Management’s discussion and analysis

(“MD&A”) – February 8, 2017

The following discussion and analysis is a review of the financial condition and operating results of Just Energy Group Inc. (“JE” or “Just Energy” or the “Company”) for the three and nine months ended December 31, 2016. It has been prepared with all information available up to and including February 8, 2017. This analysis should be read in conjunction with the unaudited interim condensed consolidated financial statements of the Company for the three and nine months ended December 31, 2016. The financial information contained herein has been prepared in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”). All dollar amounts are expressed in Canadian dollars. Quarterly reports, the annual report and supplementary information can be found on Just Energy’s corporate website at www.justenergygroup.com. Additional information can be found on SEDAR at www.sedar.com or on the U.S. Securities and Exchange Commission’s website at www.sec.gov. Information contained within the annual MD&A is not discussed if it remains substantially unchanged.

Company overview

Established under the laws of Canada, Just Energy is a leading retail energy provider specializing in electricity and natural gas commodities, energy efficient solutions and renewable energy options. Currently operating in the United States, Canada, the United Kingdom and Germany, the Company serves residential and commercial customers, providing homes and businesses with a broad range of energy solutions that deliver comfort, convenience and control. Just Energy’s margin or gross profit is derived from the difference between the commodity sale price to its customers and the related purchase price from its suppliers. Just Energy is the parent company of Amigo Energy, Commerce Energy, Green Star Energy, Hudson Energy, Just Energy Solar, Tara Energy and TerraPass.

For a more detailed description of Just Energy’s business operations, refer to the "Operations overview" section on page 5 of this MD&A.

Forward-looking information

This MD&A contains certain forward-looking information pertaining to customer additions and renewals, customer consumption levels, EBITDA, Base EBITDA, Funds from Operations, Base Funds from Operations and treatment under governmental regulatory regimes. These statements are based on current expectations that involve a number of risks and uncertainties, which could cause actual results to differ from those anticipated. These risks include, but are not limited to, levels of customer natural gas and electricity consumption, extreme weather conditions, rates of customer additions and renewals, customer attrition, fluctuations in natural gas and electricity prices, changes in regulatory regimes, decisions by regulatory authorities, competition, the results of litigation, and dependence on certain suppliers. Additional information on these and other factors that could affect Just Energy’s operations, financial results or dividend levels is included in the Annual Information Form and other reports on file with security regulatory authorities, which can be accessed on our corporate website at www.justenergygroup.com, or through the SEDAR website at www.sedar.com or at the U.S. Securities and Exchange Commission’s website at www.sec.gov.

Just Energy purchases power supply from market counterparties for residential and small Commercial customers based on forecasted customer aggregation. Power supply is generally purchased concurrently with the execution of a contract for larger Commercial customers. Historical customer usage is obtained from LDCs, which, when normalized to average weather, provides Just Energy with an expected normal customer consumption. Furthermore, Just Energy mitigates exposure to weather variations through active management of the power portfolio, which involves, but is not limited to, the purchase of options, including weather derivatives.

The Company’s ability to successfully mitigate weather effects is limited by the degree to which weather conditions deviate from normal. To the extent that balancing power purchases are outside the acceptable forecast, Just Energy bears the financial responsibility for excess or short supply caused by fluctuations in customer usage. Any supply balancing not fully covered through customer pass-throughs, active management or the options employed may impact Just Energy’s gross margin depending upon market conditions at the time of balancing.

JUSTGREEN

Customers also have the ability to choose an appropriate JustGreen program to supplement their natural gas and electricity contracts, providing an effective method to offset their carbon footprint associated with the respective commodity consumption.

JustGreen programs for gas customers involve the purchase of carbon offsets from carbon capture and reduction projects. Via power purchase agreements and renewable energy certificates, JustGreen’s electricity product offers customers the option of having all or a portion of their electricity sourced from renewable green sources such as wind, solar, hydropower or biomass. Additional green products allow customers to offset their carbon footprint without buying energy commodity products and can be offered in all states and provinces without being dependent on energy deregulation.

The Company currently sells JustGreen gas and electricity in eligible markets across North America. Of all Consumer customers who contracted with Just Energy in the past 12 months, 30% took JustGreen for some or all of their energy needs. On average, these customers elected to purchase 89% of their consumption as green supply. For comparison, as reported for the trailing 12 months ended December 31, 2015, 35% of Consumer customers who contracted with Just Energy chose to include JustGreen for an average of 91% of their consumption. As of December 31, 2016, JustGreen now makes up 8% of the Consumer gas portfolio, compared with 12% a year ago. JustGreen makes up 17% of the Consumer electricity portfolio, compared to 21% a year ago.

| EBITDA | |

| For the three months ended December 31 | |

| (thousands of dollars) | | | | | | |

| | | Fiscal 2017 | | | Fiscal 2016 | |

| Reconciliation to interim condensed consolidated statements of income | | | | | | |

| Profit for the period | | $ | 188,041 | | | $ | 10,188 | |

| Add (subtract): | | | | | | | | |

| Finance costs | | | 25,477 | | | | 17,731 | |

| Provision for (recovery of) income taxes | | | 20,976 | | | | (1,226 | ) |

| Amortization | | | 6,435 | | | | 8,759 | |

| EBITDA | | $ | 240,929 | | | $ | 35,452 | |

| Add (subtract): | | | | | | | | |

| Change in fair value of derivative instruments | | | (183,345 | ) | | | 23,478 | |

| Share-based compensation | | | 1,353 | | | | 1,364 | |

| Profit attributable to non-controlling interest | | | (7,448 | ) | | | (4,570 | ) |

| Base EBITDA | | $ | 51,489 | | | $ | 55,724 | |

| | | | | | | | | |

| Gross margin per interim condensed consolidated financial statements | | $ | 174,353 | | | $ | 179,937 | |

| Add (subtract): | | | | | | | | |

| Administrative expenses | | | (44,567 | ) | | | (42,934 | ) |

| Selling and marketing expenses | | | (55,337 | ) | | | (67,061 | ) |

| Bad debt expense | | | (16,234 | ) | | | (13,019 | ) |

| Amortization included in cost of sales/selling and marketing expenses | | | 759 | | | | 3,827 | |

| Other expenses | | | (37 | ) | | | (456 | ) |

| Profit attributable to non-controlling interest | | | (7,448 | ) | | | (4,570 | ) |

| Base EBITDA | | $ | 51,489 | | | $ | 55,724 | |

| EBITDA | |

| For the nine months ended December 31 | |

| (thousands of dollars) | | | | | | |

| | | Fiscal 2017 | | | Fiscal 2016 | |

| Reconciliation to interim condensed consolidated statements of income | | | | | | |

| Profit for the period | | $ | 509,104 | | | $ | 51,601 | |

| Add: | | | | | | | | |

| Finance costs | | | 61,332 | | | | 52,228 | |

| Provision for income taxes | | | 51,154 | | | | 11,423 | |

| Amortization | | | 16,468 | | | | 35,974 | |

| EBITDA | | $ | 638,058 | | | $ | 151,226 | |

| Add (subtract): | | | | | | | | |

| Change in fair value of derivative instruments | | | (474,293 | ) | | | (4,236 | ) |

| Share-based compensation | | | 4,255 | | | | 4,086 | |

| Profit attributable to non-controlling interest | | | (18,539 | ) | | | (10,792 | ) |

| Base EBITDA | | $ | 149,481 | | | $ | 140,284 | |

| | | | | | | | | |

| Gross margin per interim condensed consolidated financial statements | | $ | 520,559 | | | $ | 497,999 | |

| Add (subtract): | | | | | | | | |

| Administrative expenses | | | (135,985 | ) | | | (120,826 | ) |

| Selling and marketing expenses | | | (172,581 | ) | | | (195,090 | ) |

| Bad debt expense | | | (44,622 | ) | | | (49,250 | ) |

| Amortization included in cost of sales/selling and marketing expenses | | | 2,213 | | | | 20,553 | |

| Other expenses | | | (1,564 | ) | | | (2,310 | ) |

| Profit attributable to non-controlling interest | | | (18,539 | ) | | | (10,792 | ) |

| Base EBITDA | | $ | 149,481 | | | $ | 140,284 | |

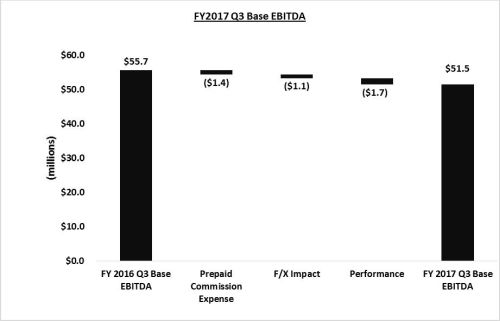

For the three months ended December 31, 2016, Base EBITDA amounted to $51.5 million, a decrease of 8% from $55.7 million in the prior comparable quarter as a result of the $1.4 million of additional expenses related to prepaid commissions, a $1.1 million reduction due to foreign currency translation and a $1.7 million decrease in operational performance, primarily driven by a reduction in the customer base over the past year.

Sales decreased by 9% for the third quarter ended December 31, 2016, reflecting the 7% decrease in customer base and lower commodity prices. Gross margin was down 3% and of this $5.6 million decrease in the quarter, foreign currency translation accounted for $3.6 million with the remaining amount attributable to higher balancing costs in the current period and the lower consumption resulting from the 7% decrease in customer base.

Administrative expenses increased by 4% from $42.9 million to $44.6 million. The increase over the prior comparable quarter included higher costs required to support customer growth in the U.K., international expansion as well as efforts relating to new strategic initiatives.

Selling and marketing expenses for the three months ended December 31, 2016 were $55.3 million, a 17% decrease from $67.1 million reported in the prior comparable quarter. The decrease in selling and marketing expenses is due to lower commission costs associated with lower gross customer additions, as well as decreased residual commission expenses.

Effective fiscal 2016, newly capitalized commissions are classified as a current asset (prepaid expense) instead of a non-current asset (contract initiation costs). This change is a result of management’s effort to reduce the average term of capitalized commission to 12 months going forward, which will reduce the outlay of cash at the time of contract signing. The fiscal 2017 guidance includes deductions to Base EBITDA of $30.0 million to $35.0 million for prepaid commercial commissions, which would previously have been included as amortization within selling and marketing expenses. This represents a $12.0 million to $17.0 million increase in this expense over fiscal 2016, which Just Energy expects to offset with continued strong gross margin performance.

Bad debt expense was $16.2 million for the three months ended December 31, 2016, an increase of 25% from $13.0 million recorded for the prior comparable quarter, resulting from an increase in customer write-offs in the third quarter of fiscal 2017. For the nine months ended December 31, 2016, the bad debt expense of $44.6 million represents approximately 2.2% of revenue in the jurisdictions where the Company bears the credit risk, down from the 2.3% of revenue reported for the nine months ended December 31, 2015, both of which are within management’s target range of 2% to 3%.

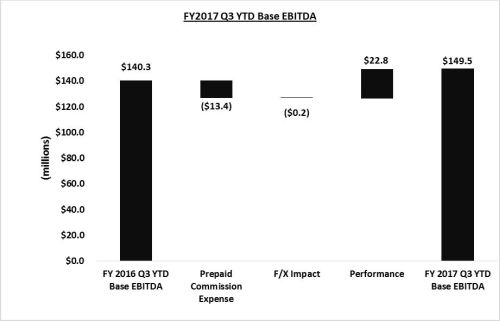

For the nine months ended December 31, 2016, Base EBITDA amounted to $149.5 million, an increase of 7% from $140.3 million in the prior comparable period. The result for the nine months ended December 31, 2016 includes the absorption of $13.4 million of additional deductions related to the change in classification of Commercial customer acquisition costs effective fiscal 2016. The exclusion of this additional expense would have resulted in Base EBITDA growth of 16% for the nine months ended December 31, 2016, primarily as a result of operational improvements, including strong gross margin contribution from the U.S. and U.K. markets.

For the nine months ended December 31, 2016, sales decreased by 7%, primarily due to the 7% decrease in customer base and lower commodity prices, while the gross margin increased by 5%, primarily as a result of the Company’s ongoing margin improvement initiative. For the nine months ended December 31, 2016, administrative expenses increased by 13% from $120.8 million to $136.0 million. The increase over the prior comparable period included growth in the U.K., costs associated with international expansion and efforts relating to new strategic initiatives. For the nine months ended December 31, 2016, selling and marketing expenses were $172.6 million, a decrease of 12% from $195.1 million in the prior comparable period, due to lower commission costs from lower gross additions in the current period, as well as lower residual commission expenses.

For more information on the changes in the results from operations, please refer to “Gross margin” on page 19 and “Administrative expenses”, “Selling and marketing expenses”, “Bad debt expense” and “Finance costs”, which are further explained on pages 21 through 23.

| EMBEDDED GROSS MARGIN | | | | |

| | | | | | |

| Management's estimate of the future embedded gross margin is as follows: |

| | | |

| (millions of dollars) | | | | | |

| | | | Dec. 31 vs. | | 2016 vs. |

| | As at | As at | Sept. 30 | As at | 2015 |

| | Dec. 31, 2016 | Sept. 30, 2016 | variance | Dec. 31, 2015 | variance |

| Energy marketing | $1,873.5 | $1,894.6 | (1)% | $1,985.0 | (6)% |

| Funds from Operations | |

| For the three months ended December 31 | |

| (thousands of dollars) | | | | |

| | | Fiscal 2017 | | | Fiscal 2016 | |

| Cash inflow from operations | | $ | 35,605 | | | $ | 28,659 | |

| Add (subtract): | | | | | | | | |

| Changes in non-cash working capital | | | 1,312 | | | | 15,298 | |

| Profit attributable to non-controlling interest | | | (7,448 | ) | | | (4,570 | ) |

| Tax adjustment | | | (5,563 | ) | | | (9,560 | ) |

| Funds from Operations | | $ | 23,906 | | | $ | 29,827 | |

| Less: Maintenance capital expenditures | | | (2,966 | ) | | | (3,044 | ) |

| Base Funds from Operations | | $ | 20,940 | | | $ | 26,783 | |

| | | | | | | | | |

| Gross margin from interim condensed consolidated financial statements | | $ | 174,353 | | | $ | 179,937 | |

| Add (subtract): | | | | | | | | |

| Adjustment required to reflect net cash receipts from gas sales | | | (2,024 | ) | | | (2,699 | ) |

| Administrative expenses | | | (44,567 | ) | | | (42,934 | ) |

| Selling and marketing expenses | | | (55,337 | ) | | | (67,061 | ) |

| Bad debt expense | | | (16,234 | ) | | | (13,019 | ) |

| Current income tax expense | | | (9,823 | ) | | | (9,612 | ) |

| Amortization included in cost of sales/selling and marketing expenses | | | 759 | | | | 3,827 | |

| Other expenses | | | (37 | ) | | | (456 | ) |

| Financing charges, non-cash | | | 9,831 | | | | 4,235 | |

| Finance costs | | | (25,477 | ) | | | (17,731 | ) |

| Other non-cash adjustments | | | (7,538 | ) | | | (4,660 | ) |

| Funds from Operations | | $ | 23,906 | | | $ | 29,827 | |

| Less: Maintenance capital expenditures | | | (2,966 | ) | | | (3,044 | ) |

| Base Funds from Operations | | $ | 20,940 | | | $ | 26,783 | |

| Base Funds from Operations payout ratio | | | 90 | % | | | 70 | % |

| Dividends/distributions | | | | | | | | |

| Dividends | | $ | 18,475 | | | $ | 18,368 | |

| Distributions for share-based awards | | | 325 | | | | 294 | |

| Total dividends/distributions | | $ | 18,800 | | | $ | 18,662 | |

| | | | | | | |

| Funds from Operations | |

| For the nine months ended December 31 | |

| (thousands of dollars) | | | | |

| | | Fiscal 2017 | | | Fiscal 2016 | |

| Cash inflow from operations | | $ | 115,743 | | | $ | 98,350 | |

| Add (subtract): | | | | | | | | |

| Changes in non-cash working capital | | | 10,884 | | | | 22,548 | |

| Profit attributable to non-controlling interest | | | (18,539 | ) | | | (10,792 | ) |

| Tax adjustment | | | 1,575 | | | | (7,136 | ) |

| Funds from Operations | | $ | 109,663 | | | $ | 102,970 | |

| Less: Maintenance capital expenditures | | | (10,493 | ) | | | (8,593 | ) |

| Base Funds from Operations | | $ | 99,170 | | | $ | 94,377 | |

| | | | | | | | | |

| Gross margin from interim condensed consolidated financial statements | | $ | 520,559 | | | $ | 497,999 | |

| Add (subtract): | | | | | | | | |

| Adjustment required to reflect net cash receipts from gas sales | | | 17,501 | | | | 17,532 | |

| Administrative expenses | | | (135,985 | ) | | | (120,826 | ) |

| Selling and marketing expenses | | | (172,581 | ) | | | (195,090 | ) |

| Bad debt expense | | | (44,622 | ) | | | (49,250 | ) |

| Current income tax expense | | | (14,449 | ) | | | (13,952 | ) |

| Amortization included in cost of sales/selling and marketing expenses | | | 2,213 | | | | 20,553 | |

| Other expenses | | | (1,564 | ) | | | (2,310 | ) |

| Financing charges, non-cash | | | 18,732 | | | | 11,595 | |

| Finance costs | | | (61,332 | ) | | | (52,228 | ) |

| Other non-cash adjustments | | | (18,809 | ) | | | (11,053 | ) |

| Funds from Operations | | $ | 109,663 | | | $ | 102,970 | |

| Less: Maintenance capital expenditures | | | (10,493 | ) | | | (8,593 | ) |

| Base Funds from Operations | | $ | 99,170 | | | $ | 94,377 | |

| Base Funds from Operations payout ratio | | | 57 | % | | | 59 | % |

| Dividends/distributions | | | | | | | | |

| Dividends | | $ | 55,346 | | | $ | 55,065 | |

| Distributions for share-based awards | | | 1,061 | | | | 997 | |

| Total dividends/distributions | | $ | 56,407 | | | $ | 56,062 | |

Base FFO for the three months ended December 31, 2016 was $20.9 million, a decrease of 22% compared with Base FFO of $26.8 million for the prior comparable quarter. The decrease in Base FFO was greater than the decrease in Base EBITDA due to the $2.7 million in additional finance charges related to the early debt repayment during the quarter. For the nine months ended December 31, 2016, Base FFO was $99.2 million, an increase of 5% from the prior comparable period when Base FFO was $94.4 million, 2% lower than the increase in Base EBITDA. For the nine months ended December 31, 2016, maintenance capital expenditures increased by $1.9 million over the prior comparable period due to information technology projects in support of the Company’s operational improvement initiative.

Dividends and distributions for the three months ended December 31, 2016 were $18.8 million, an increase of 1% from the prior comparable quarter in fiscal 2016, resulting from the issuance of additional share-based awards to Just Energy employees. For the nine months ended December 31, 2016, dividends and distributions were $56.4 million, an increase of 1% compared to $56.1 million reported for the nine months ended December 31, 2015. The payout ratio on Base Funds from Operations was 90% for the three months ended December 31, 2016, compared to 70% reported in the third quarter of fiscal 2016, primarily resulting from the lower Base FFO described above. For the nine months ended December 31, 2016, the payout ratio was 57%, compared with 59% in the prior comparable period. For the trailing 12 months ended December 31, 2016, the payout ratio was 53%, compared with a payout ratio of 59% for the trailing 12 months ended December 31, 2015.

| Summary of quarterly results for operations | |

| (thousands of dollars, except per share amounts) | | | |

| | | | Q3 | | | | Q2 | | | | Q1 | | | | Q4 | |

| | Fiscal 2017 | | Fiscal 2017 | | Fiscal 2017 | | Fiscal 2016 | |

| Sales | | $ | 918,536 | | | $ | 992,828 | | | $ | 898,409 | | | $ | 1,075,880 | |

| Gross margin | | | 174,353 | | | | 183,534 | | | | 162,672 | | | | 204,289 | |

| Administrative expenses | | | 44,567 | | | | 46,717 | | | | 44,701 | | | | 49,504 | |

| Selling and marketing expenses | | | 55,337 | | | | 59,454 | | | | 57,790 | | | | 62,259 | |

| Finance costs | | | 25,477 | | | | 17,882 | | | | 17,973 | | | | 20,312 | |

| Profit (loss) for the period | | | 188,041 | | | | (161,608 | ) | | | 482,671 | | | | 30,893 | |

| Profit (loss) for the period per share – basic | | | 1.22 | | | | (1.13 | ) | | | 3.24 | | | | 0.16 | |

| Profit (loss) for the period per share – diluted | | | 0.98 | | | | (1.13 | ) | | | 2.51 | | | | 0.14 | |

| Dividends/distributions paid | | | 18,800 | | | | 18,814 | | | | 18,793 | | | | 18,730 | |

| Base EBITDA | | | 51,489 | | | | 56,851 | | | | 41,141 | | | | 67,345 | |

| Base Funds from Operations | | | 20,940 | | | | 52,561 | | | | 25,669 | | | | 43,822 | |

| Payout ratio on Base Funds from Operations | | | 90 | % | | | 36 | % | | | 73 | % | | | 43 | % |

| | | | | | | | | | | | | | | | | |

| | | | Q3 | | | | Q2 | | | | Q1 | | | | Q4 | |

| | Fiscal 2016 | | Fiscal 2016 | | Fiscal 2015 | | Fiscal 2015 | |

| Sales | | $ | 1,009,709 | | | $ | 1,087,256 | | | $ | 933,015 | | | $ | 1,209,879 | |

| Gross margin | | | 179,937 | | | | 167,155 | | | | 150,907 | | | | 194,066 | |

| Administrative expenses | | | 42,934 | | | | 40,294 | | | | 37,598 | | | | 42,048 | |

| Selling and marketing expenses | | | 67,061 | | | | 65,248 | | | | 62,781 | | | | 63,980 | |

| Finance costs | | | 17,731 | | | | 17,641 | | | | 16,856 | | | | 16,684 | |

| Profit (loss) from continuing operations | | | 10,188 | | | | (88,258 | ) | | | 129,671 | | | | (64,976 | ) |

| Profit (loss) for the period | | | 10,188 | | | | (88,258 | ) | | | 129,671 | | | | (63,441 | ) |

| Profit (loss) for the period from continuing operations per share – basic | | | 0.04 | | | | (0.62 | ) | | | 0.87 | | | | (0.46 | ) |

| Profit (loss) for the period from continuing operations per share – diluted | | | 0.04 | | | | (0.62 | ) | | | 0.71 | | | | (0.46 | ) |

| Dividends/distributions paid | | | 18,662 | | | | 18,701 | | | | 18,699 | | | | 18,596 | |

| Base EBITDA | | | 55,724 | | | | 45,685 | | | | 38,875 | | | | 67,914 | |

| Base Funds from Operations | | | 26,783 | | | | 37,775 | | | | 29,818 | | | | 31,947 | |

| Payout ratio on Base Funds from Operations | | | 70 | % | | | 50 | % | | | 63 | % | | | 58 | % |

Administrative expenses for the three months ended December 31, 2016 increased by 4% from $42.9 million to $44.6 million as a result of costs to serve the growing customer base in the U.K., international expansion costs as well as efforts relating to new strategic initiatives.

Selling and marketing expenses for the three months ended December 31, 2016 were $55.3 million, a 17% decrease from $67.1 million reported in the prior comparable quarter. This decrease is largely attributable to lower commission expense due to a reduction in gross customer additions in the current quarter, as well as decreased residual commission costs.

Finance costs for the three months ended December 31, 2016 amounted to $25.5 million, an increase of 44% from $17.7 million reported for the three months ended December 31, 2015. The increase in finance costs was a result of the additional $2.5 million in amortization of debt issuance costs, a $3.1 million loss on the partial redemption of the 6.0% convertible debentures, as well as the $2.7 million one-time interest cost associated with early redemption of the remaining $55 million of senior unsecured notes outstanding in the third quarter of fiscal 2017.

The change in fair value of derivative instruments resulted in a non-cash gain of $183.3 million for the three months ended December 31, 2016, compared to a non-cash loss of $23.5 million in the prior comparative quarter, as market prices relative to Just Energy’s future electricity supply contracts increased by an average of $2.45/MWh, while future gas contracts decreased by an average of $0.22/GJ during the three months ended December 31, 2016. Profit for the three months ended December 31, 2016 was $188.0 million, representing a gain per share of $1.22 on a basic and $0.98 on a diluted basis. For the prior comparable quarter, the profit was $10.2 million, representing a gain per share of $0.04 on a basic and diluted basis. Just Energy ensures that customer margins are protected by entering into fixed-price supply contracts. Under current IFRS, the customer contracts are not marked to market but there is a requirement to mark to market the future supply contracts. This creates unrealized gains (losses) depending upon current supply pricing. Management believes that these short-term mark to market non-cash gains (losses) do not impact the long-term financial performance of Just Energy.

Base EBITDA was $51.5 million for the three months ended December 31, 2016, an 8% decrease from $55.7 million in the prior comparable quarter. The Company’s reported Base EBITDA for the three months ended December 31, 2016 includes an additional $1.4 million of prepaid commission expenses, reflecting the change in classification of prepaid commissions to a current asset effective April 1, 2016 as well as a net decrease of $1.1 million resulting from the impact of foreign currency translation.

Base FFO was $20.9 million for the third quarter of fiscal 2017, down 22% compared to $26.8 million in the prior comparable quarter as a result of the 8% decrease in Base EBITDA as well as one-time finance costs associated with the early redemption of the senior unsecured notes in the current quarter.

Dividends/distributions paid were $18.8 million, an increase of 1% over the prior comparable quarter based on a consistent annual dividend rate of $0.50 per common share but reflecting additional share-based awards granted to Just Energy employees. The payout ratio for the three months ended December 31, 2016 was 90%, compared with 70% in the prior comparable quarter.

Segmented Base EBITDA1 | | | | | | |

| For the nine months ended December 31 | |

| (thousands of dollars) | |

| | | | Fiscal 2017 | |

| | Consumer | | Commercial | | | |

| | division | | division | | Consolidated | |

| Sales | | $ | 1,515,209 | | | $ | 1,294,564 | | | $ | 2,809,773 | |

| Cost of sales | | | (1,130,728 | ) | | | (1,158,486 | ) | | | (2,289,214 | ) |

| Gross margin | | | 384,481 | | | | 136,078 | | | | 520,559 | |

| Add (subtract): | | | | | | | | | | | | |

| Administrative expenses | | | (98,321 | ) | | | (37,664 | ) | | | (135,985 | ) |

| Selling and marketing expenses | | | (104,175 | ) | | | (68,406 | ) | | | (172,581 | ) |

| Bad debt expense | | | (32,925 | ) | | | (11,697 | ) | | | (44,622 | ) |

| Amortization included in cost of sales | | | 2,213 | | | | - | | | | 2,213 | |

| Other expenses | | | (960 | ) | | | (604 | ) | | | (1,564 | ) |

| Profit attributable to non-controlling interest | | | (18,539 | ) | | | - | | | | (18,539 | ) |

| Base EBITDA from operations | | $ | 131,774 | | | $ | 17,707 | | | $ | 149,481 | |

| | | | | | | | | | | | | |

| | | | | | Fiscal 2016 | |

| | Consumer | | Commercial | | | | | |

| | division | | division | | Consolidated | |

| Sales | | $ | 1,583,351 | | | $ | 1,446,629 | | | $ | 3,029,980 | |

| Cost of sales | | | (1,207,490 | ) | | | (1,324,491 | ) | | | (2,531,981 | ) |

| Gross margin | | | 375,861 | | | | 122,138 | | | | 497,999 | |

| Add (subtract): | | | | | | | | | | | | |

| Administrative expenses | | | (89,050 | ) | | | (31,776 | ) | | | (120,826 | ) |

| Selling and marketing expenses | | | (117,635 | ) | | | (77,455 | ) | | | (195,090 | ) |

| Bad debt expense | | | (43,188 | ) | | | (6,062 | ) | | | (49,250 | ) |

| Amortization included in cost of sales/selling and marketing expenses | | | 1,825 | | | | 18,728 | | | | 20,553 | |

| Other expenses | | | (1,725 | ) | | | (585 | ) | | | (2,310 | ) |

| Profit attributable to non-controlling interest | | | (10,792 | ) | | | - | | | | (10,792 | ) |

| Base EBITDA from operations | | $ | 115,296 | | | $ | 24,988 | | | $ | 140,284 | |

Consumer Energy contributed $46.1 million to Base EBITDA for the three months ended December 31, 2016, a decrease of 14% from $53.7 million in the prior comparative quarter. Consumer gross margin decreased 6% due to the lower gross margin resulting from the 6% decrease in Consumer customer base year over year as well as slightly higher balancing costs. Consumer administrative costs were up 6% in fiscal 2017 due to the increase in costs associated with international expansion and new strategic initiatives.

Commercial Energy contributed $5.4 million to Base EBITDA, an increase of 168% from the prior comparable quarter, when the segment contributed $2.0 million, as a result of higher gross margin as well as lower selling costs over the prior comparable period.

For the nine months ended December 31, 2016, Base EBITDA was $149.5 million, an increase of 7% from $140.3 million recorded in the prior comparable period. The Consumer division contributed $131.8 million to Base EBITDA for the nine months ended December 31, 2016, an increase of 14% from $115.3 million reported for the nine months ended December 31, 2015. The Commercial division contributed $17.7 million to Base EBITDA, a 29% decrease from the prior comparable period, when the segment contributed $25.0 million. The decrease is primarily related to an additional $13.4 million in selling and marketing expenses related to the change in classification of prepaid expenses effective fiscal 2016.

Excluding the incremental $13.4 million in additional selling costs, Commercial Base EBITDA for the nine months ended December 31, 2016 would have increased by 24% to $31.1 million as a result of the Company’s operational improvement initiatives.

| Customer aggregation | | | | | | | | | | | | | |

| | | Oct. 1, | | | | | | | | | Failed to | | | Dec. 31, | | | % increase | | | Dec. 31, | | | % increase | |

| | | 2016 | | | Additions | | | Attrition | | | renew | | | 2016 | | | (decrease) | | | 2015 | | | (decrease) | |

| Consumer Energy | | | | | | | | | | | | | | | | | | | | | | |

| Gas | | | 624,000 | | | | 23,000 | | | | (30,000 | ) | | | (13,000 | ) | | | 604,000 | | | | (3 | )% | | | 686,000 | | | | (12 | )% |

| Electricity | | | 1,205,000 | | | | 78,000 | | | | (54,000 | ) | | | (43,000 | ) | | | 1,186,000 | | | | (2 | )% | | | 1,217,000 | | | | (3 | )% |

| Total Consumer RCEs | | | 1,829,000 | | | | 101,000 | | | | (84,000 | ) | | | (56,000 | ) | | | 1,790,000 | | | | (2 | )% | | | 1,903,000 | | | | (6 | )% |

| Commercial Energy | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gas | | | 245,000 | | | | 16,000 | | | | (5,000 | ) | | | (6,000 | ) | | | 250,000 | | | | 2 | % | | | 242,000 | | | | 3 | % |

| Electricity | | | 2,237,000 | | | | 93,000 | | | | (58,000 | ) | | | (85,000 | ) | | | 2,187,000 | | | | (2 | )% | | | 2,422,000 | | | | (10 | )% |

| Total Commercial RCEs | | | 2,482,000 | | | | 109,000 | | | | (63,000 | ) | | | (91,000 | ) | | | 2,437,000 | | | | (2 | )% | | | 2,664,000 | | | | (9 | )% |

| Total RCEs | | | 4,311,000 | | | | 210,000 | | | | (147,000 | ) | | | (147,000 | ) | | | 4,227,000 | | | | (2 | )% | | | 4,567,000 | | | | (7 | )% |

Gross customer additions for the quarter ended December 31, 2016 were 210,000, a decrease of 33% compared to 313,000 customers added in the third quarter of fiscal 2016. The customer additions were lower in the current period due to market conditions as the commodity prices were lower and therefore more competitive across all markets, as well as an increased focus on the profitability of each customer, resulting in fewer customer additions. Additionally, the low and stable market conditions (no volatility) that have prevailed for the past two years have resulted in less customer switching.

Consumer customer additions amounted to 101,000 for the three months ended December 31, 2016, a 17% decrease from 122,000 gross customer additions recorded in the prior comparable quarter. As commodity prices were lower and therefore more competitive across all markets, customer additions through door-to-door marketing decreased. As of December 31, 2016, the U.S., Canadian and U.K. segments accounted for 66%, 26% and 8% of the Consumer customer base, respectively.

Commercial customer additions were 109,000 for the three months ended December 31, 2016, a 43% decrease from 191,000 gross customer additions in the prior comparable quarter as a result of competitiveness in pricing and a more disciplined pricing strategy. Just Energy remains focused on increasing the gross margin per customer added for Commercial customers and, as a result, has been more selective in the margin added per customer. As of December 31, 2016, the U.S., Canadian and U.K. segments accounted for 75%, 18% and 7% of the Commercial customer base, respectively.

Net additions were a negative 84,000 for the third quarter of fiscal 2017, compared with a negative 46,000 net customer additions in the third quarter of fiscal 2016, primarily as a result of the lower customer additions in North America. Just Energy continues to actively focus on improving retained customers’ profitability rather than pursuing low margin growth.

In addition to the customers referenced in the above table, the Consumer customer base also includes 56,000 smart thermostat customers. These smart thermostats are bundled with a commodity contract and are currently offered in Ontario, Alberta and Texas. Customers with bundled products have lower attrition and higher overall profitability. Further expansion of the energy management solutions is a key driver of continued growth for Just Energy with additional product offerings contributing to lower attrition rates.

For the three months ended December 31, 2016, 46% of the total Consumer and Commercial customer additions were generated from commercial brokers, 33% through online and other non-door-to-door sales channels and 21% from door-to-door sales. In the prior comparable quarter, 59% of customer additions were generated from commercial brokers, 22% from online and other sales channels and 19% using door-to-door sales.

The U.K. operations increased their customer base by 8% to 309,000 RCEs over the past year with strong growth for both their Consumer and Commercial customer bases. As of December 31, 2016, the U.S., Canadian and U.K. segments accounted for 71%, 22% and 7% of the customer base, respectively. At December 31, 2015, the U.S., Canadian and U.K. segments represented 71%, 23% and 6% of the customer base, respectively.

| ATTRITION | | | | | | |

| | | Trailing 12 | | | Trailing 12 | |

| | | months ended | | | months ended | |

| | | Dec. 31, 2016 | | | Dec. 31, 2015 | |

| | | | | | | |

| Consumer | | | 24 | % | | | 27 | % |

| Commercial | | | 8 | % | | | 9 | % |

| Total attrition | | | 15 | % | | | 17 | % |

The combined attrition rate for Just Energy was 15% for the trailing 12 months ended December 31, 2016, a decrease of two percentage points from the 17% reported in the prior comparable period and consistent with the overall attrition reported for the second quarter of fiscal 2017. While the Consumer attrition rate decreased three percentage points to 24% from a year ago, the Commercial attrition rate decreased one percentage point to 8%. Both decreases are a result of Just Energy’s focus on becoming the customers’ “trusted advisor” and providing a variety of energy management solutions to its customer base to drive customer loyalty.

The Company carefully monitors the levels of customer complaints from its Consumer and Commercial divisions. The goal is to resolve all complaints registered within five days of receipt. Our corporate target is to have an outstanding complaint rate of less than 0.05% of customers at any time. As of December 31, 2016, the total outstanding rate was 0.01%.

| RENEWALS | | | | | | |

| | | Trailing 12 | | | Trailing 12 | |

| | | months ended | | | months ended | |

| | | Dec. 31, 2016 | | | Dec. 31, 2015 | |

| | | | | | | |

| Consumer | | | 79 | % | | | 75 | % |

| Commercial | | | 55 | % | | | 57 | % |

| Total renewals | | | 64 | % | | | 62 | % |

The Just Energy renewal process is a multifaceted program that aims to maximize the number of customers who choose to renew their contract prior to the end of their existing contract term. Efforts begin up to 15 months in advance, allowing a customer to renew for an additional period. Overall, the renewal rate was 64% for the trailing 12 months ended December 31, 2016, up two percentage points from a renewal rate of 62% reported for the third quarter of fiscal 2016, and up three percentage points from the renewal rate of 61% reported as of September 30, 2016. The Consumer renewal rate increased by four percentage points, while the Commercial renewal rate decreased by two percentage points to 55%. The decline in Commercial renewal rates reflected a very competitive market for Commercial renewals with competitors pricing aggressively and Just Energy’s focus on improving retained customers’ profitability rather than pursuing low margin growth.

| ENERGY CONTRACT RENEWALS | | | | | | | |

| This table shows the customers up for renewal in the following fiscal periods: | |

| | | | | | | | | | | | | |

| | | Consumer | | | Commercial | |

| | | Gas | | | Electricity | | | Gas | | | Electricity | |

| Remainder of 2017 | | | 4 | % | | | 7 | % | | | 6 | % | | | 6 | % |

| 2018 | | | 24 | % | | | 38 | % | | | 42 | % | | | 48 | % |

| 2019 | | | 25 | % | | | 26 | % | | | 23 | % | | | 23 | % |

| 2020 | | | 22 | % | | | 15 | % | | | 17 | % | | | 14 | % |

| Beyond 2020 | | | 25 | % | | | 14 | % | | | 12 | % | | | 9 | % |

| Total | | | 100 | % | | | 100 | % | | | 100 | % | | | 100 | % |

| Note: All month-to-month customers, which represent 643,000 RCEs, are excluded from the table above. | |

| Gross margin | | | | | | | | | | |

| For the three months ended December 31 | | | | |

| (thousands of dollars) | | | | | | | | | | | | | |

| | | Fiscal 2017 | | | Fiscal 2016 | |

| | Consumer | | Commercial | | Total | | Consumer | | Commercial | | Total | |

| Gas | | $ | 51,141 | | | $ | 7,274 | | | $ | 58,415 | | | $ | 51,391 | | | $ | 9,397 | | | $ | 60,788 | |

| Electricity | | | 77,961 | | | | 37,977 | | | | 115,938 | | | | 86,673 | | | | 32,476 | | | | 119,149 | |

| | | $ | 129,102 | | | $ | 45,251 | | | $ | 174,353 | | | $ | 138,064 | | | $ | 41,873 | | | $ | 179,937 | |

| Increase (decrease) | | | (6 | )% | | | 8 | % | | | (3 | )% | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| For the nine months ended December 31 | | | | | |

| (thousands of dollars) | | | | | | | | | | | | | | | | | |

| | | Fiscal 2017 | | | Fiscal 2016 | |

| | Consumer | | Commercial | | Total | | Consumer | | Commercial | | Total | |

| Gas | | $ | 107,409 | | | $ | 14,773 | | | $ | 122,182 | | | $ | 97,035 | | | $ | 18,210 | | | $ | 115,245 | |

| Electricity | | | 277,072 | | | | 121,305 | | | | 398,377 | | | | 278,826 | | | | 103,928 | | | | 382,754 | |

| | | $ | 384,481 | | | $ | 136,078 | | | $ | 520,559 | | | $ | 375,861 | | | $ | 122,138 | | | $ | 497,999 | |

| Increase | | | 2 | % | | | 11 | % | | | 5 | % | | | | | | | | | | | | |

CONSUMER ENERGY

Gross margin for the three months ended December 31, 2016 for the Consumer division was $129.1 million, a decrease of 6% from $138.1 million recorded in the prior comparable quarter. For the nine months ended December 31, 2016, gross margin for the Consumer division was $384.5 million, an increase of 2% from $375.9 million recorded for the nine months ended December 31, 2015. Average realized gross margin for the Consumer division for the rolling 12 months ended December 31, 2016 was $264/RCE, representing a 14% increase from $231/RCE reported in the prior comparable quarter. The increase is largely due to higher margins on new customers added. The gross margin/RCE value includes an appropriate allowance for bad debt expense in applicable markets.

Gross margin from gas customers in the Consumer division was $51.1 million for the three months ended December 31, 2016, a slight decrease from $51.4 million recorded in the prior comparable quarter. For the nine months ended December 31, 2016, the gross margin contribution from the gas markets increased by 11% over the prior comparable period to $107.4 million. The change is primarily a result of the growth in the U.K.

Electricity

Gross margin from electricity customers in the Consumer division was $78.0 million for the three months ended December 31, 2016, a 10% decrease from $86.7 million recorded in the prior comparable quarter. For the nine months ended December 31, 2016, gross margin from electricity markets decreased 1% to $277.1 million. The decrease in gross margin for the three and nine months ended December 31, 2016 is a result of fewer flowing customers, higher balancing costs and lower JustGreen uptake rates.

COMMERCIAL ENERGY

Gross margin for the Commercial division was $45.3 million for the three months ended December 31, 2016, an increase of 8% from $41.9 million recorded in the prior comparable quarter. For the nine months ended December 31, 2016, gross margin for the Commercial division was $136.1 million, an increase of 11% from $122.1 million recorded for the nine months ended December 31, 2015. The overall growth in margin was due to operational improvements in place to increase the margin for new customers added.

Average realized gross margin for the rolling 12 months ended December 31, 2016 was $82/RCE, an increase of 22% from the $67/RCE reported in the prior comparable period. The gross margin per RCE value includes an appropriate allowance for bad debt expense in Illinois, Texas, Georgia, Michigan and California.

Gas

Gas gross margin for the Commercial division was $7.3 million for the three months ended December 31, 2016, a decrease of 23% from $9.4 million recorded in the prior comparable quarter. For the nine months ended December 31, 2016, the gross margin contribution from the gas markets decreased by 19% from the prior comparable period to $14.8 million. The decrease in gross margin for the three and nine months ending December 31, 2016 is a result of the lower customer base and higher balancing costs in the prior periods.

The Commercial division’s electricity gross margin for the three months ended December 31, 2016 was $38.0 million, an increase of 17% from $32.5 million recorded in the prior comparable quarter. Gross margin from the Commercial electricity markets for the nine months ended December 31, 2016 was $121.3 million, an increase of 17% from $103.9 million recorded in the nine months ended December 31, 2015. The increase in gross margin is a result of increased profitability on new customers, despite the 10% decrease in customer base in the past year.

GROSS MARGIN ON NEW AND RENEWING CUSTOMERS

The table below depicts the annual margins on contracts for Consumer and Commercial customers signed during the quarter. This table reflects the gross margin (sales price less costs of associated supply and allowance for bad debt) earned on new additions and renewals, including both brown commodities and JustGreen supply.

| Annual gross margin per RCE | | | | | | | |

| | Q3 Fiscal | | Number of | | Q3 Fiscal | | Number of | |

| | 2017 | | customers | | 2016 | | customers | |

| | | | | | | | | |

| Consumer customers added and renewed | | $ | 222 | | | | 205,000 | | | $ | 213 | | | | 211,000 | |

| Consumer customers lost | | | 199 | | | | 140,000 | | | | 194 | | | | 123,000 | |

| Commercial customers added and renewed | | | 82 | | | | 229,000 | | | | 84 | | | | 304,000 | |

| Commercial customers lost | | | 81 | | | | 154,000 | | | | 63 | | | | 236,000 | |

For the three months ended December 31, 2016, the average gross margin per RCE for the customers added and renewed by the Consumer division was $222/RCE, compared with $213/RCE in the prior comparable quarter. The target margins for markets increased while management continues to focus on new products, including bundled offerings. The average gross margin per RCE for the Consumer customers lost during the three months ended December 31, 2016 was $199/RCE, compared with $194/RCE in the third quarter of fiscal 2016. The increase in gross margin on customers lost is a result of the growing number of Consumer customers that were added at higher margins. Just Energy has reported Consumer customers added and renewed at an average gross margin of $200 or higher for the past seven quarters.

For the Commercial division, the average gross margin per RCE for the customers signed during the quarter ended December 31, 2016 was $82/RCE, compared to $84/RCE in the prior comparable quarter. Customers lost through attrition and failure to renew during the three months ended December 31, 2016 were at an average gross margin of $81/RCE, an increase from $63/RCE reported in the prior comparable period due to the customers being added at higher margins in recent periods. Management will continue its margin optimization efforts by focusing on ensuring customers added meet its profitability targets.

| Overall consolidated results | | | | | | | | | | | |

| | | | | | | | | | | | | |

| ADMINISTRATIVE EXPENSES | | | | | | | | | | | | |

| (thousands of dollars) | | | | | | | | | | | | |

| | Three months | | Three months | | | | Nine months | | Nine months | | | |

| | ended | | ended | | % | | ended | | ended | | | |

| | Dec. 31, | | Dec. 31, | | increase | | Dec. 31, | | Dec. 31, | | % | |

| | 2016 | | 2015 | | (decrease) | | 2016 | | 2015 | | increase | |

| Consumer Energy | | $ | 31,267 | | | $ | 29,381 | | | | 6 | % | | $ | 98,321 | | | $ | 89,050 | | | | 10 | % |

| Commercial Energy | | | 13,300 | | | | 13,553 | | | | (2 | )% | | | 37,664 | | | | 31,776 | | | | 19 | % |

| Total administrative expenses | | $ | 44,567 | | | $ | 42,934 | | | | 4 | % | | $ | 135,985 | | | $ | 120,826 | | | | 13 | % |

Administrative expenses for the three months ended December 31, 2016 increased by 4% from $42.9 million to $44.6 million. The Consumer division’s administrative expenses were $31.3 million for the three months ended December 31, 2016, an increase of 6% from $29.4 million recorded in the prior comparable quarter. The increase over the prior comparable quarter was primarily driven by the higher operating costs associated with growth in the U.K. operation to support its growing customer base, international expansion expenses as well as efforts relating to new strategic initiatives. The Commercial division’s administrative expenses were $13.3 million for the third quarter of fiscal 2017, a 2% decrease from $13.6 million reported for the prior comparable quarter.

Administrative expenses increased by 13% to $136.0 million for the nine months ended December 31, 2016 from $120.8 million recorded in the prior comparative period. Consumer and Commercial administrative expenses for the nine months ended December 31, 2016 were $98.3 million and $37.7 million, an increase of 10% and 19%, respectively, as a result of the increased administrative costs for the growth in the U.K. operations, as well as costs associated with international expansion and new strategic initiatives.

| SELLING AND MARKETING EXPENSES | | | | | | | | | | |

| (thousands of dollars) | | | | | | | | | | | | | | |

| | Three months | | Three months | | | | Nine months | | Nine months | | | |

| | ended | | ended | | | | ended | | ended | | | |

| | Dec. 31, | | Dec. 31, | | % | | Dec. 31, | | Dec. 31, | | % | |

| | 2016 | | 2015 | | decrease | | 2016 | | 2015 | | decrease | |

| Consumer Energy | | $ | 32,514 | | | $ | 38,952 | | | | (17 | )% | | $ | 104,175 | | | $ | 117,635 | | | | (11 | )% |

| Commercial Energy | | | 22,823 | | | | 28,109 | | | | (19 | )% | | | 68,406 | | | | 77,455 | | | | (12 | )% |

| Total selling and marketing expenses | | $ | 55,337 | | | $ | 67,061 | | | | (17 | )% | | $ | 172,581 | | | $ | 195,090 | | | | (12 | )% |

Selling and marketing expenses, which consist of commissions paid to independent sales contractors, brokers and independent representatives, as well as sales-related corporate costs, were $55.3 million, a decrease of 17% from $67.1 million in the third quarter of fiscal 2016. This decrease is largely attributable to the lower gross customer additions in the current period.

The selling and marketing expenses for the Consumer division were $32.5 million for the three months ended December 31, 2016, a 17% decrease from $39.0 million recorded in the prior comparable quarter. The selling expenses decreased due to lower gross customer additions quarter over quarter.

The selling and marketing expenses for the Commercial division were $22.8 million for the three months ended December 31, 2016, down 19% from $28.1 million recorded in the prior comparable quarter. This decrease is a result of lower commission expenses on gross customer additions in the third quarter as well as the lower residual commission expenses from the decrease in customer base.

For the nine months ended December 31, 2016, selling and marketing expenses were $172.6 million, a decrease of 12% compared to $195.1 million in the prior comparable period. The Consumer division’s selling and marketing expenses were down 11% to $104.2 million compared to $117.6 million for the nine months ended December 31, 2015. Selling and marketing expenses for the Commercial division were $68.4 million for the nine months ended December 31, 2016, a decrease of 12% compared to $77.5 million in the prior comparable period as a result of lower commission expenses in the current period.

The aggregation costs per customer for the last 12 months for Consumer customers signed by independent representatives and Commercial customers signed by brokers were as follows:

| | Fiscal 2017 | Fiscal 2016 |

| Consumer | $205/RCE | $189/RCE |

| Commercial | $40/RCE | $39/RCE |

The average aggregation cost for the Consumer division was $205/RCE for the trailing 12 months ended December 31, 2016, an increase from $189/RCE reported a year ago, and slightly higher than the $203/RCE reported for the second quarter of fiscal 2017. The increase in cost in the current 12-month period over the prior year is a result of the higher allocations of overhead expense on a per RCE basis due to lower customer additions in the last 12 months.

The $40 average aggregation cost for Commercial division customers is based on the expected average annual cost for the respective customer contracts. It should be noted that commercial broker contracts are paid further commissions averaging $40 per year for each additional year that the customer flows. Assuming an average life of 2.8 years, this would add approximately $72 (1.8 x $40) to the year’s average aggregation cost reported above. As at December 31, 2015, the average aggregation cost for commercial brokers was $39/RCE. The lower cost in the prior comparable quarter is a function of broker commissions being a percentage of lower margins.

BAD DEBT EXPENSE

In Illinois, Alberta, Texas, Delaware, Ohio, California, Michigan, Georgia and the U.K., Just Energy assumes the credit risk associated with the collection of customer accounts. In addition, for commercial direct-billed accounts in British Columbia, Just Energy is responsible for the bad debt risk. Credit review processes have been established to manage the customer default rate. Management factors default from credit risk into its margin expectations for all of the above-noted markets. During the nine months ended December 31, 2016, Just Energy was exposed to the risk of bad debt on approximately 73% of its sales, compared with 70% in the prior comparable period.

Bad debt expense is included in the consolidated income statement under other operating expenses. Bad debt expense for the three months ended December 31, 2016 was $16.2 million, an increase of 25% from $13.0 million expensed for the three months ended December 31, 2015 as a result of customer write-offs in the third quarter. The bad debt expense for the nine months ended December 31, 2016 decreased by 9% to $44.6 million. Management integrates its default rate for bad debt into its margin targets and continuously reviews and monitors the credit approval process to mitigate customer delinquency.

Management expects that bad debt expense will remain in the range of 2% to 3% of relevant revenue for fiscal 2017 in markets where the Company bears credit risk. For each of Just Energy’s other markets, the LDCs provide collection services and assume the risk of any bad debt owing from Just Energy’s customers for a regulated fee.

Total finance costs for the three months ended December 31, 2016 amounted to $25.5 million, an increase of 44% from $17.7 million recorded in the third quarter of fiscal 2016. The increase in finance costs was a result of the additional $2.5 million in amortization of debt issuance costs, a loss of $3.1 million on the partial redemption of the 6.0% convertible debentures as well as the $2.7 million one-time interest cost associated with early redemption of the remaining $55 million of senior unsecured notes.

For the nine months ended December 31, 2016, finance costs were $61.3 million, an increase of 17% from $52.2 million reported for the prior comparable period. The increase in finance costs was a result of the additional $4.0 million in amortization of debt issuance costs, the aforementioned $3.1 loss on early redemption as well as the one-time interest cost associated with early redemption of the senior unsecured notes in fiscal 2017.

Just Energy has an exposure to U.S. dollar, U.K. pound and euro exchange rates as a result of its international operations. Any changes in the applicable exchange rate may result in a decrease or increase in other comprehensive income. For the three months ended December 31, 2016, a foreign exchange unrealized loss of $2.0 million was reported in other comprehensive income, versus an unrealized loss of $11.5 million reported in the third quarter of fiscal 2016. For the nine months ended December 31, 2016, a foreign exchange unrealized loss of $0.9 million was recorded, compared to a loss of $23.6 million reported for the prior comparable period.

Overall, the positive impact from the translation of the U.S.-based operations was more than offset by the impact of the declining British pound following the Brexit vote. The total estimated impact of the foreign exchange between the Canadian dollar versus the U.S. dollar and British pound was an unfavourable $1.1 million and an unfavourable $0.2 million on Base EBITDA, respectively, for the three and nine months ended December 31, 2016.

Just Energy retains sufficient funds in the U.S. to support ongoing growth, and surplus cash is repatriated to Canada. U.S. cross border cash flow is forecasted annually, and hedges for cross border cash flow are placed. Just Energy hedges between 50% and 90% of the next 12 months of cross border cash flows depending on the level of certainty of the cash flow.

| PROVISION FOR INCOME TAX | | | | | | | |

| (thousands of dollars) | | | | | | | | | | | | |

| | Three months | | Three months | | Nine months | | Nine months | |

| | ended | | ended | | ended | | ended | |

| | Dec. 31, 2016 | | Dec. 31, 2015 | | Dec. 31, 2016 | | Dec. 31, 2015 | |

| Current income tax expense | | $ | 9,823 | | | $ | 9,612 | | | $ | 14,449 | | | $ | 13,952 | |

| Deferred tax provision (recovery) | | | 11,153 | | | | (10,838 | ) | | | 36,705 | | | | (2,529 | ) |

| Provision for (recovery of) income tax | | $ | 20,976 | | | $ | (1,226 | ) | | $ | 51,154 | | | $ | 11,423 | |

Just Energy recorded a current income tax expense of $9.8 million for the three months ended December 31, 2016, versus an expense of $9.6 million in the prior comparable quarter. For the nine months ended December 31, 2016, the current income tax expense increased by 4% to $14.4 million from $14.0 million reported for the nine months ended December 31, 2015.

During the three months ended December 31, 2016, a deferred tax provision of $11.2 million was recorded for the cumulative mark to market losses from financial instruments. In fiscal 2016, a deferred tax recovery of $10.8 million was recorded, primarily resulting from the change in fair value of derivative instruments. A deferred tax provision of $36.7 million and a recovery of $2.5 million were recorded for the nine months ended December 31, 2016 and December 31, 2015, respectively.

Under IFRS, Just Energy recognizes income tax assets and liabilities based on the estimated tax consequences attributable to temporary differences between the carrying value of the assets and liabilities on the consolidated financial statements and their respective tax bases, using substantively enacted income tax rates. A deferred tax asset will not be recognized if it is not anticipated that the asset will be realized in the foreseeable future. The effect of a change in the income tax rates used in calculating deferred income tax assets and liabilities is recognized in income during the period in which the change occurs.

| | | | | | | | | | | | | |

| Liquidity and capital resources | | | | | | | | | | | | |

| SUMMARY OF CASH FLOWS | | | | | | | | | | | | |

| (thousands of dollars) | | | | | | | | | | | | |

| | Three months | | Three months | | Nine months | | Nine months | |

| | ended | | ended | | ended | | ended | |

| | Dec. 31, 2016 | | Dec. 31, 2015 | | Dec. 31, 2016 | | Dec. 31, 2015 | |

| Operating activities | | $ | 35,605 | | | $ | 28,659 | | | $ | 115,743 | | | $ | 98,350 | |

| Investing activities | | | (13,639 | ) | | | (3,600 | ) | | | (25,633 | ) | | | (15,246 | ) |

| Financing activities, excluding dividends | | | (43,691 | ) | | | (5,584 | ) | | | (81,691 | ) | | | (19,782 | ) |

| Effect of foreign currency translation | | | (712 | ) | | | 1,374 | | | | (2,103 | ) | | | 4,699 | |

| Increase in cash before dividends | | | (22,437 | ) | | | 20,849 | | | | 6,316 | | | | 68,021 | |

| Dividends (cash payments) | | | (18,788 | ) | | | (18,653 | ) | | | (56,378 | ) | | | (56,015 | ) |

| Increase (decrease) in cash | | | (41,225 | ) | | | 2,196 | | | | (50,062 | ) | | | 12,006 | |

| Cash and cash equivalents – beginning of period | | | 118,759 | | | | 88,624 | | | | 127,596 | | | | 78,814 | |

| Cash and cash equivalents – end of period | | $ | 77,534 | | | $ | 90,820 | | | $ | 77,534 | | | $ | 90,820 | |

OPERATING ACTIVITIES

Cash flow from operating activities for the three months ended December 31, 2016 was an inflow of $35.6 million, compared to $28.7 million in the prior comparable quarter due to improvements in working capital. For the nine months ended December 31, 2016, cash flow from operating activities was an inflow of $115.7 million, an increase of 18% from $98.4 million reported for the prior comparable period as a result of improved earnings in the current period.

INVESTING ACTIVITIES

Investing activities for the three and nine months ended December 31, 2016 included purchases of capital and intangible assets totalling $10.1 million and $18.6 million, respectively, compared with $3.6 million and $11.8 million, respectively, in fiscal 2016 as well as a $4.0 million cash outlay relating to the German acquisition.

FINANCING ACTIVITIES

Financing activities, excluding dividends, relates primarily to the issuance and repayment of long-term debt. During the three months ended December 31, 2016, Just Energy redeemed $225 million on the 6.0% convertible debentures and repaid the remaining $55 million on the senior unsecured notes. As of December 31, 2016, Just Energy had issued $160 million in 6.75% convertible debentures and withdrawn $90.3 million on its credit facility.

Just Energy’s liquidity requirements are driven by the delay from the time that a customer contract is signed until cash flow is generated. The elapsed period between the time a customer is signed and receipt of the first payment from the customer varies with each market. The time delays per market are approximately two to nine months. These periods reflect the time required by the various LDCs to enroll, flow the commodity, bill the customer and remit the first payment to Just Energy. In Alberta, Georgia and Texas and for commercial direct-billed customers, Just Energy receives payment directly.

DIVIDENDS

Just Energy’s annual dividend rate is $0.50 per common share paid quarterly. The dividend policy states that common shareholders of record on the 15th day of March, June, September and December, or the first business day thereafter, receive dividends at the end of that month. During the three months ended December 31, 2016, Just Energy paid cash dividends to its common shareholders and distributions to holders of share-based awards in the amount of $18.8 million, compared to $18.7 million paid in the prior comparable quarter. For the nine months ended December 31, 2016, Just Energy paid $56.4 million, compared to $56.0 million paid for the comparable period of fiscal 2016.

Balance sheet as at December 31, 2016, compared to March 31, 2016

Cash decreased from $127.6 million as at March 31, 2016 to $77.5 million. The decrease in cash is primarily attributable to the early redemption of $225 million on the 6.0% convertible debentures as well as the repayment of the remaining $80 million on the senior unsecured notes. These repayments were offset by the issuance of the 6.75% convertible debentures and the withdrawal of $90.3 million on the credit facility.

As of December 31, 2016, trade receivables and unbilled revenue amounted to $370.5 million and $246.3 million, respectively, compared to March 31, 2016, when the trade receivables and unbilled revenue amounted to $362.3 million and $227.4 million, respectively. The accounts receivable balances increased as a result of normal seasonal consumption with higher electricity bills in the current quarter. Trade payables, which include gas and electricity commodity payables of $234.8 million, increased from $511.3 million to $533.3 million during the third quarter of the fiscal year, partially due to the negotiation with some commodity suppliers for an extension of payment terms going forward with approximately $40.8 million in commodity costs payable in January 2017. Under the previous agreement, these costs would have been payable in December 2016.

In Ontario, Manitoba, British Columbia and Michigan, more gas has been delivered to LDCs than consumed by customers, resulting in gas delivered in excess of consumption and a deferred revenue position of $12.7 million and $20.4 million, respectively, as of December 31, 2016. These amounts increased from $6.3 million and $7.4 million, respectively, as of March 31, 2016. As at March 31, 2016, more gas was consumed by customers than Just Energy had delivered to the LDCs in Ontario, Manitoba and Quebec and as a result, Just Energy recognized an accrued gas receivable and accrued gas payable for $13.6 million and $11.3 million, respectively. These changes represent normal seasonal fluctuations based on consumption during the winter months.

Prepaid expenses and deposits decreased from $114.7 million at March 31, 2016 to $97.7 million as of December 31, 2016 as green commodity purchases decreased by $15.2 million during the nine months ended December 31, 2016.

Fair value of derivative financial assets and fair value of financial liabilities relate entirely to the financial derivatives. The mark to market gains and losses can result in significant changes in profit and loss and, accordingly, shareholders’ equity from year to year due to commodity price volatility. Given that Just Energy has purchased this supply to cover future customer usage at fixed prices, management believes that these non-cash changes are not meaningful and will not be experienced as future costs or cash outflows.

Long-term debt has decreased from $660.5 million as at March 31, 2016 to $519.5 million as at December 31, 2016. This decrease is a result of the early redemption of $225 million on the 6.0% convertible debentures, the repayment of the remaining $80 million on the senior unsecured notes and $92.8 million being reclassified to a current liability based on the maturity date of June 30, 2017 for the remaining 6.0% convertible debentures, offset by the issuance of the 6.75% convertible debentures and the withdrawal of $90.3 million on the credit facility. The book value of net debt was 2.5x for the Base EBITDA, lower than both the 2.6x and 2.9x reported for March 31, 2016 and the prior comparable period, respectively.

The acquisition of SWDirekt and SWPro was accounted for using the purchase method of accounting. For an allocated breakdown of the purchase price to identified assets and liabilities acquired in the acquisition, see note 7 of the interim condensed consolidated financial statements for the three and nine months ended December 31, 2016.

Contractual obligations

In the normal course of business, Just Energy is obligated to make future payments for contracts and other commitments that are known and non-cancellable.

| PAYMENTS DUE BY PERIOD | | | | | | | | | | | | | | | |

| (thousands of dollars) | | | | | | | | | | | | | | | |

| | | Less than 1 year | | | 1 – 3 years | | | 4 – 5 years | | | After 5 years | | | Total | |

| Trade and other payables | | $ | 533,349 | | | $ | - | | | $ | - | | | $ | - | | | $ | 533,349 | |

| Long-term debt (contractual cash flow) | | | 94,652 | | | | 391,700 | | | | - | | | | 160,000 | | | | 646,352 | |

| Interest payments | | | 27,110 | | | | 42,787 | | | | 21,600 | | | | - | | | | 91,497 | |

| Premises and equipment leasing | | | 4,924 | | | | 12,441 | | | | 6,099 | | | | 10,299 | | | | 33,763 | |

| Gas and electricity contracts | | | 664,780 | | | | 2,396,573 | | | | 409,748 | | | | 57,038 | | | | 3,528,139 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | $ | 1,324,815 | | | $ | 2,843,501 | | | $ | 437,447 | | | $ | 227,337 | | | $ | 4,833,100 | |

In the opinion of management, Just Energy has no material pending actions, claims or proceedings that have not been included either in its accrued liabilities or in the consolidated financial statements. In the normal course of business, Just Energy could be subject to certain contingent obligations that become payable only if certain events were to occur. The inherent uncertainty surrounding the timing and financial impact of any events prevents any meaningful measurement, which is necessary to assess any material impact on future liquidity. Such obligations include potential judgments, settlements, fines and other penalties resulting from actions, claims or proceedings.

Transactions with related parties

Just Energy does not have any material transactions with any individuals or companies that are not considered independent of Just Energy or any of its subsidiaries and/or affiliates.

Off balance sheet items

The Company has issued letters of credit in accordance with its credit facility totalling $115.0 million to various counterparties, primarily utilities in the markets where it operates, as well as suppliers.

Just Energy has issued surety bonds to various counterparties including states, regulatory bodies, utilities and various other surety bond holders in return for a fee and/or meeting certain collateral posting requirements. Such surety bond postings are required in order to operate in certain states or markets. Total surety bonds issued as at December 31, 2016 were $59.5 million.

Critical accounting estimates

The consolidated financial statements of Just Energy have been prepared in accordance with IFRS. Certain accounting policies require management to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues, cost of sales, selling and marketing, and administrative expenses. Estimates are based on historical experience, current information and various other assumptions that are believed to be reasonable under the circumstances. The emergence of new information and changed circumstances may result in actual results or changes to estimated amounts that differ materially from current estimates.

Controls and procedures

INTERNAL CONTROLS FOR DISCLOSURE AND FINANCIAL REPORTING

As of December 31, 2016, the Co-Chief Executive Officers (“Co-CEOs”) and Chief Financial Officer (“CFO”) of the Company, along with the assistance of senior management, have designed disclosure controls and procedures to provide reasonable assurance that material information relating to Just Energy is made known to the Co-CEOs and CFO, and have designed internal controls over financial reporting based on the criteria established in the 2013 Internal Control – Integrated Framework issued by the Committee of Sponsoring Organizations of the Treadway Commission (the “COSO criteria”) to provide reasonable assurance regarding the reliability of financial reporting and the preparation of consolidated financial statements in accordance with IFRS.

During the nine months ended December 31, 2016, there were no changes in Just Energy’s internal controls over financial reporting that occurred that have significantly affected, or are reasonably likely to significantly affect, the Company’s internal controls over financial reporting.

Corporate governance

Just Energy is committed to maintaining transparency in its operations and ensuring its approach to governance meets all recommended standards. Full disclosure of Just Energy’s compliance with existing corporate governance rules is available at www.justenergygroup.com and is included in Just Energy’s Management Proxy Circular. Just Energy actively monitors the corporate governance and disclosure environment to ensure timely compliance with current and future requirements.

Outlook

Just Energy continues to deploy its strategy to become a world-class consumer enterprise delivering superior value to its customers through a range of energy management solutions and a multi-channel approach. The Company has recently completed a phase of internal transformation centred on repairing its balance sheet and overall debt structure, as well as improving the profitability profile of its customer base.

Just Energy’s growth plans centre on customer growth; geographic expansion; channel growth and enhancements; strategic acquisitions; and new products and structures.

Customer Growth – The Company’s customer growth commitment centres on embracing and understanding the customer. We monitor our net promoter score regularly and seek appropriate measures to advance our score continuously while also preserving the improved profitability of our existing and newly added customers. We believe our customer growth strategy will result in improved attrition and renewal rates and ultimately generate net customer additions for Just Energy moving forward.

Geographic Expansion – The Company’s near-term geographic expansion plan is centred on Europe, where the Company recently expanded into Germany and expects to expand into at least one additional new European market in the near term. The Company remains committed to evaluating further potential expansion in continental Europe, Japan, Mexico, and beyond over the longer term.

33.