Highlights of continuing operations for the three and nine months ended December 31, 2014 included:

| | · | Gross customer additions of 354,000 for the third quarter up 6% compared to 333,000 in the second quarter of fiscal 2014. Year to date, gross customer additions are 1,149,000, up 13% year over year. |

| | · | Net customer additions of 58,000 in the quarter an increase of 53% versus net additions of 38,000 in the third quarter of fiscal 2014. Year to date net additions of 252,000 are up 83% from those realized in fiscal 2014. Customer base up 7% year over year to 4.7 million. |

| | · | Gross margin of $150.1 million, up 1%. Nine months gross margin of $406.0 million, up 10%. |

| | · | Base EBITDA from continuing operations of $50.6 million, down 19%. Base Funds from continuing operations of $21.2 million, down 43%. Year to date Base EBITDA is $112.5 million, up 1%. Year to date Base FFO of $60.5 million, down 15%. |

| | · | Management reaffirms fiscal 2015 Base EBITDA guidance at the high end of the previous $163 million to $173 million range. |

| | · | Close of the NHS sale results in further debt reduction to $659.4 million down 34% from $1.0 billion a year ago. |

Message from the Co-Chief Executive Officers

Fellow Shareholders,

Your management team has committed to reducing Just Energy’s debt and to providing a stable base for the Company’s profitable growth going forward. The third quarter continued to deliver on that commitment. Although fiscal 2015 Q3 showed a decline in EBITDA compared to fiscal 2014, this was due to non-recurring expense items and measurement against an abnormally high Q3 last year. Overall, the quarter was in line with management expectations and we are confident about the underlying performance of the business.

Year to date, our Base EBITDA is up 1% versus fiscal 2014 despite a 10% increase in gross margin largely due to $8.5 million in unanticipated legal costs and provisions for the Hurt/Hill lawsuit and our settlement with the Massachusetts Attorney General’s Office. Customer additions were strong with net additions already exceeding those reported for all of fiscal 2014. Just Energy is poised to return to double-digit Base EBITDA percentage growth in fiscal 2016.

As has been the case throughout the fiscal year, Just Energy had growth in both gross and net customer additions. All of our marketing channels were effective with the Consumer division adding 187,000 new customers with net additions of 44,000. The Commercial division added 167,000 gross and 14,000 net additions. Overall, our customer base neared 4.7 million, up 7% year over year. Very importantly, these customers have been signed to contracts with higher annual margins than those of customers lost.

Financial highlights

For the three months ended December 31(thousands of dollars, except where indicated and per share amounts)

| | | Fiscal 2015 | | | | | | Fiscal 2014 | |

| | | | | | % increase | | | | |

| | | | | | (decrease) | | | | |

| Sales | | $ | 946,752 | | | | 13 | % | | $ | 840,098 | |

| Gross margin | | | 150,098 | | | | 1 | % | | | 148,616 | |

| Administrative expenses | | | 40,912 | | | | 41 | % | | | 29,034 | |

| Selling and marketing expenses | | | 52,968 | | | | 17 | % | | | 45,373 | |

| Finance costs | | | 19,525 | | | | 16 | % | | | 16,805 | |

Profit (loss) from continuing operations1 | | | (371,403 | ) | | NMF 2 | | | | 167,077 | |

| Profit from discontinued operations | | | 165,210 | | | NMF 2 | | | | 12,531 | |

Profit (loss) 1 | | | (206,193 | ) | | NMF 2 | | | | 179,608 | |

| Profit (loss) per share from continuing operations available to shareholders – basic | | | (2.56 | ) | | | | | | | 1.15 | |

| Profit (loss) per share from continuing operations available to shareholders – diluted | | | (2.56 | ) | | | | | | | 0.99 | |

| Dividends/distributions | | | 18,572 | | | | (40 | )% | | | 30,891 | |

Base EBITDA from continuing operations2 | | | 50,592 | | | | (19 | )% | | | 62,130 | |

Base Funds from continuing operations2 | | | 21,179 | | | | (43 | )% | | | 37,379 | |

| Payout ratio on Base Funds from continuing operations | | | 88 | % | | | | | | | 83 | % |

For the nine months ended December 31

(thousands of dollars, except where indicated and per share amounts)

| | | Fiscal 2015 | | | | | | Fiscal 2014 | |

| | | | | | % increase | | | | |

| | | | | | (decrease) | | | | |

| Sales | | $ | 2,686,061 | | | | 12 | % | | $ | 2,401,864 | |

| Gross margin | | | 406,003 | | | | 10 | % | | | 368,065 | |

| Administrative expenses | | | 112,174 | | | | 27 | % | | | 88,196 | |

| Selling and marketing expenses | | | 161,263 | | | | 13 | % | | | 143,020 | |

| Finance costs | | | 56,996 | | | | 13 | % | | | 50,250 | |

Profit (loss) from continuing operations 1 | | | (511,401 | ) | | NMF 2 | | | | 15,698 | |

| Profit from discontinued operations | | | 131,138 | | | NMF 2 | | | | 11,866 | |

Profit (loss)1 | | | (380,263 | ) | | NMF 2 | | | | 27,564 | |

| Profit (loss) per share from continuing operations available to shareholders – basic | | | (3.56 | ) | | | | | | | 0.09 | |

| Profit (loss) per share from continuing operations available to shareholders –diluted | | | (3.56 | ) | | | | | | | 0.09 | |

| Dividends/distributions | | | 68,127 | | | | (26 | )% | | | 92,497 | |

Base EBITDA from continuing operations2 | | | 112,512 | | | | 1 | % | | | 111,111 | |

Base Funds from continuing operations2 | | | 60,525 | | | | (15 | )% | | | 71,252 | |

| Payout ratio on Base Funds from continuing operations | | | 113 | % | | | | | | | 130 | % |

Embedded gross margin2 | | | 1,798,800 | | | | 8 | % | | | 1,665,500 | |

| Total customers (RCEs) | | | 4,662,000 | | | | 7 | % | | | 4,360,000 | |

1Profit (loss) includes the impact of unrealized gains (losses), which represents the mark to market of future commodity supply acquired to cover future customer demand. The supply has been sold to customers at fixed prices, minimizing any realizable impact of mark to market gains and losses.

2Not a meaningful figure.

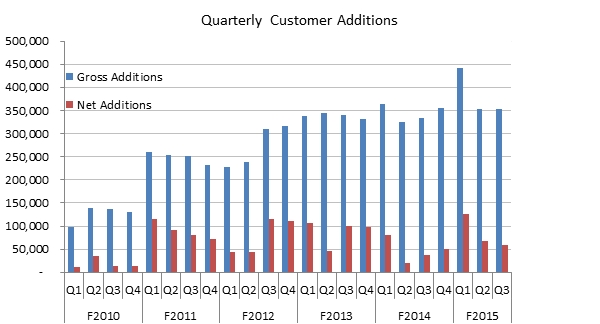

Adding Customers

Customer additions in the third quarter were 354,000, an increase of 6% compared to the third quarter of fiscal 2014. Net additions were 58,000 for the quarter, an increase of 53% from 38,000 a year earlier. Year to date, 1,149,000 customer additions have resulted in net additions of 252,000, up 83% from a year earlier. The overall customer base grew to 4.7 million, up 7% from a year earlier.

All sales channels contributed with 167,000 new commercial customers, compared to the 168,000 added in the second quarter of fiscal 2014. Consumer additions totaled 187,000, up 13% from 165,000 added in the prior comparable quarter. With record sales year to date, total outstanding customer complaints remain at 2 per 10,000 customers, well below the Company’s target of not more than 5 complaints for every 10,000 customers.

| | | October 1, | | | | | | | | | Failed to | | | Dec 31, | | | % increase | | | Dec 31, | | | % increase | |

| | | 2014 | | | Additions | | | Attrition | | | renew | | | 2014 | | | (decrease) | | | 2013 | | | (decrease) | |

| Consumer Energy | | | | | | | | | | | | | | | | | | | | | | |

| Gas | | | 727,000 | | | | 59,000 | | | | (32,000 | ) | | | (10,000 | ) | | | 744,000 | | | | 2 | % | | | 769,000 | | | | (3 | )% |

| Electricity | | | 1,220,000 | | | | 128,000 | | | | (85,000 | ) | | | (16,000 | ) | | | 1,247,000 | | | | 2 | % | | | 1,225,000 | | | | 2 | % |

| Total Consumer RCEs | | | 1,947,000 | | | | 187,000 | | | | (117,000 | ) | | | (26,000 | ) | | | 1,991,000 | | | | 2 | % | | | 1,994,000 | | | | - | |

| Commercial Energy | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gas | | | 208,000 | | | | 25,000 | | | | (1,000 | ) | | | (8,000 | ) | | | 224,000 | | | | 8 | % | | | 195,000 | | | | 15 | % |

| Electricity | | | 2,449,000 | | | | 142,000 | | | | (68,000 | ) | | | (76,000 | ) | | | 2,447,000 | | | | - | | | | 2,171,000 | | | | 13 | % |

| Total Commercial RCEs | | | 2,657,000 | | | | 167,000 | | | | (69,000 | ) | | | (84,000 | ) | | | 2,671,000 | | | | 1 | % | | | 2,366,000 | | | | 13 | % |

| Total RCEs | | | 4,604,000 | | | | 354,000 | | | | (186,000 | ) | | | (110,000 | ) | | | 4,662,000 | | | | 1 | % | | | 4,360,000 | | | | 7 | % |

Maintaining Customers

The combined attrition rate for Just Energy was 16% for the trailing 12 months ended December 31, 2014, up 1% from attrition reported in the second quarter. Consumer attrition (27%) was flat with the second quarter while commercial attrition (7%) was up 1%.

Renewal rates were consistent with those reported in the second quarter with Consumer renewals unchanged at 75% and commercial renewals down 1% to 63% on a trailing 12-month basis. This indicates continued satisfaction with the Company’s products and services. Commercial renewals are often subject to competitive bid and will inevitably be more volatile than consumer renewals. Overall management sees stability in renewals at around current levels.

Profitability

Just Energy delivered expected operating results for the three months ended December 31, 2014 compared to the very strong third quarter of fiscal 2014. Gross margin for the quarter was $150.1 million, up 1% from $148.6 million in fiscal 2014. Year to date, gross margin is $406.0 million, up 10% from the prior comparable period. Third quarter Base EBITDA from continuing operations was $50.6 million, down 19% from $62.1 million in the prior comparable period. Year to date Base EBITDA is $112.5 million, up 1% versus fiscal 2014. Base Funds from continuing operations for the third quarter was $21.2 million down from $37.4 million in fiscal 2014. Year to date, Base FFO is $60.5 million down from $71.3 million in fiscal 2014.

The following factors drove quarterly profitability in the third quarter:

| | · | The 7% year over year growth in customers led to a 1% increase in gross margin. This was in spite of a very high weather related consumption in fiscal 2014. Embedded margin in the customer base grew 8% from a year earlier, reflecting the higher number of customers and a higher U.S. dollar exchange rate. |

| | · | Despite the Consumer customer base being down slightly from a year earlier, Consumer margin rose 4%. Consumer customers added or renewed in the quarter were at higher margins ($191 per year) than the margin on customers lost ($187 per year). |

| | · | Commercial division gross margins were down 7% while the customer base increased by 13%. The lower margins were driven by unfavourable utility reconciliations in Q3 this year compared to favourable reconciliations in Q3 a year ago. Some LDCs provide estimated consumption initially with the actual consumption following in future months based on actual meter reads. Annual margins on new and renewed customers were $85 per year up from a year earlier and customers lost during the period were $71. The higher margin is a conscious decision by management to reduce low margin commercial business and focus on more profitable customer segments. |

| | · | The 41% increase in administrative expenses year over year in the third quarter was a result of a settlement reached with the Massachusetts Attorney General Office on December 31, 2014 which resulted in the payment of $4.5 million. The guidance provided by management for fiscal 2015 anticipated administrative costs growing more rapidly than margin for the year largely due to the building and expansion of the business platform in the United Kingdom. Administrative costs for the nine months to date are up 27%, primarily resulting from the item noted above and non-recurring legal and settlement costs of approximately $4.0 million recorded in the second quarter associated with a verdict supporting the plaintiffs’ class and collective action in the Hurt/Hill lawsuit. |

| | · | Selling and marketing expenses, which consist of commissions paid to independent sales contractors, brokers and independent representatives as well as sales-related corporate costs, were $53.0 million, an increase of 17% from $45.4 million in the third quarter of fiscal 2014. The number of new customers added grew by 6%. The benefit of lower cost channels was offset by higher amortization of contract initiation costs related to commercial contracts signed in prior periods in which commissions were paid up front. There are also a growing number of Consumer division customers generated by online sales channels where commissions are paid on a residual basis as the customer flows rather than upfront. |

| | · | Year to date, bad debt amounted to 2.2% of relevant sales, down from 2.3% in the comparable period of fiscal 2014 and down from the 2.3% reported in the second quarter, all of which are within the target range of 2% to 3%. |

Base Funds from operations was down 43% in the third quarter compared to a year earlier as lower Base EBITDA was further reduced by higher interest costs, cash taxes and maintenance capital spending. The dividend payout ratio was 88% for the quarter up from 83% in fiscal 2014. For the nine months ended December 31, 2014, Base Funds from operations were down 15% reflecting 1% higher Base EBITDA offset by higher interest costs, cash taxes and maintenance capital expenditures.

Outlook

The third quarter of fiscal 2015 saw continued growth with strong gross and net customer additions. The 354,000 customer additions are the fourth most in the Company history. With 1,149,000 new customers to date in fiscal 2015, Just Energy will almost certainly realize record additions for the year as they stand 13% ahead of the previous record fiscal 2014 after nine months. Net additions are 252,000, up 83% from 138,000 in the comparable nine-month period of fiscal 2014. Each of the Company’s marketing channels was strong during the quarter. Just Energy’s future profitability will benefit from the fact that 44,000 of the 58,000 net additions in the quarter were from the Consumer division. Average annual margin on these new residential customers was $191 compared to $85 for new Commercial division customers. Continued net customer additions in Q4 at the margins seen year to date should result in a return to double digit Base EBITDA growth in fiscal 2016.

Going forward, a new channel for expected Company growth will come from the new residential solar business. Just Energy has entered onto an agreement with Clean Power Finance (“CPF”) to address the U.S. residential solar market. CPF’s online platform allows Just Energy to sell residential solar finance products and connects the company with a national network of qualified solar installation professionals. Under the agreement, Just Energy will act as an originator of residential solar deals that are financed and installed via CPF. Just Energy will also be able to sell complimentary energy management solutions to solar customers.

Debt reduction remains a clear priority of management. The sales of NHS and HES have reduced the Company’s net debt to $659.4 million down 34% from $1.0 billion a year earlier. As the NHS sale closed near the end of the quarter, the Company has applied the net proceeds to its operating line. A portion of these funds will be used to pay down debt maturities in coming periods.

At the beginning of Fiscal 2015, the Company provided Base EBITDA guidance for the year of between $163 million and $173 million. This guidance was reaffirmed at the end of the first and second quarters. Based on results to date and the margins and costs expected in the fourth quarter, management expects the fiscal 2015 Base EBITDA will be at the high end of this guidance range.

Overall, this quarter delivered on our promise to reduce debt while providing results in line with those expected when we set our guidance for fiscal 2015. Our continued strong customer additions bode well for future growth. With lower debt and growing Base EBITDA, Just Energy is delivering an excellent year and is well placed for continued growth in the future.

We want to thank all of our employees for their efforts in delivering these results.

Yours sincerely,

| Deb Merril | James Lewis |

| Co-Chief Executive Officer | Co-Chief Executive Officer |

7