Filed Pursuant to Rule 424(b)(3)

Registration No. 333-232425

RREEF PROPERTY TRUST, INC.

SUPPLEMENT NO. 2 DATED MAY 21, 2020

TO THE PROSPECTUS DATED APRIL 29, 2020

This document supplements, and should be read in conjunction with, our prospectus dated April 29, 2020, as supplemented by Supplement No. 1 dated May 5, 2020. Unless otherwise defined herein, capitalized terms shall have the same meanings as set forth in the prospectus.

The purpose of this supplement is to disclose:

•an update to the valuation of our properties;

•an update to our valuation guidelines;

•an update to the “Experts” section of our prospectus; and

•our Quarterly Report on Form 10-Q for the period ended March 31, 2020.

Valuation of Properties

The estimated value of our investments in real estate as of March 31, 2020 was $398,800,000. Altus Group U.S. Inc. serves as our independent valuation advisor. Altus Group is responsible for providing an opinion of fair value in individual appraisal reports or expressing an opinion as to the reasonableness of the value expressed in individual third-party appraisal reports based on its review of the underlying reports. Altus Group does not calculate and is not responsible for our daily NAV per share for any class of our shares.

Updates to Our Valuation Guidelines

The paragraphs under the subheading “Net Asset Value Calculation and Valuation Guidelines—Valuation of Properties—Consolidated Properties” beginning on page 146 of our prospectus are hereby deleted in their entirety and replaced with the following:

At the beginning of each calendar year, our independent valuation advisor prepares a schedule with the objective of having all of our consolidated properties valued each quarter by an appraisal. Appraisals are performed in accordance with the Code of Professional Ethics and Standards of Professional Appraisal Practice of the Appraisal Institute and the Uniform Standards of Professional Appraisal Practice, or USPAP, the real estate appraisal industry standards created by The Appraisal Foundation, and other appropriate standards as reasonably agreed to by our advisor and our independent appraisers. Each appraisal is reviewed, approved and signed by an individual with the professional designation of MAI (a Designated Member of the Appraisal Institute). Although our independent valuation advisor performs the majority of the appraisals, our valuation guidelines require that on a rotating basis, approximately 25% of our properties in any particular quarter must be appraised by one or more independent third-party appraisers who are not affiliated with us, our advisor or our independent valuation advisor. We believe our policy of obtaining appraisals by another independent third-party appraiser meaningfully enhances the accuracy of our NAV calculation. Our independent valuation advisor recommends independent third-party appraisal firms to our advisor and upon approval by our advisor, the independent third-party appraisal firms are engaged by our advisor. Any appraisal provided by a firm other than our independent valuation advisor is performed in accordance with our valuation guidelines and is not incorporated into the calculation of our NAV until our independent valuation advisor has reviewed and expressed an opinion as to the reasonableness of the value developed in such appraisal report. Newly acquired, consolidated properties are initially valued at cost and thereafter join the quarterly appraisal cycle during the first full quarter in which we own the property. For the first quarter in which we acquire a property, we calculate and accrue net portfolio income with respect to such property based on the performance of the property before the acquisition and the contractual arrangements in place at the

time of the acquisition, as identified and reviewed through our due diligence and underwriting process in connection with the acquisition.

In addition to the quarterly appraisal process, prior to the beginning of each quarter, our independent valuation advisor develops a prospective quarter-end appraisal for each property. The resulting forward-looking value is based on anticipated cash flows and, if applicable, anticipated property-specific events applied to the cash flows for the property. The difference, if any, between the prospective value for quarter-end and the latest appraised value is amortized daily over the quarter, unless our independent valuation advisor, based on information provided by our advisor or based on its own information, determines that an intra-quarter appraisal is appropriate to capture any subsequent material property-specific changes or changes in the competitive or capital market conditions.

On an ongoing basis, our advisor monitors our properties for events that our advisor believes may be expected to have a material impact on the most recent estimated values provided by our independent appraisers, and notifies our independent valuation advisor of such events, if any. If, in the opinion of our independent valuation advisor, at any time during each quarter, an event identified by our advisor, or an event that becomes known to our independent valuation advisor through other means, is likely to have a material impact on previously provided estimated values of the affected properties, our independent valuation advisor prepares an intra-quarter appraisal the resulting value of which is then incorporated into our NAV. For example, an intra-quarter appraisal may be appropriate to reflect the occurrence of an unexpected property-specific event such as a termination or renewal of a material lease, a change in vacancies, an unanticipated structural or environmental event at a property or a significant capital market event that may cause the value of a wholly owned property to change materially. Intra-quarter appraisals may also be appropriate to reflect the occurrence of broader economic, social or market-driven events identified by our advisor or our independent valuation advisor which may impact more than one specific property. Any such appraisals reflect the market impact of specific events as they occur, based on assumptions and judgments that may or may not prove to be correct, and may also be based on the limited information readily available at that time. If our advisor or our independent valuation advisor believes that the value of a property has changed materially since the most recent quarterly valuation or that circumstances have arisen that were not previously contemplated in our independent appraiser’s latest appraisal for a property, our advisor or our independent valuation advisor, as applicable, promptly communicates the relevant information to the other party. If deemed appropriate by our independent valuation advisor, an intra-quarter appraisal is completed as soon as practicable. Once our independent valuation advisor has completed the intra-quarter appraisal, it updates the current value, if applicable, develops a new prospective appraisal as of the end of the current quarter and administratively prepares a revised daily amortization schedule incorporating these revised values, if any, over the remainder of the current quarter. BNY Mellon then incorporates these changes into our daily NAV calculations.

In general, we expect that any value updates will be processed as soon as practicable after a determination that a material change has occurred and the financial effects of such a change are quantifiable in an appraisal by our independent valuation advisor. However, rapidly changing market conditions or material events may not be immediately reflected in our daily NAV. The resulting potential disparity in our NAV may inure to the benefit of stockholders whose shares are redeemed or new purchasers of our common stock, depending on whether our published NAV per share for such class is overstated or understated.

Wholly owned development assets, if any, will be valued at cost plus capital expenditures, including capitalized interest, in accordance with GAAP, and will be included in the quarterly appraisal cycle upon stabilization. Acquisition costs and expenses incurred in connection with the acquisition of consolidated properties that are not directly related to any single property generally are allocated among the applicable properties pro rata based on relative values. Properties purchased as a portfolio may be valued as a single asset.

Real estate appraisals are reported on a free and clear basis (for example, without taking into consideration any mortgage on the property), irrespective of any property level financing that may be in place. We expect the primary methodology used to value properties will be the income approach, whereby value is derived by determining the present value of an asset’s stream of future cash flows (for example, through a discounted cash flow analysis). Consistent with industry practices, the income approach incorporates subjective judgments regarding comparable rental and operating expense data, capitalization or discount rate, and projections of future rent and expenses based

on appropriate evidence as well as the residual value of the property. Other methodologies that may also be used to value properties include sales comparisons and cost approaches. Because the appraisals performed by our independent appraisers involve subjective judgments, those valuations of our consolidated properties, which are included in our NAV, may not reflect the liquidation value or net realizable value of our consolidated properties.

The paragraph under the heading “Net Asset Value Calculation and Valuation Guidelines—Valuation of Real Estate-Related Assets” beginning on page 147 of our prospectus is hereby deleted in its entirety and replaced with the following:

Real estate-related assets that we may acquire include debt and equity interests backed principally by real estate, such as common and preferred stock of REITs and real estate companies, commercial mortgage-backed securities, mortgage loans, participations in mortgage loans, mezzanine loans and preferred equity positions. In general, real estate-related assets will be valued according to the procedures specified below upon acquisition or issuance and then quarterly, or in the case of liquid securities, daily, thereafter. For real estate-related assets that are not valued daily, our board of directors will retain independent valuation firms to value such real estate-related assets no less than quarterly. Intra-quarter valuations of real estate-related assets that generally are valued quarterly may be performed if our advisor or the independent valuation firm retained to value such assets believes the value of the applicable asset has changed materially since the most recent valuation.

The paragraph under the subheading “Net Asset Value Calculation and Valuation Guidelines—Valuation of Real Estate-Related Assets—Private Real Estate-Related Assets” beginning on page 148 of our prospectus is hereby deleted in its entirety and replaced with the following:

Investments in privately placed debt instruments and securities of real estate-related operating businesses (other than joint ventures), such as real estate development or management companies, will be valued by our advisor at cost (purchase price plus all related acquisition costs and expenses, such as legal fees and closing costs) and thereafter will be revalued no less than quarterly by an independent valuation firm as approved by our board of directors. In evaluating the fair value of our interests in certain commingled investment vehicles (such as private real estate funds), values periodically assigned to such interests by the respective issuers or broker-dealers may be relied upon.

The subsection “Net Asset Value Calculation and Valuation Guidelines—Valuation of Real Estate-Related Assets—Mortgage Loans, Participations in Mortgage Loans and Mezzanine Loans” beginning on page 148 of our prospectus is hereby deleted in its entirety and replaced with the following:

Mortgage Loans, Participations in Mortgage Loans, Mezzanine Loans and Preferred Equity Positions

Individual investments in mortgages, mortgage participations, mezzanine loans and preferred equity positions will be valued initially at our acquisition cost and will be revalued on a quarterly basis by an independent valuation firm as approved by our board of directors. Revaluations of mortgages will reflect the changes in value of the underlying real estate, with anticipated sale proceeds (estimated cash flows) discounted to their present value using a discount rate based on current market rates.

The paragraph under the heading “Net Asset Value Calculation and Valuation Guidelines—Liabilities” beginning on page 148 of our prospectus is hereby deleted in its entirety and replaced with the following:

The value of our company-level liabilities will be included as part of our NAV calculation. Our independent valuation advisor will not be responsible for the valuation, quarterly or otherwise, or the review of valuations of our liabilities. We expect that these liabilities will include the fees payable to our advisor and our dealer manager, accounts payable, accrued operating expenses, property-level mortgages, any portfolio-level credit facilities and other liabilities. All liabilities will be valued using widely accepted methodologies specific to each type of liability. We anticipate having access to a line of credit, which will be held at cost. Additionally, any debt obligations originated by us will be valued at amortized cost, while any debt obligations assumed by us in connection with a transaction will be valued at the time of assumption pursuant to the purchase price allocation as required by GAAP.

Thereafter, assumed debt will not be revalued and the discount or premium that resulted from the purchase price allocation will be amortized over the remaining term of the instrument. Liabilities allocable to a specific class of shares will only be included in the NAV calculation for that class. Estimated amounts of future trailing fees, as determined by our advisor, will be deducted from the NAV on a daily basis as and when they become payable to the dealer manager. These amounts have not yet been included in the calculation of our NAV because the timing and ultimate amount of the trailing fees to be paid are unknown and dependent on factors including how long the applicable shares remain outstanding. However, under GAAP, we have incurred a liability for estimated future trailing fees as of December 31, 2019.

The paragraphs under the heading “Net Asset Value Calculation and Valuation Guidelines—NAV and NAV Per Share Calculation” beginning on page 149 of our prospectus are hereby deleted in their entirety and replaced with the following:

Our NAV and our NAV per share are calculated by The Bank of New York Mellon, or BNY Mellon, in accordance with the valuation guidelines established by our board of directors. Our advisor is responsible for overseeing, and is ultimately responsible for, the calculation of our NAV and our NAV per share as performed by BNY Mellon. The valuation of our assets and liabilities which are utilized by BNY Mellon in the calculation of our NAV and our NAV per share are determined as described above.

We are offering to the public seven classes of shares of our common stock: Class A shares, Class I shares, Class M-I shares, Class N shares, Class S shares, Class T shares and Class T2 shares (see “Description of Capital Stock—Common Stock”). We are also offering Class D shares of our common stock via private placement, and we may issue Class Z shares of our common stock to our advisor or its affiliates in a private placement. Each such class has an undivided interest in our assets and liabilities, other than any class-specific liabilities. In accordance with the valuation guidelines, BNY Mellon calculates our NAV per share for each class after the end of each business day, using a process that reflects several components, including, but not limited to, (1) estimated values of each of our properties based upon individual appraisal reports provided periodically by our independent valuation advisor and other third-party independent valuation firms, (2) the value of our liquid assets for which third party market quotes are available, (3) estimated values of our other real estate equity securities and real estate loan investments, as provided by independent valuation agents, (4) estimated accruals and amortizations of our operating revenues and expenses, including our organization and offering expenses, and (5) accruals for stockholder distributions.

The calculation of our NAV is intended to be a calculation of fair value of our assets less our outstanding liabilities and may differ from our financial statements. As a public company, we are required to issue financial statements based on historical cost in accordance with GAAP. To calculate our NAV for the purpose of establishing a purchase and redemption price for our shares, we have adopted a model, as explained below, which adjusts the value of our assets from historical cost to fair value in accordance with the GAAP principles set forth in FASB Accounting Standards Codification Topic 820, Fair Value Measurements and Disclosures. Our advisor will calculate the fair value of our real estate properties based on appraisals provided by our independent appraisers and in accordance with these principles. Because these appraisals involve significant professional judgment in the application of both observable and unobservable attributes, the calculated fair value of our assets may differ from their actual realizable value or future fair value. Furthermore, no rule or regulation requires that we calculate NAV in a certain way. While we believe our NAV calculation methodologies are consistent with standard industry principles, there is no established practice among public REITs, whether listed or not, for calculating NAV in order to establish a purchase or redemption price. As a result, other public REITs may use different methodologies or assumptions to determine NAV.

At the end of each business day, before taking into consideration additional issuances of shares of capital stock, redemptions or class-specific fee accruals for that day, any change in our aggregate NAV (whether an increase or decrease) is allocated among each class of shares based on each class’s relative percentage of the previous aggregate NAV. Changes in our daily NAV will include, without limitation, daily accruals and amortizations of our net portfolio income, interest expense, the advisory fee, the dealer manager fee, the distribution fee, distributions, unrealized/realized gains and losses on assets, offering costs and any expense reimbursements. Costs incurred by us under the expense support agreement for both organization and offering expenses and operating expenses will be

allocated to all classes of shares of our common stock on a pro rata basis in connection with calculating the NAV for each class as and when such amounts are reimbursed to our advisor. In addition, all of our offering costs associated with all of our offerings (including any private placements) will be allocated to all outstanding shares of all classes, on a pro rata basis. The net portfolio income will be calculated and accrued on the basis of data extracted from (1) the quarterly budget for each property and at the company level, including organization and offering expenses and certain operating expenses, (2) material, unbudgeted non-recurring income and expense events such as capital expenditures, prepayment penalties, assumption fees, tenant buyouts, lease termination fees and tenant turnover with respect to our properties when our advisor becomes aware of such events and the relevant information is available, (3) material property acquisitions and dispositions occurring during the month and (4) reports from other vendors impacting our aggregate NAV. Acquisition costs with respect to each acquired property are amortized on a daily basis into our NAV over a five-year period following the acquisition date. On an ongoing basis, BNY Mellon will adjust the accruals to reflect actual operating results and the outstanding receivable, payable and other account balances resulting from the accumulation of daily accruals for which financial information is available.

Pursuant to the terms of our expense support agreement with our advisor described elsewhere in this prospectus, our advisor has incurred expenses related to our offerings and operations, which we refer to as expense payments. Expense payments made by our advisor in accordance with the expense support agreement will not be recognized as expenses and reflected in our daily NAV until we reimburse our advisor for these costs. Expense payments will be allocated to all classes of shares of our common stock daily on a pro rata basis in connection with calculating the daily NAV for each class. Prior to the initiation of our current follow-on offering period, and prior to initiation of future follow-on offering periods, we have incurred and will incur certain costs in preparation for such follow-on offering periods, which we refer to as prepaid offering costs. Such costs will benefit the entire follow-on offering period to which they relate and as such will be amortized on a straight-line basis over the anticipated follow-on offering period into the NAV for each class of shares beginning upon commencement of each particular follow-on offering. Organization and offering costs incurred during an active follow-on offering period will be deducted from our NAV on an accrual basis as they are incurred. In the event our advisor agrees to pay some or all of our organization and offering costs prior to the commencement of an offering period and agrees to defer reimbursement of such costs, then such costs will be amortized into the daily NAV calculation as such costs are reimbursed to our advisor. We will allocate all of our offering costs to all outstanding shares of all classes on a pro rata basis, each day that we calculate a NAV for a given class of shares. Similarly, any payments made by our dealer manager of reimbursable offering costs in connection with our offerings on our behalf will also be recognized and reflected in our daily NAV for all share classes on a pro rata basis.

Following the aggregation of the net asset values of our investments, the addition of any other assets (such as cash on hand), the deduction of any other liabilities and the allocation of income and expenses, BNY Mellon will incorporate any class-specific adjustments to our NAV, including additional issuances and redemptions of our common stock and accruals of class-specific fees such as distribution fees. Our share classes may have different fee accruals associated with the advisory fee we will pay our advisor because the performance component of our advisory fee is calculated separately with respect to each class. See “Management—The Advisory Agreement—Advisory Fee” for a discussion of the calculation of the performance component of the advisory fee. At the close of business on the date that is one business day after each record date for any declared distribution, which we refer to as the “distribution adjustment date,” our NAV for each class will be reduced to reflect the accrual of our liability to pay the distribution to our stockholders of record of each class as of the record date. NAV per share for each class is calculated by dividing such class’s NAV at the end of each trading day by the number of shares outstanding for that class on such day.

The combination of the NAV for each of our classes of common stock will equal the value of our assets, which will consist almost entirely of the value of our interest in our operating partnership, less our liabilities, which include certain class-specific liabilities. The value of our interest in our operating partnership will be equal to the excess of the value of our operating partnership over the portion thereof that would be distributed to any limited partners if our operating partnership were liquidated. The value of our operating partnership is the excess of the value of our operating partnership’s assets (including the fair value of its properties, real estate-related assets, cash and other investments) over its liabilities (including its debt, any declared and accrued unpaid distributions and the expenses attributable to its operations). BNY Mellon will calculate the value of the assets of our operating

partnership as directed by our valuation guidelines based upon values received from various sources, as described in more detail above.

Experts

The following disclosure is added to the “Experts” section of our prospectus.

The estimated value of our investments in real estate as of March 31, 2020 presented on page 1 of this Supplement No. 2 under the section “Valuation of Properties” has been reviewed by Altus Group U.S. Inc., an independent valuation firm, and is included in this Supplement No. 2 given the authority of such firm as experts in property valuations and appraisals. Altus Group is responsible for providing an opinion of fair value in individual appraisal reports or expressing an opinion as to the reasonableness of the value expressed in individual third-party appraisal reports based on its review of the underlying reports. Altus Group does not calculate and is not responsible for our daily NAV per share for any class of our shares.

Quarterly Report on Form 10-Q

The prospectus is hereby supplemented with our Quarterly Report on Form 10-Q, excluding exhibits, for the period ended March 31, 2020 that was filed with the SEC on May 14, 2020, a copy of which is attached to this Supplement No. 2 as Appendix A.

Appendix A

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________________

Form 10-Q

_________________________________________

| | | | | |

| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2020

OR

| | | | | |

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____ to ____

Commission file number 000-55598

__________________________________________

RREEF Property Trust, Inc.

(Exact name of registrant as specified in its charter)

__________________________________________

| | | | | |

| Maryland | 45-4478978 |

(State or other jurisdiction of

incorporation or organization) | (I.R.S. Employer Identification Number) |

| 875 Third Avenue, 26th Floor, New York, NY 10022 | (212) 454-4500 |

| (Address of principal executive offices; zip code) | (Registrant’s telephone number, including area code) |

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

________________________________________________________________________

Securities registered pursuant to Section 12(b) of the Act: None.

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | o | Accelerated filer | o |

| Non-accelerated filer | x | Smaller reporting company | ☒ |

| | Emerging growth company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No x

As of May 5, 2020, the registrant had 3,707,421 shares of Class A common stock, $.01 par value, outstanding, 10,351,902 shares of Class I common stock, $.01 par value, outstanding, 999,934 shares of Class T common stock, $.01 par value, outstanding, 176,101 shares of Class D common stock, $.01 par value, outstanding, and no shares of Class N common stock, $.01 par value, outstanding.

RREEF PROPERTY TRUST, INC.

QUARTERLY REPORT ON FORM 10-Q

For the Quarter Ended March 31, 2020

TABLE OF CONTENTS

PART I

FINANCIAL INFORMATION

ITEM 1. FINANCIAL STATEMENTS

RREEF PROPERTY TRUST, INC.

CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share data)

| | | | | | | | | | | |

| March 31, 2020 (unaudited) | | December 31, 2019 |

| ASSETS | | | |

| Investment in real estate assets: | | | |

| Land | $ | 124,860 | | | $ | 124,860 | |

| Buildings and improvements, less accumulated depreciation of $23,160 and $21,403, respectively | 165,832 | | | 167,004 | |

| Furniture, fixtures and equipment, less accumulated depreciation of $391 and $369, respectively | 246 | | | 220 | |

| Acquired intangible lease assets, less accumulated amortization of $25,849 and $24,413, respectively | 37,842 | | | 39,278 | |

| Total investment in real estate assets, net | 328,780 | | | 331,362 | |

| Investment in marketable securities | 16,536 | | | 21,245 | |

| Total investment in real estate assets and marketable securities, net | 345,316 | | | 352,607 | |

| Cash and cash equivalents | 6,285 | | | 4,234 | |

| | | |

| Receivables, net of allowance for doubtful accounts of $7 and $6, respectively | 4,815 | | | 4,812 | |

| Deferred leasing costs, net of amortization of $831 and $732, respectively | 2,045 | | | 2,132 | |

| Prepaid and other assets | 1,968 | | | 2,300 | |

| | | |

| Total assets | $ | 360,429 | | | $ | 366,085 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | |

| Line of credit, net | $ | 74,357 | | | $ | 81,291 | |

| Mortgage loans payable, net | 125,664 | | | 125,698 | |

| Accounts payable and accrued expenses | 3,983 | | | 2,878 | |

| Due to affiliates | 14,302 | | | 7,843 | |

| Note to affiliate, net of unamortized discount of $943 and $1,217, respectively | 4,440 | | | 7,733 | |

| Acquired below market lease intangibles, less accumulated amortization of $4,566 and $4,346, respectively | 13,999 | | | 14,219 | |

| Distributions payable | 473 | | | 441 | |

| Other liabilities | 2,418 | | | 2,140 | |

| Total liabilities | 239,636 | | | 242,243 | |

| Stockholders' Equity: | | | |

| Preferred stock, $0.01 par value; 50,000,000 shares authorized; none issued | — | | | — | |

| Class A common stock, $0.01 par value; 200,000,000 shares authorized; 3,784,431 and 3,821,127 issued and outstanding, respectively | 38 | | | 38 | |

| Class I common stock, $0.01 par value; 200,000,000 shares authorized; 10,275,751 and 9,557,896 issued and outstanding, respectively | 103 | | | 96 | |

| Class T common stock, $0.01 par value; 250,000,000 shares authorized; 998,470 and 938,409 issued and outstanding, respectively | 10 | | | 9 | |

| Class D common stock, $0.01 par value; 50,000,000 shares authorized; 176,101 and 176,101 issued and outstanding, respectively | 2 | | | 2 | |

| Class N common stock, $0.01 par value; 300,000,000 shares authorized; none issued | — | | | — | |

| Additional paid-in capital | 174,206 | | | 169,395 | |

| Deficit | (53,566) | | | (45,698) | |

| | | |

| Total stockholders' equity | 120,793 | | | 123,842 | |

| Total liabilities and stockholders' equity | $ | 360,429 | | | $ | 366,085 | |

The accompanying notes are an integral part of these consolidated financial statements.

RREEF PROPERTY TRUST, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | | | | | |

| 2020 | | 2019 | | | | |

| Revenues | | | | | | | |

| Property related income | $ | 8,013 | | | $ | 5,765 | | | | | |

| | | | | | | |

| Investment income on marketable securities | 162 | | | 151 | | | | | |

| Total revenues | 8,175 | | | 5,916 | | | | | |

| Expenses | | | | | | | |

| General and administrative expenses | 540 | | | 572 | | | | | |

| Property operating expenses | 2,238 | | | 1,882 | | | | | |

| Advisory fees | 539 | | | 371 | | | | | |

| | | | | | | |

| Depreciation | 1,779 | | | 1,310 | | | | | |

| Amortization | 1,481 | | | 1,169 | | | | | |

| Total operating expenses | 6,577 | | | 5,304 | | | | | |

| Net realized (loss) gain upon sale of marketable securities | (443) | | | 119 | | | | | |

| Net unrealized change in fair value of investment in marketable securities | (4,363) | | | 2,166 | | | | | |

| Operating (loss) income | (3,208) | | | 2,897 | | | | | |

| Interest expense | (1,952) | | | (1,293) | | | | | |

| | | | | | | |

| Net (loss) income | $ | (5,160) | | | $ | 1,604 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Basic and diluted net (loss) income per share of Class A common stock | $ | (0.34) | | | $ | 0.15 | | | | | |

| Basic and diluted net (loss) income per share of Class I common stock | $ | (0.34) | | | $ | 0.15 | | | | | |

| Basic and diluted net (loss) income per share of Class T common stock | $ | (0.34) | | | $ | 0.15 | | | | | |

| Basic and diluted net (loss) income per share of Class D common stock | $ | (0.34) | | | $ | — | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

RREEF PROPERTY TRUST, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

(Unaudited)

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Preferred Stock | | | Class A Common Stock | | | Class I Common Stock | | | Class T Common Stock | | | Class D Common Stock | | | Class N Common Stock | | | Additional Paid-in Capital | | Deficit | | | | Total

Stockholders'

Equity | |

| Number of

Shares | Par

Value | | Number of

Shares | Par

Value | | Number of

Shares | Par

Value | | Number of

Shares | Par

Value | | Number of

Shares | Par

Value | | Number of

Shares | Par

Value | | | | | | | | | |

| Balance, December 31, 2019 | — | | $ | — | | | 3,821,127 | | $ | 38 | | | 9,557,896 | | $ | 96 | | | 938,409 | | $ | 9 | | | 176,101 | | $ | 2 | | | — | | $ | — | | | $ | 169,395 | | | $ | (45,698) | | | | | $ | 123,842 | | |

| Issuance of common stock | — | | — | | | 35,762 | | — | | | 960,826 | | 9 | | | 55,884 | | 1 | | | — | | — | | | — | | — | | | 15,306 | | | — | | | | | 15,316 | | |

| Issuance of common stock through the distribution reinvestment plan | — | | — | | | 25,107 | | — | | | 63,595 | | 1 | | | 4,177 | | — | | | — | | — | | | — | | — | | | 1,338 | | | — | | | | | 1,339 | | |

| Redemption of common stock | — | | — | | | (97,565) | | — | | | (308,331) | | (3) | | | — | | — | | | — | | — | | | — | | — | | | (5,794) | | | — | | | | | (5,797) | | |

| Distributions to investors | — | | — | | | — | | — | | | — | | — | | | — | | — | | | — | | — | | | — | | — | | | — | | | (2,708) | | | | | (2,708) | | |

| Offering costs | — | | — | | | — | | — | | | — | | — | | | — | | — | | | — | | — | | | — | | — | | | (5,828) | | | — | | | | | (5,828) | | |

| Equity based compensation | — | | — | | | — | | — | | | 1,765 | | — | | | — | | — | | | — | | — | | | — | | — | | | 25 | | | — | | | | | 25 | | |

| Discount on note to affiliate | — | | — | | | — | | — | | | — | | — | | | — | | — | | | — | | — | | | — | | — | | | (236) | | | — | | | | | (236) | | |

| Net loss | — | | — | | | — | | — | | | — | | — | | | — | | — | | | — | | — | | | — | | — | | | — | | | (5,160) | | | | | (5,160) | | |

| Balance, March 31, 2020 | — | | $ | — | | | 3,784,431 | | $ | 38 | | | 10,275,751 | | $ | 103 | | | 998,470 | | $ | 10 | | | 176,101 | | $ | 2 | | | — | | $ | — | | | $ | 174,206 | | | $ | (53,566) | | | | | $ | 120,793 | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

RREEF PROPERTY TRUST, INC.

CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUITY

(Unaudited)

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Preferred Stock | | | Class A Common Stock | | | Class I Common Stock | | | Class T Common Stock | | | Class D Common Stock | | | Class N Common Stock | | | Additional Paid-in Capital | | Deficit | | | | Total

Stockholders'

Equity |

| Number of

Shares | Par

Value | | Number of

Shares | Par

Value | | Number of

Shares | Par

Value | | Number of

Shares | Par

Value | | Number of

Shares | Par

Value | | Number of

Shares | Par

Value | | | | | | | | |

| Balance, December 31, 2018 | — | | $ | — | | | 3,574,584 | | $ | 36 | | | 6,132,292 | | $ | 61 | | | 628,863 | | $ | 6 | | | — | | $ | — | | | — | | $ | — | | | $ | 115,025 | | | $ | (37,621) | | | | | $ | 77,507 | |

| Issuance of common stock | — | | — | | | 131,830 | | 1 | | | 641,503 | | 7 | | | 55,679 | | 1 | | | — | | — | | | — | | — | | | 11,913 | | | — | | | | | 11,922 | |

| Issuance of common stock through the distribution reinvestment plan | — | | — | | | 22,405 | | — | | | 34,329 | | — | | | 2,250 | | — | | | — | | — | | | — | | — | | | 841 | | | — | | | | | 841 | |

| Redemption of common stock | — | | — | | | (68,408) | | (1) | | | (43,806) | | — | | | (9,363) | | — | | | — | | — | | | — | | — | | | (1,723) | | | — | | | | | (1,724) | |

| Distributions to investors | — | | — | | | — | | — | | | — | | — | | | — | | — | | | — | | — | | | — | | — | | | — | | | (1,841) | | | | | (1,841) | |

| Offering costs | — | | — | | | — | | — | | | — | | — | | | — | | — | | | — | | — | | | — | | — | | | (916) | | | — | | | | | (916) | |

| Equity based compensation | — | | — | | | — | | — | | | 5,042 | | — | | | — | | — | | | — | | — | | | — | | — | | | 72 | | | — | | | | | 72 | |

| Net income | — | | — | | | — | | — | | | — | | — | | | — | | — | | | — | | — | | | — | | — | | | — | | | 1,604 | | | | | 1,604 | |

| Balance, March 31, 2019 | — | | $ | — | | | 3,660,411 | | $ | 36 | | | 6,769,360 | | $ | 68 | | | 677,429 | | $ | 7 | | | — | | $ | — | | | — | | $ | — | | | $ | 125,212 | | | $ | (37,858) | | | | | $ | 87,465 | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | |

The accompanying notes are an integral part of these consolidated financial statements.

RREEF PROPERTY TRUST, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(in thousands)

| | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2020 | | 2019 |

| Cash flows from operating activities: | | | |

| Net (loss) income | $ | (5,160) | | | $ | 1,604 | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | |

| Depreciation | 1,779 | | | 1,310 | |

| Net realized loss (gain) upon sale of marketable securities | 443 | | | (119) | |

| Net unrealized change in fair value of marketable securities | 4,363 | | | (2,166) | |

| Share based compensation | 25 | | | 72 | |

| Amortization of intangible lease assets and liabilities | 1,315 | | | 999 | |

| Amortization of deferred financing costs | 97 | | | 79 | |

| | | |

| Straight line rent | (157) | | | (208) | |

| Amortization of discount on note to affiliate | 38 | | | 37 | |

| Changes in assets and liabilities: | | | |

| Receivables | 151 | | | (240) | |

| Deferred leasing costs | (12) | | | (111) | |

| Prepaid and other assets | (446) | | | (289) | |

| Accounts payable and accrued expenses | 409 | | | 378 | |

| Other liabilities | 169 | | | (46) | |

| Due to affiliates | (1,065) | | | (511) | |

| Net cash provided by operating activities | 1,949 | | | 789 | |

| Cash flows from investing activities: | | | |

| | | |

| Improvements to real estate assets | (873) | | | (415) | |

| | | |

| Investment in marketable securities | (7,087) | | | (5,778) | |

| Proceeds from sale of marketable securities | 7,066 | | | 5,640 | |

| Net cash used in investing activities | (894) | | | (553) | |

| Cash flows from financing activities: | | | |

| Proceeds from line of credit | 6,500 | | | 900 | |

| Repayment of line of credit | (13,500) | | | (6,100) | |

| | | |

| Repayment of mortgage loans payable | (65) | | | (63) | |

| Proceeds from issuance of common stock | 15,281 | | | 11,909 | |

| | | |

| Payment of offering costs | (982) | | | (522) | |

| | | |

| Distributions to investors | (1,337) | | | (983) | |

| Redemption of common stock | (4,901) | | | (1,589) | |

| | | |

| | | |

| Net cash provided by financing activities | 996 | | | 3,552 | |

| Net increase in cash and cash equivalents | 2,051 | | | 3,788 | |

| Cash and cash equivalents, beginning of period | 4,234 | | | 2,002 | |

| Cash and cash equivalents, end of period | $ | 6,285 | | | $ | 5,790 | |

The accompanying notes are an integral part of these consolidated financial statements.

RREEF PROPERTY TRUST, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(continued)

(Unaudited)

| | | | | | | | | | | |

| Three Months Ended March 31, | | |

| Supplemental Disclosures of Non-Cash Investing and Financing Activities: | 2020 | | 2019 |

| | | |

| Distributions declared and unpaid | $ | 473 | | | | $ | 351 | |

| | | |

| Common stock issued through the distribution reinvestment plan | 1,339 | | | | 841 | |

| Purchases of marketable securities not yet paid | 231 | | | | 178 | |

| Proceeds from sale of marketable securities not yet received | 131 | | | 119 | |

| Proceeds from issuance of common stock not yet received | 533 | | | | 113 | |

| | | |

| Extinguishment on note to affiliate | 3,567 | | | — | |

| Discount on note to affiliate | 236 | | | | — | |

| | | |

| Accrued offering costs not yet paid | 4,565 | | | 661 | |

| Capital expenditures not yet paid | 512 | | | 362 | |

| | | |

| Redemptions of common stock not yet paid | 1,046 | | | 135 | |

| | | |

| Supplemental Cash Flow Disclosures: | | | | | |

| | | |

| Interest paid | $ | 1,669 | | | $ | 1,053 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

The accompanying notes are an integral part of these consolidated financial statements.

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2020

(Unaudited)

(in thousands except share and per share data)

NOTE 1 — ORGANIZATION

RREEF Property Trust, Inc. (the “Company”) was formed on February 7, 2012 as a Maryland corporation and has elected to qualify as a real estate investment trust (“REIT”) for federal income tax purposes. Substantially all of the Company's business is conducted through RREEF Property Operating Partnership, LP, the Company's operating partnership (the “Operating Partnership”). The Company is the sole general partner of the Operating Partnership. RREEF Property OP Holder, LLC (the “OP Holder”), a wholly-owned subsidiary of the Company, is the limited partner of the Operating Partnership. As the Company completes the settlement for purchase orders for shares of its common stock in its continuous public offering, it will continue to transfer substantially all of the proceeds to the Operating Partnership.

The Company was organized to invest primarily in a diversified portfolio consisting primarily of high quality, income-producing commercial real estate located in the United States, including, without limitation, office, industrial, retail and apartment properties (“Real Estate Properties”). Although the Company intends to invest primarily in Real Estate Properties, it also intends to acquire common and preferred stock of REITs and other real estate companies (“Real Estate Equity Securities”) and debt investments backed principally by real estate (“Real Estate Loans” and, together with Real Estate Equity Securities, “Real Estate-Related Assets”).

On January 3, 2013, the Securities and Exchange Commission ("SEC") declared effective the Company's registration statement on Form S-11 (File No. 333-180356), filed under the Securities Act of 1933, as amended (the "Initial Registration Statement"). On May 30, 2013, RREEF America L.L.C., a Delaware limited liability company (“RREEF America”), the Company's sponsor and advisor, purchased $10,000 of the Company's Class I common stock, $0.01 par value per share ("Class I Shares"), and the Company’s board of directors authorized the release of the escrowed funds to the Company, thereby allowing the Company to commence operations.

On January 15, 2016, the Company filed articles supplementary to its articles of incorporation to add a newly-designated Class D common stock, $0.01 par value per share ("Class D Shares"). On January 20, 2016, the Company commenced a private offering of up to a maximum of $350,000 in Class D Shares (the "Private Offering," and together with the Follow-On Public Offering (defined below), the "Offerings").

On July 12, 2016, the SEC declared effective the Company's registration statement on Form S-11 (File No. 333-208751), filed under the Securities Act of 1933, as amended (the "Registration Statement"). Pursuant to the Registration Statement, the Company is offering for sale up to $2,100,000 of shares of its Class A common stock, $0.01 par value per share ("Class A Shares"), Class I Shares, and Class T common stock, $0.01 par value per share ("Class T Shares"), in its primary offering and up to $200,000 of Class A Shares, Class I Shares, Class N common stock, $0.01 par value per share ("Class N Shares") and Class T Shares pursuant to its distribution reinvestment plan, to be sold on a "best efforts" basis for the Company's follow-on public offering (the "Follow-On Public Offering"). The Company's initial public offering terminated upon the commencement of the Follow-On Public Offering.

On January 8, 2020, the SEC declared effective the Company's registration statement on Form S-11 (File No. 333-232425) (the "Second Follow-On Registration Statement"). Pursuant to the Second Follow-On Registration Statement, the Company is offering for sale up to $2,300,000 of shares of its Class A shares, Class I shares or Class T shares consisting of up to $2,100,000 in its primary offering and up to $200,000 of shares of its Class A shares, Class I shares, Class N shares or Class T shares pursuant to its distribution reinvestment plan, to be sold on a "best efforts" basis for the Company's second follow-on public offering (the "Second Follow-On Public Offering"). The Follow-On Public Offering terminated upon the commencement of the Second Follow-On Public Offering.

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

March 31, 2020

(Unaudited)

(in thousands, except share and per share data)

Together, the Initial Public Offering, the Follow-On Public Offering, the Second Follow-On Public Offering and the Private Offering are referred to as the "Offerings".

On April 22, 2020, the Company filed articles supplementary to its articles of incorporation to add newly-designated Class M-I common stock, $0.01 par value per share ("Class M-I Shares"), Class S common stock, $0.01 par value per share ("Class S Shares"), Class T2 common stock, $0.01 par value per share ("Class T2 Shares") and Class Z common stock, $0.01 par value per share ("Class Z Shares"). Class M-I Shares, Class S Shares and Class T2 Shares have been added to the shares available in the Second Follow-On Public Offering. Class Z Shares are expected to be offered only in a private offering.

Shares of the Company’s common stock are sold at the Company’s net asset value (“NAV”) per share, plus, for Class A, Class S, Class T, Class T2 and Class D Shares only, applicable selling commissions. Each class of shares have a different NAV per share because of certain class-specific fees. NAV per share is calculated by dividing the NAV at the end of each business day for each class by the number of shares outstanding for that class on such day.

The Company's NAV per share for its Class A, Class I and Class T Shares is posted to the Company's website at www.rreefpropertytrust.com after the stock market close each business day. Additionally, the Company's NAV per share for its Class A, Class I and Class T Shares is published daily via NASDAQ's Mutual Fund Quotation System under the symbols ZRPTAX, ZRPTIX and ZRPTTX for its Class A Shares, Class I Shares and Class T Shares, respectively.

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

March 31, 2020

(Unaudited)

(in thousands, except share and per share data)

NOTE 2 — SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation and Principles of Consolidation

The accompanying consolidated financial statements have been prepared in accordance with the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”), the authoritative reference for U.S. generally accepted accounting principles (“GAAP”). There have been no significant changes to the Company's significant accounting policies during the three months ended March 31, 2020 except for the adoption of Accounting Standards Updates (“ASU”) noted below in Note 2. The interim financial data as of March 31, 2020 and for the three months ended March 31, 2020 and 2019 is unaudited. In the Company’s opinion, the interim data includes all adjustments, consisting only of normal recurring adjustments, necessary for a fair presentation of the results for the interim periods.

Use of Estimates

The preparation of the consolidated financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the amounts reported in the consolidated financial statements and accompanying notes. Actual results could differ from those estimates.

Real Estate Investments and Lease Intangibles

Entities are required to evaluate whether transactions should be accounted for as acquisitions (and dispositions) of assets or businesses. When substantially all of the fair value of the gross assets acquired (or disposed of) is concentrated in a single identifiable asset or a group of similar identifiable assets, the set is not a business. Generally, a real estate asset and its related leases will be considered a single identifiable asset and therefore will not meet the definition of a business. If the real estate and related leases in an acquisition are determined to be an asset and not a business, then the acquisition related costs would be capitalized onto the consolidated balance sheets. Otherwise, such costs will be expensed upon completion of the transaction.

The carrying value of the real estate investments are reviewed to ascertain if there are any indicators of impairment. Factors considered include the type of asset, the economic situation in the area in which the asset is located, the economic situation in the industry in which a tenant is involved and the timeliness of the payments made by a tenant under its lease, as well as any current correspondence that may have been had with a tenant, including property inspection reports. A real estate investment is impaired if the undiscounted cash flows over the expected hold period are less than the real estate investment’s carrying amount. In this case, an impairment loss will be recorded to the extent that the estimated fair value is lower than the real estate investment’s carrying amount. The estimated fair value is determined primarily using information contained within independent appraisals obtained quarterly by the Company from its independent valuation agent or other third-party appraisers. Real estate investments that are expected to be disposed of are valued at the lower of carrying amount or estimated fair value less costs to sell. As of March 31, 2020 and December 31, 2019, none of the Company's real estate investments were impaired.

Organization and Offering Costs

Organizational expenses and other expenses which do not qualify as offering costs are expensed as incurred. Offering costs are those costs incurred by the Company, RREEF America and its affiliates on behalf of the Company which relate directly to the Company’s activities of raising capital in the Offerings, preparing for the Offerings, the qualification and registration of the Offerings and the marketing and distribution of the Company’s shares. This includes, but is not limited to, accounting and legal fees, including the legal fees of the dealer manager for the public offerings, costs for registration statement amendments and prospectus supplements, printing, mailing and distribution costs, filing fees, amounts to reimburse RREEF America as the Company’s advisor or its affiliates for the salaries of employees and other costs in connection with preparing supplemental sales literature, amounts to reimburse the dealer manager for amounts that it may pay to reimburse the bona fide due diligence expenses of any

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

March 31, 2020

(Unaudited)

(in thousands, except share and per share data)

participating broker-dealers supported by detailed and itemized invoices, telecommunication costs, fees of the transfer agent, registrars, trustees, depositories and experts, the cost of educational conferences held by the Company (including the travel, meal and lodging costs of registered representatives of any participating broker-dealers) and attendance fees and cost reimbursement for employees of affiliates to attend retail seminars conducted by broker-dealers. Offering costs will be paid from the proceeds of the Offerings. These costs will be treated as a reduction of the total proceeds. Total organization and offering costs incurred by the Company with respect to a particular Offering will not exceed 15% of the gross proceeds from such particular Offering. In addition, the Company will not reimburse RREEF America or the dealer manager for any underwriting compensation (a subset of organization and offering costs) which would cause the Company’s total underwriting compensation to exceed 10% of the gross proceeds from the primary portion of a particular offering.

Included in offering costs are (1) distribution fees paid on a trailing basis at the rate of (a) 0.50% per annum on the NAV of the outstanding Class A Shares, and (b) 1.00% per annum for approximately three years on the NAV of the outstanding Class T Shares, and (2) dealer manager fees paid on a trailing basis at the rate of 0.55% per annum on the NAV of the outstanding Class A and Class I Shares (collectively, the "Trailing Fees"). The Trailing Fees are computed daily based on the respective NAV of each share class as of the beginning of each day and paid monthly. However, at each reporting date, the Company accrues an estimate for the amount of Trailing Fees that ultimately may be paid on the outstanding shares. Such estimate reflects the Company's assumptions for certain variables, including future redemptions, share price appreciation and the total gross proceeds raised or to be raised during each Offering. In addition, the estimated accrual for future Trailing Fees as of a given reporting date may be reduced by the aforementioned limits on total organization and offering costs and total underwriting compensation. Changes in this estimate will be recorded prospectively as an adjustment to additional paid-in capital. As of March 31, 2020 and December 31, 2019, the Company has accrued $13,868 and $6,221, respectively, in Trailing Fees to be payable in the future, which was included in due to affiliates on the consolidated balance sheets.

Revenue Recognition

In accordance with FASB Topic 842, Leases (ASC 842), and related ASU's that amended or clarified certain provisions of ASC 842, the Company elected a practical expedient to not separate lease and non-lease components of a lease and instead accounts for them as a single component if two criteria are met: (i) the timing and pattern of transfer of the non-lease component(s) and associated lease component are the same, and (ii) the lease component, if accounted for separately, would be classified as an operating lease. The Company evaluates the lease and non-lease components within its all of its leases under the practical expedient and reports rental and other property income and common area expense reimbursement income as a single component on the Company’s consolidated statements of operations.

Contractual base rental revenue from real estate leases is recognized on a straight-line basis over the terms of the related leases. The differences between contractual base rental revenue earned from real estate leases on a straight-line basis and amounts due under the respective lease agreements are amortized or accreted, as applicable, to deferred rent receivable. Property related income will also include amortization of above- and below-market leases as well as amortization of lease incentives. Revenues relating to lease termination fees for the termination of an entire lease will be recognized at the time that a tenant’s right to occupy the leased space is terminated and collectibility is reasonably assured.

Under ASC 842, the future revenue stream from leases must be evaluated for collectibility. Pursuant to these provisions, if an entity has determined that the collectibility of substantially all future lease payments from a particular lease is not at least probable, then the entity must write off its existing receivable balances (except receivable amounts which are under dispute by the tenant), including any deferred rent amounts recognized on a straight-line basis, and instead begin recognizing revenue from such lease on cash basis. The factors used to evaluate the collectibility of future lease payments for each lease may include, but not be limited to, the tenant's payment history, current payment status, publicly available information about the financial condition of the tenant and other

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

March 31, 2020

(Unaudited)

(in thousands, except share and per share data)

information about the tenant of which the entity may be aware. The Company is closely monitoring is tenants in light of the recent and ongoing coronavirus pandemic. As of March 31, 2020, the Company has assessed substantially all of its future lease payments to be at least probable.

To the extent the Company's revenues do not qualify for treatment under ASC 842 or under other specific guidance, the Company is required to recognize revenue in its financial statements in a manner that depicts the transfer of the promised goods or services to its customers in an amount that reflects the consideration to which the Company is entitled at the time of transfer of those goods or services. Such treatment may apply to other types of real estate related contracts, such as for dispositions or development of real estate.

Investment income from marketable securities is accrued at each distribution record date.

Net Earnings or Loss Per Share

Net earnings or loss per share is calculated using the two-class method. The two-class method is utilized when an entity (1) has different classes of common stock that participate differently in net earnings or loss, or (2) has issued participating securities, which are securities that participate in distributions separately from the entity’s common stock. Pursuant to the advisory agreement between the Company and its advisor (see Note 8), the advisor may earn a performance component of the advisory fee which is calculated separately for each class of common stock which therefore may result in a different allocation of net earnings or loss to each class of common stock. In addition, in March and May 2019, the Company granted shares of its Class I common stock to its independent directors (see Note 9), which qualify as participating securities.

Concentration of Credit Risk

As of March 31, 2020 and December 31, 2019, the Company had cash on deposit at multiple financial institutions which were in excess of federally insured levels. The Company limits significant cash holdings to accounts held by financial institutions with a high credit standing. Therefore, the Company believes it is not exposed to any significant credit risk on its cash deposits.

Cash and Cash Equivalents

For purposes of the presentation of the accompanying consolidated financial statements, all unrestricted short-term investments purchased with an initial maturity of three months or less are considered to be cash equivalents. The Company maintains cash and cash equivalents with various financial institutions. The combined cash balances at each institution periodically exceed Federal Deposit Insurance Corporation (“FDIC”) insurance coverage and, as a result, there is a concentration of credit risk related to amounts on deposit in excess of FDIC insurance coverage. The Company believes the risk is not significant.

Recent Accounting Pronouncements

In March 2019, FASB issued ASU 2019-01, Leases (Topic 842), which provides guidance for determining the fair value and its application to lease classification and measurement for lessors that are not manufacturers or dealers, referred to as qualifying lessors. For qualifying lessors, the fair value of the underlying asset at lease commencement would be its cost, including any acquisition costs, however if a significant amount of time has elapsed between the asset acquisition date and the lease commencement, the fair value would be based on the guidance in ASC 820. ASU 2019-01 is effective for fiscal years beginning after December 15, 2019, including interim periods therein. The Company has evaluated the impact of ASU 2019-01 and determined the adoption does not have a material impact.

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

March 31, 2020

(Unaudited)

(in thousands, except share and per share data)

On April 10, 2020, the FASB issued a question and answer document regarding accounting for lease concessions and other effects of COVID-19. The document clarifies that entities may elect a practical expedient to not evaluate whether lease-related relief that lessors provide to mitigate the economic effects of COVID-19 on lessees is a lease modification under ASC 842. Instead, an entity that elects this practical expedient can then elect whether to apply the modification guidance (i.e. assume the relief was always contemplated by the contract vs. assume the relief was not contemplated by the contract). As of May 13, 2020, the Company had not entered into any lease-relief agreements with any of its tenants. The Company will evaluate its election of the practical expedient on a lease by lease basis if and when the Company enters into any such lease-relief agreements.

NOTE 3 — FAIR VALUE MEASUREMENTS

Fair value measurements are determined based on the assumptions that market participants would use in pricing an asset or liability. As a basis for considering market participant assumptions in fair value measurements, FASB ASC 820, Fair Value Measurement and Disclosures, establishes a fair value hierarchy that distinguishes between market participant assumptions based on market data obtained from sources independent of the reporting entity (observable inputs that are classified within Levels 1 and 2 of the hierarchy) and the reporting entity's own assumptions about market participant assumptions (unobservable inputs classified within Level 3 of the hierarchy).

In August 2018, FASB issued ASU 2018-13, Fair Value Measurement (Topic 820) - Disclosure Framework - Changes to Disclosure Requirements for Fair Value Measurement. ASU 2018-13 changes the fair value measurement disclosure requirements of ASC 820 by eliminating, modifying or adding certain disclosure requirements for fair value measurements. ASU 2018-13 became effective for fiscal years beginning after December 15, 2019, including interim periods therein. ASU 2018-13 allowed an entity to early adopt the provisions regarding eliminating or modifying certain disclosures while not adopting the provisions regarding additional disclosures until the effective date of the ASU. The Company elected to early adopt the provisions regarding eliminating or modifying certain disclosures and defer adopting the provisions regarding additional disclosures until the effective date of ASU 2018-13. The Company adopted the additional disclosures under ASU 2018-13 on January 1, 2020. These additional disclosures within Topic 820 require (a) changes in unrealized gains and losses to be included in other comprehensive income, and (b) disclosure of the range and weighted average of significant unobservable inputs used to develop Level 3 fair value measurements. The adoption of ASU 2018-13 did not have a material impact on the Company's consolidated financial statements.

Level 1 inputs utilize quoted prices (unadjusted) in active markets for identical assets or liabilities that the Company has the ability to access. Level 2 inputs are inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly or indirectly. Level 2 inputs may include quoted prices for similar assets and liabilities in active markets, as well as inputs that are observable for the asset or liability (other than quoted prices), such as interest rates and yield curves that are observable at commonly quoted intervals. Level 3 inputs are the unobservable inputs for the asset or liability, which are typically based on an entity's own assumption, as there is little, if any, related market activity. In instances where the determination of the fair value measurement is based on input from different levels of the fair value hierarchy, the level in the fair value hierarchy within which the entire fair value measurement falls is based on the lowest level input that is significant to the fair value measurement in its entirety. The Company's assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment and considers factors specific to the asset or liability.

The Company's investments in marketable securities are valued using Level 1 inputs as the securities are publicly traded on major stock exchanges.

The fair value of the Company's line of credit and mortgage loans payable are determined using Level 2 and Level 3 inputs and a discounted cash flow approach with an interest rate, property valuation and other assumptions that estimate current market conditions. The carrying amount of the Company's line of credit, exclusive of deferred financing costs, approximated its fair value of $74,600 and $81,600 at March 31, 2020 and December 31, 2019, respectively. The Company estimated the fair value of the Company's mortgage loans payable at $120,240 and $126,601 as of March 31, 2020 and December 31, 2019, respectively. If the valuation of the Company's properties

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

March 31, 2020

(Unaudited)

(in thousands, except share and per share data)

as of March 31, 2020 were significantly lower, the market interest rate assumption would be higher (due to higher loan-to-value ratios) potentially resulting in a significantly lower estimated fair value for these liabilities.

The Company has estimated the fair value of its note to affiliate at approximately $4,000 and $4,500 as of March 31, 2020 and December 31, 2019, respectively. The estimated market interest rate is impacted by a number of factors. Material changes in those factors may cause a material change to the estimated market interest rate, thereby materially affecting the estimated fair value of the note to affiliate. The Company has estimated the fair value of the note to affiliate in the middle of the range of reasonably estimable values.

The following shows certain information about the estimated fair value and the unobservable inputs for the Company's debt obligations as of March 31, 2020 and December 31, 2019.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Range | | | | |

| Fair Value at March 31, 2020 | | Primary Valuation Techniques | | Significant Unobservable Inputs | | Minimum | | Maximum | | Weighted Average |

| Line of Credit | $ | 74,600 | | | Discounted cash flow | | | Loan to value | | | 50.0 | % | | 50.0 | % | | 50.0 | % |

| | | | | Market interest rate | | | 2.43 | % | | 2.43 | % | | 2.43 | % |

| Mortgage Loans Payable | 120,240 | | | Discounted cash flow | | | Loan to value | | | 38.2 | % | | 59.3 | % | | 50.7 | % |

| | | | | Market interest rate | | 4.00 | % | | 5.50 | % | | 4.56 | % |

| Note to Affiliate | 4,000 | | | Discounted cash flow | | | Loan to value | | | NA | | | NA | | | NA | |

| | | | | Market interest rate | | | 5.00 | % | | 5.00 | % | | 5.00 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Range | | | | |

| Fair Value at December 31, 2019 | | Primary Valuation Techniques | | Significant Unobservable Inputs | | Minimum | | Maximum | | Weighted Average |

| Line of Credit | $ | 81,600 | | | Discounted cash flow | | | Loan to value | | | 54.6 | % | | 54.6 | % | | 54.6 | % |

| | | | | Market interest rate | | | 3.34 | % | | 3.34 | % | | 3.34 | % |

| Mortgage Loans Payable | 126,601 | | | Discounted cash flow | | | Loan to value | | | 39.1 | % | | 59.3 | % | | 51.3 | % |

| | | | | Market interest rate | | 3.55 | % | | 4.20 | % | | 3.81 | % |

| Note to Affiliate | 4,500 | | | Discounted cash flow | | | Loan to value | | | NA | | | NA | | | NA | |

| | | | | Market interest rate | | | 5.00 | % | | 5.00 | % | | 5.00 | % |

The Company's financial instruments, other than those referred to above, are generally short-term in nature and contain minimal credit risk. These instruments consist of cash and cash equivalents, accounts and other receivables and accounts payable. The carrying amounts of these assets and liabilities in the consolidated balance sheets approximate their fair value.

NOTE 4 — REAL ESTATE INVESTMENTS

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

March 31, 2020

(Unaudited)

(in thousands, except share and per share data)

The Company acquired no real estate property during the three months ended March 31, 2020 and 2019.

NOTE 5 — RENTALS UNDER OPERATING LEASES

As of March 31, 2020, the Company owned 14 properties with a total of 60 tenants comprised of four office properties (including one medical office property), four retail properties, five industrial properties and one student housing property with 316 beds. As of March 31, 2019, the Company owned twelve properties with a total of thirty-one tenants comprised of four office properties (including one medical office property), three retail properties and four industrial properties and one student housing property with 316 beds. All leases at the Company's properties have been classified as operating leases. The Company's property related income from its real estate investments is comprised of the following:

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | | | | | |

| 2020 | | 2019 | | | | |

Lease revenue 1 | $ | 7,691 | | | $ | 5,388 | | | | | |

| Straight-line revenue | 157 | | | 208 | | | | | |

| Above- and below-market lease amortization, net | 190 | | | 195 | | | | | |

| Lease incentive amortization | (25) | | | (26) | | | | | |

| Property related income | $ | 8,013 | | | $ | 5,765 | | | | | |

1Lease revenue includes $1,226 and $957 of variable income from tenant reimbursements for the three months ended March 31, 2020 and 2019, respectively. | | | | | | | |

The Company collected nearly 100% of its lease revenue for the three months ended March 31, 2020, and collected approximately 92% of its lease revenue for the month of April 2020. The Company's retail properties are necessity-based properties, as they are grocery-anchored and contain a number of tenants that are considered essential. As of the end of April 2020, the stores of 13 of the Company's 44 retail tenants were closed. These tenants comprise approximately 10% of the Company's lease revenue for its entire property portfolio.

The future minimum rentals to be received, excluding tenant reimbursements, under the non-cancelable portions of all of the in-place leases in effect as of March 31, 2020 are as follows:

| | | | | | | | |

| Year | | Amount |

| Remainder of 2020 | | $ | 19,073 | |

| 2021 | | 22,630 | |

| 2022 | | 19,525 | |

| 2023 | | 15,723 | |

| 2024 | | 12,041 | |

| Thereafter | | 56,210 | |

| | $ | 145,202 | |

Percentages of property related income by property and tenant representing more than 10% of the Company's total property related income are shown below.

RREEF PROPERTY TRUST, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS - continued

March 31, 2020

(Unaudited)

(in thousands, except share and per share data)

| | | | | | | | | | | | | | | |

| | Percent of property related income | | | |

| Property | | Three Months Ended March 31, 2020 | | Three Months Ended March 31, 2019 | |

| Providence Square, Marietta, GA | | 14.0 | % | | — | % | |

| Seattle East Industrial, Redmond, WA | | 13.4 | | | — | | |

| Flats at Carrs Hill, Athens, GA | | 10.3 | | | 13.8 | | |

| Elston Plaza, Chicago, IL | | 10.3 | | | 14.2 | | |

| Allied Drive, Dedham, MA | | 9.5 | | | 12.8 | | |

| Loudoun Gateway, Sterling, VA | | 9.5 | | | 14.1 | | |

| Terra Nova Plaza, Chula Vista, CA | | 7.0 | | | 10.1 | | |

| | | | | |

| Total | | 74.0 | % | | 65.0 | % | |

| | | | | |

| | Percent of property related income | | | |

| Tenant | | Three Months Ended March 31, 2020 | | Three Months Ended March 31, 2019 | |

| FedEx Ground - Seattle East Industrial | | 13.4 | % | | — | % | |

| Orbital ATK Inc. - Loudoun Gateway | | 9.5 | | | 14.1 | | |

| New England Baptist Hospital-Allied Drive | | 8.5 | | | 11.3 | | |

| Total | | 31.4 | % | | 25.4 | % | |

The Company's tenants representing more than 10% of in-place annualized base rental revenues were as follows:

| | | | | | | | | | | | | | | |

| | Percent of in-place annualized base rental revenues as of | | | |

| Property | | March 31, 2020 | | March 31, 2019 | |

| FedEx Ground - Seattle East Industrial | | 15.1 | % | | — | % | |

| Orbital ATK Inc. - Loudoun Gateway | | 11.6 | | | 16.8 | | |

| Total | | 26.7 | % | | 16.8 | % | |

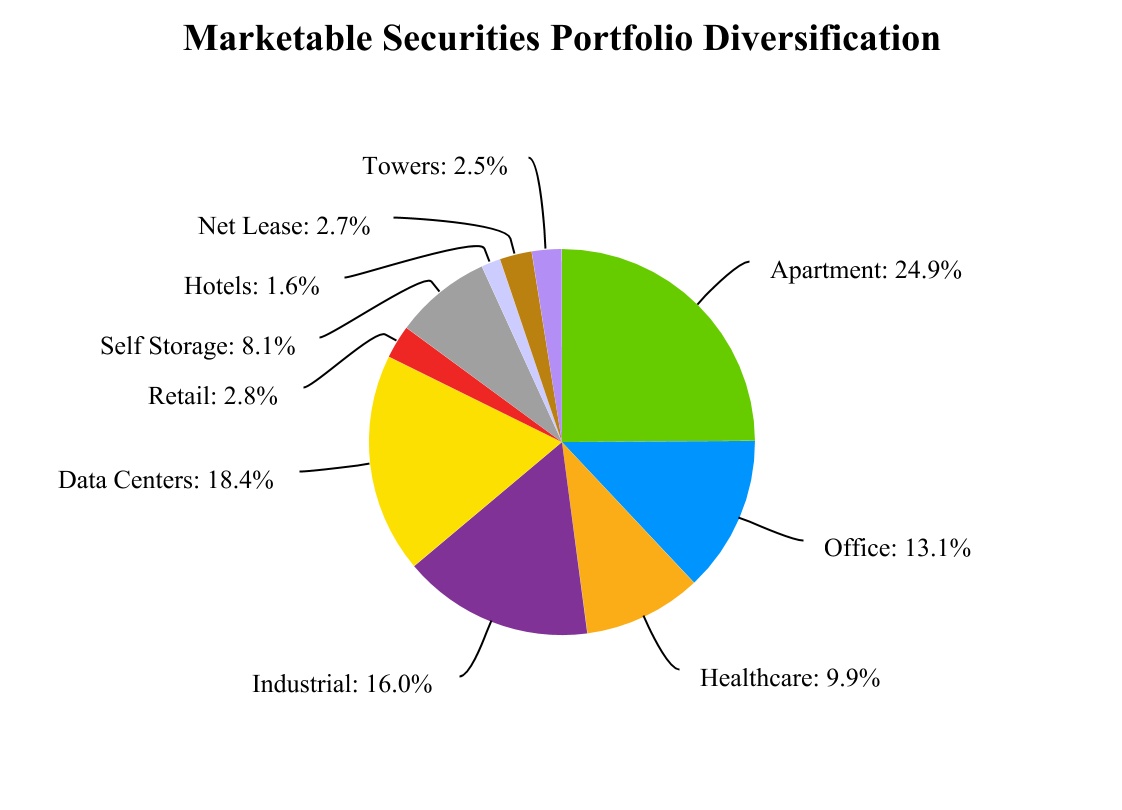

NOTE 6 — MARKETABLE SECURITIES

The following is a summary of the Company's marketable securities held as of the dates indicated, which consisted entirely of publicly-traded shares of common stock in REITs as of each date.

| | | | | | | | | | | |

| March 31, 2020 | | December 31, 2019 |

| Marketable securities—cost | $ | 17,520 | | | $ | 17,866 | |

| Unrealized gains | 1,394 | | | 3,413 | |