Q2 2019 earnings release July 17, 2019 Exhibit 99.2

Forward-Looking Statements This presentation contains forward-looking statements. Any statements about our expectations, beliefs, plans, predictions, forecasts, objectives, assumptions or future events or performance are not historical facts and may be forward-looking. You can identify forward-looking statements by the use of forward-looking terminology such as “believes,” “expects,” “could,” “may,” “will,” “should,” “seeks,” “likely,” “intends,” “plans,” “pro forma,” “projects,” “estimates” or “anticipates” or the negative of these words and phrases or similar words or phrases that are predictions of or indicate future events or trends and that do not relate solely to historical matters. You can also identify forward-looking statements by discussions of strategy, plans or intentions. Forward-looking statements involve numerous risks and uncertainties and you should not rely on them as predictions of future events. Forward-looking statements depend on assumptions, data or methods that may be incorrect or imprecise and we may not be able to realize them. We do not guarantee that the transactions and events described will happen as described (or that they will happen at all). The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements: business and economic conditions generally and in the bank and non-bank financial services industries, nationally and within our local market areas; our ability to mitigate our risk exposures; our ability to maintain our historical earnings trends; risks related to the integration of acquired businesses (including our acquisitions of First Bancorp of Durango, Inc., Southern Colorado Corp., and the operating assets of Interstate Capital Corporation and certain of its affiliates) and any future acquisitions; changes in management personnel; interest rate risk; concentration of our factoring services in the transportation industry; credit risk associated with our loan portfolio; lack of seasoning in our loan portfolio; deteriorating asset quality and higher loan charge-offs; time and effort necessary to resolve nonperforming assets; inaccuracy of the assumptions and estimates we make in establishing reserves for probable loan losses and other estimates; lack of liquidity; fluctuations in the fair value and liquidity of the securities we hold for sale; impairment of investment securities, goodwill, other intangible assets, or deferred tax assets; our risk management strategies; environmental liability associated with our lending activities; increased competition in the bank and non-bank financial services industries, nationally, regionally, or locally, which may adversely affect pricing and terms; the accuracy of our financial statements and related disclosures; material weaknesses in our internal control over financial reporting; system failures or failures to prevent breaches of our network security; the institution and outcome of litigation and other legal proceedings against us or to which we become subject; changes in carry-forwards of net operating losses; changes in federal tax law or policy; the impact of recent and future legislative and regulatory changes, including changes in banking, securities, and tax laws and regulations, such as the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and their application by our regulators; governmental monetary and fiscal policies; changes in the scope and cost of the Federal Deposit Insurance Corporation insurance and other coverages; failure to receive regulatory approval for future acquisitions; and increases in our capital requirements. While forward-looking statements reflect our good-faith beliefs, they are not guarantees of future performance. All forward-looking statements are necessarily only estimates of future results. Accordingly, actual results may differ materially from those expressed in or contemplated by the particular forward-looking statement, and, therefore, you are cautioned not to place undue reliance on such statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events or circumstances, except as required by applicable law. For a discussion of such risks and uncertainties, which could cause actual results to differ from those contained in the forward-looking statements, see “Risk Factors” and the forward-looking statement disclosure contained in Triumph’s Annual Report on Form 10-K, filed with the Securities and Exchange Commission on February 12, 2019. Non-GAAP Financial Measures This presentation includes certain non‐GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. Reconciliations of non‐GAAP financial measures to GAAP financial measures are provided at the end of the presentation. Numbers in this presentation may not sum due to rounding. Unless otherwise referenced, all data presented is as of June 30, 2019. PAGE DISCLAIMER

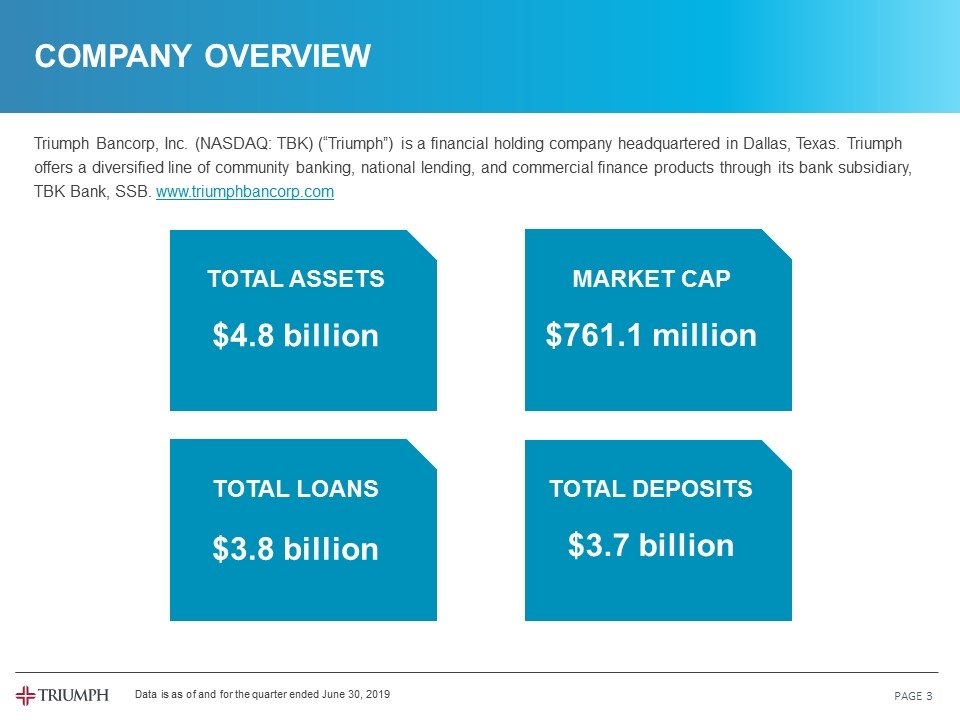

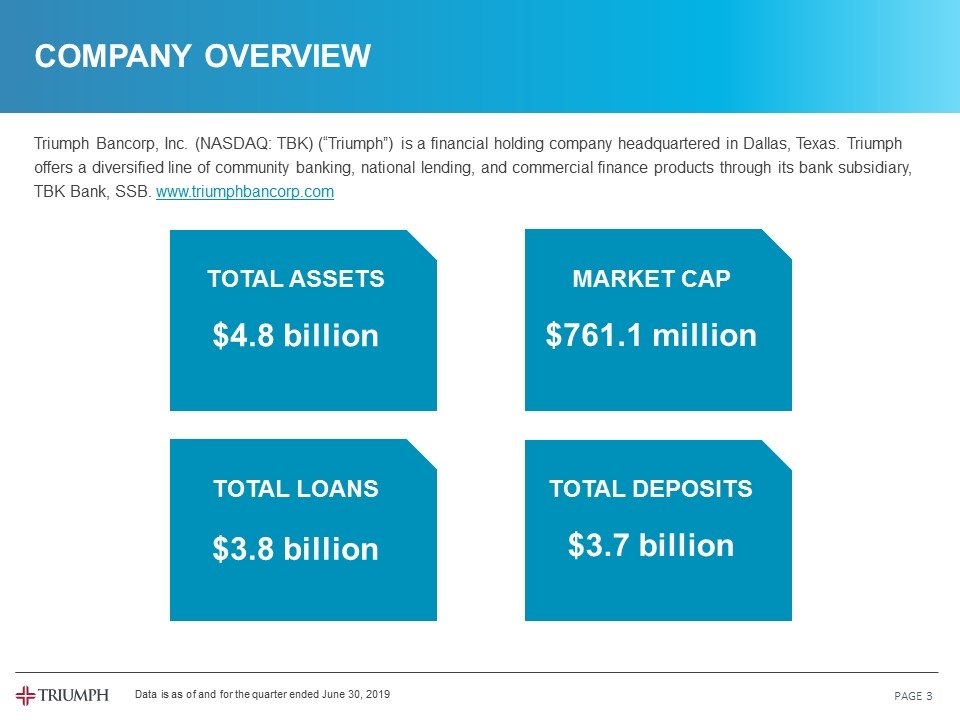

COMPANY OVERVIEW PAGE Triumph Bancorp, Inc. (NASDAQ: TBK) (“Triumph”) is a financial holding company headquartered in Dallas, Texas. Triumph offers a diversified line of community banking, national lending, and commercial finance products through its bank subsidiary, TBK Bank, SSB. www.triumphbancorp.com TOTAL ASSETS $4.8 billion MARKET CAP $761.1 million TOTAL LOANS $3.8 billion TOTAL DEPOSITS $3.7 billion Data is as of and for the quarter ended June 30, 2019

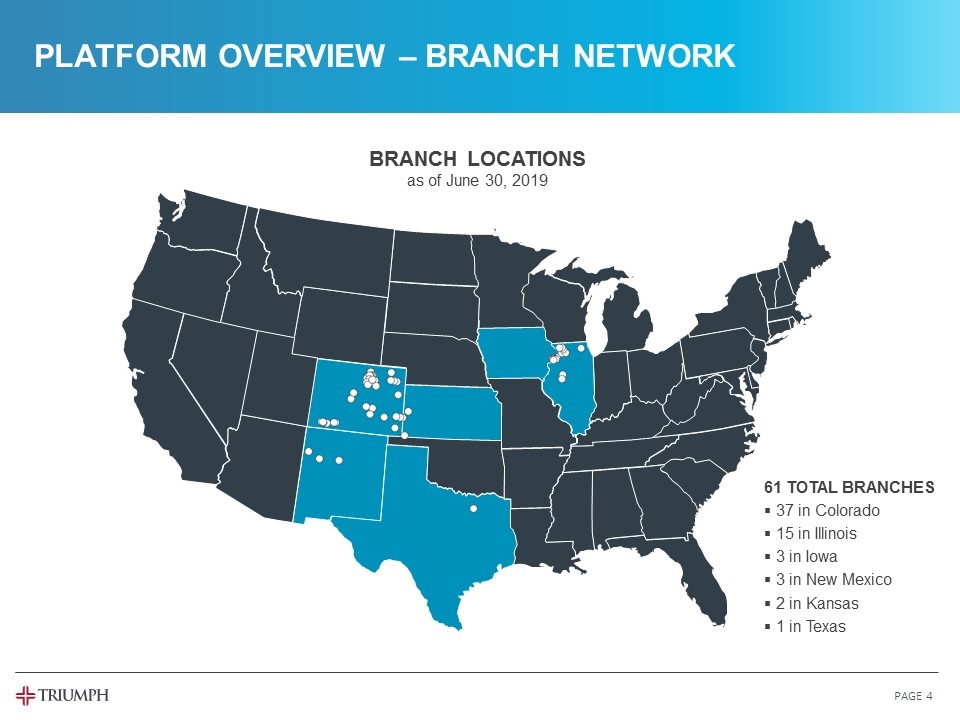

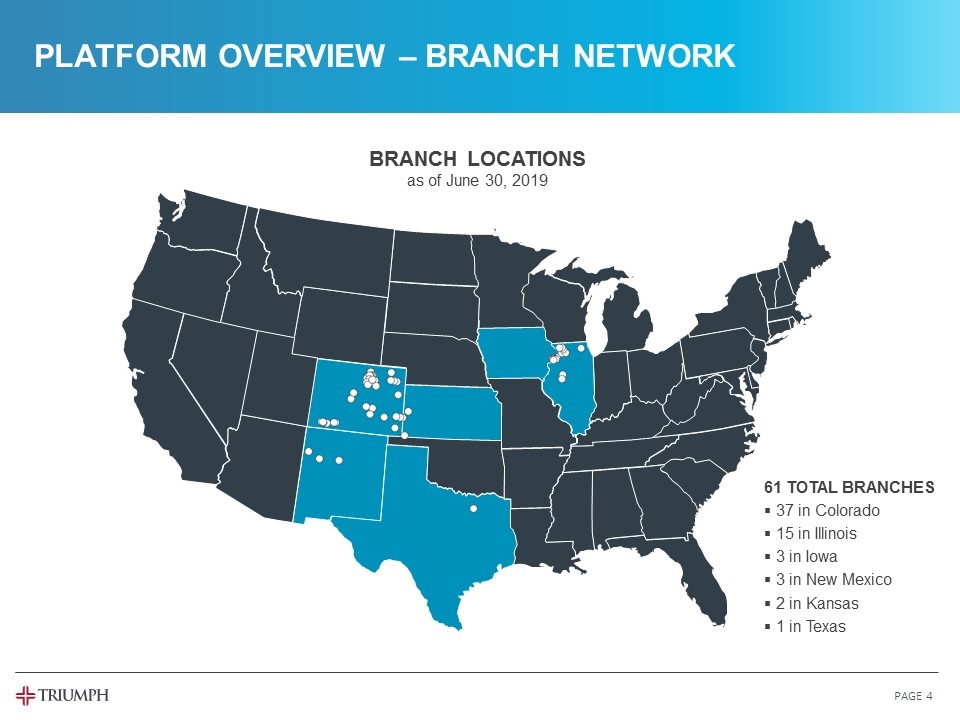

PLATFORM OVERVIEW – BRANCH NETWORK PAPAGE GE 61 TOTAL BRANCHES 37 in Colorado 15 in Illinois 3 in Iowa 3 in New Mexico 2 in Kansas 1 in Texas BRANCH LOCATIONS as of June 30, 2019

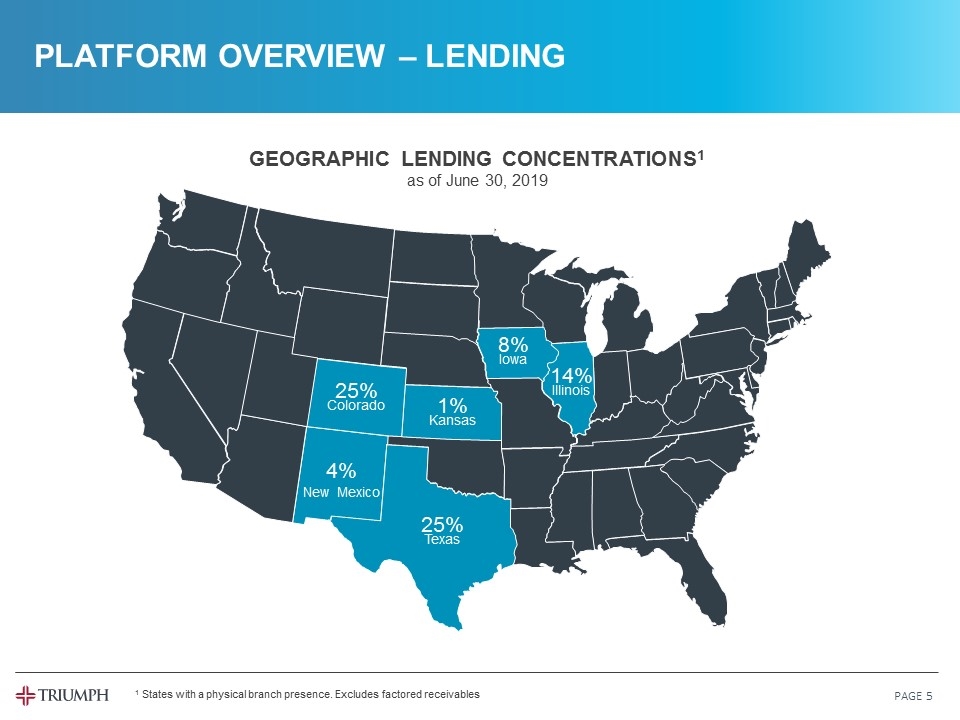

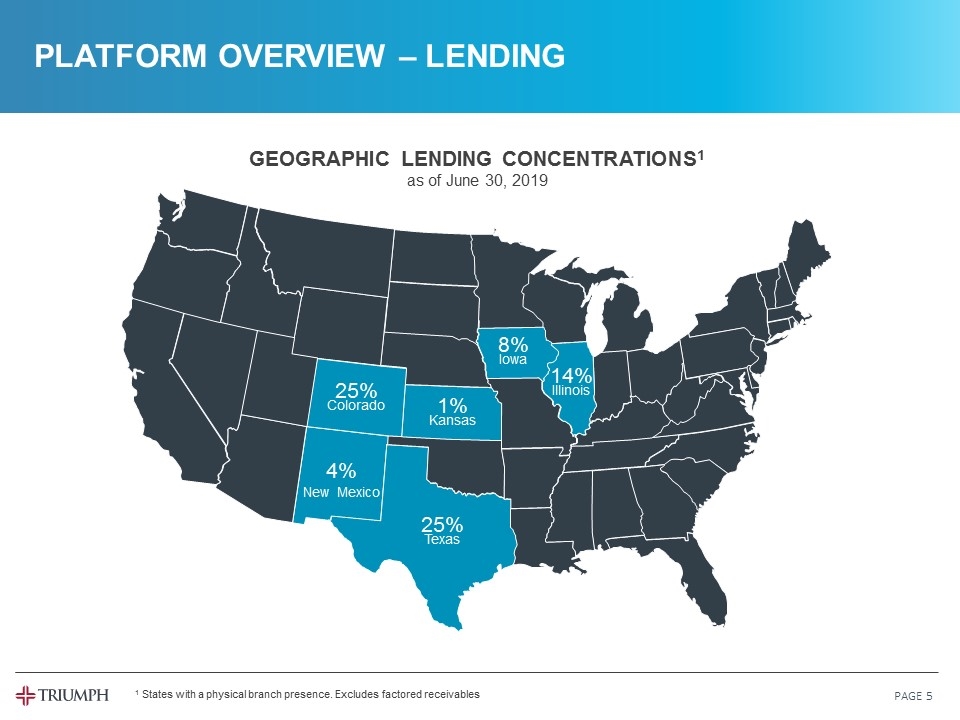

PLATFORM OVERVIEW – LENDING PAG PAGE E 25% Texas GEOGRAPHIC LENDING CONCENTRATIONS1 as of June 30, 2019 25% Colorado 1% Kansas 8% Iowa 14% Illinois 4% New Mexico 1 States with a physical branch presence. Excludes factored receivables

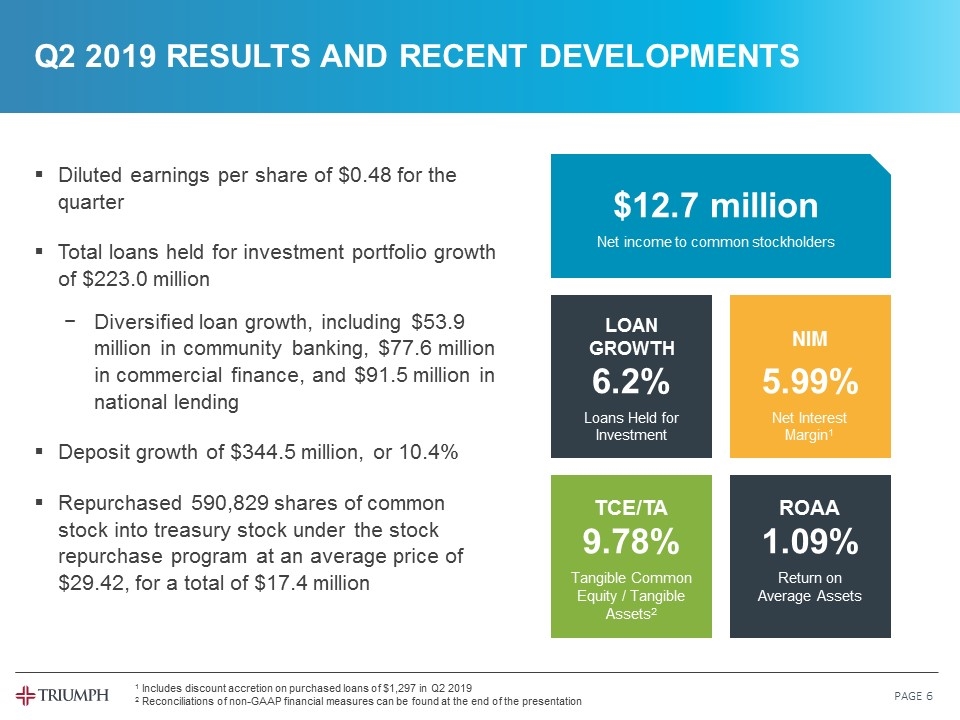

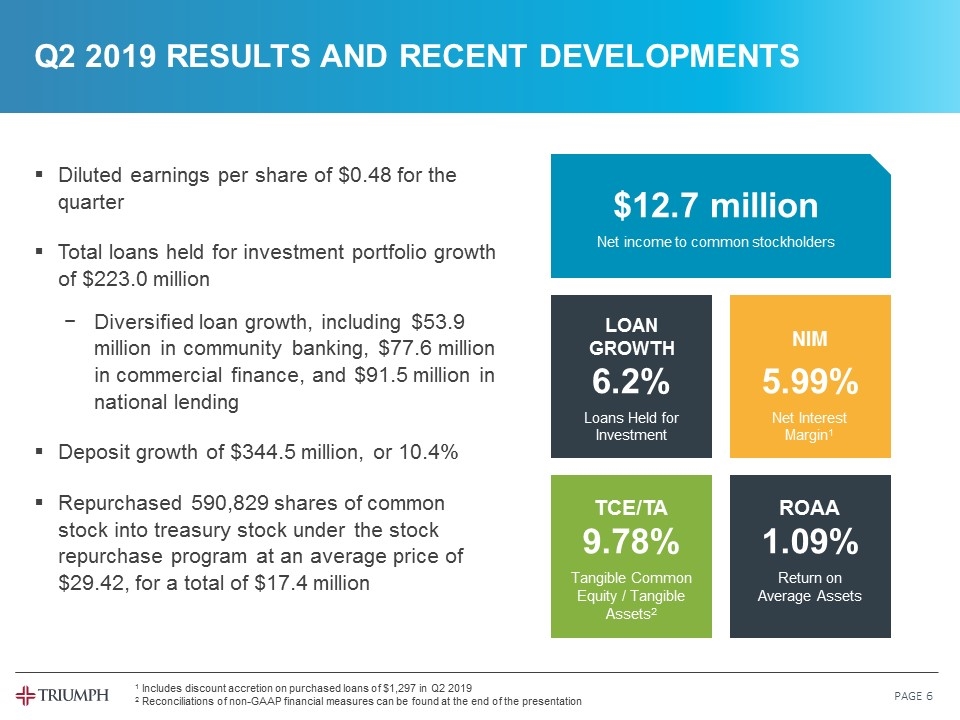

Q2 2019 RESULTS AND RECENT DEVELOPMENTS PAGE Diluted earnings per share of $0.48 for the quarter Total loans held for investment portfolio growth of $223.0 million Diversified loan growth, including $53.9 million in community banking, $77.6 million in commercial finance, and $91.5 million in national lending Deposit growth of $344.5 million, or 10.4% Repurchased 590,829 shares of common stock into treasury stock under the stock repurchase program at an average price of $29.42, for a total of $17.4 million $12.7 million Net income to common stockholders LOAN GROWTH 6.2% Loans Held for Investment NIM 5.99% Net Interest Margin1 ROAA 1.09% Return on Average Assets TCE/TA 9.78% Tangible Common Equity / Tangible Assets2 1 Includes discount accretion on purchased loans of $1,297 in Q2 2019 2 Reconciliations of non-GAAP financial measures can be found at the end of the presentation

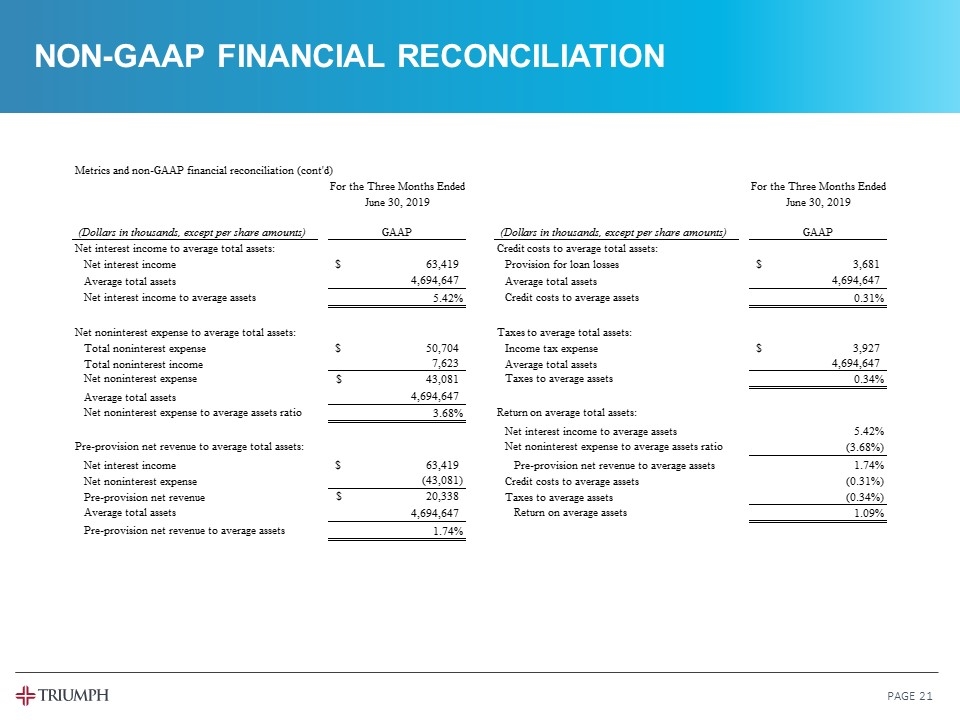

RETURN ON AVERAGE ASSETS (“ROAA”) NET OVERHEAD RATIO NET INTEREST INCOME TO AVERAGE ASSETS CREDIT COSTS PRE-PROVISION NET REVENUE TAXES 5.42% 3.68% 1.74% 0.31% 0.34% PAPAGE GE Goal 5.50 - 6.00% Goal > 2.70% Goal < 0.30% Goal ~ 0.50% Goal > 1.80% Goal 2.80 - 3.30% 1.09% Annualized performance metrics presented are for the three months ended June 30, 2019 Reconciliations of these financial measures can be found at the end of the presentation LONG TERM PERFORMANCE GOALS VS ACTUAL Q2

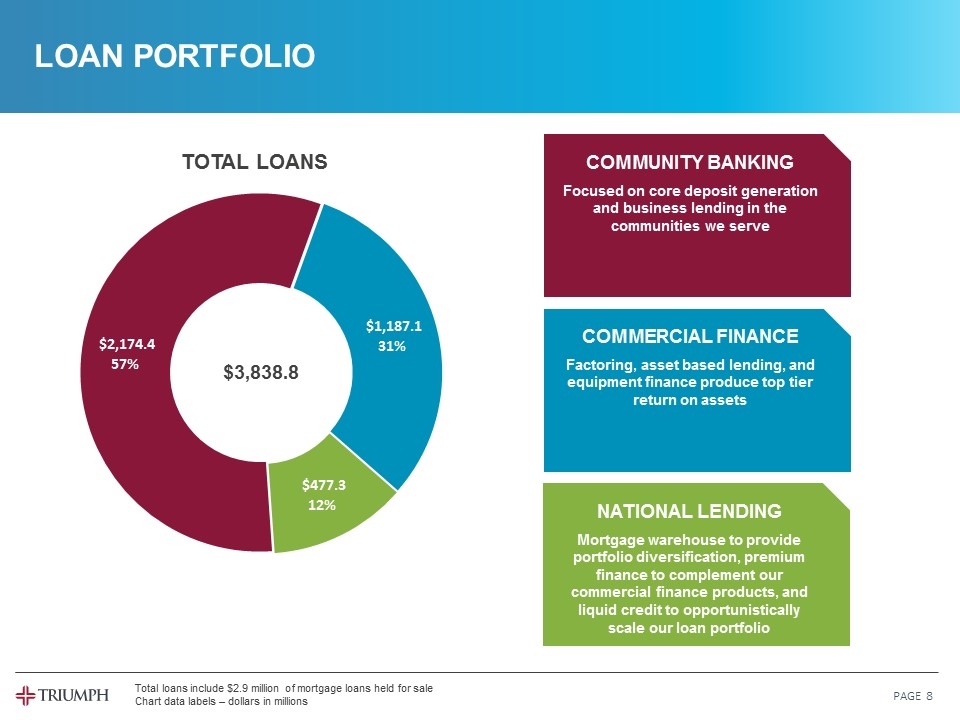

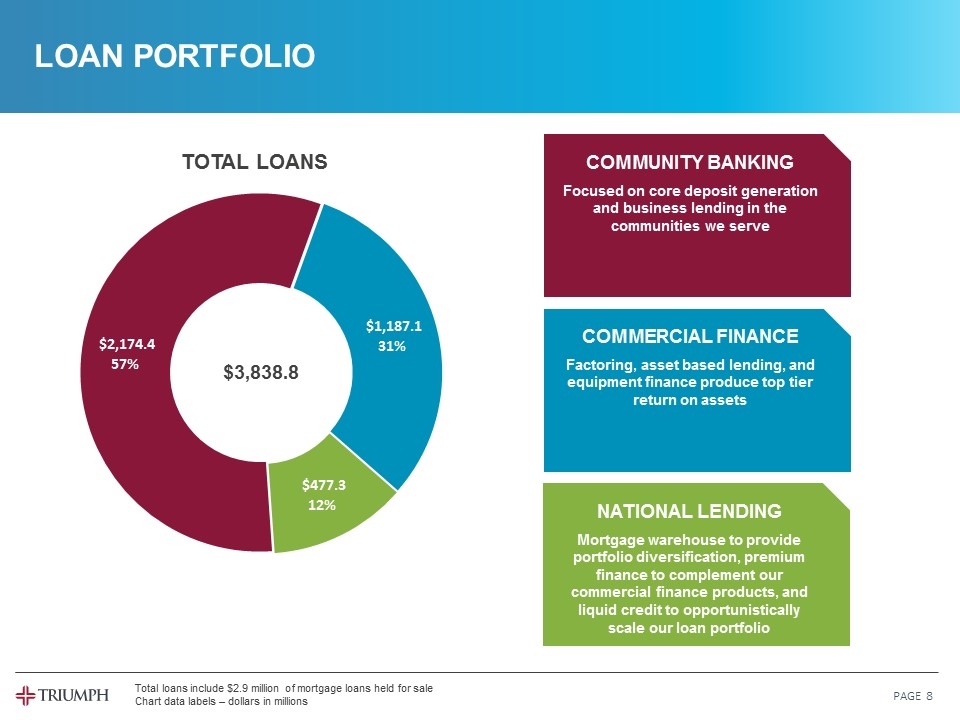

LOAN PORTFOLIO PAGEPAGE TOTAL LOANS COMMUNITY BANKING Focused on core deposit generation and business lending in the communities we serve COMMERCIAL FINANCE Factoring, asset based lending, and equipment finance produce top tier return on assets NATIONAL LENDING Mortgage warehouse to provide portfolio diversification, premium finance to complement our commercial finance products, and liquid credit to opportunistically scale our loan portfolio $3,838.8 Total loans include $2.9 million of mortgage loans held for sale Chart data labels – dollars in millions

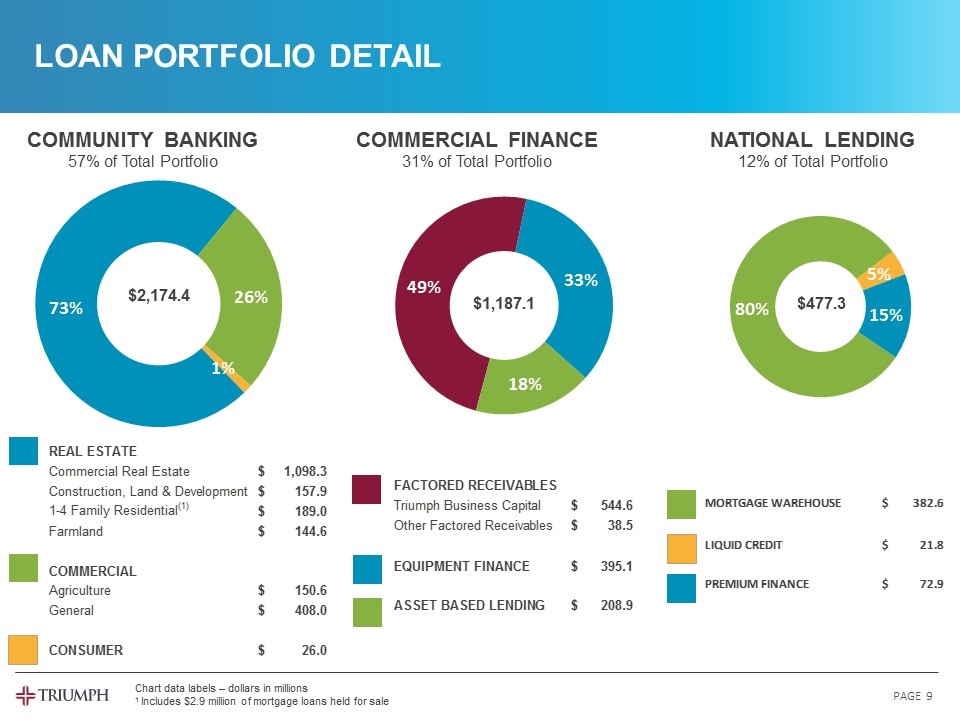

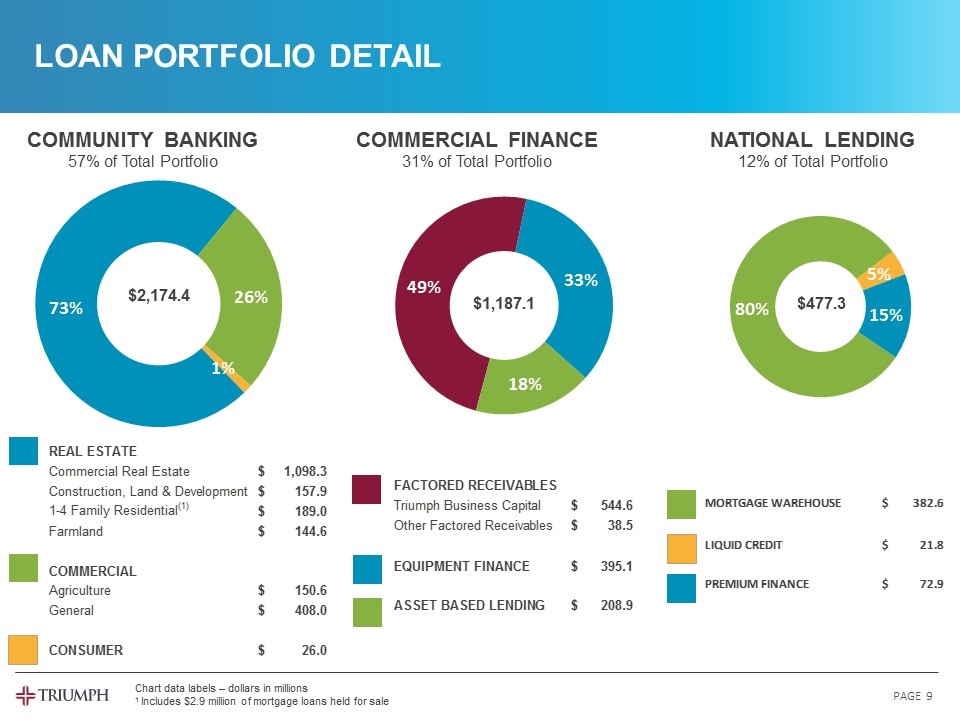

LOAN PORTFOLIO DETAIL PAGEPAGE COMMUNITY BANKING 57% of Total Portfolio NATIONAL LENDING 12% of Total Portfolio COMMERCIAL FINANCE 31% of Total Portfolio $2,174.4 $477.3 $1,187.1 Chart data labels – dollars in millions 1 Includes $2.9 million of mortgage loans held for sale 43646 Loan Summary Chart Q2 2019 Commercial Real Estate $1,098.3 Community Banking $2,174.4 0.56642700844013749 Construction, Land Development, Land $157.9 Commercial Finance $1,187.999999999999 0.30923726164426379 1-4 Family Residential Properties $186.1 Community Banking National Lending $477.3 0.12433572991559862 Farmland $144.6 $3,838.8 Commercial $1,257.3 Community Banking Chart Factored receivables $583.1 Real Estate & Farmland $1,589.8 0.73114422369389254 Consumer $26 Commercial $558.6 0.25689845474613687 Mortgage Warehouse $382.6 Consumer $26 1.1957321559970566E-2 Agriculture $150.6 <<<<<<<<<< MANUAL UPDATE $2,174.4 0 Commercial Finance Chart Equipment $395.1 Factored Receivables $583.1 0.49119703479066629 Asset based lending $208.9 Equipment Finance $395.1 0.33282789992418499 National Lending Asset-Based Lending $208.9 0.17597506528514867 Liquid credit $21.8 $1,187.1000000000001 0 Premium finance $72.900000000000006 National Lending Chart Commercial Finance: Mortgage Warehouse $382.6 0.80159228996438292 Mortgage Loans HFS $2.9 <<<<<<<<<< MANUAL UPDATE Liquid Credit $21.8 4.5673580557301481E-2 Liquid credit HFS $0 <<<<<<<<<< MANUAL UPDATE Premium Finance $72.900000000000006 0.15273412947831552 $477.30000000000007 0 REAL ESTATE FACTORED RECEIVABLES Commercial Real Estate $1,098.3 Triumph Business Capital #REF! #REF! Construction, Land & Development $157.9 Triumph Commercial Finance <<<<<<<<<< MANUAL UPDATE 1-4 Family Residential(1) $189 Farmland $144.6 EQUIPMENT FINANCE #REF! COMMERCIAL ASSET BASED LENDING #REF! Agriculture $150.6 General $408 PREMIUM FINANCE #REF! CONSUMER $26 #REF! $2,174.3999999999996 MORTGAGE WAREHOUSE $382.6 43646 Loan Summary Chart Q2 2019 Commercial Real Estate $1,098.3 Community Banking $2,174.4 0.56642700844013749 Construction, Land Development, Land $157.9 Commercial Finance $1,187.999999999999 0.30923726164426379 1-4 Family Residential Properties $186.1 Community Banking National Lending $477.3 0.12433572991559862 Farmland $144.6 $3,838.8 Commercial $1,257.3 Community Banking Chart Factored receivables $583.1 Real Estate & Farmland $1,589.8 0.73114422369389254 Consumer $26 Commercial $558.6 0.25689845474613687 Mortgage Warehouse $382.6 Consumer $26 1.1957321559970566E-2 Agriculture $150.6 <<<<<<<<<< MANUAL UPDATE $2,174.4 0 Commercial Finance Chart Equipment $395.1 Factored Receivables $583.1 0.49119703479066629 Asset based lending $208.9 Equipment Finance $395.1 0.33282789992418499 National Lending Asset-Based Lending $208.9 0.17597506528514867 Liquid credit $21.8 $1,187.1000000000001 0 Premium finance $72.900000000000006 National Lending Chart Commercial Finance: Mortgage Warehouse $382.6 0.80159228996438292 Mortgage Loans HFS $2.9 <<<<<<<<<< MANUAL UPDATE Liquid Credit $21.8 4.5673580557301481E-2 Liquid credit HFS $0 <<<<<<<<<< MANUAL UPDATE Premium Finance $72.900000000000006 0.15273412947831552 $477.30000000000007 0 REAL ESTATE FACTORED RECEIVABLES Commercial Real Estate $1,098.3 Triumph Business Capital $544.6 $0 Construction, Land & Development $157.9 Triumph Commercial Finance $38.5 <<<<<<<<<< MANUAL UPDATE (TCF and TPay) 1-4 Family Residential(1) $189 Farmland $144.6 EQUIPMENT FINANCE $395.1 COMMERCIAL ASSET BASED LENDING $208.9 Agriculture $150.6 General $408 $1,187.1000000000001 CONSUMER $26 MORTGAGE WAREHOUSE $382.6 $2,174.3999999999996 LIQUID CREDIT $21.8 PREMIUM FINANCE $72.900000000000006 LIQUID CREDIT(2) $477.30000000000007 43646 Loan Summary Chart Q2 2019 Commercial Real Estate $1,098.3 Community Banking $2,174.4 0.56642700844013749 Construction, Land Development, Land $157.9 Commercial Finance $1,187.999999999999 0.30923726164426379 1-4 Family Residential Properties $186.1 Community Banking National Lending $477.3 0.12433572991559862 Farmland $144.6 $3,838.8 Commercial $1,257.3 Community Banking Chart Factored receivables $583.1 Real Estate & Farmland $1,589.8 0.73114422369389254 Consumer $26 Commercial $558.6 0.25689845474613687 Mortgage Warehouse $382.6 Consumer $26 1.1957321559970566E-2 Agriculture $150.6 <<<<<<<<<< MANUAL UPDATE $2,174.4 0 Commercial Finance Chart Equipment $395.1 Factored Receivables $583.1 0.49119703479066629 Asset based lending $208.9 Equipment Finance $395.1 0.33282789992418499 National Lending Asset-Based Lending $208.9 0.17597506528514867 Liquid credit $21.8 $1,187.1000000000001 0 Premium finance $72.900000000000006 National Lending Chart Commercial Finance: Mortgage Warehouse $382.6 0.80159228996438292 Mortgage Loans HFS $2.9 <<<<<<<<<< MANUAL UPDATE Liquid Credit $21.8 4.5673580557301481E-2 Liquid credit HFS $0 <<<<<<<<<< MANUAL UPDATE Premium Finance $72.900000000000006 0.15273412947831552 $477.30000000000007 0 REAL ESTATE FACTORED RECEIVABLES Commercial Real Estate $1,098.3 Triumph Business Capital $544.6 $0 Construction, Land & Development $157.9 Other Factored Receivables $38.5 <<<<<<<<<< MANUAL UPDATE (TCF and TPay) 1-4 Family Residential(1) $189 Farmland $144.6 EQUIPMENT FINANCE $395.1 COMMERCIAL ASSET BASED LENDING $208.9 Agriculture $150.6 General $408 $1,187.1000000000001 CONSUMER $26 MORTGAGE WAREHOUSE $382.6 $2,174.3999999999996 LIQUID CREDIT $21.8 PREMIUM FINANCE $72.900000000000006 LIQUID CREDIT(2) $477.30000000000007

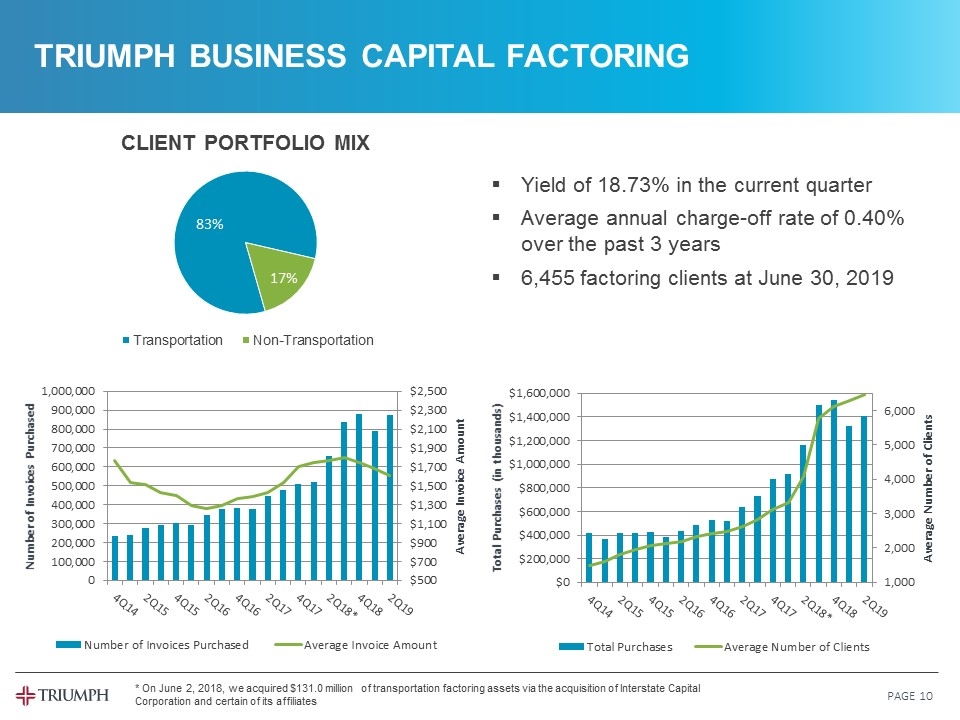

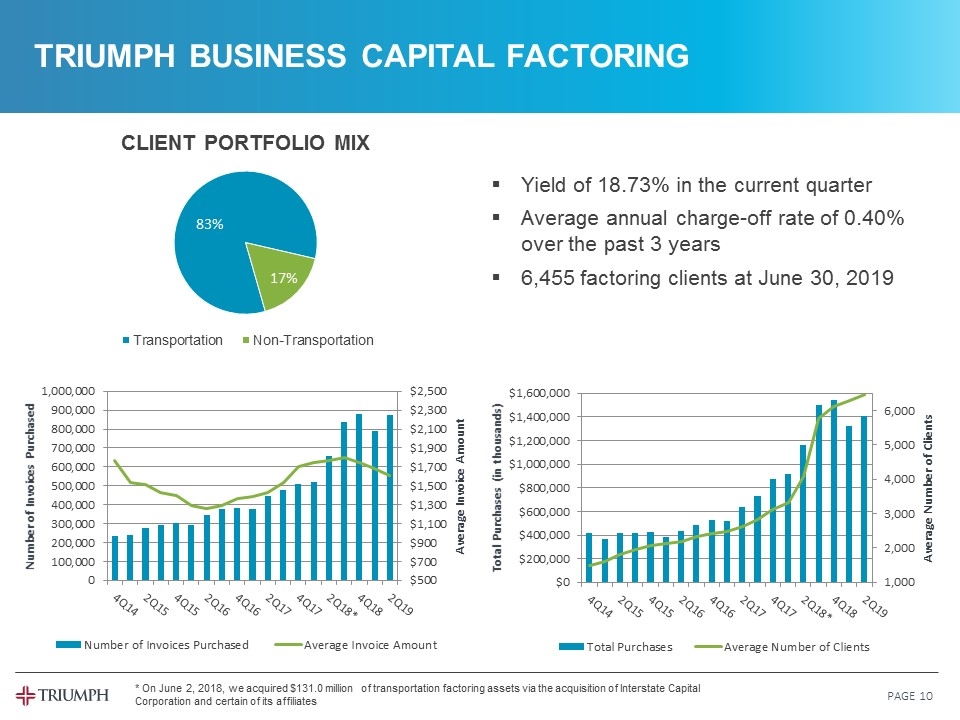

TRIUMPH BUSINESS CAPITAL FACTORING PAGE PAGE Yield of 18.73% in the current quarter Average annual charge-off rate of 0.40% over the past 3 years 6,455 factoring clients at June 30, 2019 * On June 2, 2018, we acquired $131.0 million of transportation factoring assets via the acquisition of Interstate Capital Corporation and certain of its affiliates

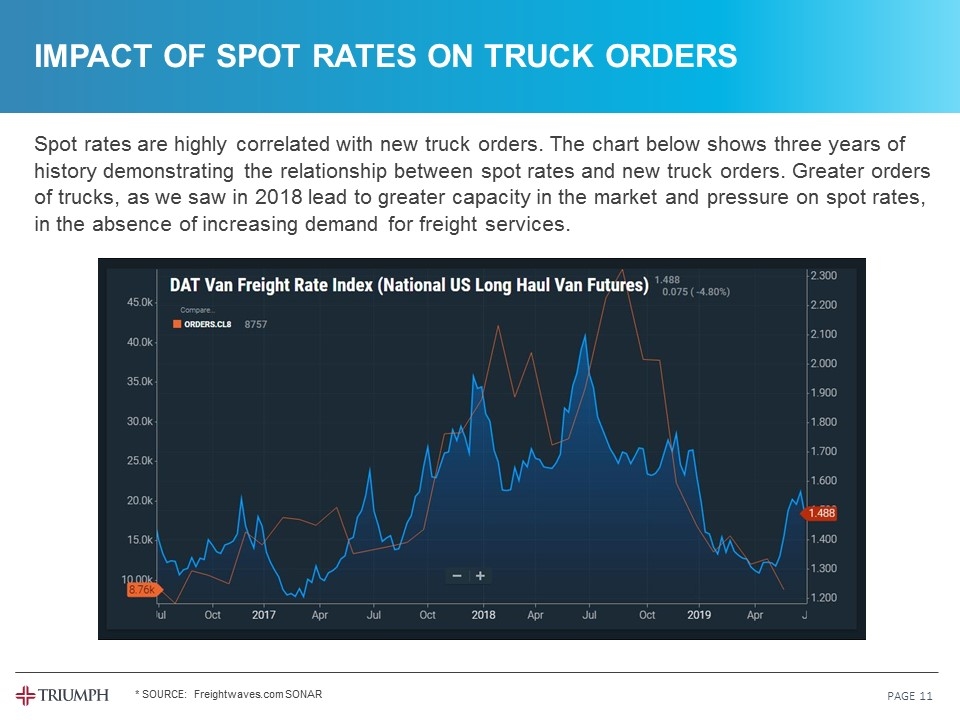

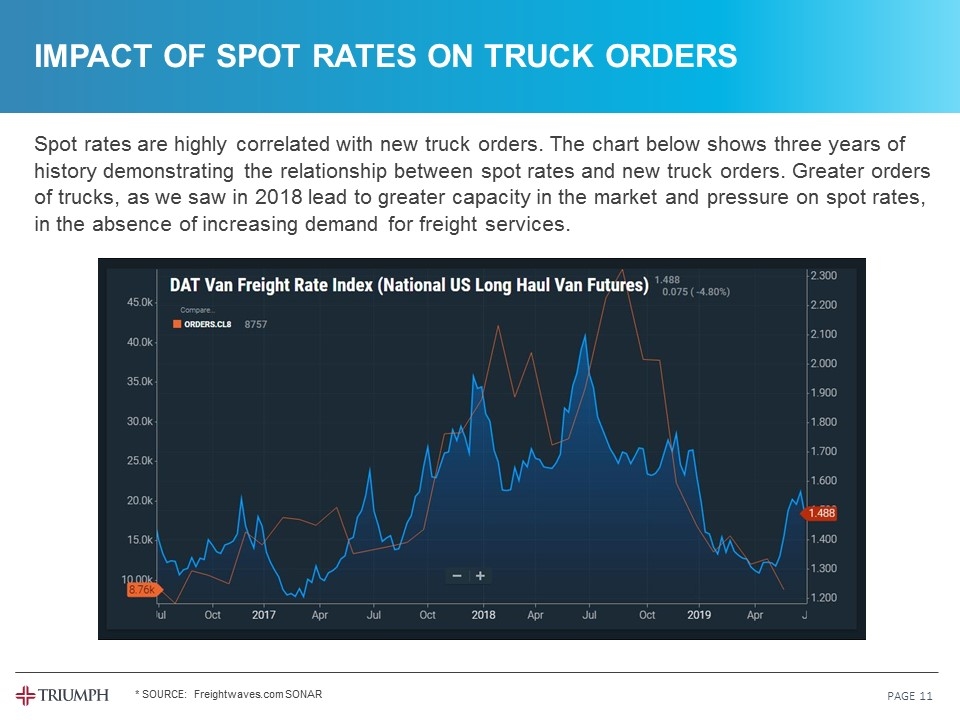

IMPACT OF SPOT RATES ON TRUCK ORDERS PAGE PAGE * SOURCE: Freightwaves.com SONAR Spot rates are highly correlated with new truck orders. The chart below shows three years of history demonstrating the relationship between spot rates and new truck orders. Greater orders of trucks, as we saw in 2018 lead to greater capacity in the market and pressure on spot rates, in the absence of increasing demand for freight services. DAT Van Freight Rate Index (National US Long Haul Van Futures) Compare Orders.CL8 8757 45.0k 40.0k 35.0k 30.0k 25.0k 20.0k 15.0k 10.0k 8.76k 2.3 2.2 2.1 2.0 1.9 1.8 1.7 1.6 1.4 1.3 1.2 1.488 Jul Oct 2017 Apr Jul Oct 2018 Apr Jul Oct 2019 Apr 1.488 0.075 (-4.80%)

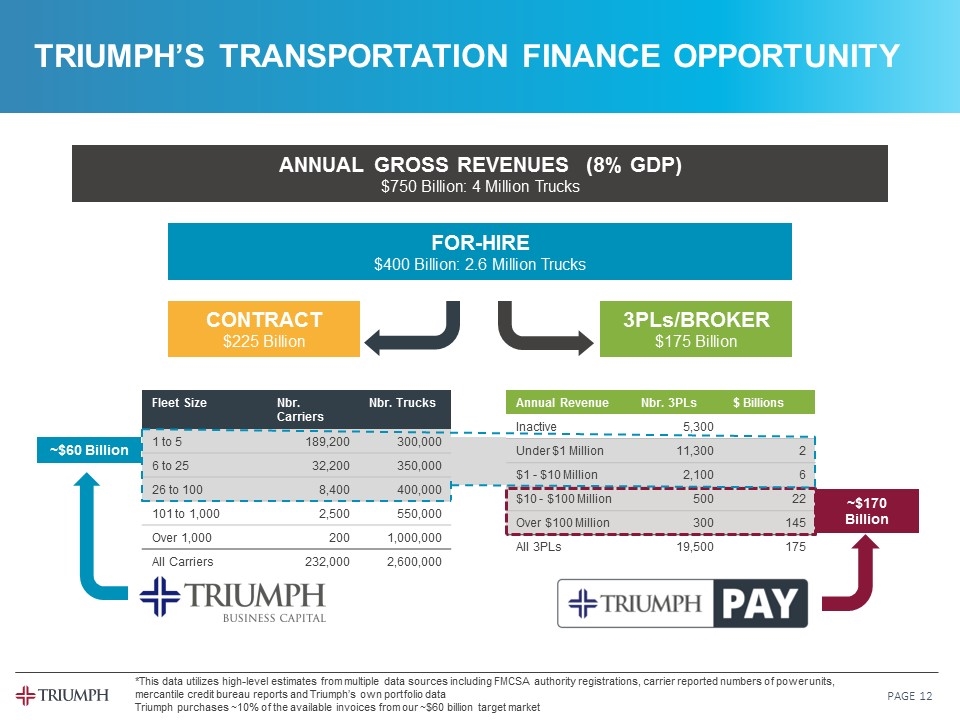

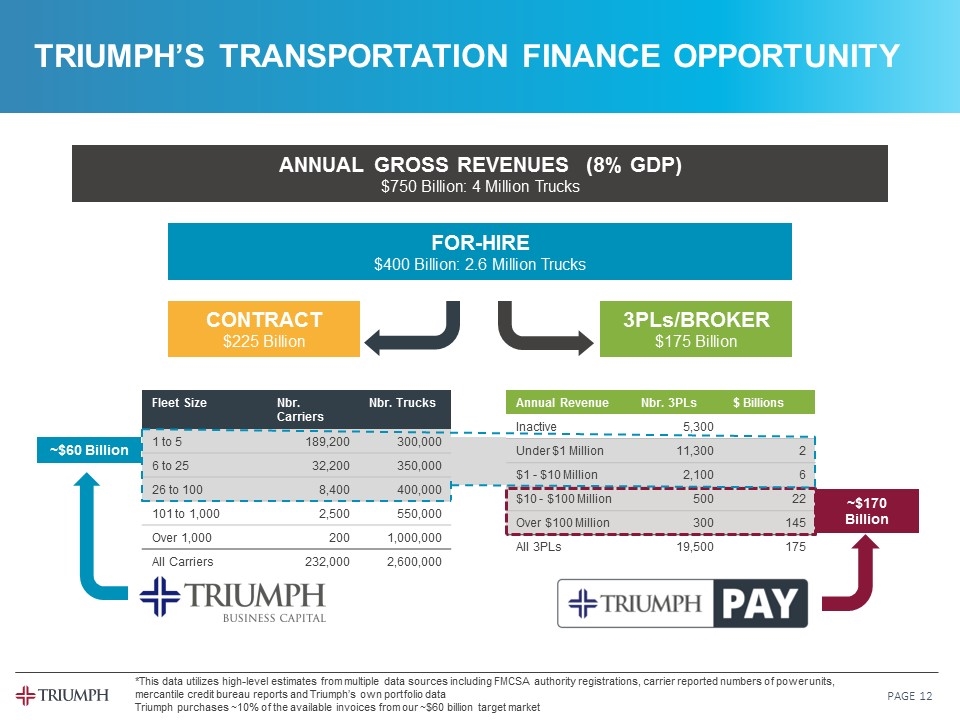

ANNUAL GROSS REVENUES (8% GDP) $750 Billion: 4 Million Trucks FOR-HIRE $400 Billion: 2.6 Million Trucks CONTRACT $225 Billion 3PLs/BROKER $175 Billion Fleet Size Nbr. Carriers Nbr. Trucks 1 to 5 189,200 300,000 6 to 25 32,200 350,000 26 to 100 8,400 400,000 101 to 1,000 2,500 550,000 Over 1,000 200 1,000,000 All Carriers 232,000 2,600,000 Annual Revenue Nbr. 3PLs $ Billions Inactive 5,300 Under $1 Million 11,300 2 $1 - $10 Million 2,100 6 $10 - $100 Million 500 22 Over $100 Million 300 145 All 3PLs 19,500 175 ~$170 Billion TRIUMPH’S TRANSPORTATION FINANCE OPPORTUNITY PAGE ~$60 Billion *This data utilizes high-level estimates from multiple data sources including FMCSA authority registrations, carrier reported numbers of power units, mercantile credit bureau reports and Triumph’s own portfolio data Triumph purchases ~10% of the available invoices from our ~$60 billion target market

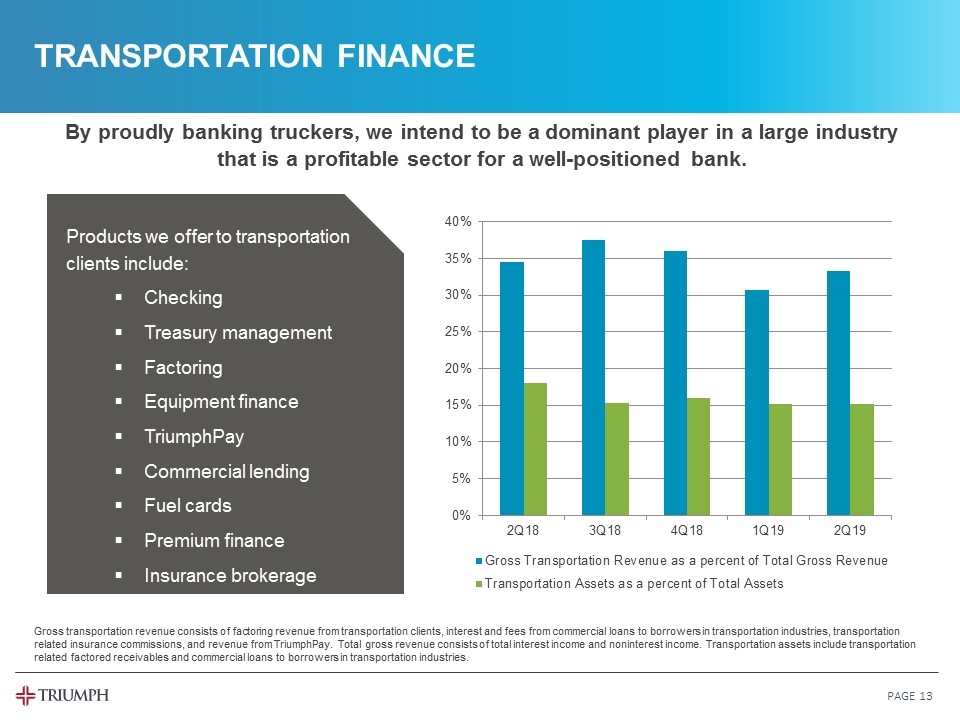

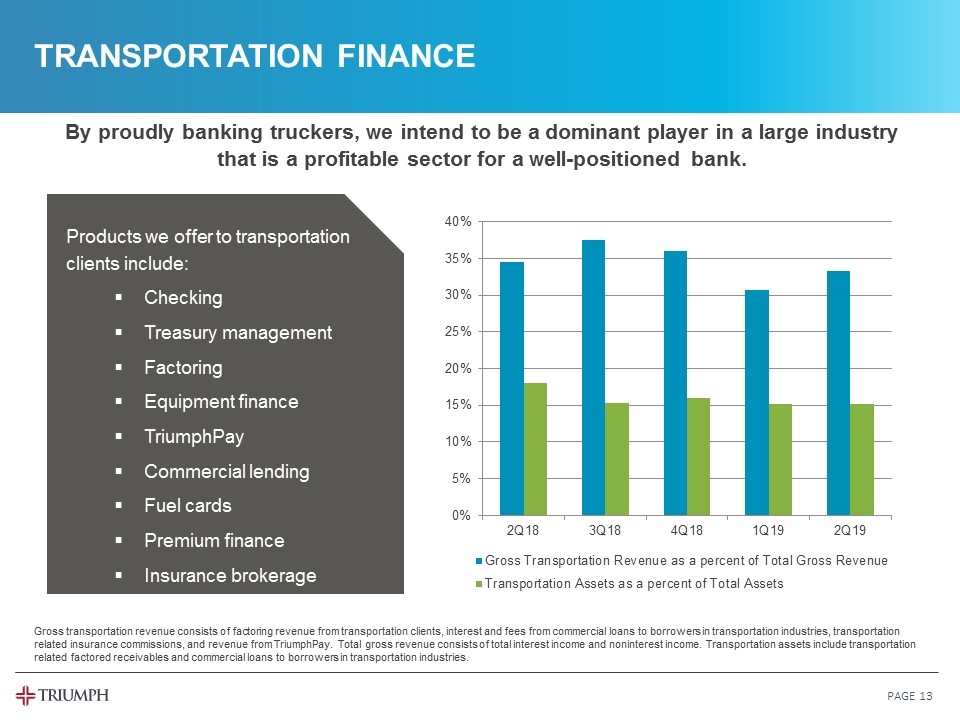

TRANSPORTATION FINANCE PAGE Gross transportation revenue consists of factoring revenue from transportation clients, interest and fees from commercial loans to borrowers in transportation industries, transportation related insurance commissions, and revenue from TriumphPay. Total gross revenue consists of total interest income and noninterest income. Transportation assets include transportation related factored receivables and commercial loans to borrowers in transportation industries. By proudly banking truckers, we intend to be a dominant player in a large industry that is a profitable sector for a well-positioned bank. Products we offer to transportation clients include: Checking Treasury management Factoring Equipment finance TriumphPay Commercial lending Fuel cards Premium finance Insurance brokerage

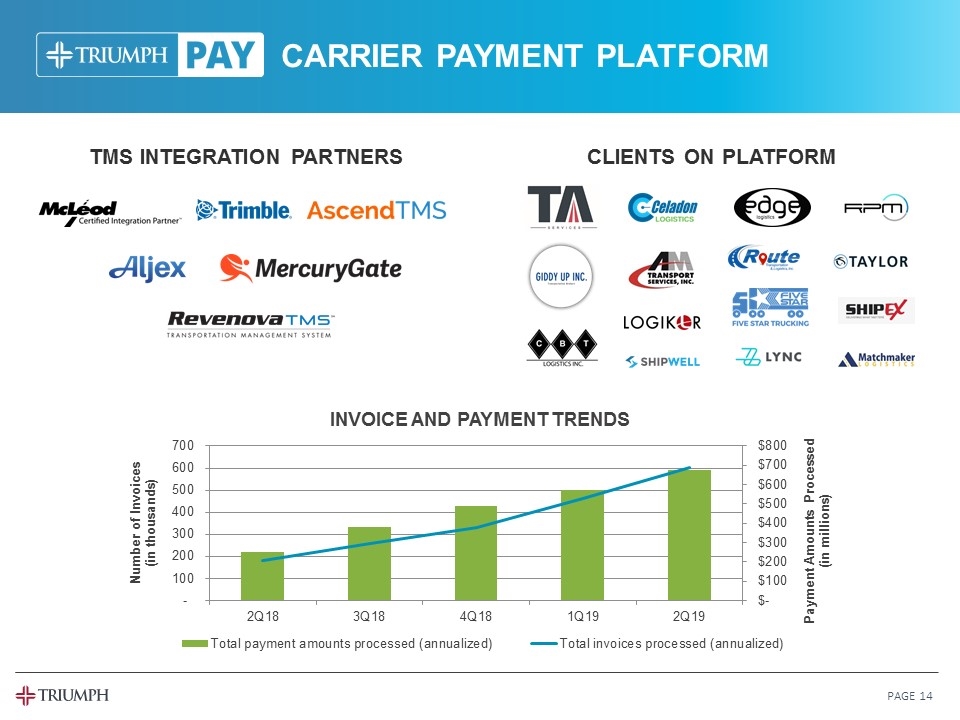

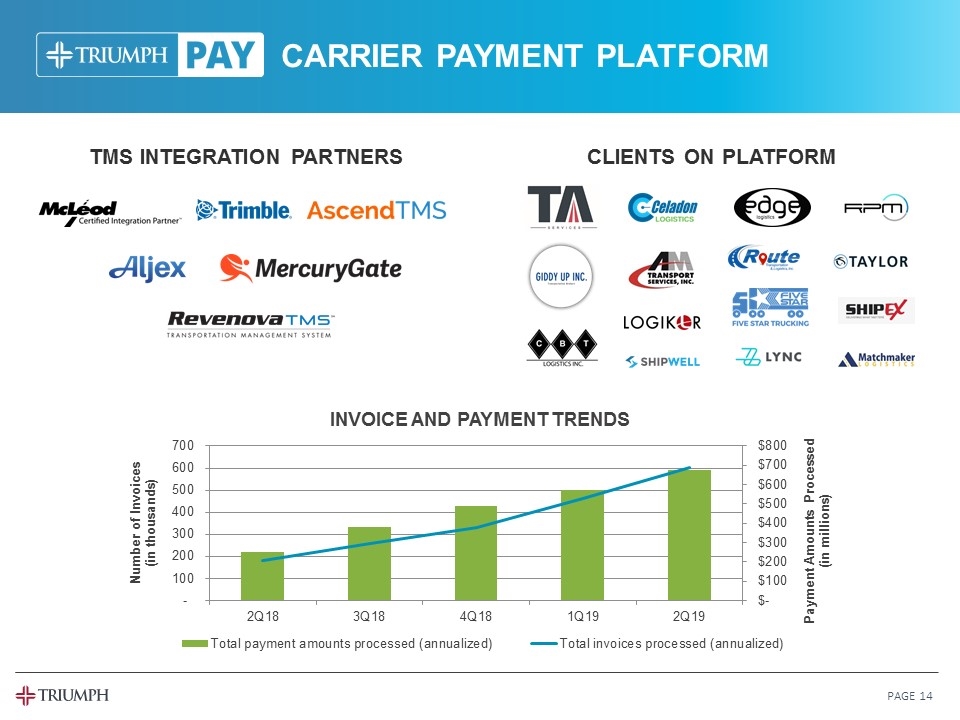

CARRIER PAYMENT PLATFORM TMS INTEGRATION PARTNERS CLIENTS ON PLATFORM PAGE

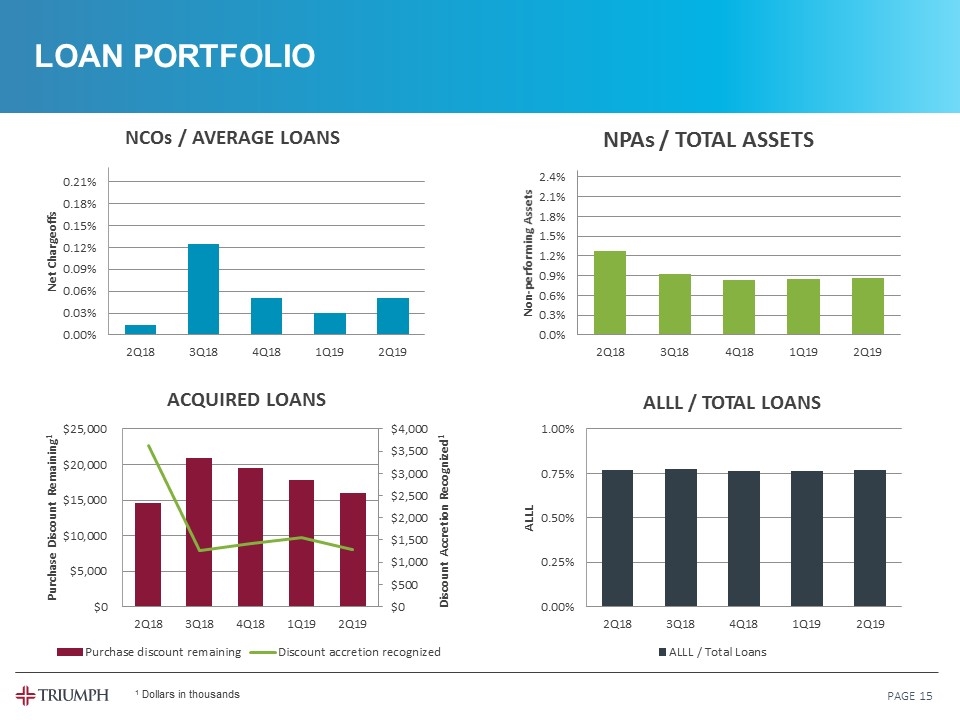

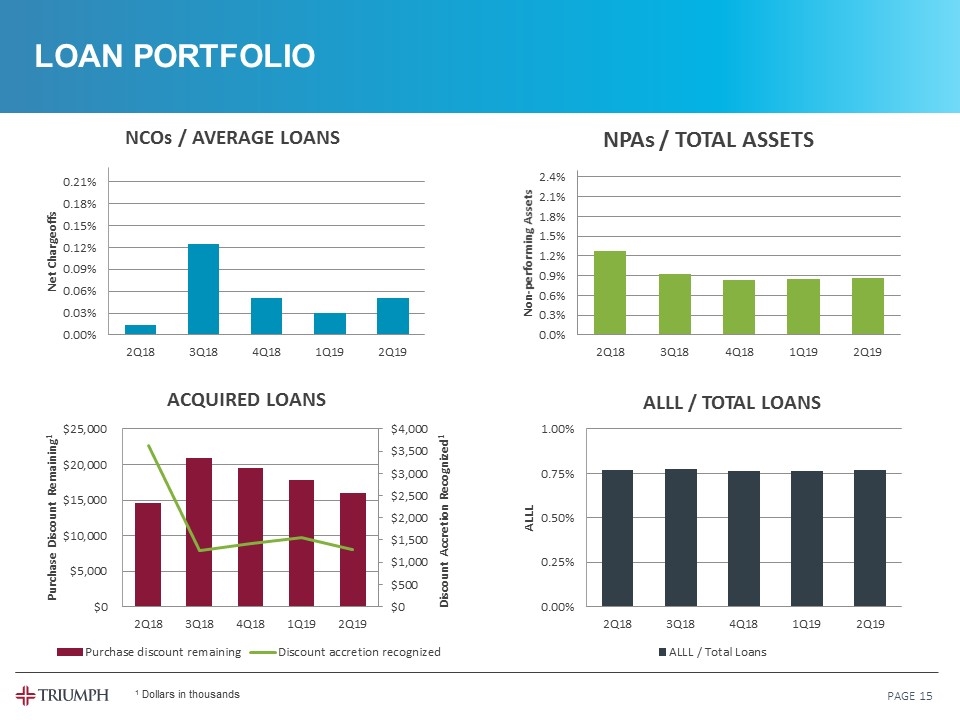

LOAN PORTFOLIO PAGE 1 Dollars in thousands

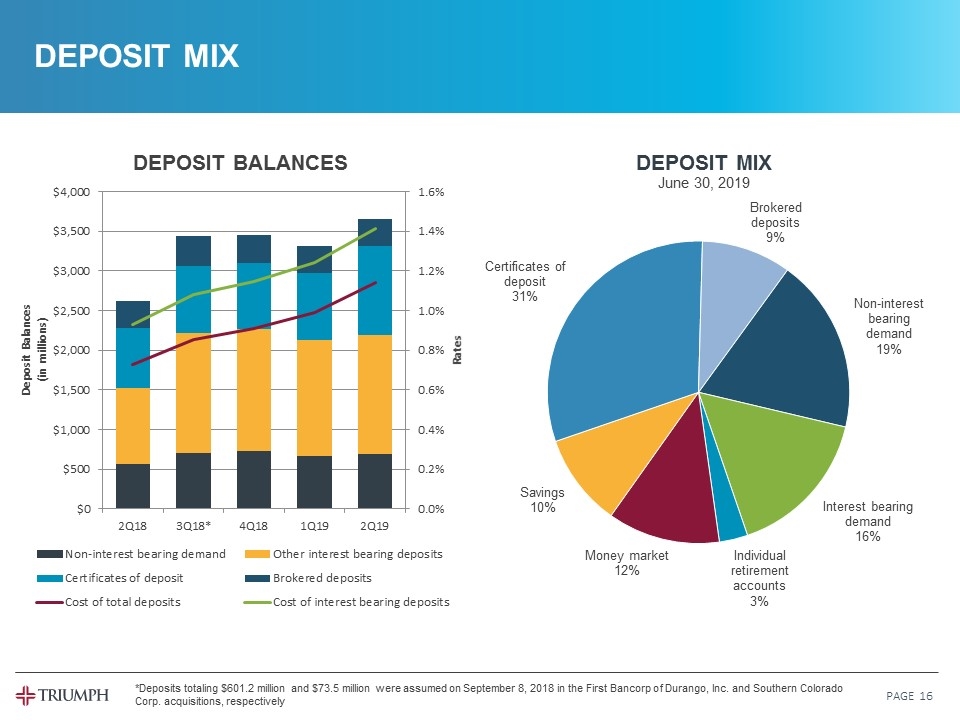

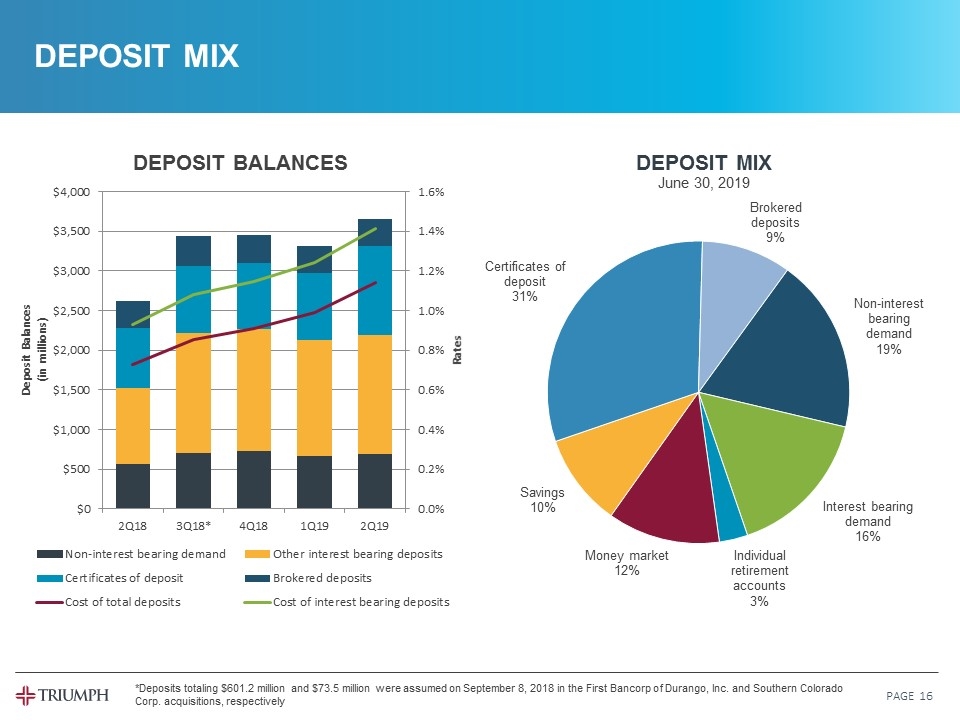

DEPOSIT MIX PAGPAGE E *Deposits totaling $601.2 million and $73.5 million were assumed on September 8, 2018 in the First Bancorp of Durango, Inc. and Southern Colorado Corp. acquisitions, respectively

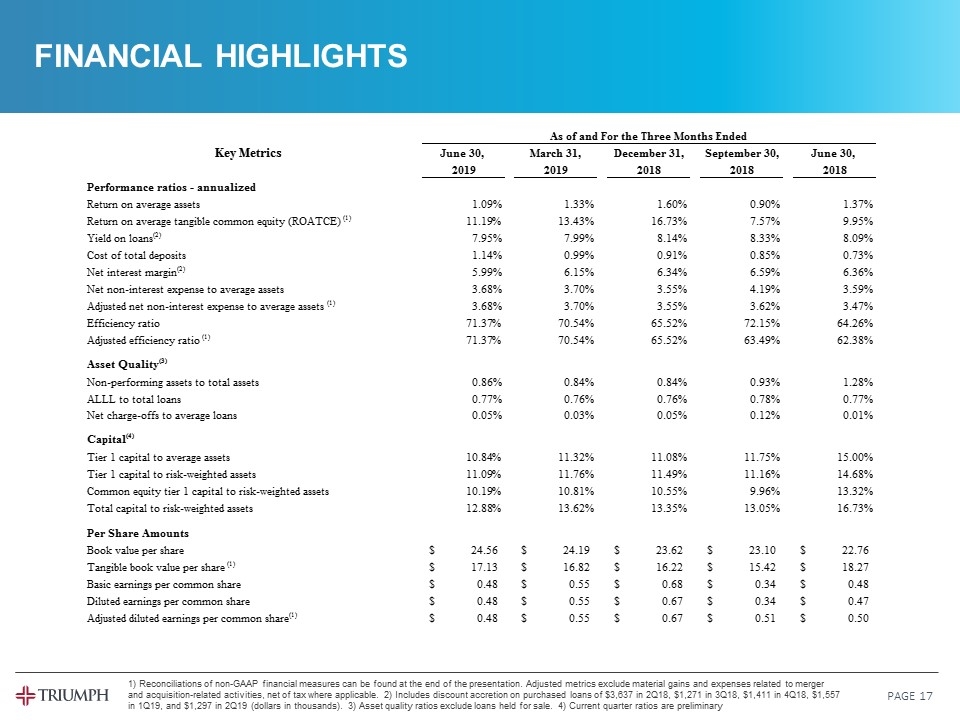

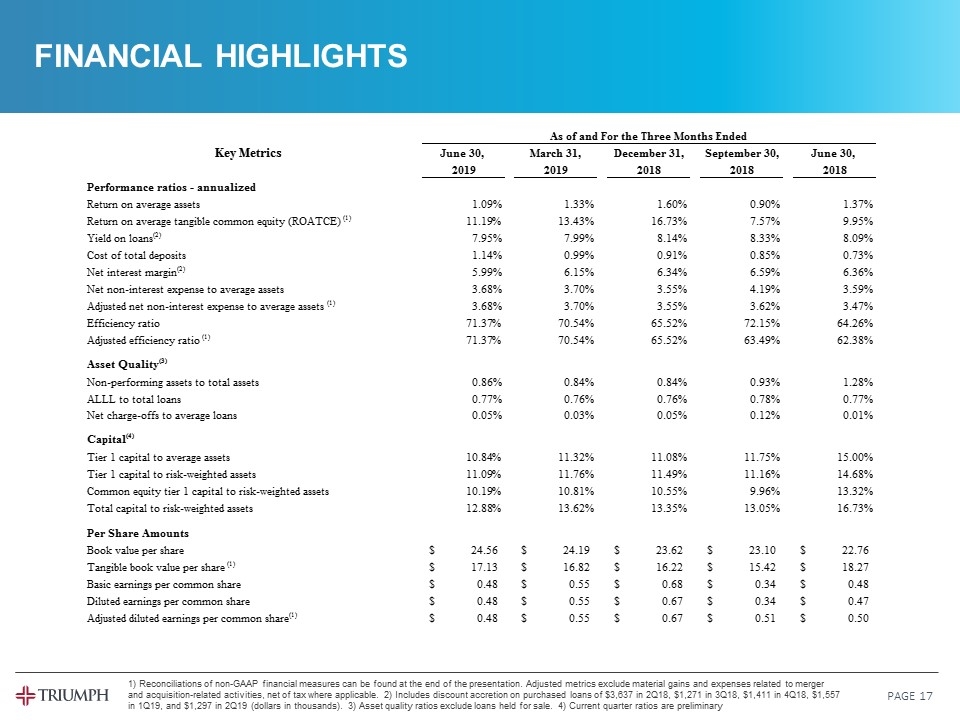

FINANCIAL HIGHLIGHTS PAGE 1) Reconciliations of non-GAAP financial measures can be found at the end of the presentation. Adjusted metrics exclude material gains and expenses related to merger and acquisition-related activities, net of tax where applicable. 2) Includes discount accretion on purchased loans of $3,637 in 2Q18, $1,271 in 3Q18, $1,411 in 4Q18, $1,557 in 1Q19, and $1,297 in 2Q19 (dollars in thousands). 3) Asset quality ratios exclude loans held for sale. 4) Current quarter ratios are preliminary 43646QTD 43555QTD 43465QTD 43373QTD 43281QTD 43646 43555 43465 43373 43281 As of and For the Three Months Ended Key Metrics June 30, March 31, December 31, September 30, June 30, 2019 2019 2018 2018 2018 Performance ratios - annualized ROAA Return on average assets 1.876615488242248% 1.332190367705069% 1.598366446545838% .895888860348001% 1.368913918307048% ROATCE Return on average tangible common equity (ROATCE) (1) 0.11189292823949414 0.13429444272197608 0.16734623929529752 7.566729599617285% 9.950252430952552% Yield_Loans Yield on loans(2) 7.95% 7.99% 8.14% 8.33% 8.9% CostOfTotalDeposits Cost of total deposits 1.140128137340148% .989966407274788% .909444799833016% .854826457502392% .728648800964141% NIM Net interest margin(2) 5.991831221661632% 6.149417161132849% 6.340318149705548% 6.587251816912991% 6.355209121569136% Net_Nonint_Exp_Avg_Assets Net non-interest expense to average assets 3.680733159739261% 3.696209686233955% 3.55021454457923% 4.190323750768411% 3.587460180756773% Net_Nonint_Exp_Avg_Assets_Adj Adjusted net non-interest expense to average assets (1) 3.680733159739261% 3.696209686233955% 3.55021454457923% 3.616676755337314% 3.46654615798428% Efficiency_Unadjusted Efficiency ratio 0.71371487891882912 0.70540688936196283 0.65521880825205669 0.721482498835187 0.6426335152399435 Efficiency Adjusted efficiency ratio (1) 0.71371487891882912 0.70540688936196283 0.65521880825205669 0.63493709562202605 0.62383665258488064 Asset Quality(3) Nonperforming assets to total assets Non-performing assets to total assets .857816824716732% .842247851607903% .839492440313445% .93030749584206% 1.27793716964838% ALLL to total loans ALLL to total loans .766859850209977% .764074202524365% .764026598356613% .776050405692479% .76794280676573% Net charge-offs to average loans Net charge-offs to average loans 50443824731717082.504438247317171% 27730538396891915.277305383968919% 45176188551532438.451761885515324% .124316094470515% 13038804646194944.130388046461949% Capital(4) Tier 1 capital to average assets Tier 1 capital to average assets 0.10837248543059837 0.113191 0.110794 0.11748529030204684 0.15002799999999999 Tier 1 capital to risk-weighted assets Tier 1 capital to risk-weighted assets 0.11085191806522068 0.117589 0.114901 0.11160782043180321 0.14676400000000001 Common equity tier 1 capital to risk-weighted assets Common equity tier 1 capital to risk-weighted assets 0.10191518689225137 0.108129 0.10545400000000001 9.963598284830128% 0.133244 Total capital to risk-weighted assets Total capital to risk-weighted assets 0.1287848838043851 0.13619400000000001 0.133522 0.13048520111929465 0.16733500000000001 Per Share Amounts Common Book Value per share, basic Book value per share $24.5574121286764 $24.194290588437159 $23.621812441780939 $23.09693951782895 $22.755096533481389 Tangible common book value per common share Tangible book value per share (1) $17.126855754196036 $16.818047069252106 $16.222260677353741 $15.416442086364484 $18.2701997701135 EPS_Basic Basic earnings per common share $0.4822823240343197 $0.55426433517403839 $0.67818178436645749 $0.34282489208822919 $0.47778654941594234 EPS_Diluted Diluted earnings per common share $0.48064223345025886 $0.55190689466232712 $0.67030412762111058 $0.33970561035251029 $0.47064017295355659 DilutedEPS_Adj Adjusted diluted earnings per common share(1) $0.48064223345025886 $0.55190689466232712 $0.67 $0.51 $0.5

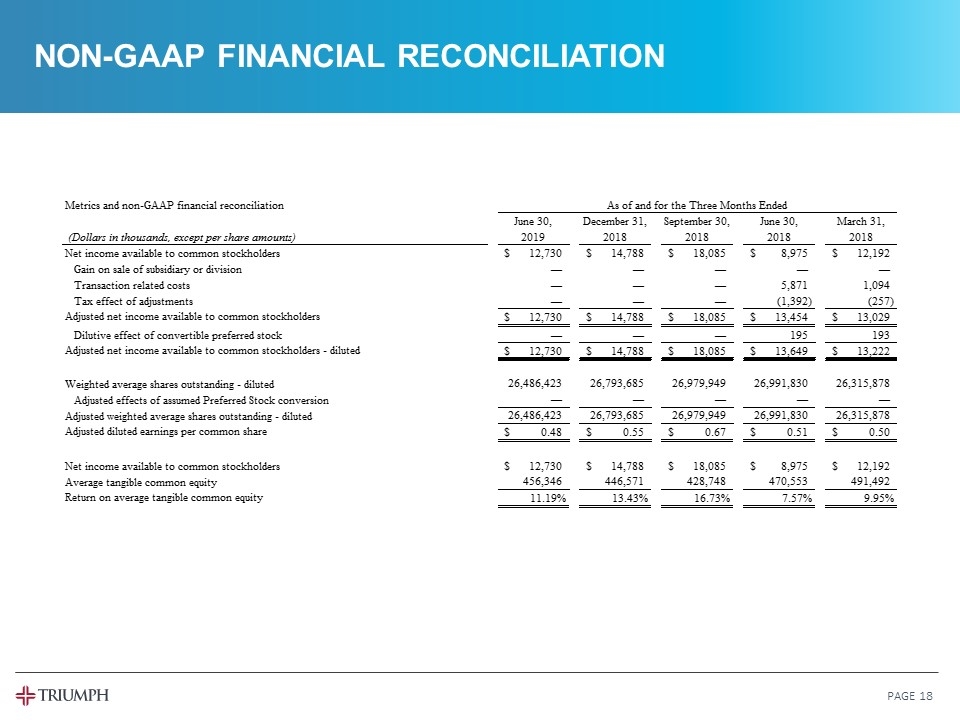

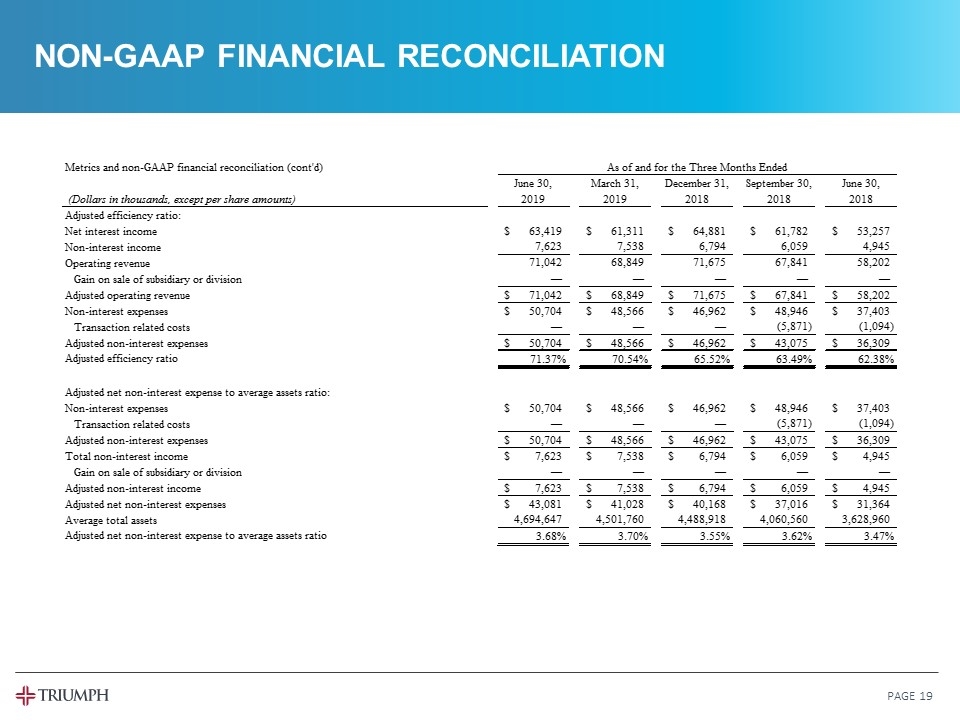

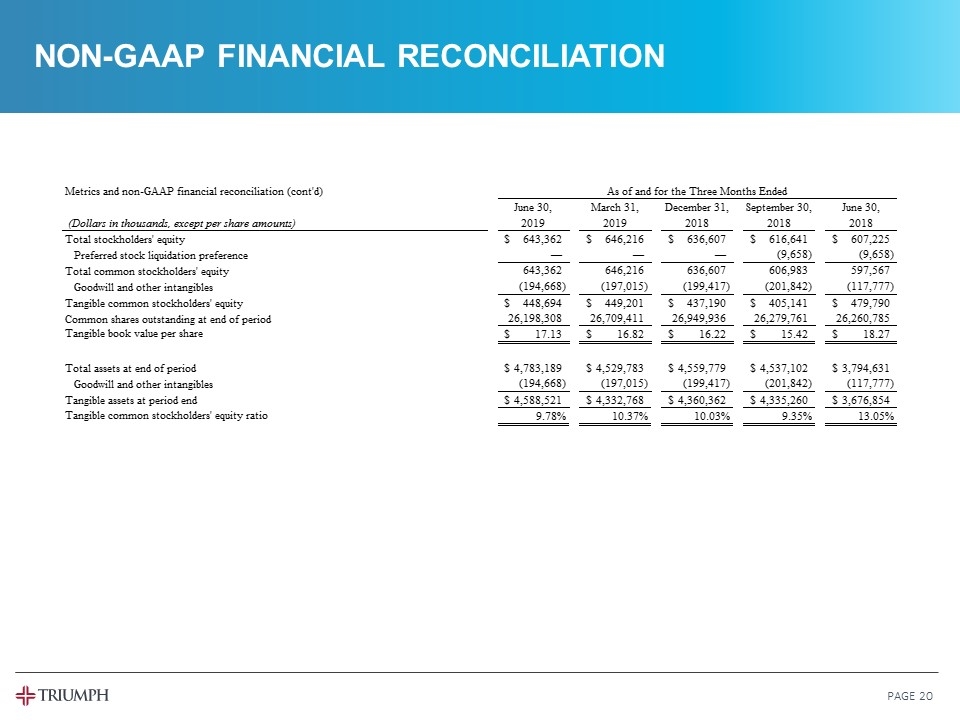

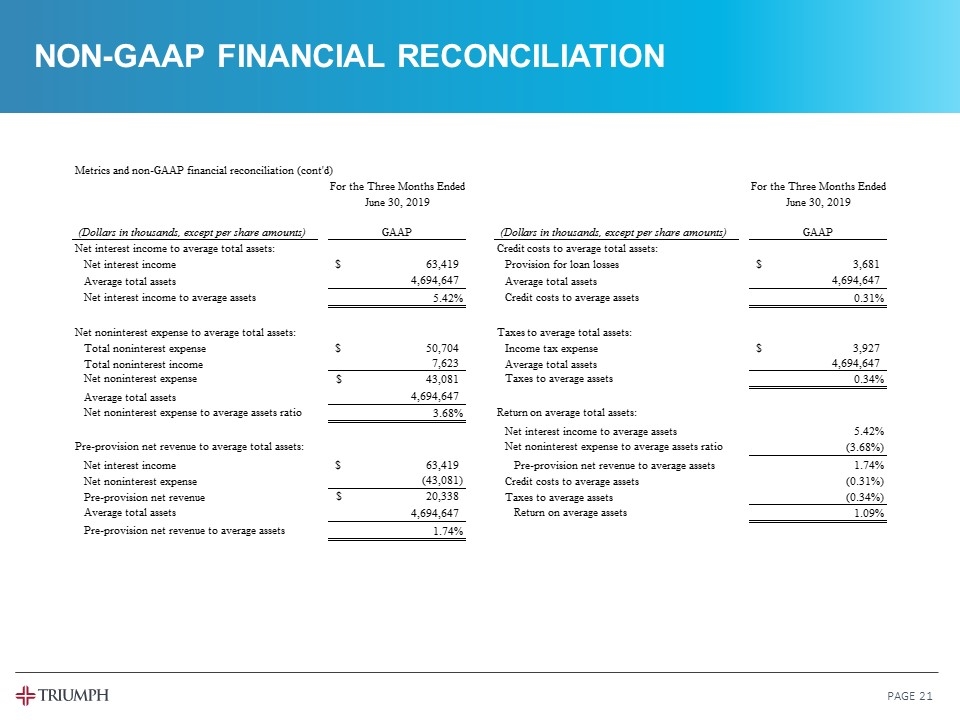

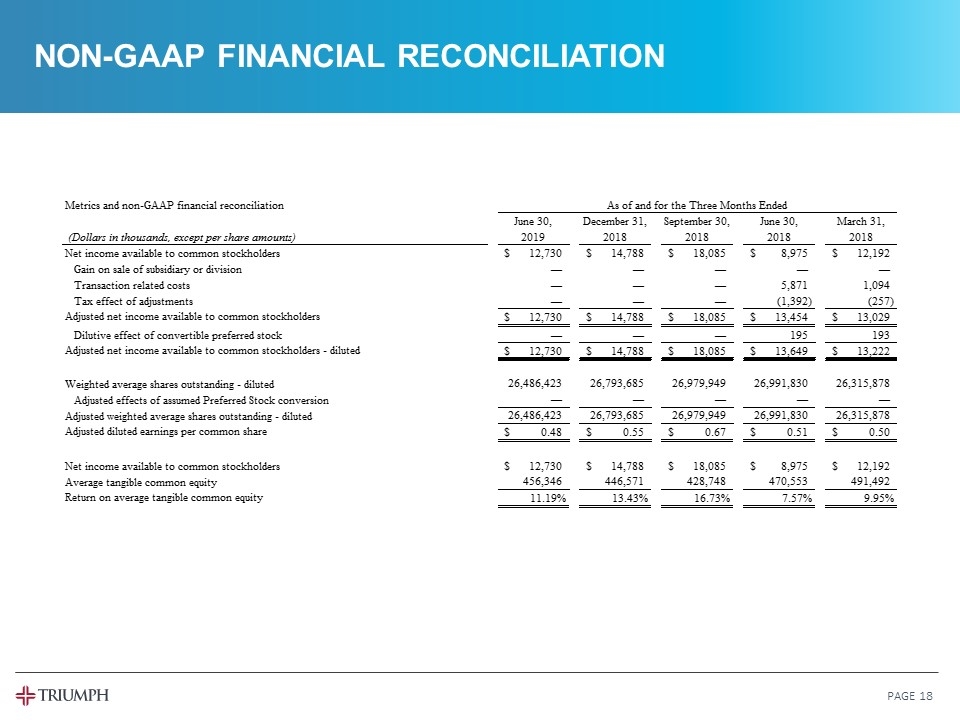

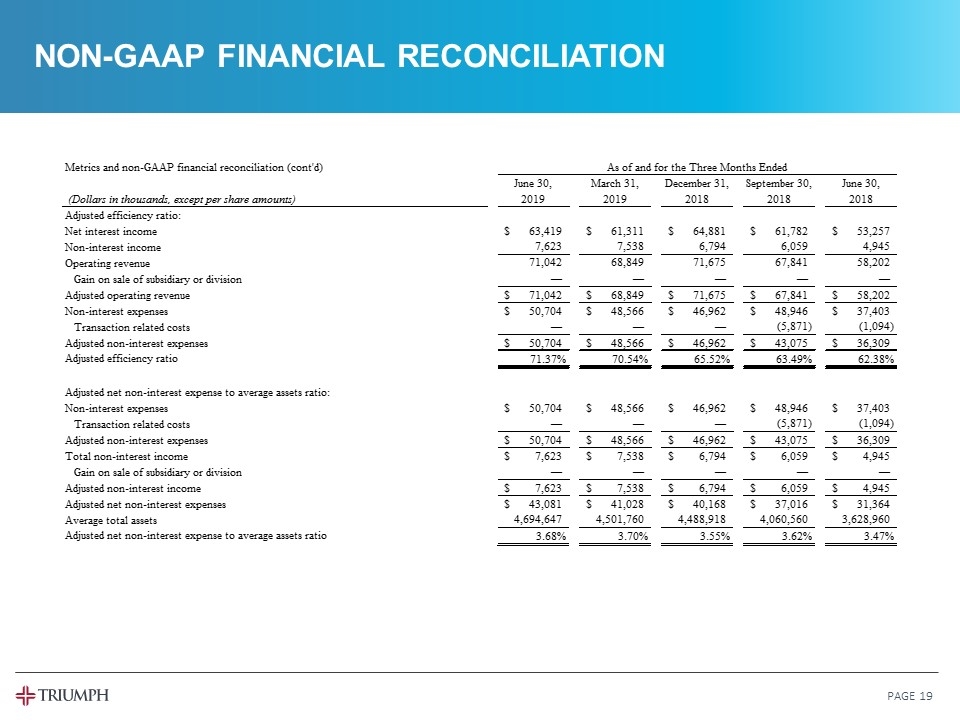

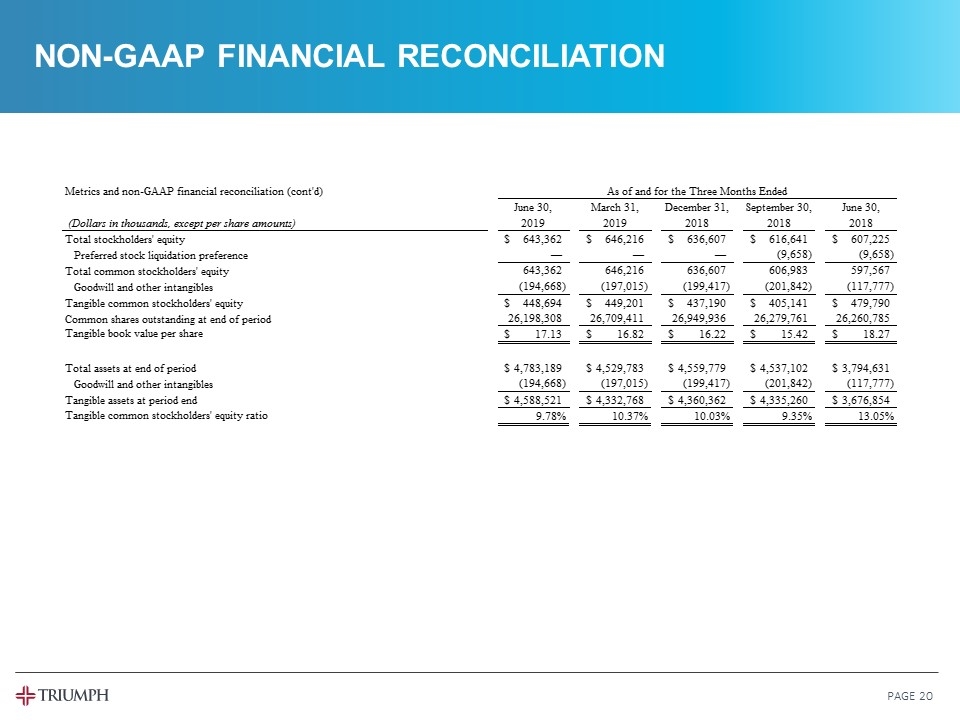

NON-GAAP FINANCIAL RECONCILIATION PAGE 43646QTD 42916QTD 42825QTD 42460QTD 42185QTD 43646YTD 43281YTD Period end date 43646 43555 43465 43373 43281 43646 43281 Quarter 2 YTD Columns hidden for March Days in Year 365 365 365 365 365 365 365 Days in Quarter 91 90 92 92 91 181 181 As of and for the Three Months Ended As of and for the Six Months Ended (Dollars in thousands, June 30, March 31, December 31, September 30, June 30, June 30, June 30, except per share amounts) 2019 2019 2018 2018 2018 2019 2018 Net income available to common stockholders $12,730 $14,788 $18,085 $8,975 $12,192 $27,518 $24,070 Gain on sale of subsidiary or division 0 0 0 0 0 0 -1,071 Transaction related costs 0 0 0 5,871 1,094 0 1,094 Tax effect of adjustments 0 0 0 -1,392 -,257 0 -9 Adjusted net income available to common stockholders $12,730 $14,788 $18,085 $13,454 $13,029 $27,518 $24,084 Manual Adj Dilutive effect of convertible preferred stock 0 0 0 195 193 0 383 Adjusted net income available to common stockholders - diluted $12,730 $14,788 $18,085 $13,649 $13,222 $27,518 $24,467 Diluted_Shrs Weighted average shares outstanding - diluted 26,486,423.318681318 26,793,684.755555555 26,979,949.391304348 26,991,830.282608695 26,315,878.197802197 26,638,426 23,950,143 Manual Adj Adjusted effects of assumed Preferred Stock conversion 0 0 0 0 0 0 0 Adjusted weighted average shares outstanding - diluted 26,486,423.318681318 26,793,684.755555555 26,979,949.391304348 26,991,830.282608695 26,315,878.197802197 26,638,426 23,950,143 YTD YTD Adjusted diluted earnings per common share $0.48 $0.55000000000000004 $0.67 $0.51 $0.5 $1.03 $1.02 $-6.4223345025887779E-4 $-3.023235306770955E-3 $0 Net income available to common stockholders $12,730 $14,788 $18,085 $8,975 $12,192 $27,518 $24,070 AvgTangEq Average tangible common equity ,456,345.82076029998 ,446,571.6126491609 ,428,747.99729180406 ,470,553.33638741396 ,491,492.37677079404 ,451,485.44311036897 ,409,508.59293092898 Return on average tangible common equity 0.11188858928262173 0.13429789961239313 0.16734835426017747 7.5671202822384542E-2 9.9500000000000005E-2 0.12291005234901528 0.11852974788353238 Adjusted efficiency ratio: Net interest income $63,419 $61,311 $64,881 $61,782 $53,257 $,124,730 $,100,387 Non-interest income 7,623 7,538 6,794 6,059 4,945 15,161 10,117 Operating revenue 71,042 68,849 71,675 67,841 58,202 ,139,891 ,110,504 Manual Adj Gain on sale of subsidiary or division 0 0 0 0 0 0 -1,071 Adjusted operating revenue $71,042 $68,849 $71,675 $67,841 $58,202 $,139,891 $,109,433 Non-interest expenses $50,704 $48,566 $46,962 $48,946 $37,403 $99,270 $71,445 Manual Adj Transaction related costs 0 0 0 -5,871 -1,094 0 -1,094 Adjusted non-interest expenses $50,704 $48,566 $46,962 $43,075 $36,309 $99,270 $70,351 Adjusted efficiency ratio 0.71371864530840912 0.70539877122398287 0.65520753400767351 0.63494052269276691 0.62380000000000002 0.70962392148172504 0.64286823901382584 Adjusted net non-interest expense to average assets ratio: Non-interest expenses $50,704 $48,566 $46,962 $48,946 $37,403 $99,270 $71,445 Manual Adj Transaction related costs 0 0 0 -5,871 -1,094 0 -1,094 Adjusted non-interest expenses $50,704 $48,566 $46,962 $43,075 $36,309 $99,270 $70,351 Total non-interest income $7,623 $7,538 $6,794 $6,059 $4,945 $15,161 $10,117 Gain on sale of subsidiary or division 0 0 0 0 0 0 -1,071 Adjusted non-interest income $7,623 $7,538 $6,794 $6,059 $4,945 $15,161 $9,046 Adjusted net non-interest expenses $43,081 $41,028 $40,168 $37,016 $31,364 $84,109 $61,305 AvgAssets Average total assets $4,694,647 $4,501,760 $4,488,918 $4,060,560 $3,628,960 $4,598,735 $3,520,522 CHECK ROUNDING $0 $0 Adjusted net non-interest expense to average assets ratio 3.6807329194807961E-2 3.6961395839256943E-2 3.5501244155728279E-2 3.6166675660928321E-2 3.4665760807685769E-2 3.6882332168129806E-2 3.5115845028770083E-2 Total stockholders' equity $,643,362 $,646,216 $,636,607 $,616,641 $,607,225 $,643,362 $,607,225 Preferred_Stock_A Preferred_Stock_B Preferred stock liquidation preference 0 0 0 -9,658 -9,658 0 -9,658 Total common stockholders' equity ,643,362 ,646,216 ,636,607 ,606,983 ,597,567 ,643,362 ,597,567 Goodwill and other intangibles -,194,668 -,197,015 -,199,417 -,201,842 -,117,777 -,194,668 -,117,777 Tangible common stockholders' equity $,448,694 $,449,201 $,437,190 $,405,141 $,479,790 $,448,694 $,479,790 Common shares outstanding, end of period Common shares outstanding 26,198,308 26,709,411 26,949,936 26,279,761 26,260,785 26,198,308 26,260,785 Tangible book value per share $17.12683124421623 $16.818079589999197 $16.22230197503994 $15.416464403919047 $18.270207840321603 $17.12683124421623 $18.270207840321603 Total assets at end of period $4,783,189 $4,529,783 $4,559,779 $4,537,102 $3,794,631 $4,783,189 $3,794,631 Goodwill and other intangibles -,194,668 -,197,015 -,199,417 -,201,842 -,117,777 -,194,668 -,117,777 Tangible assets at period end $4,588,521 $4,332,768 $4,360,362 $4,335,260 $3,676,854 $4,588,521 $3,676,854 Tangible common stockholders' equity ratio 9.7786192980265321E-2 0.10367529486923832 0.10026461105752228 9.3452526492067367E-2 0.13048927153485018 9.7786192980265321E-2 0.13048927153485018 $0 $0 $0 $0 $0 $0 $0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 $0 $0 $0 $0 $0 $0 $0 0 0 0 0 0 0 0 Slide Deck Presentation: Metrics and non-GAAP financial reconciliation As of and for the Three Months Ended June 30, December 31, September 30, June 30, March 31, (Dollars in thousands, except per share amounts) 2019 2018 2018 2018 2018 Net income available to common stockholders $12,730 $14,788 $18,085 $8,975 $12,192 Gain on sale of subsidiary or division 0 0 0 0 0 Transaction related costs 0 0 0 5,871 1,094 Tax effect of adjustments 0 0 0 -1,392 -,257 Adjusted net income available to common stockholders $12,730 $14,788 $18,085 $13,454 $13,029 Dilutive effect of convertible preferred stock 0 0 0 195 193 Adjusted net income available to common stockholders - diluted $12,730 $14,788 $18,085 $13,649 $13,222 Weighted average shares outstanding - diluted 26,486,423.318681318 26,793,684.755555555 26,979,949.391304348 26,991,830.282608695 26,315,878.197802197 Adjusted effects of assumed Preferred Stock conversion 0 0 0 0 0 Adjusted weighted average shares outstanding - diluted 26,486,423.318681318 26,793,684.755555555 26,979,949.391304348 26,991,830.282608695 26,315,878.197802197 Adjusted diluted earnings per common share $0.48 $0.55000000000000004 $0.67 $0.51 $0.5 Net income available to common stockholders $12,730 $14,788 $18,085 $8,975 $12,192 Average tangible common equity ,456,345.82076029998 ,446,571.6126491609 ,428,747.99729180406 ,470,553.33638741396 ,491,492.37677079404 Return on average tangible common equity 0.11188858928262173 0.13429789961239313 0.16734835426017747 7.5671202822384542E-2 9.9500000000000005E-2 Metrics and non-GAAP financial reconciliation (cont'd) As of and for the Three Months Ended June 30, March 31, December 31, September 30, June 30, (Dollars in thousands, except per share amounts) 2019 2019 2018 2018 2018 Adjusted efficiency ratio: Net interest income $63,419 $61,311 $64,881 $61,782 $53,257 Non-interest income 7,623 7,538 6,794 6,059 4,945 Operating revenue 71,042 68,849 71,675 67,841 58,202 Gain on sale of subsidiary or division 0 0 0 0 0 Adjusted operating revenue $71,042 $68,849 $71,675 $67,841 $58,202 Non-interest expenses $50,704 $48,566 $46,962 $48,946 $37,403 Transaction related costs 0 0 0 -5,871 -1,094 Adjusted non-interest expenses $50,704 $48,566 $46,962 $43,075 $36,309 Adjusted efficiency ratio 0.71371864530840912 0.70539877122398287 0.65520753400767351 0.63494052269276691 0.62380000000000002 Adjusted net non-interest expense to average assets ratio: Non-interest expenses $50,704 $48,566 $46,962 $48,946 $37,403 Transaction related costs 0 0 0 -5,871 -1,094 Adjusted non-interest expenses $50,704 $48,566 $46,962 $43,075 $36,309 Total non-interest income $7,623 $7,538 $6,794 $6,059 $4,945 Gain on sale of subsidiary or division 0 0 0 0 0 Adjusted non-interest income $7,623 $7,538 $6,794 $6,059 $4,945 Adjusted net non-interest expenses $43,081 $41,028 $40,168 $37,016 $31,364 Average total assets 4,694,647 4,501,760 4,488,918 4,060,560 3,628,960 Adjusted net non-interest expense to average assets ratio 3.6807329194807961E-2 3.6961395839256943E-2 3.5501244155728279E-2 3.6166675660928321E-2 3.4665760807685769E-2 Metrics and non-GAAP financial reconciliation (cont'd) As of and for the Three Months Ended June 30, March 31, December 31, September 30, June 30, (Dollars in thousands, except per share amounts) 2019 2019 2018 2018 2018 Total stockholders' equity $,643,362 $,646,216 $,636,607 $,616,641 $,607,225 Preferred stock liquidation preference 0 0 0 -9,658 -9,658 Total common stockholders' equity ,643,362 ,646,216 ,636,607 ,606,983 ,597,567 Goodwill and other intangibles -,194,668 -,197,015 -,199,417 -,201,842 -,117,777 Tangible common stockholders' equity $,448,694 $,449,201 $,437,190 $,405,141 $,479,790 Common shares outstanding at end of period 26,198,308 26,709,411 26,949,936 26,279,761 26,260,785 Tangible book value per share $17.12683124421623 $16.818079589999197 $16.22230197503994 $15.416464403919047 $18.270207840321603 Total assets at end of period $4,783,189 $4,529,783 $4,559,779 $4,537,102 $3,794,631 Goodwill and other intangibles -,194,668 -,197,015 -,199,417 -,201,842 -,117,777 Tangible assets at period end $4,588,521 $4,332,768 $4,360,362 $4,335,260 $3,676,854 Tangible common stockholders' equity ratio 9.7786192980265321E-2 0.10367529486923832 0.10026461105752228 9.3452526492067367E-2 0.13048927153485018 91 365 Metrics and non-GAAP financial reconciliation (cont'd) For the Three Months Ended For the Three Months Ended June 30, 2019 June 30, 2019 (Dollars in thousands, except per share amounts) GAAP (Dollars in thousands, except per share amounts) GAAP Net interest income to average total assets: Credit costs to average total assets: Loan Discount Accretion Net interest income $63,419 Provision for loan losses $3,681 Int_Inc_Discount_Loans $1,297 Average total assets 4,694,647 Average total assets 4,694,647 Int_Inc_Discount_Factored_Rec $0 Net interest income to average assets 5.4199999999999998E-2 Credit costs to average assets 3.0999999999999999E-3 Net noninterest expense to average total assets: Taxes to average total assets: CHANGE LABEL TO ADJUSTED WHEN THERE IS A CORE RATIO Adjusted net noninterest expense Total noninterest expense $50,704 Income tax expense $3,927 Total noninterest income 7,623 Average total assets 4,694,647 Net noninterest expense $43,081 Taxes to average assets 3.3999999999999998E-3 Average total assets 4,694,647 Net noninterest expense to average assets ratio 3.6799999999999999E-2 Return on average total assets: Net interest income to average assets 5.42% Pre-provision net revenue to average total assets: Net noninterest expense to average assets ratio -3.68% Net interest income $63,419 Pre-provision net revenue to average assets 1.74% Net noninterest expense ,-43,081 Credit costs to average assets -0.31% Pre-provision net revenue $20,338 Taxes to average assets -0.34% Average total assets 4,694,647 Return on average assets 1.0899999999999998E-2 MANUAL ADJ FOR ROUNDING Pre-provision net revenue to average assets 1.7399999999999999E-2 0 0 $ Amount 2.3384511757750318E-5 Discount Accretion #REF! (Dollars in thousands, except per share amounts) GAAP (Dollars in thousands, except per share amounts) GAAP Net interest income to average total assets: Credit costs to average total assets: Net interest income Provision for loan losses Average total assets Average total assets Net interest income to average assets Credit costs to average assets Net noninterest expense to average total assets: Taxes to average total assets: Total noninterest expense Income tax expense Transaction related costs Tax effect of adjustments Adjusted noninterest expense Adjusted tax expense Total noninterest income Average total assets Net noninterest expense Taxes to average assets Average total assets Net noninterest expense to average assets ratio Return on average total assets: Net interest income to average assets Pre-provision net revenue to average total assets: Net noninterest expense to average assets ratio Net interest income Pre-provision net revenue to average assets Net noninterest expense Credit costs to average assets Pre-provision net revenue Taxes to average assets Average total assets Return on average assets Pre-provision net revenue to average assets

NON-GAAP FINANCIAL RECONCILIATION PAGE 43646QTD 42916QTD 42825QTD 42460QTD 42185QTD 43646YTD 43281YTD Period end date 43646 43555 43465 43373 43281 43646 43281 Quarter 2 YTD Columns hidden for March Days in Year 365 365 365 365 365 365 365 Days in Quarter 91 90 92 92 91 181 181 As of and for the Three Months Ended As of and for the Six Months Ended (Dollars in thousands, June 30, March 31, December 31, September 30, June 30, June 30, June 30, except per share amounts) 2019 2019 2018 2018 2018 2019 2018 Net income available to common stockholders $12,730 $14,788 $18,085 $8,975 $12,192 $27,518 $24,070 Gain on sale of subsidiary or division 0 0 0 0 0 0 -1,071 Transaction related costs 0 0 0 5,871 1,094 0 1,094 Tax effect of adjustments 0 0 0 -1,392 -,257 0 -9 Adjusted net income available to common stockholders $12,730 $14,788 $18,085 $13,454 $13,029 $27,518 $24,084 Manual Adj Dilutive effect of convertible preferred stock 0 0 0 195 193 0 383 Adjusted net income available to common stockholders - diluted $12,730 $14,788 $18,085 $13,649 $13,222 $27,518 $24,467 Diluted_Shrs Weighted average shares outstanding - diluted 26,486,423.318681318 26,793,684.755555555 26,979,949.391304348 26,991,830.282608695 26,315,878.197802197 26,638,426 23,950,143 Manual Adj Adjusted effects of assumed Preferred Stock conversion 0 0 0 0 0 0 0 Adjusted weighted average shares outstanding - diluted 26,486,423.318681318 26,793,684.755555555 26,979,949.391304348 26,991,830.282608695 26,315,878.197802197 26,638,426 23,950,143 YTD YTD Adjusted diluted earnings per common share $0.48 $0.55000000000000004 $0.67 $0.51 $0.5 $1.03 $1.02 $-6.4223345025887779E-4 $-3.023235306770955E-3 $0 Net income available to common stockholders $12,730 $14,788 $18,085 $8,975 $12,192 $27,518 $24,070 AvgTangEq Average tangible common equity ,456,345.82076029998 ,446,571.6126491609 ,428,747.99729180406 ,470,553.33638741396 ,491,492.37677079404 ,451,485.44311036897 ,409,508.59293092898 Return on average tangible common equity 0.11188858928262173 0.13429789961239313 0.16734835426017747 7.5671202822384542E-2 9.9500000000000005E-2 0.12291005234901528 0.11852974788353238 Adjusted efficiency ratio: Net interest income $63,419 $61,311 $64,881 $61,782 $53,257 $,124,730 $,100,387 Non-interest income 7,623 7,538 6,794 6,059 4,945 15,161 10,117 Operating revenue 71,042 68,849 71,675 67,841 58,202 ,139,891 ,110,504 Manual Adj Gain on sale of subsidiary or division 0 0 0 0 0 0 -1,071 Adjusted operating revenue $71,042 $68,849 $71,675 $67,841 $58,202 $,139,891 $,109,433 Non-interest expenses $50,704 $48,566 $46,962 $48,946 $37,403 $99,270 $71,445 Manual Adj Transaction related costs 0 0 0 -5,871 -1,094 0 -1,094 Adjusted non-interest expenses $50,704 $48,566 $46,962 $43,075 $36,309 $99,270 $70,351 Adjusted efficiency ratio 0.71371864530840912 0.70539877122398287 0.65520753400767351 0.63494052269276691 0.62380000000000002 0.70962392148172504 0.64286823901382584 Adjusted net non-interest expense to average assets ratio: Non-interest expenses $50,704 $48,566 $46,962 $48,946 $37,403 $99,270 $71,445 Manual Adj Transaction related costs 0 0 0 -5,871 -1,094 0 -1,094 Adjusted non-interest expenses $50,704 $48,566 $46,962 $43,075 $36,309 $99,270 $70,351 Total non-interest income $7,623 $7,538 $6,794 $6,059 $4,945 $15,161 $10,117 Gain on sale of subsidiary or division 0 0 0 0 0 0 -1,071 Adjusted non-interest income $7,623 $7,538 $6,794 $6,059 $4,945 $15,161 $9,046 Adjusted net non-interest expenses $43,081 $41,028 $40,168 $37,016 $31,364 $84,109 $61,305 AvgAssets Average total assets $4,694,647 $4,501,760 $4,488,918 $4,060,560 $3,628,960 $4,598,735 $3,520,522 CHECK ROUNDING $0 $0 Adjusted net non-interest expense to average assets ratio 3.6807329194807961E-2 3.6961395839256943E-2 3.5501244155728279E-2 3.6166675660928321E-2 3.4665760807685769E-2 3.6882332168129806E-2 3.5115845028770083E-2 Total stockholders' equity $,643,362 $,646,216 $,636,607 $,616,641 $,607,225 $,643,362 $,607,225 Preferred_Stock_A Preferred_Stock_B Preferred stock liquidation preference 0 0 0 -9,658 -9,658 0 -9,658 Total common stockholders' equity ,643,362 ,646,216 ,636,607 ,606,983 ,597,567 ,643,362 ,597,567 Goodwill and other intangibles -,194,668 -,197,015 -,199,417 -,201,842 -,117,777 -,194,668 -,117,777 Tangible common stockholders' equity $,448,694 $,449,201 $,437,190 $,405,141 $,479,790 $,448,694 $,479,790 Common shares outstanding, end of period Common shares outstanding 26,198,308 26,709,411 26,949,936 26,279,761 26,260,785 26,198,308 26,260,785 Tangible book value per share $17.12683124421623 $16.818079589999197 $16.22230197503994 $15.416464403919047 $18.270207840321603 $17.12683124421623 $18.270207840321603 Total assets at end of period $4,783,189 $4,529,783 $4,559,779 $4,537,102 $3,794,631 $4,783,189 $3,794,631 Goodwill and other intangibles -,194,668 -,197,015 -,199,417 -,201,842 -,117,777 -,194,668 -,117,777 Tangible assets at period end $4,588,521 $4,332,768 $4,360,362 $4,335,260 $3,676,854 $4,588,521 $3,676,854 Tangible common stockholders' equity ratio 9.7786192980265321E-2 0.10367529486923832 0.10026461105752228 9.3452526492067367E-2 0.13048927153485018 9.7786192980265321E-2 0.13048927153485018 $0 $0 $0 $0 $0 $0 $0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 $0 $0 $0 $0 $0 $0 $0 0 0 0 0 0 0 0 Slide Deck Presentation: Metrics and non-GAAP financial reconciliation As of and for the Three Months Ended June 30, December 31, September 30, June 30, March 31, (Dollars in thousands, except per share amounts) 2019 2018 2018 2018 2018 Net income available to common stockholders $12,730 $14,788 $18,085 $8,975 $12,192 Gain on sale of subsidiary or division 0 0 0 0 0 Transaction related costs 0 0 0 5,871 1,094 Tax effect of adjustments 0 0 0 -1,392 -,257 Adjusted net income available to common stockholders $12,730 $14,788 $18,085 $13,454 $13,029 Dilutive effect of convertible preferred stock 0 0 0 195 193 Adjusted net income available to common stockholders - diluted $12,730 $14,788 $18,085 $13,649 $13,222 Weighted average shares outstanding - diluted 26,486,423.318681318 26,793,684.755555555 26,979,949.391304348 26,991,830.282608695 26,315,878.197802197 Adjusted effects of assumed Preferred Stock conversion 0 0 0 0 0 Adjusted weighted average shares outstanding - diluted 26,486,423.318681318 26,793,684.755555555 26,979,949.391304348 26,991,830.282608695 26,315,878.197802197 Adjusted diluted earnings per common share $0.48 $0.55000000000000004 $0.67 $0.51 $0.5 Net income available to common stockholders $12,730 $14,788 $18,085 $8,975 $12,192 Average tangible common equity ,456,345.82076029998 ,446,571.6126491609 ,428,747.99729180406 ,470,553.33638741396 ,491,492.37677079404 Return on average tangible common equity 0.11188858928262173 0.13429789961239313 0.16734835426017747 7.5671202822384542E-2 9.9500000000000005E-2 Metrics and non-GAAP financial reconciliation (cont'd) As of and for the Three Months Ended June 30, March 31, December 31, September 30, June 30, (Dollars in thousands, except per share amounts) 2019 2019 2018 2018 2018 Adjusted efficiency ratio: Net interest income $63,419 $61,311 $64,881 $61,782 $53,257 Non-interest income 7,623 7,538 6,794 6,059 4,945 Operating revenue 71,042 68,849 71,675 67,841 58,202 Gain on sale of subsidiary or division 0 0 0 0 0 Adjusted operating revenue $71,042 $68,849 $71,675 $67,841 $58,202 Non-interest expenses $50,704 $48,566 $46,962 $48,946 $37,403 Transaction related costs 0 0 0 -5,871 -1,094 Adjusted non-interest expenses $50,704 $48,566 $46,962 $43,075 $36,309 Adjusted efficiency ratio 0.71371864530840912 0.70539877122398287 0.65520753400767351 0.63494052269276691 0.62380000000000002 Adjusted net non-interest expense to average assets ratio: Non-interest expenses $50,704 $48,566 $46,962 $48,946 $37,403 Transaction related costs 0 0 0 -5,871 -1,094 Adjusted non-interest expenses $50,704 $48,566 $46,962 $43,075 $36,309 Total non-interest income $7,623 $7,538 $6,794 $6,059 $4,945 Gain on sale of subsidiary or division 0 0 0 0 0 Adjusted non-interest income $7,623 $7,538 $6,794 $6,059 $4,945 Adjusted net non-interest expenses $43,081 $41,028 $40,168 $37,016 $31,364 Average total assets 4,694,647 4,501,760 4,488,918 4,060,560 3,628,960 Adjusted net non-interest expense to average assets ratio 3.6807329194807961E-2 3.6961395839256943E-2 3.5501244155728279E-2 3.6166675660928321E-2 3.4665760807685769E-2 Metrics and non-GAAP financial reconciliation (cont'd) As of and for the Three Months Ended June 30, March 31, December 31, September 30, June 30, (Dollars in thousands, except per share amounts) 2019 2019 2018 2018 2018 Total stockholders' equity $,643,362 $,646,216 $,636,607 $,616,641 $,607,225 Preferred stock liquidation preference 0 0 0 -9,658 -9,658 Total common stockholders' equity ,643,362 ,646,216 ,636,607 ,606,983 ,597,567 Goodwill and other intangibles -,194,668 -,197,015 -,199,417 -,201,842 -,117,777 Tangible common stockholders' equity $,448,694 $,449,201 $,437,190 $,405,141 $,479,790 Common shares outstanding at end of period 26,198,308 26,709,411 26,949,936 26,279,761 26,260,785 Tangible book value per share $17.12683124421623 $16.818079589999197 $16.22230197503994 $15.416464403919047 $18.270207840321603 Total assets at end of period $4,783,189 $4,529,783 $4,559,779 $4,537,102 $3,794,631 Goodwill and other intangibles -,194,668 -,197,015 -,199,417 -,201,842 -,117,777 Tangible assets at period end $4,588,521 $4,332,768 $4,360,362 $4,335,260 $3,676,854 Tangible common stockholders' equity ratio 9.7786192980265321E-2 0.10367529486923832 0.10026461105752228 9.3452526492067367E-2 0.13048927153485018 91 365 Metrics and non-GAAP financial reconciliation (cont'd) For the Three Months Ended For the Three Months Ended June 30, 2019 June 30, 2019 (Dollars in thousands, except per share amounts) GAAP (Dollars in thousands, except per share amounts) GAAP Net interest income to average total assets: Credit costs to average total assets: Loan Discount Accretion Net interest income $63,419 Provision for loan losses $3,681 Int_Inc_Discount_Loans $1,297 Average total assets 4,694,647 Average total assets 4,694,647 Int_Inc_Discount_Factored_Rec $0 Net interest income to average assets 5.4199999999999998E-2 Credit costs to average assets 3.0999999999999999E-3 Net noninterest expense to average total assets: Taxes to average total assets: CHANGE LABEL TO ADJUSTED WHEN THERE IS A CORE RATIO Adjusted net noninterest expense Total noninterest expense $50,704 Income tax expense $3,927 Total noninterest income 7,623 Average total assets 4,694,647 Net noninterest expense $43,081 Taxes to average assets 3.3999999999999998E-3 Average total assets 4,694,647 Net noninterest expense to average assets ratio 3.6799999999999999E-2 Return on average total assets: Net interest income to average assets 5.42% Pre-provision net revenue to average total assets: Net noninterest expense to average assets ratio -3.68% Net interest income $63,419 Pre-provision net revenue to average assets 1.74% Net noninterest expense ,-43,081 Credit costs to average assets -0.31% Pre-provision net revenue $20,338 Taxes to average assets -0.34% Average total assets 4,694,647 Return on average assets 1.0899999999999998E-2 MANUAL ADJ FOR ROUNDING Pre-provision net revenue to average assets 1.7399999999999999E-2 0 0 $ Amount 2.3384511757750318E-5 Discount Accretion #REF! (Dollars in thousands, except per share amounts) GAAP (Dollars in thousands, except per share amounts) GAAP Net interest income to average total assets: Credit costs to average total assets: Net interest income Provision for loan losses Average total assets Average total assets Net interest income to average assets Credit costs to average assets Net noninterest expense to average total assets: Taxes to average total assets: Total noninterest expense Income tax expense Transaction related costs Tax effect of adjustments Adjusted noninterest expense Adjusted tax expense Total noninterest income Average total assets Net noninterest expense Taxes to average assets Average total assets Net noninterest expense to average assets ratio Return on average total assets: Net interest income to average assets Pre-provision net revenue to average total assets: Net noninterest expense to average assets ratio Net interest income Pre-provision net revenue to average assets Net noninterest expense Credit costs to average assets Pre-provision net revenue Taxes to average assets Average total assets Return on average assets Pre-provision net revenue to average assets

NON-GAAP FINANCIAL RECONCILIATION PAGE 43646QTD 42916QTD 42825QTD 42460QTD 42185QTD 43646YTD 43281YTD Period end date 43646 43555 43465 43373 43281 43646 43281 Quarter 2 YTD Columns hidden for March Days in Year 365 365 365 365 365 365 365 Days in Quarter 91 90 92 92 91 181 181 As of and for the Three Months Ended As of and for the Six Months Ended (Dollars in thousands, June 30, March 31, December 31, September 30, June 30, June 30, June 30, except per share amounts) 2019 2019 2018 2018 2018 2019 2018 Net income available to common stockholders $12,730 $14,788 $18,085 $8,975 $12,192 $27,518 $24,070 Gain on sale of subsidiary or division 0 0 0 0 0 0 -1,071 Transaction related costs 0 0 0 5,871 1,094 0 1,094 Tax effect of adjustments 0 0 0 -1,392 -,257 0 -9 Adjusted net income available to common stockholders $12,730 $14,788 $18,085 $13,454 $13,029 $27,518 $24,084 Manual Adj Dilutive effect of convertible preferred stock 0 0 0 195 193 0 383 Adjusted net income available to common stockholders - diluted $12,730 $14,788 $18,085 $13,649 $13,222 $27,518 $24,467 Diluted_Shrs Weighted average shares outstanding - diluted 26,486,423.318681318 26,793,684.755555555 26,979,949.391304348 26,991,830.282608695 26,315,878.197802197 26,638,426 23,950,143 Manual Adj Adjusted effects of assumed Preferred Stock conversion 0 0 0 0 0 0 0 Adjusted weighted average shares outstanding - diluted 26,486,423.318681318 26,793,684.755555555 26,979,949.391304348 26,991,830.282608695 26,315,878.197802197 26,638,426 23,950,143 YTD YTD Adjusted diluted earnings per common share $0.48 $0.55000000000000004 $0.67 $0.51 $0.5 $1.03 $1.02 $-6.4223345025887779E-4 $-3.023235306770955E-3 $0 Net income available to common stockholders $12,730 $14,788 $18,085 $8,975 $12,192 $27,518 $24,070 AvgTangEq Average tangible common equity ,456,345.82076029998 ,446,571.6126491609 ,428,747.99729180406 ,470,553.33638741396 ,491,492.37677079404 ,451,485.44311036897 ,409,508.59293092898 Return on average tangible common equity 0.11188858928262173 0.13429789961239313 0.16734835426017747 7.5671202822384542E-2 9.9500000000000005E-2 0.12291005234901528 0.11852974788353238 Adjusted efficiency ratio: Net interest income $63,419 $61,311 $64,881 $61,782 $53,257 $,124,730 $,100,387 Non-interest income 7,623 7,538 6,794 6,059 4,945 15,161 10,117 Operating revenue 71,042 68,849 71,675 67,841 58,202 ,139,891 ,110,504 Manual Adj Gain on sale of subsidiary or division 0 0 0 0 0 0 -1,071 Adjusted operating revenue $71,042 $68,849 $71,675 $67,841 $58,202 $,139,891 $,109,433 Non-interest expenses $50,704 $48,566 $46,962 $48,946 $37,403 $99,270 $71,445 Manual Adj Transaction related costs 0 0 0 -5,871 -1,094 0 -1,094 Adjusted non-interest expenses $50,704 $48,566 $46,962 $43,075 $36,309 $99,270 $70,351 Adjusted efficiency ratio 0.71371864530840912 0.70539877122398287 0.65520753400767351 0.63494052269276691 0.62380000000000002 0.70962392148172504 0.64286823901382584 Adjusted net non-interest expense to average assets ratio: Non-interest expenses $50,704 $48,566 $46,962 $48,946 $37,403 $99,270 $71,445 Manual Adj Transaction related costs 0 0 0 -5,871 -1,094 0 -1,094 Adjusted non-interest expenses $50,704 $48,566 $46,962 $43,075 $36,309 $99,270 $70,351 Total non-interest income $7,623 $7,538 $6,794 $6,059 $4,945 $15,161 $10,117 Gain on sale of subsidiary or division 0 0 0 0 0 0 -1,071 Adjusted non-interest income $7,623 $7,538 $6,794 $6,059 $4,945 $15,161 $9,046 Adjusted net non-interest expenses $43,081 $41,028 $40,168 $37,016 $31,364 $84,109 $61,305 AvgAssets Average total assets $4,694,647 $4,501,760 $4,488,918 $4,060,560 $3,628,960 $4,598,735 $3,520,522 CHECK ROUNDING $0 $0 Adjusted net non-interest expense to average assets ratio 3.6807329194807961E-2 3.6961395839256943E-2 3.5501244155728279E-2 3.6166675660928321E-2 3.4665760807685769E-2 3.6882332168129806E-2 3.5115845028770083E-2 Total stockholders' equity $,643,362 $,646,216 $,636,607 $,616,641 $,607,225 $,643,362 $,607,225 Preferred_Stock_A Preferred_Stock_B Preferred stock liquidation preference 0 0 0 -9,658 -9,658 0 -9,658 Total common stockholders' equity ,643,362 ,646,216 ,636,607 ,606,983 ,597,567 ,643,362 ,597,567 Goodwill and other intangibles -,194,668 -,197,015 -,199,417 -,201,842 -,117,777 -,194,668 -,117,777 Tangible common stockholders' equity $,448,694 $,449,201 $,437,190 $,405,141 $,479,790 $,448,694 $,479,790 Common shares outstanding, end of period Common shares outstanding 26,198,308 26,709,411 26,949,936 26,279,761 26,260,785 26,198,308 26,260,785 Tangible book value per share $17.12683124421623 $16.818079589999197 $16.22230197503994 $15.416464403919047 $18.270207840321603 $17.12683124421623 $18.270207840321603 Total assets at end of period $4,783,189 $4,529,783 $4,559,779 $4,537,102 $3,794,631 $4,783,189 $3,794,631 Goodwill and other intangibles -,194,668 -,197,015 -,199,417 -,201,842 -,117,777 -,194,668 -,117,777 Tangible assets at period end $4,588,521 $4,332,768 $4,360,362 $4,335,260 $3,676,854 $4,588,521 $3,676,854 Tangible common stockholders' equity ratio 9.7786192980265321E-2 0.10367529486923832 0.10026461105752228 9.3452526492067367E-2 0.13048927153485018 9.7786192980265321E-2 0.13048927153485018 $0 $0 $0 $0 $0 $0 $0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 $0 $0 $0 $0 $0 $0 $0 0 0 0 0 0 0 0 Slide Deck Presentation: Metrics and non-GAAP financial reconciliation As of and for the Three Months Ended June 30, December 31, September 30, June 30, March 31, (Dollars in thousands, except per share amounts) 2019 2018 2018 2018 2018 Net income available to common stockholders $12,730 $14,788 $18,085 $8,975 $12,192 Gain on sale of subsidiary or division 0 0 0 0 0 Transaction related costs 0 0 0 5,871 1,094 Tax effect of adjustments 0 0 0 -1,392 -,257 Adjusted net income available to common stockholders $12,730 $14,788 $18,085 $13,454 $13,029 Dilutive effect of convertible preferred stock 0 0 0 195 193 Adjusted net income available to common stockholders - diluted $12,730 $14,788 $18,085 $13,649 $13,222 Weighted average shares outstanding - diluted 26,486,423.318681318 26,793,684.755555555 26,979,949.391304348 26,991,830.282608695 26,315,878.197802197 Adjusted effects of assumed Preferred Stock conversion 0 0 0 0 0 Adjusted weighted average shares outstanding - diluted 26,486,423.318681318 26,793,684.755555555 26,979,949.391304348 26,991,830.282608695 26,315,878.197802197 Adjusted diluted earnings per common share $0.48 $0.55000000000000004 $0.67 $0.51 $0.5 Net income available to common stockholders $12,730 $14,788 $18,085 $8,975 $12,192 Average tangible common equity ,456,345.82076029998 ,446,571.6126491609 ,428,747.99729180406 ,470,553.33638741396 ,491,492.37677079404 Return on average tangible common equity 0.11188858928262173 0.13429789961239313 0.16734835426017747 7.5671202822384542E-2 9.9500000000000005E-2 Metrics and non-GAAP financial reconciliation (cont'd) As of and for the Three Months Ended June 30, March 31, December 31, September 30, June 30, (Dollars in thousands, except per share amounts) 2019 2019 2018 2018 2018 Adjusted efficiency ratio: Net interest income $63,419 $61,311 $64,881 $61,782 $53,257 Non-interest income 7,623 7,538 6,794 6,059 4,945 Operating revenue 71,042 68,849 71,675 67,841 58,202 Gain on sale of subsidiary or division 0 0 0 0 0 Adjusted operating revenue $71,042 $68,849 $71,675 $67,841 $58,202 Non-interest expenses $50,704 $48,566 $46,962 $48,946 $37,403 Transaction related costs 0 0 0 -5,871 -1,094 Adjusted non-interest expenses $50,704 $48,566 $46,962 $43,075 $36,309 Adjusted efficiency ratio 0.71371864530840912 0.70539877122398287 0.65520753400767351 0.63494052269276691 0.62380000000000002 Adjusted net non-interest expense to average assets ratio: Non-interest expenses $50,704 $48,566 $46,962 $48,946 $37,403 Transaction related costs 0 0 0 -5,871 -1,094 Adjusted non-interest expenses $50,704 $48,566 $46,962 $43,075 $36,309 Total non-interest income $7,623 $7,538 $6,794 $6,059 $4,945 Gain on sale of subsidiary or division 0 0 0 0 0 Adjusted non-interest income $7,623 $7,538 $6,794 $6,059 $4,945 Adjusted net non-interest expenses $43,081 $41,028 $40,168 $37,016 $31,364 Average total assets 4,694,647 4,501,760 4,488,918 4,060,560 3,628,960 Adjusted net non-interest expense to average assets ratio 3.6807329194807961E-2 3.6961395839256943E-2 3.5501244155728279E-2 3.6166675660928321E-2 3.4665760807685769E-2 Metrics and non-GAAP financial reconciliation (cont'd) As of and for the Three Months Ended June 30, March 31, December 31, September 30, June 30, (Dollars in thousands, except per share amounts) 2019 2019 2018 2018 2018 Total stockholders' equity $,643,362 $,646,216 $,636,607 $,616,641 $,607,225 Preferred stock liquidation preference 0 0 0 -9,658 -9,658 Total common stockholders' equity ,643,362 ,646,216 ,636,607 ,606,983 ,597,567 Goodwill and other intangibles -,194,668 -,197,015 -,199,417 -,201,842 -,117,777 Tangible common stockholders' equity $,448,694 $,449,201 $,437,190 $,405,141 $,479,790 Common shares outstanding at end of period 26,198,308 26,709,411 26,949,936 26,279,761 26,260,785 Tangible book value per share $17.12683124421623 $16.818079589999197 $16.22230197503994 $15.416464403919047 $18.270207840321603 Total assets at end of period $4,783,189 $4,529,783 $4,559,779 $4,537,102 $3,794,631 Goodwill and other intangibles -,194,668 -,197,015 -,199,417 -,201,842 -,117,777 Tangible assets at period end $4,588,521 $4,332,768 $4,360,362 $4,335,260 $3,676,854 Tangible common stockholders' equity ratio 9.7786192980265321E-2 0.10367529486923832 0.10026461105752228 9.3452526492067367E-2 0.13048927153485018 91 365 Metrics and non-GAAP financial reconciliation (cont'd) For the Three Months Ended For the Three Months Ended June 30, 2019 June 30, 2019 (Dollars in thousands, except per share amounts) GAAP (Dollars in thousands, except per share amounts) GAAP Net interest income to average total assets: Credit costs to average total assets: Loan Discount Accretion Net interest income $63,419 Provision for loan losses $3,681 Int_Inc_Discount_Loans $1,297 Average total assets 4,694,647 Average total assets 4,694,647 Int_Inc_Discount_Factored_Rec $0 Net interest income to average assets 5.4199999999999998E-2 Credit costs to average assets 3.0999999999999999E-3 Net noninterest expense to average total assets: Taxes to average total assets: CHANGE LABEL TO ADJUSTED WHEN THERE IS A CORE RATIO Adjusted net noninterest expense Total noninterest expense $50,704 Income tax expense $3,927 Total noninterest income 7,623 Average total assets 4,694,647 Net noninterest expense $43,081 Taxes to average assets 3.3999999999999998E-3 Average total assets 4,694,647 Net noninterest expense to average assets ratio 3.6799999999999999E-2 Return on average total assets: Net interest income to average assets 5.42% Pre-provision net revenue to average total assets: Net noninterest expense to average assets ratio -3.68% Net interest income $63,419 Pre-provision net revenue to average assets 1.74% Net noninterest expense ,-43,081 Credit costs to average assets -0.31% Pre-provision net revenue $20,338 Taxes to average assets -0.34% Average total assets 4,694,647 Return on average assets 1.0899999999999998E-2 MANUAL ADJ FOR ROUNDING Pre-provision net revenue to average assets 1.7399999999999999E-2 0 0 $ Amount 2.3384511757750318E-5 Discount Accretion #REF! (Dollars in thousands, except per share amounts) GAAP (Dollars in thousands, except per share amounts) GAAP Net interest income to average total assets: Credit costs to average total assets: Net interest income Provision for loan losses Average total assets Average total assets Net interest income to average assets Credit costs to average assets Net noninterest expense to average total assets: Taxes to average total assets: Total noninterest expense Income tax expense Transaction related costs Tax effect of adjustments Adjusted noninterest expense Adjusted tax expense Total noninterest income Average total assets Net noninterest expense Taxes to average assets Average total assets Net noninterest expense to average assets ratio Return on average total assets: Net interest income to average assets Pre-provision net revenue to average total assets: Net noninterest expense to average assets ratio Net interest income Pre-provision net revenue to average assets Net noninterest expense Credit costs to average assets Pre-provision net revenue Taxes to average assets Average total assets Return on average assets Pre-provision net revenue to average assets

NON-GAAP FINANCIAL RECONCILIATION PPAGE AGE 43646QTD 42916QTD 42825QTD 42460QTD 42185QTD 43646YTD 43281YTD Period end date 43646 43555 43465 43373 43281 43646 43281 Quarter 2 YTD Columns hidden for March Days in Year 365 365 365 365 365 365 365 Days in Quarter 91 90 92 92 91 181 181 As of and for the Three Months Ended As of and for the Six Months Ended (Dollars in thousands, June 30, March 31, December 31, September 30, June 30, June 30, June 30, except per share amounts) 2019 2019 2018 2018 2018 2019 2018 Net income available to common stockholders $12,730 $14,788 $18,085 $8,975 $12,192 $27,518 $24,070 Gain on sale of subsidiary or division 0 0 0 0 0 0 -1,071 Transaction related costs 0 0 0 5,871 1,094 0 1,094 Tax effect of adjustments 0 0 0 -1,392 -,257 0 -9 Adjusted net income available to common stockholders $12,730 $14,788 $18,085 $13,454 $13,029 $27,518 $24,084 Manual Adj Dilutive effect of convertible preferred stock 0 0 0 195 193 0 383 Adjusted net income available to common stockholders - diluted $12,730 $14,788 $18,085 $13,649 $13,222 $27,518 $24,467 Diluted_Shrs Weighted average shares outstanding - diluted 26,486,423.318681318 26,793,684.755555555 26,979,949.391304348 26,991,830.282608695 26,315,878.197802197 26,638,426 23,950,143 Manual Adj Adjusted effects of assumed Preferred Stock conversion 0 0 0 0 0 0 0 Adjusted weighted average shares outstanding - diluted 26,486,423.318681318 26,793,684.755555555 26,979,949.391304348 26,991,830.282608695 26,315,878.197802197 26,638,426 23,950,143 YTD YTD Adjusted diluted earnings per common share $0.48 $0.55000000000000004 $0.67 $0.51 $0.5 $1.03 $1.02 $-6.4223345025887779E-4 $-3.023235306770955E-3 $0 Net income available to common stockholders $12,730 $14,788 $18,085 $8,975 $12,192 $27,518 $24,070 AvgTangEq Average tangible common equity ,456,345.82076029998 ,446,571.6126491609 ,428,747.99729180406 ,470,553.33638741396 ,491,492.37677079404 ,451,485.44311036897 ,409,508.59293092898 Return on average tangible common equity 0.11188858928262173 0.13429789961239313 0.16734835426017747 7.5671202822384542E-2 9.9500000000000005E-2 0.12291005234901528 0.11852974788353238 Adjusted efficiency ratio: Net interest income $63,419 $61,311 $64,881 $61,782 $53,257 $,124,730 $,100,387 Non-interest income 7,623 7,538 6,794 6,059 4,945 15,161 10,117 Operating revenue 71,042 68,849 71,675 67,841 58,202 ,139,891 ,110,504 Manual Adj Gain on sale of subsidiary or division 0 0 0 0 0 0 -1,071 Adjusted operating revenue $71,042 $68,849 $71,675 $67,841 $58,202 $,139,891 $,109,433 Non-interest expenses $50,704 $48,566 $46,962 $48,946 $37,403 $99,270 $71,445 Manual Adj Transaction related costs 0 0 0 -5,871 -1,094 0 -1,094 Adjusted non-interest expenses $50,704 $48,566 $46,962 $43,075 $36,309 $99,270 $70,351 Adjusted efficiency ratio 0.71371864530840912 0.70539877122398287 0.65520753400767351 0.63494052269276691 0.62380000000000002 0.70962392148172504 0.64286823901382584 Adjusted net non-interest expense to average assets ratio: Non-interest expenses $50,704 $48,566 $46,962 $48,946 $37,403 $99,270 $71,445 Manual Adj Transaction related costs 0 0 0 -5,871 -1,094 0 -1,094 Adjusted non-interest expenses $50,704 $48,566 $46,962 $43,075 $36,309 $99,270 $70,351 Total non-interest income $7,623 $7,538 $6,794 $6,059 $4,945 $15,161 $10,117 Gain on sale of subsidiary or division 0 0 0 0 0 0 -1,071 Adjusted non-interest income $7,623 $7,538 $6,794 $6,059 $4,945 $15,161 $9,046 Adjusted net non-interest expenses $43,081 $41,028 $40,168 $37,016 $31,364 $84,109 $61,305 AvgAssets Average total assets $4,694,647 $4,501,760 $4,488,918 $4,060,560 $3,628,960 $4,598,735 $3,520,522 CHECK ROUNDING $0 $0 Adjusted net non-interest expense to average assets ratio 3.6807329194807961E-2 3.6961395839256943E-2 3.5501244155728279E-2 3.6166675660928321E-2 3.4665760807685769E-2 3.6882332168129806E-2 3.5115845028770083E-2 Total stockholders' equity $,643,362 $,646,216 $,636,607 $,616,641 $,607,225 $,643,362 $,607,225 Preferred_Stock_A Preferred_Stock_B Preferred stock liquidation preference 0 0 0 -9,658 -9,658 0 -9,658 Total common stockholders' equity ,643,362 ,646,216 ,636,607 ,606,983 ,597,567 ,643,362 ,597,567 Goodwill and other intangibles -,194,668 -,197,015 -,199,417 -,201,842 -,117,777 -,194,668 -,117,777 Tangible common stockholders' equity $,448,694 $,449,201 $,437,190 $,405,141 $,479,790 $,448,694 $,479,790 Common shares outstanding, end of period Common shares outstanding 26,198,308 26,709,411 26,949,936 26,279,761 26,260,785 26,198,308 26,260,785 Tangible book value per share $17.12683124421623 $16.818079589999197 $16.22230197503994 $15.416464403919047 $18.270207840321603 $17.12683124421623 $18.270207840321603 Total assets at end of period $4,783,189 $4,529,783 $4,559,779 $4,537,102 $3,794,631 $4,783,189 $3,794,631 Goodwill and other intangibles -,194,668 -,197,015 -,199,417 -,201,842 -,117,777 -,194,668 -,117,777 Tangible assets at period end $4,588,521 $4,332,768 $4,360,362 $4,335,260 $3,676,854 $4,588,521 $3,676,854 Tangible common stockholders' equity ratio 9.7786192980265321E-2 0.10367529486923832 0.10026461105752228 9.3452526492067367E-2 0.13048927153485018 9.7786192980265321E-2 0.13048927153485018 $0 $0 $0 $0 $0 $0 $0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 $0 $0 $0 $0 $0 $0 $0 0 0 0 0 0 0 0 Slide Deck Presentation: Metrics and non-GAAP financial reconciliation As of and for the Three Months Ended June 30, December 31, September 30, June 30, March 31, (Dollars in thousands, except per share amounts) 2019 2018 2018 2018 2018 Net income available to common stockholders $12,730 $14,788 $18,085 $8,975 $12,192 Gain on sale of subsidiary or division 0 0 0 0 0 Transaction related costs 0 0 0 5,871 1,094 Tax effect of adjustments 0 0 0 -1,392 -,257 Adjusted net income available to common stockholders $12,730 $14,788 $18,085 $13,454 $13,029 Dilutive effect of convertible preferred stock 0 0 0 195 193 Adjusted net income available to common stockholders - diluted $12,730 $14,788 $18,085 $13,649 $13,222 Weighted average shares outstanding - diluted 26,486,423.318681318 26,793,684.755555555 26,979,949.391304348 26,991,830.282608695 26,315,878.197802197 Adjusted effects of assumed Preferred Stock conversion 0 0 0 0 0 Adjusted weighted average shares outstanding - diluted 26,486,423.318681318 26,793,684.755555555 26,979,949.391304348 26,991,830.282608695 26,315,878.197802197 Adjusted diluted earnings per common share $0.48 $0.55000000000000004 $0.67 $0.51 $0.5 Net income available to common stockholders $12,730 $14,788 $18,085 $8,975 $12,192 Average tangible common equity ,456,345.82076029998 ,446,571.6126491609 ,428,747.99729180406 ,470,553.33638741396 ,491,492.37677079404 Return on average tangible common equity 0.11188858928262173 0.13429789961239313 0.16734835426017747 7.5671202822384542E-2 9.9500000000000005E-2 Metrics and non-GAAP financial reconciliation (cont'd) As of and for the Three Months Ended June 30, March 31, December 31, September 30, June 30, (Dollars in thousands, except per share amounts) 2019 2019 2018 2018 2018 Adjusted efficiency ratio: Net interest income $63,419 $61,311 $64,881 $61,782 $53,257 Non-interest income 7,623 7,538 6,794 6,059 4,945 Operating revenue 71,042 68,849 71,675 67,841 58,202 Gain on sale of subsidiary or division 0 0 0 0 0 Adjusted operating revenue $71,042 $68,849 $71,675 $67,841 $58,202 Non-interest expenses $50,704 $48,566 $46,962 $48,946 $37,403 Transaction related costs 0 0 0 -5,871 -1,094 Adjusted non-interest expenses $50,704 $48,566 $46,962 $43,075 $36,309 Adjusted efficiency ratio 0.71371864530840912 0.70539877122398287 0.65520753400767351 0.63494052269276691 0.62380000000000002 Adjusted net non-interest expense to average assets ratio: Non-interest expenses $50,704 $48,566 $46,962 $48,946 $37,403 Transaction related costs 0 0 0 -5,871 -1,094 Adjusted non-interest expenses $50,704 $48,566 $46,962 $43,075 $36,309 Total non-interest income $7,623 $7,538 $6,794 $6,059 $4,945 Gain on sale of subsidiary or division 0 0 0 0 0 Adjusted non-interest income $7,623 $7,538 $6,794 $6,059 $4,945 Adjusted net non-interest expenses $43,081 $41,028 $40,168 $37,016 $31,364 Average total assets 4,694,647 4,501,760 4,488,918 4,060,560 3,628,960 Adjusted net non-interest expense to average assets ratio 3.6807329194807961E-2 3.6961395839256943E-2 3.5501244155728279E-2 3.6166675660928321E-2 3.4665760807685769E-2 Metrics and non-GAAP financial reconciliation (cont'd) As of and for the Three Months Ended June 30, March 31, December 31, September 30, June 30, (Dollars in thousands, except per share amounts) 2019 2019 2018 2018 2018 Total stockholders' equity $,643,362 $,646,216 $,636,607 $,616,641 $,607,225 Preferred stock liquidation preference 0 0 0 -9,658 -9,658 Total common stockholders' equity ,643,362 ,646,216 ,636,607 ,606,983 ,597,567 Goodwill and other intangibles -,194,668 -,197,015 -,199,417 -,201,842 -,117,777 Tangible common stockholders' equity $,448,694 $,449,201 $,437,190 $,405,141 $,479,790 Common shares outstanding at end of period 26,198,308 26,709,411 26,949,936 26,279,761 26,260,785 Tangible book value per share $17.12683124421623 $16.818079589999197 $16.22230197503994 $15.416464403919047 $18.270207840321603 Total assets at end of period $4,783,189 $4,529,783 $4,559,779 $4,537,102 $3,794,631 Goodwill and other intangibles -,194,668 -,197,015 -,199,417 -,201,842 -,117,777 Tangible assets at period end $4,588,521 $4,332,768 $4,360,362 $4,335,260 $3,676,854 Tangible common stockholders' equity ratio 9.7786192980265321E-2 0.10367529486923832 0.10026461105752228 9.3452526492067367E-2 0.13048927153485018 91 365 Metrics and non-GAAP financial reconciliation (cont'd) For the Three Months Ended For the Three Months Ended June 30, 2019 June 30, 2019 (Dollars in thousands, except per share amounts) GAAP (Dollars in thousands, except per share amounts) GAAP Net interest income to average total assets: Credit costs to average total assets: Loan Discount Accretion Net interest income $63,419 Provision for loan losses $3,681 Int_Inc_Discount_Loans $1,297 Average total assets 4,694,647 Average total assets 4,694,647 Int_Inc_Discount_Factored_Rec $0 Net interest income to average assets 5.4199999999999998E-2 Credit costs to average assets 3.0999999999999999E-3 Net noninterest expense to average total assets: Taxes to average total assets: CHANGE LABEL TO ADJUSTED WHEN THERE IS A CORE RATIO Adjusted net noninterest expense Total noninterest expense $50,704 Income tax expense $3,927 Total noninterest income 7,623 Average total assets 4,694,647 Net noninterest expense $43,081 Taxes to average assets 3.3999999999999998E-3 Average total assets 4,694,647 Net noninterest expense to average assets ratio 3.6799999999999999E-2 Return on average total assets: Net interest income to average assets 5.42% Pre-provision net revenue to average total assets: Net noninterest expense to average assets ratio -3.68% Net interest income $63,419 Pre-provision net revenue to average assets 1.74% Net noninterest expense ,-43,081 Credit costs to average assets -0.31% Pre-provision net revenue $20,338 Taxes to average assets -0.34% Average total assets 4,694,647 Return on average assets 1.0899999999999998E-2 MANUAL ADJ FOR ROUNDING Pre-provision net revenue to average assets 1.7399999999999999E-2 0 0 $ Amount 2.3384511757750318E-5 Discount Accretion #REF! (Dollars in thousands, except per share amounts) GAAP (Dollars in thousands, except per share amounts) GAAP Net interest income to average total assets: Credit costs to average total assets: Net interest income Provision for loan losses Average total assets Average total assets Net interest income to average assets Credit costs to average assets Net noninterest expense to average total assets: Taxes to average total assets: Total noninterest expense Income tax expense Transaction related costs Tax effect of adjustments Adjusted noninterest expense Adjusted tax expense Total noninterest income Average total assets Net noninterest expense Taxes to average assets Average total assets Net noninterest expense to average assets ratio Return on average total assets: Net interest income to average assets Pre-provision net revenue to average total assets: Net noninterest expense to average assets ratio Net interest income Pre-provision net revenue to average assets Net noninterest expense Credit costs to average assets Pre-provision net revenue Taxes to average assets Average total assets Return on average assets Pre-provision net revenue to average assets

Appendix

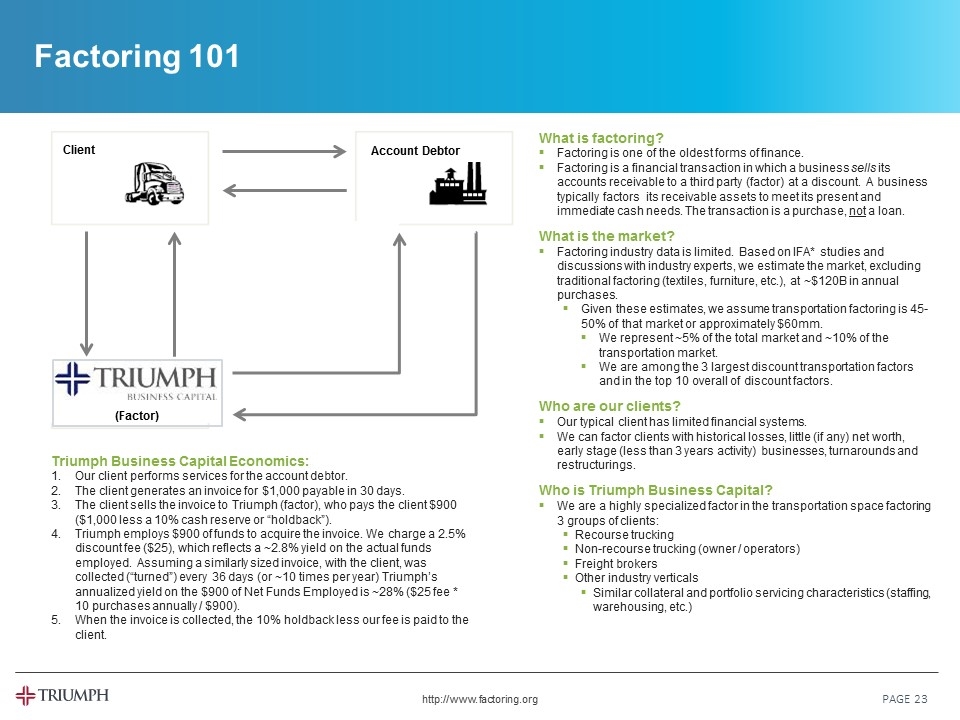

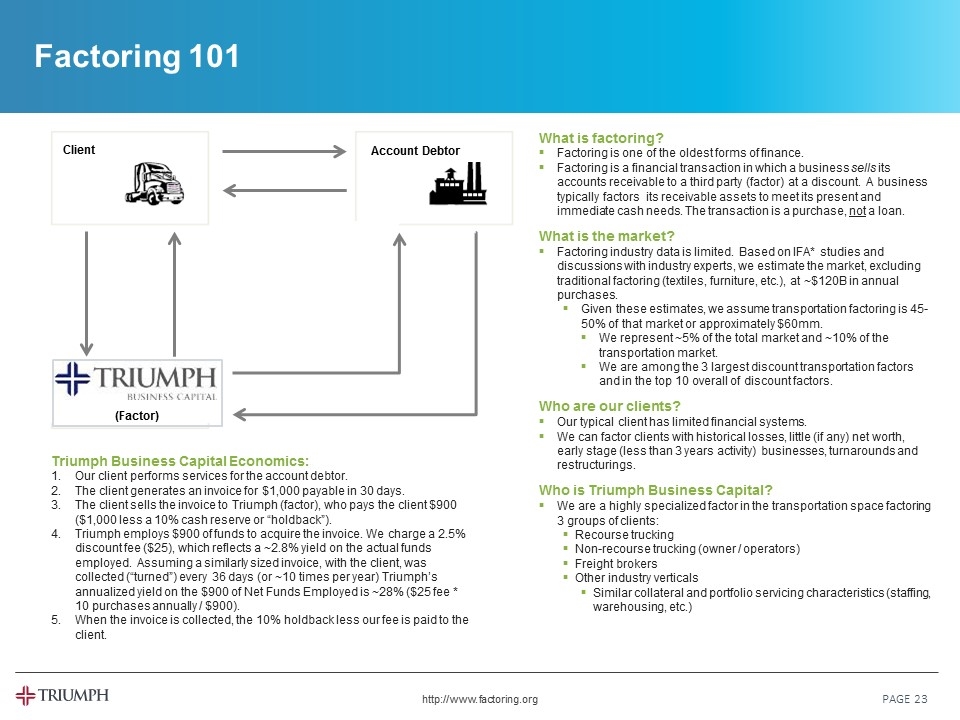

Factoring 101 PAGE Client Account Debtor What is factoring? Factoring is one of the oldest forms of finance. Factoring is a financial transaction in which a business sells its accounts receivable to a third party (factor) at a discount. A business typically factors its receivable assets to meet its present and immediate cash needs. The transaction is a purchase, not a loan. What is the market? Factoring industry data is limited. Based on IFA* studies and discussions with industry experts, we estimate the market, excluding traditional factoring (textiles, furniture, etc.), at ~$120B in annual purchases. Given these estimates, we assume transportation factoring is 45-50% of that market or approximately $60mm. We represent ~5% of the total market and ~10% of the transportation market. We are among the 3 largest discount transportation factors and in the top 10 overall of discount factors. Who are our clients? Our typical client has limited financial systems. We can factor clients with historical losses, little (if any) net worth, early stage (less than 3 years activity) businesses, turnarounds and restructurings. Who is Triumph Business Capital? We are a highly specialized factor in the transportation space factoring 3 groups of clients: Recourse trucking Non-recourse trucking (owner / operators) Freight brokers Other industry verticals Similar collateral and portfolio servicing characteristics (staffing, warehousing, etc.) Triumph Business Capital Economics: Our client performs services for the account debtor. The client generates an invoice for $1,000 payable in 30 days. The client sells the invoice to Triumph (factor), who pays the client $900 ($1,000 less a 10% cash reserve or “holdback”). Triumph employs $900 of funds to acquire the invoice. We charge a 2.5% discount fee ($25), which reflects a ~2.8% yield on the actual funds employed. Assuming a similarly sized invoice, with the client, was collected (“turned”) every 36 days (or ~10 times per year) Triumph’s annualized yield on the $900 of Net Funds Employed is ~28% ($25 fee * 10 purchases annually / $900). When the invoice is collected, the 10% holdback less our fee is paid to the client. http://www.factoring.org (Factor)

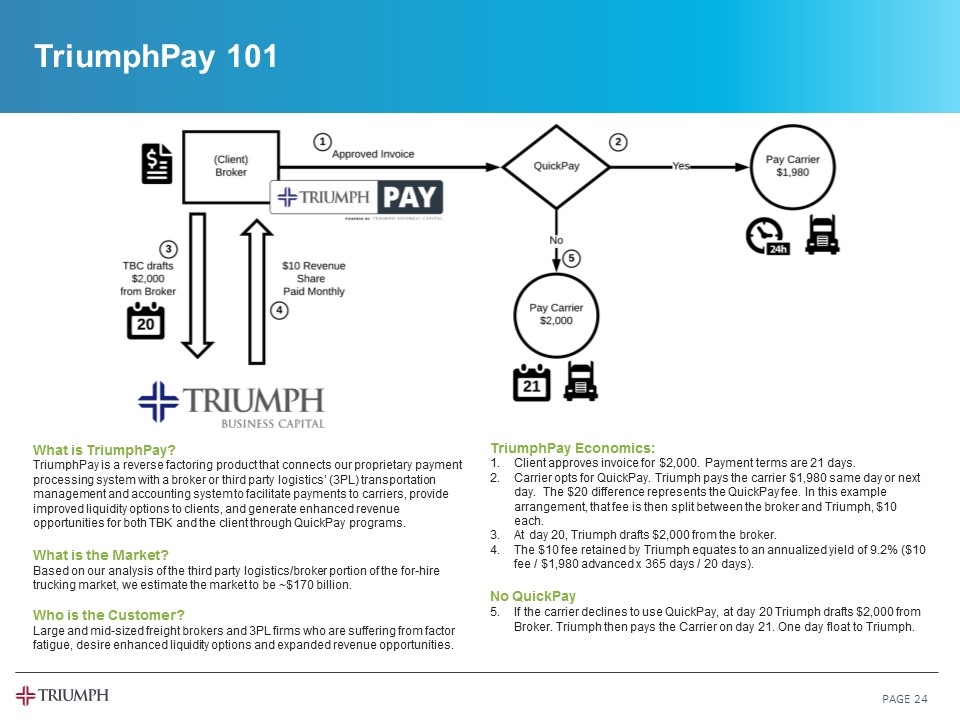

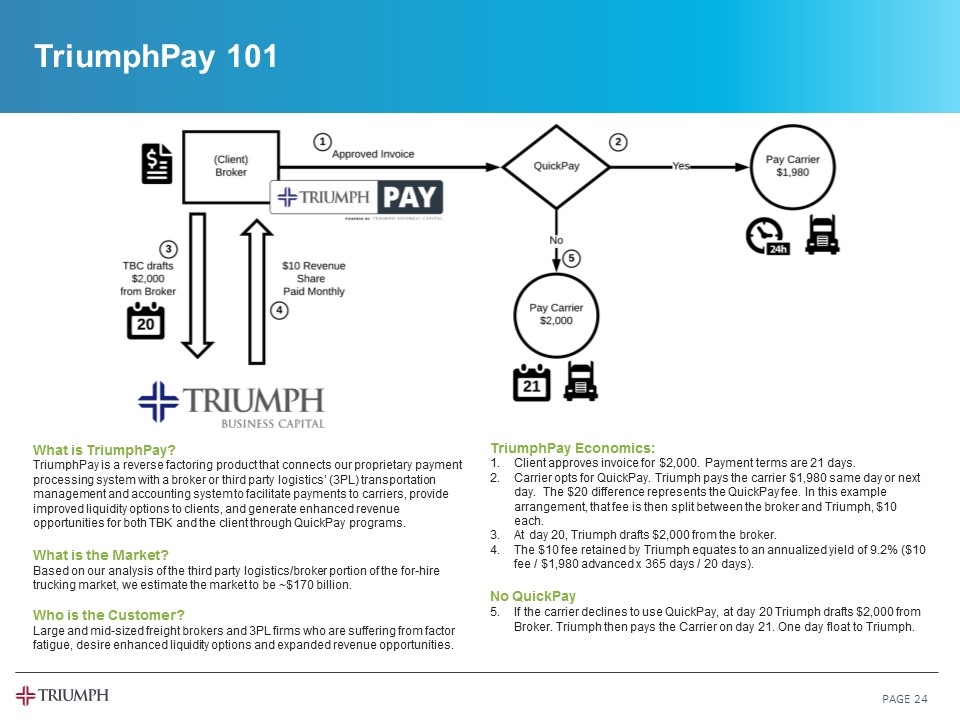

TriumphPay 101 PAGE TriumphPay Economics: Client approves invoice for $2,000. Payment terms are 21 days. Carrier opts for QuickPay. Triumph pays the carrier $1,980 same day or next day. The $20 difference represents the QuickPay fee. In this example arrangement, that fee is then split between the broker and Triumph, $10 each. At day 20, Triumph drafts $2,000 from the broker. The $10 fee retained by Triumph equates to an annualized yield of 9.2% ($10 fee / $1,980 advanced x 365 days / 20 days). No QuickPay If the carrier declines to use QuickPay, at day 20 Triumph drafts $2,000 from Broker. Triumph then pays the Carrier on day 21. One day float to Triumph. What is TriumphPay? TriumphPay is a reverse factoring product that connects our proprietary payment processing system with a broker or third party logistics’ (3PL) transportation management and accounting system to facilitate payments to carriers, provide improved liquidity options to clients, and generate enhanced revenue opportunities for both TBK and the client through QuickPay programs. What is the Market? Based on our analysis of the third party logistics/broker portion of the for-hire trucking market, we estimate the market to be ~$170 billion. Who is the Customer? Large and mid-sized freight brokers and 3PL firms who are suffering from factor fatigue, desire enhanced liquidity options and expanded revenue opportunities.