UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22668

ETF Series Solutions

(Exact name of registrant as specified in charter)

615 East Michigan Street

Milwaukee, WI 53202

(Address of principal executive offices) (Zip code)

Kristina R. Nelson

ETF Series Solutions

615 East Michigan Street

Milwaukee, WI 53202

(Name and address of agent for service)

414-516-1645

Registrant’s telephone number, including area code

Date of fiscal year end: April 30

Date of reporting period: October 31, 2024

Item 1. Reports to Stockholders.

| | |

| The Acquirers Fund | |

| ZIG (Principal U.S. Listing Exchange: NYSE) |

| Semi-Annual Shareholder Report | October 31, 2024 |

This semi-annual shareholder report contains important information about the The Acquirers Fund for the period of May 1, 2024, to October 31, 2024. You can find additional information about the Fund at https://acquirersfund.com/. You can also request this information by contacting us at 1-646-535-8629.

WHAT WERE THE FUND COSTS FOR THE LAST SIX MONTHS? (based on a hypothetical $10,000 investment)

| | |

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

| The Acquirers Fund | $41 | 0.79% |

KEY FUND STATISTICS (as of October 31, 2024)

| |

Net Assets | $48,513,480 |

Number of Holdings | 32 |

Portfolio Turnover | 108% |

30-Day SEC Yield | 1.70% |

30-Day SEC Yield Unsubsidized | 1.70% |

Visit https://acquirersfund.com/ for more recent performance information.

WHAT DID THE FUND INVEST IN? (as of October 31, 2024)

| |

Top 10 Issuers | (%) |

Texas Pacific Land Corporation | 4.1% |

Ubiquiti, Inc. | 4.1% |

Cal-Maine Foods, Inc. | 3.9% |

Warrior Met Coal, Inc. | 3.8% |

Mueller Industries, Inc. | 3.7% |

Peabody Energy Corporation | 3.7% |

Steel Dynamics, Inc. | 3.6% |

Synchrony Financial | 3.6% |

Altria Group, Inc. | 3.6% |

Bank of New York Mellon Corporation | 3.4% |

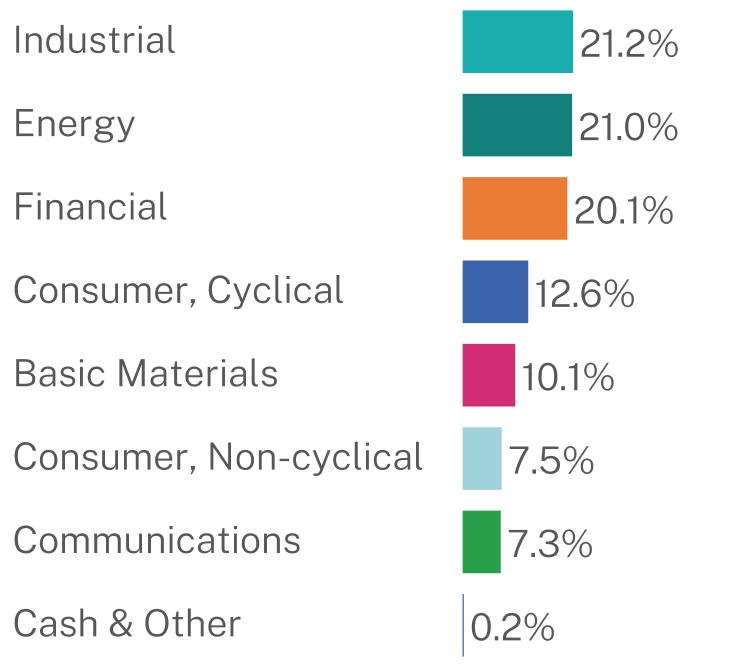

Industry Breakdown (% of Net Assets)

For additional information about the Fund; including its prospectus, financial information, holdings and proxy information, scan the QR code or visit https://acquirersfund.com/.

HOUSEHOLDING

To reduce Fund expenses, only one copy of most shareholder documents may be mailed to shareholders with multiple accounts at the same address (Householding). If you would prefer that your Acquirers Funds, LLC documents not be householded, please contact Acquirers Funds, LLC at 1-646-535-8629, or contact your financial intermediary. Your instructions will typically be effective within 30 days of receipt by Acquirers Funds, LLC or your financial intermediary.

| The Acquirers Fund | PAGE 1 | TSR-SAR-26922A263 |

21.221.020.112.610.17.57.30.2

Item 2. Code of Ethics.

Not applicable for semi-annual reports.

Item 3. Audit Committee Financial Expert.

Not applicable for semi-annual reports.

Item 4. Principal Accountant Fees and Services.

Not applicable for semi-annual reports.

Item 5. Audit Committee of Listed Registrants.

Not applicable for semi-annual reports.

Item 6. Investments.

| (a) | Schedule of Investments is included within the financial statements filed under Item 7 of this Form. |

Item 7. Financial Statements and Financial Highlights for Open-End Investment Companies.

The Acquirers Fund

Semi-Annual Financial Statements and Additional Information

October 31, 2024 (Unaudited)

TABLE OF CONTENTS

The Acquirers Fund

Schedule of Investments

October 31, 2024 (Unaudited)

| | | | | | | |

COMMON STOCKS - 99.8%

| | | | | | |

Basic Materials - 10.1%

| | | | | | |

CF Industries Holdings, Inc. | | | 19,356 | | | $1,591,644 |

Nucor Corporation | | | 11,008 | | | 1,561,375 |

Steel Dynamics, Inc. | | | 13,513 | | | 1,763,446 |

| | | | | | 4,916,465 |

Communications - 7.3%

| | | | | | |

Ubiquiti, Inc. | | | 7,479 | | | 1,987,096 |

VeriSign, Inc.(a) | | | 8,854 | | | 1,565,741 |

| | | | | | 3,552,837 |

Consumer, Cyclical - 12.6%

| | | | | | |

Crocs, Inc.(a) | | | 11,554 | | | 1,245,752 |

Dillard's, Inc. - Class A | | | 4,310 | | | 1,601,251 |

Domino's Pizza, Inc. | | | 3,887 | | | 1,608,169 |

Yum! Brands, Inc. | | | 12,429 | | | 1,630,188 |

| | | | | | 6,085,360 |

Consumer, Non-cyclical - 7.5%

| | | | | | |

Altria Group, Inc. | | | 31,933 | | | 1,739,071 |

Cal-Maine Foods, Inc. | | | 21,418 | | | 1,880,072 |

| | | | | | 3,619,143 |

Energy - 21.0%

| | | | | | |

Alpha Metallurgical Resources, Inc. | | | 7,564 | | | 1,575,581 |

California Resources Corporation | | | 30,231 | | | 1,571,105 |

PBF Energy, Inc. - Class A | | | 50,149 | | | 1,430,250 |

Peabody Energy Corporation | | | 67,634 | | | 1,776,745 |

Texas Pacific Land Corporation | | | 1,717 | | | 2,002,022 |

Warrior Met Coal, Inc. | | | 29,084 | | | 1,836,073 |

| | | | | | 10,191,776 |

Financial - 20.1%

| | | | | | |

Artisan Partners Asset Management, Inc. - Class A | | | 37,736 | | | 1,664,158 |

Bank of New York Mellon

Corporation | | | 22,186 | | | 1,671,937 |

Cohen & Steers, Inc. | | | 16,814 | | | 1,660,719 |

Popular, Inc. | | | 15,883 | | | 1,417,240 |

SLM Corporation | | | 72,913 | | | 1,606,273 |

Synchrony Financial | | | 31,547 | | | 1,739,501 |

| | | | | | 9,759,828 |

Industrial - 21.2%

| | | | | | |

Atkore, Inc. | | | 18,339 | | | 1,572,753 |

Boise Cascade Company | | | 11,322 | | | 1,506,166 |

Builders FirstSource, Inc.(a) | | | 8,063 | | | 1,381,998 |

Louisiana-Pacific Corporation | | | 15,137 | | | 1,497,049 |

Mueller Industries, Inc. | | | 21,868 | | | 1,792,520 |

Scorpio Tankers, Inc. | | | 23,397 | | | 1,363,343 |

TORM PLC - Class A | | | 45,506 | | | 1,183,156 |

| | | | | | 10,296,985 |

TOTAL COMMON STOCKS

(Cost $49,128,317) | | | | | | 48,422,394 |

| | | | | | | |

| | | | | | | |

SHORT-TERM INVESTMENTS - 0.0%(b)

| | | | | | |

Money Market Funds - 0.0%(b)

| | | | | | |

First American Government Obligations Fund - Class X, 4.78%(c) | | | 5,000 | | | $5,000 |

First American Treasury Obligations Fund - Class X, 4.74%(c) | | | 5,000 | | | 5,000 |

TOTAL SHORT-TERM INVESTMENTS

(Cost $10,000) | | | | | | 10,000 |

TOTAL INVESTMENTS - 99.8%

(Cost $49,138,317) | | | | | | $48,432,394 |

Other Assets in Excess of

Liabilities - 0.2% | | | | | | 81,086 |

TOTAL NET ASSETS - 100.0% | | | | | | $48,513,480 |

| | | | | | | |

Percentages are stated as a percent of net assets.

PLC - Public Limited Company

(a)

| Non-income producing security.

|

(b)

| Represents less than 0.05% of net assets.

|

(c)

| The rate shown represents the 7-day annualized effective yield as of October 31, 2024. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

The Acquirers Fund

Statement of Assets and Liabilities

October 31, 2024 (Unaudited)

| | | | |

ASSETS:

| | | |

Investments, at value | | | $48,432,394 |

Cash | | | 71,234 |

Dividends receivable | | | 39,274 |

Dividend tax reclaims receivable | | | 3,728 |

Interest receivable | | | 40 |

Total assets | | | 48,546,670 |

LIABILITIES:

| | | |

Payable to adviser | | | 33,190 |

Total liabilities | | | 33,190 |

NET ASSETS | | | $48,513,480 |

NET ASSETS CONSISTS OF:

| | | |

Paid-in capital | | | $58,956,926 |

Total accumulated losses | | | (10,443,446 ) |

Total net assets | | | $48,513,480 |

Net assets | | | $48,513,480 |

Shares issued and outstanding(a) | | | 1,250,000 |

Net asset value per share | | | $38.81 |

Cost:

| | | |

Investments, at cost | | | $49,138,317 |

| | | | |

(a)

| Unlimited shares authorized without par value. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

The Acquirers Fund

Statement of Operations

For the Period Ended October 31, 2024 (Unaudited)

| | | | |

INVESTMENT INCOME:

| | | |

Dividend income | | | $549,547 |

Less: dividend withholding taxes | | | (7,820) |

Interest income | | | 257 |

Total investment income | | | 541,984 |

EXPENSES:

| | | |

Investment advisory fee | | | 190,629 |

Total expenses | | | 190,629 |

NET INVESTMENT INCOME | | | 351,355 |

REALIZED AND UNREALIZED GAIN

| | | |

Net realized gain from:

| | | |

Investments | | | (2,296,003) |

In-kind redemptions | | | 7,347,552 |

Net realized gain | | | 5,051,549 |

Net change in unrealized depreciation on:

| | | |

Investments | | | (2,250,648) |

Foreign currency translation | | | (42) |

Net change in unrealized depreciation | | | (2,250,690) |

Net realized and unrealized gain | | | 2,800,859 |

NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | | | $3,152,214 |

| | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

The Acquirers Fund

Statements of Changes in Net Assets

| | | | | | | |

OPERATIONS:

| | | | | | |

Net investment income | | | $351,355 | | | $576,013 |

Net realized gain | | | 5,051,549 | | | 8,623,236 |

Net change in unrealized appreciation/(depreciation) | | | (2,250,690) | | | 535,823 |

Net increase in net assets from operations | | | 3,152,214 | | | 9,735,072 |

DISTRIBUTIONS TO SHAREHOLDERS:

| | | | | | |

Distributions to shareholders | | | — | | | (447,724) |

Total distributions to shareholders | | | — | | | (447,724) |

CAPITAL TRANSACTIONS:

| | | | | | |

Subscriptions | | | 40,012,913 | | | 67,387,578 |

Redemptions | | | (39,644,965) | | | (69,543,925) |

Net increase (decrease) in net assets from capital transactions | | | 367,948 | | | (2,156,347) |

NET INCREASE IN NET ASSETS | | | 3,520,162 | | | 7,131,001 |

NET ASSETS:

| | | | | | |

Beginning of the period | | | 44,993,318 | | | 37,862,317 |

End of the period | | | $48,513,480 | | | $44,993,318 |

| | | Shares | | | Shares |

SHARES TRANSACTIONS

| | | | | | |

Subscriptions | | | 1,050,000 | | | 2,050,000 |

Redemptions | | | (1,050,000) | | | (2,150,000) |

Total decrease in shares outstanding | | | — | | | (100,000) |

| | | | | | | |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

The Acquirers Fund

Financial Highlights

| | | | | | | | | | |

PER SHARE DATA:

| | | | | | | | | | | | | | | | | | |

Net asset value, beginning of period | | | $35.99 | | | $28.05 | | | $26.51 | | | $26.07 | | | $20.97 | | | $25.00 |

INVESTMENT OPERATIONS:

| | | | | | | | | | | | | | | | | | |

Net investment income (loss)(b) | | | 0.28 | | | 0.45 | | | 0.31 | | | 0.20 | | | (0.14) | | | 0.09 |

Net realized and unrealized gain (loss) on investments(j) | | | 2.54 | | | 7.86 | | | 1.56 | | | 0.30 | | | 5.28 | | | (4.12) |

Total from investment operations | | | 2.82 | | | 8.31 | | | 1.87 | | | 0.50 | | | 5.14 | | | (4.03) |

DISTRIBUTIONS TO SHAREHOLDERS:

| | | | | | | | | | | | | | | | | | |

Distributions from:

| | | | | | | | | | | | | | | | | | |

Net investment income | | | — | | | (0.37) | | | (0.33) | | | (0.06) | | | (0.04) | | | — |

Total distributions | | | — | | | (0.37) | | | (0.33) | | | (0.06) | | | (0.04) | | | — |

Net asset value, end of period | | | $38.81 | | | $35.99 | | | $28.05 | | | $26.51 | | | $26.07 | | | $20.97 |

TOTAL RETURN(c) | | | 7.82% | | | 29.70% | | | 7.16% | | | 1.87% | | | 24.55% | | | −16.13% |

SUPPLEMENTAL DATA AND RATIOS:

| | | | | | | | | | | | | | | | | | |

Net assets, end of period (in thousands) | | | $48,513 | | | $44,993 | | | $37,862 | | | $41,085 | | | $29,328 | | | $16,250 |

Ratio of expenses to average net assets:

| | | | | | | | | | | | | | | | | | |

Before expense reimbursement/

recoupment(d)(f)(g)(i) | | | 0.79% | | | 0.84% | | | 0.89% | | | 1.07% | | | 2.92% | | | 2.27% |

After expense reimbursement/

recoupment(d)(e)(f)(g)(i) | | | 0.79% | | | 0.84% | | | 0.89% | | | 1.07% | | | 2.88% | | | 2.12% |

Excluding dividend and interest expense on short positions before expense reimbursement/recoupment(d)(f)(g)(i) | | | 0.79% | | | 0.84% | | | 0.89% | | | 0.92% | | | 0.94% | | | 0.94% |

Excluding dividend and interest expense on short positions after expense reimbursement/recoupment(d)(e)(f)(g)(i) | | | 0.79% | | | 0.84% | | | 0.89% | | | 0.92% | | | 0.90% | | | 0.79% |

Ratio of net investment income (loss) to average net assets(d) | | | 1.46% | | | 1.41% | | | 1.19% | | | 0.70% | | | (0.60)% | | | 0.36% |

Excluding dividend and interest expense on short positions before expense reimbursement/recoupment(d) | | | 1.46% | | | 1.41% | | | 1.19% | | | 0.86% | | | 1.34% | | | 1.54% |

Excluding dividend and interest expense on short positions after expense reimbursement/recoupment(d)(e) | | | 1.46% | | | 1.41% | | | 1.19% | | | 0.86% | | | 1.38% | | | 1.69% |

Portfolio turnover rate(c)(h) | | | 108% | | | 132% | | | 105% | | | 86% | | | 233% | | | 207% |

| | | | | | | | | | | | | | | | | | | |

(a)

| Inception date of the Fund was May 14, 2019. |

(b)

| Calculated based on average shares outstanding during the period. |

(c)

| Not annualized for periods less than one year. |

(d)

| Annualized for periods less than one year. |

(e)

| Effective from commencement of operations through August 31, 2020, the Adviser contractually agreed to waive 15 basis points (0.15%) of its management fees for the Fund. |

(f)

| Effective December 7, 2021, the Adviser reduced its management fee from 0.94% to 0.89%. |

(g)

| Effective May 1, 2023, the Adviser reduced its management fee from 0.89% to 0.84% |

(h)

| Excludes the impact of in-kind transactions. |

(i)

| Effective May 1, 2024, the Adviser reduced its management fee from 0.84% to 0.79%. |

(j)

| Realized and unrealized gains and losses per share in the caption are balancing amounts necessary to reconcile the change in net asset value per share for the years, and may not reconcile with the aggregate gains and losses in the Statement of Operations due to share transactions for the year. |

The accompanying notes are an integral part of these financial statements.

TABLE OF CONTENTS

The Acquirers Fund

NOTES TO FINANCIAL STATEMENTS

October 31, 2024 (Unaudited)

NOTE 1 – ORGANIZATION

The Acquirers Fund (the “Fund”) is a diversified series of ETF Series Solutions (“ESS” or the “Trust”), an open-end management investment company consisting of multiple investment series, organized as a Delaware statutory trust on February 9, 2012. The Trust is registered with the Securities and Exchange Commission (“SEC”) under the Investment Company Act of 1940, as amended (the “1940 Act”), as an open-end management investment company and the offering of the Fund’s shares is registered under the Securities Act of 1933, as amended (the “Securities Act”). The investment objective of the Fund is to seek capital appreciation. Prior to December 7, 2021, the investment objective of the Fund was to track the performance, before fees and expenses, of the Acquirer’s Index (the “Index”). The Fund commenced operations on May 14, 2019.

The end of the reporting period for the Fund is October 31, 2024, and the period covered by these Notes to Financial Statements is the fiscal period from May 1, 2024, to October 31, 2024 (the “current fiscal period”).

NOTE 2 – SIGNIFICANT ACCOUNTING POLICIES

The Fund is an investment company and accordingly follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946 Financial Services-Investment Companies.

The following is a summary of significant accounting policies consistently followed by the Fund. These policies are in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

A.

| Security Valuation. All equity securities, including domestic and foreign common stocks, preferred stocks, and exchange traded funds that are traded on a national securities exchange, except those listed on The Nasdaq Stock Market®, Nasdaq Global Select Markets® and Nasdaq Capital Market Exchange® (collectively, “Nasdaq”) are valued at the last reported sale price on the exchange on which the security is principally traded. Securities traded on Nasdaq will be valued at the Nasdaq Official Closing Price (“NOCP”). If, on a particular day, an exchange-traded or Nasdaq security does not trade, then the mean between the most recent quoted bid and asked prices will be used. All equity securities that are not traded on a listed exchange are valued at the last sale price in the over-the-counter market. If a non-exchange traded security does not trade on a particular day, then the mean between the last quoted closing bid and asked price will be used. Prices denominated in foreign currencies are converted to U.S. dollar equivalents at the current exchange rate, which approximates fair value. |

Investments in mutual funds, including money market funds, are valued at their net asset value (“NAV”) per share.

Securities for which quotations are not readily available are valued at their respective fair values in accordance with pricing procedures adopted by the Fund’s Board of Trustees (the “Board”). When a security is “fair valued,” consideration is given to the facts and circumstances relevant to the particular situation, including a review of various factors set forth in the pricing procedures adopted by the Board. The use of fair value pricing by the Fund may cause the NAV of its shares to differ significantly from the NAV that would be calculated without regard to such considerations.

As described above, the Fund utilizes various methods to measure the fair value of its investments on a recurring basis. U.S. GAAP establishes a hierarchy that prioritizes inputs to valuations methods. The three levels of inputs are:

Level 1 –

Unadjusted quoted prices in active markets for identical assets or liabilities that the Fund has the ability to access.

Level 2 –

Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments, interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

TABLE OF CONTENTS

The Acquirers Fund

NOTES TO FINANCIAL STATEMENTS

October 31, 2024 (Unaudited)(Continued)

Level 3 –

Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available; representing the Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based on the best information available.

The availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example, the type of security, whether the security is new and not yet established in the marketplace, the liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes, the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest level input that is significant to the fair value measurement in its entirety.

The following is a summary of the inputs used to value the Fund’s investments as of the end of the current fiscal period:

| | | | | | | | | | | | | |

Common Stocks | | | $48,422,394 | | | $ — | | | $ — | | | $48,422,394 |

Short-Term Investments | | | 10,000 | | | — | | | — | | | 10,000 |

Total Investments in Securities | | | $48,432,394 | | | $— | | | $— | | | $48,432,394 |

| | | | | | | | | | | | | |

^

| See Schedule of Investments for breakout of investments by sector classification. |

During the current fiscal period, the Fund did not recognize any transfers to or from Level 3.

B.

| Federal Income Taxes. The Fund’s policy is to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986, as amended, applicable to regulated investment companies and to distribute substantially all of its net investment income and net capital gains to shareholders. Therefore, no federal income tax provision is required. The Fund plans to file U.S. Federal and applicable state and local tax returns. |

The Fund recognizes the tax benefits of uncertain tax positions only when the position is more likely than not to be sustained. Management has analyzed the Fund’s uncertain tax positions and concluded that no liability for unrecognized tax benefits should be recorded related to uncertain tax positions. Management is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will change materially in the next 12 months. Income and capital gain distributions are determined in accordance with federal income tax regulations, which may differ from U.S. GAAP. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits on uncertain tax positions as income tax expenses in the Statement of Operations. During the current fiscal period, the Fund did not incur any interest or penalties.

C.

| Security Transactions and Investment Income. Investment securities transactions are accounted for on the trade date. Gains and losses realized on sales of securities are determined on a specific identification basis. Dividend income is recorded on the ex-dividend date. Non-cash dividends included in dividend income or separately disclosed, if any, are recorded at the fair value of the security received. Withholding taxes on foreign dividends, if any, have been provided for in accordance with the Fund’s understanding of the applicable tax rules and regulations. Interest income is recorded on an accrual basis. |

D.

| Foreign Currency. Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions. The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments and currency gains or losses realized between the trade and settlement dates on securities transactions from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or |

TABLE OF CONTENTS

The Acquirers Fund

NOTES TO FINANCIAL STATEMENTS

October 31, 2024 (Unaudited)(Continued)

loss from investments. The Fund reports net realized foreign exchange gains or losses that arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on foreign currency transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the fair values of assets and liabilities, other than investments in securities at fiscal period end, resulting from changes in exchange rates.

E.

| Distributions to Shareholders. Distributions to shareholders from net investment income and net realized gains on securities are declared and paid by the Fund at least annually. Distributions are recorded on the ex-dividend date. |

F.

| Use of Estimates. The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of revenues and expenses during the current fiscal period. Actual results could differ from those estimates. |

G.

| Share Valuation. The NAV per share of the Fund is calculated by dividing the sum of the value of the securities held by the Fund, plus cash and other assets, minus all liabilities (including estimated accrued expenses) by the total number of outstanding shares of the Fund, rounded to the nearest cent. The Fund’s shares will not be priced on the days on which the New York Stock Exchange (“NYSE”) is closed for trading. The offering and redemption price per share of the Fund is equal to the Fund’s NAV per share. |

H.

| Reclassification of Capital Accounts. U.S. GAAP requires that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or NAV per share and primarily relate to differing book and tax treatments of redemptions in-kind. |

For the fiscal year ended April 30, 2024, the following table shows the reclassifications made:

| | | | |

$(10,221,565) | | | $10,221,565 |

| | | | |

J.

| Guarantees and Indemnifications. In the normal course of business, the Fund enters into contracts with service providers that contain general indemnification clauses. The Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote. |

K.

| Subsequent Events. In preparing these financial statements, management has evaluated events and transactions for potential recognition or disclosure through the date the financial statements were issued. There were no events or transactions that occurred during the period subsequent to the end of the current fiscal period that materially impacted the amounts or disclosures in the Fund’s financial statements. |

NOTE 3 – COMMITMENTS AND OTHER RELATED PARTY TRANSACTIONS

Acquirers Funds, LLC (the “Adviser”), serves as the investment adviser to the Fund. Pursuant to an Investment Advisory Agreement (“Advisory Agreement”) between the Trust, on behalf of the Fund, and the Adviser, the Adviser provides investment advice to the Fund and oversees the day-to-day operations of the Fund, subject to the direction and control of the Board and the officers of the Trust. Under the Advisory Agreement, the Adviser is responsible for arranging, in consultation with Tidal Investments LLC (the “Sub-Adviser”), transfer agency, custody, fund administration and accounting, and other non-distribution related services necessary for the Fund to operate. Under the Advisory Agreement, the Adviser has agreed to pay all expenses of the Fund, except for: the fee paid to the Adviser pursuant to the Advisory Agreement, interest charges on any borrowings, dividends and other expenses on securities sold short, taxes, brokerage commissions and other expenses incurred in placing orders for the purchase and sale of securities and other investment instruments, acquired fund fees and expenses, accrued deferred tax liability, extraordinary expenses, and distribution (12b-1) fees and expenses. For services provided to the Fund, the Fund pays

TABLE OF CONTENTS

The Acquirers Fund

NOTES TO FINANCIAL STATEMENTS

October 31, 2024 (Unaudited)(Continued)

the Adviser a unified management fee, which is calculated daily and paid monthly, at an annual rate of 0.79% of the Fund’s average daily net assets. The Adviser is responsible for paying the Sub-Adviser.

U.S. Bancorp Fund Services, LLC, doing business as U.S. Bank Global Fund Services (“Fund Services” or “Administrator”), acts as the Fund’s Administrator and, in that capacity, performs various administrative and accounting services for the Fund. The Administrator prepares various federal and state regulatory filings, reports and returns for the Fund, including regulatory compliance monitoring and financial reporting; prepares reports and materials to be supplied to the Board; monitors the activities of the Fund’s Custodian, transfer agent and fund accountant. Fund Services also serves as the transfer agent and fund accountant to the Fund. U.S. Bank N.A. (the “Custodian”), an affiliate of Fund Services, serves as the Fund’s Custodian.

All officers of the Trust are affiliated with the Administrator and Custodian.

NOTE 4 – PURCHASES AND SALES OF SECURITIES

During the current fiscal period, purchases and sales of securities by the Fund, excluding short-term securities and in-kind transactions, were as follows:

During the current fiscal period, there were no purchases or sales of U.S. Government securities by the Fund.

During the current fiscal period, in-kind transactions associated with creations and redemptions for the Fund were as follows:

NOTE 5 – INCOME TAX INFORMATION

The components of distributable earnings (accumulated deficit) and cost basis of investments for federal income tax purposes at April 30, 2024 were as follows:

| | | | |

Tax cost of investments | | | $43,534,495 |

Gross tax unrealized appreciation | | | 2,618,958 |

Gross tax unrealized depreciation | | | (1,279,478) |

Net tax unrealized appreciation (depreciation) | | | 1,339,480 |

Undistributed ordinary income | | | 275,905 |

Undistributed long-term capital gains | | | — |

Other accumulated gain (loss) | | | (15,211,045) |

Distributable earnings (accumulated deficit) | | | $(13,595,660) |

| | | | |

The differences between the cost basis for financial statement and federal income tax purposes are primarily due to timing differences in recognizing wash sales and partnerships.

A regulated investment company may elect for any taxable year to treat any portion of any qualified late year loss as arising on the first day of the next taxable year. Qualified late year losses are certain capital and ordinary losses which occur during the portion of the Fund’s taxable year subsequent to October 31 and December 31, respectively. For the taxable year ended April 30, 2024, the Fund did not elect to defer any post-October capital losses or late year ordinary losses.

As of April 30, 2024, the Fund had a short-term capital loss carryforward of $12,363,575 and a long-term capital loss carryforward of $2,847,470. These amounts do not have an expiration date.

TABLE OF CONTENTS

The Acquirers Fund

NOTES TO FINANCIAL STATEMENTS

October 31, 2024 (Unaudited)(Continued)

The tax character of distributions paid by the Fund during the fiscal years ended April 30, 2024 and April 30, 2023, was as follows:

| | | | |

Ordinary Income | | | $447,724 | | | $495,967 |

| | | | | | | |

NOTE 6 – SHARE TRANSACTIONS

Shares of the Fund are listed and trade on the New York Stock Exchange Arca, Inc. (“NYSE Arca”). Market prices for the shares may be different from their NAV. The Fund issues and redeems shares on a continuous basis at NAV generally in large blocks of shares called “Creation Units.” Creation Units are issued and redeemed principally in-kind for securities included in a specified universe. Once created, shares generally trade in the secondary market at market prices that change throughout the day. Except when aggregated in Creation Units, shares are not redeemable securities of the Fund. Creation Units may only be purchased or redeemed by certain financial institutions (“Authorized Participants”). An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System of the National Securities Clearing Corporation or (ii) a Depository Trust Company participant and, in each case, must have executed a Participant Agreement with the Distributor. Most retail investors do not qualify as Authorized Participants nor have the resources to buy and sell whole Creation Units. Therefore, they are unable to purchase or redeem shares directly from the Fund. Rather, most retail investors may purchase shares in the secondary market with the assistance of a broker and are subject to customary brokerage commissions or fees.

The Fund currently offers one class of shares, which has no front-end sales load, no deferred sales charge, and no redemption fee. A fixed transaction fee is imposed for the transfer and other transaction costs associated with the purchase or sale of Creation Units. The standard fixed transaction fee is $300, payable to the Custodian. The fixed transaction fee may be waived on certain orders if the Fund’s Custodian has determined to waive some or all of the creation order costs associated with the order, or another party, such as the Adviser, has agreed to pay such fee. In addition, a variable fee, payable to the Fund, may be charged on all cash transactions or substitutes for Creation Units of up to a maximum of 2% as a percentage of the value of the Creation Units subject to the transaction. Variable fees received by the Fund, if any, are displayed in the Capital Shares Transactions section of the Statements of Changes in Net Assets. The Fund may issue an unlimited number of shares of beneficial interest, with no par value. All shares of the Fund have equal rights and privileges.

NOTE 7 – RISKS

Sector Risk. To the extent the Fund invests more heavily in particular sectors of the economy, its performance will be especially sensitive to developments that significantly affect those sectors.

TABLE OF CONTENTS

The Acquirers Fund

ADDITIONAL INFORMATION (Unaudited)

Federal Tax Information

For the fiscal year ended April 30, 2024, certain dividends paid by the Fund may be subject to the maximum rate of 23.8%, as provided for by the Jobs and Growth Tax relief Reconciliation Act of 2003.

The percentage of dividends declared from ordinary income designated as qualified dividend income was 100.00%.

For corporate shareholders, the percentage of ordinary income distributions that qualified for the corporate dividend received deduction for the fiscal year ended April 30, 2024 was 100.00%.

The percentage of taxable ordinary income distributions that are designated as short-term capital gain distributions under Internal Revenue Section 871(k)(2)(C) for the Fund was 0.00%.

Information About Portfolio Holdings

The Fund files its complete schedule of portfolio holdings for its first and third fiscal quarters with the SEC on Part F of Form N-PORT. The Fund’s Part F of Form N-PORT is available without charge, upon request, by calling toll-free at (800) 617-0004. Furthermore, you may obtain the Part F of Form N-PORT on the SEC’s website at www.sec.gov, or on the Fund’s website at www.acquirersfund.com. The Fund’s portfolio holdings are posted on its website at www.acquirersfund.com daily.

Information About Proxy Voting

A description of the policies and procedures the Fund uses to determine how to vote proxies relating to portfolio securities is provided in the SAI. The SAI is available without charge, upon request, by calling toll-free at (800) 617-0004, by accessing the SEC’s website at www.sec.gov or by accessing the Fund’s website at www.acquirersfund.com.

When available, information regarding how the Fund voted proxies relating to portfolio securities during the twelve-month period ending June 30 is available by calling toll-free at (800) 617-0004 or by accessing the SEC’s website at www.sec.gov.

Frequency Distribution of Premiums and Discounts

Information regarding how often shares of the Fund trade on the exchange at a price above (i.e. at a premium) or below (i.e. at a discount) the NAV of the Fund is available, without charge, on the Fund’s website at www.acquirersfund.com.

| (b) | Financial Highlights are included within the financial statements filed under Item 7 of this Form. |

Item 8. Changes in and Disagreements with Accountants for Open-End Investment Companies.

There were no changes in or disagreements with accountants during the period covered by this report.

Item 9. Proxy Disclosure for Open-End Investment Companies.

There were no matters submitted to a vote of shareholders during the period covered by this report.

Item 10. Remuneration Paid to Directors, Officers, and Others of Open-End Investment Companies.

All fund expenses, including Trustee compensation is paid by the Investment Adviser pursuant to the Investment Advisory Agreement. Additional information related to those fees is available in the Fund’s Statement of Additional Information.

Item 11. Statement Regarding Basis for Approval of Investment Advisory Contract.

Not Applicable.

Item 12. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 13. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 14. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

Not applicable to open-end investment companies.

Item 15. Submission of Matters to a Vote of Security Holders.

There have been no material changes to the procedures by which shareholders may recommend nominees to the registrant’s board of trustees.

Item 16. Controls and Procedures.

| (a) | The Registrant’s President (principal executive officer) and Treasurer (principal financial officer) have reviewed the Registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940 (the “Act”)) as of a date within 90 days of the filing of this report, as required by Rule 30a-3(b) under the Act and Rules 13a-15(b) or 15d-15(b) under the Securities Exchange Act of 1934. Based on their review, such officers have concluded that the disclosure controls and procedures are effective in ensuring that information required to be disclosed in this report is appropriately recorded, processed, summarized and reported and made known to them by others within the Registrant and by the Registrant’s service provider. |

| (b) | There were no changes in the Registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Act) that occurred during the period covered by this report that have materially affected, or are reasonably likely to materially affect, the Registrant’s internal control over financial reporting. |

Item 17. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies

Not applicable to open-end investment companies.

Item 18. Recovery of Erroneously Awarded Compensation.

(a) Not Applicable.

(b) Not Applicable.

Item 19. Exhibits.

| (a) | (1) Any code of ethics or amendment thereto, that is the subject of the disclosure required by Item 2, to the extent that the registrant intends to satisfy Item 2 requirements through filing an exhibit. Not Applicable. |

(2) Any policy required by the listing standards adopted pursuant to Rule 10D-1 under the Exchange Act (17 CFR 240.10D-1) by the registered national securities exchange or registered national securities association upon which the registrant’s securities are listed. Not Applicable.

(3) A separate certification for each principal executive officer and principal financial officer of the registrant as required by Rule 30a-2(a) under the Investment Company Act of 1940 (17 CFR 270.30a-2(a)). Filed herewith.

(4) Any written solicitation to purchase securities under Rule 23c-1 under the Act sent or given during the period covered by the report by or on behalf of the registrant to 10 or more persons. Not applicable to open-end investment companies.

(5) Change in the registrant’s independent public accountant. Not applicable to open-end investment companies and ETFs.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | (Registrant) | ETF Series Solutions | |

| | By (Signature and Title)* | /s/ Kristina R. Nelson | |

| | | Kristina R. Nelson, President (principal executive officer) | |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

| | By (Signature and Title)* | /s/ Kristina R. Nelson | |

| | | Kristina R. Nelson, President (principal executive officer) | |

| | By (Signature and Title)* | /s/ Kristen M. Weitzel | |

| | | Kristen M. Weitzel, Treasurer (principal financial officer) | |

* Print the name and title of each signing officer under his or her signature.