UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

RREEF Property Trust, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

Payment of Filing Fee (Check the appropriate box)

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

| | |

| 1) | | Title of each class of securities to which transaction applies: |

| | | |

| 2) | | Aggregate number of securities to which transaction applies: |

| | | |

| 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| 4) | | Proposed maximum aggregate value of transaction: |

| | | |

| 5) | | Total fee paid: |

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

| | |

| 1) | | Amount Previously Paid: |

| | | |

| 2) | | Form, Schedule or Registration No.: |

| | | |

| 3) | | Filing Party: |

| | | |

| 4) | | Date Filed: |

April 1, 2016

Dear Stockholder:

On behalf of the Board of Directors, I cordially invite you to attend the 2016 Annual Meeting of Stockholders of RREEF Property Trust, Inc., to be held on May 5, 2016 at 8:00 a.m. local time at our corporate offices at 345 Park Avenue, 24th Floor, New York, New York 10154. We look forward to your attendance.

The accompanying Notice of Annual Meeting of Stockholders and Proxy Statement include information on the matters to be voted on at the 2016 Annual Meeting of Stockholders. Our Board of Directors has fixed the close of business on March 15, 2016 as the record date for the determination of stockholders entitled to notice of, and to vote at, the 2016 Annual Meeting of Stockholders or any adjournment or postponement thereof.

Your vote is very important. Regardless of the number of shares you own, it is important that your shares be represented at the 2016 Annual Meeting of Stockholders. ACCORDINGLY, WHETHER OR NOT YOU INTEND TO BE PRESENT IN PERSON AT THE 2016 ANNUAL MEETING OF STOCKHOLDERS, I URGE YOU TO SUBMIT YOUR PROXY AS SOON AS POSSIBLE. You may do this by completing, signing and dating the accompanying proxy card and returning it in the accompanying self-addressed postage-paid return envelope. You may also electronically submit your proxy by Internet or vote by touch-tone telephone by referring to the instructions provided on the enclosed proxy card.

Please follow the directions provided in the Proxy Statement. This will not prevent you from voting in person at the 2016 Annual Meeting of Stockholders but will assure that your vote will be counted if you are unable to attend the 2016 Annual Meeting of Stockholders.

YOUR VOTE COUNTS. THANK YOU FOR YOUR ATTENTION TO THIS MATTER AND FOR YOUR CONTINUED SUPPORT OF, AND INTEREST IN, OUR COMPANY.

Sincerely,

/s/ James N. Carbone

James N. Carbone

Chief Executive Officer

RREEF PROPERTY TRUST, INC.

345 PARK AVENUE, 26th FLOOR

NEW YORK, NEW YORK 10154

NOTICE TO STOCKHOLDERS OF ANNUAL MEETING

TO BE HELD ON

MAY 5, 2016

Dear Stockholder:

RREEF Property Trust, Inc. will hold its 2016 annual meeting of stockholders at 8:00 a.m. local time on Thursday, May 5, 2016 at the executive offices of RREEF Property Trust at 345 Park Avenue, 24th Floor, New York, New York 10154. “We,” “our,” “us” and “our company” each refers to RREEF Property Trust, Inc. The meeting will be held for the following purposes:

| |

| 1. | to elect seven directors to our board of directors for the ensuing year; |

2. to consider and vote upon a proposal to amend a provision of our Articles of Amendment and Restatement to comply with a request from a state securities administrator;

3. to ratify the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2016; and

| |

| 4. | to transact such other business as may properly come before the meeting and any adjourned session of the meeting. |

Only stockholders of record at the close of business on March 15, 2016 (the “Record Date”) are entitled to notice of, and to vote at, the meeting and any adjournments or postponements thereof. This proxy statement and proxy card are being mailed to you on or about April 1, 2016.

By Order of the Board of Directors of RREEF Property Trust, Inc.

/s/ Vikram Mehra

Vikram Mehra

Secretary

April 1, 2016

Your vote is important without regard to the number of shares you own on the Record Date. Although you are invited to attend the meeting and vote your shares in person, if you are unable to attend, you can authorize a proxy to vote your shares easily and quickly by mail or over the Internet or by touch-tone telephone. In order to authorize your proxy by mail, please indicate your voting instructions on the enclosed proxy ballot, date and sign it, and return it in the envelope provided, which is addressed for your convenience and needs no postage if mailed in the United States. In order to authorize your proxy by touch-tone telephone or over the Internet, follow the instructions on the enclosed proxy card.

If, after providing voting instructions, you later decide to change your vote, you may do so by (i) attending the meeting, including any adjournments or postponements thereof, revoking your proxy and voting your shares in person, or (ii) submitting a new proxy authorization by mail, via the Internet or by touch-tone telephone. Your subsequent proxy authorization will supersede any proxy authorization you previously made.

TABLE OF CONTENTS

|

| | |

| | Page |

|

| NOTICE TO STOCKHOLDERS OF ANNUAL MEETING | ii |

|

| QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING | 1 |

|

| PROPOSAL NO. 1: ELECTION OF DIRECTORS | 5 |

|

| EXECUTIVE OFFICERS | 9 |

|

| CORPORATE GOVERNANCE | 10 |

|

| REPORT OF THE AUDIT COMMITTEE | 13 |

|

| COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS | 14 |

|

| SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | 16 |

|

| COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION | 16 |

|

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 17 |

|

| TRANSACTIONS WITH RELATED PERSONS AND CERTAIN CONTROL PERSONS | 18 |

|

| PROPOSAL NO. 2: AMENDMENT TO OUR CHARTER | 24 |

|

| PROPOSAL NO. 3: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 26 |

|

| INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 27 |

|

| DELIVERY OF DOCUMENTS TO SECURITY HOLDERS SHARING AN ADDRESS | 28 |

|

| STOCKHOLDER COMMUNICATIONS WITH THE BOARD OF DIRECTORS | 28 |

|

| INCORPORATION BY REFERENCE | 28 |

|

| OTHER MATTERS | 29 |

|

| APPENDIX A: FORM OF SECOND ARTICLES OF AMENDMENT | 30 |

|

RREEF PROPERTY TRUST, INC.

345 PARK AVENUE, 26th FLOOR

NEW YORK, NEW YORK 10154

PROXY STATEMENT FOR THE

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 5, 2016

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

We are providing you with this proxy statement, which contains information about the items to be voted upon at the 2016 annual meeting of stockholders. To make this information easier to understand, we have presented the information below in a question and answer format. The words "RREEF Property Trust," “we,” “our,” “us” and “our company” refer to RREEF Property Trust, Inc. and its subsidiaries. The terms "RREEF America", “advisor” and “sponsor” each refer to RREEF America L.L.C. RREEF America, together with its affiliates in Europe and Asia, comprises the global real estate investment business of Deutsche Asset Management (“Deutsche AM”), a division of Deutsche Bank A.G. (“Deutsche Bank”).

When and where is the meeting?

The 2016 annual meeting of stockholders (the “Annual Meeting”) will be held on Thursday, May 5, 2016, at 8:00 a.m. Eastern time at our executive offices, which are located at 345 Park Avenue, 24th Floor, New York, New York 10154.

What is this document and why have I received it?

This proxy statement and the enclosed proxy card are being furnished to you, as a stockholder of RREEF Property Trust, because our board of directors is soliciting your proxy to vote at the Annual Meeting. This proxy statement contains information that stockholders should consider before voting on the proposals to be presented at the meeting.

We intend to mail this proxy statement and accompanying proxy card on or about April 1, 2016 to all stockholders of record entitled to vote at the meeting.

What is to be considered at the meeting?

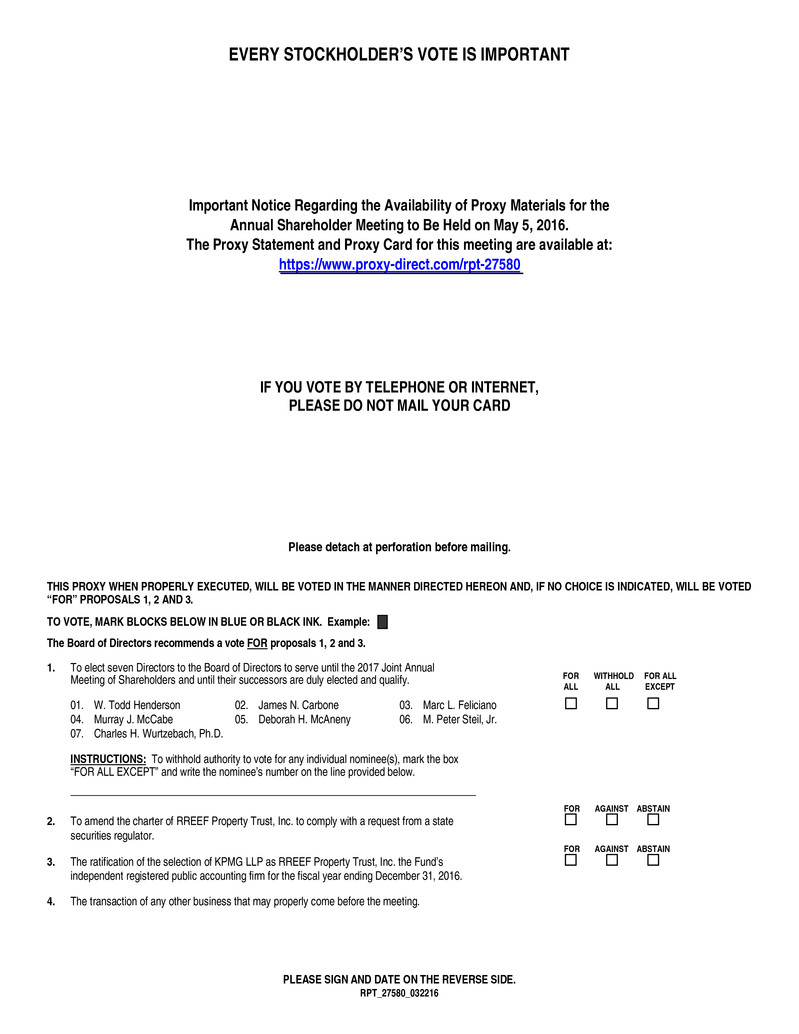

There are three proposals expected to be presented at the meeting:

| |

| 1. | the election of seven directors to our board of directors for the ensuing year; |

| |

| 2. | an amendment to our Articles of Amendment and Restatement (our “Charter”) to comply with a request from a state securities administrator; and |

| |

| 3. | the ratification of the appointment of KPMG LLP (“KPMG”), as our independent registered public accounting firm for the year ending December 31, 2016. |

How is this solicitation being made?

This solicitation is being made primarily by the mailing of these proxy materials. Supplemental solicitations may be made by mail or telephone by our officers and representatives, who will receive no extra compensation for their services. The expenses in connection with this solicitation, including preparing and mailing these proxy materials, will be borne by us. We will reimburse brokerage firms and others for their reasonable expenses in forwarding solicitation material to the beneficial owners of our common stock, $0.01 par value per share. We have hired Georgeson Inc. (“Georgeson”) to assist us in the distribution of our proxy materials and for the solicitation of proxy votes. We will pay Georgeson customary fees and expenses for these services of approximately $10,000.

Upon request, we will also reimburse brokerage houses and other custodians, nominees and fiduciaries for forwarding proxy and solicitation materials to stockholders.

Where can I get more information about RREEF Property Trust?

In connection with this solicitation, we have provided you with an annual report that contains our audited financial statements. We also file reports and other documents with the Securities and Exchange Commission (the “SEC”). You can

view these documents at the SEC’s website, www.sec.gov. You can also find more information on our website, www.rreefpropertytrust.com.

Will my vote make a difference?

Yes. Your vote is needed to ensure that the proposals can be acted upon. YOUR VOTE IS VERY IMPORTANT! Your immediate response will help avoid potential delays and may save us significant additional expenses associated with soliciting stockholder votes. We encourage you to participate in the governance of our company.

What are the voting rights and quorum requirements?

Holders of record of our shares as of the close of business on March 15, 2016 (the “Record Date”) will be entitled to vote at the Annual Meeting. At the close of business on the Record Date, there were 3,641,685, 3,183,997 and 2,208 shares of Class A, Class I and Class T common stock issued and outstanding, respectively, for a total of 6,827,890 shares of our common stock issued and outstanding as of the Record Date. No shares of our Class D common stock were issued and outstanding as of the Record Date. You are entitled to one vote for each share you held as of the Record Date.

The presence, either in person or by proxy, of at least fifty percent of the shares entitled to vote at the Annual Meeting on any matter will constitute a quorum. If a quorum is not present at the Annual Meeting, the chairman of the Annual Meeting may adjourn the Annual Meeting from time to time to a date not more than 120 days from the original Record Date for the Annual Meeting to permit further solicitation of proxies.

What is the voting requirement to approve each of the proposals?

The election of each nominee for director requires the approval of a majority of the shares represented in person or by proxy at the Annual Meeting. Any shares present in person or by proxy and not voted (whether by broker non-vote or otherwise) will have the effect of a vote against the nominees. If an incumbent nominee for the board of directors fails to receive the required number of votes for re-election, then under Maryland law, he or she will continue to serve as a “holdover” director until his or her successor is duly elected and qualifies.

The approval of the amendment to our Charter requires the affirmative vote of at least a majority of all votes entitled to be cast with respect to such amendment. Any shares not voted (whether by abstention, broker non-vote or otherwise) will have the effect of votes against the amendment to our Charter.

The ratification of KPMG as our independent registered public accounting firm for the year ending December 31, 2016 requires the affirmative vote of at least a majority of all votes cast at the Annual Meeting in person or by proxy. Any shares not voted (whether by abstention, broker non-vote or otherwise) will have no impact on the vote.

How do I vote if I am a registered stockholder?

If you are a registered stockholder (that is, if your shares are registered on our records in your name and not in the name of your broker or nominee), you may vote in person by attending the Annual Meeting at our offices listed above. If you intend to vote in person at the Annual Meeting, you must bring valid government-issued photo identification, such as a driver’s license or a passport. Additionally, you may use any of the following three options for authorizing a proxy to vote your shares prior to the Annual Meeting:

| |

| 1. | via the Internet by going to the web address listed on the proxy card and following the on-screen directions; |

2.by phone by calling the number listed on the proxy card and following the instructions; or

3.by mail by marking, signing, dating and returning the enclosed proxy card.

If you authorize a proxy by telephone or Internet, you do not need to mail your proxy card. See the attached proxy card for more instructions on how to vote your shares.

All proxies that are properly executed and received by our Secretary prior to the Annual Meeting, and are not revoked, will be voted at the Annual Meeting. Shares represented by properly executed proxies will be voted in accordance with the instructions on those proxies. If no specification is made on a properly executed proxy, it will be

voted FOR the election of each of the nominees set forth in Proposal No. 1, FOR the amendment to our Charter as set forth in Proposal No. 2 and FOR the ratification of the appointment of KPMG as our independent registered public accounting firm as set forth in Proposal No. 3. Even if you plan to attend the Annual Meeting in person, we urge you to return your proxy card or submit a proxy by telephone or via the Internet to assure the representation of your shares at the Annual Meeting.

How do I vote if I hold my shares in “street name”?

If your shares are held by your bank or broker as your nominee (in “street name”), you should receive a proxy or voting instruction form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker to vote your shares.

If your shares are held in street name and you wish to attend the Annual Meeting and/or vote in person, you must bring your broker or bank voting instruction card and a proxy, executed in your favor, from the record holder of your shares. In addition, you must bring valid government-issued photo identification, such as a driver’s license or a passport.

How is quorum determined?

For the purpose of determining whether a quorum is present at the Annual Meeting, we will count shares represented in person or by properly executed proxy. We will treat shares which abstain from voting as to a particular matter and broker non-votes (defined below) as shares that are present at the Annual Meeting for purposes of determining whether a quorum exists, but we will not count them as votes cast on such matter. A “broker non-vote” occurs when a broker does not vote on a matter on the proxy card because the broker does not have discretionary voting power for that particular matter and has not received voting instructions from the beneficial owner.

How does the board of directors recommend that I vote?

Our board of directors recommends that you vote your shares as follows:

| |

| • | FOR the election of each of the seven nominees to our board of directors |

| |

| • | FOR the amendment to our Charter; and |

| |

| • | FOR the ratification of the appointment of KPMG as our independent registered public accounting firm for the year ending December 31, 2016. |

Can I change my vote after submitting my proxy?

You may revoke a previously submitted proxy at any time prior to the Annual Meeting in any of three ways:

| |

| 1. | Submitting a written notice of revocation to the Secretary of RREEF Property Trust, c/o RREEF Property Trust, Inc., 345 Park Avenue, 26th Floor, New York, New York 10154, which must be received prior to the Annual Meeting, must be signed and must include your name and account number; |

| |

| 2. | Submitting another proxy with a later date if received prior to the Annual Meeting; or |

| |

| 3. | Attending the Annual Meeting and voting in person. |

If we receive your proxy authorization by telephone or over the Internet, we will use procedures reasonably designed to authenticate your identity, to allow you to authorize the voting of your shares in accordance with your instructions and to confirm that your instructions have been properly recorded. Proxies authorized by telephone or via the Internet may be revoked at any time before they are voted in the same manner that proxies authorized by mail may be revoked.

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

Where can I find the voting results of the Annual Meeting?

We intend to announce preliminary voting results at the Annual Meeting and then disclose the final results in a Current Report on Form 8-K filed with the SEC within four business days after the date of the Annual Meeting.

How can I get additional copies of this proxy statement or other information filed with the SEC relating to this solicitation?

You may obtain additional copies of this proxy statement by calling our solicitor, Georgeson, toll free at (888) 565-5190.

In addition, we file annual, quarterly and special reports and other information with the SEC. Our SEC filings are available to the public on the SEC’s website at www.sec.gov. You may also read and copy any reports, statements or other information we file with the SEC at the SEC’s Public Reference Room located at 100 F Street, N.E., Washington, DC 20549. You may also obtain copies of the documents at prescribed rates by writing to the Public Reference Section of the SEC at 100 F Street, N.E., Washington, DC 20549. Please call the SEC at 1-800-SEC-0330 for further information regarding the public reference facilities.

When are stockholder proposals due for next year’s annual meeting?

Under SEC regulations, any stockholder desiring to make a proposal to be acted upon at our 2017 annual meeting of stockholders must cause such proposal to be received at our principal executive offices located at 345 Park Avenue, 26th Floor, New York, NY 10154, Attention: Secretary, no later than December 2, 2016 in order for the proposal to be considered for inclusion in our proxy statement for that meeting; provided, however, that in the event that the date of the 2017 annual meeting of stockholders is advanced or delayed by more than thirty days from the first anniversary of the date of the 2016 Annual Meeting, the deadline for the delivery of such stockholder proposal will be a reasonable time prior to the date we begin to print and send our proxy materials. Stockholders also must follow the procedures prescribed in Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Pursuant to Article II, Section 11(a)(2) of our bylaws, if a stockholder wishes to present a proposal at the 2017 annual meeting of stockholders, whether or not the proposal is intended to be included in the proxy statement for that meeting, the stockholder must give advance written notice thereof to our Secretary at our principal executive offices, no earlier than November 2, 2016 and no later than 5:00 p.m., Eastern Time, on December 2, 2016; provided, however, that in the event that the date of the 2017 annual meeting of stockholders is advanced or delayed by more than thirty days from the first anniversary of the date of the 2016 Annual Meeting, written notice of a stockholder proposal must be delivered not earlier than the 150th day prior to the date of the 2017 annual meeting of stockholders and not later than 5:00 p.m., Eastern Time, on the later of the 120th day prior to the date of the 2017 annual meeting of stockholders or the tenth day following the day on which public announcement of the date of the 2017 annual meeting of stockholders is first made. Any stockholder proposals not received by us by the applicable date in previous sentence will be considered untimely. Rule 14a-4(c) promulgated under the Exchange Act permits our management to exercise discretionary voting authority under proxies it solicits with respect to such untimely proposals. We presently anticipate holding the 2017 annual meeting of stockholders in May 2017.

PROPOSAL NO. 1:

ELECTION OF DIRECTORS

Background

At the Annual Meeting, seven directors are to be elected for the ensuing year and until their successors are elected and qualify. Each of the nominees for director currently is a director of RREEF Property Trust and has consented to be named as a nominee in this proxy statement and to continue to serve as our director if elected. Pursuant to our bylaws, we can have no more than 15 and no fewer than three directors, a majority of whom must be independent of our advisor. If elected, each director will hold office until the date of the 2017 annual meeting of stockholders and until his or her successor is elected and qualifies, subject to death, resignation, retirement, disqualification or removal from office. There are no family relationships between any directors or executive officers. No person being nominated as a director is being proposed for election pursuant to any agreement or understanding between such person and any other person.

Our board of directors has nominated (i) Murray J. McCabe, Deborah H. McAneny, M. Peter Steil, Jr. and Charles H. Wurtzebach, Ph.D., as the independent directors and (ii) W. Todd Henderson, James N. Carbone and Marc L. Feliciano. Each of the nominees, except Messrs. Feliciano, Henderson and Carbone has served on our board of directors since November 27, 2012. Messrs. Henderson, Carbone and Feliciano have served on our board of directors since May 9, 2012.

Director Nominees

The following table provides information about the nominees to our board of directors:

|

| | |

| Name | Age | Position |

| W. Todd Henderson | 48 | Director, Chairman of the Board |

| James N. Carbone | 60 | Chief Executive Officer, President and Director |

| Marc L. Feliciano | 45 | Director |

| Murray J. McCabe | 48 | Lead Independent Director |

| Deborah H. McAneny | 57 | Independent Director |

| M. Peter Steil, Jr. | 73 | Independent Director |

| Charles H. Wurtzebach, Ph.D. | 67 | Independent Director |

The principal occupations and certain other information about the nominees are set forth below.

W. Todd Henderson has served as our Chairman of the Board of directors since February 2012. Mr. Henderson has also served as a Managing Director and Head of Real Estate, Americas, Deutsche AM since January 2012, where he has been responsible for all facets of the direct real estate investment management business in the Americas. From March 2009 to January 2012, Mr. Henderson served as the Chief Investment Officer of RREEF Real Estate, Americas. From June 2007 to March 2009, he supervised RREEF Real Estate’s Value-Added and Development team, managing a $4.5 billion real estate investment portfolio for multiple institutional investors. Mr. Henderson served as a Managing Director of RREEF Real Estate’s Acquisitions team from 2003 to June 2007. Prior to joining RREEF Real Estate in 2003, Mr. Henderson was Director of Acquisitions for The J.E. Robert Company in Washington, D.C., where he was involved in the sourcing, executing and financing of over $6 billion of real estate transactions. He began his career at First Gibraltar Bank

in 1991, managing the restructuring and disposition of nonperforming real estate loans on behalf of the bank and the Resolution Trust Company. Mr. Henderson holds a B.A. in History from the University of North Texas and an M.B.A. from The Wharton School of the University of Pennsylvania.

James N. Carbone has served as our Chief Executive Officer and President and as one of our directors since February 2012. Mr. Carbone has also served as a Managing Director and Head of Real Estate Retail Products, Americas, Deutsche AM since September 2012, where he is responsible for growing real estate retail offerings in the Americas. Mr. Carbone served as Managing Director and Head of Global Business Development for RREEF Real Estate from January 2009 to September 2012. During this period, Mr. Carbone also served as Global Head of RREEF Real Estate from January 2009 to July 2010. He led the Strategic Initiatives Group for RREEF Real Estate from 2006 to January 2009. Mr. Carbone served as Office Specialist of RREEF Real Estate, overseeing all of the firm’s investments in commercial office properties and managing acquisition and disposition transactions in the office sector, from 1999 to 2007. In 1997, Mr.

Carbone was named a partner of RREEF Real Estate and in 1998 became a member of RREEF Real Estate’s Americas Investment Committee. From 1979 until he joined RREEF Real Estate in 1995, Mr. Carbone worked in various capacities in the commercial real estate business, gaining experience in the management, brokerage, development, disposition and acquisition of properties. He is affiliated with numerous industry groups, including the Urban Land Institute and the National Association of Industrial and Office Properties. Mr. Carbone holds a B.A. in Economics from the University of California, Davis.

Marc L. Feliciano has served as one of our directors since November 2012. Mr. Feliciano has also served as a Managing Director, Chief Investment Officer and Head of Real Estate Portfolio Management, Americas, Deutsche AM since September 2012. As Chief Investment Officer, he works with portfolio managers in developing specific portfolio strategies for each account or fund as part of the annual investment plan process. Mr. Feliciano also serves as Chairman of Deutsche AM’s Americas Investment Committee, which governs equity and debt investments and portfolios, a member of the Americas Leadership Committee and Co-Portfolio Manager of the RREEF Debt Investments Fund. From September 2010 to January 2012, he served as Global Head of Risk and Performance Analysis for RREEF Real Estate, where he was responsible for the development of allocation, risk and performance tools. In this role, he was a member of the Global Chief Investment Officer Group, which formulated global and regional house views and strategy and developed the House Portfolio for each region. From 2005 to September 2010, Mr. Feliciano was a Portfolio Manager and assisted in the restructuring of real estate debt. Prior to joining RREEF Real Estate in 2005, Mr. Feliciano worked in the private and public real estate industries in various positions for Morgan Stanley, Heitman Real Estate Securities LLC (formerly Heitman/PRA Securities Advisors) and INVESCO Realty Advisors, Inc. He holds a B.A. in Business Administration from the University of Texas at Austin and an M.B.A. from the University of Texas McCombs School of Business.

Murray J. McCabe has served as one of our independent directors since November 2012 and as our lead independent director since March 2013. In September 2012, Mr. McCabe joined Blum Capital Partners, L.P., or Blum Capital, an investment firm, as a Managing Partner, where he serves as a member of the Management Committee of the firm, and as Managing Partner of Montgomery Street Partners. He is responsible for overseeing and managing Blum Capital’s global real estate-related investment initiatives, focusing on distressed debt, opportunistic equity investments and structured investments in public securities. Prior to joining Blum Capital, Mr. McCabe worked at JPMorgan Chase & Co., or JPMorgan, from 1992 through August 2012. During his 20-year tenure at JPMorgan, Mr. McCabe held several positions in the Investment Banking Division, including Managing Director and Co-Head of Real Estate and Lodging Investment Banking, North America, from March 2007 to March 2008, and Global Head of Real Estate and Lodging Investment Banking, from March 2008 through his departure in August 2012. In addition, Mr. McCabe served as a member of JPMorgan’s Mergers and Acquisitions Fairness Opinion Committee from 2001 to 2002, the Investment Banking Coverage Management Committee from 2010 through his departure in August 2012 and on the board of JPMorgan Real Estate Advisors during the same period. Mr. McCabe is a member of the advisory board for the Fisher Center for Real Estate and Urban Economics at the University of California at Berkeley, and is also an executive council member of the Real Estate Finance and Investment Center and serves on the REIT Investment Funds advisory board for the McCombs School of Business at the University of Texas at Austin. He has served as a director of Columbia Property Trust, Inc. since September 2013. Mr. McCabe holds a B.A. in Finance from the University of Texas at Austin.

Deborah H. McAneny has served as one of our independent directors since November 2012. Ms. McAneny served as the Chief Operating Officer of Benchmark Assisted Living, LLC, or Benchmark, an owner and operator of senior living facilities in New England, from April 2007 to May 2009. Since April 2007, she has also served as a director (2007-2013) and member of the board of advisors (2013-present) of Benchmark and member of its audit committee. Prior to joining Benchmark, she was employed by John Hancock Financial Services, or John Hancock, for approximately 20 years, where she advanced to Executive Vice President and was responsible for a portfolio of structured and alternative investment businesses including John Hancock’s real estate, structured fixed-income, timber and agricultural investment business units. Prior to joining John Hancock in 1985, she was a senior auditor for Arthur Anderson & Co. for four years. Ms. McAneny serves on the board of directors of several other companies. Since January 2007, Ms. McAneny has served on the board of HFF, Inc., or HFF, a publicly traded provider of commercial real estate capital market services listed on the NYSE. She is currently the lead independent director of HFF, the Chairperson of its Nominating and Corporate Governance Committee and a member of its Audit Committee. Since June 2015, Ms. McAneny has also been a director of THL Credit, Inc., a publicly-traded business development company and serves on its Governance and Compensation Committees. Ms. McAneny has also served as a director of RREEF America REIT II, Inc., a private REIT sponsored by our sponsor, since May 2011. From 2005 to 2014, she served as a director of KKR Financial Holdings LLC, or KFN, a publicly traded specialty finance company listed on the NYSE. She was also the Chairperson of KFN’s Compensation Committee and a member of KFN’s Affiliated Transaction Committee and Nominating and Corporate Governance Committee. She has served as a trustee of the University of Vermont since 2004 and as a trustee of the Rivers School since 2004. From 2001 to 2004, she served as President of the CRE Finance Council, formerly known as the Commercial

Mortgage Securities Association, an international trade organization for the commercial real estate finance markets. Ms. McAneny holds a Masters Professional Director Certification from the American College of Corporate Directors and a B.S. in Business Management from the University of Vermont.

M. Peter Steil, Jr. has served as one of our independent directors since November 2012. Mr. Steil has served as the Chief Executive Officer of the National Council of Real Estate Investment Fiduciaries, or NCREIF, an association of institutional real estate professionals, since July 2012. From January 2007 to July 2012, he served as a Managing Director of Prescott Capital Advisors, LLC, or Prescott, where he was responsible for Prescott’s real estate investment banking and advisory efforts and raising debt and equity capital for its principal investments. From 2001 to 2006, he served as a Managing Director of Wells Hill Partners, Ltd., a real estate investment banking firm based in New York. From 1998 to 2001, Mr. Steil served as a Managing Director of Putnam Lovell Securities, Inc., or Putnam Lovell, an investment bank that provides mergers and acquisitions advisory services to asset management firms. Prior to joining Putnam Lovell, he served in senior positions at several financial services firms, including Nesbitt Burns Securities, Inc. and KPMG Baymark Capital, LLC. Mr. Steil also serves as a Vice Chairman of the Global Exchange Council for the Urban Land Institute, is a member of PREA and serves on the Real Estate Advisory Committee of the Ontario Public Service Employees Union Pension Trust. Mr. Steil holds a B.A. in Political Science from Stanford University and an M.B.A. in International Business from the Harvard Business School.

Charles H. Wurtzebach, Ph.D., has served as one of our independent directors since November 2012. Dr. Wurtzebach is Chairman, Department of Real Estate; and as the Douglas and Cynthia Crocker Endowed Director of the Real Estate Center at DePaul University in Illinois, lecturing at the undergraduate and graduate levels, participating in research projects and providing support to the DePaul Real Estate Center. Dr. Wurtzebach joined the DePaul University faculty in January 2009. From 1999 to November 2008, Dr. Wurtzebach served as Managing Director and Property Chief Investment Officer of Henderson Global Investors (North America) Inc., or Henderson, an international investment management company headquartered in London, where he was responsible for the strategic portfolio planning and the overall management of Henderson’s North American business. He served as a member of Henderson’s Senior Management Team from 2001 to November 2008 and Chairman of Henderson’s North America Senior Management Committee from 1999 to November 2008. Dr. Wurtzebach served as President and Chief Executive Officer of Heitman Capital Management from 1994 to 1998 and President of JMB Institutional Realty from 1991 to 1994. His responsibilities included supervising the financial risk exposure, financial reporting and internal control procedures of each company. Since May 2009, Dr. Wurtzebach has served as a director of Inland Diversified Real Estate Trust, Inc., a public non-listed REIT. Since July 2014, he has served as an Independent Director of Kite Realty Group, a publicly-registered, publicly-traded REIT. He is also a founder, former president and former director of the Real Estate Research Institute, or RERI. Dr. Wurtzebach holds a B.S. in Finance from DePaul University in Illinois, an M.B.A. from Northern Illinois University and a Ph.D in finance from the University of Illinois at Urbana.

At the Annual Meeting, we will vote each valid proxy returned to us for the seven nominees listed above unless the proxy specifies otherwise. Proxies may not be voted for more than seven nominees for director. While our board does not anticipate that any of the nominees will be unable to stand for election as a director at the Annual Meeting, if that is the case, proxies will be voted in favor of such other person or persons as our board may designate.

Director Qualifications, Experience, Attributes and Skills

Our board of directors believes that the significance of each director nominee’s qualifications, experience, attributes and skills is particular to that individual, meaning that there is no single test applicable to all director candidates. The effectiveness of the board is best evaluated as a group of directors, rather than at an individual director level. As a result, our board has not established specific minimum qualifications that must be met by each individual wishing to serve as a director. When evaluating candidates for a position on our board of directors, the board considers the potential impact of the candidate, along with his or her particular experiences, on the board as a whole. The diversity of a candidate’s background or experiences, when considered in comparison to the background and experiences of other members of the board of directors, may or may not impact the board’s view as to the candidate. In evaluating director candidates, our board considers all factors that it deems relevant.

In recommending director nominees to our board of directors, our board of directors solicits candidate recommendations from its current members and our management. Our board of directors also will consider recommendations made by stockholders for director nominees who meet the established director criteria set forth above. In evaluating the persons recommended as potential directors, our board will consider each candidate without regard to the source of the recommendation and take into account those factors that the board determines are relevant. Stockholders

may directly nominate potential directors by satisfying the procedural requirements for such nomination as provided in Article II, Section 11(a)(2) of our bylaws.

In conducting its annual self-assessment and nominating the director nominees, our board of directors determined that each director nominee has the qualifications, experience, attributes and skills appropriate to continue his or her service as a director of our company in view of our business and structure. In addition to a demonstrated record of business and professional accomplishment, each of our director nominees has substantial experience serving on boards, including our board and boards of other organizations. Each of our directors has gained substantial insight as to the operation of our company and has demonstrated a commitment to discharging his or her oversight responsibilities as a director.

Each director was nominated to our board of directors on the basis of the unique skills he or she brings to our board, as well as how such skills collectively enhance our board. On an individual basis:

| |

| • | W. Todd Henderson: Our board of directors has determined that Mr. Henderson will be a valuable member of our board because of his experience as a real estate industry executive with extensive investment, capital markets and portfolio management expertise, all of which we expect to bring valuable insight to the board of directors. |

| |

| • | James N. Carbone: Our board of directors has determined that Mr. Carbone’s experience with real estate investment products, particularly alternative investments, experience in acquiring commercial real estate and oversight of a multi-billion dollar real estate portfolio will make him a valuable member of our board of directors. |

| |

| • | Marc L. Feliciano: Our board of directors has determined that Mr. Feliciano will be a valuable member of our board of directors because of his extensive experience with real estate investments and portfolio management. |

| |

| • | Murray J. McCabe: Our board of directors has determined that Mr. McCabe’s extensive investment banking and transactional experience in the real estate industry will make him a valuable member of the board of directors. |

| |

| • | Deborah H. McAneny: Our board of directors has determined that Ms. McAneny will be a valuable member of our board because of her leadership positions on boards of public companies and experience with management of commercial real estate portfolios. |

| |

| • | M. Peter Steil, Jr.: Our board of directors has determined that Mr. Steil will be a valuable member of our board of directors because of his extensive experience with investment banking, real estate advisory services and portfolio management. |

| |

| • | Charles H. Wurtzebach, Ph.D.: Our board of directors has determined that Dr. Wurtzebach will be a valuable member of our board because of his academic experience as a real estate professor, his industry experience as an executive for investment management companies and his board experience with public non-listed REITs. |

The information above is not exclusive. When considering a director nominee, our board of directors considers many intangible elements, such as intelligence, integrity, work ethic, commitment to stockholder interests and the ability to work with other directors, communicate effectively, exercise judgment and ask incisive questions.

The election of each nominee for director requires the approval of a majority of the shares represented in person or by proxy at the Annual Meeting. Any shares present in person or by proxy and not voted (whether by broker non-vote or otherwise) will have the effect of a vote against the nominees. If an incumbent nominee for the board of directors fails to receive the required number of votes for re-election, then under Maryland law, he or she will continue to serve as a “holdover” director until his or her successor is duly elected and qualifies.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR”

ALL OF THE NOMINEES LISTED ABOVE FOR NOMINATION AS DIRECTORS.

EXECUTIVE OFFICERS

The following table provides information about our executive officers. Each executive officer, once appointed, serves at the pleasure of the Board until the next annual meeting of the Board and until his or her successor shall have been duly appointed and qualified or until such individual resigns or is removed from office. There are no family relationships between any directors or executive officers. None of our executive officers was appointed pursuant to any agreement or understanding between such person and any other person.

|

| | |

| Name | Age | Position |

| James N. Carbone | 60 | Chief Executive Officer and President |

| Julianna S. Ingersoll | 36 | Chief Operating Officer and Executive Vice President |

| Eric M. Russell | 51 | Chief Financial Officer and Vice President |

The biography of Mr. Carbone is set forth above in “Proposal No. 1: Election of Directors.”

Julianna S. Ingersoll has served as our Chief Operating Officer and Executive Vice President since February 2015. In this role, Ms. Ingersoll oversees business development, operations and finance, including external and internal sales, relations with third-party distributors, product development and strategy. Ms. Ingersoll previously served as our Chief Financial Officer and Vice President from February 2012 to February 2015. Ms. Ingersoll has also served as a Director, Real Estate Retail Products, Americas, of Deutsche AM, since February 2012. Prior to this position, Ms. Ingersoll was a Vice President of Business Development for RREEF Real Estate, currently RREEF America, our sponsor, which, together with its affiliates in Europe and Asia, comprises the global real estate investment business of Deutsche AM, from November 2007 to February 2012, where she sourced, underwrote and executed strategic transactions. Prior to joining RREEF Real Estate, she held various positions with Deutsche Bank. From May 2006 to November 2007, Ms. Ingersoll served as Vice President of the Residential Mortgage-Backed Securities group of Deutsche Bank, where she was responsible for sourcing, underwriting and executing strategic acquisitions and joint ventures. From 2004 to 2006, she served as an Associate and Vice President of the Corporate Investments group of Deutsche Bank, where she was responsible for sourcing and executing strategic acquisitions and divestitures. From 2003 to 2004, she served as an Analyst for the Corporate Investments group of Deutsche Bank. Ms. Ingersoll joined Deutsche Bank in June 2001 as an analyst for the Technology Investment Banking team. Ms. Ingersoll holds a B.S. in Business Administration from Washington & Lee University.

Eric M. Russell has served as our Chief Financial Officer and Vice President since February 2015. Mr. Russell previously served as our Assistant Treasurer from May 2013 to February 2015. He has served as a Director and Controller, RREEF Real Estate Fund Finance, Americas, Deutsche AM since 2011 and as Vice President and Controller, RREEF Real Estate Fund Finance since 2000. During his tenure, Mr. Russell oversaw RREEF Property Trust since November 2012 and previously presided over a large separate account with a peak size of USD 4.5 billion, a separate account focused on ground-up development and a private foreign investor-owned REIT of approximately USD 1 billion. In these roles, Mr. Russell oversaw all financial reporting, fund accounting, tax compliance and loan compliance. Prior to joining RREEF Real Estate, Mr. Russell served as an Accounting Manager and Assistant Controller at iStar Financial, Inc., a publicly traded REIT, from 1996 to 2000. From 1994 to 1996, he worked as a Controller at Sierra National Home Warranty Corporation, a publicly traded company. Mr. Russell served as a Senior Auditor at Grant Thornton LLP from 1992 to 1994 and a Staff Auditor from 1991 to 1992. Mr. Russell holds a B.S. in Atmospheric Science from the University of California, Davis and is a certified public accountant (inactive).

CORPORATE GOVERNANCE

Role of the Board

Our board of directors oversees our management and operations, while our advisor is responsible for our day-to-day management and operations. Our board’s oversight role does not make its directors guarantors of our investments or activities.

Our board has appointed various employees of our advisor as officers of our company with the collective responsibility to monitor and report to our board of directors on our operations. In conducting its oversight, our board of directors receives regular reports from these officers and from other senior officers of our advisor regarding our operations. Some of these reports are provided as part of formal “board meetings,” which are typically held quarterly, in person, and involve the board’s review of our recent operations. From time to time, one or more of our directors may also meet with management in less formal settings, between scheduled board meetings, to discuss various topics.

Board Leadership Structure

Our board of directors has structured itself in a manner that it believes allows it to perform its oversight function effectively. A majority of our directors are independent. Our offices of Chairman of the Board and Chief Executive Officer are separate even though such separation is not required. Mr. Henderson, as our Chairman of the Board, is responsible for reviewing the agenda for the meetings of the board of directors and the annual meetings of stockholders, and Mr. Carbone, as our Chief Executive Officer, is responsible for the general management of our business, financial affairs and day-to-day operations.

In addition, our board has determined that since the Chairman of the Board is not an independent director, a lead independent director should be appointed by a majority of our independent directors. Our independent directors have appointed Mr. McCabe to serve as our lead independent director. Key responsibilities of our lead independent director include, among others, presiding at executive sessions of independent directors, facilitating communications between the independent directors and the Chairman of the Board and Chief Executive Officer, and calling meetings of the independent directors, as necessary.

Our board of directors reviews its structure annually. Our board of directors believes that its structure, in which representatives of our advisor serve on the board of directors, is appropriate in light of the significant services that our advisor provides to us. In addition, our board of directors believes that requiring a majority of the board of directors to be comprised of independent directors as well as the structure, function and composition of the Audit Committee (as described below in “Committees”) and the requirement that related party transactions be presented to the full board of directors, are an appropriate means to provide effective oversight and address any potential conflicts of interest that may arise from our relationship with our advisor.

Board Oversight of Risk Management

As part of its oversight function, the board of directors receives and reviews various reports relating to risk management. Because risk management is a broad concept comprised of many different elements (including, among other things, investment risk, valuation risk, credit risk, compliance and regulatory risk, business continuity risks, operational risk and insurance), board oversight of different types of risks is handled in different ways. For example, the full board of directors receives and reviews reports from senior personnel of our advisor (including senior compliance, financial reporting and investment personnel) or their affiliates regarding various types of risks, such as operational, compliance and investment risk, and how they are being managed. The Audit Committee supports the board’s oversight of risk management in a variety of ways, including (i) participation in and receipt and review of reports regarding our disclosure controls and procedures prior to the issuance of our quarterly financial reports, (ii) meetings with our Chief Financial Officer and our independent public accountants to discuss, among other things, the internal control structure of our financial reporting function and compliance with certain requirements of the Sarbanes-Oxley Act of 2002, as amended, and (iii) reporting to the board of directors as to these and other matters.

Director Independence

Although our shares are not listed for trading on any national securities exchange, our board of directors has determined that a majority of the members of our board of directors, and all of the members of the audit committee, are “independent” as defined by the New York Stock Exchange (the “NYSE”). The NYSE standards provide that to qualify as an independent director, in addition to satisfying certain bright-line criteria, the board of directors must affirmatively determine that a director has no material relationship with us (either directly or as a partner, stockholder or officer of an organization that has a relationship with us).

In addition, our board of directors determined that these directors are independent pursuant to the definition of independence in our Charter, as required by the North American Securities Administrators Association's Statement of Policy Regarding Real Estate Investment Trusts, as revised and adopted on May 7, 2007, or the NASAA REIT Guidelines. Our Charter provides that an independent director is a director who is not and has not for the last two years been associated, directly or indirectly, with our advisor or sponsor. A director is deemed to be associated with our advisor or sponsor if he or she owns any interest in, is employed by, is an officer or director of, or has any material business or professional relationship with our advisor, our sponsor, or any of their affiliates, performs services (other than as a director) for us, or serves as a director or trustee for more than three REITs organized by our sponsor or advised by our advisor. A business or professional relationship will be deemed material per se if the gross revenue derived by the director from our sponsor, our advisor, and any of their affiliates exceeds five percent of (i) the director’s annual gross revenue derived from all sources during either of the last two years or (ii) the director's net worth on a fair market value basis. An indirect relationship is defined to include circumstances in which the director's spouse, parents, children, siblings, mothers- or fathers-in-law, sons- or daughters-in-law or brothers- or sisters-in-law is or has been associated with us, our advisor, our sponsor or any of their affiliates. Our Charter requires that at all times at least one of our independent directors must have at least three years of relevant real estate experience.

Our board of directors has determined that Murray J. McCabe, Deborah H. McAneny, M. Peter Steil, Jr., and Charles H. Wurtzebach, Ph.D. are independent directors pursuant to our Charter and the definition of independence as defined by the NYSE.

Meetings of the Board of Directors

During the fiscal year ended December 31, 2015, our board of directors met eight times. Each of our directors attended at least 75% of the aggregate of the total number of meetings of our board of directors held during the period for which he or she served as a director and the total number of meetings held by all committees of our board of directors on which he or she served during the periods for which he or she was a director.

We do not have a formal policy requiring directors to attend annual meetings of stockholders, although we do encourage their attendance. All of our directors attended our 2015 annual meeting of stockholders.

Committees

Our board of directors has one permanent committee, the Audit Committee. The Audit Committee’s primary function is to assist our board of directors in fulfilling its responsibility to oversee the quality and integrity of our financial reporting and the audits of our financial statements. The Audit Committee fulfills these responsibilities primarily by carrying out the activities enumerated in the Audit Committee Charter adopted by our board of directors. The Audit Committee Charter is available on our web site at www.rreefpropertytrust.com.

The Audit Committee must have at least three members and be comprised solely of members of our board of directors that meet the independence criteria of our Charter and the NYSE listing standards. It is comprised of Deborah H. McAneny, M. Peter Steil, Jr. and Charles H. Wurtzebach, each of whom meets the qualifications for audit committee independence under the rules of the NYSE. Dr. Wurtzebach serves as the Chairperson of the Audit Committee, and our board of directors has determined that Dr. Wurtzebach qualifies as an “audit committee financial expert” as that term is defined by SEC rules. The Audit Committee held five meetings during the year ended December 31, 2015.

We do not have a compensation committee because we do not compensate our executive officers or non-independent directors. Recommendations with respect to compensation of our independent directors are made by our board of directors.

Our board of directors believes that each director should be nominated by our full board, which must be comprised of a majority of independent directors, rather than a committee thereof. As a result, we do not have a nominating committee.

Director Orientation and Continuing Education

We provide each director who joins our board with an initial orientation about our company, including our business operations, strategy, policies and governance. We also provide all of our directors with resources and ongoing education opportunities to assist them in staying current about developments in corporate governance and critical issues relating to the operation of boards of public companies and their committees.

Annual Board Self-Assessment

Our board of directors annually conducts a self-evaluation (with anonymous responses permitted) to determine whether it and the Audit Committee are functioning effectively and to identify opportunities to enhance their effectiveness.

Code of Ethics

Our board of directors has adopted a Code of Ethics that applies to each of our directors, our principal executive officer, principal financial officer, principal accounting officer and persons performing similar functions. Our Code of Ethics is available on our website, www.rreefpropertytrust.com. Stockholders may also request a copy of the Code of Ethics, which will be provided without charge, by writing to RREEF Property Trust, Inc. at 345 Park Avenue, 26th Floor, New York, New York 10154, Attention: Secretary. If, in the future, we amend, modify or waive a provision in the Code of Ethics, we may, rather than filing a Current Report on Form 8-K, satisfy the disclosure requirement by posting such information on our website as necessary.

Review of our Policies

Our board of directors, including our independent directors, has reviewed our policies described in our Annual Report and our registration statement related to our public equity offering, as well as other policies previously reviewed and approved by our board of directors, and determined that they are in the best interests of our stockholders because: (1) they increase the likelihood that we will be able to acquire a diversified portfolio of income producing properties, thereby reducing risk in our portfolio; (2) there are sufficient property acquisition opportunities with the attributes that we seek; (3) our executive officers, directors and affiliates of our advisor have expertise with the type of real estate investments we seek; (4) borrowings should enable us to purchase assets and earn rental income more quickly; and (5) corporate governance best practices and high ethical standards help promote our long-term performance, thereby increasing our likelihood of generating income for our stockholders and preserving stockholder capital.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee’s purpose is to assist in fulfilling the board of directors’ responsibility to oversee the quality and integrity of the financial reporting and internal controls of RREEF Property Trust, Inc. (the “Company”) and the audits of its financial statements by its independent registered public accounting firm. The Audit Committee is comprised solely of independent directors, and it operates under a written charter adopted by the Company’s board of directors, a copy of which is available on the Company’s website at www.rreefpropertytrust.com. The Audit Committee intends for its composition, and the attributes of its members and its responsibilities, as reflected in the Audit Committee Charter, to be in accordance with applicable requirements for corporate audit committees. The Audit Committee reviews and assesses the adequacy of its charter on an annual basis.

In accordance with the Audit Committee Charter, the Audit Committee, subject to any action of the Company’s board of directors, has ultimate authority and responsibility to select, compensate, evaluate and, when appropriate, replace the Company’s independent registered public accounting firm. The Audit Committee has the authority to engage its own outside advisors, including experts in particular areas of accounting, as it determines appropriate, apart from counsel or advisors hired by management.

Audit Committee members are not professional accountants or auditors, and their functions are not intended to duplicate or to certify the activities of management and the independent registered public accounting firm. The Audit Committee serves a board-level oversight role, in which it provides advice, counsel and direction to management and to the Company’s auditors on the basis of the information it receives, discussions with management and the auditors and the experience of the Audit Committee’s members in business, financial and accounting matters.

As part of its ongoing activities, the Audit Committee has:

| |

| • | reviewed and discussed the Company’s audited financial statements for the fiscal year ended December 31, 2015 with management; |

| |

| • | discussed with KPMG LLP (“KPMG”) the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1. AU section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3600T; and |

| |

| • | received the written disclosures and the letter from KPMG required by Independence Standards Board Standard No. 1 and has discussed with KPMG its independence. |

Based on the review and discussions referred to above, the Audit Committee recommended to the board of directors that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2015 for filing with the SEC.

Audit Committee:

Deborah H. McAneny

M. Peter Steil, Jr.

Charles H. Wurtzebach

The material in this report is not “soliciting material,” is not deemed “filed” with the SEC, and is not to be incorporated by reference into any filing of our company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language contained in such filing.

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

Executive Officer Compensation

We do not compensate our executive officers and have no employees as all of our day-to-day operations are managed by our advisor. Furthermore, we do not compensate our executive officers under any stock based compensation plans.

Director Compensation

The following director compensation table sets forth the compensation paid to our independent directors in fiscal year 2015 for services to us. Directors who are not independent directors are not compensated by us for their service on our board of directors. All compensation was paid in cash.

|

| | | | | | | | | | | | |

| Name | | Fees Earned or Paid in Cash | | Stock Awards(1) | | Total |

| Deborah H. McAneny | | $ | 55,500 |

| | $ | — |

| | $ | 55,500 |

|

| Murray J. McCabe | | 54,250 |

| | — |

| | 54,250 |

|

| M. Peter Steil, Jr. | | 55,500 |

| | — |

| | 55,500 |

|

| Charles H. Wurtzebach, Ph.D. | | 63,000 |

| | — |

| | 63,000 |

|

| |

| (1) | Each of our independent directors is eligible to receive grants of restricted stock pursuant to our independent directors compensation plan, described below. |

We compensated each of our independent directors with an annual retainer of $50,000, plus an additional retainer of $7,500 to the Chairman of the audit committee. We paid $1,000 for each board or board committee meeting the director attended in person and $250 for each meeting the director attended by telephone. In the event that there was a meeting of the board of directors and one or more committees thereof in a single day, the fees paid to each director were limited to $1,250 per day.

In addition, our board of directors approved the grant of shares of restricted stock to each of our independent directors under our independent directors’ compensation plan, which operates as a sub-plan of our long-term incentive plan, as described below. Under our independent directors compensation plan and subject to such plan’s conditions and restrictions, each of our current independent directors will receive an initial grant of 5,000 Class I shares of restricted stock, which we refer to as the “initial restricted stock grant,” at the end of the first full calendar quarter following the date that we issued 12,500,000 shares in our initial public offering. Each new independent director that subsequently joins the board will receive the initial restricted stock grant of 5,000 Class I shares on the date he or she joins the board. The initial restricted stock grant will generally vest in equal installments over a three-year period beginning on the first anniversary of the grant date; provided, however, that the restricted stock will become fully vested on the earlier occurrence of (1) the termination of the independent director’s service as a director due to his or her death or disability or (2) a change in control of our company. The board of directors may approve, at its discretion, an additional award of Class I shares of restricted stock upon an independent director’s subsequent re-election to the board, subject to such terms and conditions as provided by the board at such time.

All directors are reimbursed for reasonable out-of-pocket expenses incurred in connection with attendance at board meetings.

Our board of directors has adopted a long-term incentive plan, which we use to attract and retain directors, officers, employees and consultants. Our long-term incentive plan offers qualified individuals an opportunity to participate in our growth through awards in the form of, or based on, our common stock. The long-term incentive plan authorizes the granting of restricted stock, stock options, restricted or deferred stock units and other stock-based awards and cash-based awards to directors, employees and consultants of ours selected by the board of directors for participation in the plan. Stock options may not have an exercise price that is less than the fair market value of a share of our common stock on the date of grant and may not have a term in excess of ten years from the grant date.

Our board of directors or a committee appointed by our board of directors administers the long-term incentive plan, with sole authority to determine all of the terms and conditions of the awards. No awards will be granted under the long-term incentive plan if the grant or vesting of the awards would jeopardize our status as a REIT under the Code or otherwise violate the ownership and transfer restrictions imposed under our Charter. Unless otherwise determined by our

board of directors, no award granted under the plan will be transferable except through the laws of descent and distribution.

Our board of directors has authorized and reserved an aggregate maximum number of 300,000 Class I shares for issuance under the long-term incentive plan. However, no awards shall be granted under the incentive plan on any date on which the aggregate number of shares subject to awards previously issued under the incentive plan, together with the proposed awards to be granted on such date, exceeds 2% of the number of outstanding shares of common stock on such date. In the event of a transaction between our company and our stockholders that causes the per-share value of our common stock to change (including, without limitation, a stock dividend, stock split, spin-off, rights offering or large nonrecurring cash dividend), the share authorization limits under the plan will be adjusted proportionately and our board of directors will make adjustments to the long-term incentive plan and awards as it deems necessary, in its sole discretion, to prevent dilution or enlargement of rights immediately resulting from the transaction. In the event of a stock split, a stock dividend or a combination or consolidation of the outstanding shares of common stock into a lesser number of shares, the authorization limits under the plan will automatically be adjusted proportionately and the shares then subject to each award will automatically be adjusted proportionately without any change in the aggregate purchase price.

Our board of directors may, in its sole discretion at any time, determine that all or a portion of a participant’s awards will become fully vested. The board may discriminate among participants or among awards in exercising its discretion. The incentive plan will automatically expire on the tenth anniversary of the date on which it is approved by our board of directors and stockholders, which was November 27, 2012, unless extended or earlier terminated by the board of directors. Our board of directors may terminate the plan at any time. The expiration or other termination of the plan will not, without the participant’s consent, have an adverse impact on any award that is outstanding at the time the plan expires or is terminated. Our board of directors may amend the plan at any time, but no amendment will adversely affect any award without the participant’s consent and no amendment to the plan will be effective without the approval of our stockholders if such approval is required by any law, regulation or rule applicable to the plan.

The following table provides information about our common stock that may be issued under our incentive plan as of December 31, 2015.

|

| | | | | | |

| Plan Category | | Number of Securities to be Issued Upon Exercise of Outstanding Options, Warrants and Rights | | Weighted-Average Exercise of Price of Outstanding Options, Warrants, and Rights | | Number of Securities Remaining Available for Future Issuance Under Equity Compensation Plans |

Equity compensation plans approved by security holders:(1) | | — | | — | | 300,000 |

| Equity compensation plans not approved by security holders: | | N/A | | N/A | | N/A |

| Total | | — | | — | | 300,000 |

Our board of directors is responsible for determining the form and amount of compensation that is paid to our independent directors. In addition, our executive officers may make recommendations regarding the compensation level for the independent directors and provide comparison data. Our board of directors periodically assesses the level of independent director compensation, taking into account the responsibilities and duties of the independent directors and the time required to perform those duties. In determining the level of independent director compensation, our board of directors attempts to be consistent with market practices, but does not set compensation at a level that would call into question the independent directors’ objectivity.

SECTION 16(a) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE

Section 16(a) of the Exchange Act requires our directors and executive officers, and persons who own more than ten percent of a registered class of our equity securities, to file with the SEC, within specified time frames, initial reports of beneficial ownership and reports of changes in ownership of our shares of common stock. Officers, directors and greater than ten percent stockholders are required by SEC regulation to furnish us with copies of all Section 16(a) forms they file with the SEC. None of the foregoing persons were required to file Section 16(a) forms during the fiscal year ended December 31, 2015.

COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION

Our executive officers are compensated by RREEF America and not by us. In 2015, our entire board of directors determined the compensation of our independent directors. As noted above, we have no employees. During the fiscal year ended December 31, 2015, none of our executive officers served as:

| |

| • | a member of the compensation committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire board of directors) of another entity, one of whose executive officers served on our board of directors; or |

| |

| • | a director of another entity, one of whose executive officers served on our board of directors. |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

Security Ownership of Beneficial Owners and Management

The following table shows the beneficial ownership of shares of our common stock as of March 15, 2016 by:

| |

| • | any beneficial owner of more than 5% of our outstanding common stock; |

| |

| • | each of our current executive officers; and |

| |

| • | all of our current directors and executive officers as a group. |

To our knowledge, other than our sponsor and the Saginaw Chippewa Tribe of Michigan, there is no person, or group of affiliated persons, that beneficially owns more than 5% of our common stock. Information with respect to beneficial ownership has been furnished by each director and officer.

Beneficial ownership is determined under the rules of the SEC and generally includes voting or investment power with respect to securities. The address for each of the persons and RREEF America listed in the table below is c/o RREEF Property Trust, Inc., 345 Park Avenue, 26th Floor, New York, New York 10154, and the address of the Saginaw Chippewa Tribe of Michigan is 7070 E Broadway Road, Mt. Pleasant, Michigan 48858.

|

| | | | | | | | |

| Class of Stock | | Name of Beneficial Owner | | Number of Shares Beneficially Owned | | Percent of Class |

| | | Directors and Executive Officers: | | | | |

| | | W. Todd Henderson | | — |

| | — |

|

| I | | James N. Carbone | | 25,222.73 |

| | 0.79 | % |

| | | Marc L. Feliciano | | — |

| | — |

|

| | | Murray J. McCabe | | — |

| | — |

|

| I | | Deborah H. McAneny | | 4,386.78 |

| | 0.14 |

|

| | | M. Peter Steil, Jr. | | — |

| | — |

|

| I | | Charles H. Wurtzebach, Ph.D. | | 8,097.17 |

| | 0.25 |

|

| I | | Julianna S. Ingersoll | | 1,843.38 |

| | 0.06 |

|

| | | Eric M. Russell | | — |

| | — |

|

| | | All current executive officers and directors as a group (9 persons) | | 39,550.06 |

| | 1.24 | % |

| | | 5% Stockholders: | | | | |

| I | | RREEF America L.L.C. | | 938,056.97 |

| | 29.46 | % |

| A | | Saginaw Chippewa Tribe of Michigan | | 444,138.45 |

| | 12.20 | % |

TRANSACTIONS WITH RELATED PERSONS AND CERTAIN CONTROL PERSONS

The following describes all transactions during the years ended December 31, 2015, 2014 and 2013 and currently proposed transactions involving us, our directors, our advisor, our sponsor and any affiliate thereof. Our independent directors are specifically charged with the duty to examine, and have examined, the fairness of such transactions, and have determined that all such transactions are fair and reasonable to us.

Ownership Interests

RREEF America has invested an aggregate of $10.2 million in us through purchases of shares of our Class I common stock. As of March 15, 2016, our executive officers and independent directors, as a group, owned no shares of our Class A or Class T common stock and 39,550 shares of Class I common stock.

Our Relationship with Our Advisor and Our Sponsor

We are externally advised and managed by our sponsor and advisor, RREEF America, which is responsible for the management, acquisition, disposal, leasing, maintenance and operating of all our real estate investments. RREEF America’s executive offices are located at 345 Park Avenue, 26th floor, New York, New York 10154. RREEF America’s telephone number is (212) 454-6260. All of our officers and directors, other than the independent directors, are employees of RREEF America. We have and will continue to have certain relationships with RREEF America and its affiliates.

Advisory Agreement

We are managed and advised by RREEF America pursuant to an advisory agreement, as amended, that first became effective December 21, 2012 and was last renewed on November 5, 2015, effective as of January 3, 2016, for an additional one-year term expiring January 3, 2017.

Pursuant to the advisory agreement and subject to the supervision of our board of directors, our advisor will have the responsibility to, among other things:

|

| | | |

| | Ÿ | | consult with our board of directors in formulating our financial, investment, valuation and other policies, consistent with achieving our investment objectives; |

| | | | |

| | Ÿ | | find, evaluate, present and recommend to us investment opportunities consistent with our investment policies and objectives; |

|

| | | |

| | Ÿ | | serve as our investment and financial advisor and provide research and economic and statistical data in connection with our assets and investment policies; |

|

| | | |

| | Ÿ | | determine the proper allocation of our investments between properties, real estate loans, real estate equity securities and cash, cash equivalents and other short-term investments; |

|

| | | |

| | Ÿ | | select its sub-advisor, joint venture and strategic partners, and service providers for us such as our transfer agent and structure corresponding agreements; |

|

| | | |

| | Ÿ | | oversee the calculation by BNY Mellon, at the end of each business day, of our NAV per share for each class of common stock in accordance with our valuation guidelines, and in connection therewith, obtain appraisals performed by our independent valuation advisor and other independent third-party appraisal firms concerning the value of our real properties; |

|

| | | |