Free Writing Prospectus Filed pursuant to Rule 433 Registration No. 333-195495

Follow-on Offering

May 2014

Safe Harbor

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC Website at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling 1-866-805-4128.

Statements in this presentation, including the information set forth as to the future financial or operating performance of Atlas Financial Holdings, Inc., American Country Insurance Company, American Service Insurance Company and/or Gateway Insurance Company (collectively, “Atlas”), that are not current or historical factual statements may constitute “forward looking” information within the meaning of securities laws. Such forward looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Atlas, or industry results, to be materially different from any future results, performance or achievements expressed or implied by such forward looking statements. When used in this presentation, such statements may include, among other terms, such words as “may,” “will,” “expect,” “believe,” “plan,” “anticipate,” “intend,” “estimate” and other similar terminology. These statements reflect current expectations, estimates and projections regarding future events and operating performance and speak only as to the date of this presentation. Readers should not place undue importance on forward looking statements and should not rely upon this information as of any other date. These forward looking statements involve a number of risks and uncertainties. Some of the factors facing Atlas that could cause actual results to differ materially from those expressed in or underlying such forward looking statements include: (i) market fluctuations, changes in interest rates or the need to generate liquidity; (ii) access to capital; (iii) recognition of future tax benefits on realized and unrealized investment losses; (iv) managing expansion effectively; (v) conditions affecting the industries in which we operate; (vi) competition from industry participants; (vii) attracting and retaining independent agents and brokers; (viii) comprehensive industry regulation; (ix) our holding company structure; (x) our ratings with A.M. Best; (xi) new claim and coverage issues; (xii) claims payments and related expenses; (xiii) reinsurance arrangements; (xiv) credit risk; (xv) our ability to retain key personnel; (xvi) our ability to replace or remove management or Directors; (xvii) future sales of common shares; (xviii) public company challenges; and (xix) failure to effectively execute our business plan. The foregoing list of factors is not exhaustive. See also “Risk Factors” listed in the Company’s most recent registration statement filed with the SEC. Many of these issues can affect Atlas’ actual results and could cause the actual results to differ materially from those expressed or implied in any forward looking statements made by, or on behalf of, Atlas. Readers are cautioned that forward looking statements are not guarantees of future performance, and should not place undue reliance on them. In formulating the forward looking statements contained in this presentation, it has been assumed that business and economic conditions affecting Atlas will continue substantially in the ordinary course. These assumptions, although considered reasonable at the time of preparation, may prove to be incorrect.

2

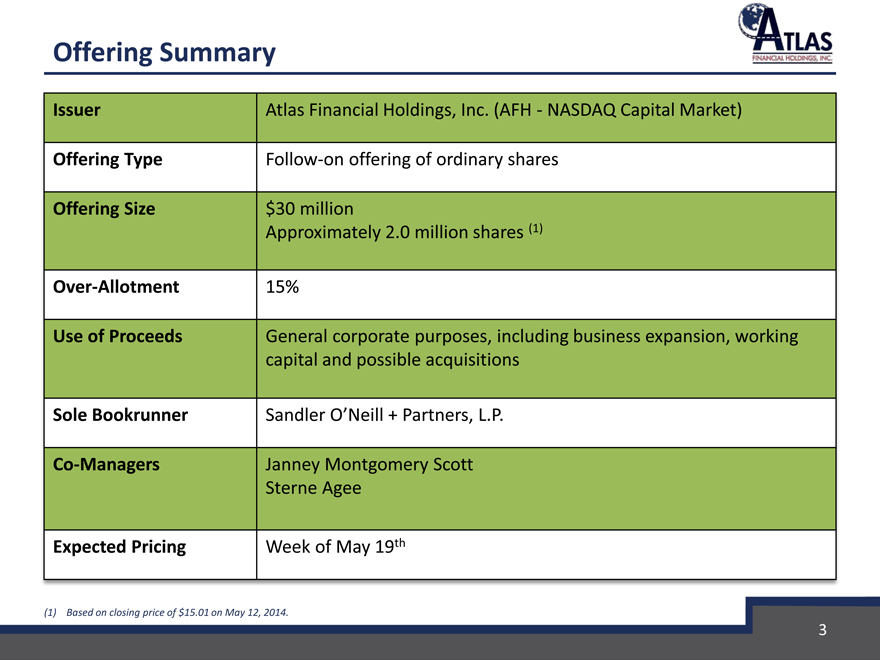

Offering Summary

Issuer Atlas Financial Holdings, Inc. (AFH—NASDAQ Capital Market)

Offering Type Follow-on offering of ordinary shares

Offering Size $30 million

Approximately 2.0 million shares (1)

Over-Allotment 15%

Use of Proceeds General corporate purposes, including business expansion, working

capital and possible acquisitions

Sole Bookrunner Sandler O’Neill + Partners, L.P.

Co-Managers Janney Montgomery Scott

Sterne Agee

Expected Pricing Week of May 19th

(1) Based on closing price of $15.01 on May 12, 2014.

3

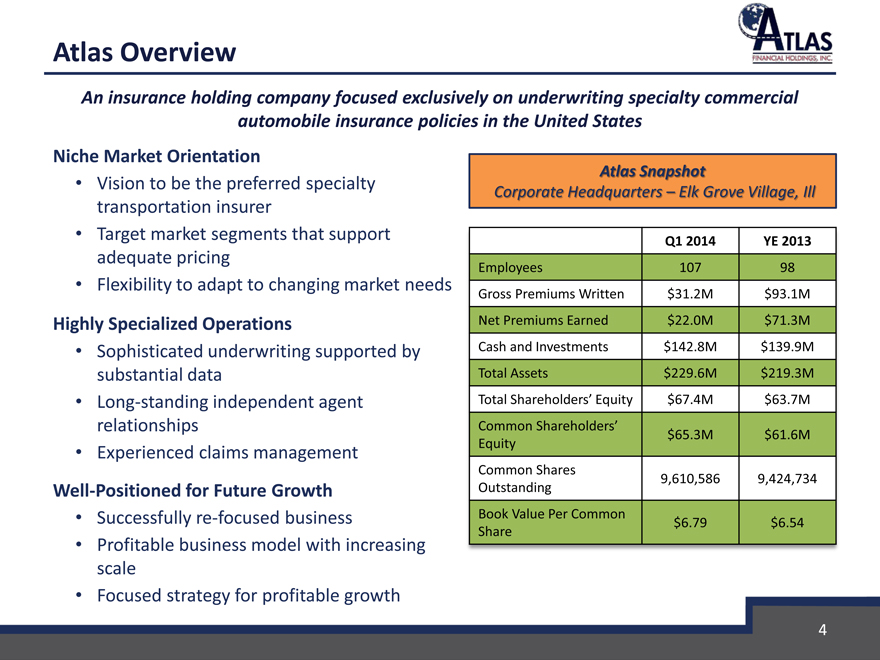

Atlas Overview

An insurance holding company focused exclusively on underwriting specialty commercial automobile insurance policies in the United States

Niche Market Orientation

Vision to be the preferred specialty transportation insurer

Target market segments that support adequate pricing

Flexibility to adapt to changing market needs

Highly Specialized Operations

Sophisticated underwriting supported by substantial data

Long-standing independent agent relationships

Experienced claims management

Well-Positioned for Future Growth

Successfully re-focused business

Profitable business model with increasing scale

Focused strategy for profitable growth

Atlas Snapshot

Corporate Headquarters – Elk Grove Village, Ill

Q1 2014 YE 2013

Employees 107 98

Gross Premiums Written $31.2M $93.1M

Net Premiums Earned $22.0M $71.3M

Cash and Investments $142.8M $139.9M

Total Assets $229.6M $219.3M

Total Shareholders’ Equity $67.4M $63.7M

Common Shareholders’ $65.3M $61.6M

Equity

Common Shares 9,610,586 9,424,734

Outstanding

Book Value Per Common $6.79 $6.54

Share

4

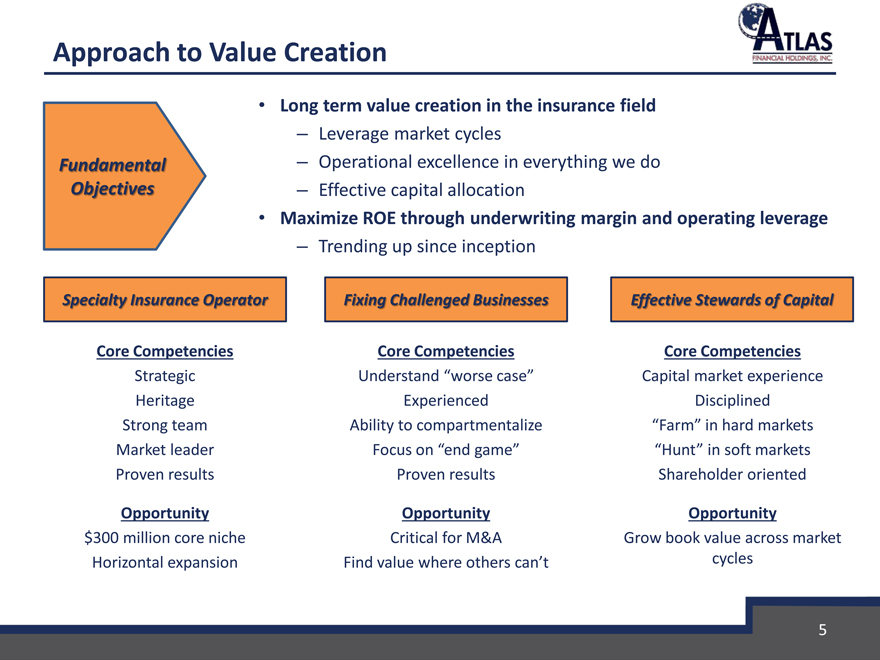

Approach to Value Creation

Long term value creation in the insurance field

– Leverage market cycles

Fundamental – Operational excellence in everything we do Objectives – Effective capital allocation

Maximize ROE through underwriting margin and operating leverage

– Trending up since inception

Specialty Insurance Operator Fixing Challenged Businesses Effective Stewards of Capital

Core Competencies Core Competencies Core Competencies

Strategic Understand “worse case” Capital market experience Heritage Experienced Disciplined Strong team Ability to compartmentalize “Farm” in hard markets Market leader Focus on “end game” “Hunt” in soft markets Proven results Proven results Shareholder oriented

Opportunity Opportunity Opportunity $300 million core niche Critical for M&A Grow book value across market Horizontal expansion Find value where others can’t cycles

5

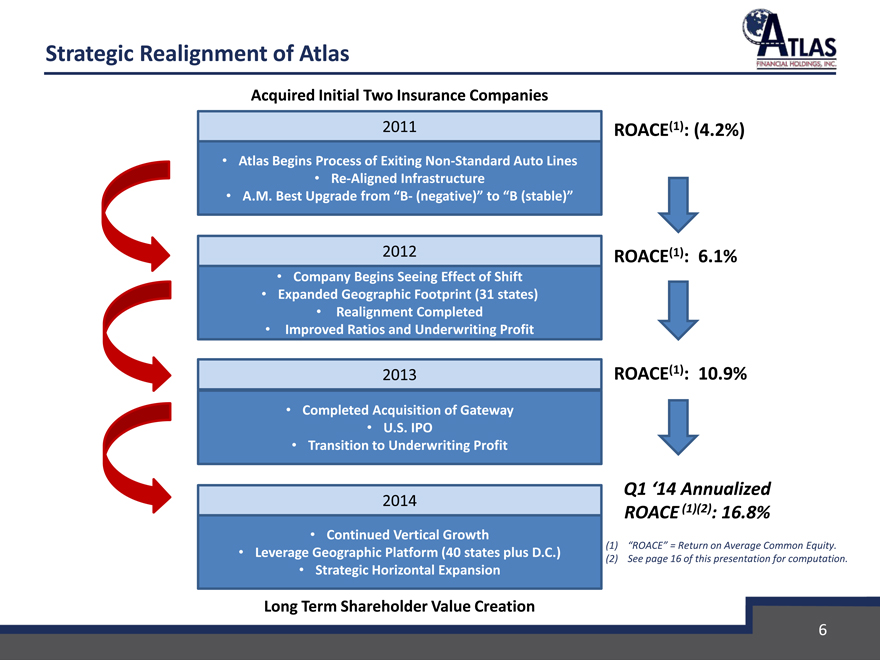

Strategic Realignment of Atlas

Acquired Initial Two Insurance Companies

2011 ROACE(1): (4.2%)

Atlas Begins Process of Exiting Non-Standard Auto Lines

Re-Aligned Infrastructure

A.M. Best Upgrade from “B- (negative)” to “B (stable)”

2012 ROACE(1): 6.1%

Company Begins Seeing Effect of Shift

Expanded Geographic Footprint (31 states)

Realignment Completed

Improved Ratios and Underwriting Profit

2013 ROACE(1): 10.9%

Completed Acquisition of Gateway

U.S. IPO

Transition to Underwriting Profit

Q1 ‘14 Annualized

2014

ROACE (1)(2): 16.8%

Continued Vertical Growth

Leverage Geographic Platform (40 states plus D.C.) (1) “ROACE” = Return on Average Common Equity.

(2) See page 16 of this presentation for computation.

Strategic Horizontal Expansion

Long Term Shareholder Value Creation

6

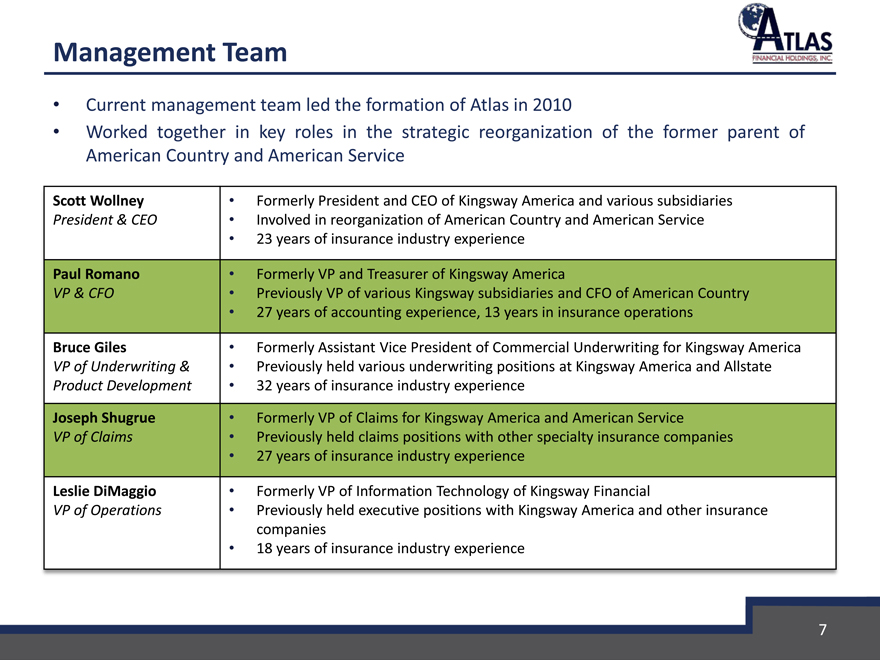

Management Team

Current management team led the formation of Atlas in 2010

Worked together in key roles in the strategic reorganization of the former parent of American Country and American Service

Scott Wollney

• Formerly President and CEO of Kingsway America and various subsidiaries President & CEO

• Involved in reorganization of American Country and American Service

23 years of insurance industry experience Paul Romano Formerly VP and Treasurer of Kingsway America

VP & CFO

• Previously VP of various Kingsway subsidiaries and CFO of American Country

27 years of accounting experience, 13 years in insurance operations

Bruce Giles

• Formerly Assistant Vice President of Commercial Underwriting for Kingsway America VP of Underwriting &

• Previously held various underwriting positions at Kingsway America and Allstate Product Development

• 32 years of insurance industry experience Joseph Shugrue

• Formerly VP of Claims for Kingsway America and American Service VP of Claims

• Previously held claims positions with other specialty insurance companies

27 years of insurance industry experience

Leslie DiMaggio

• Formerly VP of Information Technology of Kingsway Financial

VP of Operations

• Previously held executive positions with Kingsway America and other insurance companies

18 years of insurance industry experience

7

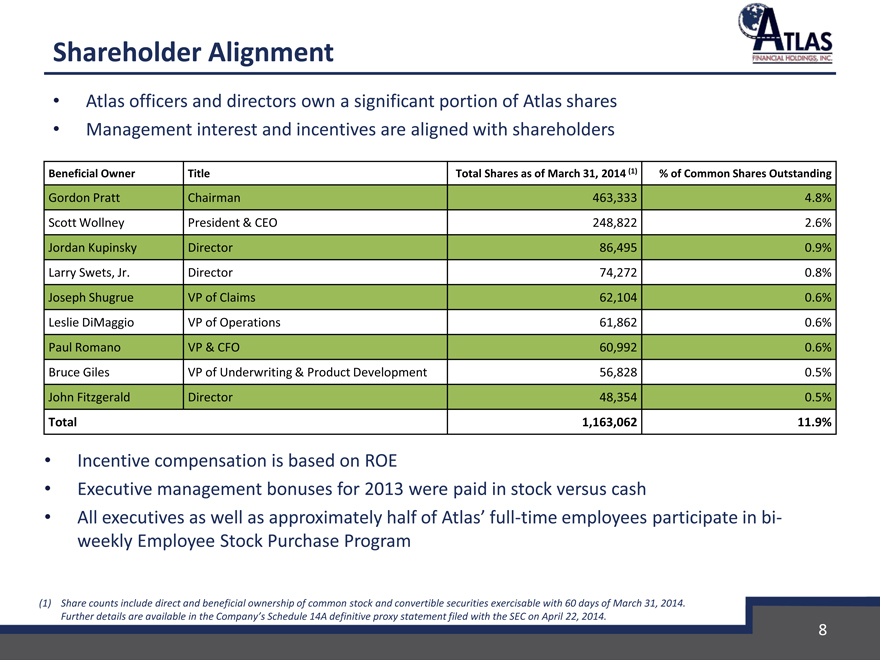

Shareholder Alignment

Atlas officers and directors own a significant portion of Atlas shares

Management interest and incentives are aligned with shareholders

Beneficial Owner Title Total Shares as of March 31, 2014 (1) % of Common Shares Outstanding

Gordon Pratt Chairman 463,333 4.8%

Scott Wollney President & CEO 248,822 2.6%

Jordan Kupinsky Director 86,495 0.9%

Larry Swets, Jr. Director 74,272 0.8%

Joseph Shugrue VP of Claims 62,104 0.6%

Leslie DiMaggio VP of Operations 61,862 0.6%

Paul Romano VP & CFO 60,992 0.6%

Bruce Giles VP of Underwriting & Product Development 56,828 0.5%

John Fitzgerald Director 48,354 0.5%

Total 1,163,062 11.9%

Incentive compensation is based on ROE

Executive management bonuses for 2013 were paid in stock versus cash

All executives as well as approximately half of Atlas’ full-time employees participate in bi-weekly Employee Stock Purchase Program

(1) Share counts include direct and beneficial ownership of common stock and convertible securities exercisable with 60 days of March 31, 2014. Further details are available in the Company’s Schedule 14A definitive proxy statement filed with the SEC on April 22, 2014.

8

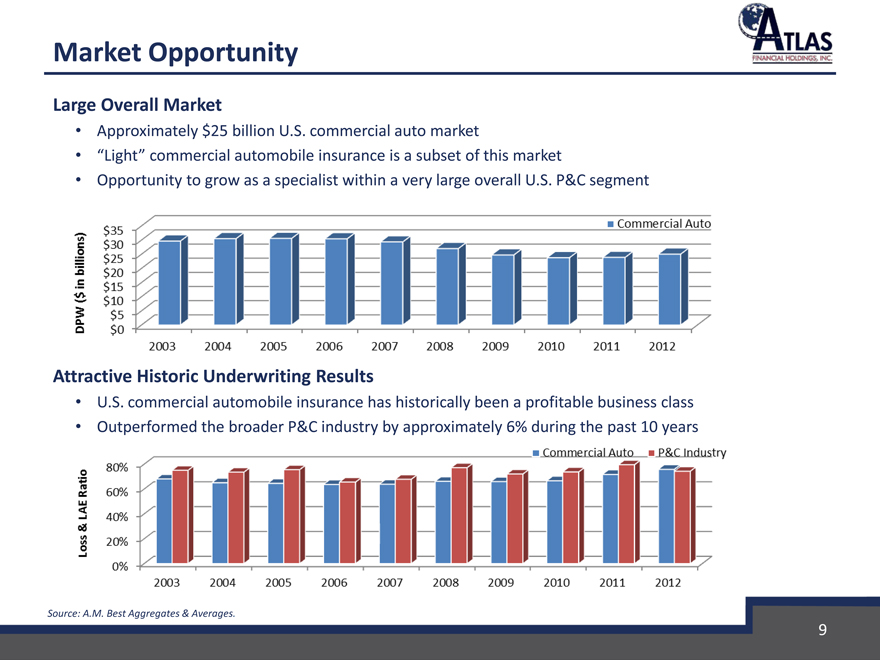

Market Opportunity

Large Overall Market

Approximately $25 billion U.S. commercial auto market

“Light” commercial automobile insurance is a subset of this market

Opportunity to grow as a specialist within a very large overall U.S. P&C segment

DPW ($ in billions)

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

$0 $5 $10 $15 $20 $25 $30 $35

Commercial Auto

Attractive Historic Underwriting Results

U.S. commercial automobile insurance has historically been a profitable business class

Outperformed the broader P&C industry by approximately 6% during the past 10 years

Loss & LAE Ratio

0% 20% 40% 60% 80%

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012

Commercial Auto P&C Industry

Source: A.M. Best Aggregates & Averages.

9

Attractive Current Niche Market Segments

“Light” Commercial Automobile Sector

Taxi, limousine, livery and non-emergency para-transit

Owner-operated and small operation fleets (1-10 vehicles)

Insured to minimum required policy limits

Uniform vehicle types across segments: “light” vehicle weight (e.g., cars, vans, pick-up trucks)

Value Proposition Based on Competitive Strengths Within Niche

Strong brand recognition and market presence

Long-standing distribution relationships

Underwriting expertise, loss data and technology

Specialized claims handling

Attractive Niche Industry Sector

Historically profitable business class

Limited number of competitors

Operators less likely to take vehicles out of service

Businesses and business reputations rely on availability

Incremental Expansion

Currently analyzing other specialty commercial auto niche markets

10

Strong Distribution Relationships

Distribution Channel Cultivated Over Many Years

In-force business has more than doubled in the past year

Volume of applications continues to accelerate

Strong Brand Recognition

Accelerates development of new distribution relationships in target markets

American Country: one of the oldest taxi insurers in the U.S., with roots dating back to 1925

American Service: commenced operations in 1983

Gateway Insurance Company: predecessor founded in 1946

Diversified Agent Network

2-5 strategic “cornerstone” partnerships in each state

Focus on Specialty Commercial Products

Significant marketing and advertising with a focus on brand recognition, value proposition and commitment to specialty commercial auto and related lines

Discontinued all non-core lines of business

– Florida personal auto in 2008

– MGA insurance programs in 2008 & 2009

– Private passenger non-standard auto in 2011

11

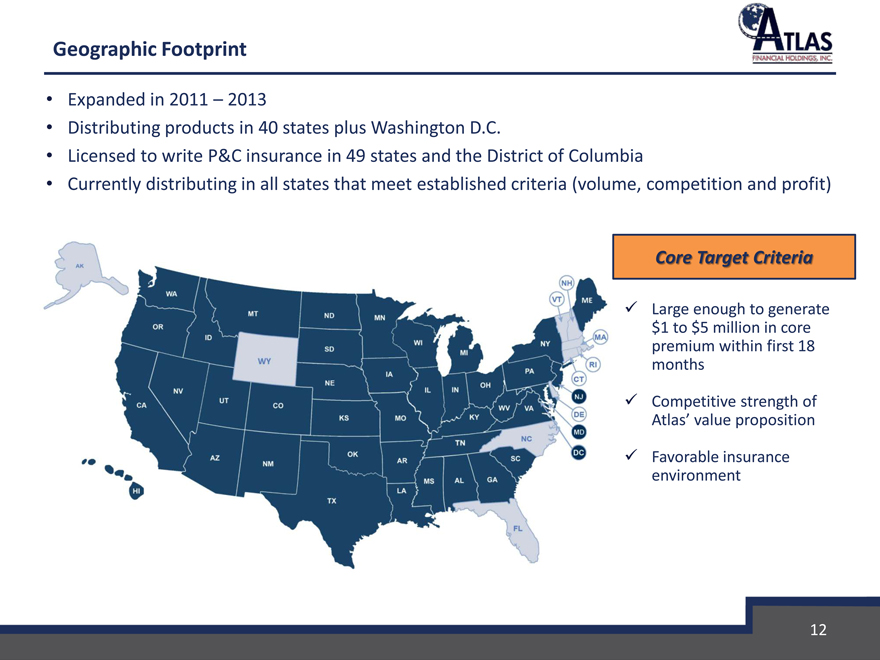

Geographic Footprint

Expanded in 2011 – 2013

Distributing products in 40 states plus Washington D.C.

Licensed to write P&C insurance in 49 states and the District of Columbia

Currently distributing in all states that meet established criteria (volume, competition and profit)

Core Target Criteria

Large enough to generate $1 to $5 million in core premium within first 18 months Competitive strength of Atlas’ value proposition Favorable insurance environment

12

Underwriting Expertise

Experienced

Underwriters average over 10 years of individual experience with a commitment to commercial auto insurance

Rich history and trusted brands

Deep data repository

Knowledgeable

Understanding of complex business processes and local protocols with extensive knowledge of municipal, state and federal requirements

Ability to identify profitable risks and set price to generate underwriting profits

Technology Initiatives

Predictive Underwriting Model - Data mining tool currently being deployed is expected to further enhance risk selection and improve underwriting results

Point-of-Sale System - Underwriting interface, easy to use and data feeds directly into system; works in conjunction with traditional rate filings and predictive model

Existing infrastructure will support POS submission and policy delivery in the future

Resources

Access to large universe of data from a much larger book of business, ensuring accurate pricing in target markets and ease of entry into new markets

Agent and policyholder services to support regulatory and operating requirements

13

Specialized Claims Handling

Knowledgeable and Geographically Dispersed Network of Adjusters

Employees located in key markets (Chicago, New York, St. Louis, and other strategic locations)

Large network of independent appraisers and other experienced vendors located in smaller markets (long-standing relationships)

Focus on Customer Priorities

Importance of processing claims quickly to repair and return vehicles back into service

Emphasis on driver training and, when applicable, support during claim process

In-depth Understanding of Insured Assets

Commercial vehicles

Special equipment

Customer business priorities

Risk management practices

Well-established Infrastructure and Long-standing Relationships

Allows for increased control over loss adjustment costs and fraud avoidance

Commitment to being an industry leading resource

14

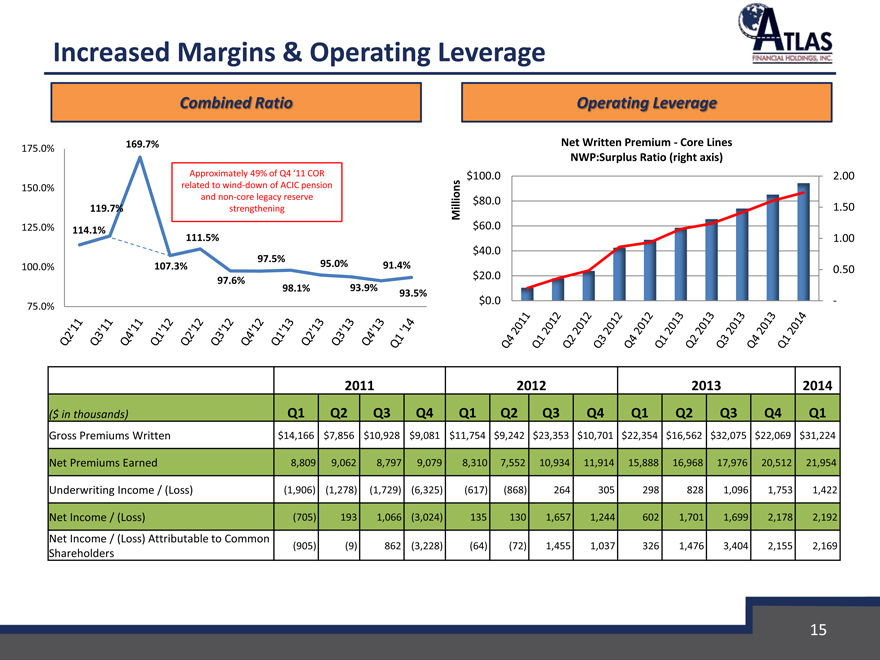

Increased Margins & Operating Leverage

Combined Ratio

175.0% 169.7%

Approximately 49% of Q4 ‘11 COR 150.0% related to wind-down of ACIC pension and non-core legacy reserve 119.7% strengthening

125.0% 114.1% 111.5%

97.5% 95.0%

100.0% 107.3% 91.4% 97.6% 98.1% 93.9% 93.5%

75.0%

Q2’11 Q3’11 Q4’11 Q1’12 Q2’12 Q3’12 Q4’12 Q1’13 Q2’13 Q3’13 Q4’13 Q1’14

Operating Leverage

Net Written Premium - Core Lines NWP:Surplus Ratio (right axis) $100.0 2.00 $80.0

Millions 1.50 $60.0

1.00 $40.0

0.50 $20.0

$0.0 -

Q4 2011 Q1 2012 Q2 2012 Q3 2012 Q4 2012 Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014

2011 2012 2013 2014

($ in thousands) Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1

Gross Premiums Written $14,166 $7,856 $10,928 $9,081 $11,754 $9,242 $23,353 $10,701 $22,354 $16,562 $32,075 $22,069 $31,224

Net Premiums Earned 8,809 9,062 8,797 9,079 8,310 7,552 10,934 11,914 15,888 16,968 17,976 20,512 21,954

Underwriting Income / (Loss) (1,906) (1,278) (1,729) (6,325) (617) (868) 264 305 298 828 1,096 1,753 1,422

Net Income / (Loss) (705) 193 1,066 (3,024) 135 130 1,657 1,244 602 1,701 1,699 2,178 2,192

Net Income / (Loss) Attributable to Common

Shareholders (905) (9) 862 (3,228) (64) (72) 1,455 1,037 326 1,476 3,404 2,155 2,169

15

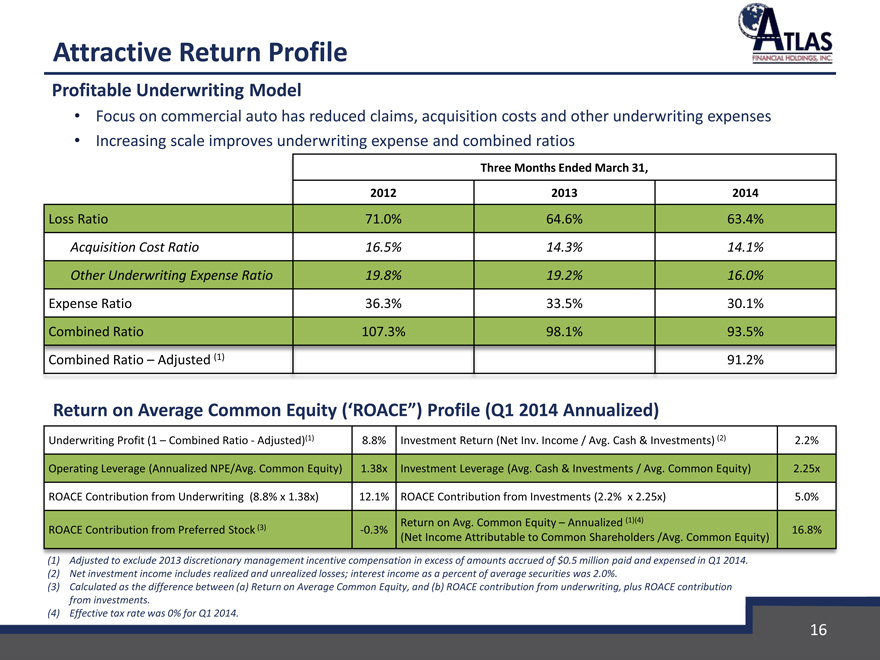

Attractive Return Profile

Profitable Underwriting Model

Focus on commercial auto has reduced claims, acquisition costs and other underwriting expenses

Increasing scale improves underwriting expense and combined ratios

Three Months Ended March 31,

2012 2013 2014

Loss Ratio 71.0% 64.6% 63.4%

Acquisition Cost Ratio 16.5% 14.3% 14.1%

Other Underwriting Expense Ratio 19.8% 19.2% 16.0%

Expense Ratio 36.3% 33.5% 30.1%

Combined Ratio 107.3% 98.1% 93.5%

Combined Ratio – Adjusted (1) 91.2%

Return on Average Common Equity (‘ROACE”) Profile (Q1 2014 Annualized)

Underwriting Profit (1 – Combined Ratio—Adjusted)(1) 8.8% Investment Return (Net Inv. Income / Avg. Cash & Investments) (2) 2.2%

Operating Leverage (Annualized NPE/Avg. Common Equity) 1.38x Investment Leverage (Avg. Cash & Investments / Avg. Common Equity) 2.25x

ROACE Contribution from Underwriting (8.8% x 1.38x) 12.1% ROACE Contribution from Investments (2.2% x 2.25x) 5.0%

Return on Avg. Common Equity – Annualized (1)(4)

ROACE Contribution from Preferred Stock (3) -0.3% 16.8%

(Net Income Attributable to Common Shareholders /Avg. Common Equity)

(1) Adjusted to exclude 2013 discretionary management incentive compensation in excess of amounts accrued of $0.5 million paid and expensed in Q1 2014. (2) Net investment income includes realized and unrealized losses; interest income as a percent of average securities was 2.0%.

(3) Calculated as the difference between (a) Return on Average Common Equity, and (b) ROACE contribution from underwriting, plus ROACE contribution from investments.

(4) Effective tax rate was 0% for Q1 2014.

16

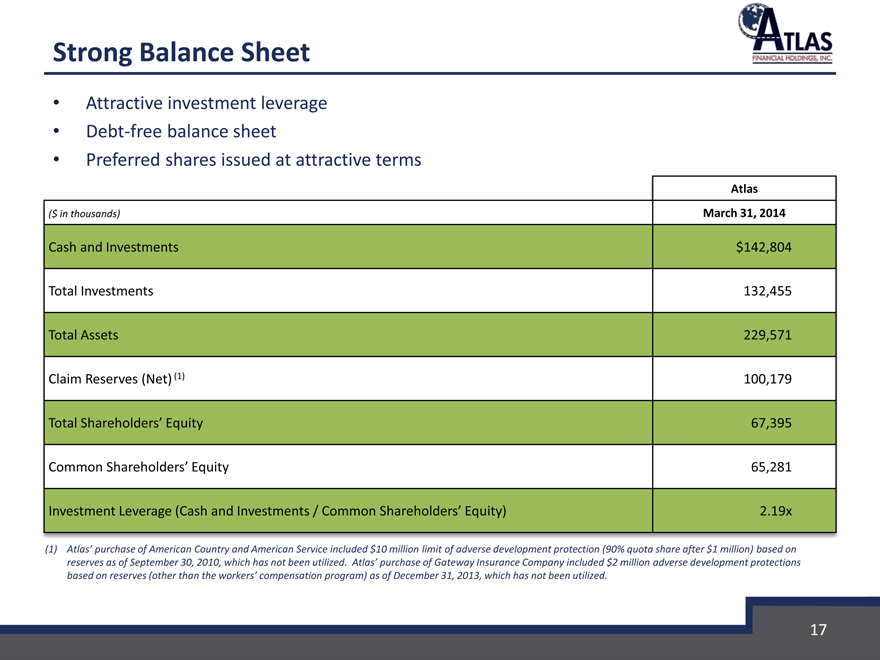

Strong Balance Sheet

Attractive investment leverage

Debt-free balance sheet

Preferred shares issued at attractive terms

Atlas

($ in thousands) March 31, 2014

Cash and Investments $142,804

Total Investments 132,455

Total Assets 229,571

Claim Reserves (Net) (1) 100,179

Total Shareholders’ Equity 67,395

Common Shareholders’ Equity 65,281

Investment Leverage (Cash and Investments / Common Shareholders’ Equity) 2.19x

(1) Atlas’ purchase of American Country and American Service included $10 million limit of adverse development protection (90% quota share after $1 million) based on reserves as of September 30, 2010, which has not been utilized. Atlas’ purchase of Gateway Insurance Company included $2 million adverse development protections based on reserves (other than the workers’ compensation program) as of December 31, 2013, which has not been utilized.

17

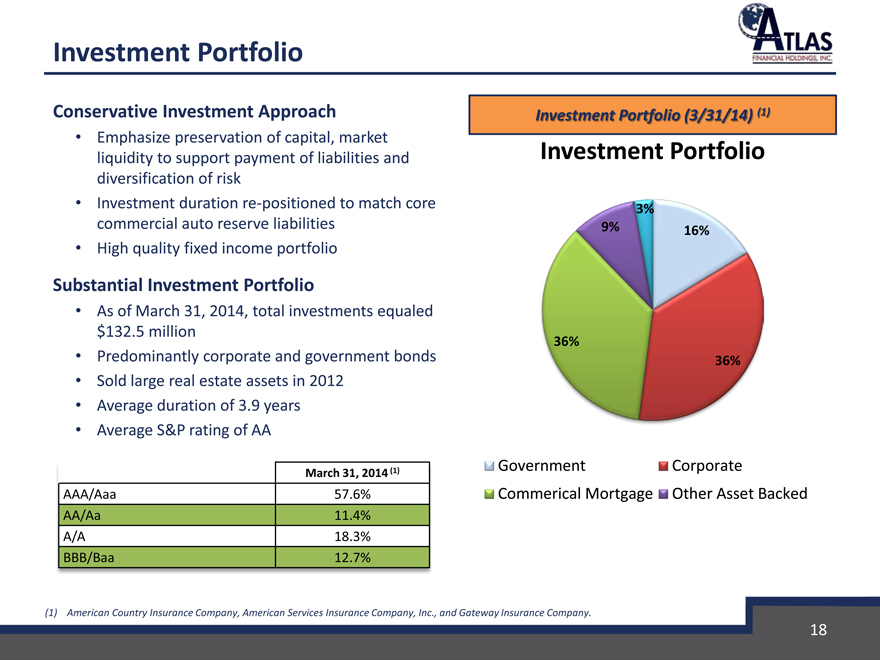

Investment Portfolio

Conservative Investment Approach

Emphasize preservation of capital, market liquidity to support payment of liabilities and diversification of risk

Investment duration re-positioned to match core commercial auto reserve liabilities

High quality fixed income portfolio

Substantial Investment Portfolio

As of March 31, 2014, total investments equaled $132.5 million

Predominantly corporate and government bonds

Sold large real estate assets in 2012

Average duration of 3.9 years

Average S&P rating of AA

Investment Portfolio (3/31/14) (1)

Investment Portfolio

3%

9% 16%

36%

36%

Government Corporate

Commerical Mortgage Other Asset Backed

March 31, 2014 (1)

AAA/Aaa 57.6%

AA/Aa 11.4%

A/A 18.3%

BBB/Baa 12.7%

(1) American Country Insurance Company, American Services Insurance Company, Inc., and Gateway Insurance Company.

18

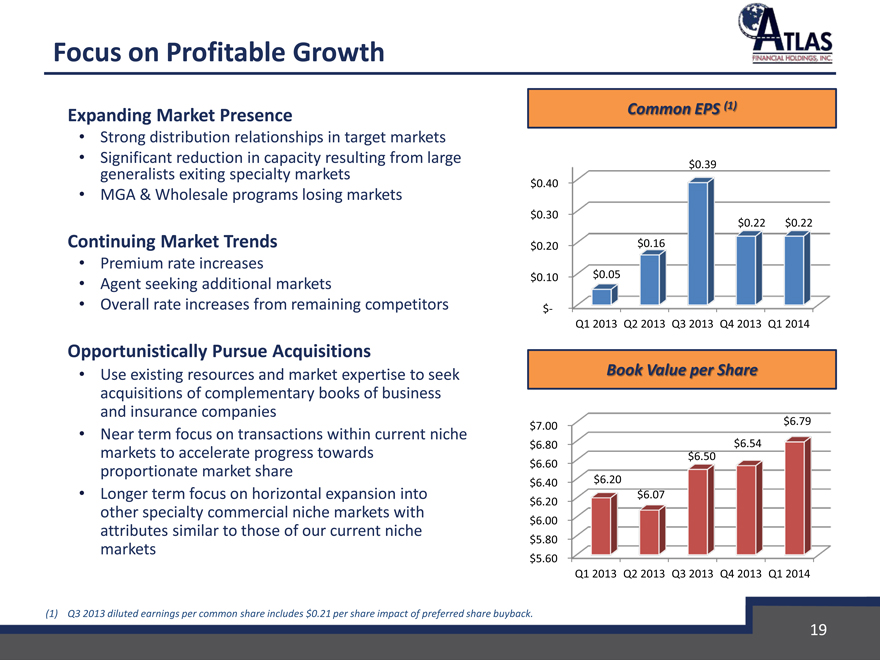

Focus on Profitable Growth

Expanding Market Presence

Strong distribution relationships in target markets

Significant generalists reduction exiting specialty in capacity markets resulting from large

MGA & Wholesale programs losing markets

Continuing Market Trends

Premium rate increases

Agent seeking additional markets

Overall rate increases from remaining competitors

Opportunistically Pursue Acquisitions

Use existing resources and market expertise to seek acquisitions of complementary books of business and insurance companies

Near term focus on transactions within current niche markets to accelerate progress towards proportionate market share

Longer term focus on horizontal expansion into other specialty commercial niche markets with attributes similar to those of our current niche markets

Common EPS (1)

$0.39

$0.40

$0.30

$0.22 $0.22

$0.20 $0.16

$0.10 $0.05

$-

Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014

Book Value per Share

$7.00 $6.79

$6.80 $6.54

$6.50

$6.60

$6.40 $6.20

$6.07

$6.20

$6.00

$5.80

$5.60

Q1 2013 Q2 2013 Q3 2013 Q4 2013 Q1 2014

(1) Q3 2013 diluted earnings per common share includes $0.21 per share impact of preferred share buyback.

19

Investment Highlights

Niche Market Focus

Favorable market dynamics

Strong brands and deep distribution relationships

Specialized underwriting and claims handling expertise

Strong Financial Return Profile

Profitable underwriting model

Efficient operating structure

Substantial investment leverage

Scalable Operations Positioned for Growth

Re-establishing legacy agent relationships

Expanding market presence

Complementary acquisition opportunities

Entrepreneurial, Committed and Experienced Management Team

Leveraging core competencies

Interests aligned with shareholders

Attractive Outlook

Completed realignment to core focus

Recently expanded market footprint

20