Exhibit 1

Just Energy Group Inc.

Notice of Annual Meeting of Shareholders

– And –

Management Information Circular

June 27, 2017

KEY FISCAL 2017 HIGHLIGHTS

· $3,757 million in sales.

· $696 million in gross margin.

· $224 million in Base EBITDA – improved Base EBITDA by 8% year over year.

Just Energy stands by its vision to be the gold standard in retail energy, delivering value, stability and innovation in every customer, shareholder, employee and community relationship. Our vision serves as the framework for every aspect of our business.

Value

Striving to deliver the highest satisfaction and greatest benefit to every customer, shareholder, employee and community partner.

Stability

Ensuring we consistently deliver dependable, predictable products and services, reliable investor returns and a strong commitment to community.

Innovation

Challenging ourselves daily to explore forward-thinking solutions and progressive options to deliver gold-standard products and services.

JUST ENERGY FOUNDATION FISCAL 2017 HIGHLIGHTS

Everywhere we operate, Just Energy has always believed in contributing to the health and well-being of communities in need. We created the Just Energy Foundation to help support Canadian and U.S. charitable organizations by providing them with resources that, in turn, are shared with an array of worthwhile programs that help people who need help. Just Energy also supports its employees in their efforts to make a positive difference in people’s lives.

· On October 13, 2016, approximately 50 Just Energy staff from across Canada and the United States joined with the Just Energy Foundation and Volunteer Houston, along with teachers, staff and students at Brookline Elementary in Houston, to break ground on the first Just Energy Sustainable Garden.

· MLSE Foundation is our teammate on the Community Action Grants program. Through this initiative, every Maple Leaf Sports and Entertainment sport (hockey, basketball and soccer) makes a $50,000 grant to a charity that gives disadvantaged youth a chance to participate in that sport. In fiscal year 2017, $50,000 Community Action Grants went to Lady Ballers Camp (April 2016), Woodgreen Community Services (August 2016) and Hockey 4 Youth (March 2017).

· At our sales leadership summit in October 2016, more than 200 energy advisors from Canada and the United States joined together to “give back” to the local community. The energy advisors raised $5,800 and Just Energy matched it for a total of $11,600. The funds were donated to two orphanages in Puerto Vallarta. The money was used to purchase beds, mattresses, water filtration and security systems, and other much-needed supplies.

· The Goodwill Ambassador Program (GAP) gives each Just Energy employee a day off during the year to volunteer at a charity of his or her choice. In 2017, 157 employees made use of this opportunity to donate their time to local organizations such as food banks, shelters, services to the poor, homeless and vulnerable, as well as hospitals and education programs for youth.

May 26, 2017

Dear Fellow Shareholder:

This is a momentous time for our Company: our 20th anniversary in the retail energy space. What started as a natural gas retailer in Ontario, Canada, in 1997 has successfully grown and transformed into what we are today – a leading independent retailer of energy management solutions with a multinational, customer-centric approach.

Over the past several years, our executive management team focused on addressing a number of issues, undertook challenging tasks and made tough decisions, including deleveraging the Company significantly, selling-off non-core assets and creating a customer-centric strategy internally and externally. This has allowed us to be where we are today – in the process of successfully executing a global enterprise strategy that is aggressively pursuing profitable growth on a mission to become the world’s leading global energy management solutions provider delivering comfort, convenience and control to our customers around the globe.

In an industry that has undergone significant change, we have weathered challenges that saw the exit of other less-grounded players. There is no other independent retailer in the world with the stability, product depth, sales channel diversity and geographic scope of Just Energy. In the years ahead, we will continue guiding the business toward a clear vision for the future by positioning Just Energy to capitalize on where we see the energy sector heading, what we believe customers will want next, and where we know opportunities for new markets exist.

We believe we can continue disrupting the utility markets with new products and channels while creating deep residential and commercial customer relationships to grow the business. We have an efficient capital structure in place and a sustainable payout ratio. We’re moving forward with a very strong balance sheet and restored financial flexibility. This strength comes at a time when the industry is once again changing, and will allow us to focus our resources and make necessary investments to aggressively pursue our growth strategy.

We believe energy plays a significant role in the changing home ecosystem and we are firmly focused on addressing growth opportunities around the rapidly changing ways that consumers use energy. Our product pipeline to meet the growing market opportunities is robust, continues to improve, and remains a top strategic priority for our organization. From smart thermostats to personalized home consumption insight reports, LED bulbs, furnace filters and smart home irrigation controllers, we are empowering consumers with the tools and information they need to find the comfort, control and convenience they want. We are clearing a path as a trusted advisor providing energy efficiency and water conservation solutions for anyone who uses energy – and that is everyone!

Everything we do, we do in the context of the customer experience. Technological advancements give us the ability to process millions of data points, giving us unparalleled insight into how our consumers behave and think. Customers are telling us what they want and how they want it – it is changing all the time and the needs are more demanding than ever. Evolving technology and more informed, empowered consumers are the most influential factors in our business today.

We must not only keep pace with customer needs, but learn to anticipate the future and deliver unparalleled customer value. For the past three years we executed on several initiatives that reduced debt, cleaned up the balance sheet and laid out a clear vision for the future. As a management team, we are now moving into a period of executing on our growth strategy, and we believe there is no one better positioned than Just Energy to be the global leader in energy management and efficiency solutions for consumers near and far.

Our commitment to our customers has never wavered, and we thank them for their continued loyalty. We also wish to thank our Board of Directors for their continued support of our mission, as well as all our employees for their tireless dedication.

We look forward to seeing you at the meeting.

Sincerely, | |

| |

Rebecca MacDonald

Executive Chair |

|

(This page has been left blank intentionally.)

Notice of Annual Meeting

To: Just Energy Common Shareholders

The annual meeting of Just Energy Group Inc. (“Just Energy”) shareholders will be held at the Toronto Stock Exchange – Broadcast Centre, The Exchange Tower, 2 First Canadian Place, 130 King Street West, Toronto, Ontario, Canada M5X 1J2 on Tuesday, June 27, 2017, at 10:00 a.m. EDT:

1. to receive the audited consolidated financial statements of Just Energy for the year ended March 31, 2017 and the auditor’s report thereon;

2. to elect the nominees of Just Energy standing for election as directors on an individual basis;

3. to re-appoint Ernst & Young LLP as auditors of Just Energy and to authorize the Board of Directors of Just Energy (the “Board”) to fix the auditors remuneration;

4. to consider, in an advisory, non-binding capacity, Just Energy’s approach to executive compensation; and

5. to transact such other business as may properly be brought before the meeting or any adjournment or postponement thereof.

The matters proposed to be dealt with at the meeting are described in the proxy circular accompanying this notice. The directors have fixed May 17, 2017, as the record date for the determination of the common shareholders entitled to receive notice of and vote at the meeting.

Dated at Toronto, Ontario | JUST ENERGY GROUP INC. |

May 26, 2017. | |

|

|

|

| |

| Jonah T. Davids |

| Executive Vice President, General Counsel and |

| Corporate Secretary |

Inside this Circular

| | Page |

| | |

KEY TERMS | | 1 |

MEETING AND VOTING INFORMATION | | 3 |

VOTING – QUESTIONS AND ANSWERS | | 3 |

BUSINESS OF THE MEETING | | 6 |

CORPORATE GOVERNANCE PRACTICES | | 9 |

DIRECTORS | | 14 |

DIRECTOR COMPENSATION | | 21 |

Director Compensation Structure | | 21 |

Director Compensation Table | | 22 |

Options and Common Share Based Awards – Outside Directors | | 23 |

Director Incentive Plan Awards – Value Vested or Earned During the Year | | 24 |

COMPENSATION DISCUSSION AND ANALYSIS | | 24 |

Compensation Principles and Philosophy | | 25 |

The Compensation Committee | | 25 |

Our Approach to Executive Compensation | | 25 |

Elements of Compensation | | 28 |

Just Energy Performance Graph | | 33 |

Summary Compensation Table | | 34 |

Incentive Plan Awards | | 36 |

Equity Compensation Plans | | 37 |

Securities Authorized for Issuance Under Equity Compensation Plans | | 41 |

TERMINATION, CHANGE OF CONTROL AND EMPLOYMENT AGREEMENT TERMS | | 42 |

Termination Provisions | | 42 |

Change of Control Events | | 43 |

Summary of Incremental Severance and Termination Payments | | 44 |

Employment Agreements – Other Terms, Conditions and Obligations | | 44 |

OTHER MATTERS | | 45 |

Indebtedness of Directors and Executive Officers | | 45 |

Interest of Informed Persons in Material Transactions | | 45 |

Regulatory Matters and Bankruptcies and Insolvencies | | 45 |

Interests of Certain Persons or Companies in Matters to be Acted Upon | | 46 |

2017 Shareholder Proposals | | 46 |

Additional Information | | 46 |

Board Approval | | 46 |

SCHEDULE A – STATEMENT OF CORPORATE GOVERNANCE PRACTICES OF JUST ENERGY | | A-1 |

SCHEDULE B – JUST ENERGY GROUP INC. – BOARD MANDATE | | B-1 |

SCHEDULE C – COMPENSATION, HUMAN RESOURCES, HEALTH, SAFETY AND ENVIRONMENTAL COMMITTEE – TERMS OF REFERENCE | | C-1 |

KEY TERMS

The following table provides definitions for terms that are used throughout this Circular.

Base EBITDA | | EBITDA adjusted to exclude the mark to market gains (losses) arising from IFRS requirements for derivative financial instruments on future supply positions. This measure reflects operating profitability as mark to market gains (losses) are associated with supply already sold at future fixed prices. |

| | |

Board | | Board of Directors of the Company |

| | |

Company or Just Energy | | Just Energy Group Inc. |

| | |

DSG | | Deferred Share Grant issued to directors pursuant to the 2010 Directors Compensation Plan, as amended from time to time. |

| | |

Embedded Gross Margin | | A rolling five-year measure of management’s estimate of future contracted energy gross margin. The energy marketing embedded margin is the difference between existing customer contract prices and the cost of supply for the remainder of term, with appropriate assumptions for customer attrition and renewals as calculated in Just Energy’s MD&A. |

| | |

Funds from Operations | | The net cash available for distribution through dividends to shareholders. Funds from Operations is calculated by Just Energy as gross margin adjusted for cash items including administrative expenses, selling and marketing expenses, bad debt expenses, finance costs, corporate taxes, capital taxes and other items. The gross margin used includes a seasonal adjustment for the gas markets in Ontario, Quebec, Manitoba and Michigan in order to include cash received. |

| | |

PBG | | Performance Bonus Grant issued pursuant to the Company’s 2013 Performance Bonus Incentive Plan, as amended from time to time. |

| | |

RSG | | Restricted Share Grant issued pursuant to the Company’s 2010 Restricted Share Grant Plan, as amended from time to time |

| | |

Shareholders | | Holders of common shares. |

| | |

Total Shareholder Return or TSR | | The percentage increase (decrease) during a Fiscal Year of the market value of Just Energy’s common shares based on the closing market price for Just Energy’s common shares on the TSX on the last day of the Fiscal Year plus the total dividends paid on such shares over during the Fiscal Year. |

Currency

Unless otherwise identified, all amounts in this Circular are in Canadian dollars.

Non-GAAP Measures

In the Circular, Just Energy has used terms that are not defined by GAAP, including Base EBITDA, Embedded Gross Margin and Funds From Operations (as defined above), but are used by management to evaluate performance of Just Energy and its business. Since Non-GAAP financial measures do not have standardized meanings prescribed by GAAP and are therefore unlikely to be comparable to similar measures presented by

| 1

| 1

other companies, securities regulations require that Non-GAAP financial measures are clearly defined, qualified and reconciled to their nearest GAAP measures. Except as otherwise indicated, these Non-GAAP financial measures are calculated and disclosed on a consistent basis from period to period. Specific adjusting items may only be relevant in certain periods. The intent of Non-GAAP financial measures is to provide additional useful information to investors and analysts and the measures do not have any standardized meaning under IFRS. The measures should not, therefore, be considered in isolation or used in substitute for measures of performance prepared in accordance with IFRS. Other issuers may calculate Non-GAAP financial measures differently. Investors should be cautioned that they should not be construed as alternatives to net earnings, cash flow from operating activities or other measures of financial results determined in accordance with GAAP as an indicator of Just Energy’s performance.

2 |

MEETING AND VOTING INFORMATION

This proxy circular is provided in connection with the solicitation of proxies by management of Just Energy for use at the annual meeting of its shareholders or at any adjournment or postponement thereof (the “Meeting”). In this document “you” and “your” refer to the shareholders of, and “Just Energy”, the “Company” or “we”, “us”, “our”, refer to, Just Energy Group Inc. The information contained in this proxy circular is given as at May 26, 2017 (the “Circular”), except as indicated otherwise.

IMPORTANT – If you are not able to attend the meeting, please exercise your right to vote by signing the enclosed form of proxy or voting instruction form and, in the case of registered shareholders by returning it to Computershare Trust Company of Canada in the enclosed envelope, or by voting by fax or online as indicated on the form of proxy, no later than 10:00 a.m. (EDT) on June 23, 2017, or, if the meeting is adjourned or postponed, by no later than 10:00 a.m. (EDT) on the business day prior to the day fixed for the adjourned or postponed meeting. See the form of proxy. If you are a non-registered shareholder, reference is made to the section entitled “How do I vote if I am a non-registered shareholder?” on page 5 of this circular.

VOTING – QUESTIONS AND ANSWERS

VOTING AND PROXIES

Who can vote?

Shareholders who are registered as at the close of business on May 17, 2017 (the “record date”), will be entitled to vote at the meeting or at any adjournment or postponement thereof, either in person or by proxy.

As of the close of business on May 17, 2017, 147,013,538 common shares (“Common Shares”) in the capital of Just Energy were issued and outstanding. Each common share carries the right to one vote.

To the knowledge of the directors and senior offices of Just Energy based on the most recent publicly available information at May 17, 2017, two persons exercised control or direction over shares carrying 10% or more of the voting rights attached to the Common Shares of Just Energy. Jim Pattison, through the Great Pacific Capital Corp. and The Jim Pattison Foundation, beneficially owns, or directly or indirectly controls, a total of 24,221,842 (16.5%) of Just Energy’s Common Shares and Ron Joyce, through Jetport Inc., beneficially owns, or directly or indirectly controls, 19,200,000 (13.1%) of Just Energy’s common shares.

Who is soliciting my proxy?

Management of Just Energy is soliciting your proxy. The solicitation is being made primarily by mail, but our directors, officers or employees may also solicit proxies at a nominal cost to Just Energy.

| 3

| 3

What is Quorum for the Meeting?

At the meeting, a quorum shall consist of two or more persons either present in person or represented by proxy and representing in the aggregate not less than 25% of the outstanding Common Shares. If a quorum is not present at the meeting within one half hour after the time fixed for the holding of the meeting, it shall stand adjourned to such day being not less than 14 days later and to such place and time as may be determined by the chair of the meeting. At such meeting, the Shareholders present either personally or by proxy shall form a quorum. In the event of a tie or deadlock vote at the meeting, the chair may not cast a deciding vote.

Am I a registered or beneficial Shareholder?

If your shares are registered on the record date directly in your name with Just Energy’s transfer agent, you are considered with respect to those shares to be a “registered shareholder”. The proxy circular and proxy have been sent directly to you by Computershare Trust Company of Canada.

If your shares are held in a stock brokerage account or by a bank or financial intermediary or other nominee, you are considered the “beneficial Shareholder” of shares held in street name. The proxy circular has been forwarded to you by your broker, bank, financial intermediary or other nominee who is considered, with respect to those shares, the registered shareholder. As the beneficial Shareholder, you have the right to direct your broker, bank, financial intermediary or other nominee how to vote your shares by using the voting instruction card included in the mailing or by following their instructions for voting.

How will matters be decided at the meeting?

A simple majority of the votes cast, in person or by proxy, will constitute approval for each matter to be voted upon.

How do I vote if I am a registered Shareholder?

1. Voting By Proxy

You are a registered shareholder if your name appears on your share certificate. If this is the case, you may appoint someone else to vote for you as your proxy holder by using the enclosed form of proxy. The persons currently named as proxies in such form of proxy are the executive chair and the lead director of Just Energy. However, you have the right to appoint any other person or company (who need not be a shareholder) to attend and act on your behalf at the meeting. That right may be exercised by writing the name of such person or company in the blank space provided in the form of proxy or by completing another proper form of proxy. Make sure that the person you appoint is aware that he or she is appointed and attends the meeting.

(i) How can I send my form of proxy?

You can either (i) return a duly completed and executed form of proxy to the transfer agent and registrar for Just Energy’s common shares, Computershare Trust Company of Canada, in the envelope provided, or (ii) you can vote as indicated above by following the instructions on the form of proxy.

(ii) What is the deadline for receiving the form of proxy?

The deadline for receiving duly completed forms of proxy or a vote following any one of the other two options as indicated above is 10:00 a.m. EDT on June 23, 2017, or if the meeting is adjourned or postponed, by no later than 10:00 a.m. EDT on the business day prior to the day fixed for the adjourned or postponed meeting.

4 |

Please see below under the heading “How will my common shares be voted if I return a proxy?” for more information.

2. Voting in Person

If you wish to vote in person, you may present yourself to a representative of Computershare Trust Company of Canada at the registration table. Your vote will be taken and counted at the meeting. If you wish to vote in person at the meeting, do not complete or return the form of proxy.

How do I vote if I am a non-registered shareholder?

If your common shares are not registered in your name and are held in the name of a nominee such as a trustee, financial institution or securities broker, you are a “non-registered shareholder”. If, as is usually the case, your common shares are listed in an account statement provided to you by your broker or other nominee or custodian, those common shares will, in all likelihood, not be registered in your name. Such common shares will more likely be registered under the name of your broker, or an agent of that broker or other nominee or custodian. Without specific instructions, Canadian brokers and their agents or nominees are prohibited from voting shares for the broker’s client. If you are a non-registered shareholder, there are two ways, listed below, that you can vote your common shares:

1. Giving Your Voting Instructions (Voting By Proxy)

Applicable securities laws require your nominee to seek voting instructions from you in advance of the meeting. Accordingly, you will receive or have already received from your nominee a request for voting instructions for the number of common shares you hold. The persons currently named as proxies are the executive chair and the lead director of Just Energy. However, you have the right to appoint any other person or company (who need not be a shareholder) to attend and act on your behalf at the meeting. Every nominee has its own mailing procedures and provides its own signature and return instructions, which should be carefully followed by non-registered shareholders to ensure that their common share are voted at the meeting.

2. Voting in Person

If you wish to vote in person at the meeting, insert your name in the space provided on the request for voting instructions provided by your nominee to appoint yourself as proxy holder and follow the signature and return instructions of your nominee. Non-registered shareholders who appoint themselves as proxy holders should present themselves at the meeting to a representative of Computershare Trust Company of Canada. Do not otherwise complete the request for voting instructions sent to you as you will be voting at the meeting.

How will my common shares be voted if I return a proxy?

By completing and returning a proxy, you are authorizing the person named in the proxy to attend the Meeting and vote your Common Shares on each item of business according to your instructions. If you have appointed the designated directors or officers of Just Energy as your proxy and you do not provide them with instructions, they will vote your common shares as follows:

· FOR the election of the nominees as directors to the Board;

· FOR the re-appointment of Ernst & Young LLP as auditors and the authorization of the directors to fix the auditor’s remuneration;

· FOR the advisory resolution approving Just Energy’s approach to executive compensation; and

| 5

| 5

· FOR the transaction of such other business as may properly be brought before the meeting or any adjournment or postponement thereof. As of May 25, 2017, no director or officer of the Company is aware of any variation, amendment or other matter to be presented for a vote at the Meeting.

What if I change my mind?

You may revoke your proxy at any time by completing a proxy form or voting instruction form that is dated later than the proxy form or voting instruction form you are changing, and delivering it as indicated above at any time up to 10:00 a.m. EDT on June 23, 2017, or if the meeting is adjourned or postponed, by no later than 10:00 a.m. EDT on the business day prior to the day fixed for the adjourned or postponed meeting.

If you are a registered Shareholder, you can also revoke a vote you made by sending a notice in writing from you or your authorized attorney to our Corporate Secretary of Just Energy at the registered office of Just Energy (First Canadian Place, 100 King Street West, Suite 2630, Toronto, Ontario M5X 1E1) at any time up to and including 10:00 a.m. EDT on June 23, 2017 or on the last business day preceding the day of the meeting or any adjournment or postponement thereof; or by giving notice with the Chair of the Meeting on the day of the Meeting or any adjournment or postponement thereof, or in any other matter permitted by law.

How can I contact the transfer agent?

You can contact the transfer agent either by mail at Computershare Trust Company of Canada, 100 University Ave., 9th Floor, North Tower, Toronto, Ontario M5J 2Y1 or by fax at 1 866 249-7775.

Just Energy’s Financial Statements

We will place before the Meeting our consolidated financial statements, including the related auditor’s report, for the year ended March 31, 2017. Our financial statements are included in our 2017 Annual Report. The Annual Report will be mailed to shareholders who requested a copy. Our financial statements are also available on our website at www.justenergygroup.com, on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

On May 17, 2017 the Board approved the consolidated audited financial statements of Just Energy for the year ended March 31, 2017. Under the Canada Business Corporations Act, the corporate legislation which governs Just Energy, the financial statements are required to be mailed to shareholders that elect to receive them but no shareholder vote is required. You will however be entitled to ask questions of financial management at the meeting.

Electing Directors

You will be electing a Board consisting of 9 members. The nominees proposed for election as directors were recommended to the board by the nominating and governance committee and are listed below. All of the nominees, except Mr. Ross, are currently directors of Just Energy.

John A. Brussa | James Lewis | Brett A. Perlman |

R. Scott Gahn | Rebecca MacDonald | M. Dallas H. Ross |

H. Clark Hollands | Deborah Merril | William F. Weld |

6 |

Please refer to the section entitled “Directors” on page 14 of this Circular for biographies and more information on the nominees. Directors elected at the Meeting will serve until the end of Just Energy’s next annual shareholders’ meeting or until their resignation, if earlier.

The Board recommends a vote FOR each of the 9 director nominees. The Board recommends a vote FOR each of the 9 director nominees.

| |

If one of the designated directors or officers is your proxyholder and you have not given instructions on how to vote your Common Shares, he or she will vote “FOR” the election of each of the 9 nominees in this Circular. If a proposed nominee is unable to serve as a director or withdraws his or her name, the individuals named in your form of proxy or voting instruction form reserve the right to nominate and vote for another individual in their discretion. Management has no reason to believe that any of the nominees for election as directors will be unable to serve if elected to office and management is not aware of any amendment or other business likely to be brought before the meeting.

The nominee directors are being elected on an individual, as opposed to a slate, basis. The board of Just Energy has adopted a policy which requires that any nominee for director who receives a greater number of votes “withheld” than votes “for” his or her election as a director shall submit his or her resignation to the nominating and governance committee for consideration promptly following the meeting. The nominating and governance committee shall consider the resignation and shall recommend to the board of Just Energy whether to accept it. The board will consider the recommendation and determine whether to accept it within 90 days of the Meeting and a news release will be issued by Just Energy announcing the board’s determination. A director who tenders his or her resignation will not participate in any meetings to consider whether the resignation shall be accepted.

Appointing the Auditor

The Board recommends a vote FOR the re-appointment of Ernst & Young LLP as Just Energy’s auditor. The Board recommends a vote FOR the re-appointment of Ernst & Young LLP as Just Energy’s auditor.

|

The Board, on the recommendation of the Audit Committee, proposes that Ernst & Young LLP (“EY”) be re-appointed as auditors of Just Energy until the end of the next annual shareholders’ meeting and that the Board be authorized to set the auditor’s remuneration. EY has served as Just Energy’s auditors since 2010. EY Canada is a member firm of Ernst & Young Global, which employs 190,000 people in more than 700 offices in 150 countries. EY Canada is headquartered in Toronto, Ontario and has offices in 17 locations across Canada. The U.S. firm is headquartered in New York City and has offices in more than 80 locations across the U.S. EY provides a full range of assurance, tax, advisory and transaction services to clients across a range of industries, including many energy companies. In order to be effective, the resolution re-appointing EY as auditors and authorizing the directors to fix their remuneration must receive the affirmative vote of a majority of the votes cast by Shareholders in person or by proxy.

If one of the designated directors or officers is your proxyholder and you have not given instructions on how to vote your Common Shares, he or she will vote “FOR” the appointment of EY as Just Energy’s auditors.

| 7

| 7

What were EY’s Fees for F2017 and F2016?

| | F2017 | | F2016 | |

| | | | | |

Audit Fees(1) | | 1,311,100 | | $1,349,500 | |

Audit Related Fees(2) | | 320,000 | | 255,000 | |

Tax Fees(3) | | 556,658 | | 534,700 | |

Other Fees | | 97,520 | | Nil | |

| | | | | |

Total(4) | | 2,285,278 | | $2,139,200 | |

| | | | | |

(1) Audit Fees include fees for services rendered by EY in relation to the audit and review of Just Energy’s financial statements and in connection with the Company’s statutory and regulatory filings.

(2) In fiscal 2017, audit-related fees primarily related to the audit of Just Energy’s consolidated financial statements as well as stand-alone subsidiary audits required for regulatory filings.

(3) The majority of the tax fees are related to tax compliance.

(4) The Audit Committee of Just Energy has considered whether the magnitude and nature of these services is compatible with maintaining the independence of the external auditors and is satisfied that they are. All services provided by EY were pre-approved by the Audit Committee.

Say on Pay Advisory Vote

The Board has adopted a non-binding advisory vote relating to executive compensation to solicit feedback on our approach to executive compensation. Shareholders have the opportunity to vote “For” or “Against” the Company’s approach to executive compensation through the following advisory resolution:

“RESOLVED that, on an advisory basis and not to diminish the role or responsibilities of the board of directors, the shareholders accept the approach to executive compensation disclosed in the Information Circular and delivered in connection with the 2017 Annual General Meeting of Shareholders of the Corporation.”

The Board recommends a vote FOR approval of the advisory vote on executive compensation. The Board recommends a vote FOR approval of the advisory vote on executive compensation.

| |

As this is an advisory vote, the results will not be binding on the Board. However, Just Energy’s Say on Pay Policy provides that if a significant proportion of the common shares represented in person or by proxy at the meeting are voted against the advisory resolution, the lead director of the board will oversee a process to seek to better understand opposing shareholders’ specific concerns. The compensation committee will consider the results of this process and, as it considers appropriate, will review the approach to executive compensation in the context of shareholders’ specific concerns and may take recommendations to the board for implementation by the compensation committee.

At Just Energy’s June 28, 2016 annual meeting 98.7% of the votes cast by shareholders approved, in an advisory, non-binding capacity, Just Energy’s approach to executive compensation.

If one of the designated directors or officers is your proxyholder and you have not given instructions on how to vote your Common Shares, he or she will vote “FOR” the approval of the advisory vote on executive compensation.

Other Business

Following the conclusion of the formal business to be conducted at the Meeting, we will present a report on Just Energy’s F2017 financial results and outlook, as well as invite questions and comments from Shareholders.

8 |

As of the date of this Circular, management is not aware of any changes to the items listed above and does not expect any other business to be brought forward at the Meeting. If there are changes or new business, if you do not provide your proxyholder with instructions, your proxyholder can vote your Common Shares on these items as he or she sees fit.

CORPORATE GOVERNANCE PRACTICES

Just Energy is committed to maintaining high standards of corporate governance and continually assesses its governance practices against evolving policies, practices and legal requirements. Schedule A of this Circular contains a detailed description of our corporate governance practices in accordance with the rules and standards of the Canadian Securities Administrators, the Toronto Stock Exchange (“TSX”) and the New York Stock Exchange (“NYSE”).

The Board is responsible for the stewardship of the Company. Its role is to provide effective leadership and oversight of Just Energy. Just Energy has officers and employees responsible for the day-to-day management and conduct of the businesses of Just Energy and the implementation of the strategic plan and approved by the Board. Fundamentally, the Board seeks to ensure that the Company conducts its business with integrity and a view to creating sustainable and long-term value and profitable growth. Supported by its committees, the Board’s processes are designed to achieve an appropriate degree of independence from management; to monitor the risk management framework of the Company, including the integrity of its approaches to hedging the supply of natural gas, electricity and green products; to oversee succession planning; and to consider, approve and monitor the Company’s strategic, operating, capital and financial plans. The duties and responsibilities of the Board are set out in a written mandate of the Board which can be found attached to this Circular as Schedule B and on the Company’s website at www.justenergygroup.com.

To assist the Board with its fiduciary responsibilities, the Board is currently supported by the following four standing committees:

· Audit Committee;

· Risk Committee;

· Compensation, Human Resources, Environmental and Health and Safety Committee; and

· Nominating and Corporate Governance Committee.

The Board was also supported by a Finance Committee during Fiscal 2015 and Fiscal 2016. However, it was dissolved by the Board on February 8, 2017, as the Company had completed the refinancing of its significant maturing debt instruments.

Independent Majority

As indicated in the Circular and as required by applicable legislation and regulation including the NYSE listing standards, 6 of the 9 persons standing for election are independent. Accordingly, two-thirds of Just Energy’s directors are currently independent as defined by applicable stock exchange and securities legislation. All directors currently serving as members of the compensation committee, the risk committee and the audit committee, are independent. The board of directors has determined and declared that the relationship of John Brussa as a partner at a law firm which represents Just Energy in selected matters is not such as to impair his independent judgment as a director and accordingly, except for purposes of the audit committee and the compensation committee, he can be regarded as independent for purposes of the Board and all other Board committees.

| 9

| 9

The following table illustrates the independence of the current directors, including the current composition of the committees of the Board:

| | | | Compensation, | | |

| | | | Human | | |

| | | | Resources, | Nominating | |

| | | | Environmental | and | |

| | | | and Health | Corporate | |

| Independent | Audit | Risk | and Safety | Governance | Finance |

Director | Y/N | Committee | Committee | Committee | Committee | Committee(1) |

| | | | | | |

Ryan Barrington-Foote(2) | Y | |

| |

| Chair |

John Brussa | Y | |

| |

|

|

R. Scott Gahn | Y |

| Chair |

| | |

H. Clark Hollands | Y | Chair | | |

|

|

James Lewis | N | | | | | |

Rebecca MacDonald, Executive Chair | N | | | | | |

Deborah Merril | N | | | | | |

Brett Perlman | Y |

|

|

| | |

George Sladoje(2) | Y |

| | Chair | | |

William F. Weld, Lead Director | Y | | |

| Chair |

|

(1) Dissolved by the Board on February 8, 2017.

(2) Messrs. Barrington-Foote and Sladoje are not standing for re-election.

Board Rejuvenation and Diversity

The board of Just Energy approved a retirement policy for directors which, in effect, requires non-management directors to step down from the board on the earlier of: (a) 15 years of service from the date they were appointed or elected or starting from Just Energy’s April 2001 initial public offering and (b) attaining age 75. Special circumstances may exist or arise when it is in Just Energy’s best interests to waive the policy for up to maximum of three years based on a director’s contribution and expertise subject to solid annual performance assessments and shareholder approval. Mr. Sladoje is retiring from the board on June 27, 2017 pursuant to this policy. On May 18, 2016 the nominating and governance committee has determined that an exception should be made for Mr. Brussa for three years, due to his extensive contribution and expertise.

In addition, the board has adopted a policy to encourage greater board diversity and renewal. We consider diversity of gender, ethnicity, age, business experience, functional expertise, personal skills, stakeholder perspectives and geography as factors to consider in identifying new directors. To implement the board’s objective a total of three new independent directors were appointed to the Just Energy board in 2012 and 2013 and an additional five new directors, three of whom are independent, were appointed in 2015. Dallas Ross, a new nominee director, is currently standing for election.

10 |

Skills Matrix

The following table identifies the areas where nominee directors have assessed themselves as expert or as having strong working knowledge. The Nominating and Governance Committee has reviewed the skills matrix and is satisfied that the Board has the appropriate combination of experience, skills and expertise to perform its duties and responsibilities.

| Business | | | | | | | | | |

| Structuring | | | | | | | | | |

| and | | Risk | | | | | | Sales and | Strategic |

Director | M&A | Energy | Management | Compensation | Finance | Governance | Technology | Public Policy | Marketing | Planning |

| | | | | | | | | | |

John Brussa |

|

|

|

|

|

| |

| |

|

R. Scott Gahn |

|

|

|

|

| |

|

|

|

|

H. Clark Hollands |

| |

| |

|

| |

| |

|

James Lewis |

|

|

|

|

| |

| |

|

|

Rebecca MacDonald, Executive Chair |

|

|

|

|

|

| |

|

|

|

Deborah Merril |

|

|

|

|

| |

| |

|

|

Brett Perlman |

|

|

|

|

|

|

|

| |

|

M. Dallas H. Ross |

| |

|

|

|

| | |

|

|

William F. Weld, Lead Director |

| |

|

|

|

| |

| |

|

Clawback Policy

On February 9, 2012 the board approved a Clawback Policy entitled “Recoupment Upon Restatement or Misstatement of Financial Results” which provides that if, in the opinion of the independent directors of the Board, Just Energy’s financial results are restated due in whole or in part to intentional fraud or misconduct by one or more of Just Energy’s executive officers the independent directors have the discretion to use their best efforts to remedy the fraud or misconduct and prevent its recurrence. Just Energy’s independent directors may, based upon the facts and circumstances surrounding the restatement, direct that Just Energy recover all or a portion of any bonus or incentive compensation paid, or cancel all, or part of, the stock-based awards granted, to an executive officer. The remedies that may be sought by the independent directors are subject to a number of conditions, including, that: (i) the bonus or incentive compensation to be recouped was based on the achievement of objective financial or other similar criteria or factors as provided for in the executive officer’s employment contract and was calculated based upon the financial results that were restated, (ii) the executive officer in question engaged in the intentional misconduct, (iii) the bonus or incentive compensation calculated or to be calculated under the restated financial results is less than the amount actually paid or awarded or to be paid or awarded, and (iv) no remedy, action or proceeding for the recovery of any amount from an executive officer that is provided for in the policy may be commenced after a period of three years from the date such executive’s employment is terminated for whatever reason.

Directors to be Elected on an Individual Basis

As a corporate governance initiative, the nominee directors are being elected on an individual, as opposed to a slate, basis. The board of Just Energy has adopted a policy which requires that any nominee for director who receives a greater number of votes “withheld” than votes “for” his or her election as a director shall submit his or her resignation to the nominating and governance committee for consideration promptly following the

| 11

| 11

meeting. The nominating and governance committee shall consider the resignation and shall recommend to the board of Just Energy whether to accept it. The board will consider the recommendation and determine whether to accept it within 90 days of the meeting and a news release will be issued by Just Energy announcing the board’s determination. A director who tenders his or her resignation will not participate in any meetings to consider whether the resignation shall be accepted.

Women on Boards

To address National Instrument 58-101 entitled “Disclosure of Corporate Governance Practices”, the board of Just Energy amended its policy on Board Diversity and Renewal to include as a guideline and target that at a minimum, one third of Just Energy’s directors should, within a reasonable period of time, be women. At present, 20% of Board are women, an increase from 11% in 2014/2015. After the June 27, 2017 annual meeting, 22% of the Board will be comprised of women, if all of the nominees are elected.

Board Overboarding

On February 10, 2016, the directors of Just Energy unanimously approved amending Just Energy’s “Board Overboarding” to be consistent with International Shareholders Services’ and Glass Lewis’ revised policies coming into force in 2017. The revised guideline provides that as a principle of good corporate governance, (i) non-management directors of Just Energy should not serve on the boards of more than four publicly listed companies; and (ii) management directors shall not serve on the board of more than two publicly listed companies. The nominating and governance committee, after a consideration of all the circumstances, may determine annually, prior to the election of directors, to waive the guideline for persons who in exceptional circumstances with unique experience and expertise, should not be constrained from serving on the board, provided that such a director maintains an attendance record of at least 80% of all board and Committee meetings. The nominating and governance committee has determined that the guidelines should not apply to John Brussa due to his expertise and extensive contribution.

Anti-Hedging Policy

On August 10, 2016, the Board adopted an Anti-Hedging Policy for Just Energy. Under the policy, no Director, officer or senior employee of Just Energy may purchase financial instruments, including prepaid variable forward contracts, instruments for the short sale or purchase or sale of call or put options, equity swaps, collars, or units of exchangeable funds that are based on fluctuations of the Company’s debt or equity instruments and that are designed to or that may reasonably be expected to have the effect of hedging or offsetting a decrease in the market value of any securities of the Company. Such transactions, while allowing the holder to own the Company’s securities without the full risks and rewards of ownership, potentially separate the holder’s interests from those of other stakeholders and, particularly in the case of equity securities, from the public shareholders of the Company. The objective of this Policy is therefore to prohibit those subject to it from directly or indirectly engaging in hedging against future declines in the market value of any securities of the Company through the purchase of financial instruments designed to offset such risk and thereby maintaining alignment with the other stakeholders of the Company.

Director Orientation and Continuing Education

The Board has approved, as a corporate governance initiative, a policy to formalize its approach to a comprehensive orientation plan for new directors and a policy to encourage directors to participate in continuing education. The intent of the policies is to ensure that: (i) new directors, whether appointed to fill a vacancy on the Board or to be elected at an annual meeting, be required to participate in a comprehensive orientation program to familiarize them with Just Energy’s business, board policies and committee structure, their fiduciary duties and responsibilities as directors and the contribution they are expected to make to the deliberations of the Board and Board committees, and (ii) a program is in place to ensure all directors will have access to education and information on an ongoing basis, both internal and external, pertaining to matters in

12 |

(i) above and to board effectiveness, the best practices associated with successful boards, briefings on strategy, succession planning and risk, so as to enable them to carry out their duties and responsibilities as outlined in the Just Energy board mandate and the mandate for individual directors both of which are published on Just Energy’s website www.justenergygroup.com. Mr. Perlman obtained certification as a Governance Fellow from the National Association of Corporate Directors in recognition of his commitment to ongoing professional development and training as a corporate director. Each of Messrs. Perlman and Sladoje has attended conferences on director education at Just Energy’s expense hosted by the NACD in Houston, Washington, Atlanta and Chicago.

Share Ownership

The board has a current policy that requires non-management directors to receive fifteen percent of their annual base retainer in director deferred share grants (“DSGs”) or common shares and requires directors to own a minimum of two times the value of their annual base retainer of $125,000 ($250,000) in common shares and DSGs within five years of their appointment or election to the board. Fees are not paid to directors who are members of executive management. Messrs. Gahn, Hollands, Perlman and Weld are not currently compliant, however each of Messrs. Gahn, Hollands and Perlman have 5 years from the date of their appointment or election to the Board to become compliant. Mr. Weld has committed to be compliant by June 2018. If appointed, Mr. Ross will have 5 years to comply.

For a comprehensive review of Just Energy’s Corporate Governance practices pursuant to National Instrument 58-101F1, see Schedule A of this Circular.

| 13

| 13

DIRECTORS

The Board recommends a vote FOR each of the nominees listed below. The Board recommends a vote FOR each of the nominees listed below.

| |

The following pages set out information for each of the persons proposed to be nominated for election as a director, including biographical summaries, independence, share and DSG ownership held as at March 31, 2017. Additional information is provided regarding Board and Committee meeting attendance in F2017, voting results of the 2015 and 2016 Annual and Special General Meetings and other public company boards. There are no interlocking directorships.

| |

JOHN A. BRUSSA Age 60 Calgary, Alberta, Canada Director since: April 2001 Independent Areas of Expertise: · Business Structuring and M&A · Energy · Risk Management · Compensation · Finance · Governance · Public Policy · Strategic Planning | Mr. Brussa is a lawyer and public company director and has been a director of Just Energy since 2001 and currently serves on one Board committee. He is the Chairman of the law firm Burnet, Duckworth & Palmer LLP where he specializes in taxation and energy law with a special expertise relating to businesses in the energy sector. Mr. Brussa serves as a director on other public boards and committees, particularly in the oil and natural gas sectors. He serves as a member of the risk committee on other public company boards and accordingly brings considerable experience as a member of Just Energy’s risk and governance committees. It is the view of other members of the Just Energy board that his experience and knowledge in these energy sectors and his regular participation at board and committee meetings adds significant value to the board of Just Energy. |

Voting Results | | Board and Committee Memberships | Attendance |

Year | For | Withheld | Board of Directors | 9/9 |

2016 | 78.1% | 21.94% | Risk | 4/4 |

2015 | 89.5% | 10.5% | Nominating and Corporate Governance | 4/4 |

| | | Finance | 2/2 |

| | | | |

| | | Overall Attendance | 19/19 |

| |

Other Public Board Directorships and Committees(4) | |

Baytex Energy Corp. (Reserves and Governance) | Storm Resources Ltd. (Compensation, Nomination and Governance) |

Cardinal Energy Ltd. (Governance and Compensation) | TORC Oil & Gas Ltd. (Compensation) |

Crew Energy Inc. (Governance, Compensation and Reserves) | Leucrotta Exploration Inc. (Compensation and Governance) |

| | |

Securities Held as at March 31, 2017(1) | | Value as at March 31, 2017(2) | |

Common Shares | 82,000 | $684,700 | |

DSGs | 36,165 | $301,978 | |

Total: | 118,165 | $986,678 | |

| | |

| | | | | | | |

14 |

| |

R. SCOTT GAHN Age 53 Houston, Texas, USA Director since: December 2013 Independent Areas of Expertise: · Business Structuring and M&A · Energy · Risk Management · Compensation · Finance · Technology · Public Policy · Sales and Marketing · Strategic Planning | Mr. Gahn, formerly Executive Vice President and Chief Operating Officer of Just Energy until June 2011 was appointed to the board on December 17, 2013. Mr. Gahn is currently the President of Gulf Coast Security Services, Inc., a Houston-based security firm. Mr. Gahn has a long history in the deregulated energy industry having served on the Texas ERCOT board from 2005 to 2008 and having been involved in the sale of deregulated and regulated electricity and natural gas for 28 years. He was one of the founding shareholders and Chief Executive Officer of Just Energy Texas L. P. which was purchased by the Company in 2007, and in that capacity was responsible for North American Wholesale energy supply operations and business developments. |

Voting Results | | Board and Committee Memberships | Attendance |

Year | For | Withheld | Board of Directors | 9/9 |

2016 | 99.3% | 0.3% | Audit | 6/6 |

2015 | 94.8% | 5.2% | Risk (Chair) | 4/4 |

| | | Compensation, Human Resources | |

| | | Environmental and Health and Safety | 4/4 |

| | | | |

| | | Overall Attendance | 23/23 |

| | | | |

Other Public Board Directorships and Committees | |

None | |

| |

Securities Held as at March 31, 2017(1) | | Value as at March 31, 2017(2) | |

Common Shares | 12,000 | $100,200 | |

DSGs | 9,932 | $82,933 | |

Total: | 21,932 | $183,133 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | | | | |

| |

H. CLARK HOLLANDS Age 64 Vancouver, British Columbia, Canada Director since: June 2015 Independent Areas of Expertise: · Business Structuring and M&A · Risk Management · Finance · Governance · Public Policy · Strategic Planning | Mr. Hollands is a chartered accountant. He obtained his B. Comm from the University of British Columbia in 1975, his CA designation in 1977 and his FCA designation in 2008. He spent 25 years of his professional career as an international tax partner with KPMG in Vancouver advising many significant Canadian based multi-national groups and large public companies on their international tax arrangements. Mr. Hollands left private practice in 2008 to devote most of his time to a variety of business and investment interests in which he is a partner and to devote more time to his family and several charitable foundations including the Jim Pattison Foundation. He also serves as a director and advisor to several other large Canadian based private foundations. Mr. Hollands’ broad background and experience in finance, accounting, business and taxation will significantly contribute, on behalf of all shareholders, to the deliberations of the Just Energy board of directors and the committees on which he will serve. |

Voting Results | | Board and Committee Memberships | Attendance |

Year | For | Withheld | Board of Directors | 9/9 |

2016 | 99.7% | 0.3% | Audit (Chair) | 6/6 |

2015 | 99.1% | 0.9% | Nominating and Corporate Governance | 4/4 |

| | | Finance (Chair) | 2/2 |

| | | | |

| | | Overall Attendance | 21/21 |

| |

Other Public Board Directorships and Committees | |

Royalty North Partners Ltd. (Audit) | |

| | |

Securities Held as at March 31, 2017(1) | | Value as at March 31, 2017(2) | |

Common Shares | 25,000 | $208,750 | |

DSGs | 4,358 | $36,390 | |

Total: | 29,358 | $245,140 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | | | | |

| 15

| 15

| |

JAMES LEWIS Age 45 Houston, Texas, USA Director since: June 2015 Not Independent Areas of Expertise: · Business Structuring and M&A · Energy · Risk Management · Compensation · Finance · Technology · Sales and Marketing · Strategic Planning | Mr. Lewis has been a senior executive of Just Energy since 2007. James Lewis brings to his position as Co-President and Co-Chief Executive Officer of Just Energy more than 17 years of experience in the retail energy industry. Before assuming his latest role, Mr. Lewis served as Chief Operating Officer for the Company with accountability for corporate- wide strategic planning, policy and program development. Prior to this role, he led Just Energy’s North Eastern U.S. residential and small business division with accountability for all aspects of the residential business including customer service, operations and sales. Mr. Lewis also served as Senior Vice President for all of Just Energy’s North American operations, which include a range of business functions from contract fulfillment and revenue assurance to customer retention and renewals. Before joining Just Energy, Mr. Lewis led the Risk Management, Structuring, and Trading portfolios for a large U.S.-based energy company, as well as Information Management and Internal Audit functions for a large multi-national corporation. Mr. Lewis earned a Bachelor and Master’s degree of Engineering from the Stevens Institute of Technology in New Jersey, as well as a Masters of Business Administration degree from New York University. |

Voting Results | | Board and Committee Memberships | Attendance |

Year | For | Withheld | Board of Directors | 9/9 |

2016 | 99.4% | 0.6% | | |

2015 | 98.9% | 1.1% | | |

| | | | |

| | | Overall Attendance | 9/9 |

| |

Other Public Board Directorships and Committees | |

None | |

| | |

Securities Held as at March 31, 2017(1) | | Value as at March 31, 2017(2) | |

Common Shares | 366,119 | $3,057,093 | |

RSGs | 490,386 | $4,094,723 | |

Total: | 856,505 | $7,151,817 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | | | | |

| |

REBECCA MACDONALD Age 63 Toronto, Ontario, Canada Director since: April 2001 Not Independent Areas of Expertise: · Business Structuring and M&A · Energy · Risk Management · Compensation · Finance · Governance · Public Policy · Sales and Marketing · Strategic Planning | Ms. MacDonald was the principal founder of Just Energy and has been a director since 2001. She has been engaged in the deregulation of natural gas for over 24 years. Before forming Just Energy in 1997 she was the president of EMI, another successful energy marketing company. She became an officer of Just Energy in January 2000 and previously served as Chief Executive Officer. For the past nine years she has been Just Energy’s Executive Chair. She is a past director of the Canadian Arthritis Foundation and is actively involved in a number of other charities. She founded the Rebecca MacDonald Centre for Arthritis Research at Toronto’s Mount Sinai Hospital. Ms. MacDonald was named Canada’s top woman CEO for 2003, 2004, 2005, 2006 and 2007 by Profit Magazine. Ms. MacDonald was also named Ontario Entrepreneur of the Year by Ernst & Young in 2003. On April 3, 2009 she received the International Horatio Alger Award – Canada. In 2012, she was elected to the board of Canadian Pacific Railways Limited in 2012. |

Voting Results | | Board and Committee Memberships | Attendance |

Year | For | Withheld | Board of Directors | 9/9 |

2016 | 97.5% | 2.5% | | |

2015 | 97.4% | 2.6% | | |

| | | | |

| | | Overall Attendance | 9/9 |

| |

Other Public Board Directorships and Committees | |

Canadian Pacific Railway Company | |

(Governance and Compensation) | |

| | |

Securities Held as at March 31, 2017(1) | | Value as at March 31, 2017(2) | |

Common Shares | 6,073,573 | $50,714,334 | |

RSGs/PBGs | 942,848 | $7,872,781 | |

Total: | 7,016,421 | $58,587,116 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | | | | |

16 |

| |

DEBORAH MERRIL Age 46 Houston, Texas, USA Director since: June 2015 Not Independent Areas of Expertise: · Business Structuring and M&A · Energy · Risk Management · Compensation · Finance · Technology · Sales and Marketing · Strategic Planning | Deborah Merril has been an officer of Just Energy since 2007. With close to 20 years of experience in the retail energy industry, Deborah Merril was appointed to her current role of Co-President and Co-Chief Executive Officer of Just Energy in April, 2014. Prior to her current role, Ms. Merril led the Company’s commercial business as President of Hudson Energy. Earlier leadership functions include her role as a founding partner and Vice President of Marketing from 2002 to 2007 of Just Energy LP when it was purchased by Just Energy. Previous industry experience includes accountability in several business portfolios ranging from operations, to physical and financial risk management, and deal structuring at Enron Energy Services. Ms. Merril gained a Bachelor of Arts degree in Economics at the College of Wooster in Ohio, and earned her Master’s degree in Business Administration (MBA) at Texas A&M University. |

Voting Results | | Board and Committee Memberships | Attendance |

Year | For | Withheld | Board of Directors | 9/9 |

2016 | 99.2% | 0.8% | | |

2015 | 98.8% | 1.2% | Overall Attendance | 9/9 |

| |

Other Public Board Directorships and Committees | |

None | |

| | |

Securities Held as at March 31, 2017(1) | | Value as at March 31, 2017(2) | |

Common Shares | 298,397 | $2,491,614 | |

RSGs/PBGs | 488,793 | $4,081,421 | |

Total: | 787,190 | $6,573,036 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | | | | | |

| |

BRETT A. PERLMAN Age 58 Houston, Texas, USA Director since: June 2013 Independent Areas of Expertise: · Business Structuring and M&A · Energy · Risk Management · Compensation · Finance · Technology · Public Policy · Strategic Planning | Mr. Perlman is the President of Vector Consultants, LLC of Houston, Texas, a consulting practice which specializes in business strategy, strategic marketing and mergers and acquisitions in the electric utility industry. He’s currently a Fellow in the Advanced Leadership Initiative at Harvard University, where he is focusing on building coalitions to address the challenge of climate change. Mr. Perlman previously served as a Commissioner of the Public Utility Commission of Texas (1999-2003) and led the market design and implementation that resulted in the successful restructuring of the Texas wholesale and retail electric utility market. Previous to his public service, he was a consultant with McKinsey and Company (1993-1999) and has practiced law with major firms in Houston and Washington, D.C. He holds advanced degrees in public policy from Harvard University and in law from the University of Texas and was a Phi Beta Kappa graduate of Northwestern University. He has previously served as a director and as an independent strategic advisor to both public and private equity-based companies. Mr. Perlman recently obtained certification as a Governance Fellow from the National Association of Corporate Directors (NACD) in recognition of his commitment to ongoing professional development and training as a Corporate Director and over the past year has attended NACD meetings in Houston, Atlanta and Washington. |

Voting Results | | Board and Committee Memberships | Attendance |

Year | For | Withheld | Board of Directors | 9/9 |

2016 | 99.6% | 0.4% | Audit | 4/4 |

2015 | 98.6% | 1.4% | Risk | 4/4 |

| | | Compensation, Human Resources | |

| | | Environmental and Health and Safety | 4/4 |

| | | Nominating and Corporate Governance | |

| | | | |

| | | Overall Attendance | 21/21 |

| |

Other Public Board Directorships and Committees | |

None | |

| | |

Securities Held as at March 31, 2016(1) | | Value as at March 31, 2016(2) | |

Common Shares | 7,500 | $62,625 | |

DSGs | 11,314 | $94,472 | |

Total: | 18,814 | $157,097 | |

| | | |

| | | |

| | | |

| | | |

| | | | | | | |

| 17

| 17

| |

M. DALLAS H. ROSS Age 60 Vancouver, B.C. Independent Areas of Expertise: · Business Structuring and M&A · Risk Management · Compensation · Finance · Governance · Sales and Marketing · Strategic Planning | Mr. Ross is a General Partner and Founder of Kinetic Capital Partners in Vancouver, BC whose equity capital and strategic attention is focused on controlling positions in several private companies in the United States with substantial value creation underway. Mr. Ross is Chair or Senior Director of those private companies. Mr. Ross currently also serves on public company boards: he is Chair of Rogers Sugar; and a Director of Westshore Terminals. Previously he was a Director of Catalyst Paper brought in to assist with its financial restructuring and was Chair of its Strategic Alternatives Committee and previously was a Director of Futureshop.com. Mr. Ross was on the Board, Chair of the Campus Task Force and on the Executive Committee of Crofton House School for its substantial campus rebuild. Prior to Kinetic Capital Partners, Mr. Ross was Managing Director Investment Banking in Vancouver and Managing Director Mergers and Acquisitions in Toronto with ScotiaMcLeod. Before that Mr. Ross had qualified as a Chartered Accountant. |

Other Public Board Directorships and Committees | |

Rogers Sugar Ltd. (Chair of the Board; | Westshore Terminals Investment |

Chair of Strategic Initiatives Committee; | Corporation |

Chair of HR Committee). | |

| | |

Securities Held as at March 31, 2016(1) | Value as at March 31, 2016(2) |

Common Shares | NIL | NIL | |

RSGs/PBGs | NIL | NIL | |

Total: | NIL | NIL | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| |

WILLIAM F. WELD Age 71 Cambridge, Massachusetts, USA Director since: April 2012 Independent Areas of Expertise: · Business Structuring and M&A · Risk Management · Compensation · Finance · Governance · Public Policy · Strategic Planning | Mr. Weld currently practices with the law firm of Mintz, Levin, Cohn, Ferris, Glovsky and Popeo, P.C., in Boston and New York where he specializes in government strategies, corporate governance and compliance and international business best practices. He also served as Senior Advisor to the Chair of Ivanhoe Capital Corporation, a private holding company headquartered in British Columbia. Mr. Weld has a very distinguished career in government and business. During the 1990’s, Mr. Weld served two terms as Governor of Massachusetts, being elected in 1990 and re-elected in 1994. He served as national co-chair of the Privatization Council and led business and trade missions to many counties in Asia, Europe, Latin America and Africa. He has served as a director of other public companies and is an active member of the United States Council on Foreign Relations. Prior to his election as Governor, Mr. Weld was a federal prosecutor for seven years, serving as the Assistant U.S. Attorney General in charge of the Criminal Division of the Justice Department in Washington, D.C. and the U.S. Attorney for Massachusetts during the Reagan administration. He was also a commercial litigator in Boston and Washington. |

Voting Results | | Board and Committee Memberships | Attendance |

Year | For | Withheld | Board of Directors | 9/9 |

2016 | 99.6% | 0.4% | Nominating and Corporate Governance (Chair) | 4/4 |

2015 | 98.9% | 1.1% | Compensation, Human Resources | |

| | | Environmental and Health and Safety | 6/6 |

| | | Finance | 2/2 |

| | | | |

| | | Overall Attendance | 21/21 |

| |

Other Public Board Directorships and Committees | |

Straight Path Communications Inc. | |

(Governance, Audit, Compensation) | | |

| | |

Securities Held as at March 31, 2017(1) | Value as at March 31, 2017(2) |

Common Shares | NIL | NIL | |

DSGs | 14,497 | $121,050 | |

Total: | 14,497 | $121,050 | |

| | | |

| | | |

| | | |

| | | |

| | | | | | | |

18 |

Notes:

(1) Pursuant to the Directors Compensation Plan, Mr. Gahn has until December 2018 to meet the ownership requirements; Mr. Hollands has until June 2020 to meet the ownership requirements; Mr. Perlman has until June 2018 to meet the ownership requirements. If Mr. Ross is elected, he will have until June 2022 to meet the ownership requirements; Mr. Weld has committed to meet the ownership requirement by June 2018. Mr. Brussa, Mr. Lewis, Ms. MacDonald and Ms. Merril all meet the ownership requirements for Directors.

(2) Based on the closing price of $8.35 as of March 31, 2017 of the Common Shares listed on the TSX.

(3) On February 10, 2016, the directors of Just Energy unanimously approved amending Just Energy’s “Board Overloading” to be consistent with International Shareholders Services’ and Glass Lewis’ revised policies coming into force in 2017. The revised guideline provides that as a principle of good corporate governance, (i) non-management directors of Just Energy should not serve on the boards of more than four publicly listed companies; and (ii) management directors shall not serve on the board of more than two publicly listed companies. The nominating and governance committee, after a consideration of all the circumstances, may determine annually, prior to the election of directors, to waive the guideline for persons who in exceptional circumstances with unique experience and expertise, should not be constrained from serving on the board, provided that such a director maintains an attendance record of at least 80% of all board and Committee meetings. The nominating and governance committee has determined that the guidelines should not apply to John Brussa due to his expertise and extensive experience in the energy industry.

| 19

| 19

Meeting Attendance

We expect directors to make every reasonable effort to attend all meetings of the Board and Committees of which they are members and the annual meeting of Shareholders. Directors may participate by teleconference if they cannot attend in person. The table below summarizes the number of Board and Committee meetings attended by each director during fiscal 2017. The directors’ attendance records are also included in the director profiles under “Directors” beginning on page 14. The independent directors also meet separately, in camera, without management present at the end of each board and committee meeting and at the annual strategy session.

| | | | Compensation, | | | |

| | | | Human | | | |

| | | | Resources, | Nominating | | Total |

| | | | Environmental | and | | Board and |

| | | | Health | Corporate | | Committee |

Director | Board | Audit | Risk | and Safety | Governance | Finance(1) | Meetings |

| | | | | | | |

Ryan Barrington-Foote(2) | 9/9 | – | 3/4 | – | 3/4 | 2/2 | 17/19 |

| 100% | | 75% | | 75% | 100% | 89% |

John Brussa | 9/9 | – | 4/4 | – | 4/4 | 2/2 | 19/19 |

| 100% | | 100% | | 100% | 100% | 100% |

R. Scott Gahn | 9/9 | 6/6 | 4/4 | 4/4(4) | – | – | 23/23 |

| 100% | 100% | 100% | 100% | | | 100% |

H. Clark Hollands | 9/9 | 6/6 | – | – | 4/4 | 2/2 | 21/21 |

| 100% | 100% | | | 100% | 100% | 100% |

James Lewis | 9/9 | – | – | – | – | – | 9/9 |

| 100% | | | | | | 100% |

Rebecca MacDonald | 9/9 | – | – | – | – | – | 9/9 |

| 100% | | | | | | 100% |

Deborah Merril | 8/9 | – | – | – | – | – | 8/9 |

| 89% | | | | | | 89% |

Brett Perlman | 9/9 | 4/4(4) | 4/4 | 4/4 | – | – | 21/21 |

| 100% | 100% | 100% | 100% | | | 100% |

George Sladoje(2) | 8/9 | 6/6 | – | 6/6 | – | – | 20/21 |

| 89% | 100% | | 100% | | | 95% |

William F. Weld | 9/9 | – | – | 6/6 | 4/4 | 2/2 | 21/21 |

| 100% | | | 100% | 100% | 100% | 100% |

| | | | | | | |

David Wagstaff(3) | 2/3 | 2/2 | – | – | – | 2/2 | 6/7 |

| 67% | 100% | | | | 100% | 85% |

Total: | | | | | | | 97% |

Notes:

(1) The Finance Committee was dissolved by the Board on February 8, 2017.

(2) Messrs. Barrington-Foote and Sladoje are not standing for re-election.

(3) Mr. Wagstaff was not nominated for re-election in May 2016.

(4) Became member of the Committee on June 28, 2016.

20 |

DIRECTOR COMPENSATION

Our approach to compensation for non-management directors is intended to achieve the following goals:

· Attract and retain highly qualified individuals with the capability to meet the responsibilities of Board members, which recognizes the increasing responsibilities, time commitments and accountability of Board members;

· Ensure the long-term interests of directors and shareholders are aligned; and

· Appropriately reflect the risks and complexity of our business.

Director Compensation Structure

The Compensation Committee periodically reviews director compensation to ensure that it is reasonable in the context of the time required from directors to achieve the objectives noted above.

Annual Retainer

Non-management directors receive an annual retainer of $125,000 in the currency of the country of their residency in four installments following the end of each quarter of service as a Board member. At least 15% of their annual retainer must be in the form of DSGs. There are no additional meeting fees for our directors.

Additional Retainers for Certain Directors

Certain directors receive additional retainers that are paid quarterly in cash:

· Lead Director: The Lead Director receives an additional $25,000 annually due to the broad responsibilities of this position.

· Audit Committee Chair: The Audit Committee Chair receives an additional $25,000 due to the workload and broad responsibilities of the committee.

· Other Committee Chairs: Other Committee Chairs receive an additional $5,000 annually due to the workload and responsibilities of these committees.

Deferred Share Grants (DSGs)

Each DSG is exchangeable for one common share and is fully vested upon grant. However, DSGs may not be exchanged for common shares until the earlier of: (i) three years from the grant date, (ii) the day such director ceases to be a director of Just Energy and (iii) a change of control, providing that no common shares may be issued in exchange for DSGs after the expiry of 15 years from the Grant Date. For more information on DSGs, please refer ‘‘Directors Compensation Plan’’ on page 39 of this Circular.

No Other Compensation

Non-executive directors do not receive any cash incentive compensation or pension benefits. Directors who are officers of the Company, namely Ms. MacDonald, Ms. Merril and Mr. Lewis, do not receive any compensation for their services as directors.

Equity Ownership Requirement

Each non-executive director is required to own a number of Shares and/or DSGs such that the value thereof at the commencement of each financial year of the Corporation shall equal at least two times the value of the Base Retainer received by such Director for the financial year of the Corporation. New Directors have five years from the date of their appointment or election to become compliant with the equity holding requirement.

| 21

| 21

Director Compensation Table

The following table indicates the compensation paid by Just Energy to its outside directors for the fiscal year ended March 31, 2017. The three management directors, Rebecca MacDonald, Deborah Merril and James Lewis, did not receive any fees or benefits for serving as directors. All cash amounts payable to Messrs. Gahn, Perlman, Sladoje and Weld are payable in U.S. dollars and for purposes of the Table and notes below, unless otherwise indicated, have been converted to Canadian dollars at an exchange rate of 1.3126.

| | Retainer(1) | | | | |

| Cash | Committee | | Option | | |

| Retainer | Chair | Share Based | Based | All Other | |

Name of Director | Earned | Retainer | Awards(2) | Awards(3) | Compensation(4) | Total(5) |

| | | | | | |

Ryan Barrington-Foote(6) | 106,250 | 1,250 | 18,750 | NIL | NIL | 126,250 |

John Brussa | 85,000 | NIL | 40,000 | NIL | NIL | 125,000 |

R. Scott Gahn | 139,464 | 6,563 | 24,611 | NIL | NIL | 170,638 |

H. Clark Hollands | 106,250 | 20,000 | 18,750 | NIL | NIL | 145,000 |

Brett Perlman | 139,464 | NIL | 24,611 | NIL | NIL | 164,075 |

George Sladoje(6) | 139,464 | 6,563 | 24,611 | NIL | NIL | 170,638 |

| | | | | | |

David Wagstaff(7) | 26,563 | NIL | 4,688 | NIL | NIL | 32,251 |

William F. Weld | 139,464 | 39,378 | 24,611 | NIL | NIL | 203,453 |

Notes:

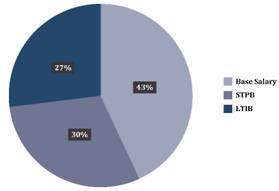

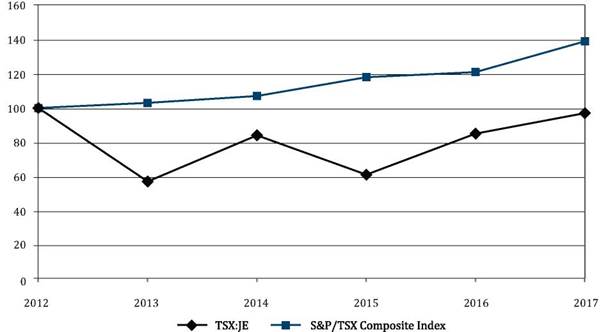

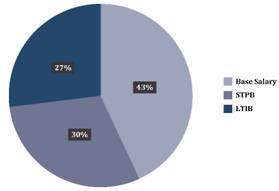

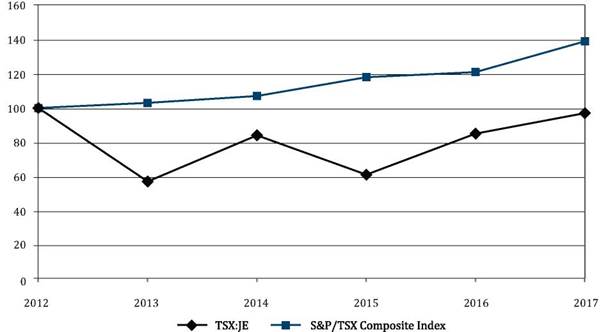

(1) Amount reflects the cash portion of Base Retainer earned by each director. The annual base retainer for each outside director is $125,000. In addition, the chair of the audit committee receives an additional annual fee of $25,000 for serving as chair. The chair of each of the other committees receives an additional annual fee of $5,000. The lead director receives an additional annual fee of $25,000 to reflect his role as lead director. All fees are payable quarterly in arrears.