November 2019 Third Quarter 2019 Earnings Call Exhibit 99.2

Forward Looking Statement Statements contained in this presentation that state the Partnership’s or management’s expectations or predictions of the future are forward-looking statements. The words “believe,” “expect,” “should,” “intends,” “anticipates”, “estimates,” “target” and other similar expressions identify forward-looking statements. It is important to note that actual results could differ materially from those projected in such forward-looking statements. For more information concerning factors that could cause actual results to differ from those expressed or forecasted, see CrossAmerica’s annual reports on Form 10-K, quarterly reports on Form 10-Q and other reports filed with the Securities and Exchange Commission and available on the Partnership’s website at www.crossamericapartners.com. If any of these factors materialize, or if our underlying assumptions prove to be incorrect, actual results may vary significantly from what we projected. Any forward-looking statement you see or hear during this presentation reflects our current views as of the date of this presentation with respect to future events. We assume no obligation to publicly update or revise these forward-looking statements for any reason, whether as a result of new information, future events, or otherwise.

CrossAmerica Business Overview Gerardo Valencia, CEO & President

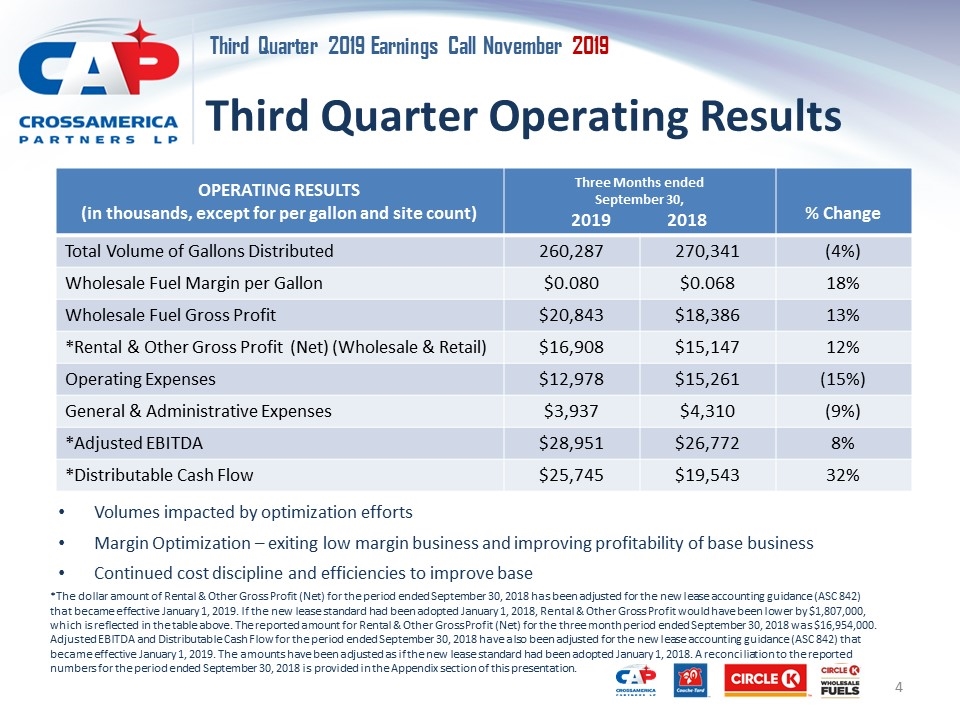

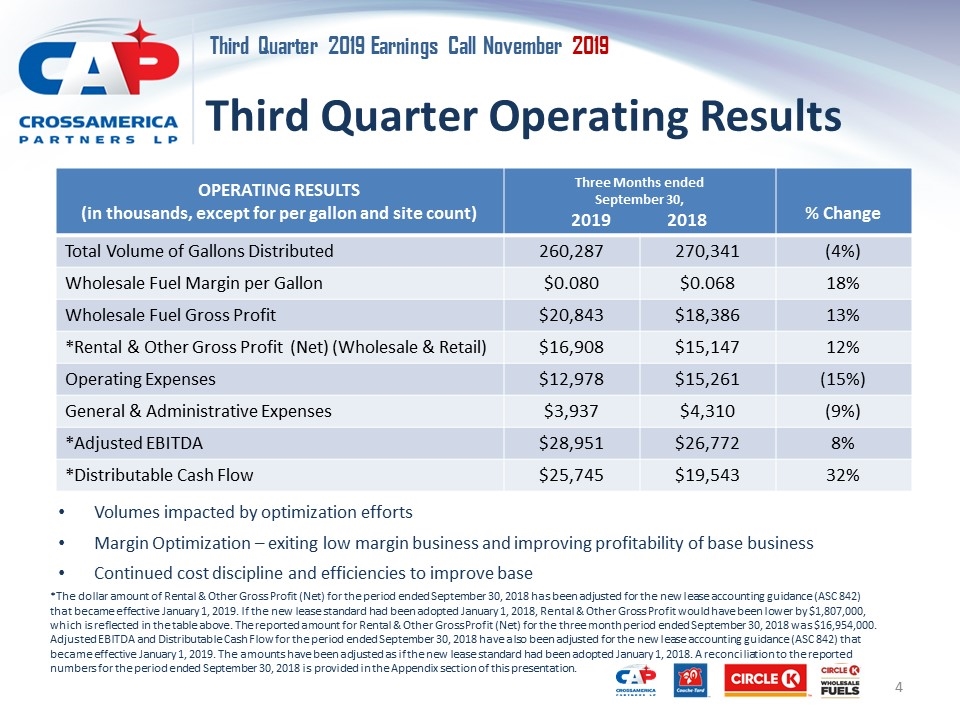

Third Quarter Operating Results OPERATING RESULTS (in thousands, except for per gallon and site count) Three Months ended September 30, 2019 2018 % Change Total Volume of Gallons Distributed 260,287 270,341 (4%) Wholesale Fuel Margin per Gallon $0.080 $0.068 18% Wholesale Fuel Gross Profit $20,843 $18,386 13% *Rental & Other Gross Profit (Net) (Wholesale & Retail) $16,908 $15,147 12% Operating Expenses $12,978 $15,261 (15%) General & Administrative Expenses $3,937 $4,310 (9%) *Adjusted EBITDA $28,951 $26,772 8% *Distributable Cash Flow $25,745 $19,543 32% Volumes impacted by optimization efforts Margin Optimization – exiting low margin business and improving profitability of base business Continued cost discipline and efficiencies to improve base *The dollar amount of Rental & Other Gross Profit (Net) for the period ended September 30, 2018 has been adjusted for the new lease accounting guidance (ASC 842) that became effective January 1, 2019. If the new lease standard had been adopted January 1, 2018, Rental & Other Gross Profit would have been lower by $1,807,000, which is reflected in the table above. The reported amount for Rental & Other Gross Profit (Net) for the three month period ended September 30, 2018 was $16,954,000. Adjusted EBITDA and Distributable Cash Flow for the period ended September 30, 2018 have also been adjusted for the new lease accounting guidance (ASC 842) that became effective January 1, 2019. The amounts have been adjusted as if the new lease standard had been adopted January 1, 2018. A reconciliation to the reported numbers for the period ended September 30, 2018 is provided in the Appendix section of this presentation.

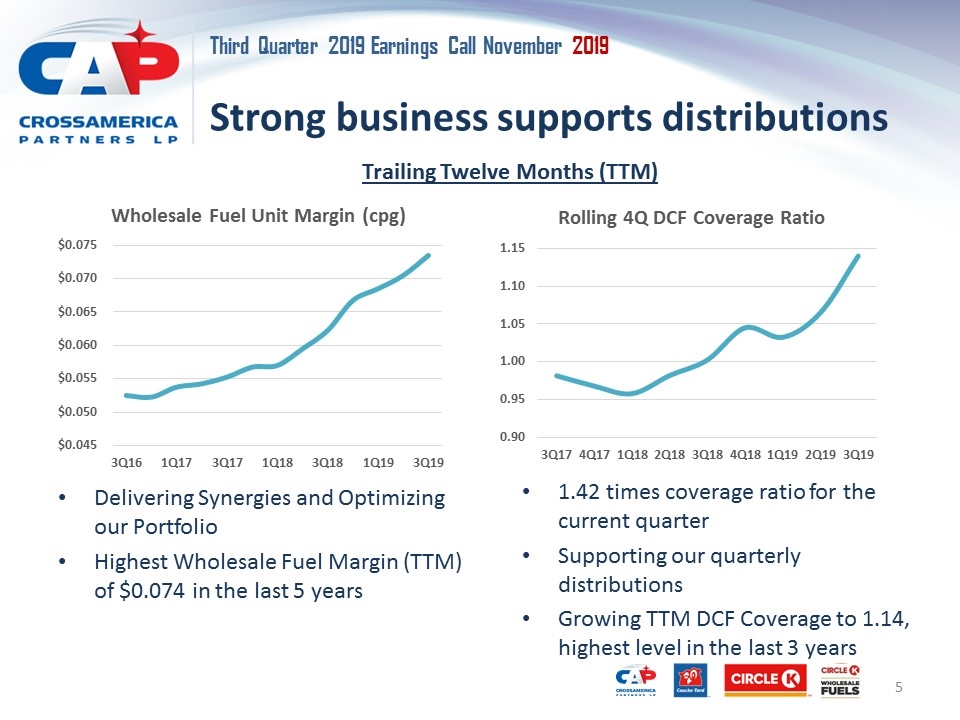

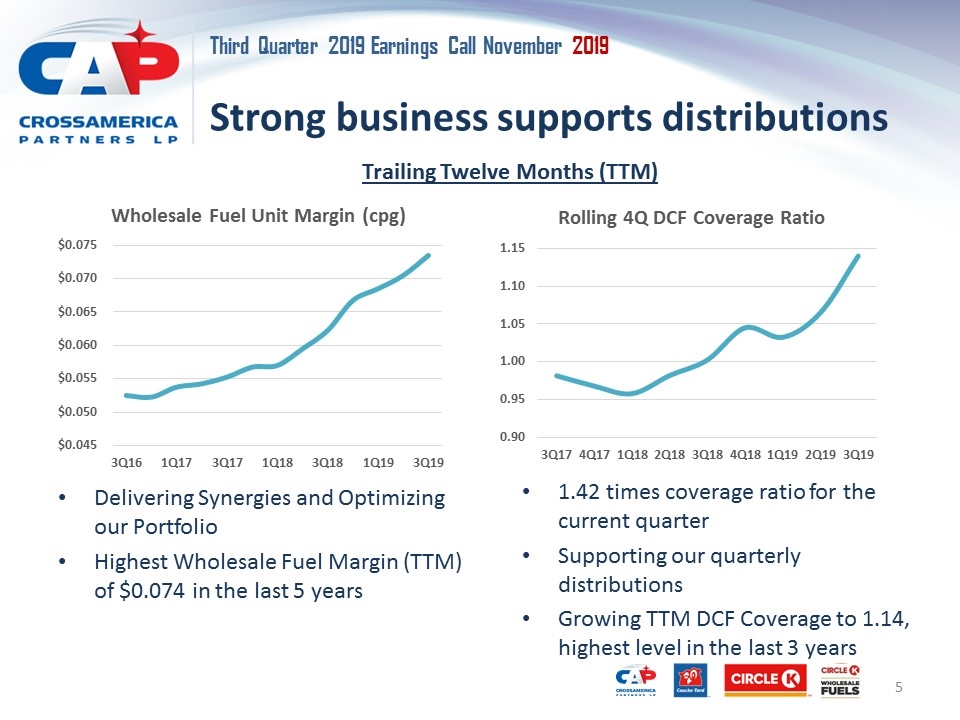

Strong business supports distributions Delivering Synergies and Optimizing our Portfolio Highest Wholesale Fuel Margin (TTM) of $0.074 in the last 5 years 1.42 times coverage ratio for the current quarter Supporting our quarterly distributions Growing TTM DCF Coverage to 1.14, highest level in the last 3 years Trailing Twelve Months (TTM)

Update on Strategic Initiatives Completed Second Asset Exchange in September and expect to complete final exchange in 1Q 2020 First tranche of 60 sites executed on May 21 Second tranche of 56 sites executed on September 5 Final tranche by First Quarter of 2020 Continued growth with Applegreen with now over 100 sites Closed agreement for 46 Upper Midwest sites on October 1 With the closing of the agreement, we are now in the final stage of exiting Retail Fuel Supply Strategic Review (Fuel Synergies) Growth in 3Q and expect continued growth in 4Q Strong collaboration with strategic suppliers Alabama Transformation Supporting Growth Optimization of business – YTD19 (9 Months) EBITDA +58% over YTD18 (9 Months) Expect further growth

CrossAmerica Financial Overview Evan Smith, Chief Financial Officer

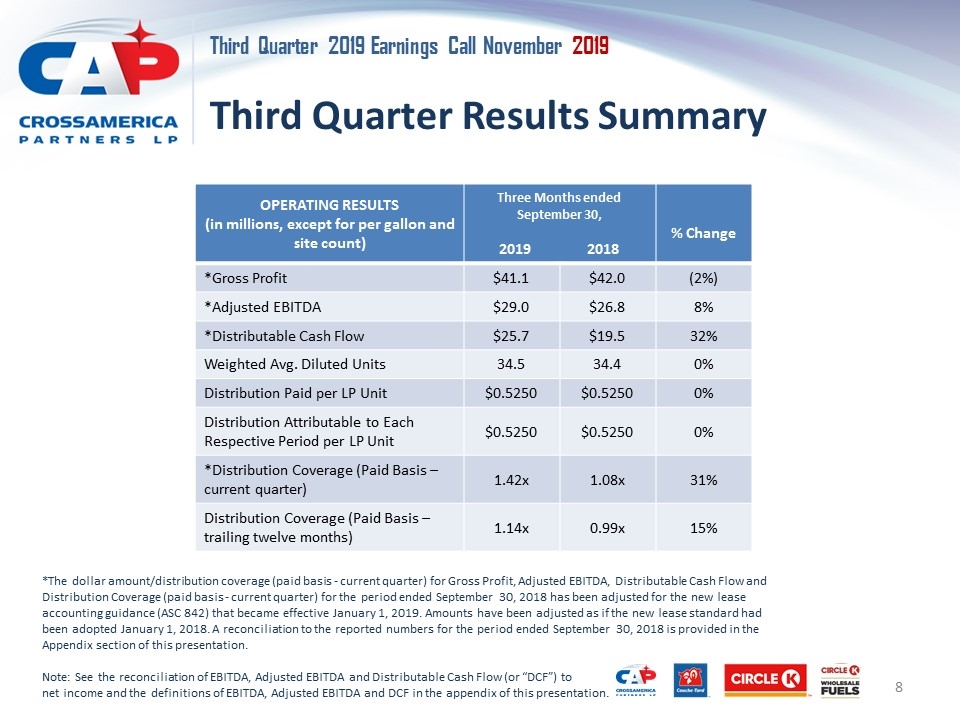

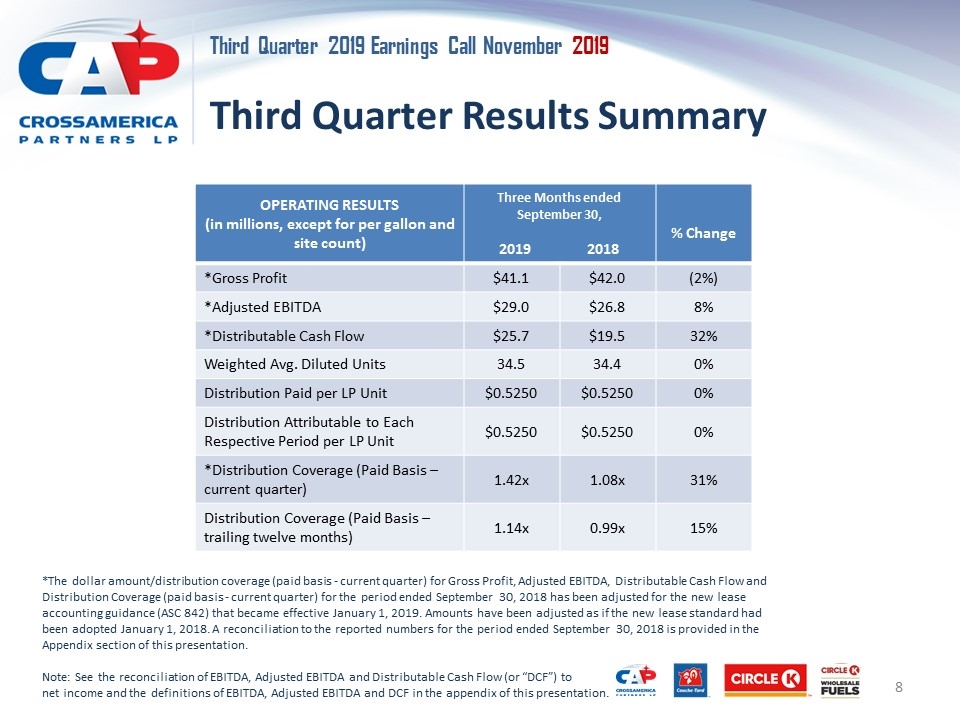

Third Quarter Results Summary OPERATING RESULTS (in millions, except for per gallon and site count) Three Months ended September 30, 2019 2018 % Change *Gross Profit $41.1 $42.0 (2%) *Adjusted EBITDA $29.0 $26.8 8% *Distributable Cash Flow $25.7 $19.5 32% Weighted Avg. Diluted Units 34.5 34.4 0% Distribution Paid per LP Unit $0.5250 $0.5250 0% Distribution Attributable to Each Respective Period per LP Unit $0.5250 $0.5250 0% *Distribution Coverage (Paid Basis – current quarter) 1.42x 1.08x 31% Distribution Coverage (Paid Basis – trailing twelve months) 1.14x 0.99x 15% Note: See the reconciliation of EBITDA, Adjusted EBITDA and Distributable Cash Flow (or “DCF”) to net income and the definitions of EBITDA, Adjusted EBITDA and DCF in the appendix of this presentation. *The dollar amount/distribution coverage (paid basis - current quarter) for Gross Profit, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage (paid basis - current quarter) for the period ended September 30, 2018 has been adjusted for the new lease accounting guidance (ASC 842) that became effective January 1, 2019. Amounts have been adjusted as if the new lease standard had been adopted January 1, 2018. A reconciliation to the reported numbers for the period ended September 30, 2018 is provided in the Appendix section of this presentation.

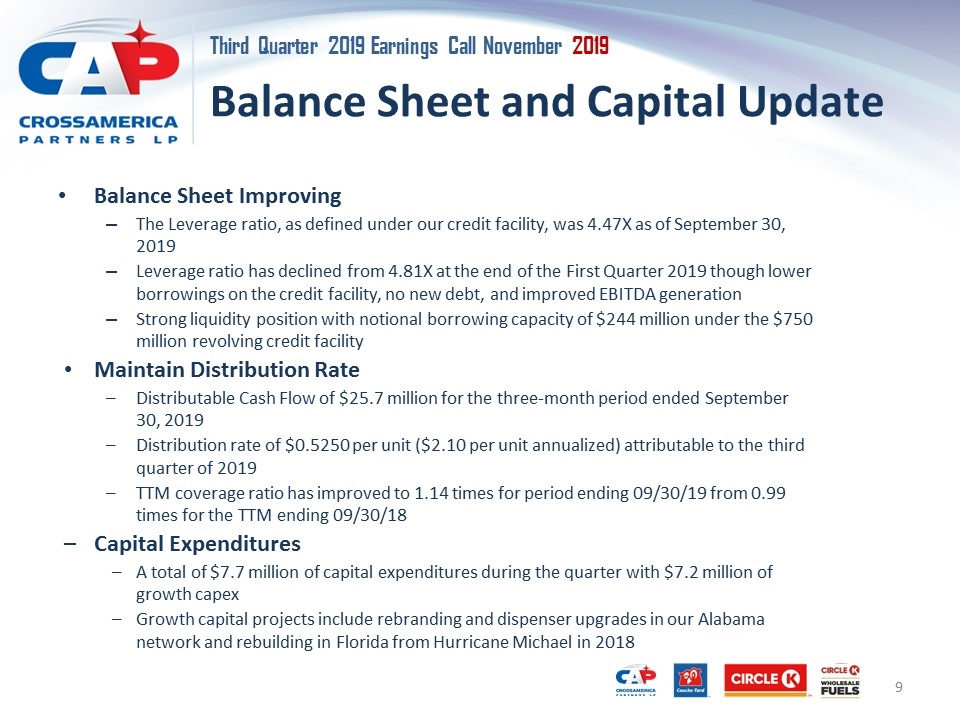

Balance Sheet and Capital Update Balance Sheet Improving The Leverage ratio, as defined under our credit facility, was 4.47X as of September 30, 2019 Leverage ratio has declined from 4.81X at the end of the First Quarter 2019 though lower borrowings on the credit facility, no new debt, and improved EBITDA generation Strong liquidity position with notional borrowing capacity of $244 million under the $750 million revolving credit facility Maintain Distribution Rate Distributable Cash Flow of $25.7 million for the three-month period ended September 30, 2019 Distribution rate of $0.5250 per unit ($2.10 per unit annualized) attributable to the third quarter of 2019 TTM coverage ratio has improved to 1.14 times for period ending 09/30/19 from 0.99 times for the TTM ending 09/30/18 Capital Expenditures A total of $7.7 million of capital expenditures during the quarter with $7.2 million of growth capex Growth capital projects include rebranding and dispenser upgrades in our Alabama network and rebuilding in Florida from Hurricane Michael in 2018

Appendix Third Quarter 2019 Earnings Call

Non-GAAP Financial Measures Non-GAAP Financial Measures We use non-GAAP financial measures EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio. EBITDA represents net income available to us before deducting interest expense, income taxes and depreciation, amortization and accretion, which includes certain impairment charges. Adjusted EBITDA represents EBITDA as further adjusted to exclude equity funded expenses related to incentive compensation and the Amended Omnibus Agreement, gains or losses on dispositions and lease terminations, certain acquisition related costs, such as legal and other professional fees and separation benefit costs associated with recently acquired companies, and certain other non-cash items arising from purchase accounting. Distributable Cash Flow represents Adjusted EBITDA less cash interest expense, sustaining capital expenditures and current income tax expense. Distribution Coverage Ratio is computed by dividing Distributable Cash Flow by the weighted average diluted common units and then dividing that result by the distributions paid per limited partner unit. EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio are used as supplemental financial measures by management and by external users of our financial statements, such as investors and lenders. EBITDA and Adjusted EBITDA are used to assess our financial performance without regard to financing methods, capital structure or income taxes and the ability to incur and service debt and to fund capital expenditures. In addition, Adjusted EBITDA is used to assess our operating performance of our business on a consistent basis by excluding the impact of items which do not result directly from the wholesale distribution of motor fuel, the leasing of real property, or the day to day operations of our retail site activities. EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio are also used to assess our ability to generate cash sufficient to make distributions to our unit-holders. We believe the presentation of EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio provides useful information to investors in assessing our financial condition and results of operations. EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio should not be considered alternatives to net income or any other measure of financial performance or liquidity presented in accordance with U.S. GAAP. EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio have important limitations as analytical tools because they exclude some but not all items that affect net income. Additionally, because EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio may be defined differently by other companies in our industry, our definitions may not be comparable to similarly titled measures of other companies, thereby diminishing their utility.

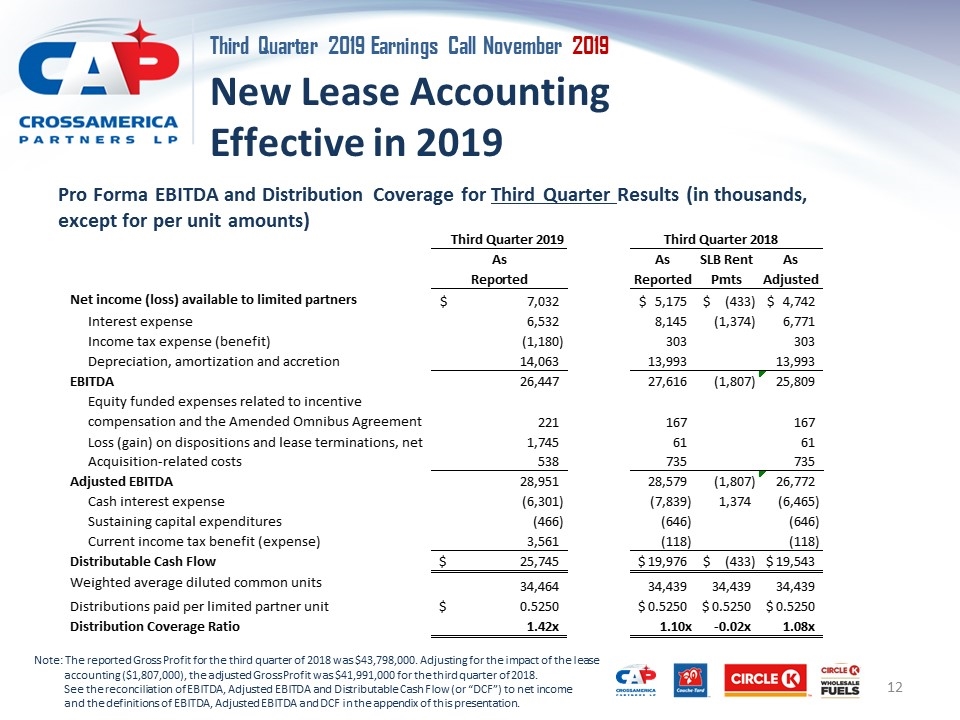

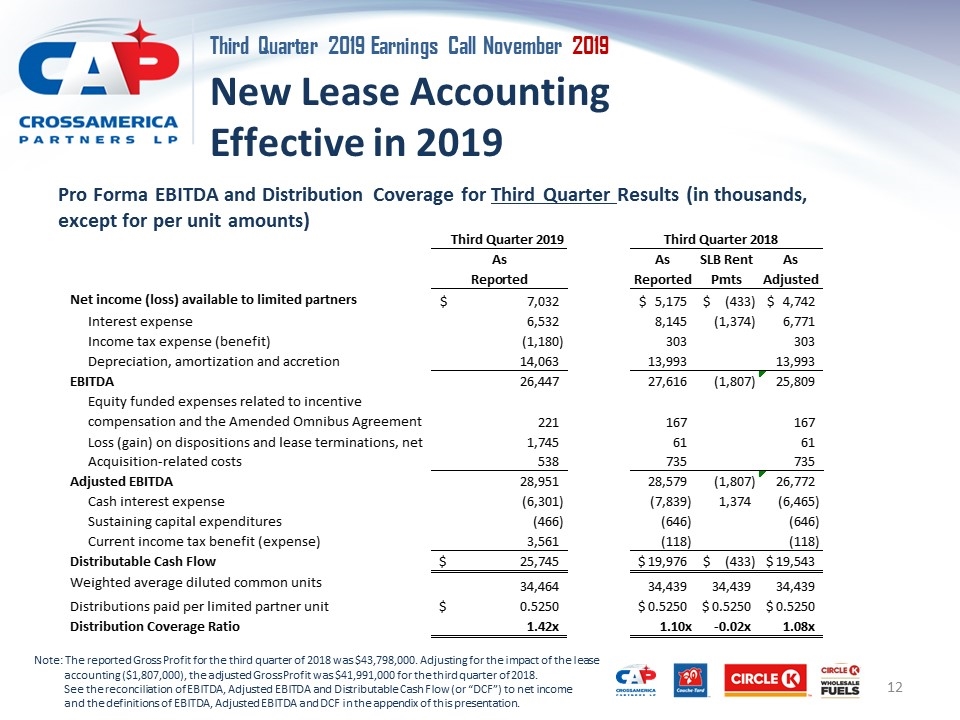

New Lease Accounting Effective in 2019 Pro Forma EBITDA and Distribution Coverage for Third Quarter Results (in thousands, except for per unit amounts) Note: The reported Gross Profit for the third quarter of 2018 was $43,798,000. Adjusting for the impact of the lease accounting ($1,807,000), the adjusted Gross Profit was $41,991,000 for the third quarter of 2018. See the reconciliation of EBITDA, Adjusted EBITDA and Distributable Cash Flow (or “DCF”) to net income and the definitions of EBITDA, Adjusted EBITDA and DCF in the appendix of this presentation. Third Quarter 2019 Third Quarter 2018 As As SLB Rent As Reported Reported Pmts Adjusted Net income (loss) available to limited partners $7,032 $5,175 $-,433 $4,742 Interest expense 6,532 8,145 -1,374 6,771 Income tax expense (benefit) -1,180 303 303 Depreciation, amortization and accretion 14,063 13,993 13,993 EBITDA 26,447 27,616 -1,807 25,809 Equity funded expenses related to incentive compensation and the Amended Omnibus Agreement 221 167 167 Loss (gain) on dispositions and lease terminations, net 1,745 61 61 Acquisition-related costs 538 735 735 Adjusted EBITDA 28,951 28,579 -1,807 26,772 Cash interest expense -6,301 -7,839 1,374 -6,465 Sustaining capital expenditures -,466 -,646 -,646 Current income tax benefit (expense) 3,561 -,118 -,118 Distributable Cash Flow $25,745 $19,976 $-,433 $19,543 Weighted average diluted common units 34,464 34,439 34,439 34,439 Distributions paid per limited partner unit $0.52500000000000002 $0.52500000000000002 $0.52500000000000002 $0.52500000000000002 Distribution Coverage Ratio 1.42x 1.10x -0.02x 1.08x

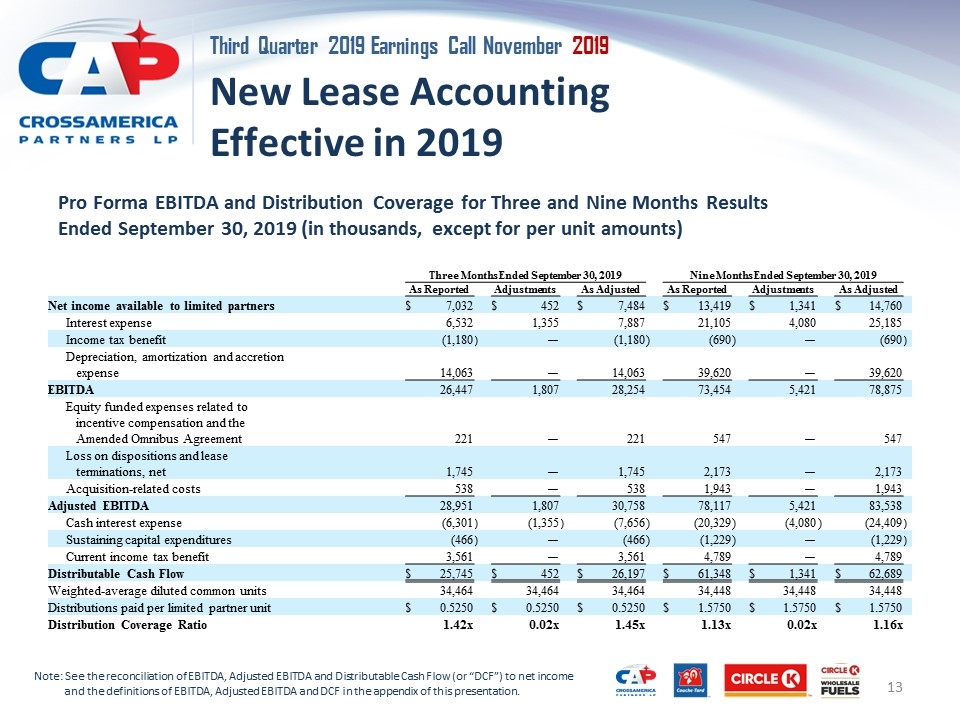

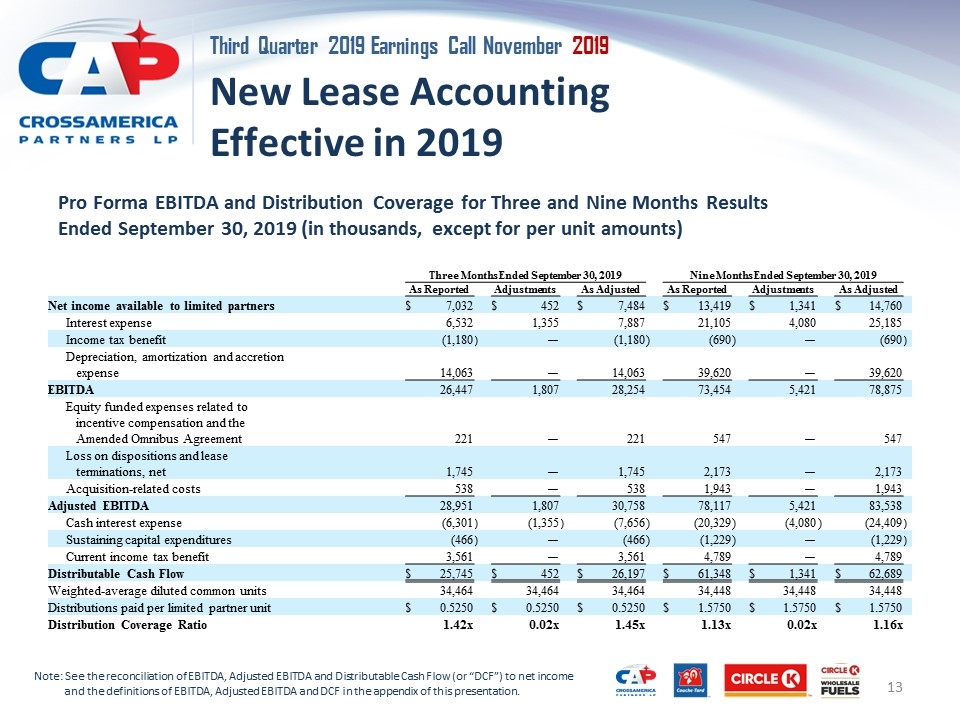

New Lease Accounting Effective in 2019 Pro Forma EBITDA and Distribution Coverage for Three and Nine Months Results Ended September 30, 2019 (in thousands, except for per unit amounts) Note: See the reconciliation of EBITDA, Adjusted EBITDA and Distributable Cash Flow (or “DCF”) to net income and the definitions of EBITDA, Adjusted EBITDA and DCF in the appendix of this presentation. Three Months Ended September 30, 2019 Nine Months Ended September 30, 2019 As Reported Adjustments As Adjusted As Reported Adjustments As Adjusted Net income available to limited partners $ 7,032 $ 452 $ 7,484 $ 13,419 $ 1,341 $ 14,760 Interest expense 6,532 1,355 7,887 21,105 4,080 25,185 Income tax benefit (1,180 ) — (1,180 ) (690 ) — (690 ) Depreciation, amortization and accretion expense 14,063 — 14,063 39,620 — 39,620 EBITDA 26,447 1,807 28,254 73,454 5,421 78,875 Equity funded expenses related to incentive compensation and the Amended Omnibus Agreement 221 — 221 547 — 547 Loss on dispositions and lease terminations, net 1,745 — 1,745 2,173 — 2,173 Acquisition-related costs 538 — 538 1,943 — 1,943 Adjusted EBITDA 28,951 1,807 30,758 78,117 5,421 83,538 Cash interest expense (6,301 ) (1,355 ) (7,656 ) (20,329 ) (4,080 ) (24,409 ) Sustaining capital expenditures (466 ) — (466 ) (1,229 ) — (1,229 ) Current income tax benefit 3,561 — 3,561 4,789 — 4,789 Distributable Cash Flow $ 25,745 $ 452 $ 26,197 $ 61,348 $ 1,341 $ 62,689 Weighted-average diluted common units 34,464 34,464 34,464 34,448 34,448 34,448 Distributions paid per limited partner unit $ 0.5250 $ 0.5250 $ 0.5250 $ 1.5750 $ 1.5750 $ 1.5750 Distribution Coverage Ratio 1.42x 0.02x 1.45x 1.13x 0.02x 1.16x

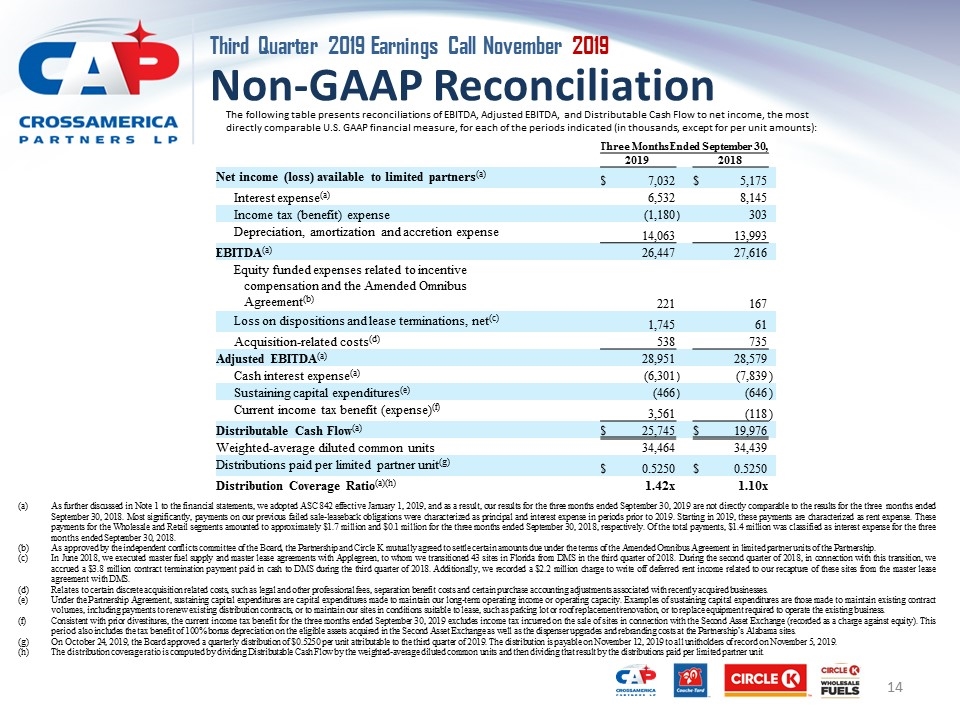

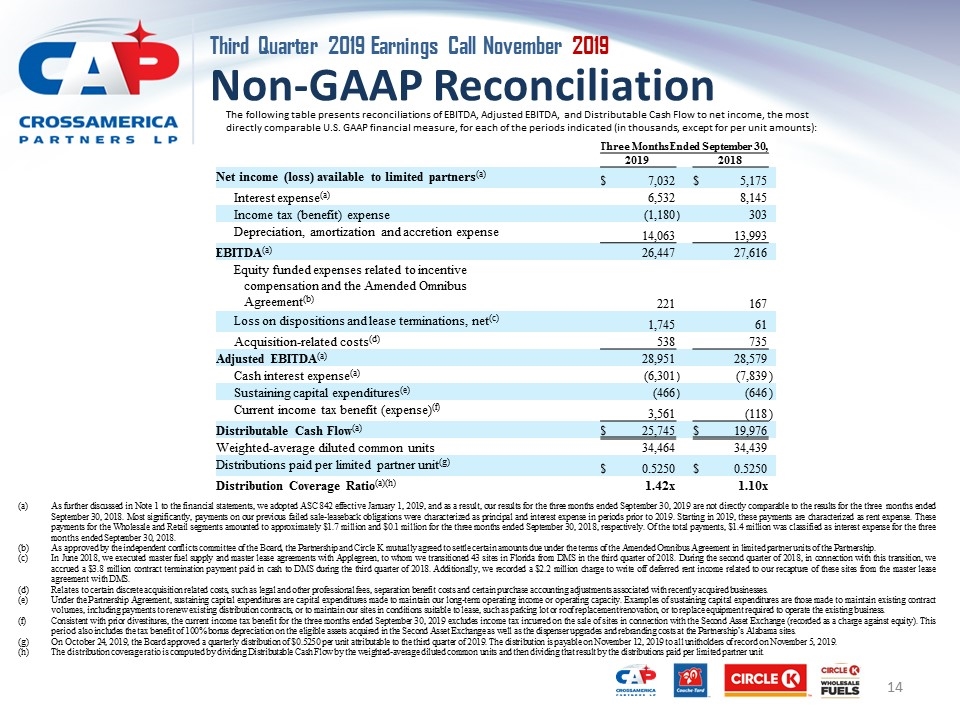

Non-GAAP Reconciliation The following table presents reconciliations of EBITDA, Adjusted EBITDA, and Distributable Cash Flow to net income, the most directly comparable U.S. GAAP financial measure, for each of the periods indicated (in thousands, except for per unit amounts): (a)As further discussed in Note 1 to the financial statements, we adopted ASC 842 effective January 1, 2019, and as a result, our results for the three months ended September 30, 2019 are not directly comparable to the results for the three months ended September 30, 2018. Most significantly, payments on our previous failed sale-leaseback obligations were characterized as principal and interest expense in periods prior to 2019. Starting in 2019, these payments are characterized as rent expense. These payments for the Wholesale and Retail segments amounted to approximately $1.7 million and $0.1 million for the three months ended September 30, 2018, respectively. Of the total payments, $1.4 million was classified as interest expense for the three months ended September 30, 2018. (b)As approved by the independent conflicts committee of the Board, the Partnership and Circle K mutually agreed to settle certain amounts due under the terms of the Amended Omnibus Agreement in limited partner units of the Partnership. (c)In June 2018, we executed master fuel supply and master lease agreements with Applegreen, to whom we transitioned 43 sites in Florida from DMS in the third quarter of 2018. During the second quarter of 2018, in connection with this transition, we accrued a $3.8 million contract termination payment paid in cash to DMS during the third quarter of 2018. Additionally, we recorded a $2.2 million charge to write off deferred rent income related to our recapture of these sites from the master lease agreement with DMS. (d)Relates to certain discrete acquisition related costs, such as legal and other professional fees, separation benefit costs and certain purchase accounting adjustments associated with recently acquired businesses. (e)Under the Partnership Agreement, sustaining capital expenditures are capital expenditures made to maintain our long-term operating income or operating capacity. Examples of sustaining capital expenditures are those made to maintain existing contract volumes, including payments to renew existing distribution contracts, or to maintain our sites in conditions suitable to lease, such as parking lot or roof replacement/renovation, or to replace equipment required to operate the existing business. (f)Consistent with prior divestitures, the current income tax benefit for the three months ended September 30, 2019 excludes income tax incurred on the sale of sites in connection with the Second Asset Exchange (recorded as a charge against equity). This period also includes the tax benefit of 100% bonus depreciation on the eligible assets acquired in the Second Asset Exchange as well as the dispenser upgrades and rebranding costs at the Partnership’s Alabama sites. (g)On October 24, 2019, the Board approved a quarterly distribution of $0.5250 per unit attributable to the third quarter of 2019. The distribution is payable on November 12, 2019 to all unitholders of record on November 5, 2019. (h)The distribution coverage ratio is computed by dividing Distributable Cash Flow by the weighted-average diluted common units and then dividing that result by the distributions paid per limited partner unit. Three Months Ended September 30, 2019 2018 Net income (loss) available to limited partners(a) $ 7,032 $ 5,175 Interest expense(a) 6,532 8,145 Income tax (benefit) expense (1,180 ) 303 Depreciation, amortization and accretion expense 14,063 13,993 EBITDA(a) 26,447 27,616 Equity funded expenses related to incentive compensation and the Amended Omnibus Agreement(b) 221 167 Loss on dispositions and lease terminations, net(c) 1,745 61 Acquisition-related costs(d) 538 735 Adjusted EBITDA(a) 28,951 28,579 Cash interest expense(a) (6,301 ) (7,839 ) Sustaining capital expenditures(e) (466 ) (646 ) Current income tax benefit (expense)(f) 3,561 (118 ) Distributable Cash Flow(a) $ 25,745 $ 19,976 Weighted-average diluted common units 34,464 34,439 Distributions paid per limited partner unit(g) $ 0.5250 $ 0.5250 Distribution Coverage Ratio(a)(h) 1.42x 1.10x