Exhibit 99.5

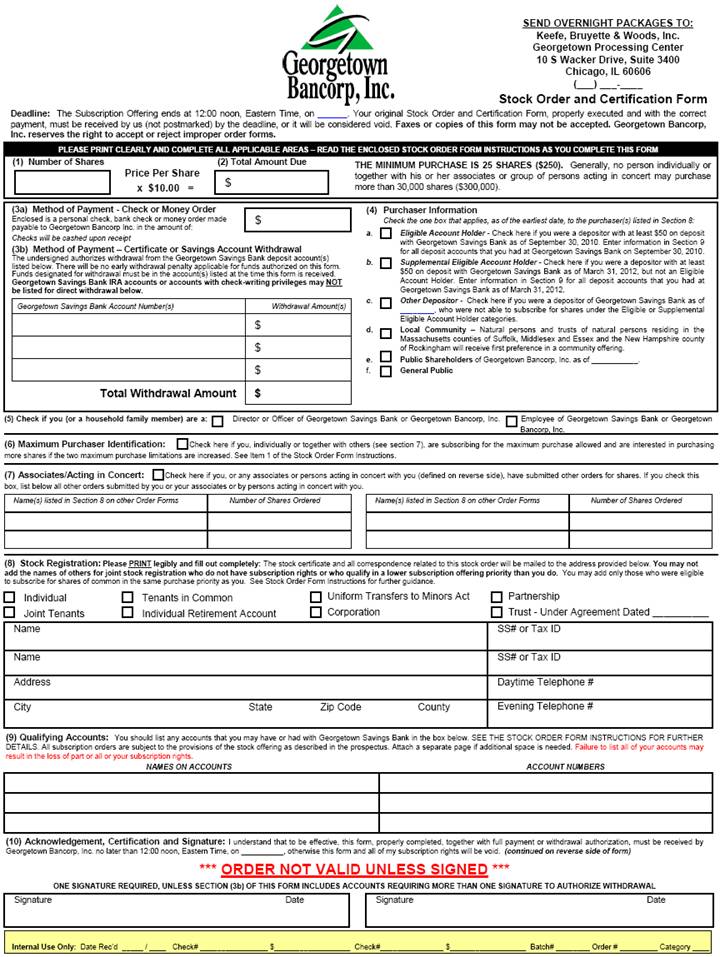

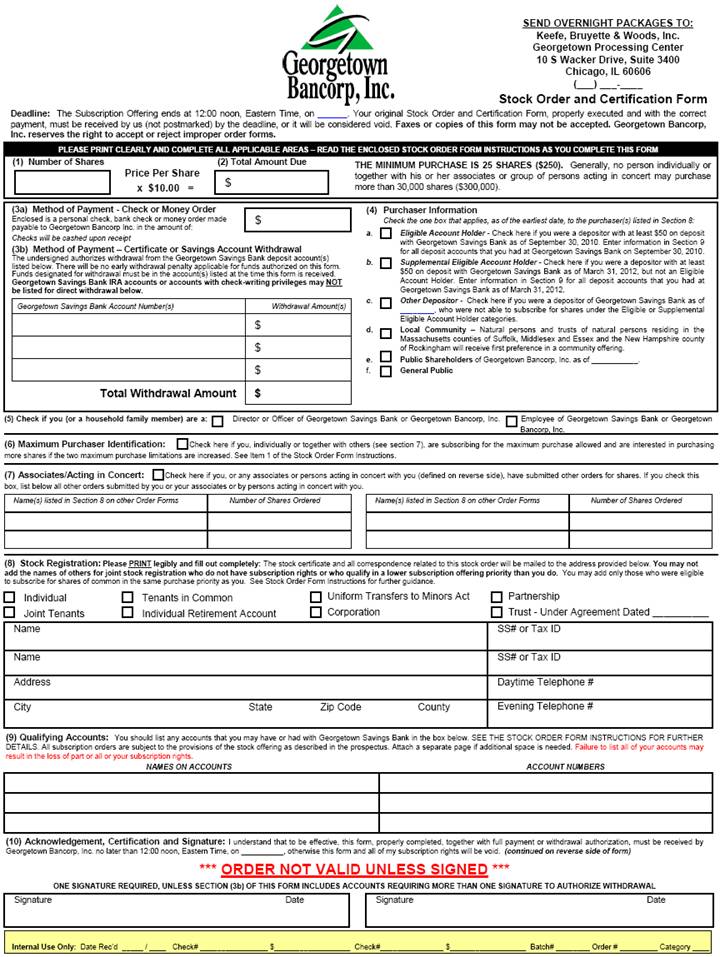

| Deadline: The Subscription Offering ends at 12:00 noon, Eastern Time, on ______. Your original Stock Order and Certification Form, properly executed and with the correct payment, must be received by us (not postmarked) by the deadline, or it will be considered void. Faxes or copies of this form may not be accepted. Georgetown Bancorp, Inc. reserves the right to accept or reject improper order forms. THE MINIMUM PURCHASE IS 25 SHARES ($250). Generally, no person individually or together with his or her associates or group of persons acting in concert may purchase more than 30,000 shares ($300,000). Tenants in Common Individual Retirement Account Individual Joint Tenants Uniform Transfers to Minors Act Corporation Partnership Trust - Under Agreement Dated __________ PLEASE PRINT CLEARLY AND COMPLETE ALL APPLICABLE AREAS – READ THE ENCLOSED STOCK ORDER FORM INSTRUCTIONS AS YOU COMPLETE THIS FORM (7) Associates/Acting in Concert: Check here if you, or any associates or persons acting in concert with you (defined on reverse side), have submitted other orders for shares. If you check this box, list below all other orders submitted by you or your associates or by persons acting in concert with you. (6) Maximum Purchaser Identification: Check here if you, individually or together with others (see section 7), are subscribing for the maximum purchase allowed and are interested in purchasing more shares if the two maximum purchase limitations are increased. See Item 1 of the Stock Order Form Instructions. Eligible Account Holder - Check here if you were a depositor with at least $50 on deposit with Georgetown Savings Bank as of September 30, 2010. Enter information in Section 9 for all deposit accounts that you had at Georgetown Savings Bank on September 30, 2010. Supplemental Eligible Account Holder - Check here if you were a depositor with at least $50 on deposit with Georgetown Savings Bank as of March 31, 2012, but not an Eligible Account Holder. Enter information in Section 9 for all deposit accounts that you had at Georgetown Savings Bank as of March 31, 2012. Other Depositor - Check here if you were a depositor of Georgetown Savings Bank as of ________, who were not able to subscribe for shares under the Eligible or Supplemental Eligible Account Holder categories. Local Community – Natural persons and trusts of natural persons residing in the Massachusetts counties of Suffolk, Middlesex and Essex and the New Hampshire county of Rockingham will receive first preference in a community offering. Public Shareholders of Georgetown Bancorp, Inc. as of ___________. f. General Public x $10.00 = (1) Number of Shares (2) Total Amount Due Signature Date Internal Use Only: Date Rec’d _____ / ____ Check# ________________ $__________________ Check#_______________ $__________________ Batch# ________ Order # _________ Category ____ Signature Date Stock Order and Certification Form SEND OVERNIGHT PACKAGES TO: Keefe, Bruyette & Woods, Inc. Georgetown Processing Center 10 S Wacker Drive, Suite 3400 Chicago, IL 60606 (___) ___-____ $ $ $ Total Withdrawal Amount $ Georgetown Savings Bank Account Number(s) Withdrawal Amount(s) (3b) Method of Payment – Certificate or Savings Account Withdrawal The undersigned authorizes withdrawal from the Georgetown Savings Bank deposit account(s) listed below. There will be no early withdrawal penalty applicable for funds authorized on this form. Funds designated for withdrawal must be in the account(s) listed at the time this form is received. Georgetown Savings Bank IRA accounts or accounts with check-writing privileges may NOT be listed for direct withdrawal below. (3a) Method of Payment - Check or Money Order Enclosed is a personal check, bank check or money order made payable to Georgetown Bancorp Inc. in the amount of: (5) Check if you (or a household family member) are a: Director or Officer of Georgetown Savings Bank or Georgetown Bancorp, Inc. Employee of Georgetown Savings Bank or Georgetown Bancorp, Inc. Name(s) listed in Section 8 on other Order Forms Number of Shares Ordered Name(s) listed in Section 8 on other Order Forms Number of Shares Ordered (8) Stock Registration: Please PRINT legibly and fill out completely: The stock certificate and all correspondence related to this stock order will be mailed to the address provided below. You may not add the names of others for joint stock registration who do not have subscription rights or who qualify in a lower subscription offering priority than you do. You may add only those who were eligible to subscribe for shares of common in the same purchase priority as you. See Stock Order Form Instructions for further guidance. Evening Telephone # City State Zip Code County Daytime Telephone # Address SS# or Tax ID Name SS# or Tax ID Name (9) Qualifying Accounts: You should list any accounts that you may have or had with Georgetown Savings Bank in the box below. SEE THE STOCK ORDER FORM INSTRUCTIONS FOR FURTHER DETAILS. All subscription orders are subject to the provisions of the stock offering as described in the prospectus. Attach a separate page if additional space is needed. Failure to list all of your accounts may result in the loss of part or all or your subscription rights. NAMES ON ACCOUNTS ACCOUNT NUMBERS (10) Acknowledgement, Certification and Signature: I understand that to be effective, this form, properly completed, together with full payment or withdrawal authorization, must be received by Georgetown Bancorp, Inc. no later than 12:00 noon, Eastern Time, on __________, otherwise this form and all of my subscription rights will be void. (continued on reverse side of form) *** ORDER NOT VALID UNLESS SIGNED *** ONE SIGNATURE REQUIRED, UNLESS SECTION (3b) OF THIS FORM INCLUDES ACCOUNTS REQUIRING MORE THAN ONE SIGNATURE TO AUTHORIZE WITHDRAWAL Price Per Share $ $ Checks will be cashed upon receipt Purchaser Information Check the one box that applies, as of the earliest date, to the purchaser(s) listed in Section 8: a., b., c., d., e., |

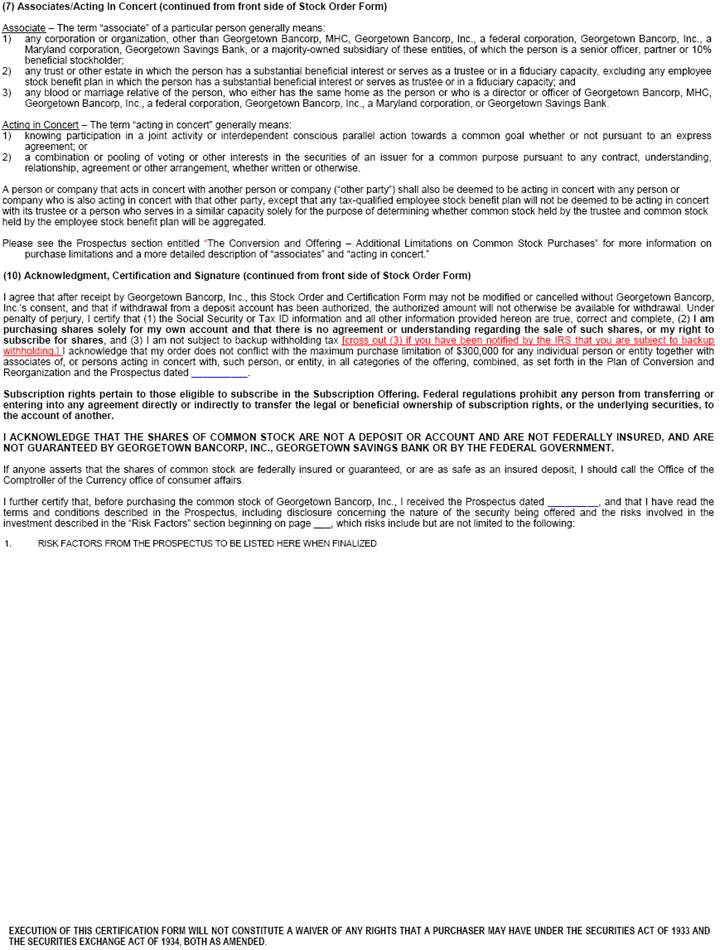

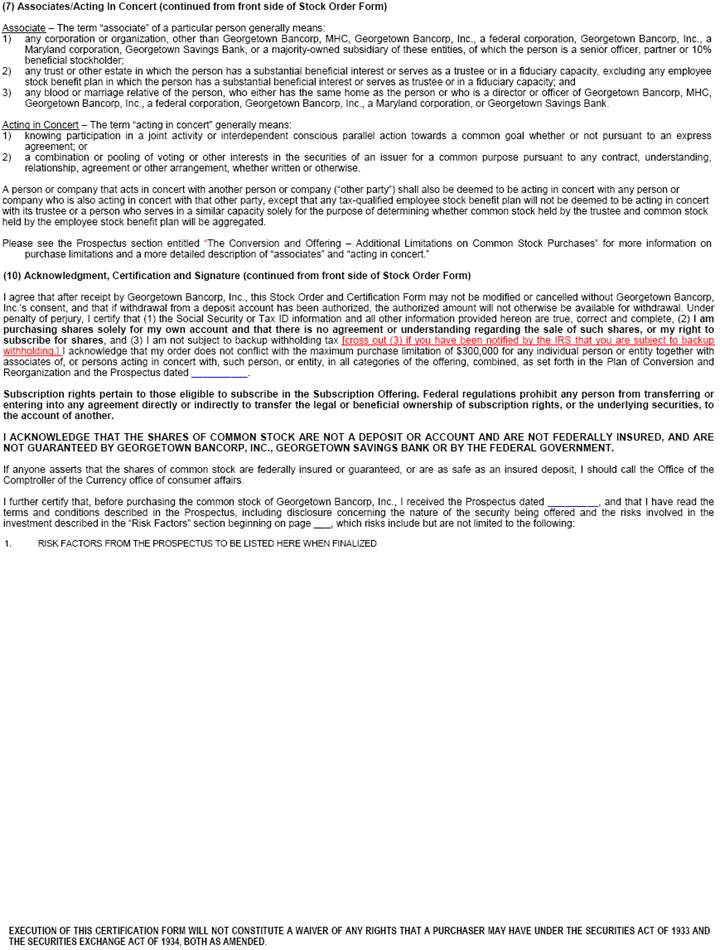

| (7) Associates/Acting In Concert (continued from front side of Stock Order Form) Associate – The term “associate” of a particular person generally means: 1) any corporation or organization, other than Georgetown Bancorp, MHC, Georgetown Bancorp, Inc., a federal corporation, Georgetown Bancorp, Inc., a Maryland corporation, Georgetown Savings Bank, or a majority-owned subsidiary of these entities, of which the person is a senior officer, partner or 10% beneficial stockholder; 2) any trust or other estate in which the person has a substantial beneficial interest or serves as a trustee or in a fiduciary capacity, excluding any employee stock benefit plan in which the person has a substantial beneficial interest or serves as trustee or in a fiduciary capacity; 3) and any blood or marriage relative of the person, who either has the same home as the person or who is a director or officer of Georgetown Bancorp, MHC, Georgetown Bancorp, Inc., a federal corporation, Georgetown Bancorp, Inc., a Maryland corporation, or Georgetown Savings Bank. Acting in Concert – The term “acting in concert” generally means: 1) knowing participation in a joint activity or interdependent conscious parallel action towards a common goal whether or not pursuant to an express agreement; or 2) a combination or pooling of voting or other interests in the securities of an issuer for a common purpose pursuant to any contract, understanding, relationship, agreement or other arrangement, whether written or otherwise. A person or company that acts in concert with another person or company (“other party”) shall also be deemed to be acting in concert with any person or company who is also acting in concert with that other party, except that any tax-qualified employee stock benefit plan will not be deemed to be acting in concert with its trustee or a person who serves in a similar capacity solely for the purpose of determining whether common stock held by the trustee and common stock held by the employee stock benefit plan will be aggregated. Please see the Prospectus section entitled “The Conversion and Offering – Additional Limitations on Common Stock Purchases” for more information on purchase limitations and a more detailed description of “associates” and “acting in concert.” EXECUTION OF THIS CERTIFICATION FORM WILL NOT CONSTITUTE A WAIVER OF ANY RIGHTS THAT A PURCHASER MAY HAVE UNDER THE SECURITIES ACT OF 1933 AND THE SECURITIES EXCHANGE ACT OF 1934, BOTH AS AMENDED. (10) Acknowledgment, Certification and Signature (continued from front side of Stock Order Form) I agree that after receipt by Georgetown Bancorp, Inc., this Stock Order and Certification Form may not be modified or cancelled without Georgetown Bancorp, Inc.’s consent, and that if withdrawal from a deposit account has been authorized, the authorized amount will not otherwise be available for withdrawal. Under penalty of perjury, I certify that (1) the Social Security or Tax ID information and all other information provided hereon are true, correct and complete, (2) I am purchasing shares solely for my own account and that there is no agreement or understanding regarding the sale of such shares, or my right to subscribe for shares, and (3) I am not subject to backup withholding tax [cross out (3) if you have been notified by the IRS that you are subject to backup withholding.] I acknowledge that my order does not conflict with the maximum purchase limitation of $300,000 for any individual person or entity together with associates of, or persons acting in concert with, such person, or entity, in all categories of the offering, combined, as set forth in the Plan of Conversion and Reorganization and the Prospectus dated __________. Subscription rights pertain to those eligible to subscribe in the Subscription Offering. Federal regulations prohibit any person from transferring or entering into any agreement directly or indirectly to transfer the legal or beneficial ownership of subscription rights, or the underlying securities, to the account of another. I ACKNOWLEDGE THAT THE SHARES OF COMMON STOCK ARE NOT A DEPOSIT OR ACCOUNT AND ARE NOT FEDERALLY INSURED, AND ARE NOT GUARANTEED BY GEORGETOWN BANCORP, INC., GEORGETOWN SAVINGS BANK OR BY THE FEDERAL GOVERNMENT. If anyone asserts that the shares of common stock are federally insured or guaranteed, or are as safe as an insured deposit, I should call the Office of the Comptroller of the Currency office of consumer affairs. I further certify that, before purchasing the common stock of Georgetown Bancorp, Inc., I received the Prospectus dated _________, and that I have read the terms and conditions described in the Prospectus, including disclosure concerning the nature of the security being offered and the risks involved in the investment described in the “Risk Factors” section beginning on page ___, which risks include but are not limited to the following: 1. RISK FACTORS FROM THE PROSPECTUS TO BE LISTED HERE WHEN FINALIZED |

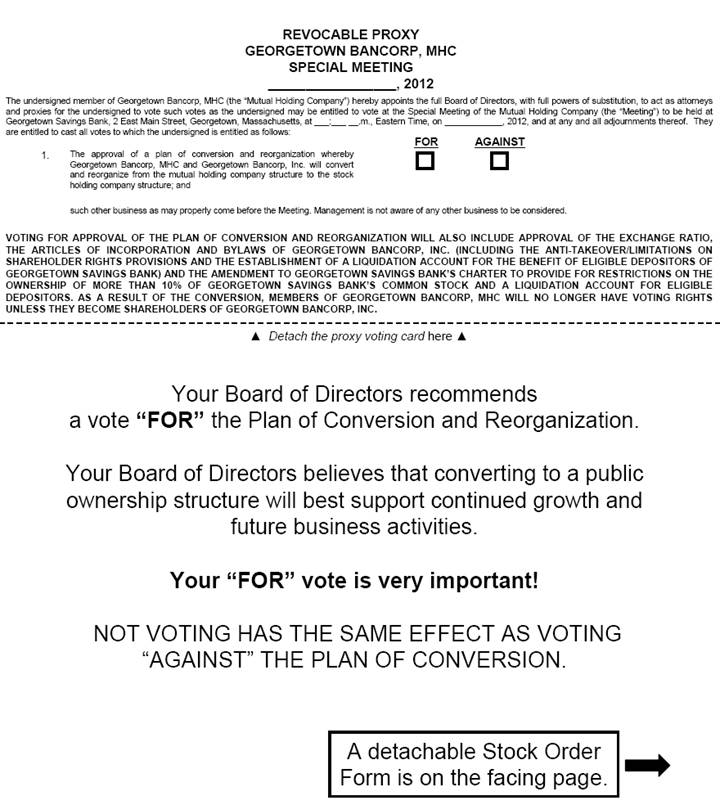

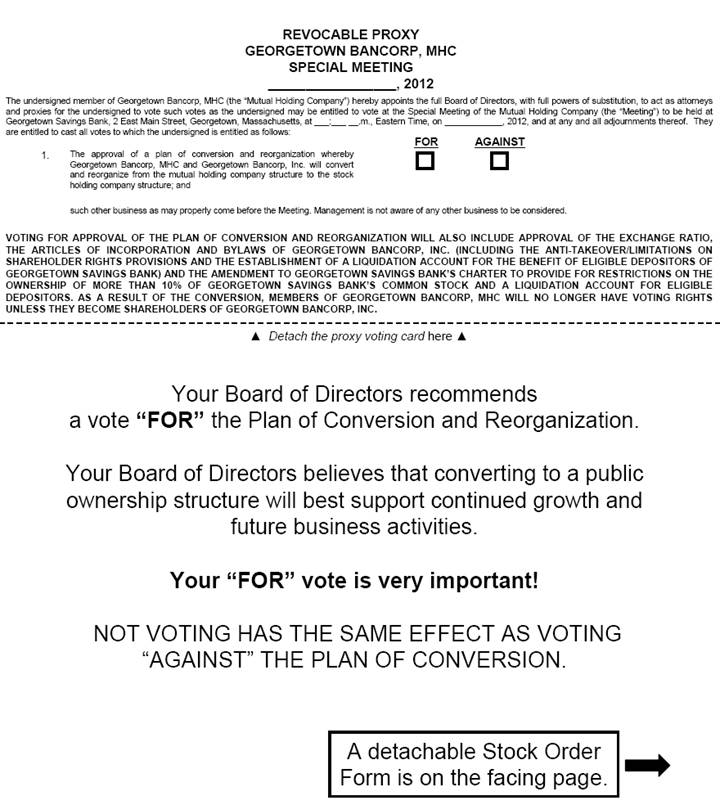

| A detachable Stock Order Form is on the facing page. REVOCABLE PROXY GEORGETOWN BANCORP, MHC SPECIAL MEETING, 2012 Detach the proxy voting card here The undersigned member of Georgetown Bancorp, MHC (the “Mutual Holding Company”) hereby appoints the full Board of Directors, with full powers of substitution, to act as attorneys and proxies for the undersigned to vote such votes as the undersigned may be entitled to vote at the Special Meeting of the Mutual Holding Company (the “Meeting”) to be held at Georgetown Savings Bank, 2 East Main Street, Georgetown, Massachusetts, at: .m., Eastern Time, on , 2012, and at any and all adjournments thereof. They are entitled to cast all votes to which the undersigned is entitled as follows: FOR AGAINST 1. The approval of a plan of conversion and reorganization whereby Georgetown Bancorp, MHC and Georgetown Bancorp, Inc. will convert and reorganize from the mutual holding company structure to the stock holding company structure; and such other business as may properly come before the Meeting. Management is not aware of any other business to be considered. VOTING FOR APPROVAL OF THE PLAN OF CONVERSION AND REORGANIZATION WILL ALSO INCLUDE APPROVAL OF THE EXCHANGE RATIO, THE ARTICLES OF INCORPORATION AND BYLAWS OF GEORGETOWN BANCORP, INC. (INCLUDING THE ANTI-TAKEOVER/LIMITATIONS ON SHAREHOLDER RIGHTS PROVISIONS AND THE ESTABLISHMENT OF A LIQUIDATION ACCOUNT FOR THE BENEFIT OF ELIGIBLE DEPOSITORS OF GEORGETOWN SAVINGS BANK) AND THE AMENDMENT TO GEORGETOWN SAVINGS BANK’S CHARTER TO PROVIDE FOR RESTRICTIONS ON THE OWNERSHIP OF MORE THAN 10% OF GEORGETOWN SAVINGS BANK’S COMMON STOCK AND A LIQUIDATION ACCOUNT FOR ELIGIBLE DEPOSITORS. AS A RESULT OF THE CONVERSION, MEMBERS OF GEORGETOWN BANCORP, MHC WILL NO LONGER HAVE VOTING RIGHTS UNLESS THEY BECOME SHAREHOLDERS OF GEORGETOWN BANCORP, INC. Your Board of Directors recommends a vote “FOR” the Plan of Conversion and Reorganization. Your Board of Directors believes that converting to a public ownership structure will best support continued growth and future business activities. Your “FOR” vote is very important! NOT VOTING HAS THE SAME EFFECT AS VOTING “AGAINST” THE PLAN OF CONVERSION. |

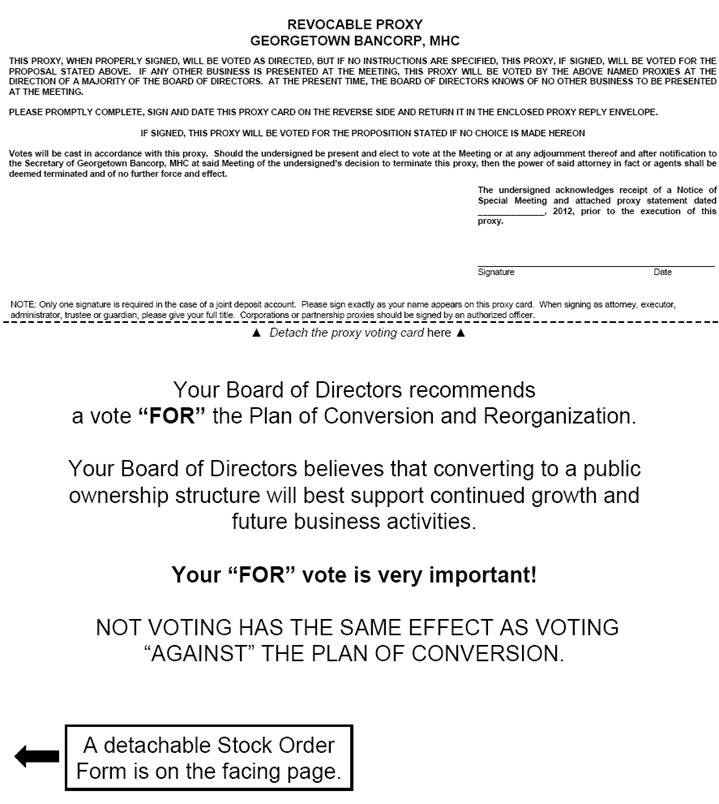

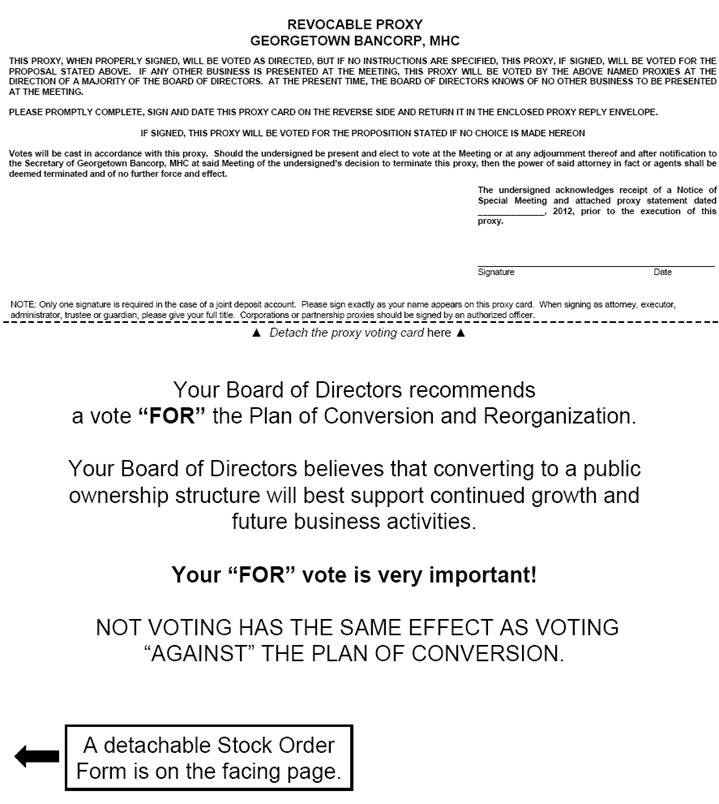

| THIS PROXY, WHEN PROPERLY SIGNED, WILL BE VOTED AS DIRECTED, BUT IF NO INSTRUCTIONS ARE SPECIFIED, THIS PROXY, IF SIGNED, WILL BE VOTED FOR THE PROPOSAL STATED ABOVE. IF ANY OTHER BUSINESS IS PRESENTED AT THE MEETING, THIS PROXY WILL BE VOTED BY THE ABOVE NAMED PROXIES AT THE DIRECTION OF A MAJORITY OF THE BOARD OF DIRECTORS. AT THE PRESENT TIME, THE BOARD OF DIRECTORS KNOWS OF NO OTHER BUSINESS TO BE PRESENTED AT THE MEETING. PLEASE PROMPTLY COMPLETE, SIGN AND DATE THIS PROXY CARD ON THE REVERSE SIDE AND RETURN IT IN THE ENCLOSED PROXY REPLY ENVELOPE. IF SIGNED, THIS PROXY WILL BE VOTED FOR THE PROPOSITION STATED IF NO CHOICE IS MADE HEREON Votes will be cast in accordance with this proxy. Should the undersigned be present and elect to vote at the Meeting or at any adjournment thereof and after notification to the Secretary of Georgetown Bancorp, MHC at said Meeting of the undersigned’s decision to terminate this proxy, then the power of said attorney in fact or agents shall be deemed terminated and of no further force and effect. Detach the proxy voting card here A detachable Stock Order Form is on the facing page. Your Board of Directors recommends a vote “FOR” the Plan of Conversion and Reorganization. Your Board of Directors believes that converting to a public ownership structure will best support continued growth and future business activities. Your “FOR” vote is very important! NOT VOTING HAS THE SAME EFFECT AS VOTING “AGAINST” THE PLAN OF CONVERSION. The undersigned acknowledges receipt of a Notice of Special Meeting and attached proxy statement dated , 2012, prior to the execution of this proxy. Signature Date NOTE: Only one signature is required in the case of a joint deposit account. Please sign exactly as your name appears on this proxy card. When signing as attorney, executor, administrator, trustee or guardian, please give your full title. Corporations or partnership proxies should be signed by an authorized officer. REVOCABLE PROXY GEORGETOWN BANCORP, MHC |

Georgetown Bancorp, Inc.

Stock Order Form Instructions

Stock Information Center: ( ) -

Stock Order Form Instructions – All orders are subject to the provisions of the stock offering as described in the prospectus.

Item 1 and 2 - Fill in the number of shares that you wish to purchase and the total payment due. The amount due is determined by multiplying the number of shares ordered by the subscription price of $10.00 per share. The minimum number of shares of common stock you may order is 25 shares. The maximum number of shares of common stock that can be ordered by an individual or through a single qualifying account is 30,000 shares, and no person together with an associate or group of persons acting in concert may purchase more than 30,000 shares. For additional information, see “The Conversion and Offering – Additional Limitations on Common Stock Purchases” in the prospectus.

Item 3a – Payment for shares may be made by check, bank draft or money order payable to Georgetown Bancorp, Inc. DO NOT MAIL CASH. Funds received during the offering will be held in a segregated account at Georgetown Savings Bank and will earn interest at a rate of [. %] per annum until completion of the offering.

Item 3b - To pay by withdrawal from a savings account or certificate of deposit at Georgetown Savings Bank insert the account number(s) and the amount(s) you wish to withdraw from each account. If more than one signature is required for a withdrawal, all signatories must sign in the signature box on the front of the Stock Order and Certification Form. To withdraw from an account with checking privileges, please write a check. Georgetown Savings Bank will waive any applicable penalties for early withdrawal from certificate of deposit accounts (CDs) for the purpose of purchasing stock in the offering. A hold will be placed on the account(s) for the amount(s) you indicate to be withdrawn. Payments will remain in account(s) until the Stock Offering closes and earn their respective rate of interest, but will not be available for your use until the completion of the transaction.

Item 4 - Please check the appropriate box to tell us the earliest of the depositor dates that apply to you, or the local community, public shareholder, or general public boxes if you were not a qualifying depositor of Georgetown Savings Bank on any of the key dates.

Item 5 - Please check one of these boxes if you are a director, officer or employee of Georgetown Savings Bank, Georgetown Bancorp, MHC, Georgetown Bancorp, Inc., or a member of such person’s household.

Item 6 - Please check the box, if applicable. If you check the box but have not subscribed for the maximum amount and did not complete Item 7, you may not be eligible to purchase more shares.

Item 7 - Check the box, if applicable, and provide the requested information. Attach a separate page, if necessary. In the Prospectus dated , 2012, please see the section entitled “The Conversion and Offering - Limitations on Common Stock Purchases” for more information regarding the definition of “associate” and “acting in concert.”

Item 8 - The stock transfer industry has developed a uniform system of shareholder registrations that we will use in the issuance of Georgetown Bancorp, Inc. common stock. Please complete this section as fully and accurately as possible, and be certain to supply your social security or Tax I.D. number(s) and your daytime and evening phone numbers. We will need to call you if we cannot execute your order as given. If you have any questions regarding the registration of your stock, please consult your legal advisor or contact the Stock Information Center at ( ) - . Subscription rights are not transferable. If you are an eligible or supplemental eligible account holder or other member, to protect your priority over other purchasers as described in the prospectus, you must take ownership in at least one of the account holder’s names.

Item 9 – You should list any qualifying accounts that you have or may have had with Georgetown Savings Bank in the box located under the heading “Qualifying Accounts”. For example, if you are ordering stock in just your name, you should list all of your account numbers as of the earliest of the three dates that you were a depositor. Similarly, if you are ordering stock jointly with another depositor, you should list all account numbers under which either of you are owners, i.e. individual accounts, joint accounts, etc. If you are ordering stock in your minor child’s or grandchild’s name under the Uniform Transfers to Minors Act, the minor must have had an account number on one of the three dates and you should list only their account number(s). If you are ordering stock as a corporation, you need to list just that corporation’s account number, as your individual account number(s) do not qualify. Failure to list all of your qualifying deposit account numbers may result in the loss of part or all of your subscription rights.

Item 10 - Sign and date the form where indicated. Before you sign please read carefully and review the information which you have provided and read the acknowledgement. Only one signature is required, unless any account listed in section 3b of this form requires more than one signature to authorize a withdrawal. Please review the Prospectus dated , carefully before making an investment decision.

For additional information, refer to the prospectus or call our information hotline at ( ) - to speak to a representative of Keefe, Bruyette & Woods, Inc. Representatives are available by telephone Monday through Friday, 10:00 a.m. to 6:00 p.m., Eastern Time. You may also meet in person with a representative by visiting our stock information center located in our office at 2 East Main Street, Georgetown, Massachusetts on Mondays from 12:00 Noon to 5:00 p.m. and Tuesdays and Wednesdays from 9:00 a.m. to 5:00 p.m. The stock information center will be closed on weekends and bank holidays.

(See Reverse Side for Stock Ownership Guide)

Georgetown Bancorp, Inc.

Stock Ownership Guide

Stock Information Center: ( ) -

Individual - The stock is to be registered in an individual’s name only. You may not list beneficiaries for this ownership.

Joint Tenants - Joint tenants with rights of survivorship identifies two or more owners. When stock is held by joint tenants with rights of survivorship, ownership automatically passes to the surviving joint tenant(s) upon the death of any joint tenant. You may not list beneficiaries for this ownership.

Tenants in Common - Tenants in common may also identify two or more owners. When stock is to be held by tenants in common, upon the death of one co-tenant, ownership of the stock will be held by the surviving co-tenant(s) and by the heirs of the deceased co-tenant. All parties must agree to the transfer or sale of shares held by tenants in common. You may not list beneficiaries for this ownership.

Individual Retirement Account - Individual Retirement Account (“IRA”) holders may potentially make stock purchases from their existing IRA if it is a self-directed IRA or through a prearranged “trustee-to-trustee” transfer if their IRA is currently at Georgetown Savings Bank. The stock cannot be held in your Georgetown Savings Bank account. Please contact your broker or self-directed IRA account provider as quickly as possible to explore this option, as it may take a number of weeks to complete a trustee-to-trustee transfer and place a subscription in this manner.

Registration for IRA’s: | On Name Line 1 - list the name of the broker or trust department followed by CUST or TRUSTEE. |

| On Name Line 2 - FBO (for benefit of) YOUR NAME [IRA a/c # ]. |

| Address will be that of the broker / trust department to where the stock certificate will be sent. |

| The Social Security / Tax I.D. number(s) will be either yours or your trustee’s, as the trustee directs. |

| Please list your phone numbers, not the phone numbers of your broker / trust department. |

Uniform Transfers To Minors Act - For residents of Massachusetts and many states, stock may be held in the name of a custodian for the benefit of a minor under the Uniform Transfers to Minors Act. In this form of ownership, the minor is the actual owner of the stock with the adult custodian being responsible for the investment until the child reaches legal age. Only one custodian and one minor may be designated.

Registration for UTMA: | On Name Line 1 – print the name of the custodian followed by the abbreviation “CUST” |

| On Name Line 2 – FBO (for benefit of) followed by the name of the minor, followed by UTMA-MA |

| (or your state’s abbreviation) |

| List only the minor’s social security number on the form. |

Corporation/Partnership – Corporations/Partnerships may purchase stock. Please provide the Corporation/Partnership’s legal name and Tax I.D. To have subscription rights, the Corporation/Partnership must have an account in its legal name and Tax I.D. Please contact the Stock Information Center to verify depositor rights and purchase limitations.

Fiduciary/Trust - Generally, fiduciary relationships (such as Trusts, Estates, Guardianships, etc.) are established under a form of trust agreement or pursuant to a court order. Without a legal document establishing a fiduciary relationship, your stock may not be registered in a fiduciary capacity.

Instructions: On the first name line, print the first name, middle initial and last name of the fiduciary if the fiduciary is an individual. If the fiduciary is a corporation, list the corporate title on the first name line. Following the name, print the fiduciary title, such as trustee, executor, personal representative, etc. On the second name line, print the name of the maker, donor or testator or the name of the beneficiary. Following the name, indicate the type of legal document establishing the fiduciary relationship (agreement, court order, etc.). In the blank after “Under Agreement Dated,” fill in the date of the document governing the relationship. The date of the document need not be provided for a trust created by a will.

For additional information, refer to the prospectus or call our information hotline at ( ) - to speak to a representative of Keefe, Bruyette & Woods, Inc. Representatives are available by telephone Monday through Friday, 10:00 a.m. to 6:00 p.m., Eastern Time. You may also meet in person with a representative by visiting our stock information center located in our office at 2 East Main Street, Georgetown, Massachusetts on Mondays from 12:00 Noon to 5:00 p.m. and Tuesdays and Wednesdays from 9:00 a.m. to 5:00 p.m. The stock information center will be closed on weekends and bank holidays.

(See Reverse Side for Stock Order Form Instructions)