Exhibit 99.1

Metal Mining Consultants, Inc

9137 S Ridgeline Blvd, Suite 140 | Phone: Fax: | (720) 348 - 1646 (303) 790 - 1872 |

| Highlands Ranch, Co 80129 | www.metalminingconsultants.com |

| |

| |

| |

NI 43-101 |

Technical Report |

| |

| |

GoldMining Inc |

La Mina Project |

Antioquia, Republic of Colombia |

| |

| |

Effective Date July 6, 2021 Published Date September 8, 2021 |

| |

| |

| |

Prepared By |

| |

| |

| |

Scott E. Wilson, C.P.G. Mauricio Castañeda, MAIG |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page I |

DATE AND SIGNATURE PAGE

Technical Report, La Mina Project, Antioquia, Republic of Colombia, with an effective date of July 6, 2021.

September 8, 2021

[Signed and Sealed] | Scott E. Wilson |

Scott E. Wilson, C.P.G. |

Geologist |

[Signed and Sealed] | Mauricio Castañeda |

Mauricio Castañeda, MAIG, QP |

Geologist |

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page II |

AUTHOR’S CERTIFICATE

I, Scott E. Wilson, CPG, SME-RM, of Highlands Ranch, Colorado, as an author of the technical report entitled “Technical Report, La Mina Project, Antioquia, Republic of Colombia” (the “Technical Report”) with an effective date of July 6, 2021 prepared for GoldMining Inc. (the “Issuer”) do hereby certify:

| | 1. | I am currently employed as President by Metal Mining Consultants Inc., Highlands Ranch, Colorado 80129. |

| | 2. | I graduated with a Bachelor of Arts degree in Geology from the California State University, Sacramento in 1989. |

| | 3. | I am a Certified Professional Geologist and member of the American Institute of Professional Geologists (CPG #10965) and a Registered Member (#4025107) of the Society for Mining, Metallurgy and Exploration, Inc. |

| | 4. | I have been employed as both a geologist and a mining engineer continuously for a total of 32 years. My experience included resource estimation, mine planning, geological modeling, geostatistical evaluations, project development, and authorship of numerous technical reports and preliminary economic assessments of various projects throughout North America, South America and Europe. I have employed and mentored mining engineers and geologists continuously since 2003. |

| | 5. | I have read the definition of “Qualified Person” set out in National Instrument 43-101 (“NI 43-101) and certify that by reason of my education, affiliation with a professional association (as defined in NI 43-101) and past relevant work experience, I fulfill the requirements to be a “Qualified Person” for the purposes of NI 43-101. |

| | 6. | I visited the Project and surrounding area August 18 and 19, 2012. |

| | 7. | I am responsible for all parts of Section 1, Section 2.0 through 2.7, Section 2.7.2, all parts of Sections 3 through 11, Sections 12.0 and 12.1 and all parts of Sections 13 through 26 of the Technical Report. |

| | 8. | I am independent of the Issuer as independence is described in Section 1.5 of NI 43-101. |

| | 9. | Prior to being retained by the Issuer, I have not had prior involvement with the property that is the subject of the Technical Report. |

| | 10. | I have read NI 43-101 and Form 43-101F1, and this Technical Report was prepared in compliance with NI 43-101. |

| | 11. | As of the effective date of this Technical Report, to the best of my knowledge, information and belief, the portions of the Technical Report for which I am responsible contain all scientific and technical information that is required to be disclosed to make the portions of the Technical Report for which I am responsible not misleading. |

Dated: September 8, 2021

[“Signed and Sealed”] |

Scott E. Wilson, C.P.G. |

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page III |

AUTHOR’S CERTIFICATE

I, Mauricio Castañeda, MAIG, of Medellin, Colombia, as an author of the technical report entitled “Technical Report, La Mina Project, Antioquia, Republic of Colombia” (the “Technical Report”) with an effective date of July 6, 2021 prepared for GoldMining Inc. (the “Issuer”) do hereby certify:

| | 1. | I am an independent consulting mineral exploration specialist doing business as Mauricio Castañeda at the address of Cra. 48 98A Sur 250, Medellín, Colombia. |

| | 2. | I graduated with a Bachelor of Science and Engineering in Geological Engineering from Universidad EIA (Former Escuela de Ingeniería de Antioquia) in Medellín, Colombia. |

| | 3. | I am a Member of the Australian Institute of Geoscientists (AIG Member ID 5443) and Member of Canadian Institute of Mining, Metallurgy and Petroleum (CIM Member No. 706703). I have worked as a geologist continuously for approximately 22 years since my graduation from university. |

| | 4. | I have been involved in mining, mineral exploration and mineral resource evaluation practice for approximately 22 years. My relevant experience for the purpose of the Technical Report is acting as an independent mineral exploration consultant specializing in the precious and base metal exploration, managing and leading mineral exploration in early and advanced projects, managing and leading mining operations, and evaluating base and precious metal projects, scoping, prefeasibility and feasibility studies. |

| | 5. | I have read the definition of “Qualified Person” as set out in the Canadian National Instrument 43-101 Standards of Disclosure for Mineral Properties (“NI 43-101”) and certify that by reason of my education, affiliation with a professional association (as defined in NI 43-101), and past relevant work experience, I fulfill the requirements to be a “Qualified Person” for the purposes of NI 43-101. |

| | 6. | I visited the Project on June 12, 2021. |

| | 7. | I am responsible for all parts of Section 1, Section 2.7.1, all parts of Sections 4 and 5, and Section 12.2 of the Technical Report. |

| | 8. | I am independent of the Issuer as independence is described in Section 1.5 of NI 43-101. |

| | 9. | Prior to being retained by the Issuer, I have not had prior involvement with the property that is the subject of the Technical Report. |

| | 10. | I have read NI 43-101 and Form 43-101F1, and this Technical Report was prepared in compliance with NI 43-101. |

| | 11. | As of the effective date of this Technical Report, to the best of my knowledge, information and belief, the portions of the Technical Report for which I am responsible contain all scientific and technical information that is required to be disclosed to make the portions of the Technical Report for which I am responsible not misleading. |

Dated September 8, 2021

[“Signed and Sealed”] |

Mauricio Castañeda, MAIG. |

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page IV |

Table of Contents

| 1 | Summary | 14 |

| 2 | Introduction | 15 |

| | 2.1 | Mineralization | 15 |

| | 2.2 | La Mina Mineral Resources | 16 |

| | 2.3 | Metallurg | 18 |

| | 2.4 | Infrastructure | 18 |

| | | 2.4.1 | Transportation | 18 |

| | | 2.4.2 | Power | 19 |

| | | 2.4.3 | Labor | 19 |

| | | 2.4.4 | Water | 19 |

| | | 2.4.5 | Security | 19 |

| | 2.5 | Environmental and Social | 20 |

| | 2.6 | Recommendations | 20 |

| | 2.7 | Purpose of Technical Report | 21 |

| | | 2.7.1 | Personal Inspection | 21 |

| | | 2.7.2 | Terms of Reference | 21 |

| | | | 2.7.2.1 | Units of Measure - Abbreviations | 22 |

| | | | 2.7.2.2 | Acronyms and Symbols | 23 |

| 3 | Reliance on Other Experts | 24 |

| 4 | Property Description and Location | 25 |

| | 4.1 | Area and Location | 25 |

| | 4.2 | Mineral Tenure | 27 |

| | 4.3 | SurFace Rights Agreements | 29 |

| | 4.4 | General | 29 |

| 5 | Accessibility, Climate, Local Resources, Infrastructure and Physiography | 30 |

| | 5.1 | Access and Infrastructure | 30 |

| | 5.2 | Physiography | 30 |

| | 5.3 | Climate | 30 |

| 6 | History | 31 |

| | 6.1 | Exploration Prior to 2002 | 31 |

| | 6.2 | Exploration 2002-2008 | 31 |

| | 6.3 | AGA Drilling | 33 |

| 7 | Geological Setting and Mineralization | 34 |

| | 7.1 | Regional Geology | 34 |

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page V |

| | 7.2 | Property Geology | 38 |

| | 7.3 | Intrusive Rocks | 39 |

| | | 7.3.1 | X2 Porphyry (X2) | 40 |

| | | 7.3.2 | X1 Porphyry (X1) | 41 |

| | | 7.3.3 | X3 Porphyry (x3) | 41 |

| | | 7.3.4 | La Cantera Porphyry (C1) | 41 |

| | | 7.3.5 | El Limon Porphyry (L1) | 42 |

| | | 7.3.6 | El Limon Porphyry (L2) | 42 |

| | | 7.3.7 | El limon Porhyry (L3) | 43 |

| | | 7.3.8 | G1 Porphyry (G1) | 43 |

| | | 7.3.9 | G2 Porphyry (G2) | 43 |

| | | 7.3.10 | G4 Porphyry (G4) | 44 |

| | | 7.3.11 | Intrusive Breccias | 44 |

| | 7.4 | Volcanic Rocks | 45 |

| | 7.5 | Structure | 45 |

| | 7.6 | La Cantera Prospect Geology | 46 |

| | 7.7 | La Cantera Prospect Alteration | 48 |

| | 7.8 | La Cantera Prospect Mineralization | 51 |

| | 7.9 | Middle Zone Prospect Geology | 53 |

| | 7.10 | Middle Zone Prospect Alteration | 54 |

| | 7.11 | Middle Zone Propsect Mineralization | 55 |

| | 7.12 | La Garrucha Prospect Geology | 57 |

| | 7.13 | La Garrucha Prospect Alteration | 60 |

| | 7.14 | La Garrucha Propect Mineralization | 61 |

| | 7.15 | El Limon Propsect Geology | 61 |

| | 7.16 | El Limon Propsect Alteration | 62 |

| | 7.17 | El Limon Prospect Mineralization | 62 |

| 8 | Deposit Types | 63 |

| 9 | Exploration | 64 |

| 10 | Drilling | 67 |

| | 10.1 | La Cantera Drilling | 67 |

| | 10.2 | Middle Zone Drilling | 71 |

| | 10.3 | La Garrucha Drilling | 74 |

| | 10.4 | El Limon Drilling | 75 |

| | 10.5 | Trenching | 76 |

| | 10.6 | Rock Sampling and Soil Geochemistry | 76 |

| 11 | Sample Preparation, Analyses, and Security | 77 |

| | 11.1 | Standard, Blank, and Duplicate Samples | 78 |

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page VI |

| | | 11.1.1 | Standard Results | 79 |

| | | 11.1.2 | Blank results | 92 |

| | | 11.1.3 | Duplicate Types and results | 97 |

| | 11.2 | Independent Check Assay Program | 100 |

| | 11.3 | Summary of QA/QC Program | 103 |

| 12 | Data Verification | 106 |

| | 12.1 | Assay Certificate and Drill Hole Database Validation | 106 |

| | 12.2 | Current Inspection and DATA VALIDATION | 107 |

| 13 | Mineral Processing and Metallurgical Testing | 124 |

| | 13.1 | Summary | 124 |

| | 13.2 | Metallurgical Introduction | 124 |

| | | 13.2.1 | Metallurgical Test Work | 125 |

| | | 13.2.2 | Sample Preparation and Characterization | 125 |

| | 13.3 | In-Place Bulk Densities | 126 |

| | 13.4 | Ball Mill Work Indices | 127 |

| | 13.5 | Grind Studies | 127 |

| | 13.6 | Gravity Tests | 128 |

| | 13.7 | Whole Ore Cyanidation Leach tests | 130 |

| | 13.8 | Flotation Tests | 131 |

| | | 13.8.1 | Rougher Flotation | 131 |

| | 13.9 | 2016 met tests | 135 |

| | 13.10 | Metallurgical Conclusions | 136 |

| | 13.11 | Recommendations | 136 |

| 14 | Mineral Resource Estimate | 137 |

| | 14.1 | Resource Estimation Procedures | 137 |

| | 14.2 | La Cantera Resources Estimate | 137 |

| | | 14.2.1 | Database for Geologic Model | 137 |

| | | 14.2.2 | Geologic Model | 143 |

| | | 14.2.3 | Topography | 149 |

| | | 14.2.4 | Block Model | 149 |

| | | 14.2.5 | Grade Estimation | 152 |

| | | 14.2.6 | Block Model Validation | 156 |

| | | 14.2.7 | Density | 156 |

| | | 14.2.8 | Inferred and Indicated Mineral Resources | 156 |

| | 14.3 | Middle Zone Resource Estimation | 157 |

| | | 14.3.1 | Database for Geologic Model | 157 |

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page VII |

| | | 14.3.2 | Geologic Model | 162 |

| | | 14.3.3 | Topography | 169 |

| | | 14.3.4 | Block Model | 169 |

| | | 14.3.5 | Grade Estimation | 171 |

| | | 14.3.6 | Density | 174 |

| | | 14.3.7 | Pit Constraining Optimization Criteria including Metals Pricing Used | 174 |

| | | 14.3.8 | Inferred and Indicated Mineral resources | 175 |

| | 14.4 | La Mina Resources | 176 |

| | | 14.4.1 | Block Model Validation | 177 |

| | | | 14.4.1.1 | Visual Validation | 177 |

| 15 | Mineral Reserve Estimates | 178 |

| 16 | Mining Methods | 179 |

| 17 | Recovery Methods | 180 |

| 18 | Project Inrastructure | 181 |

| 19 | Market Studies and Contracts | 182 |

| 20 | Environmental Studies, Permitting and Social or Community | 183 |

| 21 | Capital and Operating Costs | 184 |

| 22 | Economic Analysis | 185 |

| 23 | Adjacent Properties | 186 |

| 24 | Other Relevant Data and Information | 187 |

| 25 | Interpretation and Conclusions | 188 |

| 26 | Recommendations | 189 |

| 27 | References | 190 |

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page VIII |

LIST OF TABLES

| Table 2‑1 | La Mina Indicated Resources for July 2021 | 17 |

| Table 2‑2 | La Mina Inferred Resources for July 2021 | 17 |

| Table 4‑1 | La Mina Property Ownership | 28 |

| Table 6‑1 | AGA Drill Results | 32 |

| Table 7‑1 | Lithological Descriptions | 40 |

| Table 9‑1 | Drilling Completed by Bellhaven at La Mina | 64 |

| Table 10‑1 | La Cantera Drilling - All Holes | 70 |

| Table 10‑2 | La Cantera Deposit Significant Intercepts Through February 2012 | 71 |

| Table 10‑3 | Middle Zone Collar Surveys | 72 |

| Table 10‑4 | Middle Zone deposit Drilling Subsequent to the 2012 Resource | 73 |

| Table 10‑5 | La Garrucha Drill Holes Location and Depth | 74 |

| Table 10‑6 | La Garrucha Significant Drill Core Intercepts | 74 |

| Table 10‑7 | El Limon Drill Holes and Locations | 75 |

| Table 10‑8 | El Limon Significant Drill Intercepts | 76 |

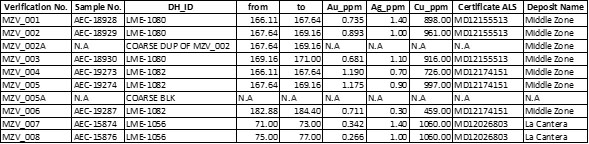

| Table 12‑1 | Example of Database Validation Table | 107 |

| Table 12‑2 | Original samples and assay results from the intervals selected for resampling by the QP (initial sampling as reported from the ALS Chemex lab). | 118 |

| Table 12‑3 | Check samples collected by the QP to be compared to the initial ½ core samples (results as determined by Bureau Veritas.) | 118 |

| Table 13‑1 | Description of Composite Samples | 125 |

| Table 13‑2 | Head Analysis of Bellhaven Samples | 125 |

| Table 13‑3 | Proportion of Different Forms of Copper in the Bellhaven Samples | 125 |

| Table 13‑4 | ICP Analyses of Composite Samples | 126 |

| Table 13‑5 | In Place Bulk Densities for the Selected Core Samples | 127 |

| Table 13‑6 | Bond's Ball Mill Work Index @ 100 Mesh | 127 |

| Table 13‑7 | Gravity Test Results for Composite No. 1 | 128 |

| Table 13‑8 | Gravity Test Results for Composite No.2 | 129 |

| Table 13‑9 | Gravity Test Results for Composite No. 3 | 129 |

| Table 13‑10 | Gravity Test Results for Composite No. 4 | 130 |

| Table 13‑11 | Cyanidation Leach Test Results (P80 = 200 Mesh) | 131 |

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page IX |

| Table 13‑12 | Carbon-in-Leach (CIL) Test Results | 131 |

| Table 13‑13 | Flotation Process Test Parameter | 132 |

| Table 13‑14 | Flotation Test Results for Composite No. 1 | 133 |

| Table 13‑15 | Flotation Test Results for Composite No. 2 | 134 |

| Table 13‑16 | Flotation Test Results for Composite No. 4 | 135 |

| Table 14‑1 | La Cantera Block Model Parameters | 150 |

| Table 14‑2 | Parameters for Ordinary Kriging Based on Nested Variography | 152 |

| Table 14‑3 | Pit Constrained Resources for La Cantera | 157 |

| Table 14‑4 | Total Resources with 0.25 g/t Cut-off for La Cantera | 157 |

| Table 14‑5 | Total Project Drill Holes | 157 |

| Table 14‑6 | Middle Zone Block Parameters | 169 |

| Table 14‑7 | Middle Zone Capping Criteria | 171 |

| Table 14‑8 | BMO Analysis of Metals Price Used for Determining Resources | 174 |

| Table 14‑9 | Pit Constrained Resources for Middle Zone | 175 |

| Table 14‑10 | Total Resources with 0.25g/t Cutoff for Middle Zone | 176 |

| Table 14‑11 | In-Pit Resources for La Mina Project (La Cantera and Middle Zone) | 176 |

| Table 14‑12 | Total Indicated and Inferred Resources for La Mina Project (Cutoff Grade 0.25g/t Au) | 176 |

| Table 26‑1 | Proposed Phase 1 Work Program to advance La Mina | 189 |

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page X |

LIST OF FIGURES

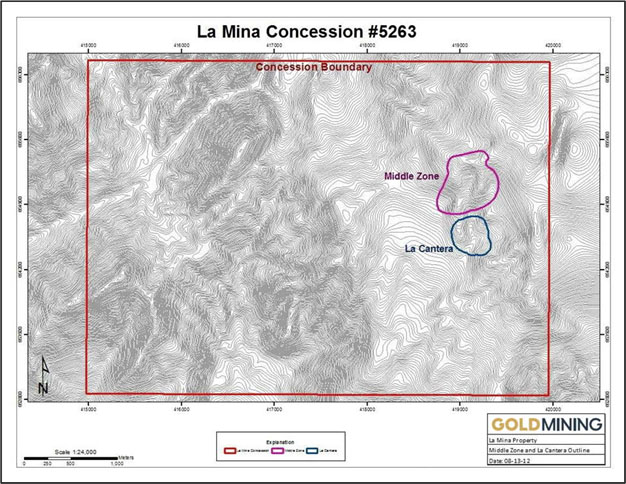

| Figure 4‑1 | La Mina Property, Colombia | 26 |

| Figure 4‑2 | La Mina Project Location and Access Map | 27 |

| Figure 4‑3 | Claim Map Showing Location of La Mina Porphyry Bodies in Relation to Concession Boundaries | 28 |

| Figure 6‑1 | Portion of Aerial Magnetics, Avasca Joint Venture 2007 | 32 |

| Figure 7‑1 | Geomorphological Regions of Colombia Showing the Approximate Location of La Mina | 35 |

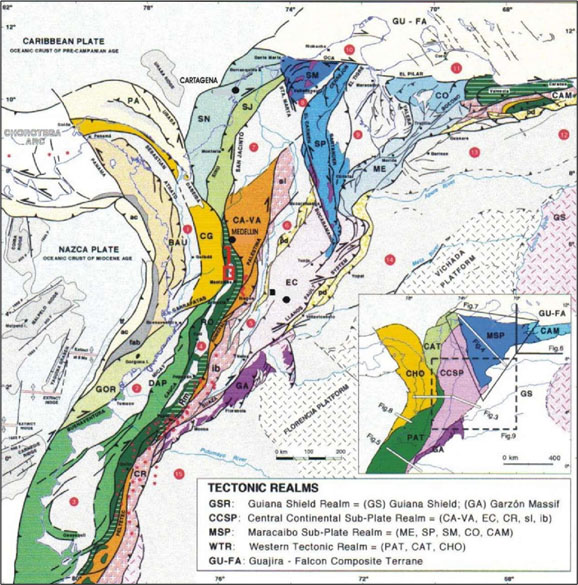

| Figure 7‑2 | Tectonic Map of Colombia | 37 |

| Figure 7‑3 | Generalized Geologic Map of the La Mina Project Area | 38 |

| Figure 7‑4 | Surface Geology of the La Cantera Prospect Showing the Location of the Drill Holes | 47 |

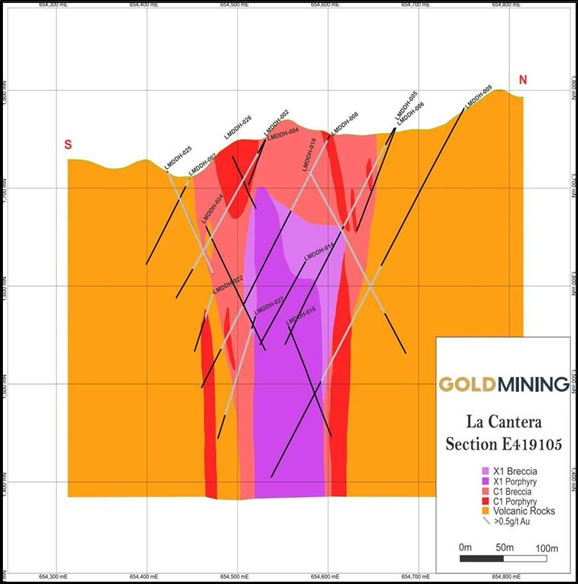

| Figure 7‑5 | North-South Cross Section (Looking West) of Geology through the La Cantera Deposit | 48 |

| Figure 7‑6 | LMDDH-008-288m. C1 Porphyry with Pervasive Biotite-Magnetite Alteration of the Matrix and Actinolite Alteration of Primary Magmatic Mafic Phenocrysts | 49 |

| Figure 7‑7 | LMDDH-016 392.5m. C1 Breccia with Potassic Alteration (Magnetite-k-Feldspar +/- Actinolite) Cut by Sheeted Magnetite Veins, Quartz Magnetite Stockwork Veins and Late Pyrite-filled Fractures | 50 |

| Figure 7‑8 | Drill Hole Intercepts with >0.5g/t Au in the La Cantera Prospect | 52 |

| Figure 7‑9 | Surface Geology and Drill Holes Used in Resource Estimate at Middle Zone Prospect | 54 |

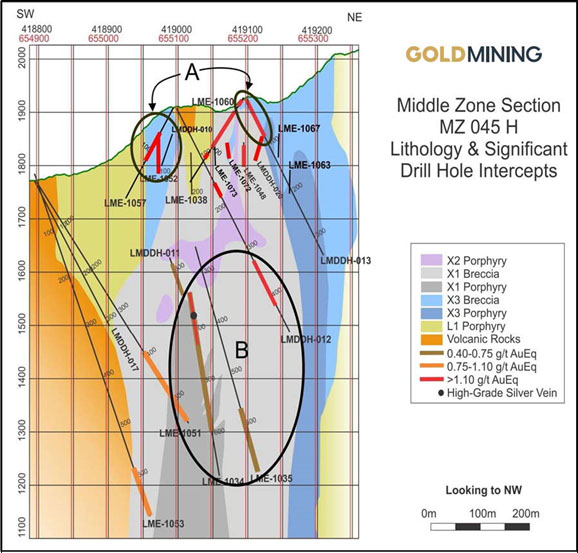

| Figure 7‑10 | NE-SW Cross Section through Middle Zone, Showing Significant Intercepts. Labels A and B Refer to the Two Distinct Mineralization Types | 56 |

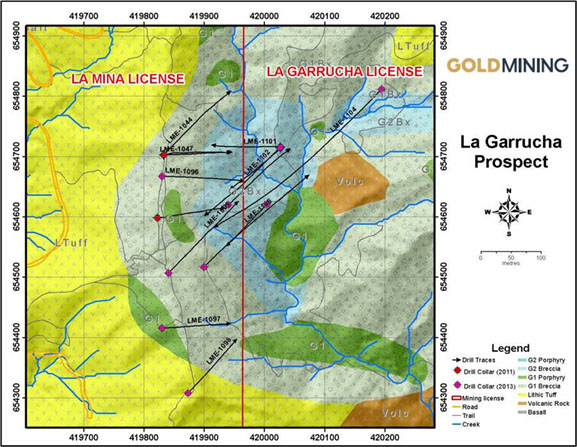

| Figure 7‑11 | Surface Geology of Drill Holes at La Garrucha | 58 |

| Figure 7‑12 | NE-SW La Garrucha Cross Section | 59 |

| Figure 7‑13 | El Limon Prospect Geology | 62 |

| Figure 9‑1 | Exploration Targets at La Mina Project | 65 |

| Figure 9‑2 | Magnetic Susceptibility Model at 100 m Depth. The Area of the Ground Magnetic Survey is the Red Box in Figure 6.1 | 66 |

| Figure 10‑1 | La Mina Drill Collar Monuments | 69 |

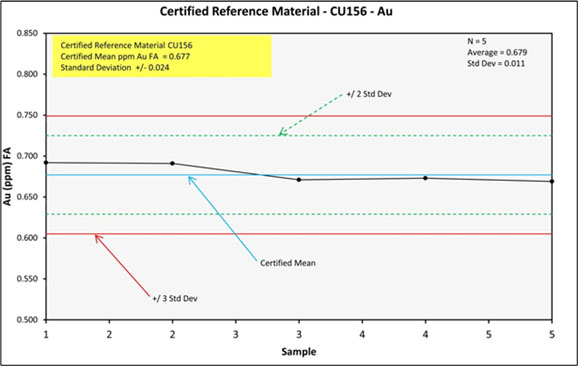

| Figure 11‑1 | Reference Material CU156 Performance for Au | 79 |

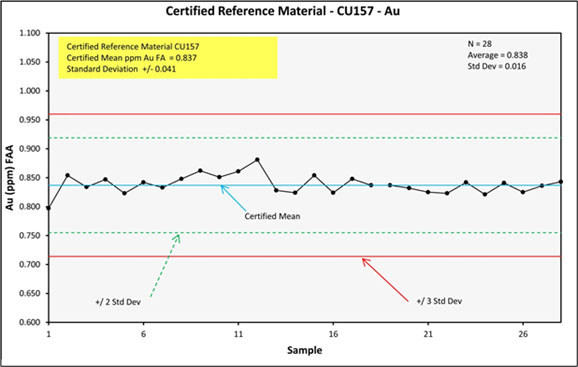

| Figure 11‑2 | Reference Material CU157 Performance for Au | 80 |

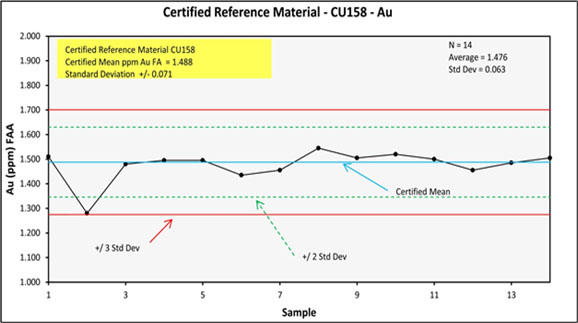

| Figure 11‑3 | Reference Material CU158 Performance for Au | 80 |

| Figure 11‑4 | Reference Material CU159 Performance for Au | 81 |

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page XI |

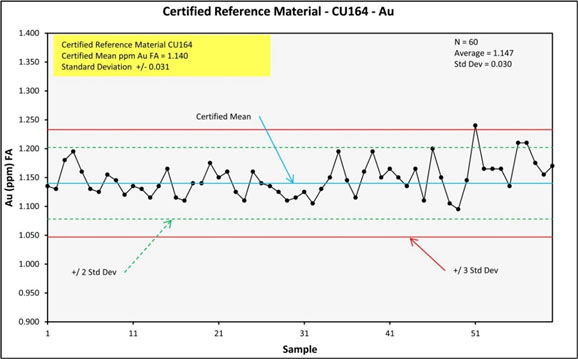

| Figure 11‑5 | Reference Material CU164 Performance for Au | 81 |

| Figure 11‑6 | Reference Material CU175 Performance for Au | 82 |

| Figure 11‑7 | Reference Material CU184 Performance for Au | 82 |

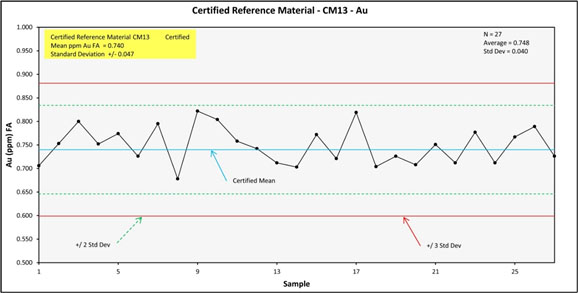

| Figure 11‑8 | Reference Material CM13 Performance for Au | 83 |

| Figure 11‑9 | Reference Material CM14 Performance for Au | 83 |

| Figure 11‑10 | Reference Material CGS27 Performance for Au | 84 |

| Figure 11‑11 | Reference Material PM434 Performance for Au | 84 |

| Figure 11‑12 | Reference Material PM436 Performance for Au | 85 |

| Figure 11‑13 | Reference Material PM438 Performance for Au | 85 |

| Figure 11‑14 | Reference Material PM446 Performance for Au | 86 |

| Figure 11‑15 | Reference Material PM447 Performance for Au | 86 |

| Figure 11‑16 | Reference Material CU156 Performance for Cu | 87 |

| Figure 11‑17 | Reference Material CU157 for Cu | 87 |

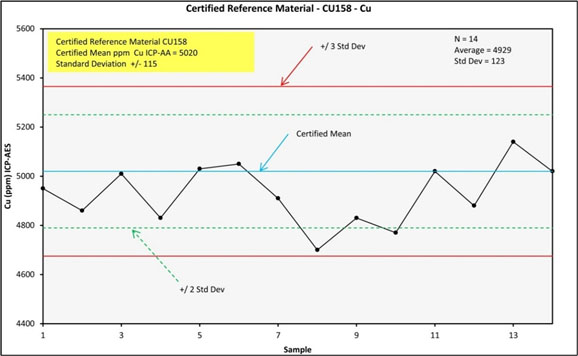

| Figure 11‑18 | Reference Material CU158 Performance for Cu | 88 |

| Figure 11‑19 | Reference Material CU159 Performance for Cu | 88 |

| Figure 11‑20 | Reference Material CU164 Performance for Cu | 89 |

| Figure 11‑21 | Reference Material CU175 Performance for Cu | 89 |

| Figure 11‑22 | Reference Material CU184 Performance for Cu | 90 |

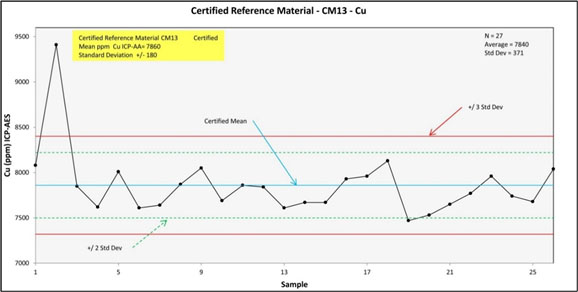

| Figure 11‑23 | Reference Material CM13 Performance for Cu | 90 |

| Figure 11‑24 | Reference Material CM14 Performance for Cu | 91 |

| Figure 11‑25 | Reference Material CGS27 Performance for Cu | 91 |

| Figure 11‑26 | Reference Material - Blank BL110 Performance for Au | 92 |

| Figure 11‑27 | Reference Material - Blank BL111 Performance for Au | 92 |

| Figure 11‑28 | Reference Material - Blank BL112 Performance for Au | 93 |

| Figure 11‑29 | Reference Material - Blank BL113 Performance for Au | 93 |

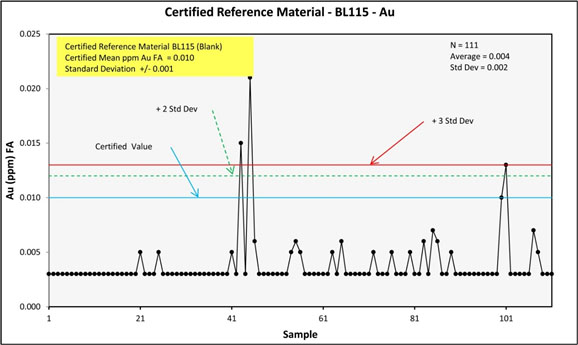

| Figure 11‑30 | Reference Material - Blank BL115 Performance for Au | 94 |

| Figure 11‑31 | Reference Material - Blank BL110 Performance for Cu | 94 |

| Figure 11‑32 | Reference Material - Blank BL111 Performance for Cu | 95 |

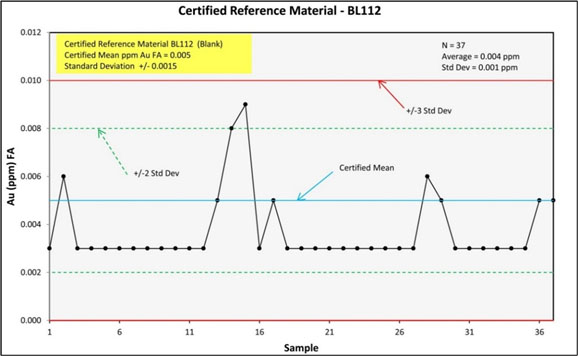

| Figure 11‑33 | Reference Material - Blank BL112 Performance for Cu | 95 |

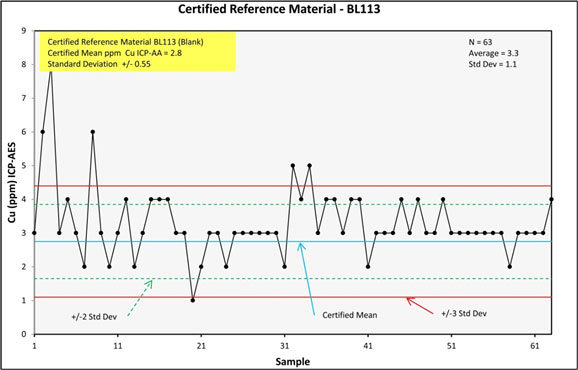

| Figure 11‑34 | Reference Material - Blank BL113 Performance for Cu | 96 |

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page XII |

| Figure 11‑35 | Reference Material - Blank BL115 Performance for Cu | 96 |

| Figure 11‑36 | Au Analyses (FA AA) for Preparation Duplicate Samples | 97 |

| Figure 11‑37 | Au Analyses (FA AA) for Preparation Duplicate Samples | 98 |

| Figure 11‑38 | Au Analyses (FA AA) for Preparation Duplicate Samples | 98 |

| Figure 11‑39 | Cu Analyses (ICP-AES) for Preparation Duplicate Samples | 99 |

| Figure 11‑40 | Cu Analyses (ICP-AES) for Preparation Duplicate Samples | 99 |

| Figure 11‑41 | Cu Analyses (ICP-AES) for Preparation Duplicate Samples | 100 |

| Figure 11‑42 | Original vs Check Sample Comparison for Middle Zone - Au The Blue Dotted lines are +/- 10% from the Mean | 101 |

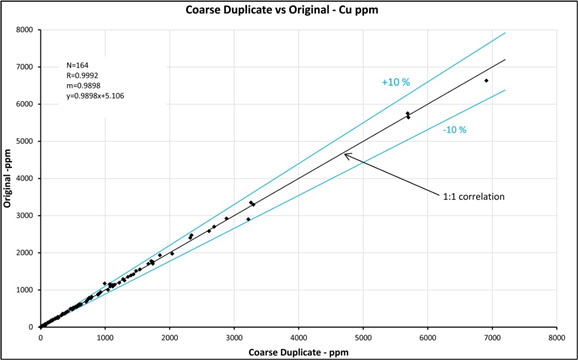

| Figure 11‑43 | Original vs Check Sample Comparison for Middle Zone - Cu The Blue Dotted Lines are +/- 10% from the Mean | 102 |

| Figure 11‑44 | Original Assays vs Rechecks - with Outliers Rejected | 103 |

| Figure 11‑45 | Changes in the Magnitude of Difference between Standards and Blanks for Copper Plotted against Date of Analysis | 105 |

| Figure 12‑1 | Gravel road from Fredonia town to La Mina Project. (source: Mauricio Castañeda, June 12, 2021) | 108 |

| Figure 12‑2 | Gate at the entrance of the facilities provides security to the drill cores, and other reliable information. (Source: Mauricio Castañeda, June 12, 2021) | 109 |

| Figure 12‑3 | Geology office and accommodation house. (Source: Mauricio Castañeda, June 12, 2021) | 109 |

| Figure 12‑4 | Electricity supply by regional grid interconnection. (Source: Mauricio Castañeda, June 12, 2021) | 110 |

| Figure 12‑5 | Warehouse drill-core storage. (Source: Mauricio Castañeda, June 12, 2021) | 111 |

| Figure 12‑6 | Pulp rejects storage. (Source: Mauricio Castañeda, June 12, 2021) | 112 |

| Figure 12‑7 | Core shed for core logging and sampling. (Source: Mauricio Castañeda, June 12, 2021) | 113 |

| Figure 12‑8 | Technician demonstrating core cutting procedures. (Source: Mauricio Castañeda, June 12, 2021) | 114 |

| Figure 12‑9 | Core logging facilities. (Source: Mauricio Castañeda, June 12, 2021) | 115 |

| Figure 12‑10 | Geology and model review by plan view and systematic sections – La Mina, Fredonia. (Source: Mauricio Castañeda, June 12, 2021) | 116 |

| Figure 12‑11 | Well organized core trays storage. (Source: Mauricio Castañeda, June 12, 2021) | 117 |

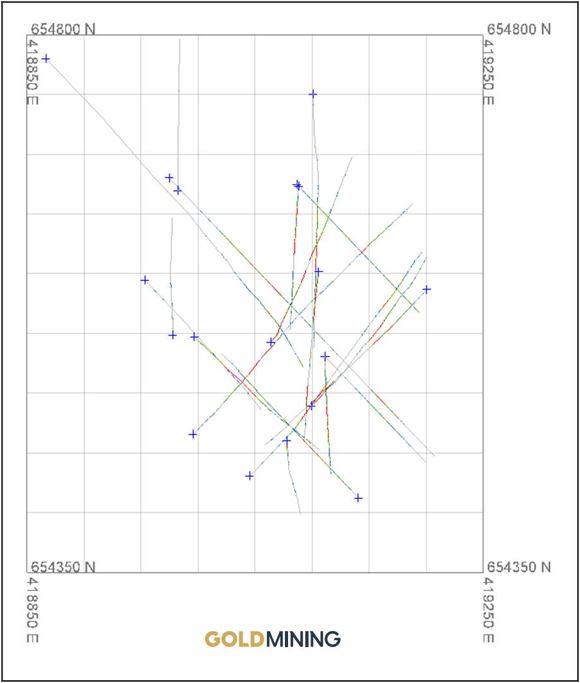

| Figure 12‑12: | Plan view & Section geology map with drill holes reviewed Middle Zone. (Source: Mauricio Castañeda, June 12, 2021) | 119 |

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page XIII |

| Figure 14‑1 | Plan View of La Cantera Drilling - Not to Scale | 138 |

| Figure 14‑2 | Isometric View La Cantera Drilling - Not to Scale | 139 |

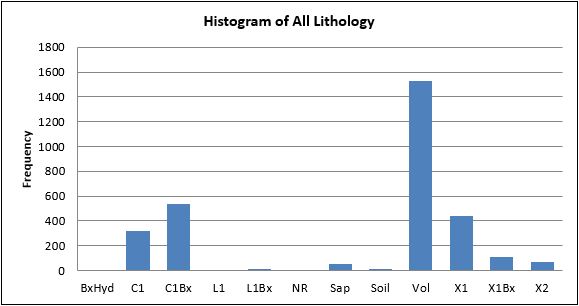

| Figure 14‑3 | Distribution of Lithology | 140 |

| Figure 14‑4 | Distribution of Major Lithologies at La Cantera | 140 |

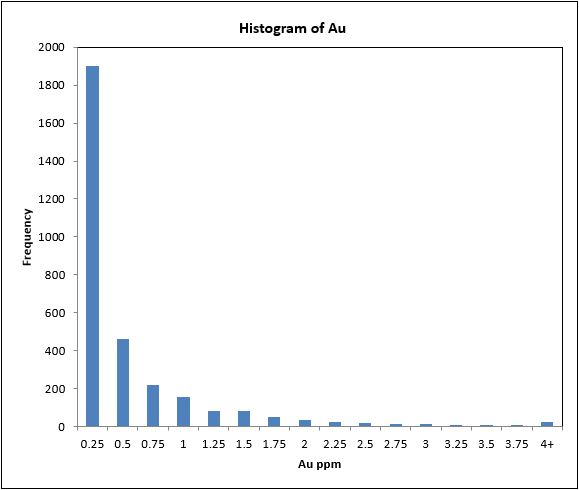

| Figure 14‑5 | Incremental Histogram for La Cantera Gold Data | 141 |

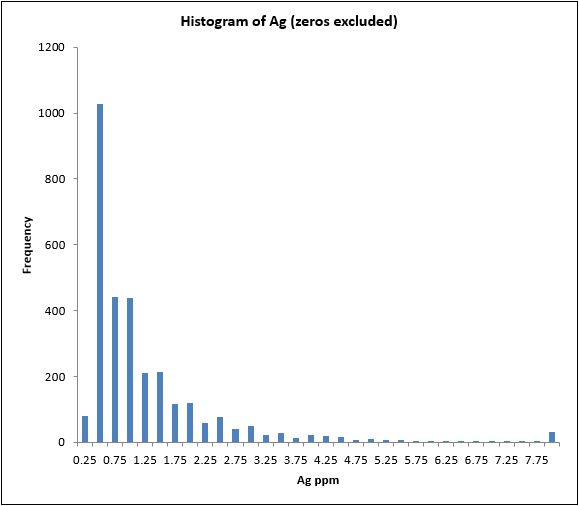

| Figure 14‑6 | Incremental Histogram for La Cantera Silver Data | 142 |

| Figure 14‑7 | Incremental Histogram for La Cantera Copper Data | 143 |

| Figure 14‑8 | Bellhaven Geologic Interpretation Section LC419105 | 145 |

| Figure 14‑9 | Bellhaven Sections with Geologic Interpretation for La Cantera | 146 |

| Figure 14‑10 | Bench Section Profiles of C and X in Vulcan | 147 |

| Figure 14‑11 | Bench Section Profiles Including Volcanic Buffer | 148 |

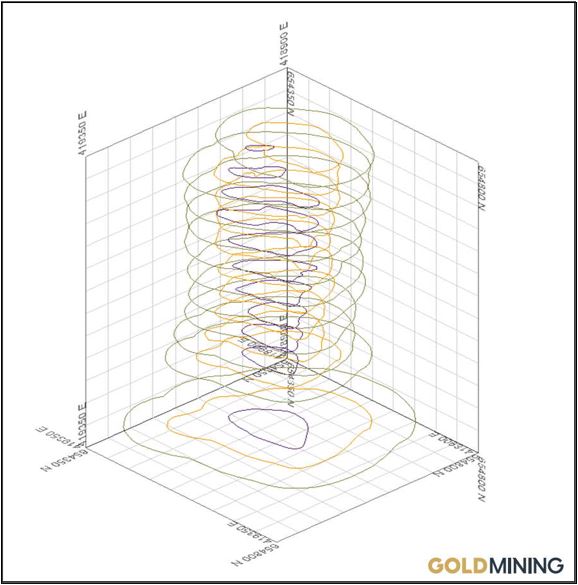

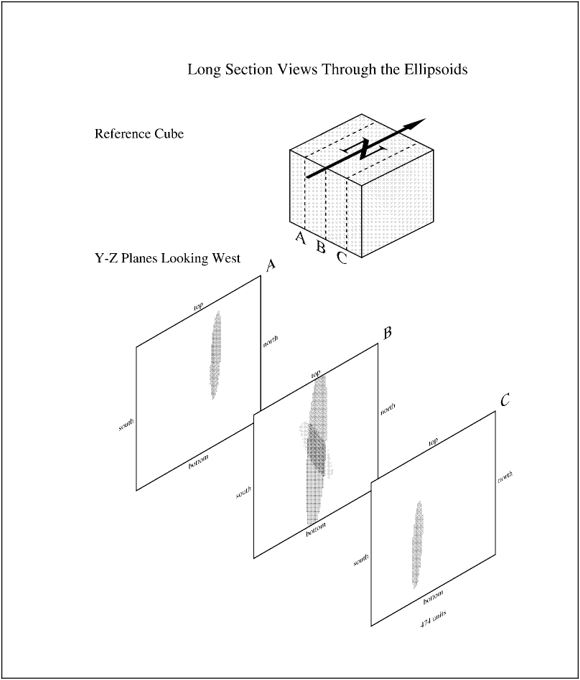

| Figure 14‑12 | Wireframes of C, X and Volcanic Boundaries | 149 |

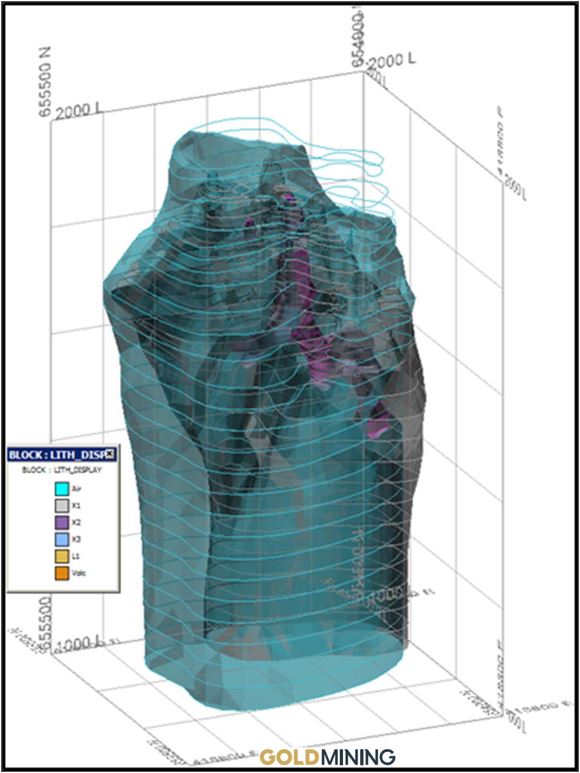

| Figure 14‑13 | Block Model Showing Lithology of La Cantera | 151 |

| Figure 14‑14 | La Cantera Ellipsoids | 153 |

| Figure 14‑15 | La Cantera Block Model Slice Showing Pit Constrained Au Estimated Grades | 154 |

| Figure 14‑16 | La Cantera Block Slice Showing Pit Constrained Cu Estimated Grades | 155 |

| Figure 14‑17 | Plan View of Middle Zone Drilling | 158 |

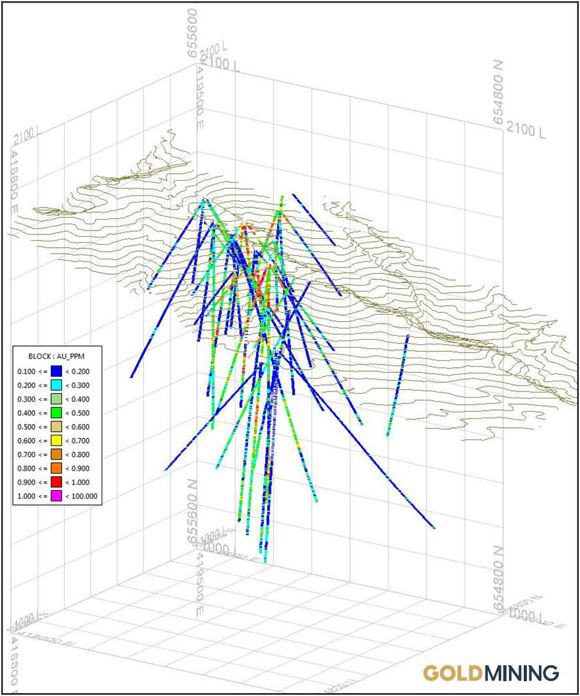

| Figure 14‑18 | Isometric View of Middle Zone Drilling | 159 |

| Figure 14‑19 | Distribution of Lithology - Middle Zone | 160 |

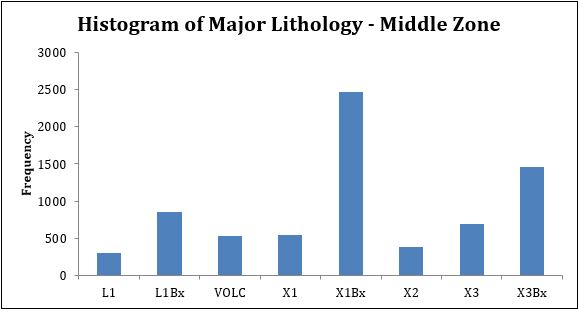

| Figure 14‑20 | Distribution of Major Lithologies - Middle Zone | 160 |

| Figure 14‑21 | Histogram for Middle Zone Gold Data | 161 |

| Figure 14‑22 | Histogram of Silver Data - Middle Zone | 161 |

| Figure 14‑23 | Histogram of Copper Data - Middle Zone | 162 |

| Figure 14‑24 | Bellhaven Geologic Interpretation Section MZ_315_J | 163 |

| Figure 14‑25 | Middle Zone Sections with Geologic Interpretation | 164 |

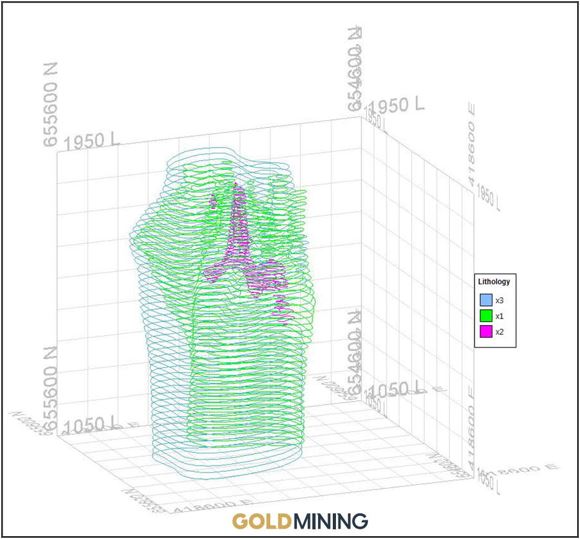

| Figure 14‑26 | Bench Section Profiles of X1, X2 and X3 | 165 |

| Figure 14‑27 | Bench Section Profiles including L1 and Volcanic Lithologies | 166 |

| Figure 14‑28 | Wireframes of X1, X2 and X3 Boundaries | 167 |

| Figure 14‑29 | Wireframes of L1, Volc, X3 and X1 Boundaries | 168 |

| Figure 14‑30 | Block Model showing Lithology of Middle Zone | 170 |

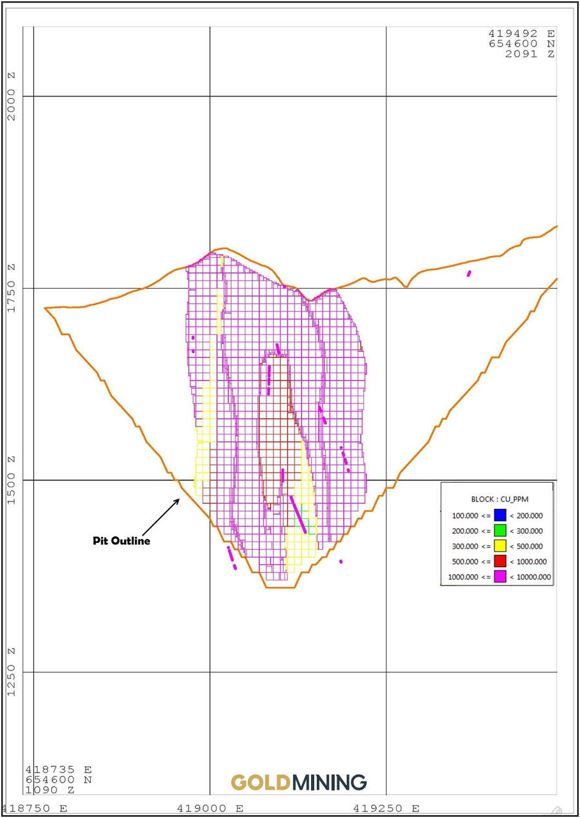

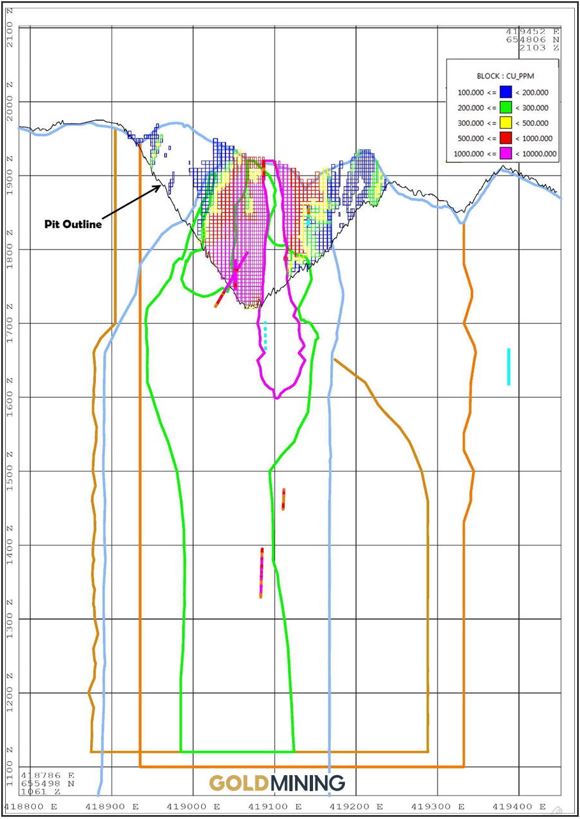

| Figure 14‑31 | Middle Zone Block Model Slice showing Pit Constrained Au Estimated Grades | 172 |

| Figure 14‑32 | Middle Zone Block Model Slice Showing Pit Constrained Cu Estimated Grades | 173 |

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page 14 |

| | The La Mina property consists of two concession contracts and two concession contract applications located in the Department of Antioquia, Republic of Colombia, South America. GoldMining Inc. (“GoldMining”) owns the property through its wholly owned subsidiary, Bellhaven Copper & Gold Inc. (“Bellhaven”) which in turn owns the property through its wholly-owned Colombian subsidiaries Bellhaven Exploraciones Sucursal Colombia ("Bellhaven Exploraciones") and La Mina Fredonia S.A.S. (formerly Aurum Exploration Inc. Colombia). GoldMining announced on May 30, 2017 that it completed the acquisition of Bellhaven by way of a plan of arrangement pursuant to an arrangement agreement between the parties dated April 11, 2017. |

Bellhaven acquired its first exploration license by entering into an earn-in agreement in mid-2010 to acquire 80% of the mineral rights of a 1,794-hectare license over a four-year period with the option to acquire the remaining 20% on the basis of an ounces-in-reserve formula defined by the earn-in agreement. The option agreement has been since modified several times by mutual consent and Bellhaven currently owns 100% of the La Mina Concession. This exploration license turned into a concession contract on August 5, 2020. The second concession contract, called the La Garrucha concession, is 1,416 hectares in size and occurs immediately to the east and north of the La Mina concession. It was acquired in 2013 from the wholly-owned Colombian subsidiary of AngloGold Ashanti Corporation, AngloGold Ashanti Colombia S.A. through an earn-in agreement based on total expenditures over a 3-year period. This agreement was later renegotiated in March 2015, resulting in Bellhaven acquiring the La Garrucha concession for cash payments summing to US$ 290,000.

The La Mina project area forms a contiguous irregular shaped 3,210-hectares block centered at 5°55'19"N and 75°44'42"W. Geographically, the mineral title is located within the Municipalities of Venecia and Fredonia, Department of Antioquia, 51 km SW of the Colombian city of Medellin.

La Mina is located overlooking the Cauca River valley, along the eastern margin of Colombia's physiographic Western Cordillera. The topography of the region is mountainous, characterized by high-relief, vegetated mountains, and steeply incised active drainages. The geological evolution of the region is complex, and is characterized by compressional Meso-Cenozoic tectonics associated with Northern Andean Block assembly along the Romeral fault and suture system. The accretion of various allochthonous terranes in western Colombia during the Miocene resulted in deformation, uplift, magmatism and erosion. Mineralization at La Mina is genetically linked to the emplacement of a cluster of Miocene-aged hypabyssal porphyry stocks. Magmatic-hydrothermal Au-(Cu) and Au-Ag (Pb, Zn, Cu) deposit types are spatially and temporally associated with the hydrothermal evolution of the porphyry stocks.

Since acquiring La Mina, GoldMining has not conducted any material exploration activity at the project. Bellhaven and other previous operators applied systematic regional geology, geochemistry, and geophysics across the property over a period of approximately 14 years from 2002 until 2016. The focus of interest is now along the eastern quarter of the Property where copper-gold mineralization was first discovered in 2002 at the La Cantera outcrop.

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page 15 |

Scott Wilson (“Mr. Wilson”) of Metal Mining Consultants Inc. (“MMC”) and Mr. Mauricio Castañeda (“Mr. Castañeda”) have prepared this Technical Report on the La Mina property deposits, located in the Department of Antioquia, Republic of Colombia, South America. Mr. Wilson and Mr. Castañeda were retained by GoldMining Inc. to prepare an Independent Technical Report on the La Mina Project (the “Project”), Department of Antioquia (Province), Colombia, compliant to Canadian National Instrument (NI) 43-101. GoldMining owns two concessions comprising the project through its indirect wholly owned subsidiaries Bellhaven Exploraciones and La Mina Fredonia S.A.S. The purpose of this report is to provide a National Instrument 43-101 mineral resource estimate for La Mina gold project which includes the La Cantera and Middle Zone gold-copper porphyry deposits. Additionally, the La Garrucha exploration deposit is described in this report although no mineral resource estimate has been calculated for this deposit.

This is a Technical Report that includes estimates of resources occurring in two areas: La Cantera and the Middle Zone. The effective date of this Technical Report for the La Mina resource contained herein is July 6, 2021.

This Technical Report documents a mineral resource statement for the La Mina Project prepared by Mr. Wilson and Mr. Castañeda. The report has been prepared according to the guidelines of the Canadian Securities Administrators' National Instrument 43-101 and Form 43-101F1, while the mineral resource statement reported herein has been prepared in conformity with generally accepted CIM "Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines."

La Cantera and Middle Zone constitute two of the four drill-tested mineralized porphyry intrusive and breccia bodies on the La Mina property. In both deposits, the intrusive centers are characterized by a series of porphyry stocks and related breccias that together make up porphyry copper-gold deposits. In the case of La Cantera, the core of the deposit is cut out by a late, barren porphyritic stock resulting in a “doughnut” pattern (plan view) whereby the copper- and gold-bearing rocks form a concentric pattern around the late, barren porphyritic stock. In the case of Middle Zone, the barren core is an amorphous feature that appears to have intruded preferentially along pre-existing planes of weakness. Various intrusive/breccias phases were involved in development of the porphyry deposits along with multi-phase alteration-mineralization events, as most-often expressed by pronounced densities of veinlets crosscutting the diamond drill core. Hydrothermal magnetite is an important gangue mineral associated with gold and copper, and potassic alteration is an important alteration type associated with gold and copper.

The La Cantera deposit is slightly elliptical in plan view (long axis NW-SE), measuring approximately 200 m by 190 m in plan view on surface with a depth extent of 350-600 m based on the results from 26 drill holes. Average grades are close to 0.9 g/t Au with 0.3% Cu and 1.7 g/t Ag.

The Middle Zone deposit lies approximately 400 m north of La Cantera and consists of a more pronounced elliptical body in plan view (long axis NE-SW), which remains open at depths of over 600 m, based on the results of 54 drill holes. Faults appear to have offset the western and eastern lobes of mineralization. Faults also appear to delimit the western edge. Mineralization here is of two types. The first is characterized by a high copper-gold ratio, similar to what is observed at La Cantera. The second is characterized by high gold with relatively low copper. Overall, the grades are lower than La Cantera, close to 0.5 g/t Au with 0.1-0.2% Cu, over true widths of up to 100 m.

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page 16 |

2.2 | LA MINA MINERAL RESOURCES |

A cut-off grade of 0.25 g/t Au gold was used for the mineral resource estimate documented in this report. The Middle Zone deposit has been drilled at nominal 50-m spacing to approximately 300-m depth, but the data density is lower beyond that depth. Topography and complex structural geology necessitated the use of multiple drill-hole fans from some sites, as well as off-axis drilling to target some areas. The Company and previous operators have maintained a strong quality assurance and quality control program, which has validated the accuracy and precision of the assay data. Bellhaven also advanced its knowledge of the metallurgical characteristics of the La Mina mineralization, as reported in November 2011 and 2013, subsequent to the maiden Inferred Resource, and in September 2016 after the maiden Inferred Resource.

A portion of the La Mina mineralization has been categorized as Indicated Mineral Resources. The drill density and the confidence in the mineralization has allowed for both La Cantera and Middle Zone resources to be classified in the Indicated category. Indicated Resources for the La Mina project are reported in Table 2.1. Inferred Resources for the La Mina Project are reported in Table 2.2. These Mineral Resources conform to the definitions in the 2014 CIM Definition Standards – for Mineral Resources and Mineral Reserves. No reserves conforming to CIM standards have been estimated for this report, as GoldMining Inc. has not advanced the evaluation work to a point of developing mine plans, production schedules, and economic analysis. Also, no resources have been estimated for the mineralization at La Garrucha, as an estimation would be premature at this earlier stage exploration project.

The mineral resource estimate is an in-pit constrained resource calculated using a Whittle-Pit algorithm. The input parameters used to calculate the in-pit resources are as follows: metal prices of US$ 1,600/oz gold, US$ 21.00/oz silver, and US$ 3.25/lb copper, G&A of US$ 1.00 per tonne, open-pit mining costs of US$ 1.76 per tonne, processing costs of US$ 8.10 per tonne, metallurgical recoveries of 93% for gold and 90% for copper, an average pit-slope of 50 degrees and a 2% NSR royalty. Resource calculations are an estimate and some differences may occur in the totals due to rounding.

Table 2.3 presents the in-pit resources calculated at a series of gold cut-off grades that meet the standard for “reasonable prospects for eventual economic extraction”. The base cut-off grade of 0.25 g/t gold highlighted in Table 2.1 and 2.2 is currently our best estimate for mineral resources.

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page 17 |

Table 2‑1 La Mina Indicated Resources for July 2021

Cut-off | Metric | Grades | Contained Metal |

Grade (g/t Au) | Tonnes (‘000) | Au (g/t) | Ag (g/t) | Cu (%) | AuEq (g/t) | Au (oz) | Ag (oz) | Cu (lbs, ‘000) | AuEq (oz) |

Indicated Resources |

0.15 | 40,180 | 0.57 | 1.53 | 0.20 | 0.87 | 738,170 | 1,980,446 | 178,315 | 1,126,365 |

0.20 | 33,143 | 0.66 | 1.67 | 0.22 | 0.99 | 703,166 | 1,778,625 | 163,489 | 1,058,599 |

0.25 | 28,247 | 0.73 | 1.76 | 0.24 | 1.09 | 662,680 | 1,602,040 | 150,526 | 989,463 |

0.30 | 24,759 | 0.80 | 1.86 | 0.26 | 1.18 | 636,142 | 1,484,367 | 140,058 | 940,117 |

0.35 | 21,895 | 0.86 | 1.95 | 0.27 | 1.27 | 608,421 | 1,375,655 | 130,397 | 891,346 |

Table 2‑2 La Mina Inferred Resources for July 2021

Cut-off | Metric | Grades | Contained Metal |

Grade (g/t Au) | Tonnes (‘000) | Au (g/t) | Ag (g/t) | Cu (%) | AuEq (g/t) | Au (oz) | Ag (oz) | Cu (lbs, ‘000) | AuEq (oz) |

Inferred Resources |

0.15 | 19,235 | 0.52 | 1.52 | 0.22 | 0.86 | 324,165 | 939,699 | 95,232 | 529,938 |

0.20 | 15,859 | 0.60 | 1.65 | 0.25 | 0.97 | 306,249 | 842,724 | 87,490 | 495,024 |

0.25 | 13,633 | 0.65 | 1.76 | 0.27 | 1.05 | 287,005 | 772,030 | 81,246 | 462,168 |

0.30 | 12,066 | 0.71 | 1.85 | 0.29 | 1.13 | 274,173 | 717,904 | 76,238 | 438,454 |

0.35 | 10,575 | 0.76 | 1.92 | 0.30 | 1.21 | 259,196 | 653,176 | 70,369 | 410,706 |

Table 2‑3 Total Indicated and Inferred Resources for La Mina Project (Cut-off Grade: 0.25 g/t Au)

| Metric | Grades | Contained Metal |

| Deposit | Tonnes (‘000) | Au (g/t) | Ag (g/t) | Cu (%) | AuEq (g/t) | Au (oz) | Ag (oz) | Cu (lbs, ‘000) | AuEq (oz) |

Indicated Resources |

La Cantera | 18,024 | 0.86 | 2.05 | 0.32 | 1.33 | 498,346 | 1,187,917 | 125,586 | 770.697 |

Middle Zone | 10,223 | 0.50 | 1.26 | 0.11 | 0.68 | 164,335 | 382,966 | 24,940 | 223,495 |

Total Indicated | 28,247 | 0.73 | 1.76 | 0.24 | 1.09 | 662,680 | 1,602,040 | 150,526 | 989,463 |

Inferred Resources |

La Cantera | 12,034 | 0.69 | 1.84 | 0.29 | 1.13 | 266,956 | 711,883 | 78,190 | 437,189 |

Middle Zone | 1,599 | 0.39 | 1.17 | 0.09 | 0.53 | 20,049 | 60,147 | 3,056 | 27,246 |

Total Inferred | 13,633 | 0.65 | 1.76 | 0.27 | 1.05 | 287,005 | 772,030 | 81,246 | 462,168 |

Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the mineral resources will be converted into mineral reserves. Gold-equivalent grades were calculated using the following formula: AuEq = Au (g/t) + [Cu(%)} x {%Recoverable Cu / %Recoverable Au} x {Cu Price/Au Price} x 22.0462 x 31.1035] + [Ag (g/t) x {Ag Price/Au Price}]. Metal prices for calculating gold equivalency are gold (US$ 1,600/oz), silver (US$ 21.00), and copper (US$ 3.25). Metal prices are not constant and are subject to change. All quantities are rounded to the appropriate number of significant figures; consequently sums may not add up due to rounding

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page 18 |

In 2011 Aurum Exploration Colombia Inc. contracted Resource Development Inc. (RDi) to undertake a scoping-level metallurgical study for La Mina porphyry gold and copper prospect in Colombia. A final report on this first phase of work was completed in October of 2011.

A series of metallurgical tests were performed on coarse reject samples from three drill holes collared at the La Cantera prospect and one drill hole at the Middle Zone prospect. These individual assay interval samples were composited to produce four composite samples ranging in grade from 0.73 to 1.5 g/t Au and 0.31 to 0.47% Cu. The gold and complete copper analyses of the composites are presented in Table 13.2.

The metallurgical tests included Bond’s ball mill work-index determinations, in-place bulk density measurements, gravity tests, direct cyanidation recoveries, and carbon-in-leach tests, as well as rougher and cleaner flotation tests.

The Bond’s ball millwork index determinations ranged from 10.2 to 14.0; the highest work index determination was measured from the La Cantera high-grade composite, possibly reflecting a greater abundance of quartz veinlets. These work indices are typical of porphyry gold-copper deposits.

Bulk densities, determined using a standard wax-coating method, ranged from 2.48 to 2.98 g/cc.

Gravity test work did not yield a high-grade concentrate indicating that there is very little coarse gold at either La Cantera or Middle Zone. The lack of significant quantities of coarse gold is considered to be positive, allowing for more consistent flotation (by not requiring installation of a gravity circuit to collect the coarse gold) and cyanide leach results.

Whole-ore cyanide leach tests indicated recoveries of up to 90% of the gold and 70% of the copper whereas carbon-in-leach test results indicated recoveries of up to 87% of the gold and 73% of the copper from the four composite samples. As expected, copper recoveries were relatively low because of the chalcopyrite-dominant mineralogy of the composite samples (i.e., sulphide, not oxide, mineralogy).

A key outcome of the rougher flotation test work was that the application of a simple reagent suite of potassium amyl xanthate (PAX) and Aeropromotor 404 (AP 404), at a grind size of 80% passing 150 mesh, produced high gold recoveries ranging from 93.2 to 96.8% and copper recoveries ranging from 88.7 to 90.8%.

The other key result of the rougher and open-circuit cleaner flotation test work is that, with the exception of an outlier represented by Composite 2, the test work demonstrated the potential for La Mina to deliver concentrate grades ranging from 26.7 to 31.9% copper and 61.9 to 75.8 g/t gold. These concentrates are very clean, containing only trace amounts of arsenic, antimony, and lead, and below typical penalty benchmark levels charged against concentrate sales by smelters.

La Mina is well situated in terms of access to regional highways for both north and south conveyance. Highway 25 connects major transportation hubs in the north and south of the country, and nearby local roads have good access to the highway. The roughly 11 km of off-highway roads needed to access the mine site will require some expansion and drainage improvements to allow heavy machinery and equipment to reliably pass, but nothing exceptional. Road transport of goods is the primary method of delivery accounting for more than seventy percent of material transport in Colombia.

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page 19 |

Rail service is not the prime carrier in Colombia which may offer benefits in pricing. Rail only transports around twenty-five percent of all national goods. Given the rail access available from the nearest industrial city of Medellin northward to the ports of Santa Marta and Cartagena, bimodal transport may prove profitable depending on the location of the ore smelter. In the south only the city of Cali is connected to its nearby port of Buenaventura by rail. If northbound rail service from nearby the mine is desired, decommissioned railway tracks lay within 20 km and while repairs would be required, it may provide cost savings over time.

Favorable investment conditions have helped electricity generation keep up with demand and avoid any major blackouts since 1991. In spite of this improvement, electricity transmission lines still do not reach some geographically isolated areas of the country. Because of its proximity to Medellin, electrical power will not be an issue for La Mina project. The majority of generated power is produced from hydroelectric plants with most of the rest coming from biomass oxidation. The mine site lies within a few dozen kilometers of a 200 kV power substation. The additional output capacity of this substation is unknown. Local backup power generation would be advisable.

Colombia has some reserves of natural gas, and coal, some of which are exported. A nearby gas pipeline may be beneficial for the generation of power, should auxiliary power be required. Coal delivery may prove problematic without nearby rail service.

Unskilled labor is available in the area. Locally there exists a reasonably large class of high school educated locals, which may provide a workforce with some inkling of the process and methods at a reasonable cost.

Water at the site is plentiful with access to seasonal and year-round streams. On site wells should also produce exceptionally well depending on location.

Colombia, especially the Medellin area, has made great strides in the protection of industry and persons since the 1980s. However, local some narcotics forces still endanger commerce to some degree. Measures should be taken against non-governmental actions to avoid such inconveniences; such as transport of ore, and electrical power at the mine site.

Care should also be given in the selection of local heavy equipment lease, as extra-governmental bodies may control the majority of this equipment in the area.

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page 20 |

2.5 | ENVIRONMENTAL AND SOCIAL |

The La Mina Project intends to comply with applicable environmental and social regulatory requirements of the Colombian and Regional regulatory agencies and with international standards as dictated by the Equator Principles, International Finance Corporation Principles, Performance Standards and Guidelines, and the World Bank Guidelines. The development of an Environmental and Social Impact Assessment (ESIA) will be required by the government of Colombia to acquire a mining operation permit and by Western Lenders as part of their requirements to provide support for project development.

The ESIA should include a baseline assessment of the site, expected impacts due to Project activities, mitigation actions required to prevent environmental and social impacts, and monitoring programs to determine the success of mitigations. Development and implementation of detailed environmental and social management plans will be required to address construction, operations, closure and post-closure periods of the Project. Closure and post-closure management plans should include appropriate maintenance and continued monitoring of the site, pollution emissions and potential impacts. The duration of monitoring and subsequent mitigations (if required) will be extended through the post-closure period, which should be defined on a risk basis with typical periods requiring a minimum of 5 years after closure or longer.

It is recommended that GoldMining implement the following at La Mina:

| | ● | Prepare a Preliminary Economic Analysis (PEA) |

| | ● | Evaluate the exploration opportunity to further expand the La Cantera resource and evaluate possible connections to Middle Zone at depth. Drill test resulting targets. |

| | ● | Evaluate the exploration opportunity for expansion of the Middle Zone deposit, particularly at depth. Drill test resulting targets. |

| | ● | Drill test the exploration opportunity at the La Garrucha target. |

| | ● | Evaluate the requirements for infill drilling to upgrade the La Cantera resource to M&I |

| | ● | Evaluate the requirements for infill drilling to upgrade the Middle Zone resource to M&I advance the metallurgical evaluation of the La Cantera mineralization for input to future engineering studies. |

Table 2-4 Proposed Phase 1 Work Program to advance La Mina

Activity | Amount |

Drilling Program focusing on resource expansion | $ 1.65M |

Drill technical services and assaying | $ 0.20M |

Updated Mineral Resource Estimate | $ 0.10M |

Preliminary Economic Assessment | $ 0.20M |

Total | $ 2.15M |

The author has not recommended successive phases of work for the advancement of the Project.

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page 21 |

2.7 | PURPOSE OF TECHNICAL REPORT |

At the request of GoldMining, an updated technical report on the resources was prepared by the author Scott Wilson of Metal Mining Consultants, Inc. (“MMC”) and Mauricio Castañeda on the La Mina Project (“La Mina”), Municipality of Venecia and Fredonia, Department of Antioquia, Colombia. The purpose of this report is to provide GoldMining with an independent opinion on the mineral resources at La Mina, including, among other things, incorporating all drill holes completed as of the effective date of this report. This report conforms to the standards specified in Canadian Securities Administrators’ National Instrument 43-101, Companion Policy 43-101CP and Form 43-101F1.

This report describes the property geology, mineralization, exploration activities and exploration potential based on compilations of published and unpublished data and maps, geological reports and a field examination by the authors. The authors have been provided documents, maps, reports and analytical results by GoldMining. This report is based on the information provided, field observations and the authors’ familiarity with mineral occurrences and deposits and economics for development in Colombia and worldwide. All references are cited at the end of the report in Section 18, References.

The current inspection for the Project was carried out on June 12, 2021 by Mauricio Castañeda who visited the property including the exploration facilities known as “Hacienda La Mina”, located in the village (Vereda) of La Mina, municipality of Fredonia in the department of Antioquia, Colombia. While during the visit there was no active exploration work ongoing, Mr. Castañeda was able inspect historic exploration sites, the Project infrastructure including the core storage, logging areas, sample preparation areas and the office and related building infrastructure. Mr. Castañeda also met with the geological team and technicians to review the geological maps and sections, inspect drill core, review the digital database, observe the location of drill collars and collect a number of core samples to validate and confirm existing information.

Mr. Wilson has previously visited the site (most recently as 2012) to review on-going drilling and the geology of both the La Cantera and Middle Zone deposits. La Garrucha and El Limon were also visited at that time.

This Technical Report was prepared by authors Mr. Wilson and Mr. Castañeda. There is no affiliation between Mr. Wilson, Mr. Castañeda and GoldMining except that of independent consultant/client relationship.

This Technical Report addresses the addition of resources to the Middle Zone mineral deposit. The proximity of La Cantera and Middle Zone allow for both mineral occurrences to be processed by a common infrastructure.

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page 22 |

2.7.2.1 | UNITS OF MEASURE - ABBREVIATIONS |

Units of Measure - Abbreviations |

Metric | Imperial |

Unit | Description | Unit | Description |

% | Percent | % | Percent |

°C | Degrees Celsius | °F | Degrees Fahrenheit |

cm | Centimeter (Centimetre) | in | Inch |

m | Meter (Metre) | ft | Foot (12 Inches) |

g | Grams | oz | ounce |

g/t | grams per tonne | g/t | grams per tonne |

ha | Hectare (10,000 M2) | ac | Acres |

kg | Kilogram | lb | Pounds |

km | Kilometer (Kilometre) | mi | Miles |

KW or kW | Kilowatt | hp | Horsepower |

mm | Millimeters (Millimetres) | in | Inches |

opt | Ounces Per Ton | opt | Ounces Per Ton |

ppm | Parts Per Million | ppm | Parts Per Million |

SG | Specific Gravity | SG | Specific Gravity |

μm | Microns | in | Inches |

ft3 | Cubic Feet | m3 | Cubic Meters (Metres) |

in3 | Cubic Inches | cm3 | Cubic Centimeter (Centimetre) |

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page 23 |

2.7.2.2 | ACRONYMS AND SYMBOLS |

Acronyms and Symbols |

Term | Description |

Ag | Silver |

As | Arsenic |

Au | Gold |

Ba | Barium |

Bi | Bismuth |

Cd | Cadmium |

CIM | Canadian Institute of Mining, Metallurgy and Petroleum |

Co | Cobalt |

Company | GoldMining |

Cr | Chromium |

CRD | Carbonate Replacement Deposit |

Cu | Copper |

CWA | Clean Water Act |

EMT | Emergency Medical Technician |

ICP | Inductively Coupled Plasma |

ID2 | Inverse Distance to the Second Power |

K | Potassium |

Ma | Million Years |

Masl | Meters above sea level |

MMC | Metal Mining Consultants Inc |

Mn | Manganese |

Mo | Molybdenum |

Ni | Nickle |

NSR | Net Smelter Return |

Pb | Lead |

POO | Plan of operations |

Property | La Mina Project |

QA | Quality Assurance |

QA/QC | Quality Assurance/Quality Control |

QC | Quality Control |

QP(s) | Qualified Person(s) |

RC or RVC | Reverse Circulation |

Rdi | Resource Development Inc |

RQD | Rock Quality Designation |

Sr | Strontium |

tpy | Tons per Year |

US | United States |

V | Vanadium |

W | Tungsten |

Zn | Zinc |

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page 24 |

3 | RELIANCE ON OTHER EXPERTS |

The authors have not relied on information from other experts except for, in connection with certain legal matters relating to title, including information related to the concessions and their titles as described below.

The authors were provided with and reviewed documents relating to the mineral concessions including certificates of mineral registration, and certificates of good standing from GoldMining’s legal counsel (Camila Restrepo Uribe). Such documents included,” Good Standing Legal Opinion Colombian mining title No. 6355B (HHMM-04)” and, “Good Standing Legal Opinion Colombian mining title No. L5263005”, both documents prepared by Camila Restrepo Uribe, and both dated June 15, 2021, GoldMining Inc provided the authors with updated copies of mineral concessions and an updated map of the concessions and two additional applications in process. This included Certificates of Mining Registration (Certificado de Registro Minero) from the National Mining Agency (Agencia Nacional de Minería) for mining title No. 6355B (HHMM-04) and mining title No. L5263005, both certificates dated June 15, 2021. While it appears that all titles (concessions) are in force and free of any liens and encumbrances, the authors are not qualified to express a legal opinion with respect to the property titles and current ownership and possible encumbrance status, and therefore, we have relied on the Company for providing this information and disclaim direct responsibility for such legal title information.

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page 25 |

4 | PROPERTY DESCRIPTION AND LOCATION |

The La Mina project consists of two properties: 1) the 1,794 hectare La Mina Colombian concession contract identified as concession contract L5263005 (“concession”) held by La Mina Fredonia S.A.S. and 2) the 1,416 hectare La Garrucha with concession contract No. HHMM04 held by Bellhaven Exploraciones, as well as two concession contract applications currently under evaluation 1) LEA-16281 with 146 hectares requested and 2) TL5-08011 with 687 hectares requested. GoldMining Inc. (“GoldMining”) owns 100% of the Property through its wholly owned subsidiary, Bellhaven which in turn owns the property through its wholly-owned Colombian subsidiaries Bellhaven Exploraciones (formerly Aurum Exploration Inc. Colombia) and La Mina Fredonia S.A.S. GoldMining announced on May 30, 2017 that it had completed the acquisition of Bellhaven by way of a plan of arrangement pursuant to an arrangement agreement between the parties dated April 11, 2017.

The concessions are located near Medellin in the Department of Antioquia, Colombia approximately 500 km north-west of the Colombia’s federal capital of Bogota. This region has a long history of gold mining extending back several centuries. Now several parts of Antioquia are among the most active gold exploration regions in Colombia.

The closest settlement, La Mina, lies immediately adjacent to the La Mina Project. The larger town of Venecia, approximately 11 km from the project, provides a source of supplies and logistical support for the project, rural farming activities, and for several small underground coal- mining operations in the near area. Figures 4.1 and 4.2 show the location of the mineral claim in relation to surrounding geography.

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page 26 |

Figure 4‑1 La Mina Property, Colombia

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page 27 |

Figure 4‑2 La Mina Project Location and Access Map

The La Mina project property consists of two concession contracts totaling 3,210 hectares. Namely the 1798 hectare La Mina license with concession contract No. 5263 and the La Garrucha license with concession contract No. 6355B. The location and details regarding the claim block are outlined in Table 4.1 and are shown in Figure 4.3.

Exploration license No. 5263 (La Mina concession) was granted by the Instituto Colombiano de Geologia y Minera (“INGEOMINAS”) to Alejandro Montoya-Palacios (“Montoya”) in early 2000 as an Exploration Concession under the mining code of the country which grants the operator the right to explore over a three-year renewable period under certain conditions for an additional two years including submission of a work plan known as a “Plan de Trabajo de Inversión”, or PTI. This was turned into a concession contract on August 5, 2020.

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page 28 |

Table 4‑1 La Mina Property Ownership

Concession Contract Number | Size Hectares | Registered Title Holder |

L5263005 | 1,794 | La Mina Fredonia SAS |

HHMM04 | 1,416 | Bellhaven Exploraciones Inc. Sucursal Colombia |

Figure 4‑3 Claim Map Showing Location of La Mina Porphyry Bodies in Relation to Concession Boundaries

GoldMining's indirect Colombian subsidiary, Bellhaven Exploraciones (formerly Aurum Exploration Inc. Colombia) signed an option agreement with Mr. Montoya to initially acquire 80% of the concession. The property was held jointly by both parties through Mina Fredonia S.A.S. (“Fredonia”)with GoldMining currently indirectly owning 100% of the La Mina concession.

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page 29 |

La Garrucha exploration contract, No. 6355B, now owned by Bellhaven Exploraciones Inc Sucursal Colombia but originally owned by AngloGold Ashanti Colombia S.A., was optioned by Bellhaven in 2013 to explore a Au-Cu porphyry deposit indicated by the surface and drilling exploration in 2011 and 2012 respectively. This contract was renegotiated on March 7, 2015. As a result GoldMining, through its ownership of Bellhaven Exploraciones and La Mina Fredonia S.A.S. owns 100% of this mining concession with Bellhaven to pay AngloGold Ashanti US$ 1 per reserve ounce declared in a bankable Feasibility Study, or present at the start of mining construction, whichever comes first.

4.3 | SURFACE RIGHTS AGREEMENTS |

Bellhaven signed an additional agreement with B2 Gold regarding purchase of the surface rights over 60 hectares around the exploration camp site and immediate project area; this allowed Aurum to acquire these surface rights for a total of US$ 470,000 over a 3-year period. During 2011, Bellhaven completed the payments under this agreement and now owns 100% of the surface rights governed by the agreement with B2Gold.

During 2012, Bellhaven also acquired additional surface rights over the El Limon target. In April, the Company contracted with a private vendor for the purchase of 100% interest in a surface property encompassing 9.75 hectares to the north of the Middle Zone (the El Limon property). The property acquisition closed in Q3 of 2012 for a total purchase price of US $15,315 in cash.

Surface rights over a portion of the La Garrucha concession contract is subject to a surface rights lease agreement and an option agreement as outlined below:

Pursuant to a surface rights lease agreement dated July 6, 2016 and amended August 19, 2016, April 4, 2017, November 5, 2018, and July 10, 2020, Bellhaven can lease the surface rights over a portion of the La Garrucha concession contract by making the following payments:

● US$ 75,000 in May 2017 (paid);

● US$ 75,000 in November 2017 (paid);

● US$ 75,000 in May 2018 (paid);

● US$ 75,000 in November 2018 (paid);

● US$ 25,000 in June 2019 (paid);

● US$ 25,000 in December 2019 (paid);

● US$ 25,000 in June 2020 (paid);

● US$ 25,000 in December 2020 (paid);

● US$ 25,000 in June 2021 (paid );

● US$ 25,000 in December 2021;

● US$ 25,000 in June 2022; and

● US$ 55,000 in December 2022.

In addition, pursuant to an option agreement entered into by Bellhaven on November 18, 2016, amended April 4, 2017, November 5, 2018, and July 10, 2020, Bellhaven can purchase the La Garrucha concession by making an optional payment of US$ 650,000 on December 7, 2022.

The project is subject to a 2% net smelter return royalty (NSR) payable to Gold Royalty Corp.

The authors know of no other known royalties, back in rights, payments or any other agreements to which the property is subject outside of the existing Colombian mining code. There are no known environmental liabilities to the La Mina project. There are no known factors or risks that affect access, title, or the right or ability to perform work on the property.

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page 30 |

5 | ACCESSIBILITY, CLIMATE, LOCAL RESOURCES, INFRASTRUCTURE AND PHYSIOGRAPHY |

5.1 | ACCESS AND INFRASTRUCTURE |

Access and infrastructure surrounding the La Mina project are good. The area is surrounded by gravel roads which connect a rural farm population to various nearby population centers, including Medellin which is a large cosmopolitan city (Figure 4.2 above). Various small towns, including Bolombolo and La Pintada are located within a two-hour drive of the project area.

La Mina is accessed on a paved highway 30 km southwest of Medellin to the junction with a gravel road that leads 11 km to the property. Total travel time by road from Medellin is approximately 2.0 – 2.5 hours depending on road conditions and traffic around Medellin. Access to the area is available year round.

The economy surrounding La Mina is based on rural activities. Agricultural activities dominated by coffee and mixed- crop farming are the principal sources of land use and income.

While GoldMining, through its wholly owned subsidiaries Bellhaven Exploraciones and La Mina Fredonia S.A.S. owns a considerable area of surface rights over the La Cantera and Middle Zone deposits, the Company has also secured surface access agreements with other property owners in the La Garrucha area of planned exploration and drilling. Additional surface rights may be necessary for the establishment of a commercial mining project.

Water, power, and labor are readily available at the project site. Local labor is not trained in modern exploration and mining methods, indicating the need to provide training and import qualified personnel. All requirements (personnel, equipment, contractors) for project exploration and development are available in Medellin. Heavy equipment and diamond drills are readily available throughout Colombia.

The project area is located on the eastern slopes leading up from the Cauca River. It is a major physiographic feature marking the limit between the Western and Central physiographic regions where the La Mina Property is located.

The topography in the property area can be described as “tropical mountainous”, with sharp positive and negative changes in relief from an average elevation of approximately 1,700 m with ridges cresting at approximately 2,000 m.

The property is essentially 100% vegetated by Andean forest, dense secondary scrub growth, agricultural crops, and grassy cattle pastureland.

The climate in this district can vary abruptly with elevation: below an elevation of ~1,000 m (in the Cauca river valley) the climate is hot (>24°C) whereas higher up it tends to be temperate (18°C to 24°C) between 1,000 m and 2,000 m, and then becomes cool above 2,000 m (12°C to 18°C). Annual rainfall is approximately 2,000 mm with the wettest months being from March to May, and then again from September to December.

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page 31 |

6.1 | EXPLORATION PRIOR TO 2002 |

The Antioquia district of Colombia where the La Mina Property is located has been a source of gold mining that goes back several centuries to pre-Colombian times. Small-scale artisanal mining, some from hard-rock sources and some from alluvial deposits, were common throughout the district and so “barequero” prospectors were likely active throughout the Central Cordillera district on either flank of the River Cauca.

The general area around La Mina was been noted in early regional survey work by the Colombian mines department, INGEOMINAS and this led to the staking of ground by the original and still current owner, Mr. Alejandro Montoya in 2000.

Historical research by the Company has revealed local knowledge of several adits that targeted gold in the vicinity of the Middle Zone prospect. At one point, these mines were reportedly managed by a small-scale mining company from England. Artisanal miners exploited several streams originating from the resource areas in the past, a very small number of which are still active today. No records of production are known to exist, though different sources corroborate that mining activity goes back to at least the 1920’s. The amount of artisanal mining production is believed to be very small.

In the early 2000s, AngloGold Ashanti (AGA) carried out broad-scale geochemical and other exploration programs throughout this district of Colombia and was responsible for the initial discovery of copper-gold mineralization on surface at the La Cantera outcrop. In 2006, AGA drilled six holes into the La Cantera target, four of which successfully intercepted the gold-copper porphyry stock with mineralized intercepts of 50-100 m.

In 2007, AGA formed the Avasca Joint Venture with Bema Gold (subsequently transferred to B2Gold) who continued with further surface geochemistry and geophysics north and south from the La Cantera discovery, as well as further west over a prominent N-S trending magnetic ridge feature identified from aerial geophysics flown by the Avasca JV in 2007.

The early exploration work at La Mina by AGA beginning in 2002 and later in 2005-08 by the Avasca Joint Venture (Avasca) focused on the principal La Cantera Zone. These programs consisted of:

| | ● | Regional mapping, 1:20,000 scale |

| | ● | Property-scale geological mapping: 1:10,000 scale |

| | ● | Geochemical sampling, soils and rock |

| | ● | Geophysical surveys: aerial magnetic and radiometrics |

| | ● | Drilling: six, core holes totaling 1,453 m (mid-2006) – AGA |

| | ● | At the end of 2007, a regional airborne magnetic/radiometric survey was completed over the Property and neighboring ground (Avasca) |

| | ● | In early 2008, the aerial geophysics was followed by additional auger soil and rock geochemical sampling programs over the anomalies (Avasca). |

| | ● | Various sampling methods have been used to explore the La Mina Property, as follows: |

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page 32 |

| | ● | Regional-scale soil and rock/trench sampling carried out by AGA in 2002 which led to the discovery of the porphyry mineralization at the La Cantera zone. |

| | ● | In 2007/08, additional soil sampling was completed by the Avasca joint venture over the aero-magnetic anomalies identified from their aerial geophysics (2007). This soil sampling was completed on an irregular grid, widely spaced over the entire 1,794 ha Property area (123 samples), but principally focused on the area around the La Cantera prospect and immediate vicinity (~1 km by 1 km). A later rock sampling program in 2008 collected 857 samples on a 100-m standard grid, and focused on La Cantera and some nearby magnetic anomalies. |

Figure 6.1 illustrates the prominent magnetic features interpreted from aerial geophysics flown by the Avasca Joint venture in 2007. Identified clearly is the high magnetic response of the La Cantera porphyry stock at the southern end of the red rectangular block.

Figure 6‑1 Portion of Aerial Magnetics, Avasca Joint Venture 2007

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page 33 |

Six AGA drill holes were completed in and around the La Mina porphyry (later re-named the La Cantera Stock), with Holes 2 and 5 yielding 90-m plus intercepts of greater than 1 g/t Au and good copper grades at shallow depths. Drill-holes 4 and 6 also contained significant values located near the surface; however, Holes 1 and 3 were drilled off target to the west and did not encounter any mineralization of interest (Table 6.1).

Table 6‑1 AGA Drill Results

Drill Hole | Dip | Total Depth | Significant Intercepts |

Name | Degree | m | Thicknessm | Au g/t/Cu % |

LM-01 | -60.5 | 258 | No Significant Intercepts |

LM-02 | -58.5 | 189 | 152 | 0.82/0.26 |

LM-03 | -60.5 | 201 | No Significant Intercepts |

LM-04 | -60 | 250 | 106 | 0.32/0.21 |

LM-05 | -60 | 252 | 106 | 1.11/0.40 |

LM-06 | -60 | 304 | 122 | 0.40/0.24 |

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page 34 |

7 | GEOLOGICAL SETTING AND MINERALIZATION |

Colombia can be divided into four distinct geomorphological regions and can be seen in Figure 7.1.

| | 4. | The Pacific Coast Region |

The La Mina property is located along the eastern margin of the western Cordillera in the Andean System (Figure 7.1).

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page 35 |

Figure 7‑1 Geomorphological Regions of Colombia Showing the Approximate Location of La Mina

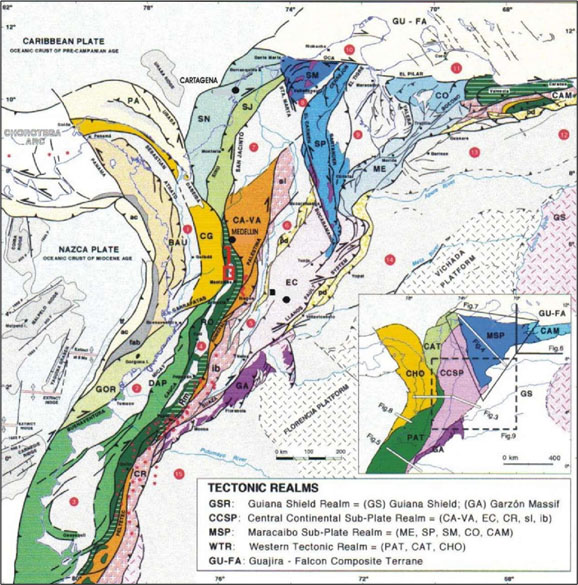

The La Mina region lies within the Romeral terrane, an oceanic mélange comprised of metamorphosed mafic to ultramafic complexes, ophiolite sequences, and oceanic sedimentary rocks of probable Late Jurassic to Early Cretaceous age (Cediel & Cáceres, 2000; Cediel et al., 2003). This terrane was accreted to the continental margin along the Romeral Fault, which lies east of the River Cauca, in the Aptian (125 to 110 Ma). Movement on the Romeral Fault was dextral indicating that terrane accretion was highly oblique from the southwest. The Romeral Fault zone is marked by dismembered ophiolitic rocks, including glaucophane schist, in a tectonic mélange and is interpreted as a terrane suture marking an old subduction zone. The resulting suture zone and mélange-related rocks can be traced for over 1,000 km along the northern Andes. The Romeral terrane is bounded on the west side by the Cauca Fault. Further west, additional oceanic and island arc terranes were subsequently accreted to the Western Cordillera in the Paleogene and Neogene periods, culminating in the on-going collision of the Choco (or Panamá) arc since the late Miocene. This reactivated the Cauca and Romeral faults with left lateral and reverse movements (Cediel & Cáceres, 2000; Cediel et al., 2003). The original structure of the Romeral fault system has been modified by various post-Romeral tectonic events.

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page 36 |

Following accretion, the Romeral terrane was overlain unconformably by siliciclastic, continentally derived sediments of the Oligocene to Lower Miocene Amagá Formation. The Amagá Formation, comprises basal conglomerates, sandstones, siltstones, shales, and local coal seams (Durán et al., 2005). These sedimentary rocks are overlain by a thick sequence of volcanic and sedimentary rocks of the Late Miocene Combia Formation. The Combia Formation is divided into a Lower Member of basalt and andesite lava flows, agglomerates, and tuffs, and an Upper Member of conglomerates, sandstones, and crystal and lithic tuffs (Durán et al., 2005). The Combia Formation volcanic rocks were associated with at least one Middle to Late Miocene volcanic arc emplaced into the Romeral terrane basement rocks during this time period. Also associated with latest stages of arc formation was the syntectonic emplacement of a series of shallow-level intrusive rocks, including poly-phase hypabyssal stocks, dikes and sills of dioritic, granodioritic, and monzonitic composition. These intrusive rocks cut all of the aforementioned sedimentary and volcanic units of the Amaga and Combia Formations. K-Ar whole-rock ages for the intrusive rocks range from 8 to 6 Ma (Cediel et al., 2003). The Combia Formation and accompanying hypabyssal intrusive rocks are well represented along a 100-km by 20-km N-S trending belt extending from Anserma in the south to Jericó, Fredonia and Titiribí, located to the north of the La Mina Project (Figure 7.2).

Following the early accretionary events, the region was subjected to compressional deformation during the Early-Middle Miocene and Middle-Late Miocene. In both cases the deformation was related to additional accretionary tectonic events taking place to the west along the active Pacific margin. The structural architecture of the Romeral fault and mélange system is essentially that of a 10+ km wide series of N-S striking, vertically dipping, and dextral transcurrent faults. Virtually all lithologic contacts within the Romeral basement rocks are structural in nature and are characterized by abundant shearing, mylonitization, and the formation of clay-rich fault gouge. Structural reactivation during the Miocene resulted in orthogonal compression accompanied by mostly west-directed (back) thrusting and high- angle reverse fault development in the basement rocks. The Amaga Formation was deformed primarily into generally open, upright folds; local tilting and near isoclinal folds were associated with the west-directed thrust faults. The Combia Formation records both tilting and open folding. Both the Amaga and Combia Formations exhibit moderate to strong diapiric doming where affected by the emplacement of the Miocene suite of intrusive rocks. N-S, NE-SW, NW-SE and E-W striking conjugate shearing and dilational fracturing affect all of the above geologic units.

Metal Mining Consultants Inc.

Effective Date July 6, 2021 | |

GoldMining Inc.

NI 43-101 Report – La Mina Project | Page 37 |

Figure 7‑2 Tectonic Map of Colombia