UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

FORM 8-K

(Amendment No. 6)

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES AND EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): September 19, 2012

GREENTECH MINING INTERNATIONAL, INC.

(Exact name of registrant as specified in its charter)

| Delaware | 000-54610 | |

(State or other jurisdiction Of incorporation) | (Commission File No.) | (IRS Employer Identification No.) |

| | | |

| 1840 Gateway Drive, Suite 200, Foster City, CA | | 94404 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (650) 283-2653

Accelerated Acquisitions XVIII, Inc.

(Former name or former address, if changed since last report)

Copies to:

Thomas E. Puzzo, Esq.

Law Offices of Thomas E. Puzzo, PLLC

3823 44th Ave. NE

Seattle, Washington 98105

Telephone No.: (206) 522-2256

Facsimile No.: (206) 260-0111

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR.425) |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

TABLE OF CONTENTS

| Item 1.01 Entry into a Material Definitive Agreement | | 3 |

| | | |

| Item 5.06 Change in Shell Company Status | | 4 |

| | | |

| Item 9.01 Financial Statements and Exhibits | | 50 |

| | | |

| SIGNATURES | | 51 |

| | | |

| EXHIBIT INDEX | | 52 |

Item 1.01 Entry into a Material Definitive Agreement

On September 17, 2012 Greentech Mining International, Inc. (“Company”, and “GMI”) entered into an Operating, Exploration and Option to Purchase Agreement (“Option Agreement”) with Greentech Mining, Inc. a Delaware Corporation and Greentech Mining Utah, LLC a Utah limited liability company, (hereinafter referred to as “Owners”). The contracted premise known as the Henry Mountain Project consists of all 671 acres of section 36, township 29 south, range 11 east, salt lake base and meridian, in Wayne County, Utah upon which an operating circuit (system to separate minerals by weight) has been built on the private property. In addition, the Henry Mountain Project includes the following Federal Government owned mining claims managed by the Bureau of Land Management (“BLM”):

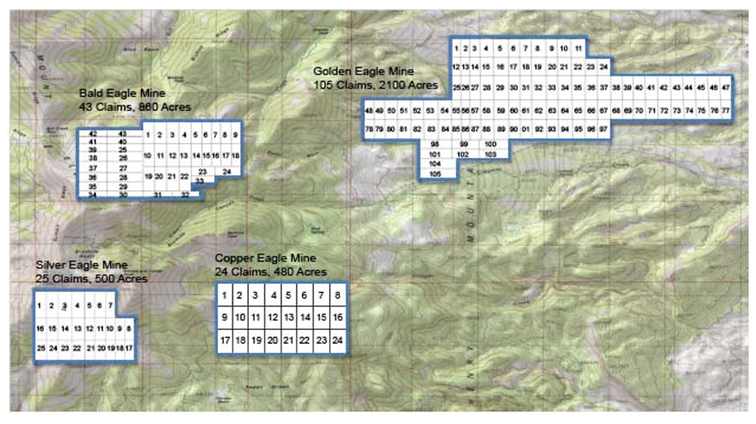

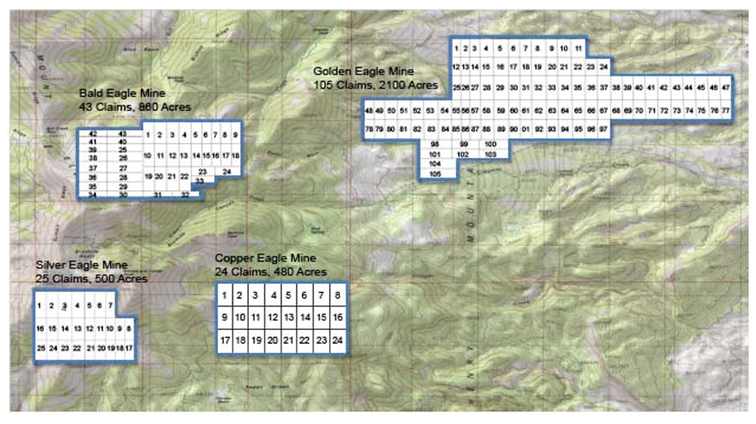

GOLDEN EAGLE CLAIM GROUP, 105 Placer Claims (loose material such as sand or gravel) totaling 2100 acres – Garfield County, Utah

Claim Numbers UMC 413213 - UMC413309

Claim Numbers UMC414263 – UMC 414270

SILVER EAGLE CLAIM GROUP, 25 Lode Claims (hard rock deposit) totaling 500 acres – Garfield County, Utah

Claim Numbers UMC414271 – UMC414295

BALD EAGLE CLAIM GROUP, 43 Lode Claims (hard rock deposit) totaling 860 acres – Garfield County, Utah

Claim Numbers UMC414196 – UMC414238

COPPER EAGLE CLAIM GROUP, 24 Lode Claims (hard rock deposit) totaling 480 acres – Garfield County, Utah

Claim Numbers UMC414239 – UMC414262

The Henry Mountain Project as described in the Option Agreement was contracted exclusively to GMI and its successor-in-interest for the following purposes, all or any of which may be performed by the Company in such manner and at such time or times as the Company may determine in its absolute discretion, subject to the terms hereof:

| | a. | | Exploring and prospecting for, developing, mining, excavating, leaching, milling, processing and smelting, whether by open pit, underground, strip mining, solution mining, heap leaching, or any other methods deemed desirable by the Company in its sole discretion, all minerals, valuable rocks, rare earths and materials of all kinds, including mine dumps and tailings (hereinafter collectively referred to as “Contracted Substances”); |

| | b. | | Processing, concentrating, beneficiating, treating, milling, smelting, shipping, selling and otherwise disposing of the Contracted Substances and receiving the proceeds of any such sale; |

| | c. | | Erecting, constructing, maintaining, using and operating in and on the Henry Mountain Project such buildings, structures, machinery, facilities and equipment as GMI deems necessary, except that modifications to existing structures machinery, facilities and equipment require the prior approval of the Owner; and |

| | d. | | Engaging in any other activity that the Company deems reasonable and necessary to achieve the foregoing purposes. |

The term of the Option Agreement is for three (3) years from the effective date set forth above, and may be renewed by GMI for successive three (3) year periods upon substantially the same terms and provisions as set forth herein based upon the then-capital structure of the Company, until declared forfeited and canceled by Owner or relinquished by GMI as provided herein. The Company shall give Owner written notice of each renewal at least thirty (30) days prior to expiration of the respective three-year term. The Option Agreement shall automatically renew and continue so long as minerals, or metals are produced or sold from the Henry Mountain Project on a continuous basis. The Company shall have the continuing right to terminate the Agreement at any time and to surrender the Henry Mountain Project to Owner by giving Owner written notice thereof at least 30 days prior to the stated date of termination. Termination of the Option Agreement shall not relieve GMI of its obligation to pay all royalties due to Owner as well as its pro-rata share of taxes and fees.

With prior consent of Owner, not to be unreasonably withheld, GMI shall have the right to assign all or any portion of the Henry Mountain Project to any financially able party or parties, provided that all conditions of the Option Agreement shall be binding upon the assignee and that he accepts Liability there for in writing and the Owner is notified of such assignment and receives written acceptance of liability. No conveyance, assignment, or transfer affecting the mineral rights on the Henry Mountain Project or the mineral production therefrom shall be made except subject to the terms and conditions of the Option Agreement.

Item 2.01 Completion of Acquisition or Disposition of Assets.

On September 17, 2011, the Company entered into an Option Agreement with the Owners described in section 1.01 above pursuant to which the Company was exclusively contracted to explore, mine and process minerals that may be found on the Henry Mountain Project. In addition the Company was granted the option to purchase the Henry Mountain Project as outlined in the agreement.

The Company acquired the rights from Greentech Mining, Inc. a Delaware Corporation and Greentech Mining Utah, LLC a Utah limited liability company. Matthew Neher is the founder and Chief Executive Officer of Greentech Mining, Inc. and Greentech Mining Utah and has been the Chief Executive Officer and Director of the Company since June 27, 2012. Novus Aurum Trust controlled by Matthew Neher owns 26,500,000 shares of the Company’s outstanding common stock, representing an 85.49% ownership interest in the Company. Novus Aurum Trust purchased its shares in the Company on June 26, 2012 as disclosed in a Form 8-K filed on June 28, 2012. There were no other agreements between the Company and Novus Aurum Trust prior to the Share Purchase Agreement entered into on June 26, 2012.

Mr. Timothy Neher, the Company’s Chief Executive Officer prior to June 26, 2012, controls Accelerated Venture Partners, LLC (“AVP”), an entity which has agreed to provide financial advisory services to the Company. AVP owns 4,500,000 shares of the Company’s outstanding common stock, representing a 14.51% ownership interest in the Company (collectively, Novus Aurum Trust and AVP own 100% of the Company as there are no other stockholders). Up to 1,000,000 of AVP’s shares can be repurchased by the Company for $0.0001 per share under certain circumstances. AVP is entitled to receive specified cash compensation if the Company achieves certain financial milestones as outlined in the “Our Business” section below.

Aside from the Owner, Greentech Mining, Inc., Greentech Mining Utah, LLC, AVP, Novus Aurum Trust, Matthew Neher and Timothy Neher, no other parties have an interest related to the Share Purchase Agreement or the Option Agreement. The parties are brothers and prior to Share Purchase Agreement Timothy Neher, AVP or the Company had no business relationship with Greentech Mining, Inc., Greentech Mining Utah, LLC, Novus Aurum Trust or Matthew Neher.

Under the terms of the Option Agreement the Company shall make payment to Owner for the initial consideration of three million dollars ($3,000,000) with the first payment of one million dollars (1,000,000) being paid on or before November 1, 2012 and the remaining balance made in ten (10) consecutive payments of $200,000 beginning on December 1, 2012. The Owner warrants and covenants that it will utilize a portion of the funds to remove debt secured by the Mines and Processing Plant of $1.4 million and hold full title and exclusive possession of the Mines and Processing Plant free and clear from all grants, sales, debt, liens, defects, adverse claims and encumbrances of any kind by November 15, 2013.

The Company shall perform exploration, mining, development, production, processing or any other activity (“Work” herein) which benefits the Henry Mountain Project at a minimum cost of $3,000,000 for the first year, $3,000,000 for the second year, and $3,000,000 for the third year of the Option Agreement commencing on September 20, 2012. All work on other lands within 500 feet of the boundary of any portion of the Henry Mountain Project shall be deemed to benefit the Henry Mountain Project for the work commitment if such work is part of an overall plan or project that includes the Henry Mountain Project. All costs expended for work in excess of $3,000,000 for any one (1) year term shall accrue and be applied to the Option Agreement price as described below. In the event that the Company does not perform work in the amount of the entire minimum expenditure required for the applicable year (which amount will include any excess amount accrued from the prior three year term), the Company shall pay Owner the amount of any such shortage in cash or cash equivalents within 30 days after the end of each three (3) year term. In addition, the Company shall establish a contingency reclamation reserve fund for the purpose of assuring payment of reclamation costs caused by the Company. The reclamation cost shall be deducted from Net Smelter Royalty (“NSR”) returns on all materials produced and sold from the Henry Mountain Project, after the Owner’s royalties are computed, five percent (5%) of the value thereof, for the purpose of a contingency reclamation reserve fund for paying potential reclamation costs, up to five hundred thousand dollars ($500,000).

Owner also granted the Company the sole and exclusive option to purchase all of Owner’s right, title and interest in the property (the Contracted Mines and Processing Plant) for a total purchase price of TWO MILLION dollars ($2,000,000), plus a perpetual two percent (2%) Net Smelter Royalty (hereinafter referred to as the “Purchase Price”). The Purchase Price may be paid in cash or other cash equivalent as mutually agreed by the Owner and Company. Exercise of the option shall be no sooner than November 15, 2013 unless Owner removes the $1.4 million in debt secured by the Mines and Processing Plant and holds full title and exclusive possession of the Contracted Mines and Processing Plant free and clear from all grants, sales, liens, defects, adverse claims and encumbrances of any kind prior to November 15, 2013 or if Owner utilizes all or a portion of the purchase price to remove all encumbrances and holds full title and exclusive possession of the Contracted Mines and Processing Plant free and clear from all grants, sales, liens, defects, adverse claims and encumbrances of any kind to be so transferred. Exercise of the option shall be effective upon delivery of written notice thereof to Owner at Owner’s business address or the address of Owner’s registered agent. The Company shall deliver to Owner a negotiable instrument in the full amount of the Purchase Price in exchange for properly executed and acknowledged Deeds and/or other indicia of ownership in recordable form. Closing shall occur within sixty (60) days after exercise of the option.

A copy of the Operating, Exploration and Option to Purchase Agreement is attached as Exhibit 10.1.

Item 5.06 Change in Shell Company Status.

Prior to our entry into the mining industry through the execution of the Option Agreement in connection therewith as described in Item 1.01 above, we were a “shell company” (as such term is defined in Rule 12b-2 under the Securities Exchange Act of 1934, as amended). As a result of entering into these agreements and undertaking efforts to begin exploration, mining and mineral distribution operations, we have ceased to be a shell company.

None of the Company’s securities are registered for resale with the Securities and Exchange Commission. The outstanding shares of common stock may only be resold through registration under the Securities Act of 1933, or under an applicable exemption from registration

OTHER PERTINENT INFORMATION

Unless specifically set forth to the contrary, when used herein, the terms “Greentech Mining International, Inc.”, "we", "our", the "Company" “Greentech” “GMI” and similar terms refer to Greentech Mining International, Inc.”, a Delaware corporation.

We are an "emerging growth company" under the federal securities laws and will be subject to reduced public company reporting requirements. Investing in our common stock involves risks. See "Risk Factors" beginning on page 28.

Implications of being an Emerging Growth Company

As a company with less than $1 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. As an emerging growth company, we may take advantage of specified reduced disclosure and other requirements that are otherwise applicable generally to public companies. These provisions include:

• Only two years of audited financial statements in addition to any required unaudited interim financial statements with correspondingly reduced “Management's Discussion and Analysis of Financial Condition and Results of Operations” disclosure.

• Reduced disclosure about our executive compensation arrangements.

• Not having to obtain non-binding advisory votes on executive compensation or golden parachute arrangements.

• Exemption from the auditor attestation requirement in the assessment of our internal control over financial reporting.

We may take advantage of these exemptions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company if we have more than $1 billion in annual revenue, we have more than $700 million in market value of our stock held by non-affiliates, or we issue more than $1 billion of non-convertible debt over a three-year period.

| 1. | MEASUREMENTS AND GLOSSARY |

For ease of reference in reviewing our business, we are providing you with term relate to our business

| 2. | GLOSSARY OF MINING TERMS |

The following mining terms are used throughout this Form 8-K.

| 3. | SEC Industry Guide 7 Definitions |

| | |

Exploration Stage | An “exploration stage” prospect is one which is not in either the development or production stage. |

| | |

Development Stage | A “development stage” project is one which is undergoing preparation of an established Commercially mineable deposit for its extraction but which is not yet in production. This stage occurs after completion of a feasibility study. |

| | |

Mineralized Material | The term “mineralized material” refers to material that is not included in the reserve as it does not meet all of the criteria for adequate demonstration for economic or legal extraction. |

| | |

Probable Reserve | The term “probable reserve” refers to reserves for which quantity and grade and/or quality are computed from information similar to that used for proven (measured) reserves, but the sites for inspection, sampling, and measurement are farther apart or are otherwise less adequately spaced. The degree of assurance, although lower than that for proven reserves, is high enough to assume continuity between points of observation. |

| | | |

Production Stage | A “production stage” project is actively engaged in the process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product. | |

| | |

Proven Reserve | The term “proven reserve” refers to reserves for which (a) quantity is computed from dimensions revealed in outcrops, trenches, workings or drill holes; grade and/or quality are computed from the results of detailed sampling and (b) the sites for inspection, sampling and measurement are spaced so closely and the geologic character is so well defined that size, shape, depth and mineral content of reserves are well-established. |

| | |

| Reserve | The term “reserve” refers to that part of a mineral deposit which could be economically and legally extracted or produced at the time of the reserve determination. Reserves must be supported by a feasibility study done to bankable standards that demonstrates the economic extraction. (“Bankable standards” implies that the confidence attached to the costs and achievements developed in the study is sufficient for the project to be eligible for external debt financing.) A reserve includes adjustments to the in-situ tons and grade to include diluting materials and allowances for losses that might occur when the material is mined. |

| | Additional Definitions |

| | |

| Acre | One acre equals 4,840 square yards, 43,560 square feet or about 4,047 square meters (0.405 hectares). |

| | |

| Alteration | Any change in the mineral composition of a rock brought about by physical or chemical means. |

| | |

| Assay | A measure of the valuable mineral content. |

| | |

| Deposit | When mineralized material has been systematically drilled and explored to the degree that a reasonable estimate of tonnage and economic grade can be made. |

| | |

Diamond Drill | A type of rotary drill in which the cutting is done by abrasion rather than percussion. The cutting bit is set with diamonds and is attached to the end of long hollow rods through which water is pumped to the cutting face. The drill cuts a core of rock, which is recovered in long cylindrical sections an inch or more in diameter. |

| | |

| Dip | The angle that a structural surface, a bedding or fault plane, makes with the horizontal, measured perpendicular to the strike of the structure. |

| | |

| Disseminated | Where minerals occur as scattered particles in the rock. |

| | |

| Electrowinning | Also called electroextraction, is the electrodeposition of metals from their ores that have been put in solution or liquefied. |

| | |

| Fault | A surface or zone of rock fracture along which there has been displacement. |

| | |

Feasibility Study | A comprehensive study of a mineral deposit in which all geological, engineering, legal, operating, economic, social, environmental and other relevant factors are considered in sufficient detail that it could reasonably serve as the basis for a final decision by a financial institution to finance the development of the deposit for mineral production. |

| | |

| Flotation | Process used for the separation of a large range of sulfides, carbonates and oxides prior to further refinement. |

| | |

| Formation | A distinct layer of sedimentary rock of similar composition. |

| | |

| Geochemistry | The study of the distribution and amounts of the chemical elements in minerals, ores, rocks, solids, water, and the atmosphere. |

| | |

| Geophysics | The study of the mechanical, electrical and magnetic properties of the earth’s crust. |

| | |

Geophysical Surveys | A survey method used primarily in the mining industry as an exploration tool, applying the methods of physics and engineering to the earth’s surface. |

| | |

| Geotechnical | The study of ground stability. | |

| | | |

| Grade | Quantity of metal per unit weight of host rock | |

| Heap Leach | A mineral processing method involving the crushing and stacking of an ore on an impermeable liner upon which solutions are sprayed to dissolve metals i.e. gold, copper etc.; the solutions containing the metals are then collected and treated to recover the metals. |

| Host Rock | The rock in which a mineral or an ore body may be contained. |

| | |

| In-Situ | In its natural position. |

| | |

| Leaching | The process of extracting minerals from a solid by dissolving them in a liquid. |

| | |

| Lithology | The character of the rock described in terms of its structure, color, mineral composition, grain size and arrangement of tits component parts, all those visible features that in the aggregate impart individuality to the rock. |

| | |

| Load Claim | A classic vein, ledge, or other rock in place between definite walls. A lode claim is located by metes and bounds. The maximum length is 1,500 feet by 600 feet. |

| | |

| Mapping | The recording of geologic information including rock units and the occurrence of structural features, and mineral deposits on maps |

| | |

| Mineral | A naturally occurring inorganic crystalline material having a definite chemical composition. |

| | |

| Mining | Mining is the process of extraction and beneficiation of mineral reserves to produce a marketable metal or mineral product. Exploration continues during the mining process and, in many cases, mineral reserves are expanded during the life of the mine operations as the exploration potential of the deposit is realized. |

| | |

| Mineralization | A natural accumulation or concentration in rocks or soil of one or more potentially economic minerals, also the process by which minerals are introduced or concentrated in a rock. |

| | |

Net Smelter Return | A share of the net revenues generated from the sale of metal produced by a mine. |

| | |

| Outcrop | That part of a geologic formation or structure that appears at the surface of the earth. |

| | |

Open Pit or Open Cut | Surface mining in which the ore is extracted from a pit or quarry, the geometry of the pit may vary with the characteristics of the ore body. |

| | |

| Option | An agreement to purchase a property reached between the property vendor and some other party who wishes to explore the property further. |

| | |

| Ore | Mineral bearing rock that can be mined and treated profitably under current or immediately foreseeable economic conditions. |

| | |

| Ore body | A mostly solid and fairly continuous mass of mineralization estimated to be economically mineable. |

| | |

| Ore grade | The average weight of the valuable metal or mineral contained in a specific weight of ore i.e. grams per ton of ore. |

| | |

| Ounce | Troy ounces precious metal. |

| | |

| Oxide | Gold bearing ore which results from the oxidation of near surface sulfide ore. |

| | |

Placer Claim | All deposits, other than lodes. These include placer deposits of sand and gravel containing free gold and other minerals. Placer claims are located by legal subdivision. An individual may locate up to 20 acres with a maximum of 160 contiguous acres with 8 or more people (an association). |

| | |

Preliminary Assessment | A study that includes an economic analysis of the potential viability of Mineral Resources taken at an early stage of the project prior to the completion of a preliminary feasibility study. |

| | |

| Precious Metal | Is a rare, naturally occurring metallic chemical element of high economic value. |

| | |

| QA/QC | Quality Assurance/Quality Control is the process of controlling and assuring data quality for assays and other exploration and mining data. |

| | |

| Quartz | A mineral composed of silicon dioxide, SiO2 (silica). |

| | |

| Rock | Indurated naturally occurring mineral matter of various compositions. |

| | |

Sampling Analytical Variance/ Precision | An estimate of the total error induced by sampling, sample preparation and analysis. |

| | |

| Sediment | Particles transported by water, wind or ice. |

| | |

Sedimentary Rock | Rock formed at the earth’s surface from solid particles, whether mineral or organic, which have been moved from their position of origin and re-deposited. |

| | |

| Royalty | An amount of money paid at regular intervals by the lessee or operator of an exploration or mining property to the owner of the ground. Generally based on a certain amount per ton or a percentage of the total production or profits. Also, the fee paid for the right to use a patented process. |

| Strike | The direction or trend that a structural surface, e.g. a bedding or fault plane, takes as it intersects the horizontal. |

| | |

| Strip | To remove overburden in order to expose ore. |

| | |

| Tailings | The residue from an ore crushing plant. |

FORM 10 DISCLOSURE

Item 2.01(f) of Form 8-K states that if the registrant was a shell company, like our company, the registrant must disclose the information that would be required if the registrant were filing a general form for registration of securities on Form 10. Accordingly, we are providing below the information that would be included in a Form 10 if we were to file a Form 10.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING INFORMATION

This report contains forward-looking statements. These forward-looking statements are subject to known and unknown risks, uncertainties and other factors which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by such forward-looking statements. These forward-looking statements were based on various factors and were derived utilizing numerous assumptions and other factors that could cause our actual results to differ materially from those in the forward-looking statements. These factors include, but are not limited to our ability to develop our operations, our ability to satisfy our obligations, our ability to consummate the acquisition of additional assets, our ability to generate revenues and pay our operating expenses, our ability to raise capital as necessary, economic, political and market conditions and fluctuations, government and industry regulation, interest rate risk, U.S. and global competition, and other factors. Most of these factors are difficult to predict accurately and are generally beyond our control. You should consider the areas of risk described in connection with any forward-looking statements that may be made herein. Readers are cautioned not to place undue reliance on these forward-looking statements and readers should carefully review this report in its entirety, including the risks described in "Risk Factors" beginning on page 28.. Except for our ongoing obligations to disclose material information under the Federal securities laws, we undertake no obligation to release publicly any revisions to any forward-looking statements, to report events or to report the occurrence of unanticipated events. These forward-looking statements speak only as of the date of this report, and you should not rely on these statements without also considering the risks and uncertainties associated with these statements and our business.

OUR BUSINESS

From inception February 6, 2012, Accelerated Acquisitions XVIII, Inc. (now known as Greentech Mining International, Inc.) was organized as a vehicle to investigate and, if such investigation warrants, acquire a target company or business seeking the perceived advantages of being a publicly held corporation. Our principal business objectives were to achieve long-term growth potential through a combination with a business rather than immediate, short-term earnings. The Company did not restrict our potential candidate target companies to any specific business, industry or geographical location.

On February 6, 2012, the Registrant sold 5,000,000 shares of Common Stock to Accelerated Venture Partners, LLC for an aggregate investment of $2,000.00. The Registrant sold these shares of Common Stock under the exemption from registration provided by Section 4(2) of the Securities Act.

On June 26, 2012, Novus Aurum Trust agreed to (“Purchaser”) agreed to acquire 26,500,000 shares of the Company’s common stock par value $0.0001 (the “Shares”) for a price of $0.0001 per share. At the same time, Accelerated Venture Partners, LLC agreed to tender 1,500,000 of its 5,000,000 shares of the Company’s common stock par value $0.0001 for cancellation. Following these transactions, Novus Aurum Trust owned 88.33% of the Company’s 30,000,000, issued and outstanding shares of common stock par value $0.0001 and the interest of Accelerated Venture Partners, LLC was reduced to approximately 11.66% of the total issued and outstanding shares. Simultaneously with the share purchase, Timothy Neher resigned as an officer of the Company effective immediately and remained on the Company’s Board of Directors and the Board appointed and elected Matthew Neher as President, Chief Executive Officer, Secretary, Treasurer and Director of the Company. The Purchaser used its working capital to acquire the Shares. The Purchaser did not borrow any funds to acquire the Shares.

Prior to the purchase of the Shares, the Purchaser was not affiliated with the Company. However, the Purchaser is now deemed an affiliate of the Company as a result of its stock ownership interest in the Company. The purchase of the shares by the Purchaser was completed pursuant to a written Subscription Agreement with the Company. The purchase was not subject to any other terms and conditions other than the sale of the Shares in exchange for the cash payment.

On June 27, 2012 the Company entered into a twelve month Consulting Services Agreement with Accelerated Venture Partners LLC (“AVP”), a company controlled by Timothy Neher that has one other similar agreement within the mining industry. The agreement requires AVP to provide the Company with certain advisory services that include reviewing the Company’s business plan, identifying and introducing prospective financial and business partners, and providing general business advice regarding the Company’s operations and business strategy in consideration of (a) an option granted by the Company to AVP to purchase 1,000,000 shares of the Company’s common stock at a price of $0.0001 per share (the “AVP Option”) (which was immediately exercised by the holder) subject to a repurchase option granted to the Company to repurchase the shares at a price of $0.0001 per share in the event the Company fails to complete funding within twelve months as detailed in the agreement subject to the following milestones:

· Milestone 1 – | Company’s right of repurchase will lapse with respect to 60% of the shares upon securing $10 million in available cash from funding; |

| | |

· Milestone 2 – | Company’s right of repurchase will lapse with respect to 40% of the Shares upon securing $15 million in available cash (inclusive of any amounts attributable to Milestone 1); |

and (b) cash compensation at a rate of $37,500 per month. The payment of such compensation is subject to Company’s achievement of certain designated milestones, specifically, cash compensation of $600,000 is due consultant upon the achievement of Milestone 1, and $300,000 upon the achievement of Milestone 2. Upon achieving each Milestone, the cash compensation is to be paid to consultant in the amount then due at the rate of $37,500 per month. The total cash compensation to be received by the consultant is not to exceed $900,000 unless Company receives an amount of funding in excess of the amount specified in Milestone 2. If the Company receives equity or debt financing that is an amount less than Milestone 1, in between any of the above Milestones or greater than the above Milestones, the cash compensation earned by the Consultant under this Agreement will be prorated according to the above Milestones. The Company will allow the Consultant to invest up to an additional $5 million in any future debt or equity offering of the Company on the same terms and conditions offered to other participants in such offerings. The Consultant will not be obligated to participate in any such offerings. Accelerated Venture Partners has executed ten consulting agreements with public shell companies it formally controlled and none of the milestones under consulting agreements have been timely achieved. Of the ten consulting services agreements, Accelerated Venture Partners terminated one, one is expired and the company has not elected to terminate the agreement and repurchase the consulting share. Furthermore, the remaining eight companies have either renewed consulting agreements with Accelerated Venture Partners or are under the original consulting agreement.

On September 17, 2012, Greentech Mining International, Inc. entered into an Operating, Exploration and Option to Purchase Agreement (“Option Agreement”) with Greentech Mining, Inc. a Delaware Corporation and Greentech Mining Utah, LLC a Utah limited liability company, (“Owners”). Under the terms of the Option Agreement the Company shall make payment to Owner for the initial consideration of three million dollars ($3,000,000) with the first payment of one million dollars being made on or before November 1, 2012 and the remaining balance paid in ten (10) consecutive payments of $200,000 beginning on December 1, 2012. In addition to the consideration set forth herein, the Company shall pay Owner a Five Percent (5%) Net Smelter Royalty on all mineral bearing ores once Commercial Production has commenced. “Commercial Production” means the commercial-scale operation of any part of the Henry Mountain Project as a Mine by, or on behalf of, the Company. The Company shall perform exploration, mining, development, production, processing or any other activity (“Work” herein) which benefits the Henry Mountain Project at a minimum cost of $3,000,000 for the first year, $3,000,000 for the second year, and $3,000,000 for the third year of the Option Agreement. Additionally, the Owners granted to Company the sole and exclusive option to purchase all of the Owner’s rights, title and interest in the Henry Mountain Project for a total purchase price of two million dollars ($2,000,000), plus a perpetual two percent (2%) Net Smelter Royalty (“NSR”). (See Item 1.01 above)

The term of the Option Agreement is for three (3) years from the effective date set forth above, and may be renewed by the Company for successive three (3) year periods upon substantially the same terms and provisions as set forth herein based upon the then-capital structure of the Company, until declared forfeited and canceled by Owner or relinquished by GMI as provided herein. The Company shall give Owner written notice of each renewal at least thirty (30) days prior to expiration of the respective three-year term. The Option Agreement shall automatically renew and continue so long as minerals, or metals are produced or sold from the Henry Mountain Project on a continuous basis. GMI shall have the continuing right to terminate the Option Agreement at any time and to surrender the Henry Mountain Project to Owner by giving Owner written notice thereof at least 30 days prior to the stated date of termination. Termination of the Option Agreement shall not relieve GMI of its obligation to pay all royalties due to Owner as well as its pro-rata share of taxes and fees.

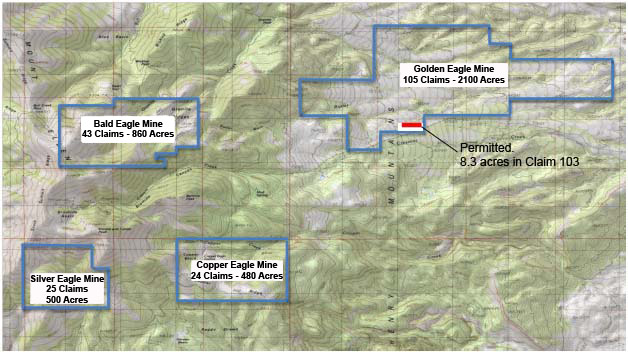

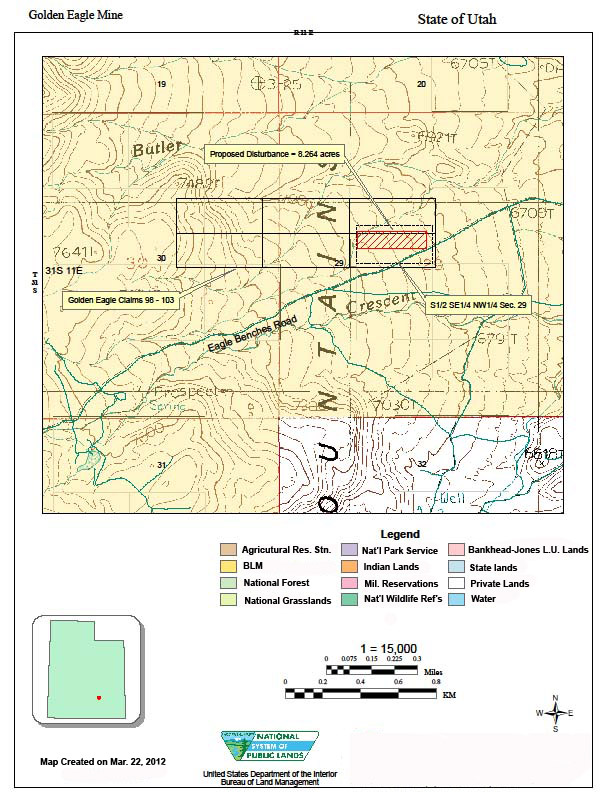

Pursuant to the Option Agreement with Greentech Mining, Inc. the Company intends to commence small mining operations in alluvial gravels situated in the Crescent Creek area on the eastern flank of the Henry Mountains. The Bureau of Land Management (“BLM”) permitted mining activity is intended to begin upon financing of Phase I as described below, and the posting of a $51,000 reclamation bond under a Greentech Mining, Inc. BLM and Division of Oil, Gas and Mining (‘DOGM”) approved Plan of Operations incorporating the Golden Eagle #103 claim located in the South Ѕ of the South East ј of the North West ј (S1/2SE1/4NW1/4) of Section 29, Township 31 South, Range 11 East with UMC #414268, Salt Lake Base and Meridian, in Garfield County, Utah (See figures 4 and 5 below). The permit includes production level of precious metals extractions and concentrations. The permitted area consists of 8.264 acres and the detailed scope of the BLM approved Plan of Operation is described on page 19 through 27. If the Company exercises the option to purchase it will need to apply for new permits with the BLM and DOGM, the full permitting process is described on page 31.

The Company, Greentech Mining, Inc. and Greentech Mining Utah, LLC are controlled by the same principals who believe that substantial benefit may potentially be derived from the Option Agreement to a publicly-reporting entity by potentially opening up new funding resources for the business and thereby facilitating the funding of future operations and permitting the further expansion of the business. Greentech Mining, Inc. and Greentech Mining Utah, LLC will continue to operate as independent companies fulfilling their current mineral processing contracts, developing and evaluating new mining technologies and other exploration opportunities for potential development.

Prior to the Option Agreement entered into on September 17, 2012, the Company was a “blank check company”. Shares of the Company’s common stock are not registered under the securities laws of any state or other jurisdiction, and accordingly there is no public trading market for our common stock. Therefore, outstanding shares of our common stock cannot be offered, sold, pledged or otherwise transferred unless subsequently registered pursuant to, or exempt from registration under, the Securities Act and any other applicable federal or state securities laws or regulations. Shares of our common stock including shares issued to AVP cannot be sold before or after an acquisition under the exemptions from registration provided by Rule 144 under or Section 4(1) of the Securities Act (“Rule 144”) if the Company is designated a “shell company,” and for 12 months after it ceases to be a “shell company,” provided the Company otherwise is in compliance with the applicable rules and regulations. Compliance with the criteria for securing exemptions under federal securities laws and the securities laws of the various states is extremely complex, especially in respect of those exemptions affording flexibility and the elimination of trading restrictions in respect of securities received in exempt transactions and subsequently disposed of without registration under the Securities Act or state securities laws.

OVERVIEW

Greentech Mining International, Inc. is a precious metals mining exploration stage and processing company that has identified potential mining projects both domestically and internationally that it intends to develop into producing mines. The Company’s initial project is the Henry Mountain Project that consists of all 671 acres of Section 36, Township 29 South, Range 11 East, Salt Lake Base and Meridian, in Wayne County, Utah upon which an operating gravimetric circuit (systems to separate minerals by weight) has been built on the private property. In addition, the Henry Mountain Project includes the following Federal Government owned mining claims managed by the Bureau of Land Management (“BLM”):

GOLDEN EAGLE CLAIM GROUP, 105 Placer Claims (loose material such as sand or gravel) totaling 2100 acres – Garfield County, Utah

Claim Numbers UMC 413213 - UMC413309

Claim Numbers UMC414263 – UMC 414270

SILVER EAGLE CLAIM GROUP, 25 Lode Claims (hard rock deposit) totaling 500 acres – Garfield County, Utah

Claim Numbers UMC414271 – UMC414295

BALD EAGLE CLAIM GROUP, 43 Lode Claims (hard rock deposit) totaling 860 acres – Garfield County, Utah

Claim Numbers UMC414196 – UMC414238

COPPER EAGLE CLAIM GROUP, 24 Lode Claims (hard rock deposit) totaling 480 acres – Garfield County, Utah

Claim Numbers UMC414239 – UMC414262

Out of those claim groups there is a BLM permit to commence small mining operations on 8.264 acres of claim #103 in the Golden Eagle claim group that is a twenty acre placer claim, the scope of the BLM approved Plan of Operation is described on pages 19 through 27. GMI intends to conduct operation and exploration activities thereon upon the posting of a $51,000 reclamation bond.

GMI has contracted with Greentech Mining, Inc. to develop and operate the Henry Mountain claims and to run the existing processing plant. The Company has executed an Operating and Exploration Contract with an Option to Purchase all of the assets and machinery at the Henry Mountain Project. Pursuant to the Option Agreement Greentech Mining, Inc. is responsible for BLM property fees and permit fees of an estimated $50,000 dollars per year that will be reimbursed by GMI until the Option to Purchase has been exercised as sets forth in the Option Agreement.

The Company intends to take a two-phase approach to expanding operations and conduct exploration efforts on the Henry Mountain claim groups. In Phase I, the Company will amend the existing processing facility’s Conditional Use Permit that on September 6, 2012 began a new term and automatically renews as long as there is no adverse effect on the community. The permit allows us to engage in mineral processing activities and conduct business under conditions designed to protect the neighborhood and the community. The amended permits will allow the Company to increase the scope of operations from R&D and pilot scale operations (10 tons of material per hour) to commercial scale operations (100 tons per hour) and will include the utilization of a leaching system, flotation system and electro-wining system. The Company estimates that the amended permitting process will take approximately one hundred eighty days for the Wayne County Planning Commission to review and approve the amendment. In parallel, GMI will fabricate install and test additional equipment for processing material imported from other mines in preparation of achieving commercial level production. During this phase the Company will also test gravel samples from several mines to determine the feasibility of importing and processing mined material from third parties.

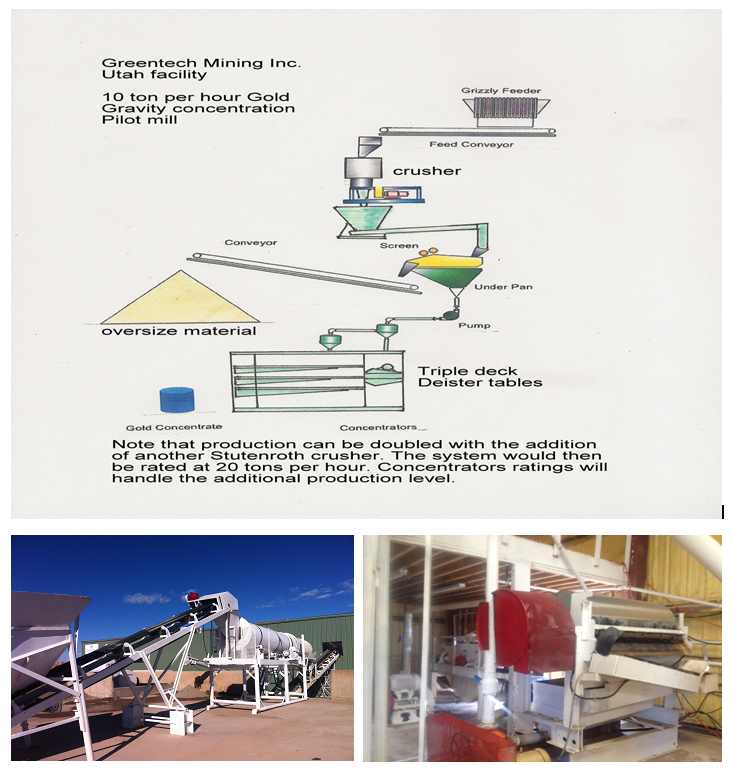

If the Company can define a proven or probable reserve after completion of comprehensive exploration work which includes metallurgical testing in Phase I and is intended to be completed in Phase II (cost is included in the management and exploration expenses on page 43) at the mine sites and has a bankable feasibility study, the Company intends to screen the material removing all oversize rock and debris which carry very little value. Then the material would be transported by truck to the GMI facility that is currently fully equipped with a ten ton per hour gravity separation system, which is 12 miles from the Henry Mountain mine site. At the GMI facility the material would be stored in the material bins and sent to the crushing grinding facility where metals is intended to be further released from the rock by crushing techniques. Once crushed, the material is screened, classified by particle size and the heaver particles are sent to the triple deck and Deister table for final gravity separation designed to produce a black sand metal concentrate that can be smelted (as described on pages 25-27). Upon receiving the amended permit (as described on page 12) the Company plans to upgrade the current system (10 tons per hour) to 100 tons per hour and incorporate a leach, flotation and electrowinning systems into the processing circuit. The enhancements of our extraction capabilities are intended increase the probability of producing a gold purity of 99.99 percent as part of our Phase II implementation.

Additionally, Phase 1 includes the Company financing the BLM approved Plan of Operation reclamation bond for the Golden Eagle claim #103 and starting exploration under the current Small Mine permit as described on page 20. This phase will consist of validation of previous exploration programs that were conducted on the property and initially described by Grove Karl Gilbert, the Powell Expedition Geologist, in his report entitled “Report of the Geology of the Henry Mountains” published in 1877 and through more recent exploration testing programs conducted by New Paradigm Research Technology Group in 1997, Western States Mining Consultants in 1998, M&W Milling & Refining, Inc. in 1998, Material Recovery Service, Inc. 1998, Bromide Mining Company in 1988, Kaibab Industries, Inc. in 1999 and 2000. Additionally, in 2006 and 2007, Martinique Mining Corporation conducted preliminary surface testing analysis on 100 samples taken from lower placer claim groups and the upper hard rock claims groups.

Henry Mountain Project properties have been explored and sampled since 1877 and the reports have indicated that there were minerals on the properties. The Company has not verified these reports and is planning to verify the mineralization of the properties within our Phase I operation. In pervious testing done on the Golden Eagle placer area by Western State Mining Consultants, PC, in 1998 proved the property potentially has economic gold value. The limited amount of sampling (60 tons from three locations) done indicated the gold values cannot effectively be concentrated using a gravity separation mill but the material is, however, quite leachable and could potentially produce a large cyanide leach operation. The fact that gravity concentration cannot be effectively employed to beneficiate the material indicates that alterative metallurgical process may have to be used. The oversized material that was crushed had a significantly higher grade than the uncrushed material. This indicates the gold is disseminated throughout the cobble and boulders found in abundance over the project site. Cyanide leach testing indicated that the material from the project site is amenable to leaching and bulk vet leach tests or column leach test must be performed to determine the optimum leaching strategy and economic viability of the project. In the test conclusion, it was indicated that the project cannot be developed solely as a placer operation. Though high-grade zones have been and will continue to be encountered the majority of the placer material can only be processed economically by leaching. To minimize cost, it was recommended that metallurgical testing began on samples according to a well-planned reserve evaluation plan.

Greentech Mining, Utah has conducted surface sampling in 2011 and 2012, pursuant to the Option Agreement with Greentech Mining, Inc. and Greentech Mining, Utah, the Company intends to commence small mining operations on 8.264 acres consisting of alluvial gravels situated in the Crescent Creek area on the eastern flank of the Henry Mountains. GMI intends to conduct operation and exploration activities thereon upon financing Phase I and the posting of a $51,000 reclamation bond under a Greentech Mining Utah BLM and DOGM approved Plan of Operations (described on pages 19 through 27) incorporating the Golden Eagle #103 claim located in the South Ѕ of the South East ј of the North West ј (S1/2SE1/4NW1/4) of Section 29, Township 31 South, Range 11 East with UMC #414268, Salt Lake Base and Meridian, in Garfield County, Utah (See figure 4 and 5 below).

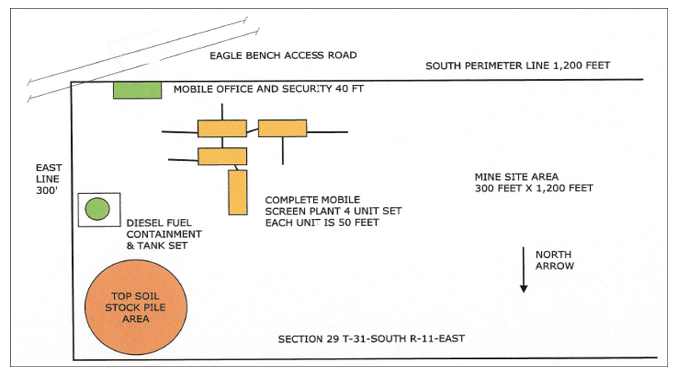

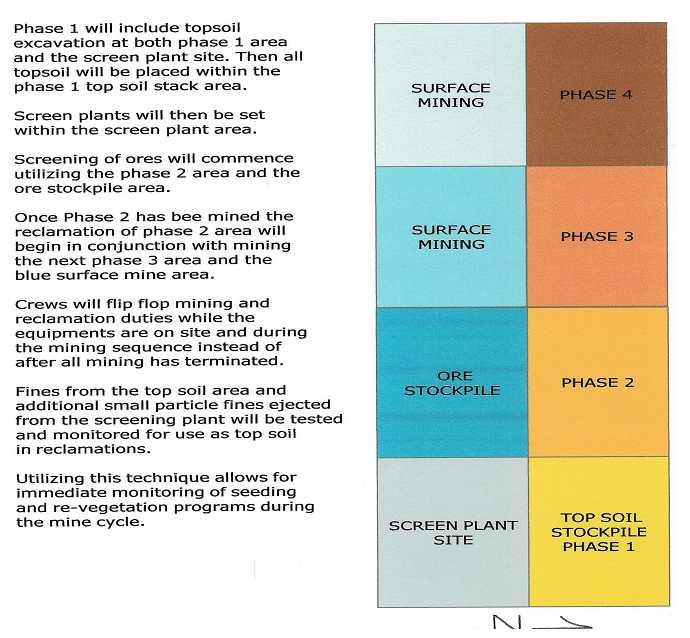

The BLM approved a 4 phase surface excavation plan (as outlined on pages 21-24) that measures 300 feet by 1,200 feet total, top soil would be stripped off and stockpiled for use in reclamation. Exposed target gravels would be excavated and processed in 300' x 200' sections. Each processed section would be reclaimed and regraded in succession. The operation is designed to process 100 to 200 tons per hour using trailer mounted “Aerosort” dry air material concentration equipment. Mining and excavation equipment would include the use of rubber tired loaders and transport and water trucks, a tracked D8 or D9 bulldozer and one tracked 345 Caterpillar excavator or backhoe. Top soil would be stripped off and stockpiled for use in reclamation. Site access would be via existing county maintained roads with the exception of one new road described as 80 feet long and 10 feet wide to allow ingress and egress to the operations site. A mobile office trailer would be placed on site to house office communications and on site safety filings with safety evacuation procedures and satellite communications which will offer instant links to emergency response units from Wayne and Garfield counties, as well as all Mine Safety and Health Administration (“MSHA”) incident reporting requirements for the site. This mobile unit would also have self-contained restroom facilities for employees, as well as a parts warehousing area with a work bench and parts shelving. No site occupancy is included and would not be required. There would be no hazardous chemicals or substances stored on site at the Golden Eagle Mine. Non-hazardous materials and substances such as fuel, oils, anti-freeze products would be stored within the fuel storage containment area. The fuel containment area would be constructed on site using earth berm and 60 millimeter government approved site liner for containment of any fuel spills for site fueling units. This area would be monitoring at least twice daily by personnel on site, as well as inspected by the fuel distributor weekly.

The Company’s Quality Assurance team will monitor all aspects of the operation on a daily basis during all hours of operations, monitoring all check dams, dust control, fuel dispensing and containment systems, as well as all reclamations soil blending programs. Samples would be taken and kept on site as a part of the quality control program for the site. Tests would include all hydrocarbons, metals such as lead and iron, and any other contaminant that may occur. Any contaminants detected at any given time would be immediately handled as hazardous waste and disposed into containers and transported to the waste facility in Sunnyside, Utah.

The Company currently does not have any proven or probable reserves and intends to validate pervious explorations that occurred on the property, expanded our prospecting, mapping, sampling and ultimately diamond drilling within our comprehensive exploration work which includes metallurgical testing to identify a proven reserve, starting in Phase I and is intended to be completed in Phase II (cost is included in the management and exploration expenses on page 43). In parallel, the Company will transport material to the processing facility for testing prior to having establishing a proven or probable reserve on the property. Phase I of our mining operations is estimated to cost $3,000,000 as outlined in our Use of Proceeds on page 43..

In Phase II, the Company will analyze the exploration and metallurgical testing data completed by certified and licensed professionals to determine the feasibility of fully executing the current Plan of Operations approved by the Division of Oil, Gas and Mining, (“DOGM”), and the BLM as described on page 20. After the company accesses the data, any modifications, if any, will be identified and the proper amendments will be submitted to DOGM and BLM for approvals. The Company will identify and implement the mining method(s) best adapted to maximize production, including: (i) effective extraction of material delineated by the exploration, mine geology and grade control department., (ii) proper handling of material and blending method to attain an economical grade without sacrificing the quality of the material, (iii) proper, effective and economical milling plant operation that can recover the gold at the highest percentage possible, and (iv) proper disposal of plant tails.

Our current plans, predicated on raising $15,000,000 from the sale of common stock to begin Phase I. If Phase I is favorable, we would then start Phase II that transitions the Company into a precious metals production company at an estimated cost of $12,000,000, which is a reflection of local costs for the type of work program planned. We will proceed to Phase II only if we are successful in being able to secure the capital funding required to complete Phase II. Therefore, we expect to expend $3,000,000 on Phase I.

Phase I may require up to sixteen weeks for the base work and an additional two months for analysis, evaluation of the work completed and the preparation of a report. The cost for Phase I. is inclusive the aforementioned expenses and includes wages, fees, geological and geochemical supplies, assaying, equipment, trucking and operation costs. It is our intention to carry the work out in 2012 and early 2013, predicated on completion of the offering described in this Form 8-K. We will assess the results of this program upon receipt of an appropriate engineering or geological report. It is our intention to retain a US-educated geoscientist to evaluate and conform to American standards the Phase I work program and to author a report to American standards for future capital raising. Phase II is not planned to be carried out until late 2013 or early 2014 and will be contingent upon favorable results from phase I and specific recommendations of a professional geoscientist based on those results. Favorable results means that a geoscientist, engineer or other recognized professional states that there is a strong likelihood of value being added by transitioning into a precious metals production company, makes a written recommendation that we proceed to the next phase of production, a resolution is approved by the Board of Directors of the Company indicating such work should proceed and that it is feasible to finance the next phase of production.

In addition to GMI's interest in the Henry Mountain Project, the Company has also identified numerous other mining projects wherein the Company would either mine and process or process material from third party mines. GMI began testing these materials in October of 2012 to evaluate their commercial viability and may consummate processing contracts with the best candidates. The Company intends to add more material processing circuits at the 671 acre site including flotation and other mineral extraction technologies to complement its current gravimetric circuit to accommodate the processing of different ore species. GMI is well positioned to do so, on the 671 acre parcel as it already has a conditional use permit for the site.

We are an exploration stage mining company whose business objective is to identify proven reserves of gold and silver, construct mill sites, build out the Henry Mountain Project’s infrastructure and place the mines and the processing circuit for other materials into production after full metallurgical testing has been completed. GMI intends to explore for mineral deposits and in parallel transport concentrated material from the permitted property to the processing facility for testing and evaluation of mineral extraction feasibility. The Company and the Henry Mountain Project do not have any proven or probable reserves further work is required on the Henry Mountain Project before a final determination as to the economic feasibility of a mining venture can be made. There is no assurance that a commercially viable deposit will be proven through our exploration efforts. The funds expended on our properties may not be successful in leading to the delineation of ore reserves that meet the criteria established under SEC guidelines.

GMI has not earned any revenues to date and do not anticipate earning revenues until such time as we are a production stage company. We are presently in the exploration stage of our business and under Industry Guide 7 the Company cannot enter the development stage or production stage until we have defined a proven or probable reserve with a bankable feasibility study.

We can provide no assurance that commercially viable mineral deposits exist on our mining claims or that we will discover commercially exploitable levels of mineral resources on our properties, or if such deposits are discovered, that we will enter into further substantial exploration programs. Further exploration is required before a final evaluation as to the economic and legal feasibility is determined as to whether our mining claims possess commercially exploitable mineral deposits.

The Company’s funding plans include selling additional capital stock and/or borrowing to fund the aforementioned expenses. The Company intends to approach Hedge Funds, Venture Capital Groups, Private Investment Groups and other Institutional Investment Groups in its efforts to achieve future funding.

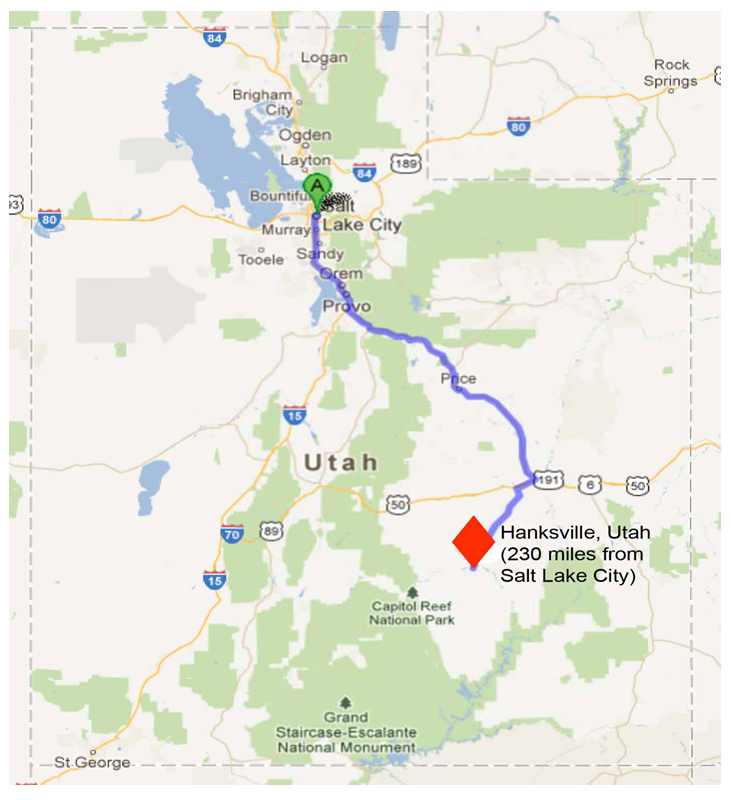

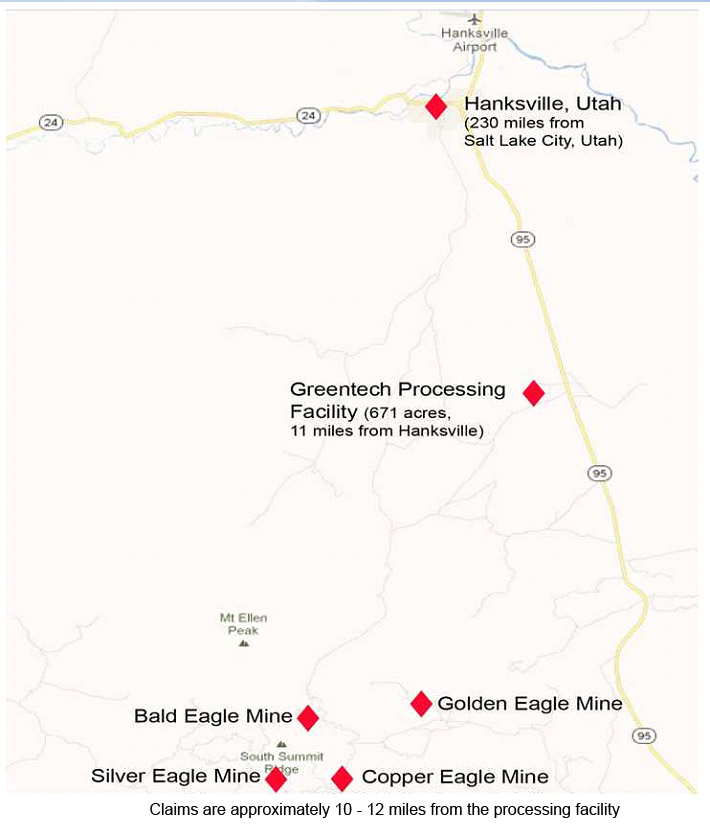

PROPERTY DESCRIPTION AND LOCATIONS

The project area is located on the eastern flank of the Henry Mountains in the Eagle Benches area within the Colorado Plateau physiographic province. The Henry Mountains are about sixty miles long by about twenty miles wide. The town of Hanksville lies about 230 miles south east of Salt Lake City, Utah (figure 1 below), 20 miles to the north of the Henry Mountain claims and 11 miles north of the processing facility (figure 2 below). The range is bounded on the east and south by the Colorado River, on the west by the Waterpocket Fold, and on the north by the San Rafael Swell. From north to south the highest peaks of the Henry Mountains are: Mount Ellen at an elevation of 11,506 feet above sea level; Mount Pennell, with an elevation of 11,371 feet; Mount Hillers, 10,723 feet; Mount Holmes, 7,930 feet; and Mount Ellsworth, at 8,235 feet. The average precipitation at the Eagle Bench is approximately 9 to 12 inches annually. Temperatures (Fahrenheit) range seasonally from below zero to above 100 degrees on the Henry Mountains. The main access road up Eagle Benches serves livestock operators, mining and exploration crews, and recreation oriented travelers and is maintained annually by Garfield County.

The Henry Mountain Project includes the mining claims known as the Golden Eagle Clam Group consisting of 105 twenty acre placer claims ((loose material such as sand or gravel) totaling 2,100 acres located in Sections 19, 20, 21, 22, 28, 29, and 30, Township 31 South, Range 11East with the claim numbers of UMC413213 through UMC413309 and UMC414263 through UNC414270. The Silver Eagle Claim Group consists of 25 twenty-acre lode claims (hard rock) totaling 500 acres located in Section 3, Township 32 South, Range 10 East with the claim numbers of UMC414271 through UMC414295. Additionally, the Bald Eagle Claim Group consist of 43, twenty-acre lode claims totaling 860 acres located in Sections 27 and 28 of Township 31South, Range 10 East with the claim numbers of UMC414196 through UMC414238. Furthermore, the Copper Eagle Claim Group consist of 24 twenty acre lode claims totaling 480 acres located in Section 1, township 32 South, Range 10 East with the claim numbers of UMC414230 through UMC414262. The total claims available to the Company are 105 twenty-acre placer claims and 92 twenty-acre lode claims for a total of 197 twenty acre claims and 3,940 acres located in Salt Lake Base and Meridian, in Garfield County, Utah. The aforementioned claims are all owned by the Federal Government and are managed by the Bureau of Land Management, these claims are located within a mile of each other and approximately 10-12 miles from the processing facility. (See figure 2 and 3 below)

Figure 1

DRIVING DIRECTIONS FROM SALT LAKE CITY TO HANKSVILLE, UTAH

Figure 2

LOCATIONS OF PROCESSING PLANT AND MINE CLAIMS

HENRY MOUNTAIN CLAIMS GROUP

Figure 5

BLM APPROVED AND PERMITTED AREA

Caution:

Land ownership data is derived from less accurate data than the 1:24000 scale base map. Therefore, land ownership may not be known for parcels less than 40 acres of land. Ownership lines may have plotting errors due to source data. No warranty is made by the Bureau of Land Management for the use of the data for use of the data for purposes not intended by the BLM.

Pursuant to the Option Agreement with Greentech Mining, Inc. and Greentech Mining, Utah, the Company intends to commence small mining operations on 8.264 acres consisting of alluvial gravels situated in the Crescent Creek area on the eastern flank of the Henry Mountains. GMI intends to conduct operation and exploration activities thereon upon the posting of a $51,000 reclamation bond under a Greentech Mining Utah BLM and DOGM approved Plan of Operations (described on pages 19 through 27) incorporating the Golden Eagle #103 claim located in the South Ѕ of the South East ј of the North West ј (S1/2SE1/4NW1/4) of Section 29, Township 31 South, Range 11 East with UMC #414268, Salt Lake Base and Meridian, in Garfield County, Utah (See figure 4 and 5 above). We are presently in the exploration stage of our business and under Industry Guide 7 companies cannot enter the development stage or production stage until they have defined a proven or probable reserve with a bankable feasibility study.

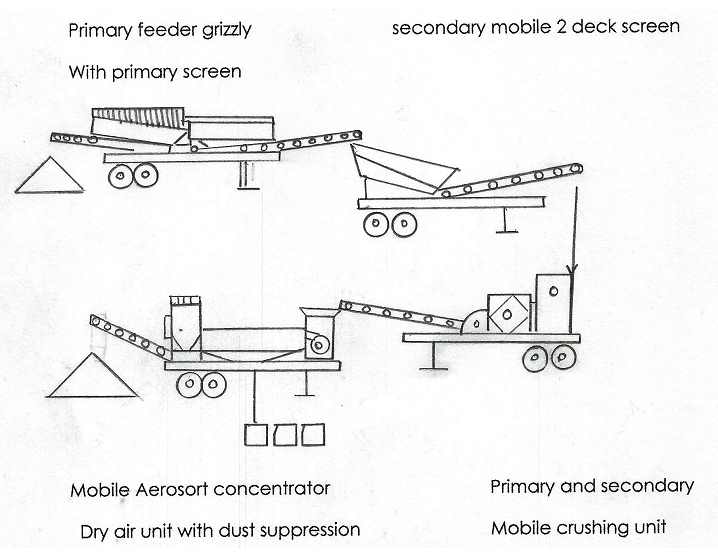

The BLM approved a 4 phase surface excavation plan (as outlined on pages 21-24) that measures 300 feet by 1,200 feet total, top soil would be stripped off and stockpiled for use in reclamation. Exposed target gravels would be excavated and processed in 300' x 200' sections. Each processed section would be reclaimed and regraded in succession. The operation is designed to process 100 to 200 tons per hour using trailer mounted “Aerosort” dry air material concentration equipment. Mining and excavation equipment would include the use of rubber-tired loaders and transport and water trucks, a tracked D8 or D9 bulldozer and one tracked 345 Caterpillar excavator or backhoe. Topsoil would be stripped off and stockpiled for use in reclamation. Site access would be via existing county maintained roads with the exception of one new road described as 80 feet long and 10 feet wide to allow ingress and egress to the operations site. A mobile office trailer would be placed on site to house office communications and on site safety filings with safety evacuation procedures and satellite communications which will offer instant links to emergency response units from Wayne and Garfield counties, as well as all Mine Safety and Health Administration (“MSHA”) incident reporting requirements for the site. This mobile unit would also have self-contained restroom facilities for employees, as well as a parts warehousing area with a work bench and parts shelving. No site occupancy is included and would not be required. There would be no hazardous chemicals or substances stored on site at the Golden Eagle Mine. Non-hazardous materials and substances such as fuel, oils, anti-freeze products would be stored within the fuel storage containment area. The fuel containment area would be constructed on site using earth berm and 60 millimeter government approved site liner for containment of any fuel spills for site fueling units. This area would be monitoring at least twice daily by personnel on site, as well as inspected by the fuel distributor weekly.

The Company’s Quality Assurance team will monitor all aspects of the operation on a daily basis during all hours of operations, monitoring all check dams, dust control, fuel dispensing and containment systems, as well as all reclamations soil blending programs. Samples would be taken and kept on site as a part of the quality control program for the site. Tests would include all hydrocarbons, metals such as lead and iron, and any other contaminant that may occur. Any contaminants detected at any given time would be immediately handled as hazardous waste and disposed into containers and transported to the waste facility in Sunnyside, Utah.

A Fugitive Dust Control Plan was approved by the Utah Division of Air Quality and by BLM within the Plan of Operations. Water supplied for dust control would be from Township 29 South, Range11 East, Section 36 (Water Right 95-5290(A79300) or contracted from private sources. The operation would use no waters from nearby streams.

Operations under the mining plan are anticipated to take 18 months to complete outside of shutdowns for inclement weather, seasonal restrictions and regulatory requirements. For the purposes of Environmental Assessment, a timeframe of three to five years is used to analyze what might be the maximum length of operations giving consideration to required shut downs. During shut down periods, equipment would be de-mobilized.

The Proposed Action was approved and the Company is authorized to commence following activities on public lands managed by BLM:

| | · | Temporary construction of an 80’ x 10’ access road to facilitate operations. |

| | · | Temporary installation of storm water runoff and sediment control structures. |

| | · | The excavation and on-site processing of target gravels in 300’ x 200’ sections. |

| | · | Reclamation of previously mined and processed sections prior to mining the next scheduled section. |

BLM APPROVED MOBILE SCEENING PLANT LOCATION SET-UP ON SITE OVERHEAD VIEW

Access to the site will require no new access roads as the perimeter of the permit area intersects with the main access road.

BLM APPROVED MOBILE SCEENING PLANT FLOW SHEET

Aerosort Concentrator Primary and Secondary Crushing Unit

Rock types include, Diorite porphyry, gray feldspar andesite porphyry as the 2 most common rock type occurrences within the alluvial fan with sedimentary rock erosive basin rocks eroding into the alluvial fan where gold may be found. (Rodney A. Blakestad, JD., CPG report 1999) Distribution of these rock types will be mapped and cataloged with grade control personnel and data reported will be used for the replacement of the waste materials which can be blended with different rock sizes so as to carefully mimic the stratification of the disturbed area for the reclamation planning and layering of the top soil program.

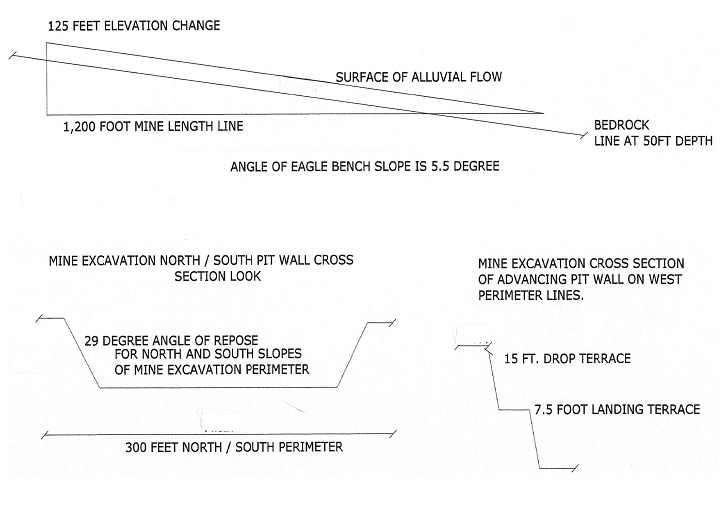

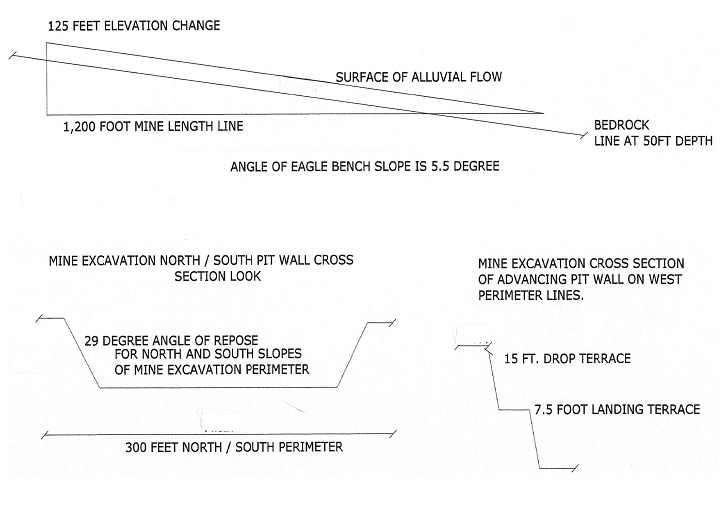

The western mine high wall once established will utilize a drop terrace mining technique using a gradient slope of ½ to 1 in ratio. This will allow a 15ft. drop for each terrace and a 7.5ft landing to support the upper terrace during excavation along the 300 foot western perimeter advance of the mine site. The northern and southern mine perimeter lines will be sloped at natural angle of repose in this system which is 29 degrees. By leaving natural angle of repose along the side pit walls wildlife and cattle will not have a safety issue if crossing or visiting the area.

BLM APPROVED GOLDEN EAGLE MINE CROSS SECTION SLOPE ANGLE IN DEGREE FOR EAGLE

BENCH NATURAL SLOPE AND ESTIMATED BEDROCK POSITION

BLM APPROVED MINING AND RECLAMATION SITE PLAN

METALS PROCESSING AND REFINING

The BLM has issued permits for the Golden Eagle #103 and a comprehensive sample program is intended to be implemented at both the upper elevation target area and the lower alluvial mine groups. This surface sampling process is generally defined in the industry as a surface anomaly test program, and once completed will define the exploration target areas for potential ore bearing regions of the entire project. Geological profile mappings are also generated from this test program and exploration drill targets are engineered for the core drilling experts. This procedure is intended to ultimately provide proven gold ounces in the ground that can be further developed into proven gold reserves for the project.

FINAL PROCESSING AND REFINMENTS OF GOLD DORE’

GREENTECH PROCESSING FACILITY

The Company has contracted to operate the facility known as the Greentech Processing Facility (above), 11 miles south of Hanksville, Utah, and 12 miles from the Henry Mountain claim group. This property consists of 671 acres of private property and is fully permitted to operate in the 40 foot x 80-foot metal building structure with a complete material stacking and bin system is in place on the site. The property has 2 water wells that provide the facility enough water that can be used for all refining and process needs including two settling ponds for the recycling of the water used in the separation process. Furthermore, there is power, a cell phone system installed and cement material bins have been constructed as well as a transport truck weight scale system. The processing facility is intended to process material from multiple mining sites including the Henry Mountain claim group upon the completion of comprehensive exploration work which includes metallurgical testing and third party owned properties after metallurgical testing, currently the facility is fully equipped with gravity separation equipment, consisting of spiral classifiers and Nelson concentrators in addition to other equipment.

Testing and enhancements of the gravity separation circuit at the facility have been done by Greentech Utah since 2011 and have included testing of materials from several different mine sites including the Henry Mountain claim group. The testing to date indicates that the current circuit design can segregate the material and produce a gold/silver concentrate that can be smelted to extract the gold from the material. Previous testing on the Henry Mountain claim group completed by Greentech Utah in 2012 indicated that the material could be segregated to produce a gold/silver black sand material and smelted into gold beads. Although there has been black sand material produce from the Henry Mountain claims, due to the limited testing it is still unknown as to the most effective extraction process and much more exploration work need to be completed with Phase I. Pervious testing done in 1998 (60 tons from three locations) indicates that any mineralized materials discovered during the exploration stage of the Henry Mountain placer claims will likely be disseminated in nature and require leaching for effective metal recovery (see page 13 for historical testing that was done in 1998 on the Henry Mountain placer claims indicating a leach process would be most effective).

Initial testing results indicate that gold and silver are present in the black sand produced by the system but it is unknown if the metals can be recovered at this time. Furthermore, the economic feasibility has not been shown due to the small amount of material that has been evaluated to date and there is the associated risk that the operation as planned will not be profitable either with respect to our own mining operations or refining tailings or other mining concentrates from other mining companies in close proximity to our operations.

We have incorporated flexibility into our processing building design to allow for alternative/additional precious metal extraction processes to be installed that may include a leach system, flotation system and eletrowinning system to enhance the extraction process, these enhancements are intended to be implemented in Phase II.

In Phase I, the Company will amend the existing processing facility’s Conditional Use Permit that on September 6, 2012 began a new term and automatically renews as long as there is no adverse effect on the community. The permit allows us to engage in mineral processing activities and conduct business under conditions designed to protect the neighborhood and the community. The amended permits will allow the Company to increase the scope of operations from R&D and pilot scale operations (10 tons of material per hour) to commercial scale operations (100 tons per hour) and will include the utilization of a leaching system, flotation system and electrowinning system. The Company estimates that the amended permitting will take approximately one hundred eighty days for the Wayne County Planning Commission to review and approve the amendment. In parallel, GMI will fabricate install and test additional equipment for processing material imported from other mines in preparation of achieving commercial level production. During this phase the Company will also test gravel samples from several mines to determine the feasibility of importing and processing mined material from third parties.

The pictured processing equipment is currently at the plant in Hanksville Utah and is owned by Greentech Mining Inc and operated by the Company. If the Company does not exercise the option to purchase or the agreement is terminated, the pictured equipment will continue to be owned by Greentech Mining Inc. In the event the Company purchases additional equipment as outlined in the plan of operation on pages 37 through 40, the equipment will be owned by the Company regardless of termination.

The following flow sheet outlines the positions of the equipment inside the building area that is present on site. The Company intends on modifying and up grading the current equipment in Phase 1 to process 75 – 100 tons per hour.

The hopper and conveyor system sends material through the trommel separation system (upper left photo) that feeds material into the buildings crushing system and screening unit (upper right photo) which then transfers the material to two clarifying systems.

The material has been received from the crushing system and is now being classified by practical size in the classifying units (upper left photo) and the lighter particles will be sent to the tailing pond and the heaver particles will be sent to the triple deck and Deister table (upper right photo) for final concentration of the precious metal minerals.

THE PROCESS FROM MINE TO REFINING

If the Company can define a proven or probable reserve after completion of comprehensive exploration work which includes metallurgical testing in Phase I and completed in Phase II (cost is included in the management and exploration expenses on page 43) at the mine sites and has a bankable feasibility study the Company intends to screen the material removing all oversize rock and debris which carry very little value. Then the material would be transported by truck to the GMI facility that is currently fully equipped with a ten ton per hour gravity separation system, which is 12 miles from the Henry Mountain mine site. At the GMI facility the material would be stored in the material bins and sent to the crushing grinding facility where metals is intended to be further released from the rock by crushing techniques. Once crushed, the material is screened, classified by particle size and the heaver particles are sent to the triple deck and Deister table for final gravity separation designed to produce a black sand metal concentrate that can be smelted (as described on pages 25-27). Upon receiving the amended permit (as described on page 12) the Company plans to upgrade the current system (10 tons per hour) to 100 tons per hour and incorporate a leach, flotation and electrowinning systems into the processing circuit. The enhancements of our extraction capabilities are intended increase the probability of producing a gold purity of 99.99 percent as part of our Phase II implementation .

THE PHOTOS ABOVE REPRESENT THE FINAL SMELTING PHASE OF PURIFYING

PRECIOUS METALS AT THE COMPANY’S FULLY PERMITTED PROCESSING FACILITY IN HANKSVILLE, UTAH

HENRY MOUNTAIN GOLD HISTORICAL

Evidence of prehistoric inhabitation by both the Fremont and Anasazi cultures is found in areas surrounding the Henry Mountains, but there is little or no indication of habitation in the mountains themselves. The Henry Mountains were little known until described by Grove Karl Gilbert, the Powell Expedition Geologist, in his report entitled “Report of the Geology of the Henry Mountains” published in 1877. By the 1890’s the lure of precious metals brought the largest influx of settlers into the area. Lumber for the mining was cut at many places in the mountains, and roads to reach the stands of timber were built up Bull Creek where a saw-mill was located. In 1890 Jack Sumner, who had been with Powell in 1869, located the Bromide Mine near the summit of Mount Ellen. By 1893 more than 100 men were reported to be working in the mines and camps of the area. A small town called Eagle City was established at Crescent Creek in the Eagle Benches area, with homes, a hotel, two saloons, a dance hall, three stores, and a post office but by 1900 gold had played out and Eagle City was a ghost town.

COMPETITION

The mineral exploration business is an extremely competitive industry. We are competing with many other exploration companies looking for minerals. We are a very early stage mineral exploration company and a very small participant in the mineral exploration business. Being a junior mineral exploration company, we compete with other companies like ours for financing and joint venture partners. Additionally, we compete for resources such as professional geologists, camp staff, helicopters and mineral exploration supplies.

GOVERNMENT REGULATIONS

Because we are engaged in the mineral exploration activities, we are exposed to many governmental and environmental risks associated with our business. We are currently the operator of the Henry Mountain project and processing plant for Greentech Mining Inc. who has obtained a small mining operations permit consisting of 8.264 acres that has a $50,000 reclamation bond that needs to be posted before mining can begin. They have also obtained a conditional use permit for the processing plant.