As filed with the Securities and Exchange Commission on September 6, 2012

1933 Act File No. 333-182742

1940 Act File No. 811-03763

Securities and Exchange Commission

Washington, D.C. 20549

Amendment No. 2

to

Form S-6

For Registration under the Securities Act of 1933 of Securities of Unit Investment Trusts Registered on Form N-8B-2

| A. | Exact name of Trust: Incapital Unit Trust, Series 9 |

| B. | Name of Depositor: Incapital LLC |

| C. | Complete address of Depositor’s principal executive offices: |

200 South Wacker Drive, Suite 3700

Chicago, IL 60606

| D. | Name and complete address of agents for service: |

Incapital LLC

Attention: Brandon L. Klerk

Chief Compliance Officer

Incapital, LLC

200 South Wacker Drive, Suite 3700

Chicago, Illinois 60606

Chapman and Cutler LLP

Attention: Morrison C. Warren

111 West Monroe Street

Chicago, Illinois 60603

It is proposed that this filing will become effective (check appropriate box)

o immediately upon filing pursuant to paragraph (b)

o on (date) pursuant to paragraph (b)

o 60 days after filing pursuant to paragraph (a)(1)

o on (date) pursuant to paragraph (a)(1) of rule 485

| E. | Title of securities being registered: Units of fractional undivided beneficial interest. |

| F. | Approximate date of proposed sale to the public: As soon as practicable after the effective date of the Registration Statement. |

Check box if it is proposed that this filing will become effective on (date) at (time) Eastern Time pursuant to Rule 487.

(Incapital Logo)

Incapital Unit Trust, Series 9

North American Dividend Builders Portfolio, 3Q 2012

Prospectus Part A

Dated September 6, 2012

You should read this prospectus

and retain it for future reference.

The Securities and Exchange Commission has not approved or disapproved of these securities or passed upon the

adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

NORTH AMERICAN

DIVIDEND BUILDERS

PORTFOLIO, 3Q 2012

OVERVIEW

Incapital Unit Trust, Series 9, is a unit investment trust that consists of North American Dividend Builders Portfolio, 3Q 2012 (the “Trust”). Incapital LLC (the “Sponsor”) serves as the Sponsor of the Trust.

The Trust is scheduled to terminate in approximately 15 months from the inception date.

INVESTMENT OBJECTIVE

The Trust seeks to provide capital appreciation with the potential to receive dividend income by investing in securities.

PRINCIPAL INVESTMENT STRATEGY

Under normal circumstances, the Trust will invest at least 80% of the value of its net assets (plus borrowings, if any) in securities of issuers tied economically to North America. The Trust seeks to achieve its objective by investing in a portfolio of securities that the Sponsor believes have high and sustainable expected dividend or income yields. The portfolio replicates the Goldman Sachs North American Dividend Builders Basket (the “basket”) as of August 21, 2012, which identifies and includes, in the manner described below, 75 publicly-traded and sector-weighted securities of issuers economically tied to either the United States or Canada (each, an “included country” and together, the “included countries”), selected from the S&P 500 Index (the “U.S. index”) and the S&P/TSX Composite Index (the “Canada index”, and each of the U.S. index and the Canada index, are the “included index”). The Trust may hold small- and mid-cap securities. The Sponsor believes that selection of securities in accordance with this methodology, which is systematic and objective, will provide the Trust with the opportunity to meet its investment objective.

| | | | | | | |

TRUST PORTFOLIO | | | | |

INCAPITAL UNIT TRUST, SERIES 9 | | | |

THE NORTH AMERICAN DIVIDEND BUILDERS PORTFOLIO, 3Q 2012 | | |

AS OF THE TRUST INCEPTION DATE, SEPTEMBER 6, 2012 | | |

| |

| | | | | Percentage | Market | |

| | | | | of Aggregate | Value | Cost of |

Number of | | | | Offering | per | Securities |

Shares | | Ticker | Issuer | Price | Share (1) | to Trust (2) |

| | | | COMMON STOCKS: 100% | | | |

| | | | Consumer Discretionary: 8.77% | | | |

124 | | AIM | Aimia Inc.(5) | 1.52% | $ 14.70 | $ 1,823 |

70 | | GCI | Gannett Co., Inc. | 0.91 | 15.56 | 1,089 |

18 | | GPC | Genuine Parts Company | 0.91 | 61.10 | 1,100 |

30 | | HAS | Hasbro, Inc. | 0.93 | 37.13 | 1,114 |

38 | | LOW | Lowe's Companies, Inc. | 0.89 | 28.10 | 1,068 |

31 | | MAT | Mattel, Inc. | 0.90 | 34.76 | 1,078 |

12 | | MCD | McDonald's Corporation | 0.89 | 89.06 | 1,069 |

102 | | SPLS | Staples, Inc. | 0.94 | 11.10 | 1,132 |

14 | | WHR | Whirlpool Corporation | 0.88 | 75.25 | 1,054 |

| | | | Consumer Staples: 8.44% | | | |

87 | | CAG | ConAgra Foods, Inc. | 1.84 | 25.43 | 2,212 |

40 | | HNZ | H.J. Heinz Company | 1.85 | 55.49 | 2,220 |

25 | | PM | Philip Morris International Inc. | 1.85 | 89.09 | 2,227 |

29 | | SC | Shoppers Drug Mart Corporation (5) | 1.04 | 43.12 | 1,251 |

74 | | SYY | Sysco Corporation | 1.86 | 30.16 | 2,232 |

| | | | Energy: 16.43% | | | |

73 | | COS | Canadian Oil Sands Ltd. (5) | 1.27 | 20.99 | 1,532 |

47 | | CVE | Cenovus Energy Inc. (5) | 1.27 | 32.41 | 1,523 |

16 | | CVX | Chevron Corporation | 1.47 | 110.77 | 1,772 |

21 | | XOM | Exxon Mobil Corporation | 1.52 | 87.33 | 1,834 |

70 | | GEI | Gibson Energy Inc. (5) | 1.27 | 21.87 | 1,531 |

71 | | IPL-U | Inter Pipeline Fund (5) | 1.28 | 21.62 | 1,535 |

34 | | KEY | Keyera Corp. (5) | 1.29 | 45.60 | 1,550 |

66 | | MTL | Mullen Group Ltd. (5) | 1.26 | 22.95 | 1,515 |

22 | | OXY | Occidental Petroleum Corporation | 1.51 | 82.65 | 1,818 |

25 | | SLB | Schlumberger Limited (3) | 1.48 | 71.25 | 1,781 |

34 | | TRP | TransCanada Corporation (5) | 1.28 | 45.18 | 1,536 |

59 | | VLO | Valero Energy Corporation | 1.53 | 31.22 | 1,842 |

| | | | | | | |

TRUST PORTFOLIO (continued) | | | |

INCAPITAL UNIT TRUST, SERIES 9 | | | |

THE NORTH AMERICAN DIVIDEND BUILDERS PORTFOLIO, 3Q 2012 | | |

AS OF THE TRUST INCEPTION DATE, SEPTEMBER 6, 2012 | | |

| |

| | | | | Percentage | Market | |

| | | | | of Aggregate | Value | Cost of |

Number of | | | | Offering | per | Securities |

Shares | | Ticker | Issuer | Price | Share (1) | to Trust (2) |

| | | | COMMON STOCKS: (continued) | | | |

| | | | Financials: 19.83% | | | |

31 | | AFL | Aflac, Inc. | 1.18% | $ 45.88 | $ 1,422 |

| 8 | | BLK | BlackRock, Inc. | 1.17 | 176.00 | 1,408 |

140 | | GWO | Great-West Lifeco Inc. (5) | 2.56 | 22.01 | 3,081 |

61 | | IVZ | Invesco Ltd. (3) | 1.21 | 23.85 | 1,455 |

17 | | MTB | M&T Bank Corporation | 1.25 | 88.35 | 1,502 |

43 | | MET | MetLife, Inc. | 1.22 | 34.01 | 1,462 |

57 | | NYX | NYSE Euronext | 1.20 | 25.39 | 1,447 |

130 | | POW | Power Corporation of Canada (5) | 2.53 | 23.39 | 3,040 |

123 | | PWF | Power Financial Corporation (5) | 2.57 | 25.18 | 3,098 |

53 | | PFG | Principal Financial Group, Inc. | 1.21 | 27.53 | 1,459 |

26 | | PRU | Prudential Financial, Inc. | 1.18 | 54.67 | 1,421 |

133 | | SLF | Sun Life Financial Inc. (5) | 2.55 | 23.07 | 3,068 |

| | | | Health Care: 8.37% | | | |

28 | | ABT | Abbott Laboratories | 1.53 | 65.75 | 1,841 |

| 8 | | CCT | Catamaran Corporation (4) (5) | 0.61 | 92.41 | 739 |

41 | | LLY | Eli Lilly and Company | 1.56 | 45.81 | 1,878 |

28 | | JNJ | Johnson & Johnson | 1.57 | 67.27 | 1,884 |

43 | | MRK | Merck & Co., Inc. | 1.55 | 43.44 | 1,868 |

78 | | PFE | Pfizer Inc. | 1.55 | 23.92 | 1,866 |

| | | | Industrials: 8.86% | | | |

28 | | EMR | Emerson Electric Co. | 1.14 | 49.00 | 1,372 |

21 | | GD | General Dynamics Corporation | 1.13 | 64.78 | 1,360 |

15 | | LMT | Lockheed Martin Corporation | 1.14 | 91.53 | 1,373 |

21 | | NOC | Northrop Grumman Corporation | 1.16 | 66.52 | 1,397 |

24 | | RTN | Raytheon Company | 1.13 | 56.84 | 1,364 |

35 | | SNC | SNC-Lavalin Group Inc. (5) | 1.04 | 35.68 | 1,249 |

19 | | UPS | United Parcel Service, Inc. | 1.14 | 71.94 | 1,367 |

27 | | WJX | Wajax Corp (5) | 0.98 | 43.56 | 1,176 |

| | | | Information Technology: 13.88% | | | |

38 | | ACN | Accenture PLC (3) | 1.94 | 61.35 | 2,331 |

40 | | ADP | Automatic Data Processing, Inc. | 1.93 | 58.19 | 2,328 |

122 | | CSCO | Cisco Systems, Inc. | 1.92 | 18.90 | 2,306 |

196 | | GLW | Corning Incorporated | 1.93 | 11.85 | 2,323 |

| 7 | | MDA | MacDonald Dettwiler & Associates Ltd. (5) | 0.37 | 63.26 | 443 |

68 | | MCHP | Microchip Technology Incorporated | 1.93 | 34.08 | 2,317 |

| | | | | | | |

TRUST PORTFOLIO (continued) | | | |

INCAPITAL UNIT TRUST, SERIES 9 | | | |

THE NORTH AMERICAN DIVIDEND BUILDERS PORTFOLIO, 3Q 2012 | | |

AS OF THE TRUST INCEPTION DATE, SEPTEMBER 6, 2012 | | |

| |

| | | | | Percentage | Market | |

| | | | | of Aggregate | Value | Cost of |

Number of | | | | Offering | per | Securities |

Shares | | Ticker | Issuer | Price | Share (1) | to Trust (2) |

| | | | COMMON STOCKS: (continued) | | | |

| | | | Information Technology (continued) | | | |

77 | | MSFT | Microsoft Corporation | 1.94% | $ 30.39 | $ 2,340 |

69 | | XLNX | Xilinx, Inc. | 1.92 | 33.39 | 2,304 |

| | | | Materials: 8.49% | | | |

13 | | AGU | Agrium Inc. (5) | 1.05 | 97.49 | 1,267 |

26 | | CLF | Cliffs Natural Resources Inc. | 0.75 | 34.72 | 903 |

18 | | DD | E.I. du Pont de Nemours and Company | 0.73 | 48.78 | 878 |

92 | | ELD | Eldorado Gold Corporation (5) | 1.04 | 13.67 | 1,257 |

24 | | FNV | Franco-Nevada Corporation (5) | 1.05 | 52.89 | 1,269 |

69 | | PAA | Pan American Silver Corporation (5) | 1.04 | 18.18 | 1,255 |

31 | | POT | Potash Corporation of Saskatchewan Inc. (5) | 1.06 | 41.01 | 1,271 |

35 | | SLW | Silver Wheaton Corporation (5) | 1.04 | 35.65 | 1,248 |

31 | | DOW | The Dow Chemical Company | 0.73 | 28.45 | 882 |

| | | | Telecommunication Services: 3.90% | | | |

69 | | T | AT&T Inc. | 2.11 | 36.93 | 2,548 |

48 | | BCE | BCE Inc. (5) | 1.79 | 44.76 | 2,148 |

| | | | Utilities: 3.03% | | | |

15 | | DUK | Duke Energy Corporation | 0.80 | 64.47 | 967 |

23 | | EMA | Emera Inc. (5) | 0.66 | 34.58 | 795 |

22 | | FE | FirstEnergy Corp. | 0.78 | 42.78 | 941 |

55 | | TE | TECO Energy,Inc. | 0.79 | 17.36 | 955 |

| | | | | | | $ 120,311 |

| |

Notes to Portfolio | | | | |

| 1 | The value of each security is based on the most recent closing sale price of each security as of the close of regular trading on the New York Stock Exchange on the business day prior to the Trust’s Inception Date. The Portfolio’s investments are classified as Level 1, which refers to security prices determined using quoted prices in active markets for identical securities. |

| 2 | The cost of the securities to the Sponsor and the Sponsor’s profit (or loss) (which is the difference between the cost of the securities to the Sponsor and the cost of the securities to the Trust) are $120,311 and $0, respectively. |

| 3 | This is a security issued by a foreign company that trades directly on a U.S. exchange. |

| 4 | Non-income producing security. |

| 5 | This is a security that trades on a foreign exchange. |

[

THE GOLDMAN SACHS NORTH AMERICAN DIVIDEND BUILDERS BASKET

The basket aims to identify securities of issuers with high and sustainable expected dividend or income yields, focusing on issuers with positive forecasted stock dividend or income payout growth. The basket is comprised of 75 publicly-traded and sector-weighted securities of issuers economically tied to either the United States or Canada with high expected dividend or income yields selected from the 10 sectors of the Global Industry Classification Standards (GICS) developed by MSCI, Inc. (“MSCI”) and Standard and Poor’s (“S&P”).Of the 75 securities, 50 were selected from the U.S. index and 25 were selected from the Canada index. As of August 21, 2012, the market capitalization range of these 75 securities was approximately $700 million to $400 billion. The U.S. index is composed of the stocks of 500 large capitalization companies in leading industries of the U.S. economy, capturing approximately 75% coverage of U.S. equities. The Canada index includes equity securities of companies domiciled in Canada and income trust units issued by income trusts domiciled in Canada, however, the Trust does not hold any income trusts. The Canada index is an indicator of market activity for Canadian equity markets and covers approximately 95% of the Canadian equities market. Please note, there can be no assurance that the securities selected will have high dividend or income yields or will have positive performance.

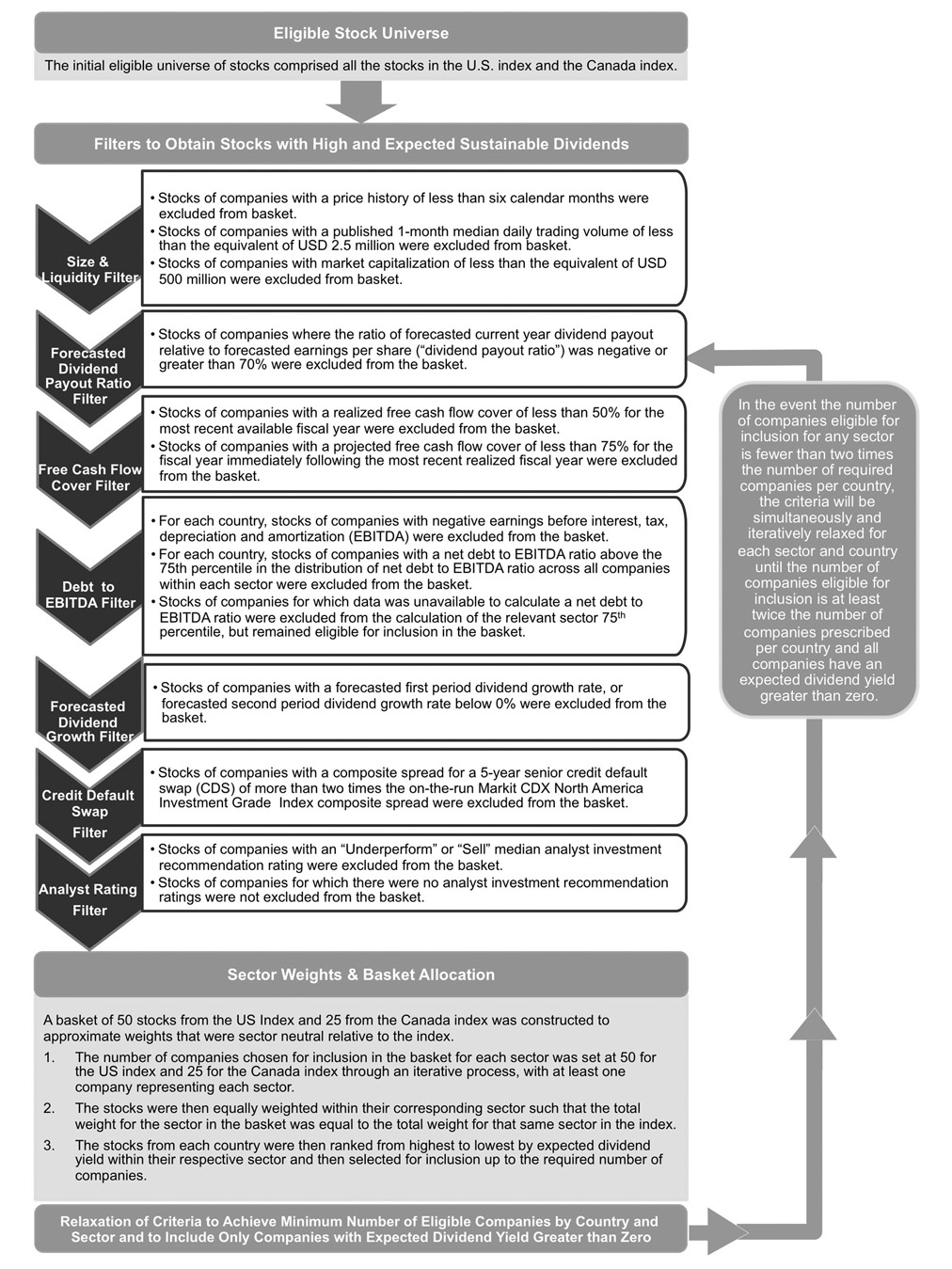

The following diagram broadly outlines the security selection process for the basket. For a more detailed step-by-step methodology see “Selection of the Basket Components” below.

Selection of the Basket Components. The basket was determined by The Goldman Sachs Group, Inc. (together with any of its affiliates, the “basket sponsor”) in accordance with the selection methods described below. The basket components were determined by applying the following steps based on data as of August 21, 2012 (the “observation date”):

Step One – Identification of Initially Eligible Securities. The securities initially eligible for inclusion in the basket comprised the securities of all of the issuers included in the U.S. index and Canada index.

Step Two – Exclusion of Smaller, Less Liquid Issuers.The securities of eligible issuers with a price history of less than six calendar months, as published by Bloomberg on their respective reference exchange (as defined below), were excluded from the basket. Similarly, the securities of eligible issuers with a published one-month median daily trading volume (“MDTV”) on their reference exchange, as indicated on Bloomberg, of less than USD 2.5 million were excluded from the basket.In addition, the securities of eligible issuers with a market capitalization of less than USD 500 million were also excluded from the basket. For securities denominated in Canadian dollars (“CAD”), their MDTV or market capitalization, as applicable, was converted to U.S. dollars (“USD”) using the local CAD/USD exchange rate based on the mid-closing exchange rate, as published by WM Company on Thomson Reuters Eikon at 4:00 P.M. New York time on the observation date.

Step Three – Exclusion of Issuers with Negative Forecasted Current Year Stock Dividend or Income Payout or High Forecasted Current Year Stock Dividend or Income Payout Relative to Forecasted Current Year Earnings. All remaining eligible securities with a forecasted current year dividend or income payout ratio that was either negative or greater than 70% were excluded from the basket.The forecasted current year dividend or income payout ratio was calculated as the forecasted dividend payout per share for the current fiscal year divided by forecasted earnings per share for the current fiscal year, in each case as published in the IBES Summary database.

Step Four – Exclusion of Issuers With Inadequate Free Cash Flow Cover for the Most Recent Available Fiscal Years. The remaining securities of eligible issuers with a realized free cash flow cover of less than 50% for the most recent available fiscal year were excluded from the basket. The securities of eligible issuers with a projected free cash flow cover of less than 75% for the fiscal year immediately following the most recent realized fiscal year were also excluded from the basket.Free cash flow cover was calculated by subtracting the capital expenditure per share from the cash flow from operations per share and dividing the result by the dividends per share, in each case using realized and projected data as published in the IBES Summary database.

Step Five – Exclusion of Issuers With Negative Earnings Before Interest, Tax, Depreciation and Amortization (“EBITDA”) and High Net Debt to EBITDA Ratios. All remaining securities with negative EBITDA, as published in the IBES Summary database, are excluded from the basket.Additionally, the securities of remaining eligible issuers with a net debt to EBITDA ratio above the 75th percentile in

the distribution of net debt to EBITDA ratio across all issuers with non-negative EBITDA within each sector for each included country, were excluded from the basket.The net debt to EBITDA ratio was calculated for each issuer by dividing the net debt by EBITDA, each as published in the IBES Summary database. The securities of issuers for which data was unavailable to calculate a net debt to EBITDA ratio were excluded from the calculation of the relevant sector 75th percentile, but remained eligible for inclusion in the basket.

Step Six – Exclusion of Issuers With Negative Forecasted Dividend or Income Growth Rates. The securities of remaining eligible issuers with a forecasted dividend or income growth rate below 0% for either the 12-month period from September 1, 2012 to August 31, 2013 (the “first period”) or the 12-month period from September 1, 2013 to August 31, 2014 (the “second period”) were excluded from the basket.

The forecasted dividend or income growth rate for the first period was calculated by dividing the forecasted dividend payout per share for the first period (the “first period payout”) by the forecasted dividend payout per share for the trailing 12-month period from September 1, 2011 to August 31, 2012 (the “prior period payout”), subtracting one (1) from the result and expressing the result as a percentage.Similarly, the forecasted dividend or income growth rate for the second period was calculated by dividing the forecasted dividend payout per share for the second period (the “second period payout”) by the first period payout, subtracting one (1) from the result and then expressing the result as a percentage. In each case the data used is taken from the IBES Summary database. The securities of remaining eligible issuers for which either dividend or income growth rate measure was below 0% were excluded from the basket.Additionally, the securities of remaining eligible issuers for which no first period payout is available were excluded from the basket.

Because the dividend payout per share data provided by the IBES Summary database is broken out by fiscal year for each remaining eligible issuer, an eligible issuer may have a fiscal year that differs from that of another eligible issuer. Additionally, because each of the specified 12-month periods can span more than one fiscal year for any eligible issuer, the forecasted dividend payout per share for each specified 12-month period was calculated on a pro-rated basis for each eligible issuer.

The realized or forecasted dividend payout per share for each eligible issuer for any month during any specified period was determined, in all cases as published in the IBES Summary database, as follows:

| · | for months that fall in the fiscal year immediately preceding the current fiscal year of such issuer, by reference to realized dividend payout per share data for such immediately preceding fiscal year; |

| · | for months that fall in the current fiscal year of such issuer, by reference to the forecasted dividend payout per share data for such current fiscal year; and |

| · | for months that fall in the fiscal years following the current fiscal year of such issuer, by reference to the |

| | forecasted dividend payout per share data for such fiscal years. |

For illustration purposes of the calculations of Step Six, please see the example below:

Assumptions:

ABC Issuer

FiscalYear Ends December 31

Observation Date: June 2012

| | |

Realized dividend payment | |

per share for the fiscal | |

year ended December 31, 2011 | $12.00 |

| |

Forecasted dividend payment | |

per share for fiscal year | |

ending December 31, 2012 | $13.00 |

| |

Forecasted dividend payment | |

per share for fiscal year | |

ending December 31, 2013 | $14.00 |

| |

Forecasted dividend payment | |

per share for fiscal year | |

ending December 31, 2014 | $15.00 |

Calculation of Specified Period Payouts and Forecasted Dividend or Income Growth:

Prior period payout = ($12/12x6) + ($13/12x6) = $12.50 First period payout = ($13/12x6) + ($14/12x6) = $13.50 Second period payout = ($14/12x6) + ($15/12x6) = $14.50

Forecasted Dividend or Income Growth for First Period = (13.50/12.50) – 1 = 0.08 = 8%

Forecasted Dividend Income Growth for Second Period = (14.50/13.50) – 1 =0.074 = 7.4%

Step Seven – Exclusion of Issuers With Elevated Credit Default Swap Levels. The securities of remaining eligible issuers with a composite spread for a five-year senior credit default swap as reported by Markit on the observation date of more than two times the on-the-run Markit CDX North America Investment Grade Index composite spread were excluded from the basket. Issuers for which there was no five-year senior credit default swap composite spreads remained eligible for inclusion in the basket.As used herein, “on-the-run” means the most recent composite spread of a specified tenor.

Step Eight – Exclusion of Issuers With An “Underperform” or “Sell” Median Analyst Investment Recommendation Rating. The securities of remaining eligible issuers with an “underperform’ or “sell” median analyst investment recommendation rating, as published in the IBES Summary database, were excluded from the basket. Any securities of remaining eligible issuers for which there were no analyst investment recommendation ratings published in the IBES Summary database remained eligible for inclusion in the basket.

Step Nine – Sector Weights. The number of issuers to be included in the basket for each sector was set at 50 for companies from the U.S. index and 25 for issuers from the Canada index.The securities of those issuers were then equally weighted within their corresponding sector, such that the total weight for that

sector in the basket was equal to the total weight in the index for that same sector. The number of issuers to be allocated to each sector for each included index was calculated by applying the following steps in the following order:

(i) For each sector, one issuer from each included index was included in the basket;

(ii) The number of issuers to be included in the basket for each sector for each included index was increased by successively adding one to each sector for the basket for each included index, adding always first from the sector for an included index with the lowest ratio of sector securities in the basket relative to sector securities in such included index, until the total number of companies in the basket selected from the U.S. index reached 50 and the total number of issuers in the basket selected from the Canada index reached 25; and

(iii) In the event the basket does not reach the required 50 companies from the U.S. index and 25 issuers from the Canada index, the number of issuers in each sector for each included index is further increased in the following manner: if there is more than one sector for a given included index with the lowest ratio of sector securities in the basket relative to sector securities in such included index, one is added to the number of issuers for whichever such sector for such included index, assuming all the issuers are equally weighted within each respective sector for such included index, the percentage weighting per issuer is the highest, and then successively thereafter.

Step Ten – Relaxation of Criteria to Achieve Minimum Number of Eligible Issuers by Sector. In the event the number of remaining issuers eligible for inclusion in the basket for any sector for each included index is fewer than two times the number of issuers required for that sector for each included index as specified in Step Nine, the criteria for all the following steps for each included index will be simultaneously and iteratively relaxed until the number of issuers eligible for inclusion in the basket for any sector is at least twice the number of issuers required for that sector for each included index as specified in Step Nine:

| · | In Step Three, the maximum threshold for forecasted current year dividend or income payout ratio for the securities of each eligible issuer is increased from 70% to 80%, and by increments of 10% thereafter. |

| · | In Step Four, the minimum requirement for realized free cash flow cover for the most recently available fiscal year for each eligible issuer is reduced from 50% to 40% and by increments of 10% thereafter and the minimum requirement for projected free cash flow cover for the fiscal year immediately following the most recent realized fiscal year for each eligible issuer is reduced from 75 to 65% and by increments of 10% thereafter. |

| · | In Step Five, the maximum percentile threshold for non-negative net debt to EBITDA ratio for each eligible issuer is increased from the 75th percentile in distribution to the 80th percentile in distribution and by increments of 5 percentile points in distribution thereafter.Once the criteria is relaxed to 100 percent of the distribution, all issuers with |

| | negative net debt to EBITDA ratio are eligible for inclusion in the basket. |

| · | In Step Six the minimum required forecasted dividend or income growth rate for each eligible issuer is reduced from 0% to -5% and by increments of 5% thereafter. |

| · | In Step Seven, the maximum permissible multiple of composite spread for a five-year senior credit default swap for each eligible issuer relative to the on-the-run Markit CDX North America Investment Grade Index composite spread is increased from 2 times to 2.5 times and by increments of 0.5 times thereafter. |

Step Eleven – Basket Allocation. The issuers remaining eligible for inclusion in the basket within each sector for each included index were ranked from highest to lowest based on their expected dividend or income yield.The expected dividend or income yield was calculated for each remaining eligible security by dividing the first period payout, as defined in Step Six and using data as published in the IBES Summary database, by the security price as of the observation date, as published by Bloomberg. For securities denominated in CAD, the first period payout and security price, as applicable, in local currency was converted to USD using the local CAD/USD exchange rate based on the mid-closing exchange rate, as published by WM Company on Thomson Reuters Eikon at 4:00 P.M. New York time on the observation date.The securities of the highest-ranked issuers within each sector for each included index were selected for inclusion in the basket up to the required number of securities for each sector for each included index as determined pursuant to Step Nine. If for a given sector for a particular included index the resulting security selection would include a security with an expected dividend or income yield equal to zero, the criteria for Steps Three through Seven will be relaxed iteratively pursuant to Step Ten until all the securities to be included for the sector have an expected dividend or income yield greater than zero or until further relaxation of the criteria does not yield any change in the basket composition.

Financial Data and Values. The underlying financial data and values used by the basket sponsor to calculate the basket were calculated or published by Bloomberg, WM Company, IBES Summary database, Markit and Thomson Reuters Eikon (collectively, the “data providers”), each as described above and obtained by the basket sponsor without independent verification and are as of August 21, 2012, unless otherwise stated herein. Some of these values are non-GAAP financial measures and are computed by the data providers using their own specifications. Other financial data providers may compute these values differently. The basket sponsor makes no representation or warranty, express or implied, regarding the reliability and accuracy of the information obtained from the data providers or drawn from other sources.

Reference Exchange. The “reference exchange” is the corresponding stock exchange as specified by the sponsor of the index in the list of stock exchanges and trading systems, as specified by the index sponsor.

Portfolio and Portfolio Methodology

The portfolio consists of the securities of issuers included in the basket on August 21, 2012. On the date of deposit, the securities included in the portfolio are generally equally weighted within their corresponding sector, such that the total weight for that sector in the basket was equal to the total weight in the corresponding index for that same sector as of August 21, 2012, subject to rounding to the nearest whole share for any constituent security.This lag provides sufficient time before the date of deposit to screen for any liquidity or regulatory issues in regards to the securities selection. At the time of purchase, the securities in the basket, and therefore the portfolio, were no longer weighted as they were on August 21, 2012 on a market capitalization basis because of market price movements of the securities.

The basket is subject to rebalancing from time to time, but the portfolio will not be rebalanced or adjusted other than the adjustments described in “Trust Administration—Changes to Your Portfolio” in this prospectus.The performance of the portfolio will diverge from the performance of the basket. In the event of any inadvertent discrepancy in the constituents resulting from the application of the basket methodology as described in this prospectus and the portfolio constituents disclosed in this prospectus, the portfolio constituents will remain as disclosed in this prospectus.

PRINCIPAL RISKS

As with all investments, you may lose some or all of your investment in the Trust.Units of the Trust are not deposits of any bank and are not insured or guaranteed by the Federal Deposit Insurance Corporation or any other government agency. No assurance can be given that the Trust’s investment objective will be achieved. The Trust also might not perform as well as expected. This can happen for reasons such as the following:

Price volatility. The value of your investment may fall over time. Market value fluctuates in response to various factors.These can include stock market movements, purchases or sales of securities by the Trust, government policies, litigation and changes in interest rates, inflation, the financial condition of the securities’ issuer or even perceptions of the issuer.

Current economic conditions. Due to the current state of the economy, the value of the securities held by the Trust may be subject to steep declines or increased volatility due to changes in performance or perception of the companies issuing the securities held in the portfolio. Starting in December 2007, economic activity declined across all sectors of the economy, and the United States experienced increased unemployment. The economic crisis affected the global economy with European and Asian markets also suffering historic losses. Standard & Poor’s Rating Services lowered its long-term sovereign credit rating on the United States to “AA+” from “AAA,” which could lead to increased interest rates and volatility. Extraordinary steps have been taken by the governments of several leading countries to combat the economic crisis; however, the impact of these measures is not yet fully known and cannot be predicted.

The method used to select the portfolio may be flawed and will not necessarily have a positive return. The

selection method used by the basket sponsor to determine the basket securities may not result in the selection of securities having a positive return.The measures of forecasted security dividend or income payouts, forecasted dividend or income growth, high net debt to EBITDA ratio and free cash flow cover may not accurately capture the risks they seek to reflect and individually and collectively may not actually result in the selection of securities that will perform better than a basket of securities selected by other methods or by one selected using only one or a limited number of the selection criteria used by the basket sponsor. A portfolio that is selected using different financial ratios, variables or methodologies as one of its selection criteria may outperform, perhaps substantially, a portfolio selected using the basket as calculated by the basket sponsor.

The portfolio was selected on the basis of data as of a given date and used values that can be calculated differently. The securities of the issuers comprising the portfolio were selected based on the basket, which was determined by the basket sponsor on August 21, 2012 and market capitalization weighted as of August 21, 2012, based on the publicly available data for each constituent issuer as of those dates. If the basket had been calculated on any date other than August 21, 2012, the basket, and therefore the portfolio, likely would contain different securities from those included in the basket.In addition, because the basket was selected on August 21, 2012, the financial data used in the selection is now stale. An issuer that had a high expected dividend or income yield at the time the basket was selected may now have a much lower expected dividend or income yield depending on its most recent financial results.As a result, there can be no assurance that the portfolio will perform as well as one selected using current financial data.In addition, the values obtained by the basket sponsor from the data providers can be calculated in different ways and may be subject to judgments made by the third party data vendor that another data vendor may have made differently.As a result, the portfolio may not perform as well as one selected using a different data source or a different formulation for calculating the values on which the basket is based.

Each portfolio component will be subject to various business and market risks. Each issuer of a portfolio component is subject to various business and market risks that may adversely affect the reference asset’s value.The prices of the underlying securities may be volatile, subject to currency exchange rates and cannot be predicted.In addition, the securities, and therefore the units, are subject to the Canadian and United States equity market risks, as applicable, and to economic, financial, political, regulatory, legal and other events that affect the equity markets.You should familiarize yourself with the business and market risks faced by the security’s issuers and consider those risks, along with the risks described in this prospectus, in considering whether to invest in the units.

The securities in the portfolio are not weighted in the same manner as the basket. The basket securities were equally weighted within their corresponding sector, such that the total weight for that sector in the basket was equal to the total weight in the corresponding index for that same sector as of August 21, 2012. The portfolio was purchased in an amount that reflected the number of shares used by the basket sponsor to equally weight within their

corresponding sector, such that the total weight for that sector in the basket was equal to the total weight in the corresponding index for that same sector as of August 21, 2012, subject to rounding to the nearest whole share for any constituent security.The portfolio securities could not be purchased in the precise amounts used in the baskets because of the rounding restrictions described above.Further, the Sponsor retains the ability to remove stocks selected for inclusion in the portfolio. Generally speaking, this would only occur if there was a material negative credit event, or significant liquidity concerns, as set forth in the Trust Agreement. Consequently, while the portfolio will generally be representative of the basket stocks, holdings in the portfolio may diverge from the holdings in the basket and the portfolio may not perform in the same manner as the basket, and it may perform adversely as compared to the basket over time as a result of these potential differences.

The portfolio, the basket and the index from which the basket securities and the portfolio securities are selected are different and the performance of the basket and the portfolio will diverge from the performance of the included indexes. The securities that comprise the basket and the portfolio are chosen using a methodology to select 50 stocks from among the 500 stocks that comprise the U.S index and 25 securities from among the approximately 257 securities that comprise the Canada index. The portfolio will hold only a relatively small number of the securities included in each included index and the weightings of the securities that comprise the basket and the portfolio will be different from the weightings of the securities in the respective included index. Therefore, the performance of the basket and the performance of the portfolio likely will not track the performance of the included indexes, and consequently, the return on the units will not be the same as investing directly in the included indexes or in the securities underlying the included indexes, and will not be the same as investing in units with returns linked to the performance of the indexes.

An investment in the units will be subject to risks associated with foreign securities markets. Investments in foreign securities involve particular risks. The foreign securities markets whose securities comprise the basket may have less liquidity and may be more volatile than U.S. or other securities markets and market developments may affect foreign markets differently from U.S. or other securities markets. Although the portfolio securities are listed for trading on the Toronto Stock Exchange, there is no assurance that an active trading market will continue for the portfolio securities or that there will be liquidity in the trading market. Direct or indirect government intervention to stabilize these foreign securities markets, as well as cross-shareholdings in foreign issuers, may affect trading prices and volumes in these markets. Also, there is generally less publicly available information about foreign issuers than about those U.S. companies that are subject to the reporting requirements of the U.S. Securities and Exchange Commission, and foreign issuers are subject to accounting, auditing and financial reporting standards and requirements that differ from those applicable to U.S. reporting companies.

Securities prices in foreign countries are subject to political, economic, financial and social factors that apply in those geographical regions. These factors, which

could negatively affect those securities markets, include the possibility of recent or future changes in a foreign government’s economic and fiscal policies, the possible imposition of, or changes in, currency exchange laws or other laws or restrictions applicable to foreign issuers or investments in foreign securities and the possibility of fluctuations in the rate of exchange between currencies, the possibility of outbreaks of hostility and political instability and the possibility of natural disaster or adverse public health development in the region. Moreover, foreign economies may differ favorably or unfavorably from the U.S. economy in important respects such as growth of gross national product, rate of inflation, capital reinvestment, resources and self-sufficiency.

In addition, the portfolio securities are subject to custody risk, which refers to the risks in the process of clearing and settling trades and to the holding of securities by local banks, agent and depositories. Low trading volumes and volatile prices in less developed markets make trades harder to complete and settle, and governments or trade groups may compel local agents to hold securities in designated depositories that are not subject to independent evaluation. The less developed a country’s securities markets is, the greater the likelihood of custody problems.

TheTrust invests in securities issued by issuers operating in Canada. Because certain of the securities in the Trust are issued by companies with a significant presence in Canada, the Trust is subject to Canadian country risk and may be particularly susceptible to changes in the political, diplomatic and economic conditions of Canada. The Canadian and U.S. economies are closely integrated. The United States is Canada’s largest trading partner and foreign investor. Canada is a major producer of forest products, metals, agricultural products and energy-related products, such as oil, gas and hydroelectricity. The Canadian economy is dependent on the demand for, and supply and price of, natural resources, and the Canadian market is relatively concentrated in issuers involved in the production and distribution of natural resources. Continued demands by the Province of Quebec for sovereignty could significantly affect the Canadian market, particularly if such demands are met. A small number of sectors, including the materials sector, represent a large portion of the Canadian market. In addition, regulatory and tax developments in Canada could impact the U.S. tax treatment of securities of companies headquartered or incorporated in Canada and, consequently, units of the Trust.

The forecasted dividend payouts per share used to select the basket securities are not objective and may not be reached. The basket sponsor used forecasted dividend payouts per share data as published in the IBES Summary database to calculate forecasted dividend or income growth, which is one of the metrics used to select the basket securities. The forecasted dividend payouts per share represent the forecasts of dividend payouts per share as submitted by stock research analysts to IBES Summary database. These forecasts represent the opinions of individual analysts and of their firms, which may include opinions submitted by Goldman, Sachs & Co. (an affiliate of the basket sponsor), or one or more of its affiliates, without any consideration for the value of the basket or the units. The forecasted dividend payouts per share are not reviewed for accuracy by

IBES before their inclusion in the IBES Summary database, nor does IBES screen the quality of the analysts providing the forecasts. The opinions of the analysts are subjective and may not reflect the actual dividends paid per share for the forecasted periods. These opinions of individual analysts may have been based on assumptions involving incorrect or incomplete information and may not be an accurate prediction of the future performance of any basket security to which those opinions relate.

Neither the relevant analysts nor the issuers of the relevant securities comprising the basket are under any obligation to correct incomplete or inaccurate estimates, except to the limited extent required by law. Estimates over a 12-month period or for periods further out in time from the observation date may be more likely to be inaccurate than shorter estimates, such as three-month estimates, or those for periods closer in time to the observation date. These factors may adversely affect the selection of the basket securities and, as a result, the return on your units. Neither the basket sponsor nor the Sponsor have independently verified any individual analyst’s opinion or the assumptions or calculations supporting that opinion.

The forecasted dividend payouts per share used to select the basket securities may have been distorted due to the number of analysts providing such estimates for the data underlying the calculation, and the opinions of Goldman, Sachs & Co. or its affiliates may have had a substantial impact on the forecasted dividend payouts per share of one or more securities. The number of analysts submitting dividend or income forecasts on the basket securities that were used by the IBES Summary database to compile forecasted dividend payouts per share data and then used by the basket sponsor to calculate the dividend or income growth varied and may have been as few as one, depending on the security. As a result, the impact of an individual analyst’s opinion on the decision to include or exclude a security in the basket varied in each case depending on the total number of analyst opinions compiled for that basket security. This variance may increase the impact of an individual analyst’s opinion that is based on incorrect or incomplete information or of an individual analyst’s opinion that does not accurately predict future dividends or income if the total number of analyst opinions compiled for that security are relatively few. If the basket sponsor had used a different means of obtaining the forecasted dividend payouts per share, the basket securities may have been different from the basket securities set forth in this prospectus. In cases where few analysts cover a particular security, the opinion of one analyst may distort the average forecast. Further, analyst dividend or income forecasts may be updated infrequently, and may not represent the analyst’s current opinion regarding the security. Where a limited number of dividend or income forecasts were provided as to any basket security, the dividend or income estimates, if any, provided by analysts employed by Goldman, Sachs & Co., or one or more of its affiliates may have had a significant impact on, or been determinative of, the inclusion or exclusion of that security from the basket. Even where many dividend or income forecasts were provided as to any basket security, if the dividend or income forecasts of Goldman, Sachs & Co. or one or more of its affiliates influenced the dividend or income forecasts provided by other analysts, the dividend or income

forecasts provided by Goldman, Sachs & Co. or its affiliates would have had a disproportionate influence on the dividend or income forecasts used to select the basket securities.

You should not view the inclusion of any basket security in the basket as an investment recommendation with respect to that basket security or as an endorsement of any analyst’s opinion used in selecting any basket security by the basket sponsor, even if Goldman, Sachs & Co. or one or more of its affiliates submits dividend or income forecasts to the IBES Summary database as to any of the basket securities.

Analysts’ forecasts are highly sensitive to market perceptions and can change daily. The basket securities were selected from among the approximately 757 securities that comprise the included indexes using certain financial metrics for those securities as of the observation date. Some of those metrics are based on data which utilize analysts’ dividend or income forecasts. Analysts’ forecasts are highly sensitive to market perceptions and can change daily. Analysts revise their dividend or income forecasts for securities constantly, even within a single trading day. In addition, issuers release information to the public at different times. Some issuers may provide some form of publicly available earnings guidance during a fiscal quarter; however, most issuers do not do so on a regular basis. Expected earnings is one factor taken into account in analysts’ estimates of future dividends or income. Analysts tend to update such forecasts for issuers after the relevant issuer releases periodic results. The timing of updates to analyst forecasts and the public dissemination of earnings can affect analyst forecasts and, as a result, the selection of the basket securities. Also, issuers may alter their actual dividend or income payouts based on factors unrelated to market variables, such as government regulations. If the basket securities had been selected using data on a different date, the resulting basket might contain different securities, and the return based on a basket comprised of such securities could result in a higher return on your units.

The median analyst investment recommendation rating used to select the basket securities may not accurately reflect the credit worthiness of the basket security issuers. Analysts investment recommendation ratings on eligible issuers, as published in the IBES Summary database, are used to calculate the median analysts recommendation rating for such securities and this is one of the metrics used by the basket sponsor to exclude securities from the basket. The number of analysts issuing ratings on the basket security issuers compiled by IBES Summary database varied and may have been as few as one, depending on the security. As a result, the metrics used by the several analysts in rating a particular basket security issuer may also vary. This variance may increase the impact of an individual analyst’s rating that does not accurately predict the credit risk for a particular basket security issuer. In cases where few analysts cover a particular security, the rating of one analyst may distort the median investment recommendation rating. Further, analyst ratings may be updated infrequently, and may not represent the analyst’s current opinion regarding the security. Where a limited number of ratings were provided as to any basket security, the ratings provided by analysts employed by Goldman, Sachs & Co., or one or more of its affiliates may have had a significant impact on, or been

determinative of, the inclusion or exclusion of that security from the basket.

Past security performance is no guide to future performance. You cannot predict the future prices of the portfolio securities based on their historical fluctuations. The actual prices of the portfolio securities over the life of the units may bear little or no relation to the historical closing prices of the portfolio.We cannot predict the future performance of the portfolio securities.

You have no shareholder rights or rights to receive shares of the portfolio securities. Investing in your units will not make you a holder of any of the portfolio securities.Neither you nor any other holder or owner of your units will have any voting rights, any right to receive dividends, income or other distributions or any other rights with respect to such securities.Your units will be paid in cash, and you will have no right to receive delivery of any such securities.

The performance of the portfolio will diverge from the performance of the basket. The basket is subject to reconstitution and reweighting from time to time, but the portfolio will not be reconstituted, reweighted or adjusted other than the adjustments described in “Trust Administration—Changes to Your Portfolio” in this prospectus.The performance of the portfolio will therefore diverge from the performance of the basket.

Small- and mid-cap risk. Stocks of small- and mid-cap companies may be subject to more abrupt or erratic market movements than those of larger, more established companies or the market averages in general. Small-and mid-cap companies may have limited product lines, markets or financial resources, and they may be dependent on a limited management group. In addition, they may be more vulnerable to adverse general market or economic developments.

Legislation/Litigation. From time to time, various legislative or regulatory initiatives are proposed which may have a negative impact on certain of the issuers represented in the Trust. In addition, litigation regarding any of the issuers of the securities or of the industries represented by such issuers, may negatively impact the value of these securities. We cannot predict what impact any pending or proposed legislation or pending or threatened litigation will have on the value of the securities.

Inflation risk. Inflation risk is the risk that the value of assets or income from investments will be less in the future as inflation decreases the value of money.The value of your investment in the units may fall as a result of inflation.

Dividend payment risk. An issuer of a security may be unable or unwilling to make dividend payments, which may decrease the value of your investment in the Trust.

The Sponsor does not actively manage the portfolio. The Trust is a unit investment trust and, as a result, is not actively managed.Securities are only bought and sold in limited circumstances as described herein.The Trust will generally hold, and may continue to buy, the same securities even though a security’s outlook, rating, market value or yield may have changed.The value of your investment may fall over time.

Investment strategy risk. The Trust is exposed to additional risk due to its policy of investing in accordance with an investment strategy. Although the Trust’s investment strategy is designed to achieve the Trust’s investment objective, the strategy may not prove to be successful. The investment decisions may not produce the intended results and there is no guarantee that the investment objective will be achieved.

Dilution risk. As the Sponsor sells units, the size of the Trust will increase. The Sponsor will seek to replicate the existing portfolio and when the Trust buys securities, it will pay brokerage or other acquisition fees. Existing unitholders could experience a dilution of their investment because of these fees and fluctuations in security prices between the time the Sponsor creates units and the time the Trust buys the securities. The Sponsor cannot guarantee that the Trust will keep its present size and composition for any length of time.

Liquidity risk. A unitholder may be subject to liquidity risk if the Sponsor does not maintain a secondary market, however, unitholder who does not dispose of units in the secondary market may cause units to be redeemed by the Trustee.

See “Investment Risks” in Part B of the prospectus for additional information.

| | | |

ESSENTIAL INFORMATION |

(AS OF THE INCEPTION DATE) |

| |

Public offering price | |

at inception | | $10.00 |

| | | |

Inception date | | September 6, 2012 |

| | | |

Termination date | | December 9, 2013 |

| | | |

Distribution date | | 25th day of |

| | | each month |

(commencing on October 25, 2012, |

| | | if any) |

| | | |

Record date | | 10th day of |

| | | each month |

(commencing on October 10, 2012, |

| | | if any) |

| | |

Evaluation Time | As of the close of trading of |

| | | the New York Stock |

| | Exchange (normally 4:00 p.m. |

| | Eastern Time). (However, on |

| | the first day units are sold the |

| | Evaluation Time will be as of |

| | | the close of trading on the |

| | New York Stock Exchange or |

| | | the time the registration |

| | | statement filed with the |

| | | Securities and Exchange |

| | | Commission becomes |

| | | effective, if later.) |

| |

| | | |

CUSIP Numbers | | |

Standard Accounts | |

Cash Distributions | 45327K106 |

Reinvest Distributions | 45327K114 |

Fee Based Accounts | |

Cash Distributions | 45327K122 |

Reinvest Distributions | 45327K130 |

| |

Minimum investment | $1,000/100 units |

IRA | | 250/25 |

FEE TABLE

The amounts below are estimates of the direct and indirect expenses that you may incur for primary market purchases based on a $10 public offering price. Actual expenses may vary.You may qualify for sales charge discounts if you and your family invest at least $50,000 in the Trust or in other Incapital Unit Trusts. More information about these and other discounts, including exchange or rollover discounts, is available from your financial advisor and in “Buying Units” in Part B of the Prospectus.

| | | |

| | Percentage | |

| | of Public | |

| | Offering | Amount Per |

Investor Fees | Price (1) | Unit |

| |

Initial sales fee | | |

paid on purchase (2) | 1.00% | $0.100 |

Deferred sales fee (3) | 1.45 | 0.145 |

Creation and | | |

development fee (4) | 0.50 | 0.050 |

Maximum sales fees | | |

(including creation | | |

and development fee) | 2.95% | $0.295 |

| |

Estimated organization | | |

costs (5) | 0.80% | $0.080 |

| |

| |

| | Approximate | |

Annual Fund | % of Public | |

Operating | Offering | Amount Per |

Expenses | Price (1) | Unit |

Trustee’s fee | 0.105% | $0.0105 |

Supervisory fee | 0.030 | 0.0030 |

Evaluator’s fee | 0.030 | 0.0030 |

Bookkeeping and | | |

administrative fee | 0.035 | 0.0035 |

Estimated other Trust | | |

operating expenses (6) | 0.357 | 0.0357 |

Total | 0.557% | $0.0557 |

| 1 | Based on a unit with a $10.00 per unit Public Offering Price as of the Inception Date. |

| 2 | The initial sales fee provided above is based on the public offering price on the Inception Date. Because the initial sales fee equals the difference between the maximum sales fee and the sum of the remaining deferred sales fee and the creation and development fee (as described below), the percentage and dollar amount of the initial sales fee will vary as the public offering price varies and after deferred fees begin. Despite the variability of the initial sales fee, each investor is obligated to pay the entire applicable maximum sales fee. |

| 3 | The deferred sales fee is a fixed dollar amount equaling $0.145 per unit.The deferred sales fee will be deducted in three monthly installments commencing December 31, 2012 and ending February 28, 2013 (approximately $0.0483 per unit on the last business day of each month). If units are redeemed prior to the deferred sales fee period, the entire deferred sales fee will be collected. If you purchase units in the secondary market, your maximum sales fee will be 2.95% of the public offering price and may consist of an initial sales fee and the amount of any remaining deferred sales fee payments.The initial sales fee, which you will pay at the time of purchase, is equal to the difference between 2.95% of the public offering price and the maximum remaining deferred sales fee. If you purchase units after the last deferred sales fee payment has been assessed, your maximum sales fee will consist of a one-time sales charge of 2.95% of the Public Offering Price per unit. |

| 4 | The creation and development fee compensates the Sponsor for creating and developing the Trust. The actual creation and development fee is $0.05 per unit and is paid to the Sponsor at the close of the initial offering period, which is expected to be approximately 3 months from the Inception Date. The percentages provided are based on a $10 unit as of the Inception Date and the percentage amount will vary over time. If the public offering price exceeds $10.00 per unit, the creation and development fee will be less than 0.50% of the public offering price; if the public offering price is less than $10.00 per unit, the creation and development fee will exceed 0.50% of the public offering price. However, in no event will the maximum sales fee exceed 2.95% of a unitholder’s initial investment. |

| 5 | The estimated organization costs include the amount per unit paid by the Trust at the earlier of the end of the initial offering period or after six months. |

| 6 | The estimated Trust operating expenses are based upon an estimated Trust size of approximately $6,000,000. Because certain of the operating expenses are fixed amounts, if the Trust does not reach such estimated size or falls below the estimated size over its life, the actual amount of the operating expenses may exceed the amounts reflected. In some cases, the actual amount of the |

| | operating expenses may greatly exceed the amounts reflected. Other operating expenses do not include brokerage costs and other transactional fees. |

EXAMPLE

This example helps you compare the cost of this Trust with other unit trusts and mutual funds. In the example we assume that you reinvest your investment in a new trust every year at a reduced sales charge, the Trust’s operating expenses do not change and the Trust’s annual return is 5%.Your actual returns and expenses will vary. Based on these assumptions, you would pay these expenses for every $10,000 you invest in the Trust:

| | |

1 year | $ 431 |

3 years | 1,100 |

5 years | 1,791 |

10 years | 3,611 |

These amounts are the same regardless of whether you sell your investment at the end of a period or continue to hold your investment. The example does not consider any transaction fees paid by the Trust or that broker-dealers may charge for processing redemption requests.

TAXES

Distributions from the Trust are generally subject to federal income taxes for U.S. investors. The distributions may also be subject to state and local taxes.

For non-resident aliens, certain income from the Trust will be exempt from withholding for U.S. federal income tax, provided certain conditions are met. Consult your tax advisor with respect to the conditions that must be met in order to be exempt for U.S. tax purposes.

See “Tax Status” in Part B of the Prospectus for further tax information.

DISTRIBUTIONS

Holders of units will receive dividends from its net investment income, if any, along with any excess capital on each distribution date to unitholders of record on the preceding record date.You may elect to:

| · | reinvest distributions in additional units of the Trust at no fee, or |

| · | receive distributions in cash. |

You may change an election by contacting your financial professional or the trustee of the Trust (the “Trustee”). Once you elect to participate in a reinvestment program, the Trustee will automatically reinvest any distributions into additional units at their net asset value three business days prior to the distribution date. We waive the sales fee for reinvestments into units of the Trust. We cannot guarantee that units will always be available for reinvestment. If units are unavailable, you will receive cash distributions. We may discontinue these options at any time without notice.

Distributions will be made from the Income and Capital Accounts on the distribution date provided the aggregate amount available for distribution equals at least 0.01% of the net asset value of the Trust. Undistributed money in the Income and Capital Accounts will be distributed in the next month in which the aggregate amount available for distribution equals or

exceeds 0.01% of the net asset value of the Trust.

In some cases, the Trust might pay a special distribution if it holds an excessive amount of principal pending distribution. For example, this could happen as a result of a merger or similar transaction involving a company whose security is in your portfolio. The amount of your distributions will vary from time to time as companies change their dividends, Trust expenses change or as a result of changes in the Trust’s portfolio.

Each unit of the Trust at the Inception Date represents the fractional undivided interest in the underlying securities set forth in the “Trust Portfolio” and net income of the Trust.

Reports. The Trustee or your financial professional will make available to you a statement showing income and other receipts of the Trust for each distribution. Each year the Trustee will also provide an annual report on the Trust’s activity and certain tax information.You may request copies of security evaluations to enable you to complete your tax forms and audited financial statements for the Trust, if available.

PURCHASE AND REDEMPTION OF UNITS

You may purchase or redeem units of the Trust on any business day, which is any day the New York Stock Exchange is open for business.You may purchase or redeem units of the Trust through your financial advisor or other financial intermediary.Your financial intermediary can either redeem units through the Sponsor or the Trustee, the Bank of New York Mellon. See “Buying Units” and “Selling Units” in Part B of the Prospectus for more information.

The Sponsor currently intends to repurchase units from unitholders who want to redeem their units. These redemptions will be at the redemption price; however, a unitholder will pay any remaining deferred sales fees upon the sale or redemption of units. The Sponsor is not obligated to maintain a market and may stop doing so without prior notice for any reason. If the Sponsor stops repurchasing units, a unitholder’s financial intermediary may dispose of units by redemption through The Bank of New York Mellon, which serves as the Trustee. The price received from the Trustee by the unitholder for units being redeemed is based upon the redemption price of the underlying securities. Unitholders will be assessed any remaining deferred sales fees upon the sale or redemption of units.

Until the earlier of six months after the Inception Date or the end of the initial offering period, the price at which the Trustee will redeem units and the price at which the Sponsor may repurchase units generally includes estimated organization costs. After such period, the amount paid will not include such estimated organization costs.

BASKET SPONSOR’S DISCLAIMERS

The portfolio is not sponsored, endorsed, sold or promoted by the basket sponsor. The basket sponsor makes no representation or warranty, express or implied, regarding (i) the advisability of investing in the portfolio, (ii) the ability of the portfolio to track the basket performance, or (iii) the reliability and accuracy of the

information from third parties used to calculate the basket. The basket sponsor’s only relationship to the Sponsor in connection with the Trust is the grant of a license for the basket and the payment of start-up costs and expenses, which is composed and calculated by the basket sponsor, or its agent, without regard to the Sponsor or the portfolio. While the basket sponsor has identified the securities for selection in the basket, the basket sponsor has no obligation, involvement or liability in connection with the selection, administration, marketing or trading of the portfolio. The Sponsor or its affiliates and the basket sponsor have other business relationships which include the basket sponsor providing investment products, such as structured notes, structured bank certificates of deposit and insurance products, for distribution by the Sponsor to its clients. In addition, as of the date of this prospectus, the basket sponsor and Incapital Holdings LLC, the parent company of the Sponsor, have signed a non-binding term sheet for the acquisition by the basket sponsor of up to 9.9% non-voting membership interest in Incapital Holdings LLC.

The basket sponsor is not responsible for any investment decisions, damages or other losses resulting from use of the portfolio or any information provided in conjunction with it. The basket sponsor does not guarantee the accuracy, completeness or timeliness of the portfolio methodology or any portion of it and will not be liable for any errors, omissions or interruptions arising from its use. The basket sponsor makes no express or implied warranties, and expressly disclaims all warranties of merchantability or fitness for a particular purpose or use, with respect to the portfolio methodology or any portion of it.

The U.S. index and the Canada index were used by the basket sponsor as the reference universe for selection of the issuers included in the Goldman Sachs North American Dividend Builders Basket. S&P does not in any way sponsor, support, promote or endorse the Goldman Sachs North American Dividend Builders Basket. S&P was not and is not involved in any way in the creation, calculation, maintenance or review of the Goldman Sachs North American Dividend Builders Basket. The U.S. index and the Canada index were each provided on an “as is” basis. S&P, each of its affiliates and each other person involved in or related to compiling, computing or creating each of the U.S. index and the Canada index (collectively, the “S&P Parties”) expressly disclaim all warranties (including, without limitation, any warranties of originality, accuracy, completeness, timeliness, non-infringement, merchantability and fitness for a particular purpose). Without limiting any of the foregoing, in no event shall any S&P Party have any liability for any direct, indirect, special, incidental, punitive, consequential (including, without limitation, lost profits) or any other damages in connection with the U.S. index, the Canada index or the Goldman Sachs North American Dividend Builders Basket.

Report of Independent Registered Public Accounting Firm

Unitholders

Incapital Unit Trust, Series 9

We have audited the accompanying statement of financial condition, including the Trust portfolio set forth on pages 3, 4 and 5 of this prospectus, of Incapital Unit Trust, Series 9, as of September 6, 2012, the initial date of deposit. The statement of financial condition is the responsibility of the Trust’s Sponsor. Our responsibility is to express an opinion on this statement of financial condition based on our audit.

We conducted our audit in accordance with auditing standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the statement of financial condition is free of material misstatement. The Trust is not required to have, nor were we engaged to perform, an audit of its internal control over financial reporting. Our audit included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Trust’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the statement of financial condition, assessing the accounting principles used and significant estimates made by the Sponsor, as well as evaluating the overall statement of financial condition presentation. Our procedures included confirmation with The Bank of New York Mellon, the Trustee, of cash or an irrevocable letter of credit deposited for the purchase of securities as shown in the statement of financial condition as of September 6, 2012. We believe that our audit of the statement of financial condition provides a reasonable basis for our opinion.

In our opinion, the statement of financial condition referred to above presents fairly, in all material respects, the financial position of Incapital Unit Trust, Series 9 as of September 6, 2012, in conformity with accounting principles generally accepted in the United States of America.

/s/ Grant Thornton LLP

Chicago, Illinois

September 6, 2012

| | |

Incapital Unit Trust, Series 9 | |

North American Dividend Builders Portfolio, 3Q 2012 | |

Statement of Financial Condition | |

as of September 6, 2012 | |

| |

Investment in securities | |

Contracts to purchase underlying securities (1),(2) | $ 120,311 |

Total | $ 120,311 |

Liabilities and interest of investors | |

Liabilities: | |

Organization costs (3) | $ 972 |

Creation and development fee (4) | 608 |

Deferred sales fee (5) | 1,762 |

Total | 3,342 |

Interest of Investors: | |

Cost to investors (6) | 121,520 |

Less initial sales fee (5) | 1,209 |

Less deferred sales fee, creation and development fee | |

and organization costs (3),(4),(5),(6) | 3,342 |

Net interest of unitholders | 116,969 |

Total | $ 120,311 |

Units | 12,152 |

Net asset value per unit | $ 9.6255 |

| 1 | Aggregated cost of the securities is based on the closing sale price evaluations as determined by the Evaluator. |

| 2 | Cash or an irrevocable letter of credit has been deposited with the Trustee covering the funds (aggregating $500,000) necessary for the purchase of securities in the Trust represented by purchase contracts. |

| 3 | A portion of the public offering price represents an amount sufficient to pay for all or a portion of the costs incurred in establishing the Trust. These costs have been estimated at $0.08 per unit for the Trust. A distribution will be made as of the earlier of the close of the initial offering period or six months following the Trust’s Inception Date to an account maintained by the Trustee from which this obligation of the investors will be satisfied. Organization costs will not be assessed to units that are redeemed prior to the earlier of the close of the initial offering period or six months following the Trust’s Inception Date. To the extent the actual organization costs are greater than the estimated amount, only the estimated organization costs added to the public offering price will be reimbursed to the Sponsor and deducted from the assets of the Trust. |

| 4 | The Trust is committed to pay a creation and development fee of $5.00 per 100 units at the close of the initial public offering period. The creation and development fee will not be assessed to units that are redeemed prior to the close of the initial offering period. |

| 5 | The total sales fee consists of a creation and development fee, an initial sales fee and deferred sales fee.The initial sales fee is equal to the difference between the maximum sales fee and the sum of the remaining deferred sales fee and the creation and development fee.The maximum sales fee is 2.95% (2.98% of amount invested) of the public offering price per unit.The deferred sales fee is equal to $0.145 per unit and the creation and development fee is equal to $0.05 per unit. |

| 6 | The aggregate cost to investors includes the applicable transactional sales fee assuming no reduction of transactional sales fees for quantity purchases. |

End of Prospectus Part A

Incapital Unit Trust

Prospectus Part B

Dated September 6, 2012

The prospectus for an Incapital Unit Trust (a“Trust”) is divided into two parts. Part A of the prospectus relates exclusively to a particular Trust or Trusts and provides specific information regarding each Trust’s portfolio, strategies, investment objectives, expenses, financial highlights, income and capital distributions, hypothetical performance information, risk factors and optional features. Part B of the prospectus provides more general information regarding the Incapital Unit Trust.You should read both parts of the prospectus and retain them for future reference. Except as provided in Part A of the prospectus, the information contained in this Part B will apply to each Trust.

ORGANIZATION

The Trust is one of a series of similar but separate unit investment trusts created under the laws of the State of New York by a certain Trust Agreement (the “Trust Agreement”). The Trust Agreement is dated as of the Inception Date and is by and among Incapital LLC, as Sponsor, Incapital Asset Management LLC, as evaluator (“Evaluator”) and supervisor (“Supervisor”), and The Bank of New York Mellon, as Trustee. The value of the securities is determined on each business day by the Evaluator based on the closing sale prices on a national securities exchange or the Nasdaq National Market System or by taking into account the same factors referred to under “Selling Units—Redemption—Computation of Offer and Redemption Price.” On the Inception Date, the Sponsor deposited securities, contracts and/or funds (represented by cash or a certified check(s) and/or an irrevocable letter(s) of credit issued by a major commercial bank) for the purchase of certain securities. After the deposit of the securities and the creation of the Trust, the Trustee delivered to the Sponsor the units (the “units”) comprising the ownership of the Trust. These units are now being offered pursuant to this prospectus.

UNITS

Each unit represents an undivided interest in the assets of the Trust. If any units of the Trust are redeemed after the Inception Date, the fractional undivided interest in the Trust represented by each unredeemed unit will increase. Units will remain outstanding until redeemed or until the termination of the Trust Agreement for the related Trust.

BUYING UNITS

Public Offering Price. You can buy units of the Trust on any business day the New York Stock Exchange is open by contacting your financial professional. Public offering prices are available daily on the Internet at www.incapital.com. The public offering price includes: the aggregate underlying value of the securities in the Trust, organization costs, the maximum sales fee (which includes an initial sales fee, a deferred sales fee and the creation and development fee), and cash and other net assets in the portfolio. Incapital often refers to the purchase price of units as the “public offering price.” Incapital must receive your order to buy units prior to the close of the New York Stock Exchange (normally 4:00 p.m. Eastern time) to give you the price for that day. If Incapital receives your order after

this time, you will receive the price computed on the next business day.

During the initial public offering period, for sales of at least $50,000 investors will be entitled to a volume discount from the sales charge as described below. For units purchased during the initial offering period, a portion of the sales charge will be deferred. However, at the earlier of the end of the initial offering period or six months after the Inception Date, the public offering price of the units will not include a pro rata portion of estimated organizational costs.