Exhibit 99.1

| | São Jorge Gold Project, Pará State, |

| | Brazil |

| | (Latitude 6.48ºS, Longitude 55.58ºW) |

| | |

| | Independent Technical Report on Mineral Resources |

| | Prepared by GE21 Consultoria Mineral Ltda on behalf of: |

| | |

| | GoldMining Inc. (GMI) |

| | |

| | |

| | Report Date: 01 July 2021 |

| | Effective Date: 31 May 2021 |

| | Qualified Person: Porfirio Rodriguez – BSc (Min Eng), FAIG |

| | Qualified Person: Leonardo de Moraes Soares - BSc (Geo), MAIG |

| | |

| | |

| | GE21 210515 |

Author(s): | Porfirio Rodriguez Associate Consultant BSc(Eng), FAIG |

| Leonardo de Moraes Resource Geologist BSc(Geo), MAIG Soares |

| |

| |

Date: | 1st July 2021 |

| | |

Project Number: | GE21 - 210515 |

| | |

Version / Status: | Update / Final |

| | |

File Name: | SS:\Projetos\GOLDMINING\210515-Update-CIM43101-TechReport\23_Relatorio |

| | |

‘Print Date: | 16 July 2021 |

| | |

| |

Copies: | GoldMining Inc 1 |

| GE21– Belo Horizonte, Brazil 1 |

Document Change Control

Version | Description (section(s) amended) | Author(s) | Date |

| | | |

| | | |

| | | |

Document Review and Sign Off

Signed and Sealed | | Signed and Sealed |

| | | |

| Primary Author | | Co-Author |

| Porfirio Rodriguez | | Leonardo M. Soares |

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

Date and Signature Page

This report titled São Jorge Gold Project, Para State, Brazil: Independent Technical Report on Mineral Resources with an effective date of May 31, 2021 was prepared on behalf of GoldMining Inc. by Porfirio Cabaleiro Rodriguez and Leonardo M. Soares and signed:

Dated at Belo Horizonte, this 1st day of July, 2021

Porfirio Rodriguez, BSc(Eng), FAIG.

Principal Engineer

Leonardo M. Soares, BSc(Geo), MAIG.

Resource Geologist

| Table of Contents | |

| 1 | SUMMARY | 1 |

| | 1.1 | Introduction | 1 |

| | 1.2 | Location | 2 |

| | 1.3 | Ownership | 2 |

| | 1.4 | Geology | 2 |

| | 1.5 | Mineralisation | 2 |

| | 1.6 | Project Status | 3 |

| | 1.7 | Resources | 3 |

| | 1.8 | Interpretations and Conclusions | 5 |

| | 1.9 | Recommendations | 6 |

| 2 | INTRODUCTION | 7 |

| | 2.1 | Scope of Work | 7 |

| | 2.2 | Principal Sources of Information | 8 |

| | 2.3 | Qualifications and Experience | 9 |

| | 2.4 | Units of Measurements and Currency | 9 |

| | 2.5 | Abbreviations | 10 |

| 3 | RELIANCE ON OTHER EXPERTS | 11 |

| 4 | PROPERTY DESCRIPTION AND LOCATION | 12 |

| | 4.1 | Background Information on Brazil | 12 |

| | 4.2 | Mining Legislation | 12 |

| | | 4.2.1 Prospecting Licenses | 13 |

| | | 4.2.2 Exploration Licenses | 13 |

| | | 4.2.3 Mining Licenses | 14 |

| | 4.3 | Project Location | 15 |

| | 4.4 | Tenement Status | 16 |

| | 4.5 | Royalties and Agreements | 18 |

| | 4.6 | Environmental Liabilities | 19 |

| | 4.7 | Permitting | 19 |

| | 4.8 | Other Significant Factors | 20 |

| 5 | ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY | 20 |

| | 5.1 | Project Access | 20 |

| | 5.2 | Physiography and Climate | 20 |

| | 5.3 | Local Infrastructure and Services | 20 |

| 6 | HISTORY | 22 |

| | 6.1 | Exploration History | 22 |

| | 6.2 | Resource History | 24 |

| | 6.3 | Production History | 26 |

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

7 | GEOLOGICAL SETTING AND MINERALISATION | 27 |

| 7.1 | Regional Geology | 27 |

| 7.2 | Project Geology | 28 |

| | 7.2.1 Lithology | 29 |

| | 7.2.2 Alteration minerals | 31 |

| | 7.2.3 Alteration assemblages | 31 |

| | 7.2.4 Alteration Intensity | 36 |

| | 7.2.5 Structure | 37 |

| 7.3 | Mineralisation | 39 |

8 | DEPOSIT TYPES | 42 |

9 | EXPLORATION | 43 |

| 9.1 | Ground geophysics - IP Survey | 43 |

| 9.2 | Soil Geochemistry | 44 |

10 | DRILLING | 46 |

| 10.1 | Drilling Programs | 46 |

| 10.2 | Relevant Drillhole Intersections and True Thickness | 46 |

| 10.3 | RTDM Drilling | 50 |

| 10.4 | Talon Drilling | 50 |

| 10.5 | BGC Drilling | 51 |

| 10.6 | Drilling Results and Quality | 52 |

11 | SAMPLE PREPARATION, ANALYSES AND SECURITY | 53 |

| 11.1 | Density Determinations | 53 |

| 11.2 | Sample Preparation and Analysis | 54 |

| 11.3 | Sample Security | 55 |

| 11.4 | Adequacy of Procedures | 55 |

| 11.5 | QAQC | 56 |

| | 11.5.1 RTDM Drill Samples | 56 |

| | 11.5.2 Talon Drill Samples | 56 |

| | 11.5.3 BGC Drill Samples | 62 |

| 11.6 | Data Quality Summary | 64 |

| 11.7 | Summary | 64 |

12 | DATA VERIFICATION | 64 |

| 12.1 | Geological Database | 64 |

| 12.2 | Site Visit | 64 |

13 | MINERAL PROCESSING AND METALLURGICAL TESTING | 70 |

| 13.1 | Mineral Processing | 70 |

| 13.2 | Metallurgical Testing 2006 | 70 |

| 13.3 | Metallurgical Testing 2012 | 74 |

| | 13.3.1 Sample Selection and Location | 74 |

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

| | 13.3.2 Head Samples and Assays | 74 |

| | 13.3.3 Granulometric Test Work | 76 |

| | 13.3.4 Grindability Testing | 77 |

| | 13.3.5 Gravity Concentration Test Work | 78 |

| | 13.3.6 Pre-Lime Addition | 79 |

| | 13.3.7 Kinetic Curves for Leaching Without Gravity Concentration | 79 |

| | 13.3.8 Kinetic Curves for Leaching With Gravity Concentration | 80 |

| | 13.3.9 Optimization of Cyanide Dosage | 85 |

| 13.4 | Additional Metallurgical Testing | 87 |

| | 13.4.1 Column Tests | 88 |

| 13.5 | Metallurgical Tests - Conclusion and Recommendations | 90 |

| | 13.5.1 Conclusions | 90 |

| | 13.5.2 Recommendations | 93 |

14 | MINERAL RESOURCE ESTIMATES | 95 |

| 14.1 | Introduction | 95 |

| 14.2 | Geological Modelling | 95 |

| 14.3 | Block Model Development | 98 |

| 14.4 | Statistical Analysis | 98 |

| 14.5 | Variography | 103 |

| | 14.5.1 Introduction | 103 |

| | 14.5.2 São Jorge Variography | 103 |

| 14.6 | Grade Estimation | 107 |

| 14.7 | Multiple Indicator Kriging Parameters | 107 |

| 14.8 | Resource Reporting | 110 |

| | 14.8.1 Mineral Resources Category Definitions | 110 |

| | 14.8.2 Cut Off grade | 111 |

| | 14.8.3 Mineral Resources estimation parameters | 111 |

15 | MINERAL RESERVE ESTIMATES | 119 |

16 | MINING METHODS | 119 |

17 | RECOVERY METHODS | 119 |

18 | PROJECT INFRASTRUCTURE | 119 |

19 | MARKET STUDIES AND CONTRACTS | 119 |

20 | ENVIRONMENTAL STUDIES, PERMITTING AND SOCIAL OR COMMUNITY IMPACT | 119 |

21 | CAPITAL AND OPERATING COSTS | 119 |

22 | ECONOMIC ANALYSIS | 119 |

23 | ADJACENT PROPERTIES | 119 |

24 | OTHER RELEVANT DATA AND INFORMATION | 120 |

25 | INTERPRETATION AND CONCLUSIONS | 121 |

26 | RECOMMENDATIONS | 122 |

27 | REFERENCES | 124 |

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

List of Tables

Table 1 - Mineral Resources Calculation Parameters | 4 |

Table 2 - Mineral Resource Statement | 4 |

Table 3 - List of Abbreviations | 10 |

Table 4 - São Jorge Project - Summary of GMI’s Concessions Status | 17 |

Table 5 - São Jorge Project - Property Exploration History | 22 |

Table 6 - 2013 Historical Mineral Resource estimate | 24 |

Table 7 - 2013 Historic Mineral Resource estimate - Calculation Parameters | 25 |

Table 8 - Drilling Statistics Summary | 46 |

Table 9 - Relevant Drill Hole intersections | 49 |

Table 10 - Density Measurements for São Jorge Deposit rock types | 54 |

Table 11 - Density Measurements for Rock Alteration Types | 54 |

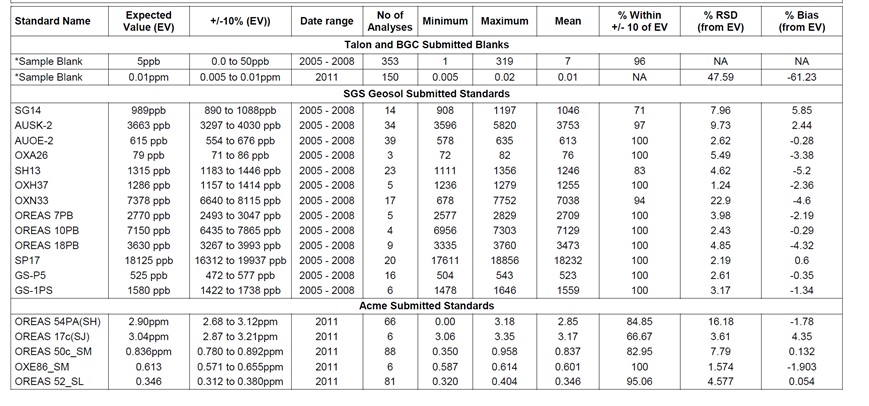

Table 12 - Summary Table of Blanks and Standards Statistical Analysis | 59 |

Table 13 - Head Sample Analysis (excluding SJ-MET-01) | 71 |

Table 14 - Summary of Gravity Separation tests | 71 |

Table 15 - Summary of Leaching Tests | 72 |

Table 16 - Comparison of Metallurgical Test Results | 73 |

Table 17 - Chemical Analysis for Sample MET-1 | 75 |

Table 18 - Gold Analysis for sample MET 1 | 75 |

Table 19 - Calculated and Assayed Heads for Sample MET 1 tests | 76 |

Table 20 - Recovery of Gold by Size fraction for sample MET 1 | 77 |

Table 21 - Bond work Index values for selected samples | 77 |

Table 22 - Pre-Lime Addition – Variation with Time | 79 |

Table 23 - Leach Recovery without the use of Gravity Separation – Sample MET-01 | 80 |

Table 24 - Gravity Concentration before Leaching P80 106-Microns | 81 |

Table 25 - Gravity Concentration before Leaching P80 75 Microns | 81 |

Table 26 - Leach Recovery rates of the Gravity Tails from sample MET 1 | 82 |

Table 27 - Calculated Overall Recoveries from Gravity and Leaching - Sample MET-01 | 83 |

Table 28 - Gold Recovery Rate as a Function of Cyanide Consumption | 86 |

Table 29 - Summary of Leaching Test Results | 87 |

Table 30 - Head Sample Grade – Sulphide Ore | 88 |

Table 31 - Head Sample Grade - Oxide Ore | 88 |

Table 32 - Column Test Leaching Results | 89 |

Table 33 - Column Test Leaching Curves | 89 |

Table 34 - Summary of the Block Model Parameters | 98 |

Table 35 - Statistics Summary– 1m Composites | 99 |

Table 36 - Indicator Class Means | 100 |

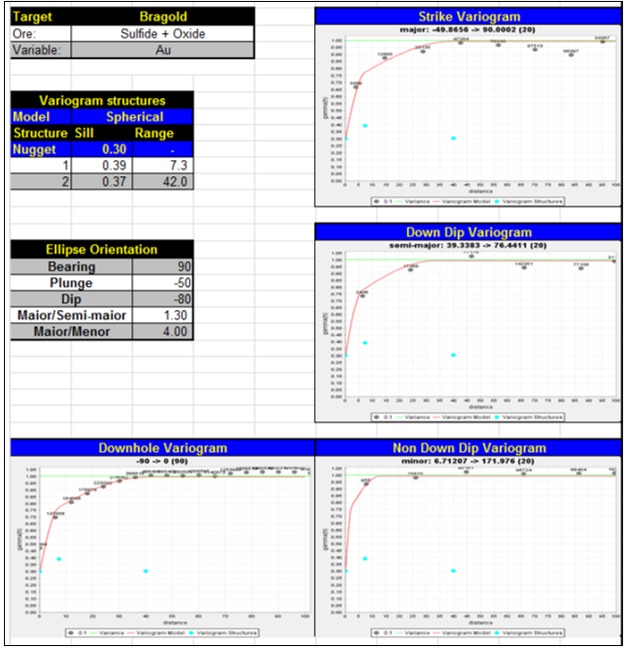

Table 37 - Variogram Models Summary- Nested Spherical | 104 |

Table 38 - Multiple Indicator Kriging Sample – Search Parameters | 108 |

Table 39 - Mineral Resources estimation parameters | 111 |

Table 40 - Confidence Levels of Key Categorisation Criteria | 114 |

Table 41 - Resource Statement Table – Total Resources per Category | 116 |

Table 42 - Phase I -Exploration and PEA Cost Estimates | 123 |

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

List of Figures

Figure 1 - São Jorge Gold Project Location Map | 15 |

Figure 2 - São Jorge Project - GMI’’s Exploration Licences Location | 18 |

Figure 3 - Regional Geology Map | 28 |

Figure 4 - São Jorge Project Surface Geology | 29 |

Figure 5 - Typical São Jorge Deposit Lithologies | 30 |

Figure 6 - ‘Nada’ Alteration Zone | 32 |

Figure 7 - Fe-oxide +/- chlorite alteration zone | 33 |

Figure 8 - K-feldspar – epidote– chlorite alteration zone | 34 |

Figure 9 - Mixed zone alteration type | 35 |

Figure 10 - Heterogeneous alteration type zone | 36 |

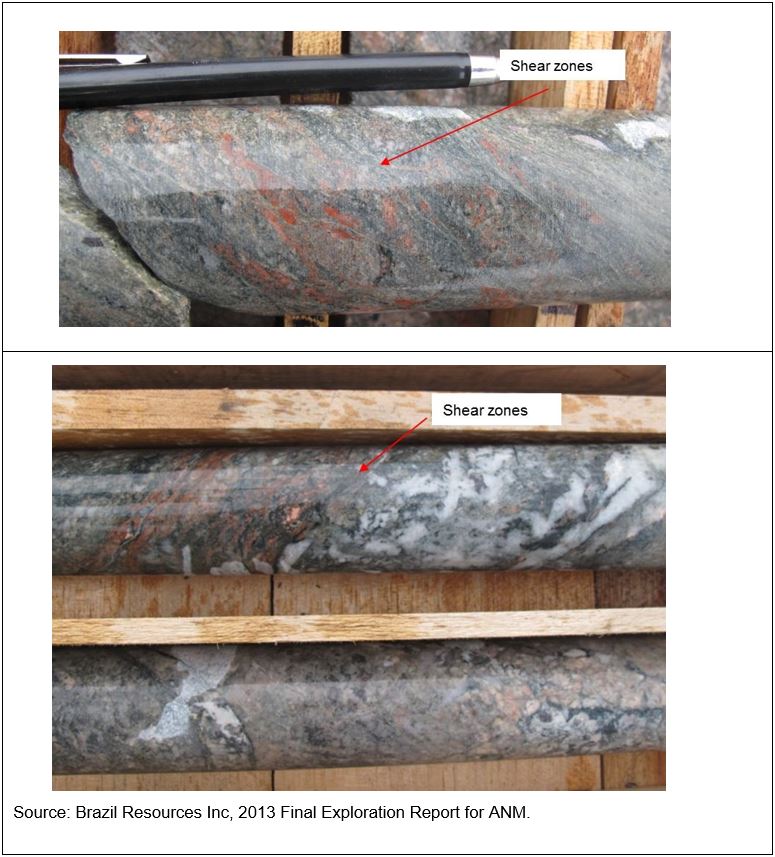

Figure 11 - Typical small shear zones | 38 |

Figure 12 - Fine disseminated sulphide within mixed zone | 39 |

Figure 13 - Fracture controlled vein style pyrite within Fe-Ox-Chlorite material | 40 |

Figure 14 - Massive sulphide bleb | 41 |

Figure 15 - São Jorge deposit typical section with alteration zones | 42 |

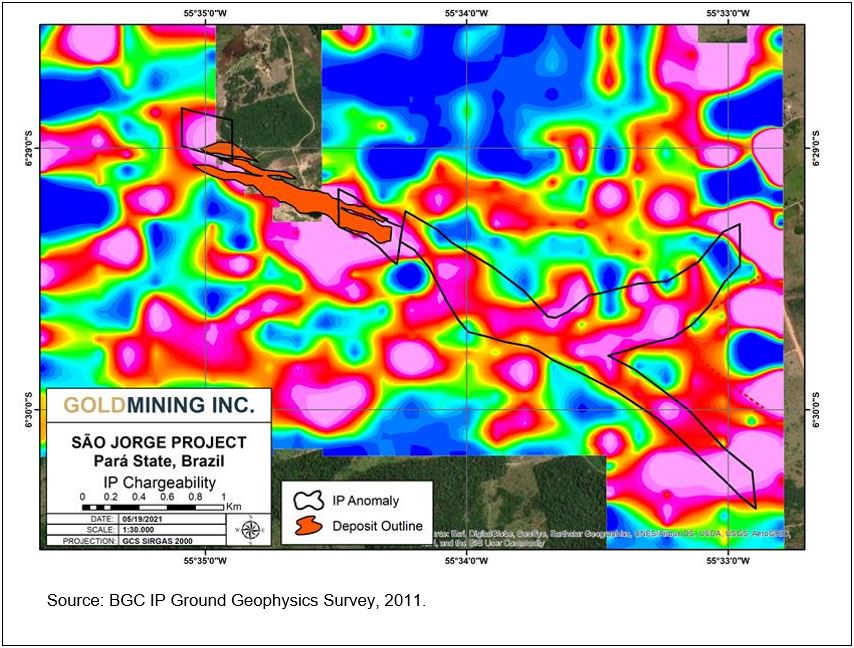

Figure 16 - IP Chargeability Map (100m level) | 44 |

Figure 17 - São Jorge Exploration - Soil Geochemistry - Gold in Soil Anomalies | 45 |

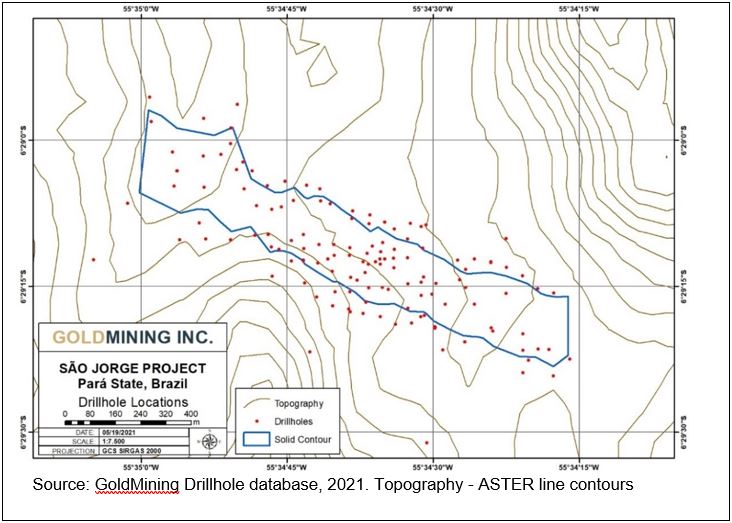

Figure 18 - São Jorge Gold Project Drillhole Locations | 47 |

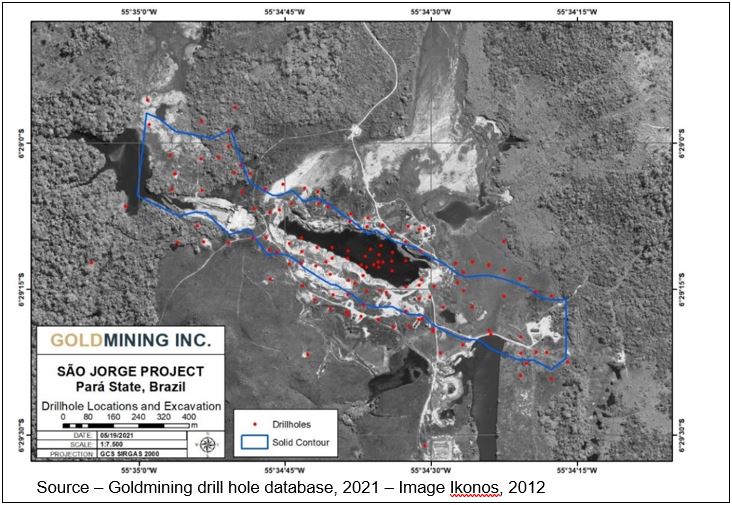

Figure 19 - São Jorge Gold Project Drillhole Location and the old Garimpo Pit | 48 |

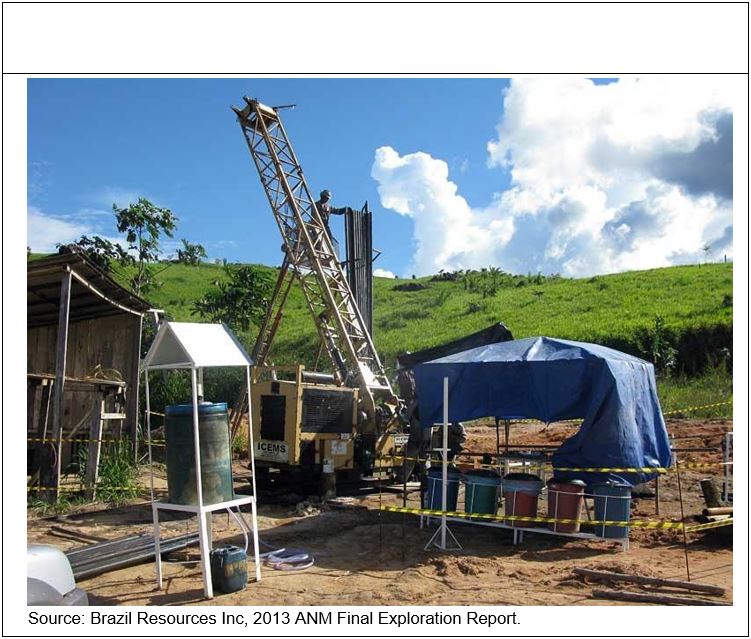

Figure 20 - Drill Rig operating at São Jorge Gold Project | 52 |

Figure 21 - Blank and Standards Statistical Data Example | 58 |

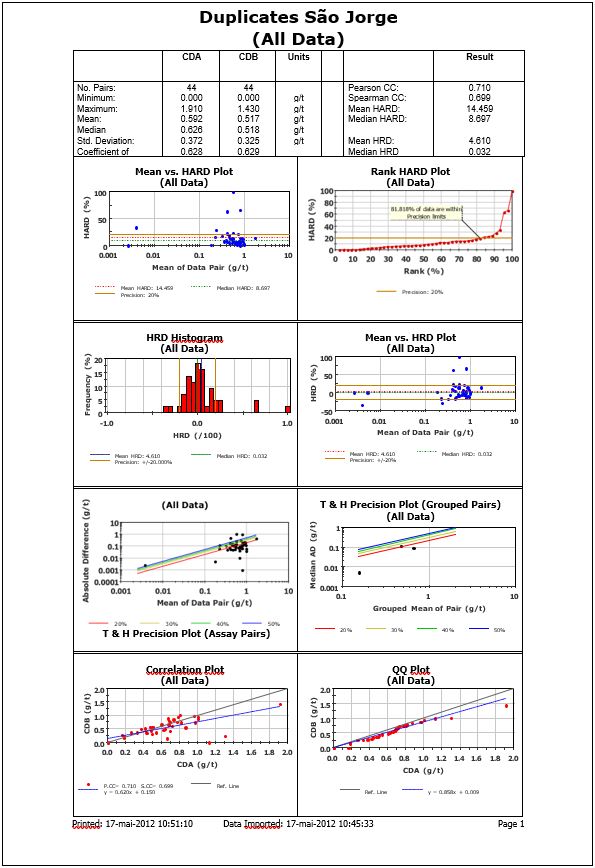

Figure 22 - Summarized Duplicates Quality Controls | 61 |

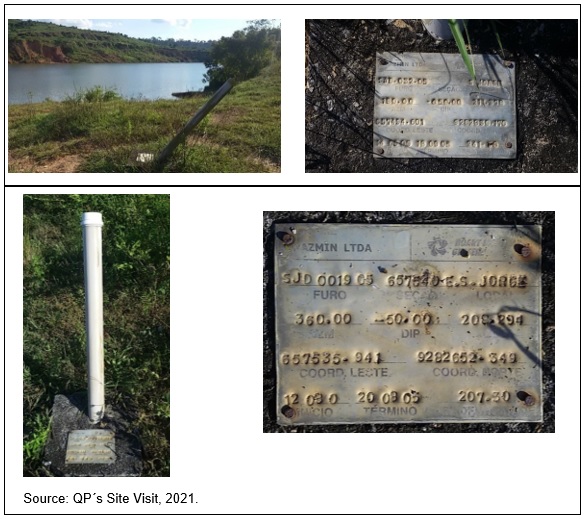

Figure 23 - Drill holes SJD-032-05 and SJD-019-05 collar locations | 66 |

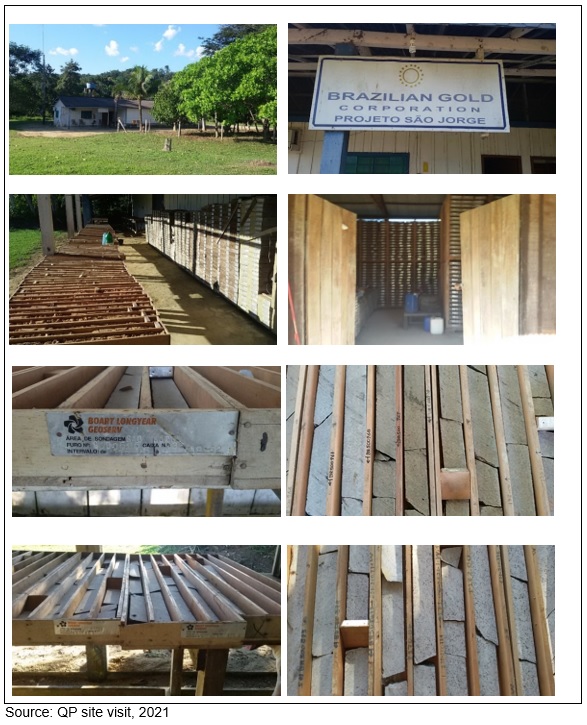

Figure 24 - QP Site Visit - Core Shed and Core Boxes Inspected | 67 |

Figure 25 - Relevant Selected Intercept Inspected - Drillhole SJD0505 | 68 |

Figure 26 - Relevant Selected Intercept Inspected - Drillhole SJD-004-05 | 69 |

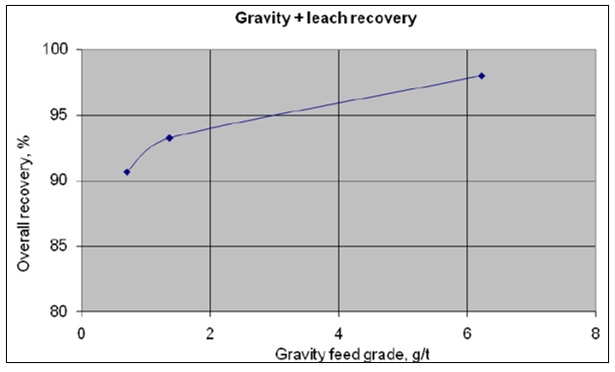

Figure 27 - São Jorge Gravity Recovery Test Result | 71 |

Figure 28 - Leaching Recovery Test Result | 72 |

Figure 29 - Gravity + Leach Recovery Test Result | 73 |

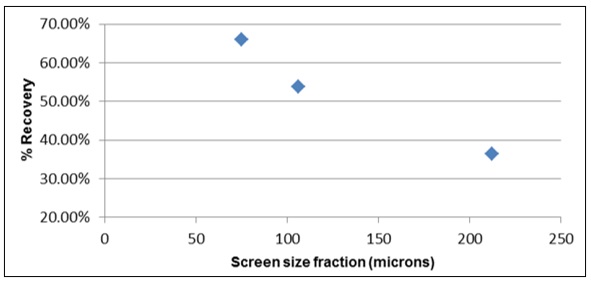

Figure 30 - Gold Recovery in percent versus grind size | 78 |

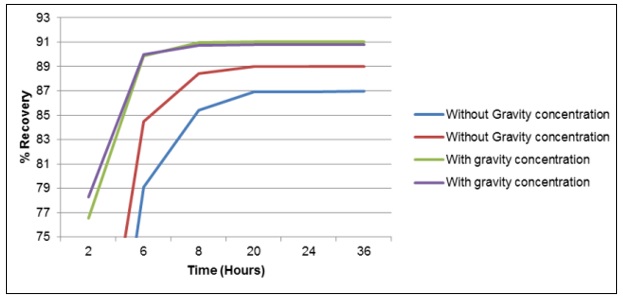

Figure 31 - Leaching Test - Percentage Recovery versus Time | 84 |

Figure 32 - Recovery versus Leach Time P80 = 106 Microns | 84 |

Figure 33 - Recovery versus Leach Time P80=75 Microns | 85 |

Figure 34- NaCN (g/t) Consumption | 86 |

Figure 35 - Predicted Grade versus Recovery for High Grade Ore | 92 |

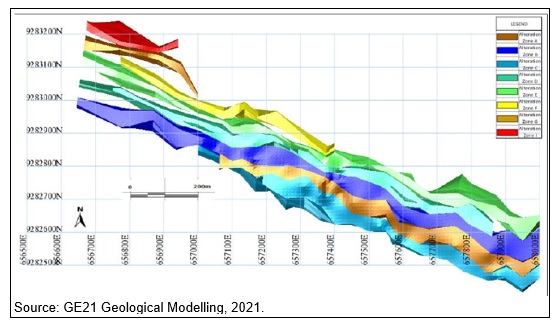

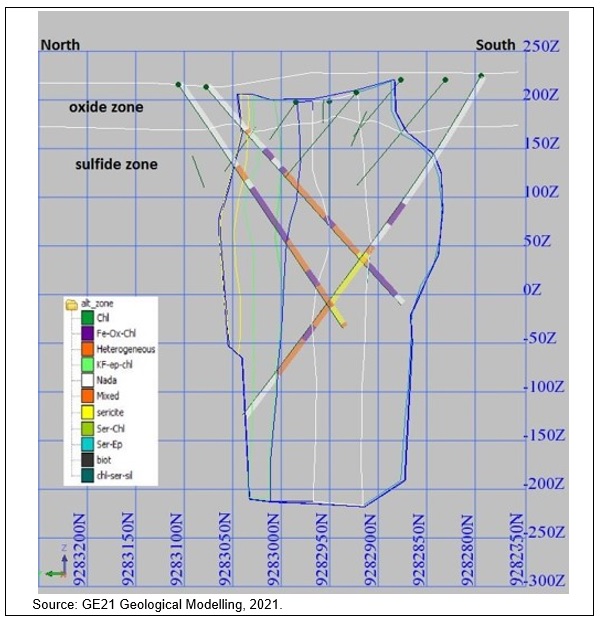

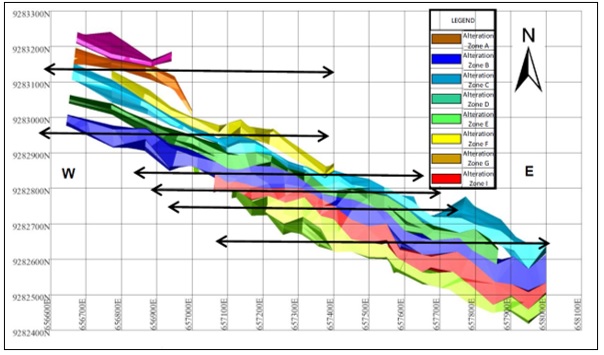

Figure 36 - Deposit Alteration Zones Model | 96 |

Figure 37 - Envelope modelling - Vertical Sections Location | 96 |

Figure 38 - Envelope Modelling - Vertical Section Example | 97 |

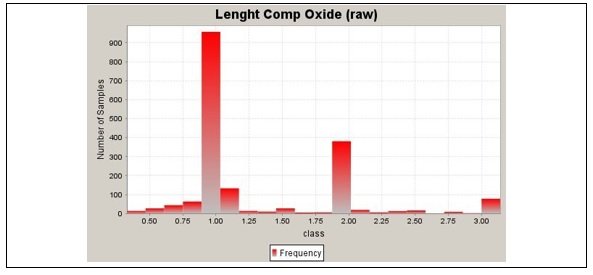

Figure 39 - Histogram showing sample lengths inside mineralized Oxide zone. | 98 |

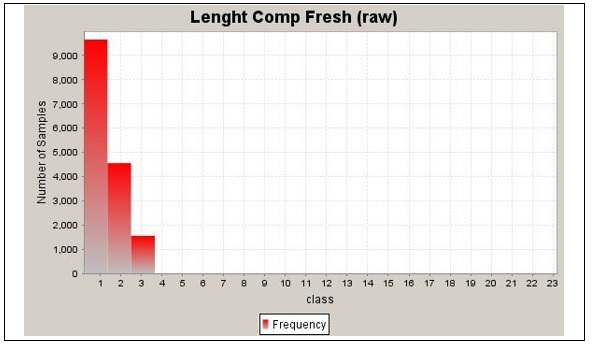

Figure 40 - Histogram showing sample lengths inside mineralised Sulphide zone. | 99 |

Figure 41 - Statistical Analysis for Oxide Domain Samples – 1 m Composite | 101 |

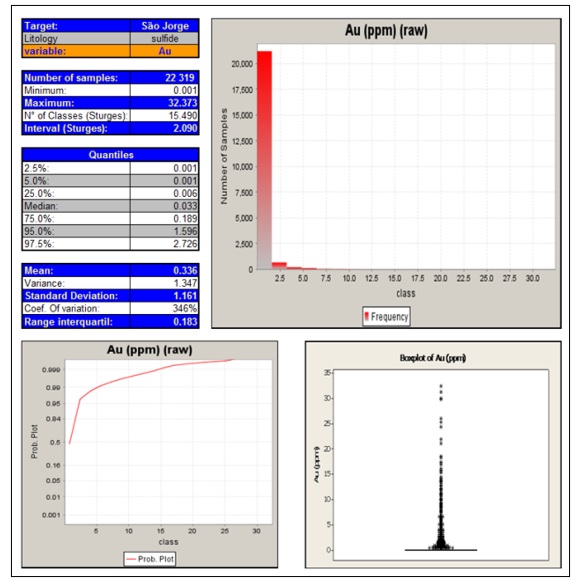

Figure 42 - Statistical Analysis for Sulphide Domain Samples – 1 m Composite | 102 |

Figure 43 - Definition of Small-Scale Bearing | 105 |

Figure 44 - Variography for Oxide and Sulphide Resource Estimation | 106 |

Figure 45 - MIK Validation - Sulphide | 109 |

Figure 46 - MIK Validation - Oxide | 109 |

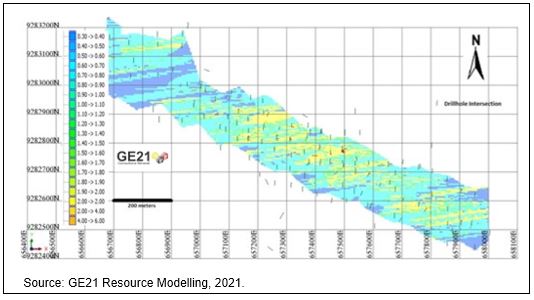

Figure 47 - Block Model Plan View – Grade Distribution >0,3 g/t Au – 100m asl | 112 |

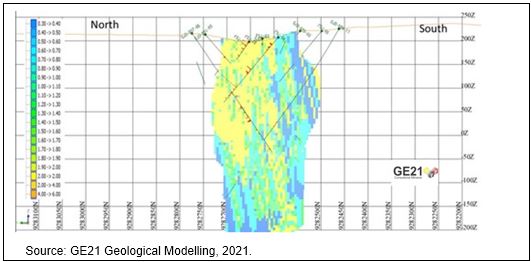

Figure 48 - Block Model - Vertical Section - Grade Distribution >0,3 g/t Au | 112 |

Figure 49 - Isometric View of Block Model - Grade Distribution >0,3 g/t Au | 113 |

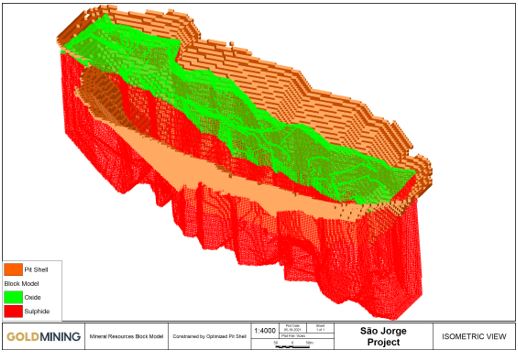

Figure 50 - Mineral Resources Block Model and Optimized Pit – Looking NW | 117 |

Figure 51 - Mineral Resources Block Model and Optimized Pit Plan view | 117 |

Figure 52 - Classified Mineral Resources Block Model and Optimized Pit | 118 |

Figure 53 - Classified Mineral Resources Block Model and Optimized Pit | 118 |

List of Appendices

Appendix A – Certificate of Qualified Persons

Appendix B – Drillhole Summary

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

GE21 Consultoria Mineral, (GE21) has been commissioned by GoldMining Inc. (GMI) to prepare an updated Independent Technical Report on the Mineral Resource for the São Jorge Gold Project (the Project) in Para State, Brazil. The purpose of this report is to update the Mineral Resource Estimation for the Project. GE21 Consultoria Mineral assigned Mr. Porfirio Rodriguez, and Mr. Leonardo de Moraes Soares, all Qualified Professionals (QPs) as recognized under NI 43-101, to prepare the technical report.

Mr. Rodriguez is a professional Mining Engineer with more than 40 years of experience in Mineral Resource and Mineral Reserve estimation. His experience includes uranium, iron ore, gold and nickel. Mr. Rodriguez is a Fellow of the Australian Institute of Geoscientists (FAIG). Mr. Leonardo M. Soares is a geologist with more than 16 years of experience, most of them in resource estimation on gold properties. His experience includes iron ore, gold and copper. Mr. Soares is a Member of the Australian Institute of Geoscientists (MAIG). Both Messrs. Rodriguez and Soares are independent of GMI as that term is defined in Section 1.5 of the National Instrument 43-101.

The Mineral Resource estimation utilizes an optimized pit shell to constrain resources, a database of 145 drill holes totaling more than 37,000 metres and uses modernized cost and pricing assumptions. All available information from drilling exploration programs to the effective date have been included in this report.

Updates to commodity pricing and operational costing, as well as the improved and updated Mineral Resource basis, have been utilized to confirm that the constrained São Jorge Mineral Resources estimation has demonstrated reasonable potential of eventual economic extraction.

The QPs are unaware of any exploration work that has been undertaken on this project since 2012. This has been verified by the authors by reviewing public disclosures, the technical data provided by GMI and reviewed by the QPs and by the site visit by Mr. Soares.

This report complies with NI 43-101. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for public disclosure by issuer of scientific and technical information concerning mineral projects.

All costs in this study have been expressed in US dollars unless noted otherwise.

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

The São Jorge Gold Project is located in the southeast of Pará State, Brazil, in the municipality of Novo Progresso. The region is known as Tapajós and São Jorge is located 320km south of the main regional city Itaituba. Access to the São Jorge Gold Project from the cities of Itaituba or Novo Progresso is via highway BR163 or a 1 hour flight in a light aircraft from Itaituba.

GMI, through its Brazilian subsidiaries Brazilian Resources Mineração Ltda., Mineração Regent Brasil Ltda. and BRI Mineração Ltda., is the sole registered and beneficial holder of seven gold exploration licences in the São Jorge project for a total landholding of 45,996.63 ha.

On November 22, 2013, Brazilian Gold Corporation (BGC) completed an agreement with Brazil Resources Inc. (BRI), pursuant to which BRI acquired all the outstanding common shares of BGC. Brazil Resources Inc. announced that effective December 6, 2016, it had changed its name to GoldMining Inc. (GMI). As a result of its acquisition of BGC, GMI indirectly owns Brazilian Resources Mineração Ltda., Mineração Regent Brasil Ltda. and BRI Mineração Ltd., which in turn own the Project.

GMI is a public mineral exploration company with a focus on the acquisition and development of projects in emerging and producing gold districts in North America (United States and Canada) and South America (Brazil, Colombia and Peru).

The São Jorge property is underlain by a granitoid pluton dominantly composed of an amphibole-biotite monzogranite. The gold mineralisation is hosted in a circular shaped body comprised of the younger São Jorge granite. The intrusive body measures approximately 1.2km in diameter and is generally massive, grey to pink in colour with a porphyritic granular texture. The São Jorge intrusion trends 290° and is sub-parallel to the strike of the regional Cuiú-Cuiú - Tocantinzinho shear zone, which also hosts several important gold deposits including the Palito mine, Tocantinzinho and Cuiú-Cuiú deposits, and Bom Jardim and Batalha gold prospects.

Gold mineralisation is related to a hydrothermal alteration zone in the monzogranite along a structurally controlled fracture - vein system, approximately 1,400m long and up to 160m wide, and intersected in drill holes up to 350m below surface; the mineralisation is open along strike and down dip. The main trend is 290° with an almost vertical dip. The main mineralized zone is defined by a sharp but irregular contact between altered and unaltered monzogranite to the southwest and a more gradational transition from altered to unaltered rocks to the northeast. Strong alteration is associated with discrete quartz veinlets (1 to 2cm wide), associated with coarse pyrite grains and clusters that cut zones of intense quartz flooding.

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

BGC conducted the most recent exploration program on the São Jorge Gold Project, during 2011, in an effort to increase the mineralized resource and raise confidence in the continuity of the deposit.

The results from this drill program have been made public and drilling results including all information available from previous exploration diamond drilling programs completed to date were used to estimate the updated Mineral Resource that is reported in this document.

The project is managed under an exploration license granted by Brazilian authorities, and which is in good standing.

Mineral Resource estimates for the São Jorge Gold Project have been generated by the QP on the basis of analytical and technical results available up to May 31, 2021. The resources are reported in this Independent Technical report on Mineral Resource São Jorge Gold Project, Para State, Brazil, National Instrument 43-101, dated 01 July 2021.

The Resource Statement has been determined with an effective date of May 31, 2021 and has been prepared and reported in accordance with Canadian National Instrument 43-101, Standards of Disclosure for Mineral Projects (the Instrument). Mineral Resources have been classified in accordance with the Canadian Institute of Mining, Metallurgy and Petroleum (CIM) Definition Standards on Mineral Resources and Mineral Reserves, whose definitions are incorporated by reference into National Instrument NI 43-101.

The cut-off grade represents the value, expressed in grams of gold per tonne, obtained as the sum of process costs, mining costs, G&A costs and other costs including royalties divided by the gold price, expressed in dollars per gram of gold (US$/g) multiplied by process recovery rate. The values used to determine the cut-off grade are shown in the Table 1.

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

Table 1 - Mineral Resources Calculation Parameters

Item | Unit | Value |

| Financial Parameters | Sales Price | US$/oz | 1600 |

| | | Discount rate | % | 10 |

| | ROM | Density | g/cm³ | model & 2.69 on other waste |

| | | Grades | g/t | model - MIK cog@0.3g/t |

| | Block Model | Block dimensions | Unit | Value |

| | X | | 5 |

| Revenue | Y | m | 5 |

| | Z | | 5 |

| | Overall Slope Angle | Saprolite | ° | 35 |

| | | Fresh | 52 |

| | Processing | Metallurgical Recovery | % | 90 |

| | Cut-off Grade | g/t | 0.3 |

| Mining | US$/t mined | 2.00 |

| Costs | Processing | US$/T ROM | 8.50 |

| | G&A | 2.10 |

| | NSR Royalties | % product | 3.5% |

The summary of the total resources (oxide + sulphide) for the Project is:

| | ● | 14.275Mt at an average grade of 1.55g/t Au of Indicated Mineral Resources for 771.8 Koz; and |

| | ● | 17.58Mt at an average grade of 1.27g/t Au of Inferred Mineral Resources for 716.5 Koz. |

Table 2 lists the constrained resource tonnage, grade and contained gold ounces per Mineral Resource category at the cut-off grade of 0.3g/t Au for the total resource.

Table 2 - Mineral Resource Statement

Resource Category | Tonnes (Mt) | Average Grade (g/t Au) | Contained Gold (Kozs) |

Indicated Mineral Resource | 14.275 | 1.55 | 711.8 |

Inferred Mineral Resource | 17.582 | 1.27 | 716.5 |

Multiple Indicator Kriging Estimate - 31 May 2021 Indicated and Inferred open pit constrained resources reported above a 0.30g/t Au cut-off grade 5E x 5mN x 5mRL Selective Mining Unit |

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

The independent QPs responsible for the Mineral Resource estimate in this report are Messrs. Porfirio Rodriguez and Leonardo M. Soares. Mr. Rodriguez is a professional Mining Engineer with more than 40 years of experience in Mineral Resource and mineral reserve estimation. His experience includes uranium, iron ore, gold and nickel. Mr. Rodriguez is a Fellow of the Australian Institute of Geoscientists (FAIG). Mr. Leonardo M. Soares is a geologist with more than 16 years of experience, most of them in resource estimation on gold properties. His experience includes iron ore, gold and copper. Mr. Soares is a Member of the Australian Institute of Geoscientists (MAIG). Both Messrs. Rodriguez and Soares are independent of GMI as that term is defined in Section 1.5 of the National Instrument 43-101.

Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources will be converted into mineral reserves. The estimate of Mineral Resources may be materially affected by environmental permitting, legal, title, taxation, sociopolitical, marketing or other relevant issues. The Company is not currently aware of any known environmental, permitting, legal, title-related, taxation, socio-political, marketing or other relevant issue that could materially affect this Mineral Resource estimate.

These Mineral Resources have been estimated on the basis of a block model of the deposit which, in the opinion of Mr. Rodriguez, has been constrained to honour appropriate geological domains. Grades have been interpolated into individual blocks by Multiple Indicator kriging (MIK), using search radii and these are fully supported by the variography analysis. Mr. Rodriguez has estimated and classified the Mineral Resources contained within the São Jorge Gold Project deposit using procedures which are generally accepted within the industry and that these procedures have been properly applied.

The estimation was prepared based on the methodology and parameters determined appropriate for the Project and, the selective mining unit (SMU) block size of 5m x 5m x 5m was considered reasonable for the estimation based on Mr. Rodriguez’s experience with estimating gold resources in Brazil.

1.8 | Interpretations and Conclusions |

Mr. Rodriguez and Mr. Soares in compliance with Canadian National Instrument 43-101 which regulates the public disclosure of mining companies in Canada, concludes that the São Jorge Gold Project Mineral Resource estimate has been prepared in accordance with the best practices of the industry.

The São Jorge Project is underlain by a granitoid pluton dominantly composed of an amphibole-biotite monzogranite. The gold mineralisation is hosted in a circular shaped body comprised of the younger São Jorge granite. Gold mineralisation is related to a hydrothermal alteration zone in the monzogranite along a structurally controlled fracture - vein system approximately 1,400m long and up to 160m wide, and intersected in drill holes up to 350m below surface. The main trend is 290° with an almost vertical dip. There has been a total of 145 diamond drill holes completed on the property totaling 37,154 metres. The QP considers the Project to have relevant exploration potential along strike of the main identified São Jorge shear structure which hosts the Mineral Resource. Along strike from the drilling defining the Mineral Resource, there is very limited to no drilling and remain potential targets to discover additional mineralisation. Additional targets exist below the limits of diamond drilling where the boundaries of mineralisation have not been defined.

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

In summary, the constrained Mineral Resource estimate, reported above a 0.30 g/t cut-off (oxide + sulphide) for the Project is:

14.275Mt at an average grade of 1.55g/t Au of Indicated Mineral Resources; and

17.58Mt at an average grade of 1.27g/t Au of Inferred Mineral Resources.

| | ■ | Potential head grade enhancement may be possible through selective mining of internal waste based on pit mapping and grade control; and |

| | ■ | Potential head grade enhancement may result from further upgrading of inferred resource to indicated. |

In the QPs' opinion, the property warrants a Preliminary Economic Assessment (PEA) to define the next course of action.

Mr. Rodriguez and Mr. Soares have the following recommendations:

| | ■ | A new exploration program and budget to drill test and support the conversion of targets to Mineral Resources; |

| | ■ | A study to determine the optimum drilling grid (drill spacing) for Mineral Resource conversion from Inferred to Indicated, based on the current database. One method is based on analysis of kriging variances for existing samples in the study area; |

| | ■ | Evaluate underground Mineral Resource potential beneath the current open pit model at São Jorge; and |

| | ■ | Prepare a preliminary economic analysis (PEA), to further evaluate the economic potential of an open-pit operation and advance opportunities to upgrade and expand the current resource base. |

The QPs also recommend the following Phase I exploration program for the São Jorge project:

| | ■ | Diamond drilling to advance opportunities to upgrade and expand the current resource base including drilling near surface (to approx. 200m depth) existing Mineral Resources to potentially upgrade Inferred resources to Indicated resources. |

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

| | ■ | Additional modelling and interpretation of previously collected geophysical data: |

| | ☐ | Airborne magnetic survey completed by Fugro in 2006 that covers the entire property to identify possible structures for follow-up exploration. |

| | ☐ | Induced polarization survey (120 line km) completed by Fugro in 2011 that covers the strike extents of the São Jorge deposit with a particular emphasis on the resistivity +/- chargeability anomaly located along strike and for 2.5km southeast of the São Jorge deposit. |

| | ■ | Trenching and sampling of targets identified by the modelling and interpretation of the geophysical data. |

| | ■ | Near-deposit diamond drilling of geophysical-geochemical targets. |

| | ■ | A thorough re-examination of the existing diamond drill core including investigating potential additional sampling opportunities in areas that were not historically sampled. |

| | ■ | Conduct additional density measurements across representative lithologies for any additional diamond drilling programs. |

| | ■ | Develop a regional geochemical program to identify new targets on the largely unexplored São Jorge property. The program would consist of regional soil traverses using the existing east-west roads that cross the property. |

If a decision is made to move forward and advance the Project, it is recommended that more formal social and community programs should be established. Each program should be developed to address stakeholder concerns and needs to be sustainable.

GE21 Consultoria Mineral, (GE21) has been commissioned by GoldMining Inc. (GMI) to prepare an updated Independent Technical Report on the Mineral Resource for the São Jorge Gold Project (the Project) in Para State, Brazil. GE21 Consultoria Mineral assigned Mr. Porfirio Rodriguez, and Mr. Leonardo de Moraes Soares, all Qualified Professionals as recognized under NI 43-101, to prepare the technical report.

The QPs are unaware of any exploration work that has been undertaken on this project since 2012. This has also been verified by the authors by reviewing public disclosures, the technical data provided and by the site visit by Mr. Soares. All programs of sampling and assaying from exploration drilling to the effective date have been included in this report. This updated report reflects changes in metal prices and updated resource estimations based upon modified resource parameters and is based on the São Jorge Gold Project, Pará State, Brazil, Amended Independent Technical Report on Mineral Resources prepared by Coffey Mining on behalf of Brazil Resources Inc, and dated 15th January 2014.

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

This report complies with NI 43-101. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for public disclosure by issuer of scientific and technical information concerning mineral projects.

The issuer for whom this report has been prepared is GMI, a corporation under the laws of Canada.

Mr. Soares visited the São Jorge Gold Project on May 24 and May 25, 2021, where he reviewed the property, verified the infrastructure, procedures, data and the geological data used to prepare the Mineral Resource estimate. Such visit is being treated as the current personal inspection for the purposes of this report. Mr. Rodriguez last visited the Project in July 2012.

During the site visit, the QP conducted technical discussions and reviewed with the issuer’s local project geologist the lithology, mineralisation, alteration and structures. Such visit is being treated as the current personal inspection for the purposes of this report.

See Section 12.2 for further information regarding the site visit.

All costs in this study have been expressed in US dollars unless noted otherwise.

2.2 | Principal Sources of Information |

In addition to information collected through a current site visit undertaken by Leonardo Soares, to the São Jorge Gold Project on May 24th and 25th, 2021, the authors of this report prepared the report based upon information provided by GMI to the QPs during the course of the QPs' investigations and extensive discussions with GMI staff in Brazil. A list of the principal sources of information reviewed is provided below:

| | ■ | Coffey (2008) – NI43-101 Technical Report (resource estimate) on São Jorge Project, Para State, Brazil, for Talon Resources; |

| | ■ | Coffey (September 2010) – NI43-101 Technical Report (resource estimate) on São Jorge |

Project, Para State, Brazil, for Brazilian Gold Corporation;

| | ■ | Coffey (June, 2011) – Preliminary Economic Assessment NI 43-101 Technical Report on São Jorge Project, Pará State, Brazil for Brazilian Gold Corporation. |

| | ■ | Coffey (November, 2013) – NI 43-101 Independent Technical Report on Mineral Resources on São Jorge Project, Pará State, Brazil for Goldmining Inc |

The QP has made independent enquiries to verify and establish the completeness and authenticity of the information provided and identified.

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

2.3 | Qualifications and Experience |

GE21 is a consulting firm specializing in the areas of geology, mining and geotechnical engineering, metallurgy, hydrogeology, hydrology, tailings disposal, environmental science and social and physical infrastructure.

The “qualified persons” (as defined in NI 43-101) for the purpose of this report are Porfirio Cabaleiro Rodriguez and Leonardo Soares.

This report has been compiled by Mr. Rodriguez, who is a professional Mining Engineer with more than 40 years of experience in Mineral Resource and mineral reserve estimation. His experience is spread across several commodities including uranium, iron ore, gold and nickel, among others. Mr. Rodriguez is a Fellow of the Australian Institute of Geoscientists (FAIG). Mr. Rodriguez is a principal engineer with GE21.

Mr. Rodriguez was supported by Leonardo Soares, a geologist with more than 16 years of experience, most of them in resource estimation on gold properties. His experience is spread across several commodities including iron ore, gold, copper, among others. Mr. Soares is a Member of the Australian Institute of Geoscientists (MAIG). Mr. Soares is an employee of GE21. Mr. Soares visited the São Jorge Gold project site between May 24th and 25th, 2021. Mr. Rodriguez is a principal geologist with GE21.

Neither GE21 nor the authors of this report have or have had any material interest in GMI or related entities or interests. GE21, and the QPs of this report’s relationship with GMI is solely one of professional association between client and independent consultant. This report is prepared in return for fees based on agreed commercial rates and the payment of these fees is in no way contingent on the results of this report.

This report is intended to be used by GMI, subject to the terms and conditions of its contract with GE21. This contract permits GMI to file this report as a Technical Report with Canadian Securities Regulatory Authorities pursuant to National Instrument 43-101, Standards of Disclosure for Mineral Projects.

2.4 | Units of Measurements and Currency |

Metric (SI) units are used throughout this report unless noted otherwise. Currency is in United States dollars ("US$"). At the time of writing this report, on May 31, 2021 the currency exchange rate was approximately 5.2328 Brazilian Real per US$, the spot gold price was US$1,905 per Troy ounce, and the three year average closing gold price on the COMEX was $1,554 per Troy ounce.

The QPs did not convert any currency figures during this study. A conversion factor of 31.1035 grams per Troy ounce was used.

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

A full listing of abbreviations used in this report is provided in Table 3

Table 3 - List of Abbreviations

| Description | | | Description |

$ | United States of America dollars | | l/hr/m2 | litres per hour per square metre |

“ | Inches | | M | million |

µ | Microns | | m | metres |

3D | three dimensional | | Ma | thousand years |

AAS | atomic absorption spectrometry | | Mg | Magnesium |

Au | Gold | | ml MIK | millilitre Multiple Indicator Kriging |

bcm | bank cubic metres | | mm | millimetres |

CC | correlation coefficient | | Mtpa | million tonnes per annum |

cm | Centimetre | | N (Y) | northing |

Co | Cobalt | | Ni | nickel |

CRM | certified reference material or certified standard | | NPV | net present value |

Cu | Copper | | NQ2 | Size of diamond drill rod/bit/core |

CV | coefficient of variation | | ºC | degrees centigrade |

DDH | diamond drillhole | | OK | Ordinary Kriging |

DTM | digital terrain model | | P80 -75µ | 80% passing 75 microns |

E (X) | Easting | | Pd | palladium |

EDM | electronic distance measuring | | ppb | parts per billion |

Fe | Iron | | ppm | parts per million |

G | Gram | | psi | pounds per square inch |

Ga | Giga annun | | | |

g/m3 | grams per cubic metre | | PVC | poly vinyl chloride |

g/t | grams per tonne of gold | | QC | quality control |

HARD | Half the absolute relative difference | | QQ | quantile-quantile |

HDPE | High density poly ethylene | | RC | reverse circulation |

HQ2 | Size of diamond drill rod/bit/core | | RL (Z) | reduced level |

Hr | Hours | | ROM | run of mine |

HRD | Half relative difference | | RQD | rock quality designation |

ICP- AES | inductivity coupled plasma atomic emission spectroscopy | | SD | standard deviation |

ICPMS | inductivity coupled plasma mass spectroscopy | | SG | Specific gravity |

ISO | International Standards Organisation | | Si | silica |

kg | Kilogram | | SMU | selective mining unit |

kg/t | kilogram per tonne | | t | tonnes |

km | Kilometres | | t/m3 | tonnes per cubic metre |

km2 | square kilometres | | tpa | tonnes per annum |

kW | Kilowatts | | UC | Uniform conditioning |

kWhr/t | kilowatt hours per tonne | | w:o | waste to ore ratio |

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

3 | RELIANCE ON OTHER EXPERTS |

This report was prepared as a National Instrument 43-101 Technical Report, in accordance with Form 43-101F1, for GoldMining Inc. by the authors. The quality of information and conclusions contained herein are consistent with the level of experience of the authors of this report.

The authors of this report are not qualified to provide extensive comment on legal land title status associated with the GMI concessions in Brazil included in Section 4.4 of this report. As such, for the purposes of its assessment of legal title in Section 4.4 hereof, the QPs have relied on information regarding such legal title status provided to them by GMI and have not been independently verified by the authors. The authors have relied on GMI, for the information on tenement status for the São Jorge project, which was provided in a tabular format with an effective date of May 31, 2021, which consisted of a list of land holdings compiled from the National Mining Agency´s record. The information related to tenement status has been relied upon solely for the purpose of listing the land holdings as stated in Section 4.4.

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

4 | PROPERTY DESCRIPTION AND LOCATION |

4.1 | Background Information on Brazil |

Brazil occupies a land surface area of about 8.5 million square kilometres, slightly larger than Australia. The climate is largely tropical, with more temperate regions in the south. The topography is mostly flat, with rolling lowlands in the north, some plains and a narrow coastal belt. The total population is about 211 million (2020) and literacy is about 93% (2018). The official language is Portuguese, while English, Spanish and French are also spoken. The capital city is Brasilia, located in the centre of the country, and the largest city is São Paulo.

Political conditions in Brazil are stable. Brazil has been a member of the World Trade Organization since 1995 and is a founding member of Mercosul, a trade liberalization program for South America.

The fundamentals of Brazilian macro-economic policy are based primarily on fiscal austerity, the control of inflation and free foreign exchange. The strength of the world economy and the high level of liquidity in international financial resources have accelerated production, led to more intense global trade and created favourable conditions for foreign investment and the recovery of the country’s economy since 2004. Brazil is the largest national economy in Latin America and is the world’s ninth largest economy (2018).

Brazil has a mixed economy with abundant natural resources. In the mining sector, Brazil is the second highest world exporter of iron ore and is a significant producer of copper, gold, bauxite, manganese, tin, niobium and nickel. Brazil has been the world’s largest producer of coffee for 150 years and is a major producer of soy, maize, beef, chicken, and sugar. After rapid growth in preceding decades, the country entered an ongoing recession in 2014 amid a political corruption scandal and nationwide protests. The country has been expanding its presence in international financial and commodities markets, and is one of a group of four emerging economies called the BRIC countries`

Tenements in Brazil are granted subject to various conditions prescribed by the Mining Code, including the payment of rent and reporting requirements and each tenement is granted subject to standard conditions that regulate the holder’s activities or are designed to protect the environment. These standard conditions are not detailed in this report, however where a tenement is subject to further specific conditions, these are detailed in the notes accompanying the tenement schedule.

Mineral tenements in Brazil generally comprise Prospecting Licenses, Exploration Licenses and Mining Licenses.

The holder of a granted Prospecting License, Exploration License or Mining License is not required to spend a set annual amount per hectare in each tenement on exploration or mining activities. Therefore, there is no statutory or other minimum expenditure requirement in Brazil. However, annual rental payments are made to the ANM (National Mining Agency) and the holder of an Exploration License must pay rates and taxes, ranging from R$3.70 to R$5.56per hectare, to the Local Government, as of May 2021.

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

Lodging a caveat or registering a material agreement against the tenement may protect various interests in a Mining License.

If a mineral tenement is located on private land, then the holder must arrange or agree with the landowners to secure access to the property.

4.2.1 | Prospecting Licenses |

A Prospecting License entitles the holder, to the exclusion of all others, to explore for minerals in the area of the License, but not to conduct commercial mining. A Prospecting License may cover a maximum area of 50 hectares and remains in force for up to 5 years. The holder may apply for a renewal of the Prospecting License which is subject to ANM approval. The period of renewal may be up to a further 5 years.

4.2.2 | Exploration Licenses |

An Exploration License entitles a holder, to the exclusion of all others, to explore for minerals in the area of the License, but not to conduct commercial mining. The maximum area of an Exploration License is 2,000 hectares outside of the Amazonia region and 10,000 hectares within the Amazonia region (Amazonas, Para, Mato Grosso, Amapá, Rondonia, Roraima and Acre states). An Exploration License remains in force for a maximum period of 3 years and can be extended by no more than a further 3 year period. Any extension is at ANM's discretion and will require full compliance with the conditions stipulated by the Mining Code that must be outlined in a report to ANM applying for the extension of the License.

Once the legal and regulatory requirements have been met, exploration authorisation is granted under an Exploration License, granting its holder all rights and obligations relating to public authorities and third parties. An Exploration License is granted subject to conditions regulating the conduct of activities. These include the requirement to commence exploration work no later than 60 days after the Exploration License has been published in the Federal Official Gazette and not to interrupt it without due reason for more than 3 consecutive months or 120 non-consecutive days; to perform exploration work under the responsibility of a geologist or mining engineer legally qualified in Brazil; to inform ANM of the occurrence of any other mineral substance not included in the exploration permit and to inform ANM of the start or resumption of the exploration work and any possible interruption.

If the holder of an exploration License proves the existence of a commercial ore reserve on the granted exploration License, the ANM cannot refuse the grant of a mining License with respect to that particular tenement if the License holder has undertaken the following:

| | ■ | An exploration study to prove the existence of an ore reserve. |

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

| | ■ | A feasibility study on the commercial viability of the reserve. |

| | ■ | The grant of an environmental License to mine on the particular tenement. |

A Mining License entitles the holder to work, mine and take minerals from the mining lease subject to obtaining certain approvals.

Mining rights can be denied in very occasional circumstances, where a public authority considers that a subsequent public interest exceeds that of the utility of mineral exploration, in which case the Federal Government must compensate the mining concession holder.

A Mining License in Brazil covers an area of between 2,000 hectares and 10,000 hectares, depending on the geographical area, as detailed above, and remains in force indefinitely. The holder must report annually on the status and condition of the mine.

As with other mining tenements, a Mining License is granted subject to conditions regulating the conduct of activities. Standard conditions regulating activities include matters such as:

| | ■ | The area intended for mining must lie within the boundary of the exploration area. |

| | ■ | Work described in the mining plan must be commenced no later than 6 months from the date of publication of the grant of the Mining License, except in the event of a force majeure. |

| | ■ | Mining activity must not cease for more than 6 consecutive months once the operation has begun, except where there is proof of force majeure. |

| | ■ | The holder must work the deposit according to the mining plan approved by the ANM. |

| | ■ | The holder must undertake the mining activity according to environmental protection standards stipulated in an environmental License obtained by the holder. |

| | ■ | The holder must pay the landowner’s share of mining proceeds according to values and conditions of payments stipulated by law, which is a minimum of 50% of CFEM (see below), but is usually agreed to be higher under a contract between the holder of the Mining License and the landowner. |

| | ■ | The holder must pay financial compensation to States and local authorities for exploring Mineral Resources by way of a Federal royalty being the CFEM, which is a maximum of 3% of revenue, depending on commodity. In Pará State, the royalty on gold deposits is 1%. |

An application for a Mining License may only be granted solely and exclusively to individual firms or companies incorporated under Brazilian law, which will have a head office, management and administration in Brazil, and are authorized to operate as a mining company.

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

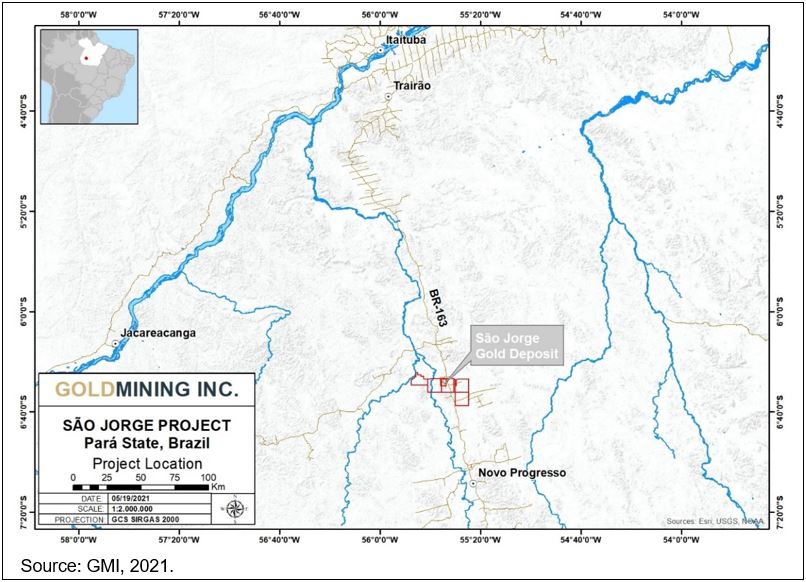

The São Jorge Gold Project is located in the southeast of Pará State, in the municipality of Novo Progresso, approximately 70km north of the town of Novo Progresso. Regional highway BR-163 passes through the São Jorge project site. The region is known as the Tapajós and São Jorge is located 320km south of the main regional city Itaituba (Figure 1).

Itaituba is located at the intersection of the Trans-Amazonica Highway with the Tapajós River. The topographical coordinates of the project are 6.48º latitude South and 55.58º longitude West. The nearest major cities with connections to international flights are Belém and Manaus. Several small regional airlines service Itaituba and Novo Progresso from Belem and Manaus.

Novo Progresso has a population of approximately 25,000 people (2020) and can supply the project with labour force, fuel and equipment that will be necessary to develop the project.

Figure 1 - São Jorge Gold Project Location Map

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

The description of the mineral tenure is based on information supplied to the QP by GMI as of May 31st, 2021.

GMI, through its Brazilian subsidiaries Brazilian Resources Mineração Ltda., Mineração Regent Brasil Ltda. and BRI Mineração Ltda., is the sole registered and beneficial holder of seven gold exploration concessions in the São Jorge project area.

The mineral rights of São Jorge Project are represented by the Processes ANM Nrs. 850.058/2002, 850.275/2003, 850.556/2013, 850.193/2017, 850.194/2017. 850.195/2017 and 850.196/2017, which comprise an aggregate area of 45,996.63 hectares in the Municipalities of Itaituba and Novo Progresso, in the State of Pará.

Processes ANM Nrs. 850.058/2002 is an exploration licence for gold ore, held by Brazilian Resources Mineração Ltda., with the Final Exploration Report submitted to ANM in July, 2013. This license encompasses the São Jorge gold deposit. On the approval of the Final Exploration Report the company will have a one year period to prepare an Economic Assessment Plan (PAE) and submit to ANM with the application for a Mining License and start the Environmental licensing process.

All the other six mineral titles are currently valid exploration licences for gold ore, of which Brazilian Resources Mineração Ltda., Mineração Regent Brasil Ltda. and BRI Mineração Ltda. GMI subsidiaries, are the titleholders.

Details of GMI’s gold concession holdings in the São Jorge region, with an effective date of May 31, 2021 are found in Table 4 and Figure 2.

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

Table 4 - São Jorge Project - Summary of GMI’s Concessions Status

Nº _ANM | Titleholder | Status | Phase | Area (ha) | District | State |

850058/2002 | Brazilian Resources Mineração Ltda. | IN PROGRESS | EXPLORATION LICENSE | 1,660.56 | Novo Progresso | Pará |

850275/2003 | Brazilian Resources Mineração Ltda. | IN PROGRESS | EXPLORATION LICENSE | 7,344.31 | Novo Progresso | Pará |

850556/2013 | Mineração Regent Brasil Ltda. | IN PROGRESS | EXPLORATION LICENSE | 9,619.15 | Novo Progresso | Pará |

8550193/2017 | BRI Mineração Ltda. | IN PROGRESS | EXPLORATION LICENSE | 7,307.93 | Novo Progresso | Pará |

850194/2017 | BRI Mineração Ltda. | IN PROGRESS | EXPLORATION LICENSE | 9,541.61 | Itaituba | Pará |

850195/2017 | BRI Mineração Ltda. | IN PROGRESS | EXPLORATION LICENSE | 9,572.68 | Novo Progresso | Pará |

850196/2017 | BRI Mineração Ltda. | IN PROGRESS | EXPLORATION LICENSE | 950.39 | Novo Progresso | Pará |

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

Figure 2 - São Jorge Project - GMI’’s Exploration Licences Location

Source: ANM, 2021

4.5 | Royalties and Agreements |

Information provided by GMI indicates a number of underlying royalties on the São Jorge Property:

| | ● | 1.0% NSR over entire property – Osisko Gold Royalties Ltd. |

| | ● | 1.0% NSR over entire property – Gold Royalty Corp. |

| | ● | 1.5% NSR over entire property – Brazilian National Mining Agency (ANM) |

| | ● | 1.0% NSR over concession 850.275/2003 on NI 43-101 Proven reserves – Tapajos Mineração Ltda. Can be purchased for US$2.5 million until September 30, 2006; no resources or reserves identified on this concession to date. |

Furthermore, if GMI is not the owner of the surface rights at the time of production, a further 0.75% NSR (set at half the ANM rate) is payable to the overlying surface rights owner.

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

Based on information supplied to the authors, GMI has complied with all its contractual obligations in respect to the original owners of the licenses (see Section 6.2 regarding Ownership History). The following payments and agreements listed below are the remaining contractual obligations to be completed by GMI:

| | • | Payment by BRML to Pedro Pacheco dos Santos Lima Neto and Tapajós Mineração Ltda. of an amount equivalent to 1% of the proven Mineral Resources within the area represented by ANM process N.850.275/2003; |

Pedro Pacheco and Tapajós sent a notice to BRML on 14 March 2013 claiming payment of an installment calculated based on the proven Mineral Resources at São Jorge based on a feasibility study. Pedro Pacheco and Tapajós claim that such feasibility study was prepared and they never received payment related thereto. BRML responded that there are no royalties or payments to be paid for Pedro Pacheco on the claim no.850.058/2002 that holds the current resources defined in the property.

4.6 | Environmental Liabilities |

The São Jorge deposit is located on an exploration license outside environmentally restricted areas.

A small open pit and 2 small leach pads remain from the previous garimpo operation that was in place in early 2000. The pit has been since filled with water. With the exception of one exploration licence that is located to the west of Jamaxim river that lies on the Jamaxim National Forest protected area (on which mining is permitted under certain conditions), all the other exploration licences of the property are located outside of environmentally restricted areas.

New legislation requires preservation of natural vegetation areas including margins of drainages that were in part degraded by previous artisanal miners activities. The company will have to comply with the minimum preservation area required by legislation and this will be verified and established based on the Environmental baseline studies that will be conducted as part of the Environmental Licensing work to be initiated after the ANM’s approval of the Final Exploration Report.

The authors have not been made aware of any current material environmental liabilities on the Property.

No additional permits, beyond what has been described in preceding sections, are required at the current stage of exploration.

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

4.8 | Other Significant Factors |

To the extent known, the QPs are unaware of any other significant factors and risks that may affect access, title, or the right or ability to perform work on the property.

5 | ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY |

Access to the São Jorge Gold Project from the city of Itaituba is via 320km of paved roads on highway BR 163, and secondary roads that transect the property (Figure 2).

Itaituba is a well-established city with good port facilities on the Tapajós River and a capacity for large freight aircraft. Itaituba is located on the Transamazonian highway, and is approximately 1,000km west of Marabá, which is 1,500km from Brasília via the Belem-Brasília highway. Itaituba can be reached by scheduled jet aircraft from Manaus and Belem, where international connections are available. The area can also be reached by a one hour flight from Itaituba using the un-paved airstrip in the village of Morais de Almeida.

GMI has planned to base its operations in Novo Progresso as this town is much closer to the project, using the following criteria;

| | ■ | Located 70km by paved road south of the project; |

| | ■ | Town of approximately 25,000 inhabitants capable of supplying labour and services to the project; |

| | ■ | Novo Progresso airport has been upgraded with a longer and wider tarmac runway; |

| | ■ | Hydro-electric transmission line from Novo Progresso can supply power to the project; |

5.2 | Physiography and Climate |

The climate is tropical with an annual rainfall of around 2,000mm and seasonal variations with a drier period between July and November and a wetter period between December and May. Existing mining operations in the region can operate year-round. The average annual temperature is approximately 27.5ºC with minimal month to month variations.

The topography is gently rolling with elevations of 150m to 400m above mean sea level.

Vegetation varies from tropical rainforest, with the project area located within farmland.

5.3 | Local Infrastructure and Services |

São Jorge has an exploration camp comprising:

| | ■ | Housing facilities for up to 40 persons; |

| | ■ | Office with phone and internet; |

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

| | ■ | Core storage and logging facility; |

| | ■ | Powerline and generator power. |

A core shed has been constructed to house all the drillcore from the project. The São Jorge exploration site is connected to the regional power line from the locality of Novo Progresso with emergency backup supplied by diesel generators. The power line will require upgrading to 138 kV capacity along with a local substation at the plant site for potential future mining operations.

A skilled work force and labour are mainly sourced from Novo Progresso located 70km to the south. Fuel, food and service companies are located in Novo Progresso.

The local economy consists mainly of cattle ranching, logging and small scale mining.

Water for industrial and potable use has been assumed to be drawn from the Jamanxim River, 9 km to the west of the project site. While GMI does not own surface rights in the Project area, they have a land use agreement with a local cattle farmer, for an area overlaying the exploration concessions, including land overlaying the Mineral Resource. As the Project is still in an exploration stage, it is premature to discuss mining personnel, potential tailings storage areas, potential waste disposal areas, and processing plant sites. However, it would be expected that such potential future infrastructure to support a mining operation could be located on undeveloped local land following the provisions of a potential future mining license.

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

The exploration history for the São Jorge property is summarised in Table 5 below.

Table 5 - São Jorge Project - Property Exploration History

Date | Entity | Work Program | Significant Results |

Before 1990 | Informal miners during Tapajós Gold Rush | Alluvial and saprolite Garimpo mining | Some gold production (not reported) |

1993 - 1995 | RTDM | Mapping, soil sampling, trenching, auger and diamond drilling (26 holes for 4350.3m) | |

1997 - 1998 | RTDM | Scoping study and diamond drilling with 16 drillholes | First Mineral Resource estimation by RTDM (non- compliant with NI 43-101 guidelines) |

1998 | Altoro | Negotiated property with RTDM but didn’t advance with the option due to a merger with Solitario Resources | |

2001 - 2005 | Tapajós Mineração Ltda | Garimpo open pit mining operation | Production of gold by heap leaching (final production not reported); final pit 400m long, 80m wide and 20 to 30m deep |

2005 | Talon (previously named BrazMin) | Phase I diamond drilling program of 48 drillholes for 10,104m. | Defined a envelope of a vein and stockwork zone of 700m strike extent |

2006 | Talon | Phase II diamond drilling program of 34 drillholes for 7,952m and airborne and ground geophysics | New targets and extensions from Wilton Zone defined to the west – ‘Kite zone” and east “Wilton East zone”. First NI 43-101-compliant Mineral Resource estimation. |

2007 | Talon | Extension of regional soil sampling grid | Anomalous gold values along 600m on one line |

2011 | BGC | 120 linear km of soil geochemistry and geophysics (IP), and drilling (14,708m) in 37 holes | Increased the Mineral Resource and upgraded the resource classification |

Gold is reported to have been first discovered in the Tapajos region in the 18th century.

Significant production has been recorded since the end of the 1970s and beginning of the 1980s, when the BR 163 (Cuiaba - Santarém road) was opened. A gold rush started in the Tapajos region with thousands of garimpeiros entering the region that was until then totally isolated. Production from the region apparently peaked between 1983 and 1989, with as many as 300,000 garimpeiros reportedly extracting somewhere between 500,000oz and 1Moz per year, predominantly based on alluvial gold. Up until 1993, production was officially estimated at 7Moz, but real production is unknown. Production has since declined, reaching an average of 160,000oz of gold per year in the late 1990s.

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

São Jorge is located in the eastern part of the so called “Tapajos Gold District”. São Jorge garimpo mining reportedly commenced in the 1970s. There are no published records to support the timing or amount of production. The exploration of the São Jorge area was initiated by Rio Tinto Desenvolvimento Minerais Ltda (“RTDM”), a subsidiary of Rio Tinto Plc Mineral Group, in 1993. At that time the São Jorge garimpeiro workings (Wilton Pit), was approximately 30m in diametre. Following sampling in this small open pit, RTDM applied for four exploration licences in order to acquire the bedrock mining rights. Additionally, they negotiated an agreement with the landowner Wilton Amorim, which enabled them to initiate exploration on the property.

The RTDM exploration program involved a 300m line spacing airborne magnetic survey, 200m by 200m soil sampling grid around the São Jorge garimpo workings, 202 auger holes totalling 1,868m (drilled on a 50m by 20m grid with infill 8m by 8m), trenching with channel sampling (total of 1,071 samples collected in 16 trenches), detailed geological mapping to define the geological and structural framework and 26 diamond drillholes for a total of 4,350.3m.

In 1997, as part of a scoping study, RTDM estimated a non-compliant NI43-101 Mineral Resource for the São Jorge Property and completed an additional 16 diamond drillhole program to test conclusions of the scoping study (see Section 6.3 below).

In March 1998, Altoro Gold Corp. (Altoro) negotiated an agreement on the property with RTDM and reviewed all data by check sampling of drillholes and surface sampling at the garimpeiro pit. However, due to a merger with Solitario Resources Corporation, no further work was completed on the property. In early 2003, RTDM relinquished the four São Jorge exploration licenses.

One of the licenees (No 850.024/02), was immediately acquired by a private individual and subsequently optioned to Centaurus Mineração e Participações Ltda (Centaurus). No exploration work was undertaken by Centaurus.

From 2001 to 2005, garimpeiro operations were undertaken by Tapajós Mineração Ltda (TML). These operations included small heap leach pads using cyanide solutions to recover gold. Production by TML was reported at 15,000t of ore per month grading 0.3 to 0.7g/t of gold. Harron (2004) reported an estimated production of “approximately 1,500 oz of gold per year.”

After garimpeiro operations ceased on the property, a pit of approximately 400m long, 80m wide and 20 to 30m deep had been excavated over the Wilton Pit area.

On July 16, 2004 Talon acquired from Centaurus a 100% interest in the São Jorge exploration licenses and in April 2005 entered into an agreement with Jaguar Resources Limited acquiring a 100% interest in the three adjacent claims.

On 14 June, 2010 Brazilian Gold Corporation (BGC) acquired from Talon a 100% interest in the São Jorge exploration licenses.

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

BGC completed an exploration program in 2011 with 14,673m of diamond drilling on the São Jorge Gold Project. The conclusions from the program are published in this report.

On November 22, 2013, BGC completed an agreement with Brazil Resources Inc. (BRI), pursuant to which BRI acquired all of the outstanding common shares of BGC. Brazil Resources Inc. announced that effective December 6, 2016, it had changed its name to GoldMining Inc. As a result of its acquisition of BGC, GMI indirectly owns Brazilian Resources Mineração Ltda., Mineração Regent Brasil Ltda. and BRI Mineração Ltd., which in turn own the Project.

Several historical mineral resource estimates have been prepared for the gold deposits on the São Jorge gold project prior to the mineral resources presented in Section 14. The reader is cautioned that the historical mineral resource estimates are being treated by GoldMining as historical in nature, and should not be relied upon, and are superseded by the resource estimate detailed in this report. Neither the QPs or GoldMining has done sufficient work to classify the historical estimates as current mineral resources and are not treating these historic estimates as current mineral resources. The following section provides a brief history of the mineral resource estimates of the project by the previous owners including the now historical 2013 Mineral Resource.

Table 6 is the historical 2013 resource statement published by BGC in 2013 contained in the report titled “São Jorge Gold Project, Para State, Brazil: Amended Independent Technical Report on Mineral Resources.”

Table 6 - 2013 Historical Mineral Resource estimate

| Lower Cutoff Grade (g/t Au) | Million Tonnes | Average Grade (g/t Au) | Contained Gold (Kozs) |

Indicated Mineral Resource | 0.3 0.4 | 14.42 12.15 | 1.54 1.77 | 715 690 |

| | 0.5 | 10.49 | 1.97 | 666 |

Inferred Mineral Resource | 0.3 0.4 | 28.19 22.43 | 1.14 1.35 | 1035 971 |

| | 0.5 | 18.78 | 1.52 | 918 |

The 2013 historic Mineral Resource uses the same categories as the Mineral Resource presented in Section 14. The key assumptions and parameters used to prepare the 2013 historic Mineral Resource are outlined in Table 7

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

Table 7 - 2013 Historic Mineral Resource estimate - Calculation Parameters

Item | Value | Unit |

Mining Cost | 1.39 | (US$/t mined) |

Processing Cost | 7.19 | (US$/t) |

G&A | 1.54 | (US$/t) |

Recovery | 90 | (%) |

Royalty etc. | 1.50 | (%) |

Gold Price | 1,300 | (US$/oz) |

Cut-off Grade | 0.3 | g/t |

Other than the above estimate, previous estimates, now treated as historical mineral resource estimates, were included in the following reports of predecessor operators:

| | ● | “Technical Report on Sao Jorge Project, Para State Brazil” with an effective date of Sept. 1, 2004 prepared for Resource Holdings & Investments Inc. by G. A. Harron P.Eng. |

| | ● | “Technical Report on Sao Jorge Project, Para State Brazil” with an effective date of Mar. 31, 2006 prepared for BrazMin Corp. by G. A. Harron P.Eng. |

| | ● | “Talon Metals Corp.: Sao Jorge Gold Project, Para State, Brazil, National Instrument 43-101 Second Technical Report” with an effective date of Sept. 4, 2008 prepared for Talon Metals Corp by Beau Nicholls, MAIG (Coffey Mining Pty Ltd.) |

| | ● | “Brazilian Gold Corporation - Sao Jorge Gold Project, Para State, Brazil, National Instrument 43-101 First Technical Report” with an effective date of Sept. 14, 2010 prepared for Brazilian Gold Corporation by Beau Nicholls, MAIG (Coffey Mining Pty Ltd.) |

| | ● | “Brazilian Gold Corporation - Sao Jorge Gold Project, Para State, Brazil, Preliminary Economic Assessment NI 43-101 First Technical Report” with an effective date of June 21, 2011 prepared for Brazilian Gold Corporation by Porfirio Cabaleiro (Coffey Mining Pty Ltd.) |

| | ● | “Brazilian Gold Corporation - Sao Jorge Gold Project, Para State, Brazil, Preliminary Economic Assessment NI 43-101” with an effective date of Jan. 31, 2013 prepared for Brazilian Gold Corporation by Curtis Clarke, MMSA (Coffey Mining Pty Ltd.) |

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

A ‘garimpo’ type operation had existed previously at São Jorge.

Harron (2004) reported a non-official production for the garimpo production at São Jorge Gold Project of approximately 1,500oz of gold per year between 2001 and 2005.

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

7 | GEOLOGICAL SETTING AND MINERALISATION |

The São Jorge Gold Project is located within the Tapajós District situated in the south-central portion of the Amazon Craton. The Amazon craton became tectonically stable at the end of the Late Proterozoic period. The Craton is generally divided into the Guyana Shield north of the Amazon River and the Brazil Shield south of the Amazon River. The provinces have a northwest trend across the shields. The Brazil Shield has, as its nucleus, the Archean granitoid - greenstone terranes of the Carajás-Imataca Province in the east. The structural provinces become younger towards the west and are dominantly granitic rocks of Paleoproterozoic age. There is a general agreement that in this region, initial oblique collision tectonism was associated with crustal shortening linked to subduction and or accretion of magmatic arcs and early continental nucleation.

The main units that form the basement of the Tapajós Gold Province are the Paleoproterozoic Cuiú-Cuiú Metamorphic Suite (2.0 to 2.4Ga old), and the Jacareacanga Metamorphic Suite, also of possible Paleoproterozoic age (>2.1Ga). The Cuiú-Cuiú Suite comprises gneisses, migmatites, granitoid rocks and amphibolites. The Jacareacanga Suite comprises a supracrustal sedimentary-volcanic sequence, which has been deformed and metamorphosed to greenschistfacies. Both Suites are intruded by granitoids of the Parauari Intrusive Suite consisting of a monzodiorite dated at 1.9 to 2.0Ga. These form the basement of the extensive felsic to intermediate volcanic rocks of the Iriri Group, dated at 1.87 to 1.89Ga, including comagmatic and anorogenic plutons of the Maloquinha Suite with intrusive events dated at 1.8 to 1.9Ga. The Iriri - Maloquinha igneous event is associated with a strong extensional period. Regional structural analysis in the Tapajós area has identified important lineaments that trend mainly northwest to southeast with a less well defined transverse east to west set.

The primary gold mineralisation in the Tapajos region is related to:

| | ■ | Lode-like mesothermal orogenic gold deposits, in the context of quartz veins in shear zones with local hydrothermal alteration in the context of the basement rocks; and |

| | ■ | Stockwork and disseminated gold with a more pervasive hydrothermal alteration in the context of the granitic and volcanic rocks, similar to porphyry and epithermal styles of mineralisation . |

The São Jorge gold deposit is related to the east extension of the regional 450km long northwest-southeast Cuiú-Cuiú - Tocantinzinho lineament which also hosts several important gold deposits including the Palito mine, Tocantinzinho deposit and Cuiú-Cuiú, Bom Jardim and Batalha gold prospects (Figure 3).

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

Figure 3 - Regional Geology Map

The São Jorge property geology (Figure 4) is covered by a granitoid pluton dominantly composed of an amphibole-biotite monzogranite In the past, this pluton was interpreted to comprise one granitoid series, however geological research completed by the Federal University of Pará (UFPA) indicates that the pluton is heterogeneous and is comprised of two main granitoid series including:

| | ■ | Older São Jorge granite - massive granites and granite porphyries composed of amphibolite, biotite monzogranite to quartz monzogranite rocks and biotite leuco-monzogranites to syenogranite rocks, massive, displaying only local, nonpenetrative foliation; |

| | ■ | Younger São Jorge granite - massive granites composed of biotite leuco-monzogranite and syenogranites occurring as circular shaped bodies, with locally brecciated foliation indicating brittle-ductile deformation as in the vicinity of gold mineralisation. |

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

The São Jorge granites frequently include 5 to 10cm long, oval-shaped mafic enclaves. They also display local rapakivi texture characterized by sparse crystals of K-feldspar mantled by plagioclase.

Figure 4 - São Jorge Project Surface Geology

The São Jorge mineralised envelope is currently estimated at 1,400 metres in length, striking WNW-ESE (110-290 degrees). The mineralised zone attains a maximum thickness of approximately 160 metres and has been shown to extend to at least 350 metres depth (limit of drilling). The mineralised zone/s are subvertical (Pedley, 2011).

Typically soil, laterite, saprolite and saprock comprise the upper 30 to 40 metres. Below this is fresh granite of a fairly narrow range of primary composition. Microscope work on representative samples indicates the following ranges for the major rock forming minerals in the weakly to moderately altered lithologies:

| Quartz: | 20 to 35 % |

| | |

| Plagioclase: | 20 to 35 % |

| | |

| K-feldspar (Microcline): | 15 to 40 % |

| | |

| Mafic minerals (chl/biot/amph): | 1 to 20 % |

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

Based upon these compositions the primary rock is mostly monzogranite though lesser amounts of granodiorite (where microcline content is lower) are present. Depending on the contribution of hornblende, biotite and magnetite, a prefix of hornblende or biotite may be added to the rock name.

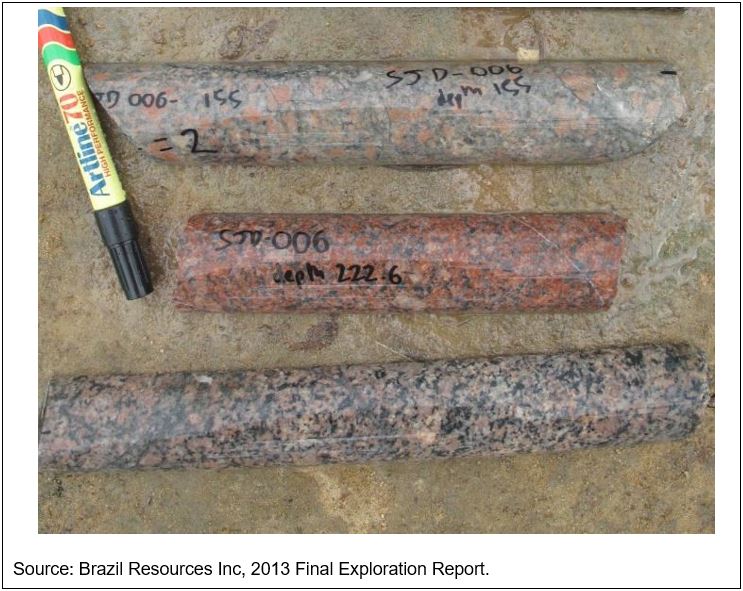

Figure 5 shows typical São Jorge lithologies; from top to bottom they are monzogranite with large orange/pink microcline crystals, 35% plagioclase (largely altered to sericite), 20% quartz; granodiorite comprised of 35% quartz, 30% plagioclase, 15% microcline and 15% chlorite (reddish colouration is due to fine hematite within plagioclase); and very weakly altered hornblende monzogranite comprised of 20% quartz, 30% plagioclase, 20% microcline, 18% hornblende, 6% biotite and 1 % chlorite. This sample is most representative of the original rock composition (Pedley, 2011).

Figure 5 - Typical São Jorge Deposit Lithologies

São Jorge Gold Project, Pará State, Brazil GE21210515

Independent Technical Report on Mineral Resources – 31 May 2021

The São Jorge granites are mostly medium grained and equigranular but where potassic alteration is advanced, microcline crystals up to 100mm size may give the rock a coarse porphyritic texture. A small percentage (<0.5%) of the rock mass is comprised of fine grained aplites which are pink/orange K-feldspar rich, cross-cutting and up to three metres thick. A small amount of leuco-granite is present in some boreholes; comprised mainly of K-feldspar, possibly as a result of pervasive potassic alteration. Where intensely sheared, the granite composition and texture is unrecognisable and the lithology is best described as a low-grade metamorphic granite or meta-granite (Pedley, 2011).

The main variable in the São Jorge lithology is alteration. The main visible alteration types are:

| | ■ | Sericitisation of plagioclase |

| | ■ | Chloritisation of hornblende and biotite |

| | ■ | Microclinisation (potassic) alteration of plagioclase |