Issuer Free Writing Prospectus

Filed Pursuant to Rule 433

Registration File No.: 333-172366-02

Date: March 12, 2012

Free Writing Prospectus

Structural and Collateral Term Sheet

$925,007,833

(Approximate Aggregate Cut-off Date Balance of Mortgage Pool)

$790,881,000

(Approximate Aggregate Principal Balance of Offered Certificates)

WFRBS Commercial Mortgage Trust 2012-C6

as Issuing Entity

Wells Fargo Commercial Mortgage Securities, Inc.

as Depositor

Wells Fargo Bank, National Association

The Royal Bank of Scotland

Liberty Island Group I LLC

C-III Commercial Mortgage LLC

Basis Real Estate Capital II, LLC

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2012-C6

March 12, 2012

| | |

| WELLS FARGO SECURITIES | | RBS |

| |

| Co-Lead Manager and | | Co-Lead Manager and |

| |

| Co-Bookrunner | | Co-Bookrunner |

Citigroup

Co-Manager

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (“SEC”) (SEC File No. 333-172366) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-745-2063 (8 a.m. – 5 p.m. EST) or by emailing wfs.cmbs@wellsfargo.com.

Nothing in this document constitutes an offer of securities for sale in any other jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of Wells Fargo Securities, LLC (“WFS”), RBS Securities Inc. (“RBSSI”), Citigroup Global Markets Inc. or any of their respective affiliates make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects”, “intends”, “anticipates”, “estimates” and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

Wells Fargo Securities is the trade name for certain capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including Wells Fargo Securities, LLC, member FINRA and SIPC, and Wells Fargo Bank, National Association.

RBS is a trade name for the investment banking business of RBSSI. Securities, syndicated loan arranging, financial advisory and other investment banking activities are performed by RBSSI and their securities affiliates. Lending, derivatives and other commercial banking activities are performed by The Royal Bank of Scotland plc and their banking affiliates. RBSSI is a member of SIPC, FINRA and the NYSE.

IRS CIRCULAR 230 NOTICE

THIS TERM SHEET IS NOT INTENDED OR WRITTEN TO BE USED, AND CANNOT BE USED, FOR THE PURPOSE OF AVOIDING U.S. FEDERAL, STATE OR LOCAL TAX PENALTIES. THIS TERM SHEET IS WRITTEN AND PROVIDED BY THE DEPOSITOR IN CONNECTION WITH THE PROMOTION OR MARKETING BY THE DEPOSITOR AND THE CO-LEAD BOOKRUNNING MANAGERS OF THE TRANSACTION OR MATTERS ADDRESSED HEREIN. INVESTORS SHOULD SEEK ADVICE BASED ON THEIR PARTICULAR CIRCUMSTANCES FROM AN INDEPENDENT TAX ADVISOR.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The Offered Certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. Prospective investors should understand that, when considering the purchase of the Offered Certificates, a contract of sale will come into being no sooner than the date on which the relevant class of certificates has been priced and the underwriters have confirmed the allocation of certificates to be made to investors; any “indications of interest” expressed by any prospective investor, and any “soft circles” generated by the underwriters, will not create binding contractual obligations for such prospective investors, on the one hand, or the underwriters, the depositor or any of their respective agents or affiliates, on the other hand.

As a result of the foregoing, a prospective investor may commit to purchase certificates that have characteristics that may change, and each prospective investor is advised that all or a portion of the certificates referred to in these materials may be issued without all or certain of the characteristics described in these materials. The underwriters’ obligation to sell certificates to any prospective investor is conditioned on the certificates and the transaction having the characteristics described in these materials. If the underwriters determine that a condition is not satisfied in any material respect, such prospective investor will be notified, and neither the depositor nor the underwriters will have any obligation to such prospective investor to deliver any portion of the Offered Certificates which such prospective investor has committed to purchase, and there will be no liability between the underwriters, the depositor or any of their respective agents or affiliates, on the one hand, and such prospective investor, on the other hand, as a consequence of the non-delivery.

Each prospective investor has requested that the underwriters provide to such prospective investor information in connection with such prospective investor’s consideration of the purchase of the certificates described in these materials. These materials are being provided to each prospective investor for informative purposes only in response to such prospective investor’s specific request. The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

2

WFRBS Commercial Mortgage Trust 2012-C6 | Certificate Structure |

| | | | | | | | | | | | | | | | |

Class | | Expected Ratings

(Fitch/Moody’s/KBRA)(1) | | Approximate

Initial Certificate

Balance or

Notional

Amount(2) | | Approx.

Initial

Credit

Support(3) | | Pass-

Through

Rate

Description | | Weighted

Average Life

(Years)(4) | | Expected Principal

Window(4) | | Certificate

Principal to

Value Ratio(5) | | Certificate

Principal

U/W NOI

Debt Yield(6) |

| | Offered Certificates | | | | | | | | | | | | | | |

A-1 | | AAA(sf)/Aaa(sf)/AAA(sf) | | $57,427,000 | | 30.000% | | (7) | | 2.30 | | 5/2012 – 7/2016 | | 41.8% | | 17.7% |

A-2 | | AAA(sf)/Aaa(sf)/AAA(sf) | | $136,818,000 | | 30.000% | | (7) | | 4.47 | | 7/2016 – 4/2017 | | 41.8% | | 17.7% |

A-3 | | AAA(sf)/Aaa(sf)/AAA(sf) | | $67,832,000 | | 30.000% | | (7) | | 7.20 | | 4/2017 – 6/2021 | | 41.8% | | 17.7% |

A-4 | | AAA(sf)/Aaa(sf)/AAA(sf) | | $385,428,000 | | 30.000% | | (7) | | 9.45 | | 6/2021 – 1/2022 | | 41.8% | | 17.7% |

A-S | | AAA(sf)/Aaa(sf)/AAA(sf) | | $100,595,000 | | 19.125% | | (7) | | 9.82 | | 1/2022 – 2/2022 | | 48.3% | | 15.3% |

B | | AA(sf)/Aa2(sf)/AA(sf) | | $42,781,000 | | 14.500% | | (7) | | 9.95 | | 2/2022 – 3/2022 | | 51.0% | | 14.5% |

| | | | | | | | |

| | Non-Offered Certificates | | | | | | | | | | | | | | |

X-A | | AAA(sf)/Aaa(sf)/AAA(sf) | | $748,100,000(8) | | N/A | | Variable(9) | | N/A | | N/A | | N/A | | N/A |

X-B | | NR/NR/NR | | $176,907,832(10) | | N/A | | Variable(11) | | N/A | | N/A | | N/A | | N/A |

C | | A(sf)/A2(sf)/A(sf) | | $31,219,000 | | 11.125% | | (7) | | 9.95 | | 3/2022 – 3/2022 | | 53.0% | | 14.0% |

D | | BBB-(sf)/Baa3(sf)/BBB-(sf) | | $47,407,000 | | 6.000% | | (7) | | 9.96 | | 3/2022 – 4/2022 | | 56.1% | | 13.2% |

E | | BB(sf)/Ba2(sf)/BB(sf) | | $13,875,000 | | 4.500% | | (7) | | 10.03 | | 4/2022 – 4/2022 | | 57.0% | | 13.0% |

F | | B(sf)/B2(sf)/B(sf) | | $13,875,000 | | 3.000% | | (7) | | 10.03 | | 4/2022 – 4/2022 | | 57.9% | | 12.8% |

G | | NR/NR/NR | | $27,750,832 | | 0.000% | | (7) | | 10.03 | | 4/2022 – 4/2022 | | 59.7% | | 12.4% |

Notes:

| | (1) | The expected ratings presented are those of Fitch, Inc. (“Fitch”), Moody’s Investors Service, Inc. (“Moody’s”) and Kroll Bond Rating Agency, Inc. (“KBRA”) which the depositor hired to rate the rated offered certificates. One or more other nationally recognized statistical ratings organizations that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), to rate or provide market reports and/or published commentary related to the offered certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical ratings organization would assign or that its reports will not express differing, possibly negative, views of the mortgage loans and/or the offered certificates. See “Risk Factors—Risks Related to the Offered Certificates—Ratings of the Certificates Have Substantial Limitations” and “Ratings” in the free writing prospectus, dated March 12, 2012 (the “Free Writing Prospectus”). |

| | (2) | The principal balances and notional amounts set forth in the table are approximate. The actual initial principal balances and notional amounts may be larger or smaller depending on the aggregate cut-off date principal balance of the mortgage loans definitively included in the pool of mortgage loans, which aggregate cut-off date principal balance may be as much as 5% larger or smaller than the amount presented in the Free Writing Prospectus. |

| | (3) | The approximate initial credit support with respect to the Class A-1, A-2, A-3 and A-4 Certificates represents the approximate credit enhancement for the Class A-1, A-2, A-3 and A-4 Certificates in the aggregate. |

| | (4) | Weighted Average Lives and Expected Principal Windows are calculated based on an assumed prepayment rate of 0% CPR and the “Structuring Assumptions” described under “Glossary” in the Free Writing Prospectus. |

| | (5) | The Certificate Principal to Value Ratio for each Class of Certificates (other than the Class A-1, A-2, A-3 and A-4 Certificates) is calculated by dividing the aggregate principal balance of such class of certificates and all classes of certificates senior to such class by the aggregate appraised value of $1,550,180,000 (calculated as described in the Free Writing Prospectus) of the mortgaged properties securing the mortgage loans. The Certificate Principal to Value Ratios for each of the Class A-1, A-2, A-3 and A-4 Certificates are calculated by dividing the aggregate principal balance of the Class A-1, A-2, A-3 and A-4 Certificates by such aggregate appraised value. However, excess mortgaged property value associated with a mortgage loan will not be available to offset losses on any other mortgage loan (unless such mortgage loans are cross-collateralized and the cross-collateralization remains in effect). |

| | (6) | The Certificate Principal U/W NOI Debt Yield for each Class of Certificates (other than the Class A-1, A-2, A-3 and A-4 Certificates) is calculated by dividing the underwritten net operating income for the mortgage pool of $114,804,775 (calculated as described in the Free Writing Prospectus) by the aggregate certificate balance of such class of certificates and all classes of certificates senior to such class of certificates. The Underwritten NOI Debt Yield for each of the Class A-1, A-2, A-3 and A-4 Certificates is calculated by dividing such mortgage pool underwritten net operating income by the aggregate principal balance of the Class A-1, A-2, A-3 and A-4 Certificates. However, cash flow from each mortgaged property supports only the related mortgage loan and will not be available to support any other mortgage loan (unless such mortgage loans are cross-collateralized and the cross-collateralization remains in effect). |

| | (7) | The pass-through rates for the Class A-1, A-2, A-3, A-4, A-S, B, C, D, E, F and G Certificates in each case will be one of the following: (i) a fixed rateper annum, (ii) the WAC Rate (as defined in the Free Writing Prospectus) for the related distribution date, (iii) a variable rateper annum equal to the lesser of (a) a fixed rate and (b) the WAC Rate for the related distribution date or (iv) a variable rateper annum equal to the WAC Rate for the related distribution date minus a specified percentage. |

| | (8) | The Class X-A Certificates are notional amount certificates. The Notional Amount of the Class X-A Certificates will be equal to the aggregate principal balance of the Class A-1, A-2, A-3, A-4 and A-S Certificates outstanding from time to time. The Class X-A Certificates will not be entitled to distributions of principal. |

| | (9) | The pass-through rate for the Class X-A Certificates for any distribution date will equal the excess, if any, of (a) the WAC Rate for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-1, A-2, A-3, A-4 and A-S Certificates for the related distribution date, weighted on the basis of their respective aggregate principal balances outstanding immediately prior to that distribution date. |

| | (10) | The Class X-B Certificates are notional amount certificates. The Notional Amount of the Class X-B Certificates will be equal to the aggregate principal balance of the Class B, C, D, E, F and G Certificates outstanding from time to time. The Class X-B Certificates will not be entitled to distributions of principal. |

| | (11) | The pass-through rate for the Class X-B Certificates for any distribution date will equal the excess, if any, of (a) the WAC Rate for the related distribution date, over (b) the weighted average of the pass-through rates on the Class B, C, D, E, F and G Certificates for the related distribution date, weighted on the basis of their respective aggregate principal balances outstanding immediately prior to that distribution date. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

3

WFRBS Commercial Mortgage Trust 2012-C6 | Transaction Highlights |

| II. | Transaction Highlights |

Mortgage Loan Sellers:

| | | | | | | | | | |

Mortgage Loan Seller | | Number of

Mortgage

Loans | | Number of

Mortgaged

Properties | | Aggregate Cut-off

Date Balance | | | % of Cut-off

Date Pool

Balance |

Wells Fargo Bank, National Association | | 35 | | 63 | | | $506,055,754 | | | 54.7% |

The Royal Bank of Scotland(1) | | 24 | | 26 | | | 210,002,034 | | | 22.7 |

Liberty Island Group I LLC | | 7 | | 11 | | | 85,439,504 | | | 9.2 |

C-III Commercial Mortgage LLC | | 17 | | 21 | | | 74,362,217 | | | 8.0 |

Basis Real Estate Capital II, LLC | | 6 | | 31 | | | 49,148,324 | | | 5.3 |

| | | | | | | | | | |

Total | | 89 | | 152 | | | $925,007,833 | | | 100.0% |

| | | | | | | | | | |

| (1) | The mortgage loan seller referred to herein as The Royal Bank of Scotland is comprised of two affiliated companies: The Royal Bank of Scotland plc and RBS Financial Products Inc. With respect to the mortgage loans being sold for the deposit into the trust by The Royal Bank of Scotland (a) Twenty (20) mortgage loans, having an aggregate cut-off date principal balance of $174,648,065 and representing 18.9% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date, are being sold for deposit into the trust only by The Royal Bank of Scotland plc and (b) Four (4) mortgage loans, having an aggregate cut-off date principal balance of $35,353,969 and representing 3.8% of the aggregate principal balance of the pool of mortgage loans as of the cut-off date are being sold for the deposit into the trust only by RBS Financial Products Inc. |

Loan Pool:

| | | | |

Cut-off Date Balance: | | $ | 925,007,833 | |

Number of Mortgage Loans: | | | 89 | |

Average Cut-off Date Balance per Mortgage Loan: | | | $10,393,346 | |

Number of Mortgaged Properties: | | | 152 | |

Average Cut-off Date Balance per Mortgaged Property(1): | | | $6,085,578 | |

Weighted Average Mortgage Interest Rate: | | | 5.598% | |

Ten Largest Mortgage Loans as % of Cut-off Date Pool Balance: | | | 37.5% | |

Weighted Average Original Term to Maturity (months): | | | 111 | |

Weighted Average Remaining Term to Maturity (months): | | | 106 | |

Weighted Average Original Amortization Term (months)(2): | | | 332 | |

Weighted Average Remaining Amortization Term (months)(2): | | | 329 | |

Weighted Average Seasoning (months): | | | 5 | |

| (1) | Information regarding mortgage loans secured by multiple properties (other than through cross-collateralization with other mortgage loans) is based on an allocation according to relative appraised values or the allocated loan amounts or property-specific release prices set forth in related loan documents. Information regarding mortgage loans that are cross-collateralized with other mortgage loans is based upon the individual loan balances, except that the applicable loan-to-value ratio, debt service coverage ratio or debt yield for each such mortgage loan is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group. On an individual basis, without regard to the cross-collateralization feature, any mortgage loan that is part of a cross-collateralized group of mortgage loans may have a higher loan-to-value ratio, lower debt service coverage ratio and/or lower debt yield than is presented herein. |

| (2) | Excludes any mortgage loan that does not amortize. |

Credit Statistics:

| | | | |

Weighted Average U/W Net Cash Flow DSCR(1): | | | 1.58x | |

Weighted Average U/W Net Operating Income Debt Yield Ratio(1): | | | 12.4% | |

Weighted Average Cut-off Date Loan-to-Value Ratio(1): | | | 61.1% | |

Weighted Average Balloon Loan-to-Value Ratio(1): | | | 51.2% | |

% of Mortgage Loans with Additional Debt: | | | 2.3% | |

% of Mortgage Loans with Single Tenants(2): | | | 12.8% | |

| | (1) | Information regarding mortgage loans secured by multiple properties (other than through cross-collateralization with other mortgage loans) is based on an allocation according to relative appraised values or the allocated loan amounts or property-specific release prices set forth in related loan documents. Information regarding mortgage loans that are cross- collateralized with other mortgage loans is based upon the individual loan balances, except that the applicable loan-to-value ratio, debt service coverage ratio or debt yield for each such mortgage loan is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group. On an individual basis, without regard to the cross-collateralization feature, any mortgage loan that is part of a cross-collateralized group of mortgage loans may have a higher loan-to-value ratio, lower debt service coverage ratio and/or lower debt yield than is presented herein. |

| | (2) | Excludes mortgage loans that are secured by multiple single-tenant properties. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

4

WFRBS Commercial Mortgage Trust 2012-C6 | Transaction Highlights |

Loan Structural Features:

Amortization: Based on the Cut-off Date Balance, 99.0% of the mortgage pool (88 mortgage loans) has scheduled amortization, as follows:

79.2% (82 mortgage loans) requires amortization during the entire loan term

19.8% (6 mortgage loans) provides for an interest-only period followed by an amortization period

Interest-Only: Based on the Cut-off Date Balance, 1.0% of the mortgage pool (1 mortgage loan) provides for interest-only payments during the entire loan term.

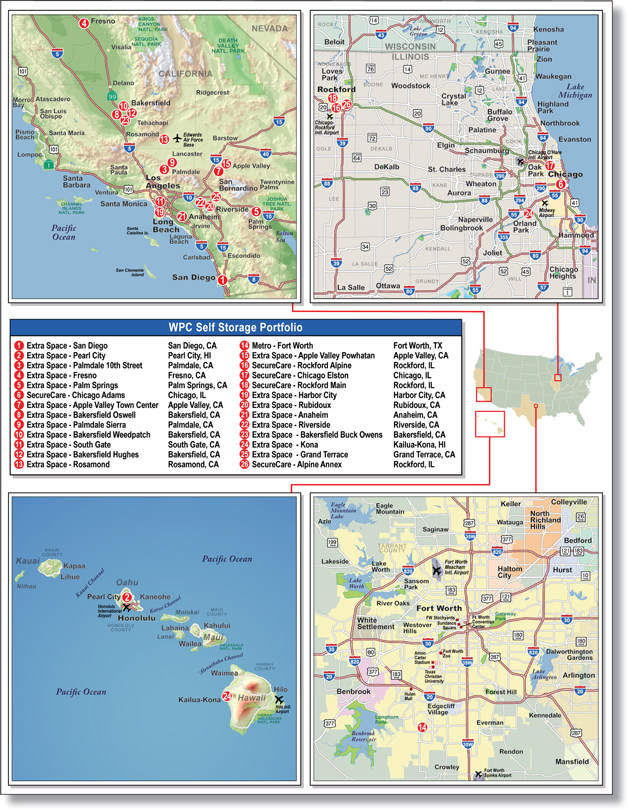

Hard Lockboxes(1): Based on the Cut-off Date Balance, 53.0% of the mortgage pool (29 mortgage loans) has hard lockboxes in place.

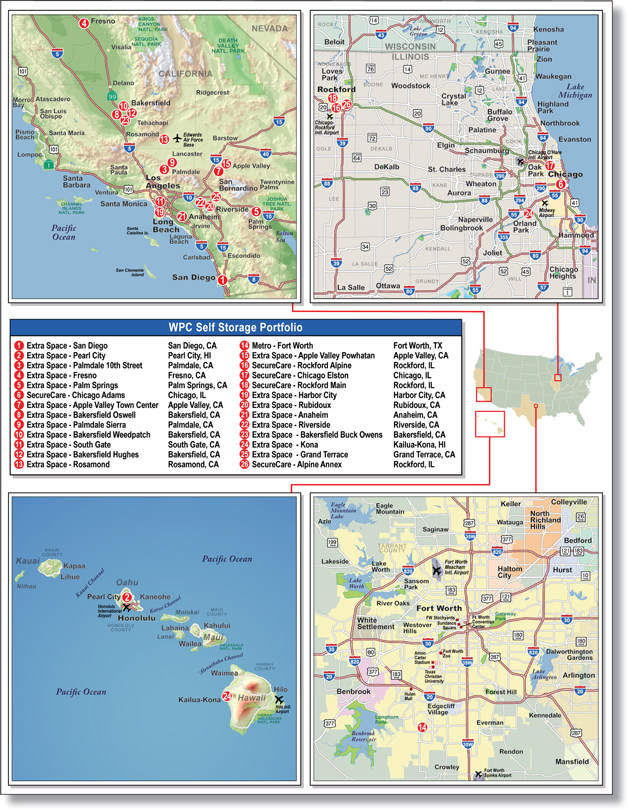

| | (1) | With respect to the WPC Self Storage Portfolio, 25 of the underlying properties are subject to hard lockboxes with springing cash management; one property, Metro - Forth Worth, is subject to a soft lockbox with springing cash management. With respect to Parrish Portfolio, 2 of the underlying properties have soft lockboxes with springing cash management and the third property has soft lockbox with upfront cash management. Please refer to Annex A-1 for further details. |

Reserves: The mortgage loans require amounts to be escrowed monthly as follows (excluding any mortgage loans with springing provisions):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Real Estate Taxes: | | | 81.7% of the pool | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Insurance Premiums: | | | 71.1% of the pool | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Capital Replacements: | | | 89.2% of the pool | | | | | | | | | | | | | | | | | | | | | | | | | | | |

TI/LC: | | | 69.3% of the pool | * | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

* The percentage of Cut-off Date Balance for loans with TI/LC reserves is based on the aggregate principal balance allocable to office, retail, mixed-use and industrial properties. | | | | | | | | | | | | | | | | | | | | | | | | |

Call Protection/Defeasance: Based on the Cut-off Date Balance, the mortgage pool has the following call protection and defeasance features:

89.3% of the mortgage pool (75 mortgage loans) features a lockout period, then defeasance only until an open period

10.7% of the mortgage pool (14 mortgage loans) features a lockout period, then the greater of a prepayment premium or yield maintenance until an open period

Please refer to Annex A-1 to the Free Writing Prospectus for further description of individual loan call protection.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

5

WFRBS Commercial Mortgage Trust 2012-C6 | Issue Characteristics |

| III. | Issue Characteristics |

Securities Offered: | $790,881,000 approximate monthly pay, multi-class, commercial mortgage REMIC pass-through certificates consisting of six classes (Classes A-1, A-2, A-3, A-4, A-S and B), which are offered pursuant to a registration statement filed with the SEC. |

Mortgage Loan Sellers: | Wells Fargo Bank, National Association (“WFB”); The Royal Bank of Scotland (“RBS”); Liberty Island Group I LLC (“LIG I”); C-III Commercial Mortgage LLC (“CIIICM”); and Basis Real Estate Capital II, LLC (“Basis”). |

Co-lead Bookrunning

Managers: | Wells Fargo Securities, LLC and RBS Securities Inc. |

Co-Manager: | Citigroup Global Markets Inc. |

Rating Agencies: | Fitch, Inc., Moody’s Investors Service, Inc. and Kroll Bond Rating Agency, Inc. |

Master Servicer: | Wells Fargo Bank, National Association |

Special Servicer: | Midland Loan Services, a division of PNC Bank, National Association |

Certificate Administrator: | Wells Fargo Bank, National Association |

Trustee: | Deutsche Bank Trust Company Americas |

Trust Advisor: | Pentalpha Surveillance LLC |

Cut-off Date: | The Cut-off Date with respect to each mortgage loan is the due date for the monthly debt service payment that is due in April 2012 (or, in the case of any mortgage loan that has its first due date in May 2012, the date that would have been its due date in April 2012 under the terms of that mortgage loan if a monthly debt service payment were scheduled to be due in that month). |

Expected Closing Date: | On or about April 4, 2012. |

Determination Dates: | The 11th day of each month (or if that day is not a business day, the next succeeding business day), commencing in May 2012. |

Distribution Dates: | The fourth business day following the Determination Date in each month, commencing in May 2012. |

Rated Final Distribution

Date: | The Distribution Date in April 2045. |

Interest Accrual Period: | With respect to any Distribution Date, the calendar month preceding the month in which such Distribution Date occurs. |

Day Count: | The Offered Certificates will accrue interest on a 30/360 basis. |

Minimum

Denominations: | $25,000 for each Class of Offered Certificates. Investments may also be made in any whole dollar denomination in excess of the applicable minimum denomination. |

Delivery: | DTC, Euroclear and Clearstream Banking |

ERISA/SMMEA Status: | Each Class of Offered Certificates is expected to be eligible for exemptive relief under ERISA. No Class of Offered Certificates will be SMMEA eligible. |

Risk Factors: | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. SEE THE “RISK FACTORS” SECTION OF THE FREE WRITING PROSPECTUS. |

Bond Analytics Information: | The Certificate Administrator will generally be required to make distribution date settlements, CREFC reports and certain supplemental reports (other than confidential information) available to certain financial modeling and data provision services, including Bloomberg L.P., Trepp LLC, Intex Solutions, Inc., Markit Group Limited and BlackRock Financial Management Inc. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

6

WFRBS Commercial Mortgage Trust 2012-C6 | Characteristics of the Mortgage Pool |

| IV. | Characteristics of the Mortgage Pool |

| A. | Ten Largest Mortgage Loans |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Mortgage

Loan

Seller | | Mortgage Loan Name | | City | | State | | Number of

Mortgage Loans /

Mortgaged

Properties | | Mortgage Loan

Cut-off Date

Balance ($) | | | % of Cut-off

Date Balance

(%) | | Property Type | | Number of

SF, Rooms

or Pads | | | Cut-off Date

Balance Per

SF, Room or

Pad ($) | | Cut-off Date

LTV Ratio

(%) | | Balloon

LTV Ratio

(%) | | U/W NCF

DSCR (x) | | U/W NOI

Debt Yield

(%) |

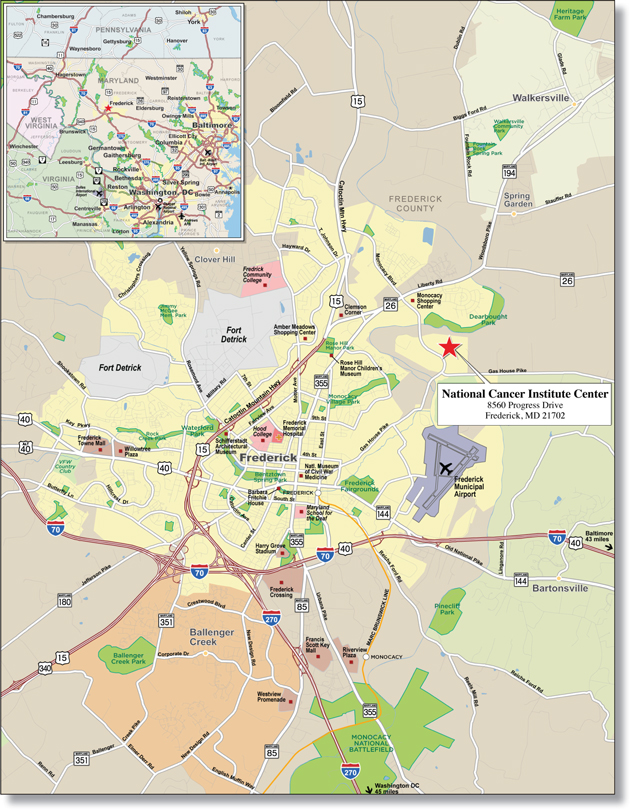

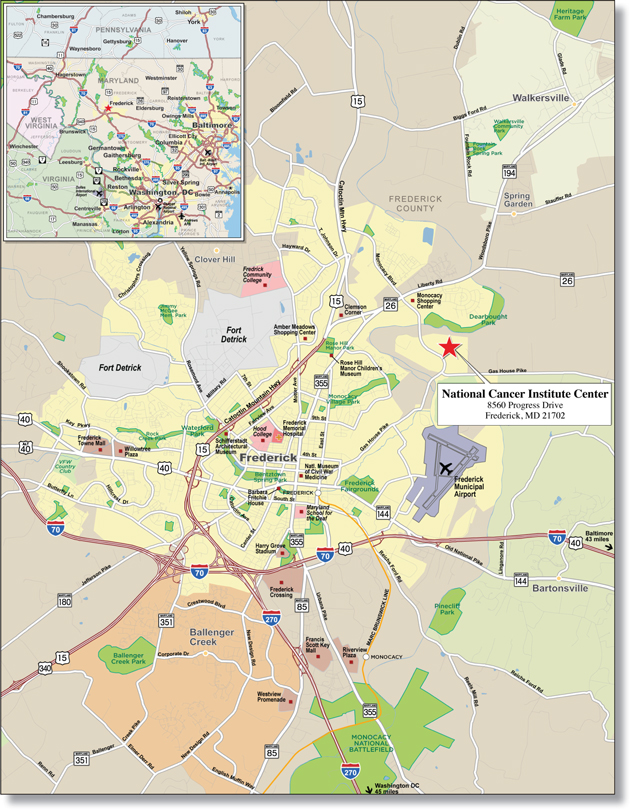

WFB | | National Cancer Institute Center | | Frederick | | MD | | 1 / 1 | | | $76,500,000 | | | 8.3% | | Office | | | 341,271 | | | $224 | | 61.7% | | 51.2% | | 1.30x | | 10.2% |

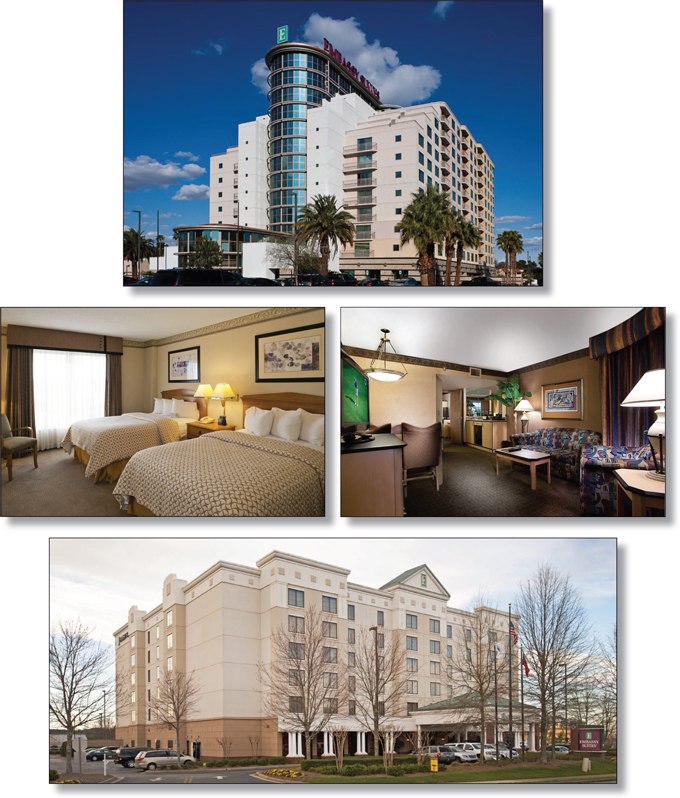

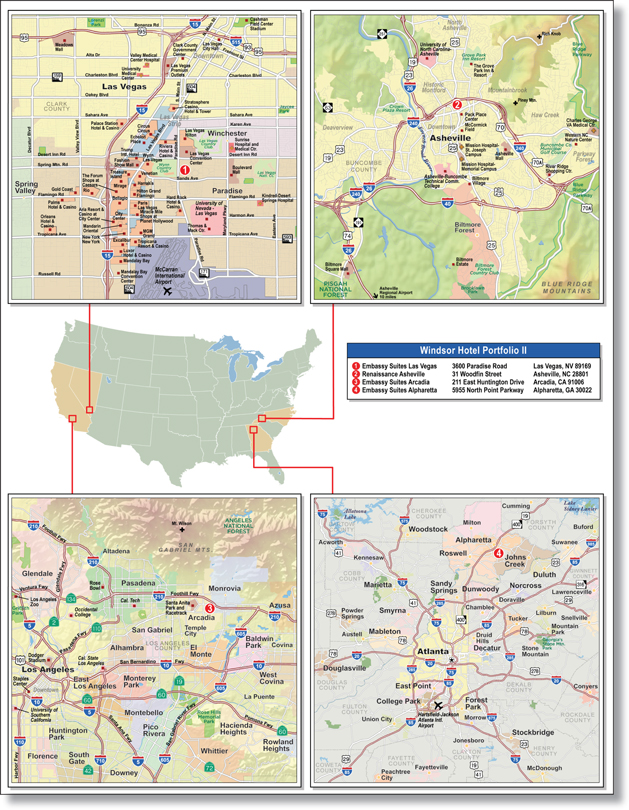

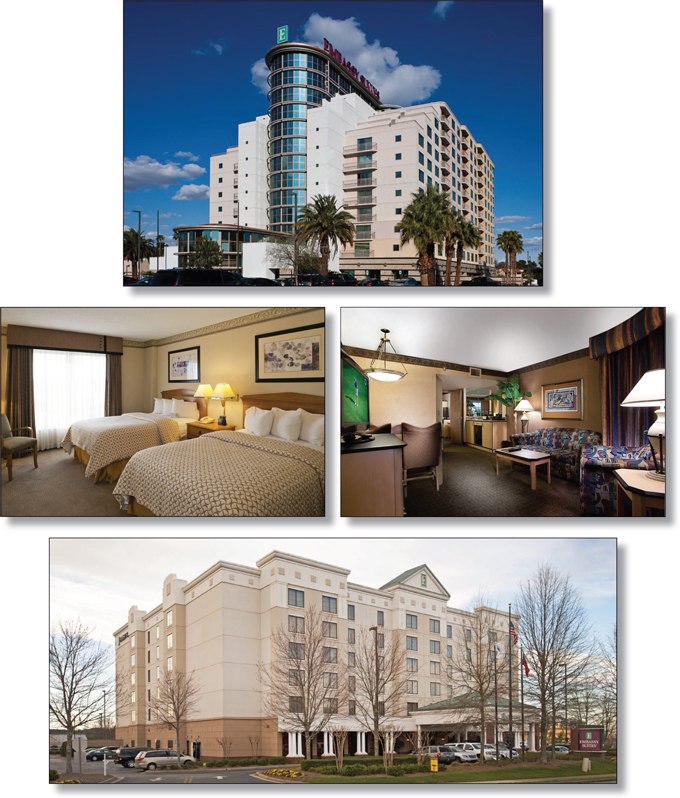

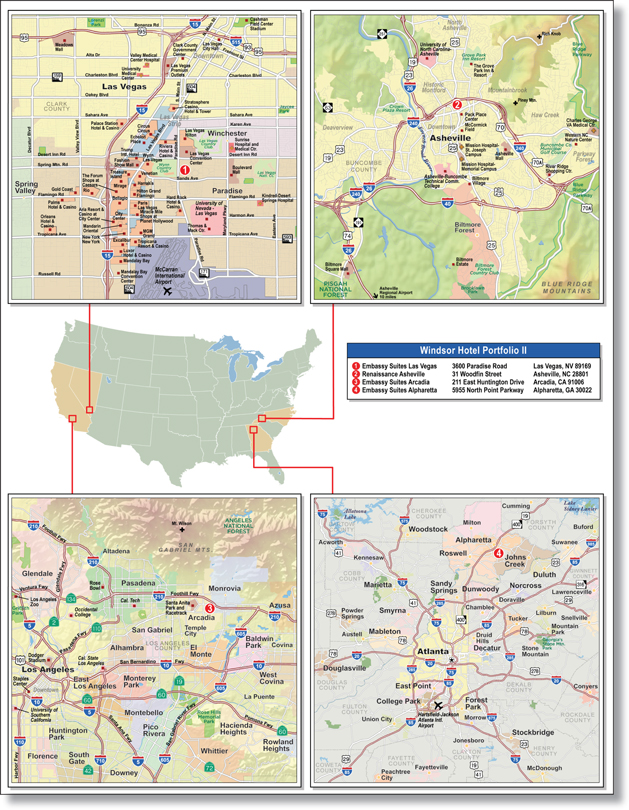

WFB | | Windsor Hotel Portfolio II | | Various | | Various | | 1 / 4 | | | 67,279,272 | | | 7.3 | | Hospitality | | | 901 | | | 74,672 | | 59.9 | | 54.5 | | 1.66 | | 14.7 |

WFB | | WPC Self Storage Portfolio | | Various | | Various | | 1 / 26 | | | 48,157,500 | | | 5.2 | | Self Storage | | | 1,718,350 | | | 28 | | 49.1 | | 45.4 | | 1.84 | | 12.9 |

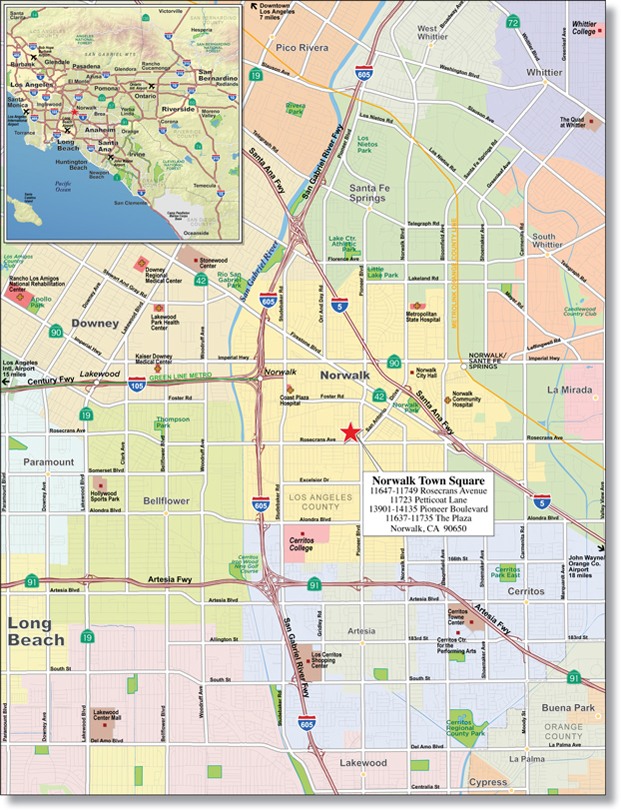

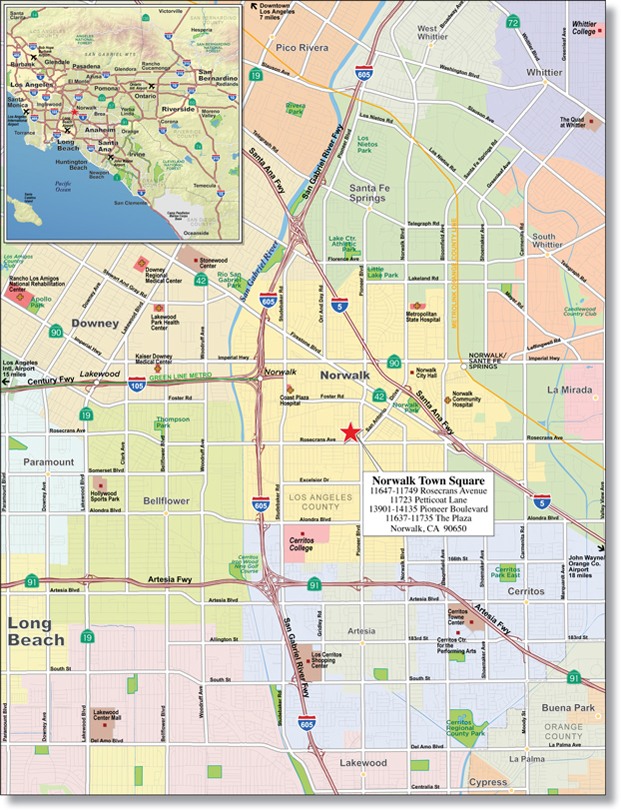

WFB | | Norwalk Town Square | | Norwalk | | CA | | 1 / 1 | | | 27,259,020 | | | 2.9 | | Retail | | | 232,987 | | | 117 | | 58.6 | | 49.0 | | 1.64 | | 11.8 |

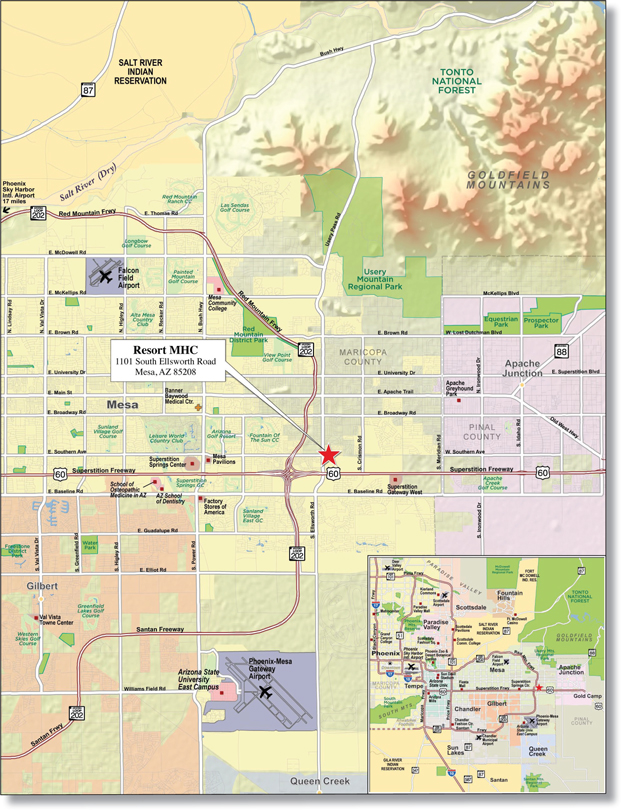

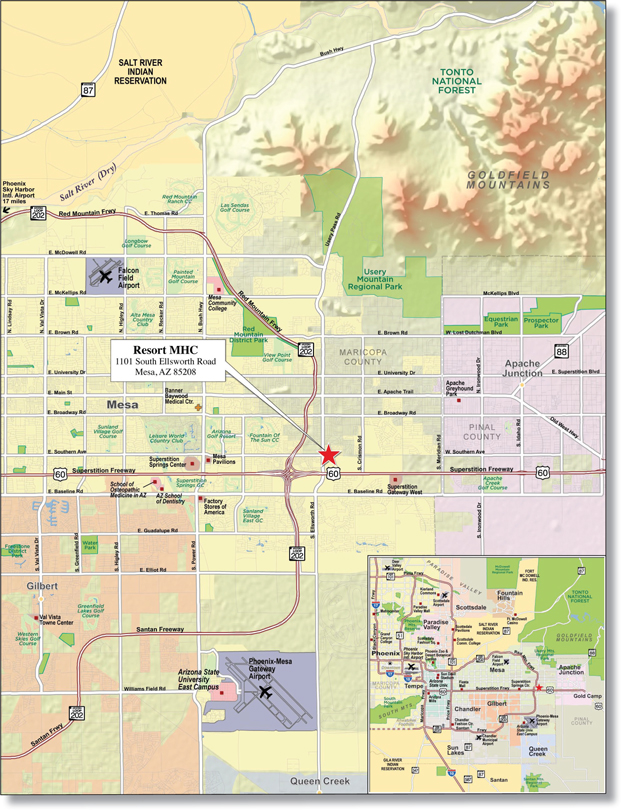

WFB | | Resort MHC | | Mesa | | AZ | | 1 / 1 | | | 22,801,387 | | | 2.5 | | Manufactured Housing Community | | | 791 | | | 28,826 | | 74.1 | | 62.1 | | 1.51 | | 10.3 |

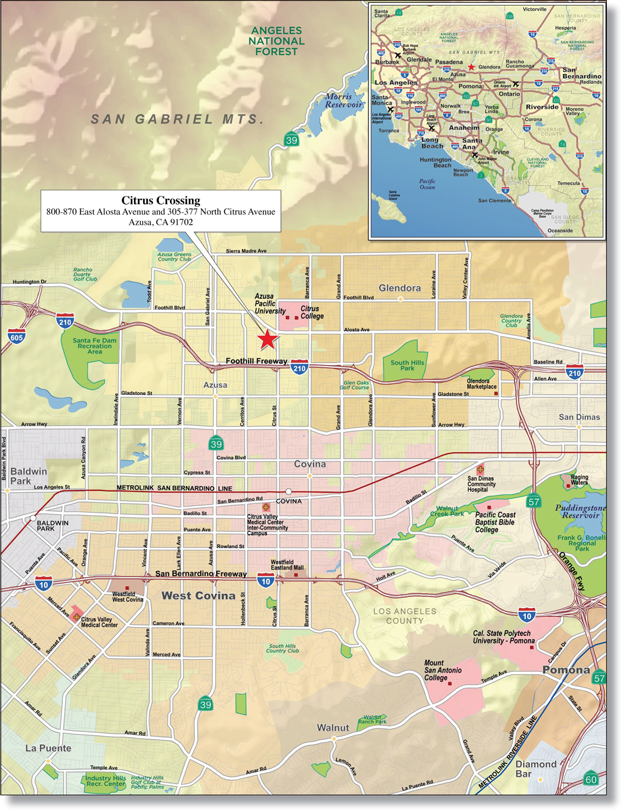

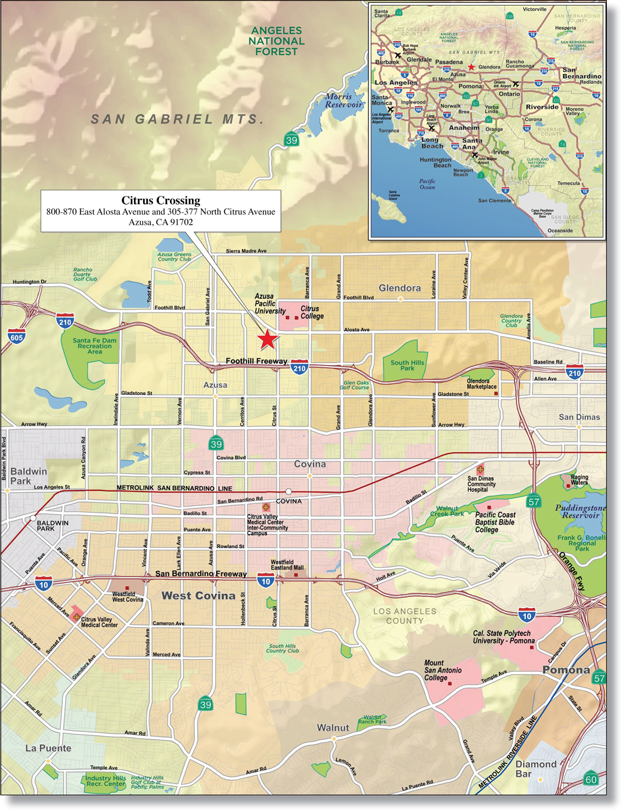

WFB | | Citrus Crossing | | Azusa | | CA | | 1 / 1 | | | 22,307,737 | | | 2.4 | | Retail | | | 172,533 | | | 129 | | 54.4 | | 45.6 | | 1.54 | | 11.5 |

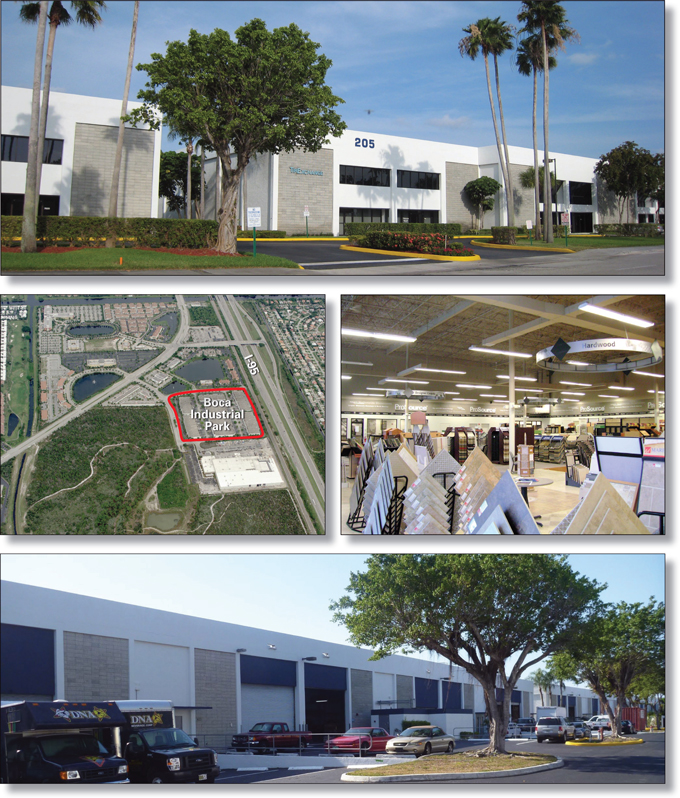

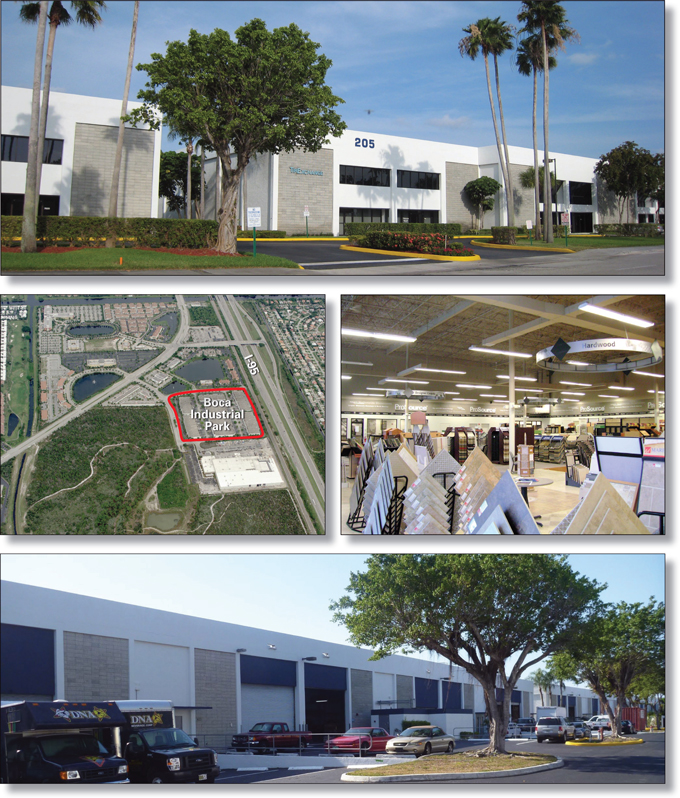

WFB | | Boca Industrial Park | | Boca Raton | | FL | | 1 / 1 | | | 22,250,000 | | | 2.4 | | Industrial | | | 386,846 | | | 58 | | 60.3 | | 55.7 | | 1.59 | | 11.5 |

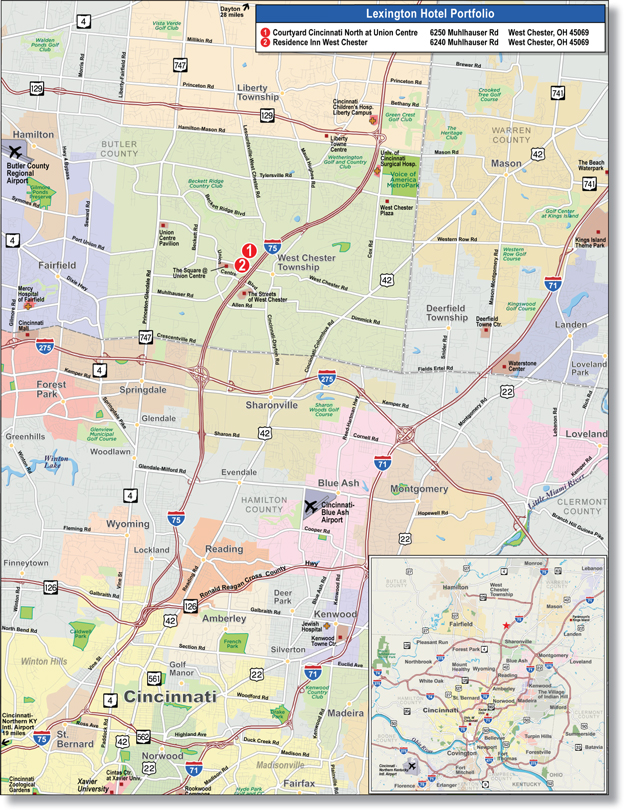

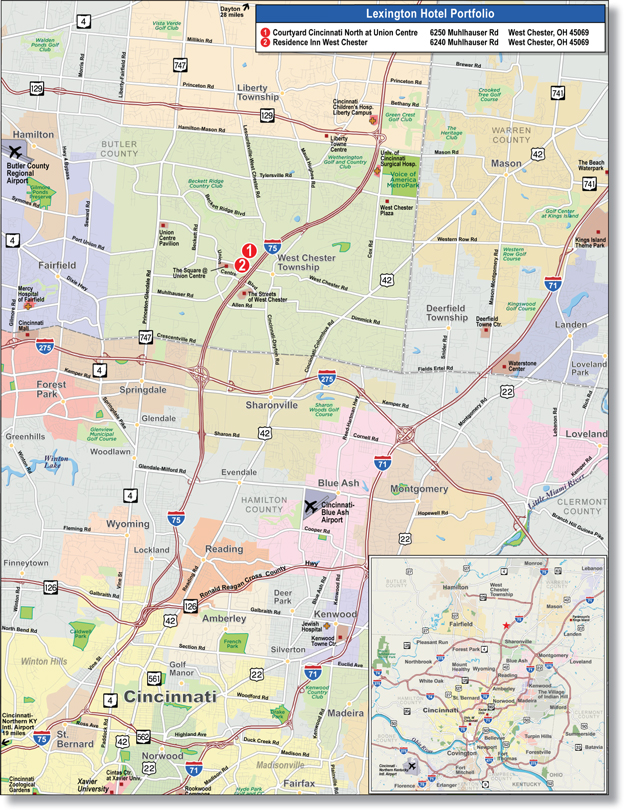

RBS | | Lexington Hotel Portfolio | | West Chester | | OH | | 1 / 2 | | | 20,473,784 | | | 2.2 | | Hospitality | | | 226 | | | 90,592 | | 60.4 | | 46.8 | | 1.58 | | 13.7 |

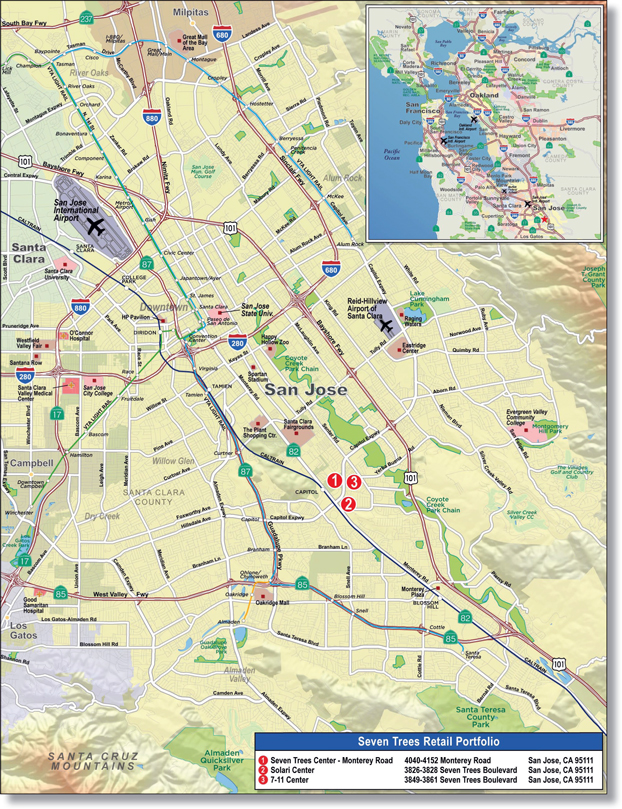

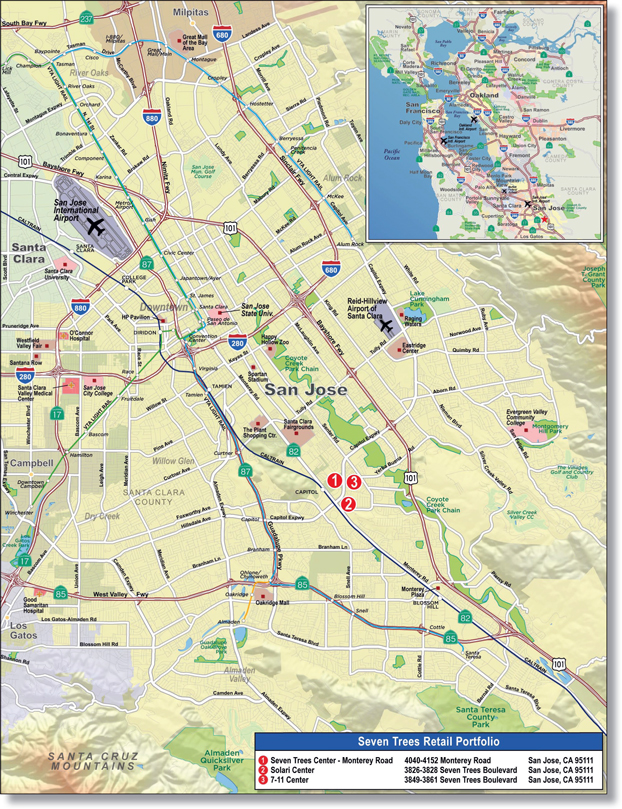

LIG I | | Seven Trees Retail Portfolio | | San Jose | | CA | | 1 / 3 | | | 19,958,826 | | | 2.2 | | Retail | | | 156,085 | | | 128 | | 46.0 | | 38.9 | | 1.74 | | 13.6 |

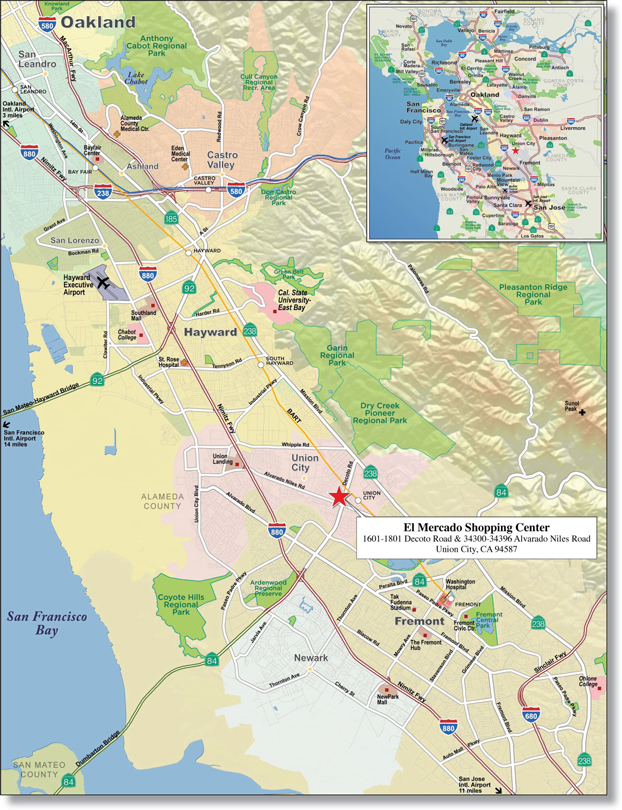

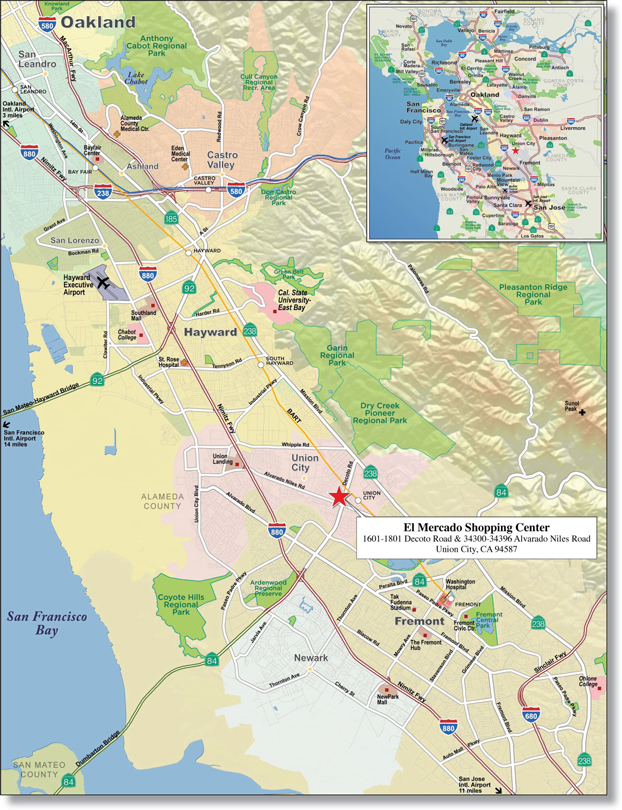

LIG I | | El Mercado Shopping Center | | Union City | | CA | | 1 / 1 | | | 19,941,865 | | | 2.2 | | Retail | | | 109,468 | | | 182 | | 55.7 | | 47.2 | | 1.49 | | 11.6 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Top Three Total / Weighted Average | | | | 3 / 31 | | | $191,936,772 | | | 20.7% | | | | | | | | | | 57.9% | | 50.9% | | 1.56x | | 12.5% |

Top Five Total / Weighted Average | | | | 5 / 33 | | | $241,997,178 | | | 26.2% | | | | | | | | | | 59.5% | | 51.7% | | 1.57x | | 12.2% |

Top Ten Total / Weighted Average | | | | 10 / 41 | | | $346,929,390 | | | 37.5% | | | | | | | | | | 58.3% | | 50.3% | | 1.57x | | 12.2% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| B. | Mortgage Loans with Additional Secured and Mezzanine Financing(1) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Loan No. | | Mortgage Loan Seller | | Mortgage Loan Name | | Mortgage

Loan

Cut-off Date

Balance ($) | | | % of Cut-

off Date

Balance

(%) | | Non-Trust

Mortgage Loan

Cut-off Date

Balance ($) | | | Mezzanine

Debt Cut-off

Date Balance

($) | | Total Debt

Interest

Rate (%) | | Mortgage

Loan

U/W NCF

DSCR (x) | | Total Debt

U/W NCF

DSCR (x) | | Mortgage

Loan Cut-

off Date

U/W NOI

Debt Yield

(%) | | Total Debt

Cut-off Date

U/W NOI

Debt Yield

(%) | | Mortgage

Loan Cut-off

Date LTV

Ratio (%) | | Total Debt

Cut-off

Date LTV

Ratio (%) |

14 | | WFB | | Claremont Village Square(2) | | | $15,049,818 | | | 1.6% | | | $1,243,000 | | | $0 | | 4.832% | | 1.67x | | 1.67x | | 12.2% | | 11.3% | | 43.4% | | 47.0% |

53 | | WFB | | Elks Building(3) | | | 6,419,098 | | | 0.7 | | | 850,000 | | | 0 | | 4.687 | | 1.58 | | 1.58 | | 13.6 | | 12.0 | | 57.3 | | 64.9 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Total/Weighted Average | | | $21,468,916 | | | 2.3% | | | $2,093,000 | | | $0 | | | | 1.64x | | 1.64x | | 12.6% | | 11.5% | | 47.6% | | 52.4% |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | In addition, the borrowers under certain of the mortgage loans also have incurred unsecured additional debt as described in the Free Writing Prospectus. |

| (2) | The subordinate debt is secured by the mortgaged property. The secured subordinate debt requires payments to the subordinate lender from time to time only to the extent of a specified portion of cash available taking into account all debts, liabilities and obligations of the borrower then due or net insurance proceeds, condemnation proceeds or sale or refinancing proceeds after repayment of other outstanding debt. Each of the Total Debt Interest Rate and Total Debt U/W NCF DSCR for the mortgage loan and the secured subordinate debt presented in the table is the same as that for the mortgage loan only. |

| (3) | The subordinate debt is secured by the mortgaged property. The secured subordinate debt bears no interest and requires periodic payments of principal before maturity only to the extent that a restaurant operated on the premises generates income in excess of specified thresholds. Each of the Total Debt Interest Rate and Total Debt U/W NCF DSCR for the mortgage loan and the secured subordinate debt presented in the table is the same as that for the mortgage loan only. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

7

WFRBS Commercial Mortgage Trust 2012-C6 | Characteristics of the Mortgage Pool |

| C. | Previous Securitization History(1) |

| | | | | | | | | | | | | | | | | | |

Loan No. | | Mortgage

Loan Seller | | Mortgage

Loan Name | | City | | State | | Property

Type | | Mortgage Loan

Cut-off Date

Balance ($) | | | % of Cut-off

Date Balance

(%) | | Previous Securitization |

| 2 | | WFB | | Windsor Hotel Portfolio II | | Various | | Various | | Hospitality | | | $67,279,272 | | | 7.3% | | GMACC 2005-C1 |

| 4 | | WFB | | Norwalk Town Square | | Norwalk | | CA | | Retail | | | 27,259,020 | | | 2.9 | | CCMSC 1997-2 |

| 7 | | WFB | | Boca Industrial Park | | Boca Raton | | FL | | Industrial | | | 22,250,000 | | | 2.4 | | GMACC 2002-C1 |

| 10 | | LIG I | | El Mercado Shopping Center | | Union City | | CA | | Retail | | | 19,941,865 | | | 2.2 | | JPMCC 2003-ML1A |

| 11 | | Basis | | Sunwest Portfolio | | Various | | Various | | Retail | | | 19,500,000 | | | 2.1 | | ASC 1997-D4 |

| 13 | | WFB | | Williams Centre Plaza | | Tucson | | AZ | | Retail | | | 16,605,456 | | | 1.8 | | CSFB 2005-C5 |

| 15 | | RBS | | Commerce Park IV & V | | Beachwood | | OH | | Office | | | 14,985,810 | | | 1.6 | | BACM 2002-PB2 |

| 22 | | RBS | | Hulen Bend Shopping Center | | Fort Worth | | TX | | Retail | | | 13,061,681 | | | 1.4 | | FULBA 1998-C2 |

| 24 | | RBS | | Summerhill Marketplace | | East

Brunswick | | NJ | | Retail | | | 12,173,719 | | | 1.3 | | BSCMS 2005-PWR9 |

| 26 | | RBS | | Santa Rosa Southside | | Santa Rosa | | CA | | Retail | | | 11,400,000 | | | 1.2 | | GMACC 2002-C2 |

| 27 | | RBS | | Buford Plaza | | Doraville | | GA | | Retail | | | 10,985,545 | | | 1.2 | | MSC 2004-HQ3 |

| 33 | | RBS | | Southland Plaza | | San Diego | | CA | | Retail | | | 9,500,000 | | | 1.0 | | BSCMS 2004-T14 |

| 34 | | LIG I | | Lottsford Business Center | | Upper

Marlboro | | MD | | Office | | | 9,200,000 | | | 1.0 | | GMACC 2002-C2 |

| 42 | | WFB | | Hilton Garden Inn - Denver Airport | | Aurora | | CO | | Hospitality | | | 7,913,148 | | | 0.9 | | BACM 2006-4 |

| 45 | | WFB | | 64th & Greenway | | Phoenix | | AZ | | Retail | | | 7,550,000 | | | 0.8 | | SBM7 2001-C2(2) |

| 52 | | RBS | | Grande Pointe Apartments | | Jacksonville | | FL | | Multifamily | | | 6,465,992 | | | 0.7 | | CSFB 1998-C2 |

| 55 | | CIIICM | | Crossings at Roswell | | Roswell | | GA | | Retail | | | 3,357,178 | | | 0.4 | | GECMC 2003-C2 |

| 56 | | CIIICM | | Cumberland Place | | Smyrna | | GA | | Retail | | | 2,797,649 | | | 0.3 | | LBUBS 2004-C2 |

| 57 | | WFB | | Natomas Self Storage | | Sacramento | | CA | | Self Storage | | | 5,959,466 | | | 0.6 | | CSFB 2002-CKP1 |

| 58 | | CIIICM | | LaCarreta | | Miami | | FL | | Retail | | | 5,733,807 | | | 0.6 | | GMACC 2002-C1 |

| 59 | | RBS | | Shady Grove Shopping Center | | Irving | | TX | | Retail | | | 5,476,530 | | | 0.6 | | BACM 2001-1 |

| 61 | | WFB | | Van Buren Estates | | Belleville | | MI | | Manufactured Housing Community | | | 4,691,556 | | | 0.5 | | JPMCC 2001-C1 |

| 62 | | RBS | | All Storage Mesquite | | Mesquite | | TX | | Self Storage | | | 3,013,632 | | | 0.3 | | BACM 2002-2 |

| 64 | | CIIICM | | King’s Row MHC | | Houston | | TX | | Manufactured Housing Community | | | 4,481,943 | | | 0.5 | | BACM 2002-2 |

| 67 | | RBS | | Shoppes at Garland | | Garland | | TX | | Retail | | | 2,492,764 | | | 0.3 | | BACM 2001-PB1 |

| 70 | | CIIICM | | Walker Plaza | | Walker | | LA | | Retail | | | 3,986,102 | | | 0.4 | | JPMCC 2005-CB11 |

| 72 | | CIIICM | | Parkway 3&4 | | Virginia

Beach | | VA | | Industrial | | | 3,803,723 | | | 0.4 | | MSC 1997-C1 |

| 76 | | Basis | | Canton Center Crossing | | Canton

Township | | MI | | Retail | | | 3,146,097 | | | 0.3 | | MSC 2005-HQ7 |

| 80 | | Basis | | Westfield Ridge Apartments | | Humble | | TX | | Multifamily | | | 2,466,659 | | | 0.3 | | GMACC 2002-C2 |

| 82 | | CIIICM | | Northwest Self Storage | | Fort Worth | | TX | | Self Storage | | | 2,150,000 | | | 0.2 | | BSCMS 2006-T22 |

| 83 | | CIIICM | | Leisure Living MHC | | Fort Worth | | TX | | Manufactured Housing Community | | | 2,116,198 | | | 0.2 | | LBUBS 2002-C1 |

| 87 | | CIIICM | | Apple Valley MHC | | Fort Wayne | | IN | | Manufactured Housing Community | | | 1,500,000 | | | 0.2 | | BACM 2006-4 |

| 89 | | CIIICM | | Kirkwood MHC | | Binghamton | | NY | | Manufactured Housing Community | | | 1,468,823 | | | 0.2 | | JPMCC 2002-CIB4 |

| | | | | | | | | | | | | | | | | | |

| | | | Total | | | | | | | | | $334,713,635 | | | 36.2% | | |

| | | | | | | | | | | | | | | | | | |

| (1) | The table above represents the most recent securitization with respect to the mortgaged property securing the related mortgage loan, based on information provided by the related borrower or obtained through searches of a third-party database. The information has not otherwise been confirmed by the mortgage loan sellers. |

| (2) | The shop space at the subject property (not including the Fry’s parcel) was securitized in SBM7 2001-C2. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

8

WFRBS Commercial Mortgage Trust 2012-C6 | Characteristics of the Mortgage Pool |

| D. | Mortgage Loans with Scheduled Balloon Payments and Related Classes |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Class A-2(1) |

Loan No. | | Mortgage

Loan

Seller | | Mortgage Loan Name | | State | | Property Type | | Mortgage Loan

Cut-off Date

Balance ($) | | | % of

Cut-off

Date

Balance

(%) | | Mortgage Loan

Balance at

Maturity ($) | | | % of Class

A-2

Certificate

Principal

Balance

(%) | | SF/

Rooms/

Pads/

Units | | Loan

per SF/

Room/

Pad/

Unit | | U/W NCF

DSCR (x) | | U/W NOI

Debt Yield

(%) | | Cut-off

Date LTV

Ratio

(%) | | Balloon

LTV Ratio

(%) | | Rem. IO

Period

(mos.) | | Rem.

Term to

Maturity

(mos.) |

| 2 | | WFB | | Windsor Hotel Portfolio II | | Various | | Hospitality | | | $67,279,272 | | | 7.3% | | | $61,194,328 | | | 49.2% | | 901 | | $74,672 | | 1.66x | | 14.7% | | 59.9% | | 54.5% | | 0 | | 51 |

| 17 | | WFB | | Pyramid Office | | TX | | Office | | | 14,832,658 | | | 1.6 | | | 13,387,679 | | | 10.8 | | 218,836 | | 68 | | 1.51 | | 13.5 | | 55.3 | | 50.0 | | 0 | | 53 |

| 19 | | Basis | | Holiday Inn Maingate East | | FL | | Hospitality | | | 14,000,000 | | | 1.5 | | | 12,743,833 | | | 10.2 | | 444 | | 31,532 | | 1.58 | | 13.7 | | 54.7 | | 49.8 | | 0 | | 60 |

| 23 | | WFB | | Hacienda MHC | | CA | | Manufactured Housing Community | | | 12,878,295 | | | 1.4 | | | 11,974,706 | | | 9.4 | | 149 | | 86,432 | | 1.40 | | 9.1 | | 70.4 | | 65.5 | | 0 | | 52 |

| 36 | | CIIICM | | Florida Hotel Portfolio | | FL | | Hospitality | | | 9,092,762 | | | 1.0 | | | 8,311,993 | | | 6.6 | | 228 | | 39,881 | | 1.70 | | 15.8 | | 56.1 | | 51.3 | | 0 | | 58 |

| 42 | | WFB | | Hilton Garden Inn - Denver Airport | | CO | | Hospitality | | | 7,913,148 | | | 0.9 | | | 7,349,879 | | | 5.8 | | 157 | | 50,402 | | 2.10 | | 16.1 | | 39.6 | | 36.7 | | 0 | | 51 |

| 45 | | WFB | | 64th & Greenway | | AZ | | Retail | | | 7,550,000 | | | 0.8 | | | 7,073,737 | | | 5.5 | | 79,903 | | 94 | | 1.25 | | 10.3 | | 66.2 | | 62.1 | | 13 | | 55 |

| 81 | | WFB | | High Cliff Estates MHP | | IL | | Manufactured Housing Community | | | 2,341,619 | | | 0.3 | | | 2,145,230 | | | 1.7 | | 224 | | 10,454 | | 1.61 | | 13.4 | | 64.9 | | 59.4 | | 0 | | 54 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Total/Weighted Average | | | | | | | $135,887,755 | | | 14.7% | | | $124,181,386 | | | 99.3% | | | | | | 1.62x | | 13.8% | | 58.9% | | 53.8% | | 1 | | 53 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | The table above presents the mortgage loans whose balloon payments would be applied to pay down the principal balance of the Class A-2 Certificates, assuming a 0% CPR and applying the “Structuring Assumptions” described in the Free Writing Prospectus, including the assumptions that (i) none of the mortgage loans in the pool experience prepayments, defaults or losses; (ii) there are no extensions of maturity dates of any mortgage loans in the pool; and (iii) each mortgage loan in the pool is paid in full on its stated maturity date. Each class of Certificates, including the Class A-2 Certificates, evidences undivided ownership interests in the entire pool of mortgage loans. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

9

WFRBS Commercial Mortgage Trust 2012-C6 | Characteristics of the Mortgage Pool |

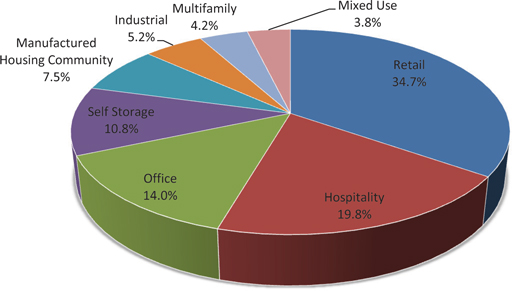

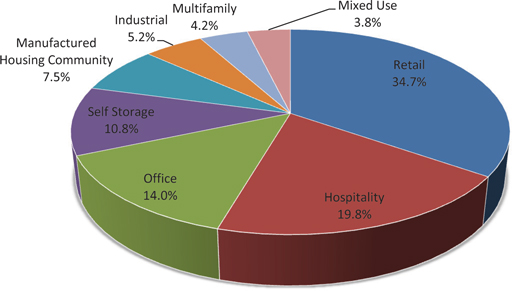

| E. | Property Type Distribution |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Property Type | | Number of

Mortgaged

Properties | | Aggregate Cut-

off Date

Balance ($)(1) | | | % of

Cut-off

Date

Balance

(%) | | | Weighted

Average

Cut-off

Date LTV

Ratio (%) | | | Weighted

Average

Balloon

LTV Ratio

(%) | | | Weighted

Average

U/W NCF

DSCR (x) | | | Weighted

Average

U/W NOI

Debt

Yield (%) | | | Weighted

Average

U/W NCF

Debt

Yield (%) | | | Weighted

Average

Mortgage

Rate (%) | |

Retail | | 60 | | | $321,169,891 | | | | 34.7 | % | | | 61.6 | % | | | 51.5 | % | | | 1.59 | x | | | 11.9 | % | | | 11.0 | % | | | 5.642 | % |

Anchored | | 24 | | | 224,198,768 | | | | 24.2 | | | | 61.5 | | | | 51.6 | | | | 1.54 | | | | 11.7 | | | | 10.8 | | | | 5.605 | |

Unanchored | | 11 | | | 56,552,870 | | | | 6.1 | | | | 63.3 | | | | 53.1 | | | | 1.58 | | | | 12.3 | | | | 11.3 | | | | 5.821 | |

Shadow Anchored | | 4 | | | 20,266,287 | | | | 2.2 | | | | 54.2 | | | | 48.8 | | | | 2.24 | | | | 13.8 | | | | 12.8 | | | | 5.444 | |

Single Tenant | | 21 | | | 20,151,966 | | | | 2.2 | | | | 64.6 | | | | 49.5 | | | | 1.47 | | | | 12.3 | | | | 11.0 | | | | 5.751 | |

Hospitality | | 21 | | | 182,862,016 | | | | 19.8 | | | | 58.8 | | | | 49.1 | | | | 1.69 | | | | 14.9 | | | | 12.9 | | | | 5.729 | |

Full Service | | 6 | | | 89,862,408 | | | | 9.7 | | | | 59.1 | | | | 52.4 | | | | 1.66 | | | | 14.8 | | | | 12.5 | | | | 5.546 | |

Limited Service | | 14 | | | 84,410,606 | | | | 9.1 | | | | 58.3 | | | | 45.8 | | | | 1.74 | | | | 15.2 | | | | 13.4 | | | | 5.898 | |

Extended Stay | | 1 | | | 8,589,002 | | | | 0.9 | | | | 60.4 | | | | 46.8 | | | | 1.58 | | | | 13.7 | | | | 12.2 | | | | 5.990 | |

Office | | 6 | | | 129,491,535 | | | | 14.0 | | | | 61.4 | | | | 51.5 | | | | 1.40 | | | | 11.3 | | | | 10.0 | | | | 5.435 | |

Medical | | 2 | | | 84,053,969 | | | | 9.1 | | | | 62.1 | | | | 51.6 | | | | 1.31 | | | | 10.3 | | | | 9.3 | | | | 5.417 | |

Suburban | | 3 | | | 39,018,468 | | | | 4.2 | | | | 60.5 | | | | 52.5 | | | | 1.58 | | | | 13.2 | | | | 11.2 | | | | 5.494 | |

CBD | | 1 | | | 6,419,098 | | | | 0.7 | | | | 57.3 | | | | 43.9 | | | | 1.58 | | | | 13.6 | | | | 11.6 | | | | 5.300 | |

Self Storage | | 39 | | | 99,897,423 | | | | 10.8 | | | | 57.6 | | | | 49.8 | | | | 1.74 | | | | 12.5 | | | | 12.0 | | | | 5.497 | |

Self Storage | | 39 | | | 99,897,423 | | | | 10.8 | | | | 57.6 | | | | 49.8 | | | | 1.74 | | | | 12.5 | | | | 12.0 | | | | 5.497 | |

Manufactured Housing Community | | 12 | | | 68,990,219 | | | | 7.5 | | | | 69.4 | | | | 58.0 | | | | 1.49 | | | | 10.9 | | | | 10.6 | | | | 5.605 | |

Manufactured Housing Community | | 12 | | | 68,990,219 | | | | 7.5 | | | | 69.4 | | | | 58.0 | | | | 1.49 | | | | 10.9 | | | | 10.6 | | | | 5.605 | |

Industrial | | 5 | | | 48,405,671 | | | | 5.2 | | | | 66.6 | | | | 54.4 | | | | 1.49 | | | | 11.6 | | | | 10.8 | | | | 5.489 | |

Flex | | 4 | | | 43,419,135 | | | | 4.7 | | | | 66.2 | | | | 53.8 | | | | 1.48 | | | | 11.5 | | | | 10.7 | | | | 5.403 | |

Warehouse | | 1 | | | 4,986,536 | | | | 0.5 | | | | 69.7 | | | | 59.7 | | | | 1.60 | | | | 12.8 | | | | 11.9 | | | | 6.240 | |

Multifamily | | 6 | | | 39,231,090 | | | | 4.2 | | | | 64.7 | | | | 52.6 | | | | 1.50 | | | | 12.2 | | | | 10.9 | | | | 5.771 | |

Garden | | 4 | | | 21,560,867 | | | | 2.3 | | | | 64.5 | | | | 50.3 | | | | 1.58 | | | | 13.0 | | | | 11.7 | | | | 5.676 | |

High Rise | | 1 | | | 13,681,440 | | | | 1.5 | | | | 72.2 | | | | 61.5 | | | | 1.28 | | | | 9.8 | | | | 9.1 | | | | 5.840 | |

Low Rise | | 1 | | | 3,988,783 | | | | 0.4 | | | | 40.7 | | | | 34.7 | | | | 1.84 | | | | 15.8 | | | | 13.3 | | | | 6.050 | |

Mixed Use | | 3 | | | 34,959,988 | | | | 3.8 | | | | 50.4 | | | | 42.0 | | | | 1.60 | | | | 12.0 | | | | 10.7 | | | | 5.331 | |

Retail/Office | | 2 | | | 25,768,761 | | | | 2.8 | | | | 56.3 | | | | 47.0 | | | | 1.56 | | | | 11.3 | | | | 10.4 | | | | 5.288 | |

Retail/Hotel/Office | | 1 | | | 9,191,228 | | | | 1.0 | | | | 33.8 | | | | 28.2 | | | | 1.70 | | | | 13.7 | | | | 11.5 | | | | 5.450 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total/Weighted Average | | 152 | | | $925,007,833 | | | | 100 | % | | | 61.1 | % | | | 51.2 | % | | | 1.58 | x | | | 12.4 | % | | | 11.3 | % | | | 5.598 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, (a) the information for mortgage loans secured by more than one mortgaged property (other than through cross-collateralization with other mortgage loans) is based on allocated amounts (allocating the mortgage loan principal balance to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents), and (b) the information for each mortgaged property that relates to a mortgage loan that is cross-collateralized with other mortgage loans is based upon the principal balance of that mortgage loan, except that the applicable loan-to-value ratio, debt service coverage ratio or debt yield for each such mortgaged property is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group. On an individual basis, without regard to the cross-collateralization feature, any mortgaged property securing a mortgage loan that is part of a cross-collateralized group of mortgage loans may have a higher loan-to-value ratio, lower debt service coverage ratio and/or lower debt yield than is presented herein. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

10

WFRBS Commercial Mortgage Trust 2012-C6 | Characteristics of the Mortgage Pool |

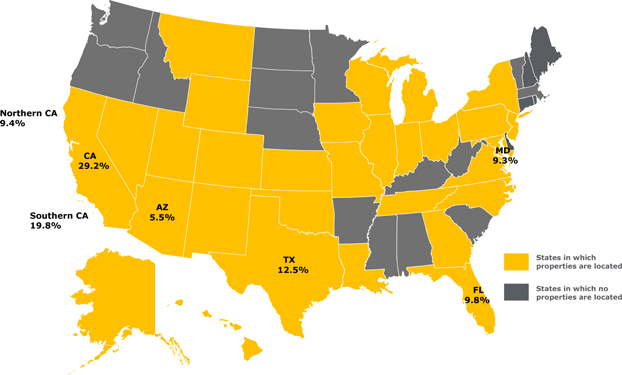

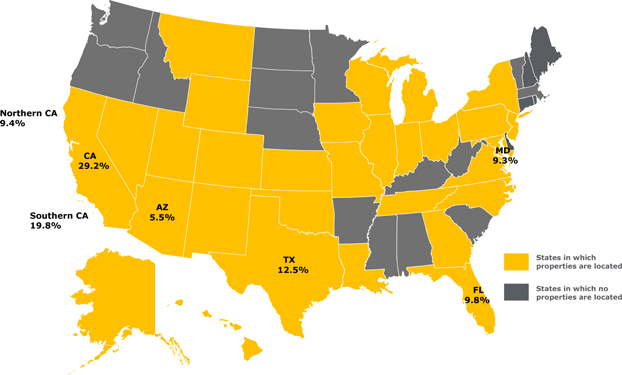

| F. | Geographic Distribution* |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Location(1) | | Number of

Mortgaged

Properties | | Aggregate Cut-

off Date Balance

($)(2) | | | % of Cut-

off Date

Balance | | | Weighted

Average

Cut-off

Date LTV

Ratio (%) | | | Weighted

Average

Balloon or

ARD LTV

Ratio (%) | | | Weighted

Average

U/W NCF

DSCR (x) | | | Weighted

Average

U/W NOI

Debt Yield

(%) | | | Weighted

Average

U/W NCF

Debt

Yield

(%) | | | Weighted

Average

Mortgage

Rate (%) | |

California | | 40 | | $ | 269,939,159 | | | | 29.2 | % | | | 55.3 | % | | | 47.6 | % | | | 1.69 | x | | | 12.4 | % | | | 11.4 | % | | | 5.417 | % |

Southern | | 29 | | | 182,911,798 | | | | 19.8 | | | | 53.7 | | | | 46.5 | | | | 1.75 | | | | 12.6 | | | | 11.6 | | | | 5.329 | |

Northern | | 11 | | | 87,027,360 | | | | 9.4 | | | | 58.7 | | | | 50.0 | | | | 1.58 | | | | 11.9 | | | | 11.0 | | | | 5.603 | |

Texas | | 32 | | | 115,490,731 | | | | 12.5 | | | | 65.7 | | | | 53.6 | | | | 1.51 | | | | 12.3 | | | | 11.1 | | | | 5.751 | |

Florida | | 11 | | | 90,424,378 | | | | 9.8 | | | | 58.2 | | | | 49.7 | | | | 1.61 | | | | 13.2 | | | | 11.6 | | | | 5.667 | |

Maryland | | 2 | | | 85,700,000 | | | | 9.3 | | | | 62.2 | | | | 51.9 | | | | 1.32 | | | | 10.4 | | | | 9.3 | | | | 5.422 | |

Arizona | | 4 | | | 50,945,626 | | | | 5.5 | | | | 67.4 | | | | 57.8 | | | | 1.46 | | | | 10.9 | | | | 10.3 | | | | 5.641 | |

Other States(3) | | 63 | | | 312,507,939 | | | | 33.8 | | | | 64.0 | | | | 52.5 | | | | 1.60 | | | | 13.1 | | | | 11.8 | | | | 5.717 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total/ Weighted Average | | 152 | | $ | 925,007,833 | | | | 100.0 | % | | | 61.1 | % | | | 51.2 | % | | | 1.58x | | | | 12.4 | % | | | 11.3 | % | | | 5.598 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| * | The Mortgaged Properties are located in 30 states. |

| (1) | For purposes of determining whether a mortgaged property is in Northern California or Southern California, Northern California includes areas with zip codes above 93600 and Southern California includes areas with zip codes of 93600 and below. |

| (2) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, (a) the information for mortgage loans secured by more than one mortgaged property (other than through cross-collateralization with other mortgage loans) is based on allocated amounts (allocating the mortgage loan principal balance to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents), and (b) the information for each mortgaged property that relates to a mortgage loan that is cross-collateralized with other mortgage loans is based upon the principal balance of that mortgage loan, except that the applicable loan-to-value ratio, debt service coverage ratio or debt yield for each such mortgaged property is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group. On an individual basis, without regard to the cross-collateralization feature, any mortgaged property securing a mortgage loan that is part of a cross-collateralized group of mortgage loans may have a higher loan-to-value ratio, lower debt service coverage ratio and/or lower debt yield than is presented herein. |

| (3) | Includes 25 other states. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

11

WFRBS Commercial Mortgage Trust 2012-C6 | Characteristics of the Mortgage Pool |

| G. | Characteristics of the Mortgage Pool(1) |

CUT-OFF DATE BALANCE

| | | | | | | | |

Range of Cut-off Date

Balances ($) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | % of Cut-off

Date Balance | | |

1,468,823 – 2,000,000 | | 7 | | $11,477,361 | | 1.2% | | |

2,000,001 – 3,000,000 | | 10 | | 24,490,573 | | 2.6 | | |

3,000,001 – 4,000,000 | | 10 | | 35,659,906 | | 3.9 | | |

4,000,001 – 5,000,000 | | 5 | | 22,809,780 | | 2.5 | | |

5,000,001 – 6,000,000 | | 3 | | 17,169,803 | | 1.9 | | |

6,000,001 – 7,000,000 | | 7 | | 46,200,468 | | 5.0 | | |

7,000,001 – 8,000,000 | | 8 | | 61,353,173 | | 6.6 | | |

8,000,001 – 9,000,000 | | 2 | | 17,345,670 | | 1.9 | | |

9,000,001 – 10,000,000 | | 6 | | 55,911,098 | | 6.0 | | |

10,000,001 – 15,000,000 | | 17 | | 215,005,338 | | 23.2 | | |

15,000,001 – 20,000,000 | | 6 | | 110,555,965 | | 12.0 | | |

20,000,001 – 30,000,000 | | 5 | | 115,091,928 | | 12.4 | | |

30,000,001 – 50,000,000 | | 1 | | 48,157,500 | | 5.2 | | |

50,000,001 – 70,000,000 | | 1 | | 67,279,272 | | 7.3 | | |

70,000,001 – 76,500,000 | | 1 | | 76,500,000 | | 8.3 | | |

| | | | | | | | |

Total: | | 89 | | $925,007,833 | | 100.0% | | |

| | | | | | | | |

Average: | | $10,393,346 | | | | | | |

| | | | | | | | |

UNDERWRITTEN NOI DEBT SERVICE COVERAGE RATIO

| | | | | | | | | | |

Range of U/W NOI

DSCRs (x) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | | % of Cut-off

Date Balance | |

1.27 – 1.30 | | 1 | | | $14,817,796 | | | | 1.6% | |

1.31 – 1.40 | | 8 | | | 74,734,032 | | | | 8.1 | |

1.41 – 1.50 | | 6 | | | 121,941,124 | | | | 13.2 | |

1.51 – 1.60 | | 12 | | | 115,188,299 | | | | 12.5 | |

1.61 – 1.70 | | 15 | | | 93,309,425 | | | | 10.1 | |

1.71 – 1.80 | | 15 | | | 146,868,208 | | | | 15.9 | |

1.81 – 1.90 | | 10 | | | 71,344,092 | | | | 7.7 | |

1.91 – 2.00 | | 11 | | | 197,351,916 | | | | 21.3 | |

2.01 – 2.25 | | 7 | | | 61,243,916 | | | | 6.6 | |

2.26 – 2.50 | | 2 | | | 10,795,877 | | | | 1.2 | |

2.51 – 3.00 | | 1 | | | 7,913,148 | | | | 0.9 | |

3.01 – 3.24 | | 1 | | | 9,500,000 | | | | 1.0 | |

| | | | | | | | | | |

Total: | | 89 | | | $925,007,833 | | | | 100.0 | % |

| | | | | | | | | | |

Weighted Average: | | 1.74x | | | | | | | | |

| | | | | | | | | | |

UNDERWRITTEN NCF DEBT SERVICE COVERAGE RATIO

| | | | | | | | | | |

Range of U/W NCF

DSCRs (x) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | | % of Cut-off

Date Balance | |

1.25 – 1.30 | | 5 | | | $120,549,235 | | | | 13.0% | |

1.31 – 1.40 | | 11 | | | 124,932,973 | | | | 13.5 | |

1.41 – 1.50 | | 13 | | | 90,717,330 | | | | 9.8 | |

1.51 – 1.60 | | 19 | | | 194,471,957 | | | | 21.0 | |

1.61 – 1.70 | | 18 | | | 194,029,236 | | | | 21.0 | |

1.71 – 1.80 | | 13 | | | 86,873,697 | | | | 9.4 | |

1.81 – 1.90 | | 3 | | | 63,131,827 | | | | 6.8 | |

1.91 – 2.00 | | 2 | | | 20,239,048 | | | | 2.2 | |

2.01 – 2.25 | | 3 | | | 13,632,332 | | | | 1.5 | |

2.26 – 2.50 | | 1 | | | 6,930,195 | | | | 0.7 | |

2.51 – 3.04 | | 1 | | | 9,500,000 | | | | 1.0 | |

| | | | | | | | | | |

Total/Weighted Average: | | 89 | | | $925,007,833 | | | | 100.0 | % |

| | | | | | | | | | |

Weighted Average: | | 1.58x | | | | | | | | |

| | | | | | | | | | |

LOAN PURPOSE(1)

| | | | | | | | | | | | |

Loan Purpose | | Number of

Mortgage

Loans | | | Aggregate Cut-

off Date Balance | | | % of Cut-off

Date Balance | |

Refinance | | | 77 | | | | $815,103,248 | | | | 88.1% | |

Acquisition | | | 11 | | | | 103,330,659 | | | | 11.2 | |

Various | | | 1 | | | | 6,573,925 | | | | 0.7 | |

| | | | | | | | | | | | |

Total: | | | 89 | | | | $925,007,833 | | | | 100.0 | % |

| | | | | | | | | | | | |

| (1) | With respect to the T&M Retail Portfolio, Three Bears Supermarket was an acquisition and Marsh Supermarket was a refinance. Please refer to Annex A-1 for further details. |

MORTGAGE RATE

| | | | | | | | | | |

Range of Mortgage Rates

(%) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | | % of Cut-off

Date Balance | |

4.740 – 4.750 | | 1 | | | $7,913,148 | | | | 0.9% | |

4.751 – 5.000 | | 2 | | | 22,378,295 | | | | 2.4 | |

5.001 – 5.250 | | 9 | | | 155,154,655 | | | | 16.8 | |

5.251 – 5.500 | | 19 | | | 319,875,281 | | | | 34.6 | |

5.501 – 5.750 | | 8 | | | 54,928,389 | | | | 5.9 | |

5.751 – 6.000 | | 26 | | | 218,558,116 | | | | 23.6 | |

6.001 – 6.250 | | 19 | | | 118,342,503 | | | | 12.8 | |

6.251 – 6.500 | | 4 | | | 18,764,683 | | | | 2.0 | |

6.501 – 6.550 | | 1 | | | 9,092,762 | | | | 1.0 | |

| | | | | | | | | | |

Total: | | 89 | | | $925,007,833 | | | | 100.0 | % |

| | | | | | | | | | |

Weighted Average: | | 5.598% | | | | | | | | |

| | | | | | | | | | |

UNDERWRITTEN NOI DEBT YIELD

| | | | | | | | | | |

Range of U/W NOI

Debt Yields (%) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | | % of Cut-off

Date Balance | |

9.1 – 10.0 | | 6 | | | $73,133,454 | | | | 7.9% | |

10.1 – 11.0 | | 11 | | | 187,607,302 | | | | 20.3 | |

11.1 – 12.0 | | 22 | | | 183,433,202 | | | | 19.8 | |

12.1 – 13.0 | | 13 | | | 138,972,073 | | | | 15.0 | |

13.1 – 14.0 | | 22 | | | 169,218,223 | | | | 18.3 | |

14.1 – 15.0 | | 3 | | | 89,644,488 | | | | 9.7 | |

15.1 – 16.0 | | 9 | | | 56,173,541 | | | | 6.1 | |

16.1 – 17.0 | | 2 | | | 16,496,284 | | | | 1.8 | |

17.1 – 18.1 | | 1 | | | 10,329,266 | | | | 1.1 | |

| | | | | | | | | | |

Total: | | 89 | | | $925,007,833 | | | | 100.0 | % |

| | | | | | | | | | |

Weighted Average: | | 12.4% | | | | | | | | |

| | | | | | | | | | |

UNDERWRITTEN NCF DEBT YIELD

| | | | | | | | | | |

Range of U/W NCF

Debt Yields (%) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | | % of Cut-off

Date Balance | |

8.7 – 9.0 | | 3 | | | $27,778,295 | | | | 3.0% | |

9.1 – 10.0 | | 8 | | | 164,283,527 | | | | 17.8 | |

10.1 – 11.0 | | 22 | | | 272,865,373 | | | | 29.5 | |

11.1 – 12.0 | | 24 | | | 135,300,079 | | | | 14.6 | |

12.1 – 13.0 | | 18 | | | 221,491,273 | | | | 23.9 | |

13.1 – 14.0 | | 6 | | | 45,150,570 | | | | 4.9 | |

14.1 – 15.0 | | 4 | | | 30,442,617 | | | | 3.3 | |

15.1 – 16.0 | | 3 | | | 17,366,834 | | | | 1.9 | |

16.1 – 16.4 | | 1 | | | 10,329,266 | | | | 1.1 | |

| | | | | | | | | | |

Total: | | 89 | | | $925,007,833 | | | | 100.0 | % |

| | | | | | | | | | |

Weighted Average: | | 11.3% | | | | | | | | |

| | | | | | | | | | |

| (1) | Information regarding mortgage loans secured by multiple properties (other than through cross-collateralization with other mortgage loans) is based on an allocation according to relative appraised values or the allocated loan amounts or property-specific release prices set forth in related loan documents. Information regarding mortgage loans that are cross-collateralized with other mortgage loans is based upon the individual loan balances, except that the applicable loan-to-value ratio, debt service coverage ratio or debt yield for each such mortgage loan is based upon the ratio or yield (as applicable) for the aggregate indebtedness evidenced by all loans in the group. On an individual basis, without regard to the cross-collateralization feature, any mortgage loan that is part of a cross-collateralized group of mortgage loans may have a higher loan-to-value ratio, lower debt service coverage ratio and/or lower debt yield than is presented herein. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

12

WFRBS Commercial Mortgage Trust 2012-C6 | Characteristics of the Mortgage Pool |

ORIGINAL TERM TO MATURITY

| | | | | | | | |

Range of Original Terms to

Maturity (months) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | | % of Cut-off

Date Balance |

60 | | 8 | | | $135,887,753 | | | 14.7% |

85 – 120 | | 81 | | | 789,120,079 | | | 85.3 |

| | | | | | | | |

Total: | | 89 | | | $925,007,833 | | | 100.0% |

| | | | | | | | |

Weighted Average: | | 111 | | | | | | |

| | | | | | | | |

REMAINING TERM TO MATURITY

| | | | | | | | |

Range of Remaining Terms to

Maturity (months) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | | % of Cut-off

Date Balance |

51 – 60 | | 8 | | | $135,887,753 | | | 14.7% |

85 – 120 | | 81 | | | 789,120,079 | | | 85.3 |

| | | | | | | | |

Total: | | 89 | | | $925,007,833 | | | 100.0% |

| | | | | | | | |

Weighted Average: | | 106 | | | | | | |

| | | | | | | | |

ORIGINAL AMORTIZATION TERM

| | | | | | | | |

Range of Original

Amortization Terms (months) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | | % of Cut-off

Date Balance |

Non-Amortizing | | 1 | | | $9,500,000 | | | 1.0% |

240 | | 4 | | | 35,825,894 | | | 3.9 |

241 – 300 | | 28 | | | 271,221,628 | | | 29.3 |

301 – 360 | | 56 | | | 608,460,311 | | | 65.8 |

| | | | | | | | |

Total: | | 89 | | | $925,007,833 | | | 100.0% |

| | | | | | | | |

Weighted Average:* | | 332 | | | | | | |

| | | | | | | | |

| * | Excludes the non-amortizing loans. |

REMAINING AMORTIZATION TERM(1)

| | | | | | | | |

Range of Remaining

Amortization Terms (months) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | | % of Cut-off

Date Balance |

Non-Amortizing | | 1 | | | $9,500,000 | | | 1.0% |

230 – 240 | | 4 | | | 35,825,894 | | | 3.9 |

241 – 300 | | 28 | | | 271,221,628 | | | 29.3 |

301 – 360 | | 56 | | | 608,460,311 | | | 65.8 |

| | | | | | | | |

Total: | | 89 | | | $925,007,833 | | | 100.0% |

| | | | | | | | |

Weighted Average:* | | 329 | | | | | | |

| | | | | | | | |

| * | Excludes the non-amortizing loans. |

| (1) | The remaining amortization term shown for any mortgage loan that is interest-only for part of its term does not include the number of months in its interest-only period and reflects only the number of months as of the commencement of amortization remaining from the end of such interest-only period. |

LOCKBOXES

| | | | | | | | |

Type of Lockbox | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | | % of Cut-off

Date Balance |

Hard/Springing Cash Management | | 20 | | | $285,149,802 | | | 30.8% |

None | | 26 | | | 220,055,637 | | | 23.8 |

Hard/Upfront Cash Management | | 8 | | | 158,791,341 | | | 17.2 |

Soft/Springing Cash Management | | 21 | | | 139,957,108 | | | 15.1 |

Various(1) | | 2 | | | 63,014,395 | | | 6.8 |

Springing (Without Established Account) | | 10 | | | 51,884,722 | | | 5.6 |

Springing (With Established Account) | | 2 | | | 6,154,827 | | | 0.7 |

| | | | | | | | |

Total: | | 89 | | | $925,007,833 | | | 100.0% |

| | | | | | | | |

| (1) | With respect to the WPC Self Storage Portfolio, 25 of the underlying properties are subject to hard lockboxes with springing cash management; one property (Metro - Forth Worth) is subject to a soft lockbox with springing cash management. With respect to Parrish Portfolio, 2 of the underlying properties have soft lockboxes with springing cash management and the third property has soft lockbox with upfront cash management. Please refer to Annex A-1 for further details. |

PREPAYMENT PROVISION SUMMARY

| | | | | | | | |

Prepayment Provision | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | | % of Cut-off

Date Balance |

Lockout/Defeasance/Open | | 75 | | | $825,879,947 | | | 89.3% |

Lockout/YM%/Open | | 14 | | | 99,127,886 | | | 10.7 |

| | | | | | | | |

Total: | | 89 | | | $925,007,833 | | | 100.0% |

| | | | | | | | |

CUT-OFF DATE LOAN-TO-VALUE RATIO

| | | | | | | | |

Range of Cut-off Date LTV

Ratios (%) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | | % of Cut-off

Date Balance |

33.8 – 35.0 | | 1 | | | $9,191,228 | | | 1.0% |

35.1 – 40.0 | | 2 | | | 17,413,148 | | | 1.9 |

40.1 – 45.0 | | 2 | | | 19,038,601 | | | 2.1 |

45.1 – 50.0 | | 3 | | | 81,573,862 | | | 8.8 |

50.1 – 55.0 | | 7 | | | 74,305,296 | | | 8.0 |

55.1 – 60.0 | | 10 | | | 164,871,713 | | | 17.8 |

60.1 – 65.0 | | 19 | | | 210,627,130 | | | 22.8 |

65.1 – 70.0 | | 33 | | | 220,041,646 | | | 23.8 |

70.1 – 74.4 | | 12 | | | 127,945,209 | | | 13.8 |

| | | | | | | | |

Total: | | 89 | | | $925,007,833 | | | 100.0% |

| | | | | | | | |

Weighted Average: | | 61.1% | | | | | | |

| | | | | | | | |

BALLOON LOAN-TO-VALUE RATIO

| | | | | | | | | | |

Range of Balloon LTV Ratios

(%) | | Number of

Mortgage

Loans | | | Aggregate Cut-

off Date Balance | | | % of Cut-off

Date Balance |

28.2 – 30.0 | | | 1 | | | | $9,191,228 | | | 1.0% |

30.1 – 35.0 | | | 2 | | | | 14,318,048 | | | 1.5 |

35.1 – 40.0 | | | 5 | | | | 61,004,928 | | | 6.6 |

40.1 – 45.0 | | | 8 | | | | 58,763,105 | | | 6.4 |

45.1 – 50.0 | | | 20 | | | | 257,962,708 | | | 27.9 |

50.1 – 55.0 | | | 15 | | | | 228,218,128 | | | 24.7 |

55.1 – 60.0 | | | 29 | | | | 178,274,741 | | | 19.3 |

60.1 – 65.0 | | | 8 | | | | 104,396,651 | | | 11.3 |

65.1 – 65.5 | | | 1 | | | | 12,878,295 | | | 1.4 |

| | | | | | | | | | |

Total: | | | 89 | | | | $925,007,833 | | | 100.0% |

| | | | | | | | | | |

Weighted Average: | | | 51.2 | % | | | | | | |

| | | | | | | | | | |

AMORTIZATION TYPE

| | | | | | | | |

Type of Amortization | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | | % of Cut-off

Date Balance |

Amortizing Balloon | | 82 | | | $732,350,333 | | | 79.2% |

Interest-only, Amortizing Balloon | | 6 | | | 183,157,500 | | | 19.8 |

Interest-only, Balloon | | 1 | | | 9,500,000 | | | 1.0 |

| | | | | | | | |

Total: | | 89 | | | $925,007,833 | | | 100.0% |

| | | | | | | | |

ORIGINAL TERM OF INTEREST-ONLY PERIOD FOR PARTIAL IO LOANS*

| | | | | | | | |

IO Term (months) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | | % of Cut-off

Date Balance |

12 | | 1 | | | $9,200,000 | | | 1.0% |

13 – 18 | | 1 | | | 7,550,000 | | | 0.8 |

19 – 24 | | 2 | | | 96,000,000 | | | 10.4 |

49 – 60 | | 2 | | | 70,407,500 | | | 7.6 |

| | | | | | | | |

Total: | | 6 | | | $183,157,500 | | | 19.8% |

| | | | | | | | |

Weighted Average: | | 37 | | | | | | |

| | | | | | | | |

| * | Excludes non-amortizing loans and amortizing loans that do not provide for a partial interest-only period. |

SEASONING

| | | | | | | | |

Seasoning (months) | | Number of

Mortgage

Loans | | Aggregate Cut-

off Date Balance | | | % of Cut-off

Date Balance |

0 | | 9 | | | $92,450,000 | | | 10.0% |

1 – 3 | | 45 | | | 330,254,314 | | | 35.7 |

4 – 6 | | 14 | | | 81,785,126 | | | 8.8 |

7 – 9 | | 20 | | | 405,700,597 | | | 43.9 |

10 | | 1 | | | 14,817,796 | | | 1.6 |

| | | | | | | | |

Total: | | 89 | | | $925,007,833 | | | 100.0% |

| | | | | | | | |

Weighted Average: | | 5 | | | | | | |

| | | | | | | | |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

13

WFRBS Commercial Mortgage Trust 2012-C6 | Certain Terms and Conditions |

| V. | Certain Terms and Conditions |

Interest Entitlements: | The interest entitlement of each Class of Offered Certificates on each Distribution Date generally will be the interest accrued during the related Interest Accrual Period on the related Certificate Principal Balance or Notional Amount at the related pass-through rate, net of any prepayment interest shortfalls allocated to that Class for such Distribution Date as described below. If prepayment interest shortfalls arise from voluntary prepayments (without special servicer consent) on non-specially serviced mortgage loans during any collection period, the Master Servicer is required to make a compensating interest payment to offset those shortfalls, generally up to an amount equal to the portion of its master servicing fees that accrues at two basis pointsper annum. The remaining amount of prepayment interest shortfalls will be allocated to reduce the interest otherwise distributable on all Classes of Certificates (other than the Class X-A and Class X-B Certificates),pro rata, based on their respective amounts of accrued interest for the related Distribution Date. If a Class receives less than the entirety of its interest entitlement on any Distribution Date, then the shortfall will be added to its interest entitlement for the next succeeding Distribution Date. Interest entitlements on the Class D, C and B Certificates, in that order, may be reduced by certain Trust Advisor expenses. |

Principal Distribution Amount: | The Principal Distribution Amount for each Distribution Date generally will be the aggregate amount of principal received or advanced in respect of the mortgage loans, net of any nonrecoverable advances and interest thereon that are reimbursed to the Master Servicer, the Special Servicer or the Trustee during the related collection period. Nonrecoverable advances and interest thereon are reimbursable from principal collections and advances before reimbursement from other amounts. The Principal Distribution Amount may also be reduced, with a corresponding loss to the Class D, C, B and A-S Certificates, then to the Class A-1, A-2, A-3 and A-4 Certificates (with any losses on the Class A-1, A-2, A-3 and A-4 Certificates allocatedpro rata according to their respective Certificate Principal Balances immediately prior to that Distribution Date), in that order, in connection with certain Trust Advisor expenses to the extent that interest entitlements on the Class B, C and D Certificates are insufficient to absorb the effect of the expense on any particular Distribution Date. |

Distributions: | On each Distribution Date, funds available for distribution from the mortgage loans, net of specified trust fees, expenses and reimbursements will generally be distributed in the following amounts and order of priority (in each case to the extent of remaining available funds): |

| | 1. | Class A-1, A-2, A-3, A-4, X-A and X-B Certificates: To interest on the Class A-1, A-2, A-3, A-4, X-A and X-B Certificates,pro rata, according to their respective interest entitlements. |