UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☐ Filed by a Party other than the Registrant ☒

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☐ | | Definitive Proxy Statement |

| |

| ☒ | | Definitive Additional Materials |

| |

| ☐ | | Soliciting material Pursuant to §240.14a-12 |

Buffalo Wild Wings, Inc.

(Name of Registrant as Specified In Its Charter)

MARCATO CAPITAL MANAGEMENT LP

MARCATO INTERNATIONAL MASTER FUND LTD.

MARCATO SPECIAL OPPORTUNITIES MASTER FUND LP

SCOTT O. BERGREN

RICHARD T. MCGUIRE III

SAM ROVIT

EMIL LEE SANDERS

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| ☒ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| | |

| | 1) | | Title of each class of securities to which transaction applies: |

| | 2) | | Aggregate number of securities to which transaction applies: |

| | 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | 4) | | Proposed maximum aggregate value of transaction: |

| | 5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | 1) | | Amount Previously Paid: |

| | 2) | | Form, Schedule or Registration Statement No.: |

| | 3) | | Filing Party: |

| | 4) | | Date Filed: |

On May 11, 2017, Marcato Capital Management LP delivered a presentation and supplementary materials to Institutional Shareholder Services, Inc. The presentation is attached hereto as Exhibit 1. The supplementary materials are attached hereto and include an analysis of total shareholder return (Exhibit 2), quotes from research analysts (Exhibit 3) and submissions to http://www.winningatwildwings.com (Exhibit 4).

Exhibit 1 BUFFALO WILD WINGS MAY 2017 |

DISCLAIMER 1 The views expressed in this presentation (the “Presentation”) represent the opinions of Marcato Capital Management LP and/or certain affiliates (“Marcato”) and the investment funds it manages that hold shares in Buffalo Wild Wings, Inc. (the “Company”). This Presentation is for informational purposes only, and it does not have regard to the specific investment objective, financial situation, suitability or particular need of any specific person who may receive the Presentation, and should not be taken as advice on the merits of any investment decision. The views expressed in the Presentation represent the opinions of Marcato, and are based on publicly available information and Marcato analyses. Certain financial information and data used in the Presentation have been derived or obtained from filings made with the Securities and Exchange Commission (“SEC”) by the Company or other companies that Marcato considers comparable. Marcato has not sought or obtained consent from any third party to use any statements or information indicated in the Presentation as having been obtained or derived from a third party. Any such statements or information should not be viewed as indicating the support of such third party for the views expressed in the Presentation. Information contained in the Presentation has not been independently verified by Marcato, and Marcato disclaims any and all liability as to the completeness or accuracy of the information and for any omissions of material facts. Marcato disclaims any obligation to correct, update or revise the Presentation or to otherwise provide any additional materials. Neither Marcato nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy, fairness or completeness of the information contained herein and the recipient agrees and acknowledges that it will not rely on any such information. Marcato recognizes that the Company may possess confidential information that could lead it to disagree with Marcato’s views and/or conclusions. Funds managed by Marcato currently beneficially own, and/or have an economic interest in, shares of the Company. These funds are in the business of trading— buying and selling—securities. Marcato may buy or sell or otherwise change the form or substance of any of its investments in any manner permitted by law and expressly disclaims any obligation to notify any recipient of the Presentation of any such changes. There may be developments in the future that cause funds managed by Marcato to engage in transactions that change the beneficial and/or economic interest in the Company. The Presentation may contain forward-looking statements which reflect Marcato’s views with respect to, among other things, future events and financial performance. Forward-looking statements are subject to various risks and uncertainties and assumptions. There can be no assurance that any idea or assumption herein is, or will be proven, correct. If one or more of the risks or uncertainties materialize, or if Marcato’s underlying assumptions prove to be incorrect, the actual results may vary materially from outcomes indicated by these statements. Accordingly, forward-looking statements should not be regarded as a representation by Marcato that the future plans, estimates or expectations contemplated will ever be achieved. The securities or investment ideas listed are not presented in order to suggest or show profitability of any or all transactions. There should be no assumption that any specific portfolio securities identified and described in the Presentation were or will be profitable. Under no circumstances is the Presentation to be used or considered as an offer to sell or a solicitation of an offer to buy any security, nor does the Presentation constitute either an offer to sell or a solicitation of an offer to buy any interest in funds managed by Marcato. Any such offer would only be made at the time a qualified offeree receives the Confidential Explanatory Memorandum of such fund. Any investment in the Marcato Funds is speculative and involves substantial risk, including the risk of losing all or substantially all of such investment. |

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS 2 Marcato International Master Fund Ltd. (“Marcato International”), together with the other participants in Marcato International’s proxy solicitation, have filed with the Securities and Exchange Commission (the “SEC”) a definitive proxy statement and accompanying WHITE proxy card to be used to solicit proxies in connection with the 2017 annual meeting of shareholders (the “Annual Meeting”) of Buffalo Wild Wings, Inc. (the “Company”). Shareholders are advised to read the proxy statement and any other documents related to the solicitation of shareholders of the Company in connection with the Annual Meeting because they contain important information, including information relating to the participants in Marcato International’s proxy solicitation. These materials and other materials filed by Marcato International with the SEC in connection with the solicitation of proxies are available at no charge on the SEC’s website at http://www.sec.gov. The definitive proxy statement and other relevant documents filed by Marcato International with the SEC are also available, without charge, by directing a request to Marcato International’s proxy solicitor, Innisfree M&A Incorporated, toll-free at (888) 750-5834 (banks and brokers may call collect at (212) 750-5833). The participants in the proxy solicitation are Marcato International, Marcato Capital Management LP, Marcato Special Opportunities Master Fund LP (“Marcato Special Opportunities Fund”), Emil Lee Sanders, Richard T. McGuire III, Sam Rovit and Scott O. Bergren (collectively, the “Participants”). As of the date hereof, Marcato International directly owns 950,000 shares of common stock, no par value, of the Company (the “Common Stock”), representing approximately 5.9% of the outstanding shares of Common Stock and Marcato Special Opportunities Fund directly owns 32,600 shares of Common Stock, representing approximately 0.2% of the outstanding shares of Common Stock. In addition, Marcato Capital Management LP, as the investment manager of Marcato International and Marcato Special Opportunities Fund, may be deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) the shares of Common Stock held by Marcato and Marcato Special Opportunities Fund, therefore, may be deemed to be the beneficial owner of such shares. By virtue of Mr. McGuire’s position as the managing partner of Marcato Capital Management LP, Mr. McGuire may be deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) the shares of Common Stock held by Marcato International and Marcato Special Opportunities Fund and, therefore, Mr. McGuire may be deemed to be the beneficial owner of such shares. |

BUFFALO WILD WINGS (“BWLD”): A GROWING, DISTINCTIVE RESTAURANT BRAND Differentiated concept focused on “wings, beer, and sports” ~1,200 units with long-term potential to grow to 1,700 units in US & Canada and 400+ units internationally (75% future unit growth) 3 Consensus Estimates: 2017E EPS: ~$5.76 per share 2017E EBITDA: ~$305 million Valuation (’17E): P / E: 26.8x EV / EBITDA: 8.8x Ticker: “BWLD” Recent Stock Price: $155 Source: Company filings, CapitalIQ. Market data as of 4/19/17, the last day before Marcato’s definitive proxy filing. Capitalization: Market Cap: $2.5 billion Enterprise Value: $2.7 billion |

WHY WE INVESTED IN BUFFALO WILD WINGS Differentiated concept with long runway for growth SSS declines, operational missteps, and poor capital allocation have hurt shares Opportunity to create substantial shareholder value by: 1) Improving “4-wall” profitability and returns 2) Transitioning to a 90%+ franchised model 3) Optimizing capital structure 4 |

Highlights from Marcato’s Campaign 5 |

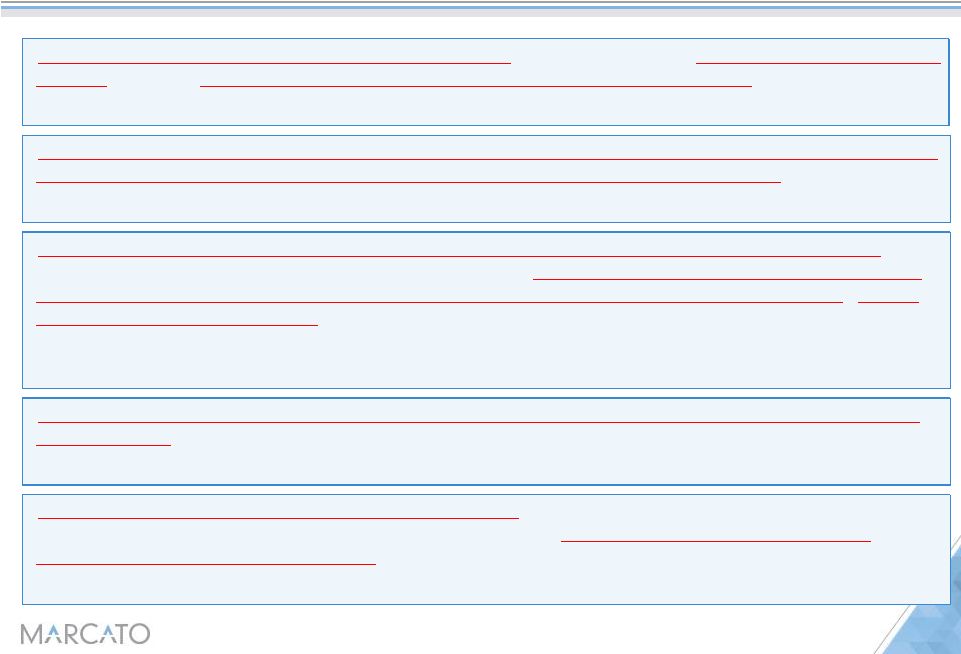

Total Shareholder Return 1- Year 3- Year 5- Year S&P 500 Index 14% 34% 89% NASDAQ Index 20% 48% 108% S&P 600 Restaurants Index 13% 53% 167% Proxy Peer Median 11% 30% 103% Buffalo Wild Wings 10% 10% 84% Underperformance vs. S&P 500 (4%) (23%) (5%) Underperformance vs. NASDAQ (11%) (38%) (24%) Underperformance vs. S&P 600 Restaurants (3%) (42%) (83%) Underperformance vs. Proxy Peer Median (2%) (20%) (19%) BWLD’S SHARES HAVE UNDERPERFORMED AGAINST RELEVANT BENCHMARKS 6 SUMMARY OF SHAREHOLDER RETURNS “We believe the stock performance is compelling evidence of the effectiveness of the Board and management” -Buffalo Wild Wings Media Statement, 3/8/17 Source: Company filings, CapitalIQ. Market data as of 4/19/17, the last day before Marcato’s definitive proxy filing. Note: Proxy peers include BJRI, BLMN, BOBE, EAT, CAKE, CMG, CBRL, PLAY, DIN, DPZ, DNKN, FIVE, PNRA, RRGB, RT, TXRH, and ULTA. Total shareholder return for proxy peer group uses the median return for applicable peers over each timeframe. |

BWLD’S SHARE PRICE HAS REACTED FAVORABLY TO MARCATO’S CALL FOR CHANGE 7 SHARES JUMPED ~+20% IN THE WEEK WE FILED OUR 13-D Marcato’s 13D Filing on 7/25/16: 13-D filed intra-day Prior close: $141 BWLD reported Q2’16 earnings on 7/26/16: SSS: -2.1% vs. -0.5% est. “4-wall” margins contracted 90bps YoY EPS: $1.27 vs. $1.25 est.: Low-quality “beat” driven by reduced SBC from decreased bonuses SHARES UP +6% UPON CALL FOR CEO RESIGNATION Source: CapitalIQ, Bloomberg. Marcato’s DEFC14A Filing on 4/20/17: Sent letter to BWLD shareholders seeking resignation of CEO Sally Smith Released presentation highlighting validation from third parties of the need for change $170 $130 $135 $140 $145 $150 $155 $160 $165 $170 $175 7/1/16 7/7/16 7/13/16 7/19/16 7/25/16 7/31/16 $163 $150 $152 $154 $156 $158 $160 $162 $164 4/1/17 4/7/17 4/13/17 4/19/17 4/25/17 |

STOCK PERFORMANCE DECOUPLED FROM FUNDAMENTALS FOLLOWING MARCATO’S 13D 8 Source: CapitalIQ, Bloomberg. Market data as of 4/19/17, the last day before Marcato’s definitive proxy filing. Marcato’s 13D Filing on 7/25/16: Shares have clearly been supported by a floor following our public involvement… …Despite a precipitous drop in estimated future earnings power $5.50 $6.00 $6.50 $7.00 $7.50 $8.00 $8.50 $9.00 $9.50 $65 $85 $105 $125 $145 $165 $185 $205 Apr-14 Oct-14 Apr-15 Oct-15 Apr-16 Oct-16 Apr-17 BWLD Closing Share Price Consensus EPS - FY'17 |

9 SAME-STORE SALES GROWTH, TRAFFIC, AND MARGINS HAVE ALL DETERIORATED SSS GROWTH IS AT LOWEST LEVELS IN OVER A DECADE, DUE TO DEEP & ACCELERATING DECLINES IN TRAFFIC AND MIX MARCATO BELIEVES “4-WALL” MARGINS HAVE SUFFERED DUE TO EXPENSE MISMANAGEMENT Q1 Q2 Q3 Q4 Q4 2016 ‘13 Q1 Q2 Q3 Q4 2015 2014 Source: Company filings, Wall Street research. (1) Underperformance relative to industry refers to Knapp-Track. Q1 Q2 Q3 Q4 Q4 2016 ‘13 Q1 Q2 Q3 Q4 2015 2014 -590 bps since Q1’14 peak (5.4%) (5.2%) (5.6%) (4.8%) (2.1%) 0.0% 0.4% 2.7% 2.5% 4.1% 5.1% 4.5% 3.9% 1.4% 3.4% 3.5% 3.1% 4.0% 3.9% 3.8% 4.3% 3.4% 1.9% 2.6% 2.1% 1.3% (4.0%) (1.8%) (2. 1%) (1.7%) 1.9% 3.9% 4.2% 7.0% 5.9% 6.0% 7.7% 6.6% 5.2% Menu Price Adjustments Traffic, Mix & Other 15.6% 17.6% 17.9% 19.5% 18.6% 18.2% 18.8% 18.9% 17.7% 18.4% 20.3% 21.5% 19.8% "4-Wall" Margins Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 |

WHEN GROWTH SLOWED, BWLD ACQUIRED FRANCHISED STORES FOR HIGH MULTIPLES 10 Total Acquisition Expense $33.7m $43.6m $4.3m $30.5 $205.2m # Units Acquired: Avg. Replacement Cost: $2,300 Source: Company filings, Marcato estimates. Franchise rights for Rusty Taco included in purchase price. 2014 calculation assumes full ownership of all restaurants acquired. (1) 2015 acquisition included franchise rights of $99m. BWLD’s franchisee acquisitions in 2015 valued acquired stores ~80% above prior four- year average and ~50% above replacement cost 18 18 3 15 59 $1,875 $2,421 $1,432 $2,033 $3,478 (1) 2011 2012 2013 2014 2015 - Avg. Purchase Price per Company -Operated Restaurant ESTIMATED ACQUISITION COST PER RESTAURANT | 2011 – 2016 |

MARCATO’S KEY RECOMMENDATIONS TO BWLD 11 I. Improve “4-Wall” Profitability and Returns Transition to a 90% Franchised Model Optimize Capital Structure II. III. STRATEGIC & FINANCIAL DRIVERS IMPACT TO VALUE Improve Returns on Capital Reduce Cost of Capital Create Economic Value + = |

12 INDUSTRY EXPERTS SEE MULTIPLE WAYS TO IMPROVE MARGINS Source: Marcato’s presentation to BWLD management from June 2016, external consultants. A major consulting firm that evaluated BWLD at Marcato’s request identified several areas for potential margin improvement equivalent to 275 – 600bps Address Food Costs Menu design, protein management and waste mitigation 50 to 100 basis points Labor and staffing efficiencies Optimization of staffing between floor and kitchen 50 to 100 basis points Procurement Purchasing leverage, reduce non value added costs 75 to 125 basis points Spans & Layers Operational control bands to manage company owned and franchised units 25 to 150 basis points Franchise Management Domestic vs. international focus and service level 25 to 50 basis points Other Concepts Determine value add of being part of BWLD 50 to 75 basis points COST SG&A |

13 WALL STREET ANALYST: “[FRANCHISEES] CURRENTLY GENERATE STORE MARGINS THAT ARE UP TO 1000BP STRONGER THAN BWLD COMPANY STORES” “[Franchisees] generate much stronger store margins even after paying royalties and advertising fees to BWLD corporate” –Jim Sanderson, Arthur Wood, 3/28/17 Source: Company filings, Wall Street research. Note: “Food, beverage & packaging” refers to “cost of sales” line item for BWLD and “food, beverage and packaging” costs line item for the largest BWLD franchisee (also referred to henceforth as “SAUC”). “Labor” costs refer to “labor” line item for BWLD and “compensation costs” for SAUC. Other operating costs for SAUC add back the 5% royalty paid to BWLD for comparability. BWLD’S LARGEST FRANCHISEE’S “4-WALL” MARGINS ARE MATERIALLY HIGHER THAN BWLD’S Largest BWLD Franchisee The real margin gap is even larger than reported: BWLD’s COGS and rent are “subsidized” by vendor rebates on franchisee purchases & significant RE ownership The real margin gap is even larger than reported: BWLD’s COGS and rent are “subsidized” by vendor rebates on franchisee purchases & significant RE ownership RESTAURANT OPERATING EXPENSES AS A % OF RESTAURANT SALES Fiscal Year 2016 Differential Food, beverage & packaging 28.1% 29.9% (175 bps) Labor 24.8% 31.7% (686 bps) Occupancy 6.8% 5.8% 107 bps Other operating costs, adj. for 5% royalty 15.9% 15.1% 85 bps "4-Wall" Margin 24.3% 17.7% (669 bps) |

14 HIGHLY FRANCHISED COMPANIES TRADE AT HIGHER MULTIPLES 70+% mix = higher multiples BWLD is one of few “in the middle” BWLD’s growth would command a premium multiple if it were more highly franchised Source: (1) Franchise Mix = Margin = ROIC = Multiple funded with cash flow, new debt, and the proceeds from refranchising. Panera cited its engagement in constructive dialogue with Luxor Capital. (2) Represents unaffected multiples referring to last days before widespread public M&A rumors (4/2/17 and 2/10/17 for PNRA and PLKI, respectively). Company filings, CapitalIQ. Market data as of 4/19/17. EBITDA multiples shown on an “NTM” basis, based on Wall Street consensus estimates. On April 15, 2015, Panera announced progress on its earlier goal of refranchising 50-150 stores in 2015, as well as achieving G&A savings & an increased repurchase program |

15 INDUSTRY-LEADING ADVISOR SAYS MAJOR REFRANCHISING IS HIGHLY FEASIBLE Source: Marcato’s presentation at Sohn SF in October 2016. “We are highly confident BWLD could refranchise their owned stores at a multiple of 6.0x or higher and estimate a refranchising process to 90% could take as few as 18-24 months” – Cypress Group |

WE BELIEVE BWLD’S STOCK PRICE COULD RISE BY MORE THAN 2-3x UNDER MARCATO'S PROPOSAL POTENTIAL VALUE CREATION FOR BUFFALO WILD WINGS| 2016A – 2021E Source: Marcato’s June 2016 presentation to BWLD management. Market data as of 4/19/17. Note: Status quo case from June 2016 assumed no refranchising and no impact from leveraged share buyback announced subsequently by management 49% 63% 72% 81% 90% 90% ~8.5x 13.0x Franchise Mix EV/EBITDA 17.4 13.7 11.8 8.8 7.0 6.6 Basic Share Count 16 Status Quo Current / 2016A 2017E 2018E 2019E 2020E 2021E High: $311 @ 10.0x EBITDA Mid: $265 @ 8.5x EBITDA Low: $218 @ 7.0x EBITDA 90% Franchised High: $458 @ 14.5x EBITDA Mid: $402 @ 13.0x EBITDA Low: $346 @ 11.5x EBITDA +83% +53% ‘16 - ’21 (62%) 7.3% 9.8% 11.1% 14.5% 21.1% 26.9% EBIT Margin +268% Recent: $155 $100 $175 $250 $325 $400 $475 Dec-14 Dec-15 Dec-16 Dec-17 Dec-18 Dec-19 Dec-20 Dec-21 |

Righting the Ship Requires New Leadership 17 |

LET’S BE CLEAR: BWLD MANAGEMENT HAS PROVEN TO BE INCAPABLE OF EXECUTING 18 “4-Wall” profit margins well below management’s longstanding goal of 20% International development targets have been missed & extended by 2-5 years Loyalty and Tablet Order & Pay still not fully rolled out, despite three years of planning and millions of dollars spent Guest Experience Captains program has wasted money for nearly five years, having never produced positive ROI through operating leverage Sally Smith and her team have failed to hit their own goals for years: Why should they be given another opportunity to fail? Management is years behind plan on nearly every strategic priority: |

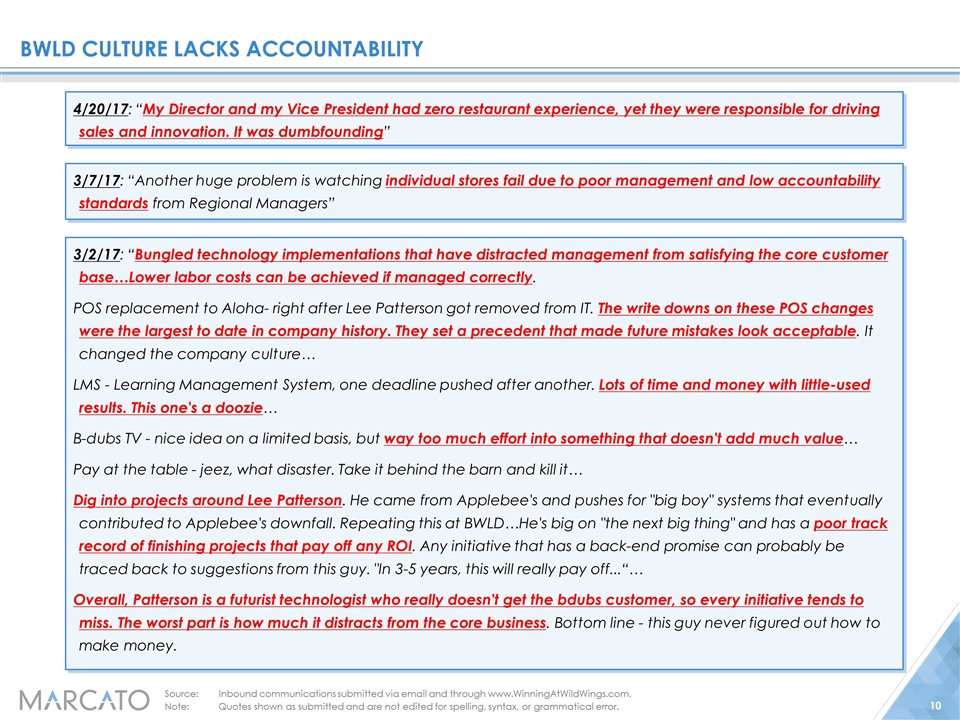

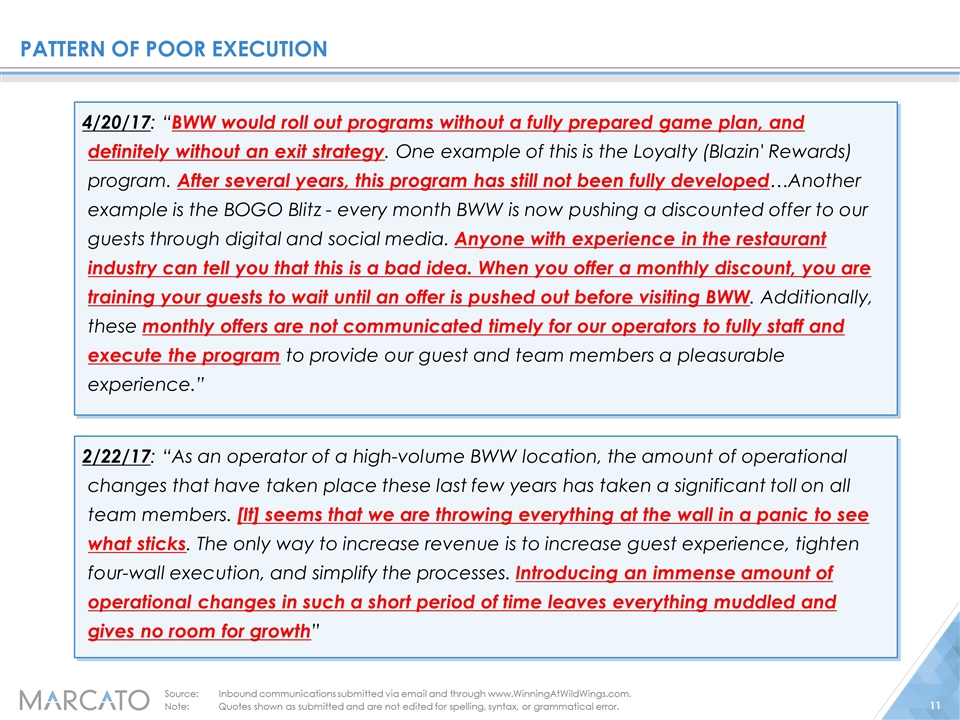

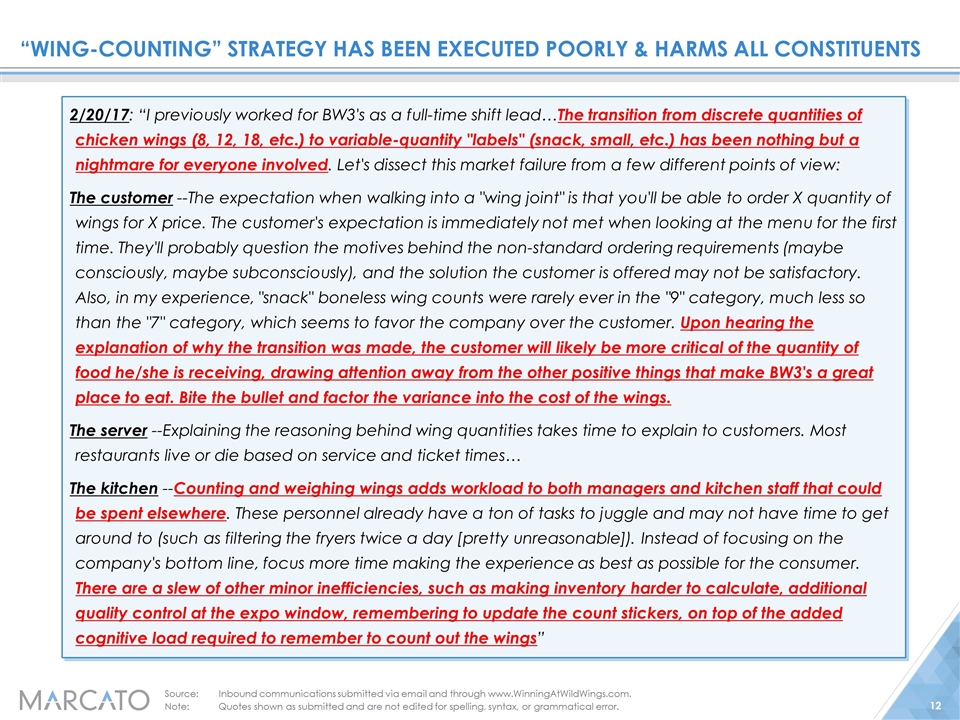

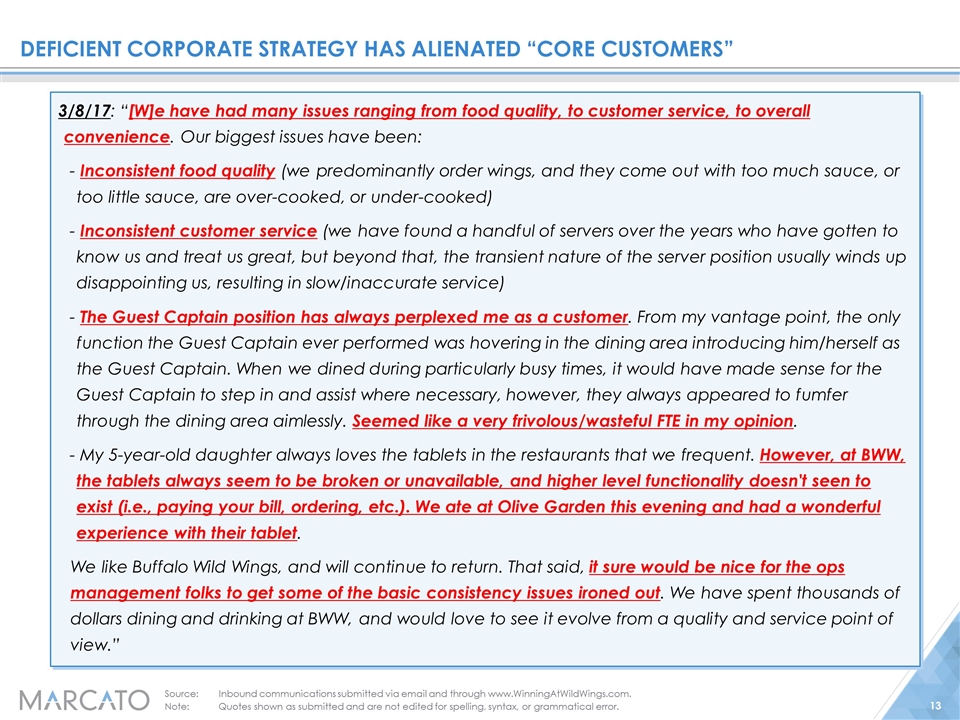

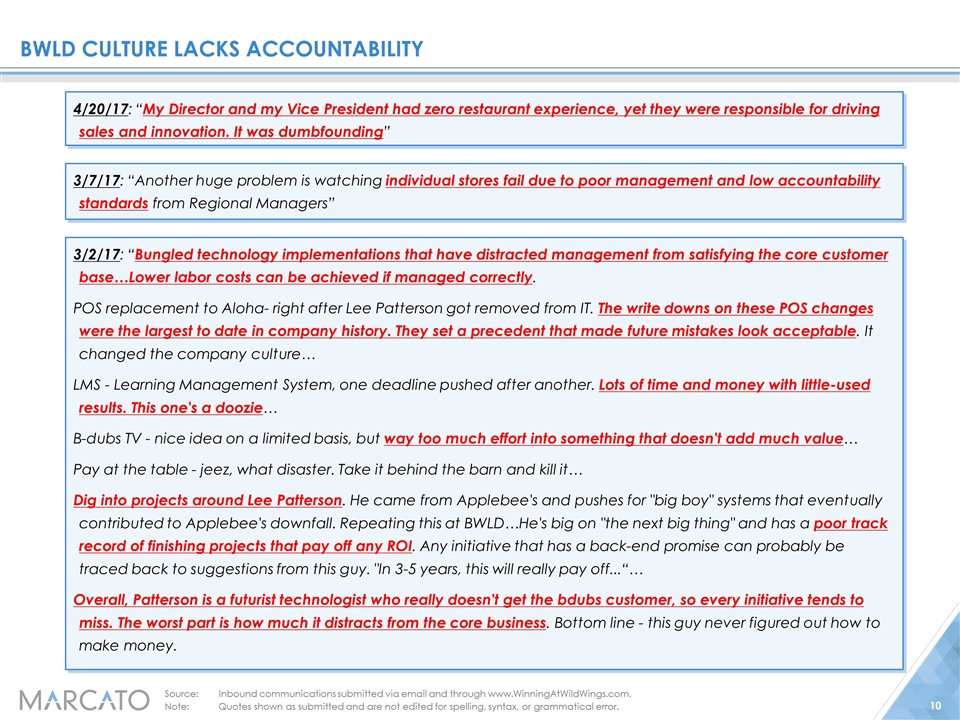

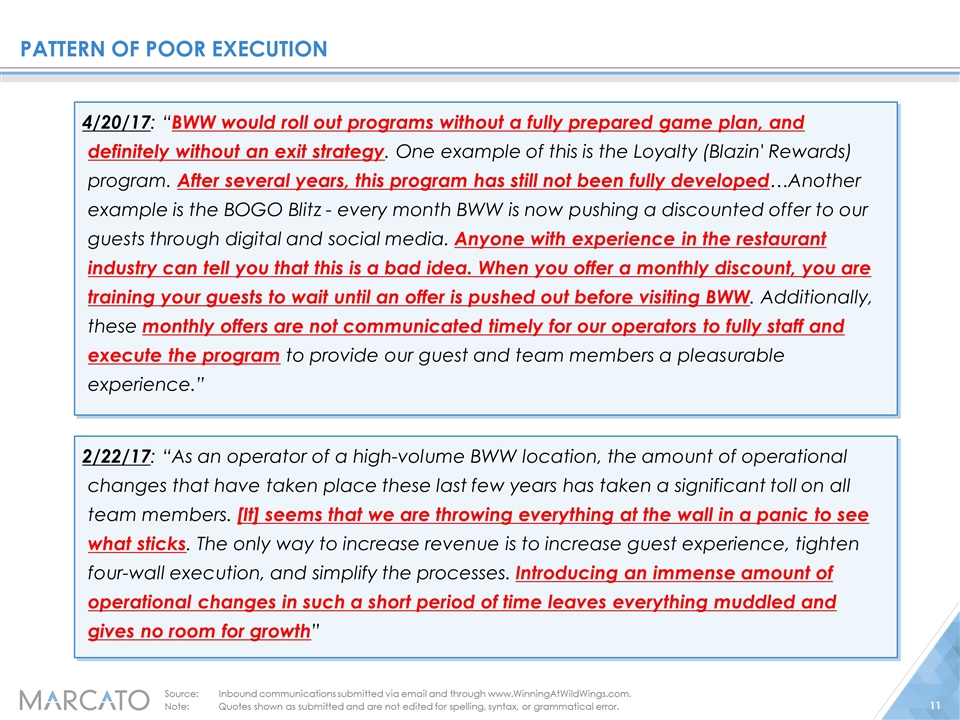

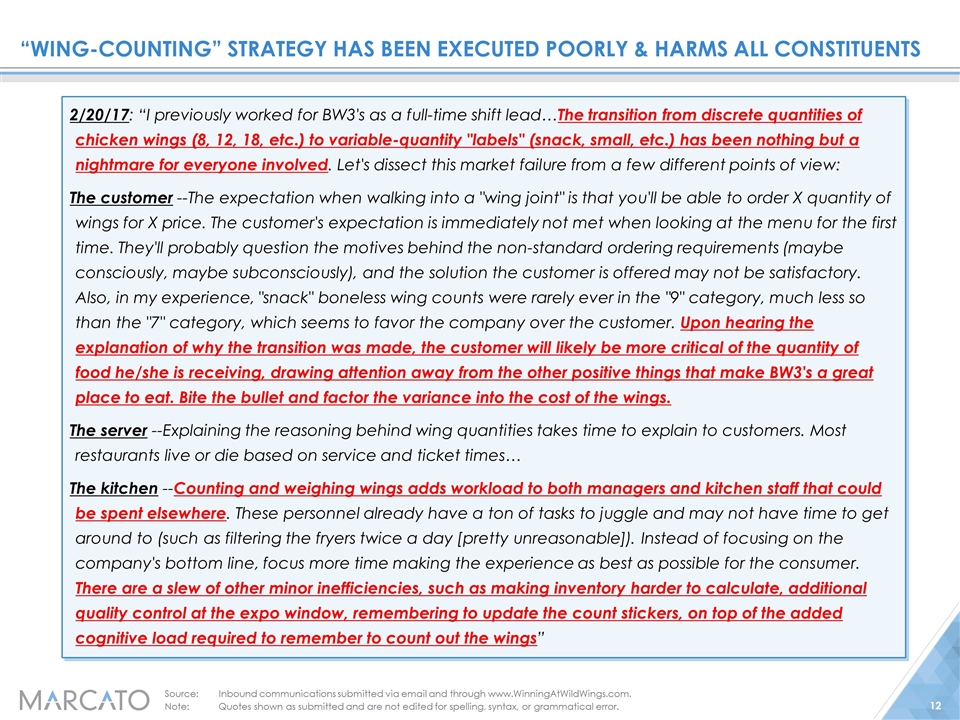

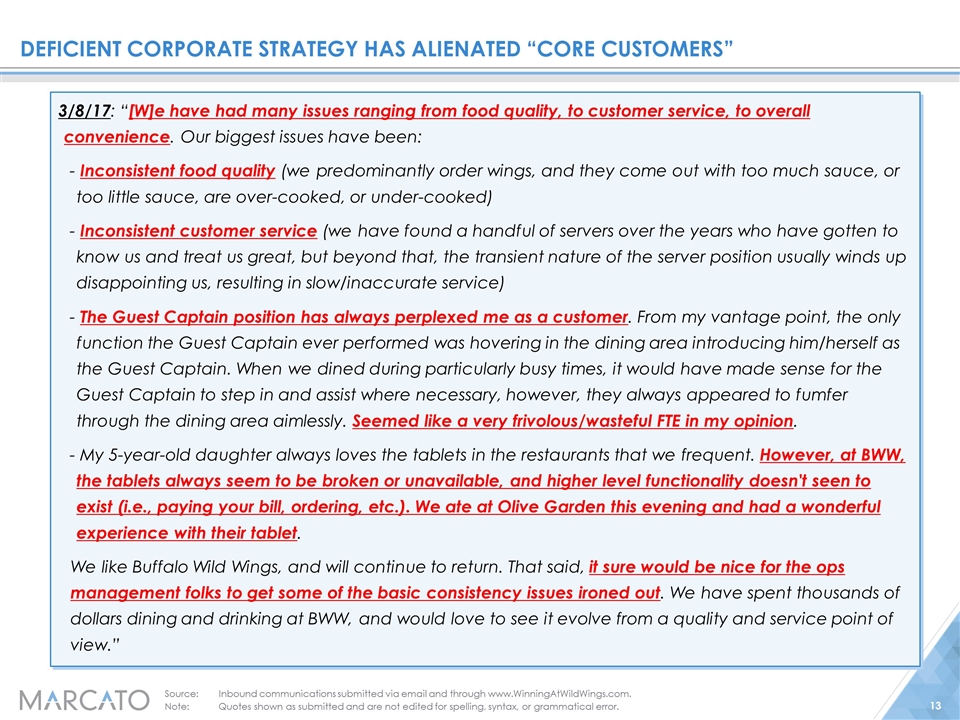

MANAGEMENT’S PLAN REPRESENTS “BUSINESS AS USUAL” 19 Slowing development of full-size units Takeout and delivery Small-footprints & Urban locations In-restaurant technology Improve margins Stated Areas of Focus We doubt that any of management’s goals will be achieved Abrupt changes in capital deployment framework validate our view that hundreds of millions of dollars had been imprudently deployed in low-returning units over the years Management is unable/unwilling to say whether these initiatives drive profits, not just sales Buffalo Wild Wings has been unable to keep up with Wingstop in this area Ignoring the core earnings driver and main brand engine (the ~1,230 traditional units already built) Like PizzaRev & RTaco, these are just speculative new concepts that distract management from improving execution in the core business Missed nearly every objective from 2014 on technology rollouts (mobile / tablet order & pay, POS rollout, server handhelds, mobile app & rewards program) No accountability: sponsors of bungled tech (Lee Patterson & Ben Nelsen) are still in charge at BWLD Management has been unable to hit its “20% margin target” sustainably for years Current bridge relies heavily on refranchising & operating leverage, not improved execution CFO admits that targets were articulated to investors before a credible plan was put in place International development Tim Murphy, leader of int’l operations, is a company loyalist (since ‘88) with no relevant int’l experience Targets for 400 units internationally have been perpetually extended by as much as 2-5 years Company has extremely poor track record of selecting and penetrating new markets Source: Company filings. Note: Support for assertions about technology, international, takeout, and diminishing ROIC have been discussed extensively in presentations available at www.WinningAtWildWings.com. |

ARE MANAGEMENT AND SHAREHOLDERS FOCUSED ON THE SAME ISSUES? 20 “We are surprised the Company’s investor presentations continue to center on tactical efforts, like FastBreak Lunch and Wing Tuesday, and secondary strategic priorities, like international development and new concepts, rather than full explanations for why traffic is declining, how costs will be reduced or why the business model is appropriate. It is not clear to us the issues and alternatives are fully understood” – Chris O’Cull, Keybanc, 2/7/17 Source: Wall Street research. |

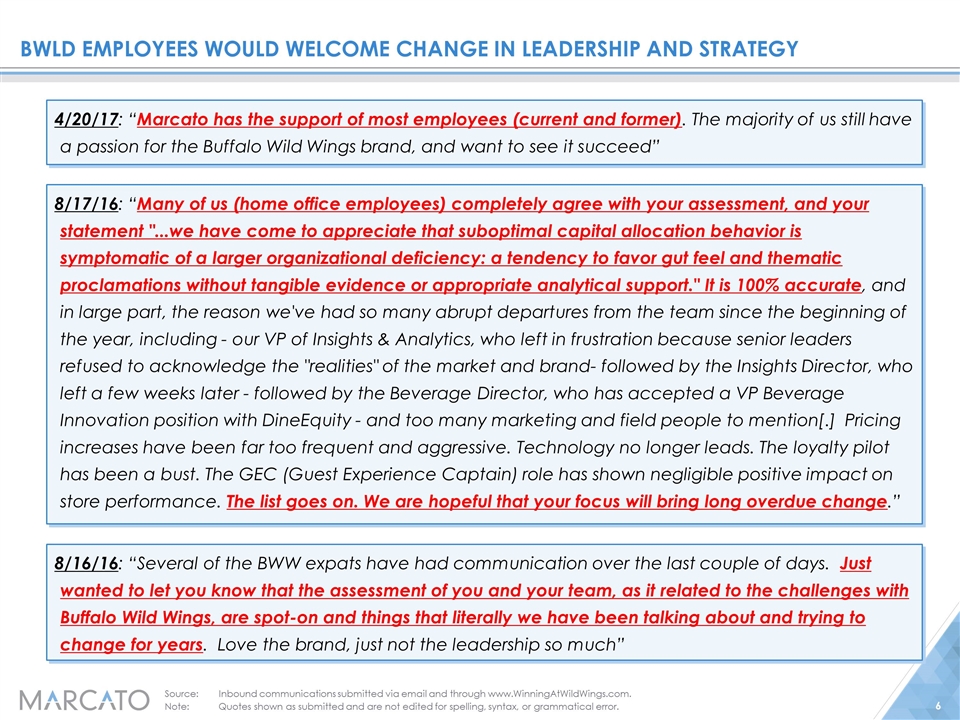

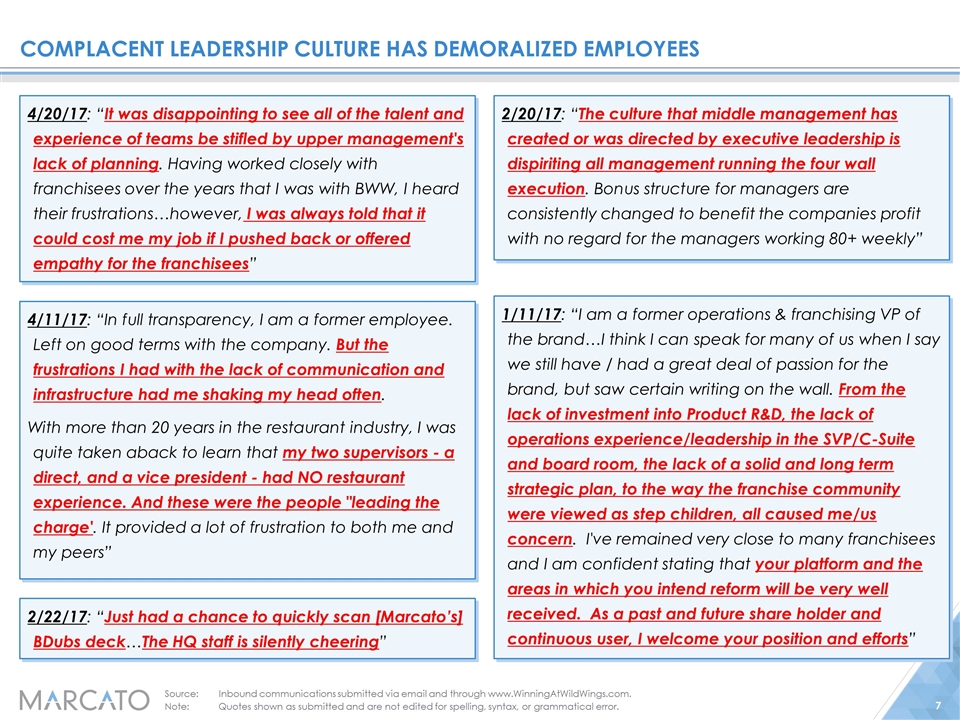

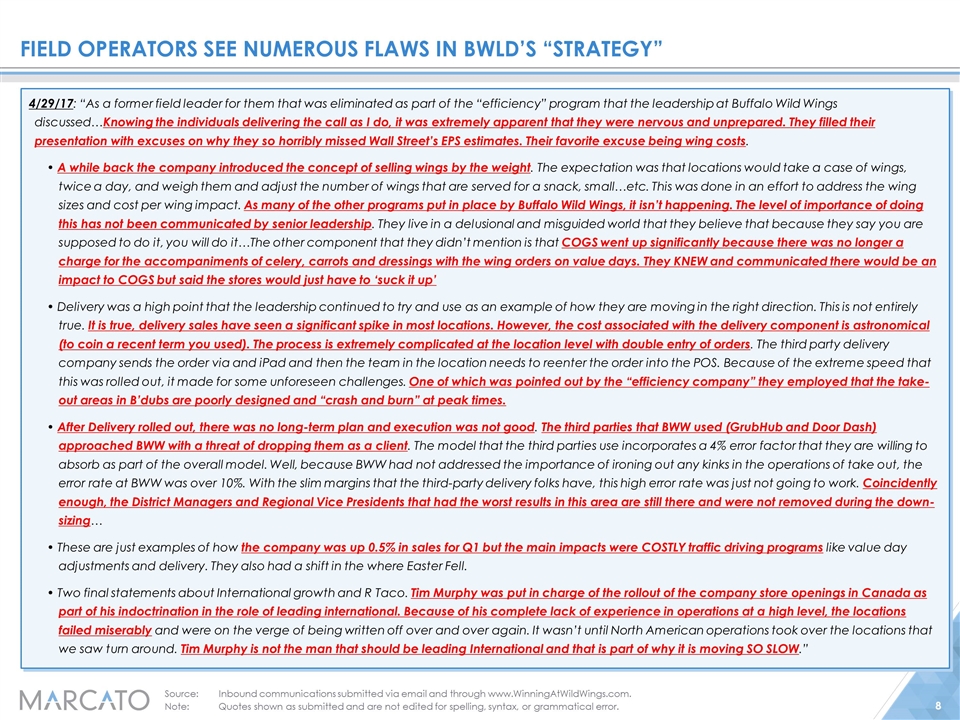

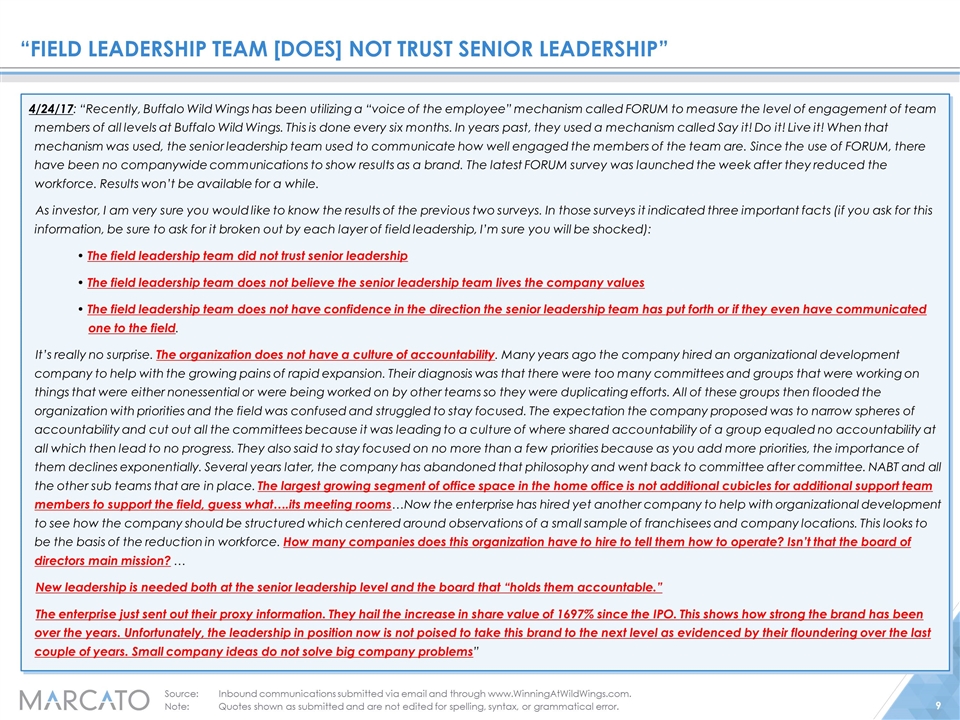

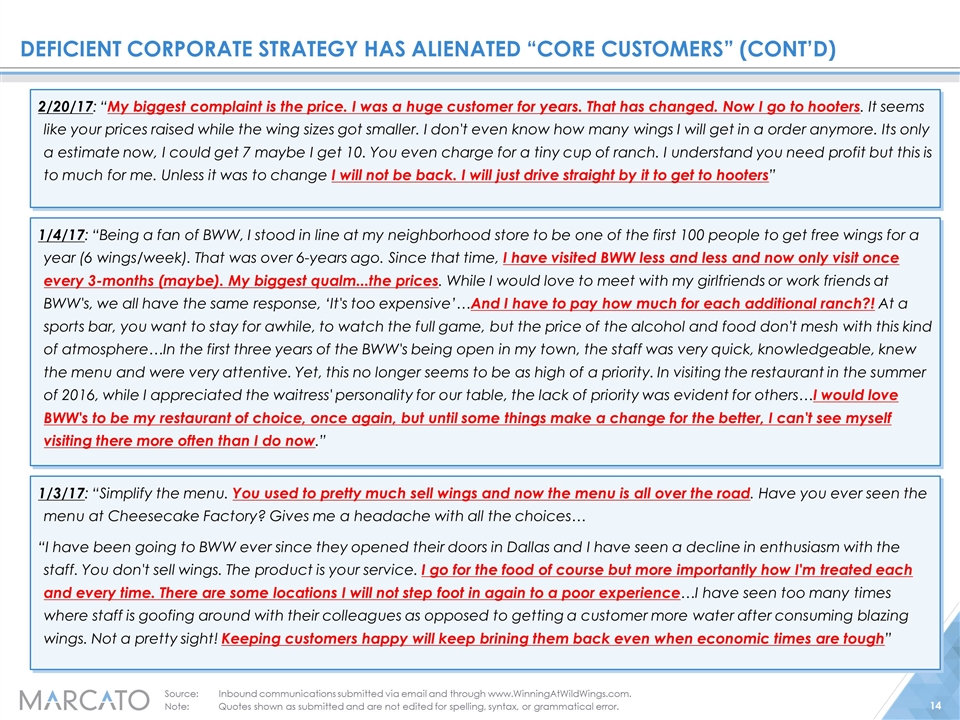

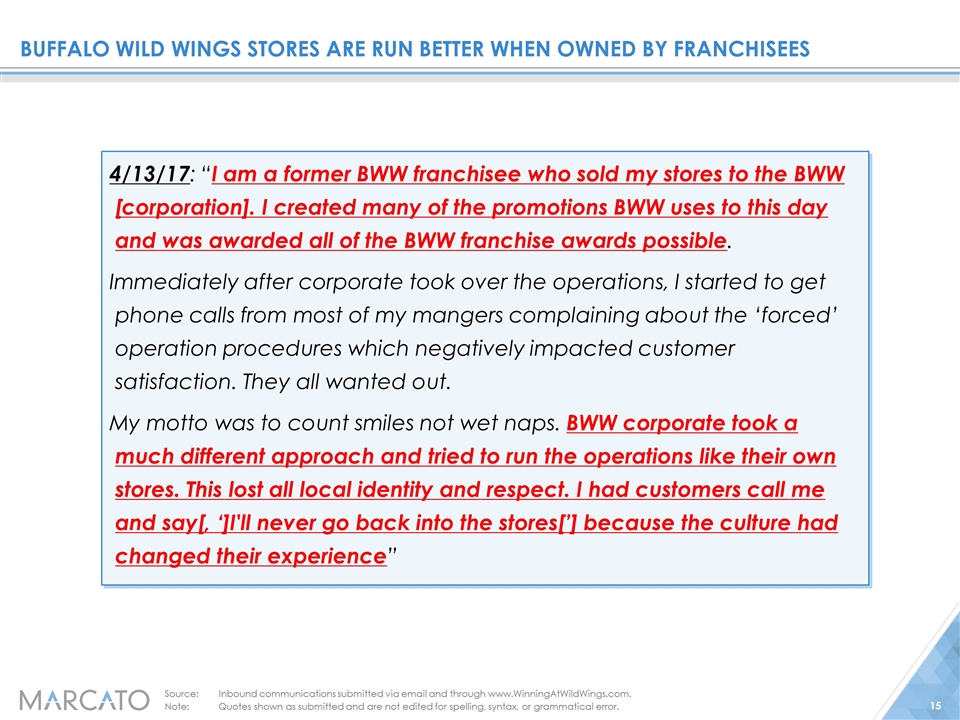

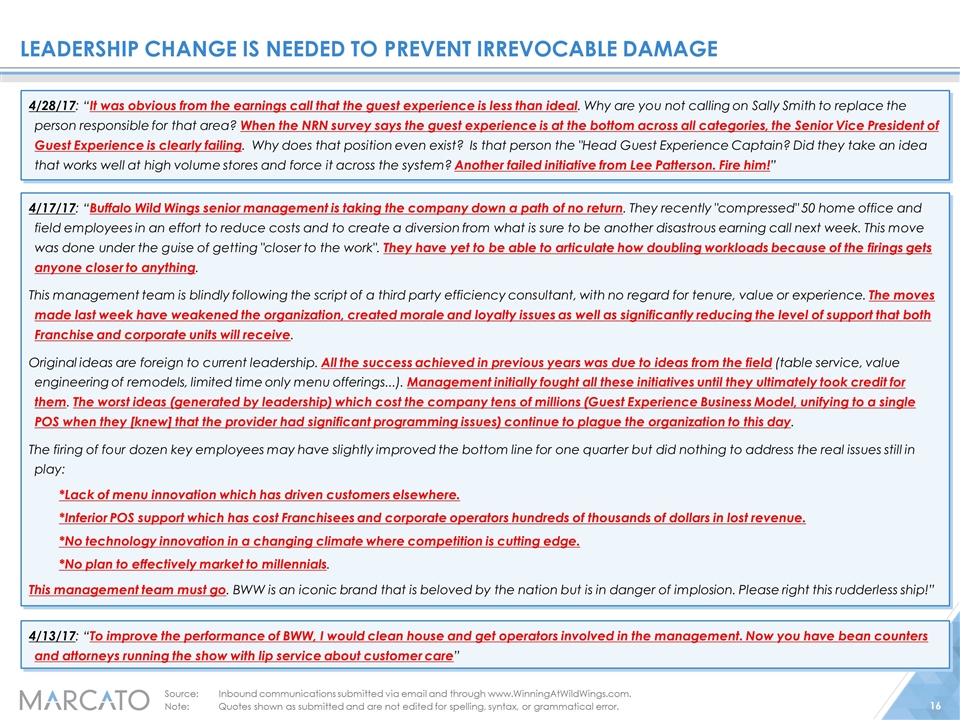

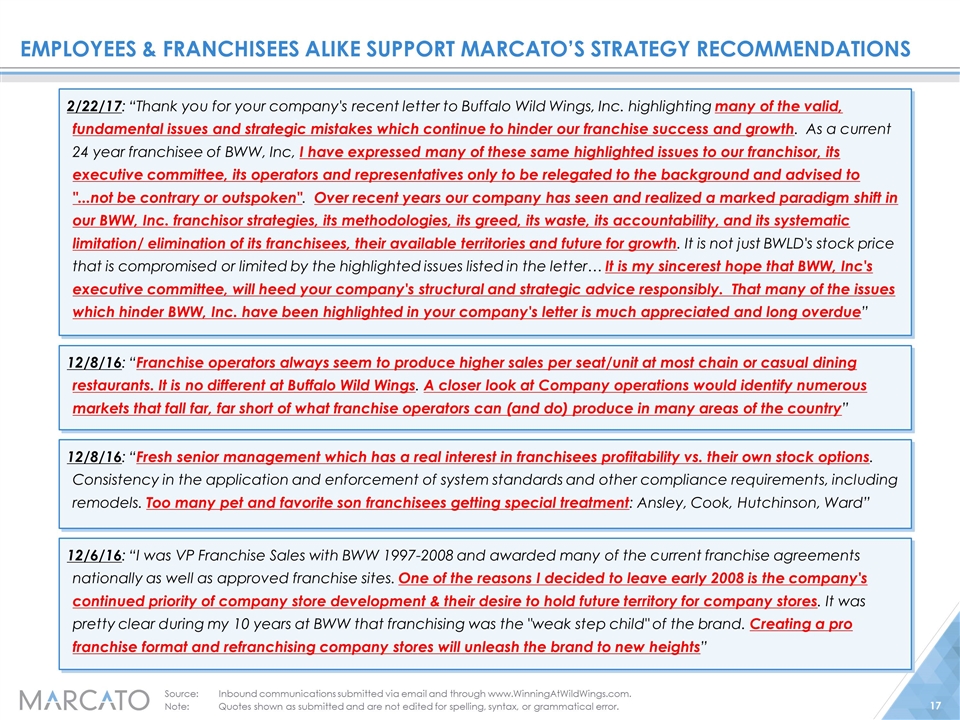

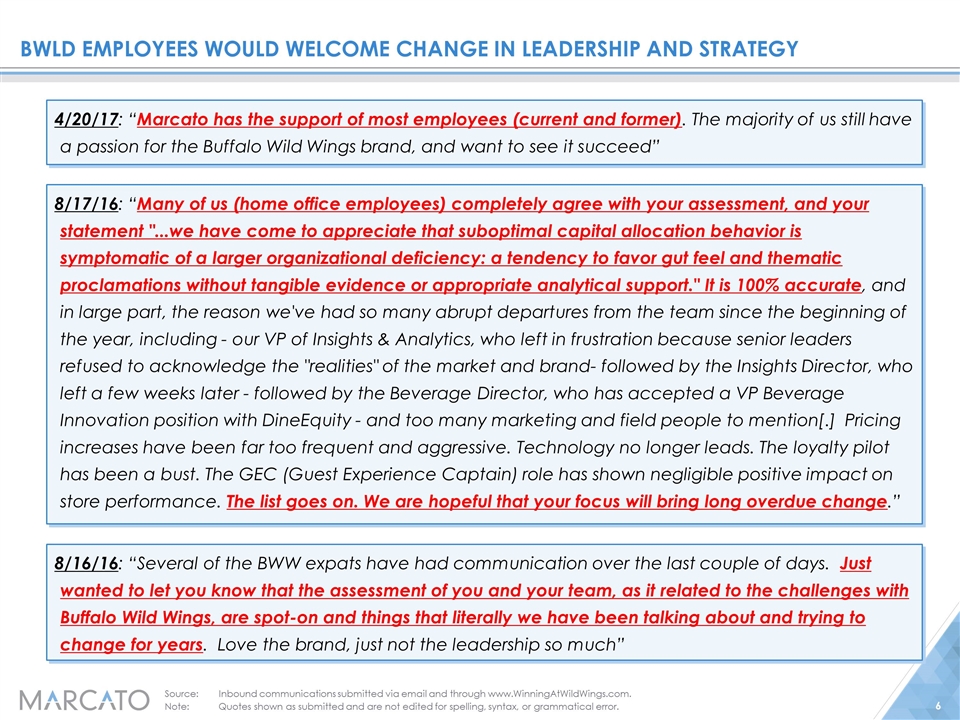

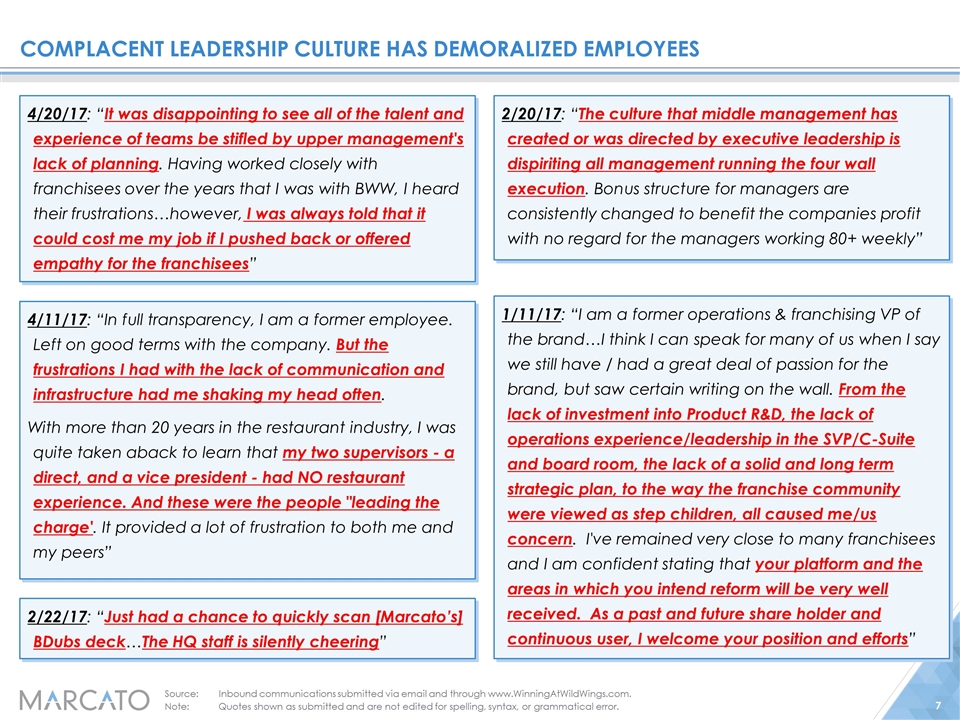

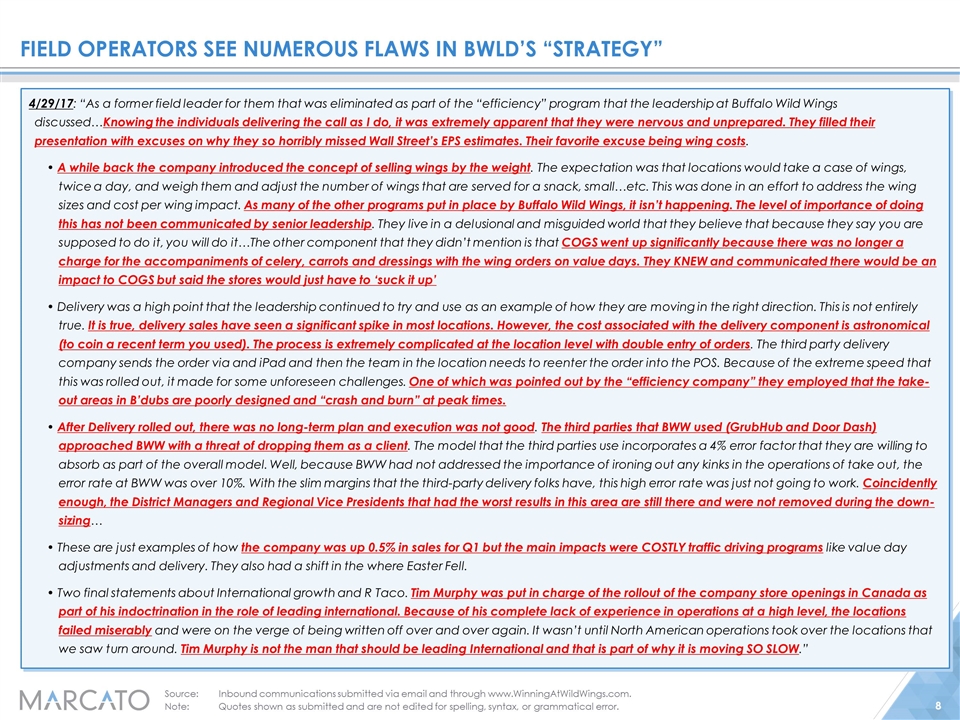

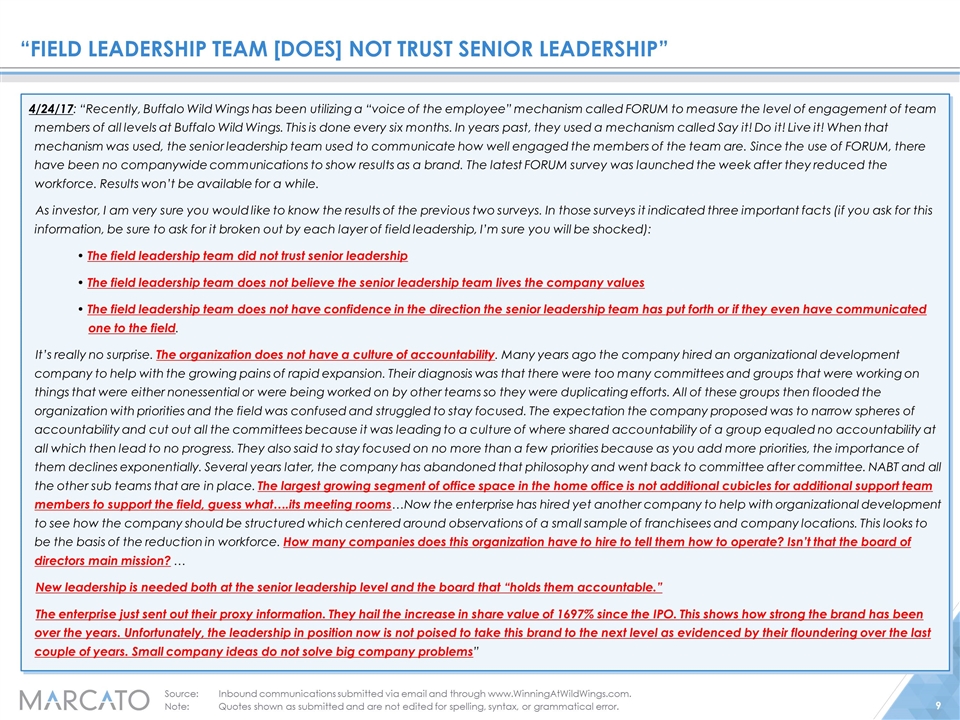

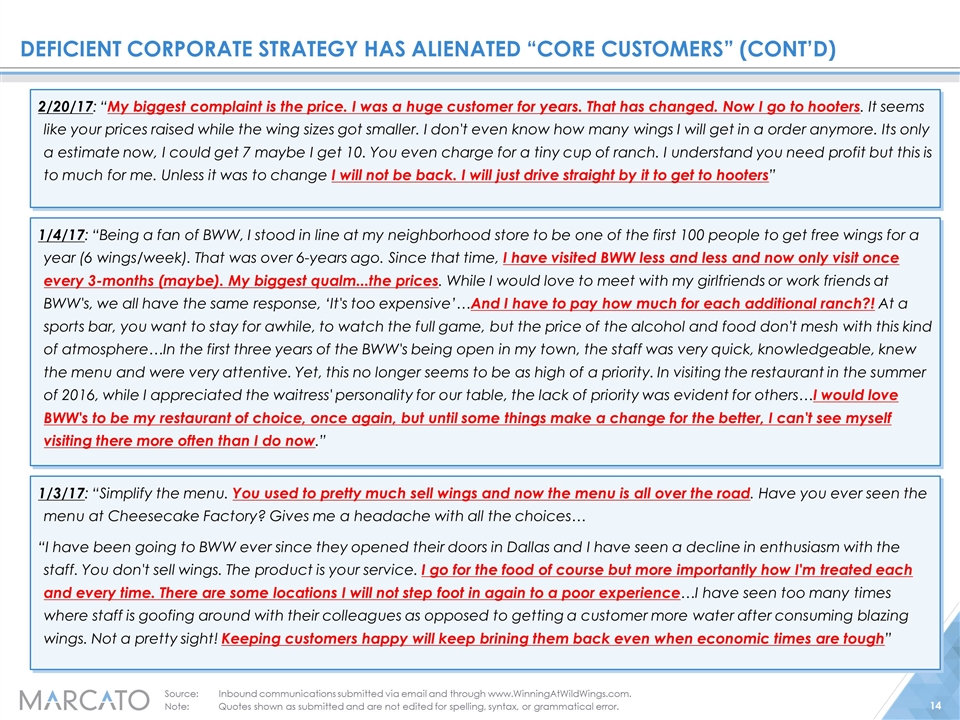

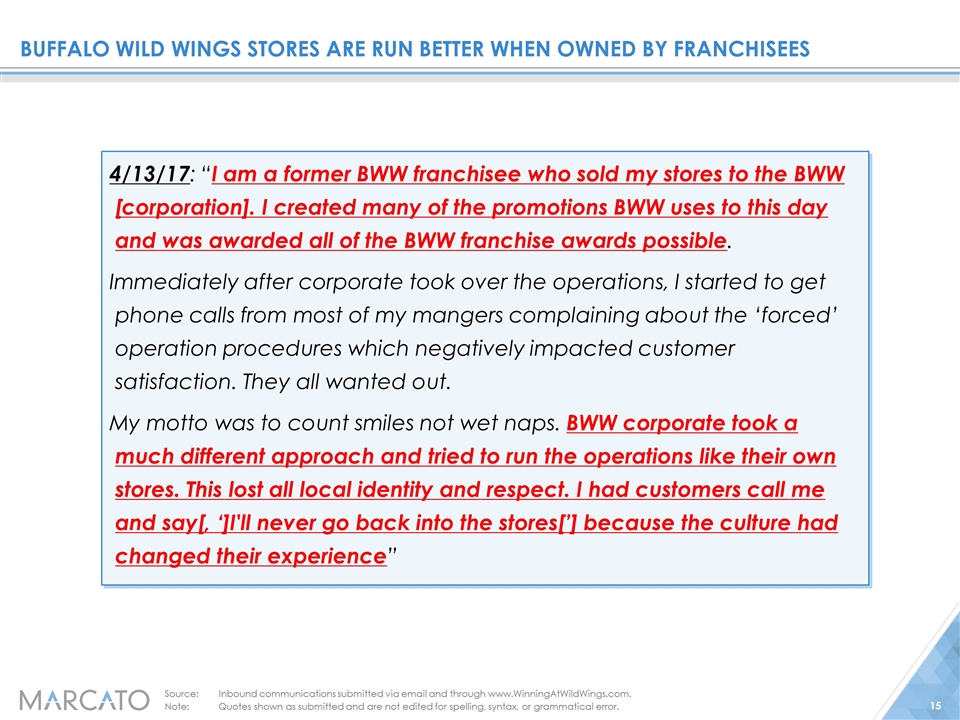

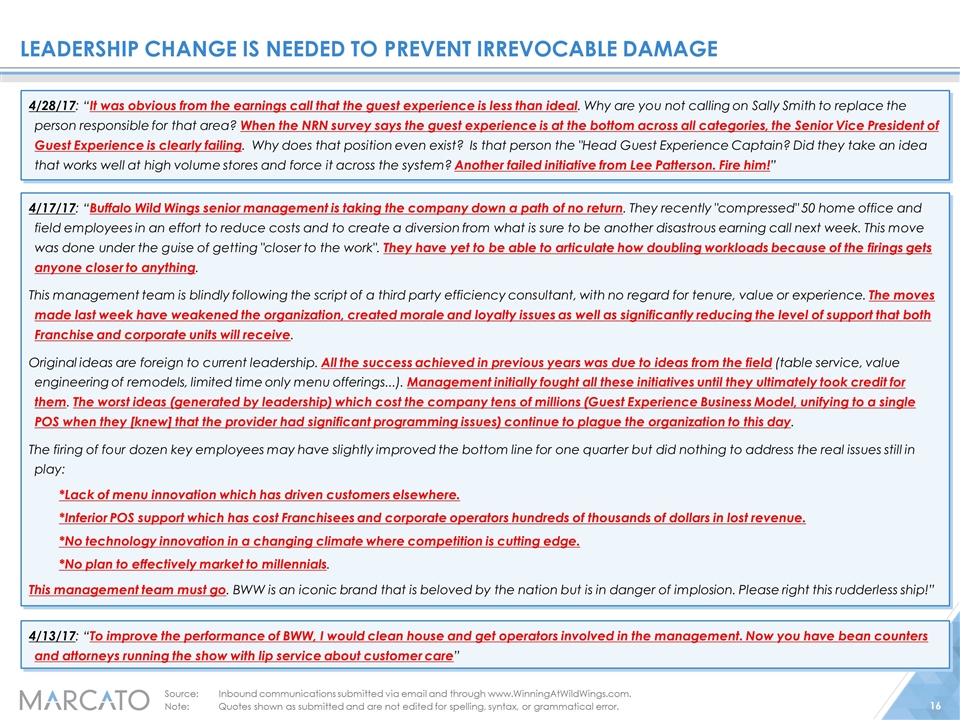

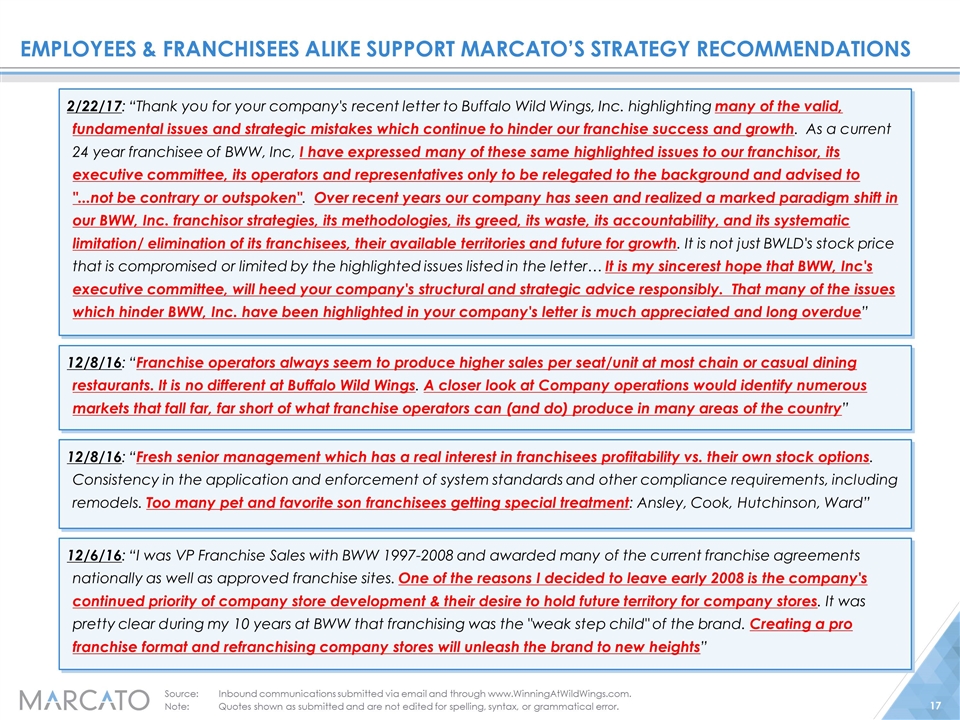

EMPLOYEES AND FRANCHISEES EXPRESS SIMILAR VIEWS 21 EMPLOYEES “Company retains a ‘small- company’ mentality that is lacking…structured corporate processes” “Buffalo Wild Wings senior management is taking the company down a path of no return” FRANCHISEES “[M]y two supervisors – a direct, and a vice president - had NO restaurant experience” “To improve the performance of BWW, I would clean house and get operators involved in the management” “It is my sincerest hope that [BWW] will heed your company’s structural and strategic advice” “[BWW needs] fresh senior management which has a real interest in franchisees[’] profitability” Source: Submissions to www.WinningAtWildWings.com. Quotes shown were previously published in Marcato’s “Third Party Validation” presentation, filed on Form DFAN14A on 4/20/17. |

Open Mkt. Transactions Sales Purchases Current + Recent Insiders 667 1 SENIOR MANAGEMENT Sally Smith 129 – James Schmidt 80 – Judith Shoulak 65 – TENURED DIRECTORS J. Oliver Maggard 48 – James Damian 16 – Michael Johnson – – Jerry Rose – – Cindy Davis – 1 RECENTLY-DEPARTED SENIOR MANAGEMENT Mary Twinem 133 – Kathleen Benning 73 – RECENTLY-REPLACED DIRECTORS Warren Mack 71 – Dale Applequist 52 – 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 22 HUNDREDS OF OPEN MARKET SALES & ONLY ONE OPEN MARKET PURCHASE IN 13+ YEARS Source: Company filings as of 3/6/17. Note: Open market transactions include outright sales only and do not include shares gifted, transferred, or delivered or withheld for tax purposes, or shares purchased through the ESPP. Not all individual sale transactions included in total count of open market transactions are depicted on timeline due to multiple sales and other transactions occurring on the same day. Open-market Sale Open-market Purchase Only once in 13+ years has a BWLD insider (Cindy Davis) reached into their own pocket and bought stock at market value Since 2003, insiders have constantly sold stock |

NOMINATIONS SINCE IPO MEMBERS SINCE IPO A CULTURE OF COMPLACENCY: BOARD APPEARS TO HAVE NO OVERSIGHT OR ACCOUNTABILITY OVER MANAGEMENT July 2016: Marcato files 13D - Longstanding directors appear to concede all strategic decisions to CEO Sally Smith - Financial & legal “advisors” hired by the Company have only defended status quo - New directors selected by entrenched Board members to embrace and reinforce status quo 23 Since we arrived, the Board has exhibited dismissive and entrenching behavior… - Company has not produced a single analysis of how status quo creates equity value - Management focused on the easiest and smallest actions to help “win” proxy contest Start of Director Tenure Durtion of Director Tenure Source: Company filings. Note: Names in red indicate directors nominated by the Company for election at the 2017 Annual Meeting. End of Director Tenure |

J. Oliver Maggard ONLY ONE OF BWLD’S INDEPENDENT DIRECTOR NOMINEES HAS WORKED AT A RESTAURANT IN THE PAST DECADE 24 Jerry Rose Cindy Davis Andre Fernandez Hal Lawton Harmit Singh Janice Fields Investment Banking Agribusiness Golf Media Big-Box Retail, eCommerce Apparel, Lodging, Restaurants Restaurants Finance Supply Chain Golf Equipment & Media Finance and Strategy Hardlines Merchan- dising Finance Franchising & Operations We believe that BWLD’s turnaround should be led by a Board with relevant qualifications in restaurant operations Directors whose replacement we seek Directors recently nominated by BWLD Source: Company filings. Note: Directors shown in order of decreasing tenure, from left to right. Directors shown exclude Sally Smith (President & CEO of BWLD) and Sam Rovit, who was originally nominated by Marcato and whom BWLD has chosen to include on their 2017 nominee slate as well. |

OLLIE MAGGARD’S “RESTAURANT EXPERIENCE” IS QUESTIONABLE 25 Prior to this year, the Company cited the following as Ollie Maggard’s “qualifications” to serve on the Board, but never asserted that he had direct restaurant experience : “Mr. Maggard has significant financial experience and brings strong leadership to [the Board and the Audit Committee]. He understands the intricacies of restaurant-level financials as well as how they have an impact on the financials of the overall company” – Definitive Proxies filed 3/25/16, 3/27/15, 3/28/14, 4/5/13, 3/22/12, 4/4/11, 4/7/10 However, after seven years, the Company decided to add that he has investment experience in “multiple restaurant concepts”: “Throughout his career, he has advised and invested in numerous consumer oriented businesses, including multiple restaurant concepts. While reviewing hundreds of investment opportunities each year, he has a thorough understanding of the drivers of value in both public and private companies” – Definitive Proxy filed 4/21/17 Mr. Maggard’s now-defunct prior firm, Regent Capital, made just one documented restaurant investment other than in BWLD (in Buca di Beppo)—each over 15 years ago His current firm, Caymus Equity, has never invested in a restaurant company in its history Source: Company filings, http://caymusequity.com/portfolio/. |

WHICH WOULD YOU PREFER? 26 J. Oliver Maggard Incumbent Nominee Mick McGuire Shareholder Nominee Co-founder of Caymus Equity, which has never invested in a single restaurant company in its history Mick McGuire’s qualifications for Director far exceed Ollie Maggard’s in both quality and magnitude Source: Company filings, Bloomberg, http://caymusequity.com/portfolio/. Note: Ownership information as reported by Bloomberg based on 13-F data as available on 5/3/17. Investment manager with broad experience investing in consumer businesses, including numerous publicly-traded restaurant companies Genuine ownership mentality: currently BWLD’s third-largest shareholder Current ownership: 3,522 shares (0.02% of sh. outst.) Has never purchased BWLD stock in the open market Has personally sold stock 48 times since 2003 Prior employer, Regent Capital, sold its entire stake in BWLD in 2005 Current ownership: 982,600 shares (6.1% of sh. outst.) Entire stake purchased in the open market, alongside current shareholders |

JERRY ROSE AND CINDY DAVIS DID NOT DO THEIR JOB ON THE GOVERNANCE COMMITTEE 27 Source: Company filings. Note: Commentary regarding Rose’s and Davis’ time on the Governance Committee refers to events prior to Marcato’s 13-D filings in BWLD. (1) Jerry Rose was elected to the Board in December 2010 and the Governance Committee from August 2011 to December 2016. Cindy Davis was elected to the Board in November 2014 and was named as a member of the Governance Committee as of the 2014 proxy. Board and committee activity during Rose’s and Davis’ tenures excludes the departure of Robert MacDonald in 2014, whose vacancy Davis filled later that year. 1) BWLD had one of the oldest-tenured Boards in the restaurant industry 2) No changes were made to composition or chairpersons of any Board committees 3) Not a single new director other than themselves was appointed to the Board 4) In response to our initial 13D filing, “circled the wagons” to further entrench the Board by appointing new directors with no restaurant experience During Jerry Rose’s and Cindy Davis’ years on the Governance Committee (1) : As reported by Barclays in September 2016 |

IF JERRY ROSE’S SUPPLY CHAIN “EXPERTISE” HAS ADDED VALUE, WE CAN’T SEE IT 28 24% 27% 25% 23% ??? Wings as % of COGS 27% 25% 19% Source: Company filings. $2.08 $1.91 $1.83 $1.55 $1.76 $1.97 $1.21 $1.58 2017E 2016 2015 2014 2013 2012 2011 2010 AVG. PRICE PER POUND FOR BONE-IN TRADITIONAL CHICKEN WINGS PAID BY BWLD DURING JERRY ROSE’S TENURE |

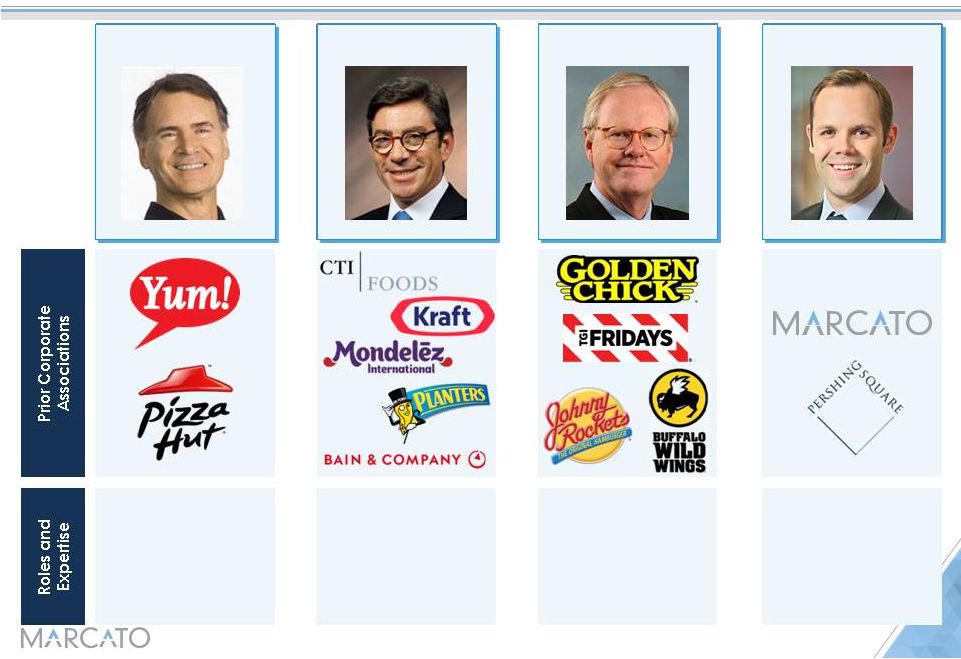

OUR NOMINEES WILL MAKE BUFFALO WILD WINGS A WINNING COMPANY AGAIN 29 Sam Rovit Scott Bergren Lee Sanders Mick McGuire Former CEO of Pizza Hut’s Global Business Veteran Franchising, Marketing, & Operations Expert 20yrs. in Restaurant Supply Chain, Retail, Food, & Corporate Strategy Turnaround Expert Former CEO and Franchising Head at Several Global Brands, Including Buffalo Wild Wings BWLD’s 3rd Largest Shareholder, Committed to Accountability & Shareholder Alignment |

SETTING THE RECORD STRAIGHT ON BUFFALO WILD WINGS’ PEER GROUP MAY 2017 Exhibit 2 |

DISCLAIMER 1 The views expressed in this presentation (the “Presentation”) represent the opinions of Marcato Capital Management LP and/or certain affiliates (“Marcato”) and the investment funds it manages that hold shares in Buffalo Wild Wings, Inc. (the “Company”). This Presentation is for informational purposes only, and it does not have regard to the specific investment objective, financial situation, suitability or particular need of any specific person who may receive the Presentation, and should not be taken as advice on the merits of any investment decision. The views expressed in the Presentation represent the opinions of Marcato, and are based on publicly available information and Marcato analyses. Certain financial information and data used in the Presentation have been derived or obtained from filings made with the Securities and Exchange Commission (“SEC”) by the Company or other companies that Marcato considers comparable. Marcato has not sought or obtained consent from any third party to use any statements or information indicated in the Presentation as having been obtained or derived from a third party. Any such statements or information should not be viewed as indicating the support of such third party for the views expressed in the Presentation. Information contained in the Presentation has not been independently verified by Marcato, and Marcato disclaims any and all liability as to the completeness or accuracy of the information and for any omissions of material facts. Marcato disclaims any obligation to correct, update or revise the Presentation or to otherwise provide any additional materials. Neither Marcato nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy, fairness or completeness of the information contained herein and the recipient agrees and acknowledges that it will not rely on any such information. Marcato recognizes that the Company may possess confidential information that could lead it to disagree with Marcato’s views and/or conclusions. Funds managed by Marcato currently beneficially own, and/or have an economic interest in, shares of the Company. These funds are in the business of trading— buying and selling—securities. Marcato may buy or sell or otherwise change the form or substance of any of its investments in any manner permitted by law and expressly disclaims any obligation to notify any recipient of the Presentation of any such changes. There may be developments in the future that cause funds managed by Marcato to engage in transactions that change the beneficial and/or economic interest in the Company. The Presentation may contain forward-looking statements which reflect Marcato’s views with respect to, among other things, future events and financial performance. Forward-looking statements are subject to various risks and uncertainties and assumptions. There can be no assurance that any idea or assumption herein is, or will be proven, correct. If one or more of the risks or uncertainties materialize, or if Marcato’s underlying assumptions prove to be incorrect, the actual results may vary materially from outcomes indicated by these statements. Accordingly, forward-looking statements should not be regarded as a representation by Marcato that the future plans, estimates or expectations contemplated will ever be achieved. The securities or investment ideas listed are not presented in order to suggest or show profitability of any or all transactions. There should be no assumption that any specific portfolio securities identified and described in the Presentation were or will be profitable. Under no circumstances is the Presentation to be used or considered as an offer to sell or a solicitation of an offer to buy any security, nor does the Presentation constitute either an offer to sell or a solicitation of an offer to buy any interest in funds managed by Marcato. Any such offer would only be made at the time a qualified offeree receives the Confidential Explanatory Memorandum of such fund. Any investment in the Marcato Funds is speculative and involves substantial risk, including the risk of losing all or substantially all of such investment. |

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS 2 Marcato International Master Fund Ltd. (“Marcato International”), together with the other participants in Marcato International’s proxy solicitation, have filed with the Securities and Exchange Commission (the “SEC”) a definitive proxy statement and accompanying WHITE proxy card to be used to solicit proxies in connection with the 2017 annual meeting of shareholders (the “Annual Meeting”) of Buffalo Wild Wings, Inc. (the “Company”). Shareholders are advised to read the proxy statement and any other documents related to the solicitation of shareholders of the Company in connection with the Annual Meeting because they contain important information, including information relating to the participants in Marcato International’s proxy solicitation. These materials and other materials filed by Marcato International with the SEC in connection with the solicitation of proxies are available at no charge on the SEC’s website at http://www.sec.gov. The definitive proxy statement and other relevant documents filed by Marcato International with the SEC are also available, without charge, by directing a request to Marcato International’s proxy solicitor, Innisfree M&A Incorporated, toll-free at (888) 750-5834 (banks and brokers may call collect at (212) 750-5833). The participants in the proxy solicitation are Marcato International, Marcato Capital Management LP, Marcato Special Opportunities Master Fund LP (“Marcato Special Opportunities Fund”), Emil Lee Sanders, Richard T. McGuire III, Sam Rovit and Scott O. Bergren (collectively, the “Participants”). As of the date hereof, Marcato International directly owns 950,000 shares of common stock, no par value, of the Company (the “Common Stock”), representing approximately 5.9% of the outstanding shares of Common Stock and Marcato Special Opportunities Fund directly owns 32,600 shares of Common Stock, representing approximately 0.2% of the outstanding shares of Common Stock. In addition, Marcato Capital Management LP, as the investment manager of Marcato International and Marcato Special Opportunities Fund, may be deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) the shares of Common Stock held by Marcato and Marcato Special Opportunities Fund, therefore, may be deemed to be the beneficial owner of such shares. By virtue of Mr. McGuire’s position as the managing partner of Marcato Capital Management LP, Mr. McGuire may be deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) the shares of Common Stock held by Marcato International and Marcato Special Opportunities Fund and, therefore, Mr. McGuire may be deemed to be the beneficial owner of such shares. |

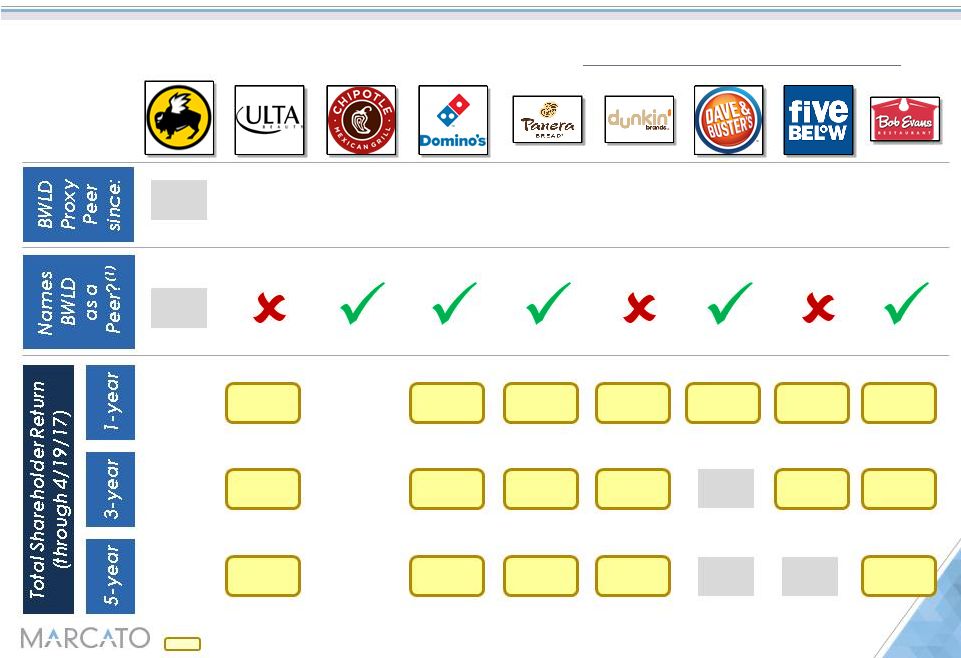

3 BUFFALO WILD WINGS HAS PLAYED GAMES WITH ITS PEER GROUP I. Constant changes to peer group are suspicious I. Constant changes to peer group are suspicious II. “Casual Dining” distinction is a red herring II. “Casual Dining” distinction is a red herring III. New “casual” peers include inappropriate comparisons III. New “casual” peers include inappropriate comparisons IV. Use of broader restaurant peer set is appropriate methodology IV. Use of broader restaurant peer set is appropriate methodology We believe that BWLD’s focus on shareholder returns relative to “Casual Dining” peers alone is inappropriate, and that a broader, more accurate peer group shows that BWLD has underperformed Note: Throughout this presentation, market data has been derived as of 4/19/17, unless otherwise noted. Unless otherwise noted, TSR is not calculated for any company that was not public for the entire duration of any 1-year, 3-year, or 5-year trailing period from the corresponding date. We believe this methodology is more appropriate than that used by Buffalo Wild Wings in recent shareholder communications. |

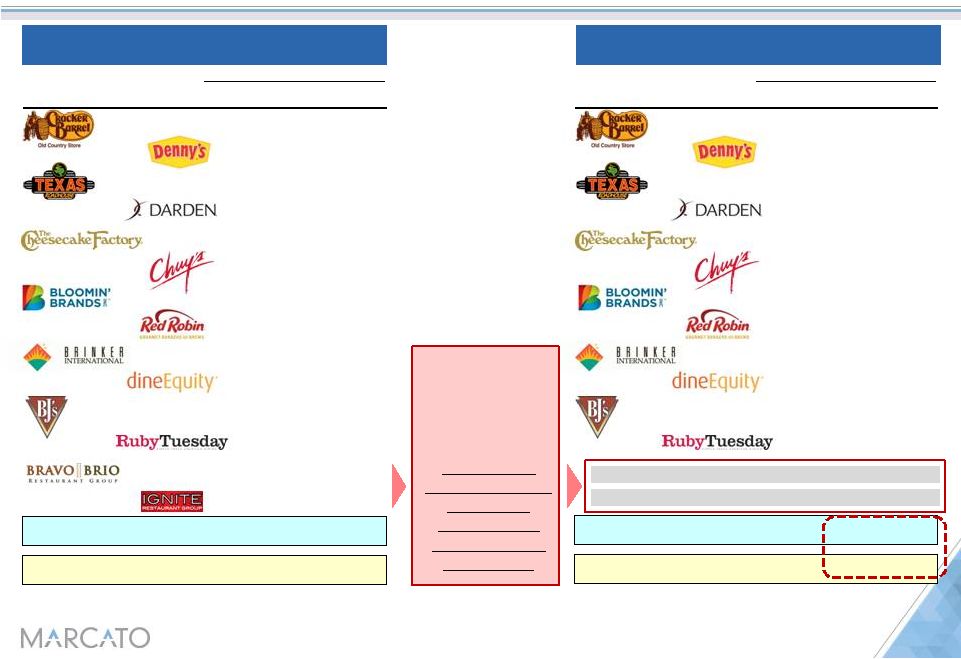

BUFFALO WILD WINGS CONSTANTLY CHANGES WHO THEY DEFINE AS “PEERS” 4 BWLD USES ONE PEER GROUP FOR PAYING EXECUTIVES… Source: Company filings (clockwise from top-left: BWLD’s Definitive Proxy filed 4/21/17, August 2016 Analyst Day presentation, Press Release filed 5/4/17, Definitive Proxy filed 4/21/17. …ANOTHER FOR BUSINESS PLANNING… …A THIRD FOR TOTAL RETURN COMPARISONS… …AND A FOURTH TO CLAIM TO HAVE OUTPERFORMED The Board selectively re- designed BWLD’s peer group, which makes past performance look better than it is |

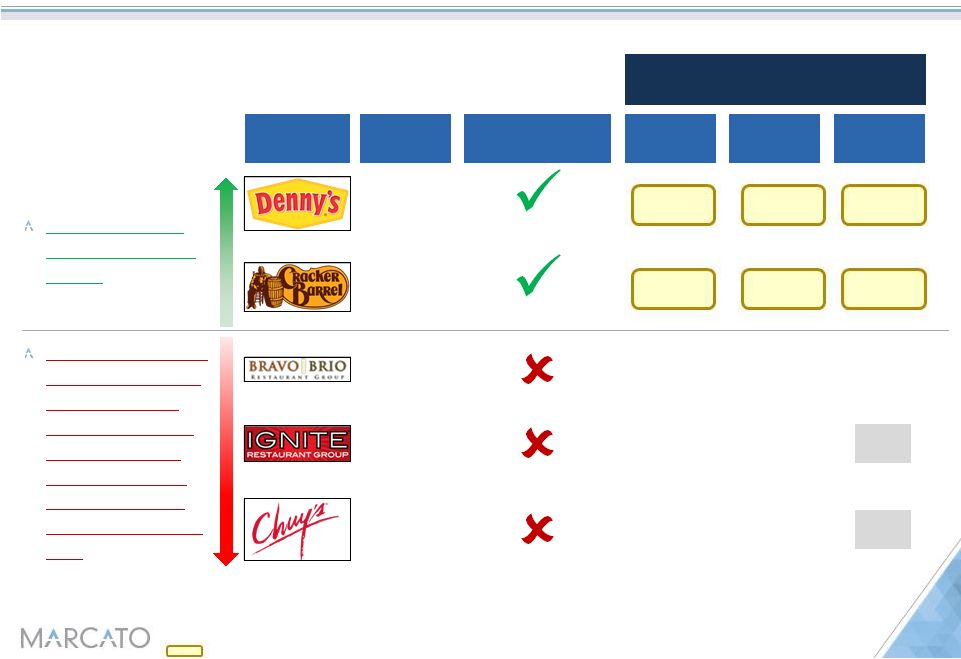

PEER GROUP COMPOSITION HAS CHANGED SEVERAL TIMES IN LAST NINE MONTHS 5 Source: Company filings, CapitalIQ, Marcato press release filed 5/4/17. Market data as of 4/19/17. Note: Median calculations reflect only those peers whose shares were publicly traded for the entire duration of the 5-year period ended 4/19/17. Reference in other filings to BWLD’s underperformance relative to the S&P 600 Restaurants refers to the index itself, not just current members. These peers are closer to the “right” comps for BWLD, and reveal BWLD’s underperformance… …While subsequent iterations obscure relative underperformance BWLD has used different peers for executive compensation and operating benchmarking from those used in recent proxy-related shareholder communications We believe the recent changes exclude numerous relevant peer businesses, particularly those with high franchise mixes The peer group that BWLD selected before the proxy contest began was more logical & showed BWLD’s underperformance, while subsequent changes create the illusion of industry outperformance |

DON’T JUST TAKE OUR WORD FOR IT: MANAGEMENT ALSO BELIEVES THAT THE BWW BRAND COMPETES WITH FAST CASUAL AND QUICK-SERVICE, NOT JUST CASUAL DINING 6 Source: Company filings. “I’d say that we were really fast casual long before there was even the term ‘fast casual’” –Sally Smith, President & CEO, 3/6/17 “I’d say that we were really fast casual long before there was even the term ‘fast casual’” –Sally Smith, President & CEO, 3/6/17 “You can get in and out of a Buffalo Wild Wings just about as fast as you can for fast casual. And so, if you want an alternative to the sandwich or something like that, wings are a great alternative” –Sally Smith, President & CEO, 4/26/16 “You can get in and out of a Buffalo Wild Wings just about as fast as you can for fast casual. And so, if you want an alternative to the sandwich or something like that, wings are a great alternative” –Sally Smith, President & CEO, 4/26/16 “[W]e’re not too focused on a comparison to casual dining” –James Schmidt, COO, 7/26/16 “[W]e’re not too focused on a comparison to casual dining” –James Schmidt, COO, 7/26/16 |

BWLD HAS SELECTIVELY REMOVED PROXY PEERS THAT HAVE OUTPERFORMED 7 Source: Company filings, CapitalIQ. Market data as of 4/19/17. Companies listed from left to right in descending order of enterprise value. (1) Based on disclosures in most recently-filed definitive proxies. Indicates outperformance relative to BWLD for the corresponding time period. 2012 +37% +218% +196% 2008 +5% (8%) +11% 2014 +29% +145% +434% 2008 +45% +87% +108% 2012 +17% +22% +98% 2016 +56% 2016 +21% 2012 +42% +66% +108% Despite their use by the Compensation Committee for years, these companies have been suddenly excluded from share performance comparisons: suspiciously, nearly all have outperformed BWLD +10% +10% +84% +14% |

INCLUDES IRRELEVANT PEERS TO IMPROVE RELATIVE PERFORMANCE 8 Source: Company filings, CapitalIQ, Bloomberg. Market data as of 4/19/17. (1) Based on disclosures in most recently-filed definitive proxies. CHUY and BBRG based on competitor disclosures in most recent 10-Ks, as no peer group is listed in their definitive proxies. IRGT lists BWLD as a competitor for its Brick House brand (which comprises 25 of its 140 total units ) in its 10-K only, and does not list BWLD among its proxy peers. Indicates outperformance relative to BWLD for the corresponding time period. Names BWLD as a Peer? (1) # of Stores 140 118 83 1,731 645 Total Shareholder Return (through 4/19/17) 1-year (98%) (40%) (4%) +20% +11% 3-year (100%) (69%) (27%) +93% 5-year (77%) +219% +244% Both DENN & CBRL have outperformed BWLD… ..So BWLD appears to have selected three small & irrelevant underperformers to offset the positive contribution to the peer median from including DENN and CBRL In order to construct a list of peers in casual dining, BWLD logically included DENN and CBRL… “Casual” Peers +87% |

ADDITION OF BBRG AND IRGT IS INAPPROPRIATE & SKEWS THE ANALYSIS TO HIDE BWLD’S UNDERPERFORMANCE 9 Source: Company filings, CapitalIQ, Bloomberg. Market data as of 4/19/17. Note: TSR rankings shown in relation to current members of the Russell 3000 Restaurants index, per Bloomberg. Index used as an indicative set inclusive of a broad base of potentially usable restaurant company peers. IRGT and BBRG are not members of the index. Rankings exclude companies that were not public for the full duration of the applicable time period. Franchise mix includes one managed restaurant for BBRG. 140 Stores ~2% Franchised $1.8 million $120.4 million 1-yr.: 3-yr.: 5-yr.: (98%) (100%) NAa TSR 118 Stores ~2% Franchised $70.4 million $110.7 million 1-yr.: 3-yr.: 5-yr.: (40%) (69%) (77%) 49 out of 49 41 out of 41 NA TSR Rank (Russell 3000 Rest.) 44 out of 49 38 out of 41 31 out of 31 Rank (Russell 3000 Rest.) ~10% the size of BWLD’s system unit count ~10% the size of BWLD’s system unit count Virtually no franchising vs. ~50% for BWLD Virtually no franchising vs. ~50% for BWLD Micro-cap businesses & potentially in distress Micro-cap businesses & potentially in distress Highly levered: Debt equals ~35-100% of TEV Highly levered: Debt equals ~35-100% of TEV These are clearly inappropriate peers for BWLD These are clearly inappropriate peers for BWLD th th th st st |

Total Shareholder Return 1- Year 3- Year 5- Year 14% 94% 235% 27% 103% 208% 16% 107% 201% 39% 112% 128% 27% 52% 116% 1% (22%) 98% 17% 6% 80% (8%) (10%) 68% (1%) (2%) 57% (32%) (15%) 39% 2% 57% 0% (42%) (67%) (63%) "Casual Dining" Peer Median 8% 29% 89% Buffalo Wild Wings 20% 18% 85% Total Shareholder Return 1- Year 3- Year 5- Year 14% 94% 235% 27% 103% 208% 16% 107% 201% 39% 112% 128% 27% 52% 116% 1% (22%) 98% 17% 6% 80% (8%) (10%) 68% (1%) (2%) 57% (32%) (15%) 39% 2% 57% 0% (42%) (67%) (63%) (35%) (68%) (76%) (98%) (100%) (100%) "Casual Dining" Peer Median 2% 2% 74% Buffalo Wild Wings 20% 18% 85% DID BWLD INCLUDE TWO OBVIOUS UNDERPERFORMERS IN ORDER TO SKEW THE ANALYSIS IN THEIR FAVOR? 10 Source: Company filings, CapitalIQ. Market data as of 4/28/17. Note: The above tables intend to replicate BWLD’s analysis published on 5/4/17 by including CHUY, BLMN, and IRGT in the 5-year TSR median using the closing share price on date of their respective IPOs. Marcato disputes the validity of this methodology, as well as the use of 4/28/17 as the appropriate period-end date; thus, this methodology differs from that used in other calculations in this presentation. Removing these irrelevant peers changes the analysis dramatically: BWLD in fact underperformed its “Casual Dining Peers” over the past 3 and 5 years Including irrelevant peers gives BWLD the appearance of outperformance… …Stripping out the irrelevant peers, BWLD has actually underperformed its cherry-picked “comps”! |

OUR ORIGINAL PRESENTATION TO MANAGEMENT INCLUDED RESTAURANT COMPANIES THAT WE BELIEVE ARE REPRESENTATIVE PEERS FOR BWLD BENCHMARKING 11 Given BWLD’s ~50% franchise mix, we believe it is appropriate to balance the different economic characteristics that comprise BWLD’s earnings, rather than differentiate between service styles within a restaurant Note that the substantial majority of these peers themselves list BWLD as a comparable business in their filings These peers have materially outperformed BWLD Source: Company filings, CapitalIQ. Market data as of 4/19/17. Note: PLKI had been included in Marcato’s June 2016 presentation to management but was subsequently purchased by QSR and is thus excluded above. Indicates outperformance relative to BWLD for the corresponding time period. |

RESEARCH ANALYST SUPPORT FOR STRATEGIC & LEADERSHIP CHANGE MAY 2017 Exhibit 3 |

DISCLAIMER 1 The views expressed in this presentation (the “Presentation”) represent the opinions of Marcato Capital Management LP and/or certain affiliates (“Marcato”) and the investment funds it manages that hold shares in Buffalo Wild Wings, Inc. (the “Company”). This Presentation is for informational purposes only, and it does not have regard to the specific investment objective, financial situation, suitability or particular need of any specific person who may receive the Presentation, and should not be taken as advice on the merits of any investment decision. The views expressed in the Presentation represent the opinions of Marcato, and are based on publicly available information and Marcato analyses. Certain financial information and data used in the Presentation have been derived or obtained from filings made with the Securities and Exchange Commission (“SEC”) by the Company or other companies that Marcato considers comparable. Marcato has not sought or obtained consent from any third party to use any statements or information indicated in the Presentation as having been obtained or derived from a third party. Any such statements or information should not be viewed as indicating the support of such third party for the views expressed in the Presentation. Information contained in the Presentation has not been independently verified by Marcato, and Marcato disclaims any and all liability as to the completeness or accuracy of the information and for any omissions of material facts. Marcato disclaims any obligation to correct, update or revise the Presentation or to otherwise provide any additional materials. Neither Marcato nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy, fairness or completeness of the information contained herein and the recipient agrees and acknowledges that it will not rely on any such information. Marcato recognizes that the Company may possess confidential information that could lead it to disagree with Marcato’s views and/or conclusions. Funds managed by Marcato currently beneficially own, and/or have an economic interest in, shares of the Company. These funds are in the business of trading— buying and selling—securities. Marcato may buy or sell or otherwise change the form or substance of any of its investments in any manner permitted by law and expressly disclaims any obligation to notify any recipient of the Presentation of any such changes. There may be developments in the future that cause funds managed by Marcato to engage in transactions that change the beneficial and/or economic interest in the Company. The Presentation may contain forward-looking statements which reflect Marcato’s views with respect to, among other things, future events and financial performance. Forward-looking statements are subject to various risks and uncertainties and assumptions. There can be no assurance that any idea or assumption herein is, or will be proven, correct. If one or more of the risks or uncertainties materialize, or if Marcato’s underlying assumptions prove to be incorrect, the actual results may vary materially from outcomes indicated by these statements. Accordingly, forward-looking statements should not be regarded as a representation by Marcato that the future plans, estimates or expectations contemplated will ever be achieved. The securities or investment ideas listed are not presented in order to suggest or show profitability of any or all transactions. There should be no assumption that any specific portfolio securities identified and described in the Presentation were or will be profitable. Under no circumstances is the Presentation to be used or considered as an offer to sell or a solicitation of an offer to buy any security, nor does the Presentation constitute either an offer to sell or a solicitation of an offer to buy any interest in funds managed by Marcato. Any such offer would only be made at the time a qualified offeree receives the Confidential Explanatory Memorandum of such fund. Any investment in the Marcato Funds is speculative and involves substantial risk, including the risk of losing all or substantially all of such investment. |

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS 2 Marcato International Master Fund Ltd. (“Marcato International”), together with the other participants in Marcato International’s proxy solicitation, have filed with the Securities and Exchange Commission (the “SEC”) a definitive proxy statement and accompanying WHITE proxy card to be used to solicit proxies in connection with the 2017 annual meeting of shareholders (the “Annual Meeting”) of Buffalo Wild Wings, Inc. (the “Company”). Shareholders are advised to read the proxy statement and any other documents related to the solicitation of shareholders of the Company in connection with the Annual Meeting because they contain important information, including information relating to the participants in Marcato International’s proxy solicitation. These materials and other materials filed by Marcato International with the SEC in connection with the solicitation of proxies are available at no charge on the SEC’s website at http://www.sec.gov. The definitive proxy statement and other relevant documents filed by Marcato International with the SEC are also available, without charge, by directing a request to Marcato International’s proxy solicitor, Innisfree M&A Incorporated, toll-free at (888) 750-5834 (banks and brokers may call collect at (212) 750-5833). The participants in the proxy solicitation are Marcato International, Marcato Capital Management LP, Marcato Special Opportunities Master Fund LP (“Marcato Special Opportunities Fund”), Emil Lee Sanders, Richard T. McGuire III, Sam Rovit and Scott O. Bergren (collectively, the “Participants”). As of the date hereof, Marcato International directly owns 950,000 shares of common stock, no par value, of the Company (the “Common Stock”), representing approximately 5.9% of the outstanding shares of Common Stock and Marcato Special Opportunities Fund directly owns 32,600 shares of Common Stock, representing approximately 0.2% of the outstanding shares of Common Stock. In addition, Marcato Capital Management LP, as the investment manager of Marcato International and Marcato Special Opportunities Fund, may be deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) the shares of Common Stock held by Marcato and Marcato Special Opportunities Fund, therefore, may be deemed to be the beneficial owner of such shares. By virtue of Mr. McGuire’s position as the managing partner of Marcato Capital Management LP, Mr. McGuire may be deemed to have the shared power to vote or direct the vote of (and the shared power to dispose or direct the disposition of) the shares of Common Stock held by Marcato International and Marcato Special Opportunities Fund and, therefore, Mr. McGuire may be deemed to be the beneficial owner of such shares. |

ANALYSTS LACK CONFIDENCE IN BWLD LEADERSHIP FOLLOWING WEAK Q1’17 EARNINGS 3 “While BWLD’s strategy appears compelling on paper, operational missteps continue to drive a lack of confidence in BWLD’s outlook…issues seem to consistently crop up that make it difficult to have confidence in the strategy laid out by management. We were surprised by the guidance reduction, particularly the magnitude, but find it challenging to have confidence in the revised outlook or 20% restaurant margin target given uncertainty across comps, margins, and execution…Although same store sales outpaced expectations in the quarter, BWLD effectively ‘bought the comp’ through heavy promotions at the expense of profitability” –Andrew Strelzik, BMO Capital Markets, 4/26/17 “’Poor execution blocks last-second buzzer beater as shareholder meeting looms’…We continue to be frustrated by poor execution of sales-building and cost-savings initiatives” –Chris O’Cull, KeyBanc, 4/27/17 “We worry that the current mgmt. team will struggle to navigate the challenging external backdrop, while also repositioning the company to focus on leaner operations over store growth…Some might argue that there’s a silver lining to BWLD’s weakening trends, in that this increases the likelihood of activist influence and mgmt. change…We agree that recent trends increase the likelihood of leadership change, and getting new energy and fresh eyes/ideas on the biz are probably a net positive” –Jason West, Credit Suisse, 4/27/17 “[R]ecently BWLD has been plagued by complacency and a continued lack of adequate leadership…The lack of managerial direction and vision can be seen in the Company’s most recent fiscal year projections, which have been significantly altered since BWLD’s 4Q16 presentation…This is unsettling, to say the least, and shows management’s lack of adequate foresight. It is hard to trust a management team that will drastically change the outlook and shows a lack of understanding of its business…At a time when the leaders in the restaurant industry refuse to participate in the race to the bottom, BWLD continues to offer aggressive promotions as a way to draw patrons” –Howard Penney, Hedgeye, 4/27/17 Source: Wall Street research. “We are concerned by the lack of accountability by management for SSS struggles as softness is attributed to industry pressures. March Madness experienced sales declines despite higher TV ratings, which in our view suggests their marketing message is missing the mark. We view the June 2, 2017 annual shareholder meeting as a potential catalyst for change as the activist has nominated 4 new board members along with its slate to increase the company's franchise skew along with management changes” –Matt DiFrisco, Guggenheim, 4/27/17 “The Q1 report marked the tenth consecutive quarter of disappointing revenue/EPS performance for BWLD…we are concerned about the profitability of the top-line performance amid heightened promotional activity” –David Tarantino, Baird, 4/27/17 “It would seem that this quarter will be a test of investor patience as operating profit will be flat for the third year in a row…industry dynamics and persistent cost pressures don't paint a very attractive picture, at least right now, for long term company ownership unless the sales and margin enhancements prove effective and longer term costs begin to normalize” –John Glass, Morgan Stanley, 4/27/17 |

ANALYSTS HAVE CONSISTENTLY QUESTIONED MANAGEMENT’S ABILITIES & STRATEGY 4 “We are surprised the Company’s investor presentations continue to center on tactical efforts, like FastBreak Lunch and Wing Tuesday, and secondary strategic priorities, like international development and new concepts, rather than full explanations for why traffic is declining, how costs will be reduced or why the business model is appropriate. It is not clear to us the issues and alternatives are fully understood” –Chris O’Cull, KeyBanc, 2/7/17 “[T]here remains a sense that the company retains a “small-company” mentality that is lacking the structured corporate processes often found in larger companies…Frustration regarding the lack of communication and strategic direction could be a reason for a high level of turnover in corporate staff. While improvements have been made in recent years, better tools and formalized structure more akin to a ~$3B market cap company could help” –Nick Setyan, Wedbush, 2/7/17 “We believe a deep dive into the right asset design makes strategic sense on the back of meaningful build cost inflation; however, we question if a focus on more urban areas is the right approach” –Karen Holthouse, Goldman Sachs, 2/13/17 “We believe the appointment of a CFO…enables BWLD to further evaluate its long-term strategic direction and engage with outside investors. However, we also imagine that a CFO with deeper experience in restaurants and franchising in particular would have indicated a level of preparation and willingness to change the current course of action” –John Zolidis, Buckingham, 10/25/16 “[Investors canvassed agree] that there are numerous things [that] can be done including management changes, operational fixes (cost cutting, labor) or on the financial side (including, but not limited to refranchising)…Many believed some level of managerial changes is likely/needed” –Brett Levy, Deutsche Bank, 10/11/16 “We believe BWLD’s sales issues are fixable…but the turnaround could take time as current initiatives highlighted do not go far enough…[V]alue enhancements to Wing Tuesday leave much to be desired for the remaining six days of the week. We note Fast Break lunch features value but we do not view this as a durable sales driver” –Andrew Charles, Cowen, 8/12/16 “We believe mgmt. will be slow to implement meaningful change” –Jason West, Credit Suisse, 8/9/16 “We look forward to hearing from new CFO Alex Ware on the topics of cost mgmt. and optimizing the business and financial structure. However, our concern is that BWLD needs a deeper reset in the areas of value, food quality and service to truly turn around the business” –Jason West, Credit Suisse, 1/25/17 “ [T]he investor day came and went and…it was clear that there was minimal preparation for the meeting. Overall, your management team came across as nervous, clueless and weak. Lastly, did I see that you actually sold stock the day before the analyst meeting?” –Howard Penney, Hedgeye, 10/17/16 Source: Wall Street research. |

RESEARCH ANALYSTS RECOGNIZE MARGIN DEFICIENCIES 5 “[W]e believe BWLD company-owned stores could improve margins substantially, by up to 500 [basis points] based on our analysis, by adopting labor practices currently deployed by [franchisees]” –Jim Sanderson, Arthur Wood, 3/28/17 Source: Wall Street research. “Our advisor believes there is an opportunity to bring lower performers more in line with the rest of the system, with store-level labor perhaps the largest opportunity. The example of Guest Experience Captains was cited…In his experience, BWLD franchisees are as or more qualified to run a large number of restaurants than corporate personnel” –Nick Setyan, Wedbush, 2/7/17 “[Margin opportunities] exist across labor, operating expenses, and COGS…Diversified Restaurant Holdings, Buffalo Wild Wing’s largest franchisee, highlights opportunity for greater margin efficiency. While there are notable differences, including geographic and overall exposure, SAUC has exhibited favorable food & labor margins relative to BWLD” –Dennis Geiger, UBS, 1/5/17 |

THE STREET RECOGNIZES THAT FRANCHISEE ACQUISITIONS WERE POOR USE OF CAPITAL 6 “[T]he last minute exercise of the first right of refusal to buy a big block of franchise stores in 2015 …is a perfect example of how misguided your incentive compensation structure is and how poor strategic planning can lead to poor capital allocation decisions” –Howard Penney, Hedgeye, 10/17/16 “[T]he most recent acquisition (38 units in the 3Q15) has weighed on earnings and came with a rich multiple, adjusting for the foregone royalties” –John Glass, Morgan Stanley, 7/25/16 “[R]eturn metrics suffered from the company’s FY15 decision to acquire a large number of franchisees…[which] resulted in lower operating margins and financial returns as incremental capital was deployed to eliminate a high margin royalty revenue stream” –John Zolidis, Buckingham, 7/26/16 “Acquiring franchise stores increases business risk…Why in a slowing sales[,] lower return environment would the parent company want even greater exposure to the volatility in the business?” –Howard Penney, Hedgeye, 6/13/16 Source: Wall Street research. Indicates a quote taken from a report published before Marcato publicly disclosed its suggestions to management, indicating an “unaided” observation. Observers agree: the large franchisee acquisitions of 2015 destroyed value by diluting ROIC and eliminating a highly valuable, high-margin royalty stream |

ANALYSTS AGREE WITH MARCATO’S RECOMMENDATIONS 7 “Our patience on BWLD is running thin after another disappointing report…that said, with comps showing signs of stabilization in Q1 and with management focused on financial strategies that could enhance shareholder value amid the presence of an activist investor, we are cautiously optimistic” –David Tarantino, Baird, 2/7/17 “Our advisor stood by his opinion that Marcato’s initial board letter, while perhaps not being 100% correct in its assessment, may not have been off the mark on many points. A refocus on operations in particular, especially when done by or in conjunction with franchisees, was something that rang true with most employees internally, our advisor believes. Increased franchisee ownership could also allow management to focus more closely on strategy, initiative implementation, and operational improvement” –Nick Setyan, Wedbush, 2/7/17 “BWLD’s recent upward re-rating (against weak sales results) partly anticipates potential restructuring and activist pressure…We see a bull/bear case on the stock…with the bear case assuming no major restructuring and continued deterioration in SSS and unit growth, and the bull case assuming improvement in SSS and material financial engineering moves” –Jason West, Credit Suisse, 8/9/16 “4Q suggests BWLD still has a long ways to go to regain stability and visibility in the business…[T]he very weak 4Q result may bolster the case for activist involvement. However, with the Board vote still ~3 mos. away, it will be a while before this potential change will begin to impact strategy and results” –Jason West, Credit Suisse, 2/8/17 “[Q4’16 earnings were] so Bad it could be Good…While the reliability in guidance is highly questionable, we are encouraged that management is now giving consideration to some of the activist’s requests” –Matt DiFrisco, Guggenheim, 2/8/17 “Looking out to 2018-19, we agree with the vast majority of activist Marcato’s restructuring recommendations…We are also uncomfortable with BWLD’s announced (1/24/17) year-end 2017 target leverage ratio of 1.5x EBITDA” –Paul Westra, Stifel, 1/31/17 “We recognize that the activist presence at BWLD provides a sense of urgency for mgmt. to address recent market share loss and margin erosion” –Jason West, Credit Suisse, 1/25/17 Source: Wall Street research. “Given the recent events, the biggest mistake you [CEO Sally Smith] are currently making is not taking Marcato (or your investor day) seriously...Marcato has put forth compelling arguments and substantial evidence that you have ignored the basic principles of corporate finance” –Howard Penney, Hedgeye, 10/17/16 |

SEVERAL ANALYSTS AGREE THAT MARCATO’S INVOLVEMENT HAS HELPED THE STOCK 8 “We think that the substance of Marcato’s investment thesis goes much deeper than a simple ‘lever up and buyback stock’ and will require a material change in business strategy, something best done with influence in the boardroom” –UBS US Special Situations, 8/18/16 “The emergence of an activist shareholder could provide a “floor” for the stock and a potential win-win for shareholders, i.e., either fundamentals improve and/or restructuring comes into play…Our analysis of potential strategies, such as leveraged- buybacks, cost-cutting and refranchising points to significant EPS accretion, should mgmt. pursue these measures…[We see] significant upside from the activist case [and] we also believe a change to mgmt.’s incentive compensation structure (heavily weighted to growth over returns) would be well received by investors” –Jason West, Credit Suisse, 8/9/16 “Recent news of an activist investor is a positive for BWLD, in our view, as the brand is strong and uniquely positioned in casual dining, but likely needs strategy tweaks as it enters its ‘maturing’ phase…BWLD does have untapped levers to create shareholder value. Among them: Refranchising” –John Glass, Morgan Stanley, 7/25/16 “We agree with the spirit of [Marcato’s] filing as we cite recent company actions which lowered ROIC among the rationale for our NEUTRAL rating” –John Zolidis, Buckingham, 7/26/16 Source: Wall Street research. “[W]e believe the presence of an activist investor (Marcato Capital), who might push BWLD to pursue value-enhancing financial strategies, can help to support investor sentiment while we await signs of better top-line momentum” –David Tarantino, Baird, 10/24/16 |

“‘LOGIC’ SUPPORTS THE PREMISE” THAT FRANCHISE BUSINESSES DESERVE HIGHER MULTIPLES 9 Source: Wall Street research. “Investors have rewarded restaurants pursuing a franchise model with multiple expansion relative to co-op peers. ‘Logic’ supports the premise that a franchise model is better insulated against economic volatility, generating a high margin annuity stream of royalties with limited operating volatility…Bottom line, the above thesis is intact and we were actually surprised at the magnitude of outperformance across all measures for our heavily franchised restaurants (75%+ of units) relative to the industry…We expect investors to further encourage (re)franchising / licensing at [BWLD]” –Jeffrey Bernstein, Barclays, 5/17/16 |

RESEARCH ANALYSTS HAVE SEEN UPSIDE FROM REFRANCHISING FROM THE BEGINNING 10 “We believe investors would applaud the introduction of multi-year refranchising programs from Buffalo Wild Wings…While we believe softening fundamentals have been the primary driver of the multiple compression seen by these three casual dining names, the acquisition of franchised units has also played a sizeable role, in our view” –Jeff Farmer, Wells Fargo, 7/13/16 “There is significant value from an operational perspective that can be gained by refranchising underperforming stores, especially from trimming corporate G&A” –Howard Penney, Hedgeye, 6/13/16 Source: Wall Street research. |

“Our math supports a more favorable range of outcomes for investors in a refranchising strategy[.]…We agree with the spirit of [Marcato’s] work” –John Zolidis, Buckingham, 9/6/16 RESEARCH ANALYSTS OVERWHELMINGLY AGREE THAT REFRANCHISING ADDS VALUE 11 “Our analysis of a theoretical model in which 80% of BWLD is franchised along conservative industry standards yields per share valuations significantly higher than BWLD’s current share price” –Nick Setyan, Wedbush, 2/8/17 “[T]he math [on a transition to a 90% franchised business model] looks intriguing, even when using what we think are conservative assumptions” –David Tarantino, Baird, 10/24/16 “We like the potential for additional value-unlocking actions or a more drastic tack in strategy in-line with some of the ideas outlined in a recent 13D filing…Investors may look past downward revisions if the prospect of transformative action is on the table, but if this is called into doubt, fundamentals suggest a lower price for the stock” –John Zolidis, Buckingham, 9/15/16 “We view refranchising as a realistic alternative path to value creation for shareholders…Investors often forget BWLD was >65% franchised a few years ago. Our conversations with brokers that specialize in restaurant and franchisee transactions lead us to believe the appetite for most of BWLD’s markets would be strong, and could command multiples towards the higher end of the 5-6x unit-level EBITDA industry standard’” –Nick Setyan, Wedbush, 9/12/16 “[D]irectionally the activist plan is a much better plan than the one the current management team is focused on” –Howard Penney, Hedgeye, 8/18/16 “[A] falling [ROIC] as a result of higher capex could suggest a greater proportion of units would create more per share value as franchised units (e.g., where the same capex could be deployed for share repurchases)…Investors remain highly focused on the potential opportunity for BWLD to increase its franchise mix” –Karen Holthouse, Goldman Sachs, 8/4/16 “[D]uring its Analyst Day…[Management] failed to address any changes to BWLD’s long-term company/franchise store mix (now at 52% company- owned, which we believe should be reduced) by defending ongoing consideration of future franchise purchases (where we would hope for a re-franchising strategy)” –Paul Westra, Stifel, 8/16/16 “We believe investors would applaud the introduction of multi-year refranchising programs from Buffalo Wild Wings” –Jeff Farmer, Wells Fargo, 7/13/16 “‘Logic’ supports the premise that a franchise model is better insulated against economic volatility, generating a high margin annuity stream of royalties with limited operating volatility…We expect investors to further encourage (re)franchising / licensing at [BWLD]” –Jeffrey Bernstein, Barclays, 5/17/16 Source: Wall Street research. Indicates a quote taken from a report published before Marcato publicly disclosed its suggestions to management, indicating an “unaided” observation. |

FEASIBILITY OF LARGE-SCALE REFRANCHISING IS OBVIOUS IN CONTEXT OF HISTORY 12 “The move to being >90% franchised is not unprecedented…Concerns on demand for franchised BWLD units seems overblown…Marcato’s cadence of proposed franchising follows the 6 year time period it took [Applebee’s], and we believe that is a feasible timeframe” –UBS US Special Situations, 8/18/16 Source: Wall Street research. ““[T]he Company accurately described the requirements for creating value from a highly franchised business model, but stated the risk of execution was simply too great, especially for a casual dining chain. It appears the Company’s concern is based on the only highly franchised, casual dining company, DineEquity, which has under-performed the past 12 months. We struggle to draw the conclusion that DineEquity’s struggles are due to its business model (i.e., why are Chili’s, Ruby Tuesday and Red Robin struggling?), and that one company’s performance portends the same fate for others. All the other publicly held restaurant companies that have shifted business models are QSR chains, but we argue the common ingredient to all of their successes was not their industry- defined segment, but their decision to shift their cultures and structure to support franchise growth. Before significant investments are made supporting company-owned restaurants, a fresh perspective at the Board level could benefit shareholders” –Chris O’Cull, KeyBanc, 2/7/17 |

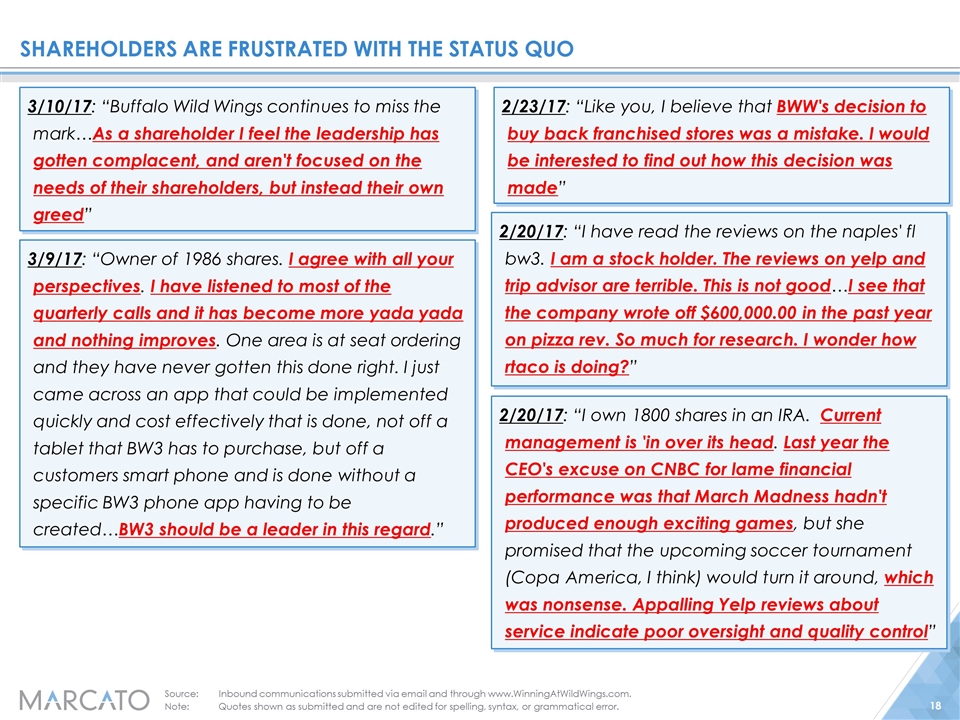

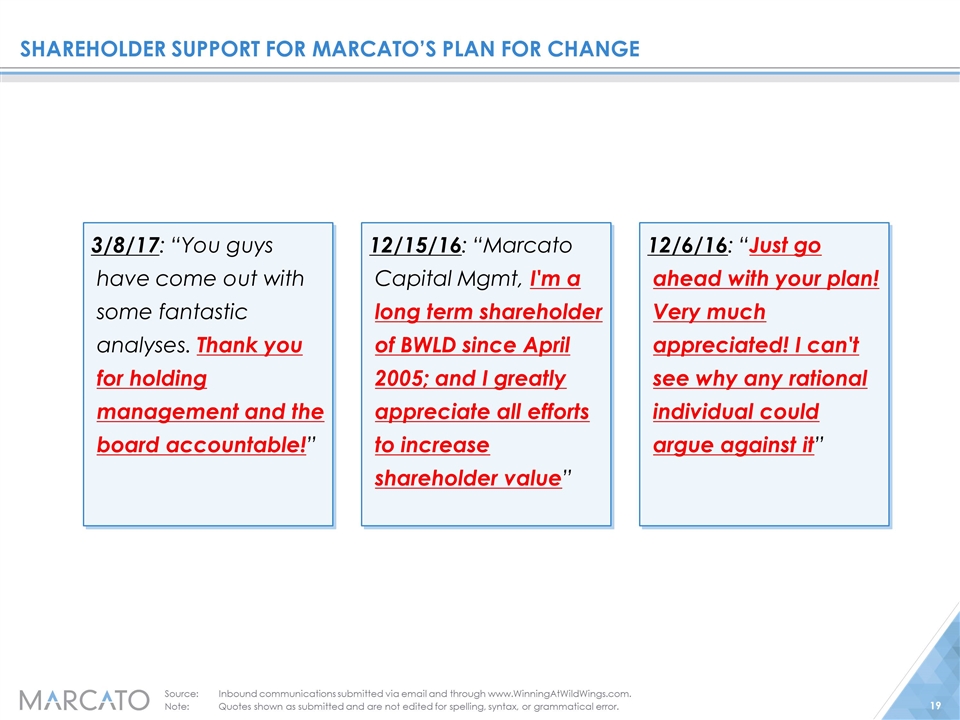

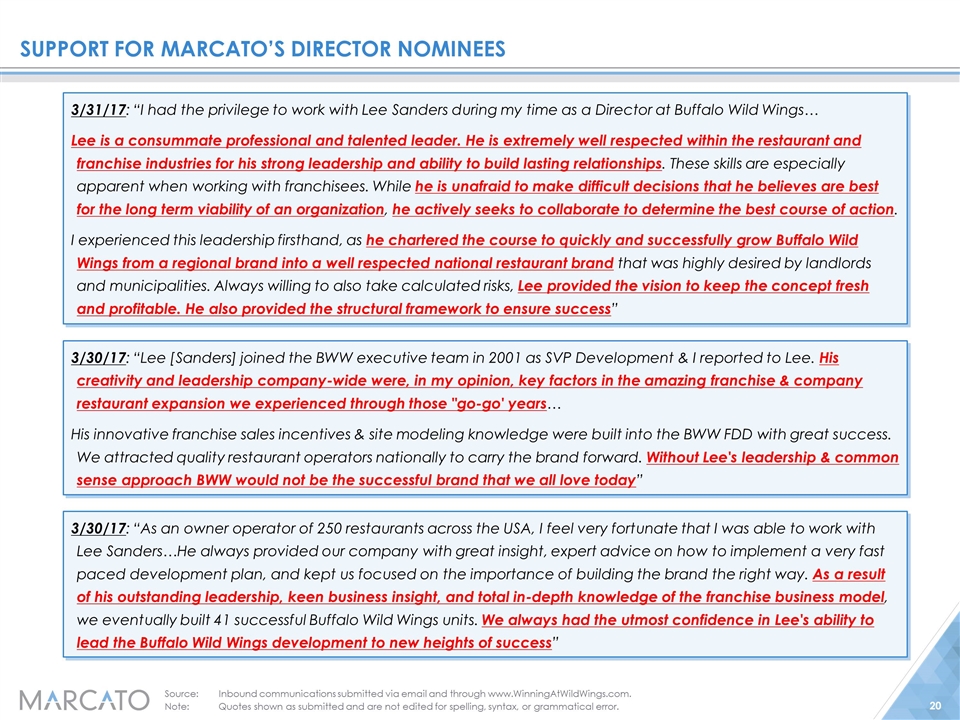

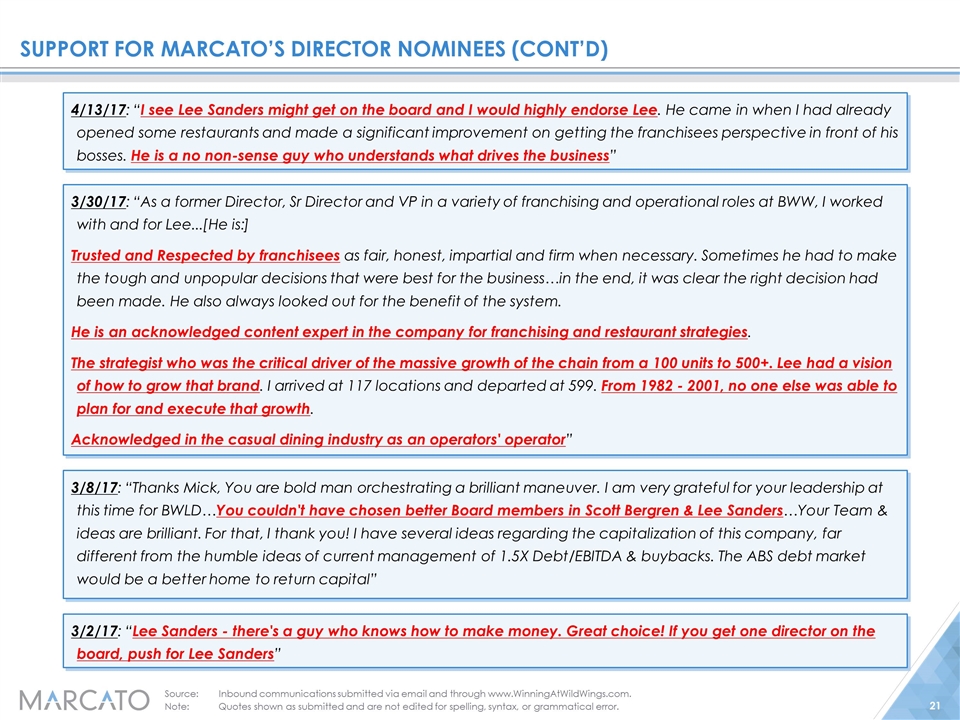

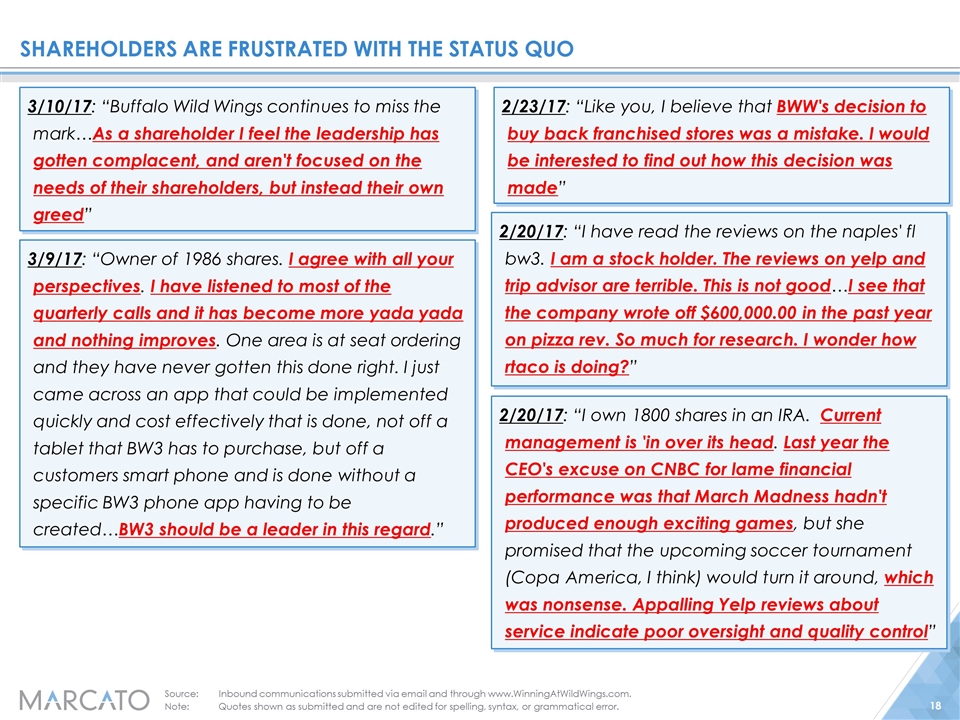

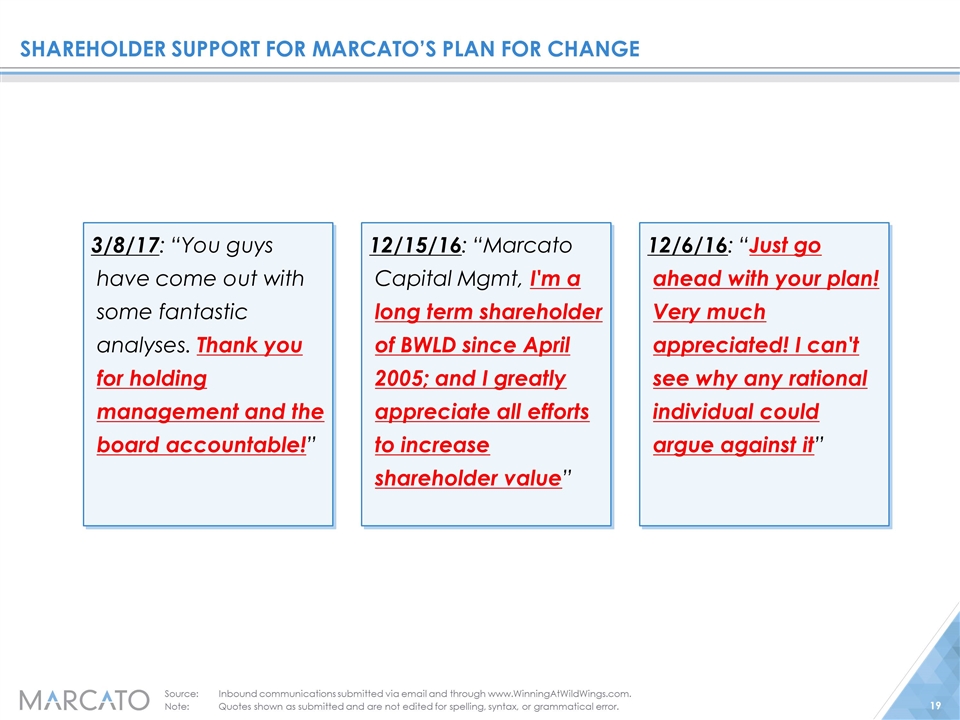

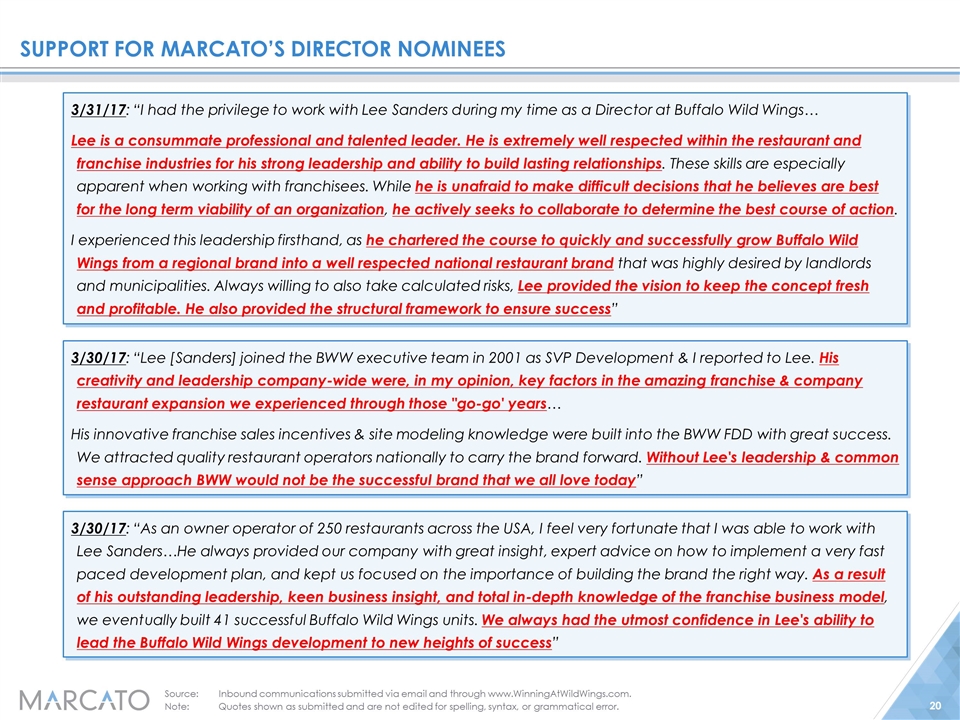

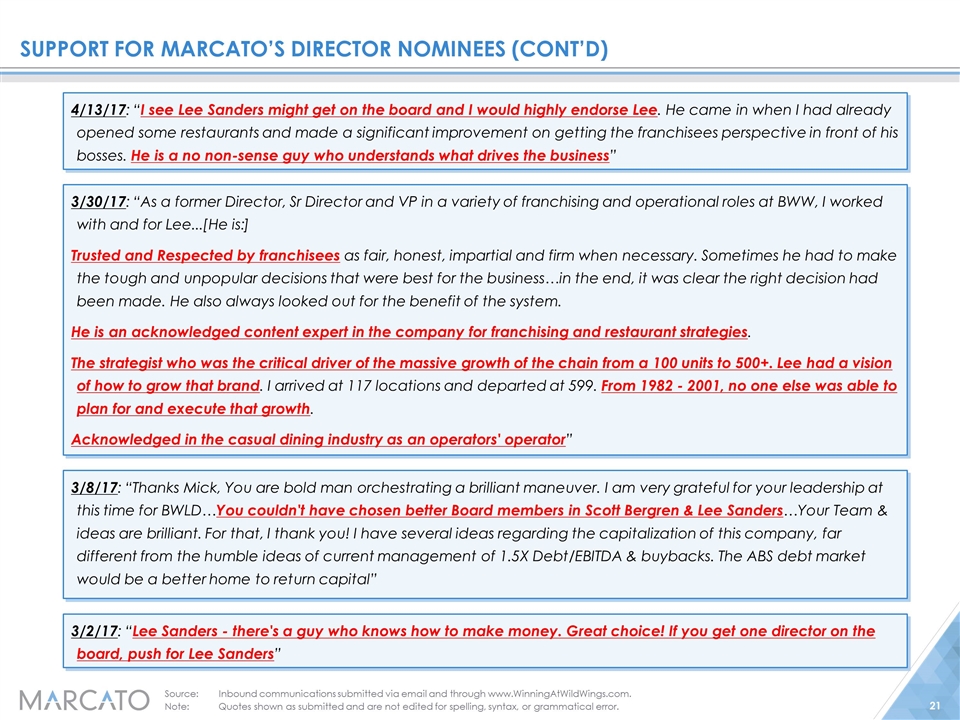

SUBMISSIONS TO WWW.WINNINGATWILDWINGS.COM VALIDATE THE NEED FOR CHANGE Exhibit 4

DisclAIMER The views expressed in this presentation (the “Presentation”) represent the opinions of Marcato Capital Management LP and/or certain affiliates (“Marcato”) and the investment funds it manages that hold shares in Buffalo Wild Wings, Inc. (the “Company”). This Presentation is for informational purposes only, and it does not have regard to the specific investment objective, financial situation, suitability or particular need of any specific person who may receive the Presentation, and should not be taken as advice on the merits of any investment decision. The views expressed in the Presentation represent the opinions of Marcato, and are based on publicly available information and Marcato analyses. Certain financial information and data used in the Presentation have been derived or obtained from filings made with the Securities and Exchange Commission (“SEC”) by the Company or other companies that Marcato considers comparable. Marcato has not sought or obtained consent from any third party to use any statements or information indicated in the Presentation as having been obtained or derived from a third party. Any such statements or information should not be viewed as indicating the support of such third party for the views expressed in the Presentation. Information contained in the Presentation has not been independently verified by Marcato, and Marcato disclaims any and all liability as to the completeness or accuracy of the information and for any omissions of material facts. Marcato disclaims any obligation to correct, update or revise the Presentation or to otherwise provide any additional materials. Neither Marcato nor any of its affiliates makes any representation or warranty, express or implied, as to the accuracy, fairness or completeness of the information contained herein and the recipient agrees and acknowledges that it will not rely on any such information. Marcato recognizes that the Company may possess confidential information that could lead it to disagree with Marcato’s views and/or conclusions. Funds managed by Marcato currently beneficially own, and/or have an economic interest in, shares of the Company. These funds are in the business of trading— buying and selling—securities. Marcato may buy or sell or otherwise change the form or substance of any of its investments in any manner permitted by law and expressly disclaims any obligation to notify any recipient of the Presentation of any such changes. There may be developments in the future that cause funds managed by Marcato to engage in transactions that change the beneficial and/or economic interest in the Company. The Presentation may contain forward-looking statements which reflect Marcato’s views with respect to, among other things, future events and financial performance. Forward-looking statements are subject to various risks and uncertainties and assumptions. There can be no assurance that any idea or assumption herein is, or will be proven, correct. If one or more of the risks or uncertainties materialize, or if Marcato’s underlying assumptions prove to be incorrect, the actual results may vary materially from outcomes indicated by these statements. Accordingly, forward-looking statements should not be regarded as a representation by Marcato that the future plans, estimates or expectations contemplated will ever be achieved. The securities or investment ideas listed are not presented in order to suggest or show profitability of any or all transactions. There should be no assumption that any specific portfolio securities identified and described in the Presentation were or will be profitable. Under no circumstances is the Presentation to be used or considered as an offer to sell or a solicitation of an offer to buy any security, nor does the Presentation constitute either an offer to sell or a solicitation of an offer to buy any interest in funds managed by Marcato. Any such offer would only be made at the time a qualified offeree receives the Confidential Explanatory Memorandum of such fund. Any investment in the Marcato Funds is speculative and involves substantial risk, including the risk of losing all or substantially all of such investment.