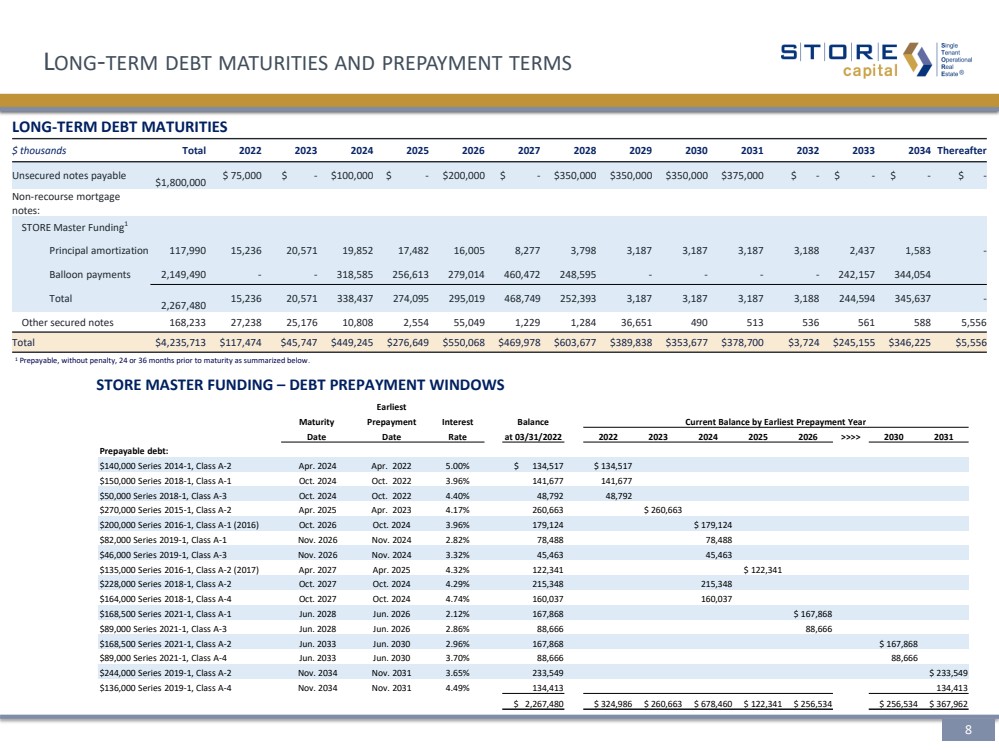

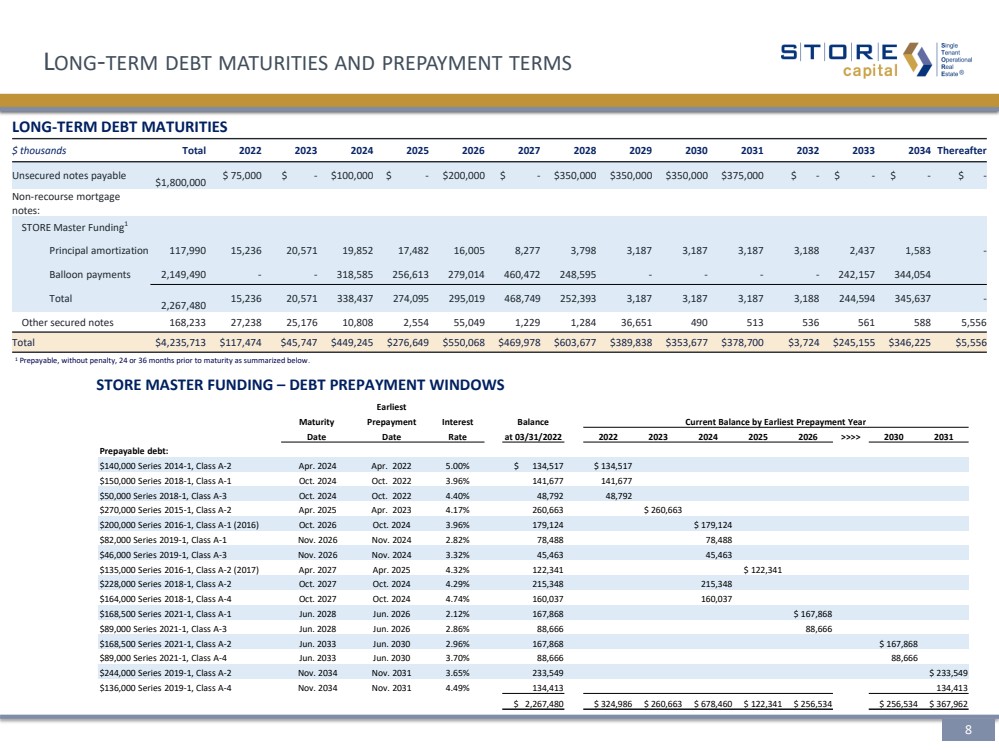

| $ thousands Total 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 Thereafter Unsecured notes payable $1,800,000 $ 75,000 $ - $100,000 $ - $200,000 $ - $350,000 $350,000 $350,000 $375,000 $ - $ - $ - $ - Non - recourse mortgage notes: STORE Master Funding 1 Principal amortization 117,990 15,236 20,571 19,852 17,482 16,005 8,277 3,798 3,187 3,187 3,187 3,188 2,437 1,583 - Balloon payments 2,149,490 - - 318,585 256,613 279,014 460,472 248,595 - - - - 242,157 344,054 Total 2,267,480 15,236 20,571 338,437 274,095 295,019 468,749 252,393 3,187 3,187 3,187 3,188 244,594 345,637 - Other secured notes 168,233 27,238 25,176 10,808 2,554 55,049 1,229 1,284 36,651 490 513 536 561 588 5,556 Total $4,235,713 $117,474 $45,747 $449,245 $276,649 $550,068 $469,978 $603,677 $389,838 $353,677 $378,700 $3,724 $245,155 $346,225 $5,556 Earliest Maturity Prepayment Interest Balance Current Balance by Earliest Prepayment Year Date Date Rate at 03/31/2022 2022 2023 2024 2025 2026 >>>> 2030 2031 Prepayable debt: $140,000 Series 2014 - 1, Class A - 2 Apr. 2024 Apr. 2022 5.00% $ 134,517 $ 134,517 $150,000 Series 2018 - 1, Class A - 1 Oct. 2024 Oct. 2022 3.96% 141,677 141,677 $50,000 Series 2018 - 1, Class A - 3 Oct. 2024 Oct. 2022 4.40% 48,792 48,792 $270,000 Series 2015 - 1, Class A - 2 Apr. 2025 Apr. 2023 4.17% 260,663 $ 260,663 $200,000 Series 2016 - 1, Class A - 1 (2016) Oct. 2026 Oct. 2024 3.96% 179,124 $ 179,124 $82,000 Series 2019 - 1, Class A - 1 Nov. 2026 Nov. 2024 2.82% 78,488 78,488 $46,000 Series 2019 - 1, Class A - 3 Nov. 2026 Nov. 2024 3.32% 45,463 45,463 $135,000 Series 2016 - 1, Class A - 2 (2017) Apr. 2027 Apr. 2025 4.32% 122,341 $ 122,341 $228,000 Series 2018 - 1, Class A - 2 Oct. 2027 Oct. 2024 4.29% 215,348 215,348 $164,000 Series 2018 - 1, Class A - 4 Oct. 2027 Oct. 2024 4.74% 160,037 160,037 $168,500 Series 2021 - 1, Class A - 1 Jun. 2028 Jun. 2026 2.12% 167,868 $ 167,868 $89,000 Series 2021 - 1, Class A - 3 Jun. 2028 Jun. 2026 2.86% 88,666 88,666 $168,500 Series 2021 - 1, Class A - 2 Jun. 2033 Jun. 2030 2.96% 167,868 $ 167,868 $89,000 Series 2021 - 1, Class A - 4 Jun. 2033 Jun. 2030 3.70% 88,666 88,666 $244,000 Series 2019 - 1, Class A - 2 Nov. 2034 Nov. 2031 3.65% 233,549 $ 233,549 $136,000 Series 2019 - 1, Class A - 4 Nov. 2034 Nov. 2031 4.49% 134,413 134,413 $ 2,267,480 $ 324,986 $ 260,663 $ 678,460 $ 122,341 $ 256,534 $ 256,534 $ 367,962 L ONG - TERM DEBT MATURITIES AND PREPAYMENT TERMS STORE MASTER FUNDING – DEBT PREPAYMENT WINDOWS LONG - TERM DEBT MATURITIES 1 Prepayable, without penalty, 24 or 36 months prior to maturity as summarized below .. .. 8 |