Exhibit 99.2

AKARI THERAPEUTICS PLC

CONSOLIDATED ANNUAL REPORT AND FINANCIAL STATEMENTS

FOR THE YEAR ENDED

31 DECEMBER 2017

Registered Number: 05252842

| AKARI THERAPEUTICS PLC |

| |

| CONSOLIDATED ANNUAL REPORT AND FINANCIAL STATEMENTS |

| |

| FOR THE YEAR ENDED 31 DECEMBER 2017 |

| |

| CONTENTS | Page |

| | |

| | |

| Officers and professional advisers | 1 |

| | |

| | |

| Directors’ report | 2 – 3 |

| | |

| | |

| Strategic Report | 4 – 10 |

| | |

| | |

| Director’s Remuneration Report | 11-19 |

| | |

| | |

| Independent Auditors’ report to the shareholders of Akari Therapeutics Plc | 20-22 |

| | |

| | |

| Consolidated statement of comprehensive loss | 23 |

| | |

| | |

| Consolidated statement of financial position | 24 |

| | |

| | |

| Parent company statement of financial position | 25 |

| | |

| | |

| Consolidated statement of changes in equity | 26 |

| | |

| | |

| Consolidated statement of cash flows | 27 |

| | |

| | |

| Parent company statement of cash flows | 28 |

| | |

| | |

| Notes to the report and financial statements | 29-42 |

| AKARI THERAPEUTICS PLC |

| |

| OFFICERS AND PROFESSIONAL ADVISERS |

| |

| FOR THE YEAR ENDED 31 DECEMBER 2017 |

| |

| Directors | G Roshwalb (resigned 29 May 2017) |

| | R Prudo-Chlebosz |

| | C Richardson |

| | J Hill |

| | S Ungar |

| | D Byrne |

| | R Ward |

| | D Williams |

| | D Solomon (appointed 28 August 2017, resigned 8 May 2018) |

| | M Grissinger (appointed 23 January 2018) |

| | P Feldschreiber (appointed 23 January 2018) |

| | |

| Secretary | SLC Corporate Services Limited |

| | R Shaw (appointed 23 March 2016, resigned 4 December 2017) |

| | D Elefant (appointed 4 December 2017) |

| | |

| Registered Office | 42-50 Hersham Road |

| | Walton-On-Thames, |

| | Surrey |

| | KT12 1RZ |

| | |

| Independent Auditors | haysmacintyre |

| | 10 Queen Street Place |

| | London |

| | EC4R 1AG |

| AKARI THERAPEUTICS PLC |

| |

| DIRECTORS’ REPORT |

| |

| FOR THE YEAR ENDED 31 DECEMBER 2017 |

| |

Unless the context otherwise requires, all references to “Akari,” “we,” “us,” “our,” the “Company”, the “Group” and similar designations refer to Akari Therapeutics, Plc and its subsidiaries. All references to “parent company” refer to Akari Therapeutics, Plc excluding its subsidiaries.

The directors present their report and the audited financial statements for the year ended 31 December 2017.

PRINCIPAL ACTIVITY

The principal activity of the Group is developing inhibitors of acute and chronic inflammation, specifically the complement system, the eicosanoid system and the bioamine system for the treatment of rare and orphan diseases.

DIRECTORS

The directors who served the company during the year and up to the date of signing the Annual Report were as follows:

G Roshwalb (resigned 29 May 2017)

R Prudo-Chlebosz

C Richardson

J Hill

S Ungar

D Byrne

R Ward

D Williams

D Solomon (appointed 28 August 2017, resigned 8 May 2018)

M Grissinger (appointed 23 January 2018)

P Feldschreiber (appointed 23 January 2018)

SUPPLIER PAYMENT POLICY

It is the Group’s policy to agree to commercial terms with its suppliers prior to purchase of goods or services. The Group negotiates favourable payment terms where possible.

CORPORATE GOVERNANCE

The Group is not required to implement the provisions of the UK Corporate Governance Code (the “Code”).

Regular board meetings are held and the Executive Directors are heavily involved in the day to day running of the business. The Board of Directors meets regularly and is responsible for formulating strategy, monitoring financial performance and approving material items of expenditure.

GOING CONCERN

The Group meets its day-to-day working capital requirements through funding. The Group’s forecast and projections, show that at present, the Group has insufficient working capital to fulfil its current business plan for the next twelve months from the date of approval of the financial statements without the Group raising additional capital. However, the Group also has the option to revise its plan including reducing the scale of its operations and pace of development, to reduce discretionary costs to ensure its cost and liabilities are met from existing working capital resources. Therefore, having reviewed the Group’s forecast and projections, and having made appropriate enquiries, the Directors have a reasonable expectation that the Group has sufficient funding and adequate resources to continue operationally for at least 12 months from the date of this Annual Report. The Group therefore continues to adopt the going concern basis for the preparation of the consolidated financial statements.

| AKARI THERAPEUTICS PLC |

| |

| DIRECTORS’ REPORT (continued) |

| |

| FOR THE YEAR ENDED 31 DECEMBER 2017 |

| |

| |

| STATEMENT OF DIRECTORS’ RESPONSIBILITIES |

The directors are responsible for preparing the Annual Report and the financial statements in accordance with applicable laws and regulations.

Company law requires the directors to prepare group and parent company financial statements for each financial year. Under that law the directors are required to prepare the group financial statements in accordance with International Financial Reporting Standards (“IFRS”) as adopted by the EU. Under company law the directors must not approve the financial statements unless they are satisfied that they give a true and fair view of the state of affairs of the Group and the Company and the profit or loss of the Group for that period.

The Group financial statements are required by law and IFRS as adopted by the EU to present fairly the financial position and performance of the group; the Companies Act 2006 provides in relation to such financial statements that references in the relevant part of that Act to financial statements giving a true and fair view are references to their achieving a fair presentation. The parent company financial statements are required by law to give a true and fair view of the state of affairs of the parent company.

In preparing these financial statements the directors are required to:

| · | select suitable accounting policies and then apply them consistently; |

| · | make judgements and accounting estimates that are reasonable and prudent; |

| · | state whether they have been prepared in accordance with IFRS as adopted by the EU subject to any material departures disclosed and explained in the financial statements; and |

| · | prepare the financial statements on the going concern basis unless it is inappropriate to presume that the Group and the parent company will continue in business. |

The directors are responsible for keeping proper accounting records which disclose with reasonable accuracy at any time the financial position of the Group and parent company and to enable them to ensure that the financial statements comply with the Companies Act 2006 and Article 4 of the IAS Regulation. They have general responsibility for taking such steps as are reasonably open to safeguard the assets of the Group and parent company and to prevent and detect fraud and

other irregularities.

The directors consider that the Annual Report, taken as a whole, is fair, balanced and understandable and provides the information necessary for shareholders to assess the Group’s performance, business model and strategy.

DISCLOSURE OF INFORMATION TO AUDITORS

So far as each of the directors is aware at the time the report is approved:

| · | there is no relevant audit information of which the Group’s auditors are unaware; and |

| · | the directors have taken all steps that they ought to have taken to make themselves aware of any relevant audit information and to establish that the auditors are aware of that information |

This report was approved by the board on 3 August 2018

and signed on its behalf.

| /s/ Clive Richardson | |

| Clive Richardson | |

| Director | |

| AKARI THERAPEUTICS PLC |

| |

| STRATEGIC REPORT |

| |

| FOR THE YEAR ENDED 31 DECEMBER 2017 |

| |

| |

| REVIEW OF BUSINESS |

We are a clinical-stage biopharmaceutical company focused on developing inhibitors of acute and chronic inflammation, specifically the complement system, the eicosanoid or leukotriene system and the bioamine system for the treatment of rare and orphan diseases. Each of these systems has scientifically well-supported causative roles in the diseases being targeted by us. We believe that blocking early mediators of inflammation will prevent initiation and continual amplification of the processes that cause certain diseases.

Ticks have undergone 300 million years of natural selection to produce inhibitors that bind tightly to key highly-conserved inflammatory mediators, are generally well tolerated in humans, and remain fully functional when a host is repeatedly exposed to the molecule. Our molecules are derived from these inhibitors.

Our lead product candidate, Coversin, which is a second-generation complement inhibitor, acts on complement component-C5, preventing release of C5a and formation of C5b–9 (also known as the membrane attack complex, or MAC), and independently also inhibits leukotriene B4, or LTB4, activity, both elements that are co-located as part of the immune/inflammatory response. Coversin is a recombinant small protein (16,740 Da) derived from a protein originally discovered in the saliva of the Ornithodoros moubata tick, where it modulates the host immune system to allow the parasite to feed without alerting the host to its presence or provoking an immune response.

Coversin has received orphan drug status from the U.S. Food and Drug Administration, or the FDA, and the European Medicines Agency, or the EMA, for paroxysmal nocturnal haemoglobinuria, or PNH, and Guillain Barré Syndrome, or GBS. Orphan drug designation provides us with certain benefits and incentives, including a period of marketing exclusivity if regulatory approval of the drug is ultimately received for the designated indication. The receipt of orphan drug designation status does not change the regulatory requirements or process for obtaining marketing approval and the designation does not mean that marketing approval will be received. We intend to apply in the future for orphan drug designation in additional indications we deem appropriate.

On 29 March 2017, we received notice from the U.S. Food and Drug Administration (FDA) of fast track designation for the investigation of Coversin for the treatment of PNH in patients who have polymorphisms conferring Soliris® (eculizumab) resistance. The fast track program was created by the FDA to facilitate the development and expedite the review of new drugs which show promise in treating a serious or life-threatening disease and address an unmet medical need. Drugs that receive this designation benefit from more frequent communications and meetings with the FDA to review the drug’s development plan including the design of the proposed clinical trials, use of biomarkers and the extent of data needed for approval. Drugs with fast track designation may also qualify for priority review to expedite the FDA review process, if relevant criteria are met.

Our initial clinical targets for Coversin are PNH and atypical Hemolytic Uremic Syndrome, or aHUS. We are also targeting patients with polymorphisms of the C5 molecule which interfere with correct binding of eculizumab, a C5 inhibitor currently approved for PNH and aHUS treatment, making these patients resistant to treatment with that drug. In addition to disease targets where complement dysregulation is the key driver, we are also targeting a range of inflammatory diseases where the inhibition of both C5 and LTB4 are implicated, including bullous pemphigoid (a blistering disease of the skin), or BP, and atopic keratoconjunctivitis, or AKC.

Other compounds in our pipeline include engineered versions of Coversin that potentially decrease the frequency of administration, improve potency, or allow for specific tissue targeting, as well as new proteins targeting LBT4 alone, as well as bioamine inhibitors (for example, anti-histamines). In general, these inhibitors act as ligand binding compounds, which may provide additional benefit versus other modes of inhibition. For example, off-target effects are less likely with ligand capture. One example of this benefit is seen with LTB4 inhibition through ligand capture. LTB4 acts to amplify the inflammatory signal by bringing and activating white blood cells to the area of inflammation. Compounds that have targeted the production of leukotrienes will inhibit both the production of pro-inflammatory as well as anti-inflammatory leukotrienes—often diminishing the potential benefit of the drug on the inflammatory system. Coversin has demonstrated that, by capturing LTB4, it is limited to disrupting the white blood cell activation and attraction aspects, without interfering with the anti-inflammatory benefits of other leukotrienes.

| AKARI THERAPEUTICS PLC |

| |

| STRATEGIC REPORT (continued) |

| |

| FOR THE YEAR ENDED 31 DECEMBER 2017 |

| |

REVIEW OF BUSINESS (CONTINUED)

Coversin is much smaller than typical antibodies currently used in therapeutic treatment. Coversin can be self-administered by subcutaneous injection, much like an insulin injection, which we believe will provide considerable benefits in terms of patient convenience. We believe that the subcutaneous formulation of Coversin as an alternative to intravenous infusion may accelerate patient uptake if Coversin is approved by regulatory authorities for commercial sale. Patient surveys contracted by us suggest that many patients would prefer to self-inject daily than undergo intravenous infusions. Additionally, Coversin’s bio-physical properties allow it to be potentially used in a variety of formulations, some of which may enable therapeutic use via topical or inhaled routes of administration.

Further information about our business can be found in our Annual Report on Form 20-F filed with the Securities and Exchange Commission, or SEC, on July 18, 2018.

On 27 April 2017, we issued a press release stating that Edison Investment Research Ltd., or Edison, has withdrawn its report issued 26 April 2017 titled “Akari’s Coversin matches Soliris in Phase II”, or the “Edison Report”, because it contains material inaccuracies, including without limitation, with respect to our interim analysis of our ongoing Phase II PNH trial of Coversin. Investors were cautioned not to rely upon any information contained in the Edison Report and instead were directed to our press release issued on 24 April 2017 that discusses the interim analysis of our then ongoing Phase II PNH trial and other matters. Our Board of Directors established an ad hoc special committee of the Board to review the involvement, if any, of our personnel with the Edison Report, which was later retracted. Edison was retained by the Company to produce research reports about us. While that review was pending, Dr. Gur Roshwalb, a former Chief Executive Officer, was placed on administrative leave and Dr. Ray Prudo in his role as Executive Chairman temporarily assumed Dr. Roshwalb’s duties in his absence. Following that review, we determined that the Edison Report was reviewed and approved by Dr. Roshwalb, in contravention of Company policy. On 29 May 2017, Dr. Roshwalb submitted his resignation as Chief Executive Officer and member of our Board of Directors, effective immediately.

On 12 May 2017, a putative securities class action captioned Derek Da Ponte v. Akari Therapeutics, PLC, Gur Roshwalb, and Dov Elefant (Case 1:17-cv-03577) was filed in the U.S. District Court for the Southern District of New York against us, a former Chief Executive Officer and our Chief Financial Officer. The plaintiff asserted claims alleging violations of Sections 10(b) and 20(a) of the Securities Exchange Act of 1934, or the Exchange Act, based primarily on our press releases or statements issued between 24 April 2017 and 11 May 2017 concerning the Phase II PNH trial of Coversin and the Edison Report about us and actions taken by us after the report was issued. The purported class covers the period from March 30, 2017 to May 11, 2017. The complaint seeks unspecified damages and costs and fees. On May 19, 2017, an almost identical class action complaint captioned Shamoon v. Akari Therapeutics, PLC, Gur Roshwalb, and Dov Elefant (Case 1:17-cv-03783) was filed in the same court. On 11-12 July 2017, candidates to be lead plaintiff filed motions to consolidate the cases and appoint a lead plaintiff. On 10 August 2017, the court issued a stipulated order: (i) consolidating the class actions under the caption In re: Akari Therapeutics, PLC Securities Litigation (Case 1:17-cv-03577); and (ii) setting out schedule for plaintiffs to file a consolidated amended complaint and defendants to respond thereto. By order dated 7 September 2017, the court appointed lead plaintiffs for the class and lead plaintiffs’ counsel. On 6 November 2017, lead plaintiffs filed a consolidated amended complaint, or the CAC. While the CAC contains similar substantive allegations to the initial complaints, it adds two additional defendants, Ray Prudo and Edison Investment Research Ltd., and the purported class period was changed to 24 April 2017 through 30 May 2017. On 10 January 2018, at a hearing regarding the defendants’ impending motions to dismiss the CAC, the Court gave plaintiffs permission to file a second consolidated amended complaint, or the SCAC and established a briefing schedule for defendants’ motions to dismiss the SCAC. Pursuant to that schedule, plaintiffs’ SCAC was filed on January 31, 2018. All briefing on the motions to dismiss was completed on 20 April 2018. On 9 May 2018, the parties engaged in a mediation session and came to an agreement in principle to settle the dispute. On 8 June 2018, the parties entered into a memorandum of understanding. A memorandum of understanding is not a definitive settlement agreement, which must be approved by the Court. By the terms of the memorandum, the parties agreed in principle to a total payment of $2.7 million in cash. We recorded the $2.7 million CAC litigation settlement loss in the consolidated statement of comprehensive loss in the year ended 31 December 2017, which is the period in which the lawsuits were originally filed. The $2.7 million CAC settlement liability was recorded as a loss contingency in accrued expenses in our consolidated balance sheets as of 31 December 2017. We expect the full amount of the litigation settlement loss to be covered by our directors’ and officers’ liability insurance. On 26 July 2018, plaintiffs filed a notice with the Court voluntarily dismissing Edison from the action. On 3 August 2018, the remaining parties executed and filed a stipulation and agreement of settlement (which largely tracked the parties’ agreement in the memorandum of understanding), and plaintiffs filed a motion seeking preliminary approval of the parties’ settlement. The motion for preliminary approval of the settlement is the first step in gaining the Court’s approval of the settlement.

| AKARI THERAPEUTICS PLC |

| |

| STRATEGIC REPORT (continued) |

| |

| FOR THE YEAR ENDED 31 DECEMBER 2017 |

| |

REVIEW OF BUSINESS (CONTINUED)

Separately, Edison has sought indemnification from us pursuant to its contract with us, including reimbursement of all legal expenses that Edison incurs in connection with the securities class action (to which, as discussed above, Edison was added as a defendant on 6 November 2017) and lost profits from customer relationships that Edison claims it lost as a result of the retraction of the Edison Report. The parties have come to an agreement in principle to settle the dispute. The settlement amount is expected to be immaterial to our operations and future cash flows. The parties are in continued discussions regarding finalizing a settlement.

We voluntarily reported to the SEC the circumstances leading to the withdrawal of the Edison Report and the outcome of our special committee’s investigation. In response, the SEC requested certain documents from us with respect to the matters we reported. We have been cooperating with the SEC’s requests for information. On 5 June 2018, we received a subpoena from the SEC, which requested further documents and information primarily related to our Phase II clinical trial of Coversin in connection with an investigation of us that the SEC is conducting. We are in the process of responding to the subpoena and will continue to cooperate with the SEC.

RESULTS AND DIVIDENDS

Research and development expenses for the year ended 31 December 2017 were $23,285,000 (2016: $17,884,000). This $5,401,000 increase was primarily due to higher expenses of approximately $1,457,000 for manufacturing, $1,633,000 for clinical trial expenses, $988,000 for consulting expense, $929,000 for personnel expenses and $134,000 for stock-based non-cash compensation expense.

Administrative expenses for the year ended 31 December 2017 were $11,799,000 (2016: $9,941,000). This $1,858,000 increase was primarily due to higher expenses of approximately $2,276,000 for legal, accounting and professional fees, $574,000 of personnel expenses and $276,000 of recruiting expenses offset by $1,332,000 for stock-based non-cash compensation expense.

Litigation settlement loss for the year ended 31 December 2017 was $2,700,000. This relates to a proposed settlement agreement of our securities class action lawsuit. The parties are in the process of documenting the settlement which will be presented to the court for approval.

Net cash used in operating activities for the year ended 31 December 2017 was $31,594,000 (2016: $24,614,000). Net cash flow used in operating activities was primarily attributed to our ongoing research activities to support Coversin, including manufacturing, clinical trial and preclinical activities.

Net cash provided by investing activities for the year ended 31 December 2017 was $9,985,000 (2016: net cash used of $10,067,000). This is cash derived from the maturities of short-term investments compared to cash used in investing activities during the prior year.

Net cash provided by financing activities was $15,672,000 during the year ended December 31, 2017. In the year ended 31 December 2016 there was no financing activity.

Cash, cash equivalents, and short-term investments decreased to approximately $28,249,000 at 31 December 2017 (2016: $34,241,000).

The Group made a loss of $29,239,000 (2016: $26,224,000). The loss for the Group is in line with the expected performance and the Directors are satisfied with the results for the year.

No dividends were paid during the year (2016: $Nil) and the directors do not propose a final dividend.

| AKARI THERAPEUTICS PLC |

| |

| STRATEGIC REPORT (continued) |

| |

| FOR THE YEAR ENDED 31 DECEMBER 2017 |

| |

| |

| PRINCIPAL RISKS AND UNCERTAINTIES |

Financing

The Group requires additional funding to continue its future operations and planned research and development activities. The directors recognise that the Group may not be able to obtain financing on favourable terms and the terms of the Group’s finance arrangements may be dilutive. The Group may also seek additional funding through arrangements with collaborators and other third parties. These types of arrangements may require the Group to relinquish rights to internally developed technology, product candidates or products. If the Group is unable to obtain additional funding on a timely basis, the Group may be required to curtail or terminate some or all of its research or development programs, including some or all of its product candidates. Additionally, the report of the Group’s independent registered public accounting firm on its financial statements for the period ended December 31, 2017, includes an explanatory paragraph raising substantial doubt about its ability to continue as a going concern as a result of recurring losses from operations and net capital deficiency. The Group’s future is dependent upon its ability to obtain financing in the future. This opinion could materially limit the Group’s ability to raise funds.

Early stage development

The Group is an early stage development Group with limited history of trading on which future projections can be based. There is no guarantee that the Group will succeed in growing its current business or that the Group will be able to provide or maintain sufficient resources required for operations in the development and introduction of its products. A large majority of early stage development companies fail to achieve their business plans mainly due to lack of being able to estimate the speed of new market entrants and the costs associated with entering markets and obtaining market share.

Drug development

The Group’s approach to drug development is complex and all of the product candidates are in an early stage of development with a high risk of failure. It is impossible to predict when or if any of the product candidates will prove effective or safe in humans or will receive regulatory approval.

Further common challenges for similar companies and the Group is to:

| · | Find a stable active product or formulation without extensive clinical trials and substantial additional costs or create adequate assay for the products for formulation or clinical testing purposes; |

| · | Manufacture, and/or formulate sufficient amounts of its product candidates or upscale or optimise such synthesis so as to enable efficient production of scale; |

| · | Find safe and effective doses and dose ratios for its product candidates without extensive clinical trials and substantial additional costs; |

| · | Obtain sufficient supply or quality of product candidates supply or materials to produce product candidates or other materials necessary to conduct clinical trials; and |

| · | Establish manufacturing capabilities or enter into agreements with third parties to supply materials to make product candidates, or manufacture clinical trial drug supplies. |

| AKARI THERAPEUTICS PLC |

| |

| STRATEGIC REPORT (continued) |

| |

| FOR THE YEAR ENDED 31 DECEMBER 2017 |

| |

| |

| PRINCIPAL RISKS AND UNCERTAINTIES (CONTINUED) |

Departure of and search for executive officers

The Group’s success depends on its ability to hire and retain the services of its current executive officers, directors, principal consultants and others. In addition, the Group has established relationships with universities and research institutions which have historically provided, and continue to provide, us with access to research laboratories, clinical trials, facilities and patients. The loss of the services of any of these individuals or institutions has had and could have a material adverse effect on the Group’s business. On 8 May 2018, David Horn Solomon resigned as Chief Executive Officer and member of the Company’s board. Dr. Solomon’s resignation followed the results of an investigation conducted, with the assistance of an independent law firm, which revealed that Dr. Solomon incurred personal charges on the Company’s corporate credit cards in violation of Company policy. Clive Richardson, who was then serving as the Company’s Chief Operating Officer, was appointed to serve as the Company’s Interim Chief Executive Officer while we seek a permanent Chief Executive Officer. Previously, in December 2017 the Company’s former Chief Legal & Compliance Officer was terminated without cause and in May 2017 the Company’s former Chief Executive Officer who preceded David Horn Solomon also resigned. The Group faces significant competition for executives with the qualifications and experience it is seeking. There can be no assurances concerning the timing or outcome of the Group’s search for a new permanent Chief Executive Officer or any other executive officer.

Pending Class Action Lawsuit and SEC Investigation

As described above, the Group is currently subject to a putative class action asserting violations of certain U.S. securities laws as well as other related claims. As a result of this, the Group may be required to pay substantial damages, incur substantial costs not covered by directors’ and officers’ liability insurance, suffer a significant adverse impact on the Group’s reputation, and management’s attention and resources may be diverted from other priorities, including the execution of business plans and strategies that are important to the Group’s ability to grow the Group’s business, any of which could have a material adverse effect on the Group’s business. In addition, as described above, the Group is subject to an SEC investigation. The Group cannot predict what, if any, actions the SEC may take or the timing or duration of the investigation. If the Group were to conclude that enforcement action is appropriate, the Group could be required to pay civil penalties and fines, and the SEC could impose other sanctions against the Group or against our current and former officers and directors. In addition, the Group’s board of directors, management and employees may expend a substantial amount of time on the SEC investigation, diverting resources and attention that would otherwise be directed toward our operations and implementation of Group business strategy, all of which could materially adversely affect the Group’s business, financial condition, results of operations or cash flows. Furthermore, while the SEC has informed the Group that the investigation should not be construed as an indication by the SEC or its staff that any violation of law has occurred, nor as a reflection upon any person, entity or security, publicity surrounding the foregoing, or any SEC enforcement action or settlement as a result of the SEC’s investigation, even if ultimately resolved favorably for the Group, could have an adverse impact on the Group’s reputation, business, financial condition, results of operations or cash flows.

Market acceptance

The Group is not guaranteed that any of its product candidates will gain market acceptance amongst physicians, patients, healthcare providers, pharmaceutical companies or other customers.

The Group’s clinical trials in humans may show that the doses or dose ratios selected based on screening, animal testing or early clinical trials do not achieve the desired therapeutic result in humans, or achieve these results only in a small part of the population. The U.S. Food and Drug Administration (“FDA”) or other regulatory agencies in the United States and foreign jurisdictions may determine that these clinical trials do not support the Group’s conclusion. The Group may be required to conduct additional long-term clinical studies and provide more evidence substantiating the safety and effectiveness of the doses or dose ratios selected in a significant patient population.

Intense competition from powerful competitors

Many companies, universities and research organisations developing product candidates have greater resources and significantly greater experience in financial, research and development, manufacturing, marketing, sales, distribution and technical regulatory matters than the Group has. These competitors could commence and complete clinical testing of their products, obtain regulatory approval, and begin commercial-scale manufacturing of their products faster than the Group is able to, thus resulting in a situation whereby the Group may not be able to commercialise its product candidates or achieve a competitive position in the market.

| AKARI THERAPEUTICS PLC |

| |

| STRATEGIC REPORT (continued) |

| |

| FOR THE YEAR ENDED 31 DECEMBER 2017 |

| |

| |

| PRINCIPAL RISKS AND UNCERTAINTIES (CONTINUED) |

Product liability exposure

The Group faces exposure to product liability and other claims if its product candidates, products or processes are alleged to have caused harm. These risks are inherent in testing, manufacturing, and marketing human therapeutic products. If the Group is sued for any injury caused by its products, product candidates or processes, the Group’s liability could exceed its product liability insurance coverage and its total assets. Claims against the Group, regardless of their merit or potential outcome, may also generate negative publicity or damage the Group’s ability to obtain physician endorsement of its products or expand its business.

Intellectual Property

The Group may be unable to protect the intellectual property relating to its product candidates, or if it infringes the rights of others, its ability to successfully commercialise its product candidates may be harmed. The Group owns or hold licenses to a number of issued patents (foreign and foreign counterparts) and pending patent applications. The Group’s success depends in part on its ability to obtain patent protection both in the United States and in other countries for its product candidates, as well as the methods for treating patients in the product indications using these product candidates. The Group’s ability to protect its product candidates from unauthorised or infringing use by third parties depends in substantial part on its ability to obtain and maintain valid and enforceable patents. Due to evolving legal standards relating to the patentability, validity and enforceability of patents covering pharmaceutical inventions and the scope of claims made under these patents, the Group’s ability to obtain, maintain and enforce patents is uncertain and involves complex legal and factual questions. Even if the Group’s product candidates, as well as methods for treating patients for prescribed indications using these product candidates are covered by valid and enforceable patents and have claims with sufficient scope, disclosure and support in the specification, the patents will provide protection only for a limited amount of time. Accordingly, rights under any issued patents may not provide the Group with sufficient protection for a commercial advantage against competitive products or processes

Material Weaknesses in Internal Controls and Ineffective Disclosure Controls

The Group identified material weaknesses in its internal control over financial reporting, and concluded that its internal control over financial reporting was not effective as of December 31, 2017 as a result of its former Chief Executive Officer violating its Code of Conduct and Ethics by utilizing the Company credit card for personal expenses and exceeding his delegation of authority by entering into unauthorized agreements with third parties and having ineffective internal controls related to the evaluation of the accounting principles and disclosure requirements for loss contingencies. Any failure to maintain internal control over financial reporting could severely inhibit the Group’s ability to accurately report its financial condition, results of operations or cash flows. Additionally, the Group’s management has concluded that its disclosure controls and procedures for the fiscal year ended December 31, 2017 were not effective for the fiscal year ended December 31, 2017 due to the material weaknesses noted above. If the Group does not effectively remediate the material weaknesses identified, it may not be able to accurately report its financial condition, results of operations or cash flows on a timely basis, which may adversely affect investor confidence in the Group.

Liquidity and Public Listing

Historically, a limited public market exists for the Group’s securities and it cannot assure that its securities will continue to be listed on the NASDAQ Capital Market or any other securities exchange or that an active trading market will ever develop for any of its securities. The Group’s ADSs were approved for listing on the NASDAQ Capital Market on 31 January 2014. The Group cannot assure that it will be successful in meeting the continuing listing standards of the NASDAQ Capital Market. On 17 May 2018 the Group received a notice from NASDAQ notifying the Group that it is not in compliance with the requirements for continued listing set forth in Nasdaq listing Rule 5250©(1) because it did not timely file its Annual Report on Form 20-F for the year ended 31 December 2017. On 19 July 2018 the Group received a notice from NASDAQ notifying the Group that it is now in compliance with the requirements for continued listing set forth in Nasdaq listing Rule 5250©(1) because it filed its Annual Report on Form 20-F for the year ended 31 December 2017.

More detailed information about the risks and uncertainties affecting us is contained under the heading "Risk Factors" included in our Annual Report on Form 20-F filed with the SEC on July 18, 2018 and in other filings that we have made and may make with the SEC in the future.

| AKARI THERAPEUTICS PLC |

| |

| STRATEGIC REPORT (continued) |

| |

| FOR THE YEAR ENDED 31 DECEMBER 2017 |

| |

| |

| FINANCIAL INSTRUMENTS |

The Group finances its operations using cash generated by the sale of equity instruments in the Group. The cash flow of the Group is monitored on a regular basis to ensure the Group has sufficient funding to meet its capital and operational requirements.

RESEARCH AND DEVELOPMENT

The Group is a clinical-stage biopharmaceutical company focused on developing inhibitors of acute and chronic inflammation, specifically the complement system, the eicosanoid system and the bioamine system for the treatment of rare and orphan diseases.

KEY PERFORMANCE INDICATORS

The directors consider the key performance indicators to be the research and development spend. This allows the Directors to manage the on-going activities and strategies for further development of the Group.

The key performance indicators are measured and reviewed on a regular basis at Board meetings and enable the Directors to communicate the performance of the Group against predetermined targets.

Key financial performance indicators:

Research and Development spend - $23,285,000 (2016: $17,884,000)

Cash, cash equivalents and short-term investments position - $28,249,000 (2016: $34,241,000)

This report was approved by the board on 3 August 2018 and signed on its behalf.

| /s/ Clive Richardson | |

| Clive Richardson | |

| Director | |

| 3 August 2018 | |

AKARI THERAPEUTICS PLC |

| |

| DIRECTORS’ REMUNERATION REPORT |

| |

| FOR THE YEAR ENDED 31 DECEMBER 2017 |

| |

PART I - ANNUAL REPORT ON REMUNERATION

Information provided in this section of the Directors’ Remuneration report is subject to audit.

Single Total Figure of Remuneration for Each Director (subject to audit)

The following table shows the compensation paid or accrued during the fiscal year ended 31 December 2017.

| Name of Director | Salary

and Fees

($) | Taxable

Benefits

($) | Bonus

($) | Stock

Awards

($) | Option

Awards

($)(1) | Pension

Benefits

($) | 2017 Total

($) |

| Executive Director |

| Ray Prudo (2) | 206,000 | - | 103,000 | - | - | - | 309,000 |

| David Solomon (3) | 173,611 | 4,129 | 119,041 | - | 654,459 | - | 951,240 |

| Gur Roshwalb, M.D. (4) | 193,263 | 13,620 (5) | - | - | - | - | 206,883 |

| Clive Richardson | 332,507 | 9,793 (6) | 135,991 | - | 113,272 | 32,650 (7) | 624,213 |

| Non-Employee Director |

| James Hill, M.D. | 56,840 | - | - | - | 42,983 | - | 99,823 |

| Stuart Ungar, M.D. | 46,690 | - | - | - | 42,983 | - | 89,673 |

| David Byrne | 46,555 | - | - | - | 42,983 | - | 89,538 |

| Donald Williams | 51,765 | - | - | - | 42,983 | - | 94,748 |

| Robert Ward | 45,451 | - | - | - | 42,983 | - | 88,434 |

(1) These amounts represent the aggregate grant date fair value for option awards for fiscal year 2017 computed in accordance with FASB ASC Topic 718. A discussion of the assumptions used in determining grant date fair value may be found in Akari’s Financial Statements, included in Akari’s Annual Report on Form 20-F for the year ended 31 December 2017.

(2) Dr. Prudo is party to a non-executive contract although he performs executive duties on behalf of Akari.

(3) Dr Solomon was appointed as our Chief Executive Officer on 28 August 2017 and resigned as chief Executive Officer on 8 May 2018

(4) Dr. Roshwalb resigned as Chief Executive Officer on 29 May 2017.

(5) Consists of company contributions to health benefits.

(6) Consists of company contributions to health benefits of $7,633 and life insurance premiums of $2,160.

(7) Consists of company contributions to a pension plan.

The following table shows the compensation paid or accrued during the fiscal year ended 31 December 2016.

| Name of Director | Salary

and Fees

($) | Taxable

Benefits

($) | Bonus

($) | Stock

Awards

($) | Option

Awards

($)(1) | Pension

Benefits

($) | 2016 Total

($) |

| Executive Director |

| Ray Prudo(2) | 200,000 | - | 150,000 | - | - | - | 350,000 |

| Gur Roshwalb, M.D. | 375,000 | 28,925 (3) | 187,500 | - | - | 18,750(4) | 581,250 |

| Clive Richardson | 282,178 | 8,757 (5) | 129,167 | - | - | 33,225(6) | 446,160 |

| Non-Employee Director |

| James Hill, M.D. | 58,249 | - | - | - | 126,226 | - | 184,475 |

| Stuart Ungar, M.D. | 50,770 | - | - | - | 126,226 | - | 176,996 |

| David Byrne (7) | 21,683 | - | - | - | 278,636 | - | 300,319 |

| Donald Williams (8) | 25,500 | - | - | - | 248,898 | - | 274,398 |

| Robert Ward (9) | 10,880 | - | - | - | 69,062 | - | 79,942 |

| Mark S. Cohen(10) | 60,749 | - | - | - | 195,287 | - | 256,036 |

| Allan Shaw (11) | 25,290 | - | - | - | - | - | 25,290 |

(1) These amounts represent the aggregate grant date fair value for option awards for fiscal year 2016 computed in accordance with FASB ASC Topic 718. A discussion of the assumptions used in determining grant date fair value may be found in Akari’s Financial Statements, included in Akari’s Annual Report on Form 20-F for the year ended 31 December 2016.

(2) Dr. Prudo is party to a non-executive contract although he performs executive duties on behalf of Akari.

(3) Consists of company contributions to health benefits.

| AKARI THERAPEUTICS PLC |

| |

| DIRECTORS’ REMUNERATION REPORT (continued) |

| |

| FOR THE YEAR ENDED 31 DECEMBER 2017 |

| |

(4) Consists of company contributions to a 401K plan.

(5) Consists of company contributions to health benefits of $7,167 and life insurance premiums of $1,590.

(6) Consists of company contributions to a pension plan.

(7) Mr. Byrne was appointed to the board as a Class A director on 20 April 2016.

(8) Mr. Williams was appointed to the board as a Class A director on 30 June 2016.

(9) Mr. Ward was appointed to the board as a Class A director on 13 October 2016.

(9) Mr. Cohen resigned as a Class C director on 13 October 2016. In connection with Mr. Cohen’s resignation, Akari and Mr. Cohen agreed that Mr. Cohen’s (i) outstanding unvested stock options from 25 November 2015 and 29 June 2016 in the amounts of 1,028,722 and 1,300,000 ordinary shares, respectively, shall be fully vested as of 13 October 2016, and (ii) vested options (including those whose vesting accelerated pursuant to the preceding clause) shall continue to be exercisable for a period ending on the earlier of (1) 10 years following the respective dates of grant of such options, or (2) three months following Akari’s 2018 AGM. In addition, Akari agreed to (i) grant Mr. Cohen an additional option to purchase 1,300,000 fully vested ordinary shares (equivalent to 13,000 ADS) at an exercise price of $0.080621 per share (or $8.0621 per ADS) and which can be exercised until three months following the 2018 AGM, and (ii) pay Mr. Cohen, in quarterly instalments, $45,750 for the balance of director fees that he would have earned through the 2017 AGM and an additional $61,000 that he would have earned in director fees from the 2017 AGM to the 2018 AGM.

(10) Mr. Shaw’s term as a Class A director expired on 29 June 2016. As of 31 December 2016, all previously granted options to Mr. Shaw expired without exercise.

Incentive Plan Awards (subject to audit)

Akari operates an equity incentive plan (the 2014 Equity Incentive Plan, or 2014 Plan) under which directors receive options to acquire ordinary shares in Akari. Options awards granted during the fiscal year ended 31 December 2017 are as follows:

| Name of Director | Option

Awards(1) | Grant Date | Exercise

Price | Option Awards ($) (2) |

| James Hill, M.D | 1,300,000 | 28/6/2017 | $0.0504 | 42,983 |

| Stuart Ungar, M.D | 1,300,000 | 28/6/2017 | $0.0504 | 42,983 |

| David Byrne | 1,300,000 | 28/6/2017 | $0.0504 | 42,983 |

| Donald Williams | 1,300,000 | 28/6/2017 | $0.0504 | 42,983 |

| Robert Ward | 1,300,000 | 28/6/2017 | $0.0504 | 42,983 |

(1) Option awards are subject to time-based vesting.

(2) These amounts represent the aggregate grant date fair value for option awards for fiscal year 2017 computed in accordance with FASB ASC Topic 718. A discussion of the assumptions used in determining grant date fair value may be found in Akari’s Financial Statements, included in Akari’s Annual Report on Form 20-F for the year ended 31 December 2017.

Director’s shareholdings (subject to audit)

The table below shows, for each director, the total number of ordinary shares owned, the total number of share options held and the number of share options vested within 60 days of 31 May 2018. No director exercised any share options during the year ended 31 December 2017.

| Name of Director | Ordinary Shares Owned | Share Options | Vested Share Options (1) |

| Executive Director |

| Ray Prudo | 782,345,600 (2) | - | - |

| David Solomon (3) | - | 26,000,000 | - |

| Clive Richardson | - | 20,771,850 | 11,186,897 |

| Non-employee Director |

| James Hill, M.D | - | 3,900,000 | 3,543,758 |

| Stuart Ungar, M.D | - | 3,900,000 | 3,537,092 |

| David Byrne | - | 3,900,000 | 3,466,666 |

| Donald Williams | - | 3,900,000 | 3,466,666 |

| Robert Ward | - | 2,600,000 | 2,166,666 |

(1) All share options that were outstanding as at 31 December 2017 use time-based vesting and are not subject to performance targets other than continued service until the date of vesting. None of the options have been exercised.

| AKARI THERAPEUTICS PLC |

| |

| DIRECTORS’ REMUNERATION REPORT (continued) |

| |

| FOR THE YEAR ENDED 31 DECEMBER 2017 |

| |

(2) Represents the entire holdings of RPC Pharma Limited. Dr. Prudo has voting and dispositive control over the ordinary shares held by RPC Pharma Limited and owns approximately 71% of RPC’s outstanding shares (including option grants), including 10.64% of RPC’s outstanding shares held in trust for Dr. Ungar. Dr. Prudo disclaims beneficial ownership except to the extent of his actual pecuniary interest in such shares.

(3) Dr. Solomon was appointed Chief Executive Officer on 28 August 2017 and resigned 8 May 2018.

The remainder of this Directors’ Remuneration Report is not subject to audit.

Illustration of Total Shareholder Return

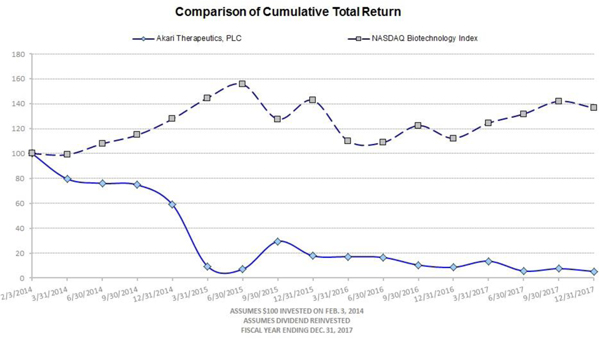

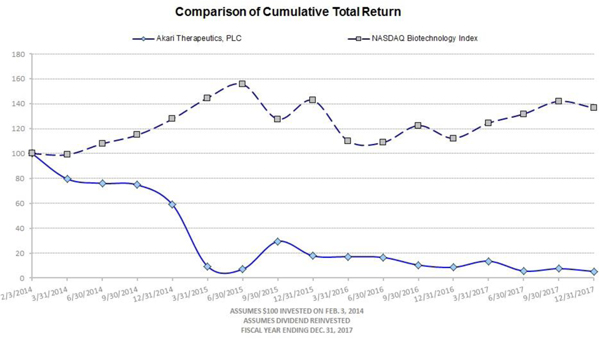

The following graph compares the cumulative total shareholder return on Akari’s ADSs, each representing 100 ordinary shares, with that of the Nasdaq Biotech Index from the period that Akari’s ADSs were publicly traded on The Nasdaq Capital Market through 31 December 2017. Akari selected the Nasdaq Biotech Index because Akari’s ADSs trade on The NASDAQ Capital Market and Akari believes this indicates its relative performance against a group consisting of more similarly situated companies.

Chief Executive Total Remuneration History

The table below sets out total remuneration details for the Chief Executive Officer.

| Period | Single total

figure of remuneration

$ | Annual

Bonus | Short-term

incentive

payout

against

maximum | Option

Awards ($) | Option

Awards

against

maximum

(4) |

| 2017 (Gur Roshwalb and David Solomon) (1) | 1,338,253 | 119,041 (5) | 100% (6) | - | - |

| 2016 (Gur Roshwalb) | 581,250 | 187,500 | 125% (7) | - | - |

| 2015 (Gur Roshwalb) | 7,306,951 | 86,625 | 100% (8) | 6,863,034 | - |

| 2014 (Gur Roshwalb) | 410,564 | - | - | 60,564 | - |

| 2013 (Gur Roshwalb) (2) | 576,389 | - | - | 173,396 | - |

| 2012 (3) | - | - | - | - | - |

| AKARI THERAPEUTICS PLC |

| |

| DIRECTORS’ REMUNERATION REPORT (continued) |

| |

| FOR THE YEAR ENDED 31 DECEMBER 2017 |

| |

| (1) | Dr. Roshwalb resigned as Akari’s Chief Executive Officer on 29 May 2017 and David Solomon was appointed as Akari’s Chief Executive Officer on 28 August 2017 and resigned 8 May 2018. |

| (2) | Dr. Roshwalb was appointed as Akari’s Chief Executive Officer on 4 March 2013. |

| (3) | Akari was not a quoted company in 2012. |

| (4) | All options were awarded on a discretionary basis on an annual basis. |

| (5) | Includes a $50,000 signing bonus. |

| (6) | Bonus was awarded in 2017 but calculated from Dr. Solomon’s appointment on 28 August 2017. |

| (7) | Bonus was awarded in 2016 but calculated for a 15-month period from the date of the acquisition of Volution Immuno Pharmaceutical SA on 18 September 2015. |

| (8) | Bonus was awarded in 2015 but calculated for a 9-month period until the date of the acquisition of Volution Immuno Pharmaceutical SA on 18 September 2015. |

Chief Executive Officer’s Remuneration Compared to Other Employees

The table below shows the percentage change in remuneration of the Chief Executive Officer and Akari’s employees as a whole between the year ended 31 December 2016 and the year ended 31 December 2017.

| | Percentage increase in remuneration in year ended 31 December 2017

compared with remuneration in the year ended 31 December 2016 |

| CEO | All employees |

| Basic Salary | 3% | 47% |

| Annual bonus | (37%) | (1%) |

| Taxable benefits | 5% | 33% |

Relative Importance of Spend on Pay

The following table sets forth the total amounts spent by the Company on remuneration for the year ended 31 December 2017 and the year ended 31 December 2016. Given that Akari remains in the early phases of its business life cycle, the comparator chosen to reflect the relative importance of Akari’s spend on pay is Akari’s research and development costs as shown in its Annual Report on Form 20-F for the year ended 31 December 2017. The Company acquired Volution Immuno Pharmaceuticals SA on 18 September 2015 and as a result spending has increased.

| Period | Year Ended 31 December 2016 $ | Year Ended 31 December 2016 $ (1) |

| Total spend on remuneration | 4,608,190 | 3,145,055 |

| Shareholder distributions | - | - |

| Research and development costs | 23,285,279 | 17,306,001 |

| (1) | Increase was due to increase in headcount and initiation of clinical trials |

Implementation of remuneration policy for year ending 31 December 2018

The following table presents the salary increases agreed for the upcoming fiscal year

Director | 31

December

2017 | 31

December

2018 (1) | Increase

% |

| Executive Director |

| Ray Prudo | $206,000 | $212,180 | 3% (2) |

| David Solomon (3) | $500,000 | $515,000 | 3% (2) |

| | | | |

| Clive Richardson (4) | £252,000 | £259,560 | 3% (2) |

| Non-employee Director |

| James Hill, M.D | $57,680 | $58,792 | 2% (2) |

| Stuart Ungar, M.D | $47,380 | $48,492 | 2% (2) |

| David Byrne | $47,380 | $48,492 | 2% (2) |

| Donald Williams | $52,530 | $53,642 | 2% (2) |

| Robert Ward | $47,380 | $48,492 | 2% (2) |

| AKARI THERAPEUTICS PLC |

| |

| DIRECTORS’ REMUNERATION REPORT (continued) |

| |

| FOR THE YEAR ENDED 31 DECEMBER 2017 |

| |

(1) Additional discretionary bonuses may be awarded in accordance with contractual entitlement and the remuneration policy.

(2) Represents an increase in line with inflation.

(3) Dr. Solomon was appointed Chief Executive Officer on 28 August 2017 and his salary is on annualised basis. Dr Solomon resigned 8 May 2018.

(4) On 8 May 2018, Mr Richardson was appointed interim Chief Executive Officer.

Compensation Committee Approach to Remuneration Matters

The Compensation Committee is comprised of Dr. James Hill (Chairman), Dr. Stuart Ungar, and Mr. David Byrne. All members have continued to serve until the date of this Directors’ Remuneration Report. The charter of the Committee is set forth on Akari’s website at http://www.akaritx.com.

Advice Provided to the Compensation Committee

The Committee retained Willis Towers Watson to provide independent advice and consultation with respect to remuneration arrangements for the Executive Officers, senior management and the Non-Executive Directors. Willis Towers Watson is a global remuneration consultant with a well established reputation for design and implementation of remuneration programmes, including the design and implementation of equity-based award programmes. The amounts paid to Willis Towers Watson in the year ended 31 December 2017 totaled $17,870.

In addition to Willis Towers Watson, the Committee solicited and received input from the Chief Executive Officer concerning the remuneration of senior executives other than himself. The Chief Executive Officer provided recommendations with respect to annual cash bonuses to be paid to these persons for service in the year ended 31 December 2017 and base salary awards effective from 1 January 2018, and with respect to equity-based awards to be made to these persons in January 2018. The Chief Executive Officer also provided input concerning the remuneration packages of senior executives appointed during the year. Finally, the Chief Executive Officer also provided input to the Committee regarding the implementation of equity-based remuneration as an element of all other employees’ remuneration.

Statement of Voting at AGM

Akari is committed to ongoing shareholder dialogue and the Compensation Committee takes an active interest in shareholder views and voting outcomes.

| AKARI THERAPEUTICS PLC |

| |

| DIRECTORS’ REMUNERATION REPORT (continued) |

| |

| FOR THE YEAR ENDED 31 DECEMBER 2017 |

| |

PART II - DIRECTORS’ REMUNERATION POLICY

INFORMATION PROVIDED IN THIS SECTION OF THE DIRECTORS’ REMUNERATION REPORT IS NOT SUBJECT TO AUDIT.

This Directors’ Remuneration Policy (“Policy”) of Akari Therapeutics, Plc (“Akari”) was approved by shareholders at the 2017 Annual General Meeting of Shareholders (“AGM”). The Policy provides a framework for execution of Akari’s compensation framework from the date of its approval at the 2017 AGM and for a period of three years thereafter, unless changes to the Policy are required earlier and a new Policy is put to shareholder vote.

For the avoidance of doubt, in approving the Directors’ remuneration policy, authority is given to Akari to honour any commitments entered into with current or former Directors (such as the payment of a pension, fees or the vesting/exercise of past share option awards).

Akari’s remuneration policy seeks to provide compensation packages which will attract, motivate, reward and retain an executive team with the right calibre of talent, experience, and skills to lead a successful future for Akari. Akari’s compensation framework is designed to provide a competitive package in comparison to companies of similar size, complexity, maturity profile and geographic presence.

The table below sets out the main elements of Akari’s remuneration policy for its Executive Directors and seeks to explain how each element of the compensation package operates:

Policy table – Executive Directors

| Element | Purpose and

link to strategy | Operation | Maximum opportunity | Performance

metrics |

| Base salary | Support the recruitment and retention of Executive Officers | · Base salary levels are set taking into account the role, responsibilities and individual’s experience in the position, performance of the individual and Akari. · Base salaries are typically reviewed annually. | · There is no prescribed maximum increase nor any requirement to increase salary at any time. · By exception, higher increases may be made to reflect individual circumstances. These may include significant changes in the job size or complexity and/or promotion. | · None, although overall performance of the individual is considered when setting and reviewing salaries. |

| Pension | Encourages and enables executives to build savings for their retirement | · Akari typically makes contributions to pension plans (or retirement savings plans) to match prevailing local market practices. | · Currently up to 10% of salary per annum. | · None. |

| Other Benefits | Provide market competitive benefits in a cost-effective way | · Provisions include medical insurance, life assurance, permanent health insurance, etc. · In exceptional circumstances, such as the relocation of an executive or for a new hire, additional benefits may be provided in the form of relocation allowance and benefits. · Other benefits may be offered if considered appropriate and reasonable by the Compensation Committee. | · No prescribed maximum. The cost of benefits will vary from year to year in accordance with the cost of insuring such benefits. | · None. |

| AKARI THERAPEUTICS PLC |

| |

| DIRECTORS’ REMUNERATION REPORT (continued) |

| |

| FOR THE YEAR ENDED 31 DECEMBER 2017 |

| |

| Element | Purpose and

link to strategy | Operation | Maximum opportunity | Performance

metrics |

| Bonus | To reward the delivery of annual targets as well as to recognise the individual contributions towards our key strategic achievements | · Any bonus is paid in cash typically within 60 days after the end of the financial year to which it relates. · Performance objectives and targets are either fixed contractually or set annually and actual payout levels are determined after the year end, based on performance against targets subject to overriding discretion of the Compensation Committee. | · The maximum annual bonus payable for any financial year is capped at 100% of salary, although the Compensation Committee reserves the right to vary this amount in exceptional circumstances. | · Where performance conditions are attached to a bonus payment, targets are either fixed contractually or selected by the Compensation Committee and set annually and can include key financial, operational and/or individual objectives. All assessments of performance against target is made by the Compensation Committee in its sole discretion. |

Equity incentive plan (2014 Equity Incentive Plan) | To motivate and reward long-term performance in alignment with the shareholder interests and value-creation | · Awards may be made periodically to Executive Officers in the form of options or in shares including stock appreciation rights, phantom stock awards or stock units. · Awards typically vest over three or four years and may be subject to phased vesting. | · There is no specific maximum set for annual equity awards. · When making awards, the Compensation Committee will take into account internal grant guidelines, which have been set in reference to local market norms. | · Where performance conditions are attached to an award, these typically include key financial, operational and/or individual objectives subject to overall Compensation Committee discretion. |

CSOP (UK resident employees and directors only) | · Executives are eligible to participate in the all-employee CSOP Plan under the same conditions as all other employees. | · Grant value of £30,000 or local market rules as amended from time to time. | · None. |

| AKARI THERAPEUTICS PLC |

| |

| DIRECTORS’ REMUNERATION REPORT (continued) |

| |

| FOR THE YEAR ENDED 31 DECEMBER 2017 |

| |

Policy table – Non-Executive Directors

Akari’s non-employee compensation policy is administered by its board of directors with the assistance of the Compensation Committee. The Compensation Committee periodically reviews non-employee director compensation policy and makes recommendations to the board.

Non-Executive Directors typically receive an annual retainer paid in cash for their service (depending on their additional membership and chairman responsibilities) and an annual grant of stock options but do not participate in the bonus plan to which Executive Officers are eligible, nor do they typically receive any other performance related payment.

The table below sets out some of the features of Akari’s current non-employee director compensation policy:

| Element | Purpose and link to strategy | Operation | Maximum opportunity | Performance metrics |

| Annual Cash Retainer Fee | Support the recruitment and retention of Non-Executive Directors | · Each Non-Executive Director serving on the Board receives an annual cash retainer, with additional amounts payable for acting as a chairman or a member of various committees. · In addition, the Chairman and Vice Chairman receive an additional cash retainer. · Annual cash retainers are typically payable on a quarterly basis. · A Non-Employee Director may elect to receive annual cash payments in the form of fully-vested ordinary shares. | · There is no prescribed maximum increase nor any requirement to increase salary at any time. | · None. |

| Share options | Strengthens the alignment to shareholders’ interests through share ownership | · Directors typically receive an annual grant of options in the form of market value options under the 2014 Equity Incentive Plan. · These awards typically vest in full on the date of the next AGM following the date of grant, subject to the Non-Executive Director’s continued service on the Board, have a term of 10 years from date of grant, and vesting accelerates in the case of a change of control. | · Normal initial grant and annual grant of share options will be equal to 1,300,000 (or equivalent value of ADS) but the Committee reserves the discretion to review and amend this amount. | · None. |

| AKARI THERAPEUTICS PLC |

| |

| DIRECTORS’ REMUNERATION REPORT (continued) |

| |

| FOR THE YEAR ENDED 31 DECEMBER 2017 |

| |

The foregoing is qualified in its entirety by Akari’s current non-employee director compensation policy, as may be amended from time to time.

Approach to recruitment compensation

Akari’s policy is to pay a fair remuneration package for the role being undertaken and the experience of the individual to be appointed.

Akari expects remuneration packages for Executive Directors to include base salary, targeted level of annual cash incentive, initial and ongoing equity-based awards, standard benefits and special provisions tailored to the recruiting situation, such as: sign-on bonus, reasonable relocation support and make-whole awards for remuneration forfeited from a prior employer (whether on account of cash bonuses, share awards, pension benefits or other forfeited items). The Compensation Committee retains the discretion to provide additional cash, share based payment, benefits and other remuneration where necessary or useful to recruit new Executive Directors or to secure the ongoing service of existing Executive Directors.

The remuneration package for any new non-Executive Director will be set in accordance with the terms of Akari’s non-employee director compensation policy then in effect.

Director’s service contracts

Akari’s board of directors is divided into three classes for purposes of election (Class A Directors, who serve a one year term before being subject to re-election at Akari’s annual general meeting; Class B Directors, who serve a two year term before being subject to re-election at the annual general meeting; and Class C Directors who serve a three year term before being subject to re-election at the annual general meeting, provided also that in any two year period, a majority of the board must stand for re-election).

Service contracts are available for inspection at Akari’s registered office or 75/76 Wimpole Street London W1G 9RT.

Policy on Payments for Loss of Office

Akari’s approach to payments to Executive Directors in the event of termination is to take account of the individual circumstances including the reason for termination, individual performance, contractual obligations and the terms of any option award.

Generally, Akari expects that employment arrangements for any Executive Director will include a notice provision and continuing payment obligations as per the individual Executive Director service contracts following termination by Akari of an Executive Director without cause or termination by the Executive Director for good reason or change of control. Payment obligations could include base salary, benefits, and all or some portion of target annual cash remuneration. Akari may offer payment in lieu of notice if it is considered to be in the best interests of Akari.

Treatment of unvested outstanding equity awards will be determined according to the specific nature of termination, individual contracts, and plan rules.

The Compensation Committee reserves the right to make payments it considers reasonable under a compromise or settlement agreement, including payment or reimbursement of reasonable legal and professional fees, and any payment or compensation (in whatever form) in respect of statutory rights under employment law in the US, UK or other jurisdictions. Payment or reimbursement (in whatever forms) of reasonable outplacement fees may also be provided.

Other relevant information considered

As appropriate, the Compensation Committee considers the pay and conditions of the broader employee workforce when making compensation related decisions for the Directors.

The Compensation Committee also considers shareholder feedback, so far as it relates to compensation, when reviewing of the appropriateness of its Policy.

This report was approved by the board on 3 August 2018 and signed on its behalf.

| /s/ Clive Richardson | |

| Clive Richardson | |

| Director | |

INDEPENDENT AUDITORS REPORT TO THE SHAREHOLDER OF

Opinion

We have audited the financial statements of Akari Therapeutics plc (the ‘parent company’) and its subsidiaries (the ‘group’) for the year ended 31 December 2017 which comprise the income statement, the consolidated balance sheet, the parent company balance sheet, the consolidated statement of changes in shareholders equity, the parent company statement of shareholders equity, the consolidated cash flow statement, the parent company cash flow statement and notes to the financial statements, including a summary of significant accounting policies. The financial reporting framework that has been applied in their preparation is applicable law and International Financial Reporting Standards (IFRSs) as adopted by the European Union.

In our opinion, the financial statements:

• give a true and fair view of the state of the group’s and of the parent company’s affairs as at 31 December 2017 and of the group’s loss for the year then ended;

• have been properly prepared in accordance with IFRSs as adopted by the European Union; and

• have been prepared in accordance with the requirements of the Companies Act 2006.

This report is made solely to the company's members, as a body, in accordance with Chapter 3 of Part 16 of the Companies Act 2006. Our audit work has been undertaken so that we might state to the company's members those matters we are required to state to them in an Auditor's report and for no other purpose. To the fullest extent permitted by law, we do not accept or assume responsibility to anyone other than the company and the company's members as a body, for our audit work, for this report, or for the opinions we have formed.

Basis for opinion

We conducted our audit in accordance with International Standards on Auditing (UK) (ISAs (UK)) and applicable law. Our responsibilities under those standards are further described in the Auditor’s responsibilities for the audit of the financial statements section of our report. We are independent of the group in accordance with the ethical requirements that are relevant to our audit of the financial statements in the UK, including the FRC’s Ethical Standard as applied to listed entities, and we have fulfilled our other ethical responsibilities in accordance with these requirements. We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion.

Conclusions relating to going concern

We have nothing to report in respect of the following matters in relation to which the ISAs (UK) require us to report to you where:

• the directors’ use of the going concern basis of accounting in the preparation of the financial statements is not appropriate; or

• the directors have not disclosed in the financial statements any identified material uncertainties that may cast significant doubt about the group’s or the parent company’s ability to continue to adopt the going concern basis of accounting for a period of at least twelve months from the date when the financial statements are authorised for issue.

Key audit matters

Key audit matters are those matters that, in our professional judgment, were of most significance in our audit of the financial statements of the current period and include the most significant assessed risks of material misstatement (whether or not due to fraud) we identified, including those which had the greatest effect on: the overall audit strategy, the allocation of resources in the audit; and directing the efforts of the engagement team. These matters were addressed in the context of our audit of the financial statements as a whole, and in forming our opinion thereon, and we do not provide a separate opinion on these matters.

| Key audit matter | How the matter was addressed |

Management Override of Controls | · We considered all areas requiring judgement, tested journal entries and incorporated unpredictability into our testing procedures. |

Going Concern | · We reviewed post year end trading activity and discussed with management. · We reviewed the cash flow forecast prepared by management and made enquiries with management on assumptions and judgements made. · We assessed the company’s ability to scale back operations and reduce costs should cash levels become low in the twelve months from the signing of the accounts. |

INDEPENDENT AUDITORS REPORT TO THE SHAREHOLDER OF

Our application of materiality

The scope and focus of our audit was influenced by our assessment and application of materiality. We define materiality as the magnitude of misstatement that could reasonably be expected to influence the readers and the economic decisions of the users of the financial statements. We use materiality to determine the scope of our audit and the nature, timing and extent of our audit procedures and to evaluate the effect of misstatements, both individually and on the financial statements as a whole. Due to the nature of the group we considered expenditure and expenditure growth to be the main focus for the readers of the financial statements, accordingly this consideration influenced our judgement of materiality. Based on our professional judgement, we determined materiality for the group to be $700,000. This value was derived from a benchmark of 2% of expenditure.

On the basis of our risk assessments, together with our assessment of the overall control environment, our judgement was that performance materiality (i.e. our tolerance for misstatement in an individual account or balance) for the company was 75% of materiality, namely $525,000

An overview of the scope of our audit

Our audit approach is based on obtaining and maintaining a thorough understanding of the group’s business, structure and scope in order to undertake a risk based audit approach. This approach requires us to identify relevant and appropriate key and significant risks of misstatement and determine the most appropriate tailored responses to this risk assessment. The extent of our work is determined by the level of risk in each area and our assessment of materiality as discussed above.

Other information

The directors are responsible for the other information. The other information comprises the information included in the annual report, other than the financial statements and our auditor’s report thereon. Our opinion on the financial statements does not cover the other information and, except to the extent otherwise explicitly stated in our report, we do not express any form of assurance conclusion thereon.

In connection with our audit of the financial statements, our responsibility is to read the other information and, in doing so, consider whether the other information is materially inconsistent with the financial statements or our knowledge obtained in the audit or otherwise appears to be materially misstated. If we identify such material inconsistencies or apparent material misstatements, we are required to determine whether there is a material misstatement in the financial statements or a material misstatement of the other information. If, based on the work we have performed, we conclude that there is a material misstatement of this other information, we are required to report that fact. We have nothing to report in this regard.

Opinions on other matters prescribed by the Companies Act 2006

In our opinion, based on the work undertaken in the course of the audit:

• the information given in the strategic report and the directors’ report for the financial year for which the financial statements are prepared is consistent with the financial statements; and

• the strategic report and the directors’ report have been prepared in accordance with applicable legal requirements.

Matters on which we are required to report by exception

In the light of the knowledge and understanding of the group and the parent company and its environment obtained in the course of the audit, we have not identified material misstatements in the strategic report or the directors’ report.

We have nothing to report in respect of the following matters in relation to which the Companies Act

2006 requires us to report to you if, in our opinion:

• adequate accounting records have not been kept by the parent company, or returns adequate for our audit have not been received from branches not visited by us; or

• the parent company financial statements are not in agreement with the accounting records and returns; or

• certain disclosures of directors’ remuneration specified by law are not made; or

• we have not received all the information and explanations we require for our audit.

Responsibilities of directors

As explained more fully in the directors’ responsibilities statement set out on page 3, the directors are responsible for the preparation of the financial statements and for being satisfied that they give a true and fair view, and for such internal control as the directors determine is necessary to enable the preparation of financial statements that are free from material misstatement, whether due to fraud or error.

INDEPENDENT AUDITORS REPORT TO THE SHAREHOLDER OF

In preparing the financial statements, the directors are responsible for assessing the group’s and the parent company’s ability to continue as a going concern, disclosing, as applicable, matters related to going concern and using the going concern basis of accounting unless the directors either intend to liquidate the group or the parent company or to cease operations, or have no realistic alternative but to do so.

Auditor’s responsibilities for the audit of the financial statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance with ISAs (UK) will always detect a material misstatement when it exists. Misstatements can arise from fraud or error and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on the basis of these financial statements.

A further description of our responsibilities for the audit of the financial statements is located on the Financial Reporting Council’s website at:www.frc.org.uk/auditorsresponsibilities. This description forms part of our auditor’s report.

Ian Cliffe (Senior statutory auditor)

for and on behalf of haysmacintyre,

Statutory Auditor

10 Queen Street Place

London

EC4R 1AG

| AKARI THERAPEUTICS PLC |

| |

| CONSOLIDATED STATEMENT OF COMPREHENSIVE LOSS |

| |

| FOR THE YEAR ENDED 31 DECEMBER 2017 |

| |

| | | | | | 2017 | | | 2016 | |

| | | Notes | | | $000 | | | $000 | |

| | | | | | | | | | |

| Research and development expenses | | | | | | | (23,285 | ) | | | (17,884 | ) |

| Administrative expenses | | | | | | | (11,799 | ) | | | (9,941 | ) |

| Contingent costs | | | | | | | (2,700 | ) | | | - | |

| | | | | | | | | | | | | |

| OPERATING LOSS | | | | | | | (37,784 | ) | | | (27,825 | ) |

| | | | | | | | | | | | | |