offer stacking. The possibility for a consumer to locate the same offer on more than one publisher, make a single purchase, and earn rewards or receive a discount more than once for that offer.

Point of Sale (POS). A device or system that is used by retailers to process consumer transactions.

Publisher. A company that hosts Ibotta-sourced offers on its websites or mobile apps, as part of the IPN. Publishers include third parties that host Ibotta’s offers on a white-label basis (e.g., a retailer publisher such as Walmart), as well as Ibotta itself, which hosts its own offers on Ibotta D2C properties.

Redeemer. A consumer who has redeemed at least one digital offer within the time period specified. If a consumer were to redeem on more than one publisher during that period, they would be counted as multiple redeemers.

Redemption. A verified purchase of an item qualifying for an offer by a client on the IPN.

Retail banner. A unique brand name of one retail store or a chain of retail stores owned by a retailer. A retailer may operate one or more retail banners.

Retailer. A company that owns and operates one or more physical or virtual stores under one or more retail banners that sell products or services to consumers. Retailer includes retailer advertisers, retailer publishers, and integrated retailers.

Retailer advertiser. A retailer that pays Ibotta a publisher commission when consumers click through to, and make a purchase from, the retailer’s website from one of Ibotta’s D2C properties. In some cases, Ibotta may also run promotions funded by retailer advertisers that encompass both online and offline sales, meaning consumers can earn cash back as a percentage of their total in-store basket spend, or as a percentage of their total online basket.

Retailer publisher. A retailer that is also a publisher on the IPN, meaning it hosts Ibotta-sourced offers on its digital properties.

Reward. Value or credit provided to a consumer upon the successful redemption of an offer, which may take the form of cash back, points, or other loyalty currency.

Third-party publisher. A non-Ibotta D2C publisher that hosts Ibotta-sourced offers on its digital properties and is part of the IPN (e.g., Walmart, Dollar General, and Instacart).

Universal Product Code (UPC). A number that uniquely identifies a product. Each offer specifies which UPCs are eligible for redemption.

White-label. An arrangement that allows publishers to leverage our technology and offers to power their loyalty program without Ibotta’s brand.

PART I

Item 1. Business

Overview

Ibotta’s mission is to Make Every Purchase Rewarding. We accomplish this mission by delivering digital promotions to clients through the Ibotta Performance Network (IPN). Through the IPN, we source digital promotions from our clients, primarily consumer packaged goods (CPG) brands, and distribute these promotions to consumers via our network of publishers, enabled by our technology platform. We have strategic relationships with Walmart Inc. (Walmart), Dollar General Corporation (Dollar General), Family Dollar, a subsidiary of Dollar Tree, Inc. (Family Dollar), Maplebear, Inc. (Instacart), and DoorDash, Inc. (announced in January 2025 but not yet launched) among others, who are third-party publishers on the IPN and use our digital offers to power their loyalty programs on a white-label basis. We also host offers on Ibotta’s direct-to-consumer properties, which include the Ibotta-branded cash back mobile app, website, and browser extension (collectively, Ibotta D2C, which is part of the IPN). Within Ibotta D2C, we also partner with affiliate networks to allow consumers to earn cash back on a percentage of their total basket spend at certain retailers.

As of December 31, 2024, we had over 830 clients, representing over 2,600 CPG brands, to source exclusive digital offers. Most of our offers cover products in non-discretionary categories, such as grocery, but we continue to grow our general merchandise categories, such as toys, clothing, beauty, electronics, pet, home goods, and sporting goods.

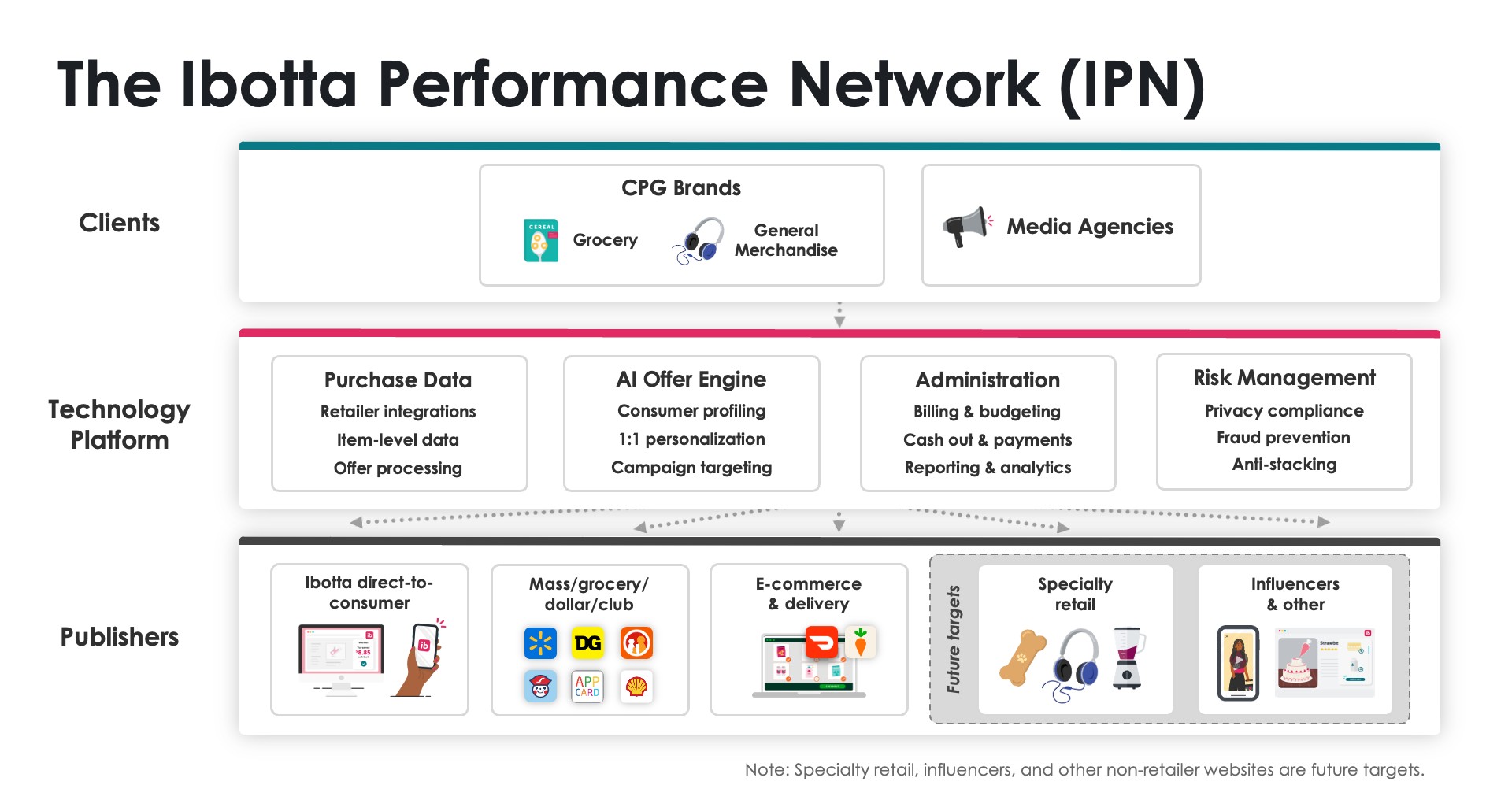

The Ibotta Performance Network

The IPN provides an at-scale success-based marketing solution where we get paid when our client’s promotion results in a sale. By using the IPN, CPG brands, retailers, and their media agencies can create digital offers and distribute them in a coordinated fashion across various publishers. These publishers currently include large retailers, which display our offers on their properties, as well as Ibotta D2C properties. The IPN is enabled by our proprietary, Artificial Intelligence (AI) enabled technology platform,

which takes advantage of a unique set of purchase data that we receive through our third-party publishers, D2C properties and point of sale (POS) integrations with retailers.

The key components of our network are as follows:

Clients. Ibotta sources digital promotions from CPG brands, retailers, and their media buying agencies. Each digital promotion is loaded into our network along with key parameters, such as the eligible products, total campaign budget, campaign expiration date (if any), and any targeting criteria specifying which consumer segments should receive the offer. Certain aspects of this process can be done on a self-serve basis, while others are accomplished with help from our account managers.

Technology platform. Our cloud-based, AI-enabled technology platform tracks which offers are selected by consumers, matches offers to the products that have been purchased, logs redemptions, handles the flow of funds, and manages downstream billing and logistics. This minimizes the risks that offer budgets are exceeded and that consumers redeem the same offer several times for a single purchase (i.e., offer stacking). We help our clients determine the optimal offer value, offer cadence, offer breadth, and targeting criteria for a given campaign, based on their strategic objectives. Using AI, we build recommenders that are designed to match the right offers with the right consumers at the right time. With AI, our recommendation algorithms continuously improve, allowing us to drive higher conversion and cost efficiency for our clients. Underpinning the platform is the item-level consumer purchase data we receive from our third-party publishers and retailer POS integrations, which we use to process offer redemptions and help drive high return on investment outcomes for CPG brands.

Publishers. We distribute our digital offers through Ibotta D2C properties and a growing network of third-party publishers that host our offers on a white-label basis. We have formed strategic relationships with retailer publishers such as Walmart, Dollar General, Family Dollar, Instacart, and DoorDash. On third-party publisher properties, consumers do not need an Ibotta account or mobile app to redeem offers.

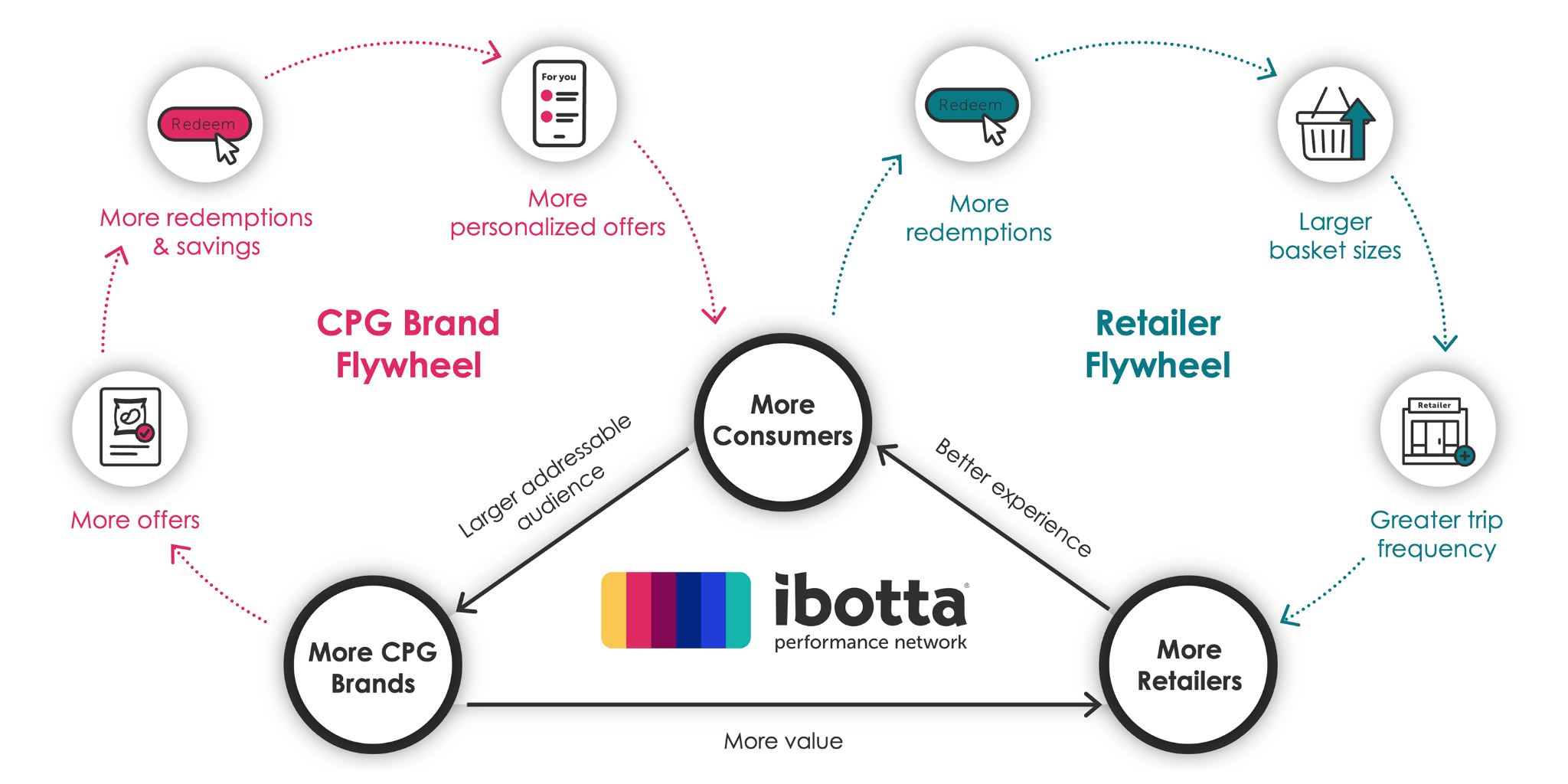

The above components of our network work together to create interconnected flywheels that can over time strengthen and accelerate the value of the IPN for our constituents.

CPG brand flywheel. The more offers CPG brands sponsor, the greater value we are able to deliver to consumers, and the more likely that they continue to engage with and recommend our offers to friends. The more consumers engage, the more investment we receive from both new and existing CPG brands that are eager to influence the greater spending power of this audience. The more offers are redeemed on the IPN, the more redemption data we collect in relation to each consumer, and the better our AI models become at recommending personally relevant offers for each consumer.

Retailer flywheel. The opportunity to entice more consumers into their stores and onto their websites motivates retailers to take steps that further increase consumer engagement. For instance, retailers can make it easier to redeem offers in their stores by integrating their POS with Ibotta or hosting our offers on their own apps and websites as part of their loyalty rewards programs. As offers become easier to redeem, more consumers use them, which in turn attracts greater investments in offers from CPG brands, which we believe ultimately results in more consumers using the retailer’s loyalty program.

The network dynamics inherent in Ibotta’s business create a strong competitive advantage. The more consumers we attract, the more CPG brands invest, and the more offers they provide for distribution across our network, the more consumers are likely to engage with our offers, increasing the value generated by each consumer. At the same time, the more content we add, the more attractive joining our network becomes to new publishers, enlarging the total audience and attracting more CPG marketing investment. As the network grows, retailers are increasingly incentivized to integrate with our technology so they can incorporate our rewards into their own loyalty programs while allowing their consumers to redeem offers as seamlessly as possible.

Our Products & Offerings

We provide a number of products and offerings to CPG brands and retailers, publishers, and consumers.

For CPG Brands and Retailers

Our offerings for CPG brands are often coordinated and delivered via the Ibotta Portal. The Ibotta Portal is a single interface that centralizes our clients’ experience with Ibotta, starting from setting up an offer to analyzing the performance of a campaign. Our clients typically purchase a combination of the following products to meet their marketing objectives.

Promotions

We allow CPG brands to deliver digital promotions to incentivize changes in consumer behavior and drive incremental sales. Through our deep experience with clients of various sizes that sell a wide range of consumer products, we have developed a number of curated, strategic “playbooks” that offer guidance on how best to achieve their specific marketing objectives. Depending on their goals, our clients can choose a set of eligible products, set offer values, introduce targeting criteria, and determine an overall budget for their campaign.

Measurement is also core to our promotions offering. We provide campaign performance analysis throughout the campaign and post-campaign via the Ibotta Portal, visualizing data on total unit movement, incremental units moved, demographic and geographic data for both in-store and online purchases at the Universal Product Code (UPC) level, partnering with our clients to measure the ongoing efficacy of their campaigns. Additionally, we provide CPG brands with insights derived from our robust item-level purchase data in order to improve their understanding of the consumer landscape and their associated promotional activities.

Our platform records the number of offers redeemed in any given campaign and invoices our clients for the total value of those offers, along with our agreed upon fee-per-sale commission. For most campaigns, we typically invoice our clients on a monthly basis.

Ibotta also partners with affiliate networks to provide consumers with cash back on a percentage of their total basket spend at retailers. The affiliate networks remit payment to us upon receipt from the retailers.

Ad and other products

On Ibotta D2C properties, we offer a variety of digital ad products to help our clients boost visibility for their brands and increase the reach of their promotions, which typically translates into increased offer redemptions. Ad products include targeted digital ads such as display ads, tiles, sponsored offers, newsletters, and feature placements bought by clients to raise awareness of their offers and/or communicate their brand messages. We typically charge fixed dollar amounts for our ad products, based on the size of the audience that views each unit.

We provide aggregated and deidentified data and insights to our clients which helps them enrich existing datasets to improve attribution tools and inform future marketing strategies. We also partner with data and media clients, and provide them with data, including personal data, used to assist their digital marketing efforts and strategies. We have differentiated access to first-party data, which includes cross-retailer and item-level data on full baskets purchased by millions of consumers, through our integrations with retailers, receipts submitted to us via our Ibotta D2C properties, and our ability to run surveys across our diverse consumer audience to gather qualitative insights. We deliver data and insights to our clients in the form of a license based on an agreement that specifies the nature and scope of the types of insights shared.

For Publishers

Publishers benefit from Ibotta’s white-label technology, or the “rewards as a service” platform. Publishers can integrate with Ibotta’s Application Programming Interfaces (APIs), and Ibotta handles all aspects of offer sourcing, purchase verification, offer matching, offer crediting, billing, and other logistics. Ibotta also provides expertise on operating a top-tier rewards program based on more than a decade of operating the Ibotta D2C. This can include valuable advice on program design and user experience (UX), recommended tactics for effective lifecycle marketing strategies to acquire and retain users of the digital offers program, and other helpful information and best practices. We believe publishers value Ibotta’s expertise in designing and operating widely used digital offer programs.

For Consumers

Consumers redeem offers through our third-party publisher properties or directly on our D2C properties. Our third-party publisher properties include white-label retailer loyalty programs powered by Ibotta, while our D2C properties include our Ibotta-branded mobile app, website, and browser extension. Cash out options on our third-party publishers vary, but consumers can usually apply cash back rewards to future trips, either in-store or online. In some cases, they can also choose to cash out to Paypal or claim their rewards as cash in-store. On our D2C properties, consumers may cash out their rewards in the form of gift cards, a transfer to their Paypal account, or a deposit to their bank account.

Third-party publisher properties

Consumers can access offers powered by Ibotta on third-party publishers’ digital properties. This creates a seamless experience for consumers through publishers, while allowing publishers to maintain a direct relationship with their consumer, keep their own brand front and center, and curate their own user experiences. There is no requirement for consumers to create an Ibotta account or download the Ibotta app to access third-party publishers’ properties; they can simply visit the publisher’s website or mobile app, select offers, buy featured products, and earn rewards or discounts, depending on how the publisher’s program is designed.

Ibotta D2C properties

We operate a free mobile app that is available on iOS and Android. With our mobile app, consumers can create an Ibotta account, browse and select offers powered by CPG brands or retailers, redeem those offers at retailers’ properties, and receive cash back when they buy the featured items either in-store or online. Once an offer is redeemed, consumers can see and manage their cash back balance within the app, and once they have reached a certain balance, they can cash out to a Paypal account, bank account, or digital gift cards from within the app. Since its debut in 2012 and as of December 31, 2024, our mobile app has attracted over 52 million registered users and been rated over 2.4 million times across the App Store and Google Play Store, earning an average of 4.7 out of 5 stars.

Ibotta also offers a free desktop browser extension for Google Chrome that is supported by the Ibotta.com website. Our browser extension compares prices across retailers and allows consumers to set price drop alerts, while providing access to cash back offers at over 3,000 online retailers. In addition, consumers can also use our website to set up or log into their accounts, redeem offers, and link their bank accounts and withdraw earnings.

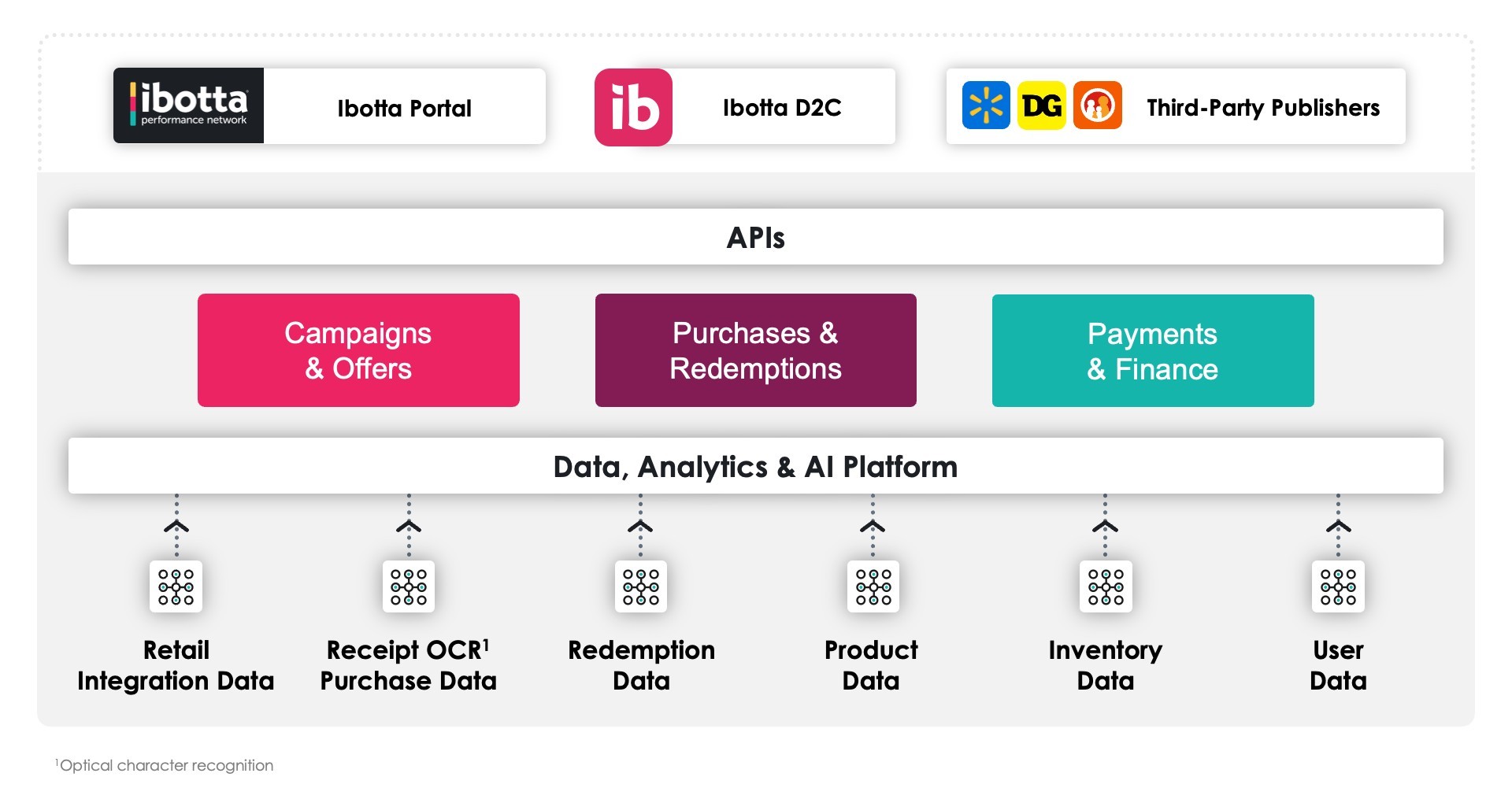

Our Technology Platform

Ibotta’s technology platform uses an AI-enabled offer engine that is designed to match and distribute the right offer to the right consumer at the right time. Underpinning our platform is a rich, ever-growing repository of data drawn from our third-party publishers and retailer POS integrations, consumer-provided receipt purchase data, offer selection and redemption data, and inventory data. We built a robust data and AI platform which powers our campaigns and offers, purchases and redemptions, and payments and finance capabilities. We designed our platform to be flexible, with APIs that allow stakeholders of the IPN to seamlessly share and receive critical information securely. CPG brands and publishers can interact on a daily basis with our technology via our carefully designed, easy-to-use portal.

The key components of our platform include:

Purchase data. We receive and process a large amount of item-level consumer purchase data from our third-party publishers and retailer POS integrations and use that data to process offer redemptions and help drive high return on investment outcomes for CPG brands. Purchase data includes the UPC, quantity, and price of the items for a transaction along with the total amount paid, date, time, and store location. The vast majority of our purchase data comes from direct integrations.

Data, analytics, and AI platform. Our cloud-based, data and AI platform is built on an open architecture that enables us to deliver millions of offers from CPG brands in a targeted, personalized way to consumers through our network of publishers. We leverage our unique cross-retailer, omnichannel, item-level purchase dataset to power proprietary AI models that can be used to predict future purchases, campaign performance, offer redemption velocity, and more. We use natural language processing, machine learning, and large language models to clean, categorize, and enhance the purchase data we process and then make it available via our data platform. It is then leveraged to adjudicate offer redemptions and power AI models and analytics across our entire technology stack including recommenders, search engines, audience targeting systems, campaign forecasting, targeted marketing efforts, and more. The more data we accumulate, the better our AI models become.

At the same time, our proprietary AI offer engine allows our CPG brands to better achieve their goals. We help our clients determine the optimal offer value, offer cadence, offer breadth, and targeting criteria for a given campaign, based on their strategic objectives. Using AI, we build recommenders that are

designed to match the right offers with the right consumers at the right time. With machine learning, our recommendation algorithms continuously improve, allowing us to drive higher conversion and cost efficiency for our clients.

We give CPG brands a single source of truth for the performance of their digital promotions nationwide, across multiple publisher environments. The Ibotta Portal allows CPG brands to set up campaigns on certain publishers, monitor redemption and budget levels, and analyze overall campaign performance in light of their specific objectives – all enabled by our technology platform.

Campaigns and offers. Our ability to drive sales for our clients turns in large part on our advanced capabilities in campaigns and offers. We believe Ibotta attracts consumers by allowing them to maximize savings, which we are able to do through the volume, quality, and personalization of the offers we provide. Our campaigns and offers capabilities include campaign creation, offer syndication, personalization, search, audiences and targeting, and distribution configuration. These capabilities power our clients’ ability to create, launch, and execute successful campaigns in a highly automated manner with strategic recommendations powered by our AI engine and informed by our differentiated access to data. Our technology also enables clients to personalize offers and decide which audiences to target.

Purchases and redemptions. Our technology platform helps orchestrate purchases and redemptions through our sophisticated capabilities in tracking and data analysis. Our systems are able to track which offers have been selected by consumers in real-time, match offers to the specific qualifying products that have been purchased, and log redemptions accordingly. Our real-time campaign tracking allows clients to monitor the success of their campaigns - providing visibility into total unit movement, sales lift, demographic and geographic data, market share, and brand switching behavior while the campaign is still ongoing, arming clients with the information they need to measure the efficacy of their campaigns and to optimize campaign performance and manage their budgets accordingly. We also help minimize offer stacking by ensuring that a consumer who earns a reward for redeeming an offer on Ibotta’s app cannot earn a second, redundant reward on a third-party publisher for the same underlying purchase.

Payments and finance. We handle all aspects of billing and collections, as well as managing cash flows. We also provide our clients with a portal that allows them to set up and refine their offer parameters, as well as monitor and analyze their campaign performance.

Robust API integrations. We built our technology platform to be highly flexible and scalable with our API-first design, enabling CPG brands and retailers to easily integrate with us. We allow our clients to leverage our APIs to integrate insights from our differentiated access to data into critical apps such as their customer relationship management software, marketing analytics tools, and more. Our APIs allow our core technology stack to extend to our constituents and their respective platforms.

Growth Strategies

We believe Ibotta is well positioned to capitalize on a large and growing market opportunity. U.S. consumers spent approximately $1.2 trillion in the grocery sector in 2024, and CPG brands compete fiercely to influence their spending habits, spending over $200 billion on marketing annually in the U.S. We intend to capitalize on this market opportunity with the following key growth strategies.

Grow our audience. To deliver more redemptions in the future, we plan to reach more consumers with our digital offers. Ibotta will seek to continue to grow the audience that we reach through the IPN through increased penetration at existing publishers and by adding to the network of third-party publishers.

•Grow redeemers on existing third-party publisher properties. We believe there is significant opportunity to grow the audience at existing third-party publishers. Ibotta works closely with its publishers and serves as an advisor to enhance publisher programs from a technical and user experience perspective. Additionally, Ibotta provides publishers with advice on marketing best

practices for digital offers programs, with a focus on reaching the maximum audience, building consumer engagement, and driving offer redemptions. We continue to see growth in usage of Ibotta-powered rewards programs at current publishers, as measured by the number of redeemers and redemptions. Our goal is to continue this growth through our efforts and those of our partners.

•Add new third-party publishers. We are focused on expanding our audience by building new partnerships with retailers that sell CPG products, as well as specialty retailers, and other, non-retailer publishers. Given Ibotta’s offer inventory, we believe we provide a strong value proposition for retailers looking to work with a white-label provider of digital offers. We believe Ibotta’s decade of experience operating a popular D2C app further strengthens our go to market message with potential new publishers.

Add offers. We have observed a strong correlation between the number offers we make available to consumers and the number of redemptions generated. An expanded library of offers increases the odds that a consumer will find something he or she wants to buy, increasing redemptions per redeemer. At the same time, adding more attractive and more numerous offers grows the redeemer base because consumers who earn rewards are more likely to keep coming back to redeem offers in the future. In order to capture a larger portion of the market, we will seek to grow investment from our existing CPG brands, while also seeking to expand into new brands and categories.

Continue to enhance the IPN through innovation. We will continue to invest in technology to further develop and accelerate the growth of the IPN for CPG brands, retailers, publishers, and consumers. As the data generated by the IPN grows, we believe Ibotta will generate more valuable insights about purchase behavior and market trends and may be able to automatically optimize campaigns for clients based on real-time data from across the network. We intend to enable CPG brands to leverage our AI-powered tools to run success-based marketing programs that achieve their specific goals. CPG brands may also be able to create digital offer campaigns programmatically via other buying platforms. Ibotta will aim to continue to engage consumers on our D2C apps, website, and browser extension by integrating more deeply with our publishers to make offer redemption as easy as possible. Wherever possible, consumers will be able to use their preferred payment instrument or loyalty program to redeem offers seamlessly on Ibotta D2C properties.

Sales and Marketing

While we believe our value proposition and the proven efficacy of our platform have together driven our organic expansion with CPG brands, we also employ various sales and marketing strategies to attract CPG brands, publishers, and consumers to the IPN.

CPG brand partnerships

We continue to scale by deepening our collaboration with our existing CPG brand partners and attracting new CPG brands to our network. As of December 31, 2024, we served over 830 clients, representing over 2,600 different CPG brands, primarily within the grocery and general merchandising categories.

We aim to shift clients’ marketing budgets from other marketing channels, including other promotions vehicles, to Ibotta. Our sales method varies to suit the needs of our clients. For smaller, more centralized clients, we may interface directly with the client’s Chief Marketing Officer. For larger clients, our team may target Chief Marketing Officers, Revenue Management/Commercial leaders, senior marketing or growth executives (or members of their team), individual brand or category managers, promotions managers, or centralized centers of excellence within the CPG brand umbrella. For larger clients, we often land with one brand and then seek to expand to others within the portfolio by demonstrating success with our campaigns.

We maintain a dedicated sales team, distributed across our Client Partnerships and Account Management teams. Our Client Partnerships team is responsible for sales to new and existing clients. Our Account Management team is dedicated to building and growing relationships with our clients, which they do by executing the campaigns sold by the Client Partnerships team and communicating the performance of those campaigns to our clients to encourage them to expand and extend their investments with Ibotta.

Each sales team within our organization may cover anywhere from one to dozens of clients, depending on the size, investment and complexity of those clients. For our largest and most strategic accounts, we have dedicated teams of employees who partner with a single client to recommend custom campaigns to achieve that client’s KPIs and to identify industry and category trends. The majority of our client accounts, however, are covered by client partners and account managers that also interact with other clients.

Our sales team is typically organized with a geographic focus based on where our clients are located in order to ensure that each team is able to interface with the brands they serve in person on a regular basis. We also have teams dedicated to specific categories, such as general merchandise. We structure our sales team incentive plan to align with the objectives of Ibotta, our clients and our publishers, including revenue and redemptions driven, instead of on common compensation plan targets such as budgets secured or redemptions generated by associated offers.

Publisher relationships

We have dedicated teams focused on maintaining and growing existing relationships with third-party publishers and bringing new publishers onto our platform.

Our strategic partner management team consists of account managers and technical account managers who work with existing third-party publishers to grow the size of the audience on publisher platforms that interact with our offers and to increase the number of redemptions per consumer. This team works with cross-functional resources from Ibotta’s marketing, sales, product design, and technical teams to provide best practices and consultative support to publishers on an ongoing basis.

Our business development team works to establish new partnerships across several target verticals, including grocery, mass, and pharmacy retailers, as well as delivery service providers, specialty retailers, and non-retailer publishers. The business development team’s efforts are centered around acquiring top strategic publishers that have large audiences and can fuel the expansion of our network.

Marketing

Our most effective marketing tactic is the value that we have created for our redeemers, with approximately $2.3 billion in cash credited to their accounts as of December 31, 2024. This has allowed us to build an efficient marketing engine with heavy organic growth while developing a broader set of marketing strategies to attract consumers to, and increase their engagement with, Ibotta’s D2C properties.

We run marketing across a wide variety of channels, including digital marketing campaigns across search engines, app stores, social media platforms, influencers, affiliates, programmatic advertising outlets, as well as more traditional channels like TV and radio, among others. Finally, we participate in key seasonal marketing events, like our annual Thanksgiving promotion, which has fed more than 10 million Americans since its inception.

As we have scaled the IPN, our marketing efforts have become increasingly business-to-business (B2B) focused. We aim to create inbound interest from additional advertisers and potential third-party publishers. Attracting more CPG brands and publishers will expand our network. These B2B marketing efforts leverage our D2C marketing experience to ensure that our clients and publishers understand the unprecedented scale and performance marketing efficiency of the IPN. Our focus here is to continue to

grow the Ibotta brand, and further embed ourselves across the industry. We market Ibotta at key events, like GroceryShop, and have marquee partnerships to increase the visibility of our brand, such as with the Denver Nuggets.

Competition

The environment in which we operate is highly competitive. We compete with a broad set of competitors for CPG brands, retailers, publishers, and consumers across our products and offerings. With increasing consumer usage of smartphones for retail shopping, the competitive landscape is constantly evolving and creating more competitive pressure to generate an innovative solution that reaches the largest consumer audience for CPG brands, retailers, and publishers.

For CPG brands. In sourcing offer budgets from CPG brands, we compete with legacy promotional tactics such as paper coupons, printable coupons, and free-standing inserts (FSIs), as well as load-to-card programs that publish digital coupons on the apps and websites of certain grocery retailers. We also compete for media agencies that choose to invest in Ibotta instead of investing in traditional, digital, social, search, and/or other advertisers, with which we also compete. These include large social media and search-oriented platforms, programmatic media networks that sell ads on a cost per click or cost per impression basis, and more traditional offline advertising spend. We believe CPG brands can generate a high and quantifiable return on their online or offline ad spend with Ibotta due to our fee-per-sale model, large audience reach, single solution to share offers across multiple retailers, omnichannel purchase-level data, our cookie-less privacy compliant marketing solution and our ability to limit stacking.

For publishers. We compete against rival digital coupon providers to convince retailers to leverage our technology and publish our offers on their digital properties. We believe that our access to national promotions budgets gives Ibotta the ability to provide publishers with a large volume of digital promotions content. Our technology provides an easy integration and onboarding process. These advantages allow our publishers to build higher consumer engagement, deliver more savings to their consumers, and create loyalty which helps them capture greater market share. Retailers could conceivably source offers for their own digital offers program, either in addition to or instead of working with a third-party partner. In that case, however, the retailer may be limited to retailer-exclusive offers and may not be able to tap into national promotions budgets within CPG brands. Further, Ibotta takes care of these functions so that retailers can focus their conversations with suppliers on negotiating the lowest possible price for goods and encouraging investments in higher margin products, such as retail media.

For consumers. Consumers can choose from among many other rewards programs that provide cash back, rewards, or discounts, including credit cards, individual retailer loyalty programs, and online shopping sites that aggregate retailer offers. There are also other mobile apps that offer digital promotions on CPG brand items, some of which provide cash back while others provide points. We win with consumers based on factors such as user experience, convenience, and value, as well as the quality and personalization of our offers. We believe consumers can generate more savings through Ibotta due to the volume and breadth of offers we provide and the fact that we offer cash back rather than points.

We face substantial competition from our primary competitors which include, but are not limited to:

•Companies that distribute paper coupons, retailer circulars, and FSIs, as well as load-to-card digital coupons through grocery retail apps and websites in a white-label fashion

•Other mobile apps that offer points, cash back rewards, or discounts to consumers when they upload their physical receipts or send in their e-receipt data

•Traditional, digital, social, search, and other advertisers

•Operators of other cash back rewards programs, including those that focus on sitewide cash back for online purchases

We compete by offering an at-scale solution that is purpose built for CPG companies, reaches a large number of consumers, provides exclusive access to some of the largest third-party publishers, hosts a large number of offers, allows for a higher degree of targeting and measurement, operates on a fee-per-sale basis, works for both in-store and online shopping, and delivers more sales and offer redemptions.

Our Culture and Employees

Ibotta’s unique, founder-led work culture is defined by our Mission and company values, and we believe these are critical to our ongoing success. Our Mission is to Make Every Purchase Rewarding, which means we seek to maximize the number of consumers who we benefit through the provision of rewards on their everyday purchases, regardless of whether they earn those rewards on our D2C properties or on one of our third-party publishers.

Our “IBOTTA” company values are:

•Integrity

•Boldness

•Ownership

•Teamwork

•Transparency

•A Good Idea Can Come From Anywhere

As of December 31, 2024, Ibotta employs 886 full-time employees, all but one of whom reside in the United States. Following a reduction in force in February 2025, Ibotta now employs approximately 800 full-time employees. We also engage with contractors, vendors, and consultants. None of our employees are covered by collective bargaining agreements. We believe our employee relations are favorable and we have not experienced any work stoppages.

We are strongly committed to maintaining a diverse, equitable, and inclusive workplace. This means we prioritize hiring and promoting people who not only have the skills required to perform their respective roles, but also bring diverse perspectives and experiences to their work at Ibotta. We invest in employee development to ensure all employees are prepared for career growth opportunities both at Ibotta and beyond their time with us. We regularly monitor our hiring and promotions practices to ensure that we live up to our commitment as an equal opportunity employer with no pay disparities based on gender, sex, sexual orientation, race, national origin, age, or religion.

In addition to providing challenging and engaging work, we also provide robust benefits, including health insurance for employees and dependents, which include options that are fully funded by Ibotta, 401k match, fertility benefits, paid parental leave, and generous time off to support both physical and mental well-being. We foster a tight-knit culture through company events, team building, concerts by our company band, and participation in our employee-led Culture Clubs, which provide opportunities for employees to engage cross-functionally. Annually, our employees can use dedicated volunteer hours to give back to their communities or via Ibotta Gives Day, our company-wide day of philanthropy. We are proud of the Ibotta culture and see its value reflected in our semi-annual employee engagement scores which reflect high engagement and a strong intent to remain with Ibotta.

Our board of directors and compensation committee oversee our human capital strategy, which is developed and managed under the leadership of our Chief People Officer, who reports to our Chief Executive Officer. Ibotta is committed to providing equitable compensation opportunities, and rewarding employees who achieve results, live our Mission and values, and help others succeed.

Intellectual Property

Our intellectual property rights are valuable and important to our business. We rely on a combination of patents, copyrights, trademarks, trade secrets, know-how, contractual provisions, and confidentiality procedures to protect our intellectual property rights.

As of December 31, 2024, we held ten issued United States patents and had five United States patent applications pending. Our issued patents are scheduled to expire as early as 2032. We continually review our development efforts to assess the existence and patentability of new intellectual property.

We have registered “Ibotta” and have also registered or are in the process of registering related marks as trademarks in the United States and other jurisdictions. We have also registered domain names for websites that we use in our business, such as www.ibotta.com and related variations.

In addition to the protection provided by our intellectual property rights, we enter into proprietary information and invention assignment agreements or similar agreements with our employees, consultants, and contractors. We further control the use of our proprietary technology and intellectual property rights through provisions in our agreements with partners.

We intend to pursue additional intellectual property protection to the extent we believe it would be beneficial and cost-effective. Despite our efforts to protect our intellectual property rights, they may not be respected in the future or may be invalidated, circumvented or challenged.

For additional information, see the sections titled Risk Factors—Risks Related to our Intellectual Property—We may not be able to adequately protect our intellectual property rights or may be accused of infringing intellectual property rights of third parties.

Government Regulation

Ibotta is subject to U.S. federal and state laws and regulations regarding privacy, data protection and information security, including laws and regulations regarding the storage, protection, sharing, use, transfer, disclosure, and other processing of personal data, as well as related subjects such as marketing and consumer protection. We are also subject to various U.S. federal and state laws and regulations that affect companies conducting business on mobile platforms, including those relating to the internet, behavioral advertising, mobile apps, content, advertising and marketing activities, and anti-corruption. For example, the California Consumer Privacy Act of 2018 (the CCPA) went into effect on January 1, 2020. The CCPA requires covered companies (including Ibotta) to, among other things, provide certain disclosures to California consumers, and afford such consumers abilities to opt-out of the sale of, to review, and to delete their personal information that is collected by businesses. The California Privacy Rights Act of 2020 (the CPRA) amended the CCPA and took effect on January 1, 2023. The CPRA, among other things, expanded the CCPA with additional privacy compliance obligations for businesses, provided additional rights to California consumers, and established a regulatory agency dedicated to enforcing those requirements. Similar legislation has been proposed or adopted in numerous other states.

We have implemented a variety of technical and organizational security and other measures designed to protect our data and other data that we maintain, including data pertaining to our redeemers, employees, and business partners. Despite implementation of these measures, we may be unable to anticipate or prevent unauthorized access to, or unavailability, acquisition, corruption, loss, disclosure, or other processing of such data. The CCPA and similar laws impose significant statutory damages as well as a private right of action for certain data breaches that implicate consumers’ personal information.

Actual or perceived non-compliance with applicable laws and regulations relating to privacy, data protection, cybersecurity, marketing, and consumer protection could result in litigation, claims, proceedings, actions or investigations by governmental entities, authorities or regulators, and significant financial penalties and related legal liabilities. There can be no assurance that we will not be subject to private claims or litigation or regulatory investigations or other action, or be subject to penalties, liabilities,

or other obligations, including financial penalties, in the event of a security breach or incident or any actual or alleged failure to comply with laws, regulations, industry standards, contractual obligations or other actual or asserted obligations relating to privacy, data protection, cybersecurity, marketing, or consumer protection. We also could be adversely affected if new legislation or regulations are passed or existing laws or regulations are expanded and interpreted in manners that are inconsistent with our policies or practices or require changes in our business practices. Further, new and evolving legislation and regulations, and changes in their enforcement and interpretation, may require changes to our business practices, including our AI platform, and may significantly increase our compliance costs and otherwise adversely affect our business and results of operations. Any of these circumstances could adversely affect our business, financial condition, results of operations, and prospects.

For additional information, please see the sections following the heading Risk Factors—Risks Related to Government Regulation, Tax, or Accounting Standards.

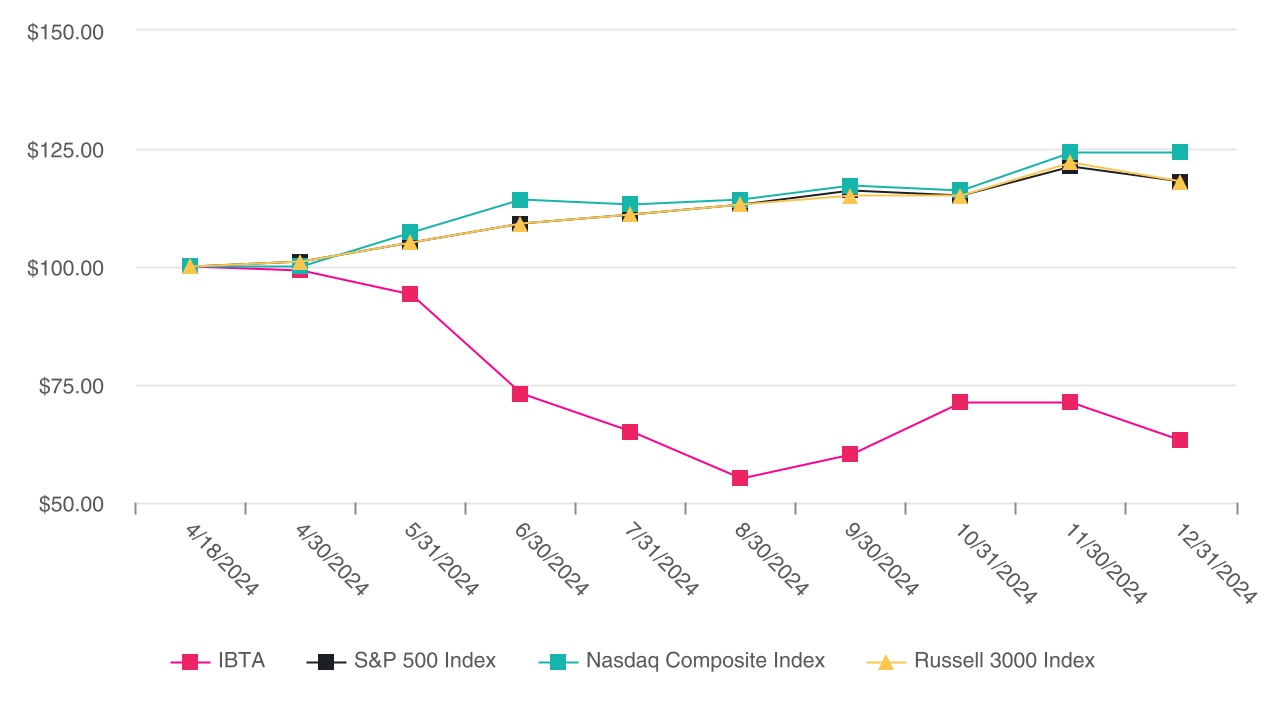

Corporate Information

We were incorporated in 2011 as Zing Enterprises, Inc., a Delaware corporation. In 2012, we changed our name to Ibotta, Inc. Our principal executive office is located at 1801 California Street, Suite 400, Denver, Colorado 80202, and our telephone number is 303-593-1633. Our website address is www.ibotta.com. We completed our initial public offering (IPO) in April 2024, and our common stock is listed on the New York Stock Exchange under the symbol “IBTA.”

We use Ibotta, the Ibotta logo, the IPN logo, and other marks as trademarks in the United States. This Annual Report on Form 10-K contains references to our trademarks and service marks and to those belonging to other entities. Solely for convenience, trademarks and trade names referred to in this Annual Report on Form 10-K, including logos, artwork, and other visual displays, may appear without the ® or TM symbols, but such references are not intended to indicate in any way that we will not assert, to the fullest extent under applicable law, our rights, or the rights of the applicable licensor to these trademarks and trade names. We do not intend our use or display of other entities’ trade names, trademarks, or service marks to imply an endorsement or sponsorship of us by any other entity.

Available Information

Our website is located at www.ibotta.com, and our investor relations website is located at investors.ibotta.com. Copies of our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and amendments to these reports filed or furnished pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (Exchange Act), are available, free of charge, on our investor relations website as soon as reasonably practicable after these materials are filed with or furnished to the SEC at www.sec.gov. We also make available through our investor relations website other reports filed with or furnished to the SEC under the Exchange Act, including our proxy statements and reports filed by officers and directors under Section 16(a) of the Exchange Act, as well as our Code of Business Conduct and Ethics, Corporate Governance Guidelines and Board committee charters.

We use filings with the SEC, our website, press releases, public conference calls, public webcasts, our social media, and our blog as a means of disclosing material nonpublic information and for complying with our disclosure obligations under Regulation Fair Disclosure. The contents of these channels are not intended to be incorporated by reference into this Annual Report on Form 10-K or in any other report or document we file with, or furnish to, the SEC, and any references to our websites or the contents of our websites are intended to be inactive textual references only.

We encourage investors, the media, and others to follow the channels listed above and to review the information disclosed through such channels. Any updates to the list of disclosure channels through which we will announce information will be posted on the investor relations page on our website.

Item 1A. Risk Factors

Investing in our Class A common stock involves a high degree of risk. You should carefully consider the risks described below, as well as the other information included in this Annual Report on Form 10-K, including the section titled, “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and related notes, before making an investment decision. The occurrence of any of the events or developments described below could materially adversely affect our business, financial condition, results of operations, and prospects. In such an event, the market price of our Class A common stock could decline, and you may lose all or part of your investment. Additional risks and uncertainties not presently known to us or that we currently deem immaterial also may impair our business operations and the market price of our Class A common stock.

Our business is subject to numerous risks and uncertainties. These risks include, but are not limited to, the following:

•We have a history of net losses, we anticipate increasing expenses in the future, and we may not be profitable.

•Our business, financial condition, results of operations, and prospects could be materially adversely affected if we do not renew, maintain, and expand our relationships with existing publishers and add new publishers to the Ibotta Performance Network (IPN), or if our publishers experience (as they have previously) downturns, store closures, or failures of their own businesses, or fail to adopt our additional offerings or fulfillment methods.

•We are also dependent on our publishers to take steps to integrate with the IPN and to maximize and encourage offer redemption, including decisions relating to user experience and design, marketing, and proper maintenance of their technology.

•If we fail to maintain or grow offer supply and redemptions on our network, our revenues and business may be negatively affected.

•Our business, financial condition, results of operations, and prospects could be materially adversely affected if we do not renew, maintain, and expand our relationships with CPG brands or add new CPG brands.

•We may not be able to sustain our revenue growth rate.

•We provide content to publishers indirectly through technology partners and our business, financial condition, results of operations, and prospects could be materially adversely affected if we do not renew, maintain, and expand our relationships with those partners.

•We expect a number of factors to cause our results of operations to fluctuate on a quarterly and annual basis, which may make it difficult to predict our future performance.

•Macroeconomic conditions, including slower growth or a recession and supply chain disruptions, have previously affected and could continue to adversely affect our business, financial condition, results of operations, and prospects.

•Competition presents an ongoing threat to the success of our business.

•Our business, financial condition, results of operations, and prospects could be materially adversely affected if we do not renew, maintain, and expand our relationships with retailers.

•If we fail to effectively manage our growth, our business, financial condition, results of operations, and prospects could be materially adversely affected.

•We have a limited operating history and operate in an evolving industry, which makes it difficult to evaluate our future prospects and may increase the risk that we will not be successful.

•We are making substantial investments to capitalize on new and unproven business opportunities and expect to increase such investments in the future. These initiatives are risky, and we may never realize any expected benefits from them.

•We are making substantial investments in our technologies, and if we do not continue to innovate and further develop our platform, our platform developments do not perform, or we are not able to keep pace with technological developments, we may not remain competitive, and our business, financial condition, results of operations, and prospects could be materially adversely affected.

•If our security measures or information we collect and maintain are compromised or publicly exposed, publishers, CPG brands, retailers, and consumers may curtail or stop using our platform, and we could be subject to claims, penalties, and fines.

•We have previously identified material weaknesses in our internal controls over financial reporting and if we are unable to maintain effective internal controls or if we identify additional material weaknesses in the future, we may not be able to accurately or timely report our financial condition or results of operations, which could materially adversely affect our business, financial condition, results of operations, and prospects.

•The dual class stock structure of our common stock concentrates voting control with Bryan Leach, our Founder, Chief Executive Officer, President, and Chairman of our board of directors, which will generally preclude our stockholders’ ability to influence the outcome of matters submitted to our stockholders for approval, subject to limited exceptions.

•We have adopted a Share Repurchase Program to purchase up to an aggregate of $100 million of the Company’s Class A common stock; however, any future decisions to reduce or discontinue repurchasing our Class A common stock pursuant to the Share Repurchase Program could cause the market price of our Class A common stock to decline.

•Although we do not expect to rely on the “controlled company” exemption under the listing standards of the New York Stock Exchange, we expect to have the right to use such exemption, and therefore we could in the future avail ourselves of certain reduced corporate governance requirements.

Risks Related to our Business

We have a history of net losses, we anticipate increasing expenses in the future, and we may not be profitable.

We have a history of net losses, and we may not be profitable. For example, we incurred a net loss of $54.9 million for the year ended December 31, 2022, and as of December 31, 2024, we had an accumulated deficit of $140.4 million. We expect our costs will increase over time as we expect to invest significant additional funds towards growing our business and operating as a public company. See the risk factor below titled, “Operating and growing our business may require additional capital, and if capital is not available to us, our business, financial condition, results of operations, and prospects may suffer.” We have expended and expect to continue to expend substantial financial and other resources on developing our platform, including expanding our solutions, developing or acquiring new platform features and solutions, and increasing our sales and marketing efforts. These efforts may be more costly than we expect and may not result in increased revenue or growth in our business. Any failure to increase our revenue sufficiently to keep pace with our investments and other expenses could prevent us from achieving profitability or positive cash flow on a consistent basis. If we are unable to successfully address

these risks and challenges as we encounter them, our business, financial condition, results of operations, and prospects could be materially adversely affected.

Our ability to maintain profitability is impacted by growth in our network and our ability to drive operational efficiencies in our business. Our efforts to maintain profitability may not succeed due to factors such as evolving consumer behavior trends in shopping, consumer engagement, and retention; our ability to maintain and expand our relationships with publishers, CPG brands, retailers, and consumers; our ability to hire and retain highly skilled personnel; unfavorable macroeconomic conditions (such as inflationary pressures); our ability to effectively scale our operations; and the continuing evolution of the industry. Many of these factors are beyond our control.

Our ability to maintain profitability also depends on our ability to manage our costs. We have expended and expect to continue to expend substantial financial and other resources to:

•increase the engagement of consumers and investment levels of publishers, CPG brands, and retailers;

•increase the number and variety of publishers that participate in the IPN;

•grow our sales force, which we expect will increase our sales and marketing expense in the foreseeable future;

•negotiate favorable revenue sharing terms or financial guarantees with publishers;

•drive adoption of Ibotta through marketing and incentives and increase awareness through brand campaigns; and

•invest in our operations to continue scaling our business to achieve and sustain long-term efficiencies.

These investments may contribute to net losses in the near term. We may discover that these initiatives are more expensive than we currently anticipate, and we may not succeed in increasing our revenue sufficiently to offset these expenses or realize the benefits we anticipate. Certain initiatives will also require incremental investments or recurring expenses and may not be accretive to revenue growth, margin, or profitability for a longer time period, if at all. Many of our efforts to increase revenue and manage operating costs are new and unproven given the unique and evolving complexities of our business and the evolving nature of the industry. In addition, we may make concessions to publishers, CPG brands, and retailers that are designed to maximize profitability in the long term but may decrease profitability in the short term. As a result, the impact of concessions on our financial results may continue into future periods or have greater impacts than we anticipate. We may also incur higher operating expenses as we implement strategic initiatives, including in response to external pressures such as competition, retailer consolidation, and evolving consumer behavior trends in shopping. For example, we expect that sales operating expenses will increase for the foreseeable future, primarily stemming from increased headcount. Additionally, we may not realize, or there may be limits to, the efficiencies we expect to achieve through our efforts to scale the business, reduce friction in the direct-to-consumer (D2C) shopping experience, client support, and consumer acquisition and onboarding costs. Our efforts to encourage the growth of loyalty programs on publishers’ apps and websites may cause fewer consumers to use our D2C properties, leading to a loss of revenue and adversely affecting our financial position. We also expect to continue to face greater compliance costs associated with the increased scope of our business and being a public company.

We may encounter unforeseen operating expenses, difficulties, complications, delays, and other factors, including as we expand our business, execute on strategic initiatives, and navigate macroeconomic uncertainty, which may result in losses or a failure to generate profitable growth in future periods.

As such, due to these factors and others described in the “Risk Factors” section, including the risk factor titled, “We may not be able to sustain our revenue growth rate,” we may not be able to maintain profitability or generate profitable growth in the future. If we are unable to maintain profitability, the value of our business and the trading price of our Class A common stock could be materially adversely affected.

Our business, financial condition, results of operations, and prospects could be materially adversely affected if we do not renew, maintain, and expand our relationships with existing publishers and add new publishers to the IPN, or if our publishers experience (as they have previously) downturns, store closures, or failures of their own businesses, or fail to adopt our additional offerings or fulfillment methods.

Our business, financial condition, results of operations, and prospects could be materially adversely affected if we do not renew, maintain, and expand our relationships with existing publishers and add new publishers to the IPN. We provide offers on a white-label basis to our publishers, including but not limited to, Walmart Inc. (Walmart), Dollar General Corporation (Dollar General), Family Dollar Stores LLC (Family Dollar), Maplebear Inc. (Instacart), and DoorDash, Inc. (announced in January 2025 but not yet launched). We have invested heavily in the IPN, which matches and distributes offers across a variety of publisher sites. Our contract negotiation process with publishers can be lengthy, which can contribute to variability in our revenue generation and makes our revenue difficult to forecast. As a result, it is difficult to predict our ability to form new partnerships with publishers, and our revenue could be lower than expected, which could have a material adverse effect on our business, financial condition, results of operations, and prospects.

We match and distribute our digital offers through large retailer publishers, grocery retailers, and our D2C properties. If we do not renew, maintain, and expand these relationships or add new publishers, our business, financial condition, results of operations, and prospects could be materially adversely affected. We rely heavily on our publishers to match and distribute our digital promotions content, with a substantial portion of our white-label redemptions originating from offer selections on their websites and mobile applications. In particular, the Walmart Program Agreement we entered into with Walmart on May 17, 2021 (Walmart Program Agreement) is a multi-year arrangement and automatically renews for successive 24 month periods unless either party provides notice of termination at least 180 days prior to the expiration of the applicable period. The Walmart Program Agreement can be terminated by Walmart with at least 270 days’ notice to us (provided that Walmart cannot replace us during the then-remaining term of the Walmart Program Agreement with a digital offers program created by Walmart or a third party), and may be terminated under certain circumstances, including for material breach by either party. If Walmart terminated or elected not to renew the Walmart Program Agreement with us, our business, financial condition, results of operations, and prospects could be materially adversely affected.

Publishers may also ask to modify their agreement terms in a cost-prohibitive or strategically detrimental manner when their agreements are up for renewal. Our inability to maintain our relationships with our publishers on terms consistent with or better than those already in place and that are otherwise favorable to us could increase competitive pressure and/or offering pricing, and otherwise materially adversely affect our business, financial condition, results of operations, and prospects. For example, a publisher could ask Ibotta to develop new digital offer structures not covered in the initial agreement when negotiating a contract renewal. Ibotta may not otherwise have those new offer structures on its product roadmap but may need to prioritize that work in order to retain the business, which could result in increased costs if, for example, Ibotta increases its hiring to meet such publisher expectations or could result in trade-offs against other items on Ibotta’s product roadmap.