$1,187.43 an ounce and the spot price of physical palladium bullion was $2,627.56 an ounce, compared to a spot price for platinum bullion of $1,072.12 an ounce and the spot price of physical palladium bullion of $2,448.81 an ounce as at December 31, 2020.

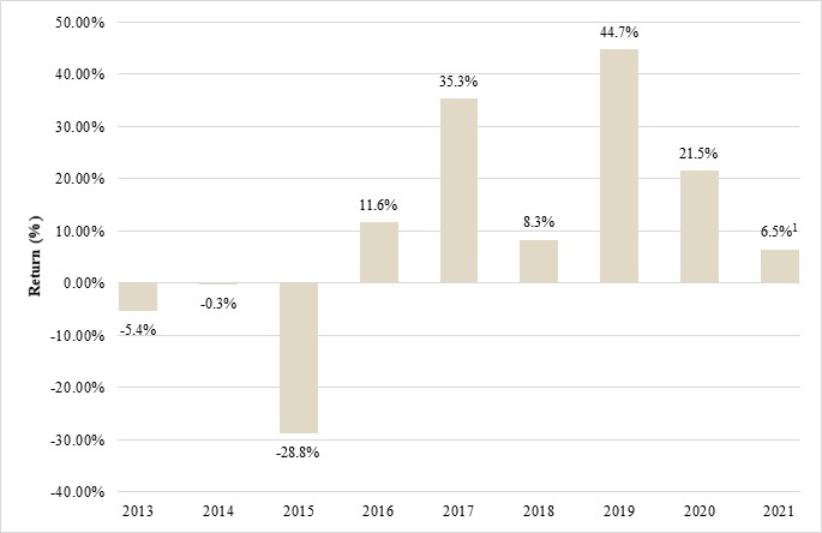

The Trust returned 6.5% compared to the returns on spot platinum of 10.8% and on spot palladium of 7.3%, for the period from January 1, 2021 to March 31, 2021. Comparatively, for the same period in 2020, the Trust returned 11.6% compared to the returns on spot platinum and palladium bullion of (25.2%) and 21.5%, respectively.

The units closed at $18.96 on the NYSE Arca and $18.65 on the TSX on March 31, 2021 compared to closing prices of $17.82 on the NYSE Arca and $17.38 on the TSX on December 31, 2020. The units are denominated in U.S. dollars on both exchanges. During the period from January 1, 2021 to March 31, 2021, the Trust’s units traded on the NYSE Arca at an average discount to net asset value of approximately 0.8%, compared to approximately 7.5% for the same period in 2020.

The Trust pays its own operating expenses, which include, but are not limited to, audit, legal and trustee fees, unitholder reporting expenses, general and administrative fees, filing and listing fees payable to applicable securities regulatory authorities and stock exchanges, storage fees for the physical bullion, costs incurred in connection with the Trust’s continuous disclosure public filing requirements and investor relations and any expenses associated with the Independent Review Committee of the Trust. Operating expenses for the period from January 1, 2021 to March 31, 2021 amounted to $0.21 million (not including applicable Canadian taxes) compared to $0.21 million for the same period in 2020. Operating expenses for the period from January 1, 2021 to March 31, 2021 amounted to 0.50% of the average net assets during the period on an annualized basis, compared to 0.14% for the same period in 2020.

During the period from January 1, 2020 to March 31, 2020, the Trust sold 927,629 units through the at-the-market offering program (the “ATM Program”), compared to 165,969 units for the same period in 2020.

There were no changes to the Manager of the Trust, nor were there any material changes to the investment philosophy or process.

Related Party Transactions

There were no transactions between the Trust and its related parties during the reporting period, except as outlined below:

Management Fees

The Trust pays the Manager, a monthly management fee equal to 1/12 of 0.50% of the value of the net assets of the Trust (determined in accordance with the Trust’s trust agreement), plus any applicable Canadian taxes. The management fee is calculated and accrued daily and payable monthly in arrears on the last day of each month. For the period from January 1, 2021 to March 31, 2021, the Trust incurred management fees of $0.2 million (not including applicable Canadian taxes) compared to $0.2 million for the same period in 2020.

1 Amounts are adjusted to exclude redemption fees and sales taxes