UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of The Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☒ | Definitive Additional Materials |

| ☐ | Soliciting Material Under Rule 14a-12 |

ROCKWELL MEDICAL, INC. |

(Name of Registrant as Specified in Its Charter) |

| |

RICHMOND BROTHERS, INC. RBI PRIVATE INVESTMENT I, LLC RBI PRIVATE INVESTMENT II, LLC RBI PI MANAGER, LLC RICHMOND BROTHERS 401(K) PROFIT SHARING PLAN DAVID S. RICHMOND MATTHEW J. CURFMAN NORMAN J. RAVICH IRREVOCABLE TRUST NORMAN AND SALLY RAVICH FAMILY TRUST ALEXANDER COLEMAN RAVICH 1991 IRREVOCABLE TRUST ALYSSA DANIELLE RAVICH 1991 IRREVOCABLE TRUST MARK H. RAVICH |

(Name of Persons(s) Filing Proxy Statement, if Other Than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| ☐ | Fee paid previously with preliminary materials: |

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing.

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

Richmond Brothers, Inc. and Mark H. Ravich, together with the other participants named herein (collectively, “Richmond Brothers”), have filed a definitive proxy statement and accompanyingBLUE proxy card with the Securities and Exchange Commission to be used to solicit votes for the election of Richmond Brothers’ highly-qualified director nominee to the Board of Directors of Rockwell Medical, Inc., a Michigan corporation (the “Company”), at the Company’s upcoming 2017 annual meeting of shareholders, or any other meeting of shareholders held in lieu thereof, and any adjournments, postponements, reschedulings or continuations thereof.

Item 1: On May 19, 2017, Richmond Brothers issued the following press release, which was also posted by Richmond Brothers towww.richmondbrothers.com/time-for-action-at-rmti, which can be reached from www.richmondbrothers.com:

Richmond Brothers and Mark H. Ravich Issue Letter to Rockwell Medical, Inc. Shareholders

Believe Mark H. Ravich is Clearly the Superior Choice for Shareholders

Ravich is a Proven Leader with Relevant Board Experience and Will Be an Independent Voice for Shareholders

Believe David Domzalski Was Hand-Picked by CEO Rob Chioini and Would Fail to Stand up to Rockwell’s Management

Vote theBLUE Proxy Card Today for Highly-Qualified Nominee Mark H. Ravich

JACKSON, MI and ST. LOUIS PARK, MN(May 19, 2017) – Richmond Brothers, Inc., a Michigan-based SEC registered investment advisor and wealth management firm that is the largest beneficial owner of Rockwell Medical, Inc. (NASDAQ: RMTI) (“Rockwell” or the “Company”), and Mark H. Ravich, who together with their affiliates beneficially own over 6.1 million shares, or 11.8% of the Company’s outstanding common stock, today sent a letter to Rockwell shareholders outlining the case for electing Mark H. Ravich to the Board at the upcoming annual meeting of shareholders to be held on June 1, 2017. The full text of the letter follows:

May 19, 2017

Dear Fellow Shareholders:

We believe – based on the outpouring of support we have received so far – that many of you share our long-standing frustrations with Rockwell Medical, Inc.’s (“Rockwell” or the “Company”) failed execution and continued poor performance.The list of failures and problems at Rockwell is long – including the failure to monetize two approved and promising drugs, abysmal corporate governance practices, egregious executive compensation practices, a complete lack of regard for shareholder concerns, disinterest in communicating with shareholders and the market, and perhaps most importantly, a lack of independent oversight.

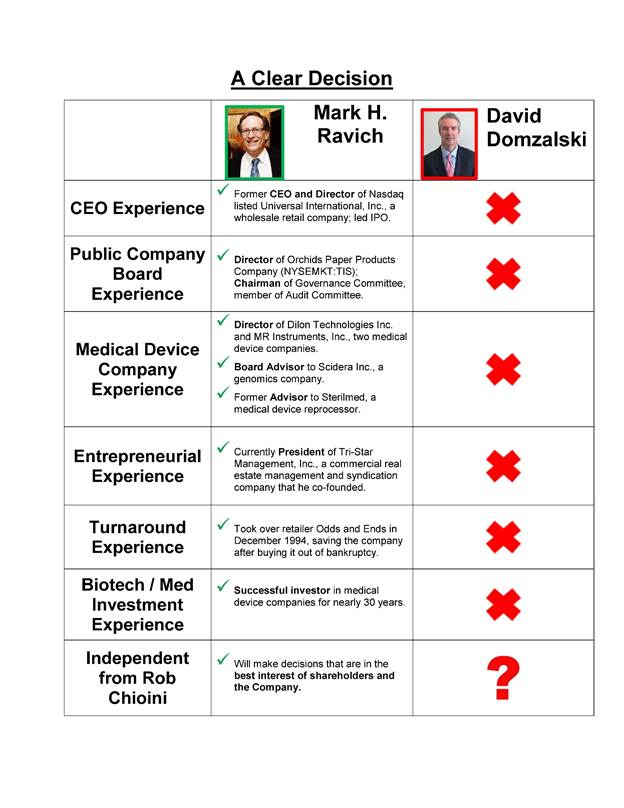

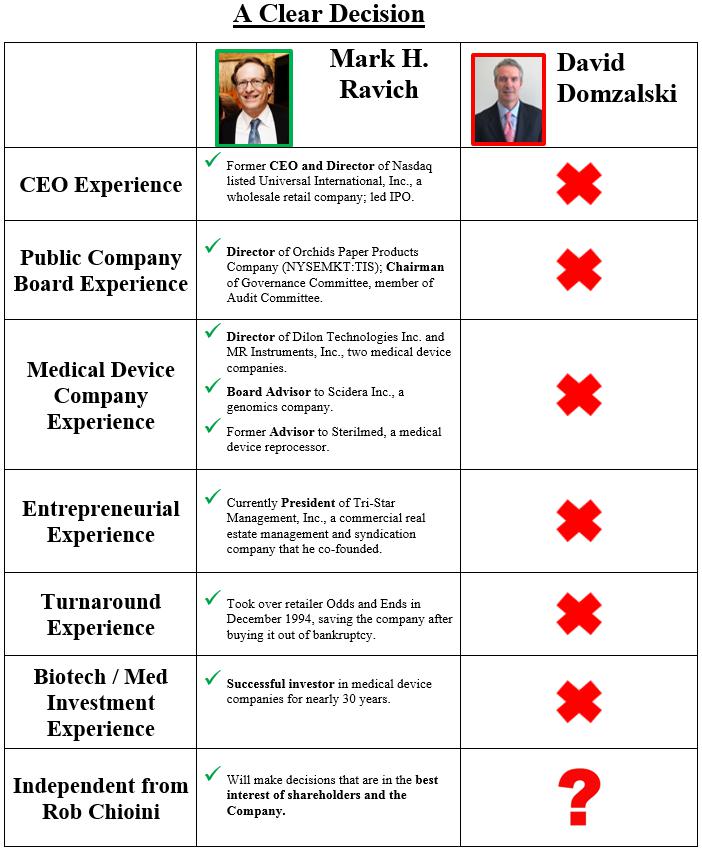

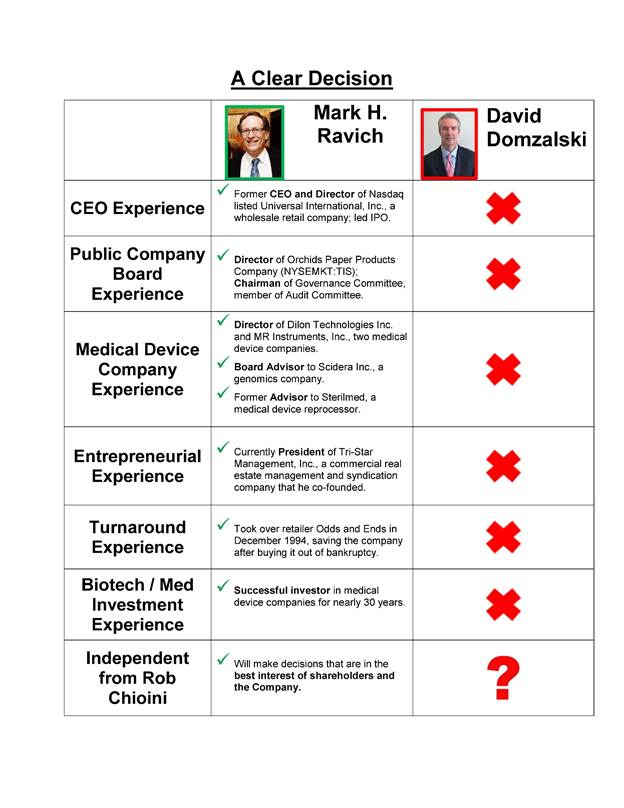

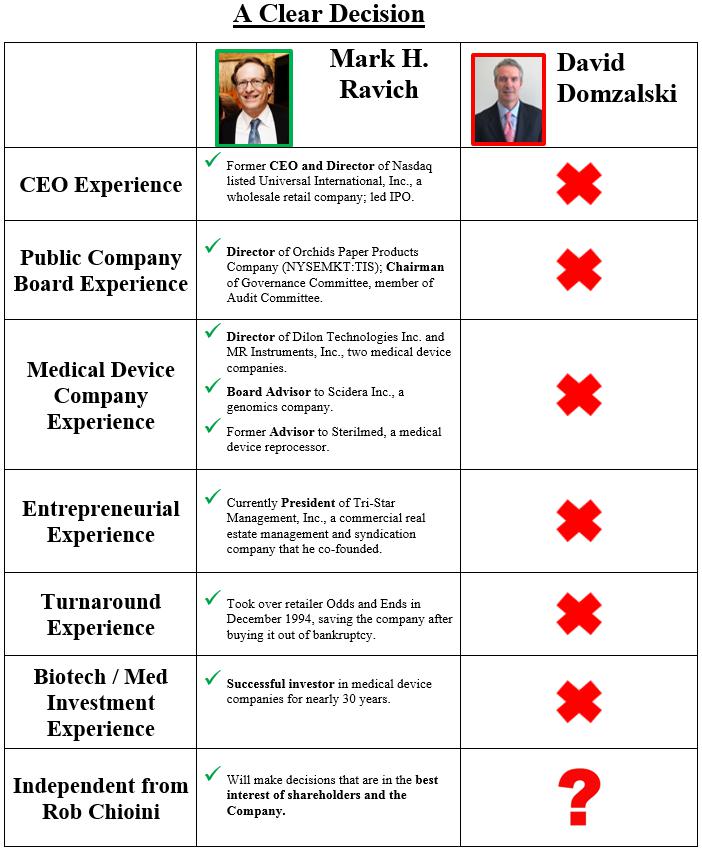

The question you face now is who is best-positioned to deliver the change that Rockwell sorely needs.In our view, Mark H. Ravich is the clear choice. He is independent, has relevant investment and board experience, and is personally invested in the Company. We believe his qualifications blow away those of David Domzalski, who in our view would be nothing more than another crony of Rockwell Chairman and CEO Rob Chioini.

Do not be fooled by Rockwell’s ever-growing list of false and misleading statements.1 The Company has stooped to new lows, even going so far as to falsely accuse Mark of being involved in the bankruptcy of retailer Odds and Ends, when the truth is that Mark took over that company when it emerged from bankruptcy in 1994, not in 1990 as Rockwell claims. We believe this blatant lie demonstrates the lengths to which the incumbents will go to further entrench themselves.

1 See our recent presentation documenting many of Rockwell’s false and misleading statements at:http://www.richmondbrothers.com/images/uploads/RMTI_Rebuttal_Deck.pdf

The bottom line is thatshareholders need a voice in Rockwell’s boardroom so thatshareholders’ best interests are put first and foremost and there is proper oversight of the Company’s management. That is the only way, in our view, that Rockwell’s underperformance can be corrected and excessive executive compensation can be reined in.

Why David Domzalski is not the Right Choice for Rockwell’s Board:

| × | Domzalski’s roles at the healthcare and pharmaceutical companies where he has worked have been primarilysales and marketing focused – expertise that Rockwell does not need at this point. |

| × | Failed to deliver meaningful sales at Leo Pharma,Inc. during his short tenure. |

| × | Failed to bring a primary drug candidate to market at Foamix Pharmaceuticals, Ltd., leading to significant stock decline. |

| × | Rockwell claims that it conducted an extensive search for Domzalski, butRockwell didn’t even interview the three world class candidates that we suggested. |

| × | Rockwell was against Domzalski before it was for him. We believe that Rockwell vetted Domzalski last year and decided against him before putting Dr. Robin Smith on the Board. |

| × | It isunclear whether Domzalski is truly independent of Rob Chioini. |

| o | It appears that Foamix, where Domzalski works, uses LifeSci Advisors, LLC as its IR / PR consultant. LifeSci is the same firm that handles IR for Rockwell and is related to LifeSci Index Partners, which created the index that Rockwell is using to artificially make its performance look less troubling. |

Do not let Rockwell’s maneuvering and entrenchment tactics fool you. We urge you to support the change Rockwell desperately needs and vote theBLUE proxy card to elect Mark H. Ravich to the Board.Remember, voting withhold on Rockwell’s nominee on the white proxy card is not the same as voting for Mark H. Ravich on the BLUE proxy card. If you have voted a white proxy card, you have every right to change your vote by voting a later datedBLUE proxy card today. You may vote by internet or telephone by following the enclosed instructions.

Thank you for your support,

Richmond Brothers, Inc. and Mark H. Ravich

TELL ROCKWELL IT MUST TAKE SHAREHOLDER CONCERNS SERIOUSLY

VOTE THEBLUE PROXY CARD TO ELECT MARK H. RAVICHTODAY

If you have any questions, or require assistance with your vote, please contact Saratoga Proxy Consulting LLC, toll- free at (888) 368-0379, call direct at (212) 257-1311 or email:info@saratogaproxy.com

For more information, and to see other communications and filings from Richmond Brothers and Mark H. Ravich, visit this link:http://www.richmondbrothers.com/time-for-action-at-rmti.

About Richmond Brothers, Inc.

Richmond Brothers, Inc. is an SEC registered investment advisor and wealth management firm founded in 1994.

About Mark H. Ravich

Mark H. Ravich is a private investor and currently serves as President of Tri-Star Management, Inc., a commercial real estate management and syndication company that he co-founded in 1998.

Shareholder Contact

Saratoga Proxy Consulting LLC

John Ferguson / Joe Mills, 212-257-1311

info@saratogaproxy.com

Media Contact

Sloane & Company

Joe Germani / Jaimee Pavia, 212-486-9500

jgermani@sloanepr.com/jpavia@sloanepr.com

Item 2: On May 19, 2017, Richmond Brothers mailed the following letter to shareholders, which was also posted by Richmond Brothers towww.richmondbrothers.com/time-for-action-at-rmti, which can be reached from www.richmondbrothers.com: