QuickLinks -- Click here to rapidly navigate through this document

Exhibit 99.1

Table of Contents

Management Report of Fund Performance |

|

2 |

Interim Financial Statements |

|

6 |

1

| Sprott Physical Platinum and Palladium Trust | | June 30, 2014 |

Management Report of Fund Performance*

Investment Objective and Strategies

Sprott Physical Platinum and Palladium Trust (the "Trust") is a closed-end mutual fund trust organized under the laws of the Province of Ontario, Canada, created to invest and hold substantially all of its assets in physical platinum and palladium bullion. The Trust seeks to provide a secure, convenient and exchange-traded investment alternative for investors interested in holding physical platinum and palladium bullion without the inconvenience that is typical of a direct investment in physical bullion. The Trust intends to achieve its objective by investing primarily in long-term holdings of unencumbered, fully allocated, physical platinum and palladium bullion and does not speculate with regard to short-term changes in platinum and palladium prices.

The units of the Trust are listed on the New York Stock Exchange ("NYSE") Arca and the Toronto Stock Exchange ("TSX") under the symbols "SPPP" and "PPT.U", respectively.

Risks

The risks of investing in the Trust are detailed in the Trust's annual information form dated March 31, 2014. There have been no material changes to the Trust since inception that have affected the overall level of risk. The principal risks associated with investing in the Trust are the price of platinum and palladium, the net asset value and/or the market price of the units, the purchase, transport, insurance and storage of physical platinum and palladium bullion, liabilities of the Trust, and redemptions of units.

Results of Operations

For the period from April 1, 2014 to June 30, 2014, total unrealized gains on physical platinum bullion amounted to $5.1 million and total unrealized gains on physical palladium bullion amounted to $11.2 million compared with total unrealized losses on physical platinum bullion of $20.1 million and total unrealized losses on physical palladium bullion of $21.1 million for the same period in 2013. For the period from January 1, 2014 to June 30, 2014, total unrealized gains on physical platinum bullion amounted to $10.4 million and total unrealized gains on physical palladium bullion amounted to $21.0 million compared with total unrealized losses on physical platinum bullion of $17.5 million and total unrealized losses on physical palladium bullion of $8.3 million for the same period in 2013.

During the period from January 1, 2014 to June 30, 2014, the Trust did not issue any units. During that period, 2,561,863 units were redeemed for physical bullion.

The value of the net assets of the Trust as of June 30, 2014 was $252.7 million or $9.99 per unit compared to $246.6 million or $8.85 per unit as at December 31, 2013. The Trust held 73,779 ounces of physical platinum bullion and 168,489 ounces of physical palladium bullion as at June 30, 2014, compared to 81,905 ounces of physical platinum bullion and 187,055 ounces of physical palladium bullion as of December 31, 2013. As at June 30, 2014, the spot price of physical platinum bullion was $1,486.00 an ounce and the spot price of physical palladium bullion was $843.25 an ounce, compared to a spot price for platinum bullion of $1,369.45 an ounce and a spot price for palladium bullion of $716.45 an ounce as at December 31, 2013. The Trust returned 12.88% compared to the returns on spot platinum and palladium bullion of 8.5% and 17.7%, respectively for the period from January 1, 2014 to June 30, 2014.

The Trust's net asset value per unit on June 30, 2014 was $9.99. The units closed at $10.12 on the NYSE Arca and $10.13 on the TSX on June 30, 2014 compared to closing prices of $8.68 on the NYSE Arca and $8.57 on the TSX on December 31, 2013. The units are denominated in U.S. dollars on both exchanges. During the period from January 1, 2014 to June 30, 2014, the Trust's units traded on the NYSE Arca at an average premium to net asset value of approximately 1.1%.

- *

- In this report, net asset value ("NAV") refers to the value of the Trust as calculated for transaction purposes, whereas net assets is used for financial statement purposes. All references to currencies in this report are in United States Dollars, unless stated otherwise.

The interim management report of fund performance is an analysis and explanation that is designed to complement and supplement an investment fund's financial statements. This report contains financial highlights but does not contain the complete interim financial statements of the investment fund. A copy of the interim financial statements has been included separately within the Report to Unitholders. You can also get a copy of the interim financial statements at your request, and at no cost, by calling 1-866-299-9906, by visiting our website at www.sprottphysicalbullion.com or SEDAR at www.sedar.com or by writing to us at: Sprott Asset Management LP, Royal Bank Plaza, South Tower, 200 Bay Street, Suite 2700, P.O. Box 27, Toronto, Ontario M5J 2J1.

2

OPERATING EXPENSES

The Trust pays its own operating expenses, which include, but are not limited to, audit, legal, trustee fees, unitholder reporting expenses, general and administrative fees, filing and listing fees payable to applicable securities regulatory authorities and stock exchanges, storage fees for the physical bullion, costs incurred in connection with the Trust's continuous disclosure public filing requirements and investor relations and any expenses associated with the Independent Review Committee of the Trust. Operating expenses for the period from April 1, 2014 to June 30, 2014, amounted to $354,068 (not including applicable Canadian taxes) compared to $187,480 for the same period in 2013. Operating expenses for the period from January 1, 2014 to June 30, 2014, amounted to $567,397 (not including applicable Canadian taxes) compared to $386,324 for the same period in 2013. The increase in expenses during the period was primarily due to higher storage expenses. Operating expenses for the period from April 1, 2014 to June 30, 2014 amounted to 0.58% of the average net assets during that period on an annualized basis, compared to 0.29% for the same period in 2013. Operating expenses for the period from January 1, 2014 to June 30, 2014 amounted to 0.47% of the average net assets during that period on an annualized basis, compared to 0.29% for the same period in 2013. The Manager anticipates expenses will decline in the second half of the year.

Related Party Transactions

MANAGEMENT FEES

The Trust pays the Manager, Sprott Asset Management LP, a monthly management fee equal to1/12 of 0.50% of the value of the net assets of the Trust (determined in accordance with the trust agreement), plus any applicable Canadian taxes. The management fee is calculated and accrued daily and payable monthly in arrears on the last day of each month. For the period from April 1, 2014 to June 30, 2014, the Trust incurred management fees of $306,109 (not including applicable Canadian taxes) compared to $324,850 for the same period in 2013. For the period from January 1, 2014 to June 30, 2014, the Trust incurred management fees of $601,492 (not including applicable Canadian taxes) compared to $653,855 for the same period in 2013.

3

| Sprott Physical Platinum and Palladium Trust | | June 30, 2014 |

Financial Highlights

The following tables show selected key financial information about the Trust and are intended to help you understand the Trust's financial performance for the three and six-month periods ended June 30, 2014 and for the years shown.

Net assets per unit1

| | | For the three

months ended

June 30,

2014

$ | | For the six

months ended

June 30,

2014

$ | | For the

year ended

December 31,

2013

$ | | For the

period ended

December 31,

20123

$ | | |

|

| Net assets per unit, beginning of period | | 9.37 | | 8.85 | | 9.35 | | 10.00 | | |

|

| Increase (decrease) from operations2: | | | | | | | | | | |

| Total revenue | | – | | – | | – | | – | | |

| Total expenses | | (0.03 | ) | (0.05 | ) | (0.08 | ) | (0.01 | ) | |

| Realized gains (losses) for the period | | – | | (0.06 | ) | – | | – | | |

| Unrealized gains (losses) for the period | | 0.65 | | 1.23 | | (0.41 | ) | (0.12 | ) | |

|

| Total increase (decrease) from operations | | 0.62 | | 1.12 | | (0.49 | ) | (0.13 | ) | |

|

| Net assets per unit, end of period | | 9.99 | | 9.99 | | 8.85 | | 9.35 | | |

|

- 1

- This information is derived from the Trust's interim financial statements.

- 2

- Net assets per unit is calculated based on the actual number of units outstanding at the relevant time. The increase/decrease from operations is based on the weighted average number of units outstanding over the period shown. This table is not intended to be a reconciliation of the beginning to ending net assets per unit.

- 3

- For the period from December 19, 2012 (the Trust's initial public offering) to December 31, 2012.

Ratios and Supplemental Data

| | | June 30,

2014 | | December 31,

2013 | | December 31,

2012 | |

|

| Total net asset value (000's)1 | | $252,732 | | $246,574 | | $261,917 | |

| Number of Units outstanding1 | | 25,301,587 | | 27,863,450 | | 28,000,000 | |

| Management expense ratio2 | | 1.05% | | 0.81% | | 0.90% | |

| Trading expense ratio3 | | Nil | | Nil | | Nil | |

| Portfolio turnover rate4 | | Nil | | Nil | | Nil | |

| Net asset value per Unit | | $9.99 | | $8.85 | | $9.35 | |

| Closing market price – NYSE Arca | | $10.12 | | $8.68 | | $9.99 | |

| Closing market price – TSX | | $10.13 | | $8.57 | | $9.95 | |

|

- 1

- This information is provided as at the date shown, as applicable.

- 2

- Management expense ratio ("MER") for the periods are based on total expenses (including applicable Canadian taxes and excluding commissions and other portfolio transaction costs) for the stated period and are expressed as annualized percentages of daily average net asset value during the period from January 1, 2014 to June 30, 2014.

- 3

- The trading expense ratio represents total commissions and other portfolio transaction costs expressed as an annualized percentage of daily average net asset value during the period shown. Since there are no direct trading costs associated with physical bullion trades, the trading expense ratio is nil.

- 4

- The Trust's portfolio turnover rate indicates how actively the Trust's portfolio adviser trades its portfolio investments. A portfolio turnover rate of 100% is equivalent to the Trust buying and selling all of the securities in its portfolio once in the course of the year. The higher the Trust's portfolio turnover rate in a year, the greater the chance of an investor receiving taxable capital gains in the year. There is not necessarily a relationship between a high turnover rate and the performance of the Trust.

4

| Sprott Physical Platinum and Palladium Trust | | June 30, 2014 |

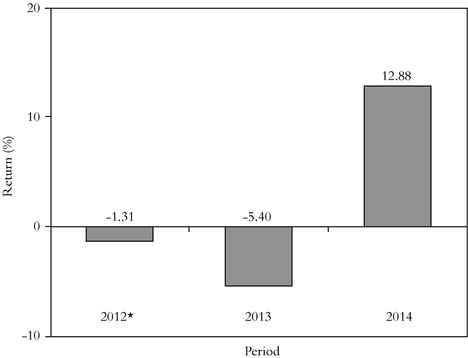

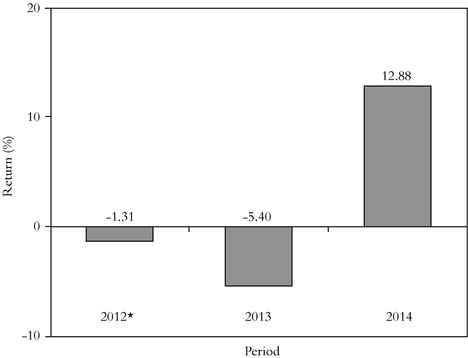

Past Performance

The indicated rates of return are the historical total returns including changes in unit values and assume reinvestment of all distributions in additional units of the Trust. These returns do not take into account sales, redemption, distribution or optional charges or income taxes payable by any unitholder that may reduce returns. Please note that past performance is not indicative of future performance. All rates of returns are calculated based on the Net Asset Value of the units of the Trust.

Year-by-Year Returns

The bar chart below indicates the performance of the Trust units for the six-month period ended June 30, 2014 and for the previous years shown. The chart shows, in percentage terms, how much an investment made on the first day of each period would have grown or decreased by the last day of each period.

- *

- Return for the period from December 19, 2012 to December 31, 2012 (not annualized).

Summary of Investment Portfolio

As of June 30, 2014

| | | Ounces | | Fair Value

per ounce

$ | | Average

Cost

$ | | Fair

Value

$ | | % of

Net Asset

Value

% | | |

|

| Physical platinum bullion | | 73,779 | | 1,486.00 | | 117,550,385 | | 109,635,408 | | 43.4 | | |

| Physical palladium bullion | | 168,489 | | 843.25 | | 117,562,322 | | 142,078,751 | | 56.2 | | |

| Cash and Cash Equivalents | | | | | | | | 1,202,960 | | 0.5 | | |

| Other Net Liabilities | | | | | | | | (185,073 | ) | (0.1 | ) | |

|

| Total Net Asset Value | | | | | | | | 252,732,046 | | 100.0 | | |

|

This summary of investment portfolio may change due to the ongoing portfolio transactions of the Trust.

5

Sprott Physical Platinum and Palladium Trust

Unaudited interim financial statements

June 30, 2014

6

Sprott Physical Platinum and Palladium Trust

Unaudited interim statements of comprehensive income (loss)

(in U.S. dollars)

| | | For the three months

ended June 30, 2014 | | For the three months

ended June 30, 2013 | | For the six months

ended June 30, 2014 | | For the six months

ended June 30, 2013 | | |

|

| | | $ | | $ | | $ | | $ | | |

|

|

|

|

|

|

|

|

|

|

|

| Income | | | | | | | | | | |

| Unrealized gains (losses) on bullion | | 16,311,741 | | (41,312,152 | ) | 31,434,912 | | (25,770,010 | ) | |

|

| | | 16,311,741 | | (41,312,152 | ) | 31,434,912 | | (25,770,010 | ) | |

|

Expenses |

|

|

|

|

|

|

|

|

|

|

| Management fees(note 11) | | 306,109 | | 324,850 | | 601,492 | | 653,855 | | |

| Bullion storage fees | | 146,051 | | 47,819 | | 251,867 | | 143,469 | | |

| Sales tax | | 62,617 | | (37,675 | ) | 92,020 | | 30,758 | | |

| Audit fees | | 38,582 | | 29,640 | | 64,609 | | 54,492 | | |

| Legal fees | | 37,200 | | 847 | | 50,460 | | 18,243 | | |

| Unitholder reporting costs | | 74,247 | | 40,577 | | 92,781 | | 42,068 | | |

| Listing and regulatory filing fees | | 28,768 | | 47,146 | | 58,676 | | 85,791 | | |

| Administrative fees | | 25,634 | | 16,599 | | 42,096 | | 32,863 | | |

| Independent Review Committee fees | | 2,290 | | 2,373 | | 4,215 | | 4,237 | | |

| Trustee fees | | 1,267 | | 2,288 | | 2,500 | | 3,531 | | |

| Custodial fees | | 29 | | – | | 193 | | – | | |

| Net foreign exchange (gains) losses | | – | | 189 | | – | | 1,630 | | |

|

| | | 722,794 | | 474,653 | | 1,260,909 | | 1,070,937 | | |

|

| Net realized losses on redemptions/sales of bullion | | (5,188 | ) | – | | (1,470,931 | ) | – | | |

|

| Net income (loss) and comprehensive income (loss) for the period | | 15,583,759 | | (41,786,805 | ) | 28,703,072 | | (26,840,947 | ) | |

|

| Increase (decrease) in total equity per Unit(note 9) | | 0.62 | | (1.49 | ) | 1.12 | | (0.97 | ) | |

|

The accompanying notes are an integral part of these financial statements.

On behalf of the Manager, Sprott Asset Management LP,

by its General Partner, Sprott Asset Management GP Inc.:

| |  |

| John Wilson | | Steven Rostowsky |

| DIRECTOR | | DIRECTOR |

7

Sprott Physical Platinum and Palladium Trust

Unaudited interim statements of financial position

(in U.S. dollars)

| | | As at June 30,

2014 | | As at December 31,

2013 | | |

|

| | | $ | | $ | | |

|

|

|

|

|

|

|

| Assets | | | | | | |

| Cash(note 6) | | 1,202,960 | | 394,488 | | |

| Platinum bullion | | 109,635,408 | | 112,164,532 | | |

| Palladium bullion | | 142,078,751 | | 134,015,412 | | |

|

| Total assets | | 252,917,119 | | 246,574,432 | | |

|

Liabilities |

|

|

|

|

|

|

| Accounts payable | | 185,073 | | – | | |

|

| Total liabilities | | 185,073 | | – | | |

|

Equity |

|

|

|

|

|

|

| Unitholders' capital | | 253,015,870 | | 278,634,500 | | |

| Unit premium and reserves | | 681 | | 681 | | |

| Retained earnings (deficit) | | 14,848,968 | | (16,927,276 | ) | |

| Underwriting commissions and issue expenses | | (15,133,473 | ) | (15,133,473 | ) | |

|

| Total equity(note 8) | | 252,732,046 | | 246,574,432 | | |

|

| Total liabilities and equity | | 252,917,119 | | 246,574,432 | | |

|

| Total equity per Unit | | 9.99 | | 8.85 | | |

|

The accompanying notes are an integral part of these financial statements.

8

Sprott Physical Platinum and Palladium Trust

Unaudited interim statements of changes in equity

(in U.S. dollars)

For the six months ended June 30, 2014 and 2013

| | | Number of

Units

Outstanding | | Unitholders'

Capital | | Retained

Earnings

(Deficit) | | Underwriting

Commissions

and Issue

Expenses | | Unit

Premiums

and

Reserves | | Total Equity | | |

|

| | | | | $ | | $ | | $ | | $ | | $ | | |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at January 1, 2013 | | 28,000,000 | | 280,000,000 | | (3,473,293 | ) | (14,610,000 | ) | – | | 261,916,707 | | |

| Proceeds from issuance of Units(note 8) | | – | | – | | – | | – | | – | | – | | |

| Cost of redemption of Units(note 8) | | – | | – | | – | | – | | – | | – | | |

| Net income for the period | | – | | – | | (26,840,947 | ) | – | | – | | (26,840,947 | ) | |

| Underwriting commissions and issue expenses | | – | | – | | – | | (500,067 | ) | – | | (500,067 | ) | |

|

| Balance at June 30, 2013 | | 28,000,000 | | 280,000,000 | | (30,314,240 | ) | (15,110,067 | ) | – | | 234,575,693 | | |

|

| Balance at January 1, 2014 | | 27,863,450 | | 278,634,500 | | (16,927,276 | ) | (15,133,473 | ) | 681 | | 246,574,432 | | |

| Proceeds from issuance of Units(note 8) | | – | | – | | – | | – | | – | | – | | |

| Cost of redemption of Units(note 8) | | (2,561,863 | ) | (25,618,630 | ) | 3,073,172 | | – | | – | | (22,545,458 | ) | |

| Net income for the period | | – | | – | | 28,703,072 | | – | | – | | 28,703,072 | | |

| Underwriting commissions and issue expenses | | – | | – | | – | | – | | – | | – | | |

|

| Balance at June 30, 2014 | | 25,301,587 | | 253,015,870 | | 14,848,968 | | (15,133,473 | ) | 681 | | 252,732,046 | | |

|

The accompanying notes are an integral part of these financial statements.

9

Sprott Physical Platinum and Palladium Trust

Unaudited interim statements of cash flows

(in U.S. dollars)

| | | For the six months

ended June 30, 2014 | | For the six months

ended June 30, 2013 | | |

|

| | | $ | | $ | | |

|

|

|

|

|

|

|

| Cash flows from operating activities | | | | | | |

| Net income (loss) for the period | | 28,703,072 | | (26,840,947 | ) | |

| Adjustment to reconcile net income (loss) for the period to net cash from operating activities | | | | | | |

| | Realized losses on redemptions for bullion | | 1,470,931 | | – | | |

| | Unrealized (gains) losses on bullion | | (31,434,912 | ) | 25,770,010 | | |

| Net changes in operating assets and liabilities | | | | | | |

| Increase in prepaid assets | | – | | (32,063 | ) | |

| Increase (decrease) in accounts payable | | 185,073 | | (651,272 | ) | |

|

| Net cash provided by (used in) operating activities | | (1,075,836 | ) | (1,754,272 | ) | |

|

| Cash flows from investing activities | | | | | | |

| Purchase of bullion | | – | | (14,315,870 | ) | |

| Sales of bullion | | 1,900,408 | | – | | |

| Increase (decrease) in due to broker | | – | | (135,274,906 | ) | |

|

| Net cash used in investing activities | | 1,900,408 | | (149,590,776 | ) | |

|

| Cash flows from financing activities | | | | | | |

| Proceeds from issuance of Units(note 8) | | – | | – | | |

| Cancellation of Unit | | – | | – | | |

| Payments on redemption of Units(note 8) | | (16,100 | ) | – | | |

| Underwriting commissions and issue expenses | | – | | (500,067 | ) | |

|

| Net cash provided by (used in) financing activities | | (16,100 | ) | (500,067 | ) | |

|

| Net increase (decrease) in cash during the period | | 808,472 | | (151,845,114 | ) | |

| Cash at beginning of period | | 394,488 | | 153,348,584 | | |

|

| Cash at end of period(note 6) | | 1,202,960 | | 1,503,470 | | |

|

The accompanying notes are an integral part of these financial statements.

10

Sprott Physical Platinum and Palladium Trust

Notes to the Interim Financial Statements June 30, 2014 (unaudited)

1. Organization of the Trust

Sprott Physical Platinum and Palladium Trust (the "Trust") is a closed-end mutual fund trust created under the laws of the Province of Ontario, Canada, pursuant to a trust agreement dated as of December 23, 2011, as amended and restated as of June 6, 2012 (the "Trust Agreement"). The Trust's initial public offering closed on December 19, 2012. The Trust is authorized to issue an unlimited number of redeemable, transferable trust units (the "Units"). All issued Units have no par value, are fully paid for, and are listed and traded on the New York Stock Exchange Arca (the "NYSE Arca") and the Toronto Stock Exchange (the "TSX") under the symbols "SPPP" and "PPT.U", respectively.

The investment objective of the Trust is to seek to provide a convenient and exchange-traded investment alternative for investors interested in holding physical platinum and palladium bullion without the inconvenience that is typical of a direct investment in physical bullion. The Trust invests and intends to continue to invest primarily in long-term holdings of unencumbered, fully allocated, physical platinum and palladium bullion and does not speculate with regard to short-term changes in platinum and palladium prices. The Trust has only purchased and expects only to own "Good Delivery Bars" as defined by the London Platinum and Palladium Market ("LPPM"), with each bar purchased being verified against the LPPM source.

The Trust's registered office is located at Suite 2700, South Tower, Royal Bank Plaza, 200 Bay Street, Toronto, Ontario, Canada, M5J 2J1.

Sprott Asset Management LP (the "Manager") acts as the manager of the Trust pursuant to the Trust Agreement and a management agreement with the Trust. RBC Investor Services Trust, a trust company organized under the laws of Canada, acts as the trustee of the Trust. RBC Investor Services Trust also acts as custodian on behalf of the Trust for the Trust's assets other than physical bullion. The Royal Canadian Mint acts as custodian on behalf of the Trust for the physical bullion owned by the Trust.

The financial statements of the Trust as at and for the three and six-month periods ended June 30, 2014 were authorized for issue by the Manager on August 14, 2014.

2. Basis of Preparation

The financial statements have been prepared in compliance with International Accounting Standards ("IAS") 34,Interim Financial Reporting.

The financial statements have been prepared on a historical cost basis, except for physical bullion and financial assets and financial liabilities held at fair value through profit or loss, that have been measured at fair value.

The financial statements are presented in U.S. dollars and all values are rounded to the nearest dollar unless otherwise indicated.

2.1 Summary of Significant Accounting Policies

(i) Cash

Cash consists of cash on deposit with the Trust's custodian, which is not subject to restrictions.

(ii) Platinum and palladium bullion

Investments in bullion are measured at fair value determined by reference to published price quotations, with unrealized and realized gains and losses recorded in income based on the International Accounting Standards 40Investment Property fair value model as IAS 40 is the most relevant standard to apply. Investment transactions in physical bullion are accounted for on the business day following the date the order to buy or sell is executed.

11

(iii) Other financial liabilities

This category includes all financial liabilities, other than those classified at fair value through profit and loss. The Trust includes in this category management fees payable, due to brokers and other accounts payable.

(iv) Unitholder's Capital

Classification of redeemable units

Redeemable units are classified as equity instruments when:

- •

- The units entitle the holder to apro rata share of the Trust's net assets in the event of the Trust's liquidation;

- •

- The redeemable units are in the class of instruments that is subordinate to all other classes of instruments;

- •

- All redeemable units in the class of instruments that is subordinate to all other classes of instruments have identical features;

- •

- The redeemable units do not include any contractual obligation to deliver cash or another financial asset other than the holder's rights to apro rata share of the Trust's net assets; and

- •

- The total expected cash flows attributable to the redeemable units over the life of the instrument are based substantially on the profit or loss, the change in the recognized net assets or the change in the fair value of the recognized and unrecognized net assets of the Trust over the life of the instrument.

In addition to the redeemable units having all the above features, the Trust must have no other financial instrument or contract that has:

- •

- Total cash flows based substantially on the profit or loss, the change in the recognized net assets or the change in the fair value of the recognized and unrecognized net assets of the Trust; and

- •

- The effect of substantially restricting or fixing the residual return to the redeemable unitholders.

The Trust continuously assesses the classification of the redeemable units. If the redeemable units cease to have all the features or meet all the conditions set out to be classified as equity, the Trust will reclassify them as financial liabilities and measure them at fair value at the date of reclassification, with any differences from the previous carrying amount recognised in equity.

(v) Fees and commission expenses

Fees and commission expenses are recognized on an accrual basis.

(vi) Income taxes

In each taxation year, the Trust will be subject to income tax on taxable income earned during the year, including net realized taxable capital gains. However, the Trust intends to distribute its taxable income to unitholders at the end of every fiscal year and therefore the Trust itself would not have any income tax liability.

(vii) Functional and presentation currency

The Trust's functional and presentation currency is the U.S. Dollar. The Trust's performance is evaluated and its liquidity is managed in U.S. Dollars. Therefore, the U.S. Dollar is considered as the currency that most faithfully represents the economic effects of the underlying transactions, events and conditions.

3. Significant Accounting Judgements, Estimates and Assumptions

The preparation of the Trust's financial statements requires the Manager to make judgments, estimates and assumptions that affect the amounts recognized in the financial statements. However, uncertainty about these assumptions and estimates could result in outcomes that may require a material adjustment to the carrying amount of the asset or liability affected in future periods.

12

Judgements

In the process of applying the Trust's accounting policies, management has made the following judgements, which have the most significant effect on the amounts recognized in the financial statements:

Going Concern

The Trust's management has made an assessment of the Trust's ability to continue as a going concern and is satisfied that the Trust has the resources to continue in business for the foreseeable future. Furthermore, management is not aware of any material uncertainties that may cast significant doubt upon the Trust's ability to continue as a going concern. Therefore, the financial statements continue to be prepared on a going concern basis.

Estimation Uncertainty

For tax purposes, the Trust generally treats gains from the disposition of platinum and palladium bullion as capital gains, rather than income, as the Trust intends to be a long-term passive holder of platinum and palladium bullion, and generally disposes of its holdings in bullion only for the purposes of meeting redemptions and to pay expenses. The Canada Revenue Agency has, however, expressed its opinion that gains (or losses) of mutual fund trusts resulting from transactions in commodities should generally be treated for tax purposes as ordinary income rather than as capital gains, although the treatment in each particular case remains a question of fact to be determined having regard to all the circumstances.

The Trust based its assumptions and estimates on parameters available when the financial statements were prepared. However, existing circumstances and assumptions about future developments may change due to market changes or circumstances arising beyond the control of the Trust. Such changes are reflected in the assumptions when they occur.

4. Certain Relevant Standards, Interpretations and Amendments Issued

New standards and standards issued but not yet effective at the date of the issuance of the Trust's financial statements are listed below.

In May 2013, the IFRS Interpretations Committee ("IFRIC"), with the approval of the IASB, issued IFRIC 21,Levies ("IFRIC 21"). IFRIC 21 provides guidance on when to recognize a liability to pay a levy imposed by the government that is accounted for in accordance with IAS 37,Provisions, Contingent Liabilities and Contingent Assets. IFRIC 21 is effective for annual periods beginning on or after January 1, 2014 and is to be applied retrospectively. The adoption of IFRIC 21 did not have a material impact on the Trust's interim financial statements.

IFRS 9,Financial Instruments ("IFRS 9"), will replace IAS 39,Financial Instruments: Recognition and Measurement ("IAS 39") effective January 1, 2018. IFRS 9 uses a single approach to determine whether a financial asset is measured at amortized cost or fair value, replacing the multiple rules presently in IAS 39. The approach in IFRS 9 is based on how an entity manages its financial instruments in the context of its business model and the contractual cash flow characteristics of the financial assets. The new standard also requires a single impairment method to be used, replacing the multiple impairment methods in IAS 39.

There are no other IFRS interpretations which are not yet effective that would be expected to have a material impact on the financial statements.

5. Segment Information

For management purposes, the Trust is organized into one main operating segment, which invests in physical bullion. All of the Trust's activities are interrelated, and each activity is dependent on the others. Accordingly, all significant operating decisions are based upon an

13

analysis of the Trust as one segment. The financial results from this segment are equivalent to the financial statements of the Trust as a whole. The Trust's operating income is earned entirely in Canada and is primarily generated from its investment in physical bullion.

6. Cash

As at June 30, 2014 and December 31, 2013, cash consisted entirely of cash on deposit.

7. Fair Value Measurements

IFRS 13,Fair Value Measurement, ("IFRS 13") establishes a single source of guidance under IFRS for all fair value measurements. IFRS 13 does not change when an entity is required to use fair value, but rather provides guidance on how to measure fair value under IFRS. IFRS 13 defines fair value as an exit price. As a result of the guidance in IFRS 13, the Trust re- assessed its policies for measuring fair values. IFRS 13 also requires additional disclosures. The application of IFRS 13 has not materially impacted the fair value measurements of the Trust.

As at June 30, 2014 and December 31, 2013, due to the short-term nature of financial assets and financial liabilities recorded at cost, it is assumed that the carrying amount of those instruments approximates their fair value.

All assets and liabilities for which fair value is measured or disclosed in the financial statements are categorized within the fair value hierarchy, described as follows, based on the lowest level input that is significant to the fair value measurement as a whole:

- •

- Level 1 – Quoted (unadjusted) market prices in active markets for identical assets or liabilities

- •

- Level 2 – Valuation techniques for which the lowest level input that is significant to the fair value measurement is directly or indirectly observable

- •

- Level 3 – Valuation techniques for which the lowest level input that is significant to the fair value measurement is unobservable

Platinum and palladium bullion is measured at fair value on a recurring basis. The fair value measurement of this bullion falls within Level 1 of the hierarchy, and is based on published price quotations.

8. Unitholders' Capital

The Trust is authorized to issue an unlimited number of redeemable, transferrable Trust Units in one or more classes and series of Units. The Trust's capital is represented by the issued, redeemable, transferable Trust Units. Quantitative information about the Trust's capital is provided in the statement of changes in equity. Under the Trust Agreement, Units may be redeemed at the option of the unitholder on a monthly basis for physical platinum and palladium bullion or cash. Units redeemed for physical bullion will be entitled to a redemption price equal to 100% of the NAV of the redeemed Units on the last business day of the month in which the redemption request is processed. A unitholder redeeming Units for physical bullion will be responsible for expenses in connection with effecting the redemption and applicable delivery expenses, including the handling of the notice of redemption, the delivery of the physical bullion for Units that are being redeemed and the applicable bullion storage in-and-out fees. Units redeemed for cash will be entitled to a redemption price equal to 95% of the lesser of (i) the volume-weighted average trading price of the Units traded on the NYSE Arca, or, if trading has been suspended on the NYSE Arca, on the TSX for the last five business days of the month in which the redemption request is processed and (ii) the NAV of the redeemed Units as of 4:00 p.m., Eastern Standard time, on the last business day of the month in which the redemption request is processed.

When Units are redeemed and cancelled and the cost of such Units is either above or below their stated or assigned value, the unitholders' capital is reduced by an amount equal to the stated or assigned value of the Units. The difference between the redemption price and the stated or assigned values of the Units is allocated to the Unit premiums and reserves account (equal to the 5% reduction to the redemption price for Units redeemed for cash as described above) and the Retained earnings account based on the allocated portion attributable to the

14

redemption. For the period ended June 30, 2014, there were no unit issuances (June 30, 2013: no Units) and 2,561,863 units were redeemed (June 30, 2013: no Units).

Net Asset Value

Net Asset Value ("NAV") is defined as the Trust's net assets (fair value of total assets less fair value of total liabilities, excluding all liabilities represented by outstanding Units, if any) calculated using the value of physical bullion based on the end-of-day price provided by a widely recognized pricing service.

Capital management

As a result of the ability to issue, repurchase and resell Units of the Trust, the capital of the Trust as represented by the Unitholders' capital in the statement of financial position can vary depending on the demand for redemptions and subscriptions to the Trust. The Trust is not subject to externally imposed capital requirements and has no legal restrictions on the issue, repurchase or resale of redeemable Units beyond those included in the Trust Agreement. The Trust may not issue additional Units except (i) if the net proceeds per Unit to be received by the Trust are not less than 100% of the most recently calculated NAV immediately prior to, or upon, the determination of the pricing of such issuance or (ii) by way of Unit distribution in connection with an income distribution.

The Trust's objectives for managing capital are:

- •

- To invest and hold substantially all of its assets in physical platinum and palladium bullion; and

- •

- To maintain sufficient liquidity to meet the expenses of the Trust, and to meet redemption requests as they arise.

Refer to "Financial risk management objectives and policies" (Note 10) for the policies and procedures applied by the Trust in managing its capital.

9. Increase (Decrease) in Total Equity per Unit

Increase (decrease) in total equity per unit is calculated by dividing the net income (loss) for the period attributable to the Trust's unitholders by the weighted average number of units outstanding during the period.

| | | For the three months ended

June 30, 2014 | | For the three months ended

June 30, 2013 | | For the six months ended

June 30, 2014 | | For the six months ended

June 30, 2013 | | |

|

| Net income (loss) for the period attributable to the Trust's units | | $15,583,759 | | $(41,786,805 | ) | $28,703,072 | | $(26,840,947 | ) | |

|

| Weighted average number of units outstanding | | 25,301,587 | | 28,000,000 | | 25,650,433 | | 28,000,000 | | |

|

| Increase (decrease) in total equity per unit | | $0.62 | | $(1.49 | ) | $1.12 | | $(0.97 | ) | |

|

10. Financial Risk and Management Objectives and Policies

Introduction

The Trust's objective in managing risk is the creation and protection of unitholder value. Risk is inherent in the Trust's activities, but it is managed through a process of ongoing identification, measurement and monitoring, subject to risk limits and other controls. The process of risk management is critical to the Trust's continuing profitability. The Trust is exposed to market risk (which includes price risk, interest rate risk and currency risk), credit risk and liquidity risk arising from the bullion that it holds. Only certain risks of the Trust are actively managed by the Manager, as the Trust is a passive investment company. The risks are managed in accordance with the Trust's offering documents.

15

Risk management structure

The Trust's Manager is responsible for identifying and controlling risks.

Risk mitigation

The Trust has investment guidelines that set out its overall business strategies, its tolerance for risk and its general risk management philosophy.

The discussion below clarifies the Trust's management of various risks:

Excessive risk concentration

The Trust's risk is concentrated in the value of physical platinum and palladium bullion, whose values constitute 43.4% and 56.2% of total equity respectively as at June 30, 2014 (December 31, 2013: 45.5% and 54.3%).

Price risk

Price risk arises from the possibility that changes in the market price of the Trust's investments, which consist almost entirely of platinum and palladium bullion, will result in changes in fair value of such investments.

If the market value of each of platinum and palladium bullion increased by 1%, with all other variables held constant, this would have increased total equity and comprehensive income by approximately $2.5 million (December 31, 2013: $2.5 million); conversely, if the value of each of platinum and palladium bullion decreased by 1%, this would have decreased total equity and comprehensive income by the same amount.

Interest rate risk

Interest rate risk arises from the possibility that changes in interest rates will affect the value of financial instruments. The Trust does not hedge its exposure to interest rate risk as that risk is minimal.

Currency risk

Currency risk arises from the possibility that changes in the price of foreign currencies will result in changes in carrying value. The Trust's assets, substantially all of which consist of investments in platinum and palladium bullion, are priced in U.S. dollars. Some of the Trust's expenses are payable in Canadian dollars. Therefore, the Trust is exposed to currency risk, as the value of its liabilities denominated in Canadian dollars will fluctuate due to changes in exchange rates. Most of such liabilities, however, are short term in nature and are not significant in relation to the net assets of the Trust, and, as such, exposure to foreign exchange risk is limited. The Trust does not enter into currency hedging transactions.

As at June 30, 2014, approximately $65,000 (December 31, 2013: none) of the Trust's liabilities were denominated in Canadian dollars.

Credit risk

Credit risk arises from the potential that counterparties will fail to satisfy their obligations as they come due. The Trust primarily incurs credit risk when entering into and settling bullion transactions. It is the Trust's policy to only transact with reputable counterparties. The Manager closely monitors the creditworthiness of the Trust's counterparties, such as bullion dealers, by reviewing their financial statements, when available, regulatory notices and press releases. The Trust seeks to minimize credit risk relating to unsettled transactions in bullion by only engaging in transactions with bullion dealers with high creditworthiness. The risk of default is considered minimal, as payment for bullion, is only made against the receipt of the bullion by the custodian.

16

Liquidity risk

Liquidity risk is defined as the risk that the Trust will encounter difficulty in meeting obligations associated with financial liabilities and redemptions. Liquidity risk arises because of the possibility that the Trust could be required to pay its liabilities earlier than expected. The Trust is also subject to redemptions for both cash and bullion on a regular basis. The Trust manages its obligation to redeem units when required to do so and its overall liquidity risk by only allowing for redemptions monthly, which require 15-day advance notice to the Trust. The Trust's liquidity risk is minimal, since its primary investment is physical platinum and palladium bullion, which trade in highly liquid markets. All of the Trust's financial liabilities, including due to brokers, accounts payable and management fees payables have maturities of less than three months.

11. Related Party Disclosures

The following parties are considered related parties to the Trust:

Investment Manager – Sprott Asset Management LP

The Trust pays the Manager a monthly management fee equal to1/12 of 0.50% of the value of net assets of the Trust (determined in accordance with the Trust Agreement) plus any applicable Canadian taxes, calculated and accrued daily and payable monthly in arrears on the last day of each month. Total management fees for the period from April 1, 2014 to June 30, 2014 amounted to $306,109 compared to $324,850 for the same period in 2013. Total management fees for the period from January 1, 2014 to June 30, 2014 amounted to $601,492 compared to $653,855 for the same period in 2013.

There have been no other transactions between the Trust and its related parties during the reporting period.

12. Independent Review Committee ("IRC")

In accordance with National Instrument 81-107, Independent Review Committee for Investment Funds ("NI 81-107"), the Manager has established an IRC for a number of funds managed by it, including the Trust. The mandate of the IRC is to consider and provide recommendations to the Manager on conflicts of interest to which the Manager is subject when managing certain funds, including the Trust. The IRC is composed of three individuals, each of whom is independent of the Manager and all funds managed by the Manager, including the Trust. Each fund subject to IRC oversight pays a share of the IRC member fees, costs and other fees in connection with operation of the IRC. The IRC reports annually to unitholders of the funds subject to its oversight on its activities, as required by NI 81-107.

13. Soft Dollar Commissions

There were no soft dollar commissions for the three and six-month periods ended June 30, 2014 and the three and six-month periods ended June 30, 2013.

14. Personnel

The Trust did not employ any personnel during the period, as its affairs were administered by the personnel of the Manager and/or the Trustee, as applicable.

15. Events After the Reporting Period

There were no material events after the reporting period.

17

Corporate Information

Head Office

Sprott Physical Platinum and Palladium Trust

Royal Bank Plaza, South Tower

200 Bay Street

Suite 2700, PO Box 27

Toronto, Ontario M5J 2J1

Telephone: (416) 203-2310

Toll Free: (877) 403-2310

Email: ir@sprott.com

Auditors

Ernst & Young LLP

Ernst & Young Tower

P.O. Box 251, 222 Bay Street

Toronto-Dominion Centre

Toronto, Ontario M5K 1J7

Legal Counsel

Baker & McKenzie LLP

Brookfield Place

Bay Wellington Tower

181 Bay Street, Suite 2100

Toronto, Ontario Canada M5J 2T3

Seward & Kissel LLP

901 K Street N.W., 8th Floor

Washington, DC 20001

QuickLinks