August 2021 Second Quarter 2021 Earnings Call Exhibit 99.2

Forward Looking Statements Statements contained in this presentation that state the Partnership’s or management’s expectations or predictions of the future are forward-looking statements. The words “believe,” “expect,” “should,” “intends,” “anticipates,” “estimates,” “target” and other similar expressions identify forward-looking statements. It is important to note that actual results could differ materially from those projected in such forward-looking statements. For more information concerning factors that could cause actual results to differ from those expressed or forecasted, see CrossAmerica’s annual reports on Form 10-K, quarterly reports on Form 10-Q and other reports filed with the Securities and Exchange Commission and available on the Partnership’s website at www.crossamericapartners.com. If any of these factors materialize, or if our underlying assumptions prove to be incorrect, actual results may vary significantly from what we projected. Any forward-looking statement you see or hear during this presentation reflects our current views as of the date of this presentation with respect to future events. We assume no obligation to publicly update or revise these forward-looking statements for any reason, whether as a result of new information, future events, or otherwise. 2

CrossAmerica Business Overview Charles Nifong, CEO & President 3

Second Quarter Operations Wholesale fuel volume increased 27% 332 million gallons distributed in 2Q21 versus 260 million gallons in 2Q20 Primarily driven by acquisitions and exchanges Continued recovery from COVID-19 Wholesale fuel margin declined 15% 9.2 cents in 2Q21 versus 10.8 cents in 2Q20 Strong Dealer Tank Wagon (DTW) margins in 2Q20 Motor Fuel Gross Profit from the Wholesale Segment increased 8% $30.5 million in 2Q21 versus $28.2 million in 2Q20 Primarily driven by 27% increase in motor fuel volume Overall Gross Profit for Wholesale Segment increased 9% ($44.2 million for 2Q21 versus $40.7 million for 2Q20) Retail Segment’s Gross Profit increased $5.2 million or 32% year-over-year $21.1 million in 2Q21 versus $15.9 million in 2Q20 Increase driven by motor fuel and merchandise gross profit Operating and General and Administrative (G&A) Expenses Operating Expenses increased $6.0 million primarily due to the increase in company operated sites as a result of the April 2020 acquisition of retail and wholesale assets and an increase in environmental costs G&A expenses increased $1.3 million in 2Q21 when compared to 2Q20 primarily driven by acquisition related costs incurred with the acquisition of the 7-Eleven assets 4

CrossAmerica Financial Overview Jon Benfield, Chief Accounting Officer 5

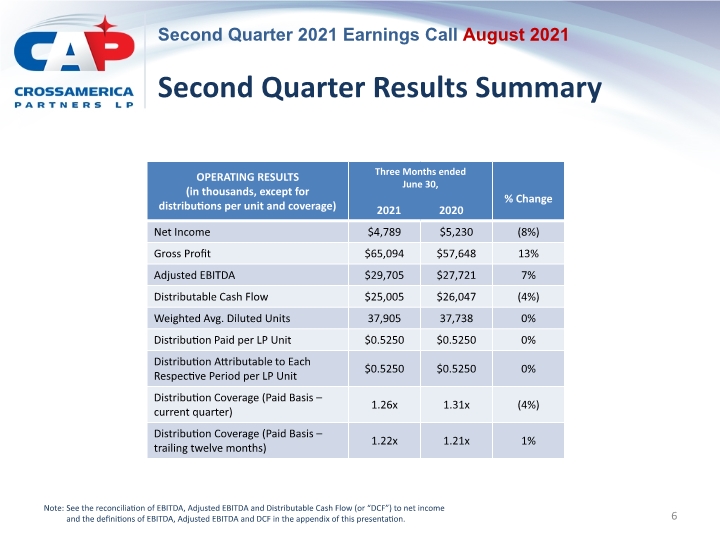

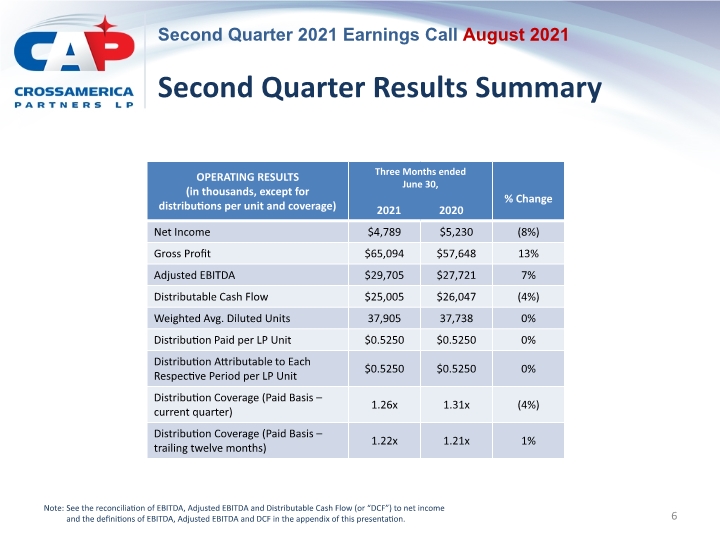

Second Quarter Results Summary 6 Note: See the reconciliation of EBITDA, Adjusted EBITDA and Distributable Cash Flow (or “DCF”) to net income and the definitions of EBITDA, Adjusted EBITDA and DCF in the appendix of this presentation.

Capital Strength Leverage, as defined under our credit facility, was 4.42X as of June 30, 2021 Maintain Distribution Rate Distributable Cash Flow of $25.0 million for the three-month period ended June 30, 2021 Distribution rate of $0.5250 per unit ($2.10 per unit annualized) attributable to the second quarter of 2021 TTM coverage ratio was 1.22 times for the period ending 06/30/21 and 1.21 times for the period ending 06/30/20 Capital Expenditures $11.3 million during the second quarter of 2021 $10.3 million of growth capital during the quarter related to EMV upgrades and rebranding of certain sites, including the sites being acquired from 7-Eleven 7 Note: See the reconciliation of EBITDA, Adjusted EBITDA and Distributable Cash Flow (or “DCF”) to net income and the definitions of EBITDA, Adjusted EBITDA and DCF in the appendix of this presentation.

New Credit Facility and Amendment to CAPL Credit Agreement JKM Credit Facility Entered into a credit agreement on July 16, 2021 Agreement among Borrower, CAPL JKM Holdings LLC, an indirect wholly-owned subsidiary of CrossAmerica and the sole member of Borrower, and Manufacturers and Traders Trust Company, as administrative agent, swingline lender and issuing bank Provides for a $200 million senior secured credit facility, consisting of a $185 million delayed draw term loan facility and a $15 million revolving credit facility The JKM Credit Facility will be used to fund the acquisition of the 106 convenience store properties from 7-Eleven Amendment to CAPL Credit Agreement On July 28, 2021, the Partnership entered into an amendment to its Credit Agreement, dated as of April 1, 2019 The Amendment, among other things: amended certain provisions relating to unrestricted subsidiaries, increased the maximum level for the consolidated leverage ratio financial covenant, and modified the applicable margin for borrowings under the CAPL Credit Facility 8 Note: Additional details regarding the JKM Credit Facility and Amendment to the CAPL Credit Agreement are provided in the most recent Second Quarter 2021 Form 10-Q.

Appendix Second Quarter 2021 Earnings Call 9

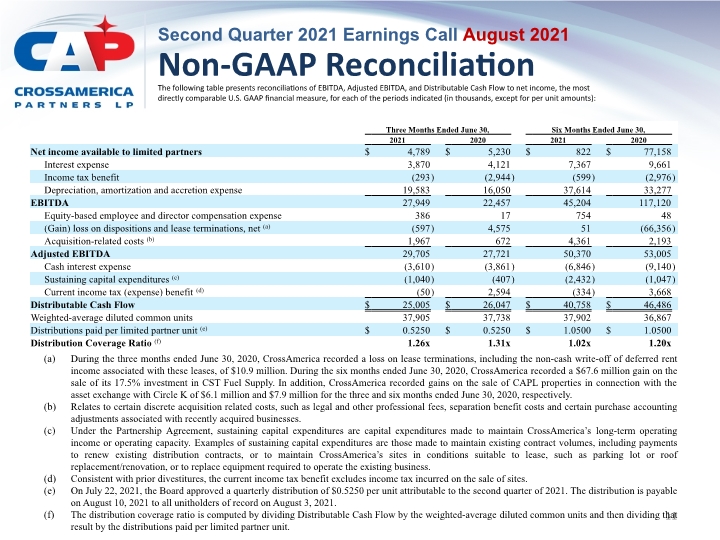

Non-GAAP Financial Measures 10 We use the non-GAAP financial measures EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio. EBITDA represents net income available to us before deducting interest expense, income taxes and depreciation, amortization and accretion, which includes certain impairment charges. Adjusted EBITDA represents EBITDA as further adjusted to exclude equity-based employee and director compensation expense, gains or losses on dispositions and lease terminations, certain acquisition related costs, such as legal and other professional fees and separation benefit costs, and certain other non-cash items arising from purchase accounting. Distributable Cash Flow represents Adjusted EBITDA less cash interest expense, sustaining capital expenditures and current income tax benefit or expense. The Distribution Coverage Ratio is computed by dividing Distributable Cash Flow by the weighted average diluted common units and then dividing that result by the distributions paid per limited partner unit. EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio are used as supplemental financial measures by management and by external users of our financial statements, such as investors and lenders. EBITDA and Adjusted EBITDA are used to assess our financial performance without regard to financing methods, capital structure or income taxes and the ability to incur and service debt and to fund capital expenditures. In addition, Adjusted EBITDA is used to assess our operating performance of our business on a consistent basis by excluding the impact of items which do not result directly from the wholesale distribution of motor fuel, the leasing of real property, or the day to day operations of our retail site activities. EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio are also used to assess our ability to generate cash sufficient to make distributions to our unit-holders. We believe the presentation of EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio provides useful information to investors in assessing our financial condition and results of operations. EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio should not be considered alternatives to net income or any other measure of financial performance or liquidity presented in accordance with U.S. GAAP. EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio have important limitations as analytical tools because they exclude some but not all items that affect net income. Additionally, because EBITDA, Adjusted EBITDA, Distributable Cash Flow and Distribution Coverage Ratio may be defined differently by other companies in our industry, our definitions may not be comparable to similarly titled measures of other companies, thereby diminishing their utility.

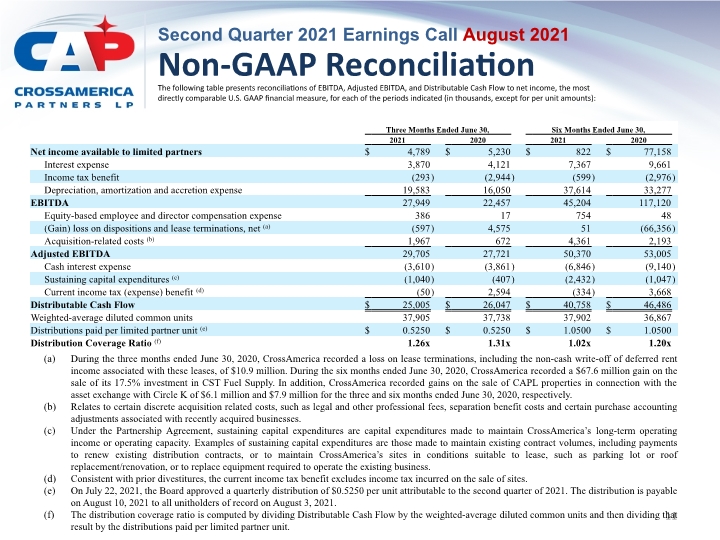

Non-GAAP Reconciliation 11 The following table presents reconciliations of EBITDA, Adjusted EBITDA, and Distributable Cash Flow to net income, the most directly comparable U.S. GAAP financial measure, for each of the periods indicated (in thousands, except for per unit amounts): During the three months ended June 30, 2020, CrossAmerica recorded a loss on lease terminations, including the non-cash write-off of deferred rent income associated with these leases, of $10.9 million. During the six months ended June 30, 2020, CrossAmerica recorded a $67.6 million gain on the sale of its 17.5% investment in CST Fuel Supply. In addition, CrossAmerica recorded gains on the sale of CAPL properties in connection with the asset exchange with Circle K of $6.1 million and $7.9 million for the three and six months ended June 30, 2020, respectively. Relates to certain discrete acquisition related costs, such as legal and other professional fees, separation benefit costs and certain purchase accounting adjustments associated with recently acquired businesses. Under the Partnership Agreement, sustaining capital expenditures are capital expenditures made to maintain CrossAmerica’s long-term operating income or operating capacity. Examples of sustaining capital expenditures are those made to maintain existing contract volumes, including payments to renew existing distribution contracts, or to maintain CrossAmerica’s sites in conditions suitable to lease, such as parking lot or roof replacement/renovation, or to replace equipment required to operate the existing business. Consistent with prior divestitures, the current income tax benefit excludes income tax incurred on the sale of sites. On July 22, 2021, the Board approved a quarterly distribution of $0.5250 per unit attributable to the second quarter of 2021. The distribution is payable on August 10, 2021 to all unitholders of record on August 3, 2021. The distribution coverage ratio is computed by dividing Distributable Cash Flow by the weighted-average diluted common units and then dividing that result by the distributions paid per limited partner unit.