GREENTECH MINING INTERNATIONAL, INC.

1840 Gateway Drive, Suite 200

Foster City, CA 94404

April 29, 2013

VIA EDGAR

United States Securities and Exchange Commission

Division of Corporate Finance

100 F Street, N.E.

Washington, D.C. 20549

Attn: Russell Mancuso, Branch Chief

Re: Greentech Mining International, Inc.

Amendment No. 5 to Form 8-K

Filed March 22, 2013

Form 10-Q for the quarterly period ended September 30, 2012

Amended April 12, 2013

Form 10-Q for the quarterly period ended December 31, 2012

Filed April 12, 2013

File No. 000-54610

Ladies and Gentlemen:

On behalf of the Company, we are responding to comments contained in the Staff letter, dated April 8, 2013 addressed to Mr. Matthew Neher, the Company’s President, Secretary and Treasurer, with respect to the Company’s filing of its Form 8-K, Form 10-Q for the quarterly period ended September 30, 2012, amended April 12, 2013 and Form 10-Q for the quarterly period ended December 31, 2012 amended April 12, 2012.

The Company has replied below to your comment with a response following a repetition of the Staff’s comment to which it applies (the “Comment”). The response to the Comment is numbered to relate to the corresponding Comment in your letter.

Amendment No. 5 to Form 8-K filed March 22, 2013

Our Business, page 10

1. We note your response to comment 5 from our letter dated February 22, 2013. Please revise to remove the term reserve from disclosure until you have defined a proven or probable reserve as defined in Section (a) of Industry Guide 7.

Company Response

We have removed the term “reserve “ and “does not allow the reserve to be considered proven but indicated reserves could be quite high” in the third paragraph on page 13.

2. We note your response to comment 6 from our letter dated February 22, 2013. Your revised disclosure now implies that it is your intention to define a proven or probable mineral reserve. Considering your two phased approach, please clarify when this will occur and if this cost has been included in your management and exploration related expenses.

Mr. Russell Mancuso

April 29, 2013

Page 2

Company Response

We have revised the disclosure throughout to clarify that we intend to define a proven or probable reserve starting in Phase I and is intended to be completed in Phase II after comprehensive exploration work which includes metallurgical testing has been completed. We have also included that the cost included in the management and exploration related expenses.

3. Additionally, comprehensive metallurgical testing is a key prerequisite to defining a mineral reserve yet, in certain instances, your disclosure implies that you have already defined your processing arrangement. Please revise throughout to clarify that processing is contingent upon the completion of comprehensive exploration work which includes metallurgical testing.

Company Response

We have clarified throughout the document that processing is contingent upon the completion of comprehensive exploration work which includes metallurgical testing.

Implications of being an Emerging Growth Company, page 35

4. We note that you have deleted more disclosure than you indicated in your response to prior comment 7. Please add back to your disclosure your irrevocable election regarding the extended transition period for complying with new or revised accounting standards.

Company Response

We have add back to our disclosure our irrevocable election regarding the extended transition period for complying with new or revised accounting standards. Stating “Under the Jumpstart Our Business Startups Act, “emerging growth companies” can delay adopting new or revised accounting standards until such time as those standards apply to private companies. We have irrevocably elected not to avail ourselves to this exemption from new or revised accounting standards and, therefore, we will be subject to the same new or revised accounting standards as other public companies that are not “emerging growth companies.”

Certain Relationships and Related Transactions, and Director Independence, page 48

5. We note that you removed disclosure from this section in response to the first sentence of prior comment 9. However, your removal of disclosure does not clarify how you reconcile the information in this section with the information in your balance sheet. Please advise.

Company Response

We have added the required information to this section including “On February 6, 2012, the Registrant sold 5,000,000 shares of Common Stock to Accelerated Venture Partners, LLC for an aggregate investment of $2,000.00. The Registrant sold these shares of Common Stock under the exemption from registration provided by Section 4(2) of the Securities Act.” This is the information that reconciles with the balance sheet.

6. You indicate that you “added additional S-K 404(a)(5) disclosure” in response to the second sentence of prior comment 9. Please tell us why you believe the added information addresses the requirements of Regulation S-K Item 404(a)(5).

Mr. Russell Mancuso

April 29, 2013

Page 3

Company Response

We have modified the disclosure of Certain Relationships and Related Transactions, and Director Independence, page 48 to include the requirements of Regulation S-K Item 404(a)(5).

Amendment No. 2 to Form 10-Q for the quarterly period ended September 30, 2012

Note 1. Background Information, page 7

Mineral Properties and Milling Assets, page 7

7. We reference your response to prior comment 1. Under U.S. GAAP, payables for assets should be recorded when the risk of ownership of the related assets has been passed to the purchaser. Please clarify for us how you determined that you have the risk of ownership of the mining assets as of September 30, 2012. In addition, we do not see where you have discussed how you considered your lack of funding and inability to make the required payments in concluding that the asset should be recorded on your balance sheet.

Company Response

We have added disclosure that the risk of ownership of the mining assets as of September 30, 2012 is not passed to the Company. Therefore, the Company did not recognize any assets or liabilities related to the Option Agreement signed on September 17, 2012 until the first payment of one million dollar has been paid in the future and this has not occurred.

8. We note your response to prior comment 13 about the general guidance under FASB ASC 360. However, it is not clear how you apply the literature to your particular facts and circumstances. In that regard, please clarify what criteria you analyze to determine whether the carrying amounts of the mineral properties and milling assets may not be recoverable. For example, discuss how you consider expected future undiscounted cash flows and the progress made toward your plan of operations.

Company Response

We have added disclosure related to ASC 930-360-35, asset impairment although the Company did not record any assets related to the Option Agreement as discussed in response #7.

9. We reference the response to prior comments 15 and 16 that the Greentech mining and milling assets were brought in at historical cost. We see that you capitalized the $3 million payment that is due under the Operating, Exploration and Option to Purchase Agreement. Please clarify how that $3 million is historical cost. Under 805-50-30-5, when accounting for a transfer of assets between entities under common control, the entity that receives the net assets should measure the recognized assets and liabilities transferred at their carrying amounts in the accounts of the transferring entity at the date of transfer.

Company Response

We have revised the 10-Q as of September 30, 2012 and no assets and liabilities are recognize since the risk of ownership of the mining assets as of September 30, 2012 is not passed to the Company. See response #7.

10. As a related matter, please revise the disclosure in your filing to state that the mineral properties and milling assets were transferred at historical cost under FASB ASC 805-50-30-5 and SAB Topic 5G due to common control between the two entities.

Mr. Russell Mancuso

April 29, 2013

Page 4

Company Response

We have revised the disclosure and stated that the mineral properties and milling assets were not recorded as of September 30, 2012 because the ownership of the mining assets as of September 30, 2012 is not passed to the Company. See response #7.

Note 9. Restatement, page 15

11. We reference your response to prior comment 17 that the equipment was ordered and paid for in October 2012. Please reconcile that statement with the disclosure on page 15 that the equipment was ordered in September 2012 but paid for in October 2012. Please clarify when you received the equipment.

Company Response

We have reconciled the disclosure on page 15when as to when the equipment was order, received and paid for in October 2012.

Item 2. Management’s Discussion and Analysis of Financial Condition and Results of Operations, page 18

Critical Accounting Policies and Use of Estimates, page 22

12. In future filings, including any amendments, please include a discussion of the judgments and estimates inherent in assessing your mineral properties and milling assets for impairment under FASB ASC 930-360-35 and 360-10-35-17. In this discussion, please include an update of your timeline for funding the project and explain if you are meeting expected milestones.

Company Response

The Company will include the discussion of the judgments and estimates inherent in assessing your mineral properties and milling assets for impairment under FASB ASC 930-360-35 and 360-10-35-17 when the risk of ownership of the mining assets is passed to the Company in the future.

Item 4T. Controls and Procedures, page 23

13. We note the revised disclosures to state that disclosure controls and procedures were not effective at September 30, 2012 and December 31, 2012. In future filings, including any amendments, please clarify the nature of the material weaknesses that you identified. Future filings should also disclose the specific steps that you have taken, if any, to remediate the material weakness and disclose whether the company believes that the material weakness still exists at the end of the period covered by the report.

Company Response

The Company has revised the disclosure and state the reason for disclosure controls and procedures were not effective at September 30, 2012 and December 30, 2012. We have also added disclosures related to the material weaknesses of the Company and remediate of the material weaknesses by the Company.

Mr. Russell Mancuso

April 29, 2013

Page 5

14. As a related matter, we see that you concluded on the effectiveness of disclosure controls and procedures as of the “evaluation date.” In future filings, including any amendment, please clearly disclose the date of your evaluation of disclosure controls and procedures.

Company Response

The Company has revised the evaluation date to clearly disclose the date of our evaluation of disclosure controls and procedures for each Form 10-Q filed to the SEC.

Amendment No. 1 to Form 10-Q for the quarterly period ended December 31, 2012

15. We note your revised disclosure referencing grade estimates, possible additional reserves, and open-pit mining with an assumed gold price. Please revise to remove such disclosure until you have defined a mineral reserve pursuant to the definitions in section (a) of Industry Guide 7.

Company Response

We have removed referencing grade estimates, possible additional reserves, and open-pit mining with an assumed gold price.

16. Additionally, we note that you have performed bulk sampling on your Mohave Co., Arizona property. As supplemental information and not as part of your filing, please provide us with the sample data and test results associated with your bulk samples pursuant to section (c) of Industry Guide 7. Please provide this information on a CD, formatted as Adobe PDF files. You may ask to have this information returned by making a written request at the time it is furnished, as provided in Rule 12b-4 of Regulation 12B. If you have questions concerning the above request, please contact John Coleman, Mining Engineer at (202) 551-3610.

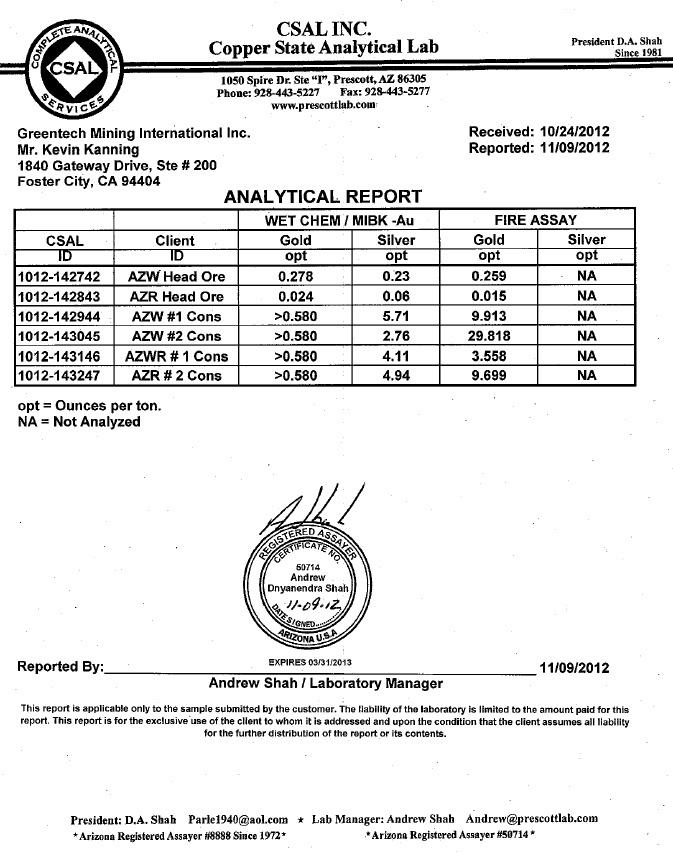

Company Response

We have provided the sample data and test results within the filing and have included the assay report as correspondence to this response. We have also included the U.S. GEOLOGICAL SURVEY BULLETIN 1737-C for review of the Portland mine.

http://pubs.er.usgs.gov/publication/b1737C

17. Refer to your response to prior comment 25. Please note that the comment process does not result in the “approval” of your filings. Refer to the acknowledgements that you provide with your responses to our comments as indicated at the end of this letter.

Company Response

We acknowledge that the comment process does not result in the “approval” of our filings. We also acknowledge our responses to your comments as indicated at the end of this letter.

Mr. Russell Mancuso

April 29, 2013

Page 6

Company Response

We revised this section to disclose the conclusions of our principal executive officer and principal financial officer regarding the effectiveness of our disclosure controls and procedures as of December 31, 2012.

On behalf of the Company, we acknowledge that:

| | ● | the Company is responsible for the adequacy and accuracy of the disclosure in the filing; |

| | ● | staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| | ● | the Company may not assert staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

Very truly yours,

Matthew J. Neher

GREENTECH MINING INTERNATIONAL, INC.

By: Matthew J. Neher

Matthew J. Neher

Chief Executive officer