March 29, 2012

Kieran G. Brown

Senior Counsel

Division of Investment Management

Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

Dear Mr. Brown:

Nuveen Real Asset Income and Growth Fund (333-179180; 811-22658)

In connection with the SEC comment response correspondence filed on March 23, 2012, regarding the above captioned fund, due to an oversight the supporting materials referenced within the response letter were not attached to the filing. Please find those supporting materials attached hereto.

If you should require additional information or need anything further, please call me at 312.807.4295 or Fatima Sulaiman at 202.778.9082.

Very truly yours,

/s/ David P. Glatz

David P. Glatz

Institutional Investor Themes: Real Assets Jeremy King, Asset Management Insights | May 23, 2011, 5:19 PM | 1,640 | Share 17 0 AAA A few weeks ago I published my Top 5 Institutional Investor Themes on Business Insider. Number one on the list was an increasing allocation to real assets driven in part by an uncertain inflationary outlook, by concern over the debasement of fiat currencies and government manipulation of financial asset prices generally. Since that post, the World Economic Forum (WEF) has published its Future of Long Term Investing report and the investment consulting firm Casey Quirk (together with eVestment Alliance) has published its annual consultant survey, both of which confirm this trend. I want look more closely at the characteristics, benefits and risks of the asset class, consider how to implement an allocation within a portfolio and provide some references to good source material. Overview The data is mixed, the inflation outlook is clouded, portfolio construction is evolving and institutional investors are increasing their allocations to real assets Real assets can provide strong total returns, solid diversification and inflation protection Allocations should be made stand-alone and comprise a portion of fixed income, equities and alternative buckets Derivative strategies can minimize the risk of unexpected ‘fat tail’ inflation Jeremy King Jeremy King is an asset management executive with deep experience structuring, marketing and distributing investment solutions to institutional clients and key wirehouses globally. Recent Posts Strategic Marketing: A 7 Point Plan to Keep Your Brand on its. How the “Crisis Effect” Has Fundamentally Altered Investor Behavior ESG: An Idea Whose Time Has Come Jeremy King ASSET MANAGEMENT INSIGHTS Building a Pension Funding Bridge Across the Atlantic Pension Funds Under Water on Both Sides of the Pond Top 10 Thought Leaders What Are Real Assets? Real assets are characterized by their physical/ tangible form, a strong correlation to inflation and a high degree of illiquidity. Real assets are often described as ‘hard assets’ having intrinsic value or ‘value in use’ that can be contrasted with financial assets, such as equities, bonds and options that derive their value from contractual claims, as well as ‘soft commodities’, that are perishable and consumable (e.g. agriculturals and livestock). Real assets are also generally significantly more illiquid than financial assets: e.g. it is more challenging to offload an interest in a piece of commercial real estate than it is a portfolio of blue chip stocks. Examples of real assets include: real estate Timber other ‘hard’ commodities such as oil and gas and infrastructure. In addition to this list the WEF adds intellectual property, specifically patents, which seems very odd as intellectual property is an intangible asset by definition. Meanwhile, Treasury Inflation-Protected Inflation Securities (TIPS) are also often considered a real asset. Ultimately the only sense in which TIPS are ‘real’ is that they are inflation-adjusted. TIPS are bonds issued by the U.S. Treasury with a financially engineered link to the level of consumer price inflation. TIPS deserve a position in investors’ portfolios but should ultimately be considered a financial asset that is subject to sovereign risk.

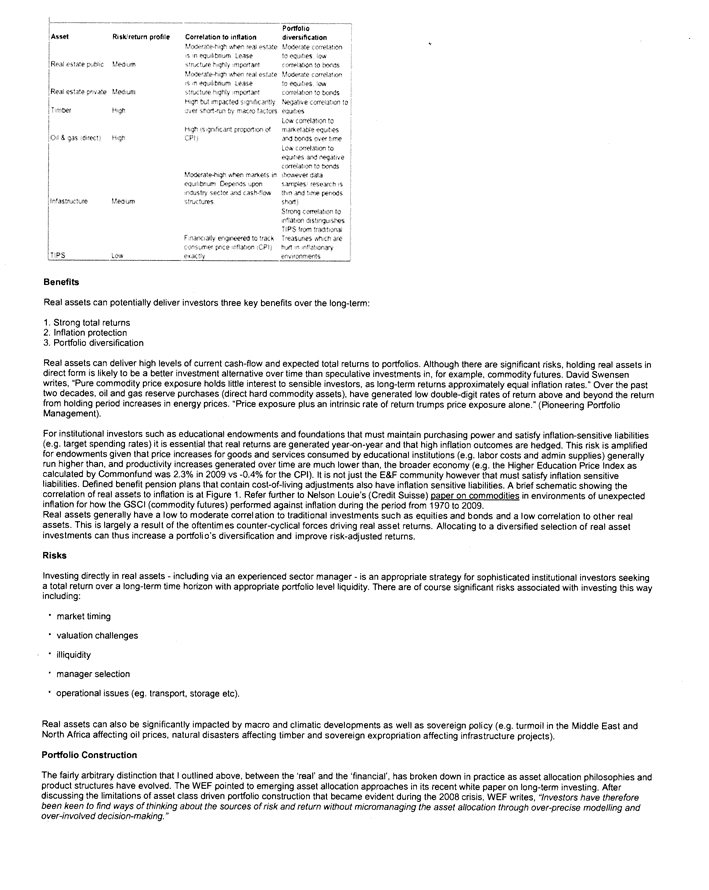

Asset Risk/return profile Correlation to inflation Portfolio diversification Real estate public Medium Moderate-high when real estate is in equilibrium. Lease structure highly important. Moderate correlation to equities, low correlation to bonds Real estate private Medium Moderate-high when real estate is in equilibrium. Lease structure highly important. Moderate correlation to equities, low correlation to bonds Timber High High but impacted significantly over short-run by macro factors Negative correlation to equities Oil & gas (direct) High High (significant proportion of CPI) Low correlation to marketable equities and bonds over time Infrastructure Medium Moderate-high when markets in equilibrium. Depends upon industry sector and cash-flow structures. Low correlation to equities and negative correlation to bonds (however data samples/research is thin and time periods short) TIPS Low Financially engineered to track consumer price inflation (CPI) exactly Strong correlation to inflation distinguishes TIPS from traditional Treasuries which are hurt in inflationary environments Benefits Real assets can potentially deliver investors three key benefits over the long-term: 1. Strong total returns 2. Inflation protection 3. Portfolio diversification Real assets can deliver high levels of current cash-flow and expected total returns to portfolios. Although there are significant risks, holding real assets in direct form is likely to be a better investment alternative over time than speculative investments in, for example, commodity futures. David Swensen writes, “Pure commodity price exposure holds little interest to sensible investors, as long-term returns approximately equal inflation rates.” Over the past two decades, oil and gas reserve purchases (direct hard commodity assets), have generated low double-digit rates of return above and beyond the return from holding period increases in energy prices. “Price exposure plus an intrinsic rate of return trumps price exposure alone.” (Pioneering Portfolio Management). For institutional investors such as educational endowments and foundations that must maintain purchasing power and satisfy inflation-sensitive liabilities (e.g. target spending rates) it is essential that real returns are generated year-on-year and that high inflation outcomes are hedged. This risk is amplified for endowments given that price increases for goods and services consumed by educational institutions (e.g. labor costs and admin supplies) generally run higher than, and productivity increases generated over time are much lower than, the broader economy (e.g. the Higher Education Price Index as calculated by Common fund was 2.3% in 2009 vs -0.4% for the CPI). It is not just the E&F community however that must satisfy inflation sensitive liabilities. Defined benefit pension plans that contain cost-of-living adjustments also have inflation sensitive liabilities. A brief schematic showing the correlation of real assets to inflation is at Figure 1. Refer further to Nelson Louie’s (Credit Suisse) paper on commodities in environments of unexpected inflation for how the GSCI (commodity futures) performed against inflation during the period from 1970 to 2009. Real assets generally have a low to moderate correlation to traditional investments such as equities and bonds and a low correlation to other real assets. This is largely a result of the oftentimes counter-cyclical forces driving real asset returns. Allocating to a diversified selection of real asset investments can thus increase a portfolio’s diversification and improve risk-adjusted returns. Risks Investing directly in real assets—including via an experienced sector manager—is an appropriate strategy for sophisticated institutional investors seeking a total return over a long-term time horizon with appropriate portfolio level liquidity. There are of course significant risks associated with investing this way including: market timing valuation challenges illiquidity manager selection operational issues (eg. transport, storage etc). Real assets can also be significantly impacted by macro and climatic developments as well as sovereign policy (e.g. turmoil in the Middle East and North Africa affecting oil prices, natural disasters affecting timber and sovereign expropriation affecting infrastructure projects). Portfolio Construction The fairly arbitrary distinction that I outlined above, between the ‘real’ and the ‘financial’, has broken down in practice as asset allocation philosophies and product structures have evolved. The WEF pointed to emerging asset allocation approaches in its recent white paper on long-term investing. After discussing the limitations of asset class driven portfolio construction that became evident during the 2008 crisis, WEF writes, “Investors have therefore been keen to find ways of thinking about the sources of risk and return without micromanaging the asset allocation through over-precise modelling and over-involved decision-making.”

Illustrative historical allocation detail Small cap growth Hedge funds Private equity Real assets Core fixed income Real return fixed Small cap value Intnl equity Large cap growth Large cap core Large cap value Simplified allocation approach Examples of new allocation frameworks that focus on drivers of return rather than asset classes 1. Risk factors 2. Macroeconomic 3. Thematic Equity Growth Ageing Liquidity Stagnation Knowledge economy Term Dislocation Resource scarcity Credit Inflation Low-cost production Source: World Economic Forum, Future of Long Term Investing, p62 Institutional investors like CalPERS and consultants like Cambridge Associates have moved away from segmenting portfolios along asset class lines towards a more outcome-oriented approach. I recently wrote for BI about the uncertain inflation outlook. Casey Quirk’s recent survey of institutional investors makes the connection between inflation and the evolution of asset allocation techniques: Inflation appears to be the most influential factor driving institutional investors to separate portfolios into return-seeking and risk-mitigation allocations, rather than simple splits between stocks and bonds. As in 2010, more than 80% of surveyed consultants believe inflation protection will either be a significant or moderate focus of search activity during 2011; more importantly, more than one-half of consultants believe search activity related to inflation risk will increase over 2010 levels. The most efficient vehicles to access ‘real assets’ have increasingly become mass-marketed and often exchange-traded financial instruments such as ETFs which were discussed above (providing exposure to e.g. underlying commodity futures contracts or infrastructure funds) and real estate investment trusts (REITS). Owning structures, such as ETFs and securitized real estate vehicles, come with market and idiosyncratic risks that can impact cash flows as well as price movements. Nonetheless, investors have significant choice across public and private markets in accessing investment exposures. In the real estate space, REITS are a low cost option, however investors should be wary of the significant price risk involved in timing market entry (REITS often trade at significant variations from NAV as shown in Figure 3). Refer to www.greenstreetadvisors.com for more information. Average Premium to NAV Source: Green Street Advisors, www.greenstreetadvisors.com Institutional investors should maintain a significant allocation to real assets within the constraints of portfolio level liquidity and diversification. I would defer to NEPC’s 5-15% strategic asset allocation range but argue for an even higher range for educational endowments and DB plans with COLAs etc. For investors with standard asset allocation buckets this allocation should be made stand-alone and across equities (natural resource stocks), bonds (TIPS) and alternatives (hedge funds and fund of hedge funds trading across real asset markets). Natural resource equities and alternatives have not been covered in this article and may be deserving of a separate post. Conclusion This article has focused on the benefits and risks of allocating to real assets. The three core benefits from allocating to this sector are the potential for strong total returns, inflation protection and portfolio diversification. While the uncertain outlook for inflation may prompt investors to increase allocations to this sector, care must be taken in timing market entry given dislocations in underlying values (e.g. the 15% premium of REITS to NAV shown above). Investors with inflation sensitive liabilities will of course also take comfort from portfolios that on average remain overweight equities. As we know, equities generally have a strong long-run correlation to inflation, but a weak short-term relationship. Derivative strategies and other alternatives may also be implemented to hedge unexpected or fat-tail inflation outcomes. These include inflation swaps, long-dated calls on equities indices and long dividend positions. More on these another time. References AIA Research Report, Real Assets in Institutional Portfolios: The Role of Commodities, 2007, http://bit.ly/mL1F8a Casey Quirk, Old Wine in New Bottles 2011 Consultant Search Forecast, April 2011, http://bit.ly/lxE62G Credit Suisse, How commodities can help investors face the uncertainty of the inflation/ deflation debate, http://bit.ly/kkKVAX Green Street Advisors, www.greenstreetadvisors.com Ibbotson, 2005 Ibbotson Hard Asset Study, 2005, http://bit.ly/jTidxK NEPC, Inflation Hedge Investing, http://bit.ly/hpsX8G S&P Indices, Practice Essentials, Commodities 201 Real Assets Solutions, 2010, http://bit.ly/kGm4pf

David Swensen, Pioneering Portfolio Management, Free Press, 2000, 2009 World Economic Forum, The Future of Long Term Investing, 2011, http://bit.ly/mbt4bT Please follow Money Game on Twitter and Facebook. Short URL http://read.bi/lN4wqj Share: Twitter Facebook Buzz Digg StumbleUpon Reddit LinkedIn Email Embed Alerts Newsletter Comments on this post are now closed.

CALLAN ASSOCIATESINC

Knowledge for Investors

Research Presentation

with talking points

Real Assets – Give Me Something Real

Callan Investments Institute

2007 National Conference

CALLAN

ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

CALLAN

ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

Presenters:

Matthew W. Costello, CFA

Vice President

Paul M. Erlendson

Senior Vice President

Chae N. Hong

Investment Consultant

James W. Van Heuit

Senior Vice President

Session Details:

Callan Investments Institute

2007 National Conference, January 29-31

San Francisco, California

The following is a presentation given by the Callan Investments Institute during one of its educational sessions.

Each slide is accompanied by the commentary provided by the presenters during the session.

Commentary is provided on the left side pages. Some commentary pages were left intentionally blank

when the presenter chose to skip that page as part of his/her presentation.

Session Title:

Real Assets – Give Me Something Real

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

??Paul Erlendson moderated this workshop on real assets, their characteristics, and how

they may enhance a portfolio.

??James Van Heuit provided an overview of real assets and how they are viewed within

an asset allocation framework.

??Matthew Costello followed with a discussion of timberland, highlighting some of the

unique opportunities this asset class has to offer.

??Chae Hong explored infrastructures, what is driving the growing demand for these

assets, and how and why to invest in this segment of the market.

RP-1

CALLAN ASSOCIATESINC

Knowledge for Investors

What are Real Assets?

James W. Van Heuit

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

??Simply defined, real assets as those that are tangible, such as real estate,

infrastructure, and commodity related assets. The market, however, has a broader

definition that often includes intangibles such as inflation-linked bonds and real return

portfolios. These intangible assets are really financial assets designed to provide a

return after inflation—or real return assets. While the market may not differentiate

between real assets and real return assets, it’s important to be aware of the

distinction as real assets do not necessarily provide a consistent rate of return.

RP-2

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

What Are Real Assets?

??Real Assets are Investments in Tangible Assets

? Real estate

? Infrastructure

? Commodities

? Inflation-Linked Bonds?

? Real Return Portfolios?

??Real Assets do not Necessarily Provide a Consistent

Real Return

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

??There are a variety of reasons why real assets are an area of growing interest. Real

assets may be a viable destination for new cash inflows when existing portfolio

investments in other asset classes are at or near capacity. In addition, real assets

may put investment dollars to work more quickly than say, private equity, hedge

funds, or real estate.

??Real assets may also serve as a hedge for inflation. Although the rate of inflation

remains fairly low, rising commodity prices and the current federal budget and trade

deficits have fueled growing inflation fears. For investors seeking to get ahead of the

curve in terms of inflation, real assets offer some important benefits.

??Because real assets often react differently to changes in inflation than do traditional

asset classes, they can serve as an effective diversification tool as well.

RP-3

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

Why the Interest?

??Destination for New Cash Inflows

? Viable investments in many other asset classes at or near

capacity

? Competitive Returns?

??Inflation Hedging

??Diversification for Traditional Asset Classes

? Investments often dominated by stocks

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

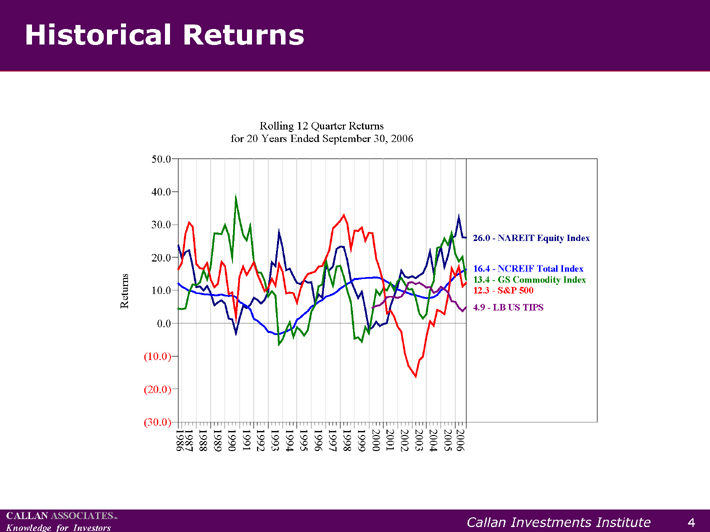

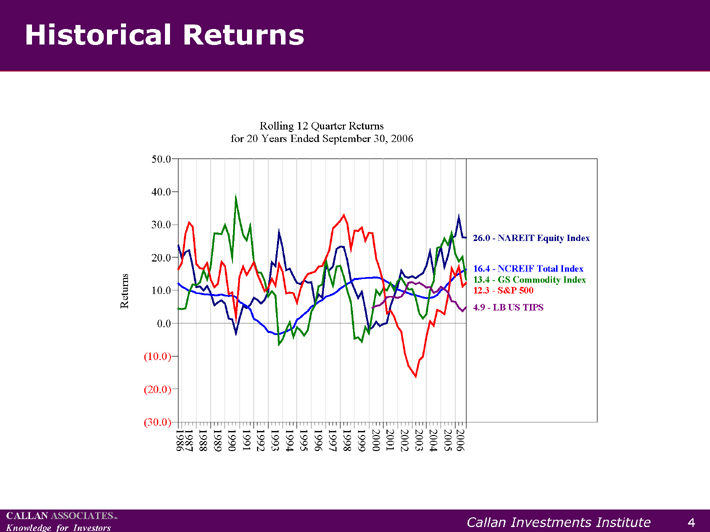

??Real assets also have a history of strong performance. This graph shows rolling threeyear

returns of real assets over the last 20 years (as measured by the NAREIT Equity

Index, NCREIF Total Index, and Goldman Sachs Commodity Index) versus the returns

of stocks (S&P 500 Index) and TIPS (Lehman Brothers U.S. TIPS Index).

??Note that for the rolling three-year period ended September 30, 2006, the NAREIT

Equity Index was up 26% on an annualized basis, a considerably higher return than

the other asset classes represented.

RP-4

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

Historical Returns

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

(30.0)

(20.0)

(10.0)

0.0

10.0

20.0

30.0

40.0

50.0

for 20 Years Ended September 30, 2006

Rolling 12 Quarter Returns Returns

26.0—NAREIT Equity Index

16.4—NCREIF Total Index

13.4—GS Commodity Index

12.3—S&P 500

4.9—LB US TIPS

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

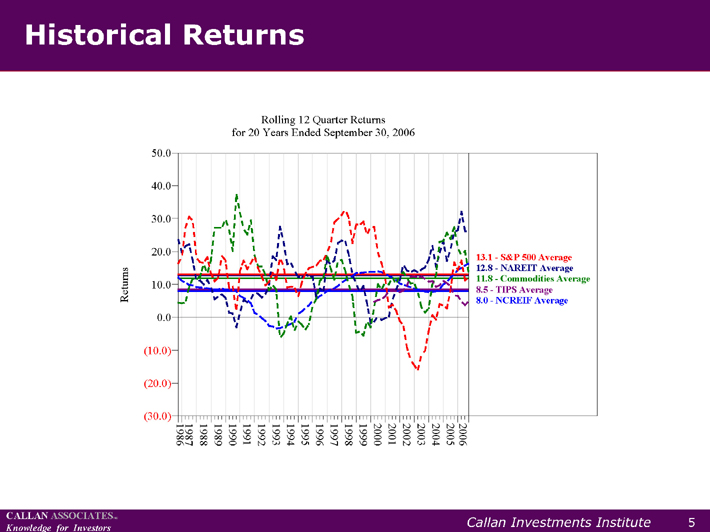

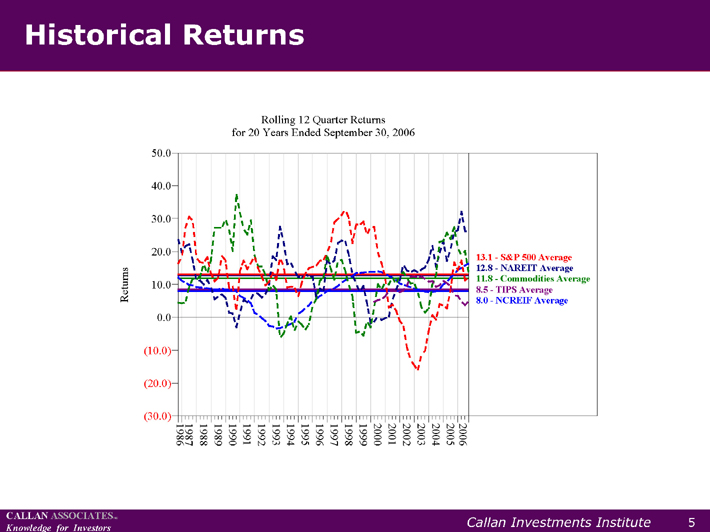

??Here we show the average returns of the indexes, represented by the solid lines, as

compared to the return patterns from the previous graph. Again, these are rolling

three-year returns over the past 20 years. Interestingly, despite the significant run

ups that commodities and real estate have experienced in recent years, the S&P 500

finished on top. In other words, the argument for adding commodities to a portfolio

does not rest on long-term return enhancement.

RP-5

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

Historical Returns

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

(30.0)

(20.0)

(10.0)

0.0

10.0

20.0

30.0

40.0

50.0

for 20 Years Ended September 30, 2006

Rolling 12 Quarter Returns Returns

12.8—NAREIT Average

8.0—NCREIF Average

11.8—Commodities Average

13.1—S&P 500 Average

8.5—TIPS Average

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

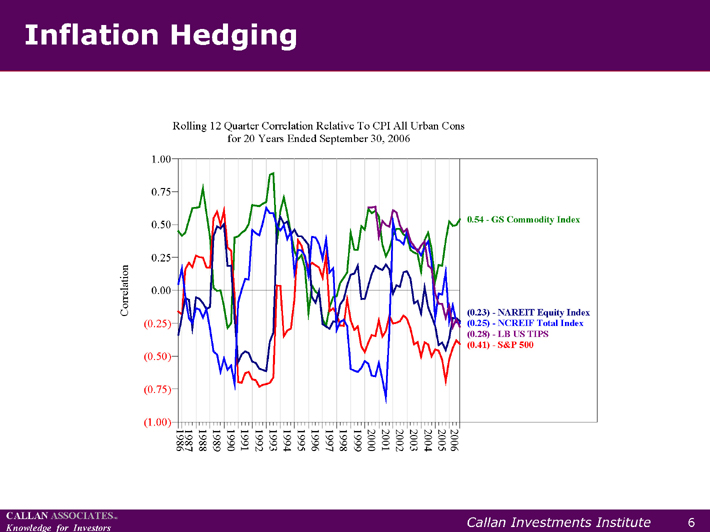

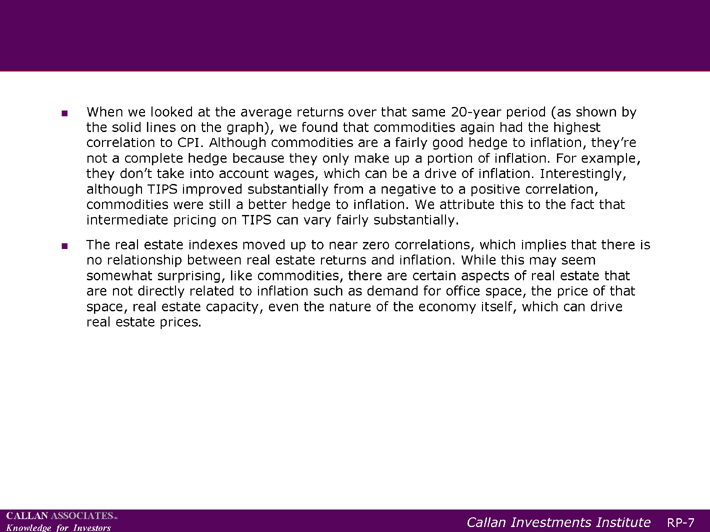

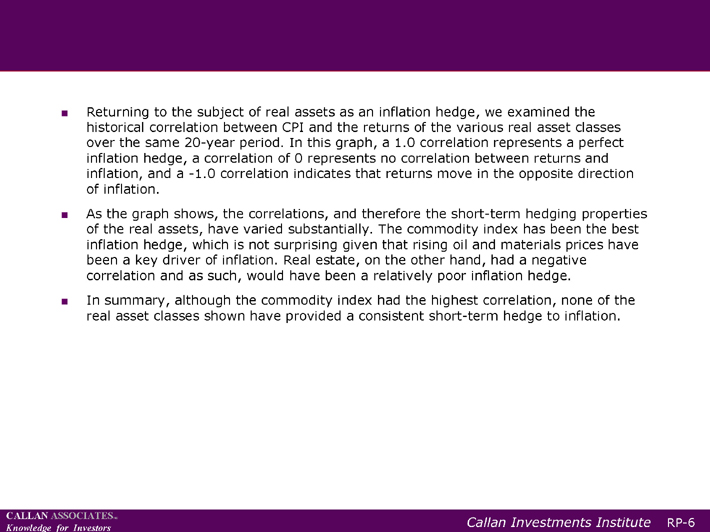

??Returning to the subject of real assets as an inflation hedge, we examined the

historical correlation between CPI and the returns of the various real asset classes

over the same 20-year period. In this graph, a 1.0 correlation represents a perfect

inflation hedge, a correlation of 0 represents no correlation between returns and

inflation, and a -1.0 correlation indicates that returns move in the opposite direction

of inflation.

??As the graph shows, the correlations, and therefore the short-term hedging properties

of the real assets, have varied substantially. The commodity index has been the best

inflation hedge, which is not surprising given that rising oil and materials prices have

been a key driver of inflation. Real estate, on the other hand, had a negative

correlation and as such, would have been a relatively poor inflation hedge.

??In summary, although the commodity index had the highest correlation, none of the

real asset classes shown have provided a consistent short-term hedge to inflation.

RP-6

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

Inflation Hedging

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

(1.00)

(0.75)

(0.50)

(0.25)

0.00

0.25

0.50

0.75

1.00

for 20 Years Ended September 30, 2006

Rolling 12 Quarter Correlation Relative To CPI All Urban Cons Correlation

0.54—GS Commodity Index

(0.41)—S&P 500

(0.23)—NAREIT Equity Index

(0.25)—NCREIF Total Index

(0.28)—LB US TIPS

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

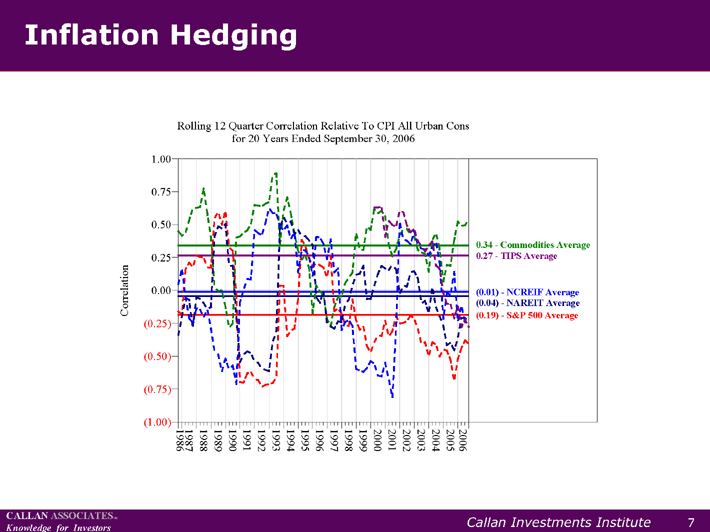

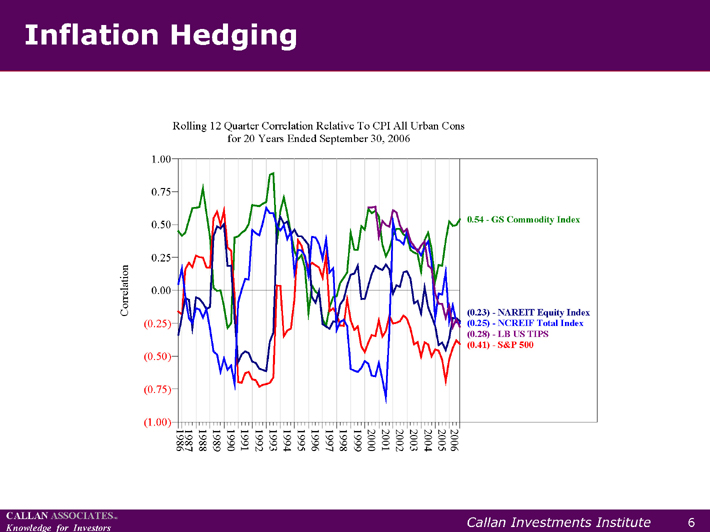

??When we looked at the average returns over that same 20-year period (as shown by

the solid lines on the graph), we found that commodities again had the highest

correlation to CPI. Although commodities are a fairly good hedge to inflation, they’re

not a complete hedge because they only make up a portion of inflation. For example,

they don’t take into account wages, which can be a drive of inflation. Interestingly,

although TIPS improved substantially from a negative to a positive correlation,

commodities were still a better hedge to inflation. We attribute this to the fact that

intermediate pricing on TIPS can vary fairly substantially.

??The real estate indexes moved up to near zero correlations, which implies that there is

no relationship between real estate returns and inflation. While this may seem

somewhat surprising, like commodities, there are certain aspects of real estate that

are not directly related to inflation such as demand for office space, the price of that

space, real estate capacity, even the nature of the economy itself, which can drive

real estate prices.

RP-7

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

Inflation Hedging

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

(1.00)

(0.75)

(0.50)

(0.25)

0.00

0.25

0.50

0.75

1.00

for 20 Years Ended September 30, 2006

Rolling 12 Quarter Correlation Relative To CPI All Urban Cons Correlation

(0.04)—NAREIT Average

(0.01)—NCREIF Average

0.27—TIPS Average

0.34—Commodities Average

(0.19)—S&P 500 Average

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

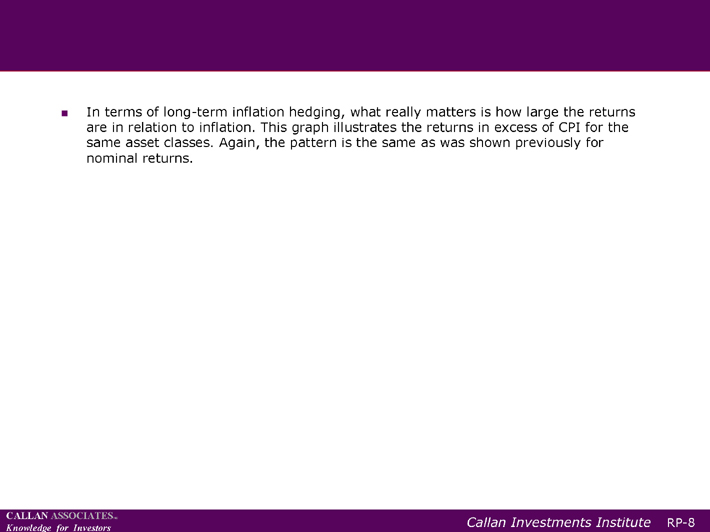

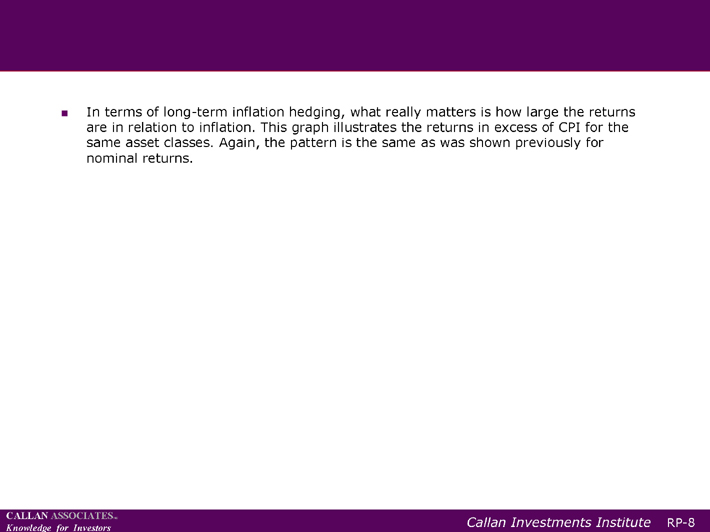

??In terms of long-term inflation hedging, what really matters is how large the returns

are in relation to inflation. This graph illustrates the returns in excess of CPI for the

same asset classes. Again, the pattern is the same as was shown previously for

nominal returns.

RP-8

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

Inflation Hedging

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

(30.0)

(20.0)

(10.0)

0.0

10.0

20.0

30.0

40.0

for 20 Years Ended September 30, 2006

Rolling 12 Quarter Relative Returns Relative To CPI All Urban Cons

Relative Returns

8.93—S&P 500

22.26—NAREIT Equity Index

12.88—NCREIF Total Index

9.99—GS Commodity Index

1.72—LB US TIPS

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

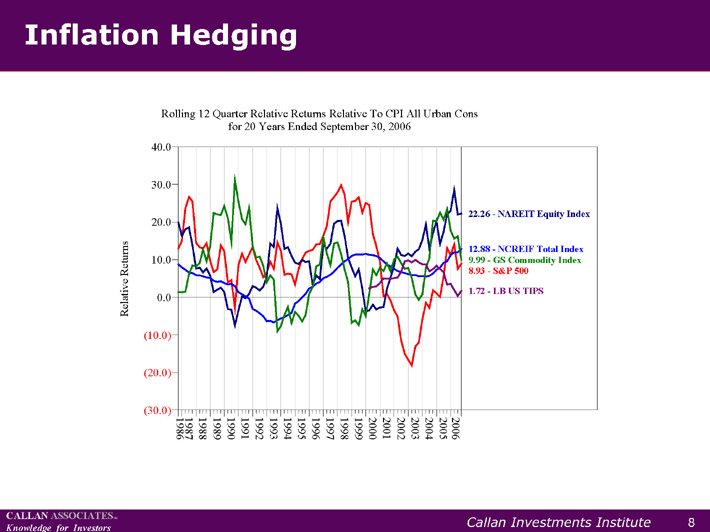

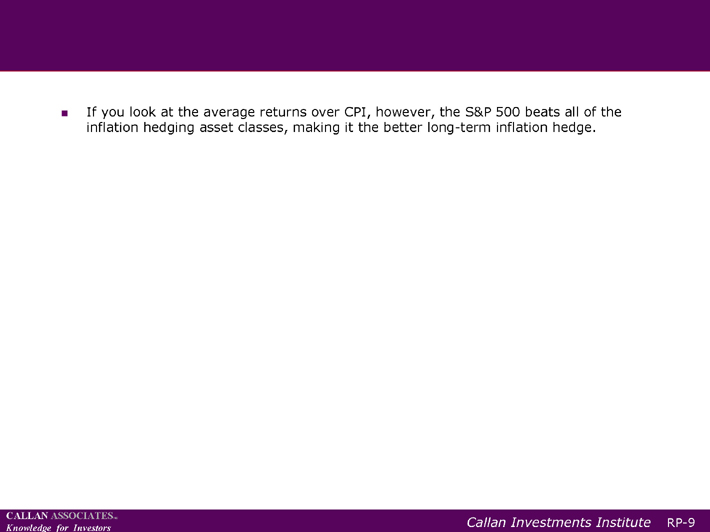

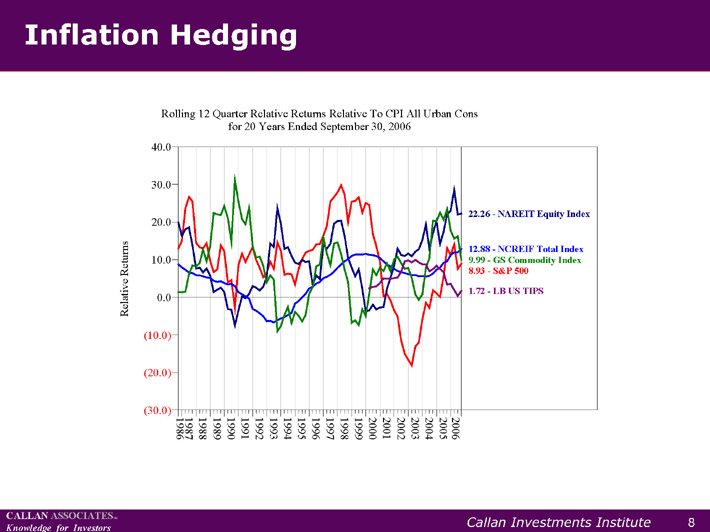

??If you look at the average returns over CPI, however, the S&P 500 beats all of the

inflation hedging asset classes, making it the better long-term inflation hedge.

RP-9

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

Inflation Hedging

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

(30.0)

(20.0)

(10.0)

0.0

10.0

20.0

30.0

40.0

for 20 Years Ended September 30, 2006

Rolling 12 Quarter Relative Returns Relative To CPI All Urban Cons Relative Returns

9.74—S&P Average

9.45—NAREIT Average

8.50—Commodities Average

4.79—NCREIF Average

5.83—TIPS Average

9

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

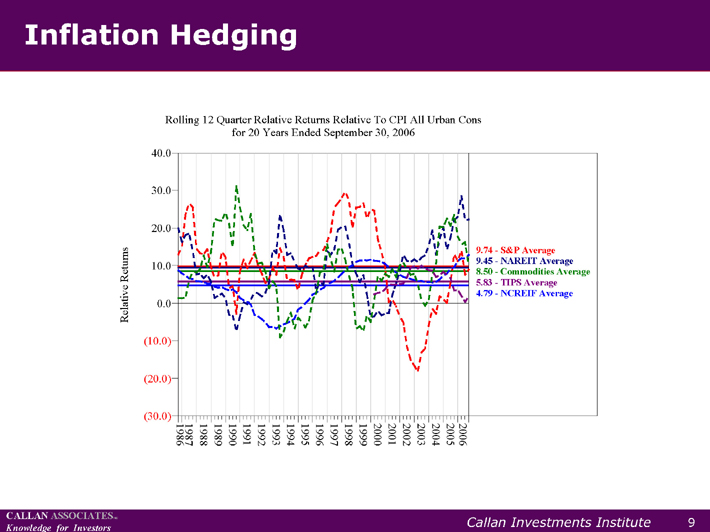

??While each of the individual real asset classes may offer valuable benefits, real return

portfolios—that is, portfolios comprised of collections of assets such as inflation-linked

bonds, commodities, natural resource-related companies, and real estate and sold as

a single package—may provide additional benefits.

??As shown earlier, while the individual real asset classes tend to move up and down in

terms of their correlation with inflation, they don’t necessarily move together. When

these assets are combined in a real return portfolio, however, they may provide a

more consistent positive real rate of return.

??The real return portfolio also offers a greater degree of diversification within real

assets investments, a potentially better source of income, and a more reasonable fee

structure than some of the more exotic investment alternatives.

RP-10

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

Real Return Portfolios

??Combination of Investments in Real Assets

? Inflation-linked bonds

? Commodities

? Natural resource and related companies

? Real Estate/REITs

??Potential Benefits

? Positive real return during rising inflation

? Greater portfolio diversification

? Potential source of income

??Fee Structures Like Traditional Asset Classes

10

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

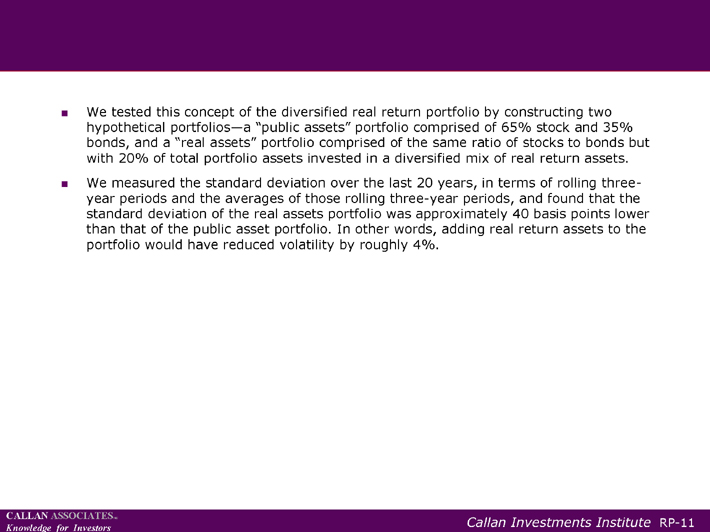

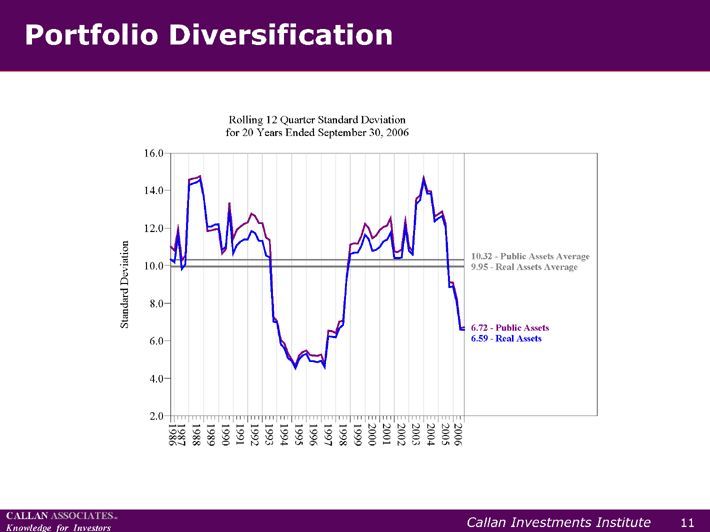

??We tested this concept of the diversified real return portfolio by constructing two

hypothetical portfolios—a “public assets” portfolio comprised of 65% stock and 35%

bonds, and a “real assets” portfolio comprised of the same ratio of stocks to bonds but

with 20% of total portfolio assets invested in a diversified mix of real return assets.

??We measured the standard deviation over the last 20 years, in terms of rolling threeyear

periods and the averages of those rolling three-year periods, and found that the

standard deviation of the real assets portfolio was approximately 40 basis points lower

than that of the public asset portfolio. In other words, adding real return assets to the

portfolio would have reduced volatility by roughly 4%.

RP-11

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

Portfolio Diversification

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

2.0

4.0

6.0

8.0

10.0

12.0

14.0

16.0

for 20 Years Ended September 30, 2006

Rolling 12 Quarter Standard Deviation Standard Deviation

10.32—Public Assets Average

9.95—Real Assets Average

6.72—Public Assets

6.59—Real Assets

11

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

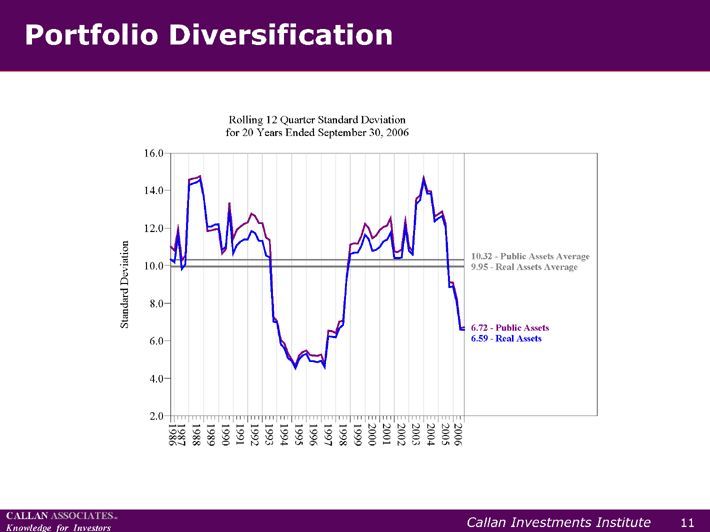

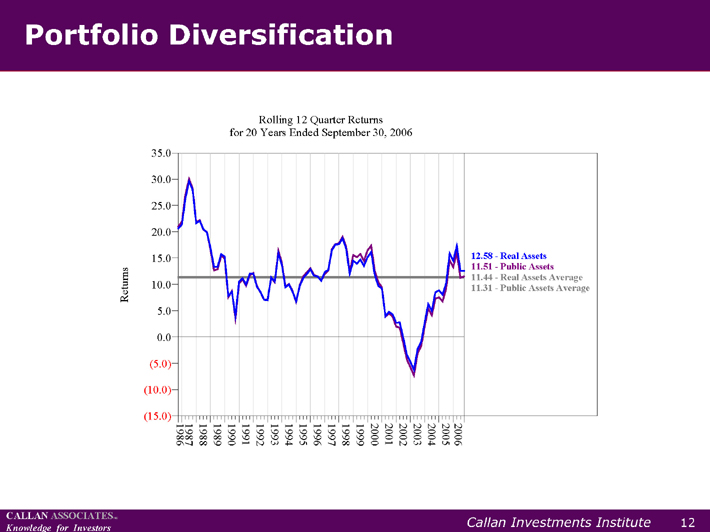

??We then compared the returns for these two portfolios and found that the real assets

portfolio outperformed the public assets portfolio, both for the individual time periods

as well as for the overall 20-year period, albeit by a small amount.

??In summary, while we would not recommend looking to real assets to add a great deal

of return to the portfolio, including them in a traditional portfolio may result in a

higher level of diversification with no impact, or a potentially positive impact, on

return.

RP-12

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

Portfolio Diversification

1986

1987

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

(15.0)

(10.0)

(5.0)

0.0

5.0

10.0

15.0

20.0

25.0

30.0

35.0

for 20 Years Ended September 30, 2006

Rolling 12 Quarter Returns Returns

11.31—Public Assets Average

11.44—Real Assets Average

11.51—Public Assets

12.58—Real Assets

12

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute RP-13

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

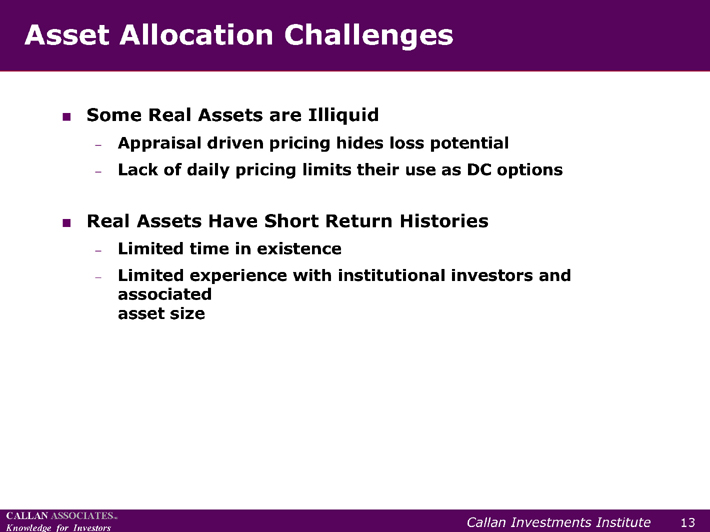

Asset Allocation Challenges

??Some Real Assets are Illiquid

? Appraisal driven pricing hides loss potential

? Lack of daily pricing limits their use as DC options

??Real Assets Have Short Return Histories

? Limited time in existence

? Limited experience with institutional investors and

associated

asset size

13

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute RP-14

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

Callan Real Asset Research

??Infrastructure: Investment that Saves the World?

??Timberland: A Growing Asset Class

??Commodities Investing: Implementation

??So You Want to Invest in Commodities

??Farmland Investing

14

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute RP-15

CALLAN ASSOCIATESINC

Knowledge for Investors

Timberland Investment Overview

Matthew W. Costello, CFA

15

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

??The second segment of the workshop explores timberland, a unique and growing

segment of the real assets market. On the following pages we provide an overview of

the characteristics of the asset class, its diversification benefits, and sources of return.

We also present some compelling reasons to invest, the inherent risks involved, and a

recent case study showing how one Callan client implemented a timberland portfolio

in their overall allocation.

RP-16

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

Outline

??Investable U.S. Market

??Diversification Considerations

??Classification of Timberland

??Sources of Return

??Why Invest in Timberland

? Competitive Relative Returns

? Cash Flow

? Low Volatility

? Diversification

? Unique Characteristics

? Inflation Hedge ?

??Risks

??Timberland Managers

??Case Study

16

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

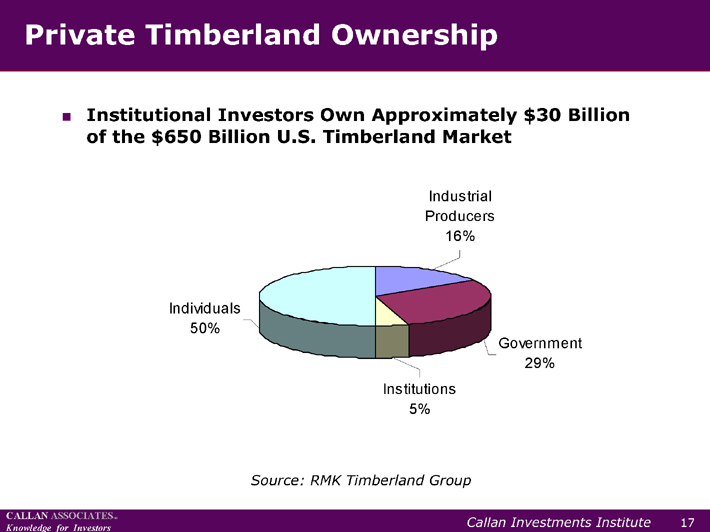

??When we talk about the U.S. timberland market here we are referring to private

timberland ownership excluding timber REITs. In our view, timber REITs are not a

substitute for private timberland ownership for various reasons. One, they tend to

correlate with the equity markets. Two, many REITs actually own the manufacturing

facilities and therefore, involve some operating scales that may be undesirable for the

investor simply seeking access to timberland. Lastly, REITs tend to trade on yield,

which is a different model than that of timberland itself.

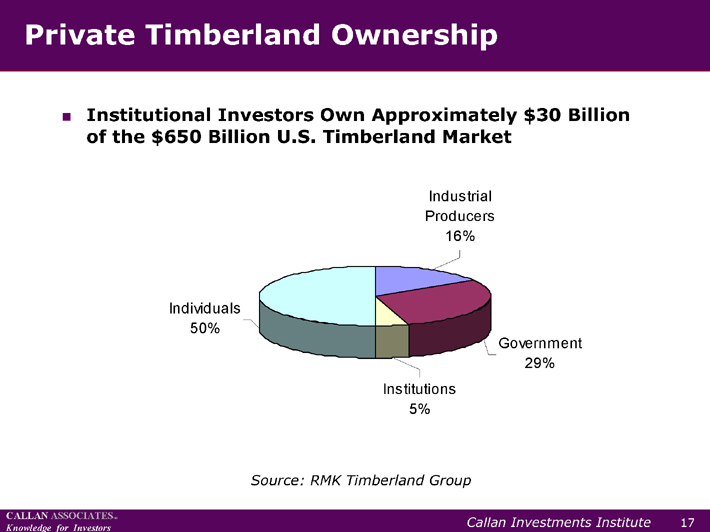

??This chart shows the breakdown of private timberland ownership. Institutional

investors currently represent the smallest segment of the market. Industrial

producers—manufacturers such as International Paper—have more or less taken

timberland off their balance sheets, which has put a lot of timberland into the market

over the past ten years.

RP-17

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

Source: RMK Timberland Group

Institutions

5%

Government

29%

Industrial

Producers

16%

Individuals

50%

Private Timberland Ownership

??Institutional Investors Own Approximately $30 Billion

of the $650 Billion U.S. Timberland Market

17

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

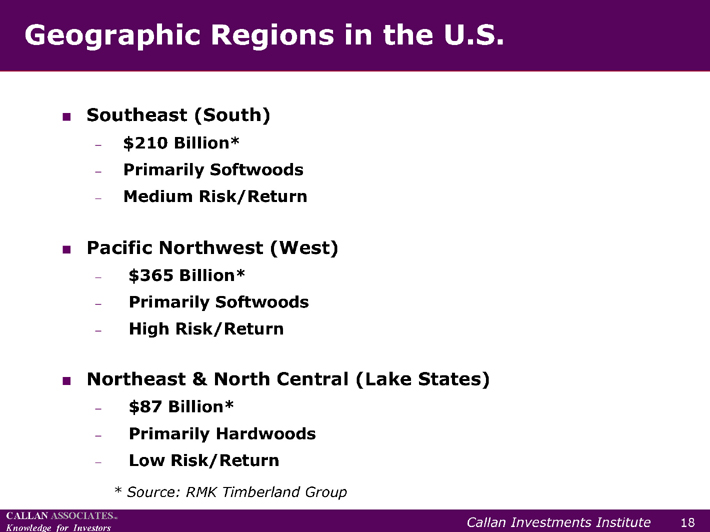

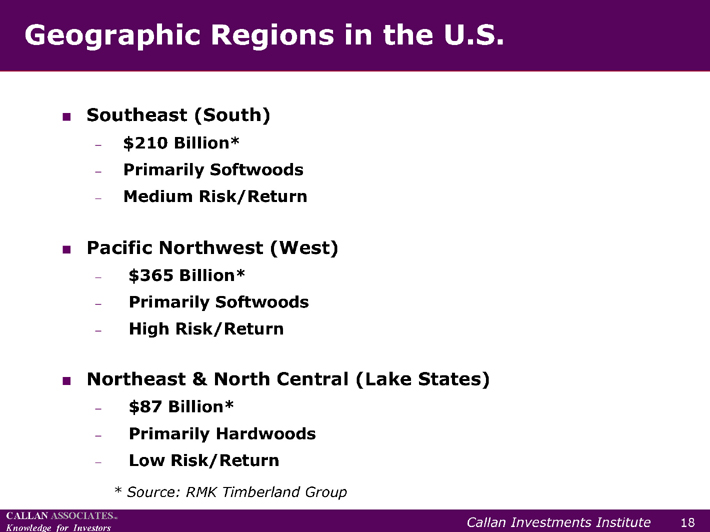

??The U.S. timberland market is comprised of three main components or regions. The

first is the Southeast, which primarily consists of fast-growing pine softwood timber

that takes roughly 30 years to mature. The second region, the Pacific Northwest, is

also comprised primarily of pine softwood timber, but in this area of the country these

trees grow considerably slower, taking nearly 60 years to reach maturity. The third

segment of the market is the Northeast, where hardwoods are mainly grown and used

in making furniture.

??The demand and supply factors in each of these timberland regions are mandated by

the mill capacities within the surrounding areas, which means that the primary

determinants of timber price are very local. As such, it is possible to build a diversified

timberland portfolio by investing in each of the three regions.

RP-18

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

* | | Source: RMK Timberland Group |

Geographic Regions in the U.S.

??Southeast (South)

? $210 Billion*

? Primarily Softwoods

? Medium Risk/Return

??Pacific Northwest (West)

? $365 Billion*

? Primarily Softwoods

? High Risk/Return

??Northeast & North Central (Lake States)

? $87 Billion*

? Primarily Hardwoods

? Low Risk/Return

18

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

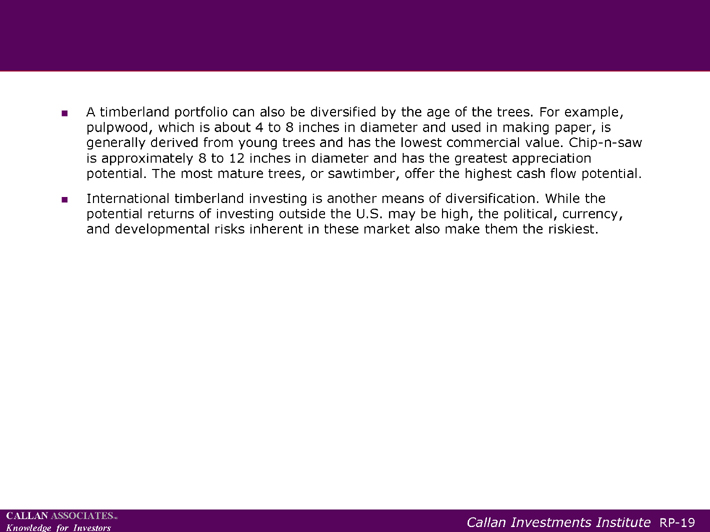

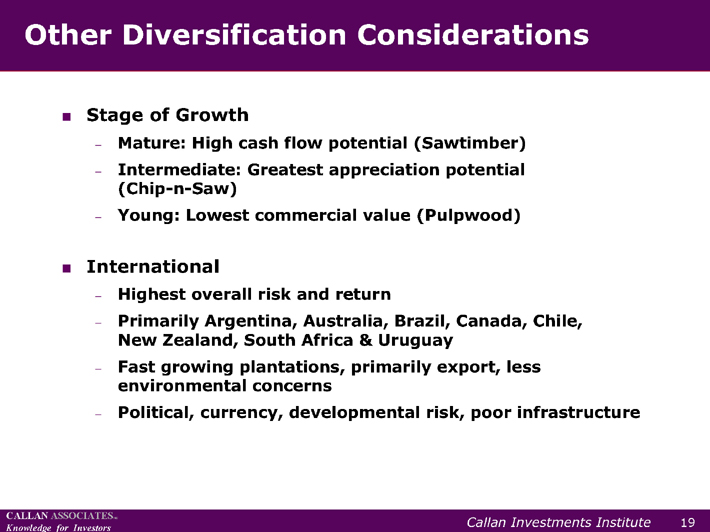

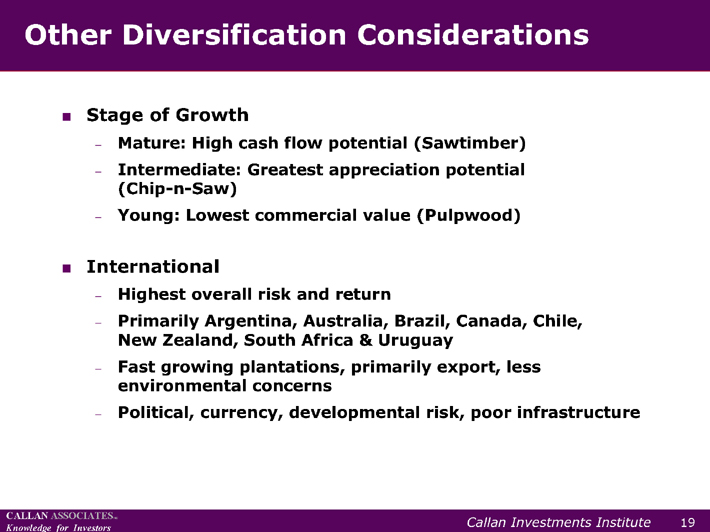

??A timberland portfolio can also be diversified by the age of the trees. For example,

pulpwood, which is about 4 to 8 inches in diameter and used in making paper, is

generally derived from young trees and has the lowest commercial value. Chip-n-saw

is approximately 8 to 12 inches in diameter and has the greatest appreciation

potential. The most mature trees, or sawtimber, offer the highest cash flow potential.

??International timberland investing is another means of diversification. While the

potential returns of investing outside the U.S. may be high, the political, currency,

and developmental risks inherent in these market also make them the riskiest.

RP-19

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

Other Diversification Considerations

??Stage of Growth

? Mature: High cash flow potential (Sawtimber)

? Intermediate: Greatest appreciation potential

(Chip-n-Saw)

? Young: Lowest commercial value (Pulpwood)

??International

? Highest overall risk and return

? Primarily Argentina, Australia, Brazil, Canada, Chile,

New Zealand, South Africa & Uruguay

? Fast growing plantations, primarily export, less

environmental concerns

? Political, currency, developmental risk, poor infrastructure

19

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

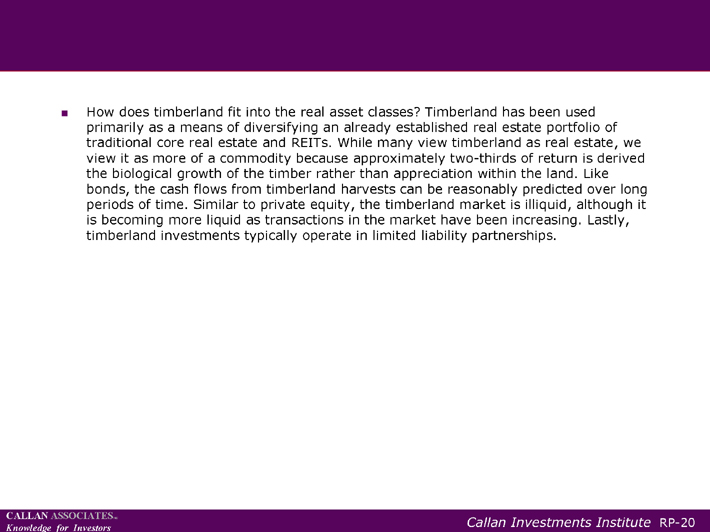

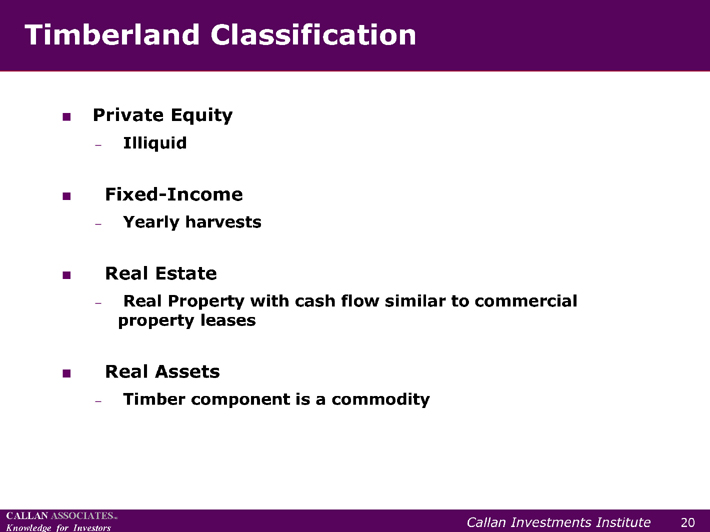

??How does timberland fit into the real asset classes? Timberland has been used

primarily as a means of diversifying an already established real estate portfolio of

traditional core real estate and REITs. While many view timberland as real estate, we

view it as more of a commodity because approximately two-thirds of return is derived

the biological growth of the timber rather than appreciation within the land. Like

bonds, the cash flows from timberland harvests can be reasonably predicted over long

periods of time. Similar to private equity, the timberland market is illiquid, although it

is becoming more liquid as transactions in the market have been increasing. Lastly,

timberland investments typically operate in limited liability partnerships.

RP-20

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

Timberland Classification

??Private Equity

? Illiquid

??Fixed-Income

? Yearly harvests

??Real Estate

? Real Property with cash flow similar to commercial

property leases

??Real Assets

? Timber component is a commodity

20

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

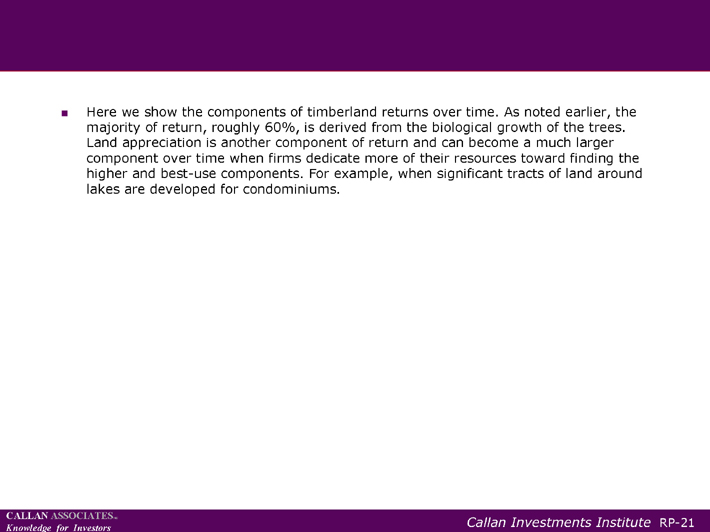

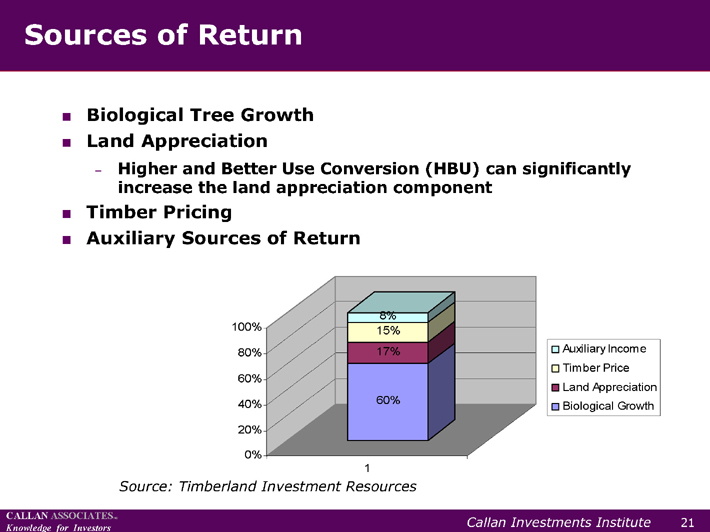

??Here we show the components of timberland returns over time. As noted earlier, the

majority of return, roughly 60%, is derived from the biological growth of the trees.

Land appreciation is another component of return and can become a much larger

component over time when firms dedicate more of their resources toward finding the

higher and best-use components. For example, when significant tracts of land around

lakes are developed for condominiums.

RP-21

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

Sources of Return

??Biological Tree Growth

??Land Appreciation

? Higher and Better Use Conversion (HBU) can significantly

increase the land appreciation component

??Timber Pricing

??Auxiliary Sources of Return

60%

17%

15%

8%

0%

20%

40%

60%

80%

100%

Auxiliary Income

Timber Price

Land Appreciation

Biological Growth

Source: Timberland Investment Resources

21

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

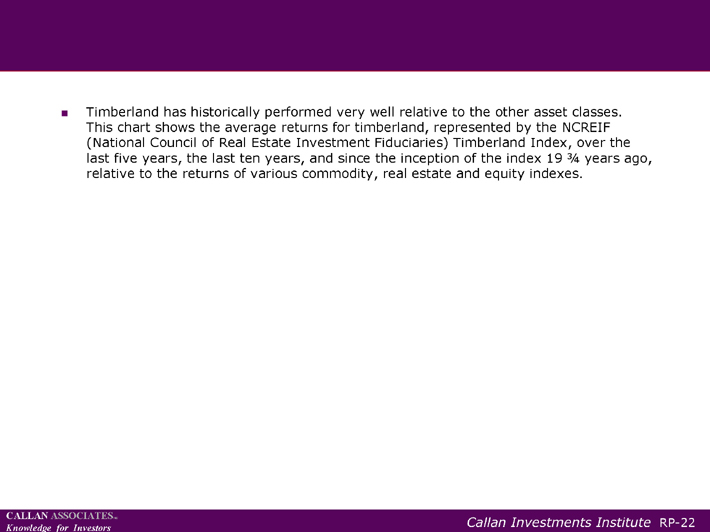

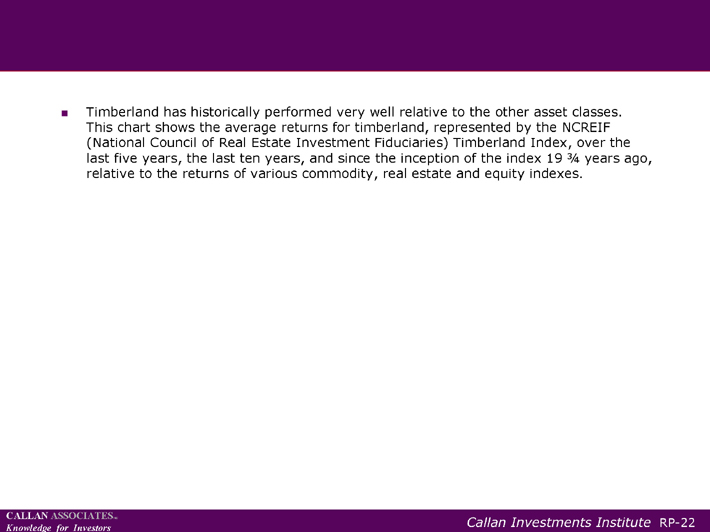

??Timberland has historically performed very well relative to the other asset classes.

This chart shows the average returns for timberland, represented by the NCREIF

(National Council of Real Estate Investment Fiduciaries) Timberland Index, over the

last five years, the last ten years, and since the inception of the index 19 3/4 years ago,

relative to the returns of various commodity, real estate and equity indexes.

RP-22

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

Timberland Historical Return Performance

Relative to Other Asset Classes

0.0

5.0

10.0

15.0

20.0

25.0

30.0

Current Quarter Ending September 30, 2006

for Various Time Periods

Returns Returns

7.8

8.6

15.0

12.4 12.5

8.2

22.9

16.4

11.4

4.8

6.4

7.4 7.0

8.6

11.6

13.8

9.1

10.6

14.3

6.8

7.6

Last 5 Years Last 10 Years Last 19 3/4 Years

NCREIF Timberland Index NCREIF Total Index DJ Wilshire REIT

Lehman Agg S&P 500 Russell 2000 Index

MSCI EAFE

22

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

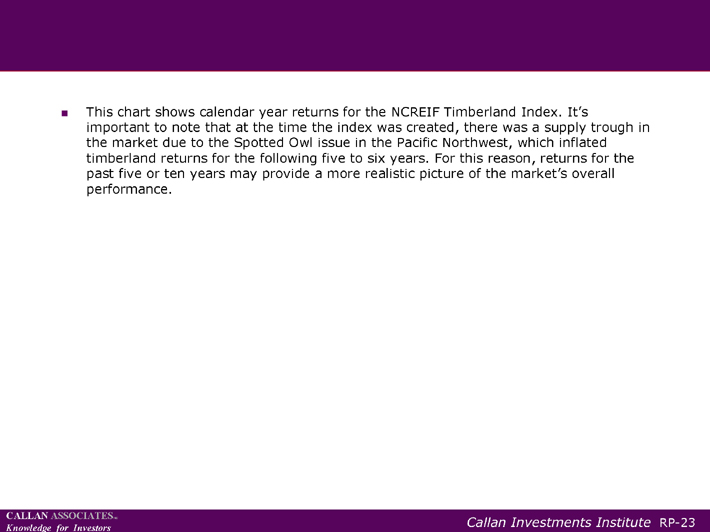

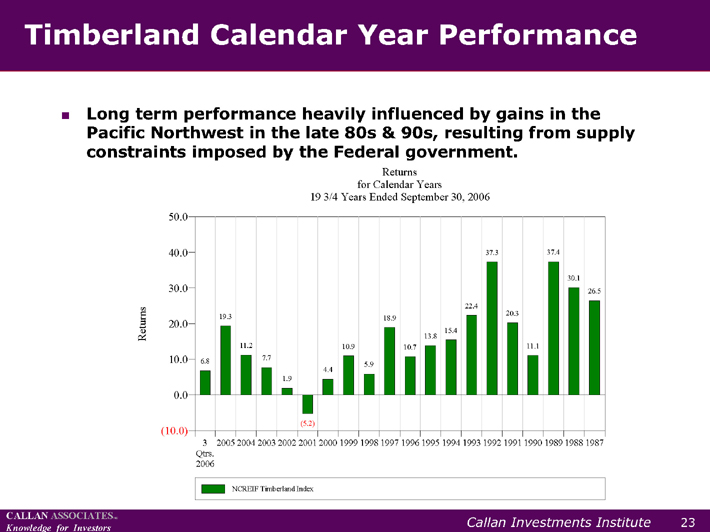

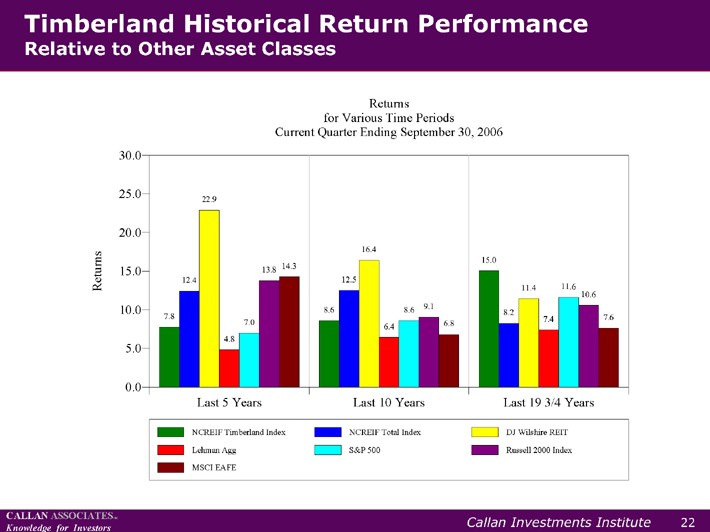

??This chart shows calendar year returns for the NCREIF Timberland Index. It’s

important to note that at the time the index was created, there was a supply trough in

the market due to the Spotted Owl issue in the Pacific Northwest, which inflated

timberland returns for the following five to six years. For this reason, returns for the

past five or ten years may provide a more realistic picture of the market’s overall

performance.

RP-23

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

(10.0)

0.0

10.0

20.0

30.0

40.0

50.0

19 3/4 Years Ended September 30, 2006

for Calendar Years

Returns

Returns

6.8

19.3

11.2

7.7

1.9

(5.2)

4.4

10.9

5.9

18.9

10.7

13.8

15.4

22.4

37.3

20.3

11.1

37.4

30.1

26.5

2006

Qtrs.

3 | | 2005 2004 2003 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 |

NCREIF Timberland Index

Timberland Calendar Year Performance

??Long term performance heavily influenced by gains in the

Pacific Northwest in the late 80s & 90s, resulting from supply

constraints imposed by the Federal government.

23

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

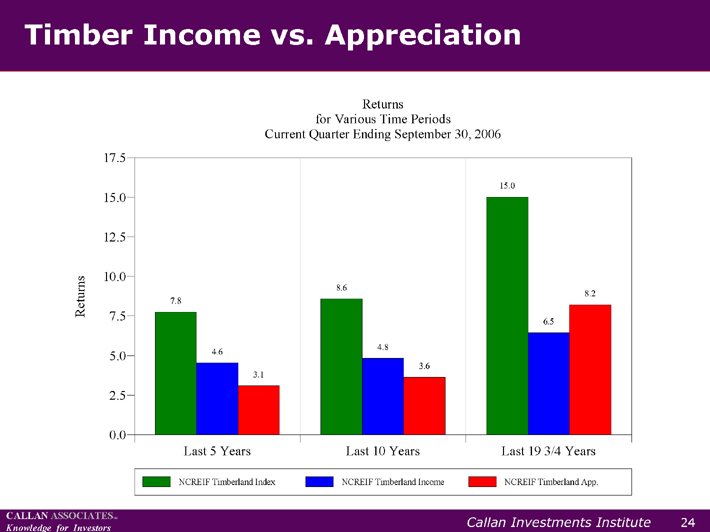

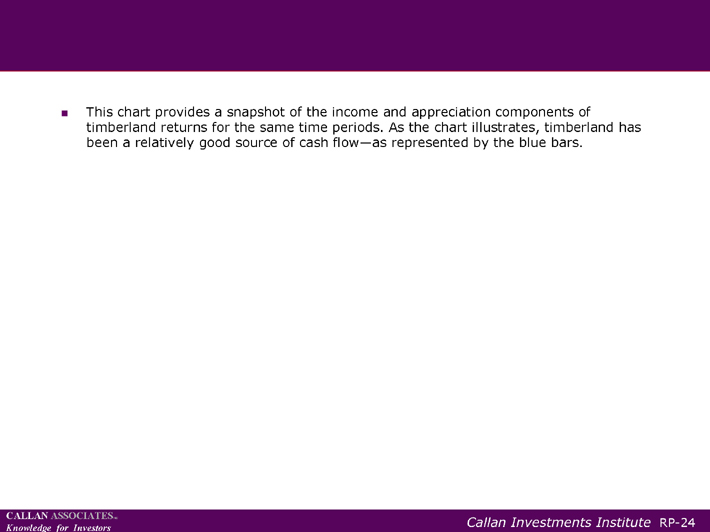

??This chart provides a snapshot of the income and appreciation components of

timberland returns for the same time periods. As the chart illustrates, timberland has

been a relatively good source of cash flow—as represented by the blue bars.

RP-24

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

Last 5 Years Last 10 Years Last 19 3/4 Years

0.0

2.5

5.0

7.5

10.0

12.5

15.0

17.5

Current Quarter Ending September 30, 2006

for Various Time Periods

Returns

Returns

7.8

8.6

15.0

4.6 4.8

6.5

3.1

3.6

8.2

NCREIF Timberland Index NCREIF Timberland Income NCREIF Timberland App.

Timber Income vs. Appreciation

24

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

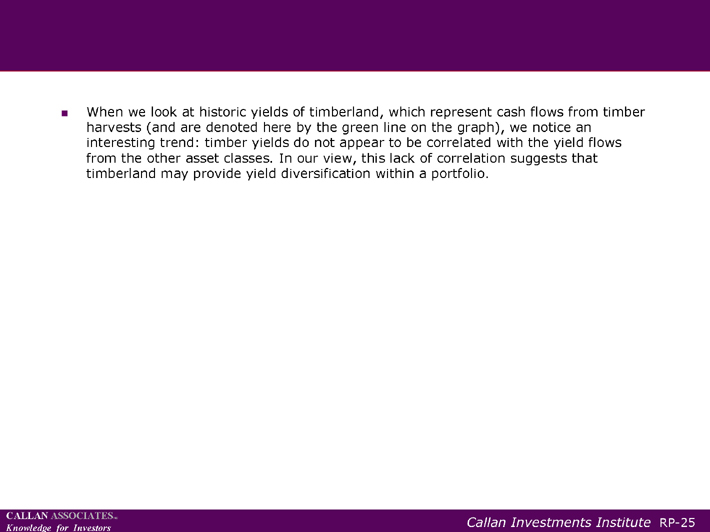

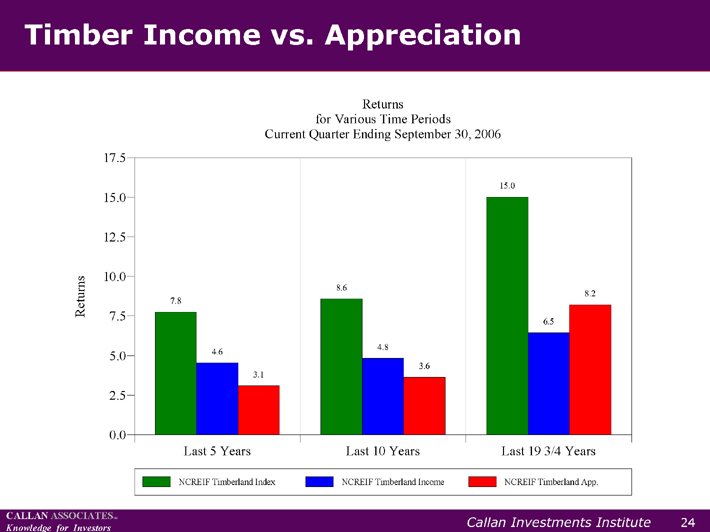

??When we look at historic yields of timberland, which represent cash flows from timber

harvests (and are denoted here by the green line on the graph), we notice an

interesting trend: timber yields do not appear to be correlated with the yield flows

from the other asset classes. In our view, this lack of correlation suggests that

timberland may provide yield diversification within a portfolio.

RP-25

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

1988

1989

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

(2.5)

0.0

2.5

5.0

7.5

10.0

12.5

15.0

17.5

for 18 3/4 Years Ended September 30, 2006

Rolling 4 Quarter Yield %

Returns

4.64—10 Year Treasury Yield

3.92—NAREIT Equity Div Yield

6.35—NCREIF Income 4Q Ret

1.86—S&P 500 Dividend Yield

5.28—Lehman Agg Current Yield

5.09—NCREIF Timber Yield

Relative Yield

25

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

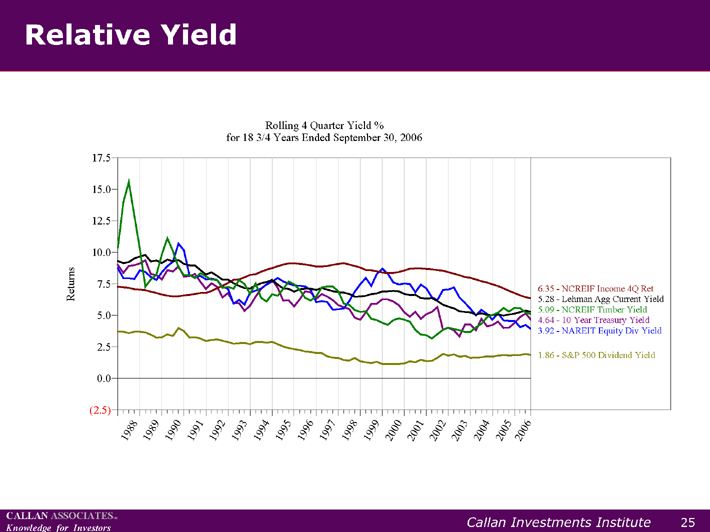

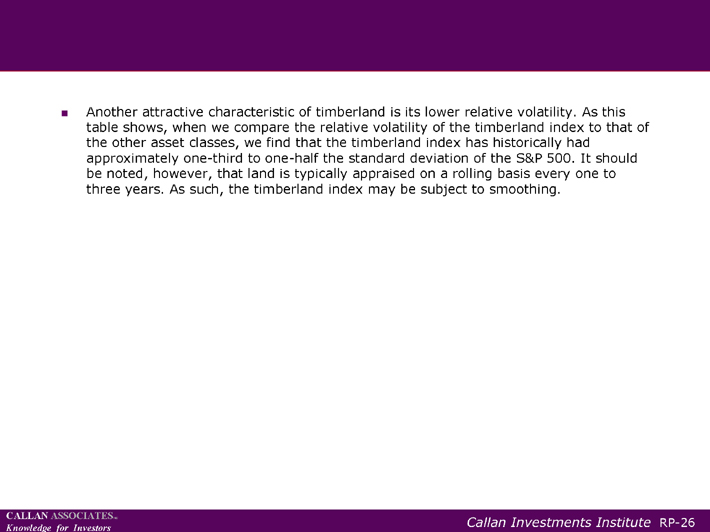

??Another attractive characteristic of timberland is its lower relative volatility. As this

table shows, when we compare the relative volatility of the timberland index to that of

the other asset classes, we find that the timberland index has historically had

approximately one-third to one-half the standard deviation of the S&P 500. It should

be noted, however, that land is typically appraised on a rolling basis every one to

three years. As such, the timberland index may be subject to smoothing.

RP-26

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

for Periods Ended September 30, 2006

Standard Deviation

Last 5 Years Last 10 Years Last 19 3/4 Years

NCREIF Timberland Index 6.68 5.83 8.69

NCREIF Total Index 2.70 2.15 3.40

DJ Wilshire REIT 14.89 15.21 15.05

Lehman Agg 3.73 3.65 4.49

S&P 500 15.60 17.54 15.91

Russell 2000 Index 21.20 22.41 21.34

MSCI EAFE 17.66 18.84 18.14

Timberland Volatility

??Both NCREIF Indices are artificially low due to appraisal

base valuation

26

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

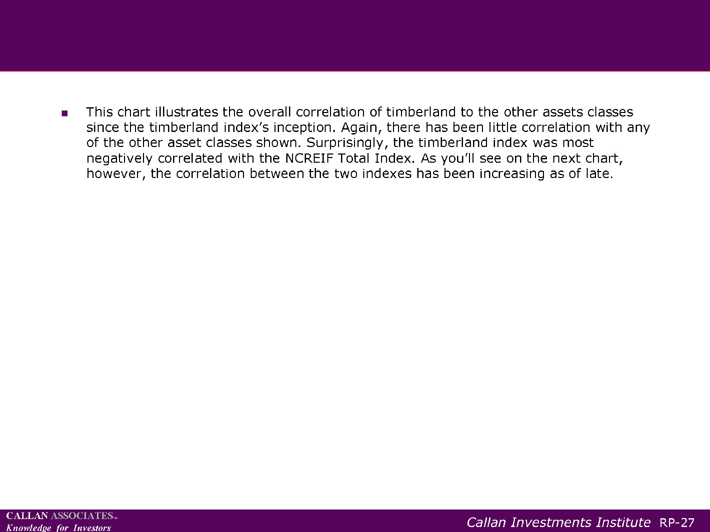

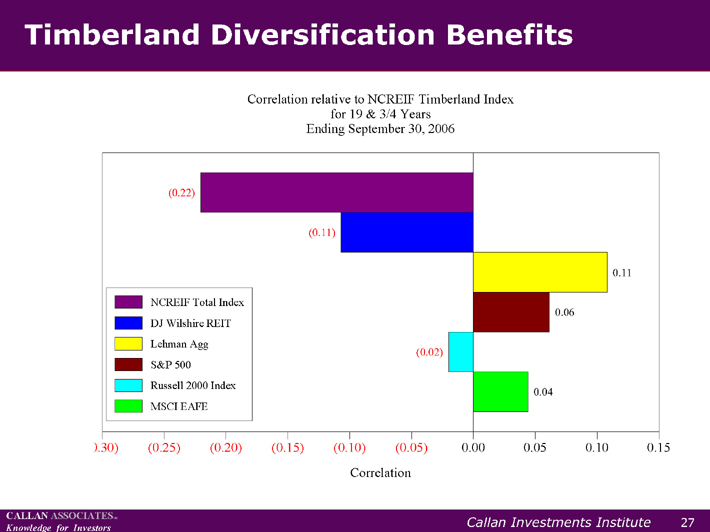

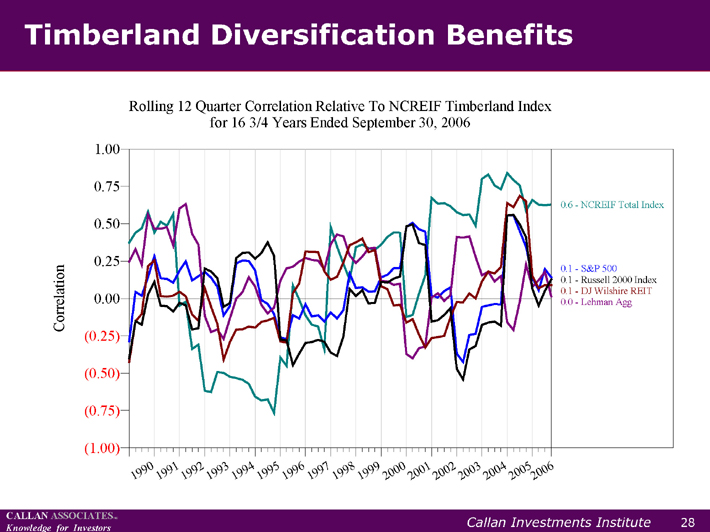

??This chart illustrates the overall correlation of timberland to the other assets classes

since the timberland index’s inception. Again, there has been little correlation with any

of the other asset classes shown. Surprisingly, the timberland index was most

negatively correlated with the NCREIF Total Index. As you’ll see on the next chart,

however, the correlation between the two indexes has been increasing as of late.

RP-27

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

0.30) (0.25) (0.20) (0.15) (0.10) (0.05) 0.00 0.05 0.10 0.15

Ending September 30, 2006

for 19 & 3/4 Years

Correlation relative to NCREIF Timberland Index

Correlation

(0.22)

(0.11)

0.11

0.06

(0.02)

0.04

NCREIF Total Index

DJ Wilshire REIT

Lehman Agg

S&P 500

Russell 2000 Index

MSCI EAFE

Timberland Diversification Benefits

27

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

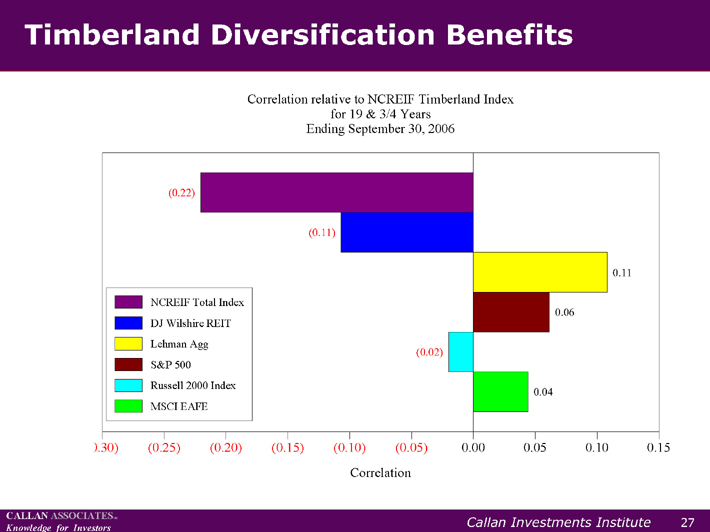

??When we plot rolling 12-quarter correlations, we see that over the past ten years the

correlation of the timberland index to the NCREIF Total Index has risen considerably.

This trend has been driven primarily by the fact that individuals and institutions have

been increasingly involved in the real estate market.

RP-28

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

(1.00)

(0.75)

(0.50)

(0.25)

0.00

0.25

0.50

0.75

1.00

for 16 3/4 Years Ended September 30, 2006

Rolling 12 Quarter Correlation Relative To NCREIF Timberland Index

Correlation

0.6—NCREIF Total Index

0.1—S&P 500

0.0—Lehman Agg

0.1—DJ Wilshire REIT

0.1—Russell 2000 Index

Timberland Diversification Benefits

28

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

??Beyond its attractive historical performance and diversification benefits, timberland

offers some other compelling characteristics. The first is the ability to “store it on the

stump.” Unlike agricultural crops, which must be harvested at a particular time or go

to waste, timber has a more flexible timeframe for harvesting. During period of falling

timber prices, trees can be left to grow and harvested when prices become more

favorable.

??A timberland portfolio can also be structured to meet cash flow objectives. The

portfolio can be structured either for higher cash flow yields through investments in

more mature tracts of timberland, or for higher appreciation potential through

investments in younger holdings.

RP-29

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

Timberland Unique Characteristics

??Biological Growth Benefit

? Potential downward movement of timber prices mitigated

by continuous volume growth

? Product can be warehoused to time final sale while

continuing to grow

??Portfolios can be structured to meet cash flow

objectives

? Mature holdings will yield higher cash flows

? Young holdings have higher appreciation potential

29

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

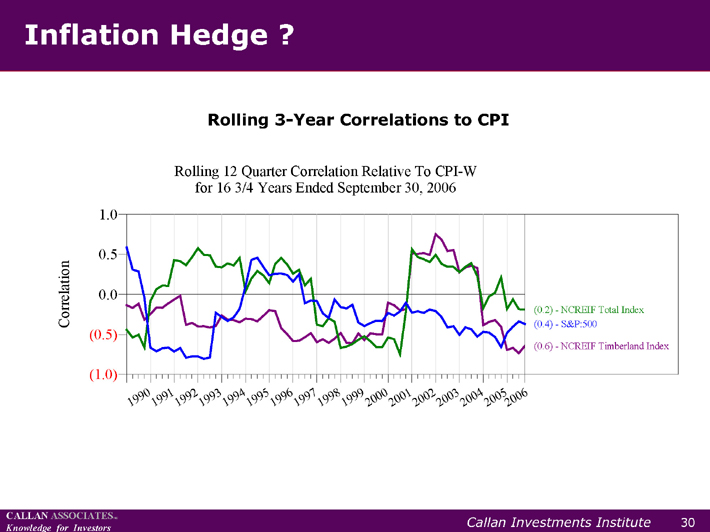

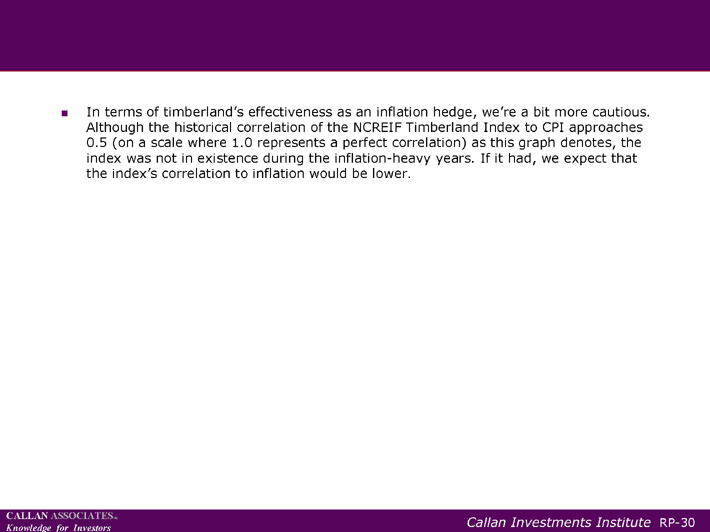

??In terms of timberland’s effectiveness as an inflation hedge, we’re a bit more cautious.

Although the historical correlation of the NCREIF Timberland Index to CPI approaches

0.5 (on a scale where 1.0 represents a perfect correlation) as this graph denotes, the

index was not in existence during the inflation-heavy years. If it had, we expect that

the index’s correlation to inflation would be lower.

RP-30

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

1990

1991

1992

1993

1994

1995

1996

1997

1998

1999

2000

2001

2002

2003

2004

2005

2006

(1.0)

(0.5)

0.0

0.5

1.0

for 16 3/4 Years Ended September 30, 2006

Rolling 12 Quarter Correlation Relative To CPI-W

Correlation

(0.6)—NCREIF Timberland Index

(0.2)—NCREIF Total Index

(0.4)—S&P:500

Inflation Hedge ?

Rolling 3-Year Correlations to CPI

30

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

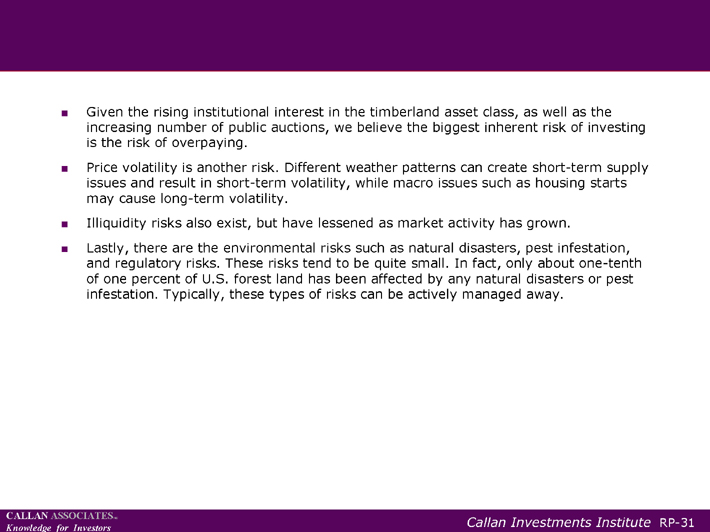

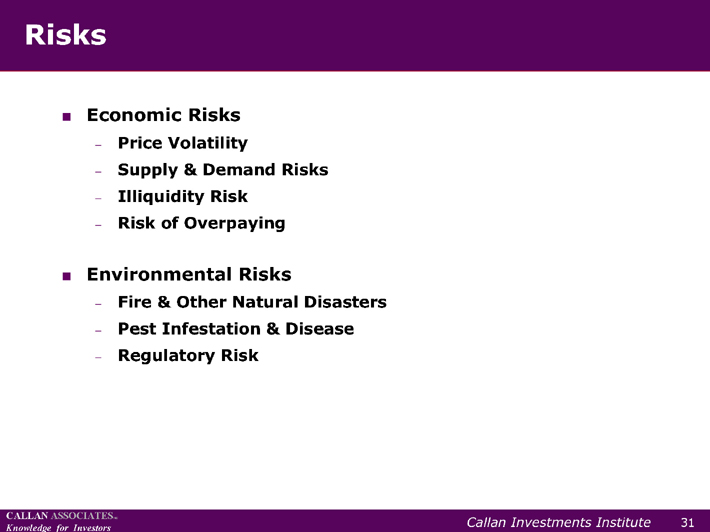

??Given the rising institutional interest in the timberland asset class, as well as the

increasing number of public auctions, we believe the biggest inherent risk of investing

is the risk of overpaying.

??Price volatility is another risk. Different weather patterns can create short-term supply

issues and result in short-term volatility, while macro issues such as housing starts

may cause long-term volatility.

??Illiquidity risks also exist, but have lessened as market activity has grown.

??Lastly, there are the environmental risks such as natural disasters, pest infestation,

and regulatory risks. These risks tend to be quite small. In fact, only about one-tenth

of one percent of U.S. forest land has been affected by any natural disasters or pest

infestation. Typically, these types of risks can be actively managed away.

RP-31

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

Risks

??Economic Risks

? Price Volatility

? Supply & Demand Risks

? Illiquidity Risk

? Risk of Overpaying

??Environmental Risks

? Fire & Other Natural Disasters

? Pest Infestation & Disease

? Regulatory Risk

31

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

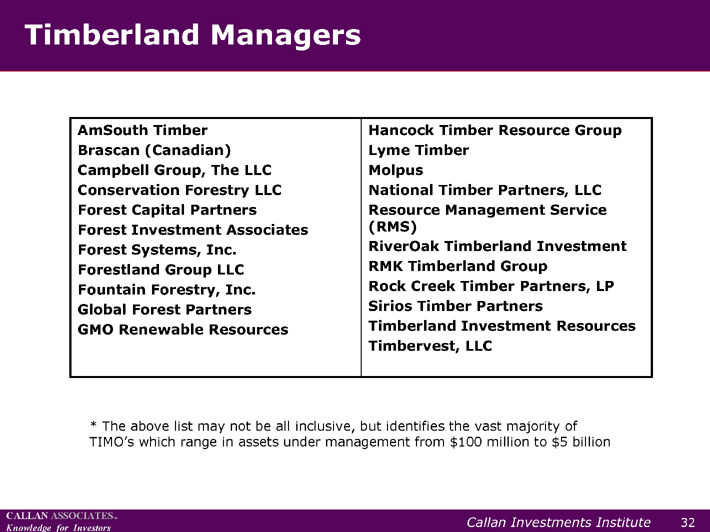

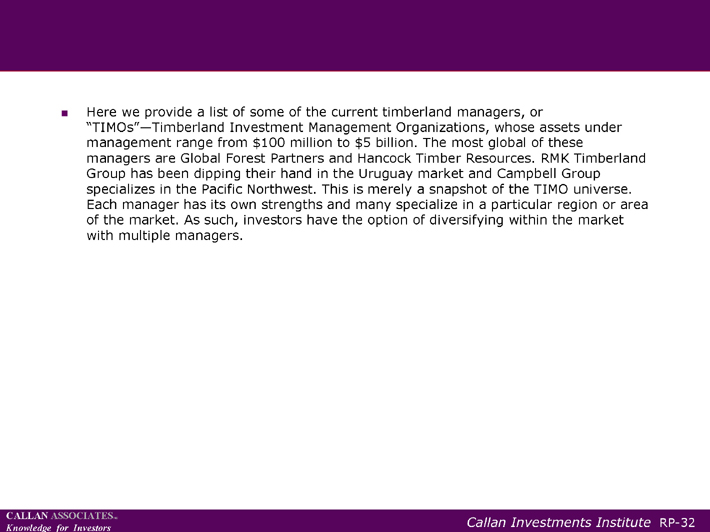

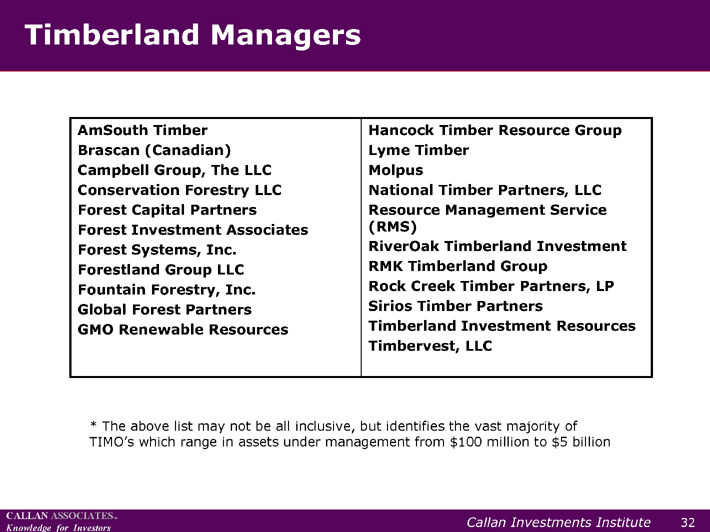

??Here we provide a list of some of the current timberland managers, or

“TIMOs”—Timberland Investment Management Organizations, whose assets under

management range from $100 million to $5 billion. The most global of these

managers are Global Forest Partners and Hancock Timber Resources. RMK Timberland

Group has been dipping their hand in the Uruguay market and Campbell Group

specializes in the Pacific Northwest. This is merely a snapshot of the TIMO universe.

Each manager has its own strengths and many specialize in a particular region or area

of the market. As such, investors have the option of diversifying within the market

with multiple managers.

RP-32

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

Hancock Timber Resource Group

Lyme Timber

Molpus

National Timber Partners, LLC

Resource Management Service

(RMS)

RiverOak Timberland Investment

RMK Timberland Group

Rock Creek Timber Partners, LP

Sirios Timber Partners

Timberland Investment Resources

Timbervest, LLC

AmSouth Timber

Brascan (Canadian)

Campbell Group, The LLC

Conservation Forestry LLC

Forest Capital Partners

Forest Investment Associates

Forest Systems, Inc.

Forestland Group LLC

Fountain Forestry, Inc.

Global Forest Partners

GMO Renewable Resources

* | | The above list may not be all inclusive, but identifies the vast majority of |

TIMO’s which range in assets under management from $100 million to $5 billion

Timberland Managers

32

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

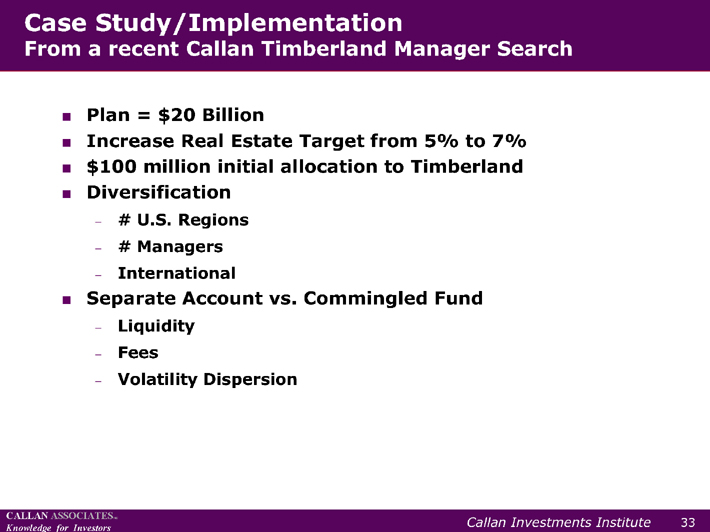

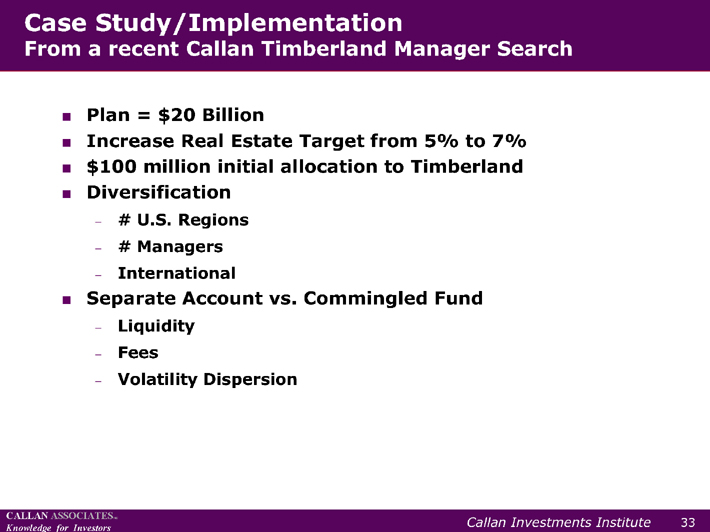

??Callan recently conducted a manager search for a client who sought to augment their

real estate portfolio with a timberland allocation. Initially, the client struggled with the

question of whether or not to include an international component. Ultimately, they

decided upon a 20% international allocation within their timberland portfolio because

they essentially wanted a core portfolio and did not want to assume the added risk

involved with a higher international allocation.

??The client had $100 million to invest in timberland initially, which gave them the

ability to create a separate account. We considered the variables involved in

establishing a separate account versus a commingled fund. A separate account can

offer some pricing power—perhaps 20 basis points off the management fee—as well

as more investor control of the assets, and is more liquid. However, by going with a

$100 million separate account as opposed to a larger commingled fund pool of

investments, you likely give up compression of volatility over time. These are merely

some of the variables they had to consider before establishing an account. In the end

the fee discount as well as the ability to customize the desired risk/return

characteristics of the timberland portfolio led the client to go with a separate account.

RP-33

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

Case Study/Implementation

From a recent Callan Timberland Manager Search

??Plan = $20 Billion

??Increase Real Estate Target from 5% to 7%

??$100 million initial allocation to Timberland

??Diversification

? # U.S. Regions

? # Managers

? International

??Separate Account vs. Commingled Fund

? Liquidity

? Fees

? Volatility Dispersion

33

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

??The last segment of the workshop explores infrastructures, what is driving the

growing demand for these assets, and how and why to invest in this segment of the

market. We also provide a brief case study overview of a client seeking to augment

their real estate allocation with an investment in infrastructure.

RP-34

CALLAN ASSOCIATESINC

Knowledge for Investors

Infrastructure

Chae N. Hong

34

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

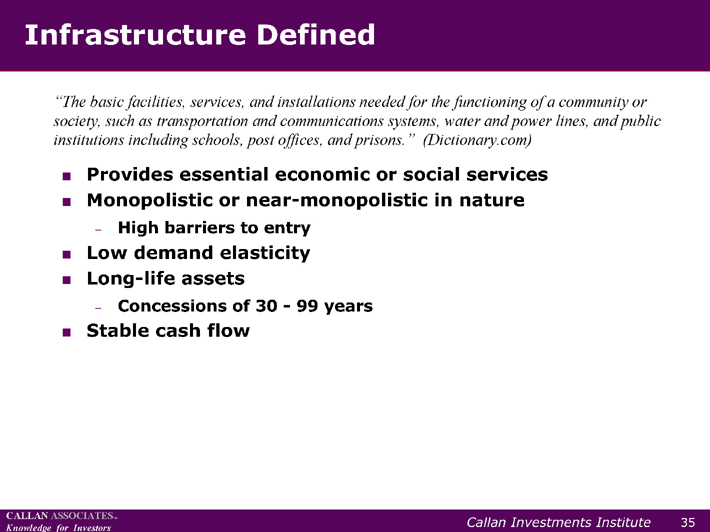

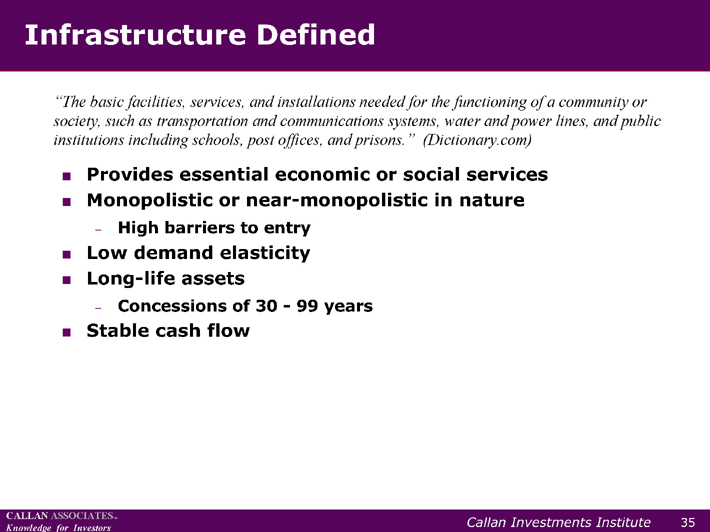

??Infrastructure plays a central role in our daily lives, though often we don’t realize it.

Transportation systems, water and power lines, public institutions such as schools,

post offices, and prisons all fall under the definition of infrastructures.

??Beyond providing essential economic or social services, infrastructure has four other

general characteristics. First, it is a monopolistic or near monopolistic market in

nature and as such, has high barriers to entry. Second, demand elasticity is low,

which essentially means that pricing power is very strong. Third, infrastructure assets

are typically long-lived; concessions from municipalities to private owners can range

from 30 to 99 years. And lastly, infrastructure assets provide a stable and predictable

cash flow.

RP-35

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

“The basic facilities, services, and installations needed for the functioning of a community or

society, such as transportation and communications systems, water and power lines, and public

institutions including schools, post offices, and prisons.” (Dictionary.com)

Infrastructure Defined

??Provides essential economic or social services

??Monopolistic or near-monopolistic in nature

? High barriers to entry

??Low demand elasticity

??Long-life assets

? Concessions of 30—99 years

??Stable cash flow

35

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

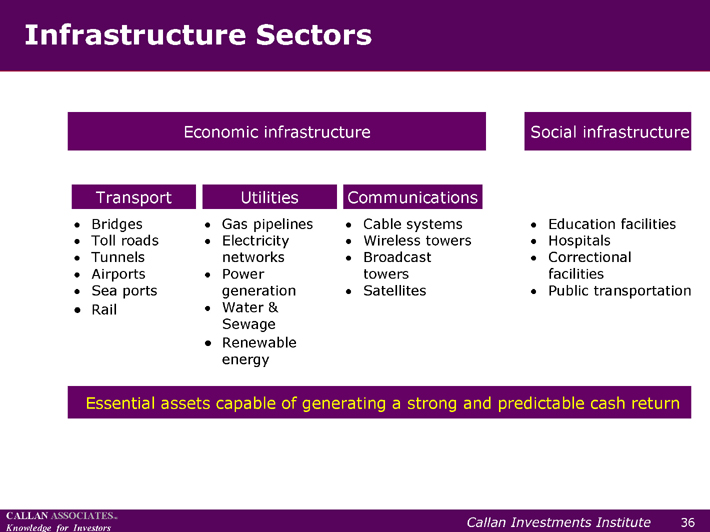

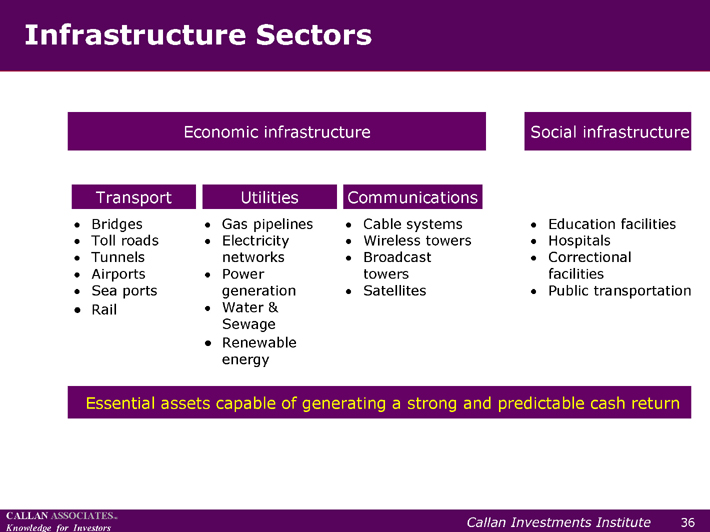

??Infrastructure can be divided into two broad sectors: economic infrastructure and

social infrastructure. Assets related to transportation, utilities, and communications

fall under the economic sector and whereas more service-oriented assets such as

educational and correctional facilities, public transportation, and hospitals comprise

the social sector. Despite their differences, these two sectors have one characteristic

in common: they both consist of essential assets capable of generating a strong and

predictable cash return.

RP-36

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

Infrastructure Sectors

Economic infrastructure Social infrastructure

Transport Utilities Communications

• Bridges

• Toll roads

• Tunnels

• Airports

• Sea ports

• Rail

• Gas pipelines

• Electricity

networks

• Power

generation

• Water &

Sewage

• Renewable

energy

• Cable systems

• Wireless towers

• Broadcast

towers

• Satellites

• Education facilities

• Hospitals

• Correctional

facilities

• Public transportation

Essential assets capable of generating a strong and predictable cash return

36

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

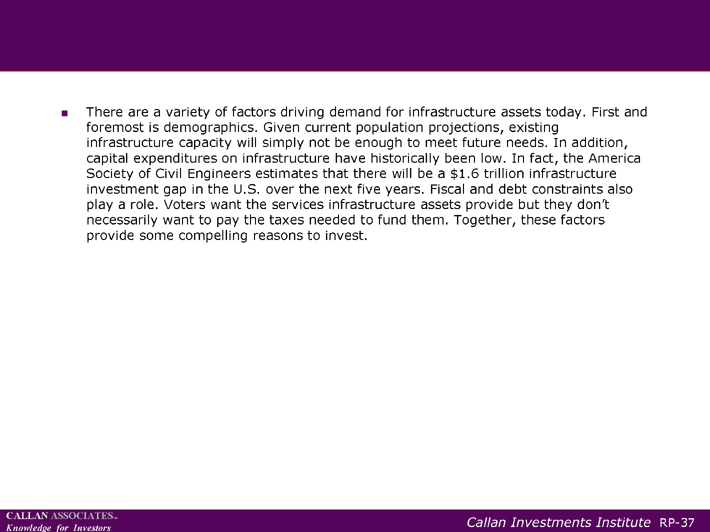

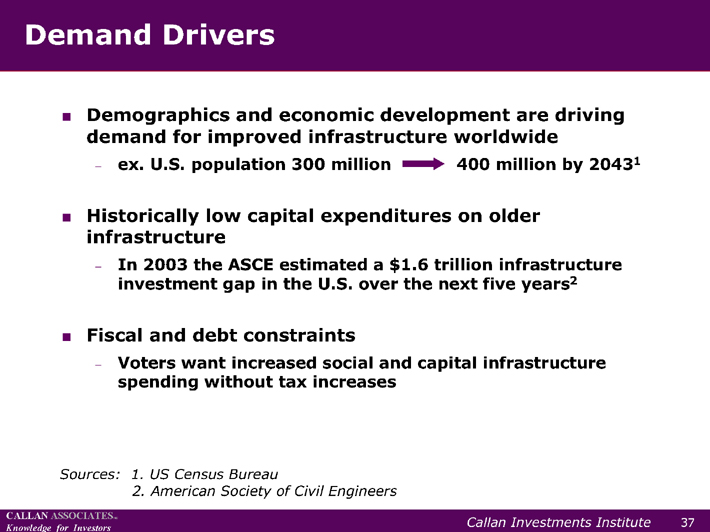

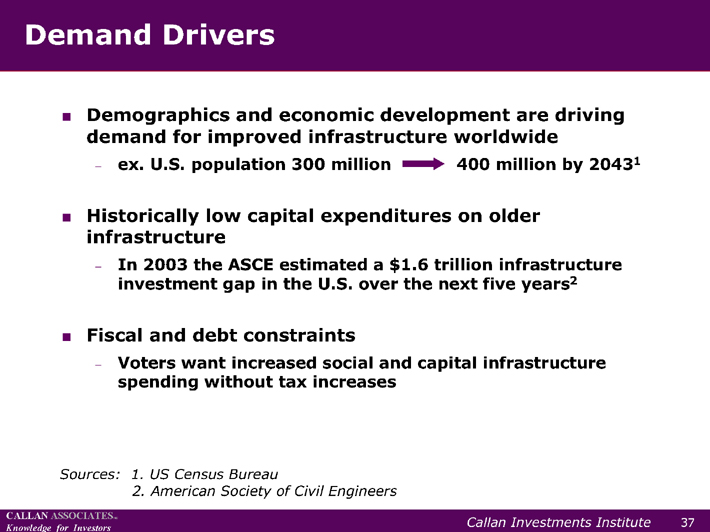

??There are a variety of factors driving demand for infrastructure assets today. First and

foremost is demographics. Given current population projections, existing

infrastructure capacity will simply not be enough to meet future needs. In addition,

capital expenditures on infrastructure have historically been low. In fact, the America

Society of Civil Engineers estimates that there will be a $1.6 trillion infrastructure

investment gap in the U.S. over the next five years. Fiscal and debt constraints also

play a role. Voters want the services infrastructure assets provide but they don’t

necessarily want to pay the taxes needed to fund them. Together, these factors

provide some compelling reasons to invest.

RP-37

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

Sources: 1. US Census Bureau

2. American Society of Civil Engineers

Demand Drivers

??Demographics and economic development are driving

demand for improved infrastructure worldwide

? ex. U.S. population 300 million 400 million by 20431

??Historically low capital expenditures on older

infrastructure

? In 2003 the ASCE estimated a $1.6 trillion infrastructure

investment gap in the U.S. over the next five years2

??Fiscal and debt constraints

? Voters want increased social and capital infrastructure

spending without tax increases

37

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

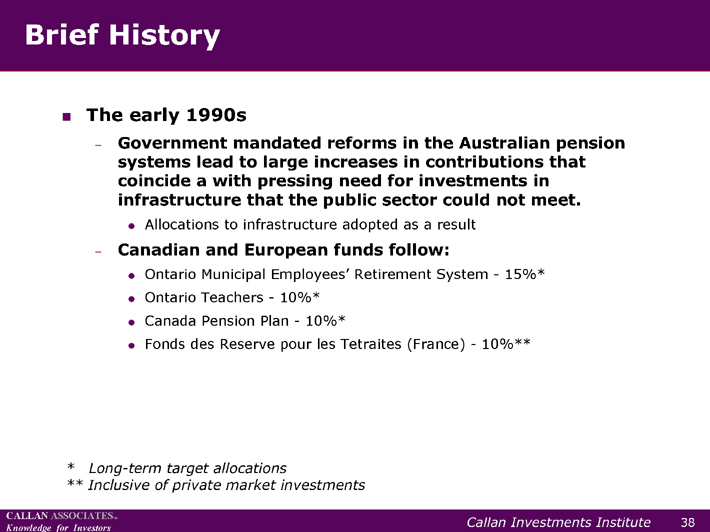

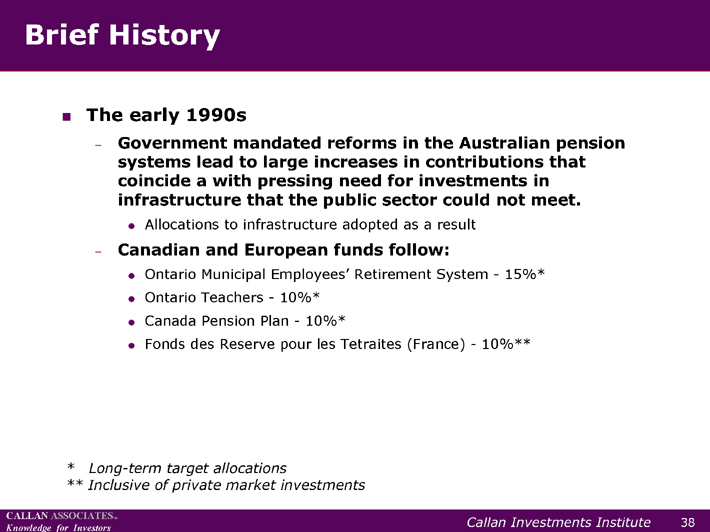

??Before we explore infrastructure further, it’s helpful to understand how the asset class

has evolved. The concept of infrastructure investment was pioneered in Australia. As

the Australian’s appetite for real assets grew, infrastructure became a prime candidate.

Reforms in the pension systems led to increasing contributions at a time when the

public sector could not meet the investment need of infrastructure. Canadian and

European funds soon followed suit. Shown here are four such funds and their target

long-term allocations to infrastructure.

RP-38

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

* | | Long-term target allocations |

** Inclusive of private market investments

Brief History

??The early 1990s

? Government mandated reforms in the Australian pension

systems lead to large increases in contributions that

coincide a with pressing need for investments in

infrastructure that the public sector could not meet.

??Allocations to infrastructure adopted as a result

? Canadian and European funds follow:

??Ontario Municipal Employees’ Retirement System—15%*

??Ontario Teachers—10%*

??Canada Pension Plan—10%*

??Fonds des Reserve pour les Tetraites (France)—10%**

38

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

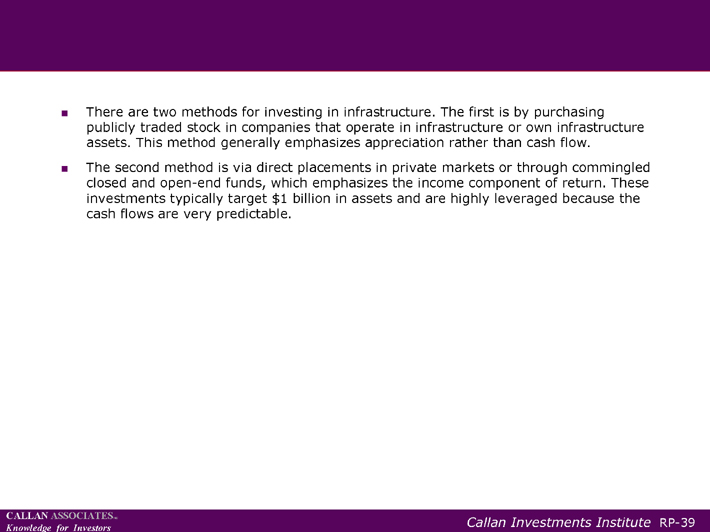

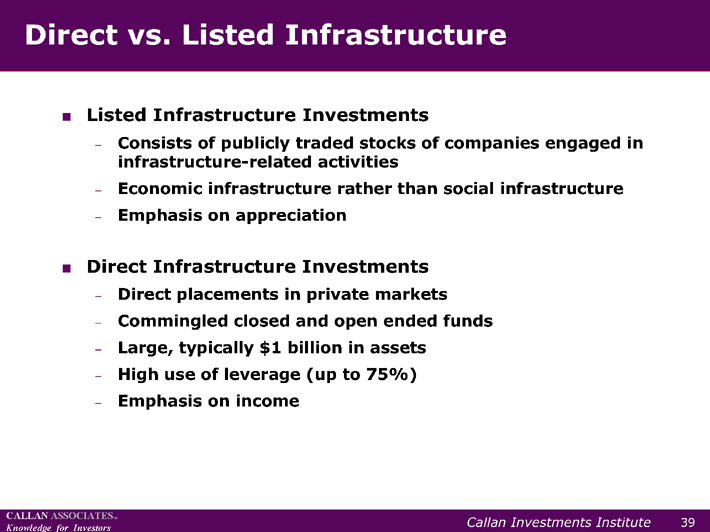

??There are two methods for investing in infrastructure. The first is by purchasing

publicly traded stock in companies that operate in infrastructure or own infrastructure

assets. This method generally emphasizes appreciation rather than cash flow.

??The second method is via direct placements in private markets or through commingled

closed and open-end funds, which emphasizes the income component of return. These

investments typically target $1 billion in assets and are highly leveraged because the

cash flows are very predictable.

RP-39

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

Direct vs. Listed Infrastructure

??Listed Infrastructure Investments

? Consists of publicly traded stocks of companies engaged in

infrastructure-related activities

? Economic infrastructure rather than social infrastructure

? Emphasis on appreciation

??Direct Infrastructure Investments

? Direct placements in private markets

? Commingled closed and open ended funds

? Large, typically $1 billion in assets

? High use of leverage (up to 75%)

? Emphasis on income

39

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

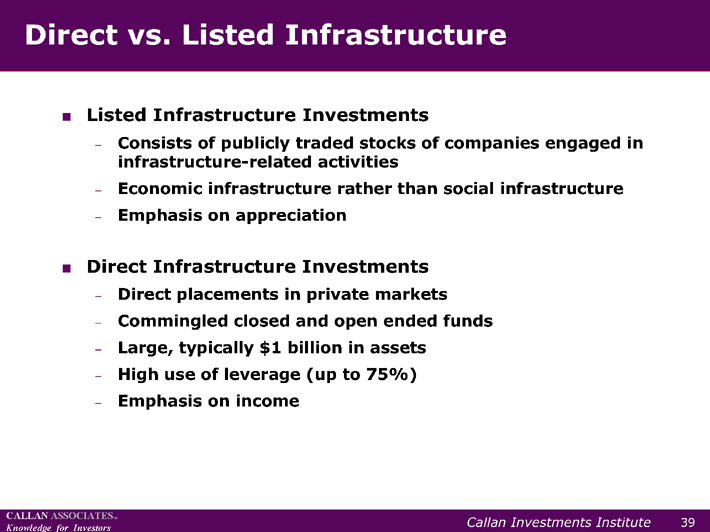

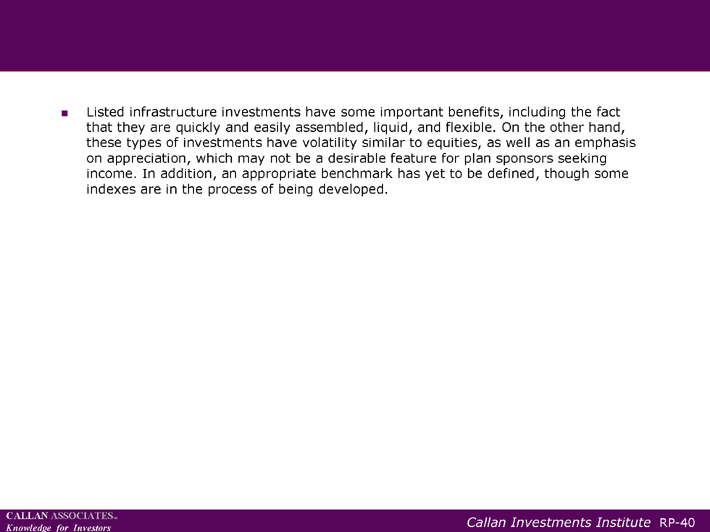

??Listed infrastructure investments have some important benefits, including the fact

that they are quickly and easily assembled, liquid, and flexible. On the other hand,

these types of investments have volatility similar to equities, as well as an emphasis

on appreciation, which may not be a desirable feature for plan sponsors seeking

income. In addition, an appropriate benchmark has yet to be defined, though some

indexes are in the process of being developed.

RP-40

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

Listed Infrastructure

??Strengths

? Quickly and easily assembled

? Liquidity

? Flexibility

??Weaknesses

? Shares volatility of equity markets

? Higher emphasis on capital gains rather than income

? Appropriate benchmark undefined

??Macquarie Global Infrastructure Index Series (FTSE)

– Historical data available from July 1, 2000

??UBS Global Infrastructure and Utilities Series (UBS & S&P)

– Historical data available from January 1, 1990

40

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

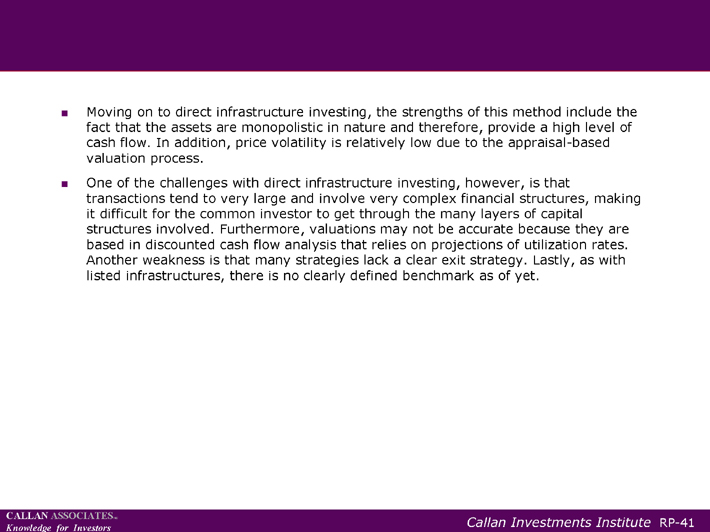

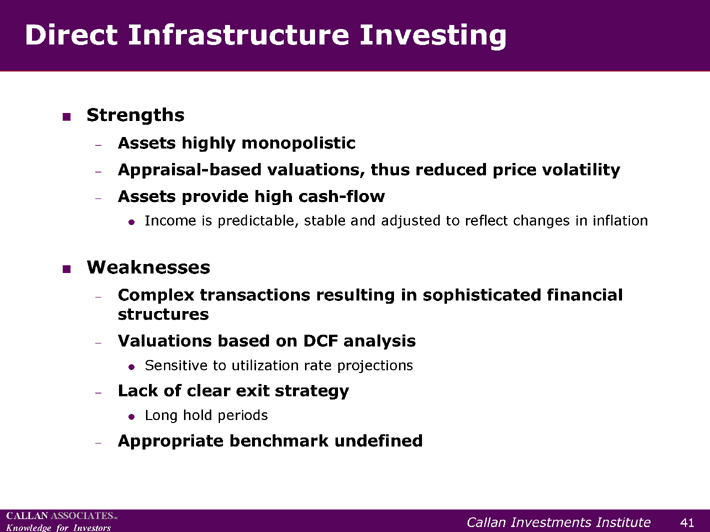

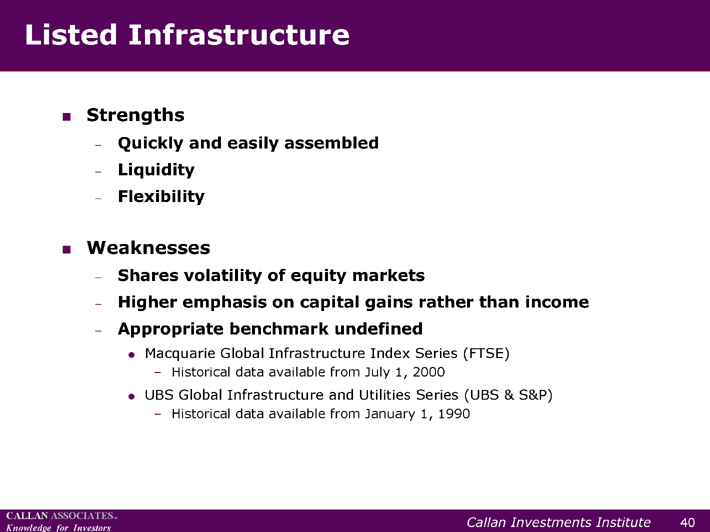

??Moving on to direct infrastructure investing, the strengths of this method include the

fact that the assets are monopolistic in nature and therefore, provide a high level of

cash flow. In addition, price volatility is relatively low due to the appraisal-based

valuation process.

??One of the challenges with direct infrastructure investing, however, is that

transactions tend to very large and involve very complex financial structures, making

it difficult for the common investor to get through the many layers of capital

structures involved. Furthermore, valuations may not be accurate because they are

based in discounted cash flow analysis that relies on projections of utilization rates.

Another weakness is that many strategies lack a clear exit strategy. Lastly, as with

listed infrastructures, there is no clearly defined benchmark as of yet.

RP-41

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

Direct Infrastructure Investing

??Strengths

? Assets highly monopolistic

? Appraisal-based valuations, thus reduced price volatility

? Assets provide high cash-flow

??Income is predictable, stable and adjusted to reflect changes in inflation

??Weaknesses

? Complex transactions resulting in sophisticated financial

structures

? Valuations based on DCF analysis

??Sensitive to utilization rate projections

? Lack of clear exit strategy

??Long hold periods

? Appropriate benchmark undefined

41

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

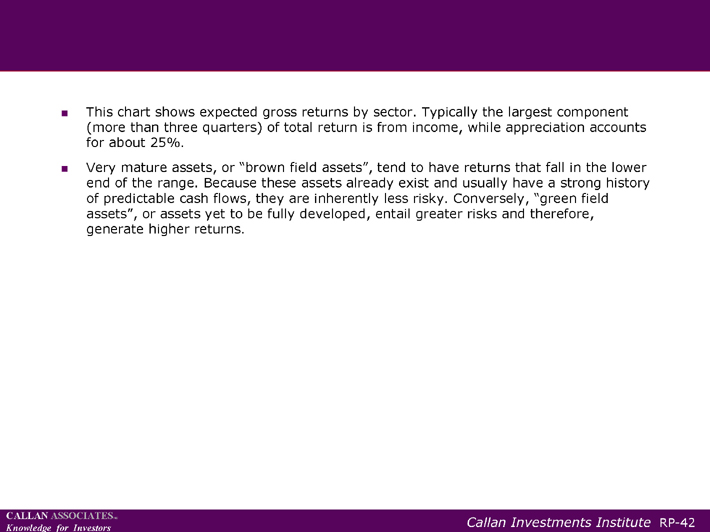

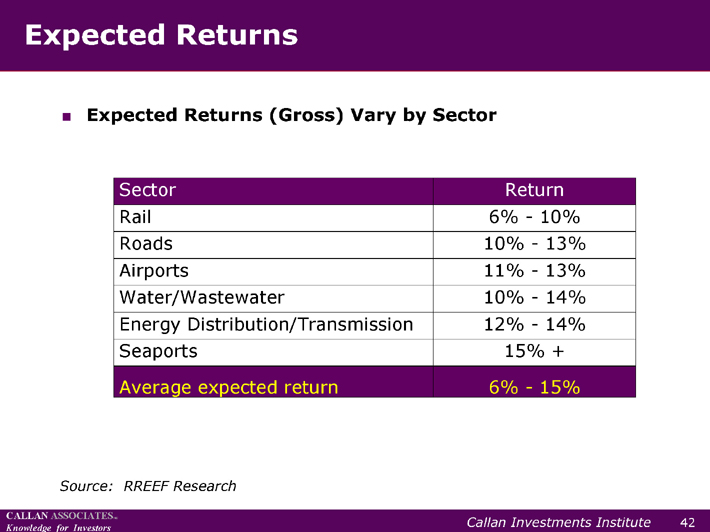

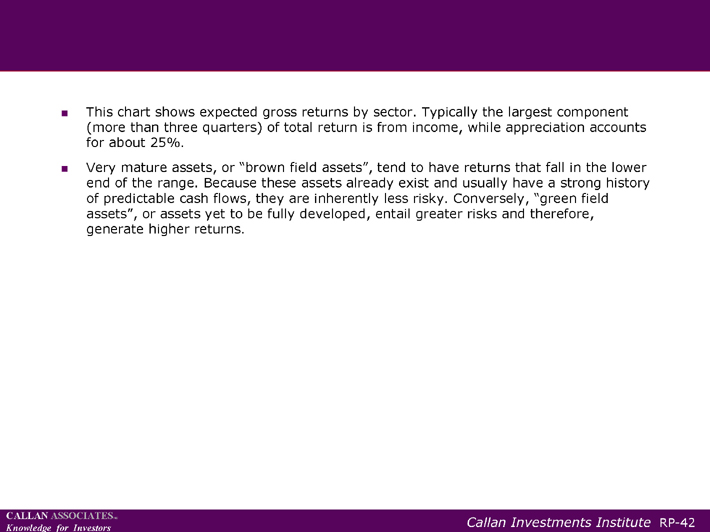

??This chart shows expected gross returns by sector. Typically the largest component

(more than three quarters) of total return is from income, while appreciation accounts

for about 25%.

??Very mature assets, or “brown field assets”, tend to have returns that fall in the lower

end of the range. Because these assets already exist and usually have a strong history

of predictable cash flows, they are inherently less risky. Conversely, “green field

assets”, or assets yet to be fully developed, entail greater risks and therefore,

generate higher returns.

RP-42

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

Expected Returns

??Expected Returns (Gross) Vary by Sector

Sector Return

Rail 6%—10%

Roads 10%—13%

Airports 11%—13%

Water/Wastewater 10%—14%

Energy Distribution/Transmission 12%—14%

Seaports 15% +

Average expected return 6%—15%

Source: RREEF Research

42

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

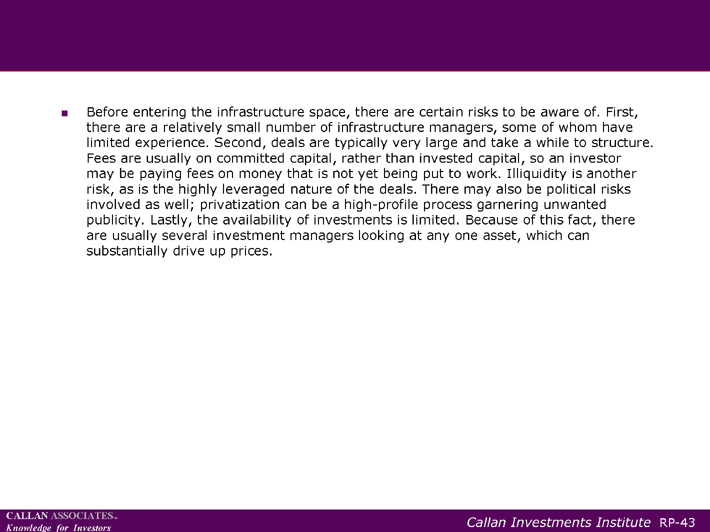

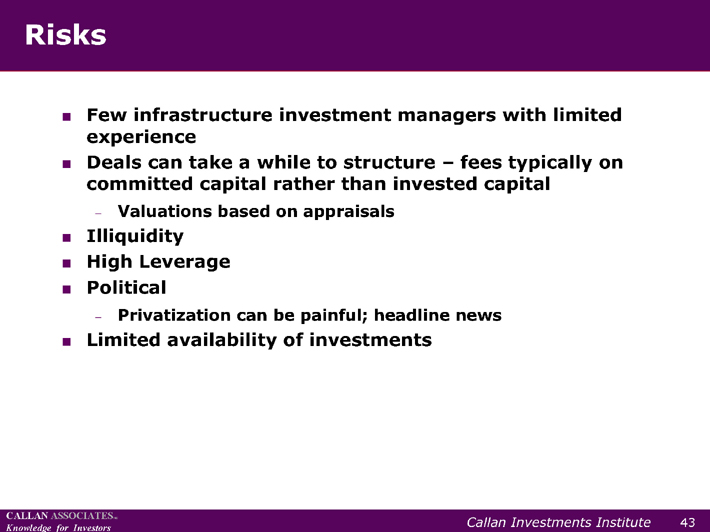

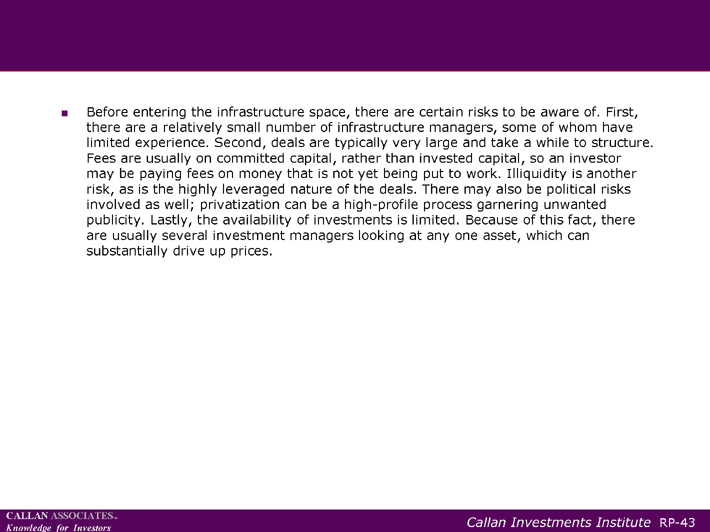

??Before entering the infrastructure space, there are certain risks to be aware of. First,

there are a relatively small number of infrastructure managers, some of whom have

limited experience. Second, deals are typically very large and take a while to structure.

Fees are usually on committed capital, rather than invested capital, so an investor

may be paying fees on money that is not yet being put to work. Illiquidity is another

risk, as is the highly leveraged nature of the deals. There may also be political risks

involved as well; privatization can be a high-profile process garnering unwanted

publicity. Lastly, the availability of investments is limited. Because of this fact, there

are usually several investment managers looking at any one asset, which can

substantially drive up prices.

RP-43

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

Risks

??Few infrastructure investment managers with limited

experience

??Deals can take a while to structure – fees typically on

committed capital rather than invested capital

? Valuations based on appraisals

??Illiquidity

??High Leverage

??Political

? Privatization can be painful; headline news

??Limited availability of investments

43

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

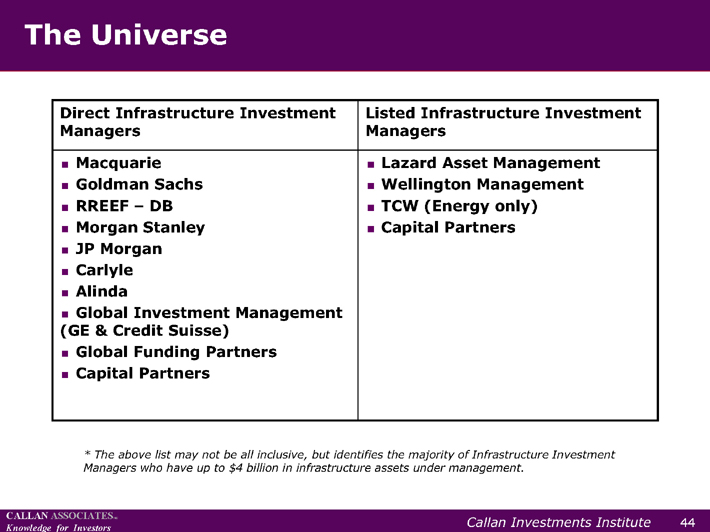

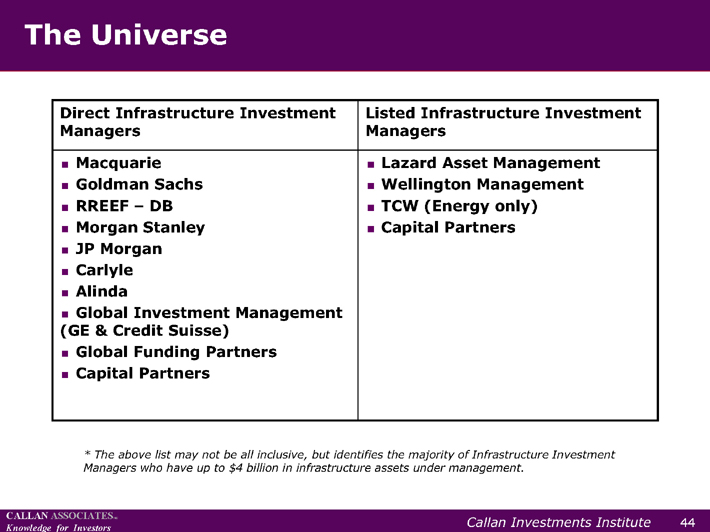

??The universe of infrastructure investment managers changes almost daily. Here we

provide a list of the majority of these managers, who have up to $4 billion in assets

under management. Some of these managers have a longer history than others;

some specialize in a particular sub-sector; and certain managers have a hybrid

strategy.

RP-44

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

The Universe

??Lazard Asset Management

??Wellington Management

??TCW (Energy only)

??Capital Partners

??Macquarie

??Goldman Sachs

??RREEF – DB

??Morgan Stanley

??JP Morgan

??Carlyle

??Alinda

??Global Investment Management

(GE & Credit Suisse)

??Global Funding Partners

??Capital Partners

Listed Infrastructure Investment

Managers

Direct Infrastructure Investment

Managers

* | | The above list may not be all inclusive, but identifies the majority of Infrastructure Investment |

Managers who have up to $4 billion in infrastructure assets under management.

44

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

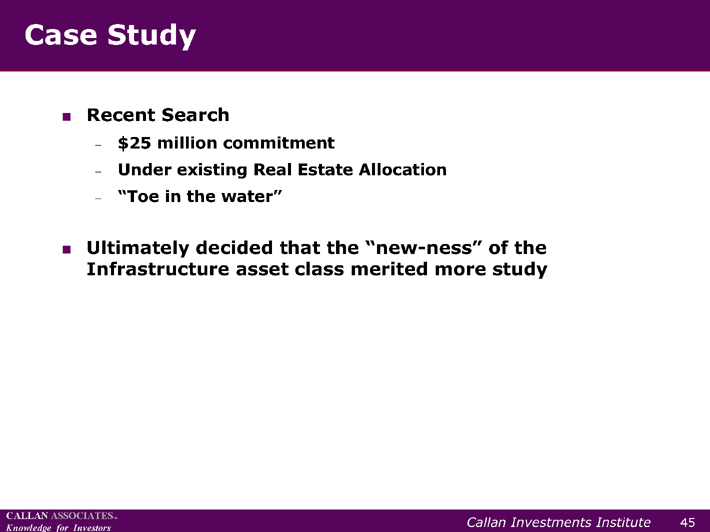

??The following is a brief client case study overview. Our client had a $25 million

commitment and sought to invest within their real estate allocation. We conducted a

manager search and identified 11 managers who were able to take investments at

that time. Initially, the client’s decision to enter the infrastructure market was

somewhat of a “toe in the water” test. If it proved successful, they were prepared to

invest more in the strategy. Ultimately, however, the client decided to take a slower

approach and we continue to work with them, helping to build their knowledge and

comfort level with infrastructure investing.

??In closing, most investors, like this client, view infrastructure as real estate due to the

fact that infrastructures are long-lived assets where the bulk of return is derived from

income. We believe that in time, as the market continues to expand, infrastructure

will become its own asset category.

RP-45

CALLAN ASSOCIATESINC

Knowledge for Investors Callan Investments Institute

Case Study

??Recent Search

? $25 million commitment

? Under existing Real Estate Allocation

? “Toe in the water”

??Ultimately decided that the “new-ness” of the

Infrastructure asset class merited more study

45

CALLAN ASSOCIATESINC

Knowledge for Investors

Callan Investments Institute

101 California Street, Suite 3500

San Francisco, CA 94111

phone 415.974.5060 fax 415.274.3049 www.callan.com

For more information about Callan Investments Institute,

please contact Gina Falsetto at 415.974.5060 or institute@callan.com.

The Callan Investments Institute is, and will be, the sole owner and copyright holder of all material

prepared or developed by the Institute. All Institute Clients shall understand that they do not have the

right to reproduce, revise, resell, disseminate externally, disseminate to subsidiaries, or post on internal

web sites any part of any material prepared or developed by the Institute, without the Institute’s

permission. All Institute Clients understand that they are subscribing only to the right to utilize such

material internally in their business. All Institute clients shall understand that Institute material is for use

only within the Institute Client firm, and not to be shared with subsidiaries or parent companies.

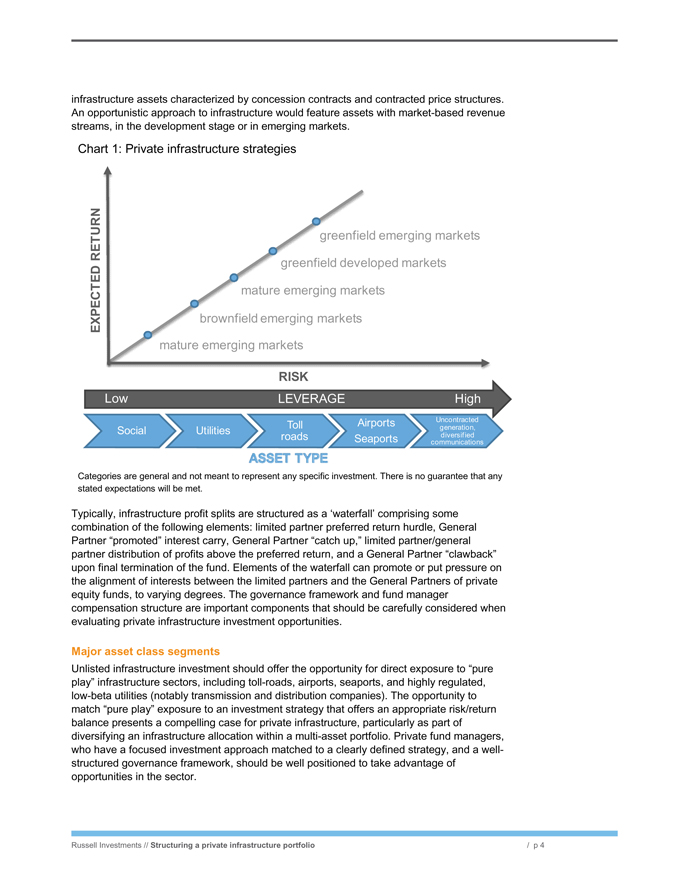

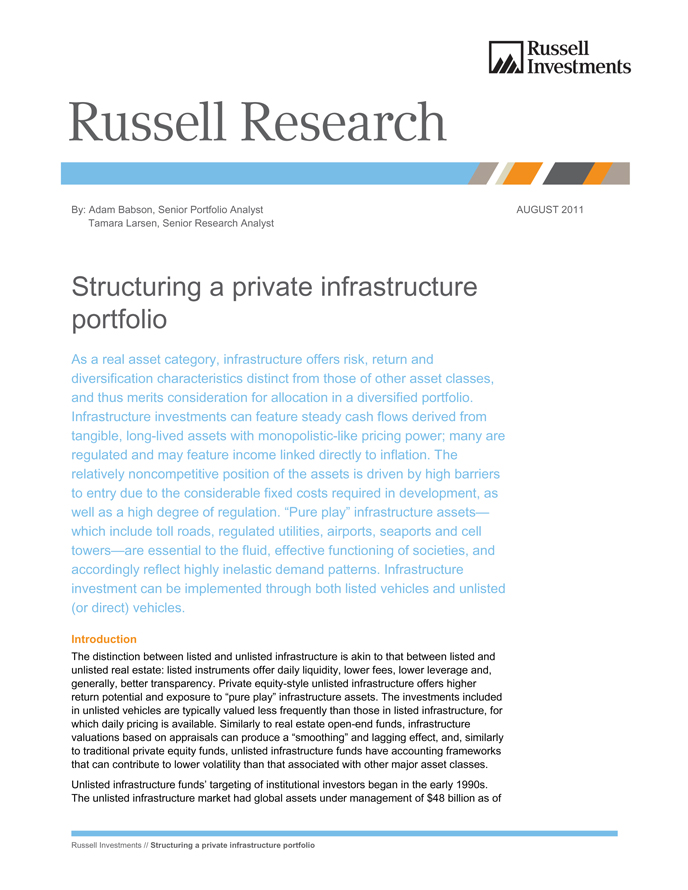

Russell Investments Russell Research By: Adam Babson, Senior Portfolio Analyst AUGUST 2011Tamara Larsen, Senior Research Analyst Structuring a private infrastructure portfolio As a real asset category, infrastructure offers risk, return and diversification characteristics distinct from those of other asset classes, and thus merits consideration for allocation in a diversified portfolio. Infrastructure investments can feature steady cash flows derived from tangible, long-lived assets with monopolistic-like pricing power; many are regulated and may feature income linked directly to inflation. The relatively noncompetitive position of the assets is driven by high barriers to entry due to the considerable fixed costs required in development, as well as a high degree of regulation. “Pure play” infrastructure assets—which include toll roads, regulated utilities, airports, seaports and cell towers—are essential to the fluid, effective functioning of societies, and accordingly reflect highly inelastic demand patterns. Infrastructure investment can be implemented through both listed vehicles and unlisted (or direct) vehicles. Introduction The distinction between listed and unlisted infrastructure is akin to that between listed and unlisted real estate: listed instruments offer daily liquidity, lower fees, lower leverage and, generally, better transparency. Private equity-style unlisted infrastructure offers higher return potential and exposure to “pure play” infrastructure assets. The investments included in unlisted vehicles are typically valued less frequently than those in listed infrastructure, for which daily pricing is available. Similarly to real estate open-end funds, infrastructure valuations based on appraisals can produce a “smoothing” and lagging effect, and, similarly to traditional private equity funds, unlisted infrastructure funds have accounting frameworks that can contribute to lower volatility than that associated with other major asset classes. Unlisted infrastructure funds’ targeting of institutional investors began in the early 1990s. The unlisted infrastructure market had global assets under management of $48 billion as of Russell Investments // Structuring a private infrastructure portfolio