Exhibit 99.2

Management’s discussion and analysis

(“MD&A”) – August 9, 2017

The following discussion and analysis is a review of the financial condition and operating results of Just Energy Group Inc. (“JE” or “Just Energy” or the “Company”) for the three months ended June 30, 2017. It has been prepared with all information available up to and including August 9, 2017. This analysis should be read in conjunction with the unaudited interim condensed consolidated financial statements of the Company for the three months ended June 30, 2017. The financial information contained herein has been prepared in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”). All dollar amounts are expressed in Canadian dollars. Quarterly reports, the annual report and supplementary information can be found on Just Energy’s corporate website at www.justenergygroup.com. Additional information can be found on SEDAR at www.sedar.com or on the U.S. Securities and Exchange Commission’s website at www.sec.gov. Information contained within the annual MD&A is not discussed if it remains substantially unchanged.

Company overview

Established under the laws of Canada, Just Energy is a leading retail energy provider specializing in electricity and natural gas commodities, energy efficient solutions and renewable energy options. Currently operating in the United States, Canada and various international markets including the United Kingdom, the Company serves residential and commercial customers, providing homes and businesses with a broad range of energy solutions that deliver comfort, convenience and control. Just Energy’s margin or gross profit on commodity products is derived from the difference between the commodity sale price to its customers and the related purchase price from its suppliers. The margin on certain non-commodity products is derived from the mark up price added to the cost of the product and charged to the customer. Just Energy is the parent company of Amigo Energy, Green Star Energy, Hudson Energy, Just Energy Advanced Solutions, Tara Energy and TerraPass.

For a more detailed description of Just Energy’s business operations, refer to the "Operations overview" section on page 5 of this MD&A.

Forward-looking information

This MD&A contains certain forward-looking information pertaining to RCE additions and renewals, customer counts, customer consumption levels, EBITDA, Base EBITDA, Funds from Operations, Base Funds from Operations and treatment under governmental regulatory regimes. These statements are based on current expectations that involve a number of risks and uncertainties, which could cause actual results to differ from those anticipated. These risks include, but are not limited to, levels of customer natural gas and electricity consumption, extreme weather conditions, rates of RCE additions and renewals, RCE attrition, fluctuations in natural gas and electricity prices, changes in regulatory regimes, decisions by regulatory authorities, competition, the results of litigation, fluctuations in currency exchange rates, and dependence on certain suppliers. Additional information on these and other factors that could affect Just Energy’s operations, financial results or dividend levels is included in the Annual Information Form and other reports on file with security regulatory authorities, which can be accessed on our corporate website at www.justenergygroup.com, or through the SEDAR website at www.sedar.com or at the U.S. Securities and Exchange Commission’s website at www.sec.gov.

Key terms

“5.75% convertible debentures” refers to the $100 million in convertible debentures issued by the Company to finance the purchase of Fulcrum Retail Holdings, LLC, issued in September 2011. The convertible debentures have a maturity date of September 30, 2018. See “Debt and financing for operations” on page 20 for further details.

“6.5% convertible bonds” refers to the US$150 million in convertible bonds issued in January 2014, which mature on July 29, 2019. Net proceeds were used to redeem Just Energy’s outstanding $90 million convertible debentures and pay down Just Energy’s line of credit. See “Debt and financing for operations” on page 20 for further details.

“6.75% convertible debentures” refers to the $160 million in convertible debentures issued in October 2016, which have a maturity date of December 31, 2021. Net proceeds were used to redeem Just Energy’s outstanding senior unsecured notes on October 5, 2016 and $225 million of its 6.0% convertible debentures on November 7, 2016. See “Debt and financing for operations” on page 20 for further details.

“Preferred shares” refers to the 8.50%, fixed-to-floating rate, cumulative, redeemable, perpetual preferred shares that were initially issued at a price of US$25.00 per preferred share in February 2017. The cumulative feature means that preferred shareholders are entitled to receive dividends at a rate of 8.50% on the initial offer price when, as and if, declared by our Board of Directors.

“Attrition” means customers whose contracts were terminated prior to the end of the term either at the option of the customer or by Just Energy.

“Customer” refers to an individual customer rather than an RCE (see key term below).

“Failed to renew” means customers who did not renew expiring contracts at the end of their term.

“Gross margin per RCE” refers to the energy gross margin realized on Just Energy’s RCE customer base, including gains/losses from the sale of excess commodity supply.

“LDC” means a local distribution company; the natural gas or electricity distributor for a regulatory or governmentally defined geographic area.

“RCE” means residential customer equivalent, which is a unit of measurement equivalent to a customer using, as regards natural gas, 2,815 m3 (or 106 GJs or 1,000 Therms or 1,025 CCFs) of natural gas on an annual basis and, as regards electricity, 10 MWh (or 10,000 kWh) of electricity on an annual basis, which represents the approximate amount of gas and electricity, respectively, used by a typical household in Ontario, Canada.

Non-IFRS financial measures

Just Energy’s consolidated financial statements are prepared in compliance with IFRS. All non-IFRS financial measures do not have standardized meanings prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other issuers.

EBITDA

“EBITDA” refers to earnings before finance costs, taxes, depreciation and amortization. This is a non-IFRS measure that reflects the operational profitability of the business.

Base EBITDA

“Base EBITDA” refers to EBITDA adjusted to exclude the impact of mark to market gains (losses) arising from IFRS requirements for derivative financial instruments as well as reflecting an adjustment for share-based compensation and non-controlling interest. This measure reflects operational profitability as the non-cash share-based compensation expense is treated as an equity issuance for the purpose of this calculation, as it will be settled in shares and the mark to market gains (losses) are associated with supply already sold in the future at fixed prices.

Just Energy ensures that customer margins are protected by entering into fixed-price supply contracts. Under current IFRS, the customer contracts are not marked to market but there is a requirement to mark to market the future supply contracts. This creates unrealized gains (losses) depending upon current supply pricing. Management believes that these short-term mark to market non-cash gains (losses) do not impact the long-term financial performance of Just Energy and management has therefore excluded them from the Base EBITDA calculation.

Funds from operations (“FFO”)

“Funds from Operations” refers to the cash flow generated by operations. Funds from Operations is calculated by Just Energy as gross margin adjusted for cash items including administrative expenses, selling and marketing expenses, bad debt expenses, finance costs, corporate taxes, capital taxes and other cash items. Funds from Operations also includes a seasonal adjustment for the gas markets in Ontario, Quebec, Manitoba and Michigan in order to include cash received from LDCs for gas not yet consumed by end customers.

base Funds from operations (“Base FFO”)

“Base Funds from Operations” refers to the Funds from Operations reduced by capital expenditures purchased to maintain productive capacity. Capital expenditures to maintain productive capacity represent the capital spend relating to capital and intangible assets.

Base Funds from Operations Payout Ratio

The payout ratio for Base Funds from Operations means dividends declared and paid as a percentage of Base Funds from Operations.

Embedded gross margin

“Embedded gross margin” is a rolling five-year measure of management’s estimate of future contracted energy gross margin. The energy marketing embedded gross margin is the difference between existing energy customer contract prices and the cost of supply for the remainder of the term, with appropriate assumptions for RCE attrition and renewals. It is assumed that expiring contracts will be renewed at target margin renewal rates.

Embedded gross margin indicates the margin expected to be realized from existing customers. It is intended only as a directional measure for future gross margin. It is not discounted to present value nor is it intended to take into account administrative and other costs necessary to realize this margin.

Financial highlights

For the three months ended June 30

(thousands of dollars, except where indicated and per share amounts)

| | | | | | % increase | | | | |

| | | Fiscal 2018 | | | (decrease) | | | Fiscal 2017 | |

| Sales | | $ | 847,706 | | | | (6 | )% | | $ | 898,409 | |

| Gross margin | | | 157,563 | | | | (3 | )% | | | 162,672 | |

| Administrative expenses | | | 48,631 | | | | 9 | % | | | 44,701 | |

| Selling and marketing expenses | | | 58,076 | | | | - | | | | 57,790 | |

| Finance costs (net of non-cash finance charges) | | | 9,387 | | | | (34 | )% | | | 14,249 | |

| Profit1 | | | 109,309 | | | | NMF | 3 | | | 482,671 | |

| Profit per share available to shareholders - basic | | | 0.71 | | | | | | | | 3.24 | |

| Profit per share available to shareholders - diluted | | | 0.56 | | | | | | | | 2.51 | |

| Dividends/distributions | | | 21,783 | | | | 16 | % | | | 18,793 | |

| Base EBITDA2 | | | 32,509 | | | | (21 | )% | | | 41,141 | |

| Base Funds from Operations2 | | | 20,508 | | | | (20 | )% | | | 25,669 | |

| Payout ratio on Base Funds from Operations2 | | | 106 | % | | | | | | | 73 | % |

| Embedded gross margin2 | | | 1,673,700 | | | | (14 | )% | | | 1,936,500 | |

| Total RCEs | | | 4,076,000 | | | | (7 | )% | | | 4,386,000 | |

1 Profit includes the impact of unrealized gains (losses), which represents the mark to market of future commodity supply acquired to cover future RCE demand. The supply has been sold to RCEs at fixed prices, minimizing any realizable impact of mark to market gains and losses.

2See “Non-IFRS financial measures” on page 2.

3Not a meaningful figure.

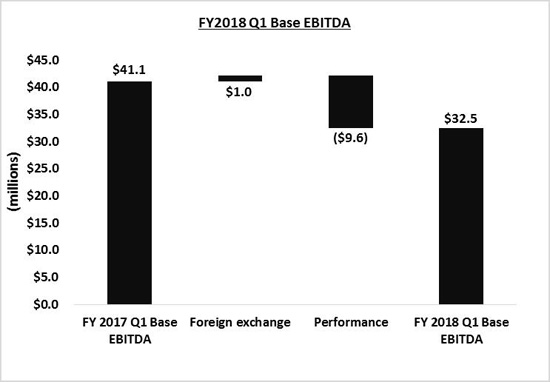

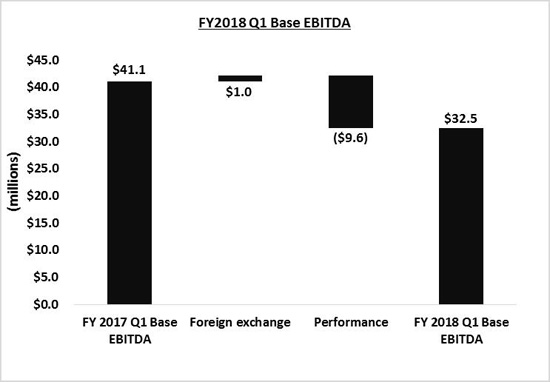

Just Energy’s financial results for the three months June 30, 2017 included gross margin of $157.6 million, 3% lower than the prior comparable quarter, and Base EBITDA of $32.5 million, down 21% compared to the first quarter of fiscal 2017. The impact from foreign exchange primarily due to the strengthening U.S. dollar, resulted in an increase of $3.6 million in gross margin and $1.0 million in Base EBITDA. The Company’s financial highlights for the three months ended June 30, 2017 are shown below.

Operations overview

CONSUMER DIVISION

The sale of gas and electricity to customers with annual consumption equivalent to 15 RCEs and less is undertaken by the Consumer division. Marketing of the energy products of this division is primarily done through online marketing, door-to-door marketing as well as other newly implemented channels such as retail and affinity. Consumer customers make up 44% of Just Energy’s customer base, which is currently focused on longer-term price-protected, flat-bill and variable rate product offerings as well as JustGreen products. To the extent that certain markets are better served by shorter-term or enhanced variable rate products, the Consumer division’s sales channels also offer these products.

Developments in connectivity and convergence and changes in customer preferences have created an opportunity for Just Energy to provide value added products and service bundles connected to energy. As a conservation solution, smart thermostats are offered as a bundled product with commodity contracts, but were also sold previously as a stand-alone unit. The smart thermostats are manufactured and distributed by ecobee Inc. (“ecobee”), a company in which Just Energy holds a 10% fully diluted equity interest. In addition, Just Energy has also expanded its product offering in some markets to include air filters, LED light bulbs and residential water sprinkler controllers.

COMMERCIAL DIVISION

Customers with annual consumption equivalent to over 15 RCEs are served by the Commercial division. These sales are made through three main channels: brokers; door-to-door commercial independent contractors; and inside commercial sales representatives. Commercial customers make up 56% of Just Energy’s customer base. Products offered to Commercial customers can range from standard fixed-price offerings to “one off” offerings, which are tailored to meet the customer’s specific needs. These products can be either fixed or floating rate or a blend of the two, and normally have terms of less than five years. Gross margin per RCE for this division is lower than Consumer margins, but customer aggregation costs and ongoing customer care costs per RCE are lower as well. Commercial customers have significantly lower attrition rates than those of Consumer customers.

ABOUT THE ENERGY MARKETS

NATURAL GAS

Just Energy offers natural gas customers a variety of products ranging from month-to-month variable-price contracts to five-year fixed-price contracts. Gas supply is purchased from market counterparties based on forecasted Consumer and small Commercial RCEs. For larger Commercial customers, gas supply is generally purchased concurrently with the execution of a contract. Variable rate products allow customers to maintain competitive rates while retaining the ability to lock into a fixed price at their discretion. Flat-bill products offer customers the ability to pay a fixed amount per period regardless of usage or changes in the price of the commodity.

The LDCs provide historical customer usage which, when normalized to average weather, enables Just Energy to purchase the expected normal customer load. Furthermore, Just Energy mitigates exposure to weather variations through active management of the gas portfolio, which involves, but is not limited to, the purchase of options including weather derivatives. Just Energy’s ability to successfully mitigate weather effects is limited by the degree to which weather conditions deviate from normal. To the extent that balancing requirements are outside the forecasted purchase, Just Energy bears the financial responsibility for fluctuations in customer usage. To the extent that supply balancing is not fully covered through active management or the options employed, Just Energy’s realized customer gross margin may be reduced or increased depending upon market conditions at the time of balancing.

| Territory | Gas delivery method |

| Ontario, Quebec, Manitoba and Michigan | The volumes delivered for a customer typically remain constant throughout the year. Sales are not recognized until the customer actually consumes the gas. During the winter months, gas is consumed at a rate that is greater than delivery, resulting in accrued gas receivables, and, in the summer months, deliveries to LDCs exceed customer consumption, resulting in accrued gas payables. Just Energy receives cash from the LDCs as the gas is delivered, which is even throughout the year. |

| Alberta, British Columbia, New York, Illinois, Indiana, Ohio, California, Georgia, Maryland, New Jersey, Pennsylvania, Saskatchewan, the United Kingdom and Germany | The volume of gas delivered is based on the estimated consumption and storage requirements for each month. Therefore, the amount of gas delivered in the winter months is higher than in the spring and summer months. Consequently, cash flow received from most of these markets is greatest during the third and fourth (winter) quarters, as cash is normally received from the LDCs in the same period as customer consumption. |

ELECTRICITY

Just Energy services various territories in Canada, the U.S., the U.K. and Germany with electricity. A variety of electricity solutions are offered, including fixed-price, flat-bill and variable-price products on both short-term and longer-term electricity contracts. Some of these products provide customers with price-protection programs for the majority of their electricity requirements. Just Energy uses historical usage data for all enrolled customers to predict future customer consumption and to help with long-term supply procurement decisions. Flat-bill products offer a consistent price regardless of usage.

Just Energy purchases power supply from market counterparties for residential and small Commercial customers based on forecasted customer aggregation. Power supply is generally purchased concurrently with the execution of a contract for larger Commercial customers. Historical customer usage is obtained from LDCs, which, when normalized to average weather, provides Just Energy with an expected normal customer consumption. Furthermore, Just Energy mitigates exposure to weather variations through active management of the power portfolio, which involves, but is not limited to, the purchase of options, including weather derivatives.

The Company’s ability to successfully mitigate weather effects is limited by the degree to which weather conditions deviate from normal. To the extent that balancing power purchases are outside the acceptable forecast, Just Energy bears the financial responsibility for excess or short supply caused by fluctuations in customer usage. Any supply balancing not fully covered through customer pass-throughs, active management or the options employed may impact Just Energy’s gross margin depending upon market conditions at the time of balancing.

JUSTGREEN

Customers also have the ability to choose an appropriate JustGreen program to supplement their natural gas and electricity contracts, providing an effective method to offset their carbon footprint associated with the respective commodity consumption.

JustGreen programs for gas customers involve the purchase of carbon offsets from carbon capture and reduction projects. Via power purchase agreements and renewable energy certificates, JustGreen’s electricity product offers customers the option of having all or a portion of their electricity sourced from renewable green sources such as wind, solar, hydropower or biomass. Additional green products allow customers to offset their carbon footprint without buying energy commodity products and can be offered in all states and provinces without being dependent on energy deregulation.

The Company currently sells JustGreen gas and electricity in eligible markets across North America. Of all Consumer customers who contracted with Just Energy in the past trailing 12 months, 29% took JustGreen for some or all of their energy needs. On average, these customers elected to purchase 80% of their consumption as green supply. For comparison, as reported for the trailing 12 months ended June 30, 2016, 32% of Consumer customers who contracted with Just Energy chose to include JustGreen for an average of 91% of their consumption. As of June 30, 2017, JustGreen now makes up 14% of the Consumer gas portfolio, compared with 12% a year ago. JustGreen makes up 16% of the Consumer electricity portfolio, compared to 20% a year ago.

EBITDA

For the three months ended June 30

(thousands of dollars)

| | | Fiscal 2018 | | | Fiscal 2017 | |

| Reconciliation to interim condensed consolidated statements of income | | | | | | |

| Profit for the period | | $ | 109,309 | | | $ | 482,671 | |

| Add: | | | | | | | | |

| Finance costs | | | 11,990 | | | | 17,973 | |

| Provision for income taxes | | | 6,797 | | | | 25,297 | |

| Amortization | | | 5,234 | | | | 4,497 | |

| EBITDA | | $ | 133,330 | | | $ | 530,438 | |

| Add (subtract): | | | | | | | | |

| Change in fair value of derivative instruments | | | (110,617 | ) | | | (485,337 | ) |

| Share-based compensation | | | 15,247 | | | | 1,477 | |

| Profit attributable to non-controlling interest | | | (5,451 | ) | | | (5,437 | ) |

| Base EBITDA | | $ | 32,509 | | | $ | 41,141 | |

| | | | | | | | | |

| Gross margin per interim condensed consolidated financial statements | | $ | 157,563 | | | $ | 162,672 | |

| Add (subtract): | | | | | | | | |

| Administrative expenses | | | (48,631 | ) | | | (44,701 | ) |

| Selling and marketing expenses | | | (58,076 | ) | | | (57,790 | ) |

| Bad debt expense | | | (15,272 | ) | | | (13,570 | ) |

| Amortization included in cost of sales | | | 777 | | | | 719 | |

| Other incomes (expenses) | | | 1,599 | | | | (752 | ) |

| Profit attributable to non-controlling interest | | | (5,451 | ) | | | (5,437 | ) |

| Base EBITDA | | $ | 32,509 | | | $ | 41,141 | |

For the three months ended June 30, 2017, Base EBITDA amounted to $32.5 million, a decrease of 21% from $41.1 million in the prior comparable quarter.

Sales decreased by 6% for the first quarter ended June 30, 2017. While the Consumer divisions’ sales increased by 5% for the three months ended June 30, 2017, the Commercial divisions’ sales decreased by 17% due to the overall 7% decrease in customer base as well as lower commodity market prices. Gross margin was down 3% with the decrease being a result of the decrease in customer base year over year offset by a positive impact of $3.6 million from foreign exchange.

Administrative expenses increased by 9% from $44.7 million to $48.6 million. The increase over the prior comparable quarter resulted from higher costs required to support customer growth in the U.K., international expansion as well as efforts relating to new strategic initiatives.

Selling and marketing expenses for the three months ended June 30, 2017 were $58.1 million, consistent with the selling and marketing expenses reported in the prior comparable quarter.

Bad debt expense was $15.3 million for the three months ended June 30, 2017, an increase of 13% from $13.6 million recorded for the prior comparable quarter, resulting from higher default rates in the U.K. This represents approximately 2.5% of revenue in the jurisdictions where the Company bears the credit risk, up from the 2.1% of revenue reported for the three months ended June 30, 2016, both of which are within management’s targeted range of 2% to 3%.

For more information on the changes in the results from operations, please refer to “Gross margin” on page 14 and “Administrative expenses”, “Selling and marketing expenses”, “Bad debt expense” and “Finance costs”, which are further clarified on pages 16 through 17.

EMBEDDED GROSS MARGIN

Management's estimate of the future embedded gross margin is as follows:

| (millions of dollars) | | | | | | | | | | | | | | | |

| | | As at | | | As at | | | June 30 vs. | | | As at | | | 2017 vs. | |

| | | June 30 | | | March 31 | | | March 31 | | | June 30 | | | 2016 | |

| | | 2017 | | | 2017 | | | variance | | | 2016 | | | variance | |

| Energy marketing | | $ | 1,673.7 | | | $ | 1,757.0 | | | | (5 | )% | | $ | 1,936.5 | | | | (14 | )% |

Management’s estimate of the future embedded gross margin within its customer contracts amounted to $1,673.7 million as of June 30, 2017, a decrease of 5% compared to the embedded gross margin as of March 31, 2017. This decrease is a result of the 3% decrease in customer base in the quarter and a negative impact of $25.9 million from foreign exchange.

Embedded gross margin indicates the margin expected to be realized over the next five years from existing customers. It is intended only as a directional measure for future gross margin. It is not discounted to present value nor is it intended to take into account administrative and other costs necessary to realize this margin. As our mix of customers continues to reflect a higher proportion of Commercial volume, the embedded gross margin may, depending on currency rates, grow at a slower pace than customer growth; however, the underlying costs necessary to realize this margin will also decline.

Funds from Operations

For the three months ended June 30

(thousands of dollars)

| | | Fiscal 2018 | | | Fiscal 2017 | |

| Cash inflow from operations | | $ | 20,609 | | | $ | 19,047 | |

| Add (subtract): | | | | | | | | |

| Changes in non-cash working capital | | | (556 | ) | | | 11,933 | |

| Profit attributable to non-controlling interest | | | (5,451 | ) | | | (5,437 | ) |

| Tax adjustment | | | 10,486 | | | | 4,460 | |

| Funds from Operations | | $ | 25,088 | | | $ | 30,003 | |

| Less: Maintenance capital expenditures | | | (4,580 | ) | | | (4,334 | ) |

| Base Funds from Operations | | $ | 20,508 | | | $ | 25,669 | |

| Gross margin from interim condensed consolidated financial statements | | $ | 157,563 | | | $ | 162,672 | |

| Add (subtract): | | | | | | | | |

| Adjustment required to reflect net cash receipts from gas sales | | | 2,649 | | | | 5,256 | |

| Administrative expenses | | | (48,631 | ) | | | (44,701 | ) |

| Selling and marketing expenses | | | (58,076 | ) | | | (57,790 | ) |

| Bad debt expense | | | (15,272 | ) | | | (13,570 | ) |

| Current income tax expense | | | (591 | ) | | | (2,055 | ) |

| Amortization included in cost of sales/selling and marketing expenses | | | 777 | | | | 719 | |

| Other incomes (expenses) | | | 1,599 | | | | (752 | ) |

| Financing charges, non-cash | | | 2,603 | | | | 3,724 | |

| Finance costs | | | (11,990 | ) | | | (17,973 | ) |

| Other non-cash adjustments | | | (5,543 | ) | | | (5,527 | ) |

| Funds from Operations | | $ | 25,088 | | | $ | 30,003 | |

| Less: Maintenance capital expenditures | | | (4,580 | ) | | | (4,334 | ) |

| Base Funds from Operations | | $ | 20,508 | | | $ | 25,669 | |

| Base Funds from Operations payout ratio | | | 106 | % | | | 73 | % |

| Dividends/distributions | | | | | | | | |

| Dividends | | $ | 21,385 | | | $ | 18,400 | |

| Distributions for share-based awards | | | 398 | | | | 393 | |

| Total dividends/distributions | | $ | 21,783 | | | $ | 18,793 | |

Base FFO for the three months ended June 30, 2017 was $20.5 million, a decrease of 20% compared with Base FFO of $25.7 million for the prior comparable quarter. The decrease in Base FFO was a result of the 21% decrease in Base EBITDA in the current quarter partially offset by the $4.9 million decrease in cash financing costs in the current quarter as a result of the Company’s finance restructuring efforts over the past year.

Dividends and distributions for the three months ended June 30, 2017 were $21.8 million, an increase of 16% from the prior comparable quarter in fiscal 2017, reflecting the dividend payments of $3.0 million to preferred shareholders, following the issuance of preferred shares in February 2017. The payout ratio on Base Funds from Operations was 106% for the three months ended June 30, 2017, compared to 73% reported in the first quarter of fiscal 2017, primarily resulting from the lower Base FFO described above. The payout ratio for the trailing 12 months ended June 30, 2017 was 65%, compared with 56% for the trailing 12 months ended June 30, 2016. It is anticipated that the payout ratio will increase in the current fiscal year over prior year as a result of the dividends associated with the preferred shares issued in February 2017.

Summary of quarterly results for operations

(thousands of dollars, except per share amounts)

| | | Q1 | | | Q4 | | | Q3 | | | Q2 | |

| | | Fiscal 2018 | | | Fiscal 2017 | | | Fiscal 2017 | | | Fiscal 2017 | |

| Sales | | $ | 847,706 | | | $ | 947,281 | | | $ | 918,536 | | | $ | 992,828 | |

| Gross margin | | | 157,563 | | | | 175,412 | | | | 174,353 | | | | 183,534 | |

| Administrative expenses | | | 48,631 | | | | 32,448 | | | | 44,567 | | | | 46,717 | |

| Selling and marketing expenses | | | 58,076 | | | | 53,727 | | | | 55,337 | | | | 59,454 | |

| Finance costs | | | 11,990 | | | | 16,745 | | | | 25,477 | | | | 17,882 | |

| Profit (loss) for the period | | | 109,309 | | | | (38,220 | ) | | | 188,041 | | | | (161,608 | ) |

| Profit (loss) for the period per share – basic | | | 0.71 | | | | (0.30 | ) | | | 1.22 | | | | (1.13 | ) |

| Profit (loss) for the period per share – diluted | | | 0.56 | | | | (0.30 | ) | | | 0.98 | | | | (1.13 | ) |

| Dividends/distributions paid | | | 21,783 | | | | 20,344 | | | | 18,800 | | | | 18,814 | |

| Base EBITDA | | | 32,509 | | | | 75,018 | | | | 51,489 | | | | 56,851 | |

| Base Funds from Operations | | | 20,508 | | | | 28,588 | | | | 20,940 | | | | 52,561 | |

| Payout ratio on Base Funds from Operations | | | 106 | % | | | 71 | % | | | 90 | % | | | 36 | % |

| | | Q1 | | | Q4 | | | Q3 | | | Q2 | |

| | | Fiscal 2017 | | | Fiscal 2016 | | | Fiscal 2016 | | | Fiscal 2016 | |

| Sales | | $ | 898,409 | | | $ | 1,075,880 | | | $ | 1,009,709 | | | $ | 1,087,256 | |

| Gross margin | | | 162,672 | | | | 204,289 | | | | 179,937 | | | | 167,155 | |

| Administrative expenses | | | 44,701 | | | | 49,504 | | | | 42,934 | | | | 40,294 | |

| Selling and marketing expenses | | | 57,790 | | | | 62,259 | | | | 67,061 | | | | 65,248 | |

| Finance costs | | | 17,973 | | | | 20,312 | | | | 17,731 | | | | 17,641 | |

| Profit (loss) for the period | | | 482,671 | | | | 30,893 | | | | 10,188 | | | | (88,258 | ) |

| Profit (loss) for the period per share – basic | | | 3.24 | | | | 0.16 | | | | 0.04 | | | | (0.62 | ) |

| Profit (loss) for the period per share – diluted | | | 2.51 | | | | 0.14 | | | | 0.04 | | | | (0.62 | ) |

| Dividends/distributions paid | | | 18,793 | | | | 18,730 | | | | 18,662 | | | | 18,701 | |

| Base EBITDA | | | 41,141 | | | | 67,345 | | | | 55,724 | | | | 45,685 | |

| Base Funds from Operations | | | 25,669 | | | | 43,822 | | | | 26,783 | | | | 37,775 | |

| Payout ratio on Base Funds from Operations | | | 73 | % | | | 43 | % | | | 70 | % | | | 50 | % |

Just Energy’s results reflect seasonality, as electricity consumption is slightly greater in the first and second quarters (summer quarters) and gas consumption is significantly greater during the third and fourth quarters (winter quarters). Electricity and gas customers currently represent 78% and 22%, respectively, of the customer base. Since consumption for each commodity is influenced by weather, annual quarter over quarter comparisons are more relevant than sequential quarter comparisons.

Analysis of the first quarter

Sales decreased by 6% to $847.7 million for the three months ended June 30, 2017 from $898.4 million recorded in the first quarter of fiscal 2017, reflecting the 7% decrease in customer base as well as lower commodity market prices.

Gross margin was $157.6 million, a decrease of 3% from the prior comparable quarter. The decrease of $5.1 million is attributable to the decline in the customer base partially offset by the foreign exchange impact of $3.6 million from the strengthening U.S. dollar.

Administrative expenses for the three months ended June 30, 2017 increased by 9% from $44.7 million to $48.6 million as a result of higher costs required to support customer growth in the U.K., international expansion as well as efforts relating to new strategic initiatives.

Selling and marketing expenses for the three months ended June 30, 2017 were $58.1 million, consistent with the selling and marketing expenses reported in the prior comparable quarter.

Total finance costs for the three months ended June 30, 2017 amounted to $12.0 million, a decrease of 33% from $18.0 million reported for the three months ended June 30, 2016. The lower finance costs was a result of the redemption of the 6.0% convertible debentures and the senior unsecured notes, offset by the finance costs from the issuance of the 6.75% convertible debentures.

The change in fair value of derivative instruments and other resulted in a non-cash gain of $110.6 million for the three months ended June 30, 2017, compared to a non-cash gain of $485.3 million in the prior comparative quarter, as market prices relative to Just Energy’s future electricity supply contracts increased by an average of $1.84/MWh, while future gas contracts decreased by an average of $0.05/GJ. The profit for the three months ended June 30, 2017 was $109.3 million, representing a gain per share of $0.71 on a basic and $0.56 on a diluted basis. For the prior comparable quarter, the profit was $482.7 million, representing a gain per share of $3.24 on a basic and $2.51 on a diluted basis. Just Energy ensures that customer margins are protected by entering into fixed-price supply contracts. Under current IFRS, the customer contracts are not marked to market but there is a requirement to mark to market the future supply contracts. This creates unrealized gains (losses) depending upon current supply pricing. Management believes that these short-term mark to market non-cash gains (losses) do not impact the long-term financial performance of Just Energy.

Base EBITDA was $32.5 million for the three months ended June 30, 2017, a decrease of 21% compared to fiscal 2017. The Company’s reported Base EBITDA for the first quarter of fiscal 2018 was impacted by foreign exchange, primarily due to the strengthening U.S. dollar, resulting in an increase of $3.6 million in gross margin and $1.0 million in Base EBITDA.

Base FFO was $20.5 million for the first quarter of fiscal 2018, down 20% compared to $25.7 million in the prior comparable quarter as a result of the lower Base EBITDA in the current quarter, partially offset by the decrease in cash financing costs in the current quarter of $4.9 million as a result of the Company’s debt restructuring efforts over the past year.

Dividends/distributions paid were $21.8 million, an increase of 16% compared to $18.8 million paid in fiscal 2017 as a result of the first quarter of dividends paid to preferred shareholders, which amounted to $3.0 million. The payout ratio for the quarter ended June 30, 2017 was 106%, compared with 73% in the prior comparable quarter. The payout ratio for the trailing 12 months ended June 30, 2017 was 65%, compared with 56% for the trailing 12 months ended June 30, 2016.

Segmented Base EBITDA1

For the three monthss ended June 30

(thousands of dollars)

| | | | | | Fiscal 2018 | |

| | | Consumer | | | Commercial | | | | |

| | | division | | | division | | | Consolidated | |

| Sales | | $ | 486,766 | | | $ | 360,940 | | | $ | 847,706 | |

| Cost of sales | | | (371,259 | ) | | | (318,884 | ) | | | (690,143 | ) |

| Gross margin | | | 115,507 | | | | 42,056 | | | | 157,563 | |

| Add (subtract): | | | | | | | | | | | | |

| Administrative expenses | | | (36,781 | ) | | | (11,850 | ) | | | (48,631 | ) |

| Selling and marketing expenses | | | (36,000 | ) | | | (22,076 | ) | | | (58,076 | ) |

| Bad debt expense | | | (12,349 | ) | | | (2,923 | ) | | | (15,272 | ) |

| Amortization included in cost of sales | | | 777 | | | | - | | | | 777 | |

| Other income (expenses) | | | (155 | ) | | | 1,754 | | | | 1,599 | |

| Profit attributable to non-controlling interest | | | (5,451 | ) | | | - | | | | (5,451 | ) |

| Base EBITDA from operations | | $ | 25,548 | | | $ | 6,961 | | | $ | 32,509 | |

| | | | | | Fiscal 2017 | |

| | | Consumer | | | Commercial | | | | |

| | | division | | | division | | | Consolidated | |

| Sales | | $ | 464,066 | | | $ | 434,343 | | | $ | 898,409 | |

| Cost of sales | | | (339,318 | ) | | | (396,419 | ) | | | (735,737 | ) |

| Gross margin | | | 124,748 | | | | 37,924 | | | | 162,672 | |

| Add (subtract): | | | | | | | | | | | | |

| Administrative expenses | | | (34,149 | ) | | | (10,552 | ) | | | (44,701 | ) |

| Selling and marketing expenses | | | (35,402 | ) | | | (22,388 | ) | | | (57,790 | ) |

| Bad debt expense | | | (11,767 | ) | | | (1,803 | ) | | | (13,570 | ) |

| Amortization included in cost of sales | | | 719 | | | | - | | | | 719 | |

| Other expenses | | | (73 | ) | | | (679 | ) | | | (752 | ) |

| Profit attributable to non-controlling interest | | | (5,437 | ) | | | - | | | | (5,437 | ) |

| Base EBITDA from operations | | $ | 38,639 | | | $ | 2,502 | | | $ | 41,141 | |

1The segment definitions are provided on page 5.

Consumer Energy contributed $25.5 million to Base EBITDA for the three months ended June 30, 2017, a decrease of 34% from $38.6 million in the prior comparative quarter. Consumer gross margin decreased 7%, primarily as a result of decreased margin from lower consumption reflecting the 3% decrease in the customer base. Consumer administrative costs and selling and marketing expenses were up 8% and 2%, respectively, in fiscal 2018. The increase in expenses was primarily related to the international expansion efforts.

Commercial Energy contributed $7.0 million to Base EBITDA for the three months ended June 30, 2017, an increase of 178% from the prior comparable quarter, when the segment contributed $2.5 million. The increase in gross margin was a result of lower commodity costs in the current period.

Customer aggregation

RCE SUMMARY

| | | April 1, | | | | | | | | | Failed to | | | June 30, | | | % increase | | | June 30, | | | % increase | |

| | | 20171 | | | Additions | | | Attrition | | | renew | | | 2017 | | | (decrease) | | | 2016 | | | (decrease) | |

| Consumer Energy | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gas | | | 611,000 | | | | 53,000 | | | | (29,000 | ) | | | (7,000 | ) | | | 628,000 | | | | 3 | % | | | 642,000 | | | | (2 | )% |

| Electricity | | | 1,186,000 | | | | 81,000 | | | | (61,000 | ) | | | (24,000 | ) | | | 1,182,000 | | | | - | | | | 1,225,000 | | | | (4 | )% |

| Total Consumer RCEs | | | 1,797,000 | | | | 134,000 | | | | (90,000 | ) | | | (31,000 | ) | | | 1,810,000 | | | | 1 | % | | | 1,867,000 | | | | (3 | )% |

| Commercial Energy | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gas | | | 270,000 | | | | 27,000 | | | | (9,000 | ) | | | (10,000 | ) | | | 278,000 | | | | 3 | % | | | 247,000 | | | | 13 | % |

| Electricity | | | 2,144,000 | | | | 84,000 | | | | (32,000 | ) | | | (208,000 | ) | | | 1,988,000 | | �� | | (7 | )% | | | 2,272,000 | | | | (13 | )% |

| Total Commercial RCEs | | | 2,414,000 | | | | 111,000 | | | | (41,000 | ) | | | (218,000 | ) | | | 2,266,000 | | | | (6 | )% | | | 2,519,000 | | | | (10 | )% |

| Total RCEs | | | 4,211,000 | | | | 245,000 | | | | (131,000 | ) | | | (249,000 | ) | | | 4,076,000 | | | | (3 | )% | | | 4,386,000 | | | | (7 | )% |

1 The balance as at April 1, 2017 has been adjusted for 9,000 large natural gas Commercial and Industrial RCEs that were not accounted for in the prior year.

Gross RCE additions for the quarter ended June 30, 2017 were 245,000, an increase of 20% compared to 205,000 RCEs added in the first quarter of fiscal 2017. The RCE additions were higher in the current period due to more competitive pricing in the U.K. Consumer market which resulted in a 195% growth in additions in the first quarter of fiscal 2018.

Consumer RCE additions amounted to 134,000 for the three months June 30, 2017, a 28% increase from 105,000 gross RCE additions recorded in the prior comparable quarter, as a result of the increase in RCE additions in the U.K. market. Net RCE additions for the Consumer division were 13,000 for the three months ended June 30, 2017, compared with the net RCE loss of 28,000 reported in the prior comparable period as a result of higher gross additions and lower attrition. As of June 30, 2017, the U.S., Canadian and U.K. segments accounted for 63%, 23% and 14% of the Consumer RCE base, respectively.

Commercial RCE additions were 111,000 for the three months June 30, 2017, an 11% increase from 100,000 gross RCE additions in the prior comparable quarter as a result of increased additions from large natural gas Commercial and Industrial RCEs. Just Energy remains focused on increasing the gross margin per RCE added for Commercial and, as a result, has been more selective in its market strategy. As of June 30, 2017, the U.S., Canadian and U.K. segments accounted for 73%, 20% and 7% of the Commercial RCE base, respectively.

Net additions were a negative 135,000 for the first quarter of fiscal 2018, compared with a negative 134,000 net RCE additions in the first quarter of fiscal 2017. The slight decrease is primarily a result of higher number of RCEs up for renewal in North America, where the Company chose not to pursue lower margin RCE renewals. Just Energy continues to actively focus on improving retained customers’ profitability rather than pursuing low margin growth.

In addition to the RCEs referenced in the above table, the Consumer RCE base also includes 55,000 smart thermostat customers. These smart thermostats are bundled with a commodity contract and are currently offered in Ontario, Alberta and Texas. Customers with bundled products have lower attrition and higher overall profitability. Further expansion of the energy management solutions is a key driver of continued growth for Just Energy with additional product offerings contributing to lower attrition rates.

For the three months ended June 30, 2017, 37% of the total Consumer and Commercial RCE additions were generated from commercial brokers, 48% through online and other non-door-to-door sales channels and 15% from door-to-door sales. In the prior comparable period, 40% of RCE additions were generated from commercial brokers, 33% from online and other sales channels and 27% using door-to-door sales.

The U.K. operations increased their RCE base by 30% to 419,000 RCEs over the past quarter with strong growth in its Consumer RCE base. As of June 30, 2017, the U.S., Canadian and U.K. segments accounted for 69%, 21% and 10% of the RCE base, respectively. At June 30, 2016, the U.S., Canadian and U.K. segments represented 71%, 22% and 7% of the RCE base, respectively.

ATTRITION

| | | Trailing 12 | | | Trailing 12 | |

| | | months ended | | | months ended | |

| | | June 30, 2017 | | | June 30, 2016 | |

| | | | | | | |

| Consumer | | | 21 | % | | | 26 | % |

| Commercial | | | 7 | % | | | 7 | % |

| Total attrition | | | 14 | % | | | 15 | % |

The combined attrition rate for Just Energy was 14% for the trailing 12 months ended June 30, 2017, a decrease of one percentage point from the 15% reported in the prior comparable period. While the Consumer attrition rate decreased five percentage points to 21% from a year ago, the Commercial attrition rate remained consistent at 7%. The decrease in the Consumer attrition rate is a result of Just Energy’s focus on becoming the customers’ “trusted advisor” and providing a variety of energy management solutions to its customer base to drive customer loyalty.

The Company carefully monitors the levels of customer complaints from its Consumer and Commercial divisions. The goal is to resolve all complaints registered within five days of receipt. Our corporate target is to have an outstanding complaint rate of less than 0.05% of customers at any time. As of June 30, 2017, the total outstanding rate was 0.01%.

| RENEWALS | | | | | | |

| | | Trailing 12 | | | Trailing 12 | |

| | | months ended | | | months ended | |

| | | June 30, 2017 | | | June 30, 2016 | |

| | | | | | | |

| Consumer | | | 73 | % | | | 76 | % |

| Commercial | | | 54 | % | | | 54 | % |

| Total renewals | | | 62 | % | | | 62 | % |

The Just Energy renewal process is a multifaceted program that aims to maximize the number of customers who choose to renew their contract prior to the end of their existing contract term. Efforts begin up to 15 months in advance, allowing a customer to renew for an additional period. Overall, the renewal rate was 62% for the trailing 12 months ended June 30, 2017, consistent with the renewal rate reported for June 30, 2016. The Consumer renewal rate decreased by three percentage points, while the Commercial renewal rate remained the same at 54%. The decline in Consumer renewal rate reflected a very competitive market for Consumer renewals with competitors pricing aggressively and Just Energy’s focus on improving retained customers’ profitability rather than pursuing low margin growth.

ENERGY CONTRACT RENEWALS

This table shows the customers up for renewal in the following fiscal periods:

| | | Consumer | | | Commercial | |

| | | Gas | | | Electricity | | | Gas | | | Electricity | |

| Remainder of 2018 | | | 19 | % | | | 28 | % | | | 30 | % | | | 31 | % |

| 2019 | | | 26 | % | | | 33 | % | | | 24 | % | | | 31 | % |

| 2020 | | | 24 | % | | | 19 | % | | | 21 | % | | | 20 | % |

| 2021 | | | 17 | % | | | 12 | % | | | 13 | % | | | 12 | % |

| Beyond 2021 | | | 14 | % | | | 8 | % | | | 12 | % | | | 6 | % |

| Total | | | 100 | % | | | 100 | % | | | 100 | % | | | 100 | % |

Note: All month-to-month customers, which represent 656,000 RCEs, are excluded from the table above.

Gross margin

For the three months ended June 30

(thousands of dollars)

| | | Fiscal 2018 | | | Fiscal 2017 | |

| | | Consumer | | | Commercial | | | Total | | | Consumer | | | Commercial | | | Total | |

| Gas | | $ | 27,655 | | | $ | 2,536 | | | $ | 30,191 | | | $ | 32,464 | | | $ | 4,757 | | | $ | 37,221 | |

| Electricity | | | 87,852 | | | | 39,520 | | | | 127,372 | | | | 92,284 | | | | 33,167 | | | | 125,451 | |

| | | $ | 115,507 | | | $ | 42,056 | | | $ | 157,563 | | | $ | 124,748 | | | $ | 37,924 | | | $ | 162,672 | |

| Increase (decrease) | | | (7 | )% | | | 11 | % | | | (3 | )% | | | | | | | | | | | | |

CONSUMER ENERGY

Gross margin for the three months ended June 30, 2017 for the Consumer division was $115.5 million, a decrease of 7% from $124.7 million recorded in the prior comparable quarter. Gas and electricity gross margins decreased by 15% and 5%, respectively, primarily as a result of the decrease in the North American customer base, partially offset by the increase in the customer base in the U.K. and by the foreign exchange impact.

Average realized gross margin for the Consumer division for the rolling 12 months ended June 30, 2017 was $252/RCE, consistent with the prior comparable period. The gross margin/RCE value includes an appropriate allowance for bad debt expense in applicable markets.

Gas

Gross margin from gas customers in the Consumer division was $27.7 million for the three months ended June 30, 2017, a decrease of 15% from $32.5 million recorded in the prior comparable quarter. The change is primarily a result of the decrease in customer base in North America.

Electricity

Gross margin from electricity customers in the Consumer division was $87.9 million for the three months ended June 30, 2017, a decrease of 5% from $92.3 million recorded in the prior comparable quarter. The change is primarily a result of the 4% decrease in customer base in North America.

COMMERCIAL ENERGY

Gross margin for the Commercial division was $42.1 million for the three months ended June 30, 2017, an increase of 11% from $37.9 million recorded in the prior comparable quarter. Gas and electricity gross margins decreased by 47% and increased by 19%, respectively. The overall growth in margin was due to operational improvements in place to increase the margin for new customers added.

Average realized gross margin for the rolling 12 months ended June 30, 2017 was $93/RCE, an increase of 22% from $76/RCE. The increase is largely due to higher margins on new customers added as well as the foreign exchange impact from the stronger U.S. dollar. The GM/RCE value includes an appropriate allowance for bad debt expense in various bad debt markets across North America.

Gas

Gas gross margin for the Commercial division was $2.5 million, a decrease of 47% from $4.8 million recorded in the prior comparable quarter due to competitive pricing pressures in certain U.S. gas markets.

Electricity

Electricity gross margin for the Commercial division was $39.5 million, an increase of 19% from $33.2 million recorded in the prior comparable quarter. The increase in gross margin is a result of increased profitability on new customers and lower commodity costs.

GROSS MARGIN ON NEW AND RENEWING CUSTOMERS

The table below depicts the annual margins on contracts for Consumer and Commercial customers signed during the quarter. This table reflects the gross margin (sales price less costs of associated supply and allowance for bad debt) earned on new additions and renewals, including both brown commodities and JustGreen supply.

| Annual gross margin per RCE | | | | | | | | | |

| | | Q1 Fiscal | | | Number of | | | Q1 Fiscal | | | Number of | |

| | | 2018 | | | customers | | | 2017 | | | customers | |

| | | | | | | | | | | | | |

| Consumer customers added and renewed | | $ | 194 | | | | 285,000 | | | $ | 207 | | | | 216,000 | |

| Consumer customers lost | | | 195 | | | | 121,000 | | | | 195 | | | | 133,000 | |

| Commercial customers added and renewed | | | 75 | | | | 253,000 | | | | 80 | | | | 260,000 | |

| Commercial customers lost | | | 81 | | | | 259,000 | | | | 76 | | | | 206,000 | |

For the three months ended June 30, 2017, the average gross margin per RCE for the customers added and renewed by the Consumer division was $194/RCE, a decrease from $207/RCE added in the prior comparable period. The decrease in average gross margin per RCE for Consumer customers added and renewed in the quarter is a result of a higher proportion of customer additions in the U.K. signed under 12-month contracts from the switching sites at lower gross margin targets. This was primarily the result of the “Big Six” energy retailers in the U.K. increasing their prices which made the Company’s 12-month product much more attractive. While these 12-month contracts carry lower gross margins than the Company’s longer-term products, the majority of these customers also selected electronic billing and electronic payment which lowers the Company’s costs to serve and improves its cash flow. The average gross margin per RCE for the Consumer customers lost during the three months ended June 30, 2017 was $195/RCE, consistent with the margin lost on customers in the prior comparable period.

For the Commercial division, the average gross margin per RCE for the customers signed during the three months ended June 30, 2017 was $75/RCE, a decrease from $80/RCE added in the prior comparable period. Customers lost through attrition and failure to renew during the three months ended June 30, 2017 were at an average gross margin of $81/RCE, an increase from $76/RCE reported in the prior comparable period due to the customers being added at higher margins in recent periods. Management will continue its margin optimization efforts by focusing on ensuring customers added meet its profitability targets.

| Overall consolidated results | | | | | | | | | |

| | | | | | | | | | |

| ADMINISTRATIVE EXPENSES | | | | | | | | | |

| For the three months ended June 30 | | | | | | | | | |

| (thousands of dollars) | | | | | | | | | |

| | | Fiscal 2018 | | | Fiscal 2017 | | | % increase | |

| Consumer Energy | | $ | 36,781 | | | $ | 34,149 | | | | 8 | % |

| Commercial Energy | | | 11,850 | | | | 10,552 | | | | 12 | % |

| Total administrative expenses | | $ | 48,631 | | | $ | 44,701 | | | | 9 | % |

Administrative expenses increased by 9% from $44.7 million to $48.6 million. The Consumer division’s administrative expenses were $36.8 million for the three months ended June 30, 2017, an increase of 8% from $34.1 million recorded in fiscal 2017. The Commercial division’s administrative expenses were $11.9 million for fiscal 2018, a 12% increase from $10.6 million in fiscal 2017. The overall increase over the prior comparable quarter was primarily driven by higher costs required to support customer growth in the U.K., international expansion as well as efforts relating to new strategic initiatives.

| SELLING AND MARKETING EXPENSES | | | |

| For the three months ended June 30 | | | | | | | | | |

| (thousands of dollars) | | | | | | | | | |

| | | | | | | | | % increase | |

| | | Fiscal 2018 | | | Fiscal 2017 | | | (decrease) | |

| Consumer Energy | | $36,000 | | | $35,402 | | | 2% | |

| Commercial Energy | | | 22,076 | | | | 22,388 | | | | (1 | )% |

| Total selling and marketing expenses | | $ | 58,076 | | | $ | 57,790 | | | | - | |

Selling and marketing expenses, which consist of commissions paid to independent sales contractors, brokers and sales agents, as well as sales-related corporate costs, were $58.1 million, consistent with the selling and marketing expenses reported in fiscal 2017.

The selling and marketing expenses for the Consumer division were $36.0 million for the three months ended June 30, 2017, a 2% increase from $35.4 million recorded in the prior comparable period as a result of the investment into the new retail sales channels. Gross margin additions increased by 20% in the current quarter with the majority of the commission expense being recognized over the term of the contract.

The selling and marketing expenses for the Commercial division were $22.1 million for the three months June 30, 2017, down 1% from $22.4 million recorded in the prior year due to lower residual commission expense.

The aggregation costs per customer for the last 12 months for Consumer customers signed by independent representatives and Commercial customers signed by brokers were as follows:

| | | Fiscal 2018 | | | Fiscal 2017 | |

| Consumer | | $ | 206 | /RCE | | $ | 207 | /RCE |

| Commercial | | $ | 42 | /RCE | | $ | 39 | /RCE |

The average aggregation cost for the Consumer division was $206/RCE for the trailing 12 months ended June 30, 2017, in line with the $207/RCE reported a year prior.

The $42 average aggregation cost for Commercial division customers is based on the expected average annual cost for the respective customer contracts. It should be noted that commercial broker contracts are paid further commissions averaging $42 per year for each additional year that the customer flows. Assuming an average life of 2.8 years, this would add approximately $76 (1.8 x $42) to the year’s average aggregation cost reported above. As at June 30, 2016, the average aggregation cost for commercial brokers was $39/RCE. The lower cost in the prior comparable period is a function of broker commissions being a percentage of lower margins.

BAD DEBT EXPENSE

In Illinois, Alberta, Texas, Delaware, Ohio, California, Michigan, Georgia and the U.K., Just Energy assumes the credit risk associated with the collection of customer accounts. In addition, for commercial direct-billed accounts in British Columbia, Just Energy is responsible for the bad debt risk. Credit review processes have been established to manage the customer default rate. Management factors default from credit risk into its margin expectations for all of the above-noted markets. During the three months ended June 30, 2017, Just Energy was exposed to the risk of bad debt on approximately 74% of its sales, compared with 73% during the quarter ended June 30, 2016.

Bad debt expense is included in the consolidated income statement under other operating expenses. Bad debt expense for the quarter ended June 30, 2017 was $15.3 million, an increase of 13% from $13.6 million expensed for the quarter ended June 30, 2016. Management integrates its default rate for bad debt within its margin targets and continuously reviews and monitors the credit approval process to mitigate customer delinquency. For the three months June 30, 2017, the bad debt expense represents 2.5% of relevant revenue, up from 2.1% reported in fiscal 2017.

Management expects that bad debt expense will remain in the range of 2% to 3% of relevant revenue where the Company bears credit risk. For each of Just Energy’s other markets, the LDCs provide collection services and assume the risk of any bad debt owing from Just Energy’s customers for a regulated fee.

FINANCE COSTS

Total finance costs for the three months ended June 30, 2017 amounted to $12.0 million, a decrease of 33% from $18.0 million recorded in the first quarter of fiscal 2017. The decrease in finance costs was a result of the redemption of the 6.0% convertible debentures and the senior unsecured notes, offset by the finance costs from the issuance of the 6.75% convertible debentures.

FOREIGN EXCHANGE

Just Energy has an exposure to U.S. dollar, U.K. pound and European euro exchange rates as a result of its international operations. Any changes in the applicable exchange rate may result in a decrease or increase in other comprehensive income. For the three months ended June 30, 2017, a foreign exchange unrealized loss of $4.8 million was reported in other comprehensive income, versus an unrealized gain of $1.4 million reported in the first quarter of fiscal 2017. In addition to changes in the U.S. foreign exchange rate, this fluctuation is a result of the significant decrease in the mark to market liability position of the Company’s derivative financial instruments.

Overall, the positive impact from the translation of the U.S.-based operations resulted in a favourable $1.0 million on Base EBITDA for the three months ended June 30, 2017.

Just Energy retains sufficient funds in its foreign subsidiaries to support ongoing growth, and surplus cash is deployed in Canada, and hedges for cross border cash flow are placed. Just Energy hedges between 50% and 90% of the next 12 months of cross border cash flows depending on the level of certainty of the cash flow.

| PROVISION FOR INCOME TAX |

| For the three months ended June 30 | | | | | | |

| (thousands of dollars) | | | | | | |

| | | Fiscal 2018 | | | Fiscal 2017 | |

| Current income tax expense | | $ | 591 | | | $ | 2,055 | |

| Deferred tax provision | | | 6,206 | | | | 23,242 | |

| Provision for income tax | | $ | 6,797 | | | $ | 25,297 | |

Just Energy recorded a current income tax expense of $0.6 million for the three months ended June 30, 2017, versus $2.1 million in the prior comparable period. The decrease is mainly due to the decreased income. During the three months ended June 30, 2017, a deferred tax expense of $6.2 million was recorded as compared to a deferred tax recovery of $23.2 million in the prior comparable quarter. The change is primarily driven by changes in fair value of derivative instruments.

| Liquidity and capital resources | | | | | | |

| SUMMARY OF CASH FLOWS | | | | | | |

| For the three months ended June 30 | | | | | | |

| (thousands of dollars) | | | | | | |

| | | Fiscal 2018 | | | Fiscal 2017 | |

| Operating activities | | $ | 20,609 | | | $ | 19,047 | |

| Investing activities | | | (10,413 | ) | | | (4,351 | ) |

| Financing activities, excluding dividends | | | 10,602 | | | | (31,403 | ) |

| Effect of foreign currency translation | | | (1,283 | ) | | | (4,738 | ) |

| Increase in cash before dividends | | | 19,515 | | | | (21,445 | ) |

| Dividends (cash payments) | | | (21,771 | ) | | | (18,784 | ) |

| Decrease in cash | | | (2,256 | ) | | | (40,229 | ) |

| Cash and cash equivalents – beginning of period | | | 57,376 | | | | 127,596 | |

| Cash and cash equivalents – end of period | | $ | 55,120 | | | $ | 87,367 | |

OPERATING ACTIVITIES

Cash flow from operating activities for the three months June 30, 2017 was an inflow of $20.6 million, compared to $19.0 million in the prior comparable quarter. Cash flow from operations was higher in the current period as a result of the impact of the stronger dollar on U.S. operations.

INVESTING ACTIVITIES

Investing activities for the first quarter of fiscal 2018 included purchases of capital and intangible assets totalling $1.2 million and $6.8 million, respectively, compared with $1.7 million and $3.1 million, respectively, in fiscal 2017. Just Energy’s capital spending related primarily to information technology-related purchases for process improvement initiatives. The three months ended June 30, 2017 also includes $2.5 million that is primarily related to the acquisition of a service provider for supply, design and installation of energy saving technologies.

FINANCING ACTIVITIES

Financing activities, excluding dividends, relates primarily to the issuance and repayment of long-term financing. In the first quarter of fiscal 2018, Just Energy issued an additional $4.4 million in preferred shares and withdrew an additional $24.7 million on the credit facility. This was offset by common shares repurchases of $11.4 million in the quarter.

Just Energy’s liquidity requirements are driven by the delay from the time that a customer contract is signed until cash flow is generated. The elapsed period between the time a customer is signed and receipt of the first payment from the customer varies with each market. The time delays per market are approximately two to nine months. These periods reflect the time required by the various LDCs to enroll, flow the commodity, bill the customer and remit the first payment to Just Energy. In Alberta, Georgia and Texas and for commercial direct-billed customers, Just Energy receives payment directly.

DIVIDENDS AND DISTRIBUTIONS

During the three months ended June 30, 2017, Just Energy paid cash dividends to its shareholders and distributions to holders of share-based awards in the amount of $21.8 million, compared to $18.8 million paid in the prior comparable quarter. The increase is a result of the issuance of preferred shares in February 2017 and the dividend payments to preferred shareholders as at June 30, 2017.

Just Energy’s annual dividend rate is currently $0.50 per common share paid quarterly. The dividend policy states that common shareholders of record on the 15th day of March, June, September and December, or the first business day thereafter, receive dividends at the end of that month, subject to Board approval.

Preferred shareholders are entitled to receive dividends at a rate of 8.50% on the initial offer price of US$25.00 per preferred share when, as and if declared by our Board of Directors, out of funds legally available for the payments of dividends, on the applicable dividend payment date. As the preferred shares are cumulative, dividends on preferred shares will accrue even if they are not paid. Common shareholders will not receive dividends until the preferred share dividends in arrears are paid. Dividend payment dates are quarterly on the last day of each of March, June, September and December. The dividend payment on June 30, 2017, was US$0.53125 per preferred share.

Balance sheet as at June 30, 2017, compared to March 31, 2017

Total cash and short-term investments decreased from $83.6 million as at March 31, 2017 to $81.0 million as at June 30, 2017. The decrease in cash is primarily attributable to the lower gross margin earned in the current period.

As of June 30, 2017, trade receivables and unbilled revenue amounted to $345.0 million and $228.2 million, respectively, compared to March 31, 2017, when the trade receivables and unbilled revenue amounted to $353.1 million and $218.4 million, respectively. The accounts receivable balance decreased as a result of the 7% decrease in customer base. Trade payables, which include gas and electricity commodity payables of $227.8 million, increased from $486.6 million to $503.7 million during the quarter as a result of the extension of payment terms negotiated in fiscal 2017 for some of the commodity supliers.

In Michigan, more gas has been delivered to LDCs than consumed by customers, resulting in gas delivered in excess of consumption and a deferred revenue position of $5.6 million and $7.2 million, respectively, as of June 30, 2017. These amounts increased from $3.2 million and $5.1 million, respectively, as of March 31, 2017. The remaining deferred revenue balance relates to the international operations which increased 113% from $12.5 million to $26.6 million as at June 30, 2017. As at June 30, 2017, more gas was consumed by customers than Just Energy had delivered to the LDCs in Ontario and Manitoba, and as a result, Just Energy recognized an accrued gas receivable and accrued gas payable of $7.9 million and $6.9 million, respectively, down from $16.4 million and $12.5 million, respectively, that was recorded in fiscal 2017. These changes represent the normal seasonality of gas storage.

Total prepaid expenses and deposits increased from $111.3 million at March 31, 2017 to $116.0 million as of June 30, 2017. The increase is a result of the 20% increase in RCE additions in the quarter, for which the commission will be expensed over the contract term.

Fair value of derivative financial assets and fair value of financial liabilities relate entirely to the financial derivatives. The mark to market gains and losses can result in significant changes in profit and, accordingly, shareholders’ equity from year to year due to commodity price volatility. Given that Just Energy has purchased this supply to cover future customer usage at fixed prices, management believes that these non-cash changes are not meaningful and will not be experienced as future costs or cash outflows.

Long-term debt increased from $498.1 million as at March 31, 2017 to $520.6 million as at June 30, 2017. This increase is a result of the withdrawal of an additional $24.7 million on the credit facility to fund seasonal working capital requirements. The book value of net debt to the trailing 12-month Base EBITDA was 2.0x, slightly higher than the 1.8x reported for March 31, 2017, however, significantly improved from the 2.6x reported for June 30, 2016.

| Debt and financing for operations |

| (thousands of dollars) | | | | | | | | | | | | |

| | | Maturity | | | June 30, 2017 | | | March 31, 2017 | | | June 30, 2016 | |

| | | | | | | | | | | | | |

| Just Energy credit facility | | | September 1, 2018 | | | $ | 92,908 | | | $ | 68,258 | | | $ | - | |

| 6.75% convertible debentures | | | December 21, 2021 | | | | 146,193 | | | | 145,579 | | | | - | |

| 5.75% convertible debentures | | | September 30, 2018 | | | | 96,657 | | | | 96,022 | | | | 93,804 | |

| 6.5% convertible bonds | | | July 29, 2019 | | | | 186,657 | | | | 190,486 | | | | 182,336 | |

| 6.0% convertible debentures | | | N/A | | | | - | | | | - | | | | 312,137 | |

| Senior unsecured note | | | N/A | | | | - | | | | - | | | | 55,000 | |

The various debt instruments are described as follows:

• A $342.5 million credit facility expiring on September 1, 2018, supported by guarantees and secured by, among other things, a general security agreement and an asset pledge excluding, primarily, the U.K. Japan, and Germany operations. Credit facility withdrawals amounted to $92.9 million as of June 30, 2017, compared with $68.3 million as of March 31, 2017. In addition, total letters of credit outstanding as at June 30, 2017 amounted to $105.0 million (March 31, 2017 - $109.2 million).

• A 6.75% senior unsecured subordinated debenture with a maturity date of December 31, 2021 was issued during the third quarter of fiscal 2017 for which interest is payable semi-annually in arrears on June 30 and December 31, at a rate of 6.75% per annum.

• A 5.75% convertible extendible unsecured subordinated debenture maturing on September 30, 2018 with interest payable semi-annually on March 31 and September 30, at a rate of 5.75% per annum.

• A 6.5% European-focused senior unsecured convertible bond with a maturity date of July 29, 2019 and interest payable semi-annually in arrears on January 29 and July 29, at a rate of 6.5% per annum.

Just Energy is required to meet a number of financial covenants under the various debt agreements. As at June 30, 2017, all of the covenants have been met. See Note 10 of the unaudited interim condensed consolidated financial statements for the three months June 30, 2017 for further details regarding the nature of each debt agreement.

Acquisition of Businesses

ACQUISITION OF INTELL ENERCARE SOLUTIONS INC.

On June 6, 2017, Just Energy completed the acquisition of 100% of the issued and outstanding shares of Intell Enercare Solutions Inc., a complete service provider for supply, design and installation of energy saving technologies, for up to $11.0 million, subject to closing adjustments. Terms of the deal include an initial payment of $2.2 million with the preliminary working capital adjustments still subject to finalization. Also, Just Energy will pay up to $9.0 million to the sellers over three years provided that certain EBITDA targets are satisfied.

The fair value of the contingent consideration at acquisition was estimated to be $7.8 million.

For an allocated breakdown of the purchase price to identified assets and liabilities acquired in the acquisition, see Note 9 of the unaudited interim condensed consolidated financial statements for the three months June 30, 2017.

ACQUISITION OF DB SWDIREKT GMBH AND DB SWPRO GMBH

On December 8, 2016, Just Energy completed the acquisition of 95% of the issued and outstanding shares of db swdirekt GmbH (“SWDirekt”), a retail energy company, and 50% of the issued and outstanding shares of db swpro GmbH (“SWPro”), a sales and marketing company, for $6.2 million, subject to closing adjustments. Terms of the deal include a $2.2 million payment upon the achievement of sales targets. In addition, variable compensation is payable to the selling shareholders which will be recorded as remuneration expense in the future subject to the financial performance of the acquired businesses. At this time, it is not practicable to estimate the amount of variable compensation payable in the future.

The acquisition of SWDirekt and SWPro was accounted for using the purchase method of accounting. The purchase price allocation is still considered preliminary, and as a result may be adjusted.

Contractual obligations

In the normal course of business, Just Energy is obligated to make future payments for contracts and other commitments that are known and non-cancellable.

| PAYMENTS DUE BY PERIOD | | | | | | | | | | | | | | | |

| (thousands of dollars) | | | | | | | | | | | | | | | |

| | | Less than 1 year | | | 1 – 3 years | | | 4 – 5 years | | | After 5 years | | | Total | |

| Trade and other payables | | $ | 503,652 | | | $ | - | | | $ | - | | | $ | - | | | $ | 503,652 | |

| Long-term debt | | | - | | | | 387,563 | | | | 160,000 | | | | - | | | | 547,563 | |

| Interest payments | | | 29,203 | | | | 43,454 | | | | 16,200 | | | | - | | | | 88,856 | |

| Premises and equipment leasing | | | 5,297 | | | | 9,982 | | | | 8,626 | | | | 11,145 | | | | 35,050 | |

| Gas, electricity and non-commodity contracts | | | 1,641,130 | | | | 1,354,431 | | | | 237,978 | | | | 40,543 | | | | 3,274,082 | |

| | | | | | | | | | | | | | | | | | | | | |

| | | $ | 2,179,282 | | | $ | 1,795,430 | | | $ | 422,804 | | | $ | 51,688 | | | $ | 4,449,204 | |

OTHER OBLIGATIONS

In the opinion of management, Just Energy has no material pending actions, claims or proceedings that have not been included either in its accrued liabilities or in the consolidated financial statements. In the normal course of business, Just Energy could be subject to certain contingent obligations that become payable only if certain events were to occur. The inherent uncertainty surrounding the timing and financial impact of any events prevents any meaningful measurement, which is necessary to assess any material impact on future liquidity. Such obligations include potential judgments, settlements, fines and other penalties resulting from actions, claims or proceedings.

Transactions with related parties

Just Energy does not have any material transactions with any individuals or companies that are not considered independent of Just Energy or any of its subsidiaries and/or affiliates.

Off balance sheet items

The Company has issued letters of credit in accordance with its credit facility totalling $105.0 million to various counterparties, primarily utilities in the markets where it operates, as well as suppliers.

Just Energy has issued surety bonds to various counterparties including states, regulatory bodies, utilities and various other surety bond holders in return for a fee and/or meeting certain collateral posting requirements. Such surety bond postings are required in order to operate in certain states or markets. Total surety bonds issued as at June 30, 2017 were $49.4 million (March 31, 2017 - $55.9 million).

Critical accounting estimates

The consolidated financial statements of Just Energy have been prepared in accordance with IFRS. Certain accounting policies require management to make estimates and judgments that affect the reported amounts of assets, liabilities, revenues, cost of sales, selling and marketing, and administrative expenses. Estimates are based on historical experience, current information and various other assumptions that are believed to be reasonable under the circumstances. The emergence of new information and changed circumstances may result in actual results or changes to estimated amounts that differ materially from current estimates.

The following assessment of critical accounting estimates is not meant to be exhaustive. Just Energy might realize different results from the application of new accounting standards promulgated, from time to time, by various rule-making bodies.

RECEIVABLES AND ALLOWANCE FOR DOUBTFUL ACCOUNTS

The allowance for uncollectible accounts reflects Just Energy’s best estimates of losses on the accounts receivable balances. Just Energy determines the allowance for doubtful accounts on customer receivables by applying loss rates based on historical results to the outstanding receivable balance. Just Energy is exposed to customer credit risk on its continuing operations in Alberta, Texas, Illinois, Ohio, Delaware, California, Michigan, Georgia, the U.K. and commercial direct-billed accounts in British Columbia. Credit review processes have been implemented to perform credit evaluations of customers and manage customer default. If a significant number of customers were to default on their payments, it could have a material adverse effect on the operations and cash flows of Just Energy. Management factors default from credit risk in its margin expectations for all the above markets.

Revenues related to the sale of energy are recorded when energy is delivered to customers. The determination of energy sales to individual customers is based on systematic readings of customer meters generally on a monthly basis. At the end of each month, amounts of energy delivered to customers since the date of the last meter reading are estimated, and corresponding unbilled revenue is recorded. The measurement of unbilled revenue is affected by the following factors: daily customer usage, losses of energy during delivery to customers and applicable customer rates.

Increases in volumes delivered to the utilities’ customers and favourable rate mix due to changes in usage patterns in the period could be significant to the calculation of unbilled revenue. Changes in the timing of meter reading schedules and the number and type of customers scheduled for each meter reading date would also have an effect on the measurement of unbilled revenue; however, total operating revenues would remain materially unchanged.

DEFERRED TAXES

In accordance with IFRS, Just Energy uses the liability method of accounting for income taxes. Under the liability method, deferred income tax assets and liabilities are recognized on the differences between the carrying amounts of assets and liabilities and their respective income tax basis.

The tax effects of these differences are reflected in the consolidated statements of financial position as deferred income tax assets and liabilities. An assessment must be made to determine the likelihood that our future taxable income will be sufficient to permit the recovery of deferred income tax assets. To the extent that such recovery is not probable, deferred income tax assets must be reduced. The reduction of the deferred income tax asset can be reversed if the estimated future taxable income improves. No assurances can be given as to whether any reversal will occur or as to the amount or timing of any such reversal. Management must exercise judgment in its assessment of continually changing tax interpretations, regulations and legislation to ensure deferred income tax assets and liabilities are complete and fairly presented. Assessments and applications differing from our estimates could materially impact the amount recognized for deferred income tax assets and liabilities.