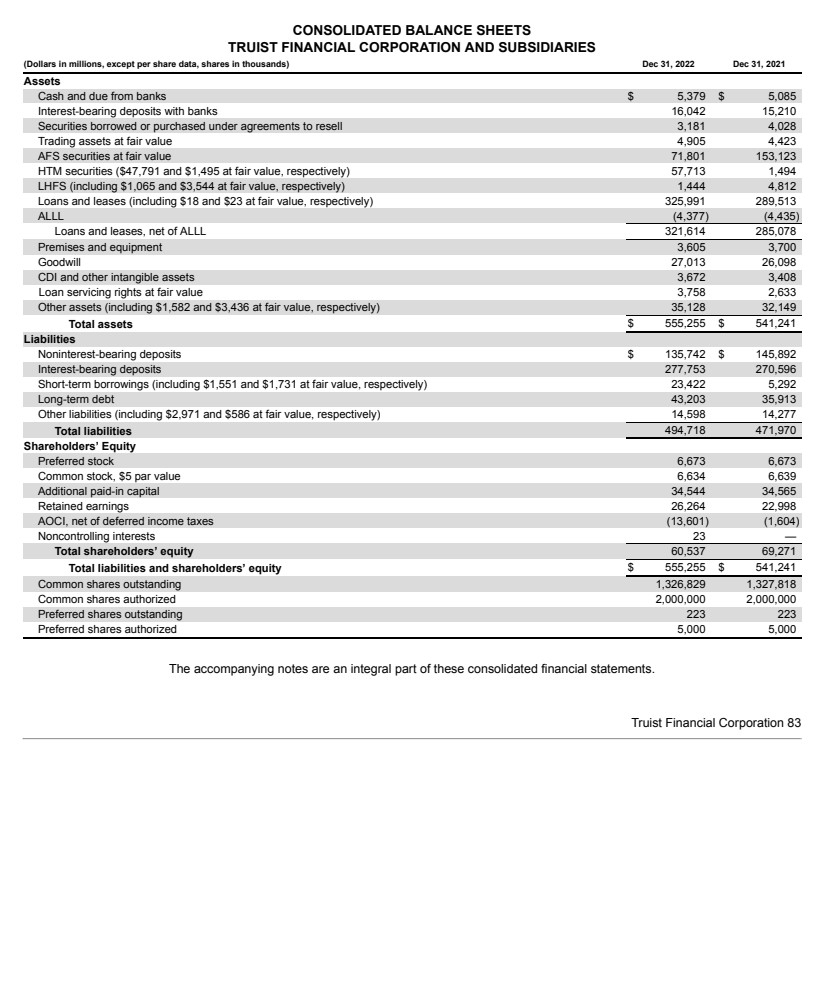

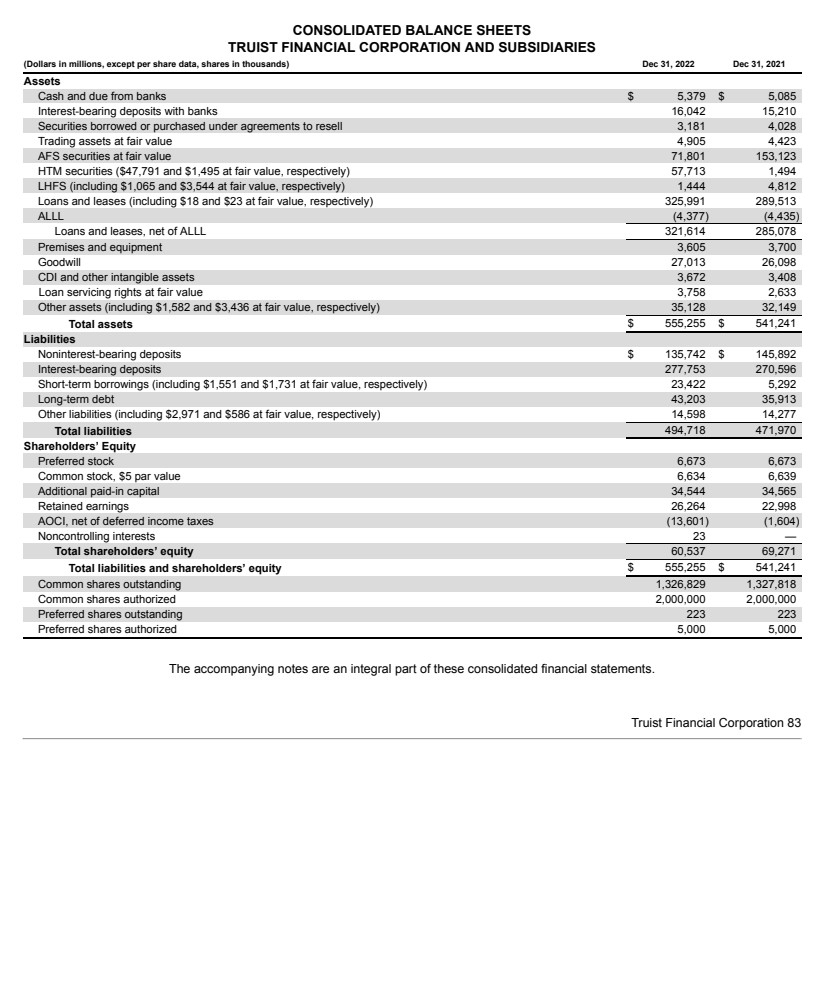

| CONSOLIDATED BALANCE SHEETS TRUIST FINANCIAL CORPORATION AND SUBSIDIARIES (Dollars in millions, except per share data, shares in thousands) Dec 31, 2022 Dec 31, 2021 Assets Cash and due from banks $ 5,379 $ 5,085 Interest-bearing deposits with banks 16,042 15,210 Securities borrowed or purchased under agreements to resell 3,181 4,028 Trading assets at fair value 4,905 4,423 AFS securities at fair value 71,801 153,123 HTM securities ($47,791 and $1,495 at fair value, respectively) 57,713 1,494 LHFS (including $1,065 and $3,544 at fair value, respectively) 1,444 4,812 Loans and leases (including $18 and $23 at fair value, respectively) 325,991 289,513 ALLL (4,377) (4,435) Loans and leases, net of ALLL 321,614 285,078 Premises and equipment 3,605 3,700 Goodwill 27,013 26,098 CDI and other intangible assets 3,672 3,408 Loan servicing rights at fair value 3,758 2,633 Other assets (including $1,582 and $3,436 at fair value, respectively) 35,128 32,149 Total assets $ 555,255 $ 541,241 Liabilities Noninterest-bearing deposits $ 135,742 $ 145,892 Interest-bearing deposits 277,753 270,596 Short-term borrowings (including $1,551 and $1,731 at fair value, respectively) 23,422 5,292 Long-term debt 43,203 35,913 Other liabilities (including $2,971 and $586 at fair value, respectively) 14,598 14,277 Total liabilities 494,718 471,970 Shareholders’ Equity Preferred stock 6,673 6,673 Common stock, $5 par value 6,634 6,639 Additional paid-in capital 34,544 34,565 Retained earnings 26,264 22,998 AOCI, net of deferred income taxes (13,601) (1,604) Noncontrolling interests 23 — Total shareholders’ equity 60,537 69,271 Total liabilities and shareholders’ equity $ 555,255 $ 541,241 Common shares outstanding 1,326,829 1,327,818 Common shares authorized 2,000,000 2,000,000 Preferred shares outstanding 223 223 Preferred shares authorized 5,000 5,000 The accompanying notes are an integral part of these consolidated financial statements. Truist Financial Corporation 83 |