Q1 2018 earnings release April 18, 2018 Exhibit 99.2

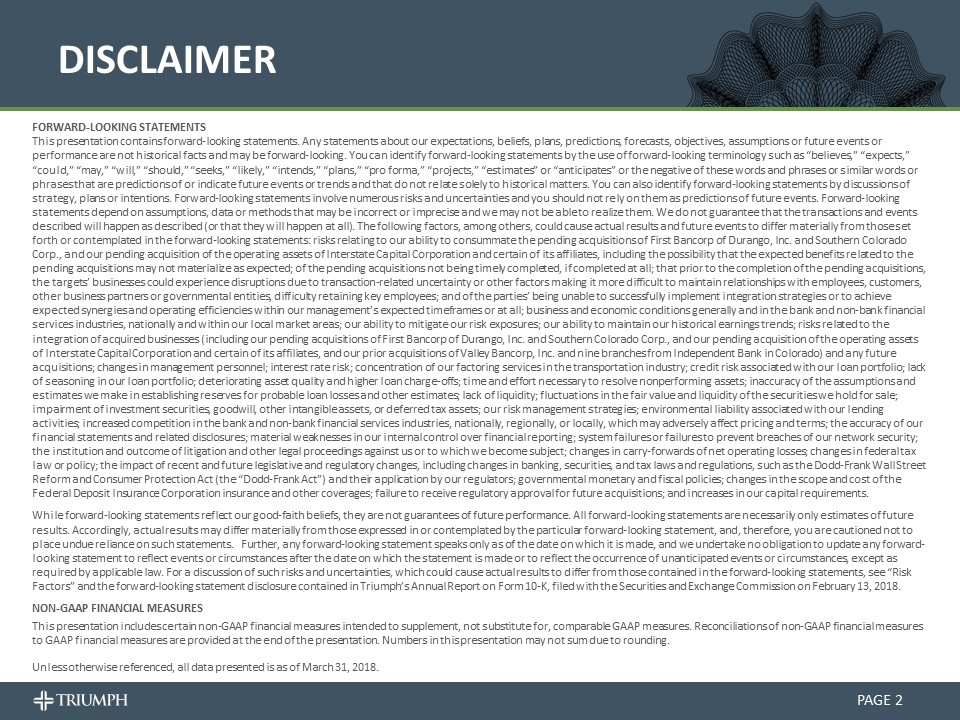

disclaimer Forward-Looking Statements This presentation contains forward-looking statements. Any statements about our expectations, beliefs, plans, predictions, forecasts, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. You can identify forward-looking statements by the use of forward-looking terminology such as “believes,” “expects,” “could,” “may,” “will,” “should,” “seeks,” “likely,” “intends,” “plans,” “pro forma,” “projects,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions. Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, data or methods that may be incorrect or imprecise and we may not be able to realize them. We do not guarantee that the transactions and events described will happen as described (or that they will happen at all). The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: risks relating to our ability to consummate the pending acquisitions of First Bancorp of Durango, Inc. and Southern Colorado Corp., and our pending acquisition of the operating assets of Interstate Capital Corporation and certain of its affiliates, including the possibility that the expected benefits related to the pending acquisitions may not materialize as expected; of the pending acquisitions not being timely completed, if completed at all; that prior to the completion of the pending acquisitions, the targets’ businesses could experience disruptions due to transaction-related uncertainty or other factors making it more difficult to maintain relationships with employees, customers, other business partners or governmental entities, difficulty retaining key employees; and of the parties’ being unable to successfully implement integration strategies or to achieve expected synergies and operating efficiencies within our management’s expected timeframes or at all; business and economic conditions generally and in the bank and non-bank financial services industries, nationally and within our local market areas; our ability to mitigate our risk exposures; our ability to maintain our historical earnings trends; risks related to the integration of acquired businesses (including our pending acquisitions of First Bancorp of Durango, Inc. and Southern Colorado Corp., and our pending acquisition of the operating assets of Interstate Capital Corporation and certain of its affiliates, and our prior acquisitions of Valley Bancorp, Inc. and nine branches from Independent Bank in Colorado) and any future acquisitions; changes in management personnel; interest rate risk; concentration of our factoring services in the transportation industry; credit risk associated with our loan portfolio; lack of seasoning in our loan portfolio; deteriorating asset quality and higher loan charge-offs; time and effort necessary to resolve nonperforming assets; inaccuracy of the assumptions and estimates we make in establishing reserves for probable loan losses and other estimates; lack of liquidity; fluctuations in the fair value and liquidity of the securities we hold for sale; impairment of investment securities, goodwill, other intangible assets, or deferred tax assets; our risk management strategies; environmental liability associated with our lending activities; increased competition in the bank and non-bank financial services industries, nationally, regionally, or locally, which may adversely affect pricing and terms; the accuracy of our financial statements and related disclosures; material weaknesses in our internal control over financial reporting; system failures or failures to prevent breaches of our network security; the institution and outcome of litigation and other legal proceedings against us or to which we become subject; changes in carry-forwards of net operating losses; changes in federal tax law or policy; the impact of recent and future legislative and regulatory changes, including changes in banking, securities, and tax laws and regulations, such as the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and their application by our regulators; governmental monetary and fiscal policies; changes in the scope and cost of the Federal Deposit Insurance Corporation insurance and other coverages; failure to receive regulatory approval for future acquisitions; and increases in our capital requirements. While forward-looking statements reflect our good-faith beliefs, they are not guarantees of future performance. All forward-looking statements are necessarily only estimates of future results. Accordingly, actual results may differ materially from those expressed in or contemplated by the particular forward-looking statement, and, therefore, you are cautioned not to place undue reliance on such statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events or circumstances, except as required by applicable law. For a discussion of such risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” and the forward-looking statement disclosure contained in Triumph’s Annual Report on Form 10-K, filed with the Securities and Exchange Commission on February 13, 2018. Non-GAAP Financial Measures This presentation includes certain non‐GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non‐GAAP financial measures to GAAP financial measures are provided at the end of the presentation. Numbers in this presentation may not sum due to rounding. Unless otherwise referenced, all data presented is as of March 31, 2018. PAGE

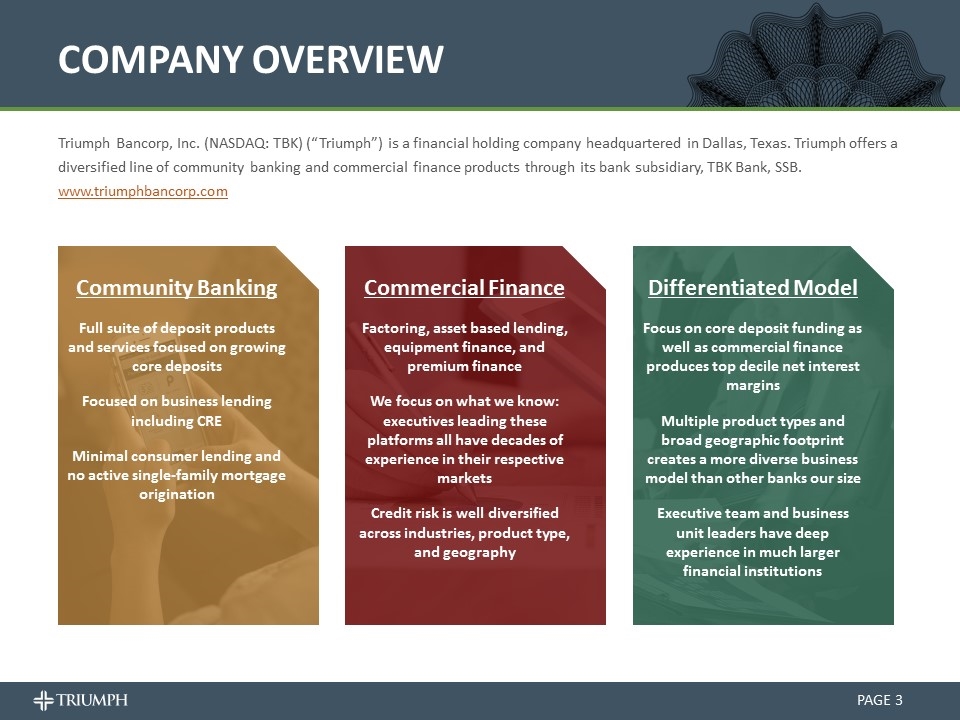

company OVERVIEW PAGE Triumph Bancorp, Inc. (NASDAQ: TBK) (“Triumph”) is a financial holding company headquartered in Dallas, Texas. Triumph offers a diversified line of community banking and commercial finance products through its bank subsidiary, TBK Bank, SSB. www.triumphbancorp.com Community Banking Full suite of deposit products and services focused on growing core deposits Focused on business lending including CRE Minimal consumer lending and no active single-family mortgage origination Differentiated Model Focus on core deposit funding as well as commercial finance produces top decile net interest margins Multiple product types and broad geographic footprint creates a more diverse business model than other banks our size Executive team and business unit leaders have deep experience in much larger financial institutions Commercial Finance Factoring, asset based lending, equipment finance, and premium finance We focus on what we know: executives leading these platforms all have decades of experience in their respective markets Credit risk is well diversified across industries, product type, and geography

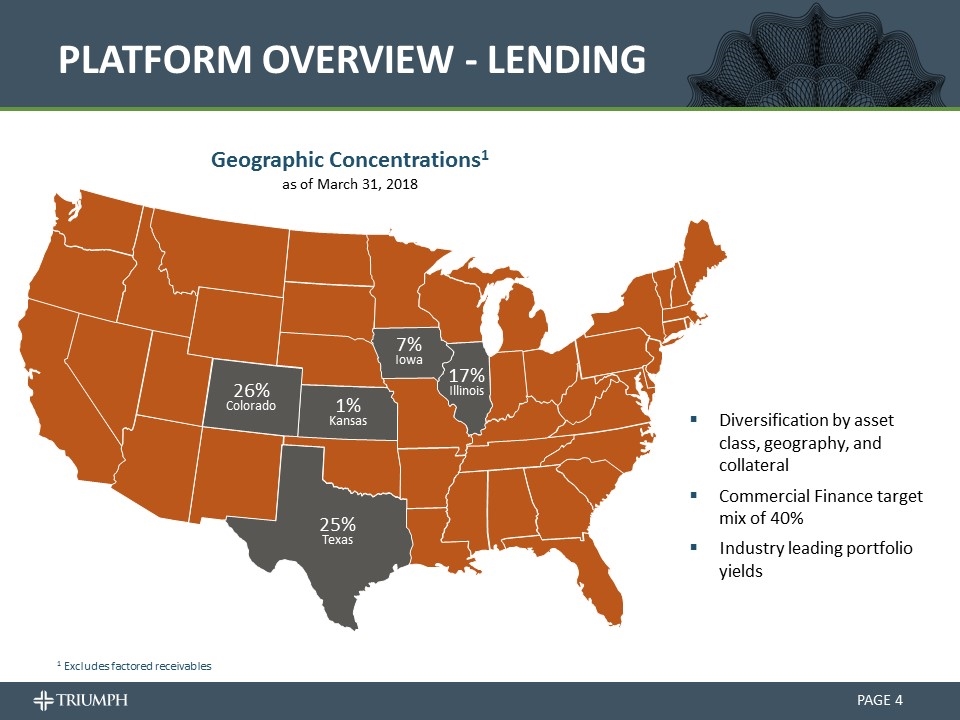

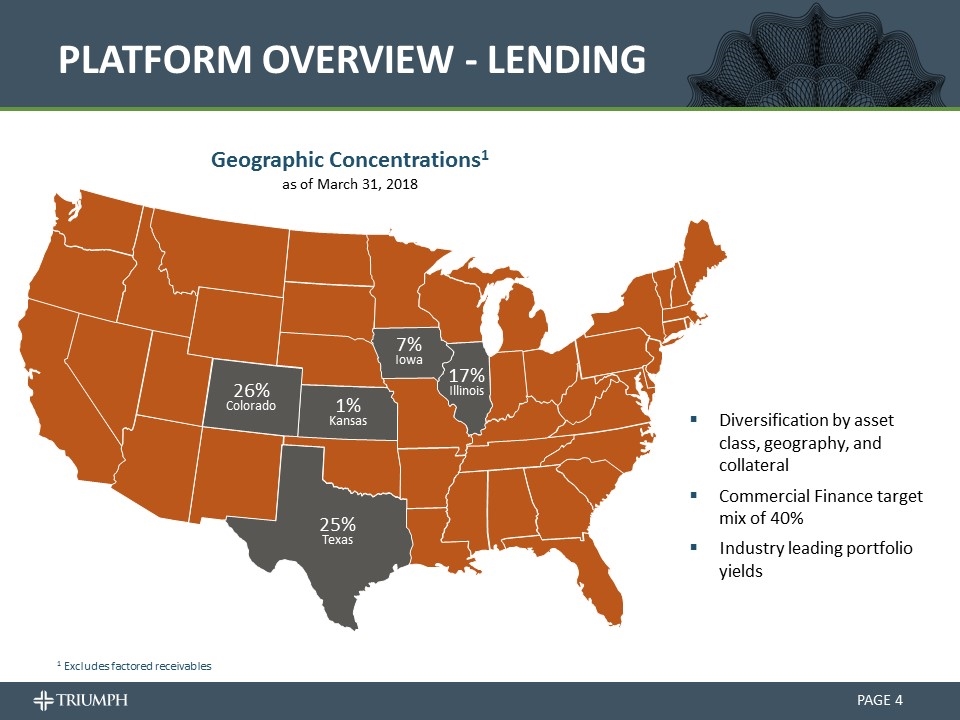

PLATFORM OVERVIEW - LENDING PAGE 25% Texas Geographic Concentrations1 as of March 31, 2018 Diversification by asset class, geography, and collateral Commercial Finance target mix of 40% Industry leading portfolio yields 1 Excludes factored receivables 26% Colorado 1% Kansas 7% Iowa 17% Illinois

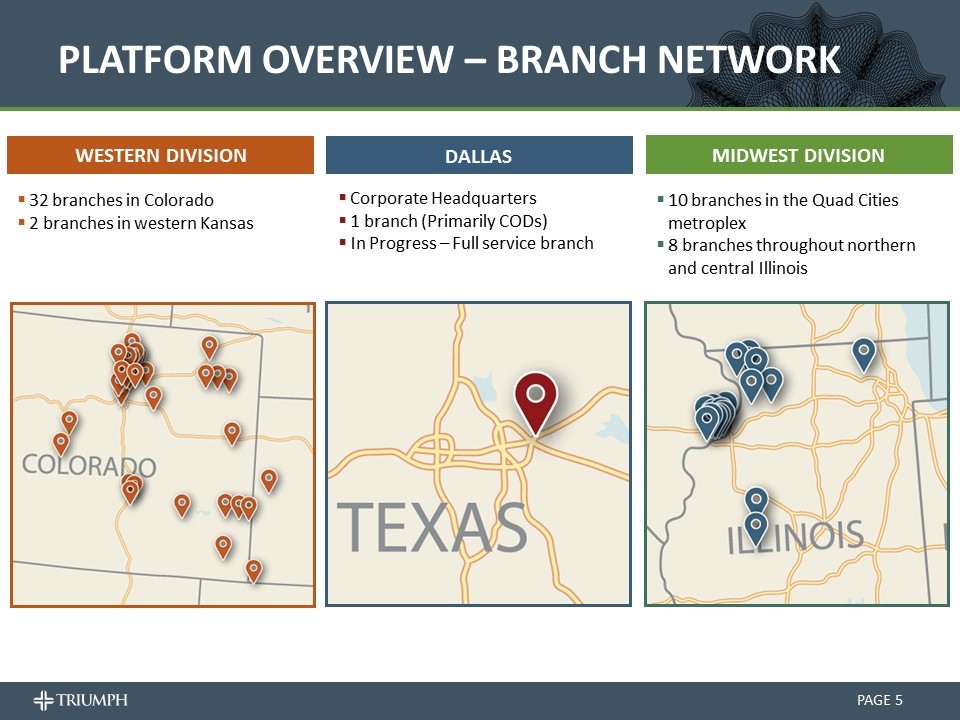

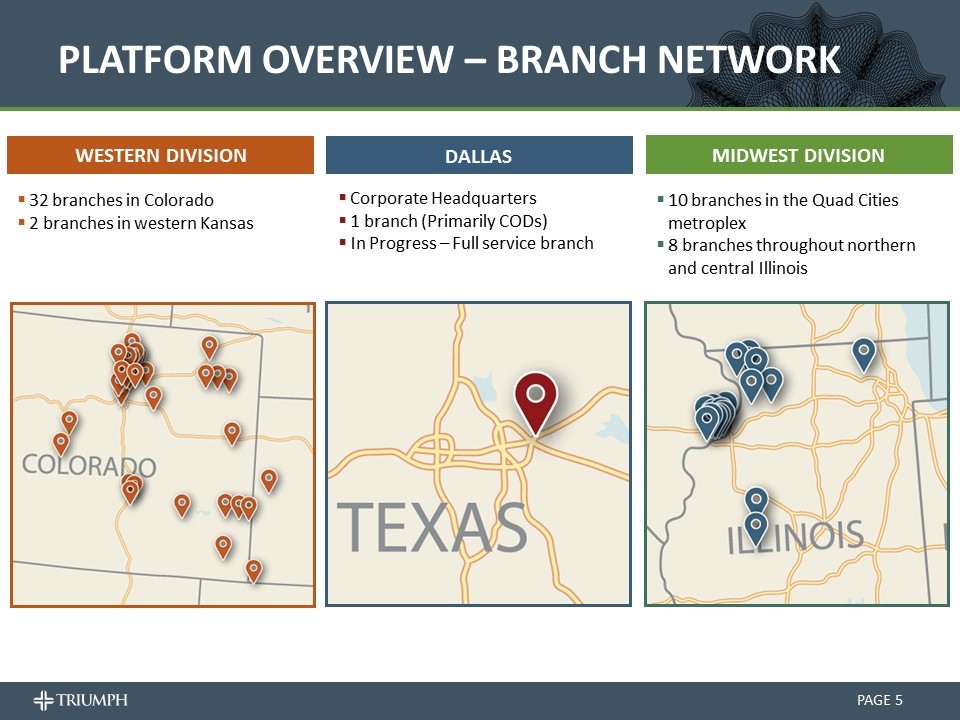

PLATFORM OVERVIEW – branch network PAGE team members(2) Western division 32 branches in Colorado 2 branches in western Kansas MIDwest division 10 branches in the Quad Cities metroplex 8 branches throughout northern and central Illinois Dallas Corporate Headquarters 1 branch (Primarily CODs) In Progress – Full service branch

PLATFORM OVERVIEW – COMMERCIAL FINANCE PAGE Triumph Commercial Finance Asset Based Lending Borrowing base working capital lending Focus on facilities between $1MM - $20MM Core industries include manufacturing, distribution, and services Equipment Finance Secured by revenue producing, essential-use equipment with broad resale markets Core markets include transportation, construction, and waste Triumph Business Capital Commercial Finance Triumph Premium Finance Factoring Among the largest discount factors in the transportation sector Clients include small owner-operator trucking companies, mid-sized fleets, and freight broker relationships Expanding client industry niches to include staffing, distribution, and other sectors Premium Finance Customized premium finance solutions for the acquisition of property and casualty insurance coverage We are a market leader for financial services to small businesses and the lower end of the middle market

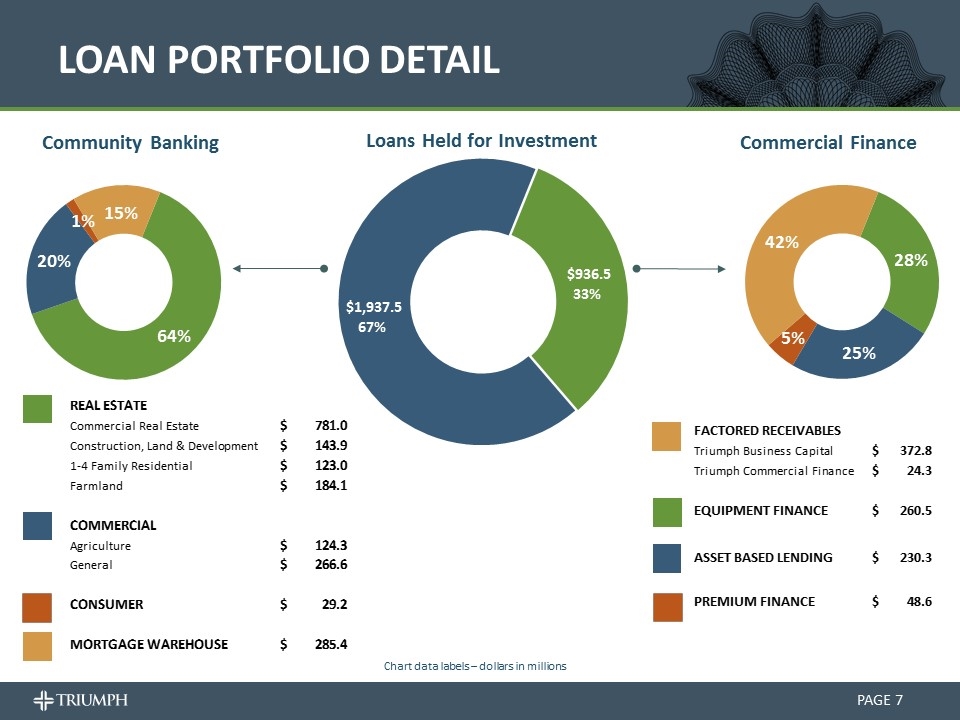

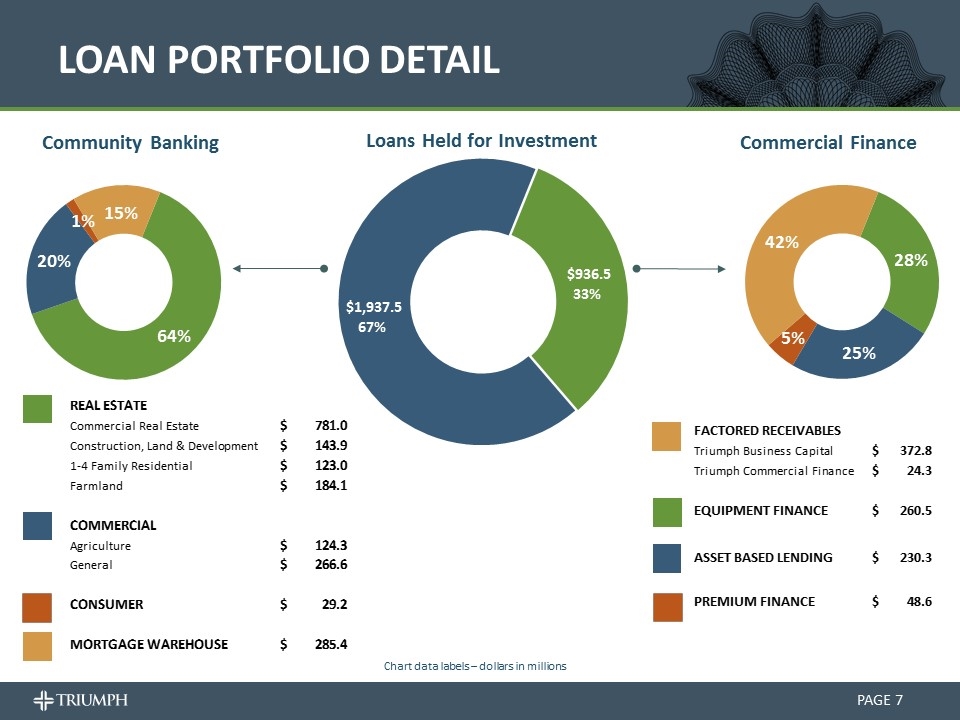

LOAN PORTFOLIO DETAIL PAGE Community Banking Commercial Finance Loans Held for Investment Chart data labels – dollars in millions 42825 42916 43008 43100 43190 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Community Banking 1,321.6 1,493.4259999999999 1,538.607 1,913.336 1,937.463 Asset based lending (Healthcare) 79.668000000000006 78.207999999999998 68.605999999999995 67.888999999999996 0 Equipment 203.251 219.904 226.12 254.119 260.50200000000001 0.2781589754431823 Commercial Finance: Asset based lending (General) 166.917 188.25700000000001 193.88399999999999 213.471 230.31399999999999 0.24592481543412753 Premium Finance 23.161999999999999 31.274000000000001 57.082999999999998 55.52 48.561 5.1852492520197066E-2 Factored receivables 242.09800000000001 293.63299999999998 341.88 374.41 397.14499999999998 0.42406371660249303 Q1 2018 Commercial Finance Products $936.52200000000005 Community Banking $1,937.463 Real Estate & Farmland $1,231.925 Commercial Real Estate $781.00599999999997 Commercial $390.90599999999995 Construction, Land Development, Land $143.876 Consumer $29.244 1-4 Family Residential Properties $122.979 Mortgage Warehouse $285.38799999999998 Farmland $184.06399999999999 Commercial $390.90599999999995 Consumer $29.244 Community Banking Mortgage Warehouse $285.38799999999998 Agriculture 124.3 <<<<<<<<<< MANUAL UPDATE REAL ESTATE Commercial Real Estate $781 Construction, Land & Development $143.9 1-4 Family Residential $123 Farmland $184.1 0.6358831110581209 COMMERCIAL 0.20175869164985347 Agriculture $124.3 General $266.59999999999997 CONSUMER $29.2 1.5071255554299619E-2 MORTGAGE WAREHOUSE $285.39999999999998 0.14730603887661339 FACTORED RECEIVABLES $1,937.5 Triumph Business Capital $372.8 Triumph Commercial Finance $24.3 <<<<<<<<<< MANUAL UPDATE EQUIPMENT FINANCE $260.5 ASSET BASED LENDING $230.3 PREMIUM FINANCE $48.6 $936.50000000000011 42825 42916 43008 43100 43190 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Q1 2018 Q4 2016 Q1 2017 Q2 2017 Q3 2017 Q4 2017 Community Banking 1,321.6 1,493.4259999999999 1,538.607 1,913.336 1,937.463 Asset based lending (Healthcare) 79.668000000000006 78.207999999999998 68.605999999999995 67.888999999999996 0 Equipment 203.251 219.904 226.12 254.119 260.50200000000001 0.2781589754431823 Commercial Finance: Asset based lending (General) 166.917 188.25700000000001 193.88399999999999 213.471 230.31399999999999 0.24592481543412753 Premium Finance 23.161999999999999 31.274000000000001 57.082999999999998 55.52 48.561 5.1852492520197066E-2 Factored receivables 242.09800000000001 293.63299999999998 341.88 374.41 397.14499999999998 0.42406371660249303 Q1 2018 Commercial Finance Products $936.52200000000005 Community Banking $1,937.463 Real Estate & Farmland $1,231.925 Commercial Real Estate $781.00599999999997 Commercial $390.90599999999995 Construction, Land Development, Land $143.876 Consumer $29.244 1-4 Family Residential Properties $122.979 Mortgage Warehouse $285.38799999999998 Farmland $184.06399999999999 Commercial $390.90599999999995 Consumer $29.244 Community Banking Mortgage Warehouse $285.38799999999998 Agriculture 124.3 <<<<<<<<<< MANUAL UPDATE REAL ESTATE Commercial Real Estate $781 Construction, Land & Development $143.9 1-4 Family Residential $123 Farmland $184.1 0.6358831110581209 COMMERCIAL 0.20175869164985347 Agriculture $124.3 General $266.59999999999997 CONSUMER $29.2 1.5071255554299619E-2 MORTGAGE WAREHOUSE $285.39999999999998 0.14730603887661339 FACTORED RECEIVABLES $1,937.5 Triumph Business Capital $372.8 Triumph Commercial Finance $24.3 <<<<<<<<<< MANUAL UPDATE EQUIPMENT FINANCE $260.5 ASSET BASED LENDING $230.3 PREMIUM FINANCE $48.6 $936.50000000000011

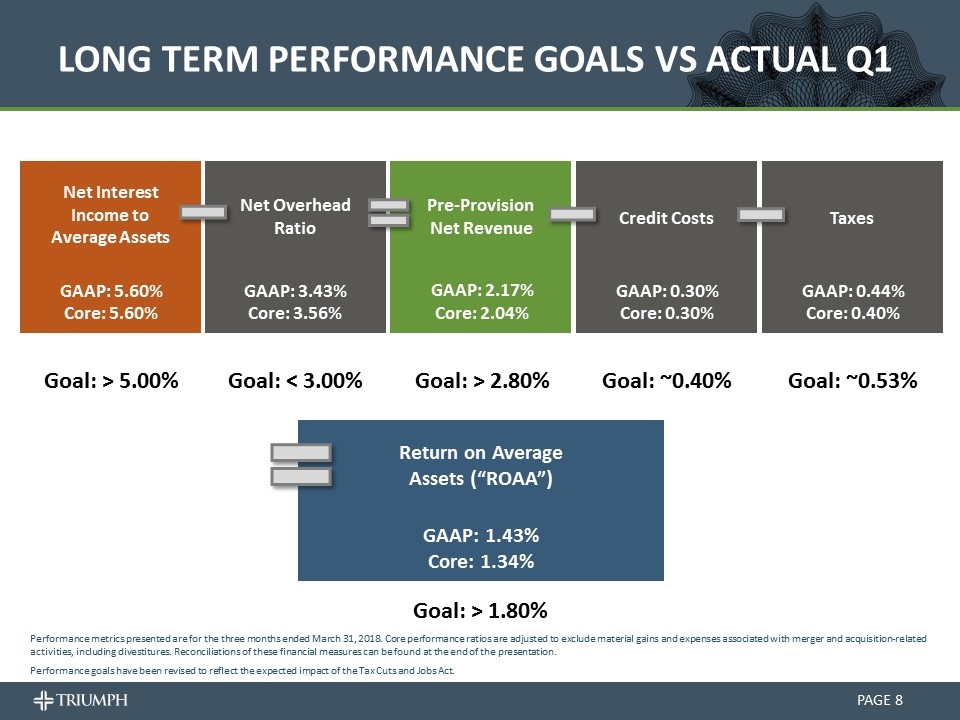

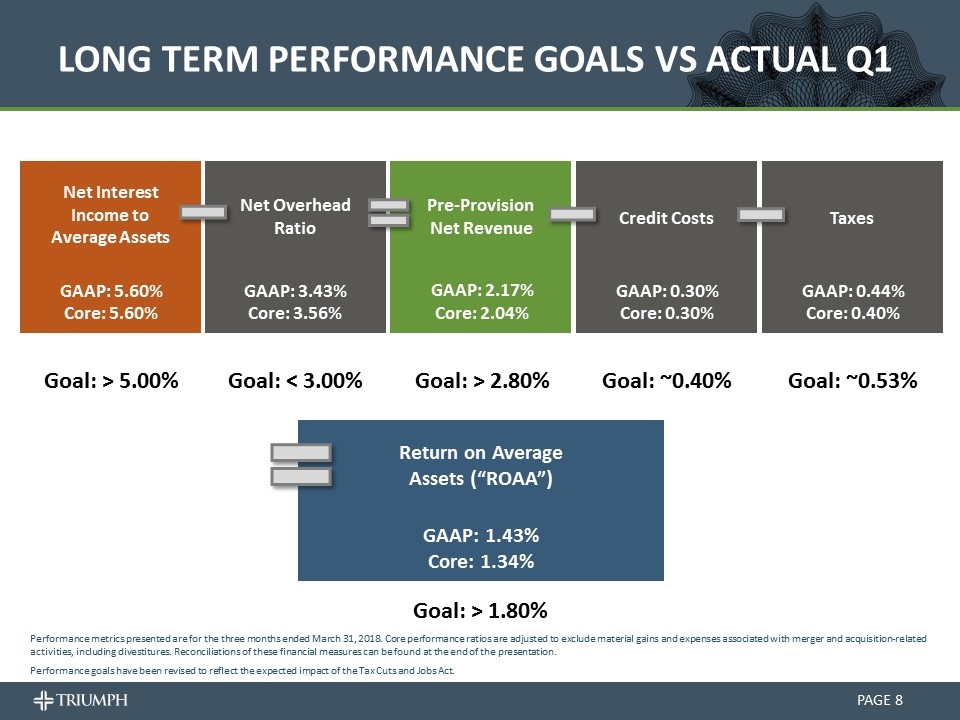

Return on Average Assets (“ROAA”) GAAP: 1.43% Core: 1.34% Goal: > 1.80% Net Overhead Ratio Net Interest Income to Average Assets Credit Costs Pre-Provision Net Revenue Taxes GAAP: 5.60% Core: 5.60% Goal: > 5.00% GAAP: 3.43% Core: 3.56% Goal: < 3.00% GAAP: 2.17% Core: 2.04% Goal: > 2.80% GAAP: 0.30% Core: 0.30% Goal: ~0.40% GAAP: 0.44% Core: 0.40% Goal: ~0.53% Long term performance goals vs Actual Q1 PAGE Performance metrics presented are for the three months ended March 31, 2018. Core performance ratios are adjusted to exclude material gains and expenses associated with merger and acquisition-related activities, including divestitures. Reconciliations of these financial measures can be found at the end of the presentation. Performance goals have been revised to reflect the expected impact of the Tax Cuts and Jobs Act.

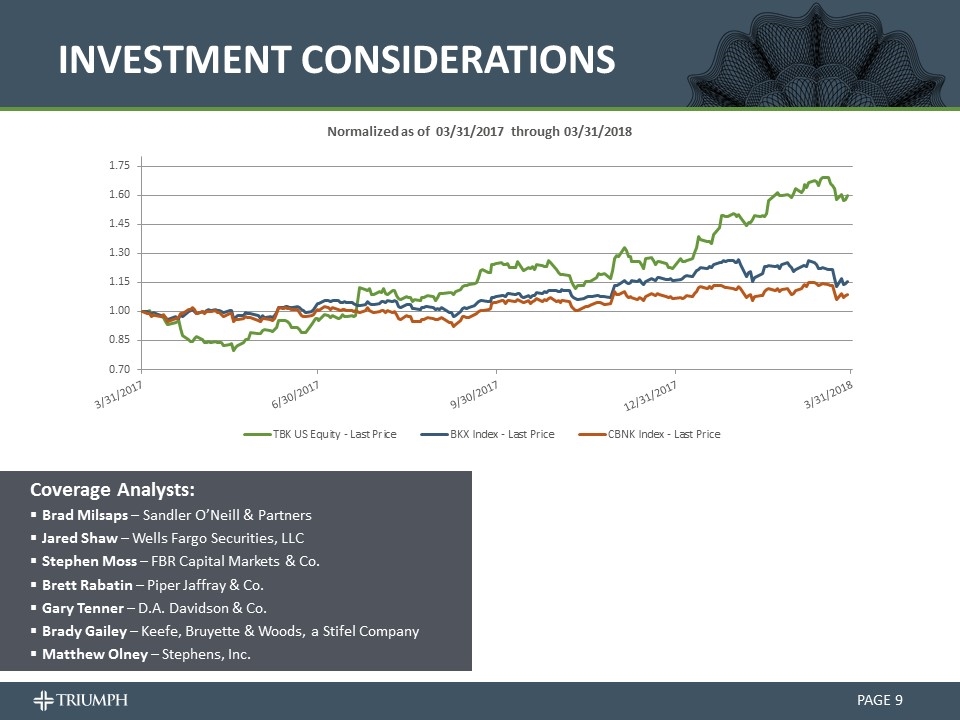

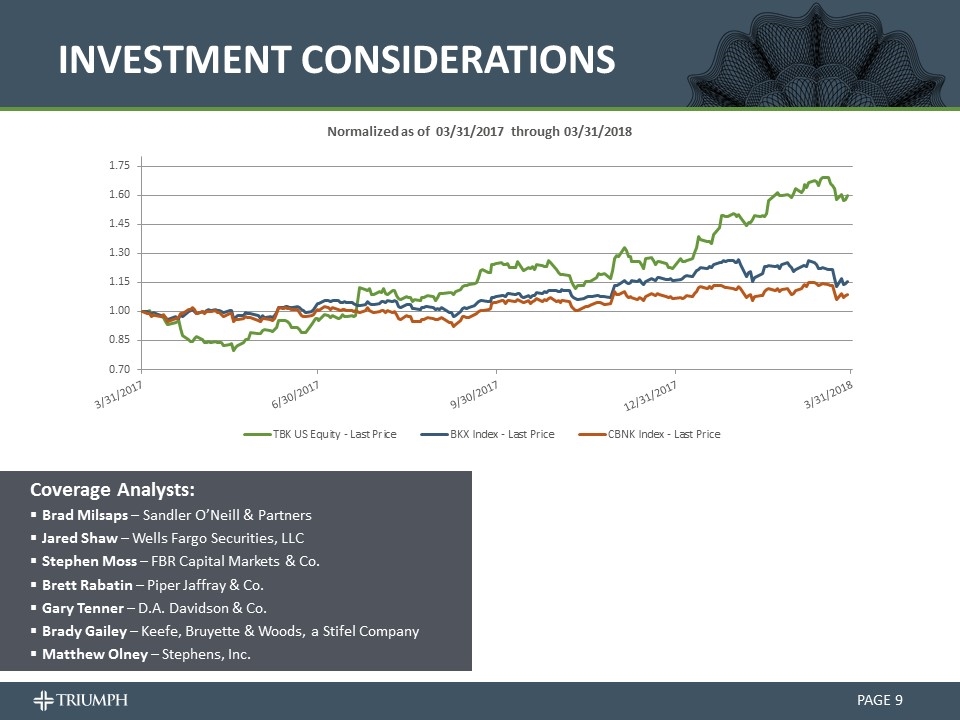

INVESTMENT CONSIDERATIONS PAGE Coverage Analysts: Brad Milsaps – Sandler O’Neill & Partners Jared Shaw – Wells Fargo Securities, LLC Stephen Moss – FBR Capital Markets & Co. Brett Rabatin – Piper Jaffray & Co. Gary Tenner – D.A. Davidson & Co. Brady Gailey – Keefe, Bruyette & Woods, a Stifel Company Matthew Olney – Stephens, Inc.

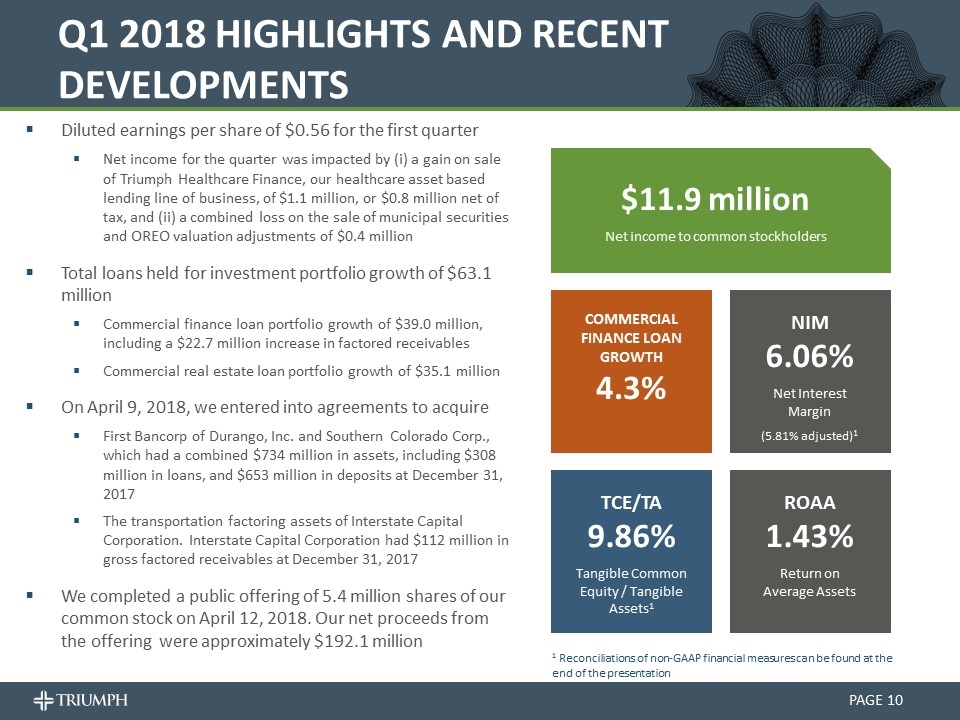

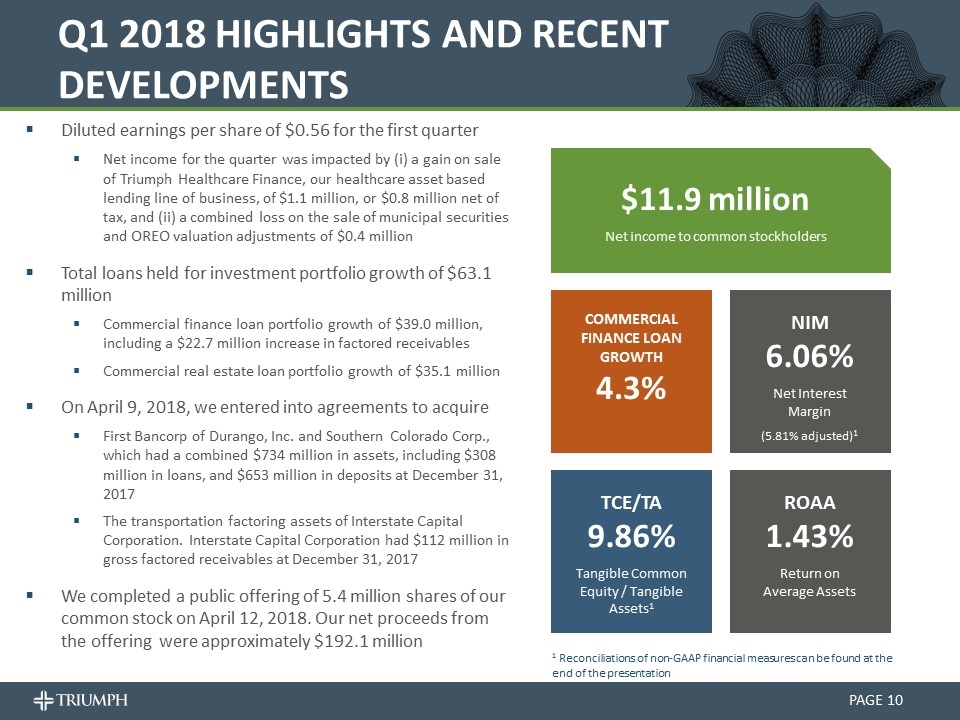

Q1 2018 HIGHLIGHTS and recent developments PAGE Diluted earnings per share of $0.56 for the first quarter Net income for the quarter was impacted by (i) a gain on sale of Triumph Healthcare Finance, our healthcare asset based lending line of business, of $1.1 million, or $0.8 million net of tax, and (ii) a combined loss on the sale of municipal securities and OREO valuation adjustments of $0.4 million Total loans held for investment portfolio growth of $63.1 million Commercial finance loan portfolio growth of $39.0 million, including a $22.7 million increase in factored receivables Commercial real estate loan portfolio growth of $35.1 million On April 9, 2018, we entered into agreements to acquire First Bancorp of Durango, Inc. and Southern Colorado Corp., which had a combined $734 million in assets, including $308 million in loans, and $653 million in deposits at December 31, 2017 The transportation factoring assets of Interstate Capital Corporation. Interstate Capital Corporation had $112 million in gross factored receivables at December 31, 2017 We completed a public offering of 5.4 million shares of our common stock on April 12, 2018. Our net proceeds from the offering were approximately $192.1 million $11.9 million Net income to common stockholders COMMERCIAL FINANCE LOAN GROWTH 4.3% NIM 6.06% Net Interest Margin (5.81% adjusted)1 ROAA 1.43% Return on Average Assets TCE/TA 9.86% Tangible Common Equity / Tangible Assets1 1 Reconciliations of non-GAAP financial measures can be found at the end of the presentation

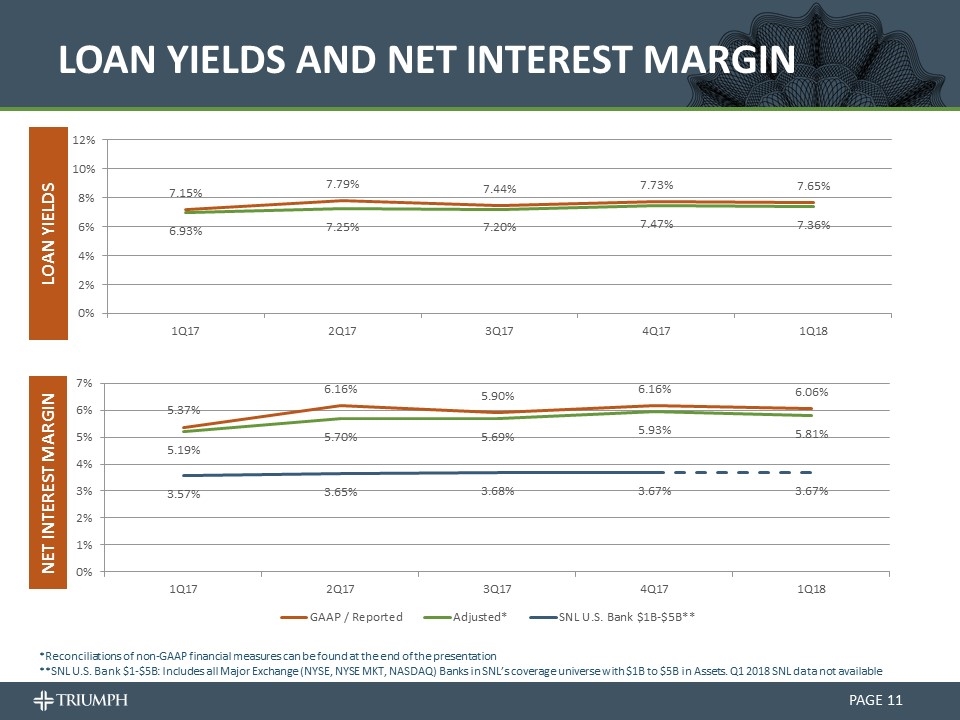

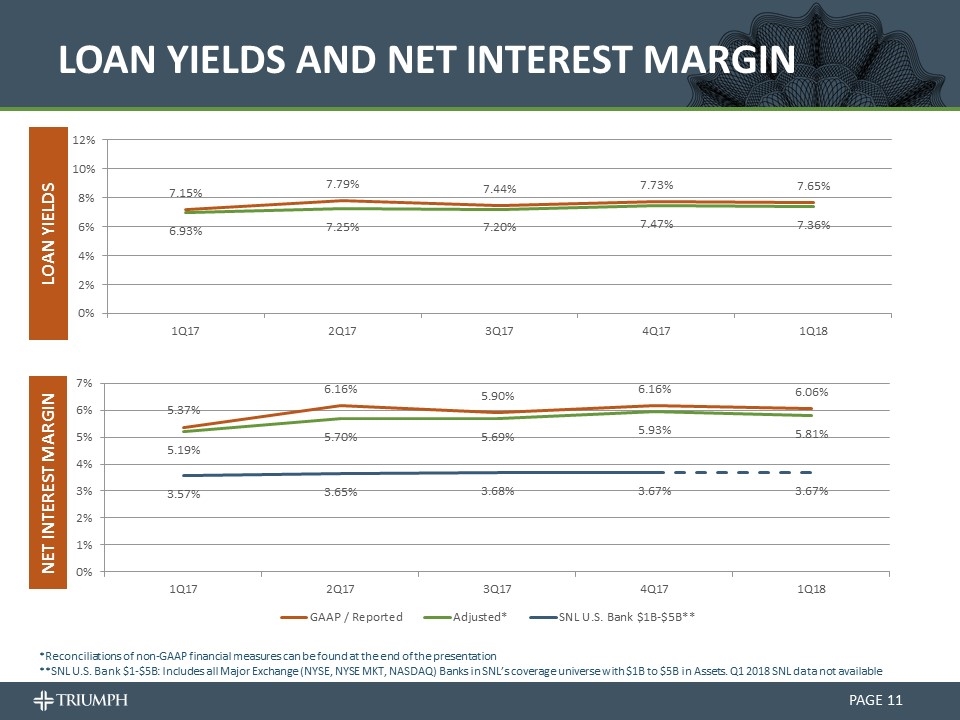

loan yields and NET INTEREST MARGIN PAGE *Reconciliations of non-GAAP financial measures can be found at the end of the presentation **SNL U.S. Bank $1-$5B: Includes all Major Exchange (NYSE, NYSE MKT, NASDAQ) Banks in SNL’s coverage universe with $1B to $5B in Assets. Q1 2018 SNL data not available Net Interest Margin Loan yields

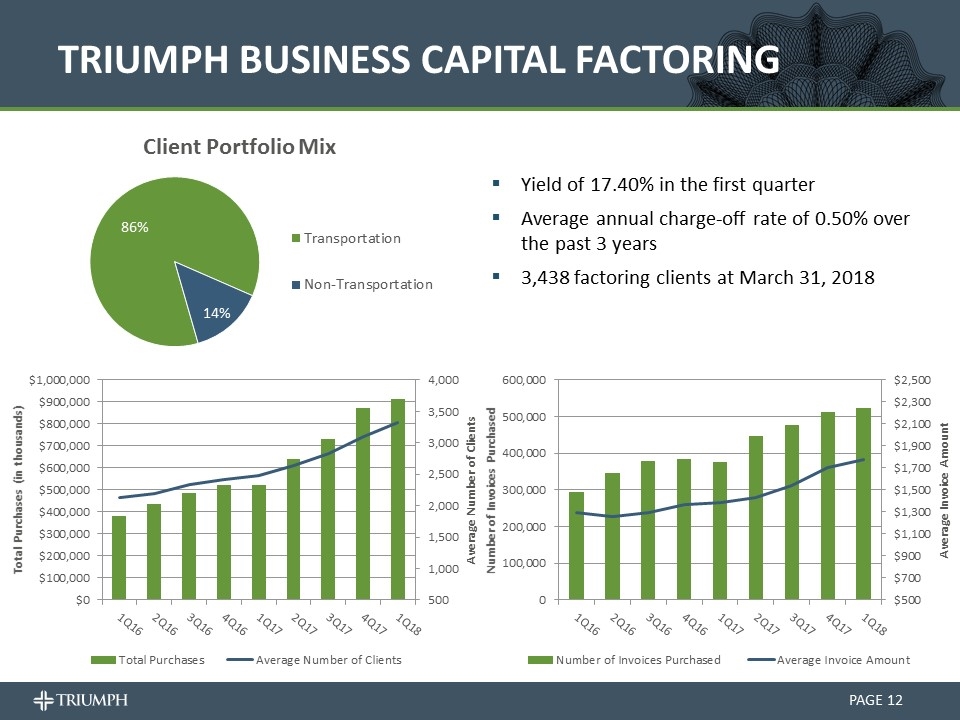

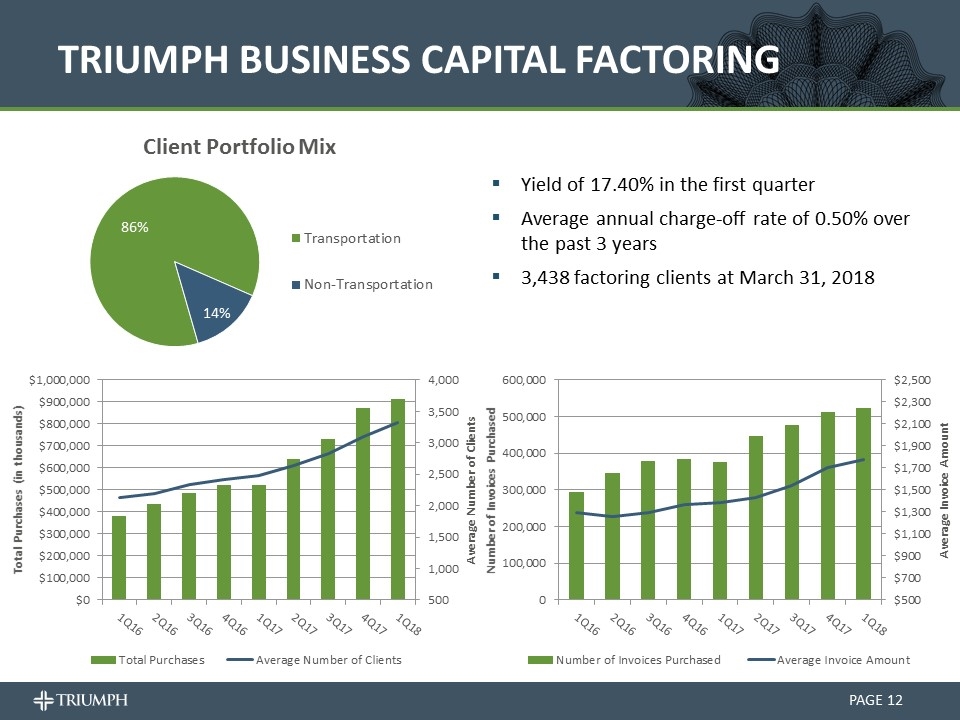

TRIUMPH BUSINESS CAPITAL FACTORING PAGE Yield of 17.40% in the first quarter Average annual charge-off rate of 0.50% over the past 3 years 3,438 factoring clients at March 31, 2018

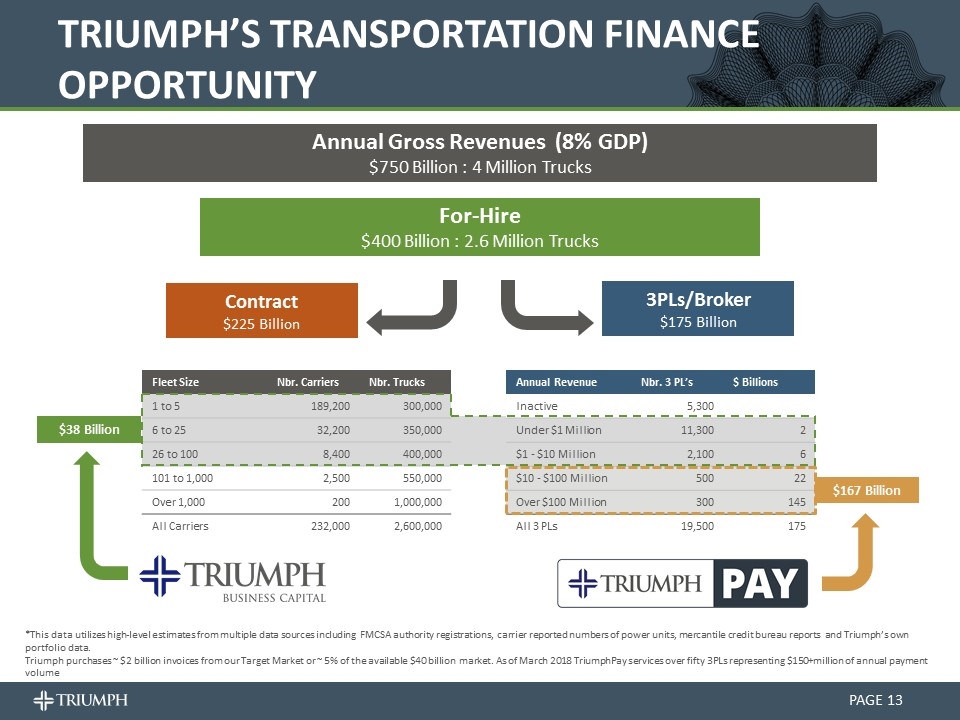

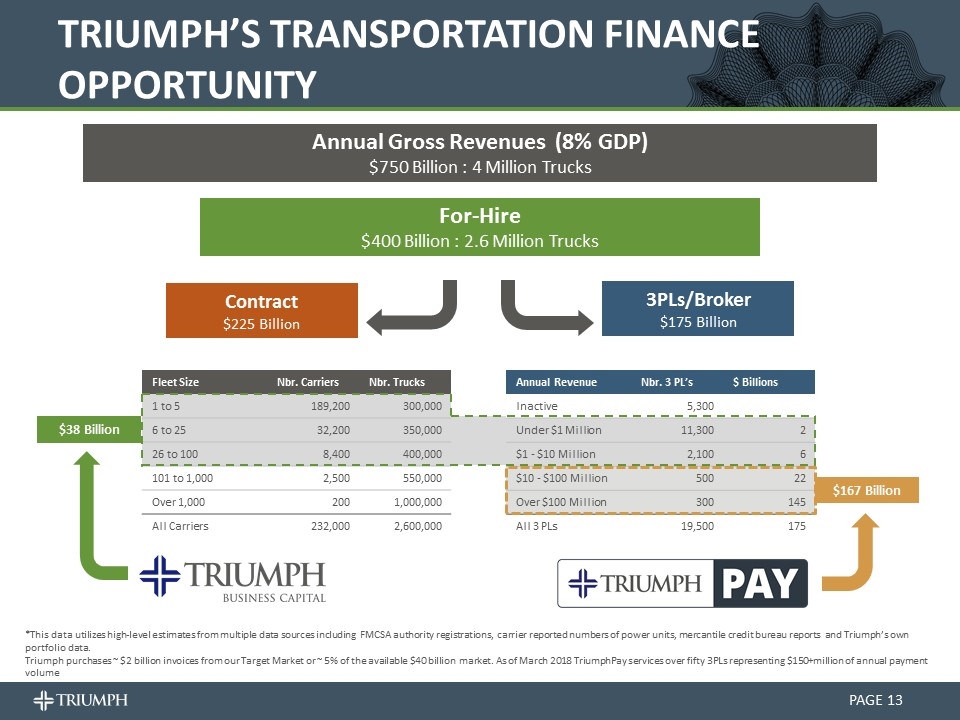

Annual Gross Revenues (8% GDP) $750 Billion : 4 Million Trucks For-Hire $400 Billion : 2.6 Million Trucks *This data utilizes high-level estimates from multiple data sources including FMCSA authority registrations, carrier reported numbers of power units, mercantile credit bureau reports and Triumph’s own portfolio data. Triumph purchases ~ $2 billion invoices from our Target Market or ~ 5% of the available $40 billion market. As of March 2018 TriumphPay services over fifty 3PLs representing $150+million of annual payment volume Contract $225 Billion 3PLs/Broker $175 Billion Fleet Size Nbr. Carriers Nbr. Trucks 1 to 5 189,200 300,000 6 to 25 32,200 350,000 26 to 100 8,400 400,000 101 to 1,000 2,500 550,000 Over 1,000 200 1,000,000 All Carriers 232,000 2,600,000 Annual Revenue Nbr. 3 PL’s $ Billions Inactive 5,300 Under $1 Million 11,300 2 $1 - $10 Million 2,100 6 $10 - $100 Million 500 22 Over $100 Million 300 145 All 3 PLs 19,500 175 $167 Billion triumph’s transportation finance opportunity PAGE $38 Billion

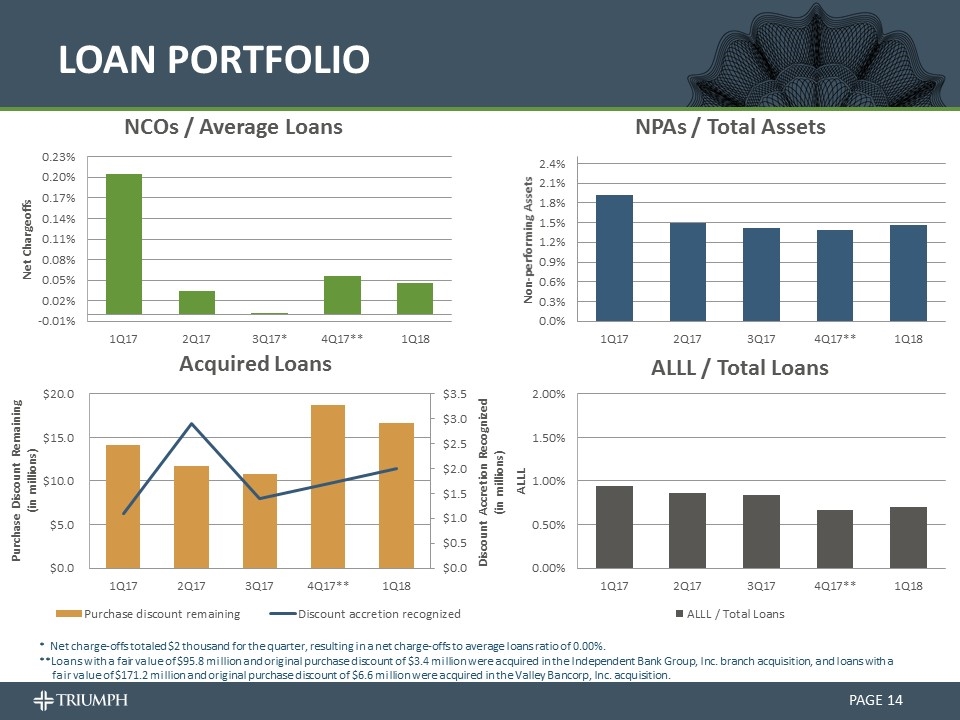

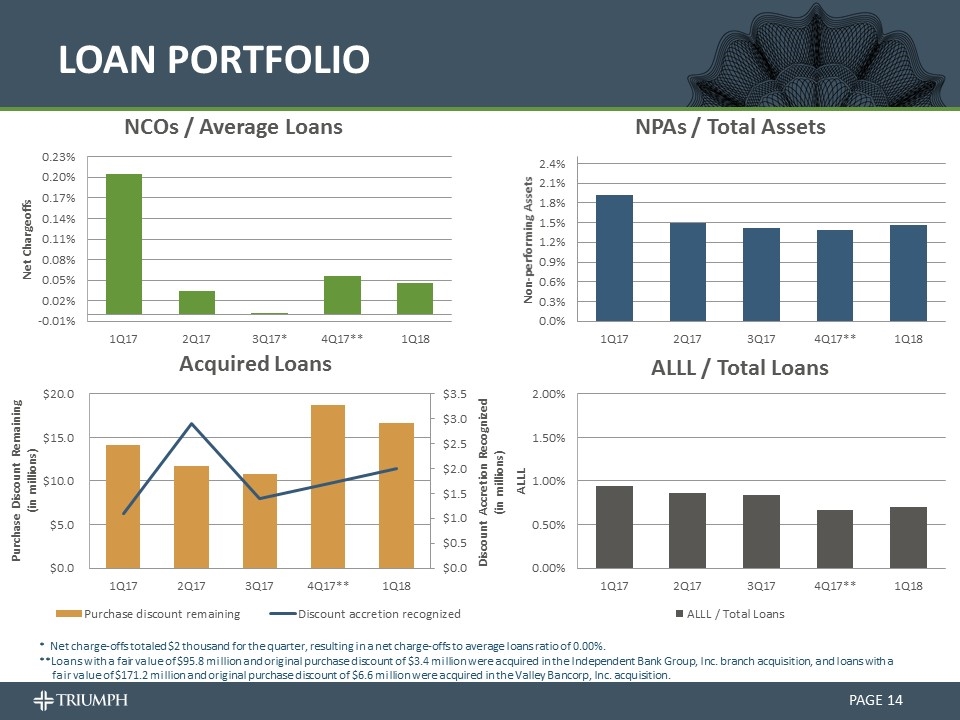

Loan portfolio PAGE * Net charge-offs totaled $2 thousand for the quarter, resulting in a net charge-offs to average loans ratio of 0.00%. **Loans with a fair value of $95.8 million and original purchase discount of $3.4 million were acquired in the Independent Bank Group, Inc. branch acquisition, and loans with a fair value of $171.2 million and original purchase discount of $6.6 million were acquired in the Valley Bancorp, Inc. acquisition.

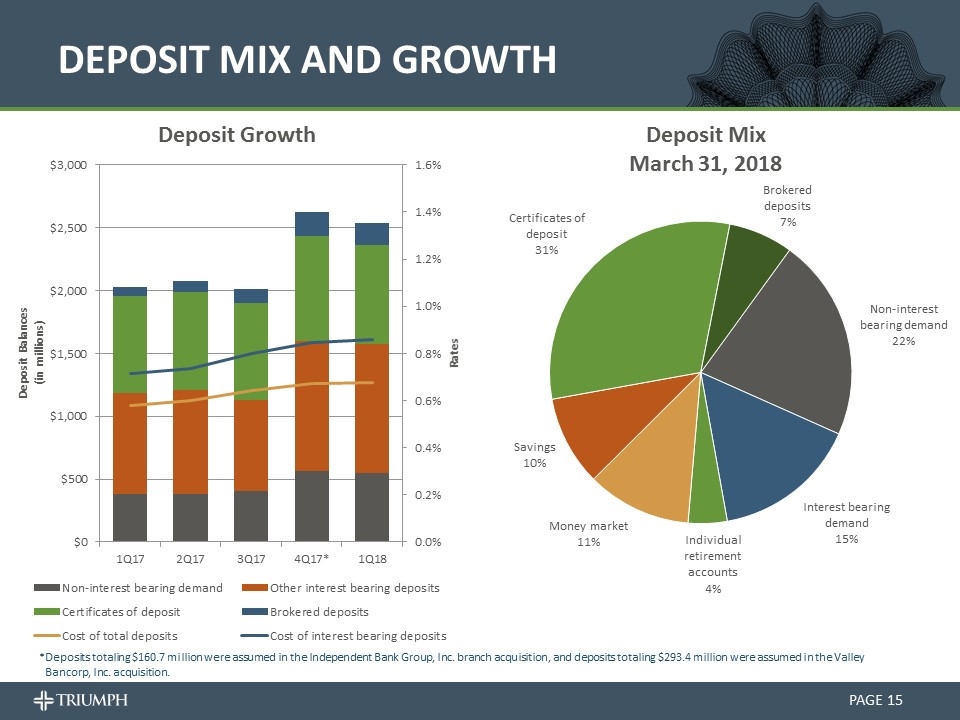

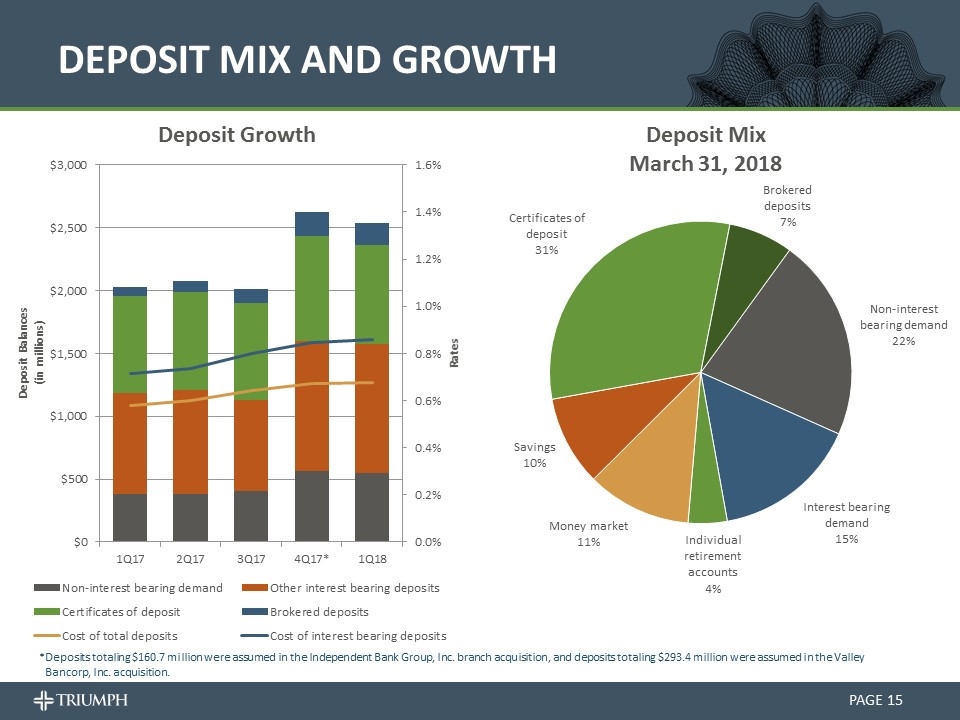

DEPOSIT MIX AND GROWTH PAGE *Deposits totaling $160.7 million were assumed in the Independent Bank Group, Inc. branch acquisition, and deposits totaling $293.4 million were assumed in the Valley Bancorp, Inc. acquisition.

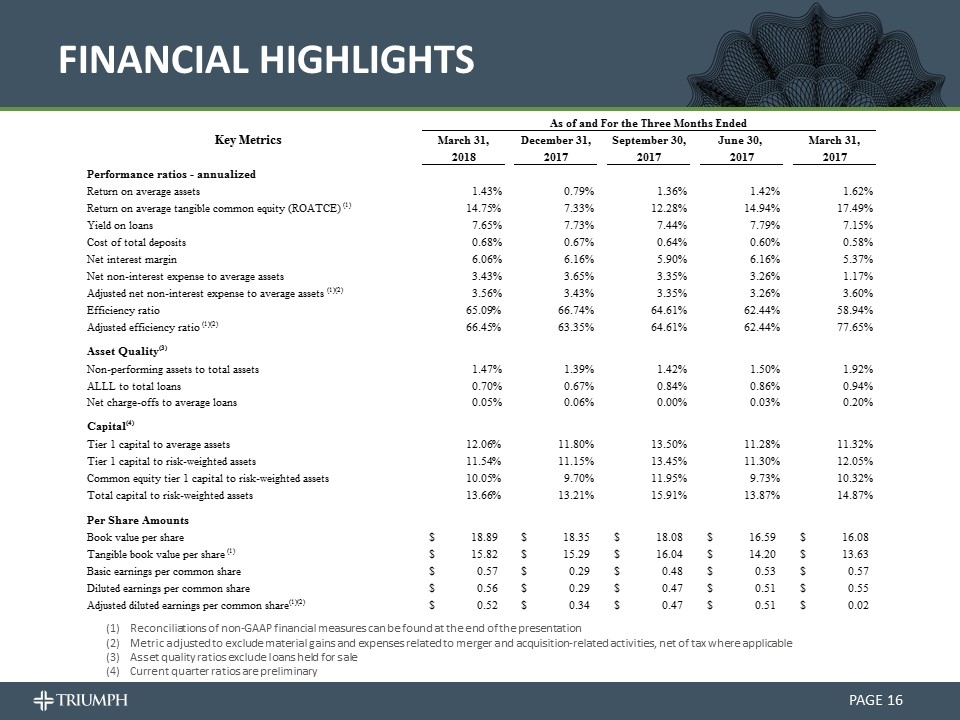

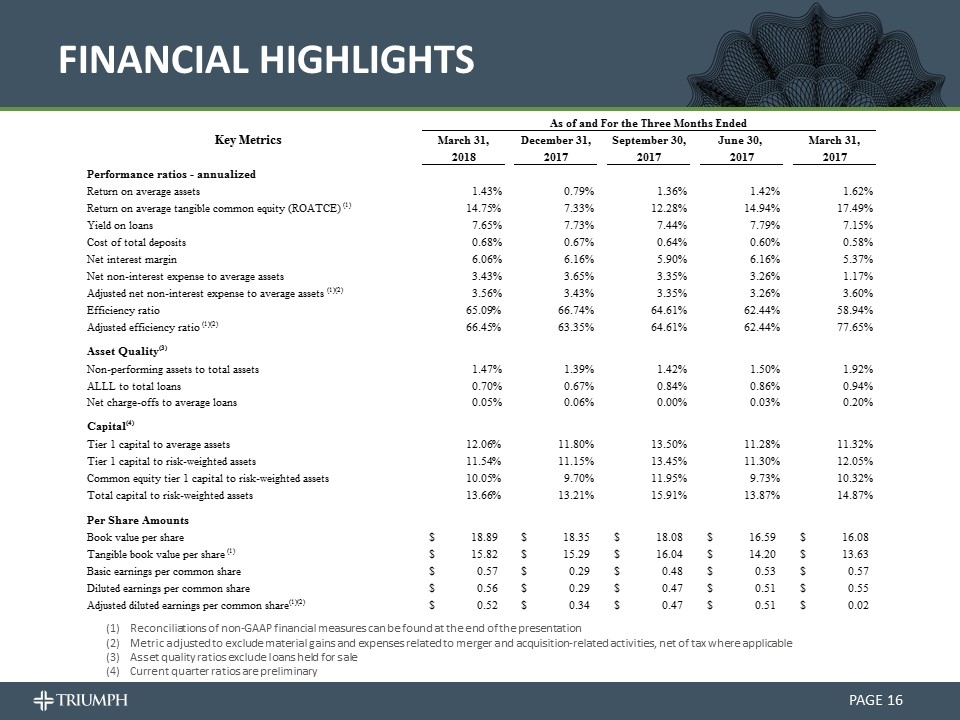

FINANCIAL HIGHLIGHTS PAGE Reconciliations of non-GAAP financial measures can be found at the end of the presentation Metric adjusted to exclude material gains and expenses related to merger and acquisition-related activities, net of tax where applicable Asset quality ratios exclude loans held for sale Current quarter ratios are preliminary 43190QTD 43100QTD 43008QTD 42916QTD 42825QTD 43190 43100 43008 42916 42825 As of and For the Three Months Ended Key Metrics March 31, December 31, September 30, June 30, March 31, 2018 2017 2017 2017 2017 Performance ratios - annualized ROAA Return on average assets 1.43488217291413% .786268711225136% 1.362122945798712% 1.422649038849168% 1.621644543200632% ROATCE Return on average tangible common equity (ROATCE) (1) 0.14748163086412747 7.328496087154611% 0.12284750027325204 0.1494382760960809 0.17489447171383407 Yield_Loans Yield on loans 7.65% 7.729999999999999% 7.439999999999999% 7.79% 7.149999999999999% CostOfTotalDeposits Cost of total deposits .676491909921952% .67167243603311% .64135770121693% .598090330467494% .578708942203601% NIM Net interest margin 6.615380371230043% 6.16258340526653% 5.897814119286116% 6.157029032674648% 5.371248944642441% Net_Nonint_Exp_Avg_Assets Net non-interest expense to average assets 3.432773044113241% 3.645047693626371% 3.349770781048048% 3.257901530873664% 1.16897342900296% Net_Nonint_Exp_Avg_Assets_Adj Adjusted net non-interest expense to average assets (1)(2) 3.560131312614495% 3.434563871673167% 3.349770781048048% 3.257901530873664% 3.603118626204888% Efficiency_Unadjusted Efficiency ratio 0.65088187279611953 0.66735544056766694 0.64613842771467411 0.62438219436777309 0.58938878398917471 Efficiency Adjusted efficiency ratio (1)(2) 0.66449018609204968 0.63345574992939546 0.64613842771467411 0.62438219436777309 0.77649901400000509 Asset Quality(3) Nonperforming assets to total assets Non-performing assets to total assets 1.467837098863146% 1.385725713361377% 1.417987509983102% 1.499638310083182% 1.919397668172598% ALLL to total loans ALLL to total loans .696663343754404% .66698543077269% .839715963508823% .862576794039476% .938122163719588% Net charge-offs to average loans Net charge-offs to average loans 46044991812014998.46044991812015% 56550519897419628.565505198974196% 87132453527905912.871324535279059% 34795297811221227.347952978112212% .204879837205254% Capital(4) Tier 1 capital to average assets Tier 1 capital to average assets 0.1206000287157459 0.117979 0.13503599999999999 0.11279400000000001 0.11315751101109683 Tier 1 capital to risk-weighted assets Tier 1 capital to risk-weighted assets 0.11535735876901632 0.11149199999999999 0.13445799999999999 0.11294999999999999 0.12049186526785988 Common equity tier 1 capital to risk-weighted assets Common equity tier 1 capital to risk-weighted assets 0.10049263549053036 9.7041% 0.11952699999999999 9.7329% 0.1032499892847283 Total capital to risk-weighted assets Total capital to risk-weighted assets 0.13662722385560225 0.13211899999999999 0.159106 0.138684 0.14865483669064053 Per Share Amounts Common Book Value per share, basic Book value per share $18.885720879181353 $18.349289063706372 $18.079930731140394 $16.589444167502869 $16.078499990790306 Tangible common book value per common share Tangible book value per share (1) $15.816120581282371 $15.286026662808258 $16.04102090159412 $14.200295420647416 $13.631839395149086 EPS_Basic Basic earnings per common share $0.5731969840679455 $0.29495941598035236 $0.48392442055470947 $0.52554545180094692 $0.57260226413786142 EPS_Diluted Diluted earnings per common share $0.55972335628645931 $0.29303085682044722 $0.47381076124417193 $0.51125508581669088 $0.55378594711677598 DilutedEPS_Adj Adjusted diluted earnings per common share(1)(2) $0.52 $0.34355943362214086 $0.47 $0.51 $0.02

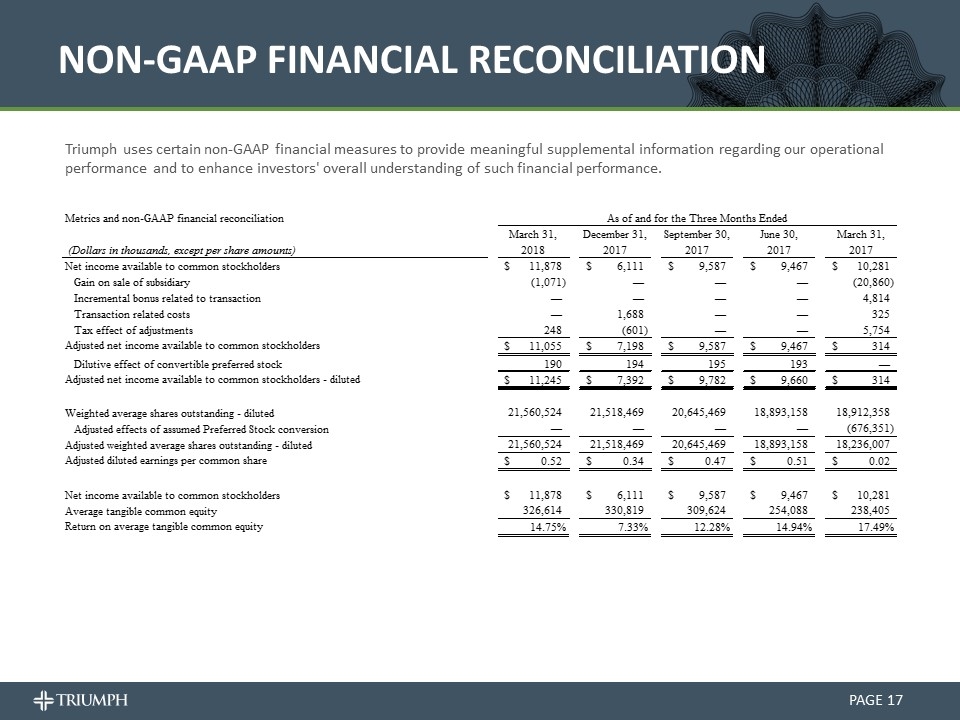

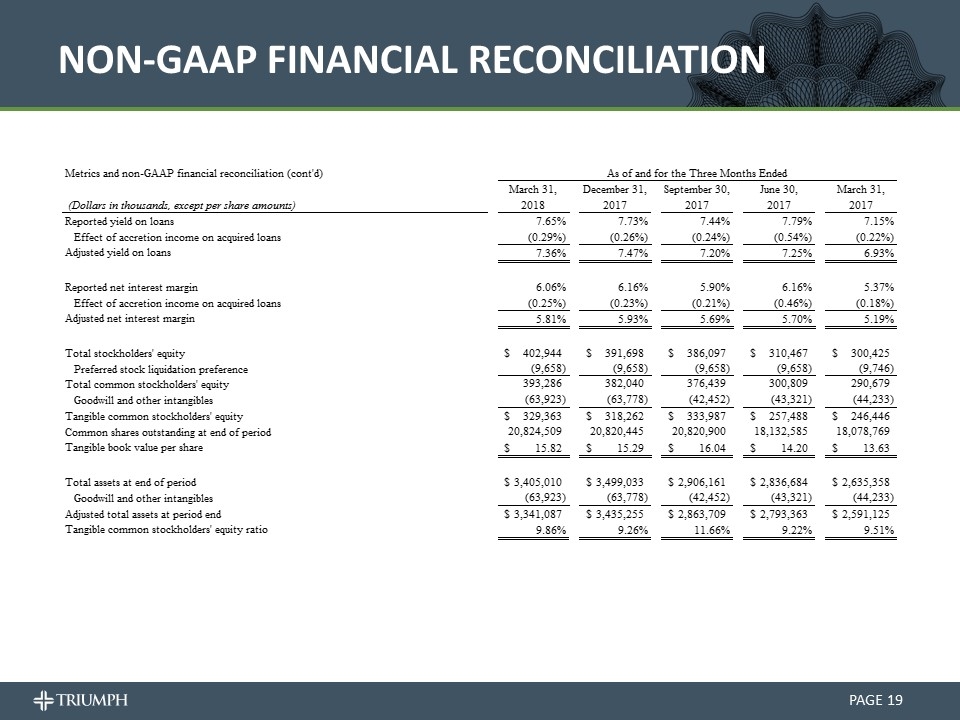

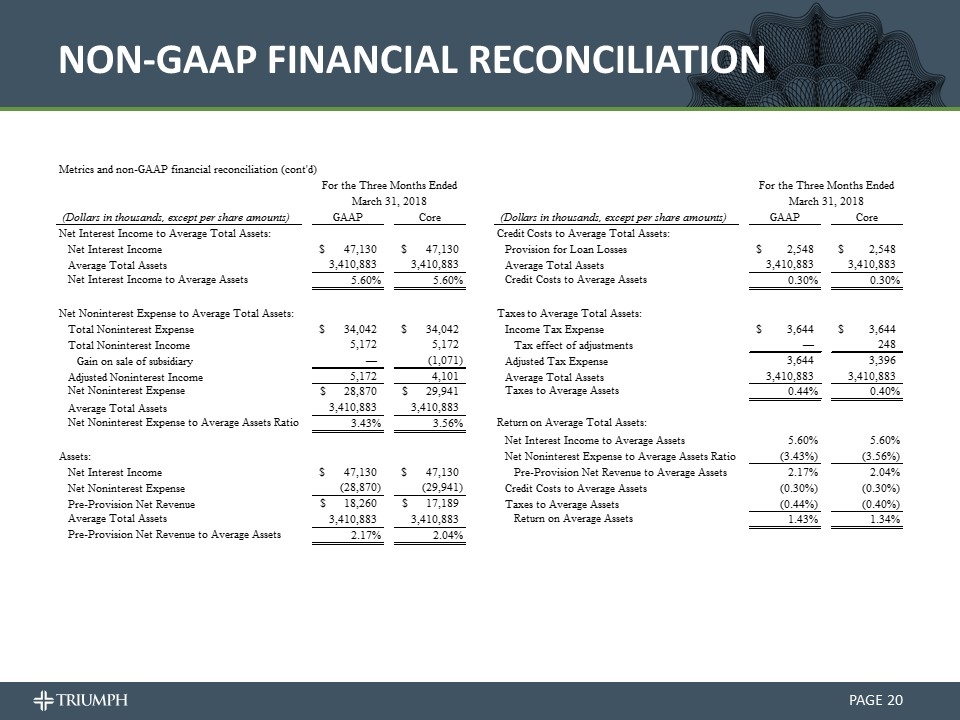

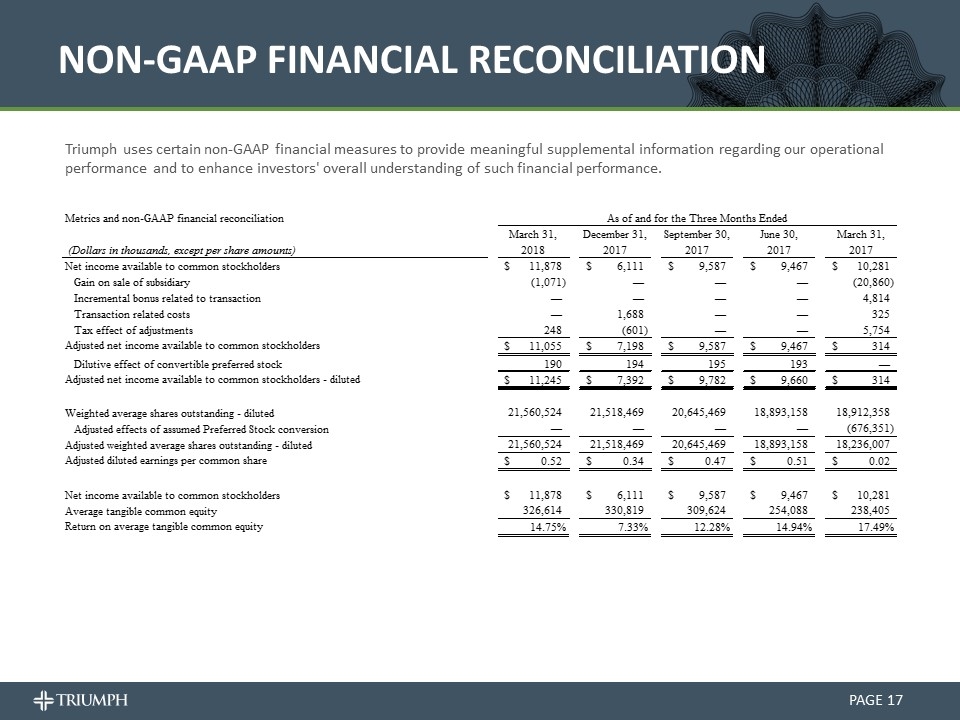

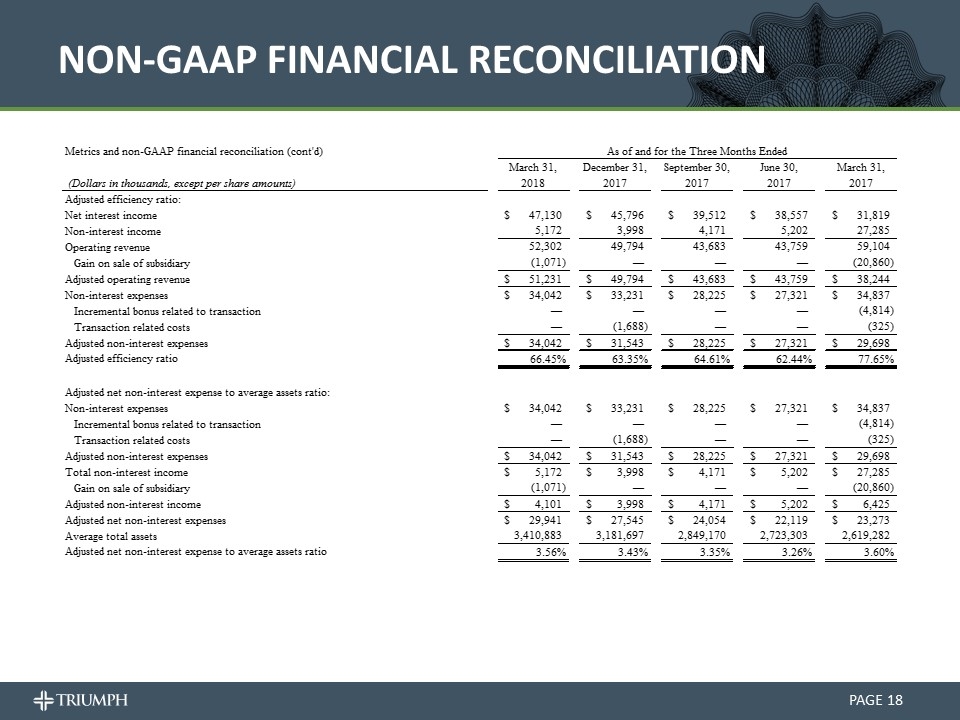

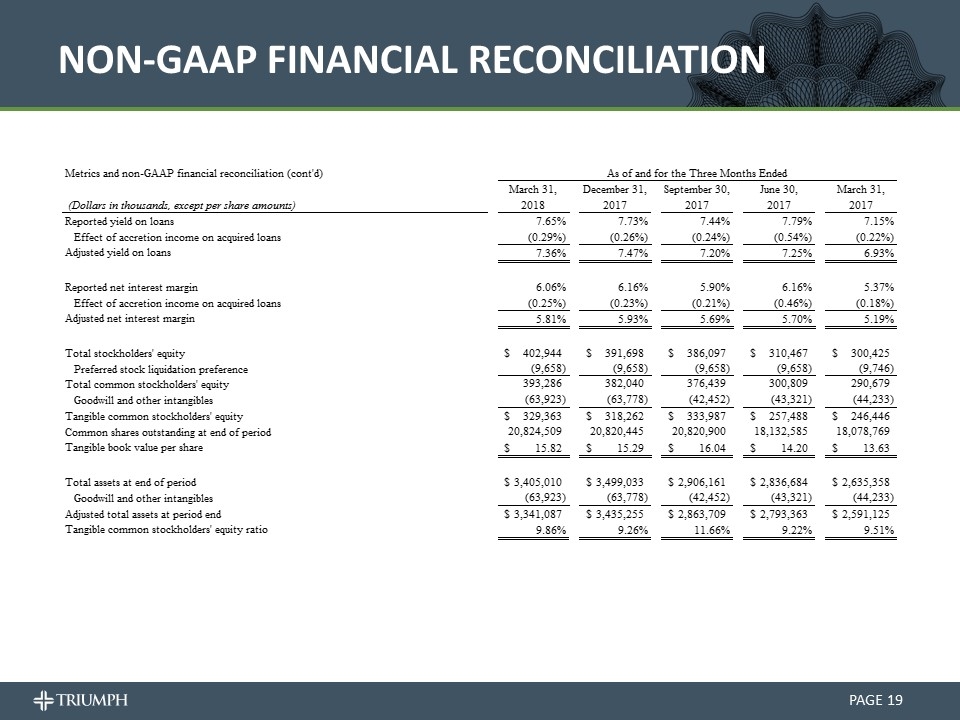

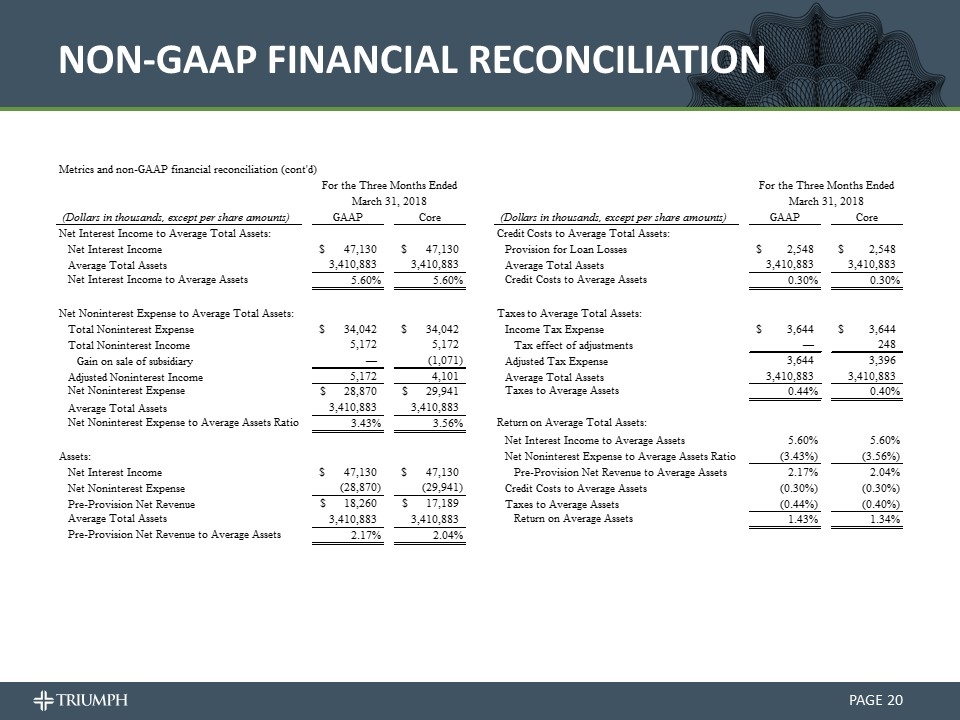

NON-GAAP FINANCIAL RECONCILIATION PAGE Triumph uses certain non-GAAP financial measures to provide meaningful supplemental information regarding our operational performance and to enhance investors' overall understanding of such financial performance. 43190QTD 42916QTD 42825QTD 42460QTD 42185QTD Period end date 43190 43100 43008 42916 42825 Quarter Days in Year 365 365 365 365 365 Days in Quarter 90 92 92 91 90 As of and for the Three Months Ended (Dollars in thousands, March 31, December 31, September 30, June 30, March 31, except per share amounts) 2018 2017 2017 2017 2017 Net income available to common stockholders $11,878 $6,111 $9,587 $9,467 $10,281 Gain on sale of subsidiary -1,071 0 0 0 ,-20,860 Manual Adj Incremental bonus related to transaction 0 0 0 0 4,814 Transaction related costs 0 1,688 0 0 325 Tax effect of adjustments 248.36490000000001 -,601 0 0 5,754 Adjusted net income available to common stockholders $11,055.3649 $7,198 $9,587 $9,467 $314 Manual Adj Dilutive effect of convertible preferred stock 190 194 195 193 0 Adjusted net income available to common stockholders - diluted $11,245.3649 $7,392 $9,782 $9,660 $314 Diluted_Shrs Weighted average shares outstanding - diluted 21,560,523.777777776 21,518,468.597826086 20,645,469.184782609 18,893,158.120879121 18,912,358.388888888 Manual Adj Adjusted effects of assumed Preferred Stock conversion 0 0 0 0 -,676,351 Adjusted weighted average shares outstanding - diluted 21,560,523.777777776 21,518,468.597826086 20,645,469.184782609 18,893,158.120879121 18,236,007.388888888 YTD YTD Adjusted diluted earnings per common share $0.52 $0.34 $0.47380855879071665 $0.51129620247684193 $1.7218681332149422E-2 $0 $-0.37 $-0.73701044770955082 Net income available to common stockholders $11,878 $6,111 $9,587 $9,467 $10,281 AvgTangEq Average tangible common equity ,326,613.87815996399 ,330,819.26071665203 ,309,624.48608661105 ,254,087.71438832497 ,238,405.481105716 Return on average tangible common equity 0.14748879980322205 7.3286930780113405E-2 0.12284358034959482 0.14944458475076014 0.17489181235802964 Adjusted efficiency ratio: Net interest income $47,130 $45,796 $39,512 $38,557 $31,819 Non-interest income 5,172 3,998 4,171 5,202 27,285 Operating revenue 52,302 49,794 43,683 43,759 59,104 Manual Adj Gain on sale of subsidiary -1,071 0 0 0 ,-20,860 Adjusted operating revenue $51,231 $49,794 $43,683 $43,759 $38,244 Non-interest expenses $34,042 $33,231 $28,225 $27,321 $34,837 Incremental bonus related to transaction 0 0 0 0 -4,814 Manual Adj Transaction related costs 0 -1,688 0 0 -,325 Adjusted non-interest expenses $34,042 $31,543 $28,225 $27,321 $29,698 Adjusted efficiency ratio 0.66448049032812162 0.63346989597140213 0.64613236270402674 0.6243515619643959 0.77654011086706409 Adjusted net non-interest expense to average assets ratio: Non-interest expenses $34,042 $33,231 $28,225 $27,321 $34,837 Incremental bonus related to transaction 0 0 0 0 -4,814 Manual Adj Transaction related costs 0 -1,688 0 0 -,325 Adjusted non-interest expenses $34,042 $31,543 $28,225 $27,321 $29,698 Total non-interest income $5,172 $3,998 $4,171 $5,202 $27,285 Gain on sale of subsidiary -1,071 0 0 0 ,-20,860 Adjusted non-interest income $4,101 $3,998 $4,171 $5,202 $6,425 Adjusted net non-interest expenses $29,941 $27,545 $24,054 $22,119 $23,273 AvgAssets Average total assets $3,410,883 $3,181,697 $2,849,170 $2,723,303 $2,619,282 CHECK ROUNDING $0 $0 Adjusted net non-interest expense to average assets ratio 3.559998653981649E-2 3.4347014652325744E-2 3.3494537158113631E-2 3.2577743252978436E-2 3.6034663104027913E-2 As of and for the Three Months Ended (Dollars in thousands, March 31, December 31, September 30, June 30, March 31, except per share amounts) 2018 2017 2017 2017 2017 Reported yield on loans 7.65% 7.729999999999999% 7.439999999999999% 7.79% 7.149999999999999% DisAcrLYLD Effect of accretion income on acquired loans -0.29% -0.259999999999999% -0.24% -0.54% -0.219999999999999% Adjusted yield on loans 7.3595524365644024E-2 7.4670195642022277E-2 7.1993057351056461E-2 7.2487574833300081E-2 6.9287190236321197E-2 Reported net interest margin 6.615380371230043% 6.16258340526653% 5.897814119286116% 6.157029032674648% 5.371248944642441% DisAcrLNIM Effect of accretion income on acquired loans -0.25% -0.23% -0.21% -0.46% -0.18% Adjusted net interest margin 5.8073183053593158E-2 5.9341455831213086E-2 5.687540444635214E-2 5.6963855528600359E-2 5.1889117637716406E-2 Total stockholders' equity $,402,944 $,391,698 $,386,097 $,310,467 $,300,425 Preferred_Stock_A Preferred_Stock_B Preferred stock liquidation preference -9,658 -9,658 -9,658 -9,658 -9,746 Total common stockholders' equity ,393,286 ,382,040 ,376,439 ,300,809 ,290,679 Goodwill and other intangibles ,-63,923 ,-63,778 ,-42,452 ,-43,321 ,-44,233 Tangible common stockholders' equity $,329,363 $,318,262 $,333,987 $,257,488 $,246,446 Common shares outstanding, end of period Common shares outstanding 20,824,509 20,820,445 20,820,900 18,132,585 18,078,769 Tangible book value per share $15.816123203673133 $15.28603255117746 $16.04094923850554 $14.200291905428818 $13.631790969838709 Total assets at end of period $3,405,010 $3,499,033 $2,906,161 $2,836,684 $2,635,358 Goodwill and other intangibles ,-63,923 ,-63,778 ,-42,452 ,-43,321 ,-44,233 Adjusted total assets at period end $3,341,087 $3,435,255 $2,863,709 $2,793,363 $2,591,125 Tangible common stockholders' equity ratio 9.8579594006381749E-2 9.2645815230601516E-2 0.11662742268854831 9.2178495956307865E-2 9.5111582806695932E-2 $0 $0 $0 $0 $0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 $0 $0 $0 $0 $0 0 0 0 0 0 Slide Deck Presentation: Metrics and non-GAAP financial reconciliation As of and for the Three Months Ended March 31, December 31, September 30, June 30, March 31, (Dollars in thousands, except per share amounts) 2018 2017 2017 2017 2017 Net income available to common stockholders $11,878 $6,111 $9,587 $9,467 $10,281 Gain on sale of subsidiary -1,071 0 0 0 ,-20,860 Incremental bonus related to transaction 0 0 0 0 4,814 Transaction related costs 0 1,688 0 0 325 Tax effect of adjustments 248.36490000000001 -,601 0 0 5,754 Adjusted net income available to common stockholders $11,055.3649 $7,198 $9,587 $9,467 $314 Dilutive effect of convertible preferred stock 190 194 195 193 0 Adjusted net income available to common stockholders - diluted $11,245.3649 $7,392 $9,782 $9,660 $314 Weighted average shares outstanding - diluted 21,560,523.777777776 21,518,468.597826086 20,645,469.184782609 18,893,158.120879121 18,912,358.388888888 Adjusted effects of assumed Preferred Stock conversion 0 0 0 0 -,676,351 Adjusted weighted average shares outstanding - diluted 21,560,523.777777776 21,518,468.597826086 20,645,469.184782609 18,893,158.120879121 18,236,007.388888888 Adjusted diluted earnings per common share $0.52 $0.34 $0.47380855879071665 $0.51129620247684193 $1.7218681332149422E-2 Net income available to common stockholders $11,878 $6,111 $9,587 $9,467 $10,281 Average tangible common equity ,326,613.87815996399 ,330,819.26071665203 ,309,624.48608661105 ,254,087.71438832497 ,238,405.481105716 Return on average tangible common equity 0.14748879980322205 7.3286930780113405E-2 0.12284358034959482 0.14944458475076014 0.17489181235802964 Metrics and non-GAAP financial reconciliation (cont'd) As of and for the Three Months Ended March 31, December 31, September 30, June 30, March 31, (Dollars in thousands, except per share amounts) 2018 2017 2017 2017 2017 Adjusted efficiency ratio: Net interest income $47,130 $45,796 $39,512 $38,557 $31,819 Non-interest income 5,172 3,998 4,171 5,202 27,285 Operating revenue 52,302 49,794 43,683 43,759 59,104 Gain on sale of subsidiary -1,071 0 0 0 ,-20,860 Adjusted operating revenue $51,231 $49,794 $43,683 $43,759 $38,244 Non-interest expenses $34,042 $33,231 $28,225 $27,321 $34,837 Incremental bonus related to transaction 0 0 0 0 -4,814 Transaction related costs 0 -1,688 0 0 -,325 Adjusted non-interest expenses $34,042 $31,543 $28,225 $27,321 $29,698 Adjusted efficiency ratio 0.66448049032812162 0.63346989597140213 0.64613236270402674 0.6243515619643959 0.77654011086706409 Adjusted net non-interest expense to average assets ratio: Non-interest expenses $34,042 $33,231 $28,225 $27,321 $34,837 Incremental bonus related to transaction 0 0 0 0 -4,814 Transaction related costs 0 -1,688 0 0 -,325 Adjusted non-interest expenses $34,042 $31,543 $28,225 $27,321 $29,698 Total non-interest income $5,172 $3,998 $4,171 $5,202 $27,285 Gain on sale of subsidiary -1,071 0 0 0 ,-20,860 Adjusted non-interest income $4,101 $3,998 $4,171 $5,202 $6,425 Adjusted net non-interest expenses $29,941 $27,545 $24,054 $22,119 $23,273 Average total assets 3,410,883 3,181,697 2,849,170 2,723,303 2,619,282 Adjusted net non-interest expense to average assets ratio 3.559998653981649E-2 3.4347014652325744E-2 3.3494537158113631E-2 3.2577743252978436E-2 3.6034663104027913E-2 Metrics and non-GAAP financial reconciliation (cont'd) As of and for the Three Months Ended March 31, December 31, September 30, June 30, March 31, (Dollars in thousands, except per share amounts) 2018 2017 2017 2017 2017 Reported yield on loans 7.65% 7.729999999999999% 7.439999999999999% 7.79% 7.149999999999999% Effect of accretion income on acquired loans -0.29% -0.259999999999999% -0.24% -0.54% -0.219999999999999% Adjusted yield on loans 7.3595524365644024E-2 7.4670195642022277E-2 7.1993057351056461E-2 7.2487574833300081E-2 6.9287190236321197E-2 Reported net interest margin 6.615380371230043% 6.16258340526653% 5.897814119286116% 6.157029032674648% 5.371248944642441% Effect of accretion income on acquired loans -0.25% -0.23% -0.21% -0.46% -0.18% Adjusted net interest margin 5.8073183053593158E-2 5.9341455831213086E-2 5.687540444635214E-2 5.6963855528600359E-2 5.1889117637716406E-2 Total stockholders' equity $,402,944 $,391,698 $,386,097 $,310,467 $,300,425 Preferred stock liquidation preference -9,658 -9,658 -9,658 -9,658 -9,746 Total common stockholders' equity ,393,286 ,382,040 ,376,439 ,300,809 ,290,679 Goodwill and other intangibles ,-63,923 ,-63,778 ,-42,452 ,-43,321 ,-44,233 Tangible common stockholders' equity $,329,363 $,318,262 $,333,987 $,257,488 $,246,446 Common shares outstanding at end of period 20,824,509 20,820,445 20,820,900 18,132,585 18,078,769 Tangible book value per share $15.816123203673133 $15.28603255117746 $16.04094923850554 $14.200291905428818 $13.631790969838709 Total assets at end of period $3,405,010 $3,499,033 $2,906,161 $2,836,684 $2,635,358 Goodwill and other intangibles ,-63,923 ,-63,778 ,-42,452 ,-43,321 ,-44,233 Adjusted total assets at period end $3,341,087 $3,435,255 $2,863,709 $2,793,363 $2,591,125 Tangible common stockholders' equity ratio 9.8579594006381749E-2 9.2645815230601516E-2 0.11662742268854831 9.2178495956307865E-2 9.5111582806695932E-2 90 365 Metrics and non-GAAP financial reconciliation (cont'd) For the Three Months Ended For the Three Months Ended March 31, 2018 March 31, 2018 (Dollars in thousands, except per share amounts) GAAP Core (Dollars in thousands, except per share amounts) GAAP Core Net Interest Income to Average Total Assets: Credit Costs to Average Total Assets: Net Interest Income $47,130 $47,130 Provision for Loan Losses $2,548 $2,548 Average Total Assets 3,410,883 3,410,883 Average Total Assets 3,410,883 3,410,883 Net Interest Income to Average Assets 5.6000000000000001E-2 5.6000000000000001E-2 Credit Costs to Average Assets 3.0000000000000001E-3 3.0000000000000001E-3 Net Noninterest Expense to Average Total Assets: Taxes to Average Total Assets: Total Noninterest Expense $34,042 $34,042 Income Tax Expense $3,644 $3,644 Total Noninterest Income 5,172 5,172 Tax effect of adjustments 0 248.36490000000001 Gain on sale of subsidiary 0 -1,071 Adjusted Tax Expense 3,644 3,395.6351 Adjusted Noninterest Income 5,172 4,101 Average Total Assets 3,410,883 3,410,883 Net Noninterest Expense $28,870 $29,941 Taxes to Average Assets 4.4000000000000003E-3 4.0000000000000001E-3 MANUAL ADJ FOR ROUNDING Average Total Assets 3,410,883 3,410,883 Net Noninterest Expense to Average Assets Ratio 3.4299999999999997E-2 3.56E-2 Return on Average Total Assets: Net Interest Income to Average Assets 5.6% 5.6% Pre-Provision Net Revenue to Average Total Assets: Net Noninterest Expense to Average Assets Ratio -3.43% -3.56% Net Interest Income $47,130 $47,130 Pre-Provision Net Revenue to Average Assets 2.17% 2.400000000000001% Net Noninterest Expense ,-28,870 ,-29,941 Credit Costs to Average Assets -0.3% -0.3% Pre-Provision Net Revenue $18,260 $17,189 Taxes to Average Assets -0.44% -0.4% Average Total Assets 3,410,883 3,410,883 Return on Average Assets 1.4300000000000004E-2 1.3400000000000002E-2 Pre-Provision Net Revenue to Average Assets 2.1700000000000001E-2 2.0400000000000001E-2 MANUAL ADJ FOR ROUNDING 0 0 0 -4.8821729141295192E-5

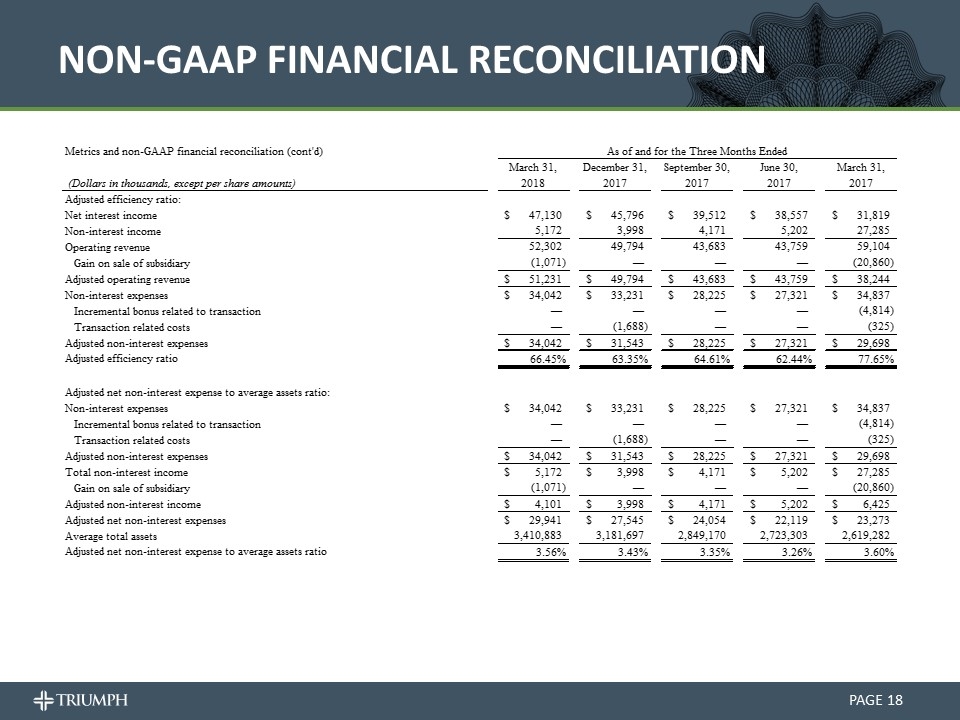

NON-GAAP FINANCIAL RECONCILIATION PAGE 43190QTD 42916QTD 42825QTD 42460QTD 42185QTD Period end date 43190 43100 43008 42916 42825 Quarter Days in Year 365 365 365 365 365 Days in Quarter 90 92 92 91 90 As of and for the Three Months Ended (Dollars in thousands, March 31, December 31, September 30, June 30, March 31, except per share amounts) 2018 2017 2017 2017 2017 Net income available to common stockholders $11,878 $6,111 $9,587 $9,467 $10,281 Gain on sale of subsidiary -1,071 0 0 0 ,-20,860 Manual Adj Incremental bonus related to transaction 0 0 0 0 4,814 Transaction related costs 0 1,688 0 0 325 Tax effect of adjustments 248.36490000000001 -,601 0 0 5,754 Adjusted net income available to common stockholders $11,055.3649 $7,198 $9,587 $9,467 $314 Manual Adj Dilutive effect of convertible preferred stock 190 194 195 193 0 Adjusted net income available to common stockholders - diluted $11,245.3649 $7,392 $9,782 $9,660 $314 Diluted_Shrs Weighted average shares outstanding - diluted 21,560,523.777777776 21,518,468.597826086 20,645,469.184782609 18,893,158.120879121 18,912,358.388888888 Manual Adj Adjusted effects of assumed Preferred Stock conversion 0 0 0 0 -,676,351 Adjusted weighted average shares outstanding - diluted 21,560,523.777777776 21,518,468.597826086 20,645,469.184782609 18,893,158.120879121 18,236,007.388888888 YTD YTD Adjusted diluted earnings per common share $0.52 $0.34 $0.47380855879071665 $0.51129620247684193 $1.7218681332149422E-2 $0 $-0.37 $-0.73701044770955082 Net income available to common stockholders $11,878 $6,111 $9,587 $9,467 $10,281 AvgTangEq Average tangible common equity ,326,613.87815996399 ,330,819.26071665203 ,309,624.48608661105 ,254,087.71438832497 ,238,405.481105716 Return on average tangible common equity 0.14748879980322205 7.3286930780113405E-2 0.12284358034959482 0.14944458475076014 0.17489181235802964 Adjusted efficiency ratio: Net interest income $47,130 $45,796 $39,512 $38,557 $31,819 Non-interest income 5,172 3,998 4,171 5,202 27,285 Operating revenue 52,302 49,794 43,683 43,759 59,104 Manual Adj Gain on sale of subsidiary -1,071 0 0 0 ,-20,860 Adjusted operating revenue $51,231 $49,794 $43,683 $43,759 $38,244 Non-interest expenses $34,042 $33,231 $28,225 $27,321 $34,837 Incremental bonus related to transaction 0 0 0 0 -4,814 Manual Adj Transaction related costs 0 -1,688 0 0 -,325 Adjusted non-interest expenses $34,042 $31,543 $28,225 $27,321 $29,698 Adjusted efficiency ratio 0.66448049032812162 0.63346989597140213 0.64613236270402674 0.6243515619643959 0.77654011086706409 Adjusted net non-interest expense to average assets ratio: Non-interest expenses $34,042 $33,231 $28,225 $27,321 $34,837 Incremental bonus related to transaction 0 0 0 0 -4,814 Manual Adj Transaction related costs 0 -1,688 0 0 -,325 Adjusted non-interest expenses $34,042 $31,543 $28,225 $27,321 $29,698 Total non-interest income $5,172 $3,998 $4,171 $5,202 $27,285 Gain on sale of subsidiary -1,071 0 0 0 ,-20,860 Adjusted non-interest income $4,101 $3,998 $4,171 $5,202 $6,425 Adjusted net non-interest expenses $29,941 $27,545 $24,054 $22,119 $23,273 AvgAssets Average total assets $3,410,883 $3,181,697 $2,849,170 $2,723,303 $2,619,282 CHECK ROUNDING $0 $0 Adjusted net non-interest expense to average assets ratio 3.559998653981649E-2 3.4347014652325744E-2 3.3494537158113631E-2 3.2577743252978436E-2 3.6034663104027913E-2 As of and for the Three Months Ended (Dollars in thousands, March 31, December 31, September 30, June 30, March 31, except per share amounts) 2018 2017 2017 2017 2017 Reported yield on loans 7.65% 7.729999999999999% 7.439999999999999% 7.79% 7.149999999999999% DisAcrLYLD Effect of accretion income on acquired loans -0.29% -0.259999999999999% -0.24% -0.54% -0.219999999999999% Adjusted yield on loans 7.3595524365644024E-2 7.4670195642022277E-2 7.1993057351056461E-2 7.2487574833300081E-2 6.9287190236321197E-2 Reported net interest margin 6.615380371230043% 6.16258340526653% 5.897814119286116% 6.157029032674648% 5.371248944642441% DisAcrLNIM Effect of accretion income on acquired loans -0.25% -0.23% -0.21% -0.46% -0.18% Adjusted net interest margin 5.8073183053593158E-2 5.9341455831213086E-2 5.687540444635214E-2 5.6963855528600359E-2 5.1889117637716406E-2 Total stockholders' equity $,402,944 $,391,698 $,386,097 $,310,467 $,300,425 Preferred_Stock_A Preferred_Stock_B Preferred stock liquidation preference -9,658 -9,658 -9,658 -9,658 -9,746 Total common stockholders' equity ,393,286 ,382,040 ,376,439 ,300,809 ,290,679 Goodwill and other intangibles ,-63,923 ,-63,778 ,-42,452 ,-43,321 ,-44,233 Tangible common stockholders' equity $,329,363 $,318,262 $,333,987 $,257,488 $,246,446 Common shares outstanding, end of period Common shares outstanding 20,824,509 20,820,445 20,820,900 18,132,585 18,078,769 Tangible book value per share $15.816123203673133 $15.28603255117746 $16.04094923850554 $14.200291905428818 $13.631790969838709 Total assets at end of period $3,405,010 $3,499,033 $2,906,161 $2,836,684 $2,635,358 Goodwill and other intangibles ,-63,923 ,-63,778 ,-42,452 ,-43,321 ,-44,233 Adjusted total assets at period end $3,341,087 $3,435,255 $2,863,709 $2,793,363 $2,591,125 Tangible common stockholders' equity ratio 9.8579594006381749E-2 9.2645815230601516E-2 0.11662742268854831 9.2178495956307865E-2 9.5111582806695932E-2 $0 $0 $0 $0 $0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 $0 $0 $0 $0 $0 0 0 0 0 0 Slide Deck Presentation: Metrics and non-GAAP financial reconciliation As of and for the Three Months Ended March 31, December 31, September 30, June 30, March 31, (Dollars in thousands, except per share amounts) 2018 2017 2017 2017 2017 Net income available to common stockholders $11,878 $6,111 $9,587 $9,467 $10,281 Gain on sale of subsidiary -1,071 0 0 0 ,-20,860 Incremental bonus related to transaction 0 0 0 0 4,814 Transaction related costs 0 1,688 0 0 325 Tax effect of adjustments 248.36490000000001 -,601 0 0 5,754 Adjusted net income available to common stockholders $11,055.3649 $7,198 $9,587 $9,467 $314 Dilutive effect of convertible preferred stock 190 194 195 193 0 Adjusted net income available to common stockholders - diluted $11,245.3649 $7,392 $9,782 $9,660 $314 Weighted average shares outstanding - diluted 21,560,523.777777776 21,518,468.597826086 20,645,469.184782609 18,893,158.120879121 18,912,358.388888888 Adjusted effects of assumed Preferred Stock conversion 0 0 0 0 -,676,351 Adjusted weighted average shares outstanding - diluted 21,560,523.777777776 21,518,468.597826086 20,645,469.184782609 18,893,158.120879121 18,236,007.388888888 Adjusted diluted earnings per common share $0.52 $0.34 $0.47380855879071665 $0.51129620247684193 $1.7218681332149422E-2 Net income available to common stockholders $11,878 $6,111 $9,587 $9,467 $10,281 Average tangible common equity ,326,613.87815996399 ,330,819.26071665203 ,309,624.48608661105 ,254,087.71438832497 ,238,405.481105716 Return on average tangible common equity 0.14748879980322205 7.3286930780113405E-2 0.12284358034959482 0.14944458475076014 0.17489181235802964 Metrics and non-GAAP financial reconciliation (cont'd) As of and for the Three Months Ended March 31, December 31, September 30, June 30, March 31, (Dollars in thousands, except per share amounts) 2018 2017 2017 2017 2017 Adjusted efficiency ratio: Net interest income $47,130 $45,796 $39,512 $38,557 $31,819 Non-interest income 5,172 3,998 4,171 5,202 27,285 Operating revenue 52,302 49,794 43,683 43,759 59,104 Gain on sale of subsidiary -1,071 0 0 0 ,-20,860 Adjusted operating revenue $51,231 $49,794 $43,683 $43,759 $38,244 Non-interest expenses $34,042 $33,231 $28,225 $27,321 $34,837 Incremental bonus related to transaction 0 0 0 0 -4,814 Transaction related costs 0 -1,688 0 0 -,325 Adjusted non-interest expenses $34,042 $31,543 $28,225 $27,321 $29,698 Adjusted efficiency ratio 0.66448049032812162 0.63346989597140213 0.64613236270402674 0.6243515619643959 0.77654011086706409 Adjusted net non-interest expense to average assets ratio: Non-interest expenses $34,042 $33,231 $28,225 $27,321 $34,837 Incremental bonus related to transaction 0 0 0 0 -4,814 Transaction related costs 0 -1,688 0 0 -,325 Adjusted non-interest expenses $34,042 $31,543 $28,225 $27,321 $29,698 Total non-interest income $5,172 $3,998 $4,171 $5,202 $27,285 Gain on sale of subsidiary -1,071 0 0 0 ,-20,860 Adjusted non-interest income $4,101 $3,998 $4,171 $5,202 $6,425 Adjusted net non-interest expenses $29,941 $27,545 $24,054 $22,119 $23,273 Average total assets 3,410,883 3,181,697 2,849,170 2,723,303 2,619,282 Adjusted net non-interest expense to average assets ratio 3.559998653981649E-2 3.4347014652325744E-2 3.3494537158113631E-2 3.2577743252978436E-2 3.6034663104027913E-2 Metrics and non-GAAP financial reconciliation (cont'd) As of and for the Three Months Ended March 31, December 31, September 30, June 30, March 31, (Dollars in thousands, except per share amounts) 2018 2017 2017 2017 2017 Reported yield on loans 7.65% 7.729999999999999% 7.439999999999999% 7.79% 7.149999999999999% Effect of accretion income on acquired loans -0.29% -0.259999999999999% -0.24% -0.54% -0.219999999999999% Adjusted yield on loans 7.3595524365644024E-2 7.4670195642022277E-2 7.1993057351056461E-2 7.2487574833300081E-2 6.9287190236321197E-2 Reported net interest margin 6.615380371230043% 6.16258340526653% 5.897814119286116% 6.157029032674648% 5.371248944642441% Effect of accretion income on acquired loans -0.25% -0.23% -0.21% -0.46% -0.18% Adjusted net interest margin 5.8073183053593158E-2 5.9341455831213086E-2 5.687540444635214E-2 5.6963855528600359E-2 5.1889117637716406E-2 Total stockholders' equity $,402,944 $,391,698 $,386,097 $,310,467 $,300,425 Preferred stock liquidation preference -9,658 -9,658 -9,658 -9,658 -9,746 Total common stockholders' equity ,393,286 ,382,040 ,376,439 ,300,809 ,290,679 Goodwill and other intangibles ,-63,923 ,-63,778 ,-42,452 ,-43,321 ,-44,233 Tangible common stockholders' equity $,329,363 $,318,262 $,333,987 $,257,488 $,246,446 Common shares outstanding at end of period 20,824,509 20,820,445 20,820,900 18,132,585 18,078,769 Tangible book value per share $15.816123203673133 $15.28603255117746 $16.04094923850554 $14.200291905428818 $13.631790969838709 Total assets at end of period $3,405,010 $3,499,033 $2,906,161 $2,836,684 $2,635,358 Goodwill and other intangibles ,-63,923 ,-63,778 ,-42,452 ,-43,321 ,-44,233 Adjusted total assets at period end $3,341,087 $3,435,255 $2,863,709 $2,793,363 $2,591,125 Tangible common stockholders' equity ratio 9.8579594006381749E-2 9.2645815230601516E-2 0.11662742268854831 9.2178495956307865E-2 9.5111582806695932E-2 90 365 Metrics and non-GAAP financial reconciliation (cont'd) For the Three Months Ended For the Three Months Ended March 31, 2018 March 31, 2018 (Dollars in thousands, except per share amounts) GAAP Core (Dollars in thousands, except per share amounts) GAAP Core Net Interest Income to Average Total Assets: Credit Costs to Average Total Assets: Net Interest Income $47,130 $47,130 Provision for Loan Losses $2,548 $2,548 Average Total Assets 3,410,883 3,410,883 Average Total Assets 3,410,883 3,410,883 Net Interest Income to Average Assets 5.6000000000000001E-2 5.6000000000000001E-2 Credit Costs to Average Assets 3.0000000000000001E-3 3.0000000000000001E-3 Net Noninterest Expense to Average Total Assets: Taxes to Average Total Assets: Total Noninterest Expense $34,042 $34,042 Income Tax Expense $3,644 $3,644 Total Noninterest Income 5,172 5,172 Tax effect of adjustments 0 248.36490000000001 Gain on sale of subsidiary 0 -1,071 Adjusted Tax Expense 3,644 3,395.6351 Adjusted Noninterest Income 5,172 4,101 Average Total Assets 3,410,883 3,410,883 Net Noninterest Expense $28,870 $29,941 Taxes to Average Assets 4.4000000000000003E-3 4.0000000000000001E-3 MANUAL ADJ FOR ROUNDING Average Total Assets 3,410,883 3,410,883 Net Noninterest Expense to Average Assets Ratio 3.4299999999999997E-2 3.56E-2 Return on Average Total Assets: Net Interest Income to Average Assets 5.6% 5.6% Pre-Provision Net Revenue to Average Total Assets: Net Noninterest Expense to Average Assets Ratio -3.43% -3.56% Net Interest Income $47,130 $47,130 Pre-Provision Net Revenue to Average Assets 2.17% 2.400000000000001% Net Noninterest Expense ,-28,870 ,-29,941 Credit Costs to Average Assets -0.3% -0.3% Pre-Provision Net Revenue $18,260 $17,189 Taxes to Average Assets -0.44% -0.4% Average Total Assets 3,410,883 3,410,883 Return on Average Assets 1.4300000000000004E-2 1.3400000000000002E-2 Pre-Provision Net Revenue to Average Assets 2.1700000000000001E-2 2.0400000000000001E-2 MANUAL ADJ FOR ROUNDING 0 0 0 -4.8821729141295192E-5

NON-GAAP FINANCIAL RECONCILIATION PAGE 43190QTD 42916QTD 42825QTD 42460QTD 42185QTD Period end date 43190 43100 43008 42916 42825 Quarter Days in Year 365 365 365 365 365 Days in Quarter 90 92 92 91 90 As of and for the Three Months Ended (Dollars in thousands, March 31, December 31, September 30, June 30, March 31, except per share amounts) 2018 2017 2017 2017 2017 Net income available to common stockholders $11,878 $6,111 $9,587 $9,467 $10,281 Gain on sale of subsidiary -1,071 0 0 0 ,-20,860 Manual Adj Incremental bonus related to transaction 0 0 0 0 4,814 Transaction related costs 0 1,688 0 0 325 Tax effect of adjustments 248.36490000000001 -,601 0 0 5,754 Adjusted net income available to common stockholders $11,055.3649 $7,198 $9,587 $9,467 $314 Manual Adj Dilutive effect of convertible preferred stock 190 194 195 193 0 Adjusted net income available to common stockholders - diluted $11,245.3649 $7,392 $9,782 $9,660 $314 Diluted_Shrs Weighted average shares outstanding - diluted 21,560,523.777777776 21,518,468.597826086 20,645,469.184782609 18,893,158.120879121 18,912,358.388888888 Manual Adj Adjusted effects of assumed Preferred Stock conversion 0 0 0 0 -,676,351 Adjusted weighted average shares outstanding - diluted 21,560,523.777777776 21,518,468.597826086 20,645,469.184782609 18,893,158.120879121 18,236,007.388888888 YTD YTD Adjusted diluted earnings per common share $0.52 $0.34 $0.47380855879071665 $0.51129620247684193 $1.7218681332149422E-2 $0 $-0.37 $-0.73701044770955082 Net income available to common stockholders $11,878 $6,111 $9,587 $9,467 $10,281 AvgTangEq Average tangible common equity ,326,613.87815996399 ,330,819.26071665203 ,309,624.48608661105 ,254,087.71438832497 ,238,405.481105716 Return on average tangible common equity 0.14748879980322205 7.3286930780113405E-2 0.12284358034959482 0.14944458475076014 0.17489181235802964 Adjusted efficiency ratio: Net interest income $47,130 $45,796 $39,512 $38,557 $31,819 Non-interest income 5,172 3,998 4,171 5,202 27,285 Operating revenue 52,302 49,794 43,683 43,759 59,104 Manual Adj Gain on sale of subsidiary -1,071 0 0 0 ,-20,860 Adjusted operating revenue $51,231 $49,794 $43,683 $43,759 $38,244 Non-interest expenses $34,042 $33,231 $28,225 $27,321 $34,837 Incremental bonus related to transaction 0 0 0 0 -4,814 Manual Adj Transaction related costs 0 -1,688 0 0 -,325 Adjusted non-interest expenses $34,042 $31,543 $28,225 $27,321 $29,698 Adjusted efficiency ratio 0.66448049032812162 0.63346989597140213 0.64613236270402674 0.6243515619643959 0.77654011086706409 Adjusted net non-interest expense to average assets ratio: Non-interest expenses $34,042 $33,231 $28,225 $27,321 $34,837 Incremental bonus related to transaction 0 0 0 0 -4,814 Manual Adj Transaction related costs 0 -1,688 0 0 -,325 Adjusted non-interest expenses $34,042 $31,543 $28,225 $27,321 $29,698 Total non-interest income $5,172 $3,998 $4,171 $5,202 $27,285 Gain on sale of subsidiary -1,071 0 0 0 ,-20,860 Adjusted non-interest income $4,101 $3,998 $4,171 $5,202 $6,425 Adjusted net non-interest expenses $29,941 $27,545 $24,054 $22,119 $23,273 AvgAssets Average total assets $3,410,883 $3,181,697 $2,849,170 $2,723,303 $2,619,282 CHECK ROUNDING $0 $0 Adjusted net non-interest expense to average assets ratio 3.559998653981649E-2 3.4347014652325744E-2 3.3494537158113631E-2 3.2577743252978436E-2 3.6034663104027913E-2 As of and for the Three Months Ended (Dollars in thousands, March 31, December 31, September 30, June 30, March 31, except per share amounts) 2018 2017 2017 2017 2017 Reported yield on loans 7.65% 7.729999999999999% 7.439999999999999% 7.79% 7.149999999999999% DisAcrLYLD Effect of accretion income on acquired loans -0.29% -0.259999999999999% -0.24% -0.54% -0.219999999999999% Adjusted yield on loans 7.3595524365644024E-2 7.4670195642022277E-2 7.1993057351056461E-2 7.2487574833300081E-2 6.9287190236321197E-2 Reported net interest margin 6.615380371230043% 6.16258340526653% 5.897814119286116% 6.157029032674648% 5.371248944642441% DisAcrLNIM Effect of accretion income on acquired loans -0.25% -0.23% -0.21% -0.46% -0.18% Adjusted net interest margin 5.8073183053593158E-2 5.9341455831213086E-2 5.687540444635214E-2 5.6963855528600359E-2 5.1889117637716406E-2 Total stockholders' equity $,402,944 $,391,698 $,386,097 $,310,467 $,300,425 Preferred_Stock_A Preferred_Stock_B Preferred stock liquidation preference -9,658 -9,658 -9,658 -9,658 -9,746 Total common stockholders' equity ,393,286 ,382,040 ,376,439 ,300,809 ,290,679 Goodwill and other intangibles ,-63,923 ,-63,778 ,-42,452 ,-43,321 ,-44,233 Tangible common stockholders' equity $,329,363 $,318,262 $,333,987 $,257,488 $,246,446 Common shares outstanding, end of period Common shares outstanding 20,824,509 20,820,445 20,820,900 18,132,585 18,078,769 Tangible book value per share $15.816123203673133 $15.28603255117746 $16.04094923850554 $14.200291905428818 $13.631790969838709 Total assets at end of period $3,405,010 $3,499,033 $2,906,161 $2,836,684 $2,635,358 Goodwill and other intangibles ,-63,923 ,-63,778 ,-42,452 ,-43,321 ,-44,233 Adjusted total assets at period end $3,341,087 $3,435,255 $2,863,709 $2,793,363 $2,591,125 Tangible common stockholders' equity ratio 9.8579594006381749E-2 9.2645815230601516E-2 0.11662742268854831 9.2178495956307865E-2 9.5111582806695932E-2 $0 $0 $0 $0 $0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 $0 $0 $0 $0 $0 0 0 0 0 0 Slide Deck Presentation: Metrics and non-GAAP financial reconciliation As of and for the Three Months Ended March 31, December 31, September 30, June 30, March 31, (Dollars in thousands, except per share amounts) 2018 2017 2017 2017 2017 Net income available to common stockholders $11,878 $6,111 $9,587 $9,467 $10,281 Gain on sale of subsidiary -1,071 0 0 0 ,-20,860 Incremental bonus related to transaction 0 0 0 0 4,814 Transaction related costs 0 1,688 0 0 325 Tax effect of adjustments 248.36490000000001 -,601 0 0 5,754 Adjusted net income available to common stockholders $11,055.3649 $7,198 $9,587 $9,467 $314 Dilutive effect of convertible preferred stock 190 194 195 193 0 Adjusted net income available to common stockholders - diluted $11,245.3649 $7,392 $9,782 $9,660 $314 Weighted average shares outstanding - diluted 21,560,523.777777776 21,518,468.597826086 20,645,469.184782609 18,893,158.120879121 18,912,358.388888888 Adjusted effects of assumed Preferred Stock conversion 0 0 0 0 -,676,351 Adjusted weighted average shares outstanding - diluted 21,560,523.777777776 21,518,468.597826086 20,645,469.184782609 18,893,158.120879121 18,236,007.388888888 Adjusted diluted earnings per common share $0.52 $0.34 $0.47380855879071665 $0.51129620247684193 $1.7218681332149422E-2 Net income available to common stockholders $11,878 $6,111 $9,587 $9,467 $10,281 Average tangible common equity ,326,613.87815996399 ,330,819.26071665203 ,309,624.48608661105 ,254,087.71438832497 ,238,405.481105716 Return on average tangible common equity 0.14748879980322205 7.3286930780113405E-2 0.12284358034959482 0.14944458475076014 0.17489181235802964 Metrics and non-GAAP financial reconciliation (cont'd) As of and for the Three Months Ended March 31, December 31, September 30, June 30, March 31, (Dollars in thousands, except per share amounts) 2018 2017 2017 2017 2017 Adjusted efficiency ratio: Net interest income $47,130 $45,796 $39,512 $38,557 $31,819 Non-interest income 5,172 3,998 4,171 5,202 27,285 Operating revenue 52,302 49,794 43,683 43,759 59,104 Gain on sale of subsidiary -1,071 0 0 0 ,-20,860 Adjusted operating revenue $51,231 $49,794 $43,683 $43,759 $38,244 Non-interest expenses $34,042 $33,231 $28,225 $27,321 $34,837 Incremental bonus related to transaction 0 0 0 0 -4,814 Transaction related costs 0 -1,688 0 0 -,325 Adjusted non-interest expenses $34,042 $31,543 $28,225 $27,321 $29,698 Adjusted efficiency ratio 0.66448049032812162 0.63346989597140213 0.64613236270402674 0.6243515619643959 0.77654011086706409 Adjusted net non-interest expense to average assets ratio: Non-interest expenses $34,042 $33,231 $28,225 $27,321 $34,837 Incremental bonus related to transaction 0 0 0 0 -4,814 Transaction related costs 0 -1,688 0 0 -,325 Adjusted non-interest expenses $34,042 $31,543 $28,225 $27,321 $29,698 Total non-interest income $5,172 $3,998 $4,171 $5,202 $27,285 Gain on sale of subsidiary -1,071 0 0 0 ,-20,860 Adjusted non-interest income $4,101 $3,998 $4,171 $5,202 $6,425 Adjusted net non-interest expenses $29,941 $27,545 $24,054 $22,119 $23,273 Average total assets 3,410,883 3,181,697 2,849,170 2,723,303 2,619,282 Adjusted net non-interest expense to average assets ratio 3.559998653981649E-2 3.4347014652325744E-2 3.3494537158113631E-2 3.2577743252978436E-2 3.6034663104027913E-2 Metrics and non-GAAP financial reconciliation (cont'd) As of and for the Three Months Ended March 31, December 31, September 30, June 30, March 31, (Dollars in thousands, except per share amounts) 2018 2017 2017 2017 2017 Reported yield on loans 7.65% 7.729999999999999% 7.439999999999999% 7.79% 7.149999999999999% Effect of accretion income on acquired loans -0.29% -0.259999999999999% -0.24% -0.54% -0.219999999999999% Adjusted yield on loans 7.3595524365644024E-2 7.4670195642022277E-2 7.1993057351056461E-2 7.2487574833300081E-2 6.9287190236321197E-2 Reported net interest margin 6.615380371230043% 6.16258340526653% 5.897814119286116% 6.157029032674648% 5.371248944642441% Effect of accretion income on acquired loans -0.25% -0.23% -0.21% -0.46% -0.18% Adjusted net interest margin 5.8073183053593158E-2 5.9341455831213086E-2 5.687540444635214E-2 5.6963855528600359E-2 5.1889117637716406E-2 Total stockholders' equity $,402,944 $,391,698 $,386,097 $,310,467 $,300,425 Preferred stock liquidation preference -9,658 -9,658 -9,658 -9,658 -9,746 Total common stockholders' equity ,393,286 ,382,040 ,376,439 ,300,809 ,290,679 Goodwill and other intangibles ,-63,923 ,-63,778 ,-42,452 ,-43,321 ,-44,233 Tangible common stockholders' equity $,329,363 $,318,262 $,333,987 $,257,488 $,246,446 Common shares outstanding at end of period 20,824,509 20,820,445 20,820,900 18,132,585 18,078,769 Tangible book value per share $15.816123203673133 $15.28603255117746 $16.04094923850554 $14.200291905428818 $13.631790969838709 Total assets at end of period $3,405,010 $3,499,033 $2,906,161 $2,836,684 $2,635,358 Goodwill and other intangibles ,-63,923 ,-63,778 ,-42,452 ,-43,321 ,-44,233 Adjusted total assets at period end $3,341,087 $3,435,255 $2,863,709 $2,793,363 $2,591,125 Tangible common stockholders' equity ratio 9.8579594006381749E-2 9.2645815230601516E-2 0.11662742268854831 9.2178495956307865E-2 9.5111582806695932E-2 90 365 Metrics and non-GAAP financial reconciliation (cont'd) For the Three Months Ended For the Three Months Ended March 31, 2018 March 31, 2018 (Dollars in thousands, except per share amounts) GAAP Core (Dollars in thousands, except per share amounts) GAAP Core Net Interest Income to Average Total Assets: Credit Costs to Average Total Assets: Net Interest Income $47,130 $47,130 Provision for Loan Losses $2,548 $2,548 Average Total Assets 3,410,883 3,410,883 Average Total Assets 3,410,883 3,410,883 Net Interest Income to Average Assets 5.6000000000000001E-2 5.6000000000000001E-2 Credit Costs to Average Assets 3.0000000000000001E-3 3.0000000000000001E-3 Net Noninterest Expense to Average Total Assets: Taxes to Average Total Assets: Total Noninterest Expense $34,042 $34,042 Income Tax Expense $3,644 $3,644 Total Noninterest Income 5,172 5,172 Tax effect of adjustments 0 248.36490000000001 Gain on sale of subsidiary 0 -1,071 Adjusted Tax Expense 3,644 3,395.6351 Adjusted Noninterest Income 5,172 4,101 Average Total Assets 3,410,883 3,410,883 Net Noninterest Expense $28,870 $29,941 Taxes to Average Assets 4.4000000000000003E-3 4.0000000000000001E-3 MANUAL ADJ FOR ROUNDING Average Total Assets 3,410,883 3,410,883 Net Noninterest Expense to Average Assets Ratio 3.4299999999999997E-2 3.56E-2 Return on Average Total Assets: Net Interest Income to Average Assets 5.6% 5.6% Pre-Provision Net Revenue to Average Total Assets: Net Noninterest Expense to Average Assets Ratio -3.43% -3.56% Net Interest Income $47,130 $47,130 Pre-Provision Net Revenue to Average Assets 2.17% 2.400000000000001% Net Noninterest Expense ,-28,870 ,-29,941 Credit Costs to Average Assets -0.3% -0.3% Pre-Provision Net Revenue $18,260 $17,189 Taxes to Average Assets -0.44% -0.4% Average Total Assets 3,410,883 3,410,883 Return on Average Assets 1.4300000000000004E-2 1.3400000000000002E-2 Pre-Provision Net Revenue to Average Assets 2.1700000000000001E-2 2.0400000000000001E-2 MANUAL ADJ FOR ROUNDING 0 0 0 -4.8821729141295192E-5

NON-GAAP FINANCIAL RECONCILIATION PAGE 43190QTD 42916QTD 42825QTD 42460QTD 42185QTD Period end date 43190 43100 43008 42916 42825 Quarter Days in Year 365 365 365 365 365 Days in Quarter 90 92 92 91 90 As of and for the Three Months Ended (Dollars in thousands, March 31, December 31, September 30, June 30, March 31, except per share amounts) 2018 2017 2017 2017 2017 Net income available to common stockholders $11,878 $6,111 $9,587 $9,467 $10,281 Gain on sale of subsidiary -1,071 0 0 0 ,-20,860 Manual Adj Incremental bonus related to transaction 0 0 0 0 4,814 Transaction related costs 0 1,688 0 0 325 Tax effect of adjustments 248.36490000000001 -,601 0 0 5,754 Adjusted net income available to common stockholders $11,055.3649 $7,198 $9,587 $9,467 $314 Manual Adj Dilutive effect of convertible preferred stock 190 194 195 193 0 Adjusted net income available to common stockholders - diluted $11,245.3649 $7,392 $9,782 $9,660 $314 Diluted_Shrs Weighted average shares outstanding - diluted 21,560,523.777777776 21,518,468.597826086 20,645,469.184782609 18,893,158.120879121 18,912,358.388888888 Manual Adj Adjusted effects of assumed Preferred Stock conversion 0 0 0 0 -,676,351 Adjusted weighted average shares outstanding - diluted 21,560,523.777777776 21,518,468.597826086 20,645,469.184782609 18,893,158.120879121 18,236,007.388888888 YTD YTD Adjusted diluted earnings per common share $0.52 $0.34 $0.47380855879071665 $0.51129620247684193 $1.7218681332149422E-2 $0 $-0.37 $-0.73701044770955082 Net income available to common stockholders $11,878 $6,111 $9,587 $9,467 $10,281 AvgTangEq Average tangible common equity ,326,613.87815996399 ,330,819.26071665203 ,309,624.48608661105 ,254,087.71438832497 ,238,405.481105716 Return on average tangible common equity 0.14748879980322205 7.3286930780113405E-2 0.12284358034959482 0.14944458475076014 0.17489181235802964 Adjusted efficiency ratio: Net interest income $47,130 $45,796 $39,512 $38,557 $31,819 Non-interest income 5,172 3,998 4,171 5,202 27,285 Operating revenue 52,302 49,794 43,683 43,759 59,104 Manual Adj Gain on sale of subsidiary -1,071 0 0 0 ,-20,860 Adjusted operating revenue $51,231 $49,794 $43,683 $43,759 $38,244 Non-interest expenses $34,042 $33,231 $28,225 $27,321 $34,837 Incremental bonus related to transaction 0 0 0 0 -4,814 Manual Adj Transaction related costs 0 -1,688 0 0 -,325 Adjusted non-interest expenses $34,042 $31,543 $28,225 $27,321 $29,698 Adjusted efficiency ratio 0.66448049032812162 0.63346989597140213 0.64613236270402674 0.6243515619643959 0.77654011086706409 Adjusted net non-interest expense to average assets ratio: Non-interest expenses $34,042 $33,231 $28,225 $27,321 $34,837 Incremental bonus related to transaction 0 0 0 0 -4,814 Manual Adj Transaction related costs 0 -1,688 0 0 -,325 Adjusted non-interest expenses $34,042 $31,543 $28,225 $27,321 $29,698 Total non-interest income $5,172 $3,998 $4,171 $5,202 $27,285 Gain on sale of subsidiary -1,071 0 0 0 ,-20,860 Adjusted non-interest income $4,101 $3,998 $4,171 $5,202 $6,425 Adjusted net non-interest expenses $29,941 $27,545 $24,054 $22,119 $23,273 AvgAssets Average total assets $3,410,883 $3,181,697 $2,849,170 $2,723,303 $2,619,282 CHECK ROUNDING $0 $0 Adjusted net non-interest expense to average assets ratio 3.559998653981649E-2 3.4347014652325744E-2 3.3494537158113631E-2 3.2577743252978436E-2 3.6034663104027913E-2 As of and for the Three Months Ended (Dollars in thousands, March 31, December 31, September 30, June 30, March 31, except per share amounts) 2018 2017 2017 2017 2017 Reported yield on loans 7.65% 7.729999999999999% 7.439999999999999% 7.79% 7.149999999999999% DisAcrLYLD Effect of accretion income on acquired loans -0.29% -0.259999999999999% -0.24% -0.54% -0.219999999999999% Adjusted yield on loans 7.3595524365644024E-2 7.4670195642022277E-2 7.1993057351056461E-2 7.2487574833300081E-2 6.9287190236321197E-2 Reported net interest margin 6.615380371230043% 6.16258340526653% 5.897814119286116% 6.157029032674648% 5.371248944642441% DisAcrLNIM Effect of accretion income on acquired loans -0.25% -0.23% -0.21% -0.46% -0.18% Adjusted net interest margin 5.8073183053593158E-2 5.9341455831213086E-2 5.687540444635214E-2 5.6963855528600359E-2 5.1889117637716406E-2 Total stockholders' equity $,402,944 $,391,698 $,386,097 $,310,467 $,300,425 Preferred_Stock_A Preferred_Stock_B Preferred stock liquidation preference -9,658 -9,658 -9,658 -9,658 -9,746 Total common stockholders' equity ,393,286 ,382,040 ,376,439 ,300,809 ,290,679 Goodwill and other intangibles ,-63,923 ,-63,778 ,-42,452 ,-43,321 ,-44,233 Tangible common stockholders' equity $,329,363 $,318,262 $,333,987 $,257,488 $,246,446 Common shares outstanding, end of period Common shares outstanding 20,824,509 20,820,445 20,820,900 18,132,585 18,078,769 Tangible book value per share $15.816123203673133 $15.28603255117746 $16.04094923850554 $14.200291905428818 $13.631790969838709 Total assets at end of period $3,405,010 $3,499,033 $2,906,161 $2,836,684 $2,635,358 Goodwill and other intangibles ,-63,923 ,-63,778 ,-42,452 ,-43,321 ,-44,233 Adjusted total assets at period end $3,341,087 $3,435,255 $2,863,709 $2,793,363 $2,591,125 Tangible common stockholders' equity ratio 9.8579594006381749E-2 9.2645815230601516E-2 0.11662742268854831 9.2178495956307865E-2 9.5111582806695932E-2 $0 $0 $0 $0 $0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 $0 $0 $0 $0 $0 0 0 0 0 0 Slide Deck Presentation: Metrics and non-GAAP financial reconciliation As of and for the Three Months Ended March 31, December 31, September 30, June 30, March 31, (Dollars in thousands, except per share amounts) 2018 2017 2017 2017 2017 Net income available to common stockholders $11,878 $6,111 $9,587 $9,467 $10,281 Gain on sale of subsidiary -1,071 0 0 0 ,-20,860 Incremental bonus related to transaction 0 0 0 0 4,814 Transaction related costs 0 1,688 0 0 325 Tax effect of adjustments 248.36490000000001 -,601 0 0 5,754 Adjusted net income available to common stockholders $11,055.3649 $7,198 $9,587 $9,467 $314 Dilutive effect of convertible preferred stock 190 194 195 193 0 Adjusted net income available to common stockholders - diluted $11,245.3649 $7,392 $9,782 $9,660 $314 Weighted average shares outstanding - diluted 21,560,523.777777776 21,518,468.597826086 20,645,469.184782609 18,893,158.120879121 18,912,358.388888888 Adjusted effects of assumed Preferred Stock conversion 0 0 0 0 -,676,351 Adjusted weighted average shares outstanding - diluted 21,560,523.777777776 21,518,468.597826086 20,645,469.184782609 18,893,158.120879121 18,236,007.388888888 Adjusted diluted earnings per common share $0.52 $0.34 $0.47380855879071665 $0.51129620247684193 $1.7218681332149422E-2 Net income available to common stockholders $11,878 $6,111 $9,587 $9,467 $10,281 Average tangible common equity ,326,613.87815996399 ,330,819.26071665203 ,309,624.48608661105 ,254,087.71438832497 ,238,405.481105716 Return on average tangible common equity 0.14748879980322205 7.3286930780113405E-2 0.12284358034959482 0.14944458475076014 0.17489181235802964 Metrics and non-GAAP financial reconciliation (cont'd) As of and for the Three Months Ended March 31, December 31, September 30, June 30, March 31, (Dollars in thousands, except per share amounts) 2018 2017 2017 2017 2017 Adjusted efficiency ratio: Net interest income $47,130 $45,796 $39,512 $38,557 $31,819 Non-interest income 5,172 3,998 4,171 5,202 27,285 Operating revenue 52,302 49,794 43,683 43,759 59,104 Gain on sale of subsidiary -1,071 0 0 0 ,-20,860 Adjusted operating revenue $51,231 $49,794 $43,683 $43,759 $38,244 Non-interest expenses $34,042 $33,231 $28,225 $27,321 $34,837 Incremental bonus related to transaction 0 0 0 0 -4,814 Transaction related costs 0 -1,688 0 0 -,325 Adjusted non-interest expenses $34,042 $31,543 $28,225 $27,321 $29,698 Adjusted efficiency ratio 0.66448049032812162 0.63346989597140213 0.64613236270402674 0.6243515619643959 0.77654011086706409 Adjusted net non-interest expense to average assets ratio: Non-interest expenses $34,042 $33,231 $28,225 $27,321 $34,837 Incremental bonus related to transaction 0 0 0 0 -4,814 Transaction related costs 0 -1,688 0 0 -,325 Adjusted non-interest expenses $34,042 $31,543 $28,225 $27,321 $29,698 Total non-interest income $5,172 $3,998 $4,171 $5,202 $27,285 Gain on sale of subsidiary -1,071 0 0 0 ,-20,860 Adjusted non-interest income $4,101 $3,998 $4,171 $5,202 $6,425 Adjusted net non-interest expenses $29,941 $27,545 $24,054 $22,119 $23,273 Average total assets 3,410,883 3,181,697 2,849,170 2,723,303 2,619,282 Adjusted net non-interest expense to average assets ratio 3.559998653981649E-2 3.4347014652325744E-2 3.3494537158113631E-2 3.2577743252978436E-2 3.6034663104027913E-2 Metrics and non-GAAP financial reconciliation (cont'd) As of and for the Three Months Ended March 31, December 31, September 30, June 30, March 31, (Dollars in thousands, except per share amounts) 2018 2017 2017 2017 2017 Reported yield on loans 7.65% 7.729999999999999% 7.439999999999999% 7.79% 7.149999999999999% Effect of accretion income on acquired loans -0.29% -0.259999999999999% -0.24% -0.54% -0.219999999999999% Adjusted yield on loans 7.3595524365644024E-2 7.4670195642022277E-2 7.1993057351056461E-2 7.2487574833300081E-2 6.9287190236321197E-2 Reported net interest margin 6.615380371230043% 6.16258340526653% 5.897814119286116% 6.157029032674648% 5.371248944642441% Effect of accretion income on acquired loans -0.25% -0.23% -0.21% -0.46% -0.18% Adjusted net interest margin 5.8073183053593158E-2 5.9341455831213086E-2 5.687540444635214E-2 5.6963855528600359E-2 5.1889117637716406E-2 Total stockholders' equity $,402,944 $,391,698 $,386,097 $,310,467 $,300,425 Preferred stock liquidation preference -9,658 -9,658 -9,658 -9,658 -9,746 Total common stockholders' equity ,393,286 ,382,040 ,376,439 ,300,809 ,290,679 Goodwill and other intangibles ,-63,923 ,-63,778 ,-42,452 ,-43,321 ,-44,233 Tangible common stockholders' equity $,329,363 $,318,262 $,333,987 $,257,488 $,246,446 Common shares outstanding at end of period 20,824,509 20,820,445 20,820,900 18,132,585 18,078,769 Tangible book value per share $15.816123203673133 $15.28603255117746 $16.04094923850554 $14.200291905428818 $13.631790969838709 Total assets at end of period $3,405,010 $3,499,033 $2,906,161 $2,836,684 $2,635,358 Goodwill and other intangibles ,-63,923 ,-63,778 ,-42,452 ,-43,321 ,-44,233 Adjusted total assets at period end $3,341,087 $3,435,255 $2,863,709 $2,793,363 $2,591,125 Tangible common stockholders' equity ratio 9.8579594006381749E-2 9.2645815230601516E-2 0.11662742268854831 9.2178495956307865E-2 9.5111582806695932E-2 90 365 Metrics and non-GAAP financial reconciliation (cont'd) For the Three Months Ended For the Three Months Ended March 31, 2018 March 31, 2018 (Dollars in thousands, except per share amounts) GAAP Core (Dollars in thousands, except per share amounts) GAAP Core Net Interest Income to Average Total Assets: Credit Costs to Average Total Assets: Net Interest Income $47,130 $47,130 Provision for Loan Losses $2,548 $2,548 Average Total Assets 3,410,883 3,410,883 Average Total Assets 3,410,883 3,410,883 Net Interest Income to Average Assets 5.6000000000000001E-2 5.6000000000000001E-2 Credit Costs to Average Assets 3.0000000000000001E-3 3.0000000000000001E-3 Net Noninterest Expense to Average Total Assets: Taxes to Average Total Assets: Total Noninterest Expense $34,042 $34,042 Income Tax Expense $3,644 $3,644 Total Noninterest Income 5,172 5,172 Tax effect of adjustments 0 248.36490000000001 Gain on sale of subsidiary 0 -1,071 Adjusted Tax Expense 3,644 3,395.6351 Adjusted Noninterest Income 5,172 4,101 Average Total Assets 3,410,883 3,410,883 Net Noninterest Expense $28,870 $29,941 Taxes to Average Assets 4.4000000000000003E-3 4.0000000000000001E-3 MANUAL ADJ FOR ROUNDING Average Total Assets 3,410,883 3,410,883 Net Noninterest Expense to Average Assets Ratio 3.4299999999999997E-2 3.56E-2 Return on Average Total Assets: Net Interest Income to Average Assets 5.6% 5.6% Pre-Provision Net Revenue to Average Total Assets: Net Noninterest Expense to Average Assets Ratio -3.43% -3.56% Net Interest Income $47,130 $47,130 Pre-Provision Net Revenue to Average Assets 2.17% 2.400000000000001% Net Noninterest Expense ,-28,870 ,-29,941 Credit Costs to Average Assets -0.3% -0.3% Pre-Provision Net Revenue $18,260 $17,189 Taxes to Average Assets -0.44% -0.4% Average Total Assets 3,410,883 3,410,883 Return on Average Assets 1.4300000000000004E-2 1.3400000000000002E-2 Pre-Provision Net Revenue to Average Assets 2.1700000000000001E-2 2.0400000000000001E-2 MANUAL ADJ FOR ROUNDING 0 0 0 -4.8821729141295192E-5