| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-206987-01 | ||

| Dated February 9, 2017 | BBCMS 2017-C1 |

Free Writing Prospectus

Structural and Collateral Term Sheet

| ||

BBCMS Mortgage Trust 2017-C1

| ||

$855,747,738 (Approximate Mortgage Pool Balance) | ||

$747,709,478 (Approximate Offered Certificates) | ||

Barclays Commercial Mortgage Securities LLC Depositor | ||

Commercial Mortgage Pass-Through Certificates Series 2017-C1 | ||

Barclays Bank PLC UBS AG Rialto Mortgage Finance, LLC Mortgage Loan Sellers

| ||

| Barclays | UBS Securities LLC | |

| Co-Lead Manager and Joint Bookrunner | Co-Lead Manager and Joint Bookrunner | |

Academy Securities, Inc. Co-Manager

| ||

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Dated February 9, 2017 | BBCMS 2017-C1 |

This material is for your information, and none of Barclays Capital Inc., UBS Securities LLC and Academy Securities, Inc. (the “Underwriters”) are soliciting any action based upon it. This material is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (File No. 333-206987) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the Securities and Exchange Commission for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Barclays Capital Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling 1-888-603-5847. The Offered Certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more Classes of Certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these Certificates, a contract of sale will come into being no sooner than the date on which the relevant Class has been priced and we have verified the allocation of Certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

Neither this document nor anything contained in this document shall form the basis for any contract or commitment whatsoever. The information contained in this document is preliminary as of the date of this document, supersedes any previous such information delivered to you and will be superseded by any such information subsequently delivered prior to the time of sale. These materials are subject to change, completion or amendment from time to time. The information should be reviewed only in conjunction with the entire offering document relating to the Commercial Mortgage Pass-Through Certificates, Series 2017-C1 (the “Offering Document”). All of the information contained herein is subject to the same limitations and qualifications contained in the Offering Document. The information contained herein does not contain all relevant information relating to the underlying mortgage loans or mortgaged properties. Such information is described elsewhere in the Offering Document. The information contained herein will be more fully described elsewhere in the Offering Document. The information contained herein should not be viewed as projections, forecasts, predictions or opinions with respect to value. Prior to making any investment decision, prospective investors are strongly urged to read the Offering Document its entirety. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this free writing prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of the Underwriters or any of their respective affiliates make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This document contains forward-looking statements. If and when included in this document, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in consumer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this document are made as of the date hereof. We have no obligation to update or revise any forward-looking statement.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this document is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 2 |  |

| Structural and Collateral Term Sheet | BBCMS 2017-C1 |

| Indicative Capital Structure | |

Publicly Offered Certificates

| Class | Expected Ratings (Moody’s / Fitch / DBRS) | Approximate Initial Certificate Balance or Notional Amount(1) | Approximate Initial Available Certificate Balance or Notional Amount(1) | Approximate Initial Retained Certificate Balance or Notional Amount(1)(2) | Approximate Initial Credit Support(3) | Expected Weighted Avg. Life (years)(4) | Expected Principal Window(4) | Certificate Principal to Value Ratio(5) | Underwritten NOI Debt Yield(6) |

| A-1 | Aaa(sf) / AAAsf / AAA(sf) | $22,421,053 | $21,300,000 | $1,121,053 | 30.000% | 2.62 | 3/17 – 11/21 | 41.9% | 15.6% |

| A-2 | Aaa(sf) / AAAsf / AAA(sf) | $66,989,474 | $63,640,000 | $3,349,474 | 30.000% | 4.91 | 11/21 – 2/22 | 41.9% | 15.6% |

| A-3 | Aaa(sf) / AAAsf / AAA(sf) | $105,263,158 | $100,000,000 | $5,263,158 | 30.000% | 9.77 | 11/26 – 12/26 | 41.9% | 15.6% |

| A-4 | Aaa(sf) / AAAsf / AAA(sf) | $366,928,423 | $348,582,000 | $18,346,423 | 30.000% | 9.87 | 12/26 – 2/27 | 41.9% | 15.6% |

| A-SB | Aaa(sf) / AAAsf / AAA(sf) | $37,421,053 | $35,550,000 | $1,871,053 | 30.000% | 7.47 | 2/22 – 11/26 | 41.9% | 15.6% |

| X-A(7) | Aaa(sf) / AAAsf / AAA(sf) | $599,023,161 | $569,072,000 | $29,951,161 | N/A | N/A | N/A | N/A | N/A |

| X-B(7) | NR / A-sf / AAA(sf) | $148,686,317 | $141,252,000 | $7,434,317 | N/A | N/A | N/A | N/A | N/A |

| A-S | Aa3(sf) / AAAsf / AAA(sf) | $66,320,000 | $63,004,000 | $3,316,000 | 22.250% | 9.97 | 2/27 – 2/27 | 46.5% | 14.0% |

| B | NR / AA-sf / AA(sf) | $43,856,843 | $41,664,000 | $2,192,843 | 17.125% | 9.97 | 2/27 – 2/27 | 49.6% | 13.2% |

| C | NR / A-sf / A(low)(sf) | $38,509,474 | $36,584,000 | $1,925,474 | 12.625% | 9.97 | 2/27 – 2/27 | 52.3% | 12.5% |

Privately Offered Certificates(8)

| Class | Expected Ratings (Moody’s / Fitch / DBRS) | Approximate Initial Certificate Balance or Notional Amount(1) | Approximate Initial Available Certificate Balance or Notional Amount(1) | Approximate Initial Retained Certificate Balance or Notional Amount(1)(2) | Approximate Initial Credit Support | Expected Weighted Avg. Life (years)(4) | Expected Principal Window(4) | Certificate Principal to Value Ratio(5) | Underwritten NOI Debt Yield(6) |

| X-D(7) | NR / BBB-sf / AAA(sf) | $43,856,846 | $41,664,000 | $2,192,846 | N/A | N/A | N/A | N/A | N/A |

| X-E(7) | NR / BB-sf / AAA(sf) | $21,393,690 | $20,324,000 | $1,069,690 | N/A | N/A | N/A | N/A | N/A |

| X-F(7) | NR / B-sf / AAA(sf) | $8,556,843 | $8,129,000 | $427,843 | N/A | N/A | N/A | N/A | N/A |

| X-G(7) | NR / NR / AAA(sf) | $8,557,895 | $8,130,000 | $427,895 | N/A | N/A | N/A | N/A | N/A |

| X-H(7) | NR / NR / AAA(sf) | $25,672,986 | $24,389,330 | $1,283,656 | N/A | N/A | N/A | N/A | N/A |

| D | NR / BBB-sf / BBB(low)(sf) | $43,856,846 | $41,664,000 | $2,192,846 | 7.500% | 9.97 | 2/27 – 2/27 | 55.3% | 11.8% |

| E | NR / BB-sf / BB(sf) | $21,393,690 | $20,324,000 | $1,069,690 | 5.000% | 9.97 | 2/27 – 2/27 | 56.8% | 11.5% |

| F | NR / B-sf / B(high)(sf) | $8,556,843 | $8,129,000 | $427,843 | 4.000% | 9.97 | 2/27 – 2/27 | 57.4% | 11.4% |

| G | NR / NR / B(low)(sf) | $8,557,895 | $8,130,000 | $427,895 | 3.000% | 9.97 | 2/27 – 2/27 | 58.0% | 11.2% |

| H | NR / NR / NR | $25,672,986 | $24,389,330 | $1,283,656 | 0.000% | 9.97 | 2/27 – 2/27 | 59.8% | 10.9% |

| (1) | In the case of each such Class, subject to a permitted variance of plus or minus 5%. |

| (2) | On the Closing Date, the certificates (other than the Class R certificates) with the initial Certificate Balances or Notional Amounts, as applicable, set forth in the table above under “Approximate Initial Retained Certificate Balance or Notional Amount” are expected to be sold by the Underwriters to RMF or a majority owned affiliate of RMF as described in “Credit Risk Retention” in the Preliminary Prospectus relating to the Publicly Offered Certificates, dated February 10, 2017 (the “Preliminary Prospectus”). |

| (3) | The credit support percentages set forth for Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB Certificates represent the approximate initial credit support for the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB Certificates in the aggregate. |

| (4) | Assumes 0% CPR / 0% CDR and a February 27, 2017 closing date. Based on modeling assumptions as described in the Preliminary Prospectus. |

| (5) | The “Certificate Principal to Value Ratio” for any Class (other than the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB Certificates) is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans, multiplied by (b) a fraction, the numerator of which is the total initial Certificate Balance of such Class of Certificates and all Classes of Principal Balance Certificates senior to such Class of Certificates and the denominator of which is the total initial Certificate Balance of all of the Principal Balance Certificates. The Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB Certificate Principal to Value Ratios are calculated in the aggregate for such Classes as if they were a single Class. Investors should note, however, that excess mortgaged property value associated with a mortgage loan will not be available to offset losses on any other mortgage loan. |

| (6) | The “Underwritten NOI Debt Yield” for any Class (other than the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB Certificates) is calculated as the product of (a) the weighted average UW NOI Debt Yield for the mortgage loans and (b) the total initial Certificate Balance of all of the Classes of Principal Balance Certificates divided by the total initial Certificate Balance for such Class and all Classes of Principal Balance Certificates senior to such Class of Certificates. The Underwritten NOI Debt Yield for each of the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB Certificates is calculated in the aggregate for such Classes as if they were a single Class. Investors should note, however, that net operating income from any mortgaged property supports only the related mortgage loan and will not be available to support any other mortgage loan. |

| (7) | The Class X-A, Class X-B, Class X-D, Class X-E, Class X-F, Class X-G and Class X-H Notional Amounts are defined in the Preliminary Prospectus. |

| (8) | The Class X-D, Class X-E, Class X-F, Class X-G, Class X-H, Class D, Class E, Class F, Class G and Class H Certificates are not being offered by the Preliminary Prospectus and this Term Sheet. The Class R and Class V Certificates are not shown above. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 3 |  |

| Structural and Collateral Term Sheet | BBCMS 2017-C1 |

| Summary of Transaction Terms | |

| Securities Offered: | $747,709,478 monthly pay, multi-class, commercial mortgage REMIC Pass-Through Certificates. |

| Co-Lead Managers and Joint Bookrunners: | Barclays Capital Inc. and UBS Securities LLC. |

| Co-Managers: | Academy Securities, Inc. |

| Mortgage Loan Sellers: | Barclays Bank PLC (“Barclays”) (43.4%), UBS AG (29.7%) and Rialto Mortgage Finance, LLC (“RMF”) (26.9%). |

| Master Servicer: | Wells Fargo Bank, National Association. |

| Special Servicer: | Rialto Capital Advisors LLC (“Rialto Capital”). |

| Directing Certificateholder: | RREF III D BBCMS 2017-C1 LLC (or its affiliate). |

| Trustee: | Wilmington Trust, National Association. |

| Certificate Administrator: | Wells Fargo Bank, National Association. |

| Operating Advisor: | Park Bridge Lender Services LLC. |

| Asset Representations Reviewer: | Park Bridge Lender Services LLC. |

| Risk Retention Consultation Party: | Expected to be RMF or an affiliate thereof |

| Credit Risk Retention: | RMF, as the retaining sponsor, intends to cause its majority owned affiliate to retain at least 5.0% of the certificate balance, notional amount or percentage interest in each class of certificates (other than the Class R certificates) in a manner that would satisfy the U.S. credit risk retention requirements. See “Credit Risk Retention” in the Preliminary Prospectus. |

| Rating Agencies: | Moody’s Investors Service, Inc. (“Moody’s”), Fitch Ratings, Inc. (“Fitch”) and DBRS, Inc. (“DBRS”). |

| Pricing Date: | On or about February 16, 2017. |

| Closing Date: | On or about February 27, 2017. |

| Cut-off Date: | With respect to each mortgage loan, the related due date in February 2017, or with respect to any mortgage loan that has its first due date in March 2017, the date that would otherwise have been the related due date in February 2017. |

| Distribution Date: | The 4th business day after the Determination Date in each month, commencing in March 2017. |

| Determination Date: | 11thday of each month, or if the 11th day is not a business day, the next succeeding business day, commencing in March 2017. |

| Assumed Final Distribution Date: | The Distribution Date in February 2027 which is the latest anticipated repayment date of the Certificates. |

| Rated Final Distribution Date: | The Distribution Date in February 2050. |

| Tax Treatment: | The Publicly Offered Certificates are expected to be treated as REMIC “regular interests” for U.S. federal income tax purposes. |

| Form of Offering: | The Class A-1, Class A-2, Class A-3, Class A-4, Class A-SB, Class X-A, Class X-B, Class A-S, Class B and Class C Certificates (the “Publicly Offered Certificates”) will be offered publicly. The Class X-D, Class X-E, Class X-F, Class X-G, Class X-H, Class D, Class E, Class F, Class G, Class H, Class R and Class V Certificates (the “Privately Offered Certificates”) will be offered domestically to Qualified Institutional Buyers and to Institutional Accredited Investors and to institutions that are not U.S. Persons pursuant to Regulation S. |

| SMMEA Status: | The Certificates will not constitute “mortgage related securities” for purposes of SMMEA. |

| ERISA: | The Publicly Offered Certificates are expected to be ERISA eligible. |

| Optional Termination: | On any Distribution Date on which the aggregate principal balance of the pool of mortgage loans is less than 1% of the aggregate principal balance of the mortgage loans as of the cut-off date, certain entities specified in the Preliminary Prospectus will have the option to purchase all of the remaining mortgage loans (and all property acquired through exercise of remedies in respect of any mortgage loan) at the price specified in the Preliminary Prospectus. Refer to “Pooling and Servicing Agreement—Termination; Retirement of Certificates” in the Preliminary Prospectus. |

| Minimum Denominations: | The Publicly Offered Certificates (other than the Class X-A and Class X-B Certificates) will be issued in minimum denominations of $10,000 and integral multiples of $1 in excess of $10,000. The Class X-A and Class X-B Certificates will be issued in minimum denominations of $1,000,000 and in integral multiples of $1 in excess of $1,000,000. |

| Settlement Terms: | DTC, Euroclear and Clearstream Banking. |

| Analytics: | The transaction is expected to be modeled by Intex Solutions, Inc. and Trepp, LLC and is expected to be available on Bloomberg L.P., Blackrock Financial Management Inc., Interactive Data Corporation, CMBS.com, Markit Group Limited and Thomson Reuters Corporation. |

| Risk Factors: | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. REFER TO THE “RISK FACTORS” SECTION OF THE PRELIMINARY PROSPECTUS. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 4 |  |

| Structural and Collateral Term Sheet | BBCMS 2017-C1 |

| Collateral Characteristics | |

Mortgage Loan Seller | Number of | Number of | Aggregate | % of | |

| Barclays | 18 | 28 | $371,195,230 | 43.4 | % |

| UBS AG | 19 | 20 | 254,503,676 | 29.7 | |

| RMF | 21 | 27 | 230,048,831 | 26.9 | |

| Total: | 58 | 75 | $855,747,738 | 100.0 | % |

| Loan Pool | ||

| Initial Pool Balance (“IPB”): | $855,747,738 | |

| Number of Mortgage Loans: | 58 | |

| Number of Mortgaged Properties: | 75 | |

| Average Cut-off Date Balance per Mortgage Loan: | $14,754,271 | |

| Weighted Average Current Mortgage Rate: | 5.02713% | |

| 10 Largest Mortgage Loans as % of IPB: | 49.9% | |

| Weighted Average Remaining Term to Maturity(1): | 114 months | |

| Weighted Average Seasoning: | 1 month | |

| Credit Statistics | ||

| Weighted Average UW NCF DSCR(2): | 1.77x | |

| Weighted Average UW NOI Debt Yield(2): | 10.9% | |

| Weighted Average Cut-off Date Loan-to-Value Ratio (“LTV”)(2)(3): | 59.8% | |

| Weighted Average Maturity Date LTV(1)(2)(3): | 55.1% | |

| Other Statistics | ||

| % of Mortgage Loans with Additional Debt: | 6.6% | |

| % of Mortgaged Properties with Single Tenants: | 10.4% | |

| Amortization | ||

| Weighted Average Original Amortization Term(4): | 354 months | |

| Weighted Average Remaining Amortization Term(4): | 354 months | |

| % of Mortgage Loans with Interest-Only: | 39.6% | |

| % of Mortgage Loans with Amortizing Balloon: | 30.1% | |

| % of Mortgage Loans with Partial Interest-Only followed by Amortizing Balloon: | 22.6% | |

| % of Mortgage Loans with Interest-Only followed by ARD-Structure: | 7.8% | |

| Lockboxes(5) | ||

| % of Mortgage Loans with Hard Lockboxes: | 60.7% | |

| % of Mortgage Loans with Springing Lockboxes: | 35.3% | |

| % of Mortgage Loans with Soft Lockboxes: | 2.6% | |

| % of Mortgage Loans with No Lockbox: | 1.4% | |

| Reserves | ||

| % of Mortgage Loans Requiring Monthly Tax Reserves: | 69.9% | |

| % of Mortgage Loans Requiring Monthly Insurance Reserves: | 42.3% | |

| % of Mortgage Loans Requiring Monthly CapEx Reserves(6): | 69.2% | |

| % of Mortgage Loans Requiring Monthly TI/LC Reserves(7): | 39.1% | |

| (1) | In the case of Loan Nos. 5 and 11, each with an anticipated repayment date, as of the related anticipated repayment date. |

| (2) | In the case of Loan Nos. 2, 4, 5, 7, 8, 9, 11, 12, 19 and 28, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan No. 2, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan. In the case of Loan Nos. 13 and 14, the two mortgage loans are cross-collateralized and cross-defaulted with one other and as such, the calculations are based on the aggregate Cut-off Date Balances, Maturity Date Balances, UW NOI, UW NCF and Debt Service of the two mortgage loans. |

| (3) | In the case of Loan Nos. 2, 18, 22, 23.02 and 44, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| (4) | Excludes 13 mortgage loans that are interest-only for the entire term or until the anticipated repayment date, as applicable. |

| (5) | For a more detailed description of Lockboxes, refer to “Description of the Mortgage Pool—Certain Terms of the Mortgage Loans—Mortgaged Property Accounts” in the Preliminary Prospectus. |

| (6) | CapEx Reserves include FF&E reserves for hotel properties. |

| (7) | Calculated only with respect to the Cut-off Date Balance of mortgage loans secured or partially secured by mixed use, retail, industrial and office properties. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 5 |  |

| Structural and Collateral Term Sheet | BBCMS 2017-C1 | |

| Collateral Characteristics | ||

| Ten Largest Mortgage Loans | |||||||||||||

| No. | Loan Name | City, State | Mortgage Loan Seller | No. of Prop. | Cut-off Date Balance | % of IPB | Square Feet / Rooms | Property Type | UW NCF DSCR(1) | UW NOI Debt Yield(1) | Cut-off Date LTV(1)(2) | Maturity Date LTV(1)(2)(3) | |

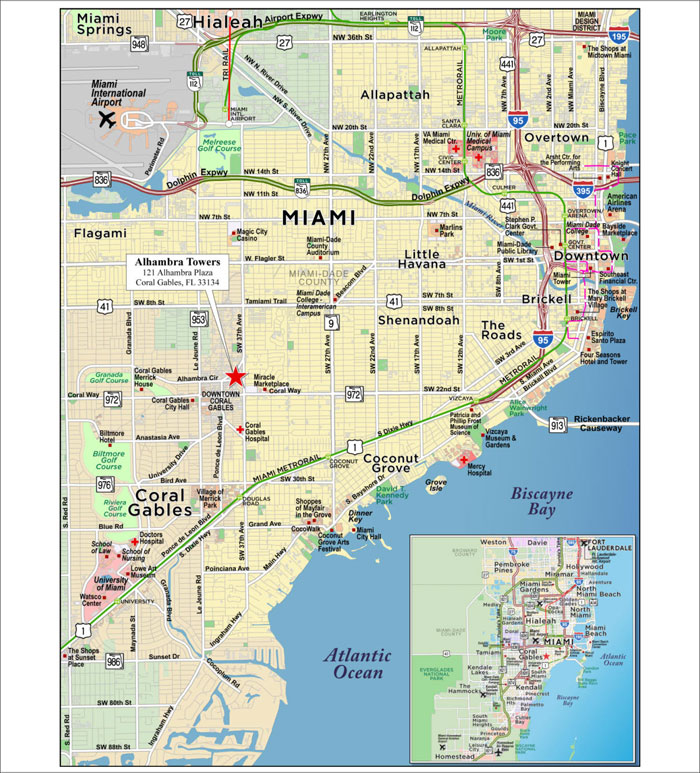

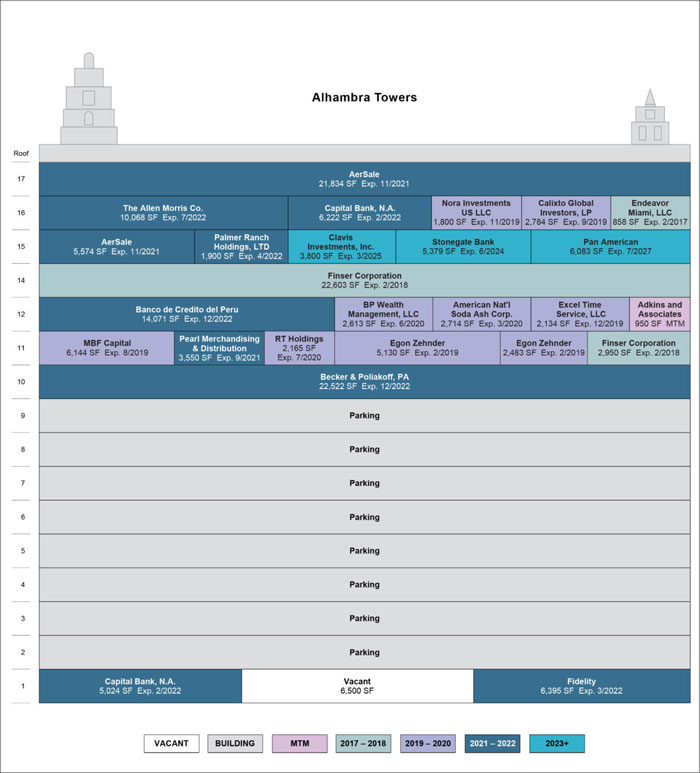

| 1 | Alhambra Towers | Coral Gables, FL | RMF | 1 | $61,000,000 | 7.1% | 174,250 | Office | 1.62x | 8.7% | 65.6% | 65.6% | |

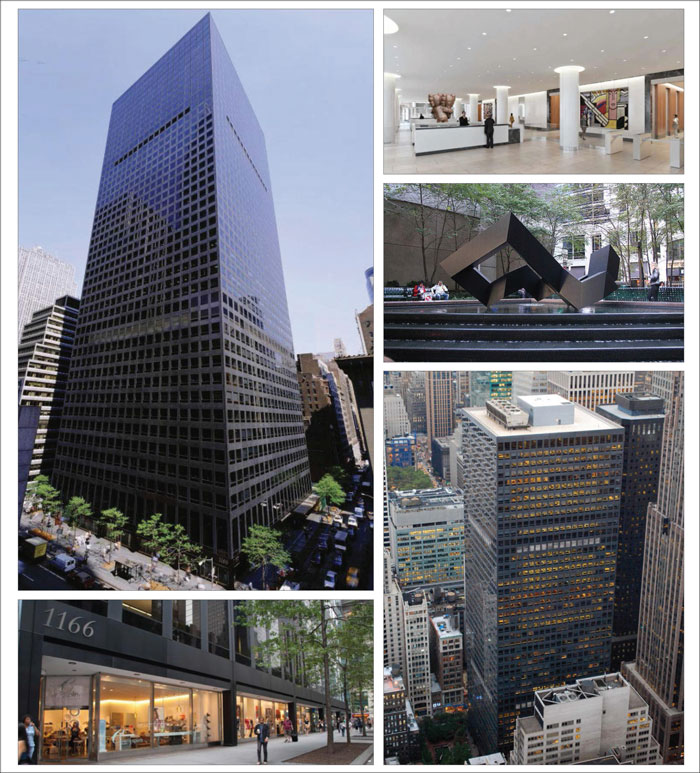

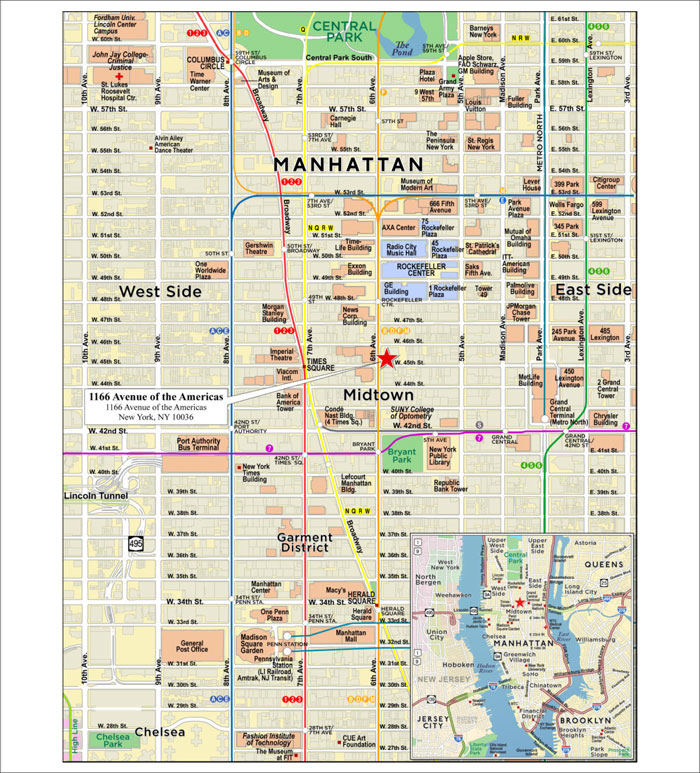

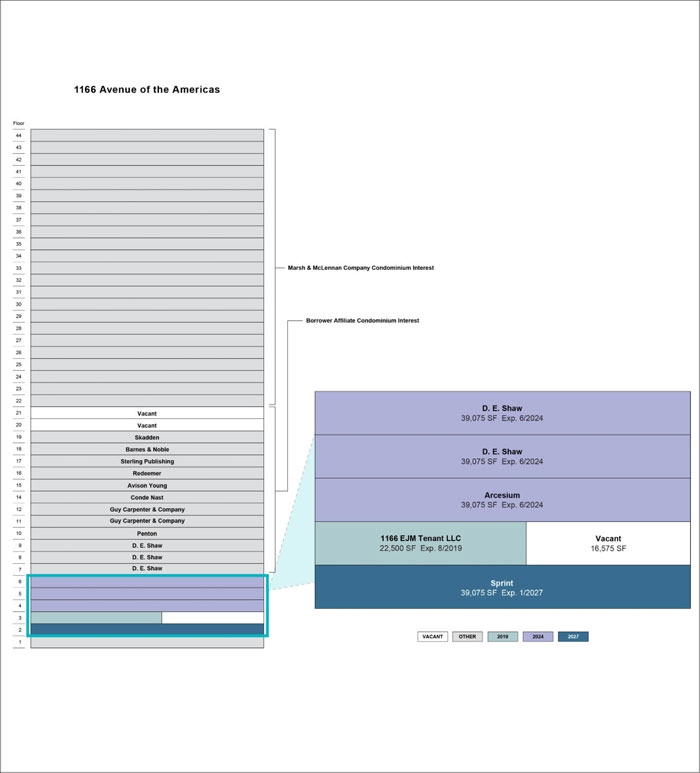

| 2 | 1166 Avenue of the Americas | New York, NY | Barclays | 1 | $56,250,000 | 6.6% | 195,375 | Office | 1.79x | 10.2% | 37.8% | 37.8% | |

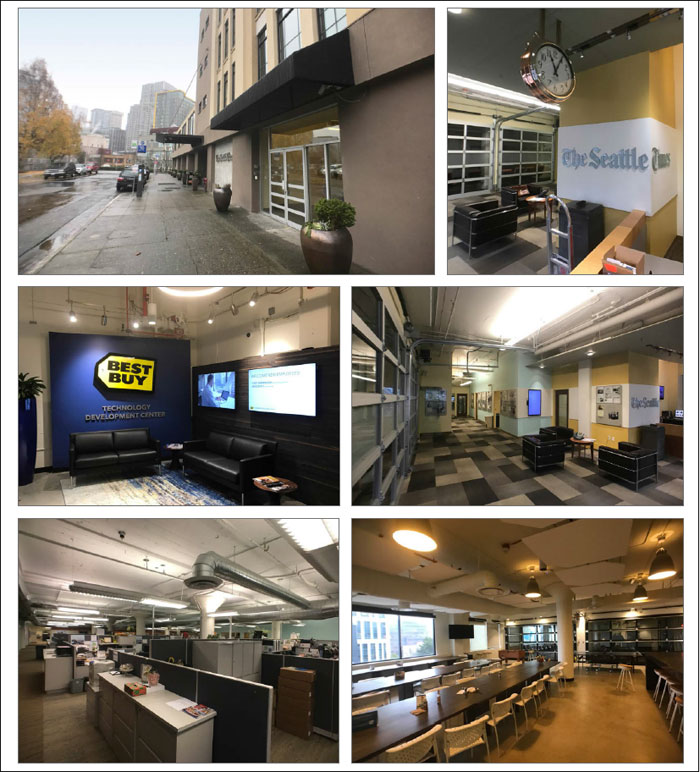

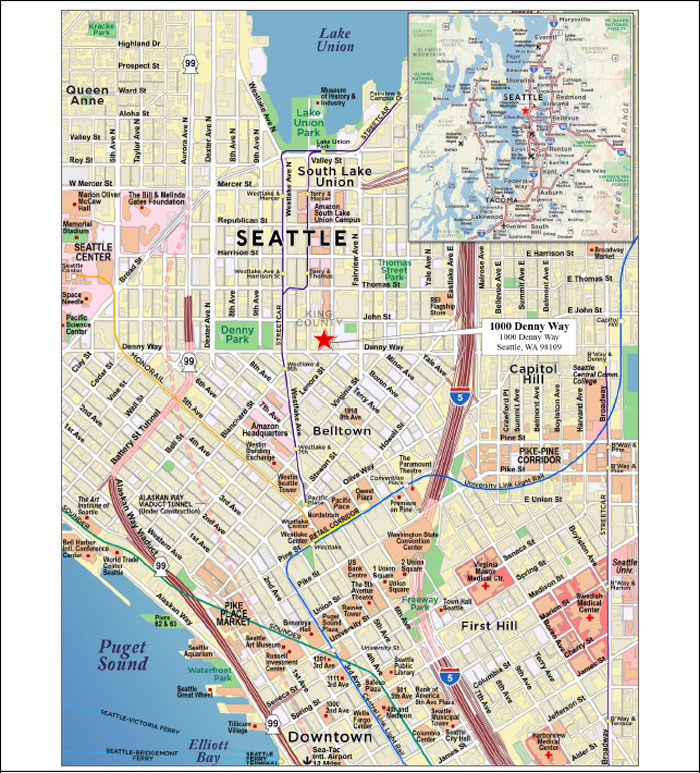

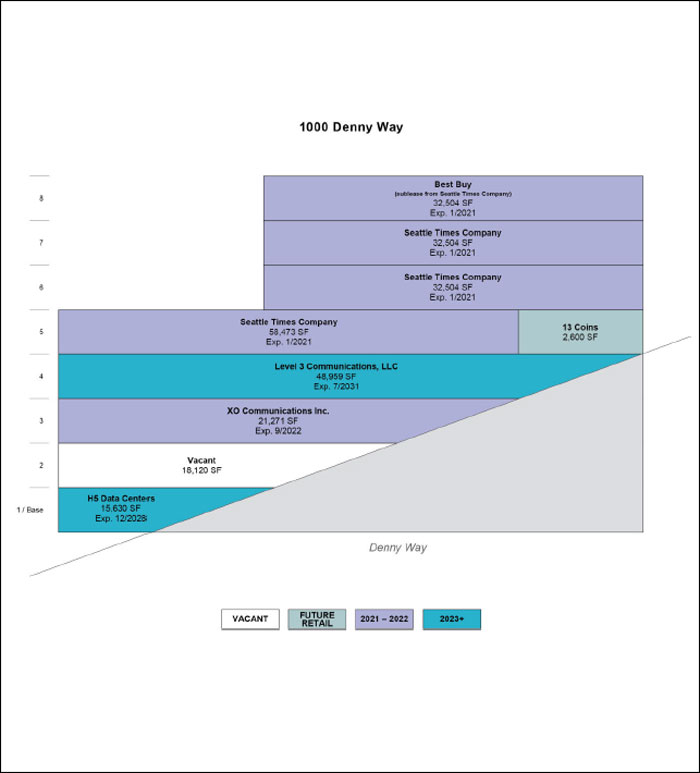

| 3 | 1000 Denny Way | Seattle, WA | Barclays | 1 | $56,000,000 | 6.5% | 262,565 | Office | 1.77x | 10.2% | 51.9% | 51.9% | |

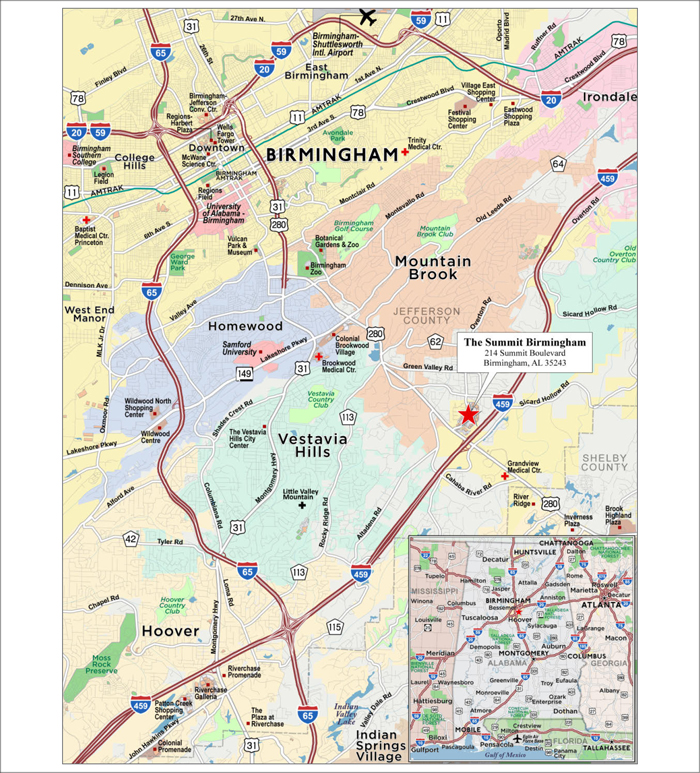

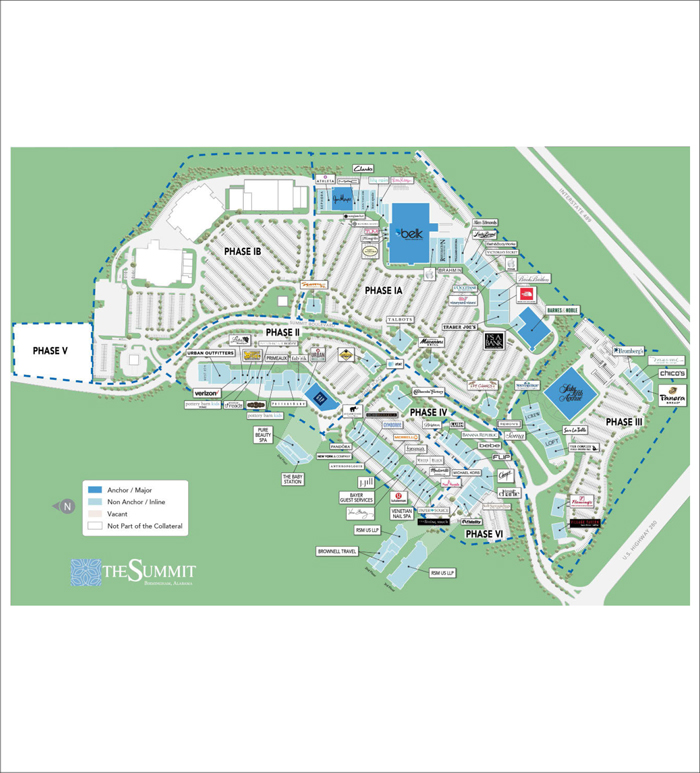

| 4 | The Summit Birmingham | Birmingham, AL | Barclays | 1 | $50,000,000 | 5.8% | 681,245 | Retail | 1.68x | 8.7% | 54.3% | 54.3% | |

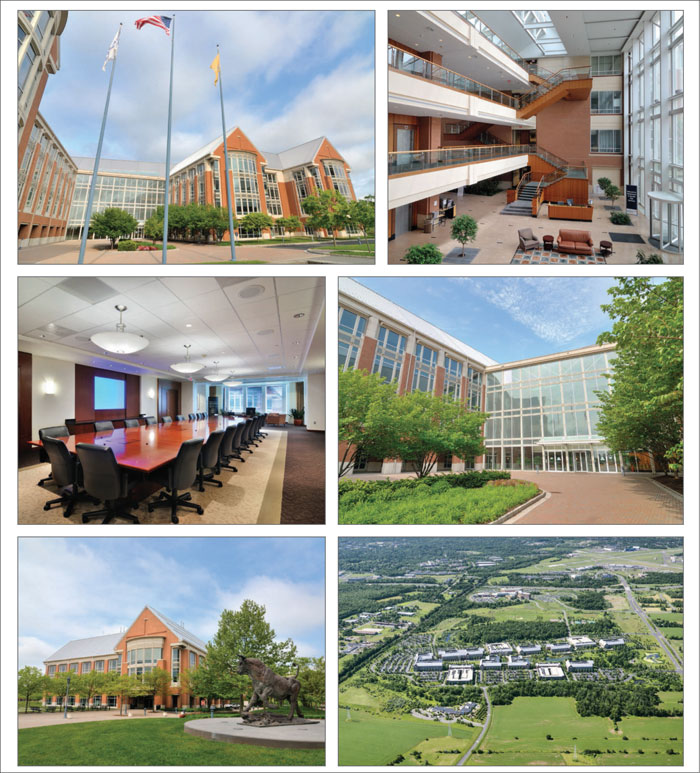

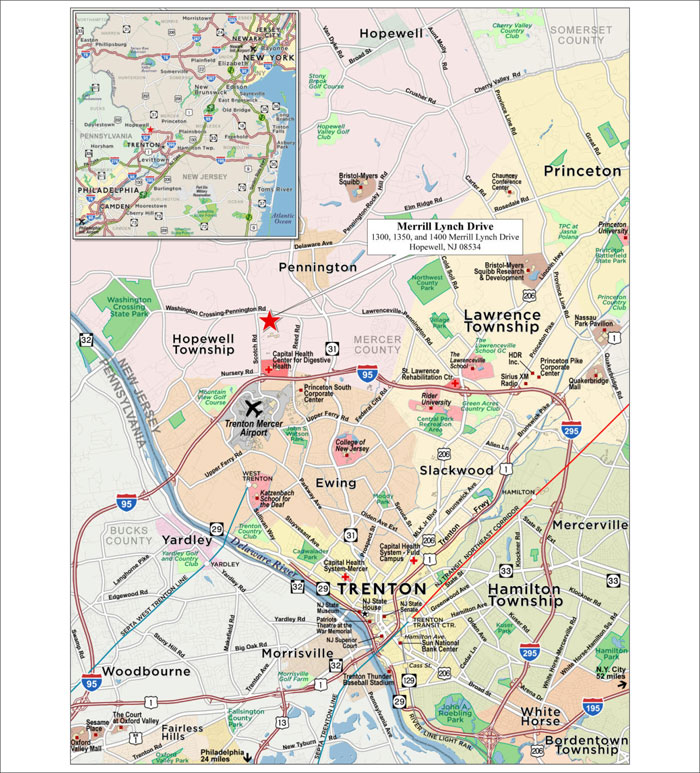

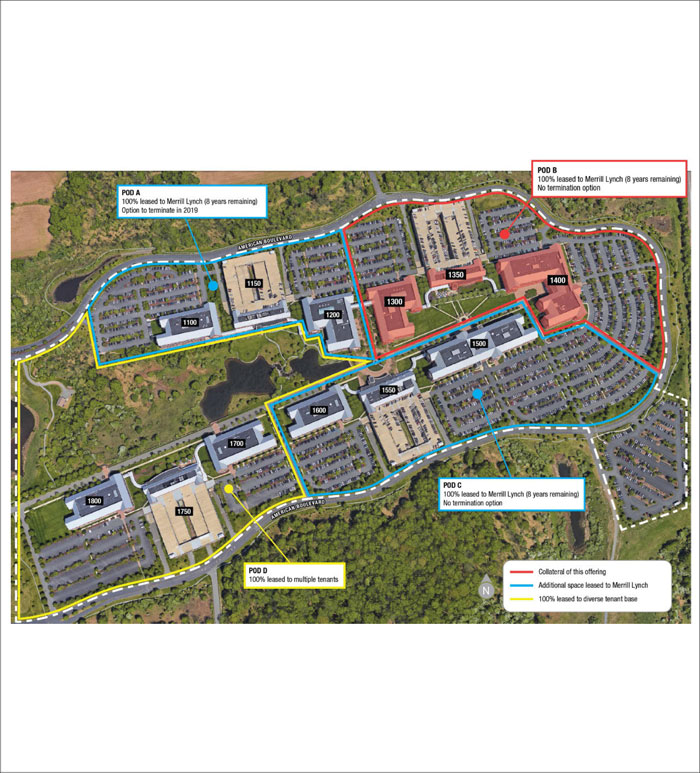

| 5 | Merrill Lynch Drive | Hopewell, NJ | Barclays | 1 | $41,500,000 | 4.8% | 553,841 | Office | 2.95x | 11.8% | 67.7% | 67.7% | |

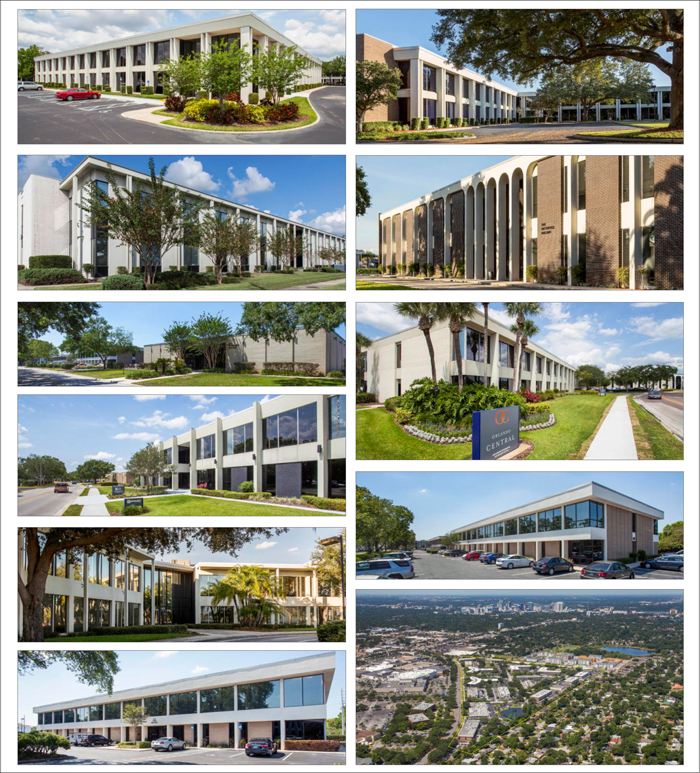

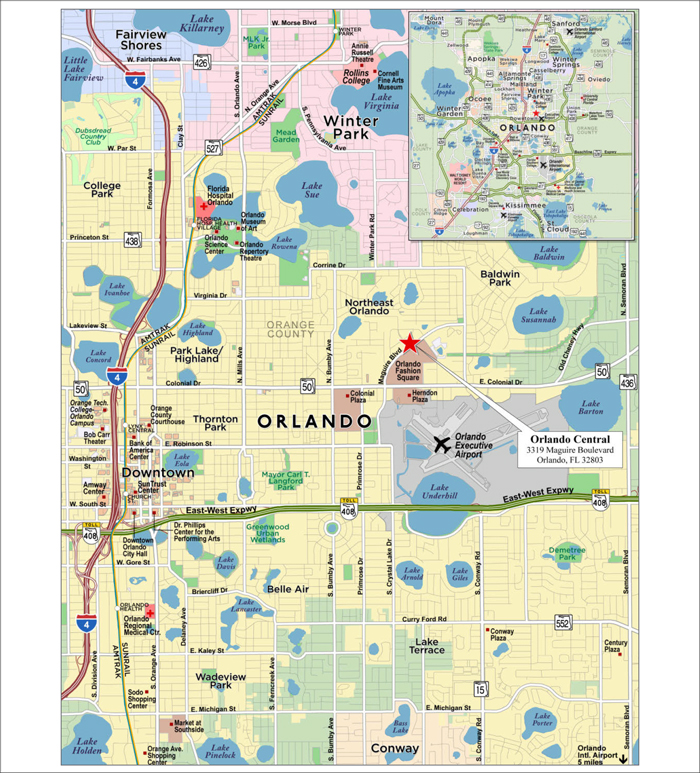

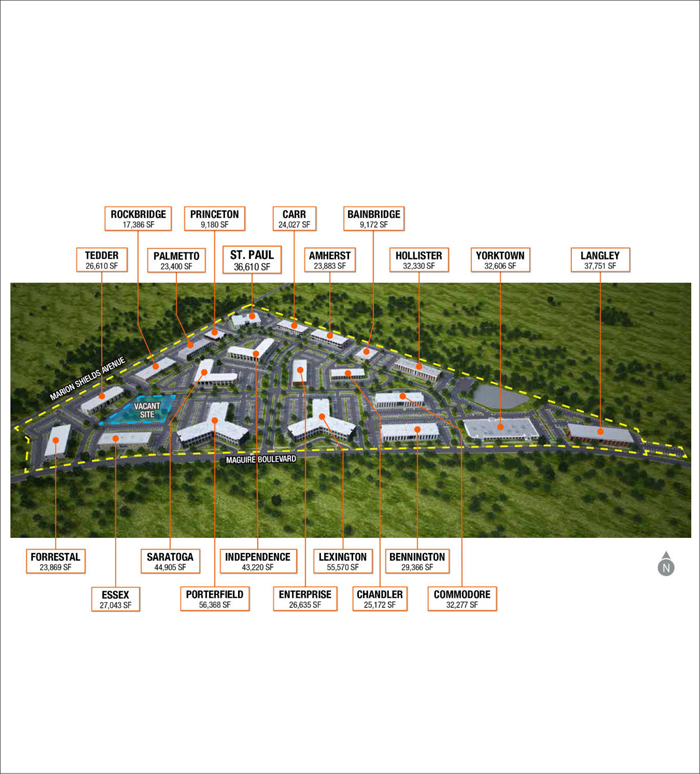

| 6 | Orlando Central | Orlando, FL | RMF | 1 | $38,250,000 | 4.5% | 637,380 | Office | 1.73x | 13.1% | 61.0% | 54.6% | |

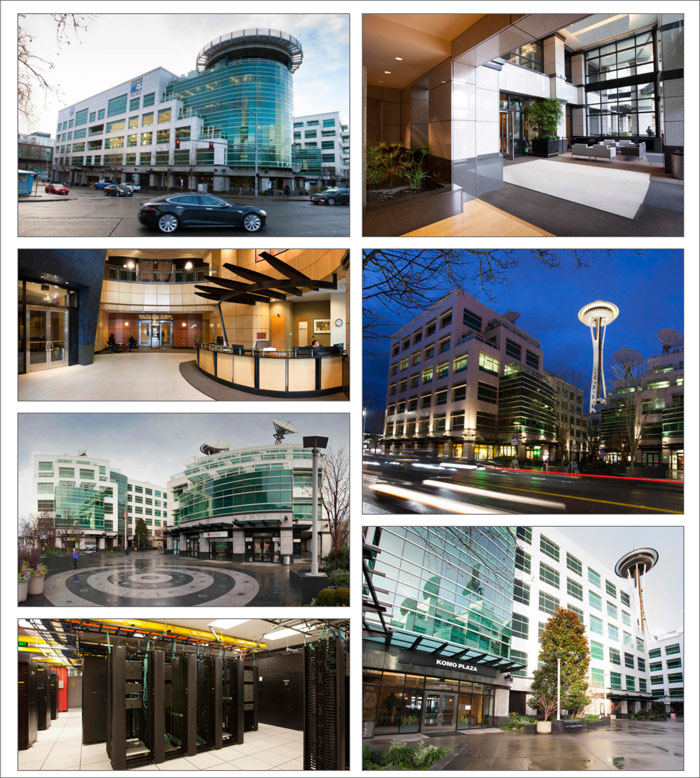

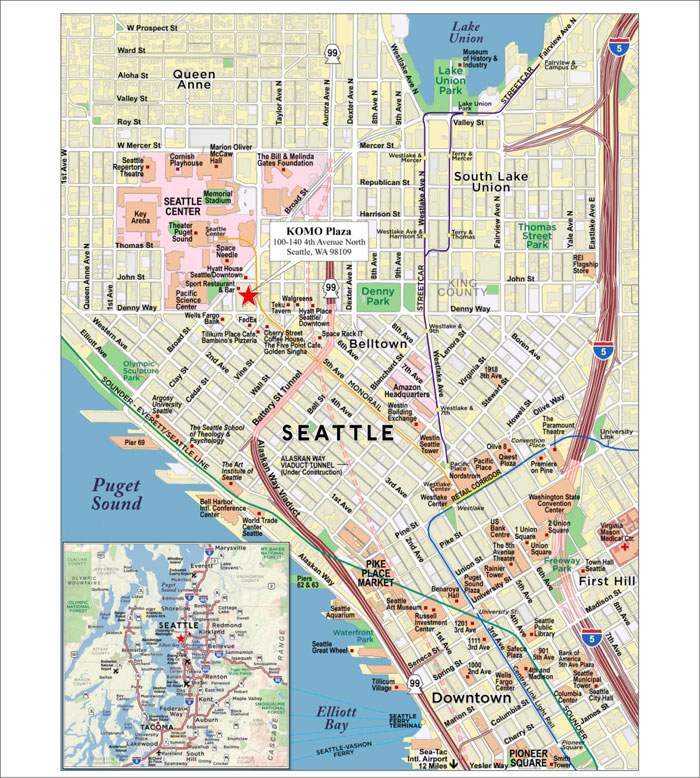

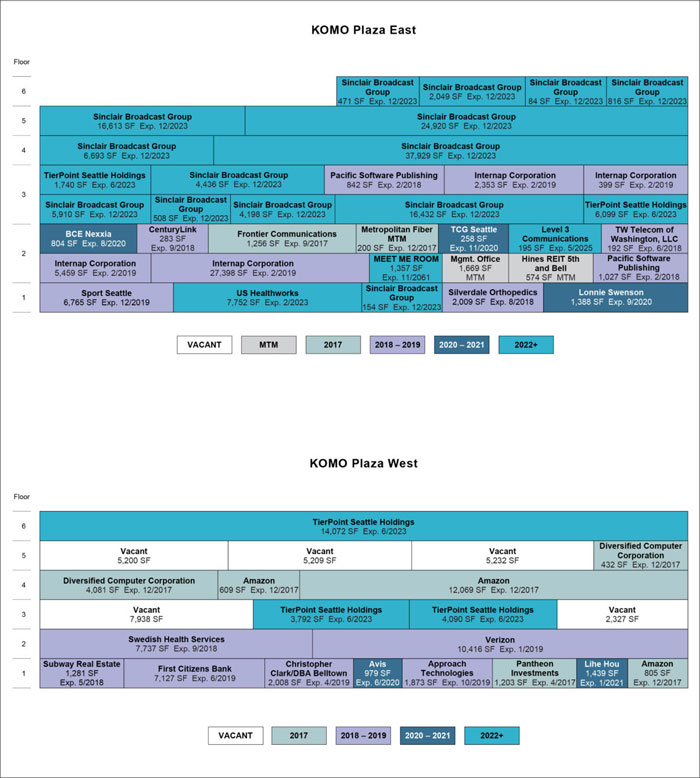

| 7 | KOMO Plaza | Seattle, WA | UBS AG | 1 | $37,000,000 | 4.3% | 291,151 | Mixed Use | 2.47x | 11.3% | 50.0% | 50.0% | |

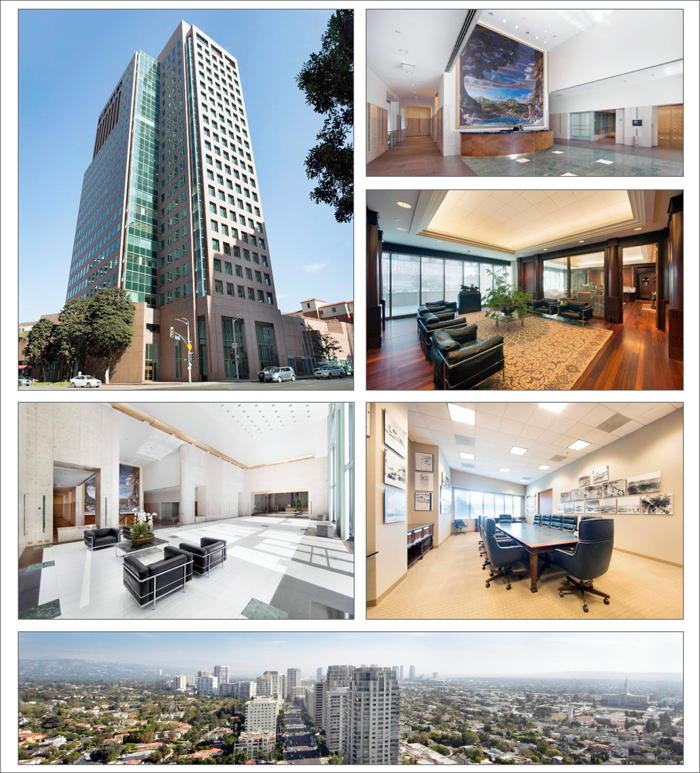

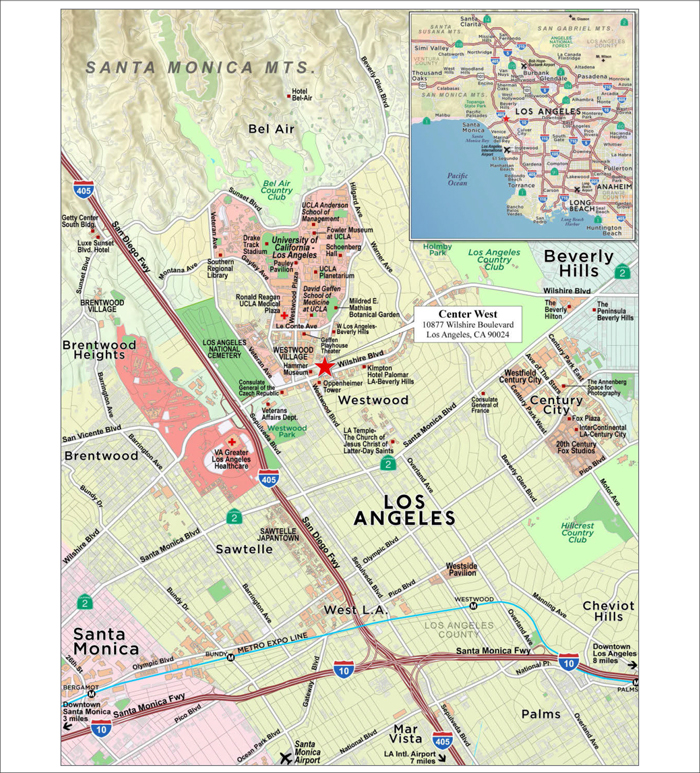

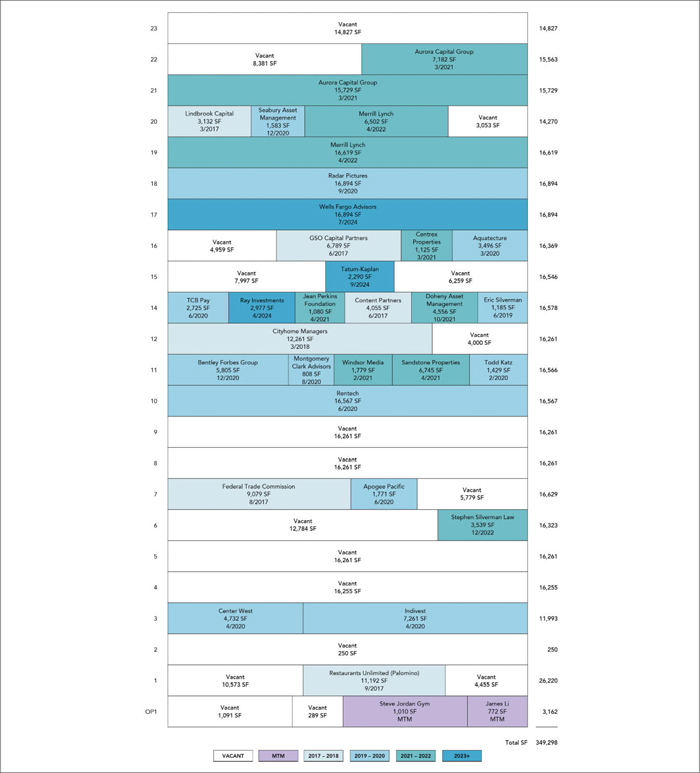

| 8 | Center West | Los Angeles, CA | UBS AG | 1 | $30,000,000 | 3.5% | 349,298 | Office | 1.94x | 9.7% | 38.3% | 38.3% | |

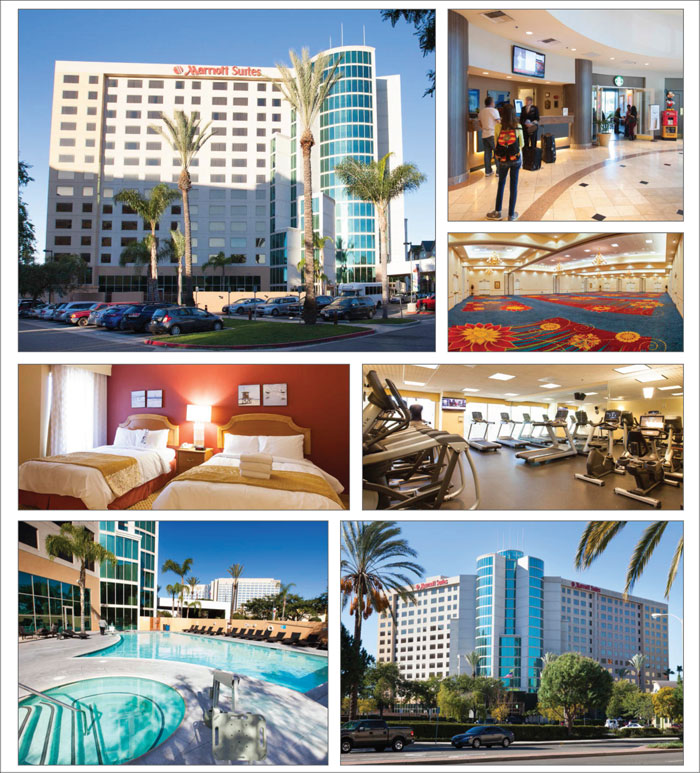

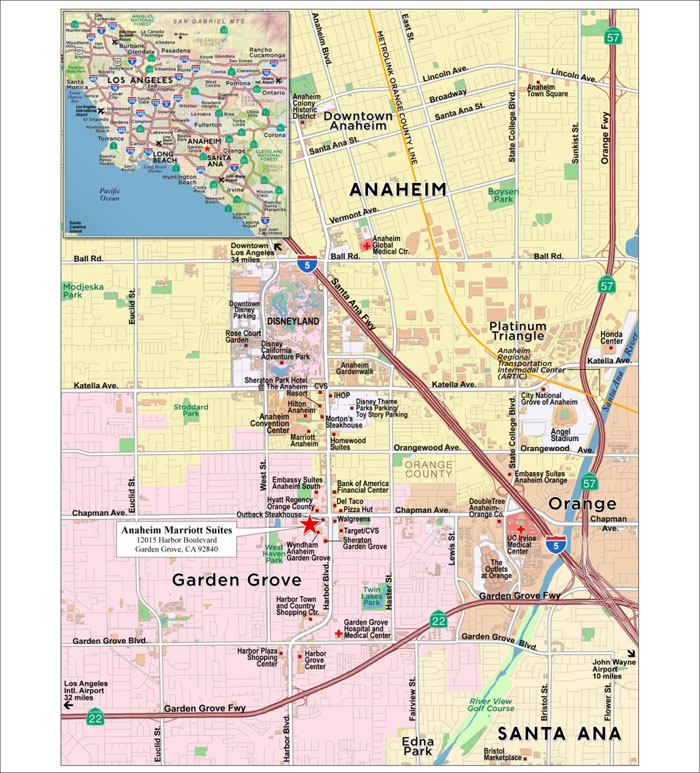

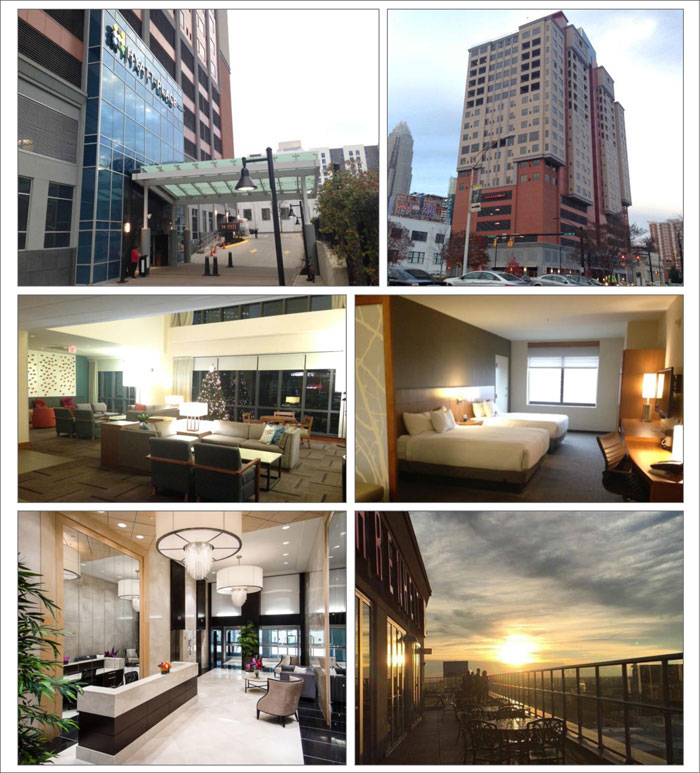

| 9 | Anaheim Marriott Suites | Garden Grove, CA | UBS AG | 1 | $30,000,000 | 3.5% | 371 | Hotel | 1.62x | 12.8% | 65.1% | 60.3% | |

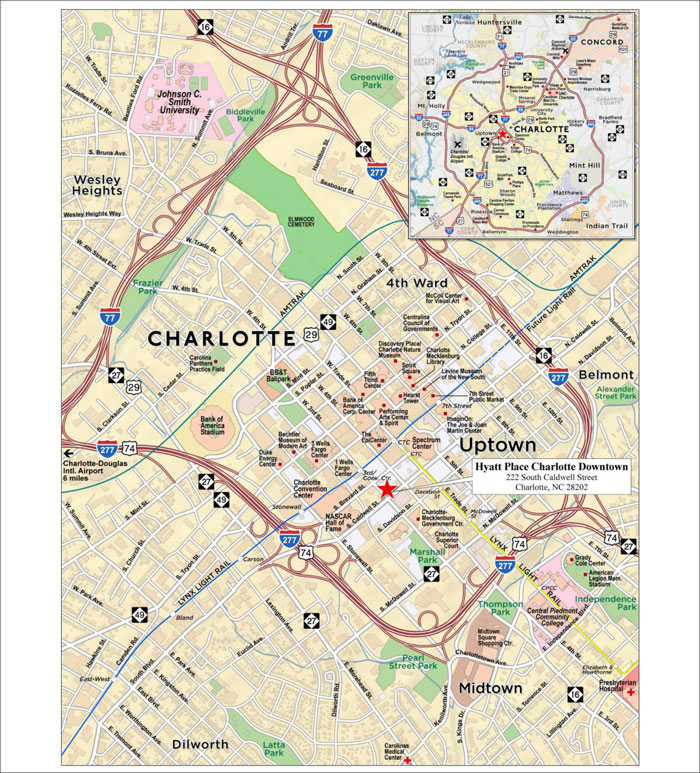

| 10 | Hyatt Place Charlotte Downtown | Charlotte, NC | Barclays | 1 | $27,000,000 | 3.2% | 172 | Hotel | 1.55x | 11.8% | 64.3% | 53.7% | |

| Top 3 Total/Weighted Average | 3 | $173,250,000 | 20.2% | 1.72x | 9.7% | 52.1% | 52.1% | ||||||

| Top 5 Total/Weighted Average | 5 | $264,750,000 | 30.9% | 1.91x | 9.8% | 55.0% | 55.0% | ||||||

| Top 10 Total/Weighted Average | 10 | $427,000,000 | 49.9% | 1.90x | 10.6% | 55.2% | 53.6% | ||||||

| Non-Top 10 Total/Weighted Average | 65 | $428,747,738 | 50.1% | 1.65x | 11.2% | 64.5% | 56.5% | ||||||

| (1) | In the case of Loan Nos. 2, 4, 5, 7, 8, 9, 11, 12, 19 and 28, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan No. 2, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan. In the case of Loan Nos. 13 and 14, the two mortgage loans are cross-collateralized and cross-defaulted with one other and as such, the calculations are based on the aggregate Cut-off Date Balances, Maturity Date Balances, UW NOI, UW NCF and Debt Service of the two mortgage loans. |

| (2) | In the case of Loan Nos. 2, 18, 22, 23.02 and 44, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| (3) | In the case of Loan Nos. 5 and 11, each with an anticipated repayment date, as of the related anticipated repayment date. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 6 |  |

| Structural and Collateral Term Sheet | BBCMS 2017-C1 | |

| Collateral Characteristics | ||

| Pari Passu Companion Loan Summary |

No. | Loan Name | Mortgage Loan Seller | Trust Cut-off Date Balance | Pari Passu Loan(s) Cut-off Date Balance | Total Mortgage Loan Cut-off Date | Controlling Pooling & Servicing Agreement | Master Servicer | Special Servicer | Voting Rights | |||||||||

| 2 | 1166 Avenue of the Americas | Barclays | $56,250,000 | $28,750,000 | $85,000,000 | BBCMS 2017-C1 | Wells Fargo | Rialto | BBCMS 2017-C1 | |||||||||

| 4 | The Summit Birmingham | Barclays | $50,000,000 | $158,000,000 | $208,000,000 | BACM 2017-BNK3 | Wells Fargo | Midland | BACM 2017-BNK3 | |||||||||

| 5 | Merrill Lynch Drive | Barclays | $41,500,000 | $62,100,000 | $103,600,000 | BBCMS 2017-C1 | Wells Fargo | Rialto | BBCMS 2017-C1 | |||||||||

| 7 | KOMO Plaza | UBS AG | $37,000,000 | $102,000,000 | $139,000,000 | BBCMS 2017-C1 | Wells Fargo | Rialto | BBCMS 2017-C1 | |||||||||

| 8 | Center West | UBS AG | $30,000,000 | $50,000,000 | $80,000,000 | BBCMS 2017-C1 | Wells Fargo | Rialto | (2) | |||||||||

| 9 | Anaheim Marriott Suites | UBS AG | $30,000,000 | $24,000,000 | $54,000,000 | BBCMS 2017-C1 | Wells Fargo | Rialto | BBCMS 2017-C1 | |||||||||

| 11 | State Farm Data Center | UBS AG | $25,000,000 | $55,000,000 | $80,000,000 | CD 2017-CD3 | Midland | Rialto | CD 2017-CD3 | |||||||||

| 12 | Connecticut Financial Center | UBS AG | $22,750,000 | $22,750,000 | $45,500,000 | BBCMS 2017-C1 | Wells Fargo | Rialto | (2) | |||||||||

| 19 | Midwest Industrial Portfolio | Barclays | $15,400,000 | $23,100,000 | $38,500,000 | WFCM 2016-C37 | Wells Fargo | LNR | WFCM 2016-C37 | |||||||||

| 28 | Wolfchase Galleria | UBS AG | $9,960,046 | $154,380,709 | $164,340,755 | MSC 2016-UBS12 | Midland | Rialto | MSC 2016-UBS12 |

| (1) | In the case of Loan No. 2, the Total Mortgage Loan Cut-off Date Balance excludes the related Subordinate Companion Loan. |

| (2) | In the case of Loan Nos. 8 and 12, the related whole loan will be serviced under the BBCMS 2017-C1 pooling and servicing agreement until such time that the controllingpari passu companion loan is securitized, at which point the whole loan will be serviced under the related pooling and servicing agreement. The initial controlling noteholder is UBS AG, or an affiliate, as holder of the related controllingpari passu companion loan. |

| Additional Debt Summary(1) |

| No. | Loan Name | Trust Cut-off Date Balance | Pari Passu Loan(s) Cut-off Date Balance | Subordinate Debt Cut-off Date Balance(2) | Total Debt Cut-off Date Balance | Mortgage Loan UW NCF DSCR(2) | Total Debt UW NCF DSCR | Mortgage Loan Cut-off Date LTV(2)(3) | Total Debt Cut-off Date LTV(3) | Mortgage Loan UW NOI Debt Yield(2) | Total Debt UW NOI Debt Yield | |||||||||||

| 2 | 1166 Avenue of the Americas | $56,250,000 | $28,750,000 | $45,000,000 | $130,000,000 | 1.79x | 1.15x | 37.8% | 57.8% | 10.2% | 6.6% |

| (1) | In the case of Loan No. 2, subordinate debt represents (i) a $25.0 million B-Note and (ii) a $20.0 million mezzanine loan. |

| (2) | In the case of Loan No. 2, Mortgage Loan UW NCF DSCR, Mortgage Loan Cut-off Date LTV and Mortgage Loan UW NOI Debt Yield calculations include any related Pari Passu Companion Loans, but exclude the related Subordinate Companion Loan. |

| (3) | In the case of Loan No. 2, the Mortgage Loan Cut-off Date LTV and the Total Cut-off Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 7 |  |

| Structural and Collateral Term Sheet | BBCMS 2017-C1 | |

| Collateral Characteristics | ||

| Mortgaged Properties by Type(1) |

Weighted Average | |||||||||||||||||

| Property Type | Property Subtype | Number of Properties | Cut-off Date Principal Balance | % of IPB | UW NCF DSCR(2)(3) | UW NOI Debt Yield(2)(3) | Cut-off Date LTV(2)(3) | Maturity Date LTV(2)(3)(4) | |||||||||

| Office | CBD | 5 | $226,000,000 | 26.4 | % | 1.78x | 10.3% | 51.6% | 50.4% | ||||||||

| Suburban | 3 | 96,800,000 | 11.3 | 2.22x | 12.2% | 65.8% | 61.8% | ||||||||||

| Data Center | 1 | 25,000,000 | 2.9 | 2.42x | 11.4% | 62.5% | 62.5% | ||||||||||

| Medical | 1 | 11,500,000 | 1.3 | 1.37x | 9.5% | 73.2% | 65.0% | ||||||||||

| Subtotal: | 10 | $359,300,000 | 42.0 | % | 1.93x | 10.8% | 56.9% | 54.8% | |||||||||

| Retail | Anchored | 10 | $106,505,263 | 12.4 | % | 1.45x | 10.2% | 67.3% | 59.3% | ||||||||

| Lifestyle Center | 1 | 50,000,000 | 5.8 | 1.68x | 8.7% | 54.3% | 54.3% | ||||||||||

| Single Tenant | 3 | 18,485,000 | 2.2 | 1.46x | 9.3% | 58.6% | 54.4% | ||||||||||

| Unanchored | 2 | 11,600,000 | 1.4 | 1.48x | 10.3% | 48.3% | 43.8% | ||||||||||

| Super Regional Mall | 1 | 9,960,046 | 1.2 | 1.72x | 10.8% | 64.7% | 51.9% | ||||||||||

| Shadow Anchored | 2 | 2,625,000 | 0.3 | 1.49x | 10.9% | 73.9% | 64.2% | ||||||||||

| Subtotal: | 19 | $199,175,309 | 23.3 | % | 1.53x | 9.8% | 62.1% | 56.4% | |||||||||

| Hotel | Limited Service | 11 | $73,482,840 | 8.6 | % | 1.71x | 13.6% | 65.5% | 53.7% | ||||||||

| Full Service | 2 | 57,000,000 | 6.7 | 1.59x | 12.3% | 64.7% | 57.2% | ||||||||||

| Subtotal: | 13 | $130,482,840 | 15.2 | % | 1.66x | 13.1% | 65.2% | 55.2% | |||||||||

| Multifamily | Garden | 6 | $43,380,230 | 5.1 | % | 1.49x | 9.5% | 63.3% | 51.2% | ||||||||

| Senior | 1 | 6,979,964 | 0.8 | 1.94x | 14.8% | 48.5% | 36.9% | ||||||||||

| Subtotal: | 7 | $50,360,194 | 5.9 | % | 1.56x | 10.3% | 61.2% | 49.2% | |||||||||

| Self Storage | Self Storage | 6 | $37,565,000 | 4.4 | % | 1.96x | 10.5% | 57.3% | 55.9% | ||||||||

| Mixed Use | Office/Data Center/Retail | 1 | $37,000,000 | 4.3 | % | 2.47x | 11.3% | 50.0% | 50.0% | ||||||||

| Subtotal: | 1 | $37,000,000 | 4.3 | % | 2.47x | 11.3% | 50.0% | 50.0% | |||||||||

| Manufactured Housing | Manufactured Housing | 8 | $26,464,395 | 3.1 | % | 1.56x | 11.6% | 65.1% | 59.2% | ||||||||

| Industrial | Warehouse | 9 | $12,400,000 | 1.4 | % | 1.39x | 9.8% | 71.3% | 65.5% | ||||||||

| Flex | 2 | 3,000,000 | 0.4 | 1.39x | 9.8% | 71.3% | 65.5% | ||||||||||

| Subtotal: | 11 | $15,400,000 | 1.8 | % | 1.39x | 9.8% | 71.3% | 65.5% | |||||||||

| Total / Weighted Average: | 75 | $855,747,738 | 100.0 | % | 1.77x | 10.9% | 59.8% | 55.1% | |||||||||

| (1) | Because this table presents information relating to the mortgaged properties and not mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts. |

| (2) | In the case of Loan Nos. 2, 4, 5, 7, 8, 9, 11, 12, 19 and 28, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan No. 2, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan. In the case of Loan Nos. 13 and 14, the two mortgage loans are cross-collateralized and cross-defaulted with one other and as such, the calculations are based on the aggregate Cut-off Date Balances, Maturity Date Balances, UW NOI, UW NCF and Debt Service of the two mortgage loans. |

| (3) | In the case of Loan Nos. 2, 18, 22, 23.02 and 44, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| (4) | In the case of Loan Nos. 5 and 11, each with an anticipated repayment date, Maturity Date LTV is as of the related anticipated repayment date. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 8 |  |

| Structural and Collateral Term Sheet | BBCMS 2017-C1 | |

| Collateral Characteristics | ||

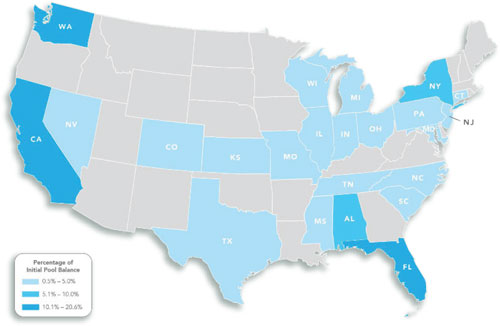

| Mortgaged Properties by Location(1) |

Weighted Average | |||||||||||||||

State | Number of | Cut-off Date | % of | UW | UW | Cut-off Date | Maturity Date | ||||||||

| California | 16 | $176,644,123 | 20.6 | % | 1.66x | 10.4% | 57.2% | 50.9% | |||||||

| Florida | 6 | 129,000,000 | 15.1 | 1.62x | 10.5% | 65.2% | 61.2% | ||||||||

| Washington | 2 | 93,000,000 | 10.9 | 2.05x | 10.6% | 51.1% | 51.1% | ||||||||

| New York | 2 | 59,750,000 | 7.0 | 1.80x | 10.4% | 37.4% | 37.1% | ||||||||

| Alabama | 2 | 50,943,000 | 6.0 | 1.68x | 8.7% | 54.7% | 54.5% | ||||||||

| New Jersey | 1 | 41,500,000 | 4.8 | 2.95x | 11.8% | 67.7% | 67.7% | ||||||||

| North Carolina | 4 | 41,229,265 | 4.8 | 1.63x | 12.6% | 63.9% | 53.9% | ||||||||

| Kansas | 2 | 37,000,000 | 4.3 | 2.22x | 12.0% | 63.6% | 59.9% | ||||||||

| Texas | 5 | 34,107,970 | 4.0 | 1.51x | 11.1% | 65.5% | 57.9% | ||||||||

| Michigan | 5 | 24,909,964 | 2.9 | 1.74x | 11.4% | 62.1% | 58.2% | ||||||||

| Pennsylvania | 2 | 24,615,000 | 2.9 | 1.52x | 10.8% | 66.6% | 60.7% | ||||||||

| Connecticut | 1 | 22,750,000 | 2.7 | 1.95x | 15.4% | 65.0% | 53.1% | ||||||||

| Tennessee | 3 | 17,460,046 | 2.0 | 1.70x | 12.4% | 64.2% | 50.9% | ||||||||

| Colorado | 1 | 17,050,000 | 2.0 | 1.53x | 11.3% | 72.2% | 63.8% | ||||||||

| Nevada | 1 | 15,486,983 | 1.8 | 1.38x | 10.3% | 69.1% | 58.6% | ||||||||

| Indiana | 3 | 12,479,387 | 1.5 | 1.64x | 12.5% | 66.4% | 57.2% | ||||||||

| Ohio | 3 | 12,140,000 | 1.4 | 1.66x | 12.1% | 63.4% | 54.4% | ||||||||

| Maryland | 1 | 12,000,000 | 1.4 | 1.32x | 9.5% | 69.0% | 61.6% | ||||||||

| Illinois | 8 | 10,100,000 | 1.2 | 1.39x | 9.8% | 71.3% | 65.5% | ||||||||

| Mississippi | 2 | 7,482,000 | 0.9 | 1.71x | 13.3% | 66.5% | 56.4% | ||||||||

| Missouri | 2 | 7,220,000 | 0.8 | 1.61x | 12.2% | 73.0% | 62.1% | ||||||||

| South Carolina | 1 | 5,000,000 | 0.6 | 1.44x | 9.3% | 71.4% | 68.8% | ||||||||

| Wisconsin | 2 | 3,880,000 | 0.5 | 1.39x | 9.8% | 71.3% | 65.5% | ||||||||

| Total / Weighted Average: | 75 | $855,747,738 | 100.0 | % | 1.77x | 10.9% | 59.8% | 55.1% | |||||||

| (1) | Because this table presents information relating to the mortgaged properties and not mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts. |

| (2) | In the case of Loan Nos. 2, 4, 5, 7, 8, 9, 11, 12, 19 and 28, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan No. 2, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan. In the case of Loan Nos. 13 and 14, the two mortgage loans are cross-collateralized and cross-defaulted with one other and as such, the calculations are based on the aggregate Cut-off Date Balances, Maturity Date Balances, UW NOI, UW NCF and Debt Service of the two mortgage loans. |

| (3) | In the case of Loan Nos. 2, 18, 22, 23.02 and 44, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and“—Appraised Value” in the Preliminary Prospectus for additional details. |

| (4) | In the case of Loan Nos. 5 and 11, each with an anticipated repayment date, Maturity Date LTV is as of the related anticipated repayment date. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 9 |  |

| Structural and Collateral Term Sheet | BBCMS 2017-C1 | |

| Collateral Characteristics | ||

| Cut-off Date Principal Balance |

| Weighted Average | |||||||||||||||||||||||

| Range of Cut-off Date Principal Balances | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW NCF DSCR(2)(3) | UW NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) | ||||||||||||||

| $1,800,000 | - | $9,999,999 | 31 | $175,191,003 | 20.5 | % | 5.17719% | 115 | 1.66x | 11.5% | 61.3% | 52.5% | |||||||||||

| $10,000,000 | - | $19,999,999 | 15 | 205,806,735 | 24.0 | 5.17853% | 115 | 1.52x | 10.6% | 67.3% | 59.5% | ||||||||||||

| $20,000,000 | - | $24,999,999 | 1 | 22,750,000 | 2.7 | 4.79750% | 120 | 1.95x | 15.4% | 65.0% | 53.1% | ||||||||||||

| $25,000,000 | - | $49,999,999 | 7 | 228,750,000 | 26.7 | 4.77725% | 109 | 2.14x | 11.7% | 58.6% | 55.6% | ||||||||||||

| $50,000,000 | - | $61,000,000 | 4 | 223,250,000 | 26.1 | 5.04925% | 119 | 1.71x | 9.5% | 52.6% | 52.6% | ||||||||||||

| Total / Weighted Average: | 58 | $855,747,738 | 100.0 | % | 5.02713% | 114 | 1.77x | 10.9% | 59.8% | 55.1% | |||||||||||||

| Mortgage Interest Rates |

Weighted Average | |||||||||||||||||||||||

| Range of Mortgage Interest Rates | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW NCF DSCR(2)(3) | UW NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) | ||||||||||||||

| 3.93000% | - | 3.99999% | 1 | $41,500,000 | 4.8 | % | 3.93000% | 60 | 2.95x | 11.8% | 67.7% | 67.7% | |||||||||||

| 4.00000% | - | 4.49999% | 8 | 112,690,276 | 13.2 | 4.31230% | 118 | 1.95x | 10.2% | 52.1% | 47.1% | ||||||||||||

| 4.50000% | - | 4.99999% | 9 | 155,815,000 | 18.2 | 4.76082% | 117 | 1.86x | 11.0% | 61.3% | 57.6% | ||||||||||||

| 5.00000% | - | 5.49999% | 27 | 391,308,244 | 45.7 | 5.19143% | 119 | 1.63x | 10.3% | 58.7% | 54.9% | ||||||||||||

| 5.50000% | - | 5.99999% | 12 | 146,934,218 | 17.2 | 5.66953% | 111 | 1.62x | 12.5% | 64.9% | 55.8% | ||||||||||||

| 6.00000% | - | 6.21350% | 1 | 7,500,000 | 0.9 | 6.21350% | 120 | 1.68x | 14.6% | 63.6% | 49.5% | ||||||||||||

| Total / Weighted Average: | 58 | $855,747,738 | 100.0 | % | 5.02713% | 114 | 1.77x | 10.9% | 59.8% | 55.1% | |||||||||||||

| Original Term to Maturity/ARD in Months(1) |

Weighted Average | |||||||||||||||||||

| Original Term to Maturity/ARD in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW NCF DSCR(2)(3) | UW NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) | ||||||||||

| 60 | 4 | $66,964,395 | 7.8 | % | 4.56787% | 59 | 2.39x | 11.5% | 68.3% | 66.3% | |||||||||

| 120 | 54 | 788,783,343 | 92.2 | 5.06612% | 119 | 1.72x | 10.9% | 59.1% | 54.1% | ||||||||||

| Total / Weighted Average: | 58 | $855,747,738 | 100.0 | % | 5.02713% | 114 | 1.77x | 10.9% | 59.8% | 55.1% | |||||||||

| Remaining Term to Maturity/ARD in Months(1) |

| Weighted Average | |||||||||||||||||||||||

| Range of Remaining Term to Maturity/ARD in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW NCF DSCR(2)(3) | UW NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) | ||||||||||||||

| 57 | - | 60 | 4 | $66,964,395 | 7.8 | % | 4.56787% | 59 | 2.39x | 11.5% | 68.3% | 66.3% | |||||||||||

| 117 | - | 120 | 54 | 788,783,343 | 92.2 | 5.06612% | 119 | 1.72x | 10.9% | 59.1% | 54.1% | ||||||||||||

| Total / Weighted Average: | 58 | $855,747,738 | 100.0 | % | 5.02713% | 114 | 1.77x | 10.9% | 59.8% | 55.1% | |||||||||||||

| (1) | In the case of Loan Nos. 5 and 11, each with an anticipated repayment date, Remaining Loan Term, Original Term to Maturity/ARD in Months, Remaining Term to Maturity/ARD in Months and Maturity Date LTV are as of the related anticipated repayment date. |

| (2) | In the case of Loan Nos. 2, 4, 5, 7, 8, 9, 11, 12, 19 and 28, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan No. 2, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan. In the case of Loan Nos. 13 and 14, the two mortgage loans are cross-collateralized and cross-defaulted with one other and as such, the calculations are based on the aggregate Cut-off Date Balances, Maturity Date Balances, UW NOI, UW NCF and Debt Service of the two mortgage loans. |

| (3) | In the case of Loan Nos. 2, 18, 22, 23.02 and 44, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 10 |  |

| Structural and Collateral Term Sheet | BBCMS 2017-C1 | |

| Collateral Characteristics | ||

| Original Amortization Term in Months |

| Weighted Average | |||||||||||||||||||

| Original Amortization Term in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW NCF DSCR(2)(3) | UW NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) | ||||||||||

| Interest Only | 13 | $405,000,000 | 47.3 | % | 4.79331% | 113 | 1.99x | 10.1% | 54.2% | 54.2% | |||||||||

| 300 | 6 | 43,677,321 | 5.1 | 5.77823% | 100 | 1.63x | 13.3% | 62.3% | 50.8% | ||||||||||

| 360 | 39 | 407,070,417 | 47.6 | 5.17917% | 117 | 1.57x | 11.5% | 65.2% | 56.4% | ||||||||||

| Total / Weighted Average: | 58 | $855,747,738 | 100.0 | % | 5.02713% | 114 | 1.77x | 10.9% | 59.8% | 55.1% | |||||||||

| Remaining Amortization Term in Months |

| Weighted Average | |||||||||||||||||||||||

| Range of Remaining Amortization Term in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW NCF DSCR(2)(3) | UW NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) | ||||||||||||||

| Interest Only | 13 | $405,000,000 | 47.3 | % | 4.79331% | 113 | 1.99x | 10.1% | 54.2% | 54.2% | |||||||||||||

| 298 | - | 300 | 6 | 43,677,321 | 5.1 | 5.77823% | 100 | 1.63x | 13.3% | 62.3% | 50.8% | ||||||||||||

| 301 | - | 360 | 39 | 407,070,417 | 47.6 | 5.17917% | 117 | 1.57x | 11.5% | 65.2% | 56.4% | ||||||||||||

| Total / Weighted Average: | 58 | $855,747,738 | 100.0 | % | 5.02713% | 114 | 1.77x | 10.9% | 59.8% | 55.1% | |||||||||||||

| Amortization Types |

Weighted Average | |||||||||||||||||||

| Amortization Types | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW NCF DSCR(2)(3) | UW NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) | ||||||||||

| Interest Only | 11 | $338,500,000 | 39.6 | % | 4.91048% | 119 | 1.85x | 9.8% | 51.9% | 51.9% | |||||||||

| Balloon | 27 | 257,507,738 | 30.1 | 5.24856% | 114 | 1.61x | 12.0% | 64.5% | 53.3% | ||||||||||

| IO-Balloon | 18 | 193,240,000 | 22.6 | 5.22211% | 117 | 1.54x | 11.2% | 65.6% | 59.3% | ||||||||||

| ARD-Interest Only | 2 | 66,500,000 | 7.8 | 4.19692% | 83 | 2.75x | 11.6% | 65.7% | 65.7% | ||||||||||

| Total / Weighted Average: | 58 | $855,747,738 | 100.0 | % | 5.02713% | 114 | 1.77x | 10.9% | 59.8% | 55.1% | |||||||||

| Underwritten Net Cash Flow Debt Service Coverage Ratios(2) |

| Weighted Average | ||||||||||||||||||||||

| Range of Underwritten Net Cash Flow Debt Service Coverage Ratios | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW NCF DSCR(2)(3) | UW NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) | |||||||||||||

| 1.28x | - | 1.39x | 13 | $125,772,019 | 14.7% | 5.23350% | 112 | 1.36x | 9.7% | 67.3% | 58.5% | |||||||||||

| 1.40x | - | 1.49x | 4 | 31,425,000 | 3.7 | 5.08719% | 109 | 1.44x | 9.9% | 65.4% | 60.3% | |||||||||||

| 1.50x | - | 1.59x | 10 | 96,873,482 | 11.3 | 5.04273% | 119 | 1.55x | 10.9% | 66.1% | 56.2% | |||||||||||

| 1.60x | - | 1.69x | 10 | 198,243,575 | 23.2 | 5.17200% | 117 | 1.64x | 10.4% | 63.1% | 59.8% | |||||||||||

| 1.70x | - | 1.79x | 10 | 210,603,698 | 24.6 | 5.24705% | 119 | 1.76x | 11.2% | 52.3% | 49.0% | |||||||||||

| 1.80x | - | 1.99x | 6 | 77,229,964 | 9.0 | 4.80457% | 119 | 1.92x | 12.7% | 51.5% | 44.8% | |||||||||||

| 2.00x | - | 2.95x | 5 | 115,600,000 | 13.5 | 4.27281% | 98 | 2.65x | 11.6% | 58.8% | 58.8% | |||||||||||

| Total / Weighted Average: | 58 | $855,747,738 | 100.0% | 5.02713% | 114 | 1.77x | 10.9% | 59.8% | 55.1% | |||||||||||||

| (1) | In the case of Loan Nos. 5 and 11, each with an anticipated repayment date, Remaining Loan Term and Maturity Date LTV are as of the related anticipated repayment date. |

| (2) | In the case of Loan Nos. 2, 4, 5, 7, 8, 9, 11, 12, 19 and 28, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan No. 2, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan. In the case of Loan Nos. 13 and 14, the two mortgage loans are cross-collateralized and cross-defaulted with one other and as such, the calculations are based on the aggregate Cut-off Date Balances, Maturity Date Balances, UW NOI, UW NCF and Debt Service of the two mortgage loans. |

| (3) | In the case of Loan Nos. 2, 18, 22, 23.02 and 44, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and“—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 11 |  |

| Structural and Collateral Term Sheet | BBCMS 2017-C1 | |

| Collateral Characteristics | ||

| LTV Ratios as of the Cut-off Date(2)(3) |

| Weighted Average | |||||||||||||||||||||||

| Range of Cut-off Date LTVs | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW NCF DSCR(2)(3) | UW NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) | ||||||||||||||

| 31.5% | - | 49.9% | 5 | $102,729,964 | 12.0 | % | 4.99526% | 119 | 1.91x | 10.6% | 38.8% | 37.8% | |||||||||||

| 50.0% | - | 59.9% | 13 | 201,303,544 | 23.5 | 4.85624% | 119 | 1.85x | 10.1% | 53.1% | 51.7% | ||||||||||||

| 60.0% | - | 64.9% | 15 | 183,715,003 | 21.5 | 5.16643% | 119 | 1.75x | 12.0% | 62.9% | 54.4% | ||||||||||||

| 65.0% | - | 69.9% | 18 | 307,209,227 | 35.9 | 5.07721% | 107 | 1.76x | 11.0% | 67.0% | 61.5% | ||||||||||||

| 70.0% | - | 73.9% | 7 | 60,790,000 | 7.1 | 4.97285% | 114 | 1.46x | 10.4% | 72.4% | 64.7% | ||||||||||||

| Total / Weighted Average: | 58 | $855,747,738 | 100.0 | % | 5.02713% | 114 | 1.77x | 10.9% | 59.8% | 55.1% | |||||||||||||

| LTV Ratios as of the Maturity Date/ARD(1)(2)(3) |

Weighted Average | |||||||||||||||||||||||

| Range of Maturity Date LTVs | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW NCF DSCR(2)(3) | UW NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) | ||||||||||||||

| 26.1% | - | 49.9% | 15 | $156,149,418 | 18.2 | % | 5.07249% | 119 | 1.79x | 11.0% | 45.8% | 41.3% | |||||||||||

| 50.0% | - | 54.9% | 18 | 329,875,632 | 38.5 | 4.99604% | 119 | 1.80x | 11.3% | 58.3% | 52.9% | ||||||||||||

| 55.0% | - | 59.9% | 7 | 76,768,293 | 9.0 | 5.32614% | 119 | 1.53x | 10.4% | 65.4% | 56.9% | ||||||||||||

| 60.0% | - | 64.9% | 11 | 140,439,395 | 16.4 | 5.21694% | 111 | 1.68x | 11.3% | 67.2% | 62.0% | ||||||||||||

| 65.0% | - | 68.8% | 7 | 152,515,000 | 17.8 | 4.72265% | 100 | 1.93x | 9.8% | 68.0% | 66.5% | ||||||||||||

| Total / Weighted Average: | 58 | $855,747,738 | 100.0 | % | 5.02713% | 114 | 1.77x | 10.9% | 59.8% | 55.1% | |||||||||||||

| Prepayment Protection |

Weighted Average | ||||||||||||||||||

| Prepayment Protection | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW NCF DSCR(2)(3) | UW NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) | |||||||||

| Defeasance(4) | 50 | $705,683,343 | 82.5 | % | 5.09391% | 118 | 1.70x | 10.9% | 59.6% | 54.2% | ||||||||

| Yield Maintenance | 8 | 150,064,395 | 17.5 | 4.71310% | 97 | 2.14x | 10.9% | 60.9% | 59.0% | |||||||||

| Total / Weighted Average: | 58 | $855,747,738 | 100.0 | % | 5.02713% | 114 | 1.77x | 10.9% | 59.8% | 55.1% | ||||||||

| Loan Purpose |

| Weighted Average | ||||||||||||||||||

| Loan Purpose | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term(1) | UW NCF DSCR(2)(3) | UW NOI DY(2) | Cut-off Date LTV(2)(3) | Maturity Date LTV(1)(2)(3) | |||||||||

| Refinance | 39 | $577,303,351 | 67.5 | % | 5.10123% | 118 | 1.67x | 10.5% | 57.8% | 53.2% | ||||||||

| Acquisition | 18 | 253,444,387 | 29.6 | 4.89654% | 107 | 1.95x | 11.7% | 64.1% | 58.7% | |||||||||

| Acquisition/Refinance | 1 | 25,000,000 | 2.9 | 4.64000% | 120 | 2.42x | 11.4% | 62.5% | 62.5% | |||||||||

| Total / Weighted Average: | 58 | $855,747,738 | 100.0 | % | 5.02713% | 114 | 1.77x | 10.9% | 59.8% | 55.1% | ||||||||

| (1) | In the case of Loan Nos. 5 and 11, each with an anticipated repayment date, Remaining Loan Term, Maturity Date LTV and LTV Ratios as of the Maturity Date/ARD are as of the related anticipated repayment date. |

| (2) | In the case of Loan Nos. 2, 4, 5, 7, 8, 9, 11, 12, 19 and 28, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan No. 2, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related Subordinate Companion Loan. In the case of Loan Nos. 13 and 14, the two mortgage loans are cross-collateralized and cross-defaulted with one other and as such, the calculations are based on the aggregate Cut-off Date Balances, Maturity Date Balances, UW NOI, UW NCF and Debt Service of the two mortgage loans. |

| (3) | In the case of Loan Nos. 2, 18, 22, 23.02 and 44, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| (4) | In the case of Loan Nos. 4, 9 and 12, the related loan documents permit the borrower to prepay the related loan with yield maintenance premium in the event the defeasance lockout period has not expired after certain dates. See the individual write-ups in this term sheet and “Description of the Mortgage Pool—Certain Terms of the Mortgage Loans—Defeasance; Collateral Substitution” in the Preliminary Prospectus. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 12 |  |

| Structural and Collateral Term Sheet | BBCMS 2017-C1 | |

| Collateral Characteristics | ||

| Previous Securitization History(1) |

| No. | Mortgage Loan Seller | Loan Name | Location | Property Type | Cut-off Date Principal Balance | % of IPB | Previous Securitization | |||||||

| 1 | RMF | Alhambra Towers | Coral Gables, FL | Office | $61,000,000 | 7.1% | WBCMT 2006-C29 | |||||||

| 2 | Barclays | 1166 Avenue of the Americas | New York, NY | Office | $56,250,000 | 6.6% | LBUBS 2007-C1 | |||||||

| 3 | Barclays | 1000 Denny Way | Seattle, WA | Office | $56,000,000 | 6.5% | WFRBS 2011-C3 | |||||||

| 6 | RMF | Orlando Central | Orlando, FL | Office | $38,250,000 | 4.5% | JPMCC 2005-LDP5 | |||||||

| 8 | UBS AG | Center West | Los Angeles, CA | Office | $30,000,000 | 3.5% | JPMCC 2007-LDPX | |||||||

| 9 | UBS AG | Anaheim Marriott Suites | Garden Grove, CA | Hotel | $30,000,000 | 3.5% | LBUBS 2007-C2 | |||||||

| 12 | UBS AG | Connecticut Financial Center | New Haven, CT | Office | $22,750,000 | 2.7% | BACM 2007-2 | |||||||

| 13 | Barclays | Casa Del Sol (Sierra Springs) | San Bernardino, CA | Multifamily | $11,126,475 | 1.3% | JPMCC 2007-LDPX | |||||||

| 14 | Barclays | Boardwalk-Park Place | Buena Park, CA | Multifamily | $10,658,307 | 1.2% | JPMCC 2007-LDPX | |||||||

| 17 | Barclays | South Towne Plaza | Indiana, PA | Retail | $16,100,000 | 1.9% | WBCMT 2006-C29 | |||||||

| 18 | RMF | West Sahara Promenade | Las Vegas, NV | Retail | $15,486,983 | 1.8% | WBCMT 2006-C29 | |||||||

| 20 | Barclays | Seaport Storage Center | Redwood City, CA | Self Storage | $15,250,000 | 1.8% | WFCM 2013-LC12 | |||||||

| 21 | Barclays | Westshore Plaza | Muskegon, MI | Retail | $14,700,000 | 1.7% | LBUBS 2007-C1 | |||||||

| 22 | UBS AG | Lakewood Village | Huffman, TX | Manufactured Housing | $13,464,395 | 1.6% | UBSBB 2012-C3 | |||||||

| 23.01 | RMF | Hampton Inn New Bern | New Bern, NC | Hotel | $6,594,486 | 0.8% | CGCMT 2006-C5 | |||||||

| 24 | RMF | Hilton Garden Inn - Overland Park | Overland Park, KS | Hotel | $12,000,000 | 1.4% | BSCMS 2006-PW11 | |||||||

| 25 | RMF | Dogwood Station | Baltimore, MD | Retail | $12,000,000 | 1.4% | CGCMT 2007-C6 | |||||||

| 28 | UBS AG | Wolfchase Galleria | Memphis, TN | Retail | $9,960,046 | 1.2% | GECMC 2007-C1 | |||||||

| 30 | RMF | Folsom Town Center | Folsom, CA | Retail | $8,241,539 | 1.0% | MLCFC 2007-5 | |||||||

| 31 | RMF | Santa Monica Retail Center | Los Angeles, CA | Retail | $8,100,000 | 0.9% | CD 2007-CD4 | |||||||

| 32 | UBS AG | LA Fitness - Montclair | Montclair, CA | Retail | $7,700,000 | 0.9% | MLMT 2008-C1 | |||||||

| 33 | RMF | Rock Springs | Houston, TX | Multifamily | $7,650,000 | 0.9% | LBUBS 2007-C1 | |||||||

| 36 | Barclays | Hollywood Pointe - Inglewood | Inglewood, CA | Multifamily | $7,072,334 | 0.8% | WBCMT 2006-C28 | |||||||

| 41 | UBS AG | Stow-A-Way | Redlands, CA | Self Storage | $6,100,000 | 0.7% | MSC 2007-IQ14 | |||||||

| 42 | UBS AG | National City Self Storage | National City, CA | Self Storage | $6,000,000 | 0.7% | CD 2007-CD4 | |||||||

| 43 | RMF | Holiday Inn Express & Suites - Jackson | Jackson, MS | Hotel | $5,800,000 | 0.7% | JPMCC 2007-CB19 | |||||||

| 48 | UBS AG | Winn Dixie - MacClenny | MacClenny, FL | Retail | $4,585,000 | 0.5% | BACM 2008-1 | |||||||

| 49 | RMF | Taft Hills Plaza | Taft, CA | Retail | $4,541,044 | 0.5% | LBUBS 2006-C6 | |||||||

| 51 | Barclays | North Pointe - Rayen | Panorama City, CA | Multifamily | $3,984,414 | 0.5% | JPMCC 2006-LDP9 | |||||||

| 55 | Barclays | Indian Creek Villas | Tehachapi, CA | Multifamily | $2,888,700 | 0.3% | JPMCC 2006-LDP9 |

| (1) | The table above represents the properties for which the previously existing debt was most recently securitized, based on information provided by the related borrower or obtained through searches of a third-party database. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 13 |  |

| Structural and Collateral Term Sheet | BBCMS 2017-C1 | |

| Class A-2(1) | ||

No. | Loan Name | Location | Cut-off Date Balance | % of IPB | Maturity Date/ARD Balance | % of Certificate Class(2) | Original Loan Term | Remaining Loan Term | UW NCF DSCR | UW NOI Debt Yield | Cut-off Date LTV(3) | Maturity Date/ARD LTV(3) | ||||||||||||

| 5 | Merrill Lynch Drive | Hopewell, NJ | $41,500,000 | 4.8% | $41,500,000 | 62.0 | % | 60 | 60 | 2.95x | 11.8% | 67.7% | 67.7% | |||||||||||

| 22 | Lakewood Village | Huffman, TX | 13,464,395 | 1.6 | 12,176,414 | 18.2 | 60 | 58 | 1.39x | 11.1% | 68.3% | 61.8% | ||||||||||||

| 38 | Reisinger MHC Portfolio | Various | 7,000,000 | 0.8 | 6,518,045 | 9.7 | 60 | 60 | 1.68x | 12.0% | 69.4% | 64.6% | ||||||||||||

| 46 | Richland Self Storage | Aiken, SC | 5,000,000 | 0.6 | 4,815,080 | 7.2 | 60 | 57 | 1.44x | 9.3% | 71.4% | 68.8% | ||||||||||||

| Total / Weighted Average: | $66,964,395 | 7.8% | $65,009,540 | 97.0 | % | 60 | 59 | 2.39x | 11.5% | 68.3% | 66.3% | |||||||||||||

| (1) | The table above presents the mortgage loans whose balloon payments would be applied to pay down the certificate balance of the Class A-2 Certificates, assuming a 0% CPR and applying the “Modeling Assumptions” described in the Preliminary Prospectus, including the assumptions that (i) none of the mortgage loans in the pool experience prepayments, defaults or losses; (ii) there are no extensions of maturity dates of any mortgage loans in the pool; and (iii) each mortgage loan in the pool is paid in full on its stated maturity date. Each Class of Certificates, including the Class A-2 Certificates, evidences undivided ownership interests in the entire pool of mortgage loans. Debt service coverage ratio, debt yield and loan-to-value ratio information does not take into account subordinate debt (whether or not secured by the mortgaged property), if any, that is allowed under the terms of any mortgage loan. See Annex A-1 to the Preliminary Prospectus. |

| (2) | Reflects the percentage equal to the Maturity Date/ARD Balance divided by the initial Class A-2 Certificate Balance. |

| (3) | In the case of Loan No. 22, the Cut-off Date LTV and the Maturity Date/ARD LTV are calculated by using an appraised value based on certain hypothetical assumptions. Refer to “Description of the Mortgage Pool—Assessments of Property Value and Condition” and“—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 14 |  |

| Structural and Collateral Term Sheet | BBCMS 2017-C1 | |

| Structural Overview | ||

| ■ Accrual: | Each Class of Certificates (other than the Class R and Class V Certificates) will accrue interest on a 30/360 basis. The Class R Certificates will not accrue interest. On each Distribution Date, any excess interest collected in respect of any mortgage loan in the trust with an anticipated repayment date during the related collection period will be distributed to the holders of the Class V Certificates.

| |

| ■ Distribution of Interest: | On each Distribution Date, accrued interest for each Class of Certificates (other than the Class R and Class V Certificates) at the applicable pass-through rate will be distributed in the following order of priority to the extent of available funds: first, to the Class A-1, Class A-2, Class A-3, Class A-4, Class A-SB, Class X-A, Class X-B, Class X-D, Class X-E, Class X-F, Class X-G and Class X-H Certificates (the “Senior Certificates”), on apro ratabasis, based on the interest entitlement for each such Class on such date, and then to the Class A-S, Class B, Class C, Class D, Class E, Class F, Class G and Class H Certificates, in that order, in each case until the interest entitlement for such date payable to each such Class is paid in full.

The pass-through rate applicable to the Class A-1, Class A-2, Class A-3, Class A-4, Class A-SB, Class A-S, Class B, Class C, Class D, Class E, Class F, Class G and Class H Certificates on each Distribution Date, will be aper annum rate equal to one of (i) a fixed rate, (ii) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), (iii) the lesser of a specified fixed pass-through rate and the rate described in clause (ii) above or (iv) the rate described in clause (ii) above less a specified percentage.

The pass-through rate for the Class X-A Certificates for any Distribution Date will be aper annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the weighted average of the pass-through rates on the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB Certificates for the related Distribution Date, weighted on the basis of their respective Certificate Balances outstanding immediately prior to that Distribution Date.

The pass-through rate for the Class X-B Certificates for any Distribution Date will be aper annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the weighted average of the pass-through rates on the Class A-S, Class B and Class C Certificates for the related Distribution Date, weighted on the basis of their respective Certificate Balances outstanding immediately prior to that Distribution Date.

The pass-through rate for the Class X-D Certificates for any Distribution Date will be aper annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the pass-through rate on the Class D Certificates for the related Distribution Date.

The pass-through rate for the Class X-E Certificates for any Distribution Date will be aper annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the pass-through rate on the Class E Certificates for the related Distribution Date.

The pass-through rate for the Class X-F Certificates for any Distribution Date will be aper annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the pass-through rate on the Class F Certificates for the related Distribution Date.

The pass-through rate for the Class X-G Certificates for any Distribution Date will be aper annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the pass-through rate on the Class G Certificates for the related Distribution Date.

The pass-through rate for the Class X-H Certificates for any Distribution Date will be aper annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day |

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 15 |  |

| Structural and Collateral Term Sheet | BBCMS 2017-C1 | |

| Structural Overview | ||

year consisting of twelve 30-day months), over (b) the pass-through rate on the Class H Certificates for the related Distribution Date.

The Class V Certificates will not have a pass-through rate or be entitled to distributions in respect of interest other than excess interest, if any, with respect to an anticipated repayment date loan.

See “Description of the Certificates—Distributions” in the Preliminary Prospectus.

| ||

| ■ Distribution of Principal: | On any Distribution Date prior to the Cross-Over Date, payments in respect of principal of the Certificates will be distributed:

first, to the Class A-SB Certificates until the Certificate Balance of the Class A-SB Certificates is reduced to the Class A-SB planned principal balance for the related Distribution Date set forth in Annex E to the Preliminary Prospectus, second, to the Class A-1 Certificates, until the Certificate Balance of such Class is reduced to zero, third, to the Class A-2 Certificates, until the Certificate Balance of such Class is reduced to zero, fourth, to the Class A-3 Certificates, until the Certificate Balance of such Class is reduced to zero, fifth, to the Class A-4 Certificates, until the Certificate Balance of such Class is reduced to zero and sixth, to the Class A-SB Certificates, until the Certificate Balance of such Class is reduced to zero and then to the Class A-S, Class B, Class C, Class D, Class E, Class F, Class G and Class H Certificates, in that order, until the Certificate Balance of each such Class is reduced to zero.

On any Distribution Date on or after the Cross-Over Date, payments in respect of principal of the Certificates will be distributed to the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB Certificates,pro rata based on the Certificate Balance of each such Class until the Certificate Balance of each such Class is reduced to zero and then to the Class A-S, Class B, Class C, Class D, Class E, Class F, Class G and Class H Certificates, in that order, until the Certificate Balance of each such Class is reduced to zero.

The “Cross-Over Date” means the Distribution Date on which the aggregate Certificate Balances of the Class A-S, Class B, Class C, Class D, Class E, Class F, Class G and Class H Certificates have been reduced to zero as a result of the allocation of realized losses to such Classes.

The Class X-A, Class X-B, Class X-D, Class X-E, Class X-F, Class X-G and Class X-H Certificates (the “Class X Certificates”) will not be entitled to receive distributions of principal; however, the notional amount of the Class X-A Certificates will be reduced by the aggregate amount of principal distributions, realized losses and trust fund expenses, if any, allocated to the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB Certificates, the notional amount of the Class X-B Certificates will be reduced by the aggregate amount of principal distributions, realized losses and trust fund expenses, if any, allocated to the Class A-S, Class B and Class C Certificates and the notional amount of the Class X-D Certificates will be reduced by the amount of principal distributions, realized losses and trust fund expenses, if any, allocated to the Class D Certificates, the notional amount of the Class X-E Certificates will be reduced by the amount of principal distributions, realized losses and trust fund expenses, if any, allocated to the Class E Certificates, the notional amount of the Class X-F Certificates will be reduced by the amount of principal distributions, realized losses and trust fund expenses, if any, allocated to the Class F Certificates, the notional amount of the Class X-G Certificates will be reduced by the amount of principal distributions, realized losses and trust fund expenses, if any, allocated to the Class G Certificates and the notional amount of the Class X-H Certificates will be reduced by the amount of principal distributions, realized losses and trust fund expenses, if any, allocated to the Class H Certificates.

| |

| ■ Yield Maintenance / Prepayment Premium Allocation: | For purposes of the distribution of Yield Maintenance Charges on any Distribution Date, if any Yield Maintenance Charge or Prepayment Premium is collected during any particular collection period with respect to any mortgage loan, then on the Distribution Date corresponding to that collection period, the certificate administrator will pay that Yield Maintenance Charge or Prepayment Premium (net of liquidation fees payable therefrom) in the following manner: (1) to each of the Class A-1, Class A-2, Class A-3, Class A-4, Class A-SB, Class A-S, Class B, Class C and Class D Certificates, the product of (a) such Yield Maintenance Charge or Prepayment Premium, (b) the related Base Interest Fraction (as defined in the Preliminary Prospectus) for such Class, and (c) a fraction, the numerator of which is equal to the amount of principal distributed to such Class for that Distribution Date, and the denominator of which is the total amount of principal distributed to all Principal Balance Certificates for that Distribution Date, and

|

THE INFORMATION IN THIS COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| 16 |  |

| Structural and Collateral Term Sheet | BBCMS 2017-C1 | |

| Structural Overview | ||

(2) to the Class X-A Certificates, the excess, if any, of (a) the product of (i) such Yield Maintenance Charge or Prepayment Premium and (ii) a fraction, the numerator of which is equal to the amount of principal distributed to the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB Certificates for that Distribution Date, and the denominator of which is the total amount of principal distributed to all Principal Balance Certificates for that Distribution Date, over (b) the amount of such Yield Maintenance Charge or Prepayment Premium distributed to the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB Certificates as described above, and (3) to the Class X-B Certificates, any remaining Yield Maintenance Charge or Prepayment Premium not distributed as described above. No Prepayment Premiums or Yield Maintenance Charges will be distributed to the holders of the Class X-D, Class X-E, Class X-F, Class X-G, Class X-H, Class E, Class F, Class G, Class H, Class R or Class V Certificates. For a description of when Prepayment Premiums and Yield Maintenance Charges are generally required on the mortgage loans, see Annex A-1 to the Preliminary Prospectus. See also “Risk Factors—Risks Relating to the Mortgage Loans—Risks Relating to Enforceability of Yield Maintenance Charges, Prepayment Premiums or Defeasance Provisions” and “Risk Factors—Other Risks Relating to the Certificates—Your Yield May Be Affected by Defaults, Prepayments and Other Factors” in the Preliminary Prospectus. Prepayment Premiums and Yield Maintenance Charges will be distributed on each Distribution Date only to the extent they are actually received on the mortgage loans as of the related Determination Date.

| ||

| ■ Realized Losses: | Losses on the mortgage loans will be allocated first to the Class H, Class G, Class F, Class E, Class D, Class C, Class B and Class A-S Certificates, in that order, in each case until the Certificate Balance of all such Classes have been reduced to zero, and then, to the Class A-1, Class A-2, Class A-3, Class A-4 and Class A-SB Certificates,pro rata, based on the Certificate Balance of each such Class, until the Certificate Balance of each such Class has been reduced to zero. The notional amounts of the Class X-A, Class X-B, Class X-D, Class X-E, Class X-F, Class X-G and Class X-H Certificates will be reduced by the aggregate amount of realized losses allocated to Certificates that are components of the notional amounts of the Class X-A, Class X-B, Class X-D, Class X-E, Class X-F, Class X-G and Class X-H Certificates, respectively.