UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

RREEF Property Trust, Inc.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than Registrant)

Payment of Filing Fee (Check the appropriate box)

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

| | | | | | | | |

| 1) | | Title of each class of securities to which transaction applies: |

| | |

| 2) | | Aggregate number of securities to which transaction applies: |

| | |

| 3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | |

| 4) | | Proposed maximum aggregate value of transaction: |

| | |

| 5) | | Total fee paid: |

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| | | | | | | | |

| 1) | | Amount Previously Paid: |

| | |

| 2) | | Form, Schedule or Registration No.: |

| | |

| 3) | | Filing Party: |

| | |

| 4) | | Date Filed: |

March 30, 2020

Dear Stockholder:

On behalf of the Board of Directors, I cordially invite you to attend the 2020 Annual Meeting of Stockholders of RREEF Property Trust, Inc., to be held on May 7, 2020 at 8:00 a.m. local time at our corporate offices at 875 Third Avenue, 26th floor, New York, New York, 10022. We look forward to your attendance.

The accompanying Notice of Annual Meeting of Stockholders and Proxy Statement include information on the matters to be voted on at the 2020 Annual Meeting of Stockholders. Our Board of Directors has fixed the close of business on March 13, 2020 as the record date for the determination of stockholders entitled to notice of, and to vote at, the 2020 Annual Meeting of Stockholders or any adjournment or postponement thereof.

Your vote is very important. Regardless of the number of shares you own, it is important that your shares be represented at the 2020 Annual Meeting of Stockholders. ACCORDINGLY, WHETHER OR NOT YOU INTEND TO BE PRESENT IN PERSON AT THE 2020 ANNUAL MEETING OF STOCKHOLDERS, I URGE YOU TO SUBMIT YOUR PROXY AS SOON AS POSSIBLE. You may do this by completing, signing and dating the accompanying proxy card and returning it in the accompanying self-addressed postage-paid return envelope. You may also electronically submit your proxy by Internet or vote by touch-tone telephone by referring to the instructions provided on the enclosed proxy card.

Please follow the directions provided in the Proxy Statement. This will not prevent you from voting in person at the 2020 Annual Meeting of Stockholders but will assure that your vote will be counted if you are unable to attend the 2020 Annual Meeting of Stockholders.

YOUR VOTE COUNTS. THANK YOU FOR YOUR ATTENTION TO THIS MATTER AND FOR YOUR CONTINUED SUPPORT OF, AND INTEREST IN, OUR COMPANY.

Sincerely,

/s/ W. Todd Henderson

W. Todd Henderson

Chief Executive Officer

RREEF PROPERTY TRUST, INC.

NOTICE TO STOCKHOLDERS OF ANNUAL MEETING

TO BE HELD ON

MAY 7, 2020

Dear Stockholder:

RREEF Property Trust, Inc. will hold its 2020 annual meeting of stockholders at 8:00 a.m. local time on Thursday, May 7, 2020 at its corporate offices at 875 Third Avenue, 26th floor, New York, New York, 10022. “We,” “our,” “us” and “our company” each refers to RREEF Property Trust, Inc. The meeting will be held for the following purposes:

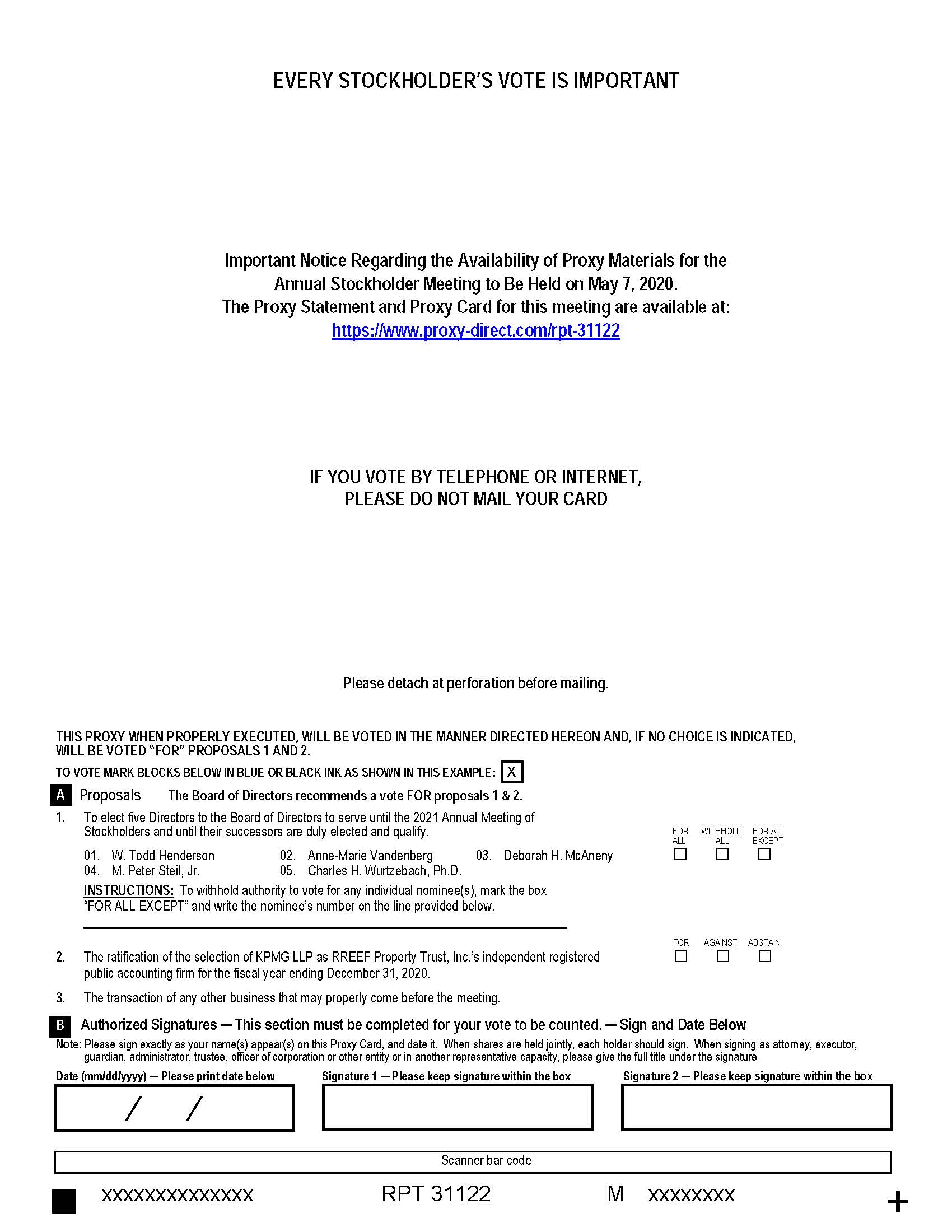

1. to elect five directors to our board of directors for the ensuing year;

2. to ratify the appointment of KPMG LLP as our independent registered public accounting firm for the year ending December 31, 2020; and

3. to transact such other business as may properly come before the meeting and any adjourned session of the meeting.

Only stockholders of record at the close of business on March 13, 2020 (the “Record Date”) are entitled to notice of, and to vote at, the meeting and any adjournments or postponements thereof. This proxy statement and proxy card are being mailed to you on or about March 30, 2020.

By Order of the Board of Directors of RREEF Property Trust, Inc.

/s/ Vikram Mehra

Vikram Mehra

Secretary

March 30, 2020

Your vote is important without regard to the number of shares you own on the Record Date. Although you are invited to attend the meeting and vote your shares in person, if you are unable to attend, you can authorize a proxy to vote your shares easily and quickly by mail or over the Internet or by touch-tone telephone. In order to authorize your proxy by mail, please indicate your voting instructions on the enclosed proxy card, date and sign it, and return it in the envelope provided, which is addressed for your convenience and needs no postage if mailed in the United States. In order to authorize your proxy by touch-tone telephone or over the Internet, follow the instructions on the enclosed proxy card.

If, after providing voting instructions, you later decide to change your vote, you may do so by (i) attending the meeting, including any adjournments or postponements thereof, revoking your proxy and voting your shares in person, or (ii) submitting a new proxy authorization by mail, via the Internet or by touch-tone telephone. Your subsequent proxy authorization will supersede any proxy authorization you previously made.

TABLE OF CONTENTS

| | | | | |

| Page |

| NOTICE TO STOCKHOLDERS OF ANNUAL MEETING | ii |

| QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING | 1 | |

| PROPOSAL NO. 1: ELECTION OF DIRECTORS | 5 | |

| EXECUTIVE OFFICERS | 9 | |

| CORPORATE GOVERNANCE | 10 | |

| REPORT OF THE AUDIT COMMITTEE | 13 | |

| COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS | 14 | |

| |

| |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS | 16 | |

| TRANSACTIONS WITH RELATED PERSONS AND CERTAIN CONTROL PERSONS | 17 | |

| PROPOSAL NO. 2: RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 23 | |

| INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | 24 | |

| DELIVERY OF DOCUMENTS TO SECURITY HOLDERS SHARING AN ADDRESS | 25 | |

| STOCKHOLDER COMMUNICATIONS WITH THE BOARD OF DIRECTORS | 25 | |

| INCORPORATION BY REFERENCE | 25 | |

| OTHER MATTERS | 26 | |

RREEF PROPERTY TRUST, INC.

PROXY STATEMENT FOR THE

ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON MAY 7, 2020

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

We are providing you with this proxy statement, which contains information about the items to be voted upon at the 2020 annual meeting of stockholders. To make this information easier to understand, we have presented the information below in a question and answer format. The words “RREEF Property Trust,” “we,” “our,” “us” and “our company” refer to RREEF Property Trust, Inc. and its subsidiaries. The terms “RREEF America,” “advisor” and “sponsor” each refer to RREEF America L.L.C. RREEF America, together with its affiliates in Europe and Asia, comprises the global real estate investment business of DWS (“DWS”), an asset management business majority owned by Deutsche Bank A.G. (“Deutsche Bank”).

When and where is the meeting?

The 2020 annual meeting of stockholders (the “Annual Meeting”) will be held on Thursday, May 7, 2020, at 8:00 a.m. Eastern time at our corporate offices located at 875 Third Avenue, 26th floor, New York, New York, 10022.

What is this document and why have I received it?

This proxy statement and the enclosed proxy card are being furnished to you, as a stockholder of RREEF Property Trust, because our board of directors is soliciting your proxy to vote at the Annual Meeting. This proxy statement contains information that stockholders should consider before voting on the proposals to be presented at the meeting.

We intend to mail this proxy statement and accompanying proxy card on or about March 30, 2020 to all stockholders of record entitled to vote at the meeting.

What is to be considered at the meeting?

There are two proposals expected to be presented at the meeting:

1.the election of five directors to our board of directors for the ensuing year; and

2.the ratification of the appointment of KPMG LLP (“KPMG”), as our independent registered public accounting firm for the year ending December 31, 2020.

How is this solicitation being made?

This solicitation is being made primarily by the mailing of these proxy materials. Supplemental solicitations may be made by mail or telephone by our officers and representatives, who will receive no extra compensation for their services. The expenses in connection with this solicitation, including preparing and mailing these proxy materials, will be borne by us. We will reimburse brokerage firms and others for their reasonable expenses in forwarding solicitation material to the beneficial owners of our common stock, $0.01 par value per share. We have hired Georgeson Inc. (“Georgeson”) to assist us in the distribution of our proxy materials and for the solicitation of proxy votes. We will pay Georgeson customary fees and expenses for these services of approximately $15,000.

Upon request, we will also reimburse brokerage houses and other custodians, nominees and fiduciaries for forwarding proxy and solicitation materials to stockholders.

Where can I get more information about RREEF Property Trust?

In connection with this solicitation, we have provided you with an annual report that contains our audited financial statements. We also file reports and other documents with the Securities and Exchange Commission (the

“SEC”). You can view these documents at the SEC’s website, www.sec.gov. You can also find more information on our website, www.rreefpropertytrust.com.

Will my vote make a difference?

Yes. Your vote is needed to ensure that the proposals can be acted upon. YOUR VOTE IS VERY IMPORTANT! Your immediate response will help avoid potential delays and may save us significant additional expenses associated with soliciting stockholder votes. We encourage you to participate in the governance of our company.

What are the voting rights and quorum requirements?

Holders of record of our shares as of the close of business on March 13, 2020 (the “Record Date”) will be entitled to vote at the Annual Meeting. At the close of business on the Record Date, there were 3,820,787 Class A shares, 994,603 Class T shares, 10,417,664 Class I shares and 176,101 Class D shares of common stock issued and outstanding, for a total of 15,409,155 shares of our common stock issued and outstanding as of the Record Date. No shares of our Class N common stock were issued and outstanding as of the Record Date. You are entitled to one vote for each share you held as of the Record Date.

The presence, either in person or by proxy, of at least fifty percent of the shares entitled to vote at the Annual Meeting on any matter will constitute a quorum. If a quorum is not present at the Annual Meeting, the chairman of the Annual Meeting may adjourn the Annual Meeting from time to time to a date not more than 120 days from the original Record Date for the Annual Meeting to permit further solicitation of proxies.

There is no cumulative voting for these proposals, and appraisal rights are not applicable to the matters being voted upon.

What is the voting requirement to approve each of the proposals?

The election of each nominee for director requires the approval of a majority of the shares represented in person or by proxy at the Annual Meeting. Any shares present in person or by proxy and not voted (whether by broker non-vote or otherwise) will have the effect of a vote against the nominees. If an incumbent nominee for the board of directors fails to receive the required number of votes for re-election, then under Maryland law, he or she will continue to serve as a “holdover” director until his or her successor is duly elected and qualifies.

The ratification of KPMG as our independent registered public accounting firm for the year ending December 31, 2020 requires the affirmative vote of at least a majority of all votes cast at the Annual Meeting in person or by proxy. Any shares not voted (whether by abstention, broker non-vote or otherwise) will have no impact on the vote.

How do I vote if I am a registered stockholder?

If you are a registered stockholder (that is, if your shares are registered on our records in your name and not in the name of your broker or nominee), you may vote in person by attending the Annual Meeting at our offices listed above. If you intend to vote in person at the Annual Meeting, you must bring valid government-issued photo identification, such as a driver’s license or a passport. Additionally, you may use any of the following three options for authorizing a proxy to vote your shares prior to the Annual Meeting:

1.via the Internet by going to the web address listed on the proxy card and following the on-screen directions;

2.by phone by calling the number listed on the proxy card and following the instructions; or

3.by mail by marking, signing, dating and returning the enclosed proxy card.

If you authorize a proxy by telephone or Internet, you do not need to mail your proxy card. See the attached proxy card for more instructions on how to vote your shares.

All proxies that are properly executed and received by our Secretary prior to the Annual Meeting, and are not revoked, will be voted at the Annual Meeting. Shares represented by properly executed proxies will be voted in accordance with the instructions on those proxies. If no specification is made on a properly executed proxy, it will be voted FOR the election of each of the nominees set forth in Proposal No. 1 and FOR the ratification of the appointment of KPMG as our independent registered public accounting firm as set forth in Proposal No. 2. Even if you plan to attend the Annual Meeting in person, we urge you to return your proxy card or submit a proxy by telephone or via the Internet to assure the representation of your shares at the Annual Meeting.

How do I vote if I hold my shares in “street name”?

If your shares are held by your bank or broker as your nominee (in “street name”), you should receive a proxy or voting instruction form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker to vote your shares.

If your shares are held in street name and you wish to attend the Annual Meeting and/or vote in person, you must bring your broker or bank voting instruction card and a proxy, executed in your favor, from the record holder of your shares. In addition, you must bring valid government-issued photo identification, such as a driver’s license or a passport.

How is quorum determined?

For the purpose of determining whether a quorum is present at the Annual Meeting, we will count shares represented in person or by properly executed proxy. We will treat shares which abstain from voting as to a particular matter and broker non-votes (defined below) as shares that are present at the Annual Meeting for purposes of determining whether a quorum exists, but we will not count them as votes cast on such matter. A “broker non-vote” occurs when a broker does not vote on a matter on the proxy card because the broker does not have discretionary voting power for that particular matter and has not received voting instructions from the beneficial owner.

How does the board of directors recommend that I vote?

Our board of directors recommends that you vote your shares as follows:

•FOR the election of each of the five nominees to our board of directors; and

•FOR the ratification of the appointment of KPMG as our independent registered public accounting firm for the year ending December 31, 2020.

Can I change my vote after submitting my proxy?

You may revoke a previously submitted proxy at any time prior to the Annual Meeting in any of three ways:

1.Submitting a written notice of revocation to the Secretary of RREEF Property Trust, c/o RREEF Property Trust, Inc., 875 Third Avenue, 26th floor, New York, New York, 10022, which must be received prior to the Annual Meeting, must be signed and must include your name and account number;

2.Submitting another proxy with a later date if received prior to the Annual Meeting; or

3.Attending the Annual Meeting and voting in person.

If we receive your proxy authorization by telephone or over the Internet, we will use procedures reasonably designed to authenticate your identity, to allow you to authorize the voting of your shares in accordance with your instructions and to confirm that your instructions have been properly recorded. Proxies authorized by telephone or via the Internet may be revoked at any time before they are voted in the same manner that proxies authorized by mail may be revoked.

If your shares are held by your broker or bank as a nominee or agent, you should follow the instructions provided by your broker or bank.

Where can I find the voting results of the Annual Meeting?

We intend to announce preliminary voting results at the Annual Meeting and then disclose the final results in a Current Report on Form 8-K filed with the SEC within four business days after the date of the Annual Meeting.

How can I get additional copies of this proxy statement or other information filed with the SEC relating to this solicitation?

You may obtain additional copies of this proxy statement by calling our solicitor, Georgeson, toll free at (888) 565-5190. In addition, we file annual, quarterly and special reports and other information with the SEC. Our SEC filings are available to the public on the SEC’s website at www.sec.gov.

When are stockholder proposals due for next year’s annual meeting?

Under SEC regulations, any stockholder desiring to make a proposal to be acted upon at our 2021 annual meeting of stockholders must cause such proposal to be received at our principal executive offices located at 875 Third Avenue, 26th floor, New York, New York, 10022, Attention: Secretary, no later than November 29, 2020 in order for the proposal to be considered for inclusion in our proxy statement for that meeting; provided, however, that in the event that the date of the 2021 annual meeting of stockholders is advanced or delayed by more than thirty days from the first anniversary of the date of the 2020 Annual Meeting, the deadline for the delivery of such stockholder proposal will be a reasonable time prior to the date we begin to print and send our proxy materials. Stockholders also must follow the procedures prescribed in Rule 14a-8 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Pursuant to Article II, Section 11(a)(2) of our bylaws, if a stockholder wishes to present a proposal at the 2021 annual meeting of stockholders, whether or not the proposal is intended to be included in the proxy statement for that meeting, the stockholder must give advance written notice thereof to our Secretary at our principal executive offices, no earlier than October 30, 2020 and no later than 5:00 p.m., Eastern Time, on November 29, 2020; provided, however, that in the event that the date of the 2021 annual meeting of stockholders is advanced or delayed by more than thirty days from the first anniversary of the date of the 2020 Annual Meeting, written notice of a stockholder proposal must be delivered not earlier than the 150th day prior to the date of the 2021 annual meeting of stockholders and not later than 5:00 p.m., Eastern Time, on the later of the 120th day prior to the date of the 2021 annual meeting of stockholders or the tenth day following the day on which public announcement of the date of the 2021 annual meeting of stockholders is first made. Any stockholder proposals not received by us by the applicable date in previous sentence will be considered untimely. Rule 14a-4(c) promulgated under the Exchange Act permits our management to exercise discretionary voting authority under proxies it solicits with respect to such untimely proposals. We presently anticipate holding the 2021 annual meeting of stockholders in May 2021.

PROPOSAL NO. 1:

ELECTION OF DIRECTORS

Background

At the Annual Meeting, five directors are to be elected for the ensuing year and until their successors are elected and qualify. Each of the nominees for director currently is a director of RREEF Property Trust and has consented to be named as a nominee in this proxy statement and to continue to serve as our director if elected. Pursuant to our bylaws, we can have no more than 15 and no fewer than three directors, a majority of whom must be independent of our advisor. If elected, each director will hold office until the date of the 2021 annual meeting of stockholders and until his or her successor is elected and qualifies, subject to death, resignation, retirement, disqualification or removal from office. There are no family relationships between any directors or executive officers. No person being nominated as a director is being proposed for election pursuant to any agreement or understanding between such person and any other person.

Our board of directors currently is comprised of five directors: (i) Deborah H. McAneny, M. Peter Steil, Jr. and Charles H. Wurtzebach, Ph.D., as the independent directors and (ii) W. Todd Henderson and Anne-Marie Vandenberg.

Our board of directors has nominated (i) Deborah H. McAneny, M. Peter Steil, Jr. and Charles H. Wurtzebach, Ph.D., as the independent directors and (ii) W. Todd Henderson and Anne-Marie Vandenberg. Each of the nominees, except Mr. Henderson and Ms. Vandenberg has served on our board of directors since November 27, 2012. Mr. Henderson has served on our board of directors since May 9, 2012. Ms. Vandenberg has served on our board of directors since October 3, 2018.

Director Nominees

The following table provides information about the nominees to our board of directors:

| | | | | | | | |

| Name | Age | Position |

| W. Todd Henderson | 52 | | Chief Executive Officer, Chairman of the Board, and Director |

| Anne-Marie Vandenberg | 38 | | Chief Operating Officer, President, and Director |

| Deborah H. McAneny | 61 | Independent Director |

| M. Peter Steil, Jr. | 77 | Independent Director |

| Charles H. Wurtzebach, Ph.D | 71 | Independent Director |

The principal occupations and certain other information about the nominees are set forth below.

W. Todd Henderson has served as our Chairman of the Board of Directors since February 2012 and as our Chief Executive Officer since October 2018. Mr. Henderson has also served as a Managing Director and Head of Real Estate, Americas, DWS since January 2012, where he has been responsible for all facets of the direct real estate investment management business in the Americas. From March 2009 to January 2012, Mr. Henderson served as the Chief Investment Officer of RREEF Real Estate, Americas. From June 2007 to March 2009, he supervised RREEF Real Estate’s Value-Added and Development team, managing a $4.5 billion real estate investment portfolio for multiple institutional investors. Mr. Henderson served as a Managing Director of RREEF Real Estate’s Acquisitions team from 2003 to June 2007. Prior to joining RREEF Real Estate in 2003, Mr. Henderson was Director of Acquisitions for The J.E. Robert Company in Washington, D.C., where he was involved in the sourcing, executing and financing of over $6 billion of real estate transactions. He began his career at First Gibraltar Bank in 1991, managing the restructuring and disposition of nonperforming real estate loans on behalf of the bank and the Resolution Trust Company. Mr. Henderson holds a B.A. in History from the University of North Texas and an M.B.A. from The Wharton School of the University of Pennsylvania.

Anne-Marie Vandenberg has served as our Chief Operating Officer and President and as one of our directors since October 2018. She is also a Director and Portfolio Manager for DWS’s Alternatives platform. Prior to her current role, she led the RREEF real estate defined contribution strategy. Ms. Vandenberg was previously the Head of Real Estate Capital Markets, responsible for asset and fund level financings across the Americas private real estate platform. In that role, she structured over 200 real estate and fund financing transactions totaling over $11.65

billion. She joined RREEF Real Estate in 2004 as part of the closing team, working on the acquisition and disposition of commercial real estate investments. In 2005, she transitioned to Capital Markets, ultimately taking on the leadership of the group in 2013. Ms. Vandenberg has also been involved in fund restructuring efforts, sits on RREEF America’s internal Investment Strategy Council and has participated in the strategic capitalization of several real estate products including RREEF America REIT II, RREEF Property Trust and RREEF Core Plus Industrial Fund. She is an active member of Urban Land Institute where she is a Vice Chair of the Urban Mixed Use and Development Silver Council, as well as on the ULI-Chicago Women’s Leadership Initiative Advisory Board. She is also the co-chair of the PREA Defined Contribution Affinity Group, a member of NCREIF and co-treasurer of DCREC. Ms. Vandenberg holds a B.A. from Tulane University, a M.S. in Real Estate Finance from DePaul University and a J.D. from The John Marshall Law School.

Deborah H. McAneny has served as one of our independent directors since November 2012 and as our lead independent director since August 2019. Ms. McAneny served as the Chief Operating Officer of Benchmark Assisted Living, LLC, or Benchmark, an owner and operator of senior living facilities in New England, from April 2007 to May 2009. Since April 2007, she has also served as a director (2007-2013) and member of the board of advisors (2013-present) of Benchmark. Prior to joining Benchmark, she was employed by John Hancock Financial Services, or John Hancock, for approximately 20 years, where she advanced to Executive Vice President and was responsible for a portfolio of structured and alternative investment businesses including John Hancock’s real estate, structured fixed-income, timber and agricultural investment business units. Prior to joining John Hancock in 1985, she was a senior auditor for Arthur Anderson & Co. for four years. Ms. McAneny serves on the board of directors of several other companies. Ms. McAneny serves on the board of Jones Lang LaSalle, Inc., or JLL, a publicly traded provider of commercial real estate services listed on the NYSE. Prior to its merger with JLL, she served as the lead independent director, Chairperson of the Nominating and Corporate Governance Committee and a member of the Compensation Committee, for HFF, Inc. Since June 2015, Ms. McAneny has also been a director of THL Credit, Inc., a publicly-traded business development company, and serves as the Chairperson of its Audit Committee. Since May 2017, Ms. McAneny also serves as a director of KKR Real Estate Finance Trust, Inc., a publicly-traded real estate finance company and serves as the Chairperson of its Audit Committee and a member of its Compensation Committee and Affiliated Transaction Committee. Ms. McAneny has also served as a director of RREEF America REIT II, Inc., a private REIT sponsored by our sponsor, since May 2011. From 2005 to 2014, she served as a director of KKR Financial Holdings LLC, or KFN, a publicly-traded specialty finance company listed on the NYSE. She was also the Chairperson of KFN’s Compensation Committee and a member of KFN’s Affiliated Transaction Committee and Nominating and Corporate Governance Committee. She is currently a member of the Board of Directors of the University of Vermont Foundation and served as a trustee of the University of Vermont from 2004 to 2016 and as a trustee of the Rivers School from 2004 to 2017. From 2001 to 2004, she served as President of the CRE Finance Council, formerly known as the Commercial Mortgage Securities Association, an international trade organization for the commercial real estate finance markets. Ms. McAneny holds a Masters Professional Director Certification from the American College of Corporate Directors and a B.S. in Business Management from the University of Vermont.

M. Peter Steil, Jr. has served as one of our independent directors since November 2012. Mr. Steil served as the Chief Executive Officer of the National Council of Real Estate Investment Fiduciaries, or NCREIF, an association of institutional real estate professionals, from July 2012 to July 2017. From January 2007 to July 2012, he served as a Managing Director of Prescott Capital Advisors, LLC, or Prescott, where he was responsible for Prescott’s real estate investment banking and advisory efforts and raising debt and equity capital for its principal investments. From 2001 to 2006, he served as a Managing Director of Wells Hill Partners, Ltd., a real estate investment banking firm based in New York. From 1998 to 2001, Mr. Steil served as a Managing Director of Putnam Lovell Securities, Inc., or Putnam Lovell, an investment bank that provides mergers and acquisitions advisory services to asset management firms. Prior to joining Putnam Lovell, he served in senior positions at several financial services firms, including Nesbitt Burns Securities, Inc. and KPMG Baymark Capital, LLC. Mr. Steil is also a member of the Global Exchange Council of the Urban Land Institute and serves on the Real Estate Advisory Committee of the Ontario Public Service Employees Union Pension Trust. Mr. Steil holds a B.A. in Political Science from Stanford University and an M.B.A. in International Business from the Harvard Business School.

Charles H. Wurtzebach, Ph.D., has served as one of our independent directors since November 2012. Dr. Wurtzebach is Chairman, Department of Real Estate, and as the Douglas and Cynthia Crocker Endowed Director of the Real Estate Center at DePaul University in Illinois, lecturing at the undergraduate and graduate levels, participating in research projects and providing support to the DePaul Real Estate Center. Dr. Wurtzebach joined the DePaul University faculty in January 2009. From 1999 to November 2008, Dr. Wurtzebach served as Managing

Director and Property Chief Investment Officer of Henderson Global Investors (North America) Inc., or Henderson, an international investment management company headquartered in London, where he was responsible for the strategic portfolio planning and the overall management of Henderson’s North American business. He served as a member of Henderson’s Senior Management Team from 2001 to November 2008 and Chairman of Henderson’s North America Senior Management Committee from 1999 to November 2008. Dr. Wurtzebach served as President and Chief Executive Officer of Heitman Capital Management from 1994 to 1998 and President of JMB Institutional Realty from 1991 to 1994. His responsibilities included supervising the financial risk exposure, financial reporting and internal control procedures of each company. Since May 2009 until July 2014, Dr. Wurtzebach served as a director of Inland Diversified Real Estate Trust, Inc., a public non-listed REIT. Since July 2014, he has served as an Independent Director of Kite Realty Group, a publicly-registered, publicly-traded REIT. He is also a founder, former president and former director of the Real Estate Research Institute, or RERI. Dr. Wurtzebach holds a B.S. in Finance from DePaul University in Illinois, an M.B.A. from Northern Illinois University and a Ph.D in finance from the University of Illinois at Urbana.

At the Annual Meeting, we will vote each valid proxy returned to us for the five nominees listed above unless the proxy specifies otherwise. Proxies may not be voted for more than five nominees for director. While our board does not anticipate that any of the nominees will be unable to stand for election as a director at the Annual Meeting, if that is the case, proxies will be voted in favor of such other person or persons as our board of directors may designate.

Director Qualifications, Experience, Attributes and Skills

Our board of directors believes that the significance of each director nominee’s qualifications, experience, attributes and skills is particular to that individual, meaning that there is no single test applicable to all director candidates. The effectiveness of the board is best evaluated as a group of directors, rather than at an individual director level. As a result, our board has not established specific minimum qualifications that must be met by each individual wishing to serve as a director. When evaluating candidates for a position on our board of directors, the board considers the potential impact of the candidate, along with his or her particular experiences, on the board as a whole. The diversity of a candidate’s background or experiences, when considered in comparison to the background and experiences of other members of the board of directors, may or may not impact the board’s view as to the candidate. In evaluating director candidates, our board considers all factors that it deems relevant.

In recommending director nominees to our board of directors, our board of directors solicits candidate recommendations from its current members and our management. Our board of directors also will consider recommendations made by stockholders for director nominees who meet the established director criteria set forth above. In evaluating the persons recommended as potential directors, our board will consider each candidate without regard to the source of the recommendation and take into account those factors that the board determines are relevant. Stockholders may directly nominate potential directors by satisfying the procedural requirements for such nomination as provided in Article II, Section 11(a)(2) of our bylaws.

In conducting its annual self-assessment and nominating the director nominees, our board of directors determined that each director nominee has the qualifications, experience, attributes and skills appropriate to continue his or her service as a director of our company in view of our business and structure. In addition to a demonstrated record of business and professional accomplishment, each of our director nominees has substantial experience serving on boards, including our board and boards of other organizations. Each of our directors has gained substantial insight as to the operation of our company and has demonstrated a commitment to discharging his or her oversight responsibilities as a director.

Each director was nominated to our board of directors on the basis of the unique skills he or she brings to our board, as well as how such skills collectively enhance our board. On an individual basis:

•W. Todd Henderson: Our board of directors has determined that Mr. Henderson will be a valuable member of our board because of his experience as a real estate industry executive with extensive investment, capital markets and portfolio management expertise, all of which we expect to bring valuable insight to the board of directors.

•Anne-Marie Vandenberg: Our board of directors has determined that Ms. Vandenberg will be a valuable member of our board of directors because of her extensive experience in real estate investments and expertise in capital markets.

•Deborah H. McAneny: Our board of directors has determined that Ms. McAneny will be a valuable member of our board because of her leadership positions on boards of public companies and experience with management of commercial real estate portfolios.

•M. Peter Steil, Jr.: Our board of directors has determined that Mr. Steil will be a valuable member of our board of directors because of his extensive experience with investment banking, real estate advisory services and portfolio management.

•Charles H. Wurtzebach, Ph.D.: Our board of directors has determined that Dr. Wurtzebach will be a valuable member of our board because of his academic experience as a real estate professor, his industry experience as an executive for investment management companies and his board experience with public non-listed REITs.

The information above is not exclusive. When considering a director nominee, our board of directors considers many intangible elements, such as intelligence, integrity, work ethic, commitment to stockholder interests and the ability to work with other directors, communicate effectively, exercise judgment and ask incisive questions.

The election of each nominee for director requires the approval of a majority of the shares represented in person or by proxy at the Annual Meeting. Any shares present in person or by proxy and not voted (whether by broker non-vote or otherwise) will have the effect of a vote against the nominees. If an incumbent nominee for the board of directors fails to receive the required number of votes for re-election, then under Maryland law, he or she will continue to serve as a “holdover” director until his or her successor is duly elected and qualifies.

OUR BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR”

ALL OF THE NOMINEES LISTED ABOVE FOR NOMINATION AS DIRECTORS.

EXECUTIVE OFFICERS

The following table provides information about our executive officers. Each executive officer, once appointed, serves at the pleasure of the board of directors until the next annual meeting of the board of directors and until his or her successor shall have been duly appointed and qualified or until such individual resigns or is removed from office. There are no family relationships between any directors or executive officers. None of our executive officers was appointed pursuant to any agreement or understanding between such person and any other person.

| | | | | | | | |

| Name | Age | Position |

| W. Todd Henderson | 52 | | Chief Executive Officer and Director |

| Anne-Marie Vandenberg | 38 | | Chief Operating Officer and President |

| Eric M. Russell | 55 | Chief Financial Officer and Vice President |

The biographies of Ms. Vandenberg and Mr. Henderson are set forth above in “Proposal No. 1: Election of Directors.”

Eric M. Russell has served as our Chief Financial Officer and Vice President since February 2015. Mr. Russell previously served as our Assistant Treasurer from May 2013 to February 2015. He has served as a Director and Controller, RREEF Real Estate Fund Finance, Americas, DWS since 2011 and as Vice President and Controller, RREEF Real Estate Fund Finance since 2000. During his tenure, Mr. Russell oversaw RREEF Property Trust since November 2012 and previously presided over a large separate account with a peak size of USD 4.5 billion, a separate account focused on ground-up development and a private foreign investor-owned REIT of approximately USD 1 billion. In these roles, Mr. Russell oversaw all financial reporting, fund accounting, tax compliance and loan compliance. Prior to joining RREEF Real Estate, Mr. Russell served as an Accounting Manager and Assistant Controller at iStar Financial, Inc., a publicly traded REIT, from 1996 to 2000. From 1994 to 1996, he worked as a Controller at Sierra National Home Warranty Corporation, a publicly traded company. Mr. Russell served as a Senior Auditor at Grant Thornton LLP from 1992 to 1994 and a Staff Auditor from 1991 to 1992. Mr. Russell holds a B.S. in Atmospheric Science from the University of California, Davis and is a certified public accountant (inactive).

CORPORATE GOVERNANCE

Role of the Board

Our board of directors oversees our management and operations, while our advisor is responsible for our day-to-day management and operations. Our board’s oversight role does not make its directors guarantors of our investments or activities.

Our board has appointed various employees of our advisor as officers of our company with the collective responsibility to monitor and report to our board of directors on our operations. In conducting its oversight, our board of directors receives regular reports from these officers and from other senior officers of our advisor regarding our operations. Some of these reports are provided as part of formal board meetings, which are typically held quarterly, in person, and involve the board’s review of our recent operations. From time to time, one or more of our directors may also meet with management in less formal settings, between scheduled board meetings, to discuss various topics.

Board Leadership Structure

Our board of directors has structured itself in a manner that it believes allows it to perform its oversight function effectively. A majority of our directors are independent. Mr. Henderson, as our Chairman of the Board and Chief Executive Officer, is responsible for reviewing the agenda for the meetings of the board of directors and the annual meetings of stockholders, as well as the general management of our business and financial affairs. Ms. Vandenberg, as our Chief Operating Officer and President, is responsible for our capital market activities and our day-to-day operations.

In addition, our board has determined that since the Chairman of the Board is not an independent director, a lead independent director should be appointed by a majority of our independent directors. Our independent directors have appointed Ms. McAneny to serve as our lead independent director. Key responsibilities of our lead independent director include, among others, presiding at executive sessions of independent directors, facilitating communications between the independent directors and the Chairman of the Board and Chief Operating Officer, and calling meetings of the independent directors, as necessary.

Our board of directors reviews its structure annually. Our board of directors believes that its structure, in which representatives of our advisor serve on the board of directors, is appropriate in light of the significant services that our advisor provides to us. In addition, our board of directors believes that requiring a majority of the board of directors to be comprised of independent directors as well as the structure, function and composition of the Audit Committee (as described below in “Committees”) and the requirement that related party transactions be presented to the full board of directors, are an appropriate means to provide effective oversight and address any potential conflicts of interest that may arise from our relationship with our advisor.

Board Oversight of Risk Management

As part of its oversight function, the board of directors receives and reviews various reports relating to risk management. Because risk management is a broad concept comprised of many different elements (including, among other things, investment risk, valuation risk, credit risk, compliance and regulatory risk, business continuity risks, operational risk and insurance), board oversight of different types of risks is handled in different ways. For example, the full board of directors receives and reviews reports from senior personnel of our advisor (including senior compliance, financial reporting and investment personnel) or their affiliates regarding various types of risks, such as operational, compliance and investment risk, and how they are being managed. The Audit Committee supports the board’s oversight of risk management in a variety of ways, including (i) participation in and receipt and review of reports regarding our disclosure controls and procedures prior to the issuance of our quarterly financial reports, (ii) meetings with our Chief Financial Officer and our independent public accountants to discuss, among other things,

the internal control structure of our financial reporting function and compliance with certain requirements of the Sarbanes-Oxley Act of 2002, as amended, and (iii) reporting to the board of directors as to these and other matters.

Director Independence

Although our shares are not listed for trading on any national securities exchange, our board of directors has determined that a majority of the members of our board of directors, and all of the members of the Audit Committee, are “independent” as defined by the New York Stock Exchange (the “NYSE”). The NYSE standards provide that to qualify as an independent director, in addition to satisfying certain bright-line criteria, the board of directors must affirmatively determine that a director has no material relationship with us (either directly or as a partner, stockholder or officer of an organization that has a relationship with us).

In addition, our board of directors determined that these directors are independent pursuant to the definition of independence in our Charter, as required by the North American Securities Administrators Association’s Statement of Policy Regarding Real Estate Investment Trusts, as revised and adopted on May 7, 2007 (the “NASAA REIT Guidelines”). Our Charter provides that an independent director is a director who is not and has not for the last two years been associated, directly or indirectly, with our advisor or sponsor. A director is deemed to be associated with our advisor or sponsor if he or she owns any interest in, is employed by, is an officer or director of, or has any material business or professional relationship with our advisor, our sponsor, or any of their affiliates, performs services (other than as a director) for us, or serves as a director or trustee for more than three REITs organized by our sponsor or advised by our advisor. A business or professional relationship will be deemed material per se if the gross revenue derived by the director from our sponsor, our advisor, and any of their affiliates exceeds five percent of (i) the director’s annual gross revenue derived from all sources during either of the last two years or (ii) the director’s net worth on a fair market value basis. An indirect relationship is defined to include circumstances in which the director’s spouse, parents, children, siblings, mothers- or fathers-in-law, sons- or daughters-in-law or brothers- or sisters-in-law is or has been associated with us, our advisor, our sponsor or any of their affiliates. Our Charter requires that at all times at least one of our independent directors must have at least three years of relevant real estate experience.

Our board of directors has determined that Deborah H. McAneny, M. Peter Steil, Jr., and Charles H. Wurtzebach, Ph.D. are independent directors pursuant to our Charter and the definition of independence as defined by the NYSE.

Meetings of the Board of Directors

During the fiscal year ended December 31, 2019, our board of directors met five times. Each of our directors attended at least 75% of the aggregate of the total number of meetings of our board of directors held during the period for which he or she served as a director and the total number of meetings held by all committees of our board of directors on which he or she served during the periods for which he or she was a director.

We do not have a formal policy requiring directors to attend annual meetings of stockholders, although we do encourage their attendance. All of our directors attended our 2019 annual meeting of stockholders.

Committees

Our board of directors has one permanent committee, the Audit Committee. The Audit Committee’s primary function is to assist our board of directors in fulfilling its responsibility to oversee the quality and integrity of our financial reporting and the audits of our financial statements. The Audit Committee fulfills these responsibilities primarily by carrying out the activities enumerated in the Audit Committee Charter adopted by our board of directors. The Audit Committee Charter is available on our web site at www.rreefpropertytrust.com.

The Audit Committee must have at least three members and be comprised solely of members of our board of directors that meet the independence criteria of our Charter and the NYSE listing standards. It is comprised of Deborah H. McAneny, M. Peter Steil, Jr. and Charles H. Wurtzebach, each of whom meets the qualifications for audit committee independence under the rules of the NYSE. Dr. Wurtzebach serves as the Chairperson of the Audit Committee, and our board of directors has determined that Dr. Wurtzebach qualifies as an “audit committee

financial expert” as that term is defined by SEC rules. The Audit Committee held four meetings during the year ended December 31, 2019.

We do not have a compensation committee because we do not compensate our executive officers or non-independent directors. Recommendations with respect to compensation of our independent directors are made by our board of directors.

Our board of directors believes that each director should be nominated by our full board, which must be comprised of a majority of independent directors, rather than a committee thereof. As a result, we do not have a nominating committee.

Director Orientation and Continuing Education

We provide each director who joins our board with an initial orientation about our company, including our business operations, strategy, policies and governance. We also provide all of our directors with resources and ongoing education opportunities to assist them in staying current about developments in corporate governance and critical issues relating to the operation of boards of public companies and their committees.

Annual Board Self-Assessment

Our board of directors annually conducts a self-evaluation (with anonymous responses permitted) to determine whether it and the Audit Committee are functioning effectively and to identify opportunities to enhance their effectiveness.

Code of Ethics

Our board of directors has adopted a Code of Ethics that applies to each of our directors, our principal executive officer, principal financial officer, principal accounting officer and persons performing similar functions. Our Code of Ethics is available on our website, www.rreefpropertytrust.com. Stockholders may also request a copy of the Code of Ethics, which will be provided without charge, by writing to RREEF Property Trust, Inc. at 875 Third Avenue, 26th floor, New York, New York, 10022, Attention: Secretary. If, in the future, we amend, modify or waive a provision in the Code of Ethics, we may, rather than filing a Current Report on Form 8-K, satisfy the disclosure requirement by posting such information on our website as necessary.

Review of our Policies

Our board of directors, including our independent directors, has reviewed our policies described in our Annual Report and our registration statement related to our public equity offering, as well as other policies previously reviewed and approved by our board of directors, and determined that they are in the best interests of our stockholders because: (1) they increase the likelihood that we will be able to acquire a diversified portfolio of income producing properties, thereby reducing risk in our portfolio; (2) there are sufficient property acquisition opportunities with the attributes that we seek; (3) our executive officers, directors and affiliates of our advisor have expertise with the type of real estate investments we seek; (4) borrowings should enable us to purchase assets and earn rental income more quickly; and (5) corporate governance best practices and high ethical standards help promote our long-term performance, thereby increasing our likelihood of generating income for our stockholders and preserving stockholder capital.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee’s purpose is to assist in fulfilling the board of directors’ responsibility to oversee the quality and integrity of the financial reporting and internal controls of RREEF Property Trust, Inc. (the “Company”) and the audits of its financial statements by its independent registered public accounting firm. The Audit Committee is comprised solely of independent directors, and it operates under a written charter adopted by the Company’s board of directors, a copy of which is available on the Company’s website at www.rreefpropertytrust.com. The Audit Committee intends for its composition, and the attributes of its members and its responsibilities, as reflected in the Audit Committee Charter, to be in accordance with applicable requirements for corporate audit committees. The Audit Committee reviews and assesses the adequacy of its charter on an annual basis.

In accordance with the Audit Committee Charter, the Audit Committee, subject to any action of the Company’s board of directors, has ultimate authority and responsibility to select, compensate, evaluate and, when appropriate, replace the Company’s independent registered public accounting firm. The Audit Committee has the authority to engage its own outside advisors, including experts in particular areas of accounting, as it determines appropriate, apart from counsel or advisors hired by management.

Audit Committee members are not professional accountants or auditors, and their functions are not intended to duplicate or to certify the activities of management and the independent registered public accounting firm. The Audit Committee serves a board-level oversight role, in which it provides advice, counsel and direction to management and to the Company’s auditors on the basis of the information it receives, discussions with management and the auditors and the experience of the Audit Committee’s members in business, financial and accounting matters.

As part of its ongoing activities, the Audit Committee has:

•reviewed and discussed the Company’s audited financial statements for the fiscal year ended December 31, 2019 with management;

•discussed with KPMG the matters required to be discussed by PCAOB Auditing Standards 1301, Communications with the Audit Committee; and

•received the written disclosures and the letter from KPMG required by Independence Standards Board Standard No. 1 and has discussed with KPMG its independence.

Based on the review and discussions referred to above, the Audit Committee recommended to the board of directors that the audited consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019 for filing with the SEC.

Audit Committee:

Deborah H. McAneny

M. Peter Steil, Jr.

Charles H. Wurtzebach

The material in this report is not “soliciting material,” is not deemed “filed” with the SEC, and is not to be incorporated by reference into any filing of our company under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, whether made before or after the date hereof and irrespective of any general incorporation language contained in such filing.

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS

Executive Officer Compensation

We do not compensate our executive officers and have no employees as all of our day-to-day operations are managed by our advisor. Furthermore, we do not compensate our executive officers under any stock based compensation plans.

Director Compensation

The following director compensation table sets forth the compensation paid to our independent directors in fiscal year 2019 for services to us. Directors who are not independent directors are not compensated by us for their service on our board of directors.

| | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned or

Paid in Cash | | Stock Awards(1) | | Total |

| Deborah H. McAneny | | $ | 54,464 | | | $ | 81,695 | | | $ | 136,159 | |

Murray J. McCabe(2) | | 20,494 | | | 71,700 | | | 92,194 | |

| M. Peter Steil, Jr. | | 54,464 | | | 81,695 | | | 136,159 | |

| Charles H. Wurtzebach, Ph.D. | | 63,571 | | | 81,695 | | | 145,266 | |

(1) Each of our independent directors is eligible to receive grants of restricted stock

pursuant to our independent directors compensation plan, described below.

(2) Mr. McCabe did not stand for re-election at the 2019 Annual Meeting.

Through the 2019 Annual Meeting, we compensated each of our independent directors with an annual retainer of $50,000, plus an additional annual retainer of $7,500 to the Chairman of the Audit Committee. We paid $1,000 for each board or board committee meeting the director attended in person and $250 for each meeting the director attended by telephone. In the event that there was a meeting of the board of directors and one or more committees thereof in a single day, the fees paid to each director were limited to $1,250 per day. On February 28, 2019, our board of directors approved our Second Amended and Restated Independent Directors’ Compensation Plan (our “independent directors’ compensation plan”), which operates as a sub-plan of our long-term incentive plan, as described below. Pursuant to the independent directors’ compensation plan, effective upon completion of the 2019 Annual Meeting, the annual retainer for our independent directors was increased to $65,000, plus an additional retainer of $10,000 to the Chairman of the Audit Committee. On an annual basis, $10,000 of the annual retainer will be paid in the form of an annual grant of Class I shares of restricted stock (the “annual restricted stock grant”) and the remaining amount will be paid in cash. The annual restricted stock grants will generally vest immediately prior to the annual meeting of stockholders in the year following the year in which such grant occurred; provided, however, that the annual restricted stock grants will become fully vested on the earlier occurrence of (1) the termination of the independent director’s service as a director due to his or her death or disability or (2) a change in control of our company. Upon completion of the 2019 Annual Meeting, we no longer pay our directors additional fees for attending board meetings, but all directors are reimbursed for reasonable out-of-pocket expenses incurred in connection with attendance at board meetings. If a director is also one of our officers, we will not pay such director separate compensation for services rendered as a director.

Our board of directors previously approved a grant of shares of restricted stock to each of our independent directors, whereby each of our current independent directors would receive a grant of 5,000 Class I shares of restricted stock, which we refer to as the “supplemental restricted stock grant,” at the end of the first full calendar quarter following the date that we issued 12,500,000 shares in our offerings. Because this threshold was met during the fourth quarter of 2018, each of our current independent directors received the supplemental restricted stock grant on March 29, 2019. New independent directors that subsequently join the board will not receive this supplemental restricted stock grant. The supplemental restricted stock grants vest in equal installments over a three-year period beginning on the first anniversary of the grant date; provided, however, that the restricted stock will become fully vested on the earlier occurrence of (1) the termination of the independent director’s service as a director due to his or her death or disability or (2) a change in control of our company. The supplemental restricted stock grants are subject to the terms and conditions of our independent directors compensation plan.

Our board of directors has adopted a long-term incentive plan, which we use to attract and retain directors,

officers, employees and consultants. Our long-term incentive plan offers qualified individuals an opportunity to participate in our growth through awards in the form of, or based on, our common stock. The long-term incentive plan authorizes the granting of restricted stock, stock options, restricted or deferred stock units and other stock-based awards and cash-based awards to directors, employees and consultants of ours selected by the board of directors for participation in the plan. Stock options may not have an exercise price that is less than the fair market value of a share of our common stock on the date of grant and may not have a term in excess of ten years from the grant date.

Our board of directors or a committee appointed by our board of directors administers the long-term incentive plan, with sole authority to determine all of the terms and conditions of the awards. No awards will be granted under the long-term incentive plan if the grant or vesting of the awards would jeopardize our status as a REIT under the Code or otherwise violate the ownership and transfer restrictions imposed under our Charter. Unless otherwise determined by our board of directors, no award granted under the plan will be transferable except through the laws of descent and distribution.

Our board of directors has authorized and reserved an aggregate maximum number of 300,000 Class I shares for issuance under the long-term incentive plan. However, no awards shall be granted under the incentive plan on any date on which the aggregate number of shares subject to awards previously issued under the incentive plan, together with the proposed awards to be granted on such date, exceeds 2% of the number of outstanding shares of common stock on such date. In the event of a transaction between our company and our stockholders that causes the per-share value of our common stock to change (including, without limitation, a stock dividend, stock split, spin-off, rights offering or large nonrecurring cash dividend), the share authorization limits under the plan will be adjusted proportionately and our board of directors will make adjustments to the long-term incentive plan and awards as it deems necessary, in its sole discretion, to prevent dilution or enlargement of rights immediately resulting from the transaction. In the event of a stock split, a stock dividend or a combination or consolidation of the outstanding shares of common stock into a lesser number of shares, the authorization limits under the plan will automatically be adjusted proportionately and the shares then subject to each award will automatically be adjusted proportionately without any change in the aggregate purchase price.

Our board of directors may, in its sole discretion at any time, determine that all or a portion of a participant’s awards will become fully vested. The board may discriminate among participants or among awards in exercising its discretion. The incentive plan will automatically expire on the tenth anniversary of the date on which it is approved by our board of directors and stockholders, which was November 27, 2012, unless extended or earlier terminated by the board of directors. Our board of directors may terminate the plan at any time. The expiration or other termination of the plan will not, without the participant’s consent, have an adverse impact on any award that is outstanding at the time the plan expires or is terminated. Our board of directors may amend the plan at any time, but no amendment will adversely affect any award without the participant’s consent and no amendment to the plan will be effective without the approval of our stockholders if such approval is required by any law, regulation or rule applicable to the plan.

The following table provides information about our common stock that may be issued under our incentive plan as of December 31, 2019.

| | | | | | | | | | | | | | | | | | | | |

| Plan Category | | Number of Securities to

be Issued Upon Exercise

of Outstanding Options,

Warrants and Rights | | Weighted-Average

Exercise of Price of

Outstanding Options,

Warrants, and Rights | | Number of Securities

Remaining Available for

Future Issuance Under

Equity Compensation Plans |

| Equity compensation plans approved by security holders: | | — | | | — | | | 277,906 | |

| Equity compensation plans not approved by security holders: | | N/A | | N/A | | N/A |

| Total | | — | | | — | | | 277,906 | |

Our board of directors is responsible for determining the form and amount of compensation that is paid to our independent directors. In addition, our executive officers may make recommendations regarding the compensation level for the independent directors and provide comparison data. Our board of directors periodically assesses the level of independent director compensation, taking into account the responsibilities and duties of the independent directors and the time required to perform those duties. In determining the level of independent director compensation, our board of directors attempts to be consistent with market practices, but does not set compensation at a level that would call into question the independent directors’ objectivity.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

Security Ownership of Beneficial Owners and Management

The following table shows the beneficial ownership of shares of our common stock as of March 13, 2020 by:

•any beneficial owner of more than 5% of our outstanding common stock;

•each of our directors;

•each of our current executive officers; and

•all of our current directors and executive officers as a group.

To our knowledge, other than our sponsor, there is no person, or group of affiliated persons, that beneficially owns more than 5% of our common stock. Information with respect to beneficial ownership has been furnished by each director and officer.

Beneficial ownership is determined under the rules of the SEC and generally includes voting or investment power with respect to securities. The address for each of the persons and RREEF America listed in the table below is c/o RREEF Property Trust, Inc., 875 Third Avenue, 26th floor, New York, New York, 10022.

| | | | | | | | | | | | | | | | | | | | |

| Class of Stock | | | Name of Beneficial Owner | | | Number of Shares Beneficially Owned | | | Percent of

Common Stock | |

| | Directors and Executive Officers: | | | | | |

| | W. Todd Henderson | | | — | | | — | |

| | Anne-Marie Vandenberg | | | — | | | — | |

| I | | | Deborah H. McAneny | | | 11,095.25 | | | 0.07 | % |

| I | | | M. Peter Steil, Jr. | | | 5,971.01 | | | 0.04 | |

| I | | | Charles H. Wurtzebach, Ph.D. | | | 13,795.17 | | | 0.09 | |

| I | | | Eric M. Russell | | | 829.55 | | | 0.01 | |

| | All current executive officers and directors as a group (6 persons) | | | 31,690.98 | | | 0.21 | % |

| | 5% Stockholders: | | | | | |

| I | | | RREEF America L.L.C. | | | 938,056.97 | | | 6.09 | % |

TRANSACTIONS WITH RELATED PERSONS AND CERTAIN CONTROL PERSONS

The following describes all transactions during the years ended December 31, 2019 and 2018 and currently proposed transactions involving us, our directors, our advisor, our sponsor, our dealer manager and any affiliate thereof. Our independent directors are specifically charged with the duty to examine, and have examined, the fairness of such transactions, and have determined that all such transactions are fair and reasonable to us.

Ownership Interests

As of March 13, 2020, RREEF America owns 938,057 shares of our Class I common stock. As of March 13, 2020, our executive officers and independent directors, as a group, owned no shares of our Class A, Class T, Class N or Class D common stock and 31,691 shares of our Class I common stock.

Our Relationship with Our Advisor, Our Sponsor and Our Dealer Manager

We are externally advised and managed by our sponsor and advisor, RREEF America, which is responsible for the management, acquisition, disposal, leasing, maintenance and operating of all our real estate investments. RREEF America’s executive offices are located at 875 Third Avenue, 26th floor, New York, New York, 10022. RREEF America’s telephone number is (212) 454-4500. All of our officers and directors, other than the independent directors, are employees of RREEF America. We have and will continue to have certain relationships with RREEF America and its affiliates.

On July 1, 2016, we entered into an agreement with DWS Distributors, Inc. (our “dealer manager”) whereby our dealer manager will market and execute the distribution of our shares of common stock in our public offerings. Our dealer manager is an affiliate of our sponsor and advisor. Prior to July 1, 2016, our former dealer manager was an unaffiliated entity. DWS Distributors, Inc.’s primary branch office is located at 222 South Riverside Plaza, 34th Floor, Chicago, IL 60606.

Advisory Agreement

We are managed and advised by RREEF America pursuant to an advisory agreement, as amended, that first became effective December 21, 2012 and was last renewed on November 12, 2019, effective as of January 20, 2020, for an additional one-year term expiring January 20, 2021.

Pursuant to the advisory agreement and subject to the supervision of our board of directors, our advisor will have the responsibility to, among other things:

| | | | | | | | | | | |

| Ÿ | | | consult with our board of directors in formulating our financial, investment, valuation and other policies, consistent with achieving our investment objectives; |

| | | |

| | Ÿ | | | find, evaluate, present and recommend to us investment opportunities consistent with our investment policies and objectives; |

| | | | | | | | | | | |

| | Ÿ | | | serve as our investment and financial advisor and provide research and economic and statistical data in connection with our assets and investment policies; |

| | | | | | | | | | | |

| | Ÿ | | | determine the proper allocation of our investments between properties, real estate loans, real estate equity securities and cash, cash equivalents and other short-term investments; |

| | | | | | | | | | | |

| | Ÿ | | | select its sub-advisor, joint venture and strategic partners, and service providers for us such as our transfer agent and structure corresponding agreements; |

| | | | | | | | | | | |

| | Ÿ | | | oversee the calculation at the end of each business day of our NAV per share for each class of common stock in accordance with our valuation guidelines, and in connection therewith, obtain appraisals performed by our independent valuation advisor and other independent third-party appraisal firms concerning the value of our real properties; |

| | | | | | | | | | | |

| | Ÿ | | | monitor our independent valuation advisor’s valuation process to ensure that it complies with our valuation guidelines and report on such compliance to our board of directors on a quarterly basis; |

| | | | | | | | | | | |

| | Ÿ | | | provide our independent valuation advisor with periodic asset and portfolio level information on our properties and real estate-related assets; |

| | | | | | | | | | | |

| | Ÿ | | | monitor our properties and real estate-related assets for events that may be expected to have a material impact on the most recent estimated values provided by our independent valuation advisor and notify our independent valuation advisor of such events; |

| | | | | | | | | | | |

| | Ÿ | | | provide the daily management and perform and/or supervise the various administrative functions reasonably necessary for our management and operations; |

| | | | | | | | | | | |

| | Ÿ | | | enter into leases of property and service contracts for assets and, to the extent necessary, perform all other operational functions for the maintenance and administration of such assets, including the servicing of mortgages and selecting, engaging and supervising the performance of third-party property managers and leasing agents for property management and leasing services; |

| | | | | | | | | | | |

| | Ÿ | | | hire, direct and establish policies for people who will have direct responsibility for the operations of each property we acquire, which may include, but is not limited to, on-site managers and building and maintenance personnel; |

| | | | | | | | | | | |

| | Ÿ | | | investigate, select, and on our behalf, engage and conduct business with such third parties as the advisor deems necessary to the proper performance of the advisor’s obligations under the advisory agreement; |

| | | | | | | | | | | |

| | Ÿ | | | consult with, and provide information to, our officers and our board of directors and assist our board of directors in formulating and implementing our financial policies; |

| | | | | | | | | | | |

| Ÿ | | | structure and negotiate the terms and conditions of our real estate acquisitions, sales or joint ventures; |

| | | |

| | Ÿ | | | review and analyze each property’s operating and capital budget; |

| | | | | | | | | | | |

| | Ÿ | | | acquire properties and make investments on our behalf in compliance with our investment objectives and policies; |

| | | | | | | | | | | |

| | Ÿ | | | arrange, structure and negotiate financing and refinancing of properties; |

| | | | | | | | | | | |

| | Ÿ | | | actively manage our real estate portfolio in accordance with our investment objectives, strategies and policies; |

| | | | | | | | | | | |

| | Ÿ | | | provide periodic reports to our board of directors on the performance of our investments and prepare and review on our behalf, with the participation of one designated principal executive officer and principal financial officer, all reports and returns required by the SEC, IRS and other state or federal governmental agencies; and |

| | | | | | | | | | | |

| | Ÿ | | | dispose of properties on our behalf in compliance with our investment objectives, strategies and policies. |

Advisory Fee

Pursuant to the advisory agreement, we pay RREEF America an advisory fee comprised of two separate components:

| | | | | | | | |

| | (1) | a fixed component in an amount equal to 1/365th of 1.0% of our NAV for each class of our common stock for each day, payable monthly in arrears; and |

| | | | | | | | |

| (2) | a performance component calculated based on the total return of each class of our common stock in any calendar year, payable annually. |

The fixed component of the advisory fee accrues on a daily basis. The performance component will be calculated such that for any calendar year in which the total return per share allocable to a class exceeds 6% per

annum (the “Hurdle Amount”), RREEF America will receive up to 10% of the aggregate total return allocable to such class with a Catch-Up (defined below) calculated as follows: first, if the total return for the applicable period exceeds the Hurdle Amount, 25% of such total return in excess of the Hurdle Amount (the “Excess Profits”) until the total return reaches 10% (commonly referred to as a “Catch-Up”); and second, to the extent there are remaining Excess Profits, 10% of such remaining Excess Profits. The total return to stockholders is defined for each class of common stock as the change in NAV per share for such class, plus distributions per share for such class. However, in the event that our NAV per share for any class of common stock decreases below $12.00, the performance component will not be earned on any increase in NAV up to $12.00 per share with respect to that class.

Expense Reimbursements

Under the advisory agreement, RREEF America is entitled to reimbursement of certain costs incurred by RREEF America or its affiliates that are not incurred under the expense support agreement, as discussed below. Costs eligible for reimbursement, if they are not incurred under the expense support agreement, include most third-party operating expenses, salaries and related costs of our advisor’s employees who perform services for us (but not those employees for which RREEF America earns a separate fee or those employees who are our executive officers) and travel related costs for its employees who incur such costs on our behalf. We may reimburse our advisor for all expenses paid or incurred in connection with the services it provided to us, subject to the limitations described below under the heading “2%/25% Guidelines." As of December 31, 2019, we owed our advisor $66,695 for such costs.

Organization and Offering Costs

Under the advisory agreement, RREEF America agreed to pay all of our organization and offering costs incurred through January 3, 2013. In addition, RREEF America agreed to pay certain of our organization and offering costs from January 3, 2013 through January 3, 2014 that were incurred in connection with certain offering related activities. In total, RREEF America incurred $4,618,318 of these costs (the “Deferred O&O”) on behalf of us or our operating partnership from our inception through January 3, 2014. Pursuant to the advisory agreement, in January 2014, we began reimbursing RREEF America monthly for the Deferred O&O on a straight-line basis over 60 months. Through December 31, 2018, we have reimbursed RREEF America for all of the Deferred O&O, with no additional payments remaining.

Expense Support Agreement

On May 29, 2013, we entered into an expense support agreement with our advisor, as most recently amended and restated on January 20, 2016 (the “expense support agreement”). Pursuant to the terms of the expense support agreement, our advisor has agreed to defer reimbursement of certain expenses related to our operations that our advisor has incurred (“expense payments”). These expense payments include, without limitation, expenses that are organizational and offering expenses and operating expenses under our advisory agreement.