UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22668

ETF Series Solutions

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Kristina R. Nelson

ETF Series Solutions

615 East Michigan Street

Milwaukee, WI 53202

(Name and address of agent for service)

414-516-1645

Registrant’s telephone number, including area code

Date of fiscal year end: September 30

Date of reporting period: September 30, 2024

Item 1. Reports to Stockholders.

| | |

| The Brinsmere Fund - Conservative ETF | |

| TBFC (Principal U.S. Listing Exchange: NYSE) |

| Annual Shareholder Report | September 30, 2024 |

This annual shareholder report contains important information about the The Brinsmere Fund - Conservative ETF for the period of January 12, 2024, to September 30, 2024. You can find additional information about the Fund at https://www.thebrinsmerefunds.com/investor-materials. You can also request this information by contacting us at 1-800-617-0004.

WHAT WERE THE FUND COSTS FOR THE FISCAL PERIOD? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| The Brinsmere Fund - Conservative ETF | $26 | 0.35% |

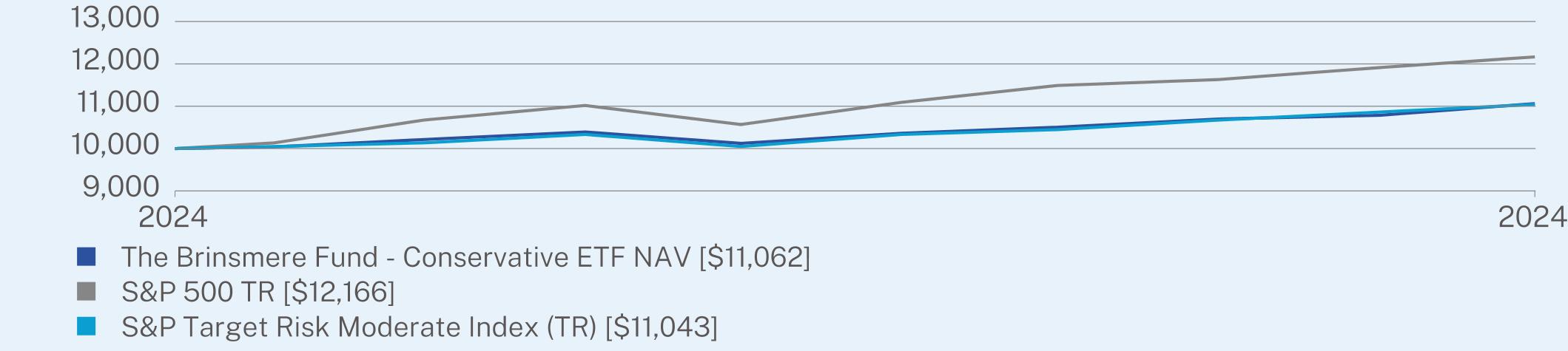

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

Since the Fund’s inception through September 30, 2024, TBFC returned 10.62% at net asset value (NAV), modestly outperforming the benchmark (S&P Target Risk Moderate) by 0.19%. The Fund benefited for most of this period from the underlying model’s ability to overweight equities, driving its outperformance. However, during a brief period in Q3 2024, the Fund underperformed due to the model’s risk mitigation measures in response to heightened market volatility. A sharp market rebound, coupled with an underexposure to equities, led to modest underperformance. In September 2024, the model’s re-positioning helped the Fund not only close the performance gap but also achieve a modest lead.

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| |

| | Since Inception

(01/12/2024) |

The Brinsmere Fund - Conservative ETF NAV | 10.62 |

S&P 500 TR | 21.66 |

S&P Target Risk Moderate Index (TR) | 10.43 |

Visit https://www.thebrinsmerefunds.com/investor-materials for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| The Brinsmere Fund - Conservative ETF | PAGE 1 | TSR-AR-26922B493 |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Net Assets | $296,281,338 |

Number of Holdings | 27 |

Net Advisory Fee | $701,306 |

Portfolio Turnover | 85% |

30-Day SEC Yield | 2.51% |

30-Day SEC Yield Unsubsidized | 2.51% |

Visit https://www.thebrinsmerefunds.com/investor-materials for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

| |

Top 10 Securities | (%) |

Invesco S&P 500 Equal Weight ETF | 13.0% |

Vanguard Short-Term Treasury ETF | 12.7% |

Vanguard Short-Term Bond ETF | 8.5% |

Vanguard Growth ETF | 6.0% |

Vanguard Intermediate-Term Corporate Bond ETF | 5.7% |

Vanguard Value ETF | 5.5% |

Vanguard Intermediate-Term Bond ETF | 4.7% |

Vanguard Total Bond Market ETF | 4.3% |

Vanguard FTSE Pacific ETF | 3.9% |

Vanguard FTSE Europe ETF | 3.9% |

Security Type Breakdown (%)

| |

Security Type | (%) |

Exchange Traded Funds | 96.5% |

Money Market Funds | 3.5% |

Cash & Other | 0.0%* |

Geographic Breakdown (%)

| |

Top Ten Countries | (%) |

United States | 100.0% |

Cash & Other | 0.0%* |

| * | Represents less than 0.05% of net assets. |

Changes to the Fund’s Principal Investment Strategy:

The primary changes included the introduction of the Systematic International Strategy (SIS), a strategy targeting international ex-US equities that employs a price trend signal to determine exposure to index ETFs across various geographical regions. Additionally, the investible universe of the Classic Asset Allocation Revisited-Conservative (CAAR-C) strategy was expanded to encompass exposure to gold, managed futures, and inverse bonds through ETF proxies. Both of these changes were implemented via a new prospectus filed in July, which took effect in September 2024.

Changes to Fund’s Principal Risks:

The addition of a new strategy and the expansion of the potential fund universe for CAAR required additional risk disclosures related to futures contract risk, inverse ETF risk, and emerging market risk.

Changes to Fund’s Portfolio Manager or Portfolio Management Team:

We added two portfolio managers Andrew J Willms and Jacob Willms from The Milwaukee Company to expand our portfolio management team for the funds.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.thebrinsmerefunds.com/investor-materials.

| The Brinsmere Fund - Conservative ETF | PAGE 2 | TSR-AR-26922B493 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your The Milwaukee Company documents not be householded, please contact The Milwaukee Company at 1-800-617-0004, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by The Milwaukee Company or your financial intermediary.

| The Brinsmere Fund - Conservative ETF | PAGE 3 | TSR-AR-26922B493 |

110621216611043

| | |

| The Brinsmere Fund - Growth ETF | |

| TBFG (Principal U.S. Listing Exchange: NYSE) |

| Annual Shareholder Report | September 30, 2024 |

This annual shareholder report contains important information about the The Brinsmere Fund - Growth ETF for the period of January 12, 2024, to September 30, 2024. You can find additional information about the Fund at https://www.thebrinsmerefunds.com/investor-materials. You can also request this information by contacting us at 1-800-617-0004.

WHAT WERE THE FUND COSTS FOR THE FISCAL PERIOD? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| The Brinsmere Fund - Growth ETF | $27 | 0.35% |

HOW DID THE FUND PERFORM LAST YEAR AND WHAT AFFECTED ITS PERFORMANCE?

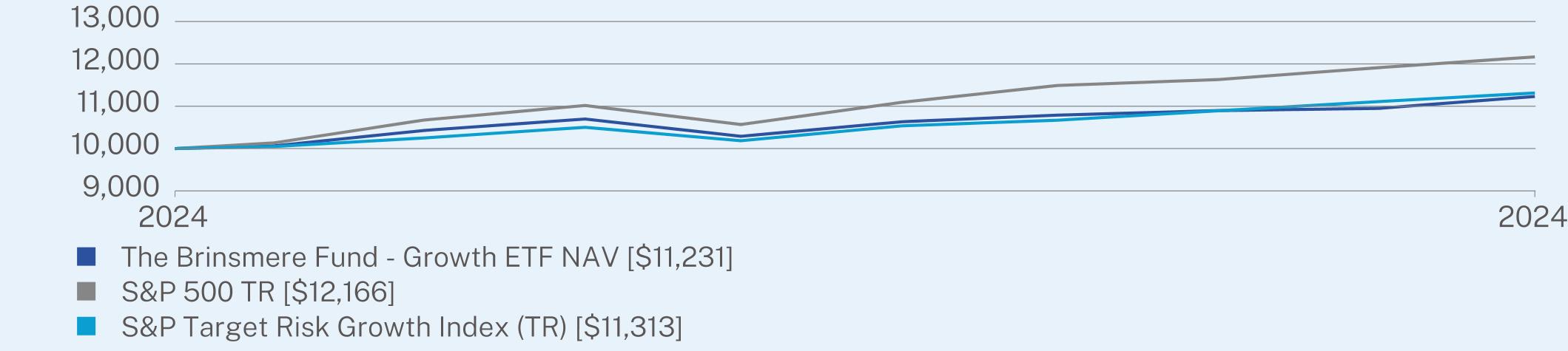

Since the Fund’s inception through September 30, 2024, TBFG returned 12.31% at net asset value (NAV), modestly underperforming the benchmark (S&P Target Risk Growth) by 0.82%. An overweight allocation to equities contributed to the Fund’s outperformance of the benchmark through the end of Q2 2024. However, in response to heightened market volatility during the first half of Q3, the Fund’s model shifted to a more defensive position by underweighting equities, and the advisor made the decision to rotate large-cap core exposure to an equal-weighted large-cap tilt as concerns over market concentration risk grew. This risk, however, did not materialize, and the markets rebounded sharply, leading to the Fund’s underperformance. Nevertheless, the Fund closed Q3 on a strong note, narrowing much of the performance gap relative to the benchmark in the final weeks of the quarter.

HOW DID THE FUND PERFORM SINCE INCEPTION?*

The $10,000 chart reflects a hypothetical $10,000 investment in the class of shares noted and assumes the maximum sales charge. The chart uses total return NAV performance and assumes reinvestment of dividends and capital gains. Fund expenses, including 12b-1 fees, management fees and other expenses were deducted.

CUMULATIVE PERFORMANCE (Initial Investment of $10,000)

ANNUAL AVERAGE TOTAL RETURN (%)

| |

| | Since Inception

(01/12/2024) |

The Brinsmere Fund - Growth ETF NAV | 12.31 |

S&P 500 TR | 21.66 |

S&P Target Risk Growth Index (TR) | 13.13 |

Visit https://www.thebrinsmerefunds.com/investor-materials for more recent performance information.

| * | The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares. |

| The Brinsmere Fund - Growth ETF | PAGE 1 | TSR-AR-26922B519 |

KEY FUND STATISTICS (as of September 30, 2024)

| |

Net Assets | $288,772,948 |

Number of Holdings | 27 |

Net Advisory Fee | $682,393 |

Portfolio Turnover | 138% |

30-Day SEC Yield | 2.06% |

30-Day SEC Yield Unsubsidized | 2.06% |

Visit https://www.thebrinsmerefunds.com/investor-materials for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of September 30, 2024)

| |

Top 10 Securities | (%) |

Invesco S&P 500 Equal Weight ETF | 16.8% |

Vanguard Value ETF | 7.7% |

Vanguard Growth ETF | 7.3% |

Vanguard Short-Term Treasury ETF | 6.8% |

Vanguard FTSE Pacific ETF | 5.9% |

Vanguard FTSE Europe ETF | 5.8% |

First American Treasury Obligations Fund | 5.4% |

Vanguard Small-Cap ETF | 4.9% |

Columbia EM Core ex-China ETF | 4.7% |

iShares MSCI China ETF | 3.7% |

Security Type Breakdown (%)

| |

Security Type | (%) |

Exchange Traded Funds | 95.1% |

Money Market Funds | 5.4% |

Cash & Other | -0.5% |

Geographic Breakdown (%)

| |

Top Ten Countries | (%) |

United States | 100.5% |

Cash & Other | -0.5% |

Changes to the Fund’s Principal Investment Strategy:

The primary changes included the introduction of the Systematic International Strategy (SIS), a strategy targeting international ex-US equities that employs a price trend signal to determine exposure to index ETFs across various geographical regions. Additionally, the investible universe of the Classic Asset Allocation Revisited-Growth (CAAR-G) strategy was expanded to encompass exposure to gold, managed futures, and inverse bonds through ETF proxies. Both of these changes were implemented via a new prospectus filed in July, which took effect in September 2024.

Changes to Fund’s Principal Risks:

The addition of a new strategy and the expansion of the potential fund universe for CAAR required additional risk disclosures related to futures contract risk, inverse ETF risk, and emerging market risk.

Changes to Fund’s Portfolio Manager or Portfolio Management Team:

We added two portfolio managers Andrew J Willms and Jacob Willms from The Milwaukee Company to expand our portfolio management team for the funds.

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://www.thebrinsmerefunds.com/investor-materials.

| The Brinsmere Fund - Growth ETF | PAGE 2 | TSR-AR-26922B519 |

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your The Milwaukee Company documents not be householded, please contact The Milwaukee Company at 1-800-617-0004, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by The Milwaukee Company or your financial intermediary.

| The Brinsmere Fund - Growth ETF | PAGE 3 | TSR-AR-26922B519 |

112311216611313

Item 2. Code of Ethics.

The registrant has adopted a code of ethics that applies to the registrant’s principal executive officer and principal financial officer. The registrant has not made any substantive amendments to its code of ethics during the period covered by this report. The registrant has not granted any waivers from any provisions of the code of ethics during the period covered by this report.

A copy of the registrant’s Code of Ethics is filed herewith.

Item 3. Audit Committee Financial Expert.

The registrant’s board of trustees has determined that there is at least one audit committee financial expert serving on its audit committee. Mr. Leonard Rush is the “audit committee financial expert” and is considered to be “independent” as each term is defined in Item 3 of Form N-CSR.

Item 4. Principal Accountant Fees and Services.

The registrant has engaged its principal accountant to perform audit services, audit-related services, tax services and other services during the past two fiscal years. “Audit services” refer to performing an audit of the registrant’s annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for those fiscal years. “Audit-related services” refer to the assurance and related services by the principal accountant that are reasonably related to the performance of the audit. “Tax services” refer to professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning. There were no “other services” provided by the principal accountant. The following table details the aggregate fees billed or expected to be billed for each of the last two fiscal years for audit fees, audit-related fees, tax fees and other fees by the principal accountant.

| | FYE 9/30/2024 | FYE 9/30/2023 |

| (a) Audit Fees | $ 37,000 | N/A |

| (b) Audit-Related Fees | $ 0 | N/A |

| (c) Tax Fees | $ 7,000 | N/A |

| (d) All Other Fees | $ 0 | N/A |

(e)(1) The audit committee has adopted pre-approval policies and procedures that require the audit committee to pre-approve all audit and non-audit services of the registrant, including services provided to any entity affiliated with the registrant.

(e)(2) The percentage of fees billed by Cohen & Company, Ltd. applicable to non-audit services pursuant to waiver of pre-approval requirement were as follows:

| | FYE 9/30/2024 | FYE 9/30/2023 |

| Audit-Related Fees | 0% | N/A |

| Tax Fees | 0% | N/A |

| All Other Fees | 0% | N/A |

(f) N/A.

(g) The following table indicates the non-audit fees billed or expected to be billed by the registrant’s accountant for services to the registrant and to the registrant’s investment adviser (and any other controlling entity, etc.—not sub-adviser) for the last two years.

| Non-Audit Related Fees | FYE 9/30/2024 | FYE 9/30/2023 |

| Registrant | N/A | N/A |

| Registrant’s Investment Adviser | N/A | N/A |

(h) The audit committee of the board of trustees has considered whether the provision of non-audit services that were rendered to the registrant’s investment adviser is compatible with maintaining the principal accountant’s independence and has concluded that the provision of such non-audit services by the accountant has not compromised the accountant’s independence.

(i) The registrant has not been identified by the U.S. Securities and Exchange Commission as having filed an annual report issued by a registered public accounting firm branch or office that is located in a foreign jurisdiction where the Public Company Accounting Oversight Board is unable to inspect or completely investigate because of a position taken by an authority in that jurisdiction.

(j) The registrant is not a foreign issuer.

Item 5. Audit Committee of Listed Registrants.

(a) The registrant is an issuer as defined in Rule 10A-3 under the Securities Exchange Act of 1934, (the “Act”) and has a separately-designated standing audit committee established in accordance with Section 3(a)(58)(A) of the Act. The independent members of the committee are as follows: Leonard M. Rush, David A. Massart, and Janet D. Olsen.

(b) Not applicable

Item 6. Investments.

| (a) | Schedule of Investments is included within the financial statements filed under Item 7 of this Form. |

| | | |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

The Brinsmere Fund - Conservative ETF

The Brinsmere Fund - Growth ETF

Annual Financial Statements and Additional Information

September 30, 2024

TABLE OF CONTENTS

The Brinsmere Fund - Conservative ETF

Schedule of Investments

September 30, 2024

| | | | | | | |

EXCHANGE TRADED FUNDS - 96.5%(a)

|

Commodities - 0.8%

| | | | | | |

SPDR Gold Shares(b) | | | 10,000 | | | $2,430,600 |

Commodities Broad Basket - 1.5%

| | | | | | |

abrdn Bloomberg All Commodity Strategy K-1 Free ETF | | | 180,921 | | | 3,698,025 |

Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF | | | 54,956 | | | 738,059 |

| | | | | | 4,436,084 |

Domestic Equity - 31.1%

| | | | | | |

Invesco S&P 500 Equal Weight ETF | | | 215,234 | | | 38,561,323 |

iShares Core S&P Mid-Cap ETF | | | 42,061 | | | 2,621,242 |

Real Estate Select Sector SPDR Fund | | | 96,242 | | | 4,299,130 |

SPDR S&P 500 ETF Trust | | | 3,919 | | | 2,248,565 |

Vanguard Growth ETF | | | 46,351 | | | 17,795,539 |

Vanguard Small-Cap ETF | | | 43,224 | | | 10,253,165 |

Vanguard Value ETF | | | 93,823 | | | 16,378,681 |

| | | | | | 92,157,645 |

Domestic Fixed Income - 49.7%

| | | | | | |

iShares 20+ Year Treasury Bond ETF | | | 76,461 | | | 7,500,824 |

iShares 7-10 Year Treasury Bond ETF | | | 76,939 | | | 7,549,255 |

iShares iBoxx $ High Yield Corporate Bond ETF | | | 46,254 | | | 3,714,196 |

iShares MBS ETF | | | 105,176 | | | 10,076,913 |

Vanguard High Dividend Yield ETF | | | 25,239 | | | 3,235,640 |

Vanguard Intermediate-Term Bond ETF | | | 176,422 | | | 13,826,192 |

Vanguard Intermediate-Term Corporate Bond ETF | | | 201,729 | | | 16,894,804 |

Vanguard Long-Term Corporate Bond ETF | | | 62,866 | | | 5,106,605 |

Vanguard Short-Term Bond ETF | | | 320,436 | | | 25,215,109 |

Vanguard Short-Term Corporate Bond ETF | | | 46,213 | | | 3,670,236 |

Vanguard Short-Term Treasury ETF | | | 638,704 | | | 37,696,310 |

Vanguard Total Bond Market ETF | | | 168,042 | | | 12,621,635 |

| | | | | | 147,107,719 |

Foreign Equity - 13.4%

| | | | | | |

iShares MSCI China ETF | | | 147,491 | | | 7,508,767 |

iShares MSCI Emerging Markets ex China ETF | | | 152,226 | | | 9,302,531 |

Vanguard FTSE Europe ETF | | | 160,901 | | | 11,440,061 |

Vanguard FTSE Pacific ETF | | | 146,848 | | | 11,511,415 |

| | | | | | 39,762,774 |

TOTAL EXCHANGE TRADED FUNDS

(Cost $261,494,884) | | | | | | 285,894,822 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

The Brinsmere Fund - Conservative ETF

Schedule of Investments

September 30, 2024(Continued)

| | | | | | | |

SHORT-TERM INVESTMENTS - 3.5%

|

Money Market Funds - 3.5%

| | | | | | |

First American Treasury Obligations Fund - Class X, 4.79%(c) | | | 10,407,955 | | | $10,407,955 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $10,407,955) | | | | | | 10,407,955 |

TOTAL INVESTMENTS - 100.0%

(Cost $271,902,839) | | | | | | $296,302,777 |

Liabilities in Excess of Other Assets - (0.0)%(d) | | | | | | (21,439) |

TOTAL NET ASSETS - 100.0% | | | | | | $296,281,338 |

| | | | | | | |

Percentages are stated as a percent of net assets.

(a)

| The risks of investing in investment companies, such as the underlying ETFs, typically reflect the risks of the types of investments in which the investment companies invest. See Note 7 in Notes to Financial Statements. |

(b)

| Non-income producing security. |

(c)

| The rate shown represents the 7-day annualized effective yield as of September 30, 2024. |

(d)

| Represents less than 0.05% of net assets. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

The Brinsmere Fund - Growth ETF

Schedule of Investments

September 30, 2024

| | | | | | | |

EXCHANGE TRADED FUNDS - 95.1%(a)

|

Commodities - 1.5%

| | | | | | |

SPDR Gold Shares(b) | | | 17,526 | | | $4,259,869 |

Commodities Broad Basket - 2.5%

| | | | | | |

abrdn Bloomberg All Commodity Strategy K-1 Free ETF | | | 269,506 | | | 5,508,703 |

Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF | | | 116,834 | | | 1,569,081 |

| | | | | | 7,077,784 |

Domestic Equity - 43.2%

| | | | | | |

Invesco S&P 500 Equal Weight ETF | | | 270,861 | | | 48,527,457 |

iShares Core S&P Mid-Cap ETF | | | 62,889 | | | 3,919,242 |

iShares Core S&P Small-Cap ETF | | | 31,484 | | | 3,682,369 |

Real Estate Select Sector SPDR Fund | | | 152,411 | | | 6,808,199 |

SPDR S&P 500 ETF Trust | | | 6,985 | | | 4,007,714 |

Vanguard Growth ETF | | | 55,052 | | | 21,136,114 |

Vanguard Small-Cap ETF | | | 60,215 | | | 14,283,600 |

Vanguard Value ETF | | | 127,566 | | | 22,269,197 |

| | | | | | 124,633,892 |

Domestic Fixed Income - 27.8%

| | | | | | |

iShares 20+ Year Treasury Bond ETF | | | 63,570 | | | 6,236,217 |

iShares 7-10 Year Treasury Bond ETF | | | 63,967 | | | 6,276,442 |

iShares iBoxx $ High Yield Corporate Bond ETF | | | 37,942 | | | 3,046,743 |

iShares MBS ETF | | | 87,443 | | | 8,377,914 |

Vanguard High Dividend Yield ETF | | | 38,046 | | | 4,877,497 |

Vanguard Intermediate-Term Corporate Bond ETF | | | 90,804 | | | 7,604,835 |

Vanguard Long-Term Corporate Bond ETF | | | 52,266 | | | 4,245,567 |

Vanguard Short-Term Bond ETF | | | 84,575 | | | 6,655,207 |

Vanguard Short-Term Corporate Bond ETF | | | 36,013 | | | 2,860,152 |

Vanguard Short-Term Treasury ETF | | | 334,048 | | | 19,715,513 |

Vanguard Total Bond Market ETF | | | 139,710 | | | 10,493,618 |

| | | | | | 80,389,705 |

Foreign Equity - 20.1%

| | | | | | |

Columbia EM Core ex-China ETF | | | 419,546 | | | 13,706,568 |

iShares MSCI China ETF | | | 208,762 | | | 10,628,073 |

Vanguard FTSE Europe ETF | | | 237,075 | | | 16,856,033 |

Vanguard FTSE Pacific ETF | | | 216,518 | | | 16,972,846 |

| | | | | | 58,163,520 |

TOTAL EXCHANGE TRADED FUNDS

(Cost $249,326,727) | | | | | | 274,524,770 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

The Brinsmere Fund - Growth ETF

Schedule of Investments

September 30, 2024(Continued)

| | | | | | | |

SHORT-TERM INVESTMENTS - 5.4%

|

Money Market Funds - 5.4%

| | | | | | |

First American Treasury Obligations Fund - Class X, 4.79%(c) | | | 15,702,256 | | | $15,702,256 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $15,702,256) | | | | | | 15,702,256 |

TOTAL INVESTMENTS - 100.5%

(Cost $265,028,983) | | | | | | $290,227,026 |

Liabilities in Excess of Other Assets - 0.5% | | | | | | (1,454,078) |

TOTAL NET ASSETS - 100.0% | | | | | | $288,772,948 |

| | | | | | | |

Percentages are stated as a percent of net assets.

(a)

| The risks of investing in investment companies, such as the underlying ETFs, typically reflect the risks of the types of investments in which the investment companies invest. See Note 7 in Notes to Financial Statements. |

(b)

| Non-income producing security. |

(c)

| The rate shown represents the 7-day annualized effective yield as of September 30, 2024. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

The Brinsmere Funds

Statements of Assets and Liabilities

September 30, 2024

| | | | | | | |

ASSETS:

| | | | | | |

Investments, at value | | | $296,302,777 | | | $290,227,026 |

Dividends receivable | | | 37,301 | | | 54,626 |

Interest receivable | | | 26,010 | | | 30,152 |

Total assets | | | 296,366,088 | | | 290,311,804 |

LIABILITIES:

| | | | | | |

Payable to adviser | | | 84,750 | | | 82,077 |

Due to Custodian | | | — | | | 1,456,779 |

Total liabilities | | | 84,750 | | | 1,538,856 |

NET ASSETS | | | $296,281,338 | | | $288,772,948 |

NET ASSETS CONSISTS OF:

| | | | | | |

Paid-in capital | | | $271,129,693 | | | $262,918,997 |

Total distributable earnings | | | 25,151,645 | | | 25,853,951 |

Total net assets | | | $296,281,338 | | | $288,772,948 |

Net assets | | | $296,281,338 | | | $288,772,948 |

Shares issued and outstanding | | | 10,894,000 | | | 10,399,000 |

Net asset value per share | | | $27.20 | | | $27.77 |

COST:

| | | | | | |

Investments, at cost | | | $271,902,839 | | | $265,028,983 |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

The Brinsmere Funds

Statements of Operations

For the Period Ended September 30, 2024(a)

| | | | | | | |

INVESTMENT INCOME:

| | | | | | |

Dividend income | | | $5,555,519 | | | $3,970,428 |

Interest income | | | 127,648 | | | 60,805 |

Total investment income | | | 5,683,167 | | | 4,031,233 |

EXPENSES:

| | | | | | |

Investment advisory fee | | | 701,306 | | | 682,393 |

Total expenses | | | 701,306 | | | 682,393 |

NET INVESTMENT INCOME | | | 4,981,861 | | | 3,348,840 |

REALIZED AND UNREALIZED GAIN

| | | | | | |

Net realized gain from:

| | | | | | |

Investments | | | 513,664 | | | 200,099 |

In-kind redemptions | | | 15,518,359 | | | 20,460,979 |

Net realized gain | | | 16,032,023 | | | 20,661,078 |

Net change in unrealized appreciation on:

| | | | | | |

Investments | | | 7,212,097 | | | 6,887,493 |

Net change in unrealized appreciation | | | 7,212,097 | | | 6,887,493 |

Net realized and unrealized gain | | | 23,244,120 | | | 27,548,571 |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | | $28,225,981 | | | $30,897,411 |

| | | | | | | |

(a)

| Inception date of the Funds was January 12, 2024. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

The Brinsmere Funds

Statements of Changes in Net Assets

For the Period Ended September 30, 2024(a)

| | | | | | | |

OPERATIONS:

| | | | | | |

Net investment income | | | $4,981,861 | | | $3,348,840 |

Net realized gain | | | 16,032,023 | | | 20,661,078 |

Net change in unrealized appreciation | | | 7,212,097 | | | 6,887,493 |

Net increase in net assets from operations | | | 28,225,981 | | | 30,897,411 |

DISTRIBUTIONS TO SHAREHOLDERS: | | | | | | |

Distributions to shareholders | | | (4,834,843) | | | (3,130,483) |

Total distributions to shareholders | | | (4,834,843) | | | (3,130,483) |

CAPITAL TRANSACTIONS:

| | | | | | |

Proceeds from shares issued in connection with in-kind contribution

(Note 7) | | | 270,106,363 | | | 247,472,989 |

Subscriptions | | | 158,216,525 | | | 210,203,498 |

Redemptions | | | (155,432,688) | | | (196,670,467) |

Net increase in net assets from capital transactions | | | 272,890,200 | | | 261,006,020 |

NET INCREASE IN NET ASSETS | | | 296,281,338 | | | 288,772,948 |

NET ASSETS:

| | | | | | |

Beginning of the period | | | — | | | — |

End of the period | | | $296,281,338 | | | $288,772,948 |

SHARE TRANSACTIONS

| | | | | | |

Shares issued in connection with in-kind contribution (Note 7) | | | 10,804,000 | | | 9,899,000 |

Subscriptions | | | 6,070,000 | | | 8,010,000 |

Redemptions | | | (5,980,000) | | | (7,510,000) |

Total increase in shares outstanding | | | 10,894,000 | | | 10,399,000 |

| | | | | | | |

(a)

| Inception date of the Funds was January 12, 2024. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

The Brinsmere Fund - Conservative ETF

Financial Highlights

| | | | |

PER SHARE DATA:

| | | |

Net asset value, beginning of period | | | $25.00 |

INVESTMENT OPERATIONS:

| | | |

Net investment income(b)(c) | | | 0.46 |

Net realized and unrealized gain on investments(d) | | | 2.18 |

Total from investment operations | | | 2.64 |

LESS DISTRIBUTIONS FROM:

| | | |

Net investment income | | | (0.44) |

Total distributions | | | (0.44) |

Net asset value, end of period | | | $27.20 |

TOTAL RETURN(e) | | | 10.62% |

SUPPLEMENTAL DATA AND RATIOS:

| | | |

Net assets, end of period (in thousands) | | | $296,281 |

Ratio of expenses to average net assets(f)(g) | | | 0.35% |

Ratio of net investment income to average net assets(f)(g) | | | 2.48% |

Portfolio turnover rate(e)(h) | | | 85% |

| | | | |

(a)

| Inception date of the Fund was January 12, 2024. |

(b)

| Net investment income per share has been calculated based on average shares outstanding during the period. |

(c)

| Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying exchange traded funds in which the Fund invests. The ratio does not include net investment income of the exchange traded funds in which the Fund invests. |

(d)

| Realized and unrealized gains and losses per share in the caption are balancing amounts necessary to reconcile the change in net asset value per share for the period, and may not reconcile with the aggregate gains and losses in the Statement of Operations due to share transactions for the period. |

(e)

| Not annualized for periods less than one year. |

(f)

| Annualized for periods less than one year. |

(g)

| These ratios exclude the impact of expenses of the underlying exchange traded funds as represented in the Schedule of Investments. Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying exchange traded funds in which the Fund invests. |

(h)

| Portfolio turnover rate excludes in-kind transactions. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

The Brinsmere Fund - Growth ETF

Financial Highlights

| | | | |

PER SHARE DATA:

| | | |

Net asset value, beginning of period | | | $25.00 |

INVESTMENT OPERATIONS:

| | | |

Net investment income(b)(c) | | | 0.32 |

Net realized and unrealized gain on investments(d) | | | 2.75 |

Total from investment operations | | | 3.07 |

LESS DISTRIBUTIONS FROM:

| | | |

Net investment income | | | (0.30) |

Total distributions | | | (0.30) |

Net asset value, end of period | | | $27.77 |

TOTAL RETURN(e) | | | 12.31% |

SUPPLEMENTAL DATA AND RATIOS:

| | | |

Net assets, end of period (in thousands) | | | $288,773 |

Ratio of expenses to average net assets(f)(g) | | | 0.35% |

Ratio of net investment income to average net assets(f)(g) | | | 1.71% |

Portfolio turnover rate(e)(h) | | | 138% |

| | | | |

(a)

| Inception date of the Fund was January 12, 2024. |

(b)

| Net investment income per share has been calculated based on average shares outstanding during the period. |

(c)

| Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying exchange traded funds in which the Fund invests. The ratio does not include net investment income of the exchange traded funds in which the Fund invests. |

(d)

| Realized and unrealized gains and losses per share in the caption are balancing amounts necessary to reconcile the change in net asset value per share for the period, and may not reconcile with the aggregate gains and losses in the Statement of Operations due to share transactions for the period. |

(e)

| Not annualized for periods less than one year. |

(f)

| Annualized for periods less than one year. |

(g)

| These ratios exclude the impact of expenses of the underlying exchange traded funds as represented in the Schedule of Investments. Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying exchange traded funds in which the Fund invests. |

(h)

| Portfolio turnover rate excludes in-kind transactions. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

The Brinsmere Funds

Notes to Financial Statements

September 30, 2024

NOTE 1 – ORGANIZATION

The Brinsmere Fund - Conservative ETF and The Brinsmere Fund - Growth ETF (individually each a “Fund” or collectively the “Funds”) are each a diversified series of ETF Series Solutions (“ESS” or the “Trust”), an open-end management investment company consisting of multiple investment series, organized as a Delaware statutory trust on February 9, 2012. The Trust is registered with the U.S. Securities and Exchange Commission (“SEC”) under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company and the offering of the Funds’ shares is registered under the Securities Act of 1933, as amended (the “Securities Act”). The investment objective of The Brinsmere Fund - Conservative ETF is to seek long-term capital appreciation in a manner that is consistent with capital preservation. The investment objective of The Brinsmere Fund - Growth ETF is to seek long-term growth of capital. Both The Brinsmere Fund - Conservative ETF and The Brinsmere Fund - Growth ETF commenced operations on January 12, 2024.

The end of the reporting period for the Funds is September 30, 2024, and the period covered by these Notes to Financial Statements is the period from January 12, 2024 through September 30, 2024 (the “current fiscal period”).

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES

The Funds are investment companies and accordingly follow the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946 Financial Services – Investment Companies.

The following is a summary of significant accounting policies consistently followed by the Funds. These policies are in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

A.

| Security Valuation. All equity securities, including domestic and foreign common stocks, preferred stocks and exchange traded funds that are traded on a national securities exchange, except those listed on the Nasdaq Global Market®, Nasdaq Global Select Market®, and the Nasdaq Capital Market® exchanges (collectively, “Nasdaq”), are valued at the last reported sale price on the exchange on which the security is principally traded. Securities traded on Nasdaq will be valued at the Nasdaq Official Closing Price (“NOCP”). If, on a particular day, an exchange-traded or Nasdaq security does not trade, then the mean between the most recent quoted bid and asked prices will be used. All equity securities that are not traded on a listed exchange are valued at the last sale price in the over-the-counter market. If a non-exchange traded security does not trade on a particular day, then the mean between the last quoted closing bid and asked price will be used. Prices denominated in foreign currencies are converted to U.S. dollar equivalents at the current exchange rate, which approximates fair value. |

Investments in mutual funds, including money market funds, are valued at their net asset value (“NAV”) per share.

Securities for which quotations are not readily available are valued at their respective fair values in accordance with pricing procedures adopted by the Funds’ Board of Trustees (the “Board”). When a security is “fair valued,” consideration is given to the facts and circumstances relevant to the particular situation, including a review of various factors set forth in the pricing procedures adopted by the Board. The use of fair value pricing by the Funds may cause the NAV of the shares to differ significantly from the NAV that would be calculated without regard to such considerations.

As described above, the Funds utilize various methods to measure the fair value of their investments on a recurring basis. U.S. GAAP establishes a hierarchy that prioritizes inputs to valuation methods. The three levels of inputs are:

Level 1 –

| Unadjusted quoted prices in active markets for identical assets or liabilities that the Funds have the ability to access. |

Level 2 –

| Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data. |

TABLE OF CONTENTS

The Brinsmere Funds

Notes to Financial Statements

September 30, 2024(Continued)

Level 3 –

| Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available; representing the Funds’ own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available. |

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The following is a summary of the inputs used to value the Funds’ investments as of the end of the current fiscal period:

The Brinsmere Fund - Conservative ETF

| | | | | | | | | | | | | |

Exchange Traded Funds | | | $285,894,822 | | | $— | | | $— | | | $285,894,822 |

Short-Term Investments | | | 10,407,955 | | | — | | | — | | | 10,407,955 |

Total Investments in Securities | | | $296,302,777 | | | $— | | | $— | | | $296,302,777 |

| | | | | | | | | | | | | |

The Brinsmere Fund - Growth ETF

| | | | | | | | | | | | | |

Exchange Traded Funds | | | $274,524,770 | | | $— | | | $— | | | $274,524,770 |

Short-Term Investments | | | 15,702,256 | | | — | | | — | | | 15,702,256 |

Total Investments in Securities | | | $290,227,026 | | | $— | | | $— | | | $290,227,026 |

| | | | | | | | | | | | | |

^

| See Schedule of Investments for further disaggregation of investment categories. |

During the current fiscal period, the Funds did not recognize any transfers to or from Level 3.

B.

| Federal Income Taxes. The Funds’ policy is to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies and to distribute substantially all of their net investment income and net capital gains to shareholders. Therefore, no federal income tax provision is required. Each Fund plans to file U.S. Federal and applicable state and local tax returns. |

Each Fund recognizes the tax benefits of uncertain tax positions only when the position is more likely than not to be sustained upon examination by tax authorities. Management has analyzed each Fund’s uncertain tax positions and concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions. Management is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months. Income and capital gain distributions are determined in accordance with federal income tax regulations, which may differ from U.S. GAAP. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits on uncertain tax positions as income tax expenses in the Statements of Operations. During the current fiscal period, the Funds did not incur any interest or penalties.

C.

| Security Transactions and Investment Income. Investment securities transactions are accounted for on the trade date. Gains and losses realized on sales of securities are determined on a specific identification basis. Dividend income is recorded on the ex-dividend date. Non-cash dividends included in dividend income or |

TABLE OF CONTENTS

The Brinsmere Funds

Notes to Financial Statements

September 30, 2024(Continued)

separately disclosed, if any, are recorded at the fair value of the security received. Withholding taxes on foreign dividends, if any, have been provided for in accordance with the Funds’ understanding of the applicable tax rules and regulations. Interest income and expense is recorded on an accrual basis.

D.

| Distributions to Shareholders. Distributions to shareholders from net investment income and realized gains, if any, are declared and paid at least annually by the Funds. Distributions are recorded on the ex-dividend date. |

E.

| Use of Estimates. The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of revenues and expenses during the current fiscal period. Actual results could differ from those estimates. |

F.

| Share Valuation. The NAV per share of each Fund is calculated by dividing the sum of the value of the securities held by each Fund, plus cash and other assets, minus all liabilities (including estimated accrued expenses) by the total number of shares outstanding of each Fund, rounded to the nearest cent. The Funds’ shares will not be priced on the days on which the New York Stock Exchange (“NYSE”) is closed for trading. The offering and redemption price per share of each Fund is equal to each Fund’s NAV per share. |

G.

| Guarantees and Indemnifications. In the normal course of business, the Funds enter into contracts with service providers that contain general indemnification clauses. The Funds’ maximum exposure under these arrangements is unknown as this would involve future claims that may be against the Funds that have not yet occurred. However, based on experience, the Funds expect the risk of loss to be remote. |

H.

| Reclassification of Capital Accounts. U.S. GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or NAV per share and primarily relate to differing book and tax treatments of redemptions in-kind. |

For the fiscal period ended September 30, 2024, the following table shows the reclassifications made:

| | | | | | | |

The Brinsmere Fund - Conservative ETF | | | $(15,427,334) | | | $15,427,334 |

The Brinsmere Fund - Growth ETF | | | $(20,223,527) | | | $20,223,527 |

| | | | | | | |

I.

| Subsequent Events. In preparing these financial statements, management has evaluated events and transactions for potential recognition or disclosure through the date the financial statements were issued. There were no events or transactions that occurred during the period subsequent to the end of the current fiscal period that materially impacted the amounts or disclosures in the Funds’ financial statements. |

NOTE 3 – COMMITMENTS AND OTHER RELATED PARTY TRANSACTIONS

Estate Counselors, LLC, doing business as The Milwaukee Company (the “Adviser”) serves as the investment adviser to the Funds. Pursuant to an Investment Advisory Agreement (“Advisory Agreement”) between the Trust, on behalf of the Funds, and the Adviser, the Adviser provides investment advice to the Funds and oversees the day-to-day operations of the Funds, subject to the direction and control of the Board and the officers of the Trust. Under the Advisory Agreement, the Adviser, in consultation with Penserra Capital Management, LLC (the “Sub-Adviser”), is also responsible for arranging transfer agency, custody, fund administration and accounting, and all other non-distribution related services necessary for the Funds to operate. Under the Advisory Agreement, the Adviser has agreed to pay all expenses of the Funds, except for: the fee paid to the Adviser pursuant to the Advisory Agreement, interest charges on any borrowings, dividends and other expenses on securities sold short, taxes, brokerage commissions and other expenses incurred in placing orders for the purchase and sale of securities and other investment instruments, acquired fund fees and expenses, accrued deferred tax liability, extraordinary expenses, and distribution (12b-1) fees and

TABLE OF CONTENTS

The Brinsmere Funds

Notes to Financial Statements

September 30, 2024(Continued)

expenses. For the services it provides to the Funds, the Funds pay the Adviser a unified management fee, which is calculated daily and paid monthly, at an annual rate of 0.35% of the Funds’ average daily net assets. The Adviser is responsible for paying the Sub-Adviser.

U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services (“Fund Services” or “Administrator”), acts as the Funds’ Administrator and, in that capacity, performs various administrative and accounting services for the Funds. The Administrator prepares various federal and state regulatory filings, reports and returns for the Funds, including regulatory compliance monitoring and financial reporting; prepares reports and materials to be supplied to the Board; monitors the activities of the Funds’ Custodian, transfer agent and fund accountant. Fund Services also serves as the transfer agent and fund accountant to the Funds. U.S. Bank N.A. (the “Custodian”), an affiliate of Fund Services, serves as the Funds’ Custodian.

All officers of the Trust are affiliated with the Administrator and Custodian.

NOTE 4 – PURCHASES AND SALES OF SECURITIES

During the current fiscal period, purchases and sales of securities by the Funds, excluding short-term securities and in-kind transactions, were as follows:

| | | | | | | |

The Brinsmere Fund - Conservative ETF | | | $245,318,063 | | | $237,180,962 |

The Brinsmere Fund - Growth ETF | | | $390,073,208 | | | $377,418,142 |

| | | | | | | |

During the current fiscal period, there were no purchases or sales of U.S. Government securities.

During the current fiscal period, in-kind transactions associated with creations and redemptions were as follows:

| | | | | | | |

The Brinsmere Fund - Conservative ETF | | | $138,783,160 | | | $154,375,921 |

The Brinsmere Fund - Growth ETF | | | $182,025,982 | | | $195,177,838 |

| | | | | | | |

NOTE 5 – INCOME TAX INFORMATION

The components of distributable earnings (accumulated deficit) and cost basis of investments for federal income tax purposes as of September 30, 2024 in the Funds, were as follows:

| | | | | | | |

Tax cost of investments | | | $272,378,130 | | | $265,710,159 |

Gross tax unrealized appreciation | | | $24,399,938 | | | $25,198,043 |

Gross tax unrealized depreciation | | | (475,291) | | | (681,176) |

Net tax unrealized appreciation (depreciation) | | | 23,924,647 | | | 24,516,867 |

Undistributed ordinary income | | | 1,432,454 | | | 355,469 |

Undistributed long-term capital gains | | | 4,543 | | | 1,454,304 |

Other accumulated gain (loss) | | | (209,999) | | | (472,689) |

Distributable Earnings (accumulated deficit) | | | $25,151,645 | | | $25,853,951 |

| | | | | | | |

The difference between book and tax-basis cost is attributable to wash sales.

A regulated investment company may elect for any taxable year to treat any portion of any qualified late year loss as arising on the first day of the next taxable year. Qualified late year losses are certain capital and ordinary losses which occur during the portion of the Fund’s taxable year subsequent to October 31 and December 31, respectively. For the taxable year ended September 30, 2024, the Funds did not have any Post-October losses or late-year ordinary losses.

TABLE OF CONTENTS

The Brinsmere Funds

Notes to Financial Statements

September 30, 2024(Continued)

At September 30, 2024, the Funds had no short-term or long-term capital loss carryforwards. During the period ended September 30, 2024, no capital loss carryforwards were utilized by the Funds.

The tax character of distributions paid by the Funds during the fiscal period ended September 30, 2024 was as follows:

| | | | |

The Brinsmere Fund - Conservative ETF | | | $4,834,843 | | | $ — |

The Brinsmere Fund - Growth ETF | | | $3,130,483 | | | $— |

| | | | | | | |

NOTE 6 – SHARE TRANSACTIONS

Shares of the Funds are listed and traded on the New York Stock Exchange Arca, Inc. (“NYSE Arca”). Market prices for the shares may be different from their NAV. The Funds issue and redeem shares on a continuous basis at NAV generally in large blocks of shares, called “Creation Units.” Creation Units are issued and redeemed principally in-kind for securities included in a specified universe. Once created, shares generally trade in the secondary market at market prices that change throughout the day. Except when aggregated in Creation Units, shares are not redeemable securities of the Funds. Creation Units may only be purchased or redeemed by certain financial institutions (“Authorized Participants”). An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System of the National Securities Clearing Corporation or (ii) a Depository Trust Company participant and, in each case, must have executed a Participant Agreement with the Distributor. Most retail investors do not qualify as Authorized Participants nor have the resources to buy and sell whole Creation Units. Therefore, they are unable to purchase or redeem shares directly from the Funds. Rather, most retail investors may purchase shares in the secondary market with the assistance of a broker and are subject to customary brokerage commissions or fees.

The Funds currently offer one class of shares, which have no front-end sales load, no deferred sales charge, and no redemption fee. A fixed transaction fee is imposed for the transfer and other transaction costs associated with the purchase or sale of Creation Units. The standard fixed transaction fee for the Funds is $300, payable to the Custodian. The fixed transaction fee may be waived on certain orders if the Funds’ Custodian has determined to waive some or all of the costs associated with the order or another party, such as the Adviser, has agreed to pay such fee. In addition, a variable fee, payable to the Funds, may be charged on all cash transactions or substitutes for Creation Units of up to a maximum of 2% as a percentage of the value of the Creation Units subject to the transaction. Variable fees received by the Funds, if any, are displayed in the Capital Transactions section of the Statements of Changes in Net Assets. The Funds may issue an unlimited number of shares of beneficial interest, with no par value. Shares of the Funds have equal rights and privileges.

NOTE 7 – RISKS

Investment Company Risk. The risks of investing in investment companies, such as the underlying funds, typically reflect the risks of the types of instruments in which the investment companies invest. By investing in another investment company, the Fund becomes a shareholder of that investment company and bears its proportionate share of the fees and expenses of the other investment company.

NOTE 8 – IN-KIND CONTRIBUTIONS

As part of the Funds’ commencement of operations on January 12, 2024, The Brinsmere Fund - Conservative ETF received an in-kind contribution from accounts managed by the Adviser, which consisted of $270,106,363 of securities which were recorded at their current value, and The Brinsmere Fund - Growth ETF received an in-kind contribution from accounts managed by the Adviser, which consisted of $247,472,989 of securities which were recorded at their current value. The purpose of the transactions was to combine accounts with similar investment strategies into single ETFs with comparable investment objectives and investment strategies. As the transactions were determined to be non-taxable transactions by management, the Funds elected to retain the securities’ original cost basis for book and tax

TABLE OF CONTENTS

The Brinsmere Funds

Notes to Financial Statements

September 30, 2024(Continued)

purposes. The cost of the contributed securities as of January 12, 2024 for The Brinsmere Fund - Conservative ETF was $252,918,522, resulting in net unrealized appreciation on investments of $17,187,841 as of that date. The cost of the contributed securities as of January 12, 2024 for The Brinsmere Fund - Growth ETF was $229,162,439, resulting in net unrealized appreciation on investments of $18,310,550 as of that date. As a result of the in-kind contributions, The Brinsmere Fund - Conservative ETF issued 10,804,000 shares at a $25.00 per share net asset value, and The Brinsmere Fund - Growth ETF issued 9,899,000 shares at a $25.00 per share net asset value. Because the combined investment portfolios have been managed as single integrated portfolios since the transaction was completed, it is not practicable to separate the amounts of revenue and earnings of the contributing investment accounts that have been included in the Funds’ Statements of Operations. All fees and expenses incurred in conjunction with the transactions were paid by the Adviser.

NOTE 9 – BENEFICIAL OWNERSHIP

The beneficial ownership, either directly or indirectly, of 25% or more of the voting securities of a fund creates a presumption of control of a fund, under section 2(a)(9) of the 1940 Act. As of September 30, 2024, one shareholder owned greater than 25% of the outstanding shares of each Fund, and may be deemed to control each Fund.

TABLE OF CONTENTS

The Brinsmere Funds

Report of Independent Registered Public Accounting Firm

To the Shareholders of The Brinsmere Funds and

Board of Trustees of ETF Series Solutions

Opinion on the Financial Statements

We have audited the accompanying statements of assets and liabilities, including the schedules of investments, of The Brinsmere Fund - Conservative ETF, and The Brinsmere Fund - Growth ETF (the “Funds”), each a series of ETF Series Solutions, as of September 30, 2024, the related statements of operations, the statements of changes in net assets and the financial highlights for the period from January 12, 2024 (commencement of operations) to September 30, 2024, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of each of the Funds as of September 30, 2024, the results of their operations, the changes in net assets, and the financial highlights for the period from January 12, 2024 (commencement of operations) to September 30, 2024, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Funds’ management. Our responsibility is to express an opinion on the Funds’ financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Funds in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of September 30, 2024, by correspondence with the custodian. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

We have served as the Funds’ auditor since 2024.

COHEN & COMPANY, LTD.

Philadelphia, Pennsylvania

November 26, 2024

TABLE OF CONTENTS

The Brinsmere Funds

Additional Information (Unaudited)

1. Federal Tax Information

QUALIFIED DIVIDEND INCOME/DIVIDENDS RECEIVED DEDUCTION

For the fiscal period ended September 30, 2024, certain dividends paid by the Funds may be subject to a maximum tax rate of 23.8%, as provided for by the Jobs and Growth Tax Relief Reconciliation Act of 2003. The percentage of dividends declared from ordinary income designated as qualified dividend income was as follows:

| | | | |

The Brinsmere Fund - Conservative ETF | | | 19.95% |

The Brinsmere Fund - Growth ETF | | | 56.84% |

| | | | |

For corporate shareholders, the percent of ordinary income distributions qualifying for the corporate dividends received deduction for the fiscal period ended September 30, 2024, was as follows:

| | | | |

The Brinsmere Fund - Conservative ETF | | | 3.09% |

The Brinsmere Fund - Growth ETF | | | 5.91% |

| | | | |

SHORT-TERM CAPITAL GAIN

The percentage of taxable ordinary income distributions that are designated as short-term capital gain distributions under Internal Revenue Section 871(k)(2)(C) for each Fund were as follows:

| | | | |

The Brinsmere Fund - Conservative ETF | | | 0.00% |

The Brinsmere Fund - Growth ETF | | | 0.00% |

| | | | |

2. INFORMATION ABOUT PORTFOLIO HOLDINGS

The Funds file their complete schedules of portfolio holdings for their first and third fiscal quarters with the SEC on Part F of Form N-PORT. The Funds’ Part F of Form N-PORT is available without charge, upon request, by calling toll-free at (800) 617-0004 or by accessing the Funds’ website at www.thebrinsmerefunds.com. Furthermore, you may obtain the Part F of Form N-PORT on the SEC’s website at www.sec.gov. The Funds’ portfolio holdings are posted on their website at www.thebrinsmerefunds.com daily.

3. Information About Proxy Voting

A description of the policies and procedures the Funds use to determine how to vote proxies relating to portfolio securities is provided in the Statement of Additional Information (“SAI”). The SAI is available without charge, upon request, by calling toll-free at (800) 617-0004, by accessing the SEC’s website at www.sec.gov, or by accessing the Funds’ website at www.thebrinsmerefunds.com.

When available, information regarding how the Funds voted proxies relating to portfolio securities during the period ending June 30 is available by calling toll-free at (800) 617-0004 or by accessing the SEC’s website at ww.sec.gov.

4. Frequency Distribution of Premiums and Discounts

Information regarding how often shares of each Fund trade on an exchange at a price above (i.e., at a premium) or below (i.e., at a discount) the NAV of each Fund is available, without charge, on the Funds’ website at www.thebrinsmerefunds.com

| (b) | Financial Highlights are included within the financial statements filed under Item 7 of this Form. |

Item 8. Changes in and Disagreements with Accountants for Open-End Investment Companies.

There were no changes in or disagreements with accountants during the period covered by this report.

Item 9. Proxy Disclosure for Open-End Investment Companies.

There were no matters submitted to a vote of shareholders during the period covered by this report.

Item 10. Remuneration Paid to Directors, Officers, and Others of Open-End Investment Companies.

All fund expenses, including Trustee compensation is paid by the Investment Adviser pursuant to the Investment Advisory Agreement. Additional information related to those fees is available in the Funds’ Statement of Additional Information.

Item 11. Statement Regarding Basis for Approval of Investment Advisory Contract.

Not Applicable

Item 12. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 13. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 14. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable to open-end investment companies.

Item 15. Submission of Matters to a Vote of Security Holders.

There have been no material changes to the procedures by which shareholders may recommend nominees to the registrant’s board of trustees.

Item 16. Controls and Procedures.

| (a) | The Registrant’s President (principal executive officer) and Treasurer (principal financial officer) have reviewed the Registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the Registrant and by the Registrant’s service provider. |

| (b) | There were no changes in the Registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the period covered by this report that have materially affected, or are reasonably likely to materially affect, the Registrant’s internal control over financial reporting. |

Item 17. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies

Not applicable to open-end investment companies.

Item 18. Recovery of Erroneously Awarded Compensation.

(a) Not Applicable.

(b) Not Applicable.

Item 19. Exhibits.

(2) Any policy required by the listing standards adopted pursuant to Rule 10D-1 under the Exchange Act (17 CFR 240.10D-1) by the registered national securities exchange or registered national securities association upon which the registrant’s securities are listed. Not Applicable.

(3) A separate certification for each principal executive officer and principal financial officer of the registrant as required by Rule 30a-2(a) under the Investment Company Act of 1940 (17 CFR 270.30a-2(a)). Filed herewith.

(4) Any written solicitation to purchase securities under Rule 23c-1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable to open-end investment companies.

(5) Change in the registrant’s independent public accountant. Not applicable to open-end investment companies and ETFs.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | (Registrant) | ETF Series Solutions | |

| | By (Signature and Title)* | /s/ Kristina R. Nelson | |

| | | Kristina R. Nelson, President (principal executive officer) | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | By (Signature and Title)* | /s/ Kristina R. Nelson | |

| | | Kristina R. Nelson, President (principal executive officer) | |

| | By (Signature and Title)* | /s/ Kristen M. Weitzel | |

| | | Kristen M. Weitzel, Treasurer (principal financial officer) | |

* Print the name and title of each signing officer under his or her signature.