|

Exhibit 99.1

|

Foresight Energy LP

March 17, 2015 FORESIGHT ENERGY

Disclaimer

Cautionary Note Regarding Forward-Looking Statements. This document contains “forward-looking” statements. You should not place undue reliance on these statements. Forward-looking statements include information concerning our possible or assumed future results of operations, including descriptions of our business strategies. These statements often include words such as “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, “seek”, “will”, “may” or similar expressions that are predictions of or indicate future events or trends. These statements are based on certain assumptions that we have made in light of our experience in the industry as well as our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate in these circumstances. As you read and consider this document, you should understand that these statements are not guarantees of performance or results and that actual future results may vary materially. They involve risks, uncertainties and assumptions. Many factors could affect our actual financial results and could cause actual results to differ materially from those expressed in the forward-looking statements.

In light of these risks, uncertainties and assumptions, the forward-looking statements contained in this document might not prove to be accurate and you should not place undue reliance upon them. All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the foregoing cautionary statements. All such statements speak only as of the date made, and we undertake no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

Market data and other statistical information used throughout this presentation are based on independent industry publications, government publications, reports by market research firms or other published independent sources. Some data are also based on our good faith estimates which are derived from our review of internal surveys, as well as the independent sources listed above. Although we believe these sources are reliable, we have not independently verified the information and cannot guarantee its accuracy and completeness.

Use of Non-GAAP Financial Measures. The Company provides financial measures and terms not calculated in accordance with accounting principles generally accepted in the United States (GAAP). Presentation of non-GAAP measures such as, but not limited to “EBITDA”,

“Adjusted EBITDA”, “free cash flow”, and “illustrative free cash flow” provide investors with an alternative method for assessing our operating results in a manner that enables them to more thoroughly evaluate our performance. These non-GAAP measures provide a baseline for assessing the Company’s future earnings expectations. Foresight management uses these non-GAAP measures for the same purpose. The non-GAAP measures included in this presentation are provided to give investors access to the types of measures that we use in analyzing our results.

Information regarding Murray Energy is based upon data made available to FELP by Murray Energy. FELP has not independently verified any such information.

I. Transaction Overview

II. Pro Forma Corporate and Ownership Structure III. Transaction Adds New Drop-Down Opportunities IV. FELP Synergies and Pro Forma Adjustments V. FELP Pro Forma 2014 EBITDA Bridge VI. Management Expertise

Transaction Overview

Murray Energy agreed to pay cash consideration of $1.395 billion to acquire from Foresight Reserves:

64.954 million outstanding subordinated units of Foresight Energy LP (NYSE: “FELP”), representing approximately 50% of the limited partner interest An 80% voting interest in Foresight Energy GP, with a 77.5% interest in the incentive distribution rights

Access to certain other coal handling, transportation and transloading facilities, including assets that Chris Cline contributed to FELP in contemplation of the transaction, and securing certain other contractual rights

Value ascribed to purchase of GP interest is approximately $70 million

Visible drop down pipeline for FELP from Murray Energy’s 12 mines, which, according to Murray Energy, generated 2014 Adjusted EBITDA of over $713 million

FELP will continue as a stand-alone public entity and does not expect to increase its leverage as part of transaction

Existing facilities will be refinanced, modified or amended to permit the transaction

FELP will not guarantee any of Murray Energy’s debt

Over $55 million of identified operational synergies

Access to certain other coal handling, transportation and transloading facilities

Additional synergies anticipated from sharing best practices

Transaction expected to close in 2Q 2015

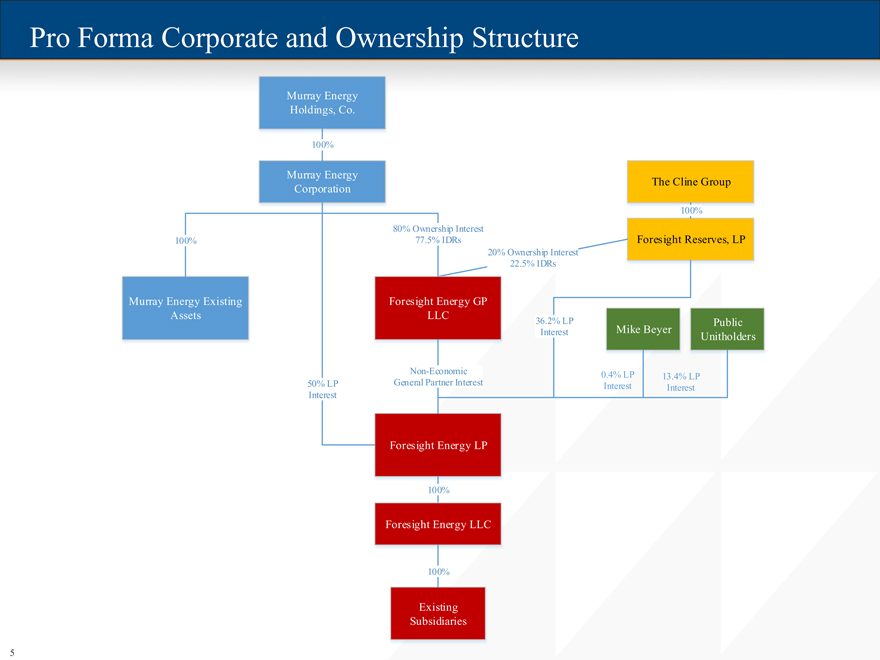

Pro Forma Corporate and Ownership Structure

Murray Energy Holdings, Co.

100%

Murray Energy Corporation

100%

Murray Energy Existing Assets

80% Ownership Interest 77.5% IDRs

20% Ownership Interest 22.5% IDRs

Foresight Energy GP LLC

36.2% LP Interest

Non-Economic 0. 50% LP General Partner Interest Interest

Foresight Energy LP

The Cline Group

100%

Foresight Reserves, LP

Public Unitholders

0.4% LP 13.4% LP

Interest Interest

100%

Foresight Energy LLC

100%

Existing Subsidiaries

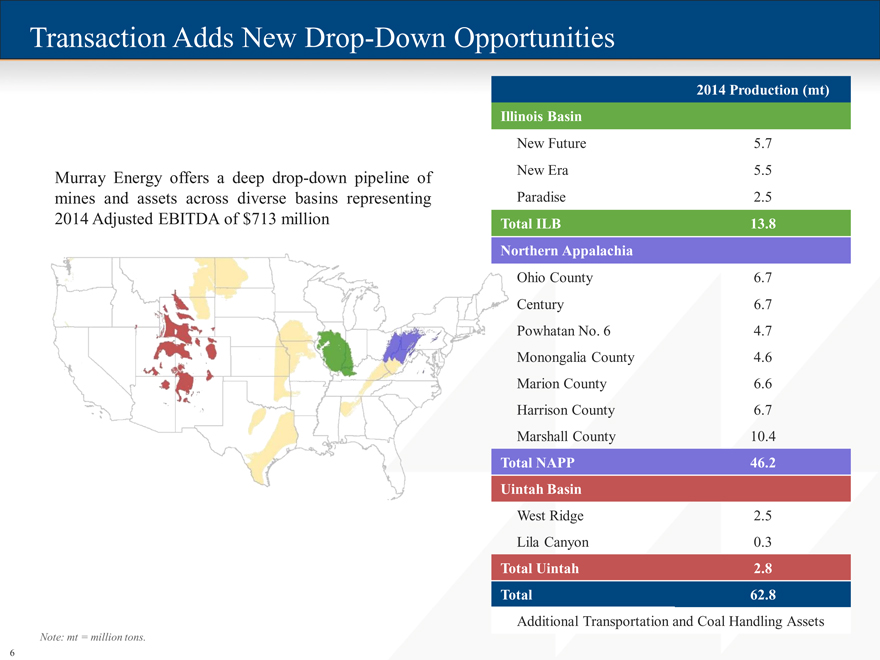

Transaction Adds New Drop-Down Opportunities

Murray Energy offers a deep drop-down pipeline of mines and assets across diverse basins representing 2014 Adjusted EBITDA of $713 million

2014 Production (mt)

Illinois Basin

New Future 5.7

New Era 5.5

Paradise 2.5

Total ILB 13.8

thern Appalachia

Ohio County 6.7

Century 6.7

Powhatan No. 6 4.7

Monongalia County 4.6

Marion County 6.6

Harrison County 6.7

Marshall County 10.4

al NAPP 46.2

tah Basin

West Ridge 2.5

Lila Canyon 0.3

Total Uintah 2.8

Total 62.8

Additional Transportation and Coal Handling Assets

Note: mt = million tons.

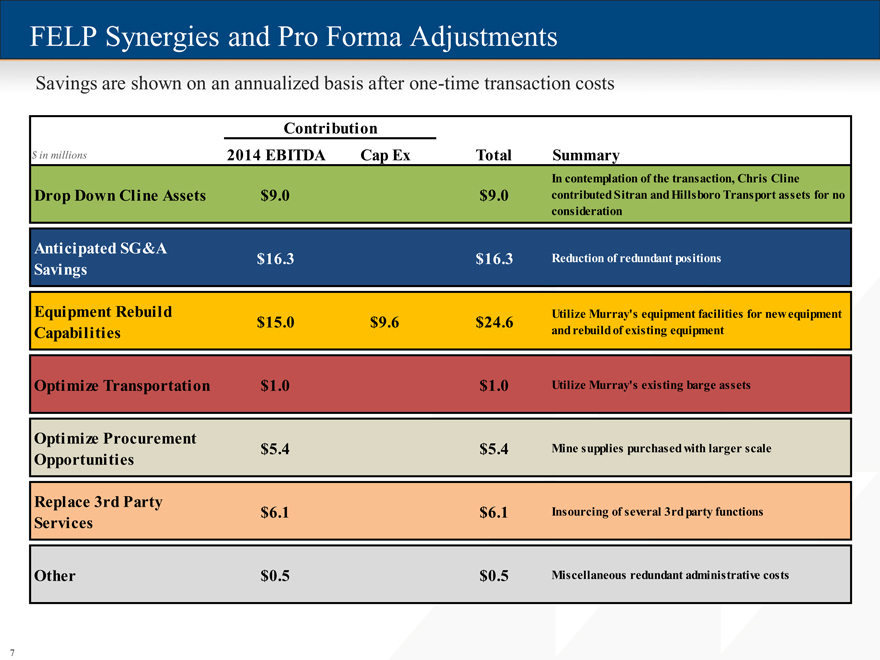

FELP Synergies and Pro Forma Adjustments

Savings are shown on an annualized basis after one-time transaction costs

Contribution

$ in millions 2014 EBITDA Cap Ex Total Summary

In contemplation of the transaction, Chris Cline

Drop Down Cline Assets $9.0 $9.0 contributed Sitran and Hillsboro Transport assets for no

consideration

Anticipated SG&A

$16.3 $16.3 Reduction of redundant positions

Savings

Equipment Rebuild Utilize Murray’s equipment facilities for new equipment

$15.0 $9.6 $24.6

Capabilities and rebuild of existing equipment

Optimize Transportation $1.0 $1.0 Utilize Murray’s existing barge assets

Optimize Procurement

$5.4 $5.4 Mine supplies purchased with larger scale

Opportunities

Replace 3rd Party

$6.1 $6.1 Insourcing of several 3rd party functions

Services

Other $0.5 $0.5 Miscellaneous redundant administrative costs

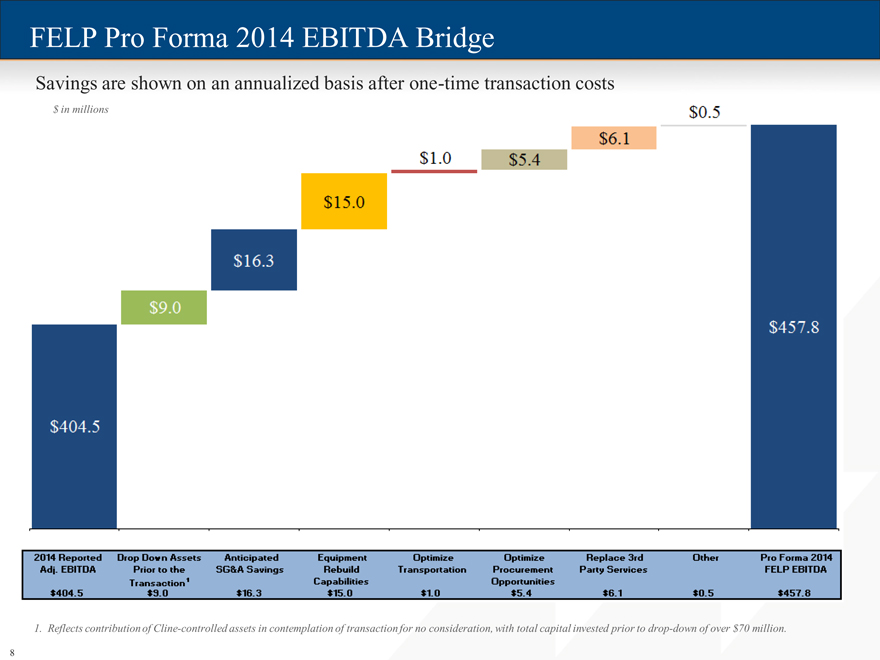

FELP Pro Forma 2014 EBITDA Bridge

Savings are shown on an annualized basis after one-time transaction costs

$ in millions

$404.5 $9.0 $16.3 $15.0 $1.0 $5.4 $6.1 $0.5 $457.8

2014 Reported Adj. EBITDA

Drop Down Assets Prior to the Transaction1

Anticipated SG&A Savings

Equipment Rebuild Capabilities

Optimize Transportation

Optimize Procurement Opportunities

Replace 3rd Party Services

Other

Pro Forma 2014 FELP EBITDA

1. Reflects contribution of Cline-controlled assets in contemplation of transaction for no consideration, with total capital invested prior to drop-down of over $70 million.

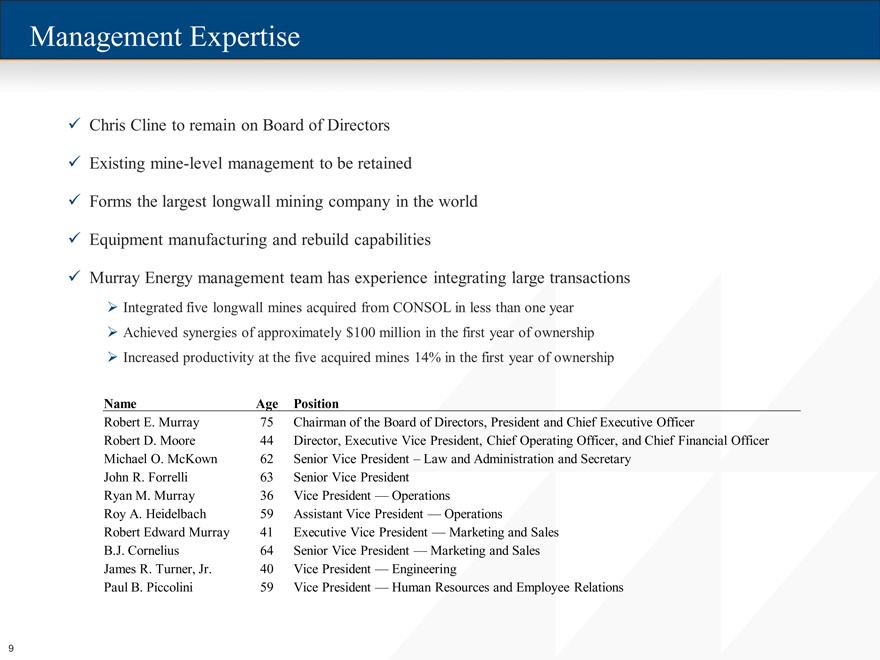

Management Expertise

Chris Cline to remain on Board of Directors

Existing mine-level management to be retained

Forms the largest longwall mining company in the world

Equipment manufacturing and rebuild capabilities

Murray Energy management team has experience integrating large transactions

Integrated five longwall mines acquired from CONSOL in less than one year

Achieved synergies of approximately $100 million in the first year of ownership

Increased productivity at the five acquired mines 14% in the first year of ownership

Name Age Position

Robert E. Murray 75 Chairman of the Board of Directors, President and Chief Executive Officer

Robert D. Moore 44 Director, Executive Vice President, Chief Operating Officer, and Chief Financial Officer

Michael O. McKown 62 Senior Vice President – Law and Administration and Secretary

John R. Forrelli 63 Senior Vice President

Ryan M. Murray 36 Vice President — Operations

Roy A. Heidelbach 59 Assistant Vice President — Operations

Robert Edward Murray 41 Executive Vice President — Marketing and Sales

B.J. Cornelius 64 Senior Vice President — Marketing and Sales

James R. Turner, Jr. 40 Vice President — Engineering

Paul B. Piccolini 59 Vice President — Human Resources and Employee Relations

9

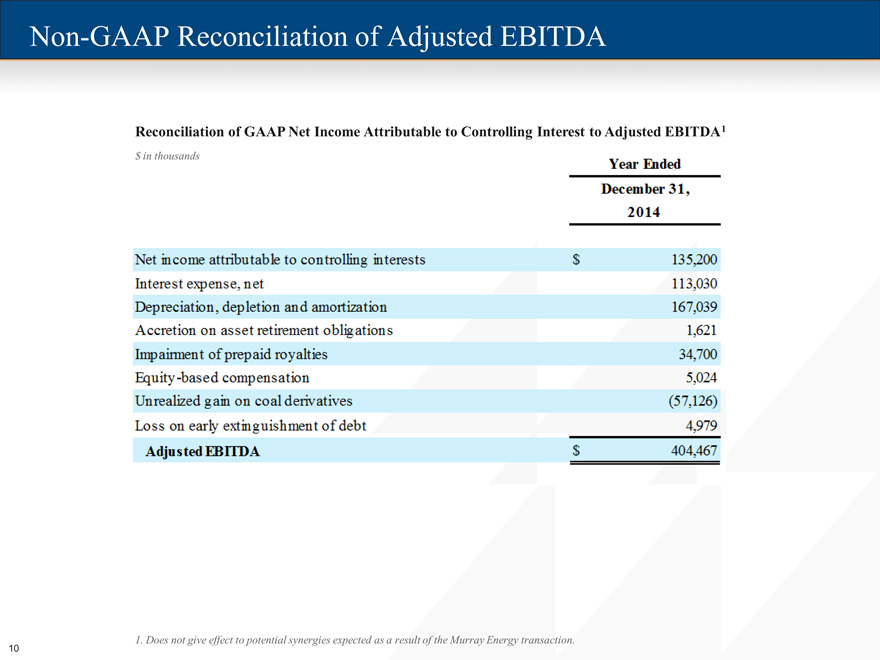

Non-GAAP Reconciliation of Adjusted EBITDA

Reconciliation of GAAP Net Income Attributable to Controlling Interest to Adjusted EBITDA1

$ in thousands

Year Ended

December 31,

2014

Net income attributable to controlling interests $135,200

Interest expense, net 113,030

Depreciation, depletion and amortization 167,039

Accretion on asset retirement obligations 1,621

Impairment of prepaid royalties 34,700

Equity-based compensation 5,024

Unrealized gain on coal derivatives (57,126)

Loss on early extinguishment of debt 4,979

Adjusted EBITDA $404,467

1. Does not give effect to potential synergies expected as a result of the Murray Energy transaction.

10