| FREE WRITING PROSPECTUS | ||

| FILED PURSUANT TO RULE 433 | ||

| REGISTRATION FILE NO.: 333-257737-13 | ||

| Dated March 12, 2024 | BBCMS 2024-5C25 |

Free Writing Prospectus Structural and Collateral Term Sheet | ||

BBCMS Mortgage Trust 2024-5C25 | ||

$886,388,000 (Approximate Mortgage Pool Balance) | ||

$792,209,000 (Approximate Offered Certificates) | ||

Barclays Commercial Mortgage Securities LLC Depositor | ||

COMMERCIAL MORTGAGE PASS-THROUGH CERTIFICATES, SERIES 2024-5C25 | ||

Barclays Capital Real Estate Inc. 3650 Real Estate Investment Trust 2 LLC German American Capital Corporation Citi Real Estate Funding Inc. UBS AG Societe Generale Financial Corporation Bank of Montreal Argentic Real Estate Finance 2 LLC Starwood Mortgage Capital LLC KeyBank National Association BSPRT CMBS Finance, LLC Mortgage Loan Sellers

| ||

Barclays Deutsche Bank Securities | UBS Securities LLC Citigroup KeyBanc Capital Markets | Societe Generale BMO Capital Markets |

| Co-Lead Managers and Joint Bookrunners | ||

Drexel Hamilton Co-Manager | Bancroft Capital, LLC Co-Manager | |

| Dated March 12, 2024 | BBCMS 2024-5C25 |

This material is for your information, and none of Barclays Capital Inc., BMO Capital Markets Corp., Citigroup Global Markets Inc., Deutsche Bank Securities Inc., KeyBanc Capital Markets Inc., SG Americas Securities, LLC, UBS Securities LLC, Drexel Hamilton, LLC and Bancroft Capital, LLC (the “Underwriters”) are soliciting any action based upon it. This material is not to be construed as an offer to sell or the solicitation of any offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal.

The depositor has filed a registration statement (including the prospectus) with the Securities and Exchange Commission (File No. 333-257737) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the Securities and Exchange Commission for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC website at www.sec.gov. Alternatively, the depositor or Barclays Capital Inc., any other underwriter, or any dealer participating in this offering will arrange to send you the prospectus if you request it by calling 1-888-603-5847. The Offered Certificates referred to in these materials, and the asset pool backing them, are subject to modification or revision (including the possibility that one or more Classes of Certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. You understand that, when you are considering the purchase of these Certificates, a contract of sale will come into being no sooner than the date on which the relevant Class has been priced and we have verified the allocation of Certificates to be made to you; any “indications of interest” expressed by you, and any “soft circles” generated by us, will not create binding contractual obligations for you or us.

Neither this document nor anything contained in this document shall form the basis for any contract or commitment whatsoever. The information contained in this document is preliminary as of the date of this document, supersedes any previous such information delivered to you and will be superseded by any such information subsequently delivered prior to the time of sale. These materials are subject to change, completion or amendment from time to time. The information should be reviewed only in conjunction with the entire offering document relating to the Commercial Mortgage Pass-Through Certificates, Series 2024-5C25 (the “Offering Document”). All of the information contained herein is subject to the same limitations and qualifications contained in the Offering Document. The information contained herein does not contain all relevant information relating to the underlying mortgage loans or mortgaged properties. Such information is described elsewhere in the Offering Document. The information contained herein will be more fully described elsewhere in the Offering Document. The information contained herein should not be viewed as projections, forecasts, predictions or opinions with respect to value. Prior to making any investment decision, prospective investors are strongly urged to read the Offering Document its entirety. Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this free writing prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This document has been prepared by the Underwriters for information purposes only and does not constitute, in whole or in part, a prospectus for the purposes of Regulation (EU) 2017/1129 (as amended or superseded) and/or Part VI of the Financial Services and Markets Act 2000 (as amended) or other offering document.

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of the Underwriters or any of their respective affiliates make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This document contains forward-looking statements. If and when included in this document, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in consumer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this document are made as of the date hereof. We have no obligation to update or revise any forward-looking statement.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this document is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE CERTIFICATES REFERRED TO IN THESE MATERIALS ARE SUBJECT TO MODIFICATION OR REVISION (INCLUDING THE POSSIBILITY THAT ONE OR MORE CLASSES OF CERTIFICATES MAY BE SPLIT, COMBINED OR ELIMINATED AT ANY TIME PRIOR TO ISSUANCE OR AVAILABILITY OF A FINAL PROSPECTUS) AND ARE OFFERED ON A “WHEN, AS AND IF ISSUED” BASIS.

THE UNDERWRITERS MAY FROM TIME TO TIME PERFORM INVESTMENT BANKING SERVICES FOR, OR SOLICIT INVESTMENT BANKING BUSINESS FROM, ANY COMPANY NAMED IN THESE MATERIALS. THE UNDERWRITERS AND/OR THEIR AFFILIATES OR RESPECTIVE EMPLOYEES MAY FROM TIME TO TIME HAVE A LONG OR SHORT POSITION IN ANY CERTIFICATE OR CONTRACT DISCUSSED IN THESE MATERIALS.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 2 | ||

| Structural and Collateral Term Sheet | BBCMS 2024-5C25 | |

| Indicative Capital Structure | ||

Publicly Offered Certificates

| Class | Expected Ratings (S&P / Fitch / KBRA) | Approximate Initial Certificate Balance or Notional Amount(1) | Approximate Initial Credit Support(2) | Expected Weighted Avg. Life (years)(3) | Expected Principal Window(3) | Certificate Principal to Value Ratio(4) | Underwritten NOI Debt Yield(5) | |

| A-1 | AAA(sf) / AAAsf / AAA(sf) | $821,000 | 30.000% | 3.06 | 4/24-12/28 | 38.6% | 18.7% | |

| A-3 | AAA(sf) / AAAsf / AAA(sf) | $619,650,000 | 30.000% | 4.88 | 12/28-3/29 | 38.6% | 18.7% | |

| X-A | AAA(sf) / AAAsf / AAA(sf) | $620,471,000 | (6) | N/A | N/A | N/A | N/A | N/A |

| X-B | NR / A-sf / AAA(sf) | $171,738,000 | (7) | N/A | N/A | N/A | N/A | N/A |

| A-S | AA-(sf) / AAAsf / AAA(sf) | $96,395,000 | 19.125% | 4.96 | 3/29-3/29 | 44.6% | 16.2% | |

| B | NR / AA-sf / AA-(sf) | $43,211,000 | 14.250% | 4.96 | 3/29-3/29 | 47.2% | 15.3% | |

| C | NR / A-sf / A-(sf) | $32,132,000 | 10.625% | 4.96 | 3/29-3/29 | 49.2% | 14.7% | |

Privately Offered Certificates(8)

| Class | Expected Ratings (S&P / Fitch / KBRA) | Approximate Initial Certificate Balance or Notional Amount(1) | Approximate Initial Credit Support(2) | Expected Weighted Avg. Life (years)(3) | Expected Principal Window(3) | Certificate Principal to Value Ratio(4) | Underwritten NOI Debt Yield(5) | |

| X-D | NR / BBBsf / BBB+(sf) | $14,404,000 | (9) | N/A | N/A | N/A | N/A | N/A |

| D | NR / BBBsf / BBB+(sf) | $14,404,000 | 9.000% | 4.96 | 3/29-3/29 | 50.1% | 14.4% | |

| E-RR | NR / BBB-sf / BBB(sf) | $13,295,000 | 7.500% | 4.96 | 3/29-3/29 | 51.0% | 14.2% | |

| F-RR | NR / BB-sf / BB+(sf) | $17,728,000 | 5.500% | 4.96 | 3/29-3/29 | 52.1% | 13.9% | |

| G-RR | NR / B-sf / BB-(sf) | $12,188,000 | 4.125% | 4.96 | 3/29-3/29 | 52.8% | 13.7% | |

| H-RR | NR / NR / B-(sf) | $9,972,000 | 3.000% | 4.96 | 3/29-3/29 | 53.4% | 13.5% | |

| J-RR | NR / NR / NR | $26,592,000 | 0.000% | 4.96 | 3/29-3/29 | 55.1% | 13.1% | |

| (1) | In the case of each such Class, subject to a permitted variance of plus or minus 5%. In addition, the Notional Amount of the Class X-A, Class X-B and Class X-D Certificates may vary depending upon the final pricing of the Classes of Principal Balance Certificates whose Certificate Balances comprise such Notional Amount, and, if as a result of such pricing the pass-through rate of the Class X-A, Class X-B or Class X-D Certificates would be equal to zero at all times, such Class of Certificates will not be issued on the closing date of this securitization. |

| (2) | The credit support percentages set forth for the Class A-1 and Class A-3 Certificates represent the approximate initial credit support for the Class A-1 and Class A-3 Certificates in the aggregate. |

| (3) | Assumes 0% CPR / 0% CDR and March 28, 2024 closing date. Based on modeling assumptions as described in the Preliminary Prospectus dated March 12, 2024 (the “Preliminary Prospectus”). |

| (4) | The “Certificate Principal to Value Ratio” for any Class of Principal Balance Certificates (other than the Class A-1 and Class A-3 Certificates) is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans, and (b) a fraction, the numerator of which is the total initial Certificate Balance of such Class of Certificates and all Classes of Principal Balance Certificates senior to such Class of Certificates and the denominator of which is the total initial Certificate Balance of all of the Principal Balance Certificates. The Class A-1 and Class A-3 Certificate Principal to Value Ratios are calculated in the aggregate for those Classes as if they were a single Class. Investors should note, however, that excess mortgaged property value associated with a mortgage loan will not be available to offset losses on any other mortgage loan. |

| (5) | The “Underwritten NOI Debt Yield” for any Class of Principal Balance Certificates (other than the Class A-1 and Class A-3 Certificates) is calculated as the product of (a) the weighted average UW NOI Debt Yield for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates and the denominator of which is the total initial Certificate Balance of such Class of Certificates and all Classes of Principal Balance Certificates senior to such Class of Certificates. The Underwritten NOI Debt Yield for each of the Class A-1 and Class A-3 Certificates is calculated in the aggregate for those Classes as if they were a single Class. Investors should note, however, that net operating income from any mortgaged property supports only the related mortgage loan and will not be available to support any other mortgage loan. |

| (6) | The Notional Amount of the Class X-A Certificates will be equal to the aggregate Certificate Balance of the Class A-1 and Class A-3 Certificates outstanding from time to time. |

| (7) | The Notional Amount of the Class X-B Certificates will be equal to the aggregate Certificate Balance of the Class A-S, Class B and Class C Certificates outstanding from time to time. |

| (8) | The Class X-D, Class D, Class E-RR, Class F-RR, Class G-RR, Class H-RR and Class J-RR are not being offered by the Preliminary Prospectus or this Term Sheet. The Class R Certificates are not shown above. |

| (9) | The Notional Amount of the Class X-D Certificates will be equal to the Certificate Balance of the Class D Certificates outstanding from time to time. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 3 | ||

| Structural and Collateral Term Sheet | BBCMS 2024-5C25 | |

| Summary of Transaction Terms | ||

| Securities Offered: | $792,209,000 monthly pay, multi-class, commercial mortgage REMIC Pass-Through Certificates. |

| Co-Lead Managers and Joint Bookrunners: | Barclays Capital Inc., BMO Capital Markets Corp., Citigroup Global Markets Inc., Deutsche Bank Securities Inc., KeyBanc Capital Markets Inc., SG Americas Securities, LLC and UBS Securities LLC. |

| Co-Managers: | Drexel Hamilton, LLC and Bancroft Capital, LLC. |

| Mortgage Loan Sellers: | Barclays Capital Real Estate Inc. (“Barclays”) (22.3%), 3650 Real Estate Investment Trust 2 LLC (“3650 REIT”) (20.0%), German American Capital Corporation (“GACC”) (15.4%), Citi Real Estate Funding Inc. (“Citi”) (14.9%), UBS AG, by and through its branch office at 1285 Avenue of the Americas, New York, New York (“UBS AG”) (7.1%), Societe Generale Financial Corporation (“SGFC”) (4.8%), Bank of Montreal (“BMO”) (3.3%), Argentic Real Estate Finance 2 LLC (“AREF2”) (3.2%), Starwood Mortgage Capital LLC (“SMC”) (3.2%), KeyBank National Association (“KeyBank”) (3.1%) and BSPRT CMBS Finance, LLC (“BSPRT”) (2.6%). |

| Master Servicer: | Midland Loan Services, a Division of PNC Bank, National Association. |

| Special Servicer: | 3650 REIT Loan Servicing LLC. |

| Trustee: | Computershare Trust Company, National Association. |

| Certificate Administrator: | Computershare Trust Company, National Association. |

| Operating Advisor: | Pentalpha Surveillance LLC. |

| Asset Representations Reviewer: | Pentalpha Surveillance LLC. |

| Rating Agencies: | Fitch Ratings, Inc. (“Fitch”), S&P Global Ratings, acting through Standard & Poor’s Financial Services LLC (“S&P”) and Kroll Bond Rating Agency, LLC (“KBRA”). |

| Initial Majority Controlling Class Certificateholder: | 3650 Real Estate Investment Trust 2 LLC or an affiliate. |

| U.S. Credit Risk Retention: | For a discussion on the manner in which 3650 REIT, as retaining sponsor, intends to satisfy the U.S. credit risk retention requirements, see “Credit Risk Retention” in the Preliminary Prospectus. |

| EU Credit Risk Retention: | The transaction is not structured to satisfy the EU risk retention and due diligence requirements. |

| Closing Date: | On or about March 28, 2024. |

| Cut-off Date: | With respect to each mortgage loan, the related due date in March 2024, or in the case of any mortgage loan that has its first due date after March 2024, the date that would have been its due date in March 2024 under the terms of that mortgage loan if a monthly debt service payment were scheduled to be due in that month. |

| Distribution Date: | The 4th business day after the Determination Date in each month, commencing in April 2024. |

| Determination Date: | 11th day of each month, or if the 11th day is not a business day, the next succeeding business day, commencing in April 2024. |

| Assumed Final Distribution Date: | The Distribution Date in March 2029 which is the latest anticipated repayment date of the Certificates. |

| Rated Final Distribution Date: | The Distribution Date in March 2057. |

| Tax Treatment: | The Publicly Offered Certificates are expected to be treated as REMIC “regular interests” for U.S. federal income tax purposes. |

| Form of Offering: | The Class A-1, Class A-3, Class X-A, Class X-B, Class A-S, Class B and Class C Certificates (the “Publicly Offered Certificates”) will be offered publicly. The Class X-D, Class D, Class E-RR, Class F-RR, Class G-RR, Class H-RR, Class J-RR and Class R Certificates (the “Privately Offered Certificates”) will be offered domestically to Qualified Institutional Buyers and to Institutional Accredited Investors (other than the Class R Certificates) and to institutions that are not U.S. Persons pursuant to Regulation S. |

| SMMEA Status: | The Certificates will not constitute “mortgage related securities” for purposes of SMMEA. |

| ERISA: | The Publicly Offered Certificates are expected to be ERISA eligible. |

| Optional Termination: | On any Distribution Date on which the aggregate principal balance of the pool of mortgage loans is less than 1% of the aggregate principal balance of the mortgage loans as of the Cut-off Date, certain entities specified in the Preliminary Prospectus will have the option to purchase all of the remaining mortgage loans (and all property acquired through exercise of remedies in respect of any mortgage loan) at the price specified in the Preliminary Prospectus. Refer to “Pooling and Servicing Agreement—Termination; Retirement of Certificates” in the Preliminary Prospectus. |

| Minimum Denominations: | The Publicly Offered Certificates (other than the Class X-A and Class X-B Certificates) will be issued in minimum denominations of $10,000 and integral multiples of $1 in excess of $10,000. The Class X-A and Class X-B Certificates will be issued in minimum denominations of $1,000,000 and in integral multiples of $1 in excess of $1,000,000. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 4 | ||

| Structural and Collateral Term Sheet | BBCMS 2024-5C25 | |

| Summary of Transaction Terms | ||

| Settlement Terms: | DTC, Euroclear and Clearstream Banking. |

| Analytics: | The transaction is expected to be modeled by Intex Solutions, Inc. and Trepp, LLC and is expected to be available on Bloomberg L.P., BlackRock Financial Management, Inc., Interactive Data Corp., CMBS.com, Inc., Markit Group Limited, Moody’s Analytics, MBS Data, LLC, RealInsight, Thomson Reuters Corporation, DealView Technologies Ltd., KBRA Analytics, LLC and CRED iQ. |

| Risk Factors: | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. REFER TO THE “SUMMARY OF RISK FACTORS” AND “RISK FACTORS” SECTIONS OF THE PRELIMINARY PROSPECTUS. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 5 | ||

| Structural and Collateral Term Sheet | BBCMS 2024-5C25 | |

| Collateral Characteristics | ||

Mortgage Loan Seller | Number of Mortgage Loans(1) | Number of Mortgaged Properties(1) | Roll-up Aggregate Cut-off Date Balance | % of IPB |

| Barclays | 8 | 12 | $197,815,000 | 22.3% |

| 3650 REIT | 5 | 5 | $177,350,000 | 20.0% |

| GACC | 5 | 5 | $136,920,000 | 15.4% |

| CREFI | 6 | 6 | $131,700,000 | 14.9% |

| UBS AG | 1 | 1 | $63,000,000 | 7.1% |

| SGFC | 3 | 4 | $42,700,000 | 4.8% |

| BMO | 3 | 3 | $29,350,000 | 3.3% |

| AREF2 | 1 | 1 | $28,500,000 | 3.2% |

| SMC | 2 | 2 | $28,300,000 | 3.2% |

| KeyBank | 3 | 3 | $27,753,000 | 3.1% |

| BSPRT | 1 | 1 | $23,000,000 | 2.6% |

| Total: | 33 | 38 | $886,388,000 | 100.0% |

| Loan Pool | ||

| Initial Pool Balance (“IPB”): | $886,388,000 | |

| Number of Mortgage Loans: | 33 | |

| Number of Mortgaged Properties: | 38 | |

| Average Cut-off Date Balance per Mortgage Loan: | $26,860,242 | |

| Weighted Average Current Mortgage Rate: | 7.15651% | |

| 10 Largest Mortgage Loans as % of IPB: | 59.9% | |

| Weighted Average Remaining Term to Maturity: | 59 months | |

| Weighted Average Seasoning: | 1 month | |

| Credit Statistics | ||

| Weighted Average UW NCF DSCR(2)(3): | 1.72x | |

| Weighted Average UW NOI Debt Yield(2): | 13.1% | |

| Weighted Average Cut-off Date Loan-to-Value Ratio (“LTV”)(2)(4): | 55.1% | |

| Weighted Average Maturity Date LTV(2)(4): | 55.0% | |

| Other Statistics | ||

| % of Mortgage Loans with Additional Debt: | 3.0% | |

| % of Mortgage Loans with Single Tenants(5): | 13.8% | |

| % of Mortgage Loans secured by Multiple Properties: | 4.7% | |

| Amortization | ||

| Weighted Average Original Amortization Term(6): | 360 months | |

| Weighted Average Remaining Amortization Term(6): | 360 months | |

| % of Mortgage Loans with Interest-Only: | 96.3% | |

| % of Mortgage Loans with Partial Interest-Only followed by Amortizing Balloon: | 2.8% | |

| % of Mortgage Loans with Amortizing Balloon: | 0.9% | |

| Lockboxes(7) | ||

| % of Mortgage Loans with Hard Lockboxes: | 76.8% | |

| % of Mortgage Loans with Springing Lockboxes: | 13.0% | |

| % of Mortgage Loans with Soft Lockboxes: | 10.2% | |

| Reserves | ||

| % of Mortgage Loans Requiring Monthly Tax Reserves: | 59.7% | |

| % of Mortgage Loans Requiring Monthly Insurance Reserves: | 36.5% | |

| % of Mortgage Loans Requiring Monthly CapEx Reserves: | 62.8% | |

| % of Mortgage Loans Requiring Monthly TI/LC Reserves(8): | 28.1% | |

| (1) | The sum of the Number of Mortgage Loans and Number of Mortgaged Properties does not equal the aggregate due to certain loans being contributed by multiple loan sellers. There are four loans with multiple loan sellers being contributed to the pool comprised of four mortgaged properties, added to the count of each applicable mortgage loan seller. |

| (2) | In the case of Loan Nos. 1, 2, 4, 6, 7, 13, 15, 20, 26 and 33, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan No. 12, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related mezzanine loan(s). |

| (3) | For the mortgage loans that are interest-only for the entire term and accrue interest on an Actual/360 basis, the Monthly Debt Service (IO) ($) was calculated as 1/12th of the product of (i) the Original Balance ($), (ii) the Interest Rate % and (iii) 365/360. |

| (4) | In the case of Loan No. 22, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on an “As Is (Extraordinary Assumption)”. Refer to “Description of the Mortgage Pool—Assessment of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

| (5) | Excludes mortgage loans that are secured by multiple properties with multiple tenants. |

| (6) | Excludes mortgage loans that are interest only for the entire term. |

| (7) | For a more detailed description of Lockboxes, refer to “Description of the Mortgage Pool—Certain Terms of the Mortgage Loans—Mortgaged Property Accounts” in the Preliminary Prospectus. |

| (8) | Calculated only with respect to the Cut-off Date Balance of mortgage loans secured or partially secured by office, retail, mixed use and industrial properties. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 6 | ||

| Structural and Collateral Term Sheet | BBCMS 2024-5C25 | |

| Collateral Characteristics | ||

| Ten Largest Mortgage Loans |

| No. | Loan Name | City, State | Mortgage Loan Seller(s) | No. of Prop. | Cut-off Date Balance | % of IPB | Square Feet / Rooms / Units | Property Type | UW NCF DSCR(1) | UW NOI Debt Yield(1) | Cut-off Date LTV(1) | Maturity Date LTV(1) |

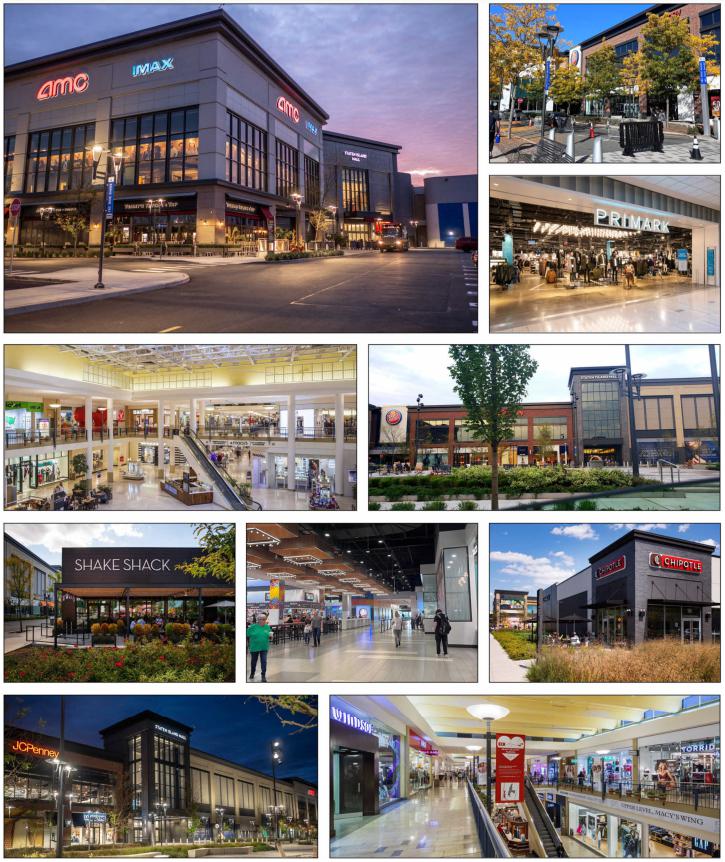

| 1 | Staten Island Mall | Staten Island, NY | GACC, Barclays | 1 | $71,500,000 | 8.1% | 995,900 | Retail | 2.09x | 16.5% | 42.8% | 42.8% |

| 2 | Sheraton Hotel Brooklyn | Brooklyn, NY | GACC | 1 | $65,000,000 | 7.3% | 321 | Hospitality | 1.78x | 14.6% | 58.6% | 58.6% |

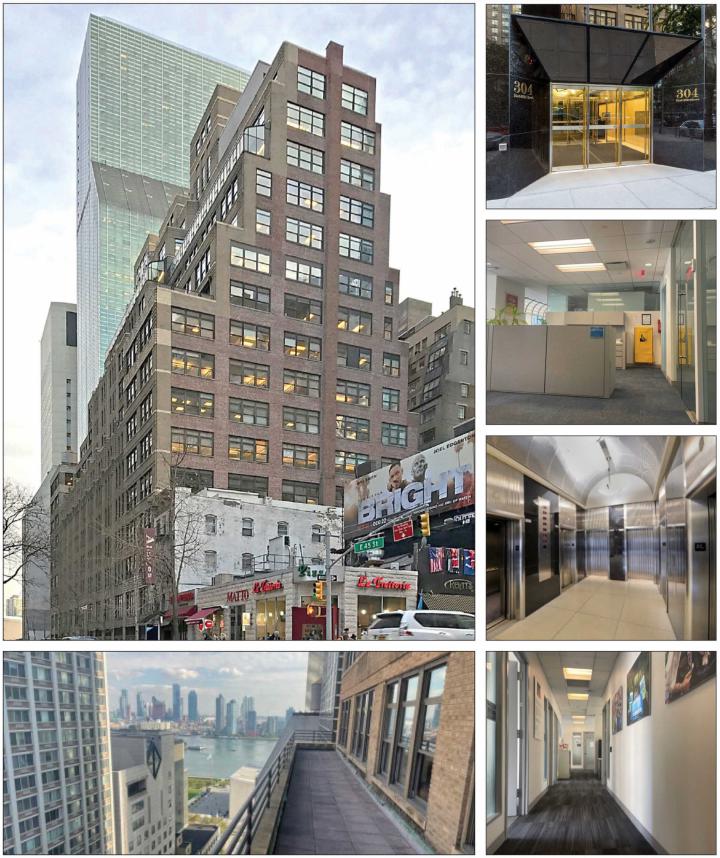

| 3 | 304 East 45th Street | New York, NY | 3650 REIT, BMO | 1 | $65,000,000 | 7.3% | 342,079 | Office | 2.39x | 17.4% | 47.1% | 47.1% |

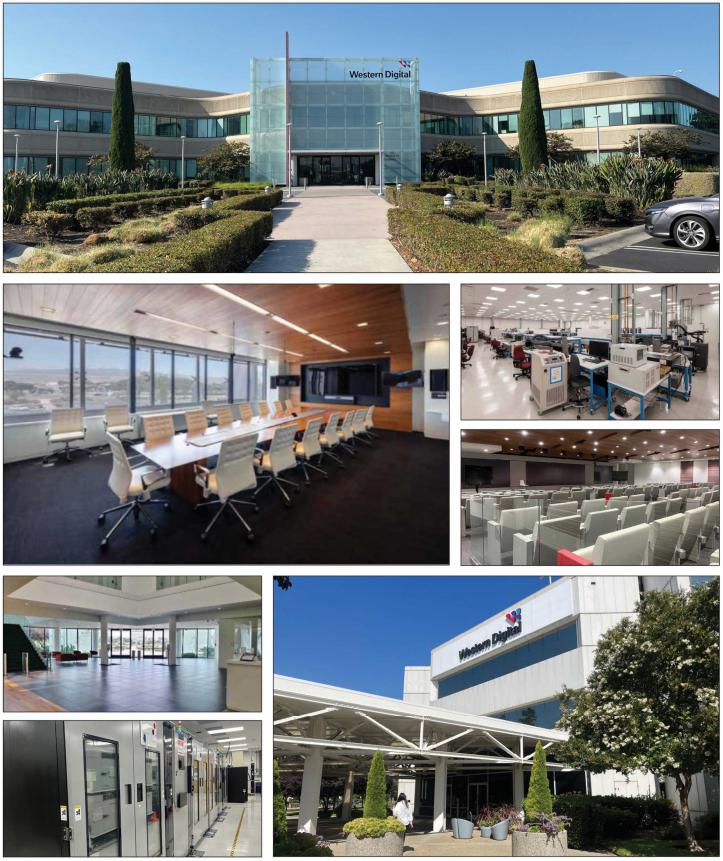

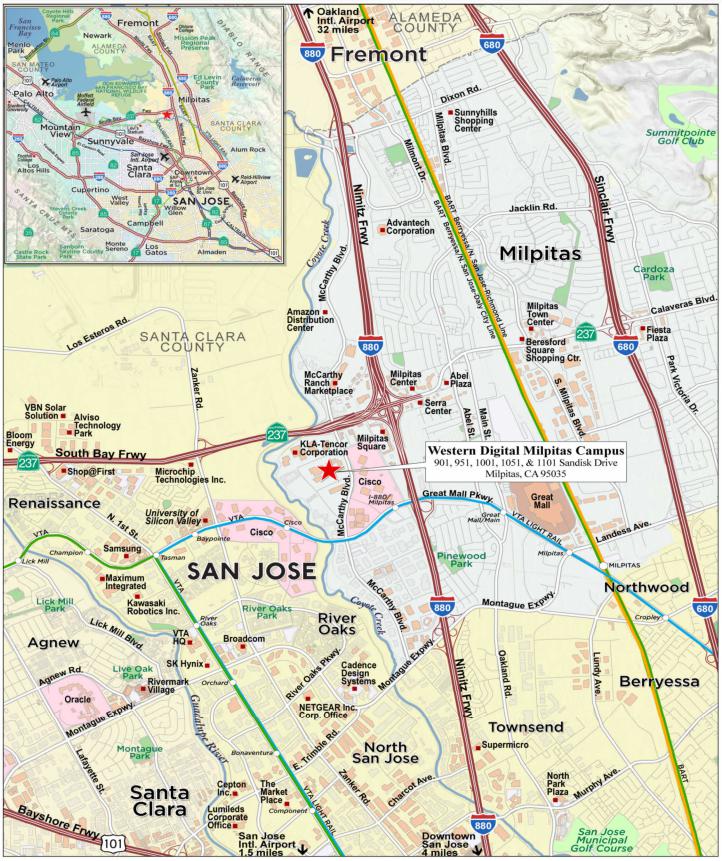

| 4 | Western Digital Milpitas Campus | Milpitas, CA | UBS AG | 1 | $63,000,000 | 7.1% | 577,956 | Mixed Use | 1.63x | 12.0% | 64.0% | 64.0% |

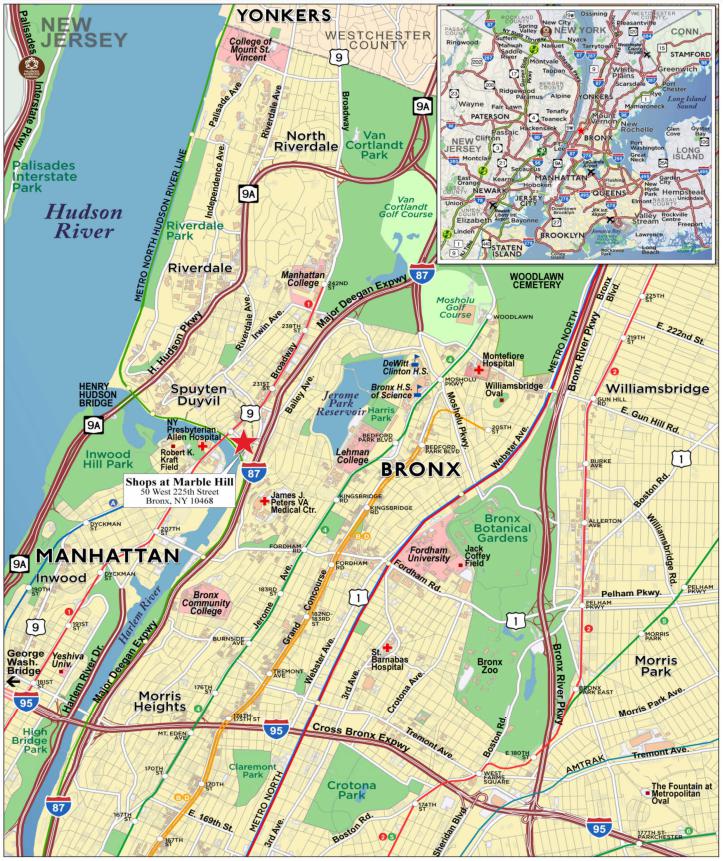

| 5 | Shops at Marble Hill | Bronx, NY | 3650 REIT | 1 | $53,750,000 | 6.1% | 123,896 | Retail | 1.35x | 10.0% | 61.3% | 61.3% |

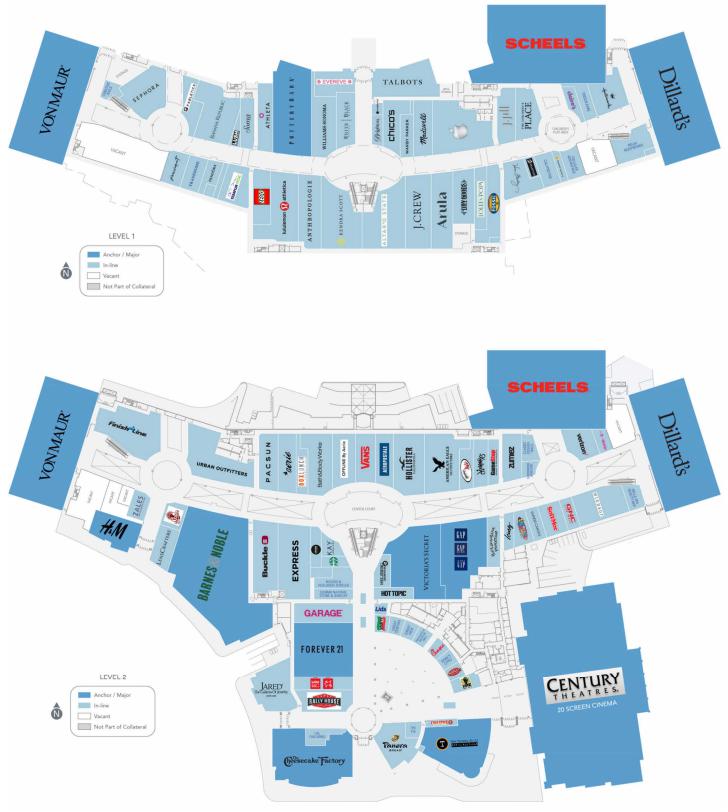

| 6 | Jordan Creek Town Center | West Des Moines, IA | Barclays | 1 | $51,000,000 | 5.8% | 940,038 | Retail | 1.93x | 14.4% | 53.0% | 53.0% |

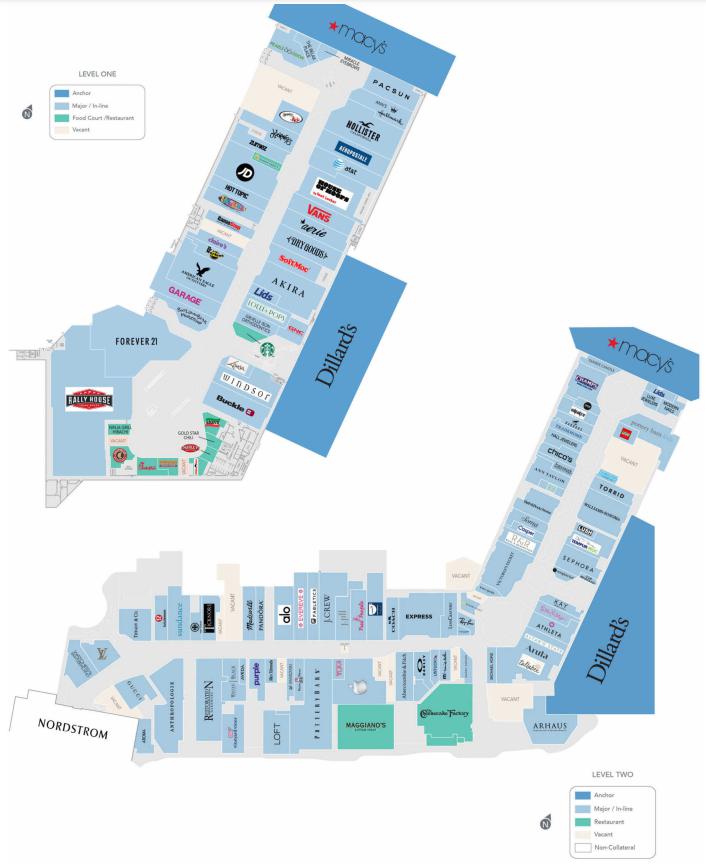

| 7 | Kenwood Towne Centre | Cincinnati, OH | SGFC, 3650 REIT | 1 | $50,000,000 | 5.6% | 1,033,141 | Retail | 2.19x | 14.6% | 45.5% | 45.5% |

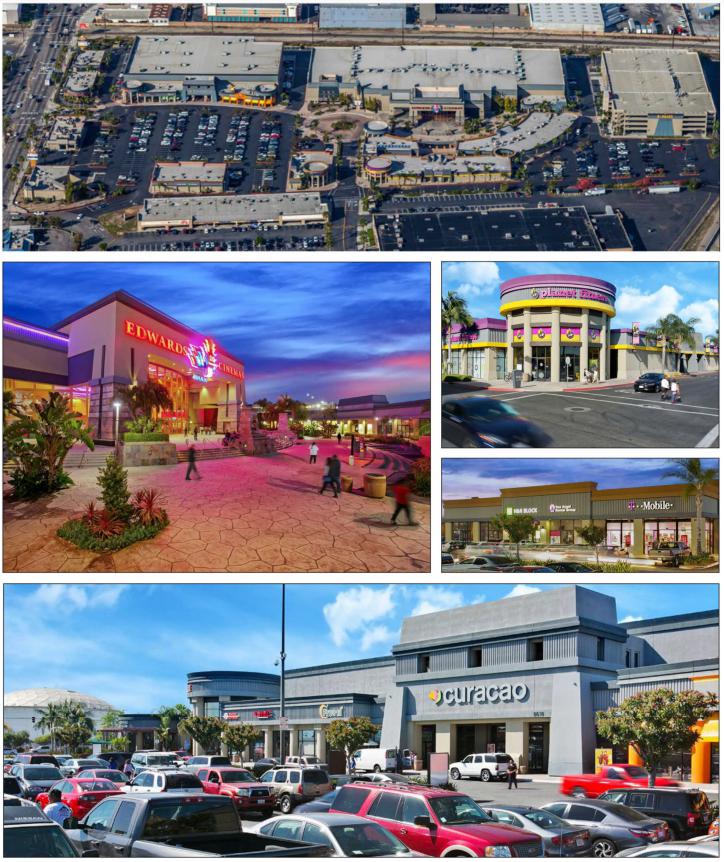

| 8 | El Paseo Shopping Center | South Gate, CA | CREFI | 1 | $43,000,000 | 4.9% | 297,482 | Retail | 1.51x | 11.9% | 54.5% | 54.5% |

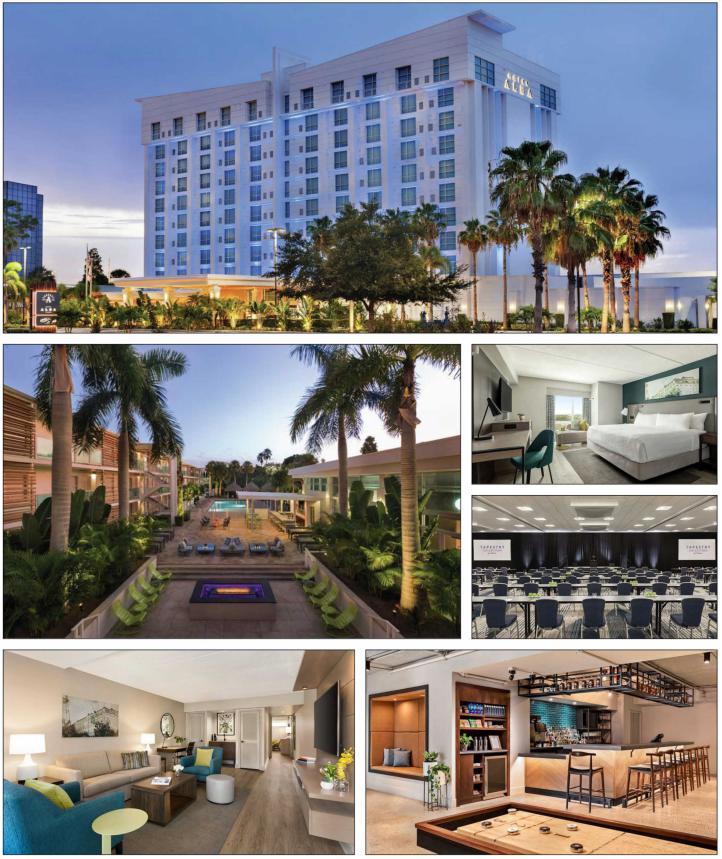

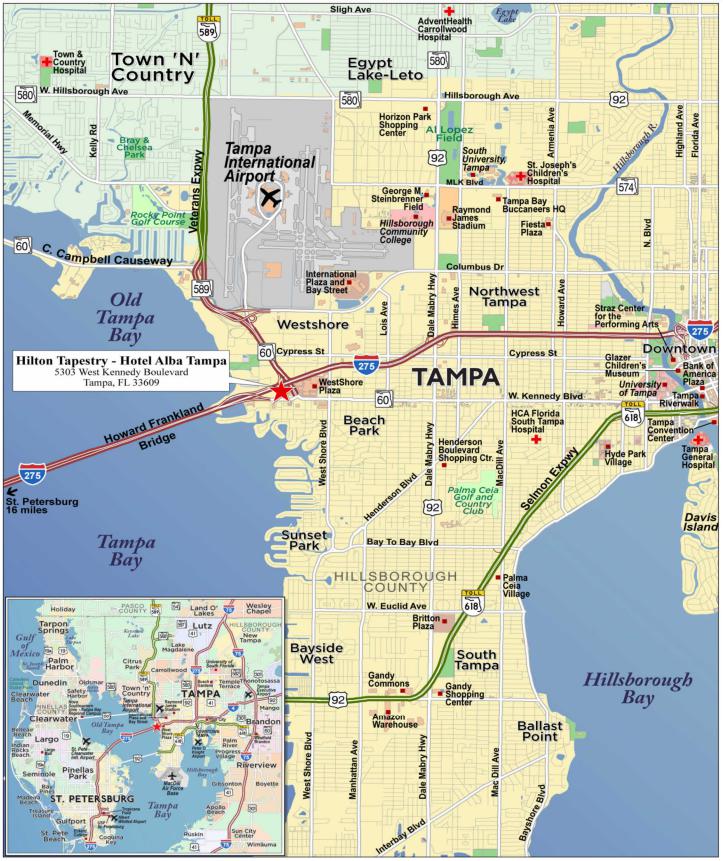

| 9 | Hilton Tapestry - Hotel Alba Tampa | Tampa, FL | CREFI | 1 | $35,000,000 | 3.9% | 222 | Hospitality | 1.48x | 14.5% | 58.3% | 58.3% |

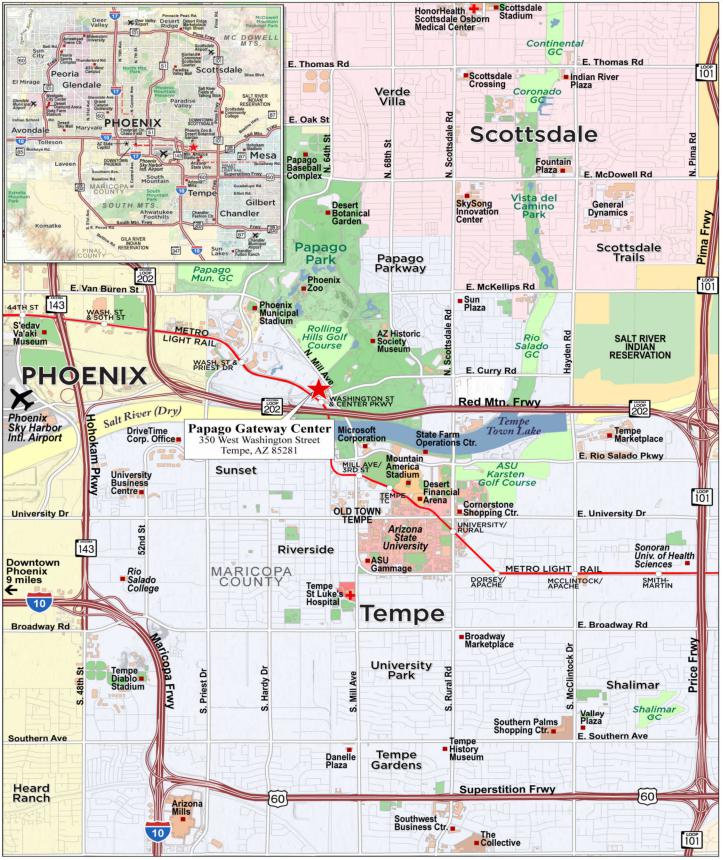

| 10 | Papago Gateway Center | Tempe, AZ | Barclays | 1 | $34,000,000 | 3.8% | 246,501 | Office | 1.88x | 16.4% | 46.3% | 46.3% |

| Top 3 Total/Weighted Average | 3 | $201,500,000 | 22.7% | 2.09x | 16.2% | 49.3% | 49.3% | |||||

| Top 5 Total/Weighted Average | 5 | $318,250,000 | 35.9% | 1.87x | 14.3% | 54.2% | 54.2% | |||||

| Top 10 Total/Weighted Average | 10 | $531,250,000 | 59.9% | 1.85x | 14.3% | 53.1% | 53.1% | |||||

| Non-Top 10 Total/Weighted Average | 28 | $355,138,000 | 40.1% | 1.52x | 11.3% | 58.0% | 57.8% | |||||

| (1) | In the case of Loan Nos. 1, 2, 4, 6 and 7, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 7 | ||

| Structural and Collateral Term Sheet | BBCMS 2024-5C25 | |

| Collateral Characteristics | ||

| Pari Passu Companion Loan Summary |

No. | Loan Name | Mortgage Loan Seller(s) | Trust Cut-off Date Balance | Total Mortgage Loan Cut-off Date Balance | Controlling Pooling/Trust & Servicing Agreement | Master Servicer | Special Servicer | Related Pari Passu Loan(s) Securitizations | Related Pari Passu Loan(s) Original Balance |

| 1 | Staten Island Mall | GACC, Barclays | $71,500,000 | $200,000,000 | BBCMS 2024-5C25 | Midland | 3650 | BMO 2024-5C3 Future Securitization(s) | $28,500,000 $100,000,000 |

| 2 | Sheraton Hotel Brooklyn | GACC | $65,000,000 | $85,000,000 | BBCMS 2024-5C25 | Midland | 3650 | Future Securitization(s) | $20,000,000 |

| 4 | Western Digital Milpitas Campus | UBS AG | $63,000,000 | $126,000,000 | BBCMS 2024-5C25 | Midland | 3650 | Future Securitization(s) | $63,000,000 |

| 6 | Jordan Creek Town Center | Barclays | $51,000,000 | $170,000,000 | (1) | (1) | (1) | Future Securitization(s) | $119,000,000 |

| 7 | Kenwood Towne Centre | SGFC, 3650 REIT | $50,000,000 | $260,000,000 | (1) | (1) | (1) | Future Securitization(s) | $210,000,000 |

| 13 | Tysons Corner Center | GACC | $25,000,000 | $710,000,000 | TYSN 2023-CRNR | Berkadia | Situs | TYSN 2023-CRNR Benchmark 2024-V5 BMO 2024-5C3 BANK 2024-5YR5 Future Securitization(s) | $440,200,000 $73,960,000 $73,960,000 $51,500,000 $45,380,000 |

| 15 | Acquisitions America Portfolio | Barclays | $24,100,000 | $84,100,000 | Benchmark 2024-V5 | Midland | Rialto | BMARK 2024-V5 | $60,000,000 |

| 20 | Elmwood Shopping Center | CREFI | $15,000,000 | $85,000,000 | BMO 2024-5C3 | Wells Fargo | Greystone | BMO 2024-5C3 | $70,000,000 |

| 26 | DoubleTree by Hilton Hotel Orlando at SeaWorld | BMO, CREFI, GACC | $10,000,000 | $85,000,000 | Benchmark 2024-V5 | Midland | Rialto | Benchmark 2024-V5 BMO 2024-5C3 | $60,000,000 $15,000,000 |

| 33 | Galleria at Tyler | SGFC | $5,000,000 | $150,000,000 | (2) | (2) | (2) | Benchmark 2024-V5 BMO 2024-5C3 Future Securitization(s) | $35,000,000 $50,000,000 $60,000,000 |

| (1) | In the case of Loan Nos. 6 and 7, the related Whole Loan will be serviced under the BBCMS 2024-5C25 pooling and servicing agreement until such time that the lead servicing pari passu companion loan is securitized, at which point the Whole Loan will be serviced under the related trust and servicing agreement or pooling and servicing agreement for such future securitization. The initial controlling noteholder is one of the originators of the related whole loan or an affiliate. |

| (2) | In the case of Loan No. 33, the related Whole Loan will be serviced under the Benchmark 2024-V5 pooling and servicing agreement until such time that the lead servicing pari passu companion loan is securitized, at which point the Whole Loan will be serviced under the related trust and servicing agreement or pooling and servicing agreement for such future securitization. The initial controlling noteholder is one of the originators of the related whole loan or an affiliate. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 8 | ||

| Structural and Collateral Term Sheet | BBCMS 2024-5C25 | |

| Collateral Characteristics | ||

| Additional Debt Summary | |||||||||||

No. | Loan Name | Trust | Pari Passu Companion Loan(s) Cut-off Date Balance | Subordinate Debt Cut-off Date Balance(1) | Total Debt Cut-off Date Balance | Mortgage Loan UW NCF DSCR(2) | Total Debt UW NCF DSCR | Mortgage Loan | Total Debt Cut-off Date LTV | Mortgage Loan UW NOI Debt Yield(2) | Total Debt UW NOI Debt Yield |

| 12 | Elevate at the Pointe | $26,500,000 | $0 | $4,250,000 | $30,750,000 | 1.39x | 1.09x | 54.9% | 63.7% | 8.9% | 7.7% |

| (1) | In the case of Loan No. 12, the subordinate debt represents a mezzanine loan. Reflects the current balance of the mezzanine loan, which allows for up to $2,500,000 of additional advances at a 12.0% interest rate. |

| (2) | Mortgage Loan UW NCF DSCR, Mortgage Loan Cut-off Date LTV and Mortgage Loan UW NOI Debt Yield calculations include any related Pari Passu Companion Loans (if applicable), but exclude any related mezzanine loan(s). |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 9 | ||

| Structural and Collateral Term Sheet | BBCMS 2024-5C25 | |

| Collateral Characteristics | ||

| Mortgaged Properties by Type(1) |

Weighted Average | |||||||||

| Property Type | Property Subtype | Number of Properties | Cut-off Date Principal Balance | % of IPB | UW NCF DSCR(2)(3) | UW NOI Debt Yield(2) | Cut-off Date LTV(2)(4) | Maturity Date LTV(2)(4) | |

| Retail | Super Regional Mall | 5 | $202,500,000 | 22.8 | % | 2.06x | 15.2% | 45.8% | 45.8% |

| Anchored | 6 | 132,970,000 | 15.0 | 1.52x | 11.6% | 57.8% | 57.6% | ||

| Subtotal: | 11 | $335,470,000 | 37.8 | % | 1.85x | 13.7% | 50.6% | 50.5% | |

| Multifamily | Garden | 4 | $67,026,000 | 7.6 | % | 1.30x | 8.8% | 61.2% | 61.2% |

| Mid Rise | 5 | 33,241,998 | 3.8 | 1.27x | 8.5% | 63.9% | 63.9% | ||

| Student Housing | 1 | 28,500,000 | 3.2 | 1.37x | 9.9% | 62.4% | 62.4% | ||

| Independent Living | 1 | 14,600,000 | 1.6 | 1.29x | 9.5% | 58.4% | 58.4% | ||

| High Rise | 1 | 11,858,002 | 1.3 | 1.25x | 8.9% | 64.4% | 64.4% | ||

| Subtotal: | 12 | $155,226,000 | 17.5 | % | 1.30x | 9.0% | 62.0% | 62.0% | |

| Hospitality | Full Service | 3 | $110,000,000 | 12.4 | % | 1.69x | 14.8% | 58.6% | 58.6% |

| Select Service | 1 | 12,490,000 | 1.4 | 1.56x | 15.6% | 66.1% | 64.6% | ||

| Limited Service | 1 | 12,475,000 | 1.4 | 1.44x | 14.1% | 65.7% | 64.4% | ||

| Extended Stay | 1 | 9,977,000 | 1.1 | 2.00x | 15.2% | 60.1% | 60.1% | ||

| Subtotal: | 6 | $144,942,000 | 16.4 | % | 1.68x | 14.8% | 59.9% | 59.7% | |

| Office | CBD | 1 | $65,000,000 | 7.3 | % | 2.39x | 17.4% | 47.1% | 47.1% |

| Suburban | 1 | 34,000,000 | 3.8 | 1.88x | 16.4% | 46.3% | 46.3% | ||

| Subtotal: | 2 | $99,000,000 | 11.2 | % | 2.21x | 17.1% | 46.8% | 46.8% | |

| Mixed Use | R&D / Office | 1 | $63,000,000 | 7.1 | % | 1.63x | 12.0% | 64.0% | 64.0% |

| Office / Retail / Multifamily | 1 | 11,700,000 | 1.3 | 1.58x | 11.9% | 49.2% | 49.2% | ||

| Subtotal: | 2 | $74,700,000 | 8.4 | % | 1.62x | 12.0% | 61.7% | 61.7% | |

| Industrial | Warehouse / Distribution | 1 | $24,500,000 | 2.8 | % | 1.32x | 10.8% | 53.0% | 53.0% |

| Manufacturing / Cold Storage | 1 | 23,000,000 | 2.6 | 1.30x | 11.5% | 52.3% | 52.3% | ||

| Warehouse | 1 | 11,850,000 | 1.3 | 2.50x | 13.1% | 49.8% | 49.8% | ||

| Subtotal: | 3 | $59,350,000 | 6.7 | % | 1.55x | 11.5% | 52.1% | 52.1% | |

| Self Storage | Self Storage | 2 | $17,700,000 | 2.0 | % | 1.44x | 9.5% | 67.3% | 67.3% |

| Total / Weighted Average: | 38 | $886,388,000 | 100.0 | % | 1.72x | 13.1% | 55.1% | 55.0% | |

| (1) | Because this table presents information relating to the mortgaged properties and not mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts. |

| (2) | In the case of Loan Nos. 1, 2, 4, 6, 7, 13, 15, 20, 26 and 33, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan No. 12, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related mezzanine loan(s). |

| (3) | For the mortgage loans that are interest-only for the entire term and accrue interest on an Actual/360 basis, the Monthly Debt Service (IO) ($) was calculated as 1/12th of the product of (i) the Original Balance ($), (ii) the Interest Rate % and (iii) 365/360. |

| (4) | In the case of Loan No. 22, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on an “As Is (Extraordinary Assumption)”. Refer to “Description of the Mortgage Pool—Assessment of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 10 | ||

| Structural and Collateral Term Sheet | BBCMS 2024-5C25 | |

| Collateral Characteristics | ||

| Mortgaged Properties by Location(1) |

Weighted Average | |||||||

State | Number of Properties | Cut-off Date | % of IPB | UW NCF DSCR(2)(3) | UW NOI Debt Yield(2) | Cut-off Date LTV(2)(4) | Maturity Date LTV(2)(4) |

| New York | 11 | $313,800,000 | 35.4% | 1.81x | 13.8% | 54.0% | 54.0% |

| California | 5 | $162,500,000 | 18.3% | 1.52x | 11.7% | 59.1% | 59.1% |

| Ohio | 2 | $57,920,000 | 6.5% | 2.06x | 14.2% | 49.1% | 48.7% |

| Florida | 3 | $57,475,000 | 6.5% | 1.54x | 14.9% | 60.1% | 59.8% |

| Iowa | 1 | $51,000,000 | 5.8% | 1.93x | 14.4% | 53.0% | 53.0% |

| Virginia | 2 | $49,500,000 | 5.6% | 1.66x | 12.3% | 46.1% | 46.1% |

| Arizona | 2 | $48,600,000 | 5.5% | 1.70x | 14.3% | 49.9% | 49.9% |

| Georgia | 3 | $46,290,000 | 5.2% | 1.43x | 11.1% | 59.5% | 59.1% |

| Texas | 3 | $23,776,000 | 2.7% | 1.32x | 9.9% | 60.4% | 60.4% |

| New Jersey | 1 | $21,000,000 | 2.4% | 1.28x | 8.2% | 63.6% | 63.6% |

| New Hampshire | 2 | $17,700,000 | 2.0% | 1.44x | 9.5% | 67.3% | 67.3% |

| Louisiana | 1 | $15,000,000 | 1.7% | 2.46x | 16.7% | 40.8% | 40.8% |

| Minnesota | 1 | $11,850,000 | 1.3% | 2.50x | 13.1% | 49.8% | 49.8% |

| North Carolina | 1 | $9,977,000 | 1.1% | 2.00x | 15.2% | 60.1% | 60.1% |

| Total / Weighted Average: | 38 | $886,388,000 | 100.0% | 1.72x | 13.1% | 55.1% | 55.0% |

| (1) | Because this table presents information relating to the mortgaged properties and not mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated loan amounts. |

| (2) | In the case of Loan Nos. 1, 2, 4, 6, 7, 13, 15, 20, 26 and 33, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan No. 12, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related mezzanine loan(s). |

| (3) | For the mortgage loans that are interest-only for the entire term and accrue interest on an Actual/360 basis, the Monthly Debt Service (IO) ($) was calculated as 1/12th of the product of (i) the Original Balance ($), (ii) the Interest Rate % and (iii) 365/360. |

| (4) | In the case of Loan No. 22, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on an “As Is (Extraordinary Assumption)”. Refer to “Description of the Mortgage Pool—Assessment of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 11 | ||

| Structural and Collateral Term Sheet | BBCMS 2024-5C25 | |

| Collateral Characteristics | ||

| Cut-off Date Principal Balance |

Weighted Average | |||||||||||

| Range of Cut-off Date Principal Balances | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1) | Cut-off Date LTV(1)(3) | Maturity Date LTV(1)(3) | ||

| $5,000,000 | - | $9,999,999 | 7 | $53,973,000 | 6.1% | 7.21638% | 59 | 1.50x | 11.9% | 61.7% | 61.2% |

| $10,000,000 | - | $14,999,999 | 6 | 73,115,000 | 8.2% | 7.22829% | 59 | 1.68x | 13.3% | 58.2% | 57.8% |

| $15,000,000 | - | $19,999,999 | 2 | 32,700,000 | 3.7% | 6.50419% | 59 | 1.91x | 12.8% | 55.1% | 55.1% |

| $20,000,000 | - | $29,999,999 | 8 | 195,350,000 | 22.0% | 6.96484% | 59 | 1.39x | 10.1% | 57.4% | 57.4% |

| $30,000,000 | - | $39,999,999 | 2 | 69,000,000 | 7.8% | 8.37075% | 60 | 1.68x | 15.4% | 52.4% | 52.4% |

| $40,000,000 | - | $47,499,999 | 1 | 43,000,000 | 4.9% | 7.24000% | 59 | 1.51x | 11.9% | 54.5% | 54.5% |

| $47,500,000 | - | $71,500,000 | 7 | 419,250,000 | 47.3% | 7.06808% | 59 | 1.92x | 14.4% | 53.0% | 53.0% |

| Total / Weighted Average: | 33 | $886,388,000 | 100.0% | 7.15651% | 59 | 1.72x | 13.1% | 55.1% | 55.0% | ||

| Mortgage Interest Rates |

Weighted Average | |||||||||||

| Range of Mortgage Interest Rates | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1) | Cut-off Date LTV(1)(3) | Maturity Date LTV(1)(3) | ||

| 5.17000 | - | 5.99900 | 1 | $11,850,000 | 1.3% | 5.17000% | 60 | 2.50x | 13.1% | 49.8% | 49.8% |

| 6.00000 | - | 6.49900 | 4 | 115,200,000 | 13.0% | 6.28878% | 60 | 1.72x | 11.3% | 54.3% | 54.3% |

| 6.50000 | - | 6.99900 | 10 | 271,103,000 | 30.6% | 6.82734% | 59 | 1.79x | 12.9% | 56.3% | 56.3% |

| 7.00000 | - | 7.49900 | 6 | 239,050,000 | 27.0% | 7.23299% | 59 | 1.63x | 12.6% | 56.8% | 56.8% |

| 7.50000 | - | 7.99900 | 8 | 144,695,000 | 16.3% | 7.60312% | 59 | 1.77x | 14.6% | 51.5% | 51.2% |

| 8.00000 | - | 8.55000 | 4 | 104,490,000 | 11.8% | 8.39912% | 60 | 1.58x | 14.6% | 54.0% | 53.8% |

| Total / Weighted Average: | 33 | $886,388,000 | 100.0% | 7.15651% | 59 | 1.72x | 13.1% | 55.1% | 55.0% | ||

| Original Term to Maturity in Months |

Weighted Average | |||||||||

| Original Term to Maturity in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1) | Cut-off Date LTV(1)(3) | Maturity Date LTV(1)(3) |

| 60 | 33 | $886,388,000 | 100.0% | 7.15651% | 59 | 1.72x | 13.1% | 55.1% | 55.0% |

| Total / Weighted Average: | 33 | $886,388,000 | 100.0% | 7.15651% | 59 | 1.72x | 13.1% | 55.1% | 55.0% |

| Remaining Term to Maturity in Months |

| Weighted Average | |||||||||||

| Range of Remaining Term to Maturity in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1) | Cut-off Date LTV(1)(3) | Maturity Date LTV(1)(3) | ||

| 57 | - | 58 | 6 | $89,077,000 | 10.0% | 6.92302% | 58 | 1.86x | 13.6% | 51.6% | 51.6% |

| 59 | - | 60 | 27 | 797,311,000 | 90.0% | 7.18260% | 59 | 1.70x | 13.0% | 55.4% | 55.4% |

| Total / Weighted Average: | 33 | $886,388,000 | 100.0% | 7.15651% | 59 | 1.72x | 13.1% | 55.1% | 55.0% | ||

| (1) | In the case of Loan Nos. 1, 2, 4, 6, 7, 13, 15, 20, 26 and 33, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan No. 12, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related mezzanine loan(s). |

| (2) | For the mortgage loans that are interest-only for the entire term and accrue interest on an Actual/360 basis, the Monthly Debt Service (IO) ($) was calculated as 1/12th of the product of (i) the Original Balance ($), (ii) the Interest Rate % and (iii) 365/360. |

| (3) | In the case of Loan No. 22, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on an “As Is (Extraordinary Assumption)”. Refer to “Description of the Mortgage Pool—Assessment of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 12 | ||

| Structural and Collateral Term Sheet | BBCMS 2024-5C25 | |

| Collateral Characteristics | ||

| Original Amortization Term in Months |

| Weighted Average | |||||||||

| Original Amortization Term in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1) | Cut-off Date LTV(1)(3) | Maturity Date LTV(1)(3) |

| Interest Only | 30 | $853,503,000 | 96.3% | 7.12531% | 59 | 1.73x | 13.0% | 54.6% | 54.6% |

| 360 | 3 | 32,885,000 | 3.7% | 7.96646% | 59 | 1.44x | 14.0% | 67.4% | 65.5% |

| Total / Weighted Average: | 33 | $886,388,000 | 100.0% | 7.15651% | 59 | 1.72x | 13.1% | 55.1% | 55.0% |

| Remaining Amortization Term in Months |

| Weighted Average | |||||||||

| Remaining Amortization Term in Months | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1) | Cut-off Date LTV(1)(3) | Maturity Date LTV(1)(3) |

| Interest Only | 30 | $853,503,000 | 96.3% | 7.12531% | 59 | 1.73x | 13.0% | 54.6% | 54.6% |

| 360 | 3 | 32,885,000 | 3.7% | 7.96646% | 59 | 1.44x | 14.0% | 67.4% | 65.5% |

| Total / Weighted Average: | 33 | $886,388,000 | 100.0% | 7.15651% | 59 | 1.72x | 13.1% | 55.1% | 55.0% |

| Amortization Types |

Weighted Average | |||||||||

| Amortization Types | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1) | Cut-off Date LTV(1)(3) | Maturity Date LTV(1)(3) |

| Interest Only | 30 | $853,503,000 | 96.3% | 7.12531% | 59 | 1.73x | 13.0% | 54.6% | 54.6% |

| Interest Only, Amortizing Balloon | 2 | 24,965,000 | 2.8% | 8.10810% | 59 | 1.50x | 14.9% | 65.9% | 64.5% |

| Amortizing Balloon | 1 | 7,920,000 | 0.9% | 7.52000% | 60 | 1.26x | 11.5% | 72.0% | 68.6% |

| Total / Weighted Average: | 33 | $886,388,000 | 100.0% | 7.15651% | 59 | 1.72x | 13.1% | 55.1% | 55.0% |

| Underwritten Net Cash Flow Debt Service Coverage Ratios(1)(2) |

| Weighted Average | |||||||||||

| Range of Underwritten Net Cash Flow Debt Service Coverage Ratios | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1) | Cut-off Date LTV(1)(3) | Maturity Date LTV(1)(3) | ||

| 1.20x | - | 1.29x | 5 | $90,370,000 | 10.2% | 6.81692% | 59 | 1.25x | 8.9% | 65.4% | 65.1% |

| 1.30x | - | 1.49x | 12 | 252,501,000 | 28.5% | 7.37130% | 60 | 1.37x | 10.9% | 59.4% | 59.3% |

| 1.50x | - | 1.89x | 7 | 239,190,000 | 27.0% | 7.41043% | 59 | 1.69x | 13.7% | 57.5% | 57.4% |

| 1.90x | - | 1.99x | 2 | 56,000,000 | 6.3% | 7.10027% | 59 | 1.93x | 14.6% | 52.7% | 52.7% |

| 2.00x | - | 2.24x | 4 | 156,477,000 | 17.7% | 6.94215% | 59 | 2.10x | 15.4% | 44.2% | 44.2% |

| 2.25x | - | 2.50x | 3 | 91,850,000 | 10.4% | 6.63843% | 60 | 2.42x | 16.7% | 46.4% | 46.4% |

| Total / Weighted Average: | 33 | $886,388,000 | 100.0% | 7.15651% | 59 | 1.72x | 13.1% | 55.1% | 55.0% | ||

| (1) | In the case of Loan Nos. 1, 2, 4, 6, 7, 13, 15, 20, 26 and 33, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan No. 12, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related mezzanine loan(s). |

| (2) | For the mortgage loans that are interest-only for the entire term and accrue interest on an Actual/360 basis, the Monthly Debt Service (IO) ($) was calculated as 1/12th of the product of (i) the Original Balance ($), (ii) the Interest Rate % and (iii) 365/360. |

| (3) | In the case of Loan No. 22, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on an “As Is (Extraordinary Assumption)”. Refer to “Description of the Mortgage Pool—Assessment of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 13 | ||

| Structural and Collateral Term Sheet | BBCMS 2024-5C25 | |

| Collateral Characteristics | ||

| LTV Ratios as of the Cut-off Date(1)(3) |

| Weighted Average | |||||||||||

| Range of Cut-off Date LTVs | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1) | Cut-off Date LTV(1)(3) | Maturity Date LTV(1)(3) | ||

| 39.4% | - | 49.9% | 8 | $284,050,000 | 32.0% | 7.00547% | 59 | 2.16x | 15.8% | 44.8% | 44.8% |

| 50.0% | - | 54.9% | 6 | 173,000,000 | 19.5% | 7.25777% | 59 | 1.57x | 12.1% | 53.5% | 53.5% |

| 55.0% | - | 59.9% | 5 | 132,603,000 | 15.0% | 7.69408% | 59 | 1.62x | 13.9% | 58.4% | 58.4% |

| 60.0% | - | 69.9% | 12 | 266,065,000 | 30.0% | 7.01309% | 59 | 1.45x | 10.9% | 63.5% | 63.4% |

| 70.0% | - | 72.0% | 2 | 30,670,000 | 3.5% | 6.90433% | 60 | 1.22x | 9.1% | 70.9% | 70.0% |

| Total / Weighted Average: | 33 | $886,388,000 | 100.0% | 7.15651% | 59 | 1.72x | 13.1% | 55.1% | 55.0% | ||

| LTV Ratios as of the Maturity Date(1)(3) |

Weighted Average | |||||||||||

| Range of Maturity Date LTVs | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1) | Cut-off Date LTV(1)(3) | Maturity Date LTV(1)(3) | ||

| 39.4% | - | 49.9% | 8 | $284,050,000 | 32.0% | 7.00547% | 59 | 2.16x | 15.8% | 44.8% | 44.8% |

| 50.0% | - | 59.9% | 11 | 305,603,000 | 34.5% | 7.44709% | 59 | 1.60x | 12.9% | 55.6% | 55.6% |

| 60.0% | - | 63.5% | 4 | 102,000,000 | 11.5% | 7.05034% | 60 | 1.41x | 10.4% | 61.5% | 61.5% |

| 63.6% | - | 70.5% | 10 | 194,735,000 | 22.0% | 6.97644% | 59 | 1.43x | 10.8% | 65.7% | 65.4% |

| Total / Weighted Average: | 33 | $886,388,000 | 100.0% | 7.15651% | 59 | 1.72x | 13.1% | 55.1% | 55.0% | ||

| Prepayment Protection |

Weighted Average | |||||||||

| Prepayment Protection | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1) | Cut-off Date LTV(1)(3) | Maturity Date LTV(1)(3) |

| Defeasance | 26 | $746,468,000 | 84.2% | 7.19910% | 59 | 1.71x | 13.1% | 54.9% | 54.8% |

| Defeasance or Yield Maintenance | 4 | 105,300,000 | 11.9% | 6.91842% | 58 | 1.72x | 12.8% | 57.8% | 57.8% |

| Yield Maintenance | 3 | 34,620,000 | 3.9% | 6.96255% | 59 | 1.89x | 13.9% | 50.8% | 50.0% |

| Total / Weighted Average: | 33 | $886,388,000 | 100.0% | 7.15651% | 59 | 1.72x | 13.1% | 55.1% | 55.0% |

| Loan Purpose |

Weighted Average | |||||||||

| Loan Purpose | Number of Loans | Cut-off Date Principal Balance | % of IPB | Mortgage Rate | Remaining Loan Term | UW NCF DSCR(1)(2) | UW NOI DY(1) | Cut-off Date LTV(1)(3) | Maturity Date LTV(1)(3) |

| Refinance | 28 | $776,596,000 | 87.6% | 7.18463% | 59 | 1.72x | 13.1% | 54.0% | 54.0% |

| Recapitalization | 1 | 63,000,000 | 7.1% | 6.84400% | 59 | 1.63x | 12.0% | 64.0% | 64.0% |

| Acquisition | 4 | 46,792,000 | 5.3% | 7.11071% | 59 | 1.86x | 14.5% | 60.6% | 59.8% |

| Total / Weighted Average: | 33 | $886,388,000 | 100.0% | 7.15651% | 59 | 1.72x | 13.1% | 55.1% | 55.0% |

| (1) | In the case of Loan Nos. 1, 2, 4, 6, 7, 13, 15, 20, 26 and 33, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations include the related Pari Passu Companion Loan(s). In the case of Loan No. 12, the UW NCF DSCR, UW NOI Debt Yield, Cut-off Date LTV and Maturity Date LTV calculations exclude the related mezzanine loan(s). |

| (2) | For the mortgage loans that are interest-only for the entire term and accrue interest on an Actual/360 basis, the Monthly Debt Service (IO) ($) was calculated as 1/12th of the product of (i) the Original Balance ($), (ii) the Interest Rate % and (iii) 365/360. |

| (3) | In the case of Loan No. 22, the Cut-off Date LTV and the Maturity Date LTV are calculated by using an appraised value based on an “As Is (Extraordinary Assumption)”. Refer to “Description of the Mortgage Pool—Assessment of Property Value and Condition” and “—Appraised Value” in the Preliminary Prospectus for additional details. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 14 | ||

| Structural and Collateral Term Sheet | BBCMS 2024-5C25 | |

| Collateral Characteristics | ||

| Previous Securitization History(1) |

| No. | Mortgage Loan Seller | Loan Name | Location | Property Type | Cut-off Date Principal Balance | % of IPB | Previous Securitization |

| 5 | 3650 REIT | Shops at Marble Hill | Bronx, NY | Retail | $53,750,000 | 6.1% | COMM 2014-LC15 |

| 7 | SGFC, 3650 REIT | Kenwood Towne Centre | Cincinnati, OH | Retail | $50,000,000 | 5.6% | BPR 2021-KEN |

| 8 | CREFI | El Paseo Shopping Center | South Gate, CA | Retail | $43,000,000 | 4.9% | COMM 2013-CR8 |

| 11 | AREF2 | The Glen | San Bernardino, CA | Multifamily | $28,500,000 | 3.2% | ACR 2021-FL4 |

| 30 | GACC | Hill Road Plaza | Pickerington, OH | Retail | $7,920,000 | 0.9% | WFCM 2015-NXS1 |

| 31 | SMC | Lovejoy Station | Hampton, GA | Retail | $7,300,000 | 0.8% | GSMS 2014-GC18 |

| (1) | The table above represents the properties for which the previously existing debt was most recently securitized, based on information provided by the related borrower or obtained through searches of a third-party database. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 15 | ||

| Structural and Collateral Term Sheet | BBCMS 2024-5C25 | |

| Structural Overview | ||

| ■ Assets: | The Class A-1, Class A-3, Class X-A, Class X-B, Class X-D, Class A-S, Class B, Class C, Class D, Class E-RR, Class F-RR, Class G-RR, Class H-RR, Class J-RR and Class R Certificates (collectively, the “Certificates”) will be entitled to distributions solely with respect to the mortgage loans. | |

| ■ Accrual: | Each Class of Certificates (other than the Class R Certificates) will accrue interest on a 30/360 basis. The Class R Certificates will not accrue interest. | |

| ■ Distribution of Interest: | On each Distribution Date, accrued interest for each Class of Certificates (other than the Class R Certificates) at the applicable pass-through rate will be distributed in the following order of priority to the extent of available funds: first, to the Class A-1, Class A-3, Class X-A, Class X-B and Class X-D Certificates (the “Senior Certificates”), on a pro rata basis, based on the interest entitlement for each such Class on such date, and then to the Class A-S, Class B, Class C, Class D, Class E-RR, Class F-RR, Class G-RR, Class H-RR and Class J-RR Certificates, in that order, in each case until the interest entitlement for such date payable to each such Class is paid in full. The pass-through rate applicable to each of the Class A-1, Class A-3, Class A-S, Class B, Class C, Class D, Class E-RR, Class F-RR, Class G-RR, Class H-RR and Class J-RR Certificates (collectively, the “Principal Balance Certificates”) on each Distribution Date, will be a per annum rate equal to one of (i) a fixed rate, (ii) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), (iii) the lesser of a specified fixed pass-through rate and the rate described in clause (ii) above or (iv) the rate described in clause (ii) above less a specified percentage. The pass-through rate for the Class X-A Certificates for any Distribution Date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the weighted average of the pass-through rates on the Class A-1 and Class A-3 Certificates for the related Distribution Date, weighted on the basis of their respective Certificate Balances outstanding immediately prior to that Distribution Date. The pass-through rate for the Class X-B Certificates for any Distribution Date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the weighted average of the pass-through rates on the Class A-S, Class B and Class C Certificates for the related Distribution Date, weighted on the basis of their respective Certificate Balances outstanding immediately prior to that Distribution Date. The pass-through rate for the Class X-D Certificates for any Distribution Date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), over (b) the pass-through rate on the Class D Certificates for the related Distribution Date. See “Description of the Certificates—Distributions” in the Preliminary Prospectus. | |

■ Distribution of Principal:

| On any Distribution Date prior to the Cross-Over Date, payments in respect of principal will be distributed: first, to the Class A-1 Certificates, until the Certificate Balance of such Class is reduced to zero, second, to the Class A-3 Certificates, until the Certificate Balance of such Class is reduced to zero and then to the Class A-S, Class B, Class C, Class D, Class E-RR, Class F-RR, Class G-RR, Class H-RR and Class J-RR Certificates, in that order, until the Certificate Balance of each such Class is reduced to zero. On any Distribution Date on or after the Cross-Over Date, payments in respect of principal will be distributed to the Class A-1 and Class A-3 Certificates, pro rata based on the Certificate Balance of each such Class until the Certificate Balance of each such Class is reduced to zero. The “Cross-Over Date” means the Distribution Date on which the aggregate Certificate Balances of the Class A-S, Class B, Class C, Class D, Class E-RR, Class F-RR, Class G-RR, Class H-RR and Class J-RR Certificates have been reduced to zero as a result of the allocation of realized losses to such Classes. The Class X-A, Class X-B and Class X-D Certificates (the “Class X Certificates”) will not be entitled to receive distributions of principal; however, the notional amount of the Class X-A |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 16 | ||

| Structural and Collateral Term Sheet | BBCMS 2024-5C25 | |

| Structural Overview | ||

| Certificates will be reduced by the aggregate amount of principal distributions, realized losses and trust fund expenses, if any, allocated to the Class A-1 and Class A-3 Certificates, the notional amount of the Class X-B Certificates will be reduced by the aggregate amount of principal distributions, realized losses and trust fund expenses, if any, allocated to the Class A-S, Class B and Class C Certificates, and the notional amount of the Class X-D Certificates will be reduced by the amount of principal distributions, realized losses and trust fund expenses, if any, allocated to the Class D Certificates. | |

| ■ Yield Maintenance / Fixed Penalty Allocation: | If any yield maintenance charge or prepayment premium is collected during any particular collection period with respect to any mortgage loan, then on the Distribution Date corresponding to that collection period, the Certificate Administrator will pay that yield maintenance charge or prepayment premium (net of liquidation fees or workout fees payable therefrom) in the following manner: (1) to each of the Class A-1, Class A-3, Class A-S, Class B, Class C, Class D and Class E-RR Certificates, the product of (a) the yield maintenance charge or prepayment premium, (b) the related Base Interest Fraction (as defined in the Preliminary Prospectus) for such Class, and (c) a fraction, the numerator of which is equal to the amount of principal distributed to such Class for that Distribution Date, and the denominator of which is the total amount of principal distributed to all Principal Balance Certificates for that Distribution Date, (2) to the Class X-A Certificates, the excess, if any, of (a) the product of (i) such yield maintenance charge or prepayment premium and (ii) a fraction, the numerator of which is equal to the amount of principal distributed to the Class A-1 and Class A-3 Certificates for that Distribution Date, and the denominator of which is the total amount of principal distributed to all Principal Balance Certificates for that Distribution Date, over (b) the amount of such yield maintenance charge or prepayment premium distributed to the Class A-1 and Class A-3 Certificates as described above, (3) to the Class X-B Certificates, the excess, if any, of (a) the product of (i) such yield maintenance premium charge or prepayment premium and (ii) a fraction, the numerator of which is equal to the amount of principal distributed to the Class A-S, Class B and Class C Certificates for that Distribution Date, and the denominator of which is the total amount of principal distributed to all the Principal Balance Certificates for that Distribution Date, over (b) the amount of such yield maintenance charge or prepayment premium distributed to the Class A-S, Class B and Class C Certificates as described above, (4) to the Class X-D Certificates, any remaining portion of such yield maintenance charges or prepayment premiums not distributed as described pursuant to clauses (1) through (3) above and (5) after the Certificate Balances or Notional Amounts, as applicable, of the Class A-1, Class A-3, Class X-A, Class X-B, Class X-D, Class A-S, Class B, Class C, Class D and Class E-RR certificates have been reduced to zero, to each of the Class F-RR, Class G-RR, Class H-RR and Class J-RR certificates, the product of (a) such Yield Maintenance Charge or Prepayment Premium, and (b) a fraction, the numerator of which is equal to the amount of principal distributed to such class for that Distribution Date, and the denominator of which is the total amount of principal distributed to all Principal Balance Certificates for that Distribution Date. No yield maintenance charges or prepayment premiums will be distributed to the Class R Certificates. | |

| ■ Realized Losses: | On each Distribution Date, the losses on the mortgage loans will be allocated first to the Class J-RR, Class H-RR, Class G-RR, Class F-RR, Class E-RR, Class D, Class C, Class B and Class A-S Certificates, in that order, in each case until the Certificate Balance of all such Classes have been reduced to zero, and then, to the Class A-1 and Class A-3 Certificates, pro rata, based on the Certificate Balance of each such Class, until the Certificate Balance of each such Class has been reduced to zero. The notional amounts of the Class X-A, Class X-B and Class X-D Certificates will be reduced by the aggregate amount of realized losses allocated to Certificates that are components of the notional amounts of the Class X-A, Class X-B and Class X-D Certificates, respectively. Losses on each pari passu Whole Loan will be allocated, pro rata, between the related mortgage loan and the related Pari Passu Companion Loan(s), based upon their respective principal balances. | |

| ■ Interest Shortfalls: | A shortfall with respect to the amount of available funds distributable in respect of interest can result from, among other sources: (a) delinquencies and defaults by borrowers; (b) shortfalls resulting from the application of appraisal reductions to reduce P&I Advances; (c) shortfalls resulting from the payment of interest on Advances made by the Master Servicer, the Special Servicer or the Trustee; (d) shortfalls resulting from the payment of Special Servicing Fees and other additional compensation that the Special Servicer is entitled to receive; (e) shortfalls resulting from extraordinary expenses of the trust, including indemnification payments payable to the Depositor, the Master Servicer, the Special Servicer, the Certificate Administrator, the |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 17 | ||

| Structural and Collateral Term Sheet | BBCMS 2024-5C25 | |

| Structural Overview | ||

| Trustee, the Operating Advisor and the Asset Representations Reviewer; (f) shortfalls resulting from a modification of a mortgage loan’s interest rate or principal balance; and (g) shortfalls resulting from other unanticipated or default-related expenses of the trust. Any such shortfalls that decrease the amount of available funds distributable in respect of interest to the Certificateholders will reduce distributions to the classes of Certificates (other than the Class R Certificates) beginning with those with the lowest payment priorities, in reverse sequential order. See “Description of the Certificates—Distributions—Priority of Distributions” in the Preliminary Prospectus. | ||

| ■ Appraisal Reduction Amounts: | With respect to mortgage loans serviced under the Pooling and Servicing Agreement, upon the occurrence of certain trigger events with respect to a mortgage loan, which are generally tied to certain events of default under the related mortgage loan documents, the Special Servicer will be obligated to obtain an appraisal of the related mortgaged property and the Special Servicer will calculate the Appraisal Reduction Amount. The “Appraisal Reduction Amount” is generally the amount by which the current principal balance of the related mortgage loan or Serviced Whole Loan, plus outstanding advances, real estate taxes, unpaid servicing fees and certain similar amounts exceeds the sum of (a) 90% of the appraised value of the related mortgaged property and (b) the amount of any escrows, letters of credit and reserves; over the sum as of the due date in the month of the date of determination of (a) to the extent not previously advanced, unpaid interest at the mortgage rate, (b) all P&I Advances on the Mortgage Loan and all servicing advances on the related Mortgage Loan or Serviced Whole Loan not reimbursed from the proceeds and interest on those advances, and (c) all due and unpaid real estate taxes, insurance premiums, ground rents, unpaid special servicing fees and other amounts due and unpaid. With respect to the Non-Serviced Whole Loans, any Appraisal Reduction Amount will be similarly determined pursuant to the related lead securitization trust and servicing agreement or pooling and servicing agreement, as applicable, under which the non-serviced whole loan is serviced. In general, any Appraisal Reduction Amounts that are allocated to the mortgage loans are notionally allocated to reduce, in reverse sequential order, the Certificate Balance of each Class of Principal Balance Certificates (other than the Class A-1 and Class A-3 Certificates) beginning with the Class J-RR Certificates for certain purposes, including certain voting rights and the determination of the controlling class and the determination of an Operating Advisor Consultation Event. As a result of calculating one or more Appraisal Reduction Amounts (and, in the case of any Whole Loan, to the extent allocated in the related mortgage loan), the amount of any required P&I Advance will be reduced, which will have the effect of reducing the amount of interest available to the most subordinate Class of Certificates then-outstanding (i.e., first, to the Class J-RR Certificates; second, to the Class H-RR Certificates; third, to the Class G-RR Certificates, fourth to the Class F-RR Certificates, fifth, to the Class E-RR Certificates; sixth, to the Class D Certificates; seventh, to the Class C Certificates, eighth, to the Class B Certificates; ninth, to the Class A-S Certificates, and finally, pro rata based on their respective interest entitlements, to the Senior Certificates). With respect to each Serviced Whole Loan, the Appraisal Reduction Amount is notionally allocated pro rata, between the related mortgage loan and any related serviced pari passu companion loan(s), based upon their respective principal balances. | |

| ■ Master Servicer Advances: | The Master Servicer will be required to advance certain delinquent scheduled mortgage loan payments of principal and interest and certain servicing advances, in each case, to the extent the Master Servicer deems such advances to be recoverable. With respect to any Non-Serviced Whole Loan, the master servicer or trustee, as applicable, under the related lead securitization servicing agreement will have the primary obligation to make any required servicing advances with respect to such Non-Serviced Whole Loan. | |

| ■ Whole Loans: | Each of the mortgaged properties identified above under “Collateral Characteristics—Pari Passu Companion Loan Summary” secures both a mortgage loan to be included in the trust fund and one or more other mortgage loans that will not be included in the trust fund, each of which will be pari passu in right of payment with the mortgage loan included in the trust fund. We refer to each such group of mortgage loans as a “whole loan”. Such “—Pari Passu Companion Loan Summary” section includes further information regarding the various notes in each whole loan, the holders of such notes, the lead servicing agreement for each such whole loan, and the master servicer and special servicer under such lead servicing agreement. See “Description of the Mortgage Pool—The Whole Loans” in the Preliminary Prospectus. | |

| ■ Liquidated Loan Waterfall: | On liquidation of any mortgage loan, all net liquidation proceeds related to the mortgage loan will be applied (after reimbursement of advances and certain trust fund expenses) first, as a recovery |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED. | ||

| 18 | ||

| Structural and Collateral Term Sheet | BBCMS 2024-5C25 | |

| Structural Overview | ||

| of accrued interest, other than delinquent interest that was not advanced as a result of Appraisal Reduction Amounts, second, as a recovery of principal until all principal has been recovered, and then as a recovery of delinquent interest that was not advanced as a result of Appraisal Reduction Amounts. Please see “Description of the Certificates—Distributions—Application Priority of Mortgage Loan Collections or Whole Loan Collections” in the Preliminary Prospectus. | ||

| ■ Sale of Defaulted Loans and REO Properties: |