UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule14a-101)

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☐ Filed by a Party other than the Registrant ☒

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule14a-6(e)(2)) |

| |

| ☐ | | Definitive Proxy Statement |

| |

| ☒ | | Definitive Additional Materials |

| |

| ☐ | | Soliciting material Pursuant to§240.14a-12 |

Buffalo Wild Wings, Inc.

(Name of Registrant as Specified In Its Charter)

MARCATO CAPITAL MANAGEMENT LP

MARCATO INTERNATIONAL MASTER FUND LTD.

MARCATO SPECIAL OPPORTUNITIES MASTER FUND LP

SCOTT O. BERGREN

RICHARD T. MCGUIRE III

SAM ROVIT

EMIL LEE SANDERS

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| ☒ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules14a-6(i)(4) and0-11. |

| | |

| | 1) | | Title of each class of securities to which transaction applies: |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | | Proposed maximum aggregate value of transaction: |

| | 5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | 1) | | Amount Previously Paid: |

| | 2) | | Form, Schedule or Registration Statement No.: |

| | 3) | | Filing Party: |

| | 4) | | Date Filed: |

On April 20, 2017, Marcato Capital Management LP and certain affiliates issued the following presentation, which was also posted on http://www.winningatwildwings.com:

BUFFALO WILD WINGS APRIL 2017

DisclAIMER The views expressed in this presentation (the “Presentation”) represent the opinions of Marcato Capital Management LP and/or certain affiliates (“Marcato”) and the investment funds it manages that hold shares in Buffalo Wild Wings, Inc. (the “Company”). This Presentation is for informational purposes only, and it does not have regard to the specific investment objective, financial situation, suitability or particular need of any specific person who may receive the Presentation, and should not be taken as advice on the merits of any investment decision. The views expressed in the Presentation represent the opinions of Marcato, and are based on publicly available information and Marcato analyses. Certain financial information and data used in the Presentation have been derived or obtained from filings made with the Securities and Exchange Commission (“SEC”) by the Company or other companies that Marcato considers comparable. Marcato has not sought or obtained consent from any third party to use any statements or information indicated in the Presentation as having been obtained or derived from a third party. Any such statements or information should not be viewed as indicating the support of such third party for the views expressed in the Presentation. Information contained in the Presentation has not been independently verified by Marcato, and Marcato disclaims any and all liability as to the completeness or accuracy of the information and for any omissions of material facts. Marcato disclaims any obligation to correct, update or revise the Presentation or to otherwise provide any additional materials. Neither Marcato nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy, fairness or completeness of the information contained herein and the recipient agrees and acknowledges that it will not rely on any such information. Marcato recognizes that the Company may possess confidential information that could lead it to disagree with Marcato’s views and/or conclusions. Funds managed by Marcato currently beneficially own, and/or have an economic interest in, shares of the Company. These funds are in the business of trading—buying and selling—securities. Marcato may buy or sell or otherwise change the form or substance of any of its investments in any manner permitted by law and expressly disclaims any obligation to notify any recipient of the Presentation of any such changes. There may be developments in the future that cause funds managed by Marcato to engage in transactions that change the beneficial and/or economic interest in the Company. The Presentation may contain forward-looking statements which reflect Marcato’s views with respect to, among other things, future events and financial performance. Forward-looking statements are subject to various risks and uncertainties and assumptions. There can be no assurance that any idea or assumption herein is, or will be proven, correct. If one or more of the risks or uncertainties materialize, or if Marcato’s underlying assumptions prove to be incorrect, the actual results may vary materially from outcomes indicated by these statements. Accordingly, forward-looking statements should not be regarded as a representation by Marcato that the future plans, estimates or expectations contemplated will ever be achieved. The securities or investment ideas listed are not presented in order to suggest or show profitability of any or all transactions. There should be no assumption that any specific portfolio securities identified and described in the Presentation were or will be profitable. Under no circumstances is the Presentation to be used or considered as an offer to sell or a solicitation of an offer to buy any security, nor does the Presentation constitute either an offer to sell or a solicitation of an offer to buy any interest in funds managed by Marcato. Any such offer would only be made at the time a qualified offeree receives the Confidential Explanatory Memorandum of such fund. Any investment in the Marcato Funds is speculative and involves substantial risk, including the risk of losing all or substantially all of such investment.

Certain information concerning the participants Marcato International Master Fund Ltd. (“Marcato International”), together with the other participants in Marcato International’s proxy solicitation, have filed with the SEC, and are mailing to shareholders on or about April 20, 2017, a definitive proxy statement and accompanying WHITE proxy card to be used to solicit proxies in connection with the 2017 annual meeting of shareholders (the “Annual Meeting”) of Buffalo Wild Wings, Inc. (the “Company”). Shareholders are advised to read the proxy statement and any other documents related to the solicitation of shareholders of the Company in connection with the Annual Meeting because they contain important information, including information relating to the participants in Marcato International’s proxy solicitation. These materials and other materials filed by Marcato International with the SEC in connection with the solicitation of proxies are available at no charge on the SEC’s website at http://www.sec.gov. The definitive proxy statement and other relevant documents filed by Marcato International with the SEC are also available, without charge, by directing a request to Marcato International’s proxy solicitor, Innisfree M&A Incorporated, toll-free at (888) 750-5834 (banks and brokers may call collect at (212) 750-5833). The participants in the proxy solicitation are Marcato International, Marcato Capital Management LP, Marcato Special Opportunities Master Fund LP (“Marcato Special Opportunities Fund”), Emil Lee Sanders, Richard T. McGuire III, Sam Rovit and Scott O. Bergren (collectively, the “Participants”). As of the date hereof, Marcato International directly owns 950,000 shares of common stock, no par value, of BWW (the “Common Stock”), representing approximately 5.9% of the outstanding shares of Common Stock and Marcato Special Opportunities Fund directly owns 32,600 shares of Common Stock, representing approximately 0.2% of the outstanding shares of Common Stock. In addition, Marcato Capital Management LP, as the investment manager of Marcato International and Marcato Special Opportunities Fund, may be deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) the shares of Common Stock held by Marcato and Marcato Special Opportunities Fund, therefore, may be deemed to be the beneficial owner of such shares. By virtue of Mr. McGuire’s position as the managing partner of Marcato Capital Management LP, Mr. McGuire may be deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) the shares of Common Stock held by Marcato International and Marcato Special Opportunities Fund and, therefore, Mr. McGuire may be deemed to be the beneficial owner of such shares.

table of contents Introduction I.Share Price Underperformance II.Margin Deficiencies III.Deteriorating Guest Experience IV.Poor Capital Deployment V.Dismissal of More Highly-Franchised Business Model These materials are intended to set the record straight on management’s failures in the following critical business areas:

Introduction

Status quo at buffalo wild wings is not sufficient Management has repeatedly defended the status quo as BWLD shares have underperformed every relevant benchmark on a 1-year, 3-year, and 5-year basis BWLD’s Board of Directors has not held management accountable for critical areas of underperformance: Share price underperformance Margin deficiencies Deteriorating guest experience Poor capital deployment Dismissal of more highly-franchised business model Management has made optimistic statements regarding financial performance and guest experience that are betrayed by the facts Marcato’s recommendations for improvement have been validated by the market, industry experts, stakeholders, peers, and insiders but ignored by management Shareholders deserve a management team that can properly respond to these areas of underperformance

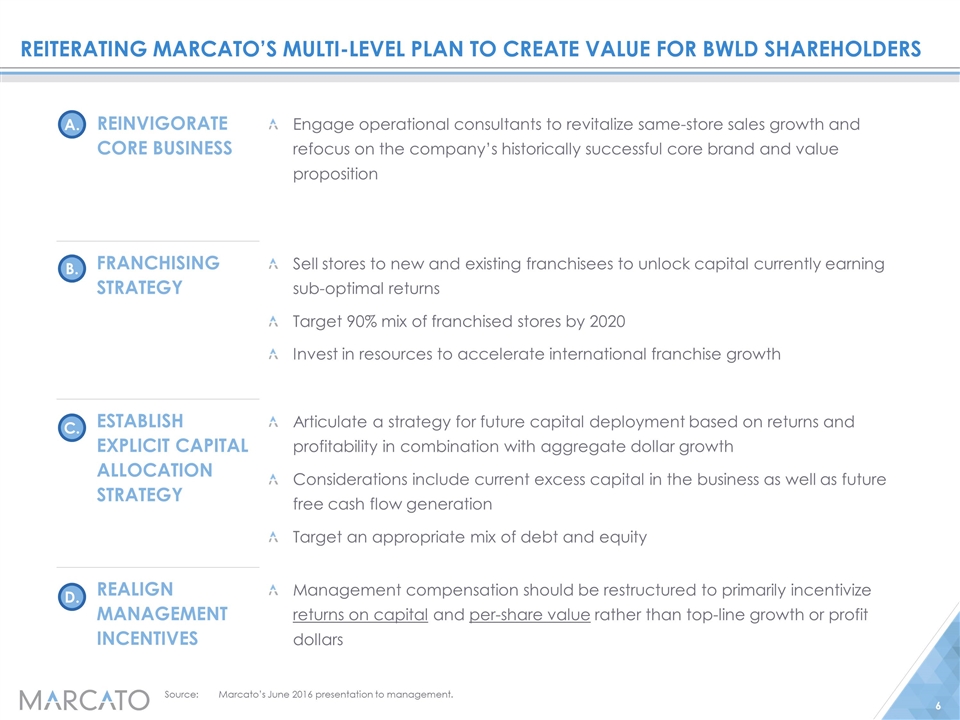

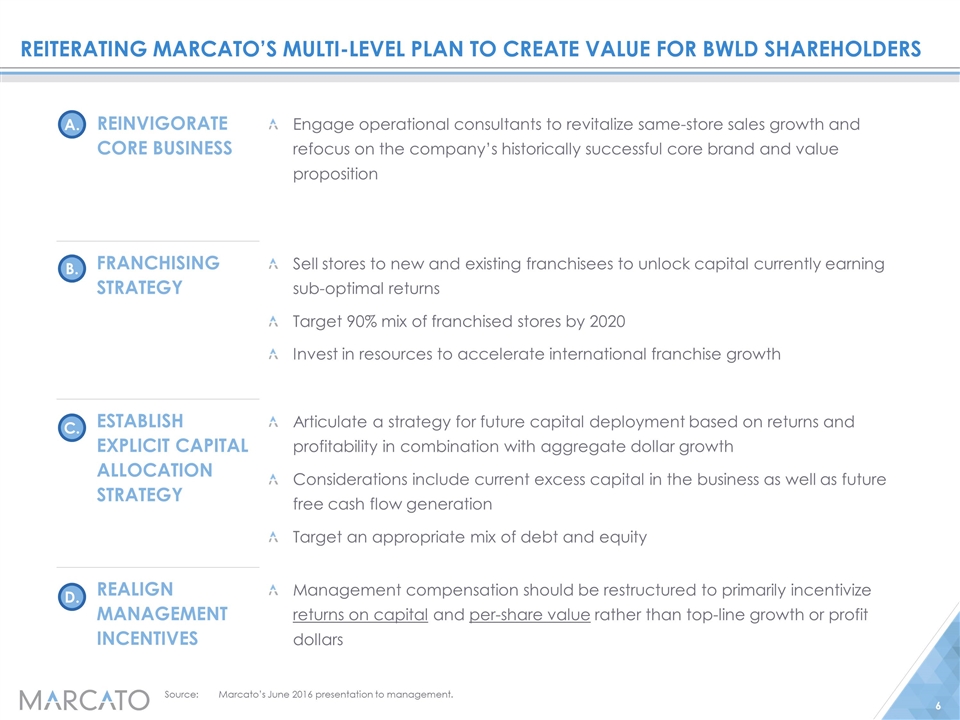

Reiterating marcato’s multi-level plan to create value for BWLD shareholders Reinvigorate core business Engage operational consultants to revitalize same-store sales growth and refocus on the company’s historically successful core brand and value proposition Franchising strategy Sell stores to new and existing franchisees to unlock capital currently earning sub-optimal returns Target 90% mix of franchised stores by 2020 Invest in resources to accelerate international franchise growth Establish explicit capital allocation strategy Articulate a strategy for future capital deployment based on returns and profitability in combination with aggregate dollar growth Considerations include current excess capital in the business as well as future free cash flow generation Target an appropriate mix of debt and equity Realign management incentives Management compensation should be restructured to primarily incentivize returns on capital and per-share value rather than top-line growth or profit dollars A. B. C. D. Source:Marcato’s June 2016 presentation to management.

Insiders agree with marcato’s assessment of management “Several of the BWW expats have had communication over the last couple of days. Just wanted to let you know that the assessment of you and your team, as it relates to the challenges with Buffalo Wild Wings, are spot-on and things that literally we have been talking about and trying to change for years” ─ Former Buffalo Wild Wings Executive, 8/19/16 Source:Email received from former BWLD Corporate employee. Note: Emphasis in all presentation quotes has been added.

Insiders agree with marcato’s assessment of management (Cont’d) Source:Wall Street research. Note:Wedbush report summarized topics discussed during an “advisor call”. “[T]here remains a sense that the company retains a ‘small-company’ mentality that is lacking the structured corporate processes often found in larger companies…better tools and formalized structure more akin to a ~$3B market cap company could help” ─ Summary from Wedbush Interview with Former Buffalo Wild Wings Marketing Executive, 2/14/17

Insiders agree with marcato’s assessment of management (Cont’d) Source:Email received from former BWLD Corporate employee. Note:Quote shown as submitted and is generally not edited for spelling, syntax, or grammatical error. “Just had a chance to quickly scan [Marcato’s] BDubs deck…the HQ staff is silently cheering” ─ Former Buffalo Wild Wings Executive, 2/22/17

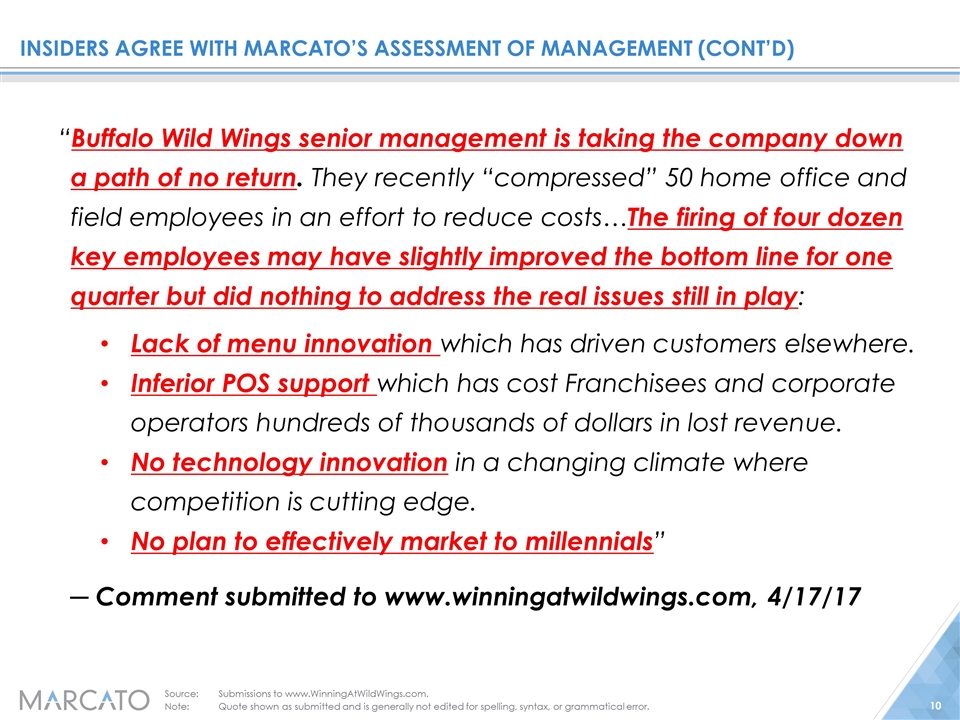

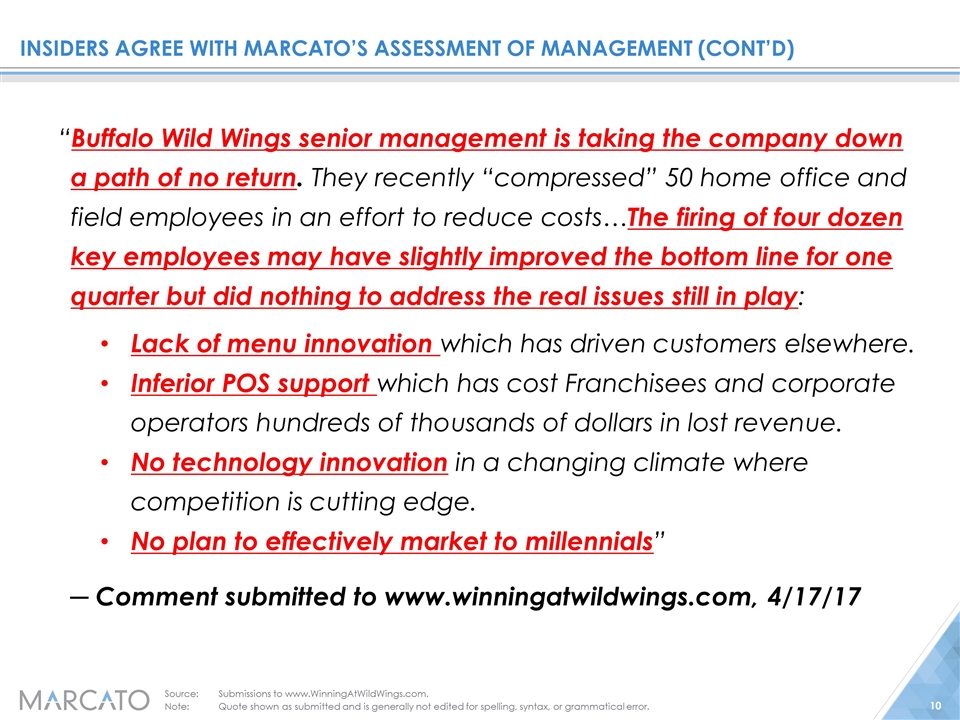

Insiders agree with marcato’s assessment of management (Cont’d) “Buffalo Wild Wings senior management is taking the company down a path of no return. They recently “compressed” 50 home office and field employees in an effort to reduce costs…The firing of four dozen key employees may have slightly improved the bottom line for one quarter but did nothing to address the real issues still in play: Lack of menu innovation which has driven customers elsewhere. Inferior POS support which has cost Franchisees and corporate operators hundreds of thousands of dollars in lost revenue. No technology innovation in a changing climate where competition is cutting edge. No plan to effectively market to millennials” ─ Comment submitted to www.winningatwildwings.com, 4/17/17 Source:Submissions to www.WinningAtWildWings.com. Note:Quote shown as submitted and is generally not edited for spelling, syntax, or grammatical error.

I.Share price underperformance

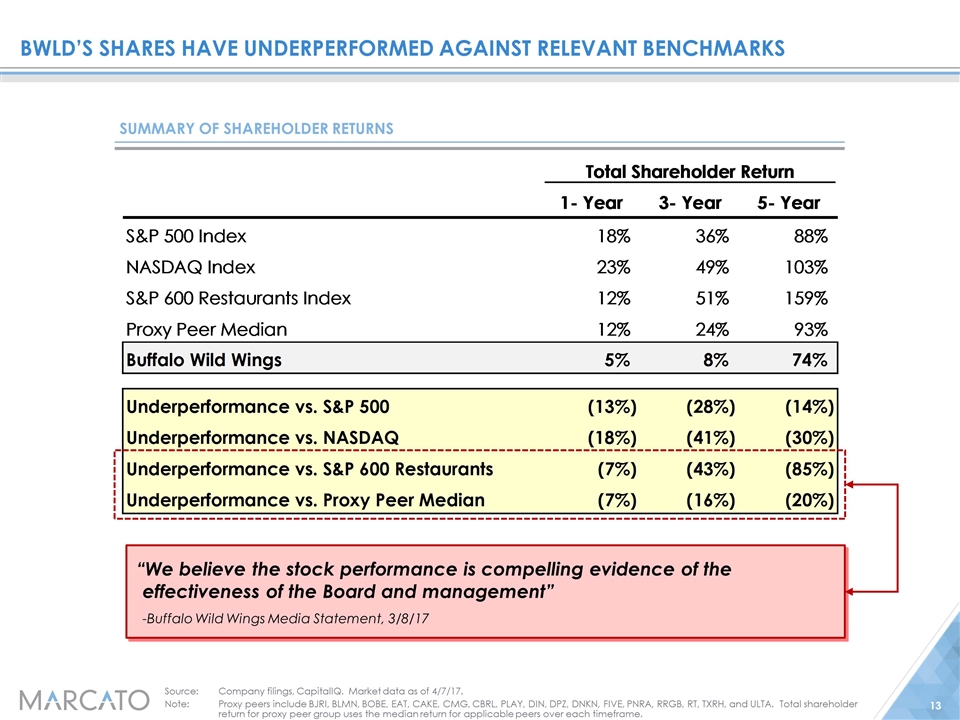

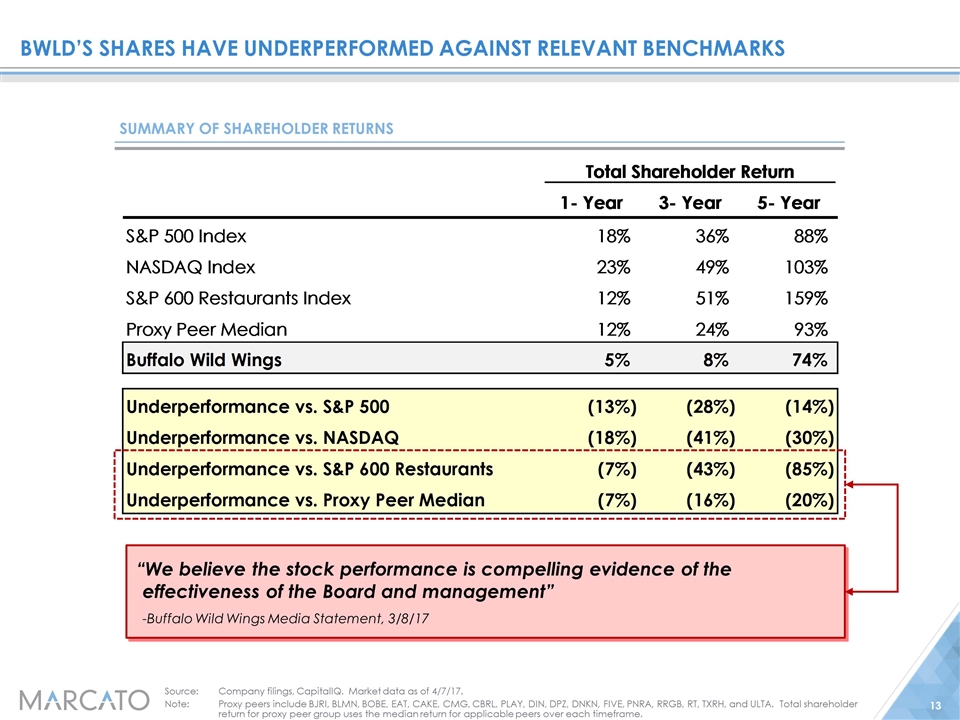

“We believe the stock performance is compelling evidence of the effectiveness of the Board and management” -Buffalo Wild Wings Media Statement, 3/8/17

BWLD’s shares have underperformed against relevant benchmarks Summary of shareholder returns “We believe the stock performance is compelling evidence of the effectiveness of the Board and management” -Buffalo Wild Wings Media Statement, 3/8/17 Source:Company filings, CapitalIQ. Market data as of 4/7/17. Note:Proxy peers include BJRI, BLMN, BOBE, EAT, CAKE, CMG, CBRL, PLAY, DIN, DPZ, DNKN, FIVE, PNRA, RRGB, RT, TXRH, and ULTA. Total shareholder return for proxy peer group uses the median return for applicable peers over each timeframe.

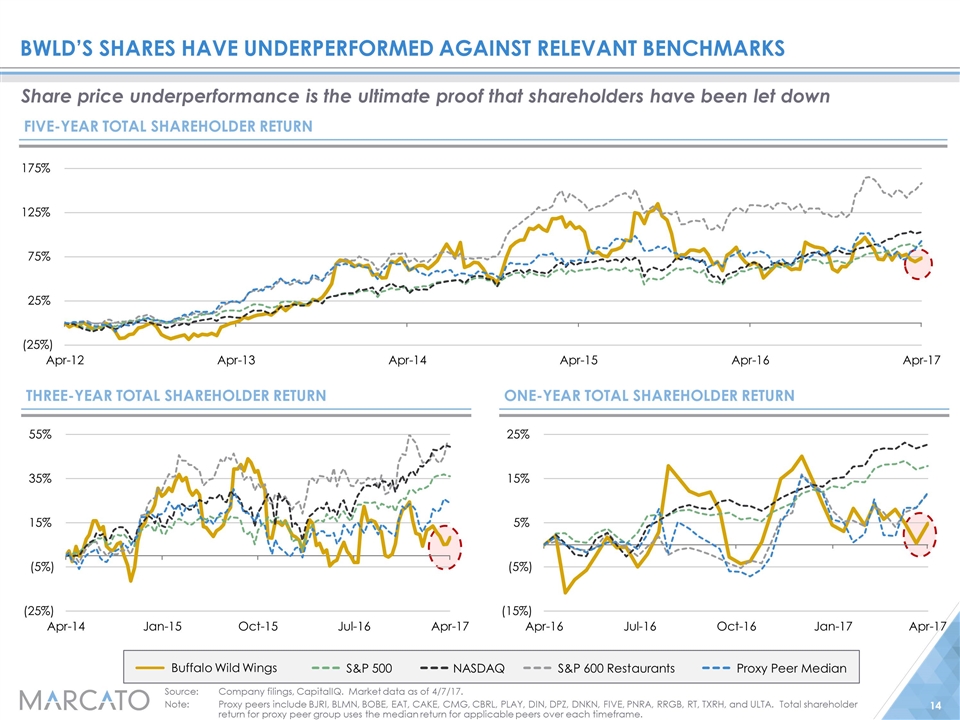

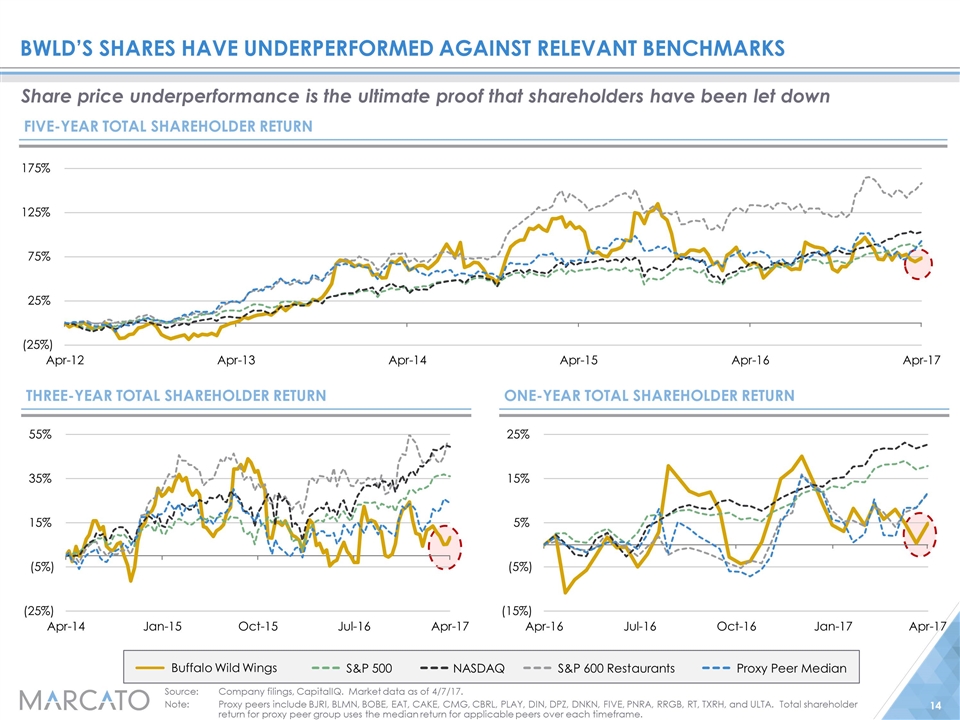

Source:Company filings, CapitalIQ. Market data as of 4/7/17. Note:Proxy peers include BJRI, BLMN, BOBE, EAT, CAKE, CMG, CBRL, PLAY, DIN, DPZ, DNKN, FIVE, PNRA, RRGB, RT, TXRH, and ULTA. Total shareholder return for proxy peer group uses the median return for applicable peers over each timeframe. five-year total shareholder return one-year total shareholder return three-year total shareholder return Buffalo Wild Wings S&P 600 Restaurants Proxy Peer Median NASDAQ S&P 500 Share price underperformance is the ultimate proof that shareholders have been let down BWLD’s shares have underperformed against relevant benchmarks

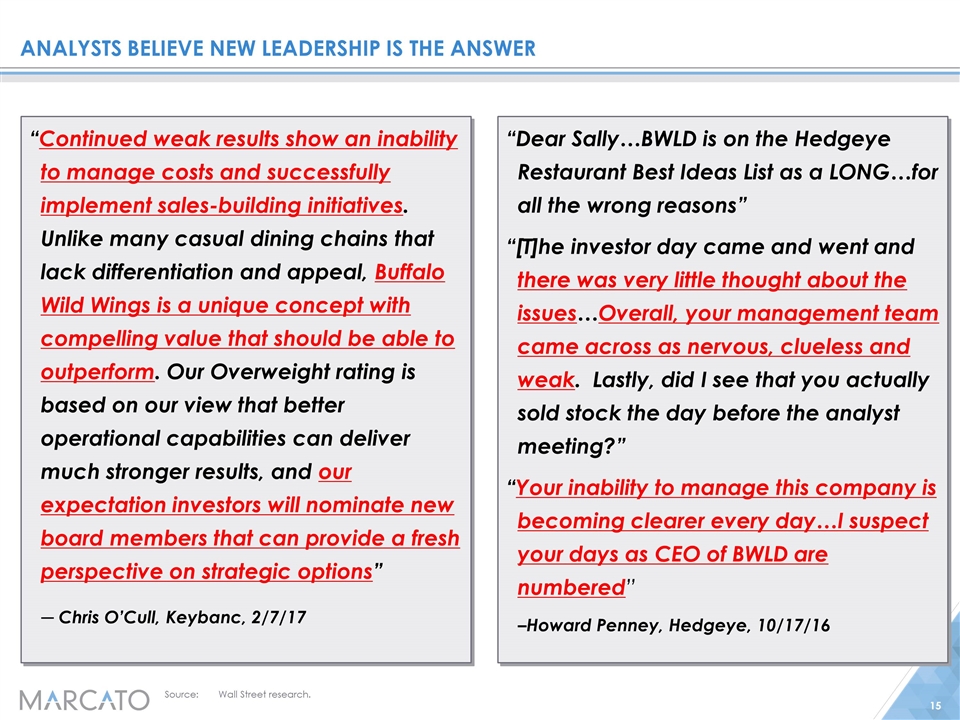

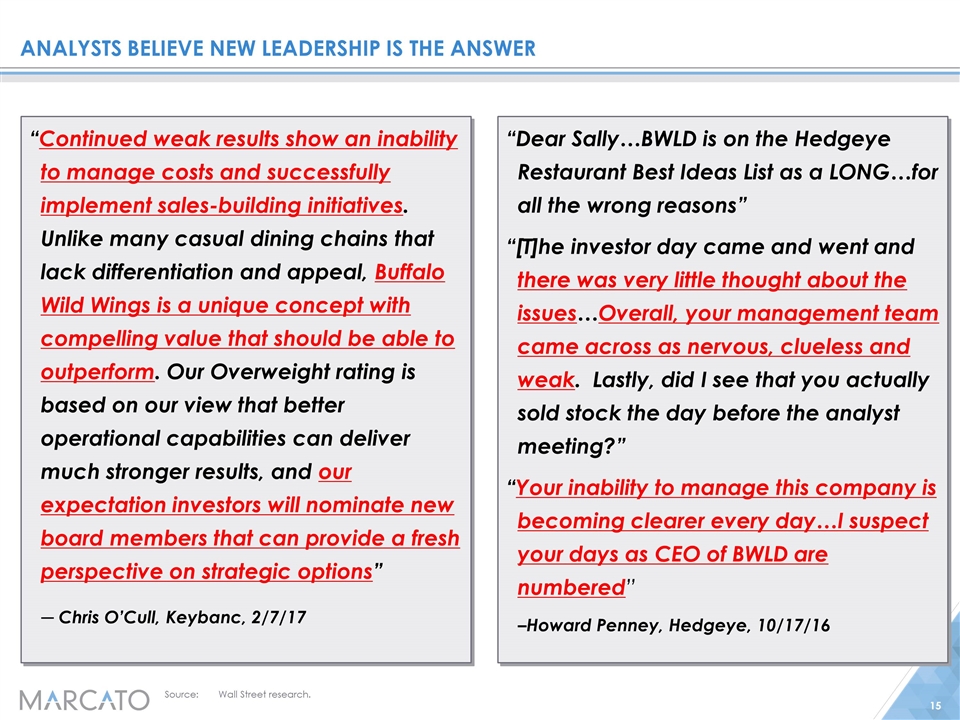

Analysts believe new leadership is the answer Source:Wall Street research. “Continued weak results show an inability to manage costs and successfully implement sales-building initiatives. Unlike many casual dining chains that lack differentiation and appeal, Buffalo Wild Wings is a unique concept with compelling value that should be able to outperform. Our Overweight rating is based on our view that better operational capabilities can deliver much stronger results, and our expectation investors will nominate new board members that can provide a fresh perspective on strategic options” ─ Chris O’Cull, Keybanc, 2/7/17 “Dear Sally…BWLD is on the Hedgeye Restaurant Best Ideas List as a LONG…for all the wrong reasons” “[T]he investor day came and went and there was very little thought about the issues…Overall, your management team came across as nervous, clueless and weak. Lastly, did I see that you actually sold stock the day before the analyst meeting?” “Your inability to manage this company is becoming clearer every day…I suspect your days as CEO of BWLD are numbered” –Howard Penney, Hedgeye, 10/17/16

II.Margin deficiencies

“[O]ur financials…show our dedication to shareholder value creation. While I am proud of the value we have created in the past, our goal is to create similar value in the future” –Sally Smith, President & CEO, 8/16/16 “[Our] combined approach to develop both Company-owned and franchise restaurants has generated outstanding results and created great value for our shareholders” –James Schmidt, Chief Operating Officer, 8/16/16 “We do believe that we operate restaurants really, really well” -Sally Smith , Chief Executive Officer, 10/26/16

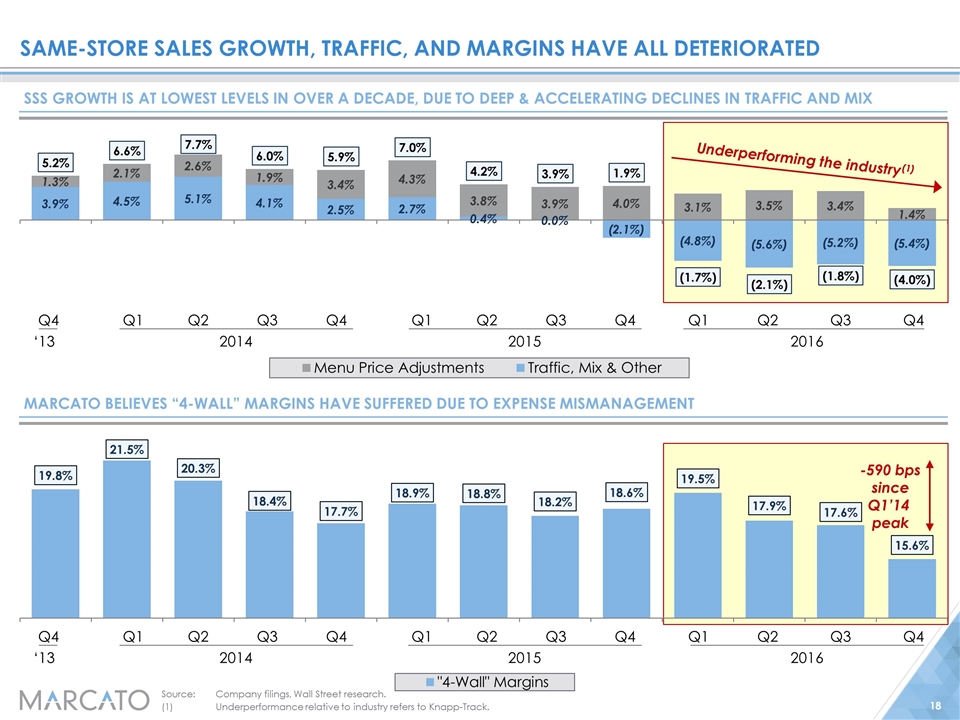

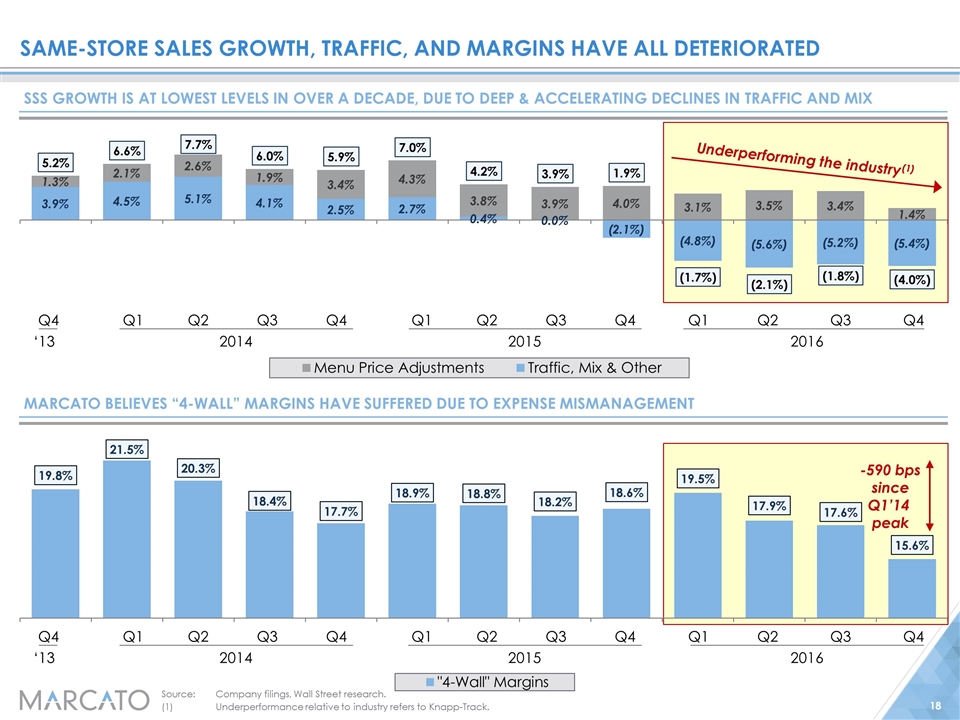

Same-store sales growth, traffic, and margins have all deteriorated SSS growth is at lowest levels in over a decade, due to deep & accelerating declines in traffic and mix Marcato believes “4-wall” margins have suffered due to expense mismanagement Q1 Q2 Q3 Q4 Q4 2016 ‘13 Q1 Q2 Q3 Q4 2015 Q1 Q2 Q3 Q4 2014 Source:Company filings, Wall Street research. (1)Underperformance relative to industry refers to Knapp-Track. Q1 Q2 Q3 Q4 Q4 2016 ‘13 Q1 Q2 Q3 Q4 2015 Q1 Q2 Q3 Q4 2014 -590 bps since Q1’14 peak Underperforming the industry(1)

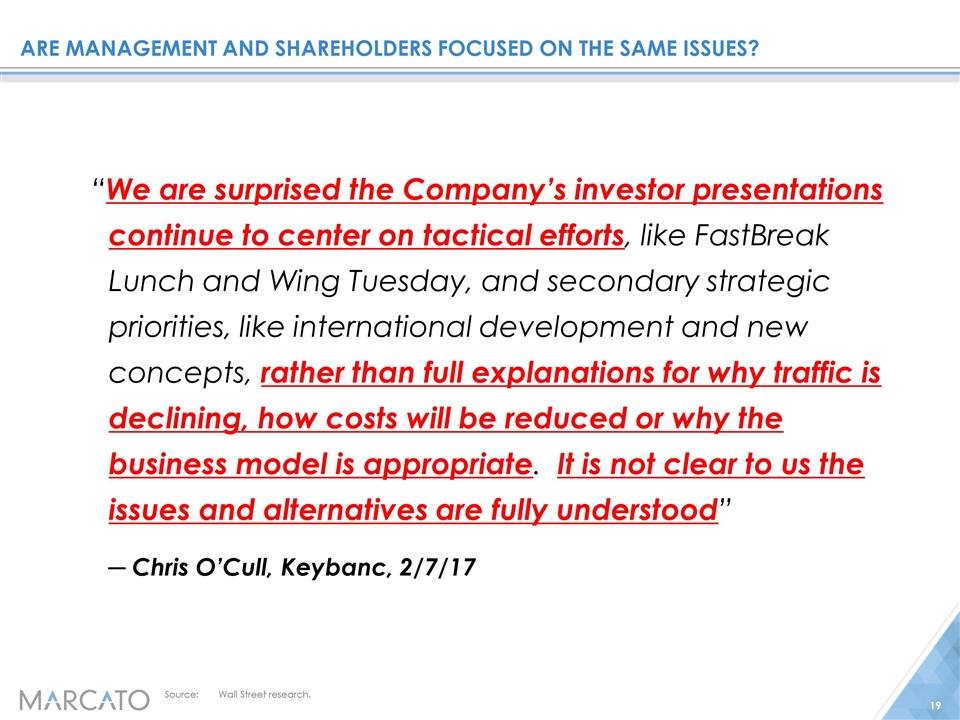

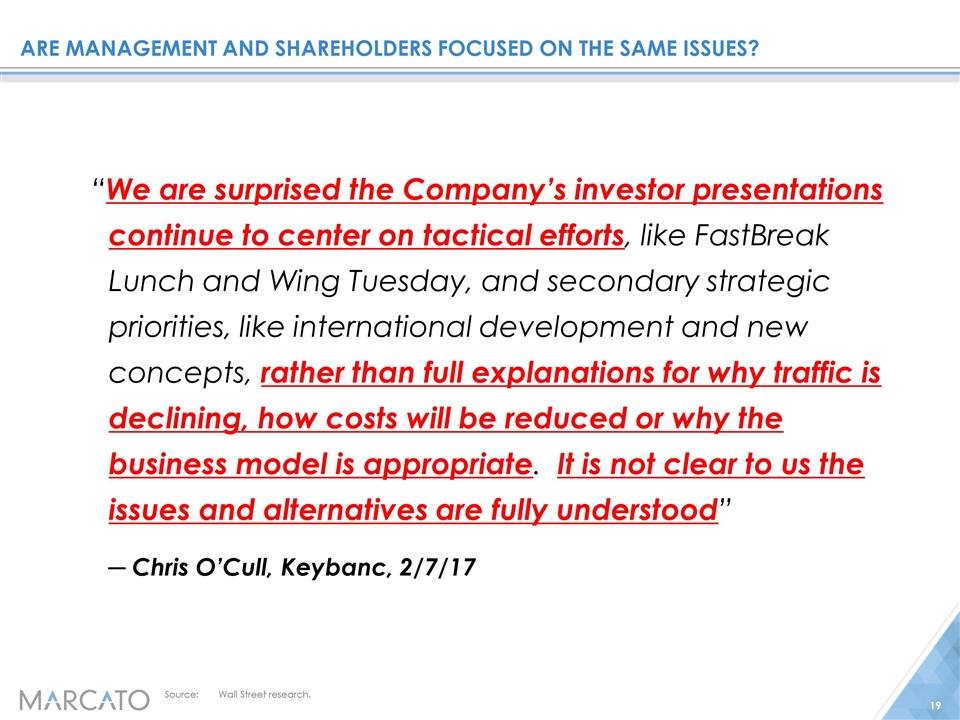

Are management and shareholders focused on the same issues? “We are surprised the Company’s investor presentations continue to center on tactical efforts, like FastBreak Lunch and Wing Tuesday, and secondary strategic priorities, like international development and new concepts, rather than full explanations for why traffic is declining, how costs will be reduced or why the business model is appropriate. It is not clear to us the issues and alternatives are fully understood” ─ Chris O’Cull, Keybanc, 2/7/17 Source:Wall Street research.

Insiders cite lack of operating experience in senior management “I am a former employee. Left on good terms with the company. But the frustrations I had with the lack of communication and infrastructure had me shaking my head often. With more than 20 years in the restaurant industry, I was quite taken aback to learn that my two supervisors - a direct, and a vice president - had NO restaurant experience. And these were the people "leading the charge.” It provided a lot of frustration to both me and my peers” ─ Former Buffalo Wild Wings Employee, 4/11/17 Source:Submissions to www.WinningAtWildWings.com. Note:Quote shown as submitted and is generally not edited for spelling, syntax, or grammatical error.

franchisees cite lack of operating experience in senior management “To improve the performance of BWW, I would clean house and get operators involved in the management. Now you have bean counters and attorneys running the show with lip service about customer care” ─ Former Buffalo Wild Wings Franchisee, 4/13/17 Source:Submissions to www.WinningAtWildWings.com. Note:Quote shown as submitted and is generally not edited for spelling, syntax, or grammatical error.

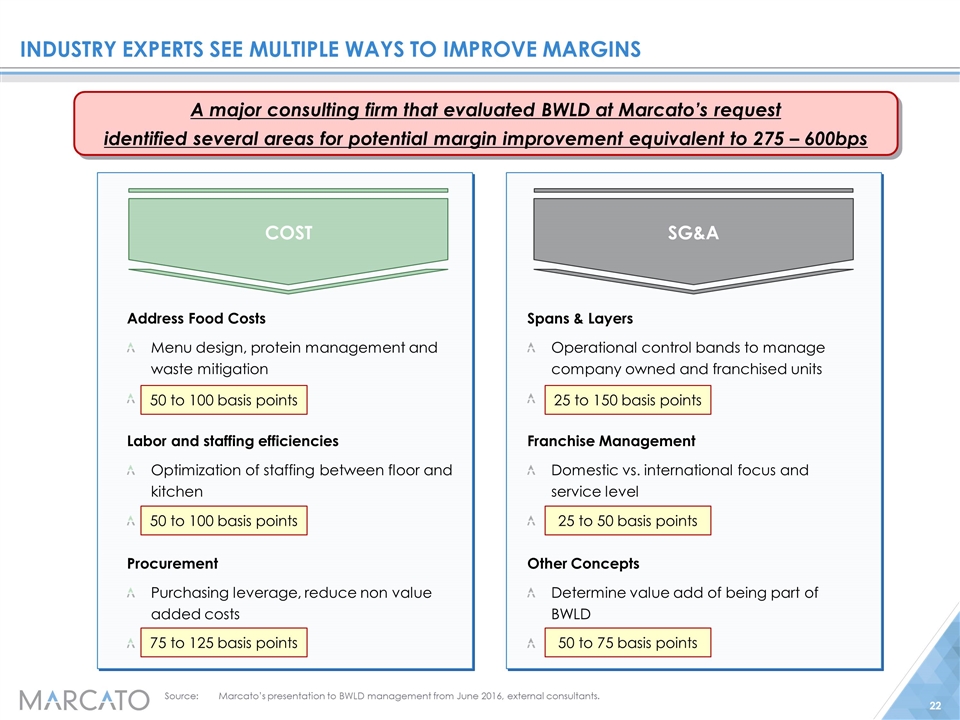

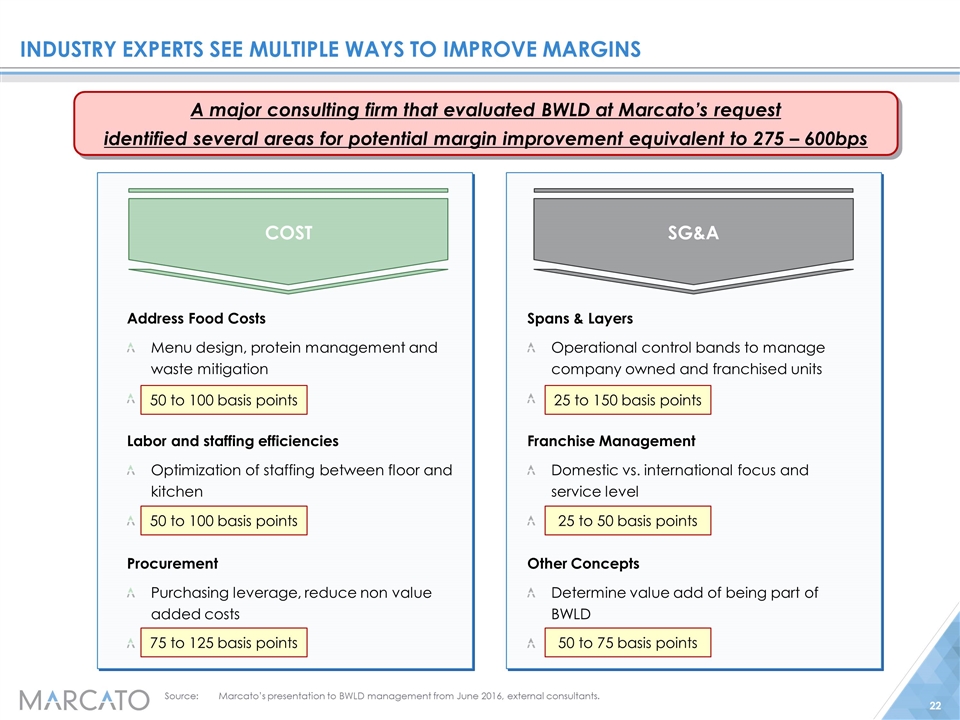

Industry experts see multiple ways to improve margins Source:Marcato’s presentation to BWLD management from June 2016, external consultants. A major consulting firm that evaluated BWLD at Marcato’s request identified several areas for potential margin improvement equivalent to 275 – 600bps Address Food Costs Menu design, protein management and waste mitigation 50 to 100 basis points Labor and staffing efficiencies Optimization of staffing between floor and kitchen 50 to 100 basis points Procurement Purchasing leverage, reduce non value added costs 75 to 125 basis points Spans & Layers Operational control bands to manage company owned and franchised units 25 to 150 basis points Franchise Management Domestic vs. international focus and service level 25 to 50 basis points Other Concepts Determine value add of being part of BWLD 50 to 75 basis points Cost SG&A 50 to 100 basis points 50 to 100 basis points 75 to 125 basis points 25 to 150 basis points 25 to 50 basis points 50 to 75 basis points

Research analysts recognize margin deficiencies “[W]e believe BWLD company-owned stores could improve margins substantially, by up to 500 [basis points] based on our analysis, by adopting labor practices currently deployed by [franchisees]” –Jim Sanderson, Arthur Wood, 3/28/17 Source:Wall Street research. “Our advisor believes there is an opportunity to bring lower performers more in line with the rest of the system, with store-level labor perhaps the largest opportunity. The example of Guest Experience Captains was cited…In his experience, BWLD franchisees are as or more qualified to run a large number of restaurants than corporate personnel” –Nick Setyan, Wedbush, 2/7/17 “[Margin opportunities] exist across labor, operating expenses, and COGS…Diversified Restaurant Holdings, Buffalo Wild Wing’s largest franchisee, highlights opportunity for greater margin efficiency. While there are notable differences, including geographic and overall exposure, SAUC has exhibited favorable food & labor margins relative to BWLD” –Dennis Geiger, UBS, 1/5/17

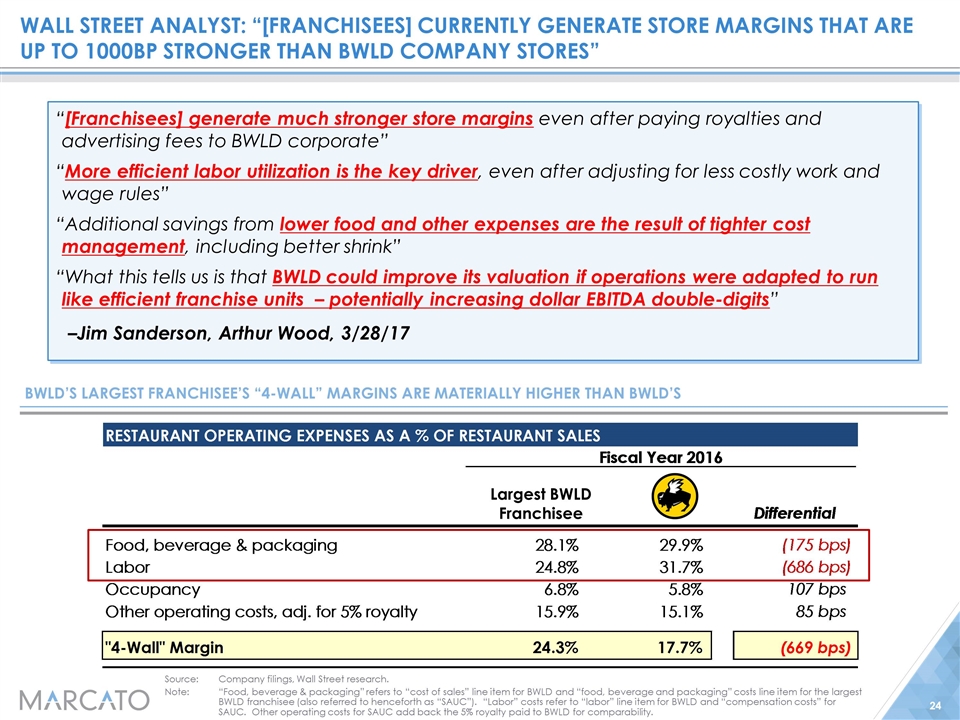

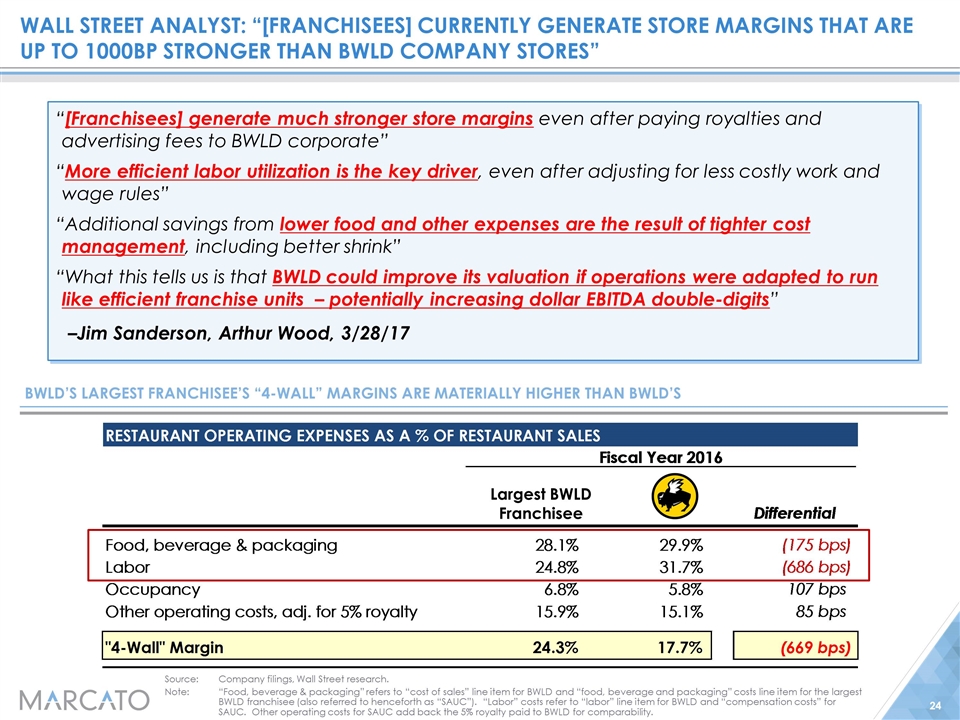

Wall Street Analyst: “[Franchisees] currently generate store margins that are up to 1000BP stronger than BWLD company stores” “[Franchisees] generate much stronger store margins even after paying royalties and advertising fees to BWLD corporate” “More efficient labor utilization is the key driver, even after adjusting for less costly work and wage rules” “Additional savings from lower food and other expenses are the result of tighter cost management, including better shrink” “What this tells us is that BWLD could improve its valuation if operations were adapted to run like efficient franchise units – potentially increasing dollar EBITDA double-digits” –Jim Sanderson, Arthur Wood, 3/28/17 Source:Company filings, Wall Street research. Note:“Food, beverage & packaging” refers to “cost of sales” line item for BWLD and “food, beverage and packaging” costs line item for the largest BWLD franchisee (also referred to henceforth as “SAUC”). “Labor” costs refer to “labor” line item for BWLD and “compensation costs” for SAUC. Other operating costs for SAUC add back the 5% royalty paid to BWLD for comparability. BWLD’s largest franchisee’s “4-wall” margins are materially higher than BWLD’s Largest BWLD Franchisee

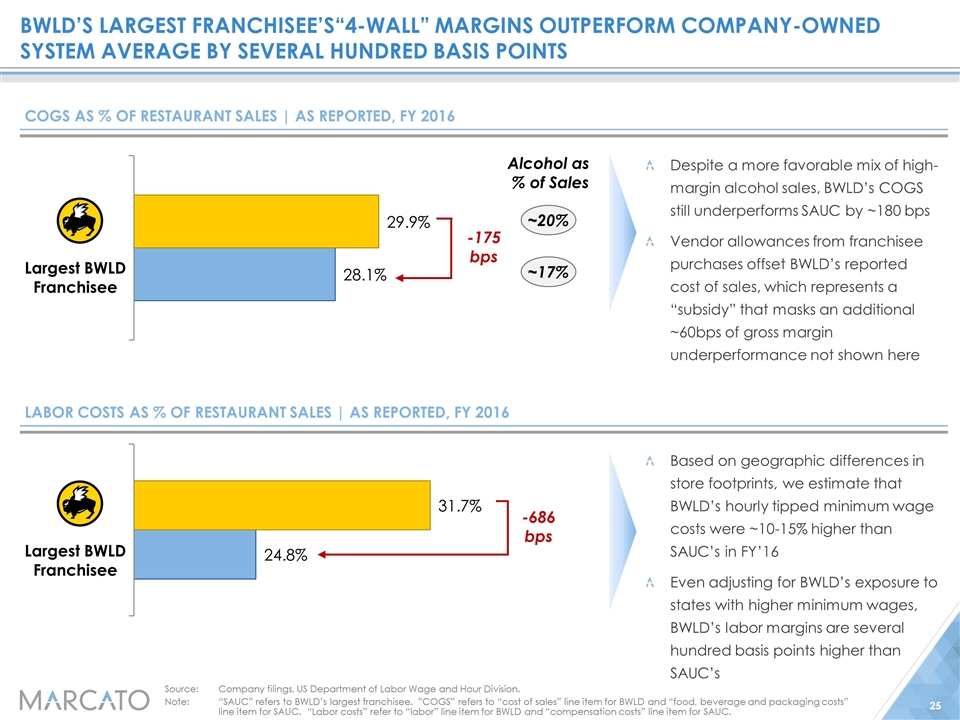

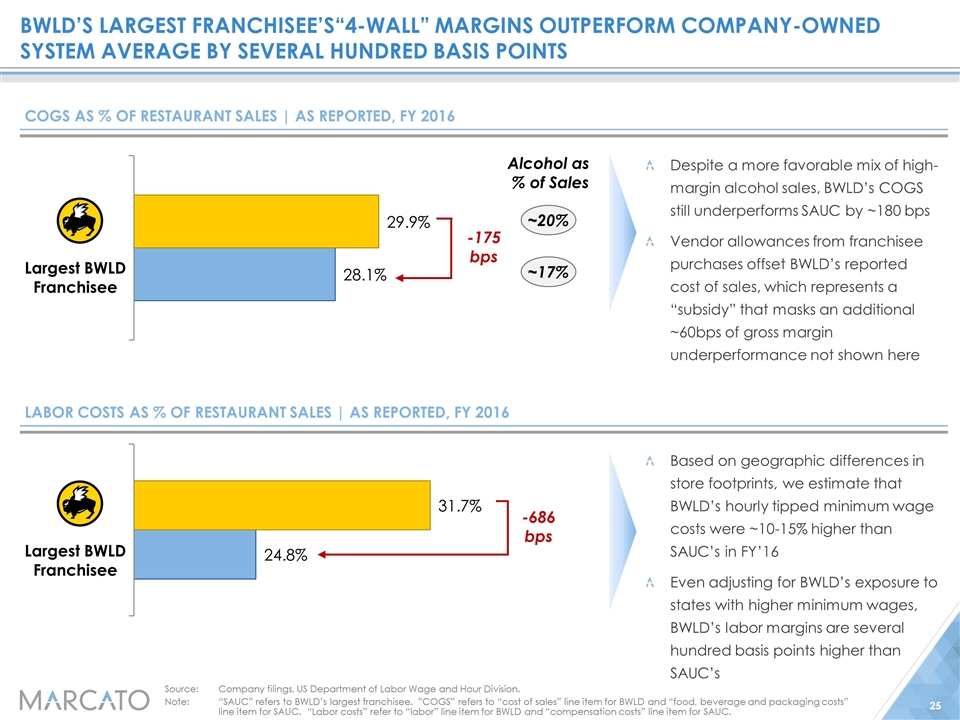

BWLD’s largest franchisee’s“4-wall” margins outperform company-owned system average by several hundred basis points Source:Company filings, US Department of Labor Wage and Hour Division. Note:“SAUC” refers to BWLD’s largest franchisee. ”COGS” refers to “cost of sales” line item for BWLD and “food, beverage and packaging costs” line item for SAUC. “Labor costs” refer to “labor” line item for BWLD and “compensation costs” line item for SAUC. BWLD: Alcohol – 20% of sales Wings / Boneless – 21% of sales each COGS as % of restaurant sales | as reported, FY 2016 Labor costs as % of restaurant sales | as reported, FY 2016 SAUC: Alcohol – 17.1% of sales ~20% Alcohol as % of Sales ~17% -175 bps -686 bps Despite a more favorable mix of high-margin alcohol sales, BWLD’s COGS still underperforms SAUC by ~180 bps Vendor allowances from franchisee purchases offset BWLD’s reported cost of sales, which represents a “subsidy” that masks an additional ~60bps of gross margin underperformance not shown here Based on geographic differences in store footprints, we estimate that BWLD’s hourly tipped minimum wage costs were ~10-15% higher than SAUC’s in FY’16 Even adjusting for BWLD’s exposure to states with higher minimum wages, BWLD’s labor margins are several hundred basis points higher than SAUC’s Largest BWLD Franchisee Largest BWLD Franchisee

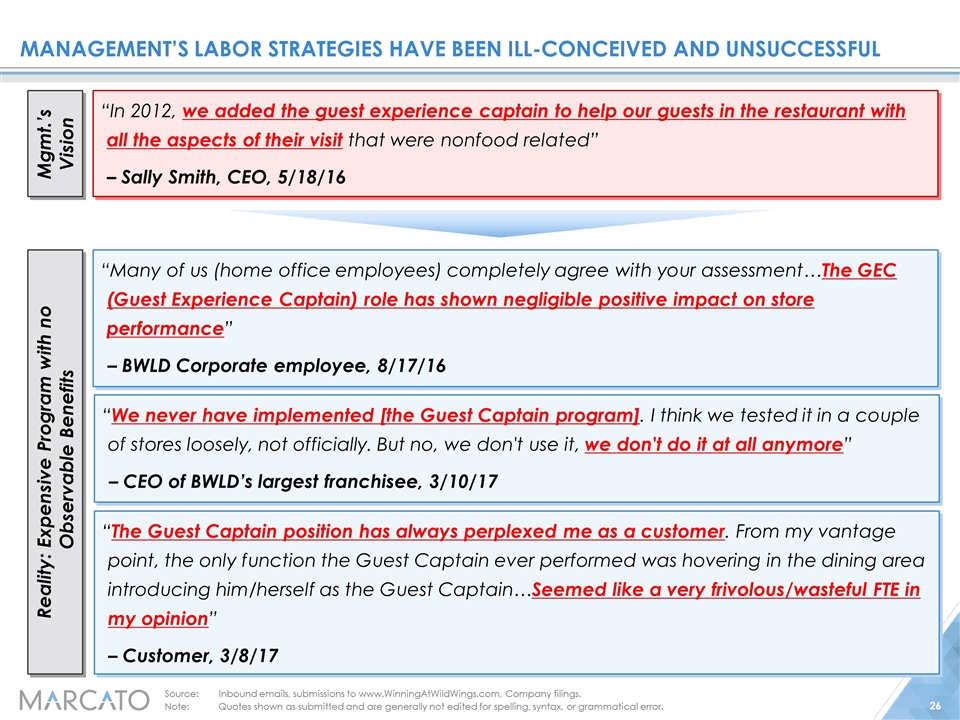

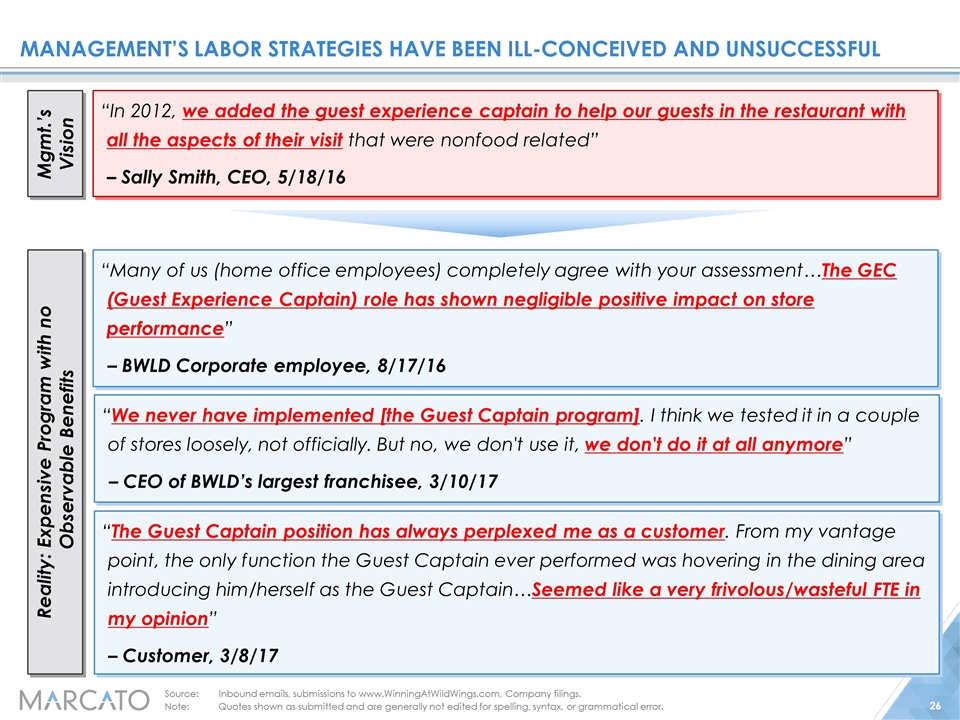

Source:Inbound emails, submissions to www.WinningAtWildWings.com, Company filings. Note:Quotes shown as submitted and are generally not edited for spelling, syntax, or grammatical error. “Many of us (home office employees) completely agree with your assessment…The GEC (Guest Experience Captain) role has shown negligible positive impact on store performance” – BWLD Corporate employee, 8/17/16 “The Guest Captain position has always perplexed me as a customer. From my vantage point, the only function the Guest Captain ever performed was hovering in the dining area introducing him/herself as the Guest Captain…Seemed like a very frivolous/wasteful FTE in my opinion” – Customer, 3/8/17 “We never have implemented [the Guest Captain program]. I think we tested it in a couple of stores loosely, not officially. But no, we don't use it, we don't do it at all anymore” – CEO of BWLD’s largest franchisee, 3/10/17 Management’s LABOR strategies have been ill-conceived and unsuccessful “In 2012, we added the guest experience captain to help our guests in the restaurant with all the aspects of their visit that were nonfood related” – Sally Smith, CEO, 5/18/16 Mgmt.’s Vision Reality: Expensive Program with no Observable Benefits

III.Deteriorating guest experience

“[O]ur financials…show our dedication to shareholder value creation. While I am proud of the value we have created in the past, our goal is to create similar value in the future” –Sally Smith, President & CEO, 8/16/16 “[Our] combined approach to develop both Company-owned and franchise restaurants has generated outstanding results and created great value for our shareholders” –James Schmidt, Chief Operating Officer, 8/16/16 -Judith Shoulak, President, North America, 8/16/16 “If there is one way to sum up our past and future success…what it really comes down to [is] the Buffalo Wild Wings fan experience. All other value creation opportunities flow from brand strength” -James Schmidt, Chief Operating Officer, 8/16/16

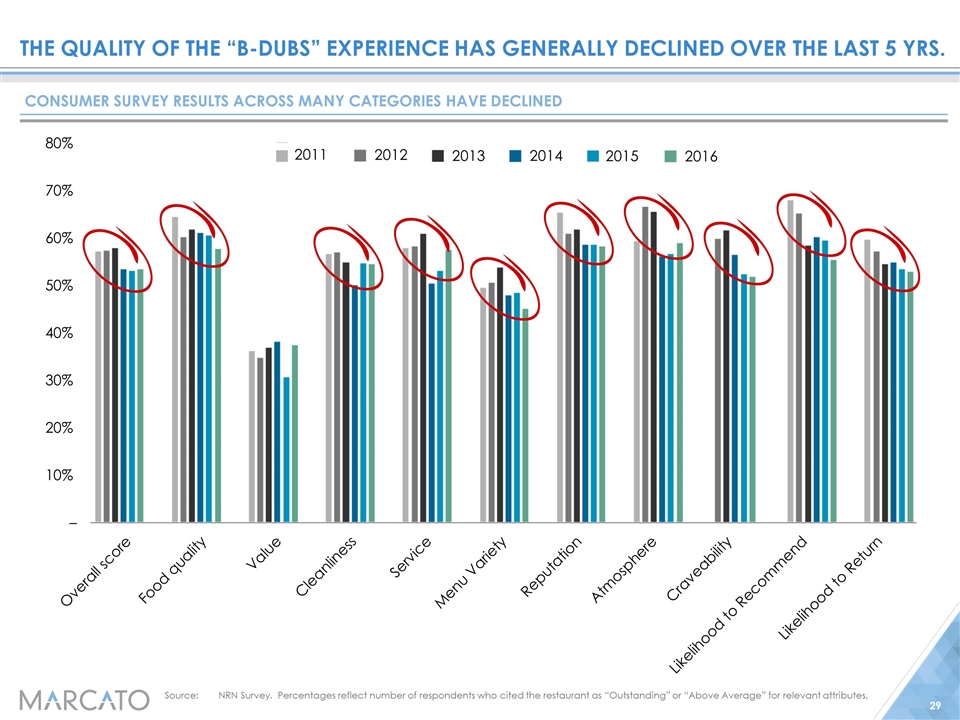

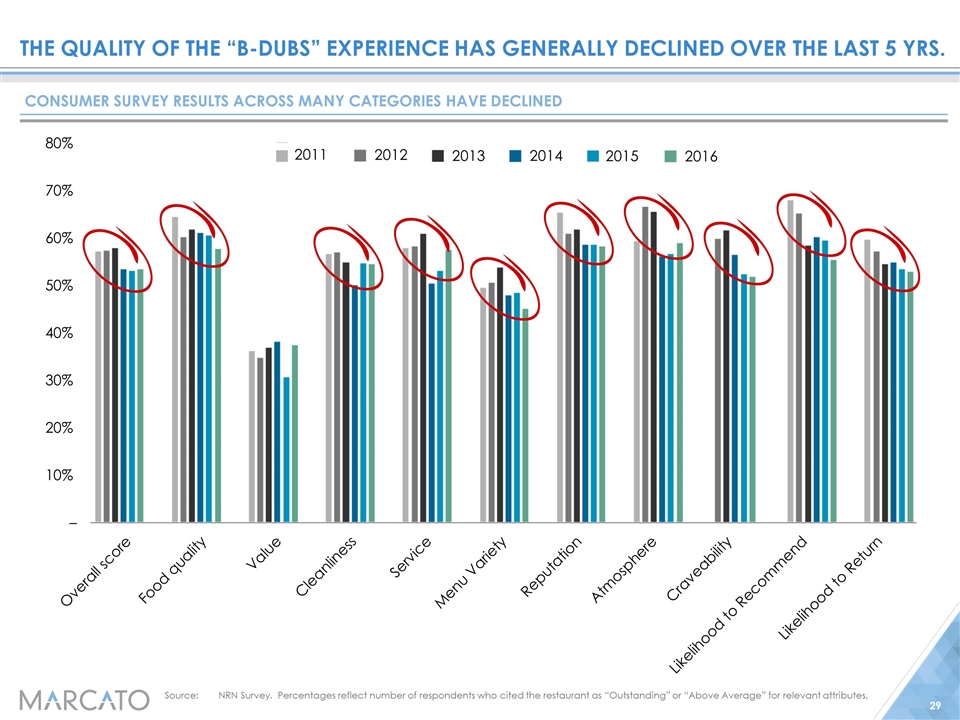

The quality of the “B-dubs” experience has generally declined over the last 5 yrs. Source:NRN Survey. Percentages reflect number of respondents who cited the restaurant as “Outstanding” or “Above Average” for relevant attributes. 2016 2015 2014 2013 2012 2011 Consumer survey results across many categories have declined

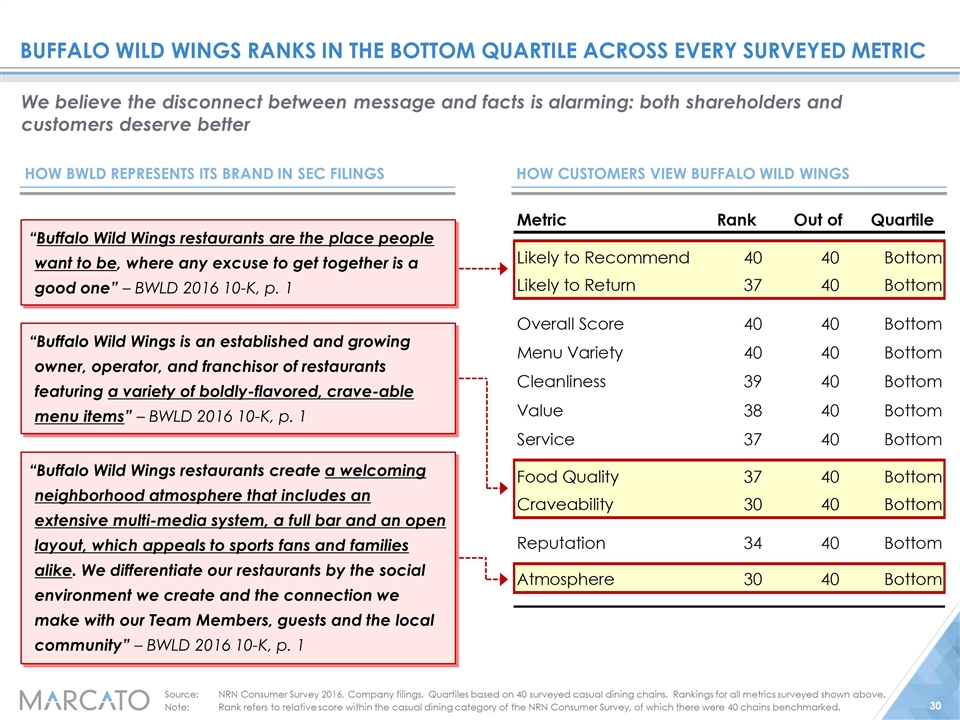

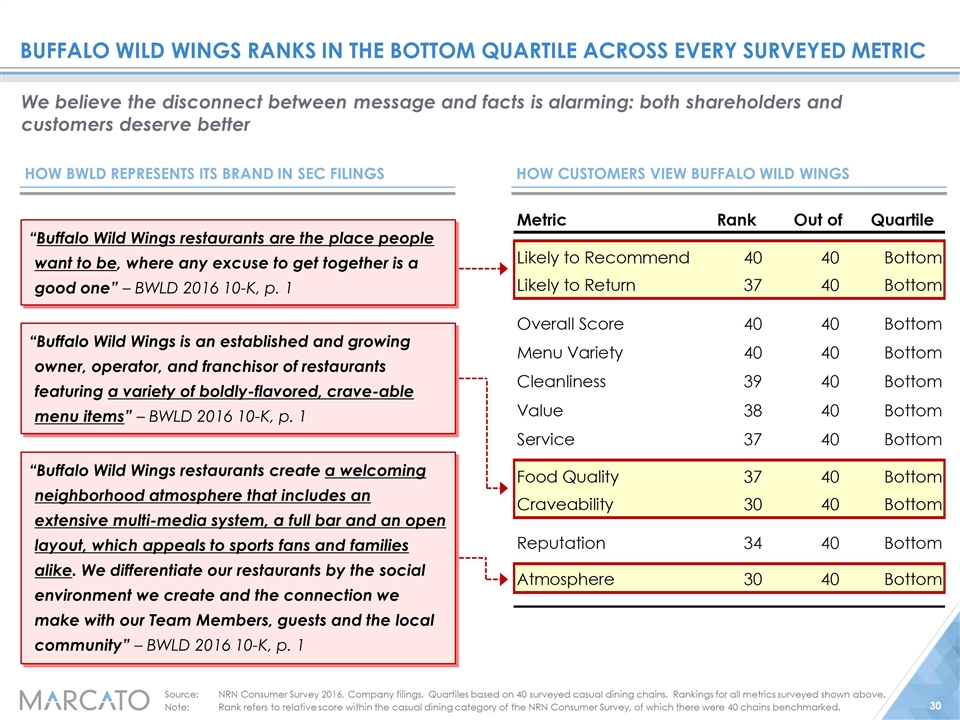

Buffalo wild wings ranks in the bottom quartile across every surveyed metric Source:NRN Consumer Survey 2016, Company filings. Quartiles based on 40 surveyed casual dining chains. Rankings for all metrics surveyed shown above. Note:Rank refers to relative score within the casual dining category of the NRN Consumer Survey, of which there were 40 chains benchmarked. “Buffalo Wild Wings is an established and growing owner, operator, and franchisor of restaurants featuring a variety of boldly-flavored, crave-able menu items” – BWLD 2016 10-K, p. 1 How BWLD represents its brand in SEC filings “Buffalo Wild Wings restaurants create a welcoming neighborhood atmosphere that includes an extensive multi-media system, a full bar and an open layout, which appeals to sports fans and families alike. We differentiate our restaurants by the social environment we create and the connection we make with our Team Members, guests and the local community” – BWLD 2016 10-K, p. 1 “Buffalo Wild Wings restaurants are the place people want to be, where any excuse to get together is a good one” – BWLD 2016 10-K, p. 1 We believe the disconnect between message and facts is alarming: both shareholders and customers deserve better How customers view Buffalo Wild Wings

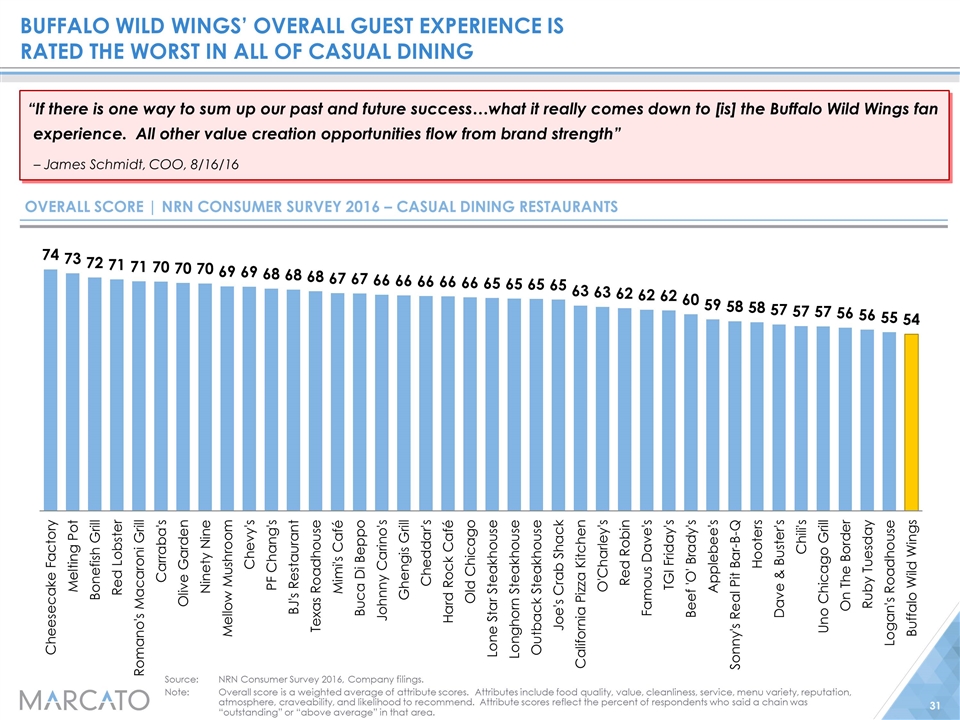

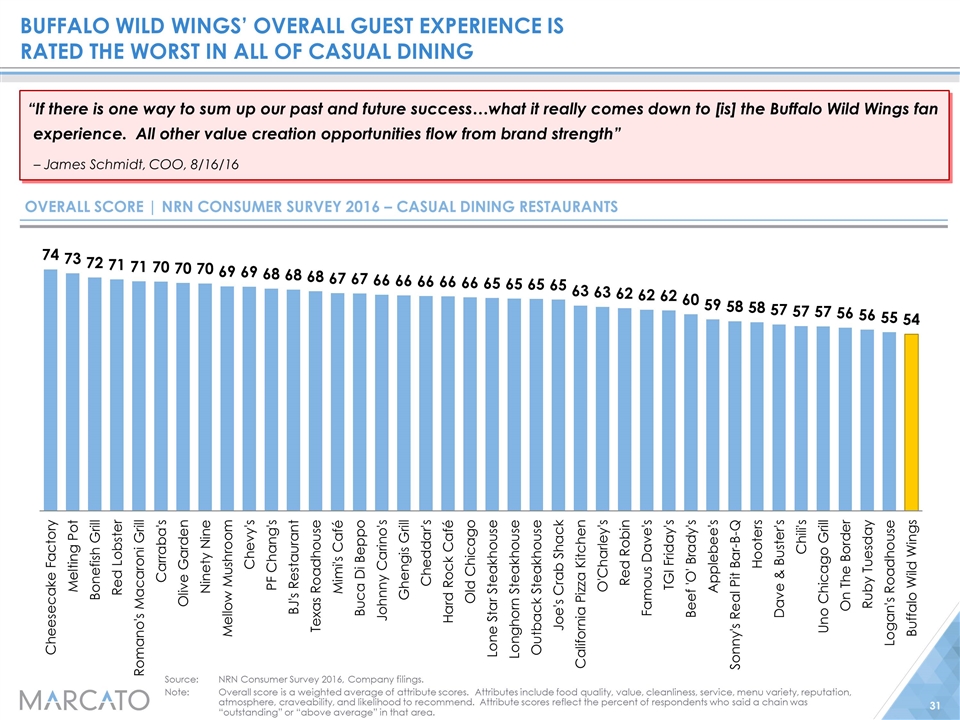

Buffalo Wild Wings’ Overall guest experience is rated the worst in all of casual dining Source:NRN Consumer Survey 2016, Company filings. Note:Overall score is a weighted average of attribute scores. Attributes include food quality, value, cleanliness, service, menu variety, reputation, atmosphere, craveability, and likelihood to recommend. Attribute scores reflect the percent of respondents who said a chain was “outstanding” or “above average” in that area. Overall Score | NRN Consumer Survey 2016 – Casual dining restaurants “If there is one way to sum up our past and future success…what it really comes down to [is] the Buffalo Wild Wings fan experience. All other value creation opportunities flow from brand strength” – James Schmidt, COO, 8/16/16

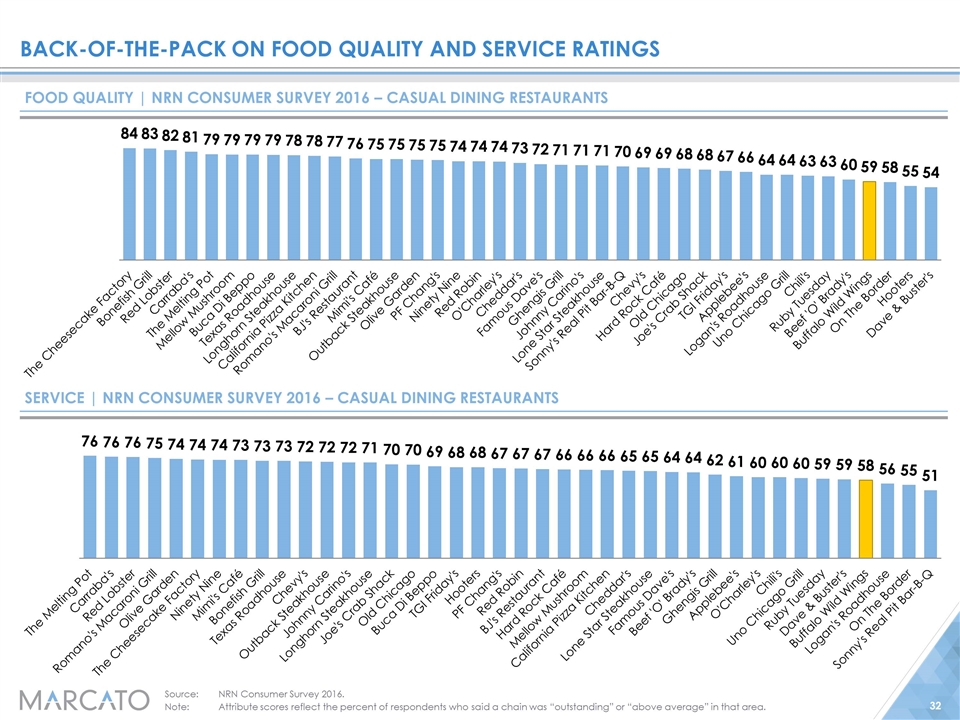

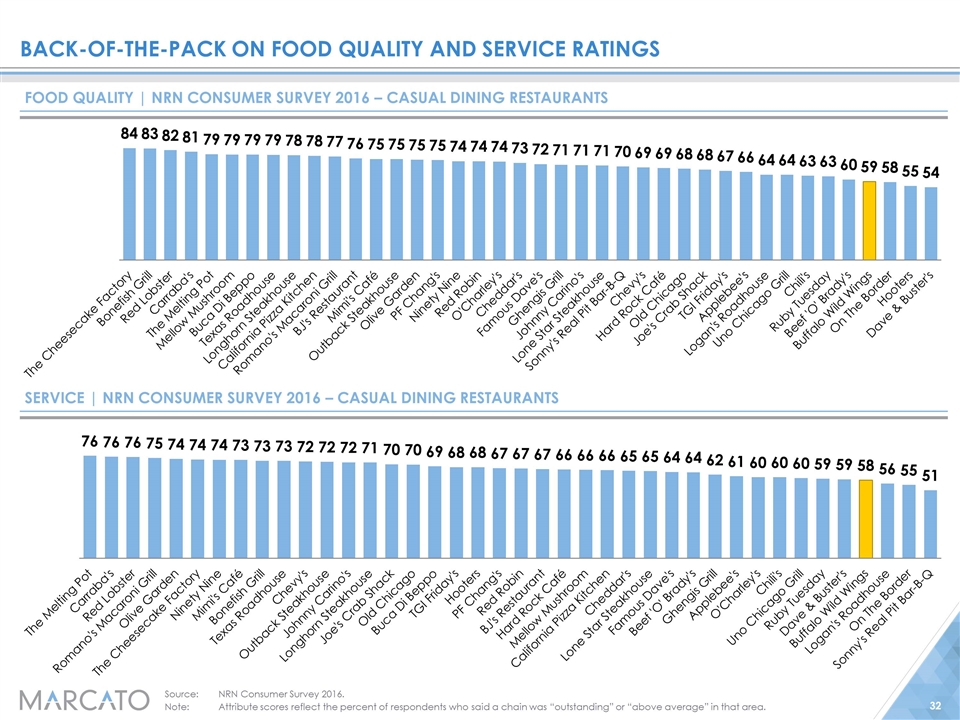

Back-of-the-pack on Food quality and service ratings Food Quality | NRN Consumer Survey 2016 – Casual dining restaurants Service | NRN Consumer Survey 2016 – Casual dining restaurants Source:NRN Consumer Survey 2016. Note:Attribute scores reflect the percent of respondents who said a chain was “outstanding” or “above average” in that area.

Management paints a rosy picture of their commitment to guest experience… “I believe the future of this brand and Company are brighter now than ever before” “[T]oday made me more excited about the brand, because there’s so much happening. And the amazing thing is…it just keeps getting better” –James Schmidt & Sally Smith, 2014 Analyst Day Source:Company filings. Pictures of food, smiling actors, and undated quotes cannot substitute for facts and analysis

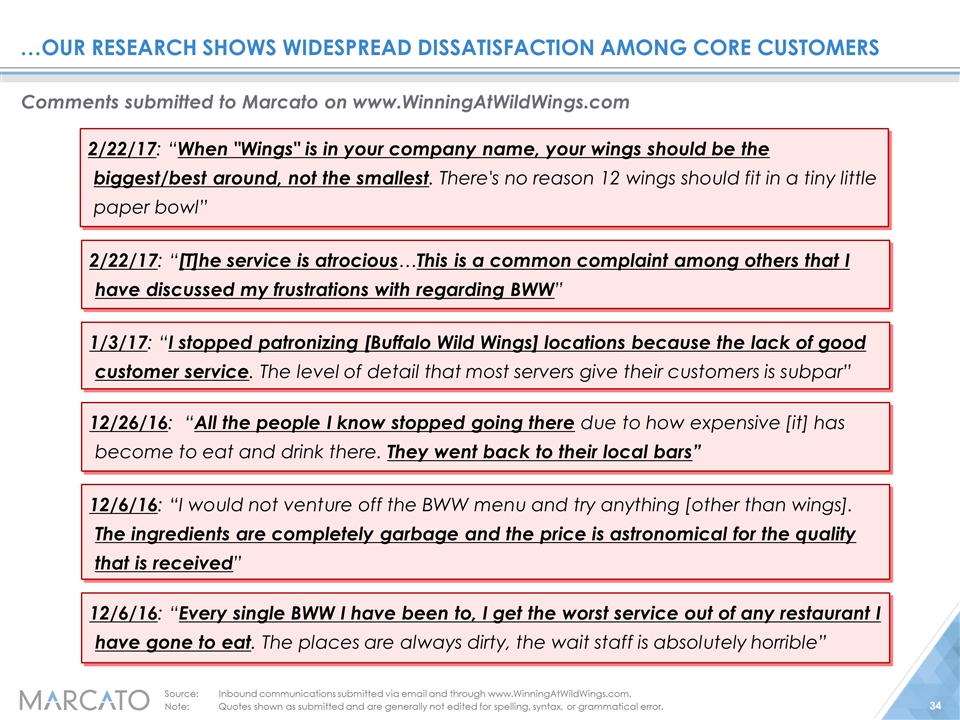

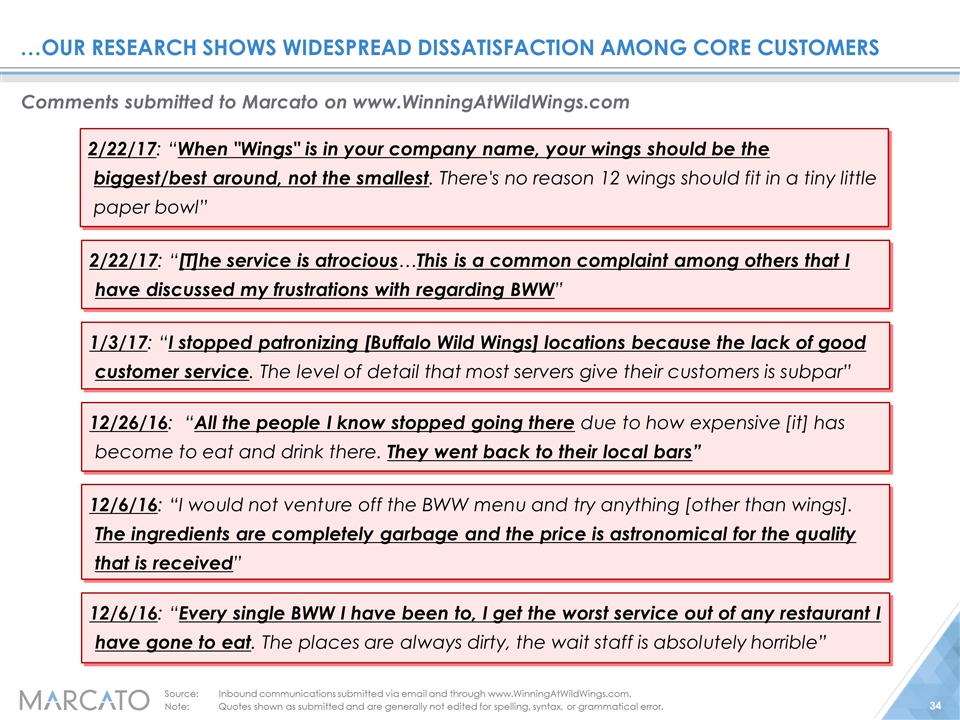

…our research shows widespread dissatisfaction among core customers “I believe the future of this brand and Company are brighter now than ever before” “[T]oday made me more excited about the brand, because there’s so much happening. And the amazing thing is…it just keeps getting better” –James Schmidt & Sally Smith, 2014 Analyst Day 2/22/17: “When "Wings" is in your company name, your wings should be the biggest/best around, not the smallest. There's no reason 12 wings should fit in a tiny little paper bowl” 12/6/16: “I would not venture off the BWW menu and try anything [other than wings]. The ingredients are completely garbage and the price is astronomical for the quality that is received” 12/26/16: “All the people I know stopped going there due to how expensive [it] has become to eat and drink there. They went back to their local bars” Source:Inbound communications submitted via email and through www.WinningAtWildWings.com. Note:Quotes shown as submitted and are generally not edited for spelling, syntax, or grammatical error. 1/3/17: “I stopped patronizing [Buffalo Wild Wings] locations because the lack of good customer service. The level of detail that most servers give their customers is subpar” 2/22/17: “[T]he service is atrocious…This is a common complaint among others that I have discussed my frustrations with regarding BWW” 12/6/16: “Every single BWW I have been to, I get the worst service out of any restaurant I have gone to eat. The places are always dirty, the wait staff is absolutely horrible” Comments submitted to Marcato on www.WinningAtWildWings.com

IV.Poor capital deployment

“Our approach to investing in franchise acquisitions is strategic and opportunistic…We have a rigorous, diligent review process. Only when the return metrics are attractive and we see long-term value creation opportunities do we consider a purchase” -Sally Smith, Chief Executive Officer, 8/16/16

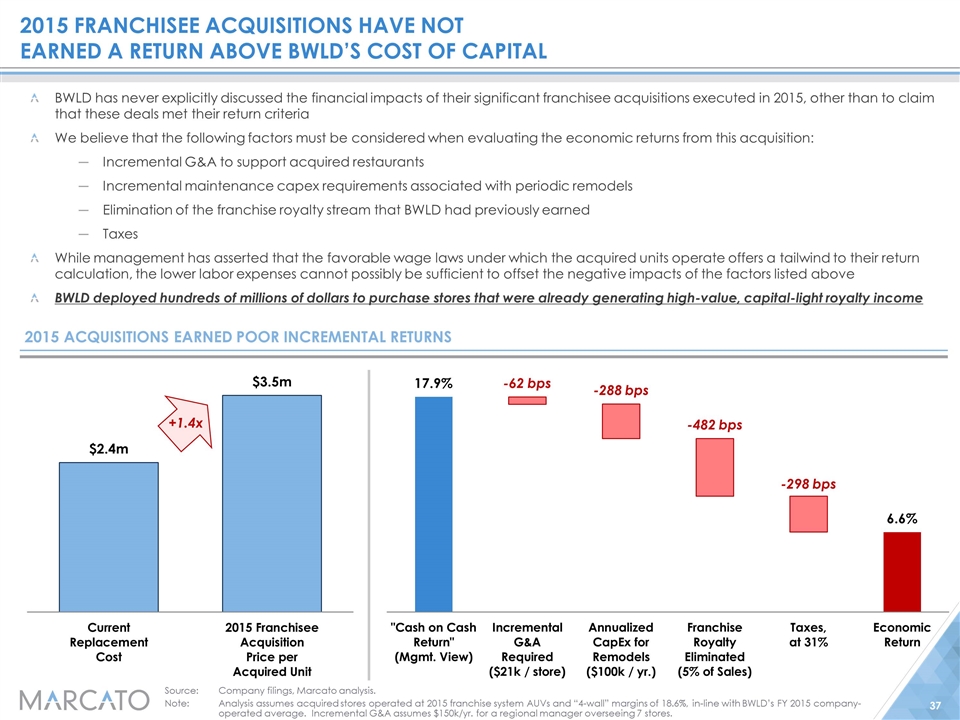

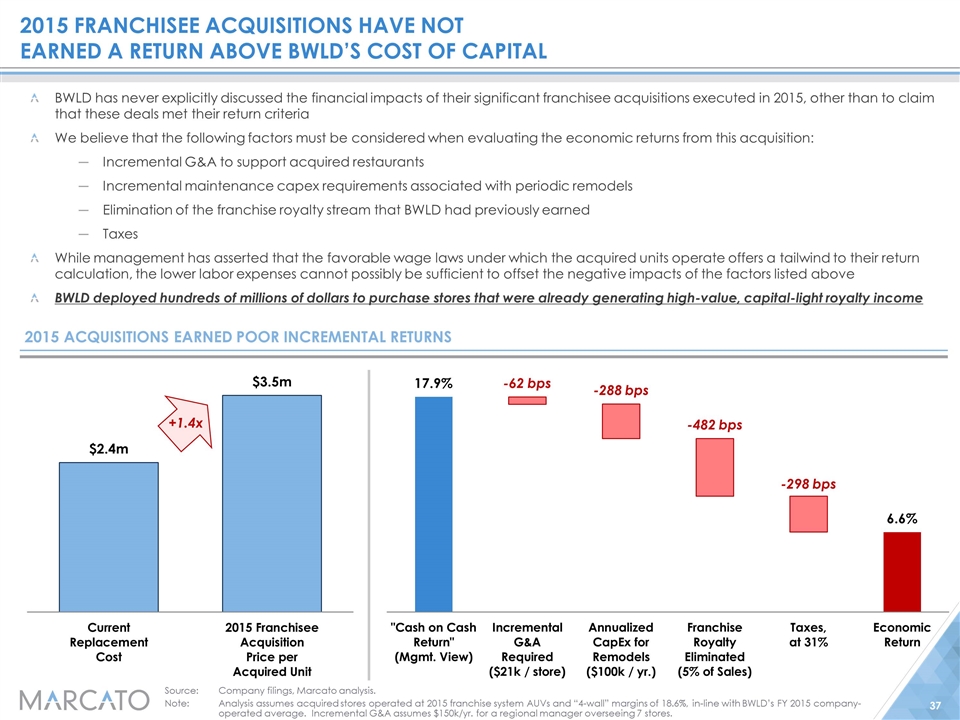

2015 Franchisee acquisitions have not earned a return above BWLD’s cost of capital Source:Company filings, Marcato analysis. Note:Analysis assumes acquired stores operated at 2015 franchise system AUVs and “4-wall” margins of 18.6%, in-line with BWLD’s FY 2015 company-operated average. Incremental G&A assumes $150k/yr. for a regional manager overseeing 7 stores. BWLD has never explicitly discussed the financial impacts of their significant franchisee acquisitions executed in 2015, other than to claim that these deals met their return criteria We believe that the following factors must be considered when evaluating the economic returns from this acquisition: Incremental G&A to support acquired restaurants Incremental maintenance capex requirements associated with periodic remodels Elimination of the franchise royalty stream that BWLD had previously earned Taxes While management has asserted that the favorable wage laws under which the acquired units operate offers a tailwind to their return calculation, the lower labor expenses cannot possibly be sufficient to offset the negative impacts of the factors listed above BWLD deployed hundreds of millions of dollars to purchase stores that were already generating high-value, capital-light royalty income 2015 acquisitions earned poor incremental returns COGS Margin Opportunities Optimized Guest Captain Hours Said in Oct. ’16 to include reduced programming fees and uniform costs, with an update to be offered in February +1.4x

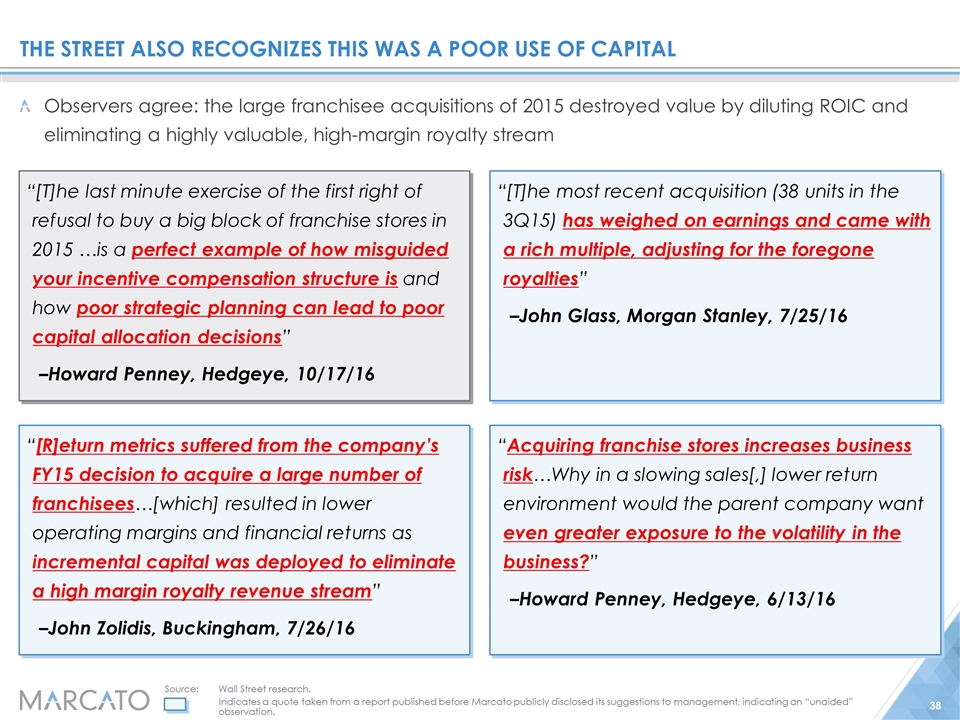

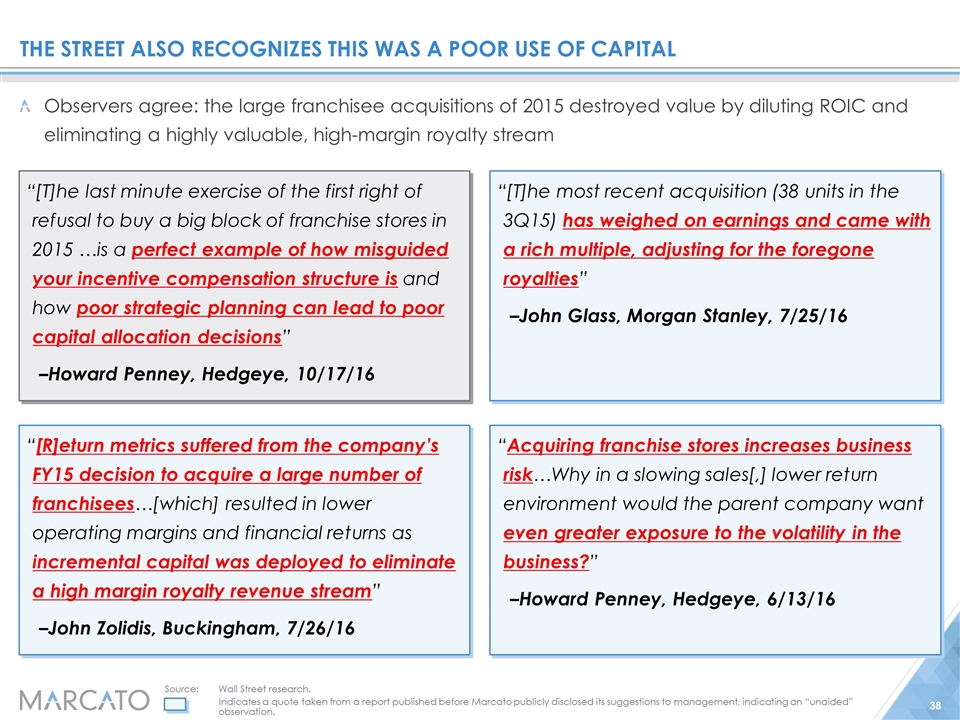

The street also recognizes this was a poor use of capital “[T]he last minute exercise of the first right of refusal to buy a big block of franchise stores in 2015 …is a perfect example of how misguided your incentive compensation structure is and how poor strategic planning can lead to poor capital allocation decisions” –Howard Penney, Hedgeye, 10/17/16 “[T]he most recent acquisition (38 units in the 3Q15) has weighed on earnings and came with a rich multiple, adjusting for the foregone royalties” –John Glass, Morgan Stanley, 7/25/16 “[R]eturn metrics suffered from the company’s FY15 decision to acquire a large number of franchisees…[which] resulted in lower operating margins and financial returns as incremental capital was deployed to eliminate a high margin royalty revenue stream” –John Zolidis, Buckingham, 7/26/16 “Acquiring franchise stores increases business risk…Why in a slowing sales[,] lower return environment would the parent company want even greater exposure to the volatility in the business?” –Howard Penney, Hedgeye, 6/13/16 Source:Wall Street research. Indicates a quote taken from a report published before Marcato publicly disclosed its suggestions to management, indicating an “unaided” observation. Observers agree: the large franchisee acquisitions of 2015 destroyed value by diluting ROIC and eliminating a highly valuable, high-margin royalty stream

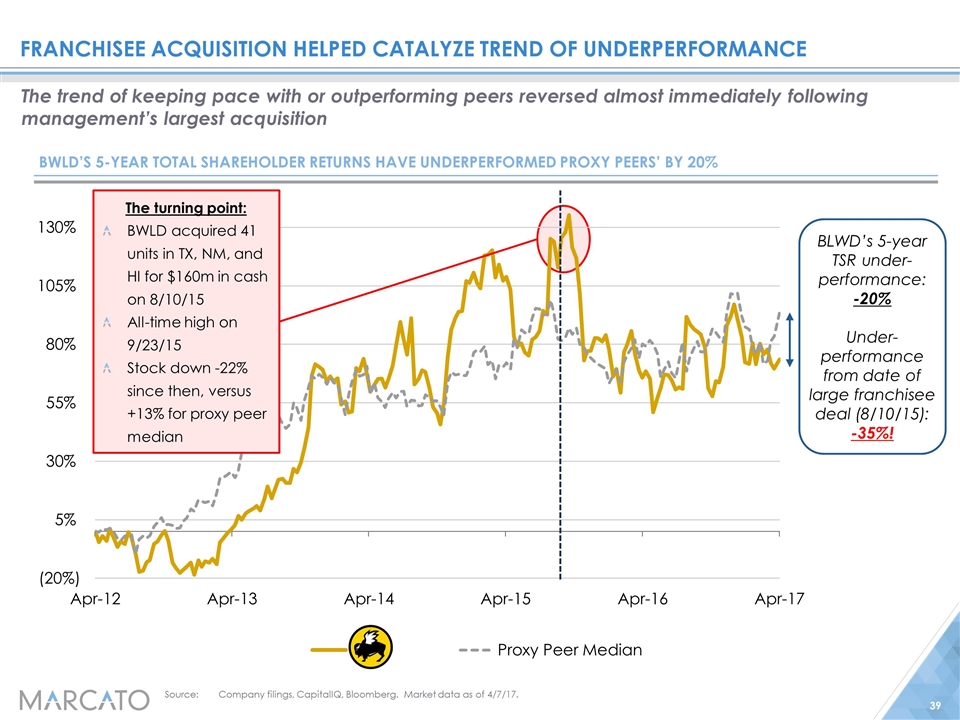

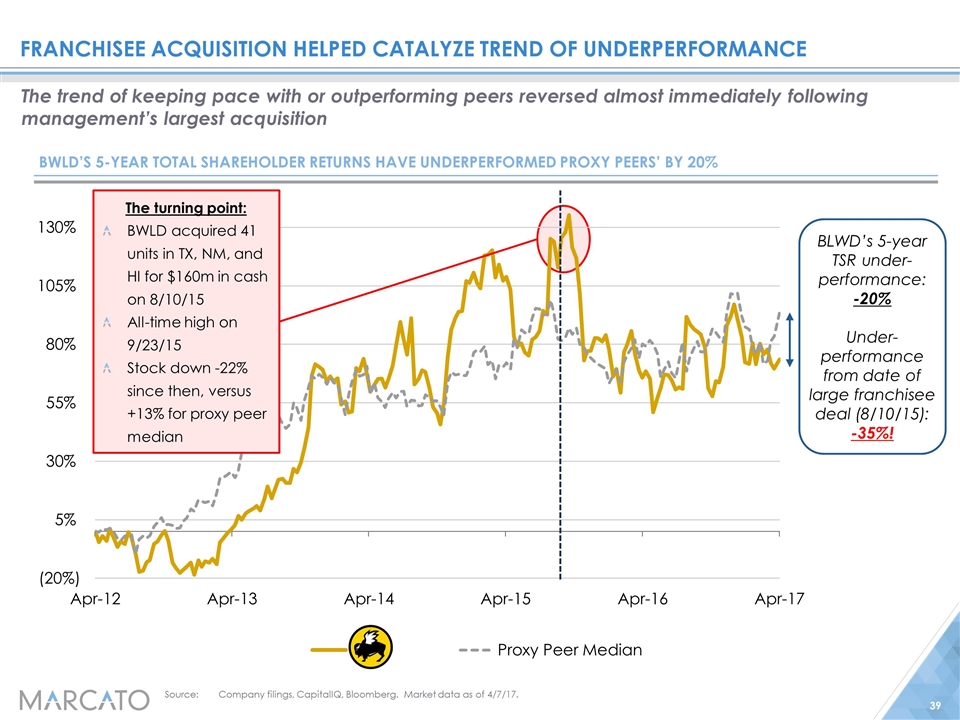

Franchisee acquisition helped catalyze trend of underperformance Source:Company filings, CapitalIQ, Bloomberg. Market data as of 4/7/17. BWLD’s 5-year Total shareholder returns have underperformed proxy peers’ by 20% BLWD’s 5-year TSR under-performance: -20% Under-performance from date of large franchisee deal (8/10/15): -35%! The trend of keeping pace with or outperforming peers reversed almost immediately following management’s largest acquisition The turning point: BWLD acquired 41 units in TX, NM, and HI for $160m in cash on 8/10/15 All-time high on 9/23/15 Stock down -22% since then, versus +13% for proxy peer median

V.Dismissal of more highly-franchised business model

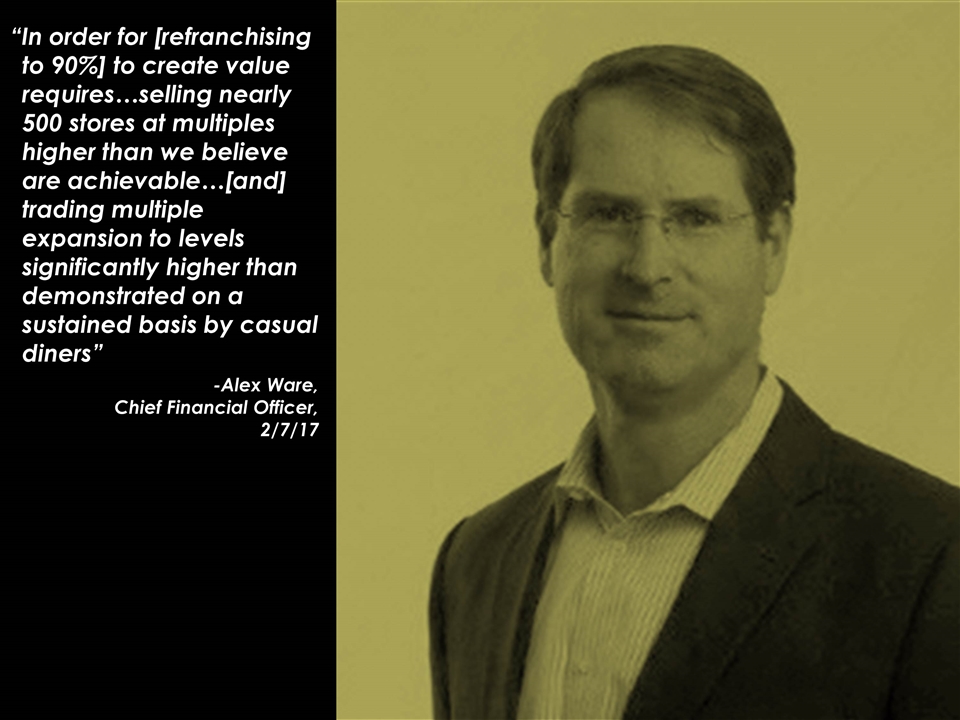

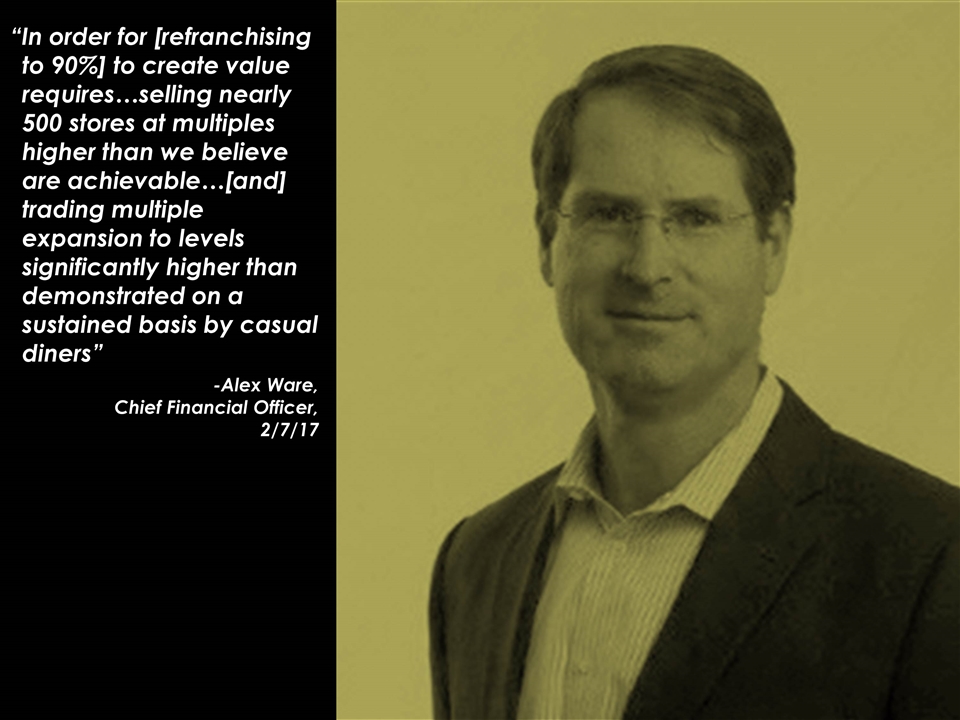

“In order for [refranchising to 90%] to create value requires…selling nearly 500 stores at multiples higher than we believe are achievable…[and] trading multiple expansion to levels significantly higher than demonstrated on a sustained basis by casual diners” -Alex Ware, Chief Financial Officer, 2/7/17

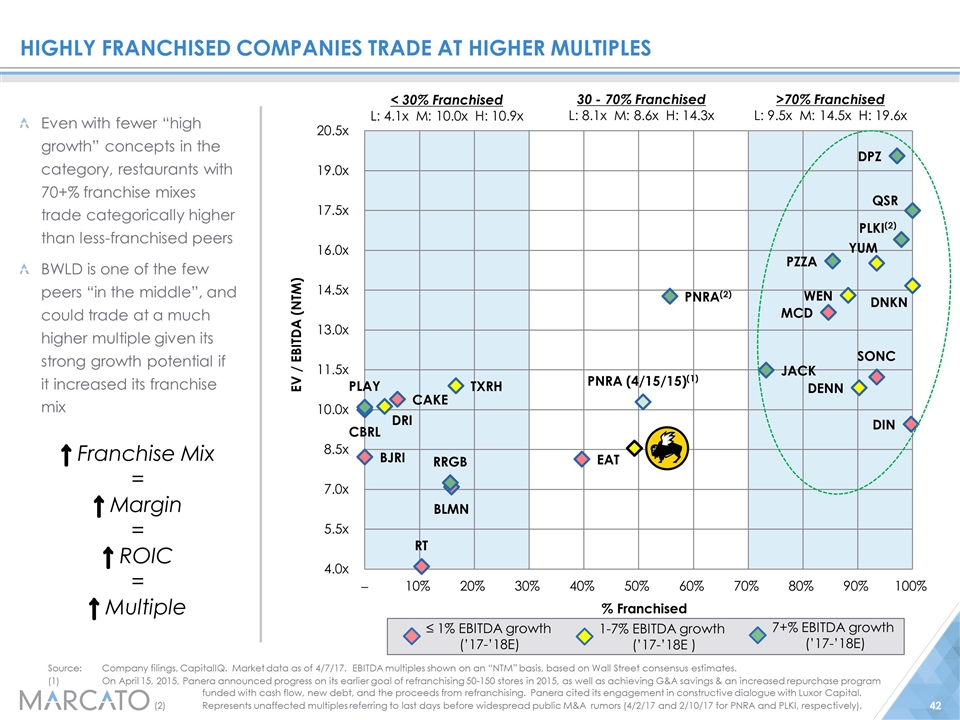

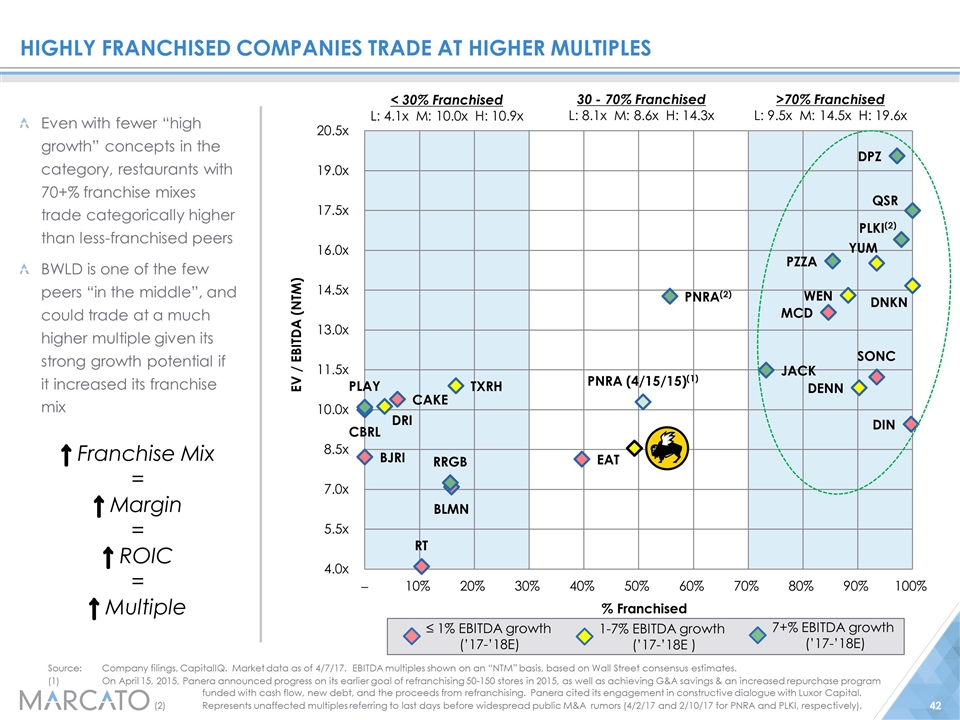

Highly franchised companies trade at higher multiples Even with fewer “high growth” concepts in the category, restaurants with 70+% franchise mixes trade categorically higher than less-franchised peers BWLD is one of the few peers “in the middle”, and could trade at a much higher multiple given its strong growth potential if it increased its franchise mix Source:Company filings, CapitalIQ. Market data as of 4/7/17. EBITDA multiples shown on an “NTM” basis, based on Wall Street consensus estimates. (1)On April 15, 2015, Panera announced progress on its earlier goal of refranchising 50-150 stores in 2015, as well as achieving G&A savings & an increased repurchase program ≤ 1% EBITDA growth (’17-’18E) 1-7% EBITDA growth (’17-’18E ) 7+% EBITDA growth (’17-’18E) ↑ Franchise Mix = ↑ Margin = ↑ ROIC = ↑ Multiple >70% Franchised L: 9.5x M: 14.5x H: 19.6x < 30% Franchised L: 4.1x M: 10.0x H: 10.9x 30 - 70% Franchised L: 8.1x M: 8.6x H: 14.3x funded with cash flow, new debt, and the proceeds from refranchising. Panera cited its engagement in constructive dialogue with Luxor Capital. (2)Represents unaffected multiples referring to last days before widespread public M&A rumors (4/2/17 and 2/10/17 for PNRA and PLKI, respectively).

Industry-leading advisor says major refranchising is highly feasible Source:Marcato’s presentation at Sohn SF in October 2016. “We are highly confident BWLD could refranchise their owned stores at a multiple of 6.0x or higher and estimate a refranchising process to 90% could take as few as 18-24 months” – Cypress Group

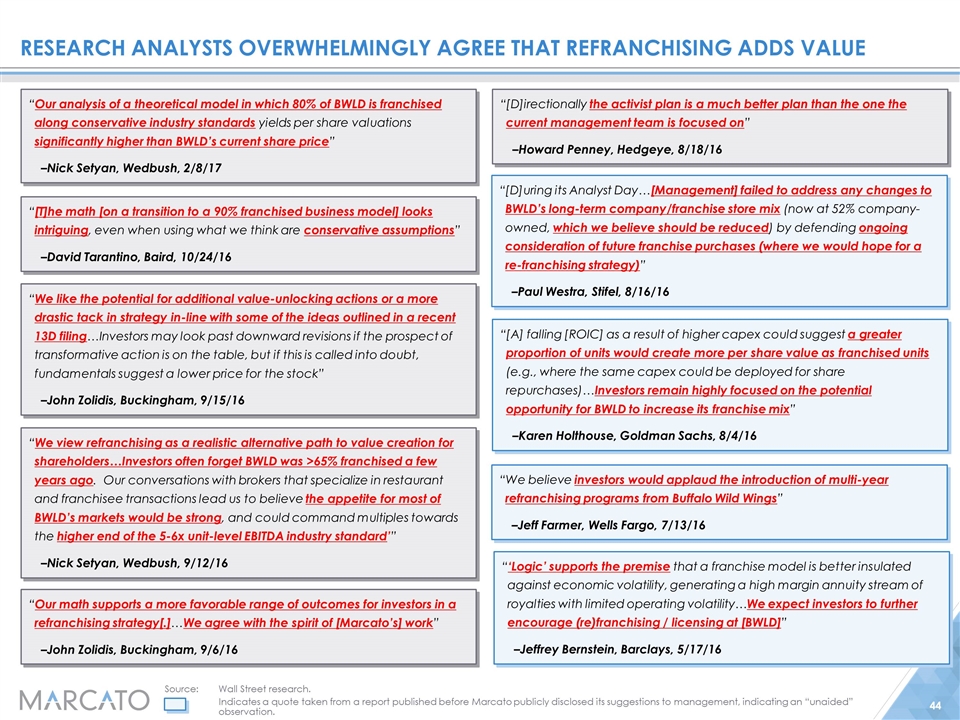

“Our math supports a more favorable range of outcomes for investors in a refranchising strategy[.]…We agree with the spirit of [Marcato’s] work” –John Zolidis, Buckingham, 9/6/16 Research analysts overwhelmingly agree that refranchising adds value “Our analysis of a theoretical model in which 80% of BWLD is franchised along conservative industry standards yields per share valuations significantly higher than BWLD’s current share price” –Nick Setyan, Wedbush, 2/8/17 “[T]he math [on a transition to a 90% franchised business model] looks intriguing, even when using what we think are conservative assumptions” –David Tarantino, Baird, 10/24/16 “We like the potential for additional value-unlocking actions or a more drastic tack in strategy in-line with some of the ideas outlined in a recent 13D filing…Investors may look past downward revisions if the prospect of transformative action is on the table, but if this is called into doubt, fundamentals suggest a lower price for the stock” –John Zolidis, Buckingham, 9/15/16 “We view refranchising as a realistic alternative path to value creation for shareholders…Investors often forget BWLD was >65% franchised a few years ago. Our conversations with brokers that specialize in restaurant and franchisee transactions lead us to believe the appetite for most of BWLD’s markets would be strong, and could command multiples towards the higher end of the 5-6x unit-level EBITDA industry standard’” –Nick Setyan, Wedbush, 9/12/16 “[D]irectionally the activist plan is a much better plan than the one the current management team is focused on” –Howard Penney, Hedgeye, 8/18/16 “[A] falling [ROIC] as a result of higher capex could suggest a greater proportion of units would create more per share value as franchised units (e.g., where the same capex could be deployed for share repurchases)…Investors remain highly focused on the potential opportunity for BWLD to increase its franchise mix” –Karen Holthouse, Goldman Sachs, 8/4/16 “[D]uring its Analyst Day…[Management] failed to address any changes to BWLD’s long-term company/franchise store mix (now at 52% company-owned, which we believe should be reduced) by defending ongoing consideration of future franchise purchases (where we would hope for a re-franchising strategy)” –Paul Westra, Stifel, 8/16/16 “We believe investors would applaud the introduction of multi-year refranchising programs from Buffalo Wild Wings” –Jeff Farmer, Wells Fargo, 7/13/16 “‘Logic’ supports the premise that a franchise model is better insulated against economic volatility, generating a high margin annuity stream of royalties with limited operating volatility…We expect investors to further encourage (re)franchising / licensing at [BWLD]” –Jeffrey Bernstein, Barclays, 5/17/16 Source:Wall Street research. Indicates a quote taken from a report published before Marcato publicly disclosed its suggestions to management, indicating an “unaided” observation.

Franchising feasibility is a matter of corporate culture and willingness to change, not of whether the brand has table service “All the other publicly held restaurant companies that have shifted business models are QSR chains, but we argue the common ingredient to all of their successes was not their industry-defined segment, but their decision to shift their cultures and structure to support franchise growth. Before significant investments are made supporting company-owned restaurants, a fresh perspective at the Board level could benefit shareholders” ─ Chris O’Cull, Keybanc, 2/7/17 Source:Wall Street research.

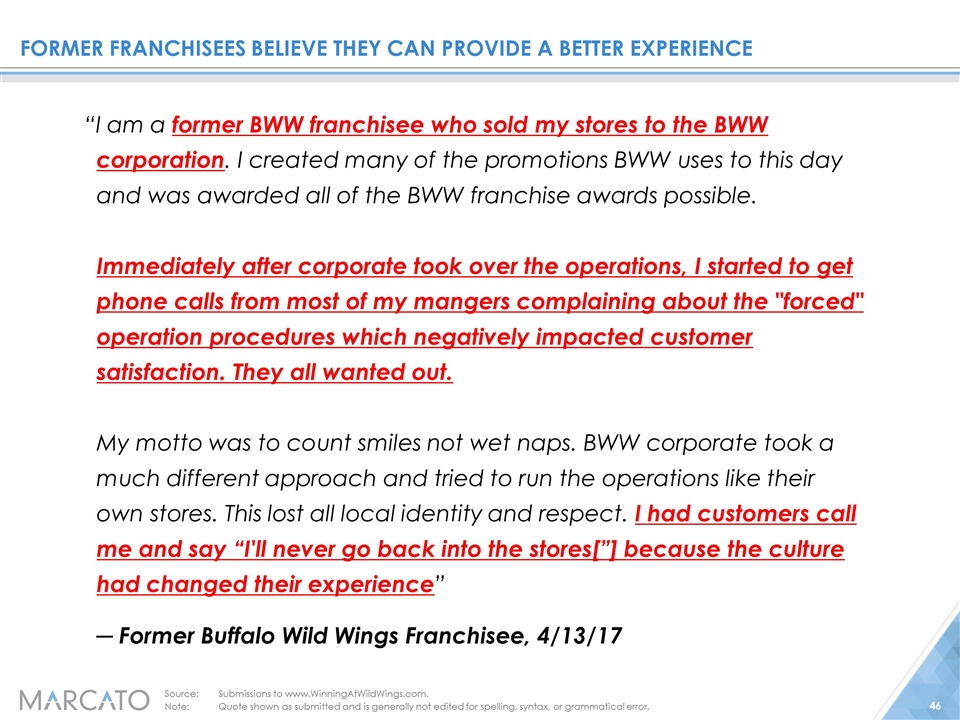

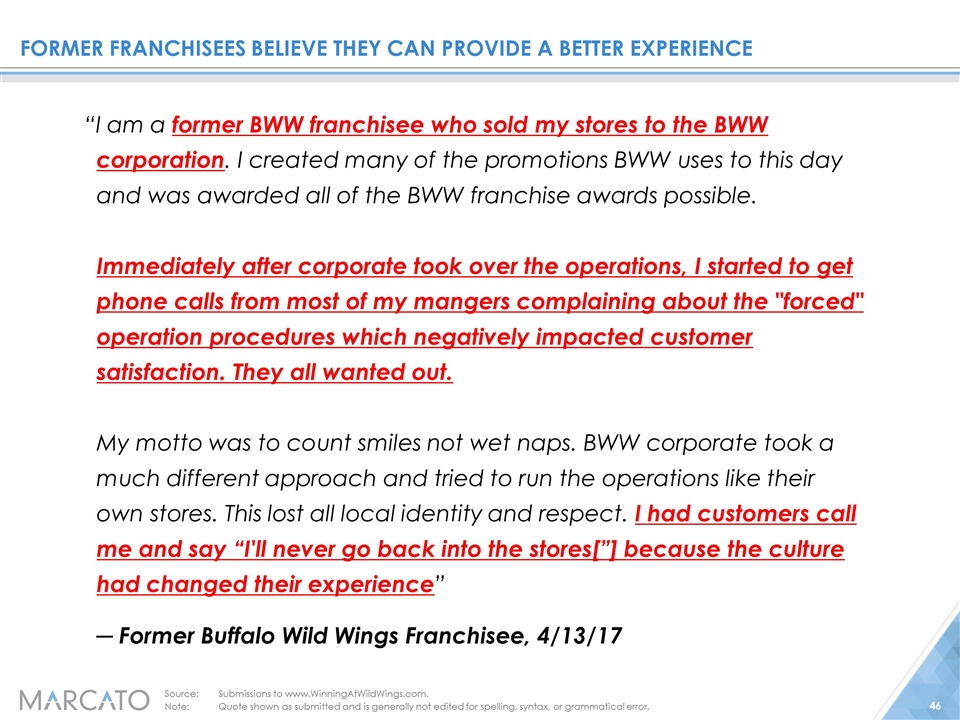

Former franchisees believe they can provide a better experience “I am a former BWW franchisee who sold my stores to the BWW corporation. I created many of the promotions BWW uses to this day and was awarded all of the BWW franchise awards possible. Immediately after corporate took over the operations, I started to get phone calls from most of my mangers complaining about the "forced" operation procedures which negatively impacted customer satisfaction. They all wanted out. My motto was to count smiles not wet naps. BWW corporate took a much different approach and tried to run the operations like their own stores. This lost all local identity and respect. I had customers call me and say “I'll never go back into the stores[”] because the culture had changed their experience” ─ Former Buffalo Wild Wings Franchisee, 4/13/17 Source:Submissions to www.WinningAtWildWings.com. Note:Quote shown as submitted and is generally not edited for spelling, syntax, or grammatical error.

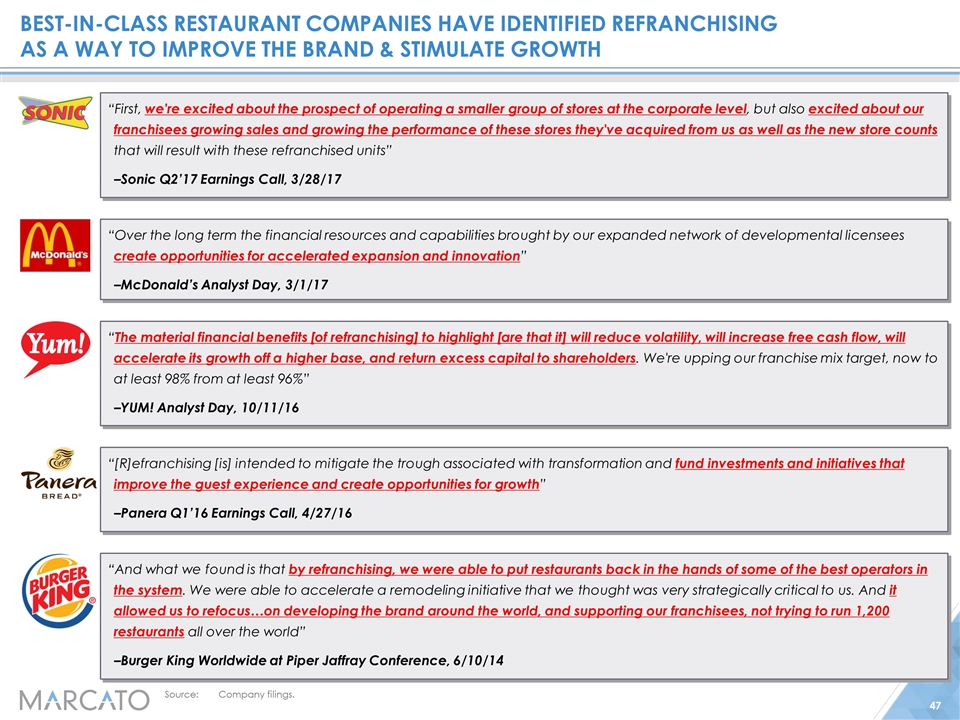

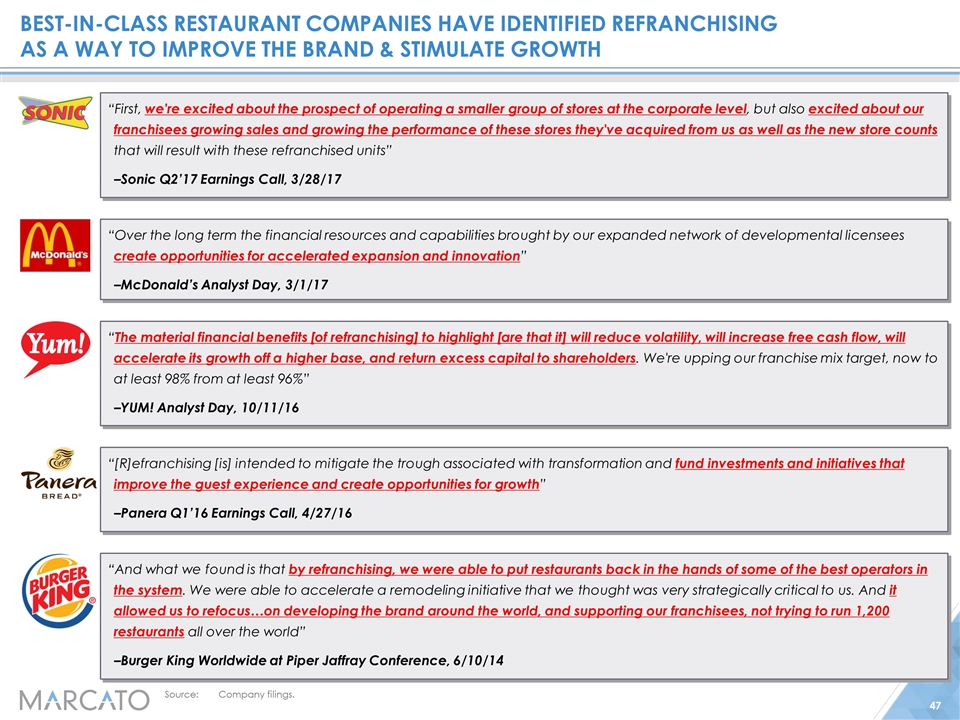

Best-in-class restaurant companies have identified refranchising as a way to improve the brand & stimulate growth Source:Company filings. “The material financial benefits [of refranchising] to highlight [are that it] will reduce volatility, will increase free cash flow, will accelerate its growth off a higher base, and return excess capital to shareholders. We're upping our franchise mix target, now to at least 98% from at least 96%” –YUM! Analyst Day, 10/11/16 “Over the long term the financial resources and capabilities brought by our expanded network of developmental licensees create opportunities for accelerated expansion and innovation” –McDonald’s Analyst Day, 3/1/17 “And what we found is that by refranchising, we were able to put restaurants back in the hands of some of the best operators in the system. We were able to accelerate a remodeling initiative that we thought was very strategically critical to us. And it allowed us to refocus…on developing the brand around the world, and supporting our franchisees, not trying to run 1,200 restaurants all over the world” –Burger King Worldwide at Piper Jaffray Conference, 6/10/14 “[R]efranchising [is] intended to mitigate the trough associated with transformation and fund investments and initiatives that improve the guest experience and create opportunities for growth” –Panera Q1’16 Earnings Call, 4/27/16 “First, we're excited about the prospect of operating a smaller group of stores at the corporate level, but also excited about our franchisees growing sales and growing the performance of these stores they've acquired from us as well as the new store counts that will result with these refranchised units” –Sonic Q2’17 Earnings Call, 3/28/17

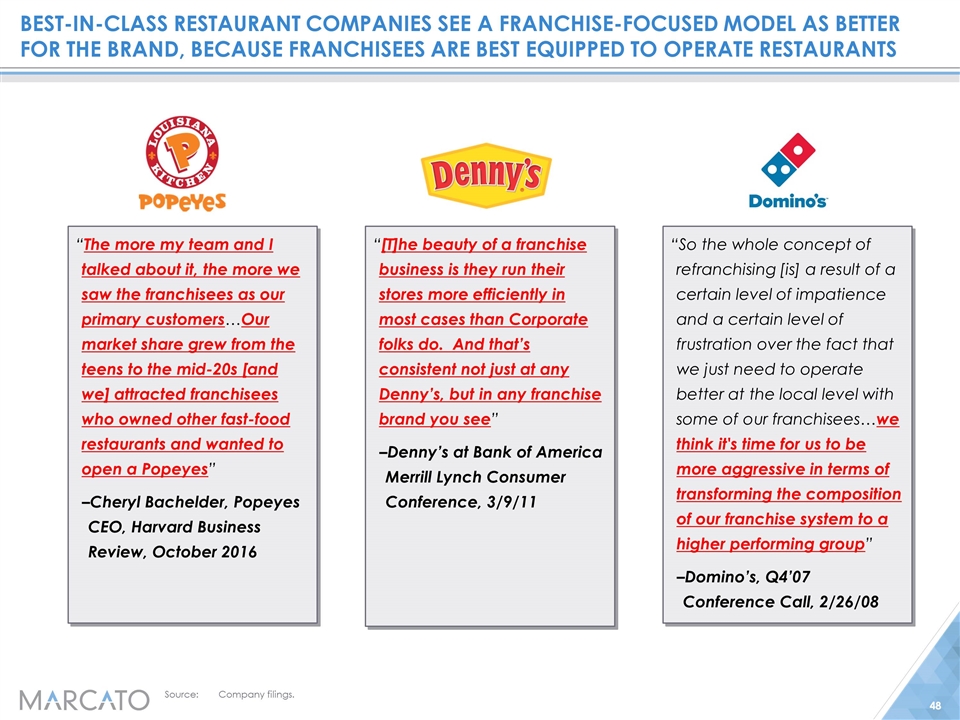

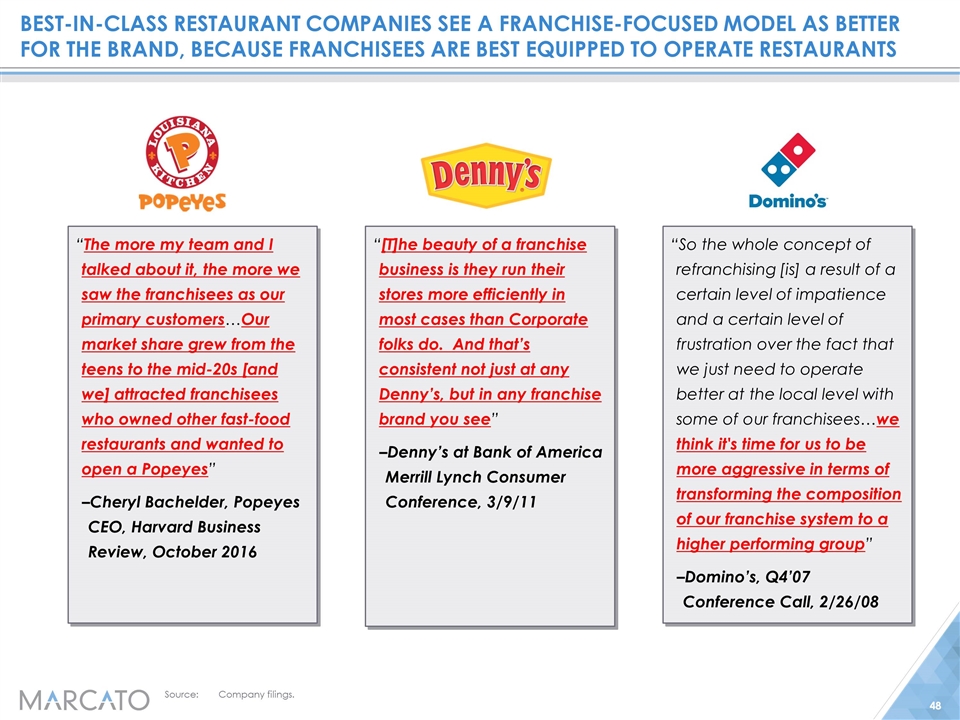

best-in-class restaurant companies see a franchise-focused model as better for the brand, because franchisees are best equipped to operate restaurants “[T]he beauty of a franchise business is they run their stores more efficiently in most cases than Corporate folks do. And that’s consistent not just at any Denny’s, but in any franchise brand you see” –Denny’s at Bank of America Merrill Lynch Consumer Conference, 3/9/11 “So the whole concept of refranchising [is] a result of a certain level of impatience and a certain level of frustration over the fact that we just need to operate better at the local level with some of our franchisees…we think it's time for us to be more aggressive in terms of transforming the composition of our franchise system to a higher performing group” –Domino’s, Q4’07 Conference Call, 2/26/08 “The more my team and I talked about it, the more we saw the franchisees as our primary customers…Our market share grew from the teens to the mid-20s [and we] attracted franchisees who owned other fast-food restaurants and wanted to open a Popeyes” –Cheryl Bachelder, Popeyes CEO, Harvard Business Review, October 2016 Source:Company filings.

Status quo at buffalo wild wings is not sufficient Management has repeatedly defended the status quo as BWLD shares have underperformed every relevant benchmark on a 1-year, 3-year, and 5-year basis BWLD’s Board of Directors has not held management accountable for critical areas of underperformance: Share price underperformance Margin deficiencies Deteriorating guest experience Poor capital deployment Dismissal of more highly-franchised business model Management has made optimistic statements regarding financial performance and guest experience that are betrayed by the facts Marcato’s recommendations for improvement have been validated by the market, industry experts, stakeholders, peers, and insiders but ignored by management Shareholders deserve a management team that can properly respond to these areas of underperformance

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Marcato International Master Fund Ltd. (“Marcato International”), together with the other participants in Marcato International’s proxy solicitation, have filed with the SEC, and are mailing to shareholders on or about April 20, 2017, a definitive proxy statement and accompanying WHITE proxy card to be used to solicit proxies in connection with the 2017 annual meeting of shareholders (the “Annual Meeting”) of Buffalo Wild Wings, Inc. (the “Company”). Shareholders are advised to read the proxy statement and any other documents related to the solicitation of shareholders of the Company in connection with the Annual Meeting because they contain important information, including information relating to the participants in Marcato International’s proxy solicitation. These materials and other materials filed by Marcato International with the SEC in connection with the solicitation of proxies are available at no charge on the SEC’s website at http://www.sec.gov. The definitive proxy statement and other relevant documents filed by Marcato International with the SEC are also available, without charge, by directing a request to Marcato International’s proxy solicitor, Innisfree M&A Incorporated, toll-free at (888)750-5834 (banks and brokers may call collect at (212)750-5833).

The participants in the proxy solicitation are Marcato International, Marcato Capital Management LP, Marcato Special Opportunities Master Fund LP (“Marcato Special Opportunities Fund”), Emil Lee Sanders, Richard T. McGuire III, Sam Rovit and Scott O. Bergren (collectively, the “Participants”).

As of the date hereof, Marcato International directly owns 950,000 shares of common stock, no par value, of BWW (the “Common Stock”), representing approximately 5.9% of the outstanding shares of Common Stock and Marcato Special Opportunities Fund directly owns 32,600 shares of Common Stock, representing approximately 0.2% of the outstanding shares of Common Stock.

In addition, Marcato Capital Management LP, as the investment manager of Marcato International and Marcato Special Opportunities Fund, may be deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) the shares of Common Stock held by Marcato and Marcato Special Opportunities Fund, therefore, may be deemed to be the beneficial owner of such shares. By virtue of Mr. McGuire’s position as the managing partner of Marcato Capital Management LP, Mr. McGuire may be deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) the shares of Common Stock held by Marcato International and Marcato Special Opportunities Fund and, therefore, Mr. McGuire may be deemed to be the beneficial owner of such shares.