Investor Presentation May 2022 Atlas Financial Holdings, Inc.

������� � � ��� �� �������� ������ � This presentation includes forward‐looking statements regarding the Company, its subsidiaries and businesses. Such statements are based on the current expectations of the management of each entity. The words "anticipate", "expect", "believe", "may", "should", "estimate", "project", "outlook", "forecast" or similar words are used to identify such forward looking information. The forward‐looking events and circumstances discussed on this call may not occur and could differ materially as a result of known and unknown risk factors and uncertainties affecting the companies. These factors can be found in their filings with the Securities and Exchange Commission, in the “Risk Factors” section of its most recent Form 10K or subsequent quarterly filings on Form 10‐Q. As such, no forward‐looking statement can be guaranteed. Except as required by applicable securities laws, forward‐looking statements speak only as of the date on which they are made and the Company and its subsidiaries undertake no obligation to publicly update or revise any forward‐looking statement, whether as a result of new information, future events, or otherwise. Forward‐Looking Statements

������� � � ��� �� �������� ������ � F o c u s e d o n “ l i g h t ” c o mm e r c i a l a u t o The primary business of Atlas is commercial automobile insurance in the United States, with a niche market orientation and focus on insurance for the “light” commercial automobile sector including taxi cabs, nonemergency para‐transit, limousine/livery (including full‐time transportation network company drivers) and business auto. Atlas’ specialized infrastructure is designed to leverage analytics, expertise and technology to efficiently and profitably provide insurance solutions for independent contractors, owner operators and other smaller accounts. The Company focuses on underserved and evolving niche markets where its differentiated approach is expected to create value for its stakeholders and shareholders. The Company’s strategy is focused on leveraging its managing general agency operation (“AGMI”) and its insurtech digital platform (“optOn”). For more information about Atlas, please visit www.atlas‐ fin.com, www.agmiinsurance.com, and www.getopton.com. About Atlas

������� � � ��� �� �������� ������ � Atlas Strategic Focus Strategic Realignment Vision To always be a preferred specialty transportation related insurance business that delivers benefit to all stakeholders by leveraging technology, analytics, expertise, partnerships and capital resources. • Deliver sustainable value to our risk‐taking partners and consumers of our products by cultivating and maintaining a unique position in the markets on which we focus. • As a nimble, innovative specialist, deploy our expertise, analytics and technology to disrupt underserved segments of commercial auto. Mission To develop and deliver superior specialty insurance products and services to meet our customers’ needs with a focus on innovation and the effective use of technology and analytics to deliver consistent operating profit for the insurance businesses we own. A strategic shift focusing on technology‐driven commercial automobile managing general agency (“MGA”) as its primary business

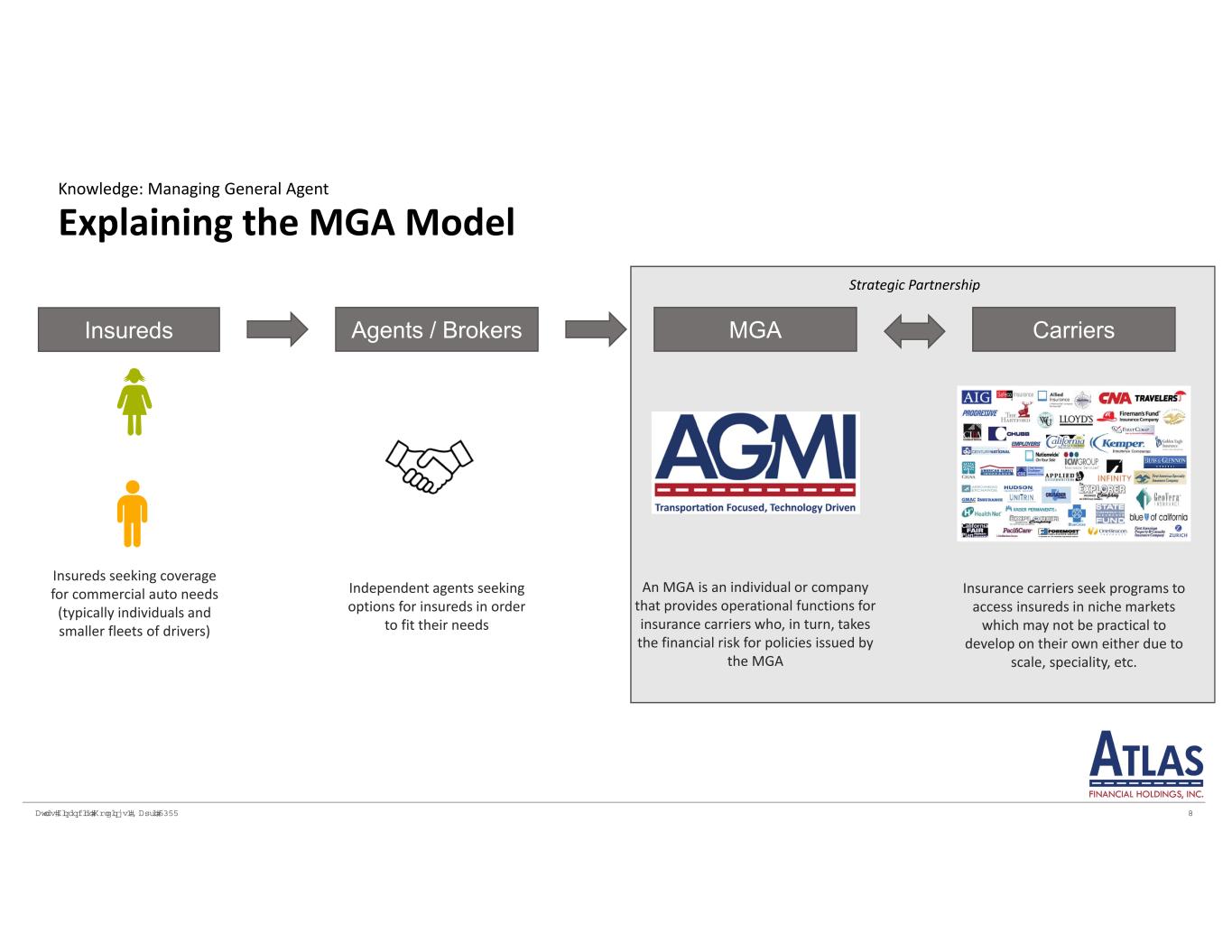

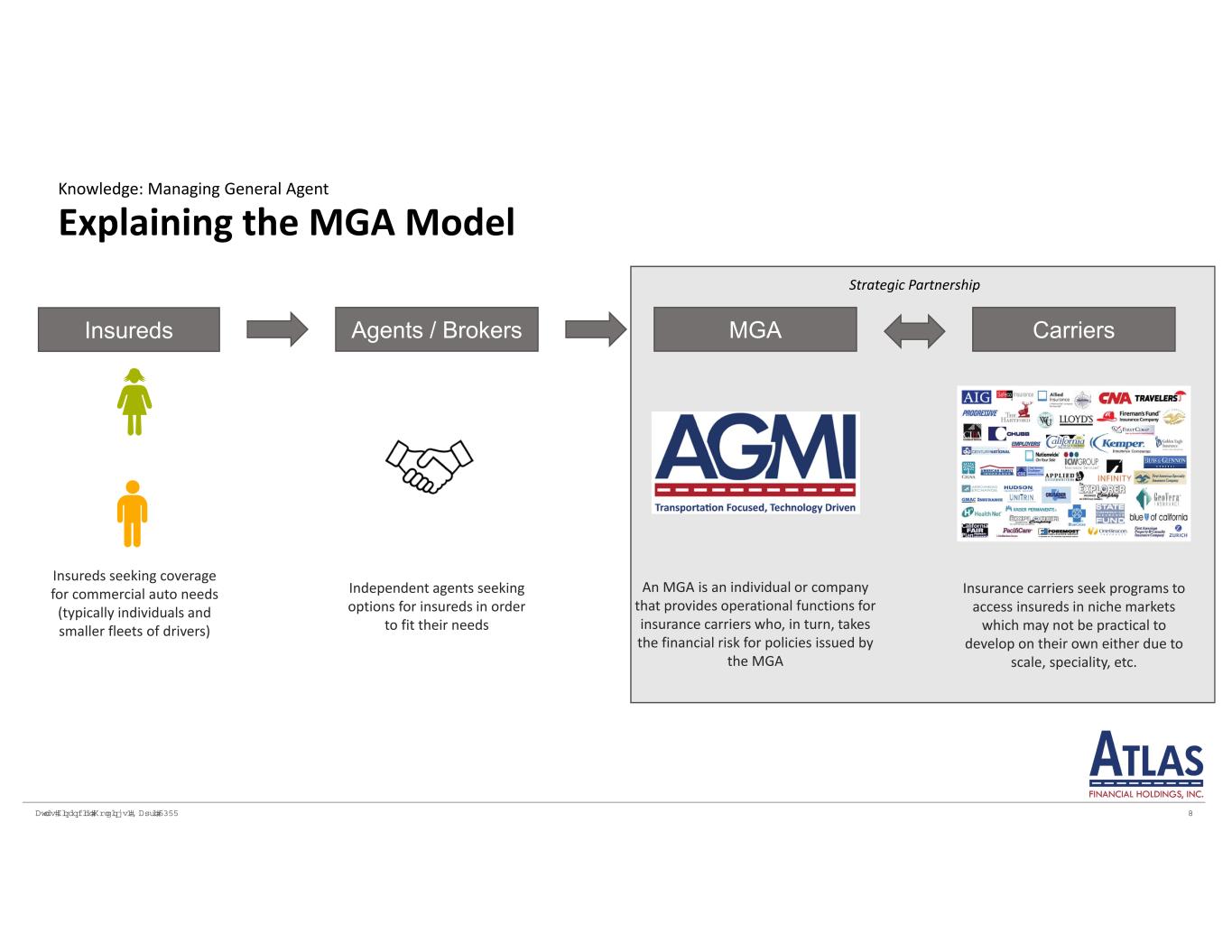

������� � � ��� �� �������� ������ � Explaining the MGA Model Knowledge: Managing General Agent Insureds seeking coverage for commercial auto needs (typically individuals and smaller fleets of drivers) Insureds Agents / Brokers MGA Carriers Independent agents seeking options for insureds in order to fit their needs Insurance carriers seek programs to access insureds in niche markets which may not be practical to develop on their own either due to scale, speciality, etc. An MGA is an individual or company that provides operational functions for insurance carriers who, in turn, takes the financial risk for policies issued by the MGA Strategic Partnership

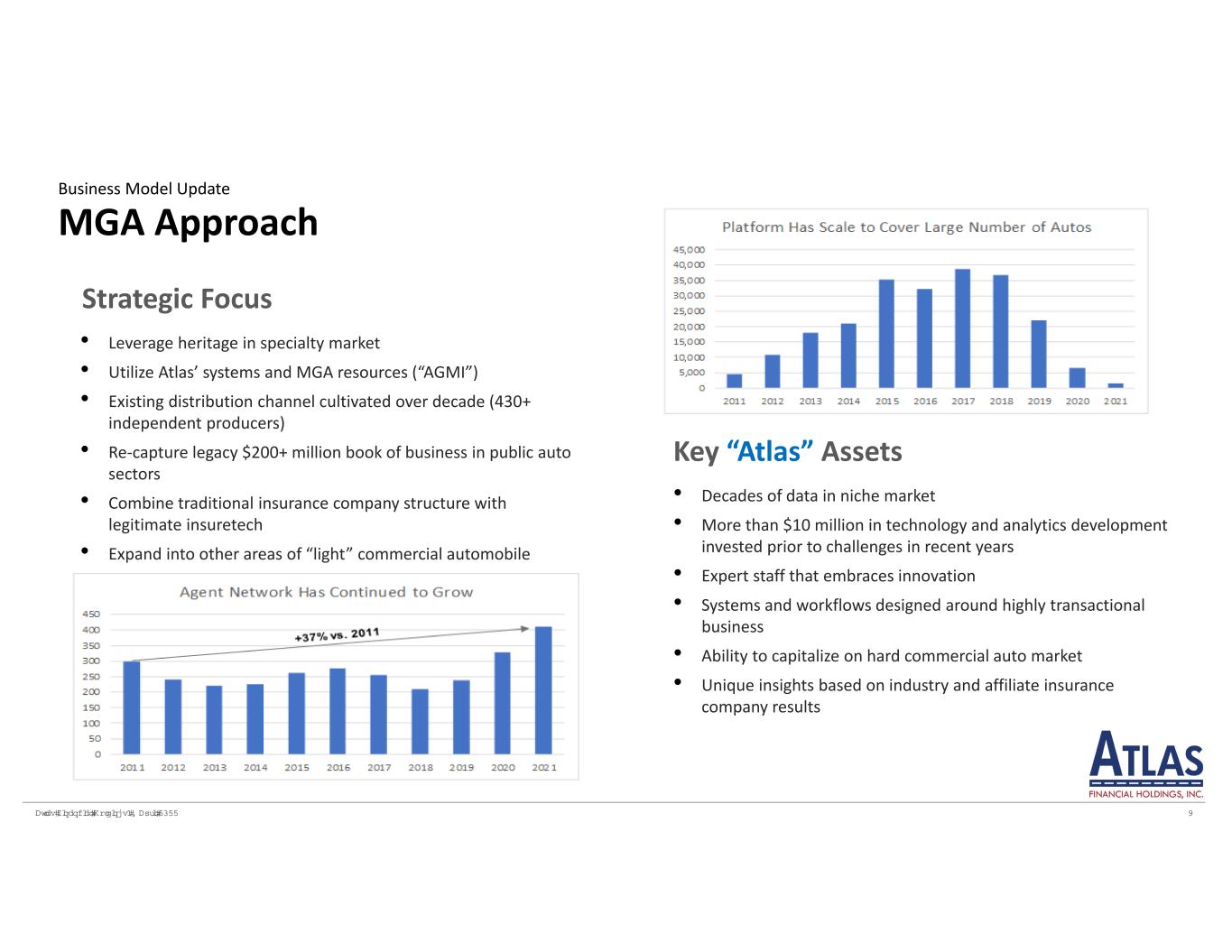

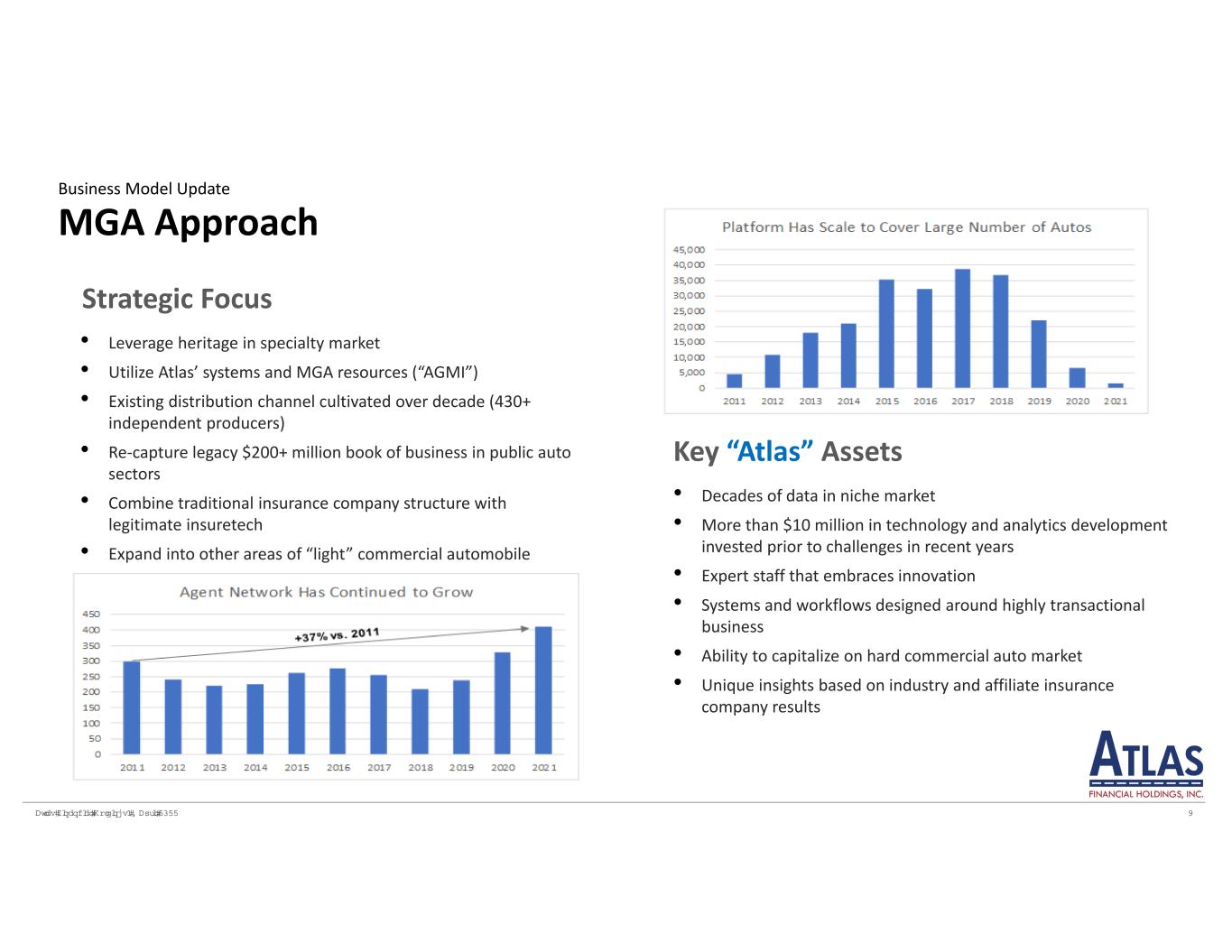

������� � � ��� �� �������� ������ � Strategic Focus • Leverage heritage in specialty market • Utilize Atlas’ systems and MGA resources (“AGMI”) • Existing distribution channel cultivated over decade (430+ independent producers) • Re‐capture legacy $200+ million book of business in public auto sectors • Combine traditional insurance company structure with legitimate insuretech • Expand into other areas of “light” commercial automobile Key “Atlas” Assets • Decades of data in niche market • More than $10 million in technology and analytics development invested prior to challenges in recent years • Expert staff that embraces innovation • Systems and workflows designed around highly transactional business • Ability to capitalize on hard commercial auto market • Unique insights based on industry and affiliate insurance company results MGA Approach Business Model Update

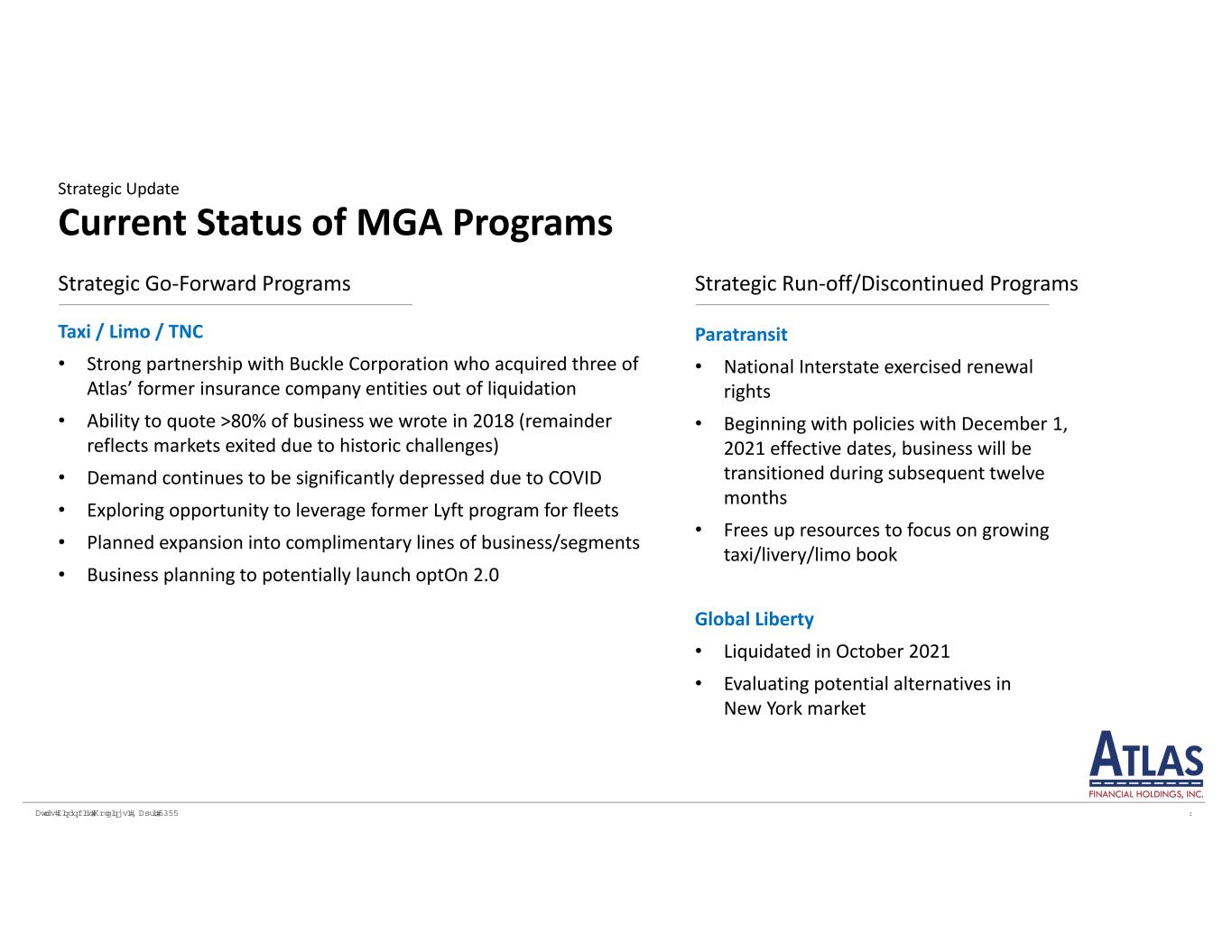

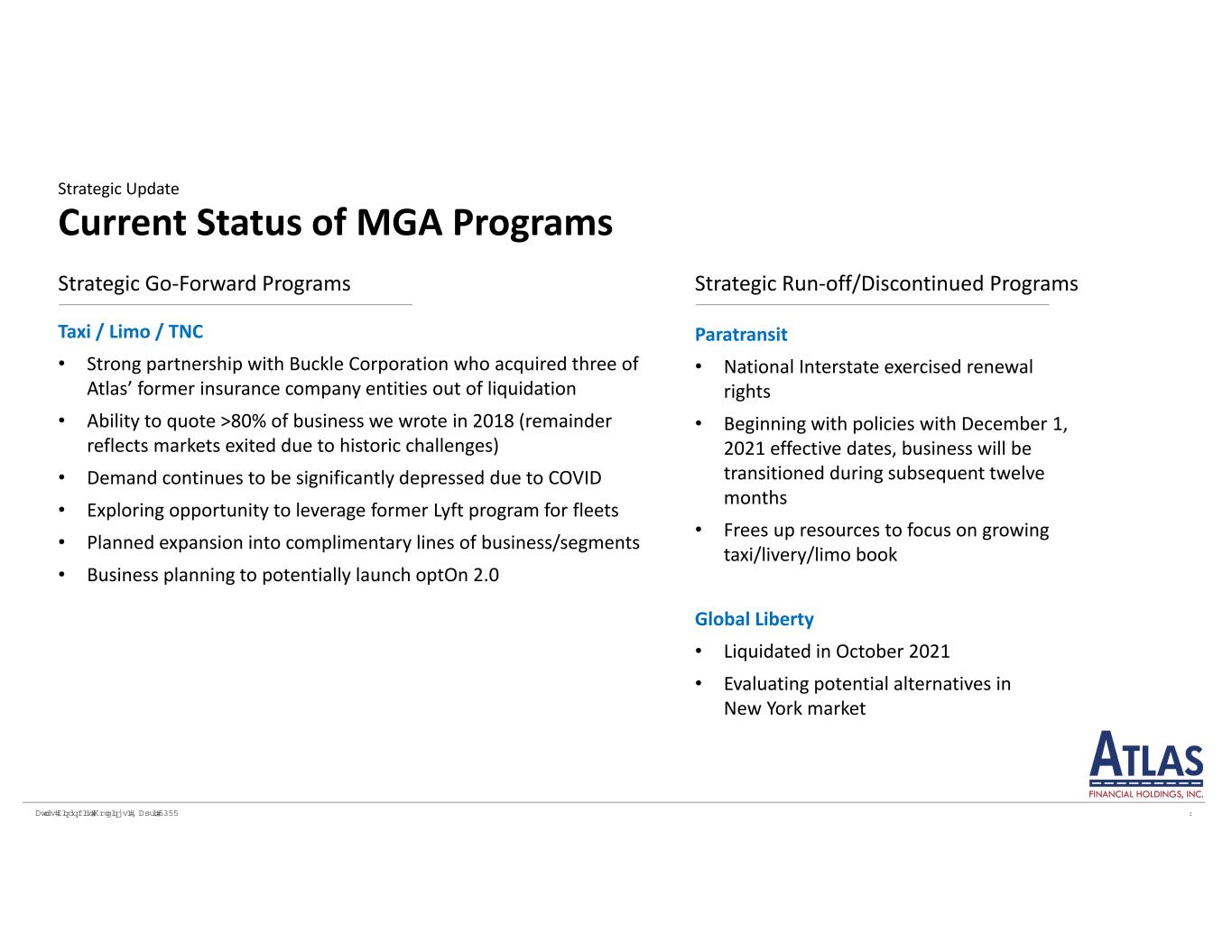

������� � � ��� �� �������� ������ � Current Status of MGA Programs Strategic Update Paratransit • National Interstate exercised renewal rights • Beginning with policies with December 1, 2021 effective dates, business will be transitioned during subsequent twelve months • Frees up resources to focus on growing taxi/livery/limo book Global Liberty • Liquidated in October 2021 • Evaluating potential alternatives in New York market Taxi / Limo / TNC • Strong partnership with Buckle Corporation who acquired three of Atlas’ former insurance company entities out of liquidation • Ability to quote >80% of business we wrote in 2018 (remainder reflects markets exited due to historic challenges) • Demand continues to be significantly depressed due to COVID • Exploring opportunity to leverage former Lyft program for fleets • Planned expansion into complimentary lines of business/segments • Business planning to potentially launch optOn 2.0 Strategic Go‐Forward Programs Strategic Run‐off/Discontinued Programs

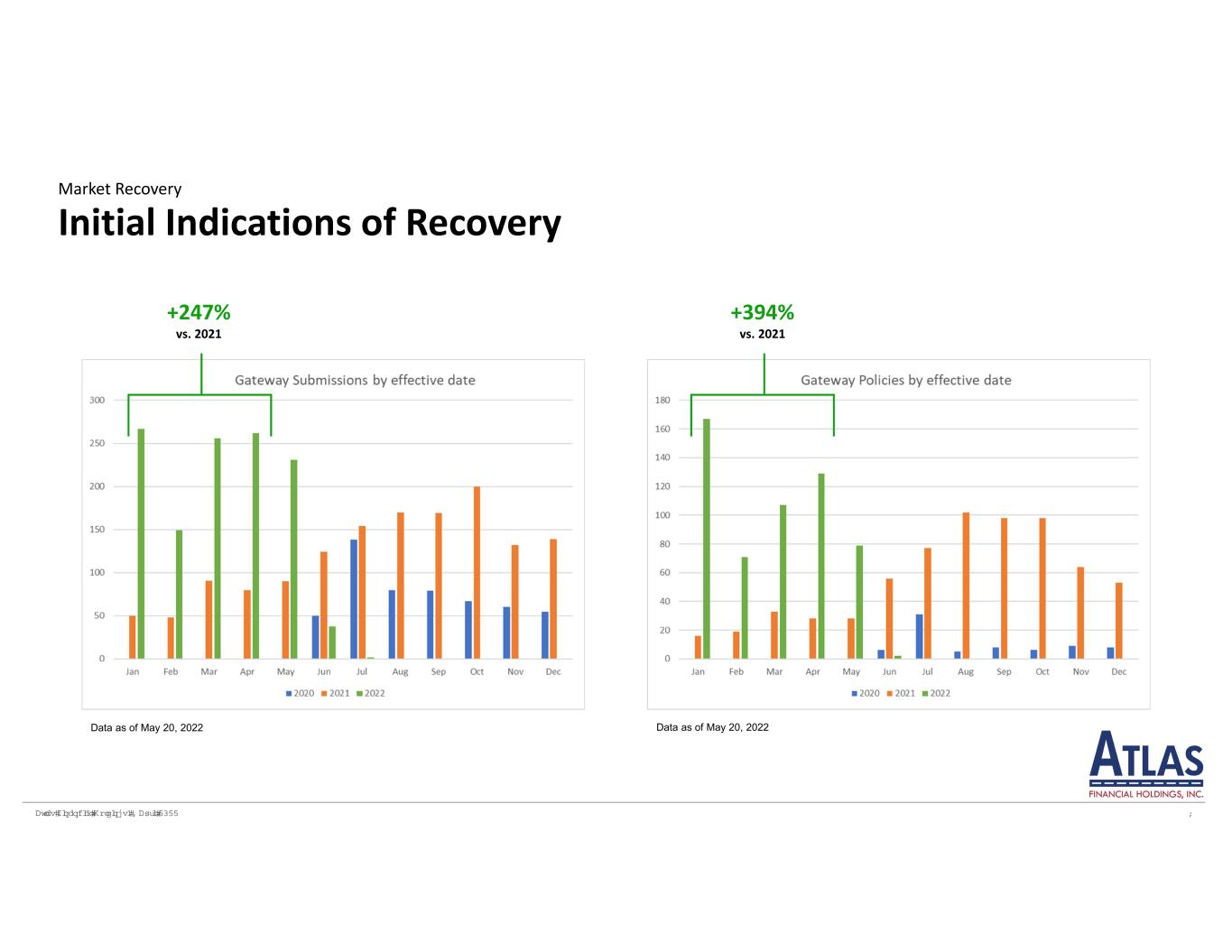

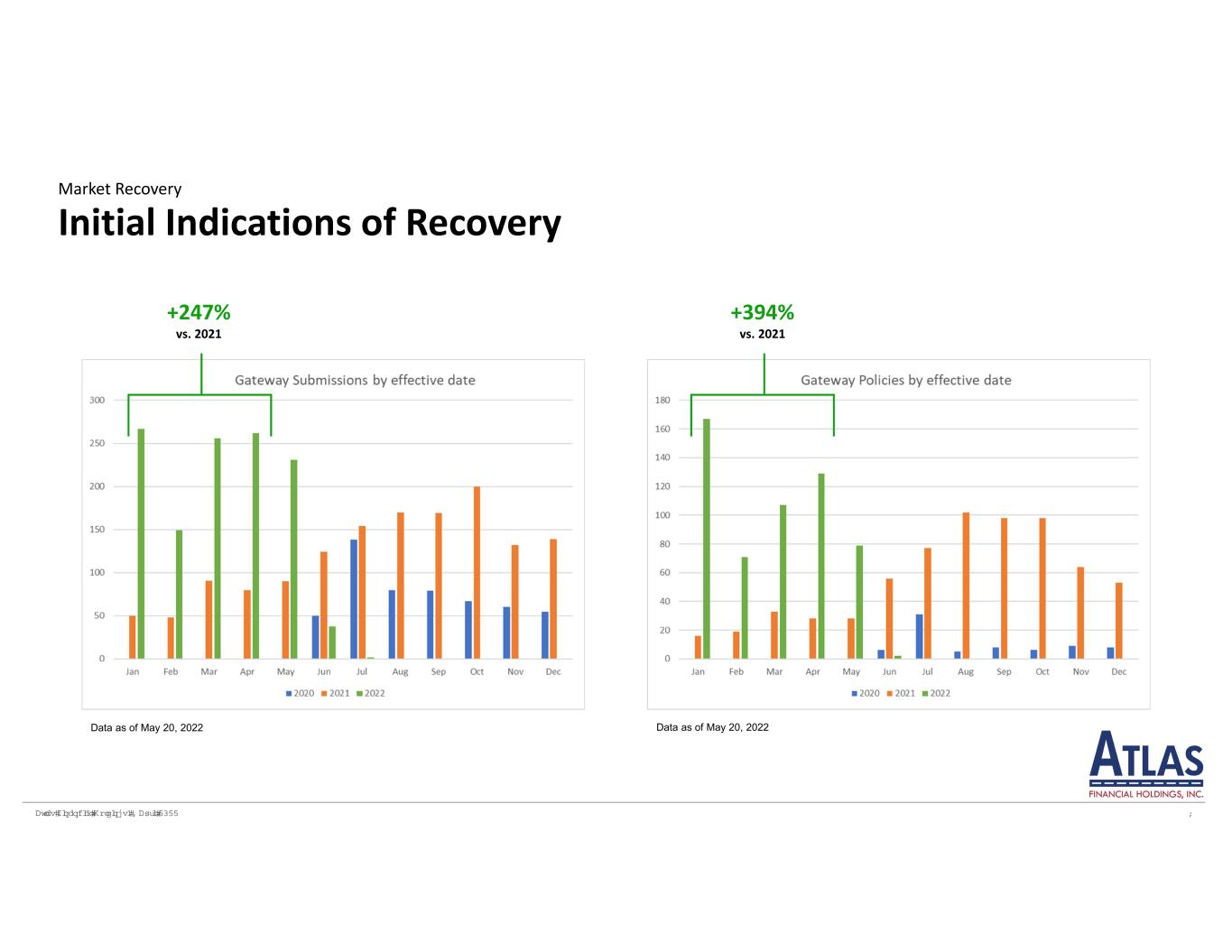

������� � � ��� �� �������� ������ � Initial Indications of Recovery Market Recovery +247% vs. 2021 Data as of May 20, 2022 Data as of May 20, 2022 +394% vs. 2021

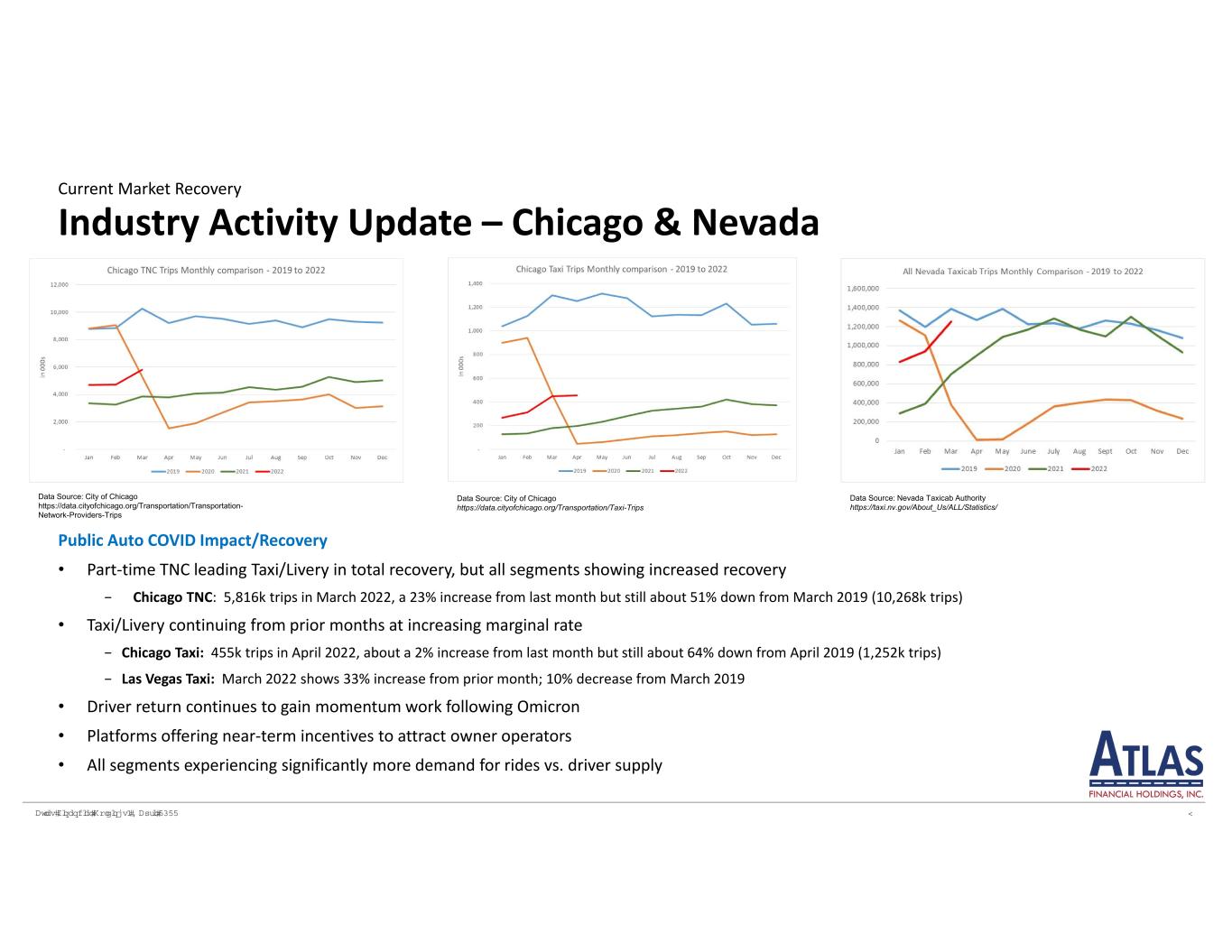

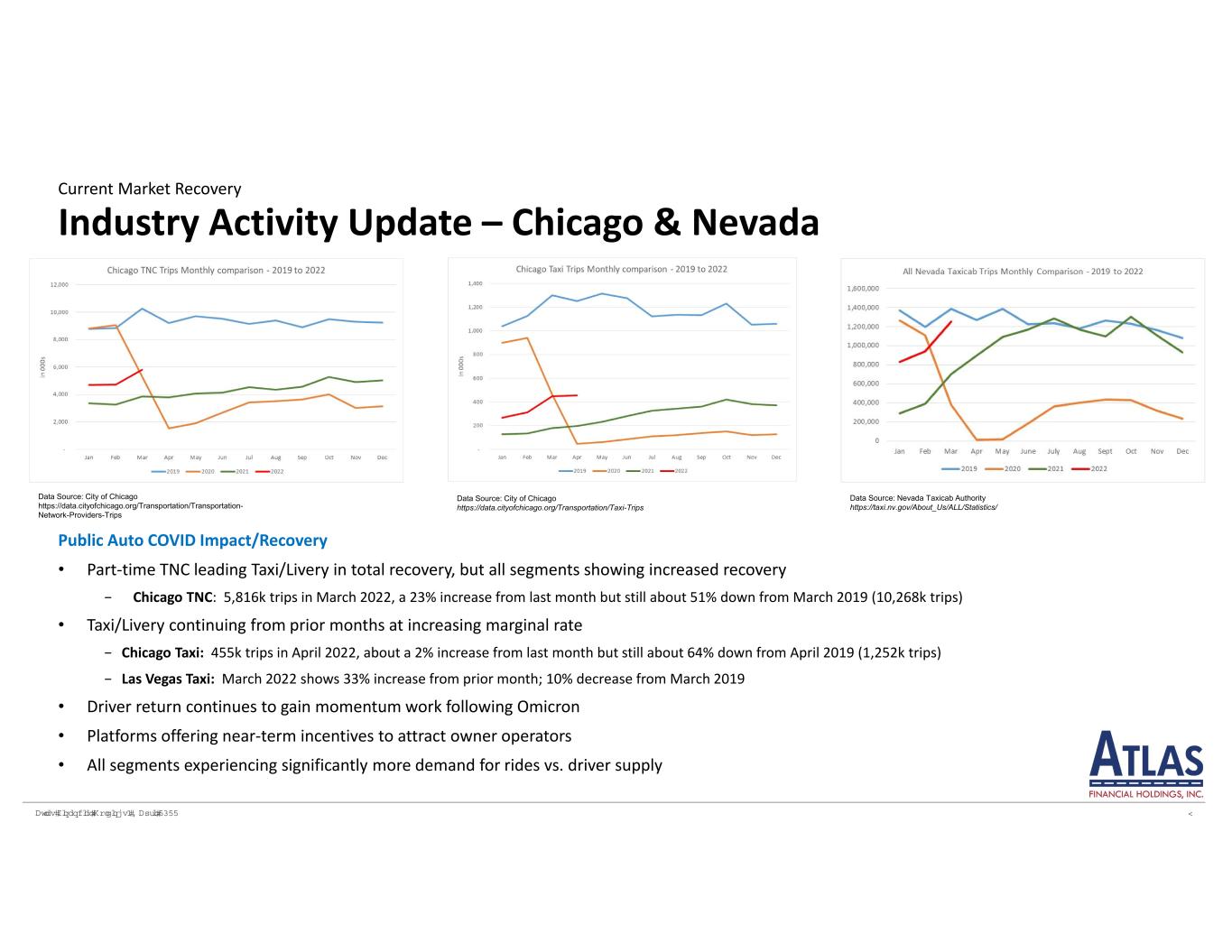

������� � � ��� �� �������� ������ � Industry Activity Update – Chicago & Nevada Current Market Recovery Public Auto COVID Impact/Recovery • Part‐time TNC leading Taxi/Livery in total recovery, but all segments showing increased recovery − Chicago TNC: 5,816k trips in March 2022, a 23% increase from last month but still about 51% down from March 2019 (10,268k trips) • Taxi/Livery continuing from prior months at increasing marginal rate − Chicago Taxi: 455k trips in April 2022, about a 2% increase from last month but still about 64% down from April 2019 (1,252k trips) − Las Vegas Taxi: March 2022 shows 33% increase from prior month; 10% decrease from March 2019 • Driver return continues to gain momentum work following Omicron • Platforms offering near‐term incentives to attract owner operators • All segments experiencing significantly more demand for rides vs. driver supply Data Source: Nevada Taxicab Authority https://taxi.nv.gov/About_Us/ALL/Statistics/ Data Source: City of Chicago https://data.cityofchicago.org/Transportation/Transportation- Network-Providers-Trips Data Source: City of Chicago https://data.cityofchicago.org/Transportation/Taxi-Trips

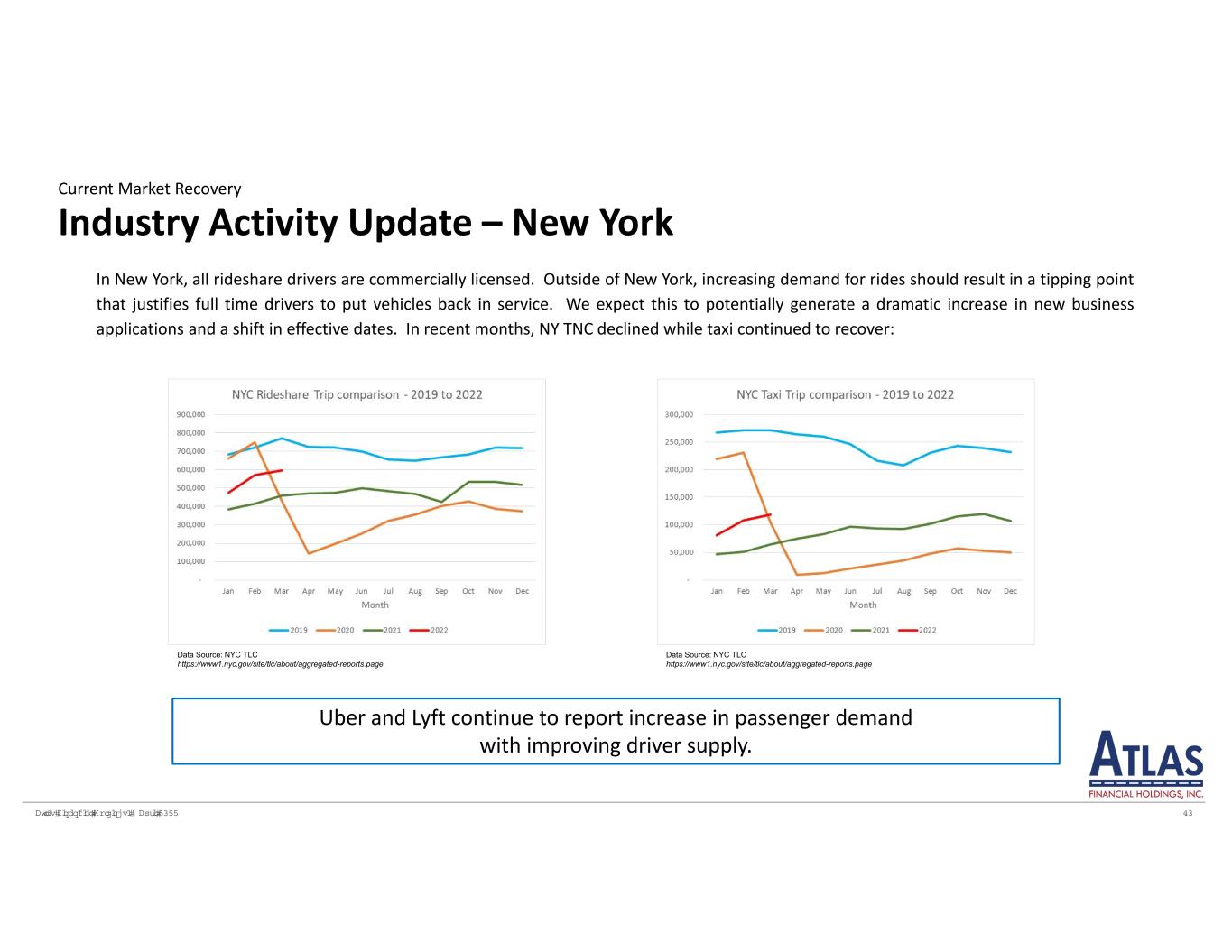

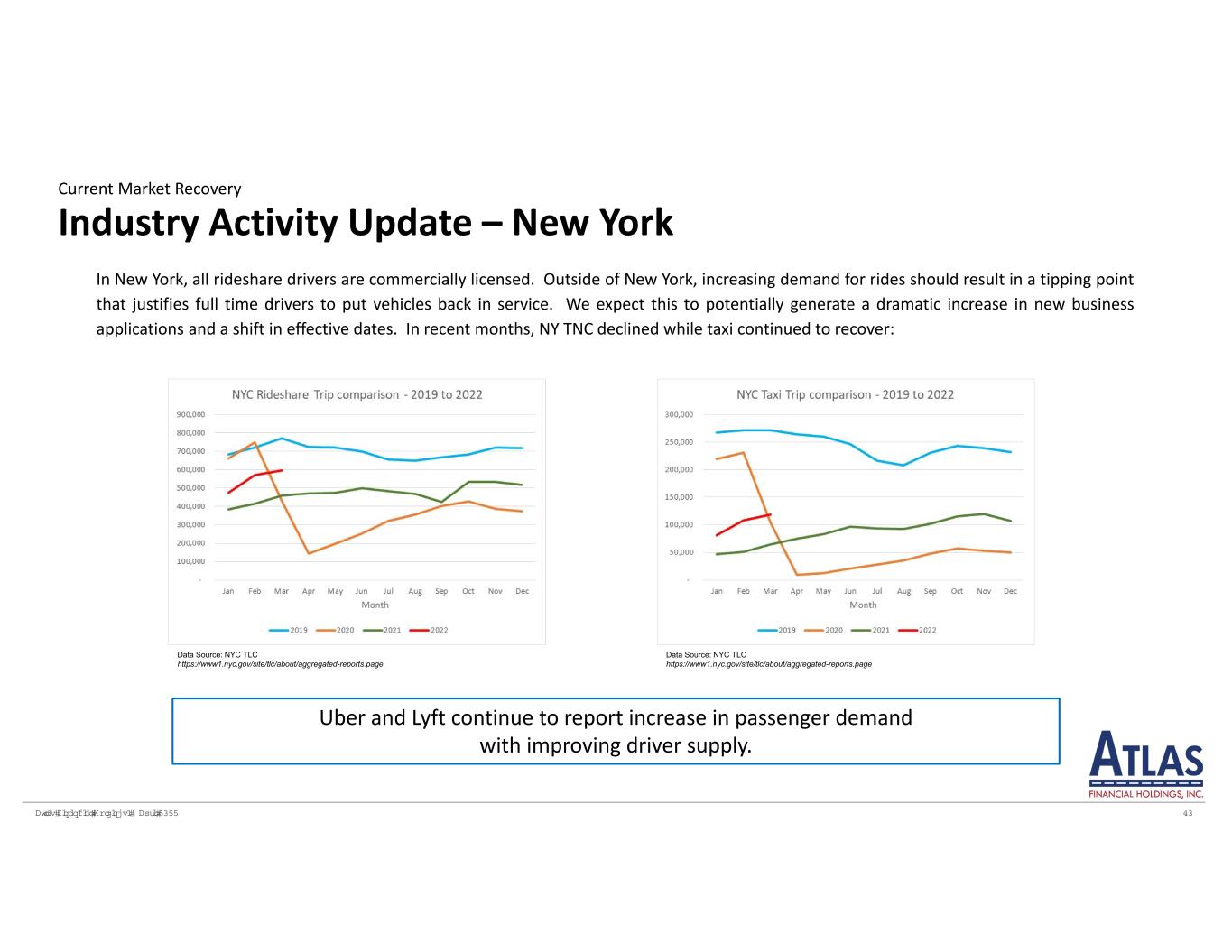

������� � � ��� �� �������� ������ �� Industry Activity Update – New York Current Market Recovery In New York, all rideshare drivers are commercially licensed. Outside of New York, increasing demand for rides should result in a tipping point that justifies full time drivers to put vehicles back in service. We expect this to potentially generate a dramatic increase in new business applications and a shift in effective dates. In recent months, NY TNC declined while taxi continued to recover: Uber and Lyft continue to report increase in passenger demand with improving driver supply. Data Source: NYC TLC https://www1.nyc.gov/site/tlc/about/aggregated-reports.page Data Source: NYC TLC https://www1.nyc.gov/site/tlc/about/aggregated-reports.page

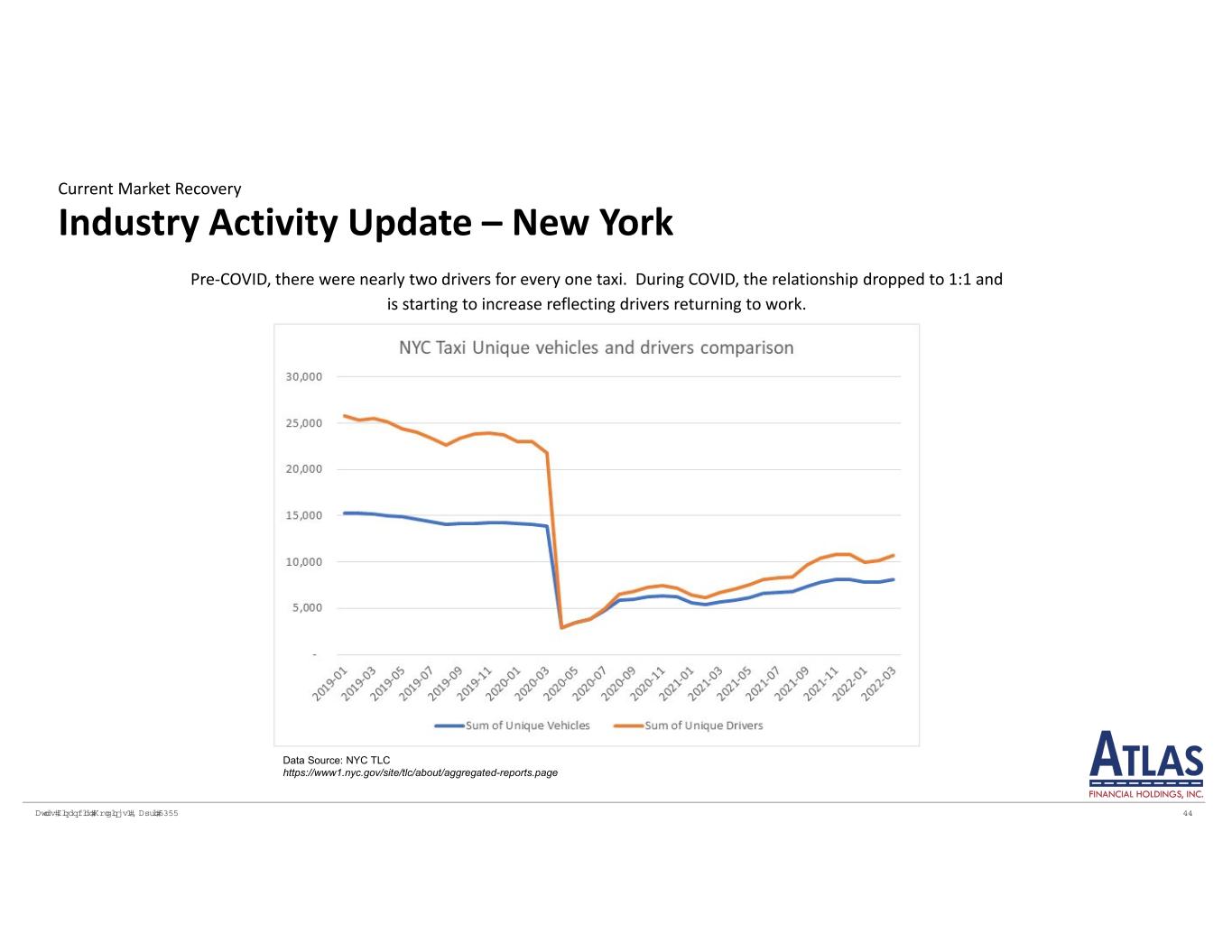

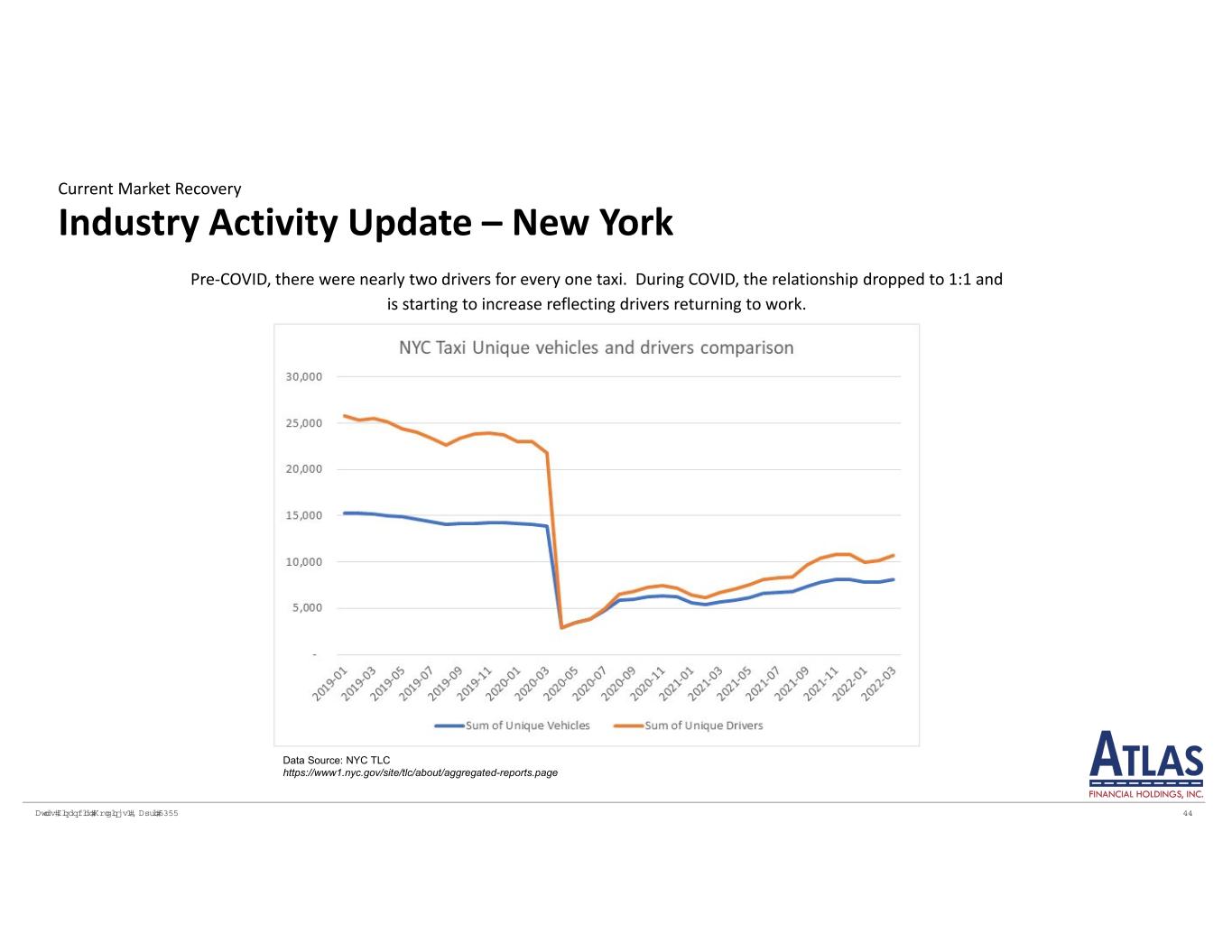

������� � � ��� �� �������� ������ �� Industry Activity Update – New York Current Market Recovery Pre‐COVID, there were nearly two drivers for every one taxi. During COVID, the relationship dropped to 1:1 and is starting to increase reflecting drivers returning to work. Data Source: NYC TLC https://www1.nyc.gov/site/tlc/about/aggregated-reports.page

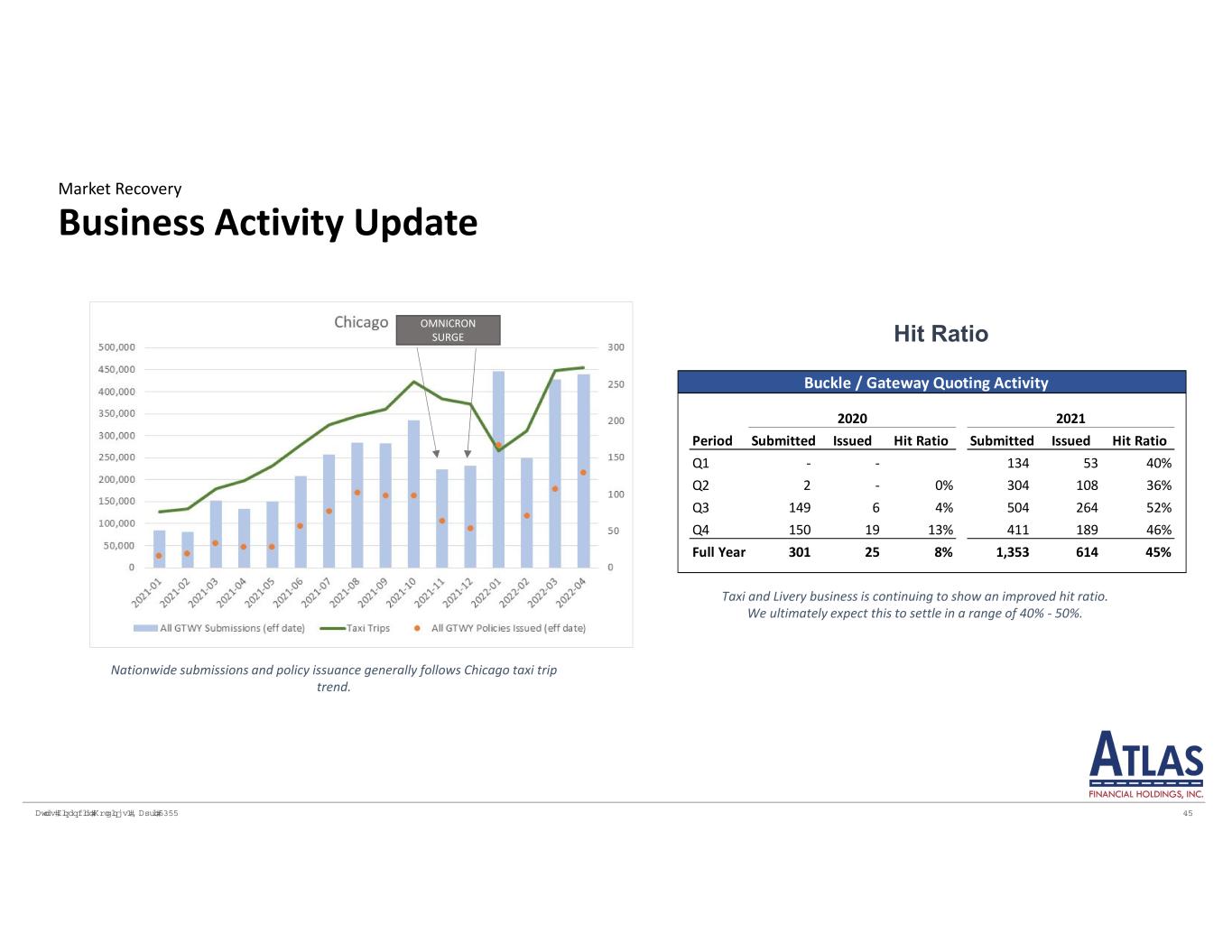

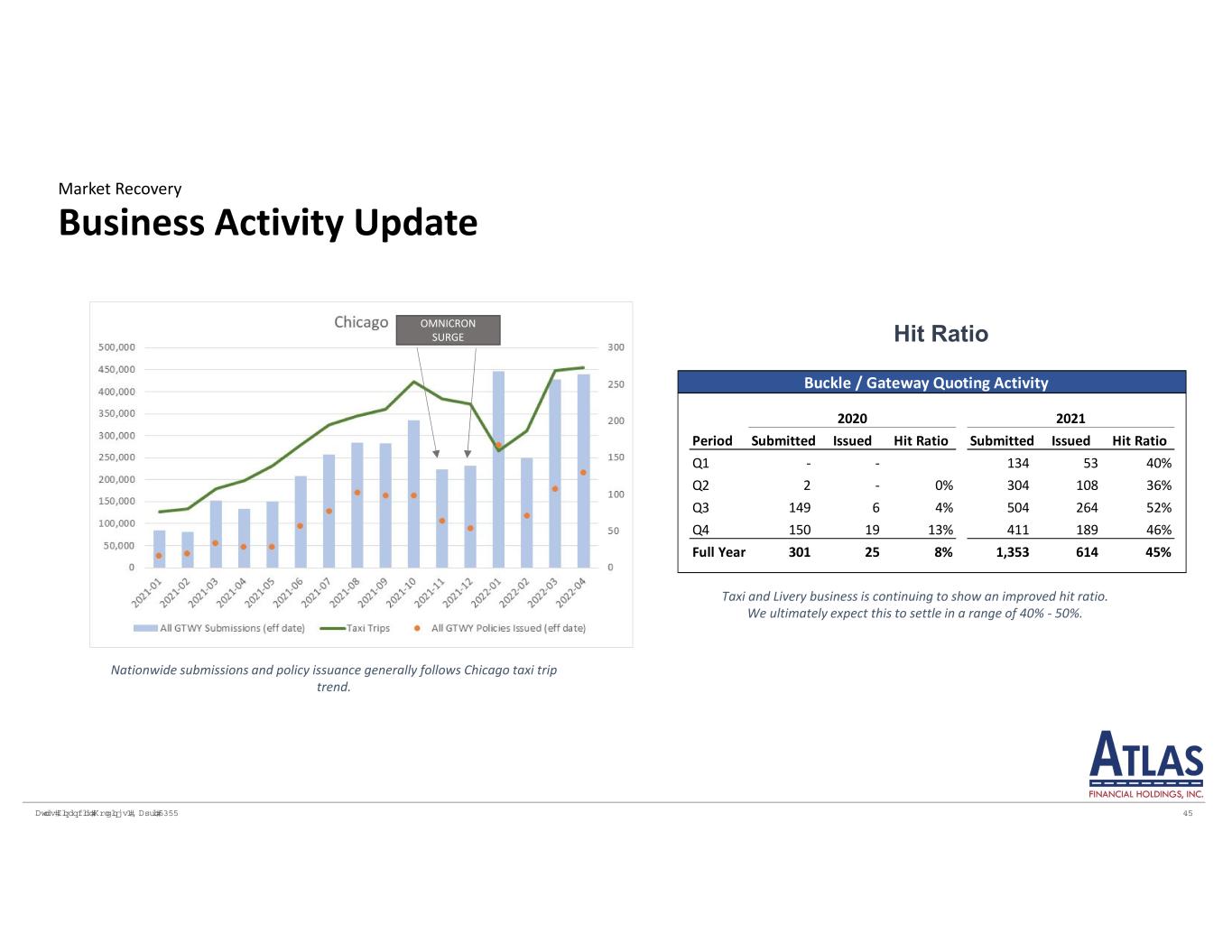

������� � � ��� �� �������� ������ �� Business Activity Update Market Recovery Nationwide submissions and policy issuance generally follows Chicago taxi trip trend. OMNICRON SURGE Taxi and Livery business is continuing to show an improved hit ratio. We ultimately expect this to settle in a range of 40% ‐ 50%. Buckle / Gateway Quoting Activity 2020 2021 Period Submitted Issued Hit Ratio Submitted Issued Hit Ratio Q1 ‐ ‐ 134 53 40% Q2 2 ‐ 0% 304 108 36% Q3 149 6 4% 504 264 52% Q4 150 19 13% 411 189 46% Full Year 301 25 8% 1,353 614 45% Hit Ratio

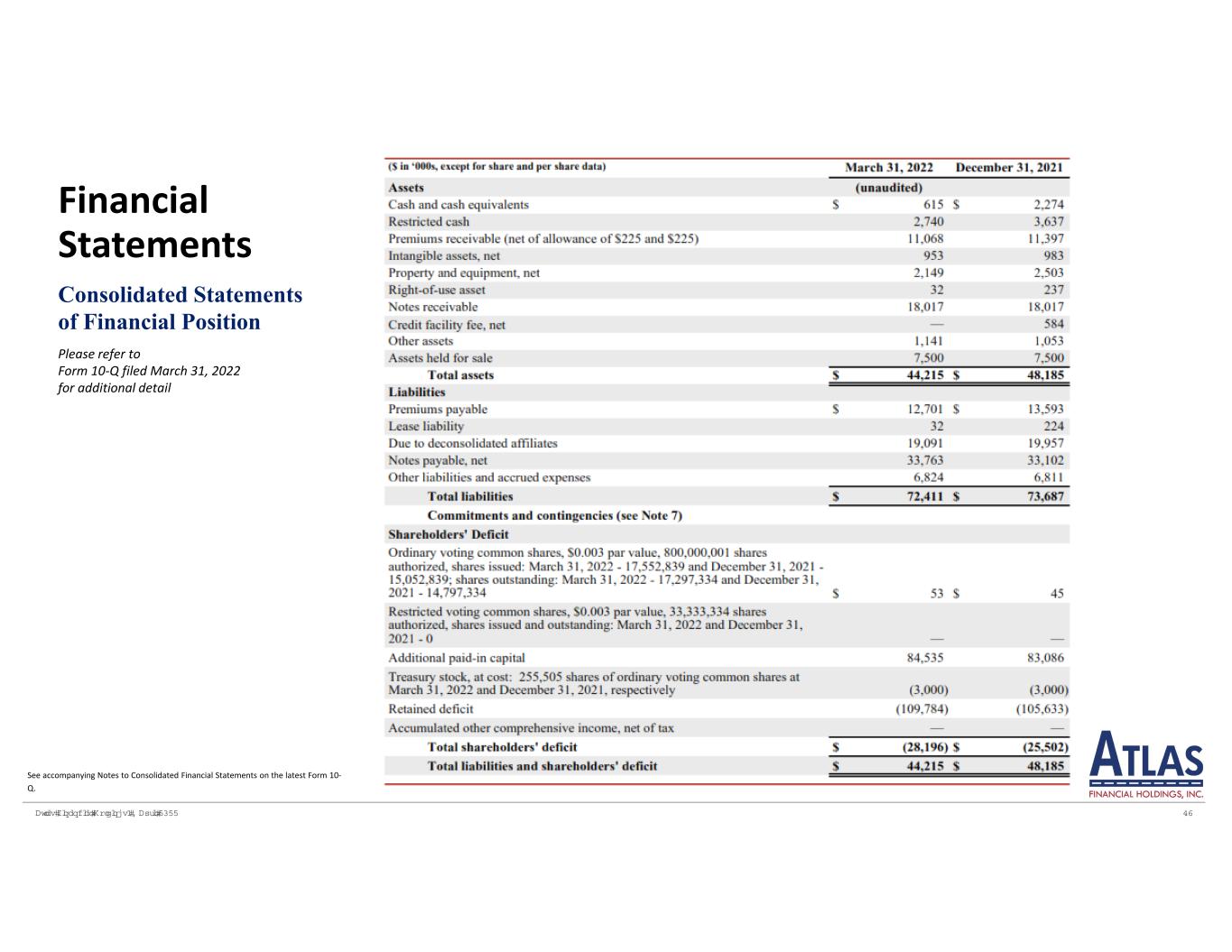

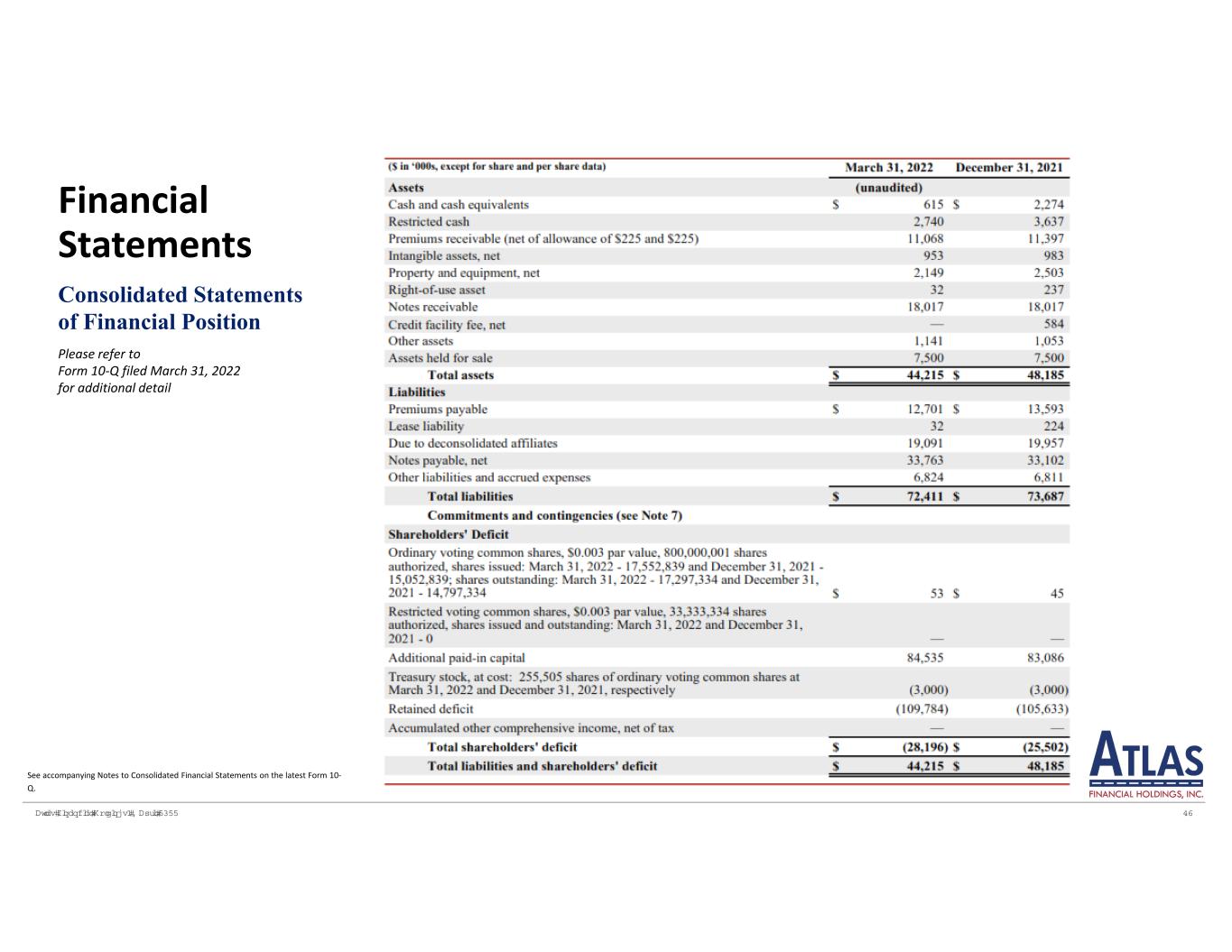

������� � � ��� �� �������� ������ �� Financial Statements Please refer to Form 10‐Q filed March 31, 2022 for additional detail Consolidated Statements of Financial Position See accompanying Notes to Consolidated Financial Statements on the latest Form 10‐ Q.

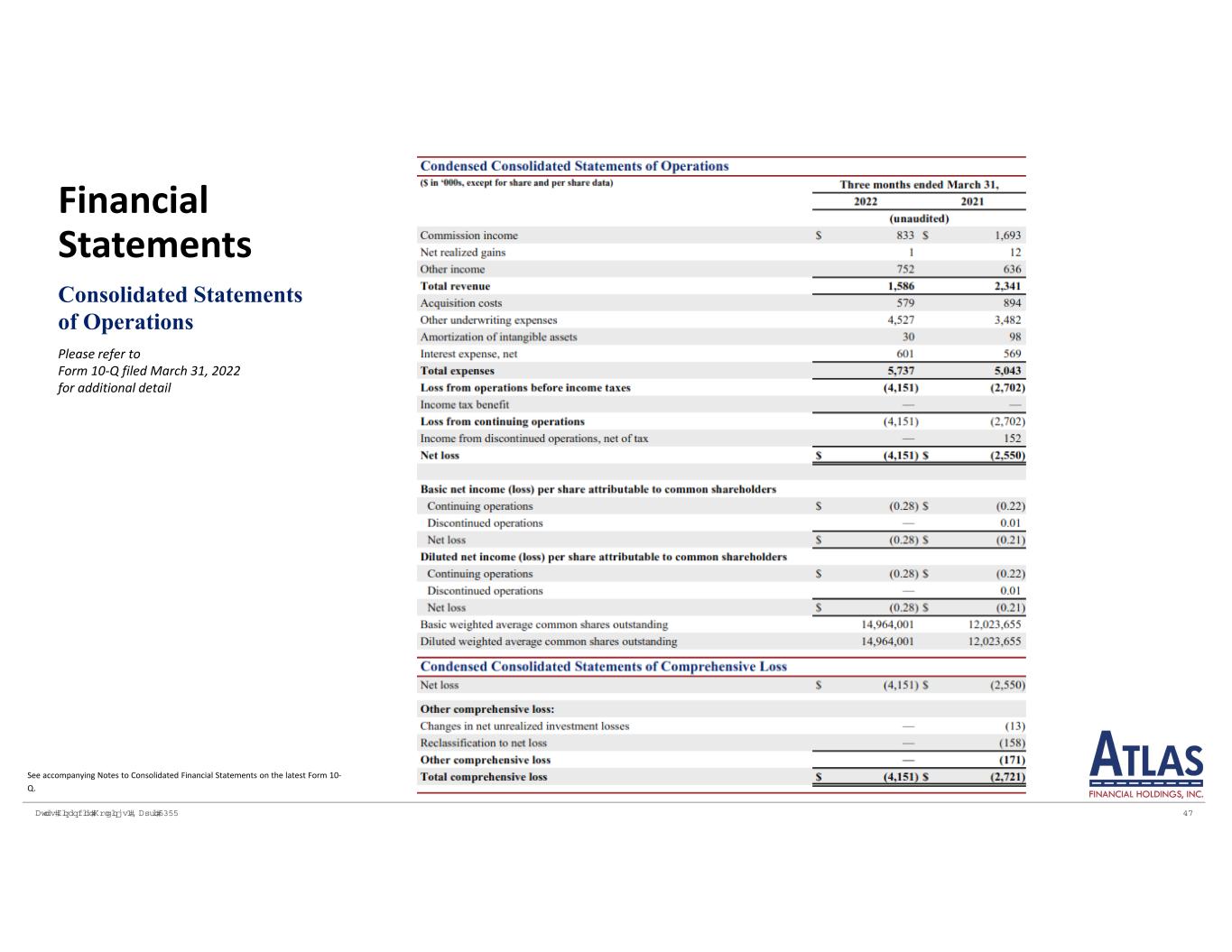

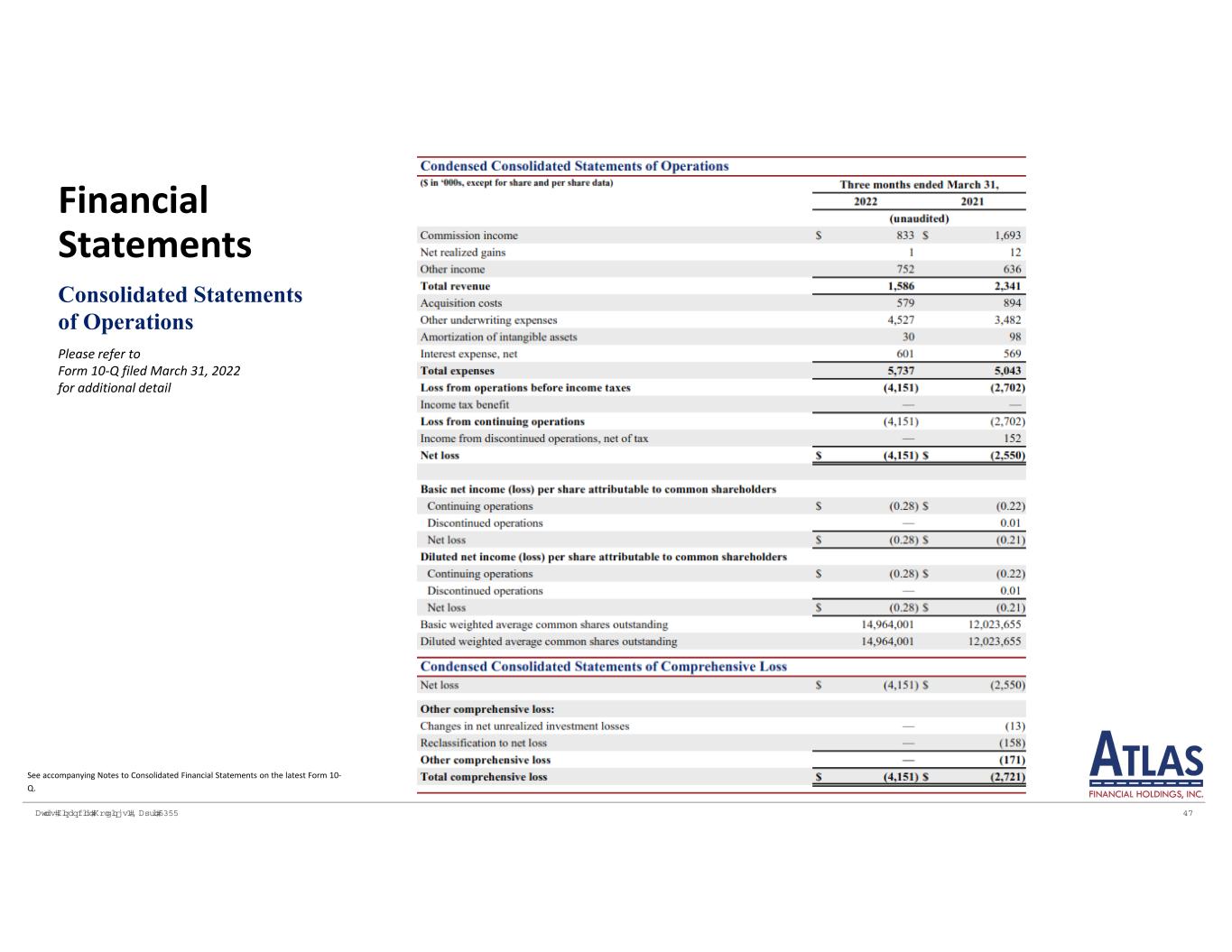

������� � � ��� �� �������� ������ �� Financial Statements Please refer to Form 10‐Q filed March 31, 2022 for additional detail Consolidated Statements of Operations See accompanying Notes to Consolidated Financial Statements on the latest Form 10‐ Q.

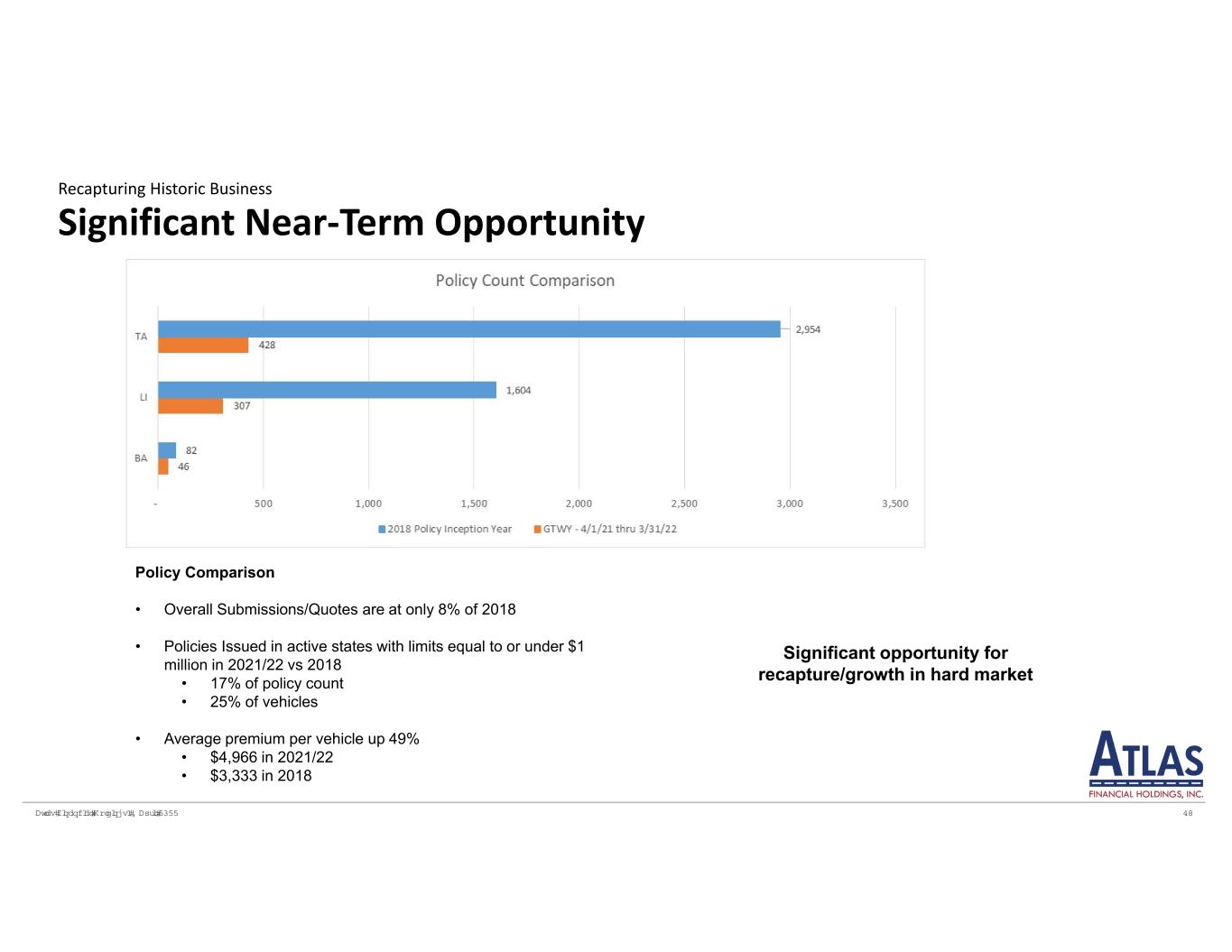

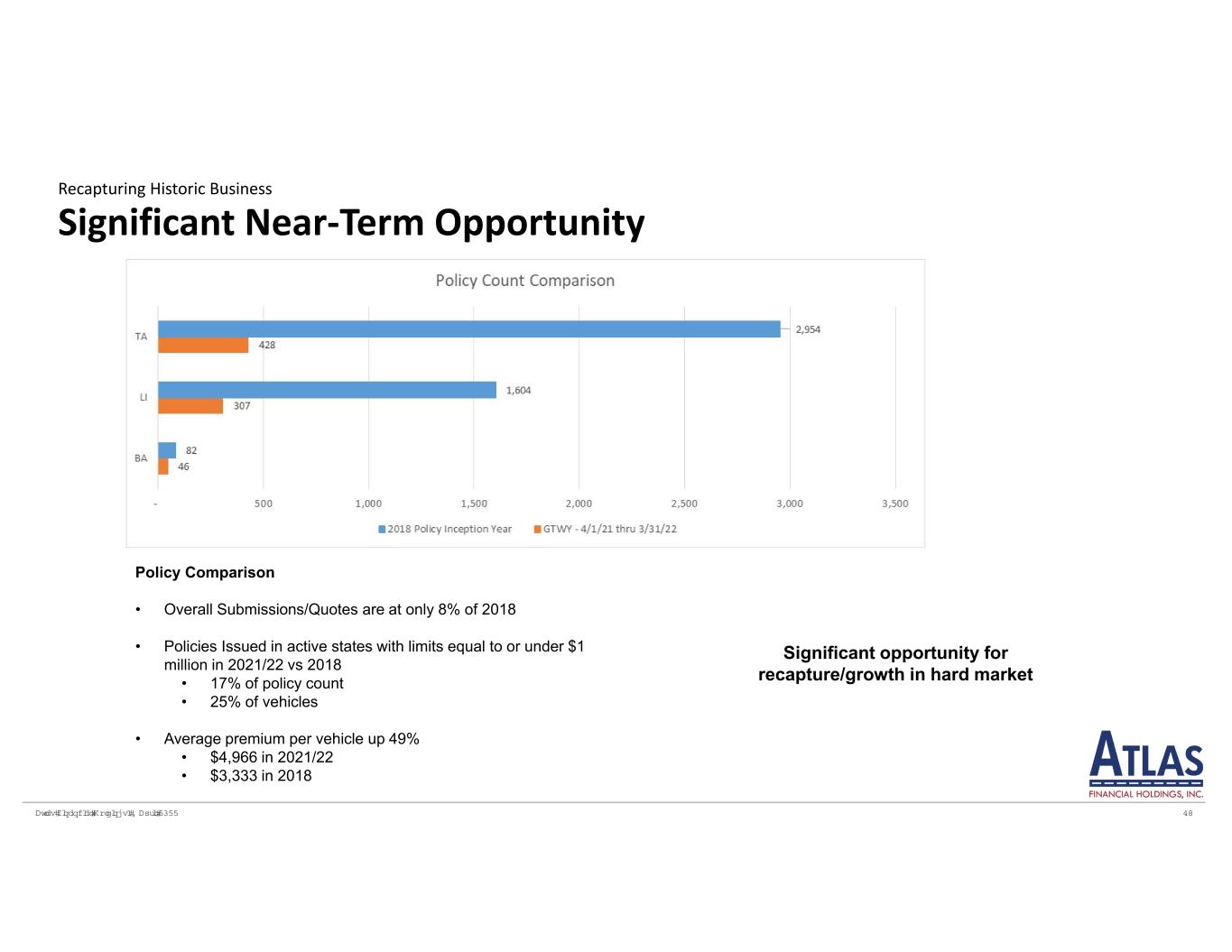

������� � � ��� �� �������� ������ �� Significant Near‐Term Opportunity Recapturing Historic Business Policy Comparison • Overall Submissions/Quotes are at only 8% of 2018 • Policies Issued in active states with limits equal to or under $1 million in 2021/22 vs 2018 • 17% of policy count • 25% of vehicles • Average premium per vehicle up 49% • $4,966 in 2021/22 • $3,333 in 2018 Significant opportunity for recapture/growth in hard market

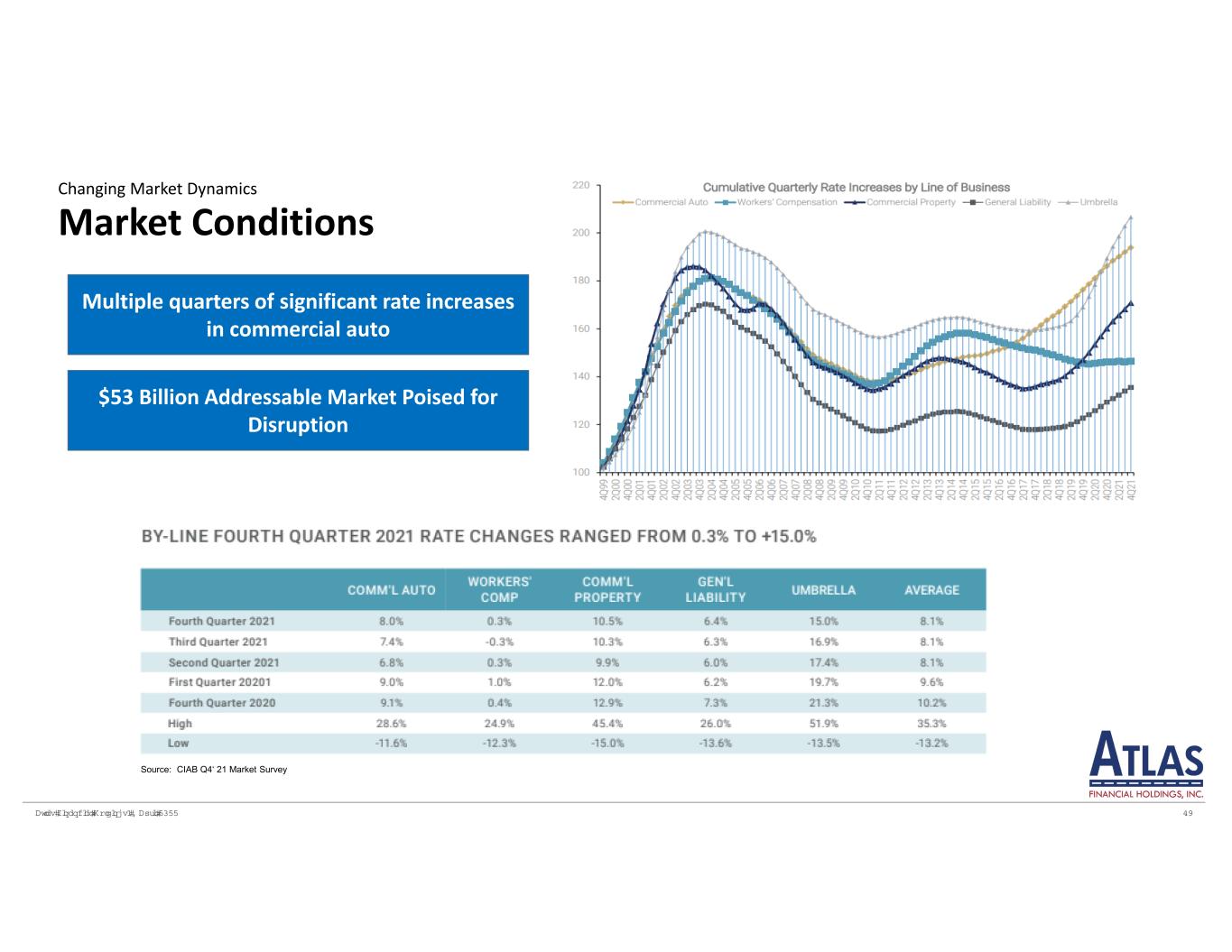

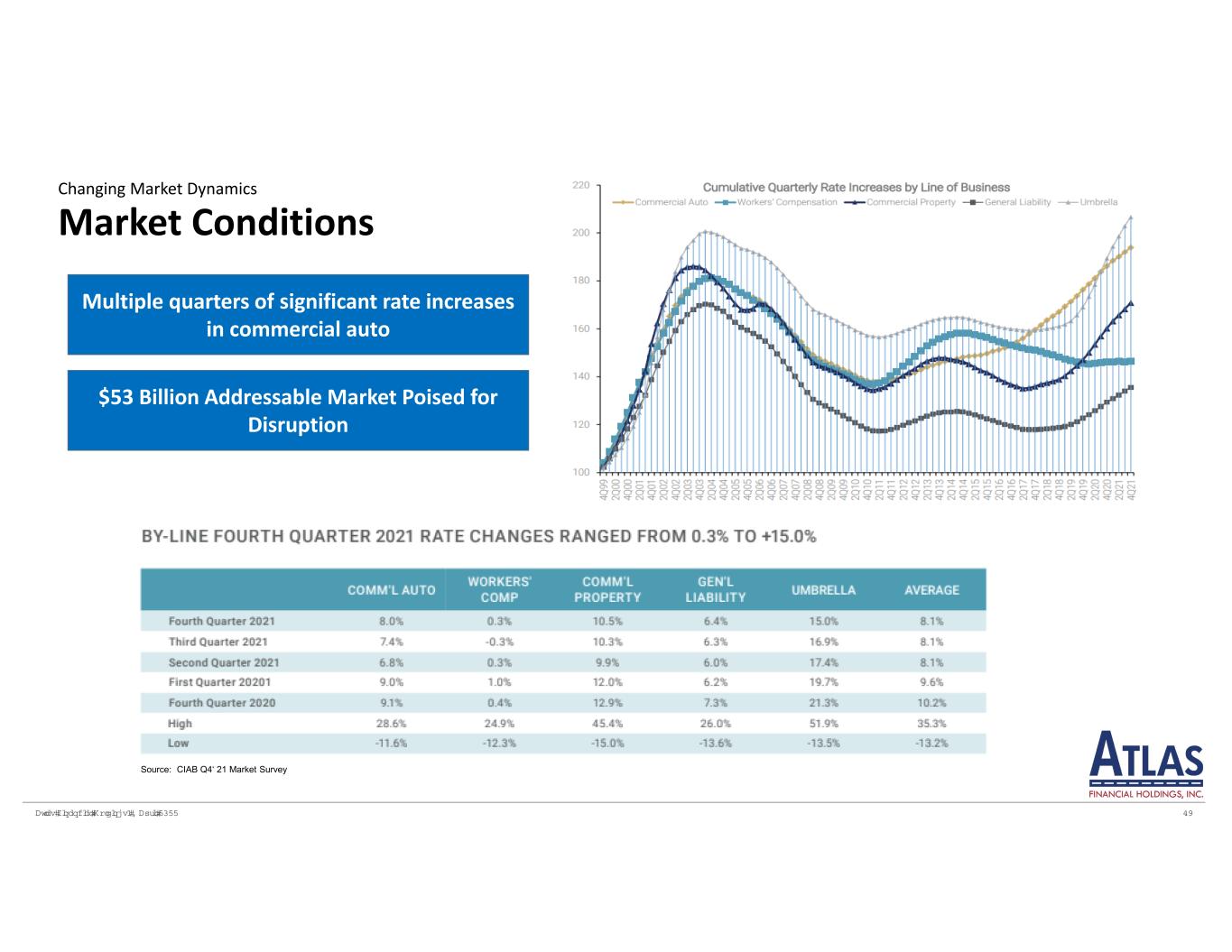

������� � � ��� �� �������� ������ �� Market Conditions Changing Market Dynamics Multiple quarters of significant rate increases in commercial auto Source: CIAB Q4‘ 21 Market Survey $53 Billion Addressable Market Poised for Disruption

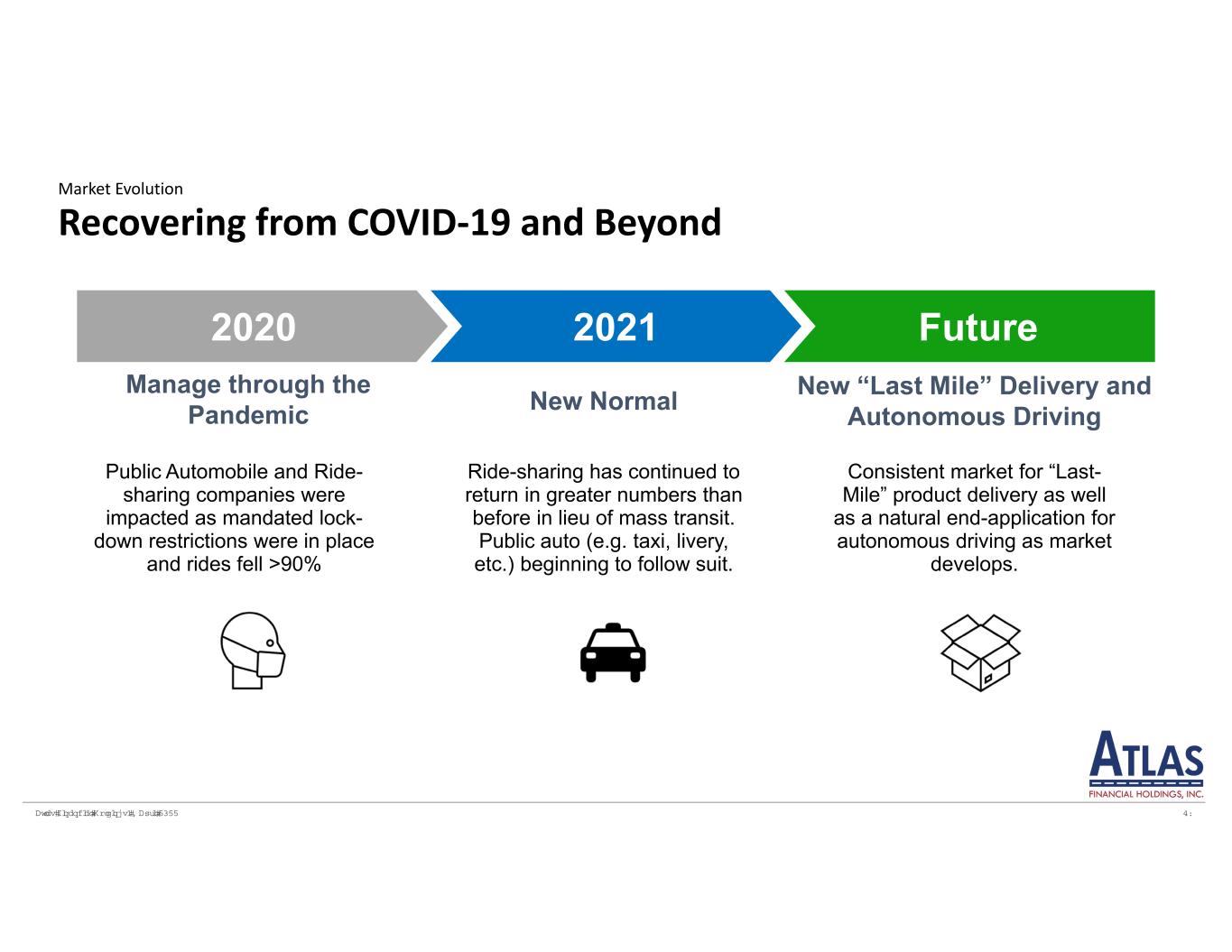

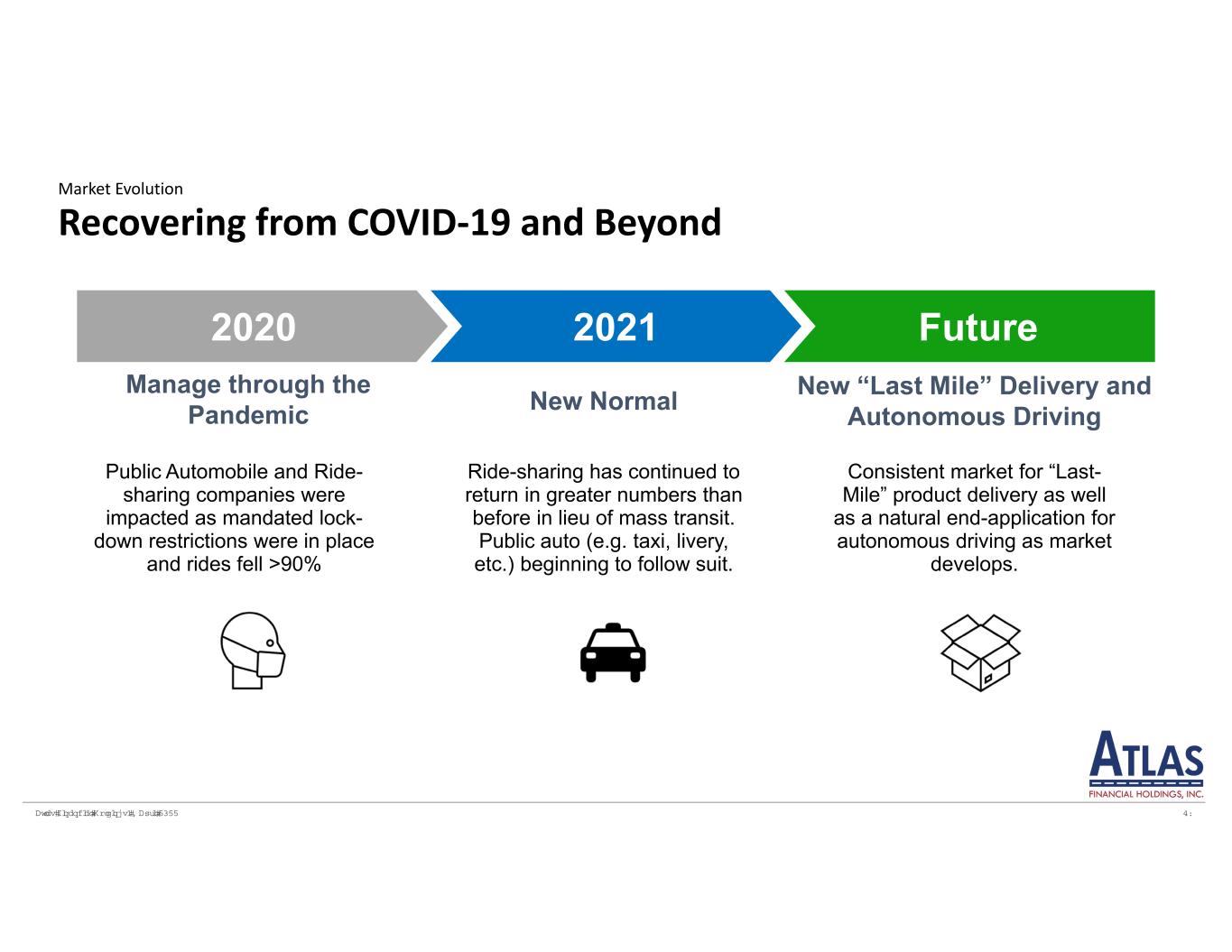

������� � � ��� �� �������� ������ �� Recovering from COVID‐19 and Beyond Market Evolution Manage through the Pandemic Public Automobile and Ride- sharing companies were impacted as mandated lock- down restrictions were in place and rides fell >90% New Normal Ride-sharing has continued to return in greater numbers than before in lieu of mass transit. Public auto (e.g. taxi, livery, etc.) beginning to follow suit. New “Last Mile” Delivery and Autonomous Driving Consistent market for “Last- Mile” product delivery as well as a natural end-application for autonomous driving as market develops. 2020 2021 Future

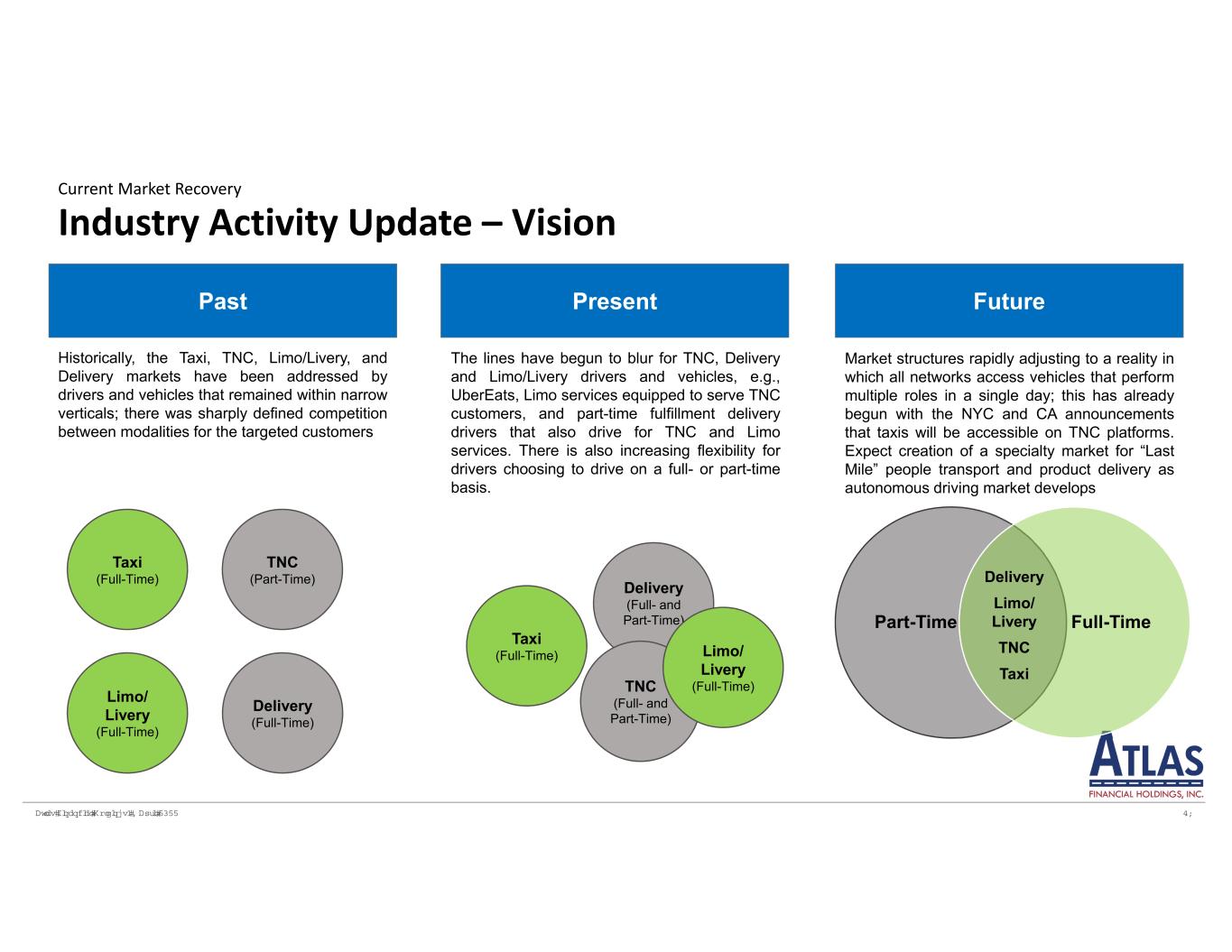

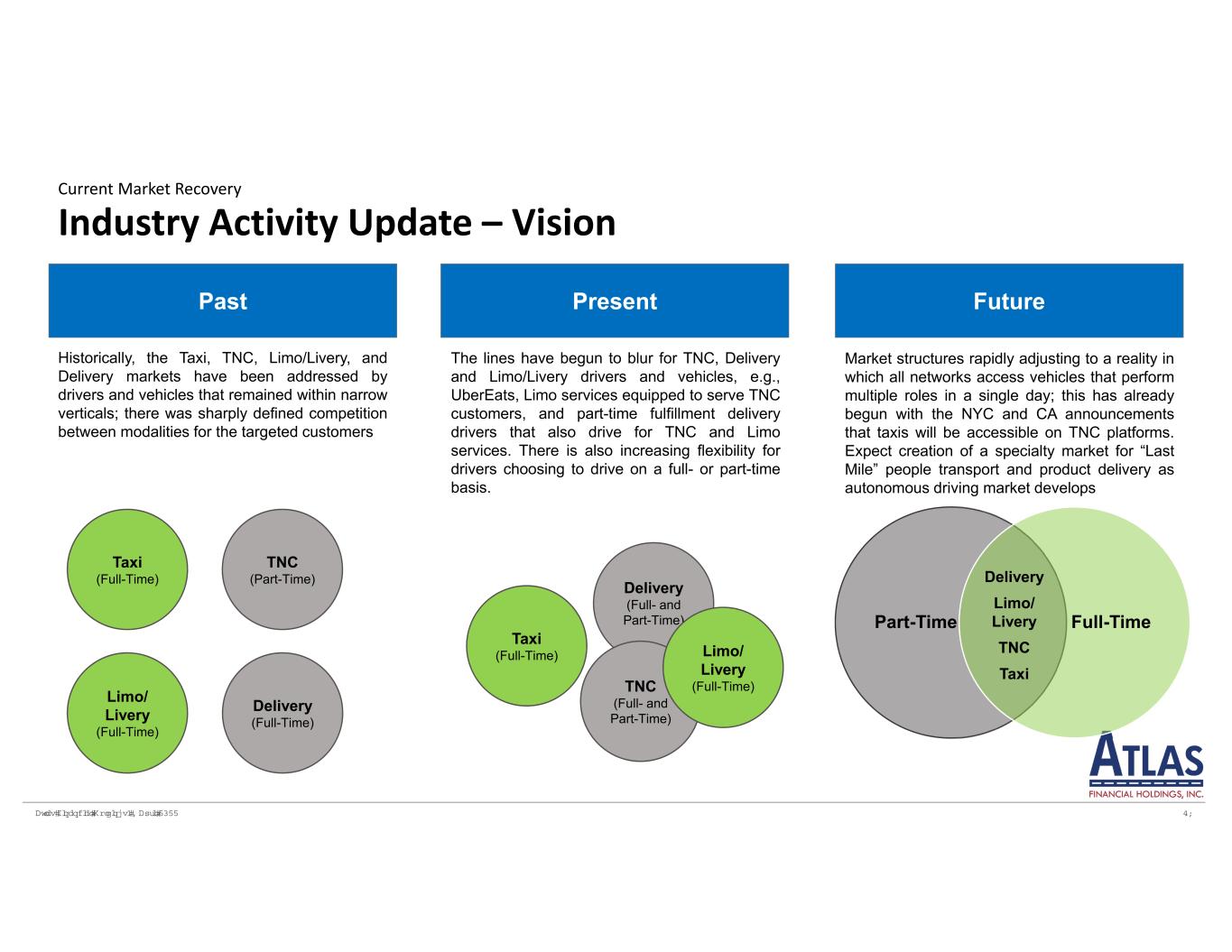

������� � � ��� �� �������� ������ �� Industry Activity Update – Vision Current Market Recovery Delivery (Full- and Part-Time) TNC (Full- and Part-Time) FuturePresentPast Limo/ Livery (Full-Time) Delivery (Full-Time) TNC (Part-Time) Limo/ Livery (Full-Time) Taxi (Full-Time) Taxi (Full-Time) Part-Time Full-Time Delivery Limo/ Livery TNC Taxi Historically, the Taxi, TNC, Limo/Livery, and Delivery markets have been addressed by drivers and vehicles that remained within narrow verticals; there was sharply defined competition between modalities for the targeted customers The lines have begun to blur for TNC, Delivery and Limo/Livery drivers and vehicles, e.g., UberEats, Limo services equipped to serve TNC customers, and part-time fulfillment delivery drivers that also drive for TNC and Limo services. There is also increasing flexibility for drivers choosing to drive on a full- or part-time basis. Market structures rapidly adjusting to a reality in which all networks access vehicles that perform multiple roles in a single day; this has already begun with the NYC and CA announcements that taxis will be accessible on TNC platforms. Expect creation of a specialty market for “Last Mile” people transport and product delivery as autonomous driving market develops

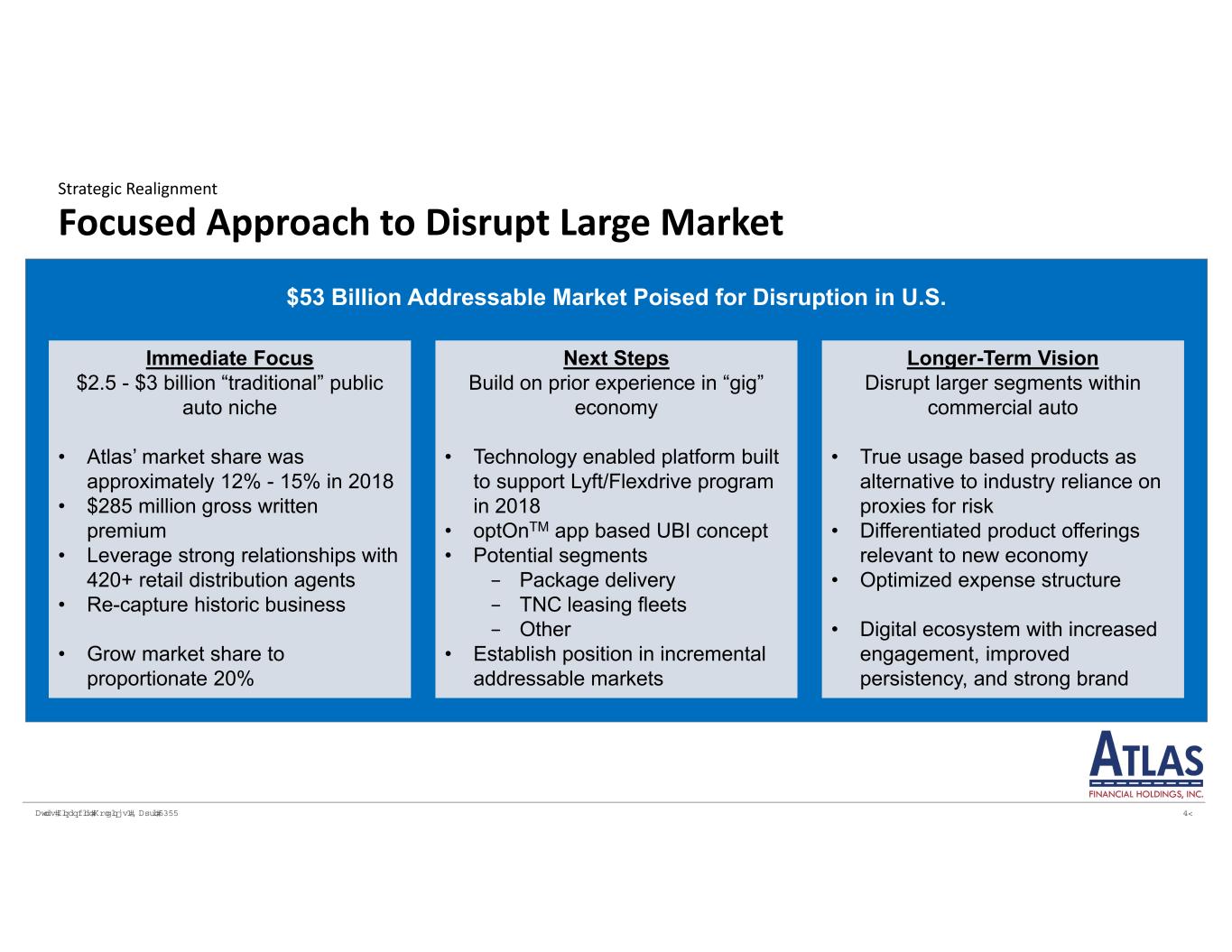

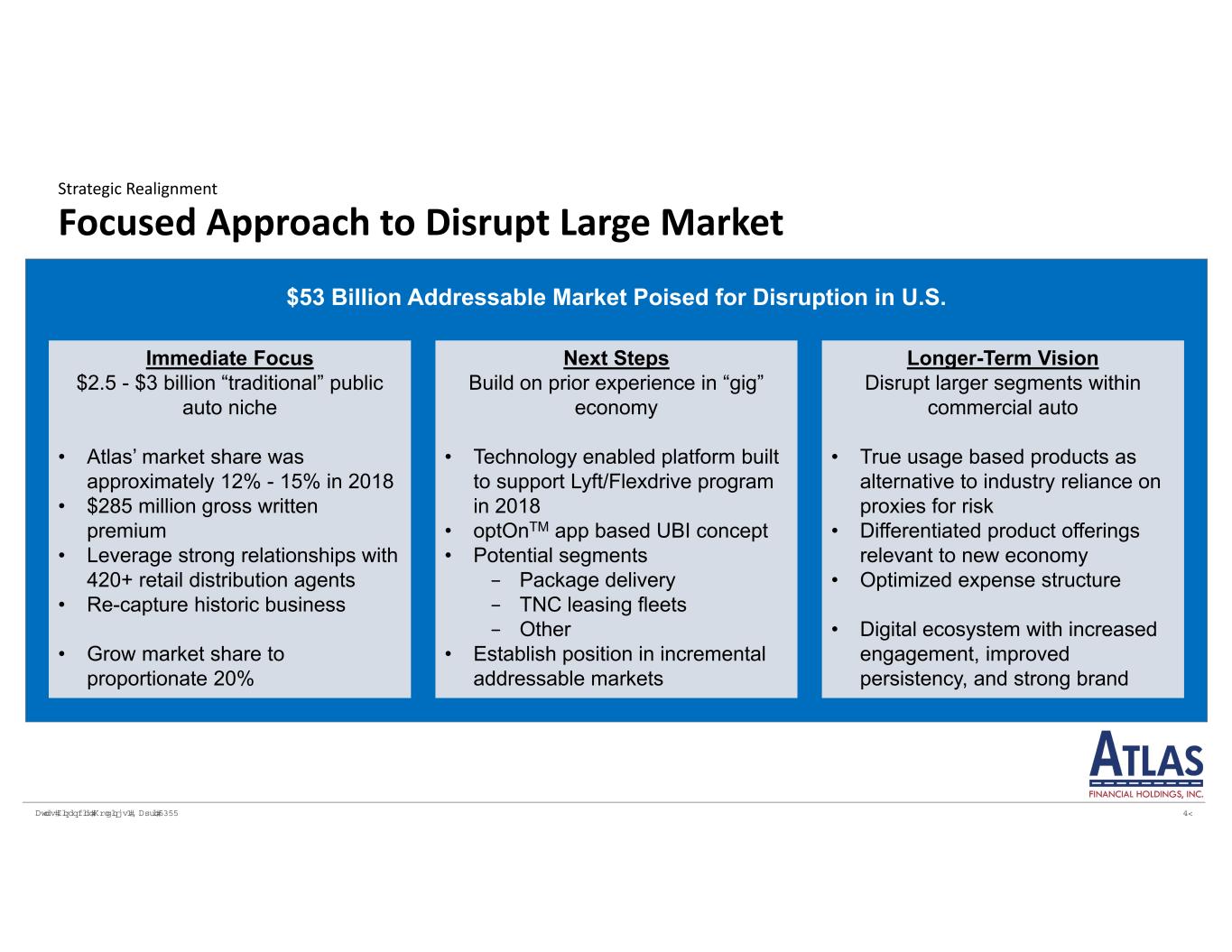

������� � � ��� �� �������� ������ �� Focused Approach to Disrupt Large Market Strategic Realignment $53 Billion Addressable Market Poised for Disruption in U.S. Immediate Focus $2.5 - $3 billion “traditional” public auto niche • Atlas’ market share was approximately 12% - 15% in 2018 • $285 million gross written premium • Leverage strong relationships with 420+ retail distribution agents • Re-capture historic business • Grow market share to proportionate 20% Next Steps Build on prior experience in “gig” economy • Technology enabled platform built to support Lyft/Flexdrive program in 2018 • optOnTM app based UBI concept • Potential segments − Package delivery − TNC leasing fleets − Other • Establish position in incremental addressable markets Longer-Term Vision Disrupt larger segments within commercial auto • True usage based products as alternative to industry reliance on proxies for risk • Differentiated product offerings relevant to new economy • Optimized expense structure • Digital ecosystem with increased engagement, improved persistency, and strong brand

Atlas Financial Holdings, Inc. 953 American Lane, 3rd Floor Schaumburg, IL 60173 Corporate Headquarters Scott D. Wollney President & Chief Executive Officer Paul A. Romano Vice President and Chief Financial Officer Executive Officers Karin Daly Vice President, The Equity Group Inc. (212) 836‐9623 kdaly@equityny.com Investor Relations