Exhibit 25.1

securities and exchange commission

Washington, D.C. 20549

__________________________

FORM T-1

STATEMENT OF ELIGIBILITY UNDER

THE TRUST INDENTURE ACT OF 1939 OF A

CORPORATION DESIGNATED TO ACT AS TRUSTEE

Check if an Application to Determine Eligibility of

a Trustee Pursuant to Section 305(b)(2)

_______________________________________________________

U.S. BANK NATIONAL ASSOCIATION

(Exact name of Trustee as specified in its charter)

31-0841368

I.R.S. Employer Identification No.

800 Nicollet Mall Minneapolis, Minnesota | 55402 |

| (Address of principal executive offices) | (Zip Code) |

Melissa A. Rosal

U.S. Bank National Association

190 S. LaSalle Street, 7th Floor

Chicago, Illinois 60603

(312) 332-7496

(Name, address and telephone number of agent for service)

| | AEP TEXAS CENTRAL TRANSITION |

| AEP TEXAS CENTRAL COMPANY | FUNDING III LLC |

| (Exact name of Registrant and Sponsor as specified in its charter) | (Exact name of Registrant and Issuing Entity as specified in its charter) |

| | |

| TEXAS | DELAWARE |

| (State or other jurisdiction of incorporation or organization) | (State or other jurisdiction of incorporation or organization) |

| | |

| 76-0830689 | 45-4223169 |

| (I.R.S. Employer Identification No.) | (I.R.S. Employer Identification No.) |

| | |

1 RIVERSIDE PLAZA COLUMBUS, OHIO 43215 (614) 716-1000 | 539 NORTH CARANCAHUA ST, SUITE 1700 CORPUS CHRISTI, TEXAS 78401 (361) 881-5399 |

Senior Secured Transition

Bonds

(Title of the Indenture Securities)

FORM T-1

| Item 1. | GENERAL INFORMATION. Furnish the following information as to the Trustee. |

| | a) | Name and address of each examining or supervising authority to which it is subject. |

Comptroller of the Currency

| | b) | Whether it is authorized to exercise corporate trust powers. |

Yes

| Item 2. | AFFILIATIONS WITH OBLIGOR. If the obligor is an affiliate of the Trustee, describe each such affiliation. |

None

| Item 3. | Voting securities of the trustee. |

| Item 4. | Trusteeships under other indentures.If the trustee is a trustee under another indenture under which any other securities, of certificates or interest or participation in any other securities, of the obligor are outstanding, furnish the following information: |

(a) Title of the securities outstanding under each such other indenture.

AEP Texas Central Transition Funding LLC, Series 2002-1 Transition Bonds issued under an indenture dated as of February 7, 2002.

(b) A brief statement of the facts relied upon as a basis for the claim that no conflicting interest within the meaning of Section 310(b)(1) of the Act arises as a result of the trusteeship under any such other indenture, including a statement as to how the indenture securities will rank as compared with the securities issued under such other indenture.

Amounts received with respect to the Series 2002-1 Transition Bonds and the Senior Secured Transition Bonds are secured by separate pari passu collateral and neither the Series 2002-1 Transition Bonds nor the Senior Secured Transition Bonds will have access to the other bond’s funds, as agreed upon in the amended and restated intercreditor agreement, expected to be dated as of the same date as the Indenture.

| Items 5-15 | Items 5-15 are not applicable because to the best of the Trustee's knowledge, the obligor is not in default under any Indenture for which the Trustee acts as Trustee. |

| Item 16. | LIST OF EXHIBITS: List below all exhibits filed as a part of this statement of eligibility and qualification. |

| | 1. | A copy of the Articles of Association of the Trustee.* |

| | 2. | A copy of the certificate of authority of the Trustee to commence business, attached as Exhibit 2. |

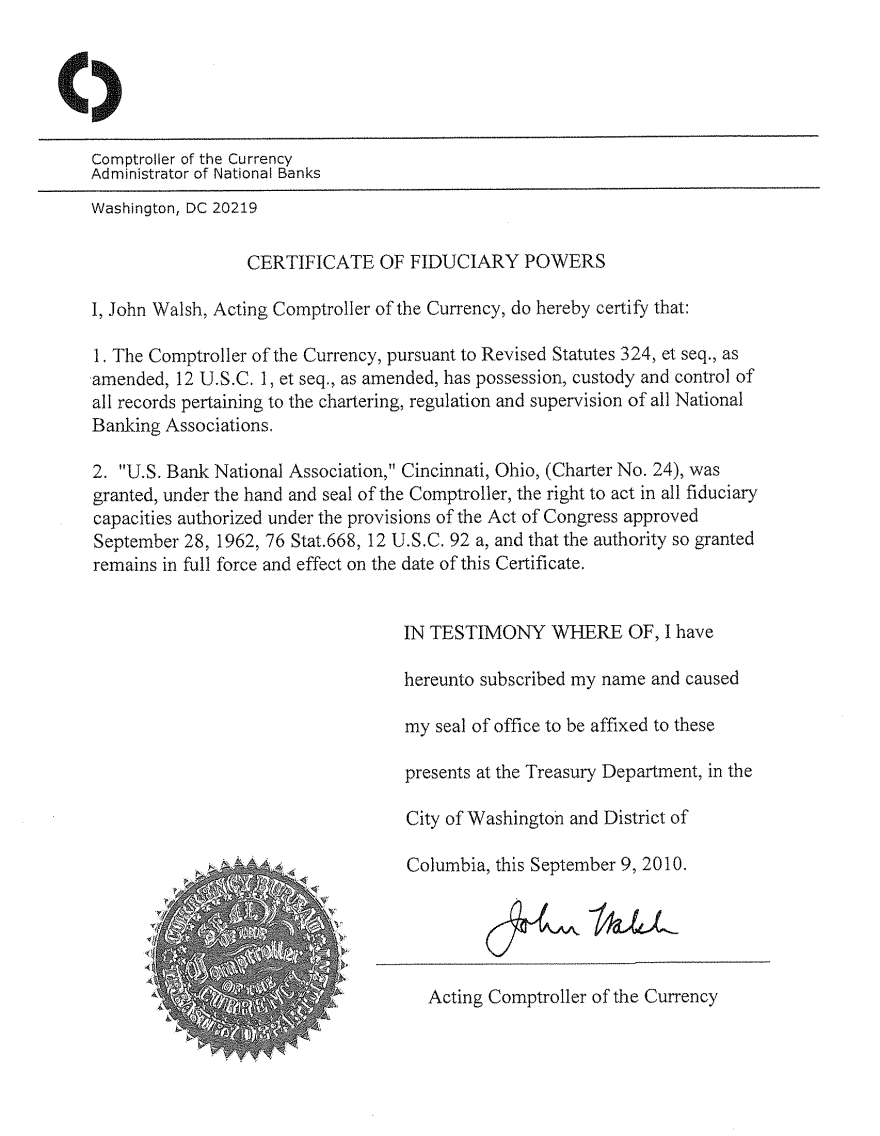

| | 3. | A copy of the certificate of authority of the Trustee to exercise corporate trust powers, attached as Exhibit 3. |

| | 4. | A copy of the existing bylaws of the Trustee.** |

| | 5. | A copy of each Indenture referred to in Item 4. Not applicable. |

| | 6. | The consent of the Trustee required by Section 321(b) of the Trust Indenture Act of 1939, attached as Exhibit 6. |

| | 7. | Report of Condition of the Trustee as of December 31, 2011 published pursuant to law or the requirements of its supervising or examining authority, attached as Exhibit 7. |

| | 8. | A copy of any order pursuant to which the foreign trustee is authorized to act as sole trustee under indentures qualified or to be qualified under the Act. Not applicable. |

| | 9. | Foreign trustees are required to file a consent to serve of process of Form F-X [§269.5 of this chapter]. Not applicable. |

* Incorporated by reference to Exhibit 25.1 to Amendment No. 2 to registration statement on S-4, Registration Number 333-128217 filed on November 15, 2005.

** Incorporated by reference to Exhibit 25.1 to registration statement on S-4, Registration Number 333-166527 filed on May 5, 2010.

SIGNATURE

Pursuant to the requirements of the Trust Indenture Act of 1939, as amended, the Trustee, U.S. BANK NATIONAL ASSOCIATION, a national banking association organized and existing under the laws of the United States of America, has duly caused this statement of eligibility and qualification to be signed on its behalf by the undersigned, thereunto duly authorized, all in the City of Chicago, State of Illinois on the 17th of February, 2012.

| | | |

| | | | |

| | By: | /s/ Melissa A. Rosal | |

| | | Melissa A. Rosal | |

| | | Vice President | |

| | | | |

Exhibit 2

Exhibit 3

Exhibit 6

CONSENT

In accordance with Section 321(b) of the Trust Indenture Act of 1939, the undersigned, U.S. BANK NATIONAL ASSOCIATION hereby consents that reports of examination of the undersigned by Federal, State, Territorial or District authorities may be furnished by such authorities to the Securities and Exchange Commission upon its request therefor.

Dated: February 17, 2012

| | | |

| | | | |

| | By: | /s/ Melissa A. Rosal | |

| | | Melissa A. Rosal | |

| | | Vice President | |

| | | | |

Exhibit 7

U.S. Bank National Association

Statement of Financial Condition

As of 12/31/2011

($000’s)

| | | 12/31/2011 | |

| Assets | | | | |

| Cash and Balances Due From | | $ | 13,960,499 | |

| Depository Institutions | | | | |

| Securities | | | 69,485,200 | |

| Federal Funds | | | 11,887 | |

| Loans & Lease Financing Receivables | | | 204,182,862 | |

| Fixed Assets | | | 5,472,961 | |

| Intangible Assets | | | 12,446,662 | |

| Other Assets | | | 24,910,739 | |

| Total Assets | | $ | 330,470,810 | |

| Liabilities | | | | |

| Deposits | | $ | 236,091,541 | |

| Fed Funds | | | 7,936,151 | |

| Treasury Demand Notes | | | 0 | |

| Trading Liabilities | | | 377,634 | |

| Other Borrowed Money | | | 34,507,710 | |

| Acceptances | | | 0 | |

| Subordinated Notes and Debentures | | | 5,945,617 | |

| Other Liabilities | | | 10,944,902 | |

| Total Liabilities | | $ | 295,803,555 | |

| Equity | | | | |

| Minority Interest in Subsidiaries | | $ | 1,926,211 | |

| Common and Preferred Stock | | | 18,200 | |

| Surplus | | | 14,133,323 | |

| Undivided Profits | | | 18,589,521 | |

| Total Equity Capital | | $ | 34,667,255 | |

| | | | | |

| Total Liabilities and Equity Capital | | $ | 330,470,810 | |