February 2025 Fourth Quarter �and Full Year 2024 �Earnings Call Exhibit 99.2

Forward Looking Statement Statements contained in this presentation that state the Partnership’s or management’s expectations or predictions of the future are forward-looking statements. The words “believe,” “expect,” “should,” “intends,” “anticipates”, “estimates,” “target” and other similar expressions identify forward-looking statements. It is important to note that actual results could differ materially from those projected in such forward-looking statements. For more information concerning factors that could cause actual results to differ from those expressed or forecasted, see CrossAmerica’s annual reports on Form 10-K, quarterly reports on Form 10-Q and other reports filed with the Securities and Exchange Commission and available on the Partnership’s website at www.crossamericapartners.com. If any of these factors materialize, or if our underlying assumptions prove to be incorrect, actual results may vary significantly from what we projected. Any forward-looking statement you see or hear during this presentation reflects our current views as of the date of this presentation with respect to future events. We assume no obligation to publicly update or revise these forward-looking statements for any reason, whether as a result of new information, future events, or otherwise.

CrossAmerica Business Overview�Charles Nifong, CEO & President

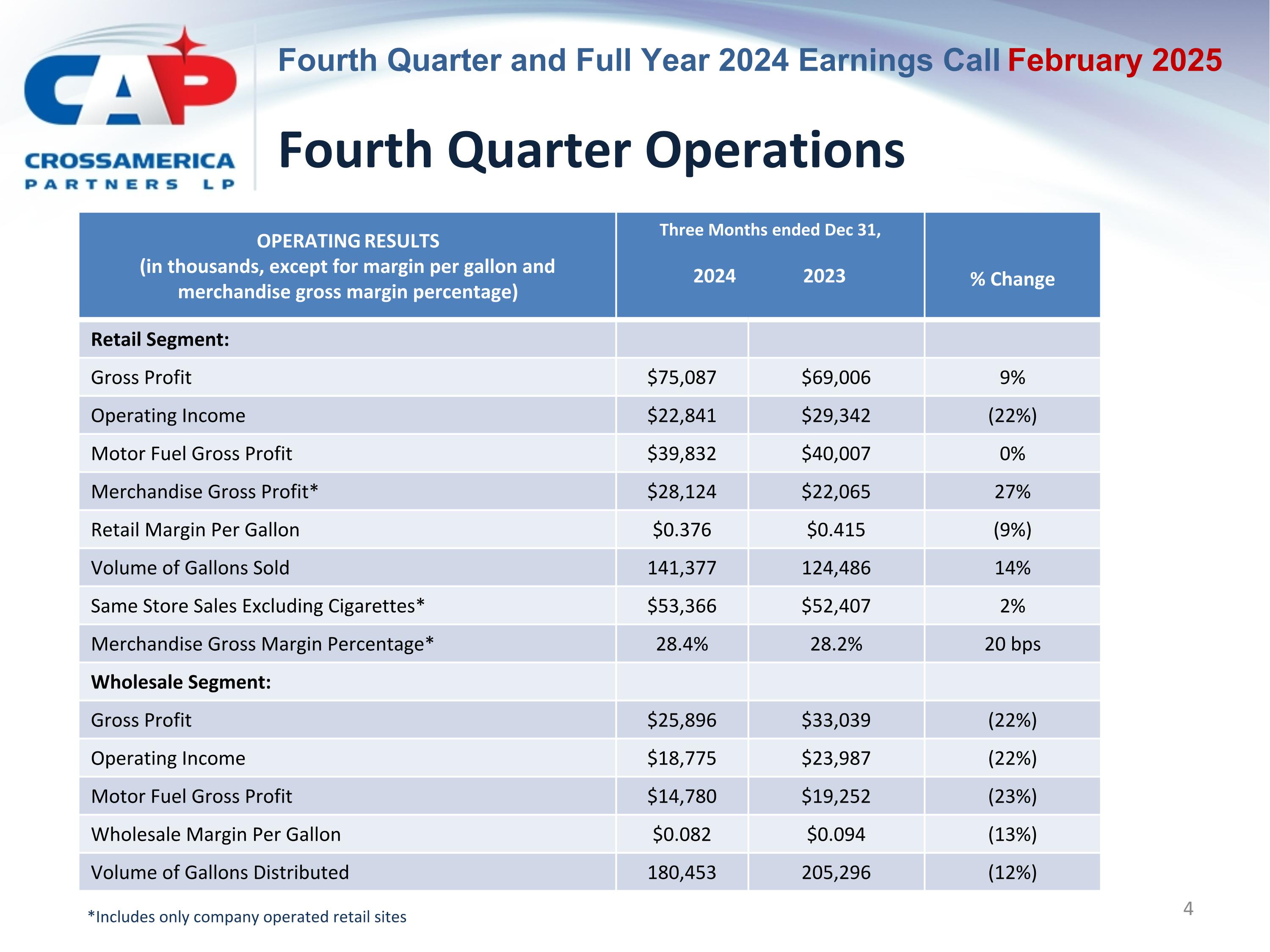

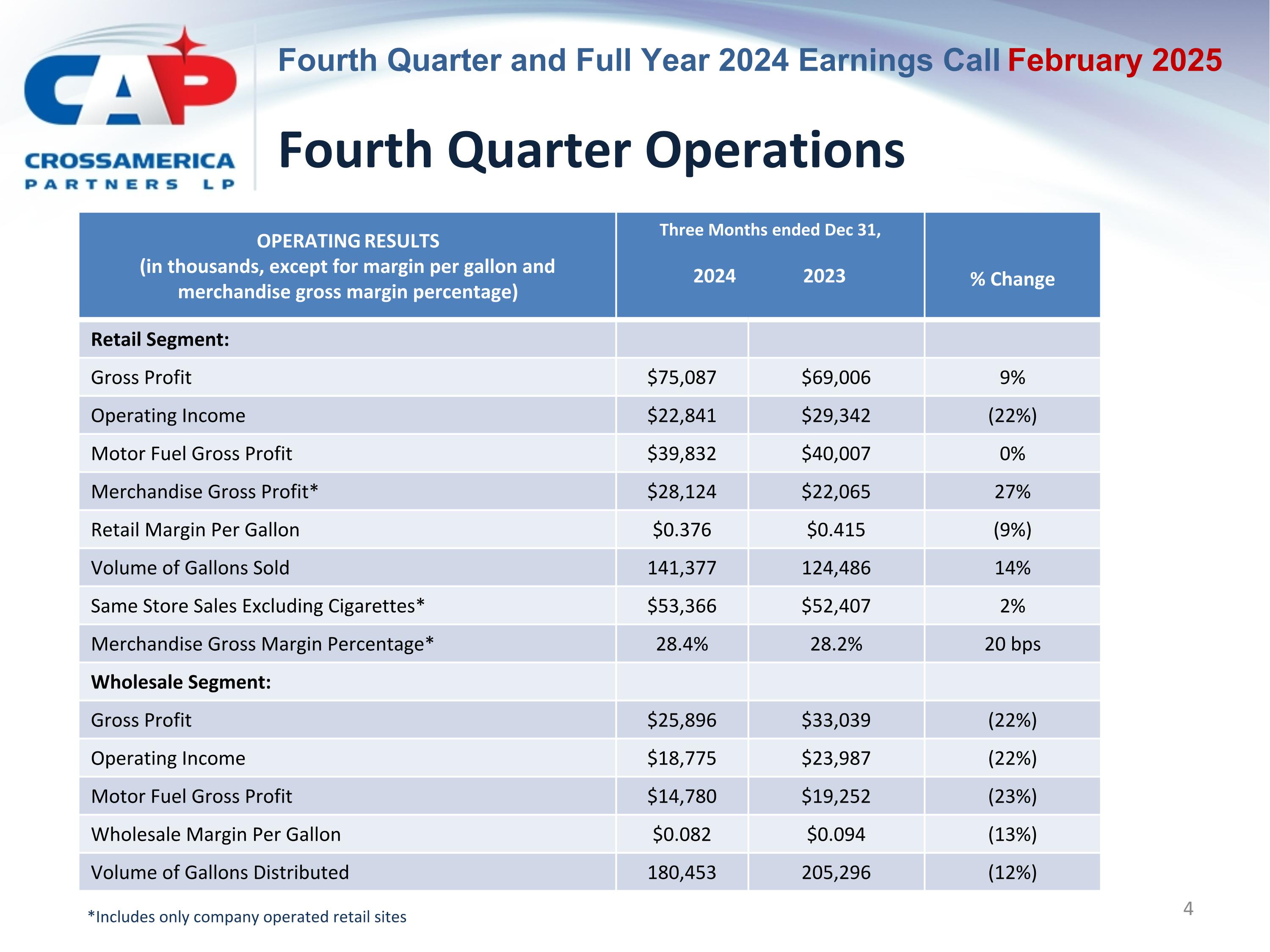

Fourth Quarter Operations OPERATING RESULTS (in thousands, except for margin per gallon and merchandise gross margin percentage) Three Months ended Dec 31, 2024 2023 % Change Retail Segment: Gross Profit $75,087 $69,006 9% Operating Income $22,841 $29,342 (22%) Motor Fuel Gross Profit $39,832 $40,007 0% Merchandise Gross Profit* $28,124 $22,065 27% Retail Margin Per Gallon $0.376 $0.415 (9%) Volume of Gallons Sold 141,377 124,486 14% Same Store Sales Excluding Cigarettes* $53,366 $52,407 2% Merchandise Gross Margin Percentage* 28.4% 28.2% 20 bps Wholesale Segment: Gross Profit $25,896 $33,039 (22%) Operating Income $18,775 $23,987 (22%) Motor Fuel Gross Profit $14,780 $19,252 (23%) Wholesale Margin Per Gallon $0.082 $0.094 (13%) Volume of Gallons Distributed 180,453 205,296 (12%) *Includes only company operated retail sites

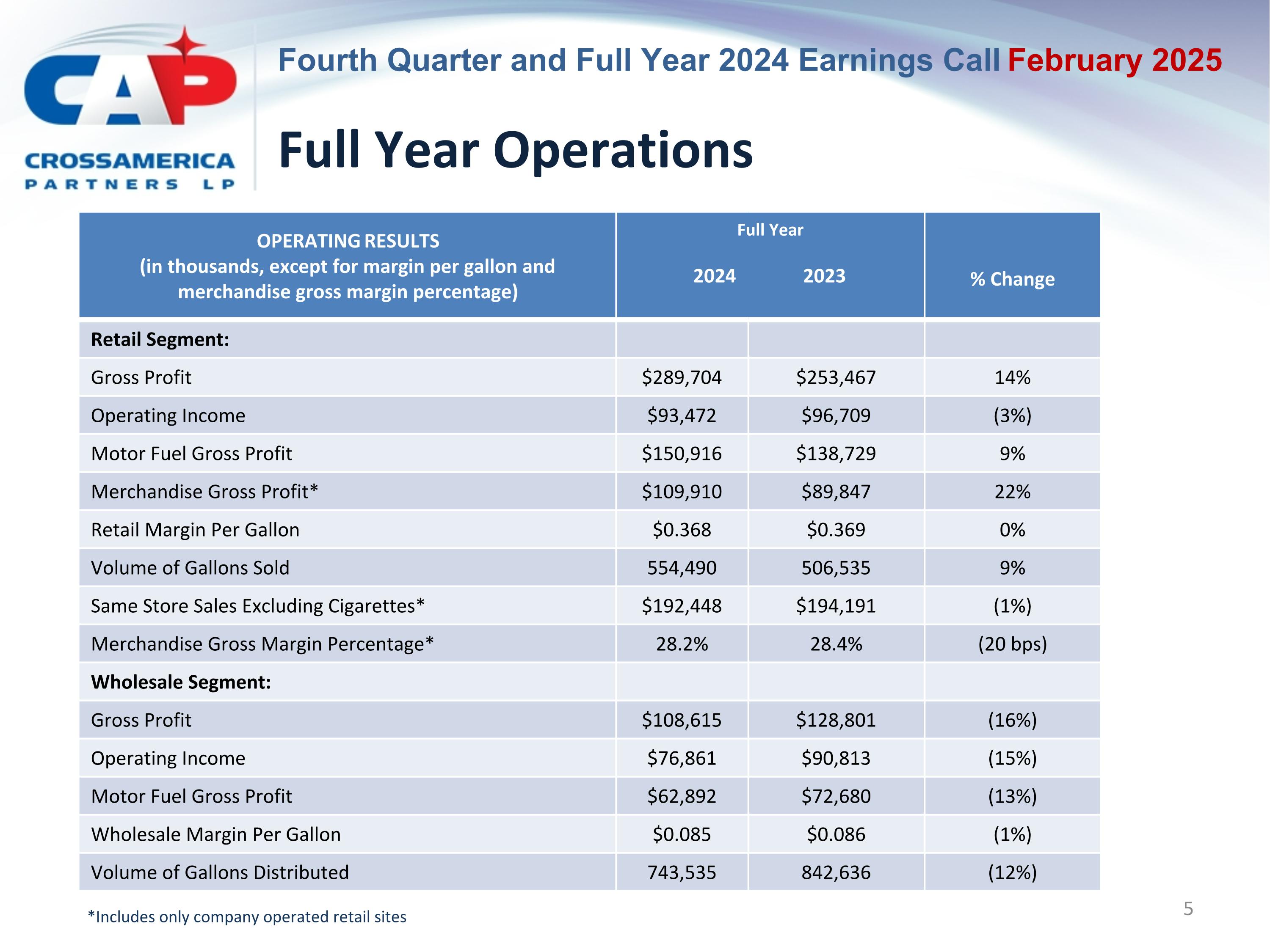

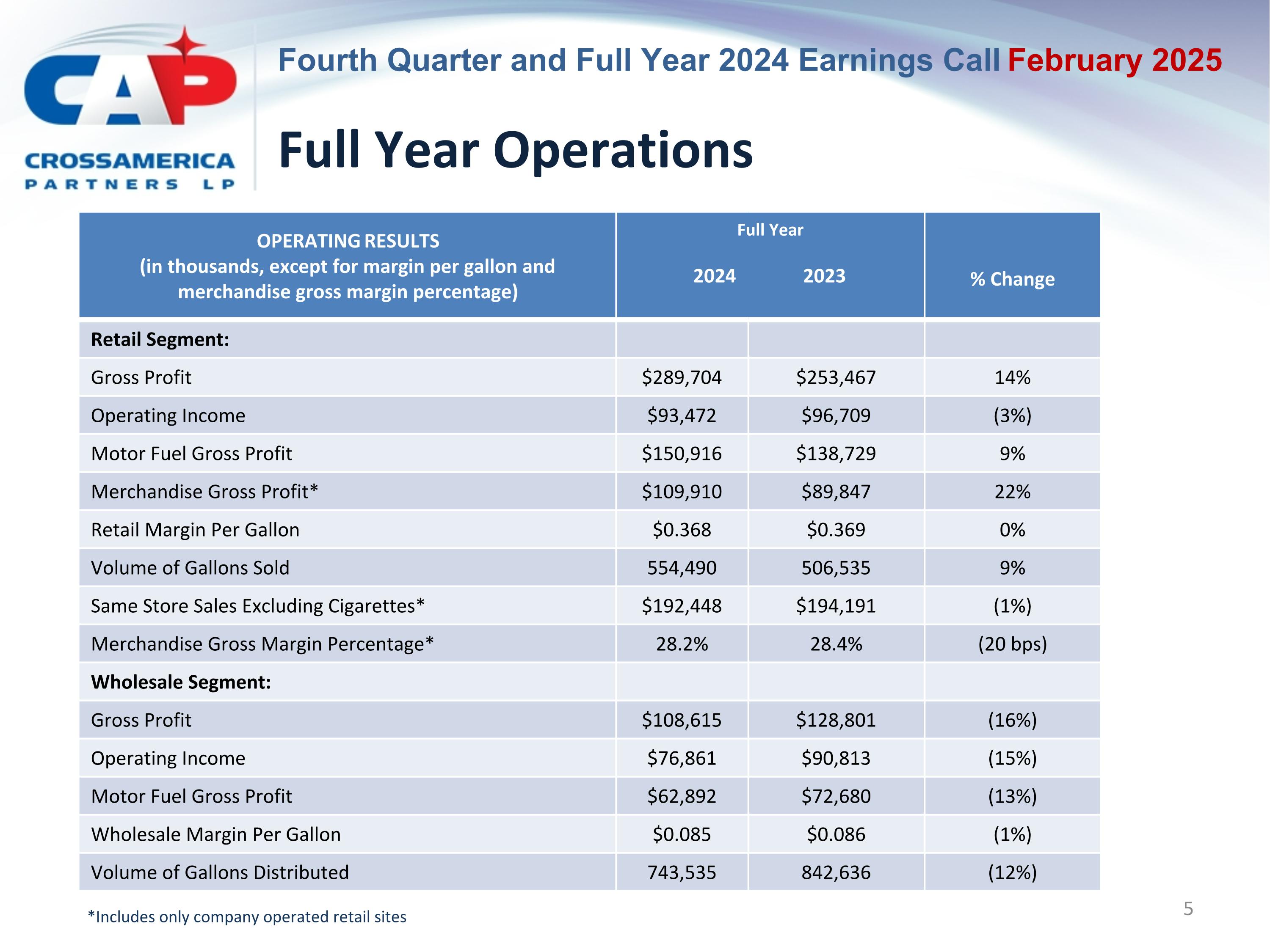

Full Year Operations OPERATING RESULTS (in thousands, except for margin per gallon and merchandise gross margin percentage) Full Year 2024 2023 % Change Retail Segment: Gross Profit $289,704 $253,467 14% Operating Income $93,472 $96,709 (3%) Motor Fuel Gross Profit $150,916 $138,729 9% Merchandise Gross Profit* $109,910 $89,847 22% Retail Margin Per Gallon $0.368 $0.369 0% Volume of Gallons Sold 554,490 506,535 9% Same Store Sales Excluding Cigarettes* $192,448 $194,191 (1%) Merchandise Gross Margin Percentage* 28.2% 28.4% (20 bps) Wholesale Segment: Gross Profit $108,615 $128,801 (16%) Operating Income $76,861 $90,813 (15%) Motor Fuel Gross Profit $62,892 $72,680 (13%) Wholesale Margin Per Gallon $0.085 $0.086 (1%) Volume of Gallons Distributed 743,535 842,636 (12%) *Includes only company operated retail sites

Strategy Overview Provide excellent service and value to our customers, both retail and wholesale Improve the business through increasing our operational efficiency and realizing benefits of our scale Position the portfolio for the future Divesting assets and recycling capital into growth opportunities within the portfolio Expanding retail operations at controlled sites to benefit from industry market dynamics

CrossAmerica Financial Overview�Maura Topper, Chief Financial Officer

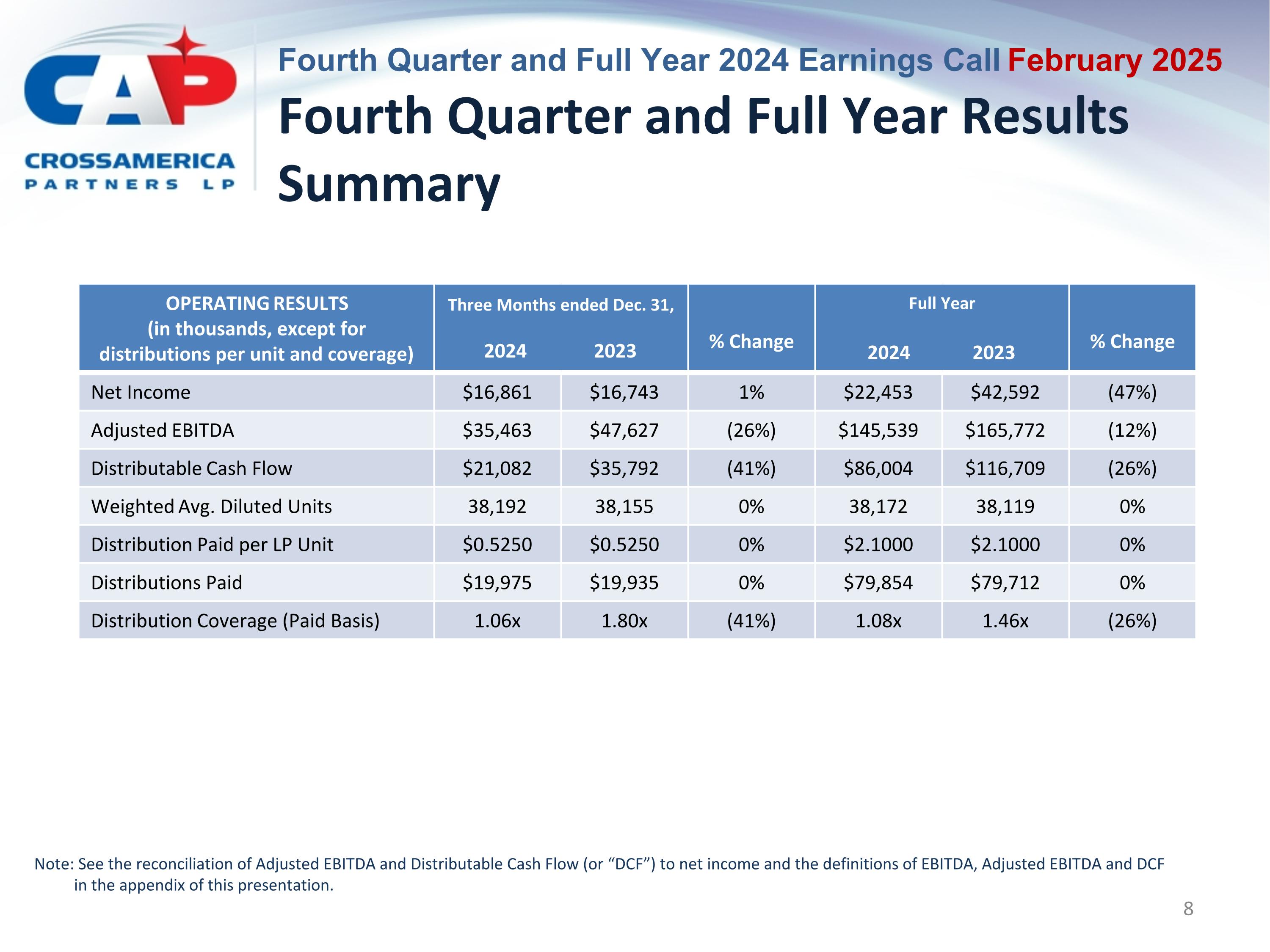

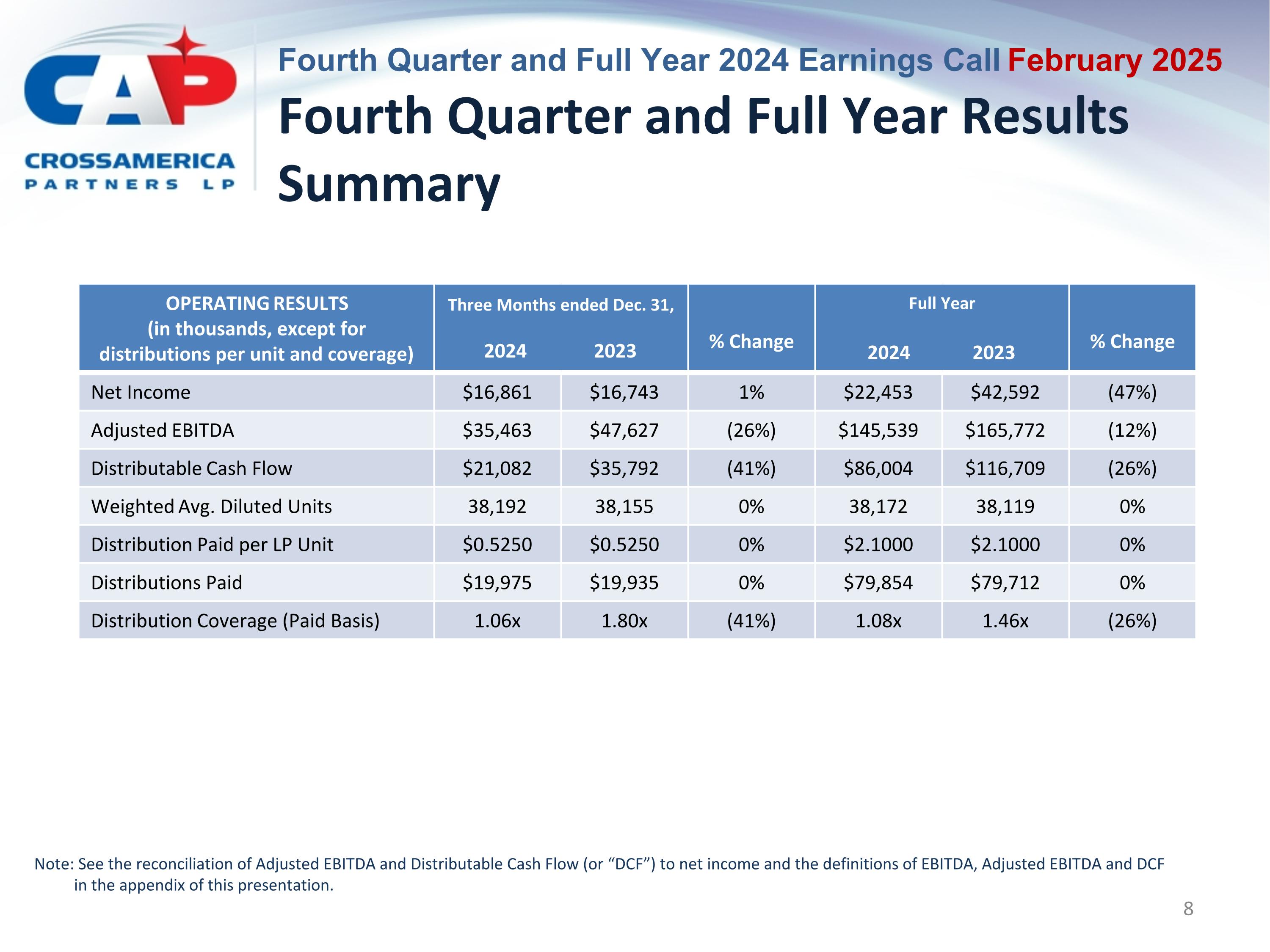

Fourth Quarter and Full Year Results Summary OPERATING RESULTS (in thousands, except for distributions per unit and coverage) Three Months ended Dec. 31, 2024 2023 % Change Full Year 2024 2023 % Change Net Income $16,861 $16,743 1% $22,453 $42,592 (47%) Adjusted EBITDA $35,463 $47,627 (26%) $145,539 $165,772 (12%) Distributable Cash Flow $21,082 $35,792 (41%) $86,004 $116,709 (26%) Weighted Avg. Diluted Units 38,192 38,155 0% 38,172 38,119 0% Distribution Paid per LP Unit $0.5250 $0.5250 0% $2.1000 $2.1000 0% Distributions Paid $19,975 $19,935 0% $79,854 $79,712 0% Distribution Coverage (Paid Basis) 1.06x 1.80x (41%) 1.08x 1.46x (26%) Note: See the reconciliation of Adjusted EBITDA and Distributable Cash Flow (or “DCF”) to net income and the definitions of EBITDA, Adjusted EBITDA and DCF in the appendix of this presentation.

Capital Strength Capital Expenditures Fourth quarter 2024 capital expenditures of $7.2 million with $5.1 million of growth capex Total 2024 capital expenditures of $26.3 million with $18.0 million of growth capex Growth capital projects during the year included targeted material renovations as well as projects to increase food offerings Leverage Credit facility balance at 12/31/24: $767.5 million Continue to manage debt levels and leverage ratio Leverage ratio was 4.36x at 12/31/24 Effective interest rate at 12/31/24: 6.2% Ongoing benefit of interest rate swaps in elevated rate environment Continued Focus on Execution, Cash Flows, and Strong Balance Sheet

Appendix Fourth Quarter and Full Year 2024 Earnings Call

Non-GAAP Financial Measures Non-GAAP Financial Measures We use the non-GAAP financial measures EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio. EBITDA represents net income before deducting interest expense, income taxes and depreciation, amortization and accretion (which includes certain impairment charges). Adjusted EBITDA represents EBITDA as further adjusted to exclude equity-based compensation expense, gains or losses on dispositions and lease terminations, net and certain discrete acquisition related costs, such as legal and other professional fees, separation benefit costs and certain other discrete non-cash items arising from purchase accounting. Distributable Cash Flow represents Adjusted EBITDA less cash interest expense, sustaining capital expenditures and current income tax expense. The Distribution Coverage Ratio is computed by dividing Distributable Cash Flow by distributions paid on common units. EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio are used as supplemental financial measures by management and by external users of our financial statements, such as investors and lenders. EBITDA and Adjusted EBITDA are used to assess our financial performance without regard to financing methods, capital structure or income taxes and the ability to incur and service debt and to fund capital expenditures. In addition, Adjusted EBITDA is used to assess the operating performance of our business on a consistent basis by excluding the impact of items which do not result directly from the wholesale distribution of motor fuel, the leasing of real property, or the day to day operations of our retail site activities. EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio are also used to assess the ability to generate cash sufficient to make distributions to our unitholders. We believe the presentation of EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio provides useful information to investors in assessing the financial condition and results of operations. EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio should not be considered alternatives to net income or any other measure of financial performance or liquidity presented in accordance with U.S. GAAP. EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio have important limitations as analytical tools because they exclude some but not all items that affect net income. Additionally, because EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio may be defined differently by other companies in our industry, our definitions may not be comparable to similarly titled measures of other companies, thereby diminishing their utility.

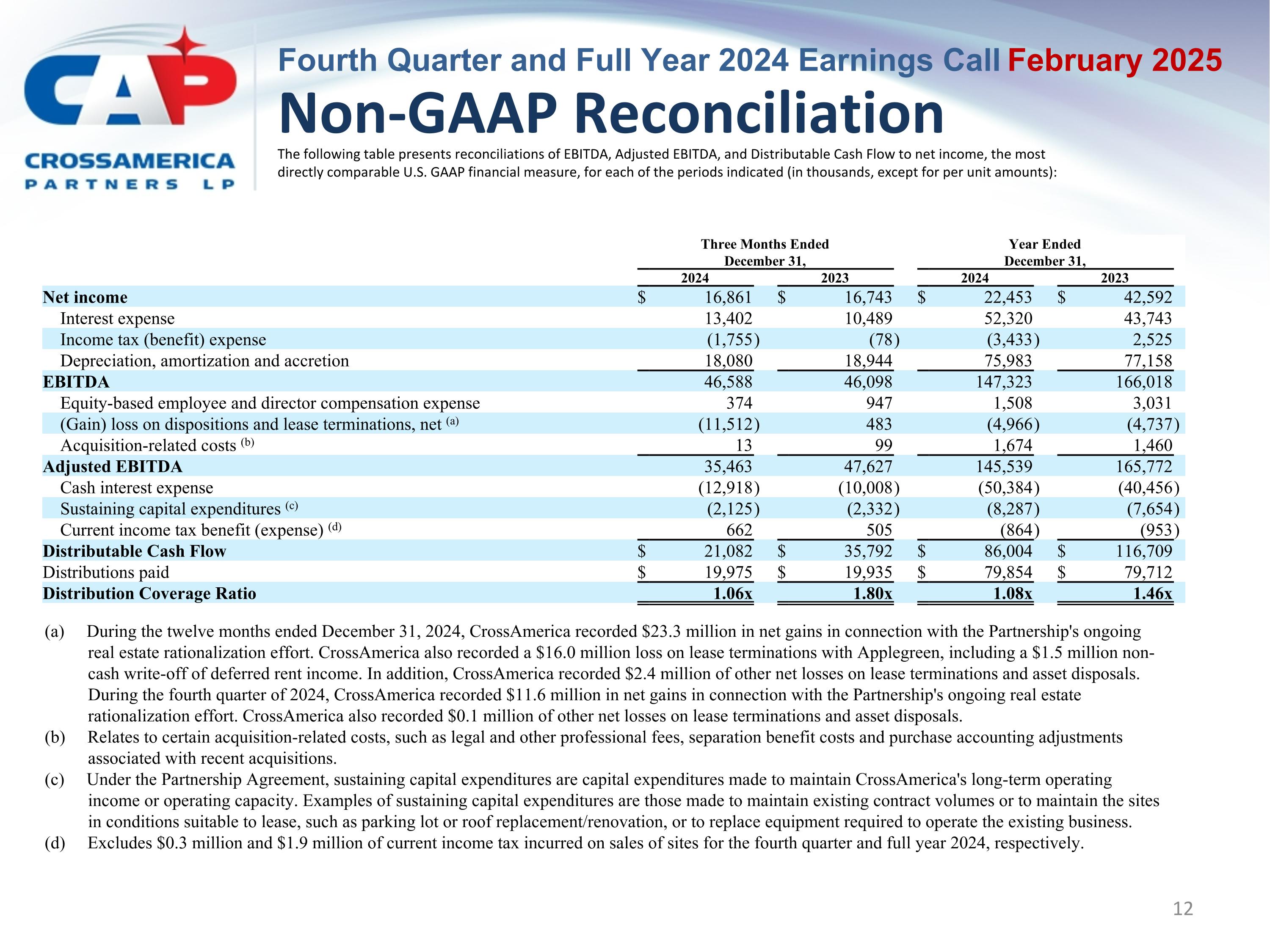

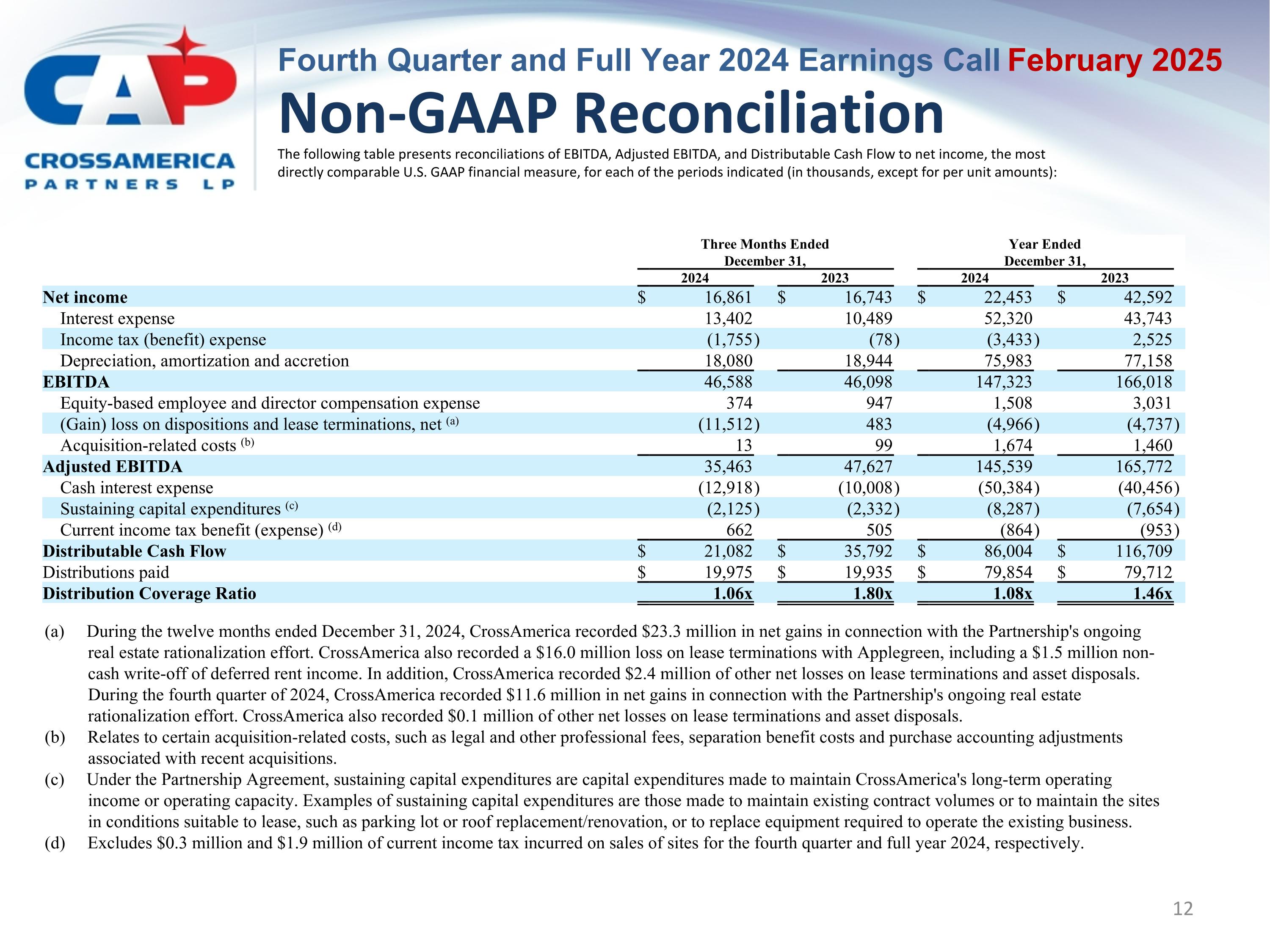

Non-GAAP Reconciliation The following table presents reconciliations of EBITDA, Adjusted EBITDA, and Distributable Cash Flow to net income, the most directly comparable U.S. GAAP financial measure, for each of the periods indicated (in thousands, except for per unit amounts): Three Months Ended�December 31, Year Ended�December 31, 2024 2023 2024 2023 Net income $ 16,861 $ 16,743 $ 22,453 $ 42,592 Interest expense 13,402 10,489 52,320 43,743 Income tax (benefit) expense (1,755 ) (78 ) (3,433 ) 2,525 Depreciation, amortization and accretion 18,080 18,944 75,983 77,158 EBITDA 46,588 46,098 147,323 166,018 Equity-based employee and director compensation expense 374 947 1,508 3,031 (Gain) loss on dispositions and lease terminations, net (a) (11,512 ) 483 (4,966 ) (4,737 ) Acquisition-related costs (b) 13 99 1,674 1,460 Adjusted EBITDA 35,463 47,627 145,539 165,772 Cash interest expense (12,918 ) (10,008 ) (50,384 ) (40,456 ) Sustaining capital expenditures (c) (2,125 ) (2,332 ) (8,287 ) (7,654 ) Current income tax benefit (expense) (d) 662 505 (864 ) (953 ) Distributable Cash Flow $ 21,082 $ 35,792 $ 86,004 $ 116,709 Distributions paid $ 19,975 $ 19,935 $ 79,854 $ 79,712 Distribution Coverage Ratio 1.06x 1.80x 1.08x 1.46x (a) During the twelve months ended December 31, 2024, CrossAmerica recorded $23.3 million in net gains in connection with the Partnership's ongoing real estate rationalization effort. CrossAmerica also recorded a $16.0 million loss on lease terminations with Applegreen, including a $1.5 million non-cash write-off of deferred rent income. In addition, CrossAmerica recorded $2.4 million of other net losses on lease terminations and asset disposals. During the fourth quarter of 2024, CrossAmerica recorded $11.6 million in net gains in connection with the Partnership's ongoing real estate rationalization effort. CrossAmerica also recorded $0.1 million of other net losses on lease terminations and asset disposals. (b) Relates to certain acquisition-related costs, such as legal and other professional fees, separation benefit costs and purchase accounting adjustments associated with recent acquisitions. (c) Under the Partnership Agreement, sustaining capital expenditures are capital expenditures made to maintain CrossAmerica's long-term operating income or operating capacity. Examples of sustaining capital expenditures are those made to maintain existing contract volumes or to maintain the sites in conditions suitable to lease, such as parking lot or roof replacement/renovation, or to replace equipment required to operate the existing business. (d) Excludes $0.3 million and $1.9 million of current income tax incurred on sales of sites for the fourth quarter and full year 2024, respectively.