2Q 2016 Earnings Call August 2016

Safe Harbor Statement Statements contained in this presentation that state the Partnership’s or management’s expectations or predictions of the future are forward-looking statements. The words “believe,” “expect,” “should,” “intends,” “estimates,” “target” and other similar expressions identify forward-looking statements. It is important to note that actual results could differ materially from those projected in such forward-looking statements. For more information concerning factors that could cause actual results to differ from those expressed or forecasted, see CrossAmerica’s Forms 10-Q or Form 10-K filed with the Securities and Exchange Commission and available on CrossAmerica’s website at www.crossamericapartners.com. If any of these factors materialize, or if our underlying assumptions prove to be incorrect, actual results may vary significantly from what we projected. Any forward-looking statement you see or hear during this presentation reflects our current views as of the date of this presentation with respect to future events. We assume no obligation to publicly update or revise these forward-looking statements for any reason, whether as a result of new information, future events, or otherwise. 2

CrossAmerica Business Overview Jeremy Bergeron, President 3

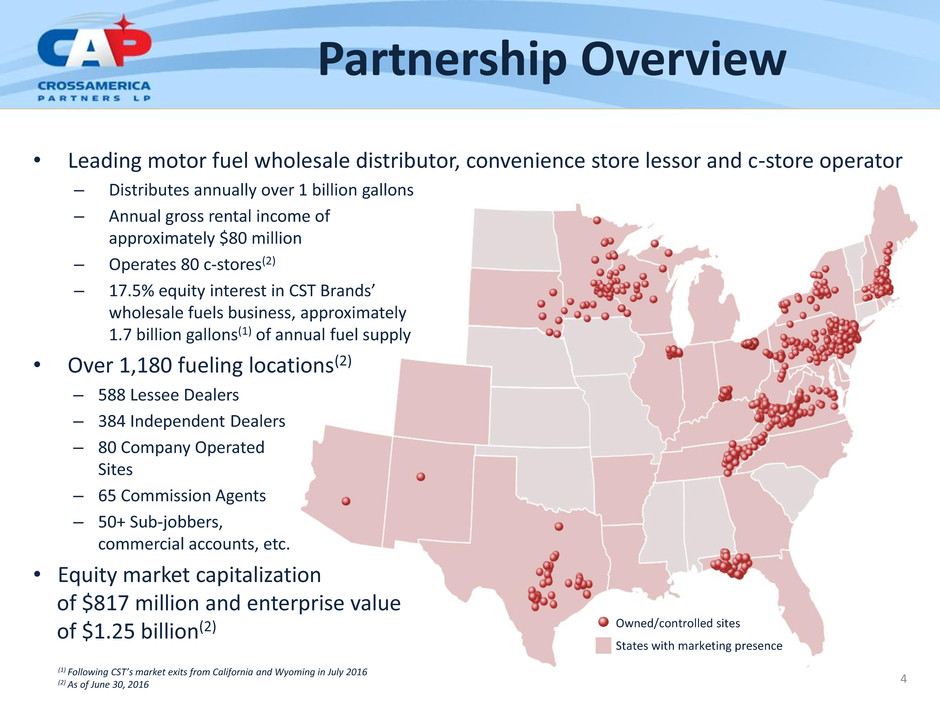

Partnership Overview • Leading motor fuel wholesale distributor, convenience store lessor and c-store operator – Distributes annually over 1 billion gallons – Annual gross rental income of approximately $80 million – Operates 80 c-stores(2) – 17.5% equity interest in CST Brands’ wholesale fuels business, approximately 1.7 billion gallons(1) of annual fuel supply • Over 1,180 fueling locations(2) – 588 Lessee Dealers – 384 Independent Dealers – 80 Company Operated Sites – 65 Commission Agents – 50+ Sub-jobbers, commercial accounts, etc. • Equity market capitalization of $817 million and enterprise value of $1.25 billion(2) (1) Following CST’s market exits from California and Wyoming in July 2016 (2) As of June 30, 2016 Owned/controlled sites States with marketing presence 4

Continuing Accretive Growth 5 55 Lessee Dealers, 25 Indep. Dealers, 3 Company Ops $45 Million Purchase 60 Million Gallons Chicago Market Marathon, Citgo, Phillips 66, Mobil, BP, Shell Est. 3Q16 close date Asset Purchase Rationale 154 current locations 85 pending locations (State Oil) CrossAmerica Upper Midwest Region Owned, Leased or Supplied Locations • 59 valuable fee sites in Greater Chicago • Located in proximity of existing markets • Expands branding relationship with several suppliers

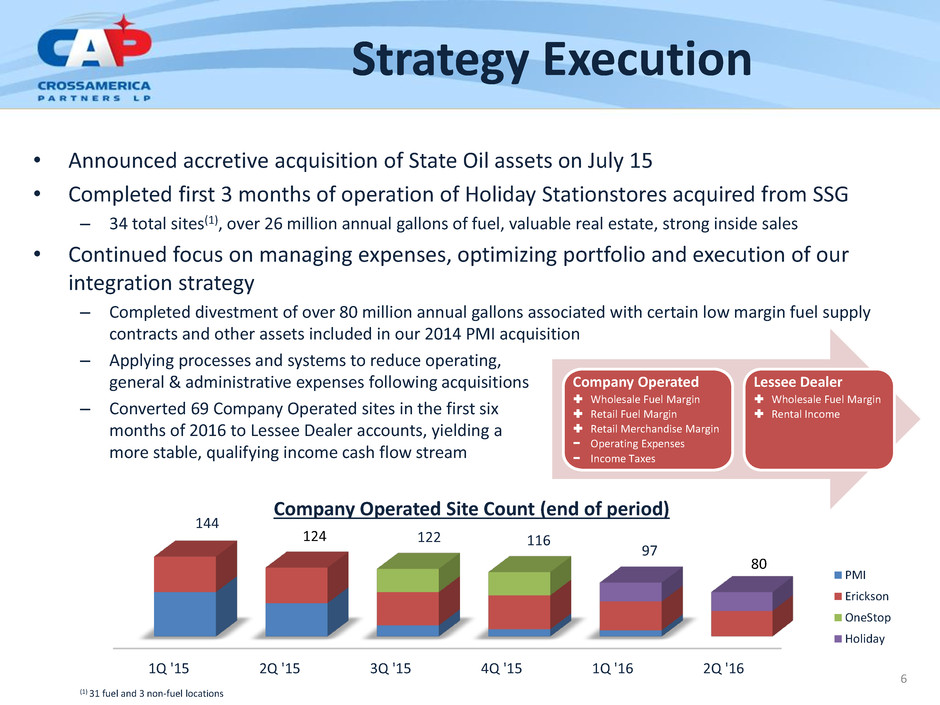

Strategy Execution • Announced accretive acquisition of State Oil assets on July 15 • Completed first 3 months of operation of Holiday Stationstores acquired from SSG – 34 total sites(1), over 26 million annual gallons of fuel, valuable real estate, strong inside sales • Continued focus on managing expenses, optimizing portfolio and execution of our integration strategy – Completed divestment of over 80 million annual gallons associated with certain low margin fuel supply contracts and other assets included in our 2014 PMI acquisition – Applying processes and systems to reduce operating, general & administrative expenses following acquisitions – Converted 69 Company Operated sites in the first six months of 2016 to Lessee Dealer accounts, yielding a more stable, qualifying income cash flow stream 1Q '15 2Q '15 3Q '15 4Q '15 1Q '16 2Q '16 144 122 116 97 124 80 Company Operated Site Count (end of period) PMI Erickson OneStop Holiday (1) 31 fuel and 3 non-fuel locations Company Operated Wholesale Fuel Margin Retail Fuel Margin Retail Merchandise Margin − Operating Expenses − Income Taxes Lessee Dealer Wholesale Fuel Margin Rental Income 6

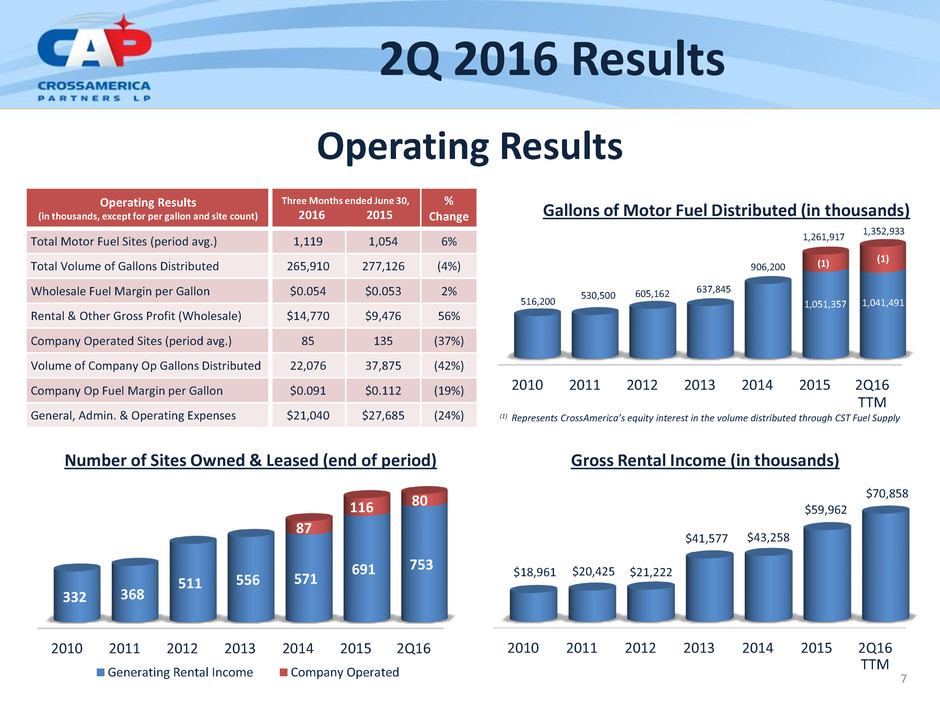

Operating Results Operating Results (in thousands, except for per gallon and site count) Three Months ended June 30, 2016 2015 % Change Total Motor Fuel Sites (period avg.) 1,119 1,054 6% Total Volume of Gallons Distributed 265,910 277,126 (4%) Wholesale Fuel Margin per Gallon $0.054 $0.053 2% Rental & Other Gross Profit (Wholesale) $14,770 $9,476 56% Company Operated Sites (period avg.) 85 135 (37%) Volume of Company Op Gallons Distributed 22,076 37,875 (42%) Company Op Fuel Margin per Gallon $0.091 $0.112 (19%) General, Admin. & Operating Expenses $21,040 $27,685 (24%) Gallons of Motor Fuel Distributed (in thousands) 1,261,917 (1) Represents CrossAmerica’s equity interest in the volume distributed through CST Fuel Supply 2010 2011 2012 2013 2014 2015 2Q16 332 368 511 556 571 691 753 87 116 80 Number of Sites Owned & Leased (end of period) Generating Rental Income Company Operated 2010 2011 2012 2013 2014 2015 2Q16 516,200 530,500 605,162 637,845 906,200 1,051,357 1,041,491 (1) (1) TTM 2010 2011 2012 2013 2014 2015 2Q16 $18,961 $20,425 $21,222 $41,577 $43,258 $59,962 $70,858 Gross Rental Income (in thousands) TTM 1,352,933 7 2Q 2016 Results

CrossAmerica Financial Overview Steven Stellato, Chief Accounting Officer 8

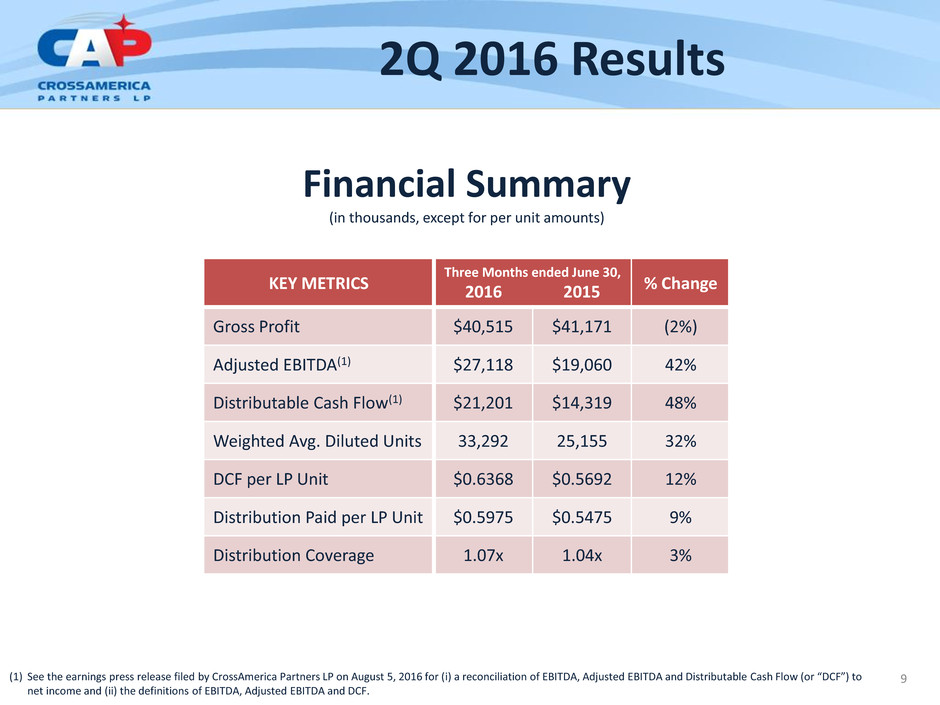

2Q 2016 Results 9 (1) See the earnings press release filed by CrossAmerica Partners LP on August 5, 2016 for (i) a reconciliation of EBITDA, Adjusted EBITDA and Distributable Cash Flow (or “DCF”) to net income and (ii) the definitions of EBITDA, Adjusted EBITDA and DCF. KEY METRICS Three Months ended June 30, 2016 2015 % Change Gross Profit $40,515 $41,171 (2%) Adjusted EBITDA(1) $27,118 $19,060 42% Distributable Cash Flow(1) $21,201 $14,319 48% Weighted Avg. Diluted Units 33,292 25,155 32% DCF per LP Unit $0.6368 $0.5692 12% Distribution Paid per LP Unit $0.5975 $0.5475 9% Distribution Coverage 1.07x 1.04x 3% Financial Summary (in thousands, except for per unit amounts)

2Q15 vs 2Q16 Adjusted EBITDA (in thousands) $27,118 $19,060 $7,232 ($1,153) $528 $1,834 ($383) Acquisitions(2) Impact of Supplier Terms Discounts Q2 2015 Adjusted EBITDA(1) Q2 2016 Adjusted EBITDA(1) Net, Misc.(3) Net Effect of Integration and Base Business (1) See the earnings press release filed by CrossAmerica Partners LP on August 5, 2016 for (i) a reconciliation of EBITDA, Adjusted EBITDA and Distributable Cash Flow (or “DCF”) to net income and (ii) the definitions of EBITDA, Adjusted EBITDA and DCF. (2) Acquisitions include third party acquisitions and CST asset drops conducted since 1/1/15 (3) Net, Misc. includes increased Incentive Distribution Right distributions and other miscellaneous items 10 2Q 2016 Results Impact of Dealer Tank Wagon Pricing

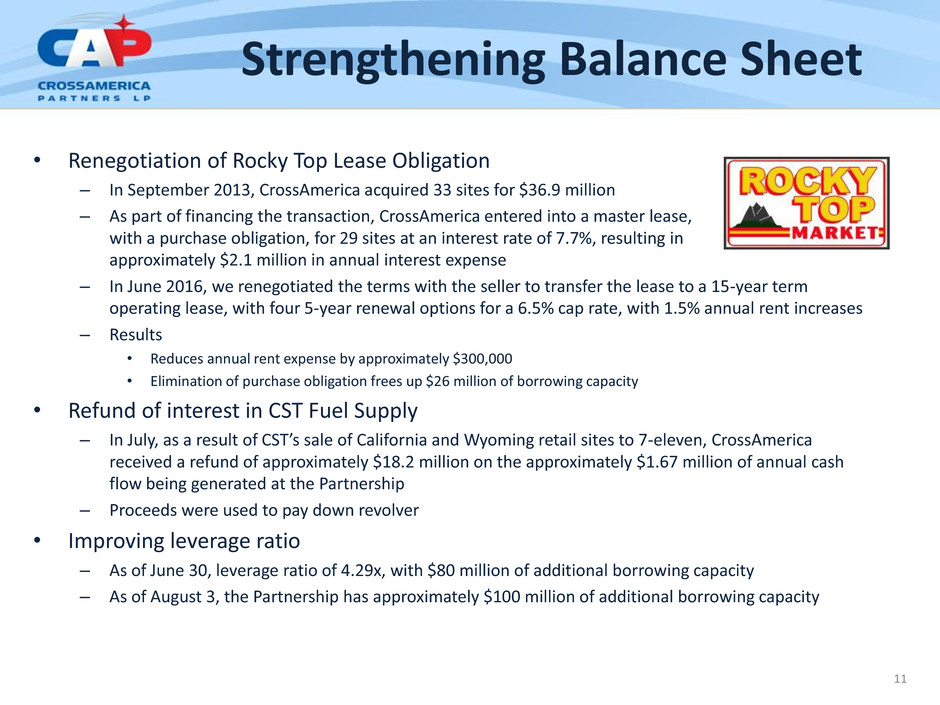

Strengthening Balance Sheet • Renegotiation of Rocky Top Lease Obligation – In September 2013, CrossAmerica acquired 33 sites for $36.9 million – As part of financing the transaction, CrossAmerica entered into a master lease, with a purchase obligation, for 29 sites at an interest rate of 7.7%, resulting in approximately $2.1 million in annual interest expense – In June 2016, we renegotiated the terms with the seller to transfer the lease to a 15-year term operating lease, with four 5-year renewal options for a 6.5% cap rate, with 1.5% annual rent increases – Results • Reduces annual rent expense by approximately $300,000 • Elimination of purchase obligation frees up $26 million of borrowing capacity • Refund of interest in CST Fuel Supply – In July, as a result of CST’s sale of California and Wyoming retail sites to 7-eleven, CrossAmerica received a refund of approximately $18.2 million on the approximately $1.67 million of annual cash flow being generated at the Partnership – Proceeds were used to pay down revolver • Improving leverage ratio – As of June 30, leverage ratio of 4.29x, with $80 million of additional borrowing capacity – As of August 3, the Partnership has approximately $100 million of additional borrowing capacity 11

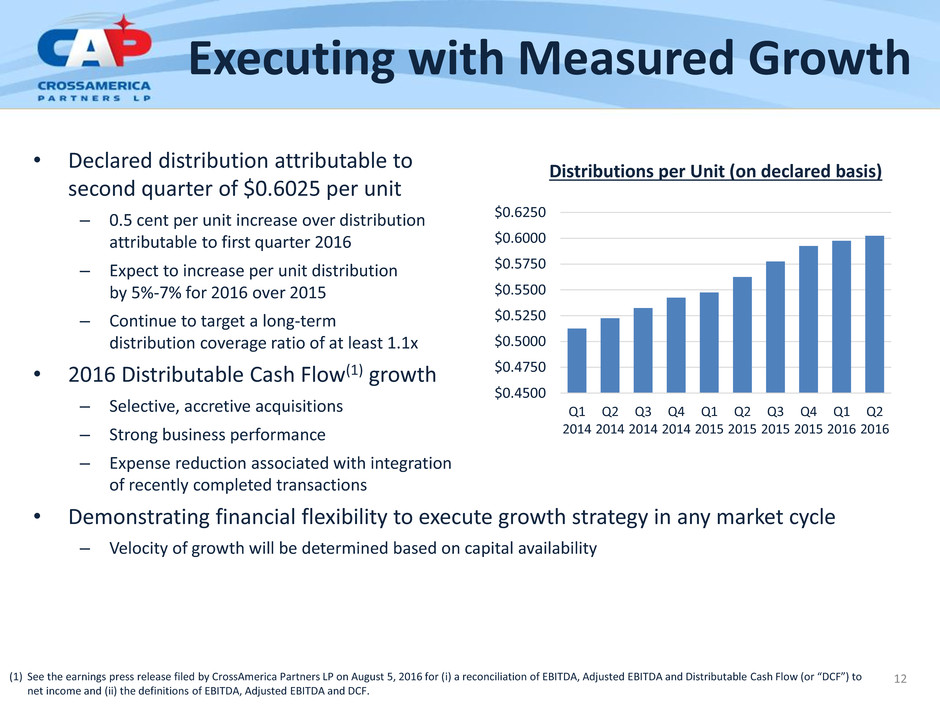

Executing with Measured Growth • Declared distribution attributable to second quarter of $0.6025 per unit – 0.5 cent per unit increase over distribution attributable to first quarter 2016 – Expect to increase per unit distribution by 5%-7% for 2016 over 2015 – Continue to target a long-term distribution coverage ratio of at least 1.1x • 2016 Distributable Cash Flow(1) growth – Selective, accretive acquisitions – Strong business performance – Expense reduction associated with integration of recently completed transactions • Demonstrating financial flexibility to execute growth strategy in any market cycle – Velocity of growth will be determined based on capital availability 12 $0.4500 $0.4750 $0.5000 $0.5250 $0.5500 $0.5750 $0.6000 $0.6250 Q1 2014 Q2 2014 Q3 2014 Q4 2014 Q1 2015 Q2 2015 Q3 2015 Q4 2015 Q1 2016 Q2 2016 Distributions per Unit (on declared basis) (1) See the earnings press release filed by CrossAmerica Partners LP on August 5, 2016 for (i) a reconciliation of EBITDA, Adjusted EBITDA and Distributable Cash Flow (or “DCF”) to net income and (ii) the definitions of EBITDA, Adjusted EBITDA and DCF.