UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22671

AB MULTI-MANAGER ALTERNATIVE FUND, INC.

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Joseph J. Mantineo

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: March 31, 2022

Date of reporting period: March 31, 2022

Explanatory Note:

Enclosed for filing you will find an amended Form N-CSR of the registrant’s original 2022 Form N-CSR filing of the referenced period. The purpose of this amended filing is to update Item 11 (b) and Item 13 (which is addressed in exhibits labeled Exhibit 12 (b)(1) and Exhibit 12 (b)(2) in the original filings). Except as set forth above, no other changes have been made to the Form N-CSR, and this amended filing does not amend, update or change any other items or disclosure found in the Form N-CSR.

ITEM 1. REPORTS TO STOCKHOLDERS.

MAR 03.31.22

ANNUAL REPORT

AB MULTI-MANAGER ALTERNATIVE FUND

| | |

| |

| Investment Products Offered | | • Are Not FDIC Insured • May Lose Value • Are Not Bank Guaranteed |

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit AB’s website at www.abfunds.com, or go to the Securities and Exchange Commission’s (the “Commission”) website at www.sec.gov, or call AB at (800) 227 4618.

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the Commission’s website at www.sec.gov.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

ANNUAL REPORT

May 17, 2022

This report provides certain performance data for the AB Multi-Manager Alternative Fund (the “Fund”) for the annual reporting period ended March 31, 2022.

The Fund’s investment objective is to seek long-term capital appreciation.

RETURNS AS OF MARCH 31, 2022 (unaudited)

| | | | | | | | |

| | |

| | | 6 Months | | | 12 Months | |

| | |

| AB MULTI-MANAGER ALTERNATIVE FUND | | | -1.17% | | | | 1.22% | |

| | |

| Benchmark: HFRI FOF Composite Index | | | -2.23% | | | | 1.32% | |

| | |

| MSCI World Index (net) | | | 2.21% | | | | 10.12% | |

| | |

| Bloomberg US Aggregate Bond Index | | | -5.92% | | | | -4.15% | |

INVESTMENT RESULTS

The table above provides performance data for the Fund and its benchmark, the HFRI Fund of Funds (“HFRI FOF”) Composite Index, for the six- and 12-month periods ended March 31, 2022. The table also includes the performance of the Morgan Stanley Capital International (“MSCI”) World Index (net) and the Bloomberg US Aggregate Bond Index.

For the 12-month period, the Fund underperformed the HFRI FOF and the MSCI World Index (net), but outperformed the Bloomberg US Aggregate Bond Index. Underperformance stemmed primarily from the Global Macro Underlying Portfolios allocation, which detracted from relative returns, most notably before the allocation was reduced in the fourth quarter of 2021. The other strategies contributed, particularly the Multi-Strategy and Long/Short Equity allocations.

For the six-month period, the Fund outperformed the HFRI FOF and the Bloomberg US Aggregate Bond Index, but underperformed the MSCI World Index (net). Outperformance was driven by the Multi-Strategy allocation, which had the largest weighting in the Fund, and the Global Macro allocation. An underweight position in the worst-performing strategy, Long/Short Equity, also contributed. Positioning in Global Macro and Event Driven allocations detracted from returns.

The Fund utilized total return swaps for hedging and investment purposes, which detracted from absolute performance for both periods.

| | |

| |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 1 |

MARKET REVIEW AND INVESTMENT STRATEGY

US and international stocks ended in positive territory and emerging markets lost ground during the 12-month period ended March 31, 2022. Accommodative monetary policy continued to support an accelerating global economic recovery, but—despite generally strong corporate earnings and economic data—equity markets experienced a dramatic increase in volatility later in the period. Persistent and rapidly rising inflation; tightening monetary policy, particularly in the US; Russia’s invasion of Ukraine; and surging COVID-19 cases in China triggered sharp swings between gains and losses. Developed markets, and to a lesser extent emerging markets, recovered some losses toward the end of the period, led by a rebound in US equities. Positive sentiment was buoyed, despite elevated geopolitical risks and a rising-rate environment, as US economic growth remained on track, supported by strong consumer demand and sustained improvement in the job market. Both growth- and value-oriented stocks rose, but growth stocks outperformed on a relative basis. Large-cap stocks gained in absolute terms and outperformed small-cap stocks—which ended in negative territory—by a wide margin.

Fixed-income government bond market yields increased rapidly, and bond prices fell in most developed markets. Government bond yields rose the most in Australia and the eurozone, and the least in Japan. Several major central banks became more hawkish and started to tighten monetary policy by raising short-term interest rates and ending bond purchases to combat high and persistent inflation. Inflation expectations worsened toward the end of the period when Russia invaded Ukraine, causing energy and agricultural prices to spike. Global inflation-linked bonds had positive returns and significantly outperformed nominal government bonds. In credit sectors, high-yield corporate bonds in developed markets outperformed treasuries, while investment-grade corporate bonds underperformed respective treasury markets, except in the eurozone. Emerging-market bonds lagged the most, particularly toward the end of the period when the invasion dampened investor demand. The US dollar advanced against most currencies as a safe haven. Brent crude oil prices surged from increased demand and as major oil producers limited production increases.

During this period of heightened uncertainty, the Fund’s Senior Investment Management Team (the “Team”) added risk in market-neutral strategies expected to preserve capital and cut exposures across selected Underlying Portfolios the Team views as susceptible to increasing market volatility. More opportunistically, the Team added exposure to Global Macro strategies that benefited from major market trends such as higher interest rates and higher commodity prices.

| | |

| |

2 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

INVESTMENT POLICIES

There can be no assurance that the Fund will achieve its investment objective, be able to structure its investments as anticipated, or that its returns will be positive over any period of time. The Fund is not intended as a complete investment program for investors.

The Fund seeks to achieve its investment objective primarily by allocating its assets among investments in a diversified portfolio of private investment vehicles commonly referred to as hedge funds (“Underlying Portfolios”). The Fund will invest primarily in Underlying Portfolios pursuing the following strategies: Long/Short Equity, Event Driven, Credit/Distressed, Global Macro and Multi-Strategy. For more information on these strategies, please see “Consolidated Portfolio of Investments” on pages 10-18. As a secondary strategy, the Fund will generally also make direct investments in securities and other financial instruments. For more information regarding the Fund’s risks, please see “Disclosures and Risks” on pages 4-6 and “Note E—Risks Involved in Investing in the Fund” of the Notes to Consolidated Financial Statements on pages 36-40.

| | |

| |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 3 |

DISCLOSURES AND RISKS

Benchmark Disclosure

All indices are unmanaged and do not reflect fees and expenses associated with the active management of a mutual fund portfolio. The HFRI FOF Composite Index is an equal-weighted performance index that includes over 650 constituent funds of hedge funds that report their monthly net-of-fee returns to Hedge Fund Research, have at least $50 million under management and have been actively trading for at least 12 months. Returns of the Index are subject to subsequent revision. The MSCI World Index (net, free float-adjusted, market capitalization weighted) represents the equity market performance of developed markets. The Bloomberg US Aggregate Bond Index represents the performance of securities within the US investment-grade fixed-rate bond market, with index components for government and corporate securities, mortgage pass-through securities, asset-backed securities and commercial mortgage-backed securities. MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices, any securities or financial products. This report is not approved, reviewed or produced by MSCI. Net returns include the reinvestment of dividends after deduction of non-US withholding tax. An investor cannot invest directly in an index, and its results are not indicative of the performance for any specific investment, including the Fund.

A Word about Risk

An investment in the Fund’s shares involves a high degree of risk and should not constitute a complete investment program. Before making an investment decision, you should carefully consider the following risk factors, together with the other information contained in the prospectus. At any point in time, an investment in the Fund’s shares may be worth less than the original amount invested, even after taking into account the distributions paid, if any, and the ability of shareholders to reinvest distributions. If any of the risks discussed below occurs, the Fund’s results of operations could be materially and adversely affected. If this were to happen, the price of Fund shares could decline significantly and you could lose all or a part of your investment.

Investment in this Fund is highly speculative and involves substantial risk, including loss of principal, and therefore may not be suitable for all investors.

General Risk Factors: Underlying Portfolios and the Fund’s direct investments may exhibit high volatility, and investors may lose all or substantially all of their investment. Investments by Underlying Portfolios and the Fund in illiquid assets and foreign markets and the use of short sales,

| | |

| |

4 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

DISCLOSURES AND RISKS (continued)

options, leverage, futures, swaps and other derivative instruments may create special risks and substantially increase the impact and likelihood of adverse price movements. Interests in Underlying Portfolios are subject to limitations on transferability and are illiquid, and no secondary market for interests typically exists or is likely to develop. Underlying Portfolios are typically not registered with securities regulators and are therefore generally subject to little or no regulatory oversight. Performance compensation payable to an Underlying Portfolio investment advisor may create an incentive to make riskier or more speculative investments. Underlying Portfolios typically charge higher fees than many other types of investments, which can offset trading profits, if any. There can be no assurance that any Underlying Portfolio will achieve its investment objectives.

Market Risk: The value of the Fund’s assets will fluctuate as the bond or stock market fluctuates. The value of its investments may decline, sometimes rapidly and unpredictably, simply because of economic changes or other events, including public health crises (including the occurrence of a contagious disease or illness), that affect large portions of the market.

Tax Risks: The Fund intends to be treated as a regulated investment company (“RIC”) under the Internal Revenue Code. However, in order to qualify as a RIC and also to avoid having to pay an “excise tax,” the Fund will be subject to certain limitations on its investments and operations, including a requirement that a specified proportion of its income come from qualifying sources, an asset diversification requirement and minimum distribution requirements. Satisfaction of the various requirements requires significant support and information from the Underlying Portfolios, and such support and information may not be available, sufficient, verifiable, or provided on a timely basis.

Limited Liquidity: The Fund’s shares are not listed on any securities exchange or traded in any other market, and are subject to substantial restrictions on transfer. Although the Fund has offered to repurchase shares on a quarterly basis, such periodic repurchase offers are at the sole discretion of the Fund’s Board of Trustees, and there is no assurance that these repurchase offers will continue. It will normally be four to six months between the time an investor tenders shares for repurchase (i.e., requests that the Fund repurchase shares as part of a repurchase offer) and the investor’s receipt of any cash proceeds associated with the repurchase.

Fund of Funds Considerations: The Fund will have no control rights over and limited transparency into the investment programs of the Underlying Portfolios in which it invests. In valuing the Fund’s holdings, the Investment Manager will generally rely on financial information provided by Underlying Portfolios, which may be unaudited, estimated and/or may not involve third parties. The Fund’s investment opportunities may be limited

| | |

| |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 5 |

DISCLOSURES AND RISKS (continued)

as a result of withdrawal terms or anticipated liquidity needs (e.g., withdrawal restrictions imposed by underlying hedge funds may delay, preclude or involve expense in connection with portfolio adjustments by the Investment Manager).

These risks are fully discussed in the Fund’s prospectus. As with all investments, you may lose money by investing in the Fund.

An Important Note About Historical Performance

The performance shown in this report represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. All fees and expenses related to the operation of the Fund have been deducted. Performance assumes reinvestment of distributions and does not account for taxes.

| | |

| |

6 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

HISTORICAL PERFORMANCE

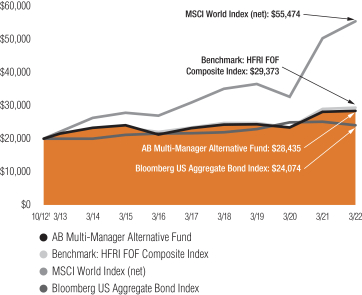

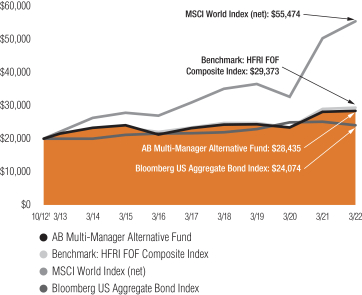

GROWTH OF A $20,000 INVESTMENT IN THE FUND (unaudited)

10/1/20121 TO 3/31/2022

This chart illustrates the total value of an assumed $20,000 investment in the AB Multi-Manager Alternative Fund (from 10/1/20121 to 3/31/2022) as compared to the performance of the Fund’s benchmarks. The chart assumes the reinvestment of dividends and capital gains distributions at prices obtained pursuant to the Fund’s dividend reinvestment plan.

| 1 | Inception date: 10/1/2012. |

| | |

| |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 7 |

HISTORICAL PERFORMANCE (continued)

AVERAGE ANNUAL RETURNS AS OF MARCH 31, 2022 (unaudited)

| | | | |

| |

| | | NAV Returns | |

| |

| 1 Year | | | 1.22% | |

| |

| 5 Years | | | 4.13% | |

| |

| Since Inception1 | | | 3.77% | |

Performance assumes the reinvestment of dividends and capital gains distributions at prices obtained pursuant to the Fund’s dividend reinvestment plan.

| 1 | Inception date: 10/1/2012. |

| | |

| |

8 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

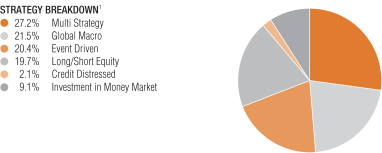

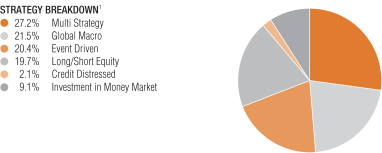

PORTFOLIO SUMMARY

March 31, 2022 (unaudited)

Net Assets ($mil): $1,049.3

| 1 | All data are as of March 31, 2022. The Fund’s portfolio strategy breakdown is based on the Investment Manager’s internal classification and is expressed as a percentage of total investment exposure, including exposure from derivatives (see “Consolidated Portfolio of Investments” section of the report for additional details). |

| | |

| |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 9 |

CONSOLIDATED PORTFOLIO OF INVESTMENTS

March 31, 2022

| | | | | | | | | | | | | | |

Underlying

Portfolios | | Shares | | | Fair Value ($) | | | % Net Assets | | | Liquidity* |

|

Multi-Strategy |

Elliott International Limited | | | 48,815 | | | $ | 96,861,155 | | | | 9.2 | % | | Quarterly |

Hudson Bay International Fund, Ltd. | | | 54,803 | | | | 55,016,993 | | | | 5.2 | | | Quarterly |

LMR Fund Limited | | | 206,673 | | | | 46,124,402 | | | | 4.4 | | | Quarterly |

Millennium International, Ltd. | | | 7,000 | | | | 7,244,600 | | | | 0.7 | | | Quarterly |

Myriad Opportunities Offshore Fund Limited | | | 32 | | | | 35,127 | | | | 0.0 | | | At Fund’s Discretion |

Point72 Capital International, Ltd. | | | 420,000 | | | | 42,118,724 | | | | 4.0 | | | Quarterly |

Schonfeld Strategic Partners Offshore Fund, Ltd. | | | 39,700 | | | | 55,128,139 | | | | 5.3 | | | Monthly |

| | | | | | | | | | | | | | |

Total | | | | | | | 302,529,140 | | | | 28.8 | | | |

| | | | | | | | | | | | | | |

|

Global Macro |

Alphadyne International Fund, Ltd. | | | 36,754 | | | | 45,852,833 | | | | 4.4 | | | Quarterly |

Brevan Howard Alpha Strategies Fund Limited | | | 457,136 | | | | 49,242,730 | | | | 4.7 | | | Monthly |

Brevan Howard AS Macro Fund Limited | | | 179,206 | | | | 21,228,744 | | | | 2.0 | | | Monthly |

John Street Systematic Fund Limited | | | 125,734 | | | | 26,234,937 | | | | 2.5 | | | Monthly |

Pharo Macro Fund, Ltd. | | | 5,995 | | | | 24,624,675 | | | | 2.3 | | | Quarterly |

The Tudor BVI Global Fund, Ltd. | | | 4,327 | | | | 72,249,520 | | | | 6.9 | | | Quarterly |

| | | | | | | | | | | | | | |

Total | | | | | | | 239,433,439 | | | | 22.8 | | | |

| | | | | | | | | | | | | | |

|

Long/Short Equity |

Coatue Offshore Fund, Ltd. | | | 101,112 | | | | 38,764,708 | | | | 3.7 | | | Quarterly |

Janchor Partners Pan-Asian Fund | | | 170,721 | | | | 23,854,456 | | | | 2.3 | | | Triennially |

Nokota LC, LLC | | | 1,166 | | | | 235,747 | | | | 0.0 | | | At Fund’s Discretion |

PFM Healthcare Offshore Fund, Ltd. | | | 344 | | | | 232,538 | | | | 0.0 | | | At Fund’s Discretion |

Schonfeld Fundamental Equity Offshore Fund, Ltd. | | | 39,203 | | | | 53,343,987 | | | | 5.1 | | | Quarterly |

The Children’s Investment Fund | | | 119,601 | | | | 27,362,370 | | | | 2.6 | | | Biennial |

Think Investments Offshore, Ltd. | | | 16,953 | | | | 42,743,112 | | | | 4.1 | | | Semi-Annual |

| | |

| |

10 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | | | |

Underlying

Portfolios | | Shares | | | Fair Value ($) | | | % Net Assets | | | Liquidity* |

|

Two Creeks Capital Offshore Fund, Ltd. | | | 21,269 | | | $ | 33,166,697 | | | | 3.2 | % | | Quarterly |

| | | | | | | | | | | | | | |

Total | | | | | | | 219,703,615 | | | | 21.0 | | | |

| | | | | | | | | | | | | | |

|

Event Driven |

Antara Capital Offshore Fund, Ltd. | | | 31,848 | | | | 31,140,441 | | | | 3.0 | | | Quarterly |

Indaba Capital Partners (Cayman), LP | | | 25,898 | | | | 39,845,999 | | | | 3.8 | | | Quarterly |

Lion Point International, Ltd. | | | 10,730 | | | | 13,871,435 | | | | 1.3 | | | Semi-Annual |

Luxor Capital Partners Offshore Liquidating SPV, Ltd. | | | 2,317 | | | | 2,320,946 | | | | 0.2 | | | At Fund’s Discretion |

Senator Global Opportunity Offshore Fund II, Ltd. | | | 18,521 | | | | 24,020,481 | | | | 2.3 | | | Quarterly |

Senator Global Opportunity Offshore Fund, Ltd. | | | 11,871 | | | | 15,034,653 | | | | 1.4 | | | Quarterly |

| | | | | | | | | | | | | | |

Total | | | | | | | 126,233,955 | | | | 12.0 | | | |

| | | | | | | | | | | | | | |

|

Credit/Distressed |

King Street Capital, Ltd. | | | 21,146 | | | | 2,297,649 | | | | 0.2 | | | At Fund’s Discretion |

LMR CCSA Fund

Limited | | | 185,763 | | | | 21,543,017 | | | | 2.1 | | | Quarterly |

Wingspan Overseas Fund, Ltd. | | | 26 | | | | 20,422 | | | | 0.0 | | | Fund in Liquidation |

| | | | | | | | | | | | | | |

Total | | | | | | | 23,861,088 | | | | 2.3 | | | |

| | | | | | | | | | | | | | |

| | | | |

Total Underlying Portfolios

(cost $694,781,223) | | | | | | | 911,761,237 | | | | 86.9 | | | |

| | | | | | | | | | | | | | |

| | | | |

Common Stocks | | | | | | | | | | | | | | |

Special Purpose Acquisition Company | | | | | | | | | | | | | | |

BlueRiver Acquisition Corp. – Class A(a) | | | 100,000 | | | | 980,000 | | | | 0.1 | | | |

Churchill Capital Corp. VII – Class A(a) | | | 24,402 | | | | 238,896 | | | | 0.0 | | | |

Climate Real Impact Solutions II Acquisition Corp. – Class A(a) | | | 57,556 | | | | 563,473 | | | | 0.1 | | | |

Compute Health Acquisition Corp. – Class A(a) | | | 100,000 | | | | 978,000 | | | | 0.1 | | | |

Constellation Acquisition Corp. I – Class A(a) | | | 45,223 | | | | 443,638 | | | | 0.0 | | | |

D & Z Media Acquisition Corp. – Class A(a) | | | 15,000 | | | | 146,850 | | | | 0.0 | | | |

| | |

| |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 11 |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

Company | | Shares | | | Fair Value ($) | | | % Net Assets | |

| |

DiamondHead Holdings Corp. – Class A(a) | | | 51,562 | | | $ | 505,308 | | | | 0.1 | % |

Elliott Opportunity II Corp. – Class A(a) | | | 535,800 | | | | 5,240,124 | | | | 0.5 | |

EQ Health Acquisition Corp. – Class A(a) | | | 93,458 | | | | 915,888 | | | | 0.1 | |

Hudson Executive Investment Corp. II(a) | | | 97,230 | | | | 951,882 | | | | 0.1 | |

Kernel Group Holdings, Inc. – Class A(a) | | | 50,000 | | | | 490,500 | | | | 0.0 | |

Lazard Growth Acquisition Corp. I(a) | | | 110,655 | | | | 1,084,419 | | | | 0.1 | |

Music Acquisition Corp. (The) – Class A(a) | | | 76,500 | | | | 745,875 | | | | 0.1 | |

New Vista Acquisition Corp. – Class A(a) | | | 97,916 | | | | 958,598 | | | | 0.1 | |

Pivotal Investment Corp. III – Class A(a) | | | 109,130 | | | | 1,067,291 | | | | 0.1 | |

RMG Acquisition Corp. III – Class A(a) | | | 15,344 | | | | 150,371 | | | | 0.0 | |

Social Leverage Acquisition Corp. I – Class A(a) | | | 34,012 | | | | 332,977 | | | | 0.0 | |

Thunder Bridge Capital Partners III, Inc. – Class A(a) | | | 25,572 | | | | 251,117 | | | | 0.0 | |

TLG Acquisition One Corp. – Class A(a) | | | 97,161 | | | | 951,206 | | | | 0.1 | |

| | | | | | | | | | | | |

| | | |

Total Common Stocks

(cost $16,878,962) | | | | | | | 16,996,413 | | | | 1.6 | |

| | | | | | | | | | | | |

|

Warrants | |

Special Purpose Acquisition Company | | | | | | | | | | | | |

BlueRiver Acquisition Corp. – Class A, expiring 01/04/2026(a) | | | 33,333 | | | | 8,333 | | | | 0.0 | |

Churchill Capital Corp. VII, expiring 02/29/2028(a) | | | 4,898 | | | | 2,939 | | | | 0.0 | |

Climate Real Impact Solutions II Acquisition Corp., expiring 12/31/2027(a) | | | 11,511 | | | | 5,295 | | | | 0.0 | |

Compute Health Acquisition Corp. – Class A, expiring 12/31/2027(a) | | | 25,000 | | | | 12,125 | | | | 0.0 | |

Constellation Acquisition Corp. I – Class A, expiring 12/31/2027(a) | | | 15,074 | | | | 4,824 | | | | 0.0 | |

D & Z Media Acquisition Corp. – Class A, expiring 12/31/2027(a) | | | 5,000 | | | | 1,500 | | | | 0.0 | |

| | |

| |

12 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

Company | | Shares | | | Fair Value ($) | | | % Net Assets | |

| |

DiamondHead Holdings Corp. – Class A, expiring 01/28/2028(a) | | | 12,890 | | | $ | 4,383 | | | | 0.0 | % |

Elliott Opportunity II Corp., expiring 02/19/2023(a) | | | 133,950 | | | | 80,343 | | | | 0.0 | |

EQ Health Acquisition Corp. – Class A, expiring 02/02/2028(a) | | | 46,729 | | | | 16,061 | | | | 0.0 | |

Hudson Executive Investment Corp. II, expiring 01/31/2027(a) | | | 24,307 | | | | 9,088 | | | | 0.0 | |

Kernel Group Holdings, Inc. – Class A, expiring 01/31/2027(a) | | | 25,000 | | | | 6,250 | | | | 0.0 | |

Lazard Growth Acquisition Corp. I, expiring 01/31/2027(a) | | | 22,131 | | | | 11,557 | | | | 0.0 | |

Music Acquisition Corp. (The) – Class A, expiring 02/05/2028(a) | | | 38,250 | | | | 8,499 | | | | 0.0 | |

New Vista Acquisition Corp. – Class A, expiring 12/31/2027(a) | | | 32,638 | | | | 12,667 | | | | 0.0 | |

Pivotal Investment Corp. III, expiring 12/31/2027(a) | | | 21,826 | | | | 10,077 | | | | 0.0 | |

RMG Acquisition Corp. III, expiring 12/31/2027(a) | | | 3,068 | | | | 1,354 | | | | 0.0 | |

Social Leverage Acquisition Corp. I – Class A, expiring 12/31/2027(a) | | | 8,503 | | | | 3,401 | | | | 0.0 | |

Thunder Bridge Capital Partners III, Inc. – Class A, expiring 02/15/2028(a) | | | 5,114 | | | | 2,727 | | | | 0.0 | |

TLG Acquisition One Corp. – Class A, expiring 12/31/2027(a) | | | 32,387 | | | | 6,416 | | | | 0.0 | |

| | | | | | | | | | | | |

| | | |

Total Warrants

(cost $488,619) | | | | | | | 207,839 | | | | 0.0 | |

| | | | | | | | | | | | |

| | | |

Short-Term Investments | | | | | | | | | | | | |

Investment Companies | | | | | | | | | | | | |

AB Fixed Income Shares, Inc. – Government Money Market Portfolio – Class AB, 0.19%(b)(c)(d)

(cost $110,999,000) | | | 110,999,000 | | | | 110,999,000 | | | | 10.6 | |

| | | | | | | | | | | | |

| | | |

Total Investments

(cost $823,147,804) | | | | | | | 1,039,964,489 | | | | 99.1 | |

Other assets less liabilities | | | | | | | 9,340,188 | | | | 0.9 | |

| | | | | | | | | | | | |

| | | |

Net Assets | | | | | | $ | 1,049,304,677 | | | | 100.0 | % |

| | | | | | | | | | | | |

| | |

| |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 13 |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

TOTAL RETURN SWAPS (see Note C)

| | | | | | | | | | | | | | | | | | | | |

Counterparty &

Referenced Obligation | | Rate Paid/

Received | | | Payment

Frequency | | Current

Notional

(000) | | | Maturity

Date | | | Unrealized

Appreciation/

(Depreciation) | |

Receive Total Return on Reference Obligation | |

Goldman Sachs & Co. | | | | |

Activision Blizzard, Inc. | |

| 1 Month SOFR

Plus 0.35% |

| | Maturity | | USD | | | 4,709 | | | | 07/15/2025 | | | $ | (185,233 | ) |

Cerner Corp. | |

| 1 Month SOFR

Plus 0.35% |

| | Maturity | | USD | | | 4,153 | | | | 07/15/2025 | | | | 102,945 | |

Change Healthcare, Inc. | |

| 1 Month SOFR

Plus 0.35% |

| | Maturity | | USD | | | 4,667 | | | | 01/05/2023 | | | | (439,716 | ) |

Clinigen Group PLC | |

| 1 Month SONIA

Plus 0.35% |

| | Maturity | | GBP | | | 923 | | | | 07/15/2025 | | | | 4,289 | |

CMC Materials, Inc. | |

| 1 Month SOFR

Plus 0.35% |

| | Maturity | | USD | | | 4,408 | | | | 07/15/2025 | | | | (6,335 | ) |

Coherent, Inc. | |

| 1 Month SOFR

Plus 0.35% |

| | Maturity | | USD | | | 5,182 | | | | 01/05/2023 | | | | 1,387,499 | |

Flagstar Bancorp, Inc. | |

| 1 Month SOFR

Plus 0.35% |

| | Maturity | | USD | | | 4,620 | | | | 07/15/2025 | | | | (432,703 | ) |

GCP Applied Technologies, Inc. | |

| 1 Month SOFR

Plus 0.35% |

| | Maturity | | USD | | | 812 | | | | 07/15/2025 | | | | (1,823 | ) |

Mimecast, Ltd. | |

| 1 Month SOFR

Plus 0.35% |

| | Maturity | | USD | | | 1,434 | | | | 07/15/2025 | | | | (2,816 | ) |

Ortho Clinical Diagnostics Holdings PLC | |

| 1 Month SOFR

Plus 0.35% |

| | Maturity | | USD | | | 1,827 | | | | 07/15/2025 | | | | 150,260 | |

People’s United Financial, Inc. | |

| 1 Month SOFR

Plus 0.35% |

| | Maturity | | USD | | | 4,731 | | | | 07/15/2025 | | | | 534,788 | |

Sanne Group PLC | |

| 1 Month SONIA

Plus 0.35% |

| | Maturity | | GBP | | | 1,887 | | | | 07/15/2025 | | | | 24,796 | |

Shaw Communications, Inc. | |

| 1 Month CDOR

Plus 0.35% |

| | Maturity | | CAD | | | 6,135 | | | | 01/05/2023 | | | | 668,240 | |

Umpqua Holdings Corp. | |

| 1 Month SOFR

Plus 0.35% |

| | Maturity | | USD | | | 3,742 | | | | 07/15/2025 | | | | (311,173 | ) |

Vifor Pharma AG | |

| 1 Month SOFR

Plus 0.35% |

| | Maturity | | USD | | | 3,337 | | | | 07/15/2025 | | | | 43,112 | |

Vivo Energy PLC | |

| 1 Month SOFR

Plus 0.35% |

| | Maturity | | USD | | | 2,653 | | | | 07/15/2025 | | | | 25,940 | |

Welbilt, Inc. | |

| 1 Month SOFR

Plus 0.35% |

| | Maturity | | USD | | | 4,855 | | | | 07/15/2025 | | | | 601,334 | |

JPMorgan Chase Bank, NA | | | | | | | | | | | | | | | | | | | | |

Anaplan, Inc. | |

| 1 Month OBFR

Plus 0.40% |

| | Maturity | | USD | | | 1,247 | | | | 08/12/2022 | | | | 6,714 | |

Atotech, Ltd. | |

| 1 Month OBFR

Plus 0.40% |

| | Maturity | | USD | | | 3,257 | | | | 08/12/2022 | | | | (428,036 | ) |

Avast PLC | |

| 1 Month SONIA

Plus 0.35% |

| | Maturity | | GBP | | | 3,113 | | | | 08/12/2022 | | | | (506,838 | ) |

Clipper Logistics PLC | |

| 1 Month SONIA

Plus 0.35% |

| | Maturity | | GBP | | | 883 | | | | 08/12/2022 | | | | 8,162 | |

CNP Assurances | |

| 1 Month ESTR

Plus 0.30% |

| | Maturity | | EUR | | | 1,912 | | | | 08/12/2022 | | | | 6,053 | |

Cornerstone Building Brands | |

| 1 Month OBFR

Plus 0.40% |

| | Maturity | | USD | | | 832 | | | | 08/12/2022 | | | | 5,463 | |

| | |

| |

14 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | | | | | | | |

Counterparty &

Referenced Obligation | | Rate Paid/

Received | | Payment

Frequency | | Current

Notional

(000) | | | Maturity

Date | | | Unrealized

Appreciation/

(Depreciation) | |

Ferro Corp. | | 1 Month OBFR

Plus 0.40% | | Maturity | | USD | | | 1,169 | | | | 08/12/2022 | | | $ | 8,501 | |

First Horizon Corp. | | 1 Month OBFR

Plus 0.40% | | Maturity | | USD | | | 4,404 | | | | 08/12/2022 | | | | 31,143 | |

Healthcare Trust of America | | 1 Month OBFR

Plus 0.40% | | Maturity | | USD | | | 3,149 | | | | 08/12/2022 | | | | 85,622 | |

Hibernia REIT PLC | | 1 Month ESTR

Plus 0.30% | | Maturity | | EUR | | | 953 | | | | 08/12/2022 | | | | (100 | ) |

Intertape Polymer Group, Inc. | | 1 Month CDOR

Plus 0.40% | | Maturity | | CAD | | | 787 | | | | 08/12/2022 | | | | 5,321 | |

LHC Group, Inc. | | 1 Month OBFR

Plus 0.40% | | Maturity | | USD | | | 3,060 | | | | 08/12/2022 | | | | 28,829 | |

Mandiant, Inc. | | 1 Month OBFR

Plus 0.40% | | Maturity | | USD | | | 3,340 | | | | 08/12/2022 | | | | 24,816 | |

Meritor, Inc. | | 1 Month OBFR

Plus 0.40% | | Maturity | | USD | | | 3,326 | | | | 08/12/2022 | | | | 11,876 | |

NeoPhotonics Corp. | | 1 Month OBFR

Plus 0.40% | | Maturity | | USD | | | 3,176 | | | | 08/12/2022 | | | | (11,869 | ) |

Nielsen Holdings PLC | | 1 Month OBFR

Plus 0.40% | | Maturity | | USD | | | 1,688 | | | | 08/12/2022 | | | | 23,355 | |

Plantronics, Inc. | | 1 Month OBFR

Plus 0.40% | | Maturity | | USD | | | 158 | | | | 08/12/2022 | | | | 1,089 | |

PNM Resources, Inc. | | 1 Month OBFR

Plus 0.40% | | Maturity | | USD | | | 4,820 | | | | 08/12/2022 | | | | (188,887 | ) |

Preferred Apartment Communities | | 1 Month OBFR

Plus 0.40% | | Maturity | | USD | | | 415 | | | | 08/12/2022 | | | | 2,107 | |

Renewable Energy Group, Inc. | | 1 Month OBFR

Plus 0.40% | | Maturity | | USD | | | 194 | | | | 08/12/2022 | | | | 51 | |

Rogers Corp. | | 1 Month OBFR

Plus 0.40% | | Maturity | | USD | | | 5,067 | | | | 08/12/2022 | | | | (2,779 | ) |

South Jersey Industries | | 1 Month OBFR

Plus 0.40% | | Maturity | | USD | | | 1,259 | | | | 08/12/2022 | | | | 57,208 | |

Tenneco, Inc. | | 1 Month OBFR

Plus 0.40% | | Maturity | | USD | | | 1,811 | | | | 08/12/2022 | | | | (38,666 | ) |

Tristate Capital Holdings, Inc. | | 1 Month OBFR

Plus 0.40% | | Maturity | | USD | | | 3,098 | | | | 08/12/2022 | | | | 277,184 | |

Vonage Holdings Corp. | | 1 Month OBFR

Plus 0.40% | | Maturity | | USD | | | 3,768 | | | | 08/12/2022 | | | | (59,351 | ) |

Zynga, Inc. | | 1 Month OBFR

Plus 0.40% | | Maturity | | USD | | | 4,088 | | | | 08/12/2022 | | | | 281,803 | |

Morgan Stanley Capital Services, LLC | | | | | | | | | | | | | | | | | | |

American National Group, Inc. | | 1 Month

FedFundEffective

Plus 0.38% | | Maturity | | USD | | | 2,903 | | | | 10/18/2023 | | | | (1,305 | ) |

Citrix Systems, Inc. | | 1 Month

FedFundEffective

Plus 0.38% | | Maturity | | USD | | | 1,205 | | | | 10/18/2023 | | | | (16,839 | ) |

Golden Nugget Online Gaming | | 1 Month

FedFundEffective

Plus 0.38% | | Maturity | | USD | | | 345 | | | | 10/18/2023 | | | | (549,130 | ) |

| | |

| |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 15 |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | | | | | | | |

Counterparty &

Referenced Obligation | | Rate Paid/

Received | | Payment

Frequency | | Current

Notional

(000) | | | Maturity

Date | | | Unrealized

Appreciation/

(Depreciation) | |

Houghton Mifflin Harcourt Co. | | 1 Month

FedFundEffective

Plus 0.38% | | Maturity | | USD | | | 1,235 | | | | 10/18/2023 | | | $ | 6,536 | |

Intersect ENT, Inc. | | 1 Month

FedFundEffective

Plus 0.38% | | Maturity | | USD | | | 3,351 | | | | 10/18/2023 | | | | 71,404 | |

Intertrust NV | | 1 Month

EURIBOR Plus

0.50% | | Maturity | | EUR | | | 3,727 | | | | 10/18/2023 | | | | 41,313 | |

Investors Bancorp, Inc. | | 1 Month

FedFundEffective

Plus 0.38% | | Maturity | | USD | | | 4,422 | | | | 10/18/2023 | | | | 52,510 | |

Meggitt PLC | | 1 Month SONIA

Plus 0.54% | | Maturity | | GBP | | | 3,202 | | | | 10/18/2023 | | | | 145,114 | |

MGM Growth Properties LLC | | 1 Month

FedFundEffective

Plus 0.38% | | Maturity | | USD | | | 32 | | | | 10/18/2023 | | | | (457 | ) |

Moneygram International, Inc. | | 1 Month

FedFundEffective

Plus 0.38% | | Maturity | | USD | | | 1,308 | | | | 10/18/2023 | | | | (16,600 | ) |

Progenics Pharmaceuticals, Inc. | | 1 Month

FedFundEffective

Plus 0.08% | | Maturity | | USD | | | 0 | ** | | | 10/18/2023 | | | | – 0 | – |

Sanderson Farms, Inc. | | 1 Month

FedFundEffective

Plus 0.38% | | Maturity | | USD | | | 1,293 | | | | 10/18/2023 | | | | (46,808 | ) |

Sanne Group PLC | | 1 Month SONIA

Plus 0.54% | | Maturity | | GBP | | | 1,566 | | | | 10/18/2023 | | | | 14,430 | |

Spirit Airlines, Inc. | | 1 Month

FedFundEffective

Plus 0.38% | | Maturity | | USD | | | 696 | | | | 10/18/2023 | | | | (131,849 | ) |

Terminix Global Holdings, Inc. | | 1 Month

FedFundEffective

Plus 0.38% | | Maturity | | USD | | | 1,419 | | | | 10/18/2023 | | | | 37,425 | |

Tower Semiconductor, Ltd. | | 1 Month

FedFundEffective

Plus 0.38% | | Maturity | | USD | | | 3,776 | | | | 10/18/2023 | | | | 97,332 | |

Ultra Electronics Holdings PLC | | 1 Month SONIA

Plus 0.54% | | Maturity | | GBP | | | 3,252 | | | | 10/18/2023 | | | | 18,798 | |

US Ecology, Inc. | | 1 Month

FedFundEffective

Plus 0.38% | | Maturity | | USD | | | 4,027 | | | | 10/18/2023 | | | | 33,445 | |

Veoneer, Inc. | | 1 Month

FedFundEffective

Plus 0.38% | | Maturity | | USD | | | 4,823 | | | | 10/18/2023 | | | | 430,593 | |

Verso Corp. | | 1 Month

FedFundEffective

Plus 0.38% | | Maturity | | USD | | | 633 | | | | 10/18/2023 | | | | 12,291 | |

|

Pay Total Return on Reference Obligation | |

Goldman Sachs & Co. | | | |

Columbia Banking System, Inc. | | 1 Month

SOFR Minus

0.32% | | Maturity | | USD | | | 3,814 | | | | 07/15/2025 | | | | 319,562 | |

| | |

| |

16 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

Counterparty &

Referenced Obligation | | Rate Paid/

Received | | | Payment

Frequency | | | Current

Notional

(000) | | | Maturity

Date | | | Unrealized

Appreciation/

(Depreciation) | |

Entegris, Inc. | |

| 1 Month SOFR Minus

0.32% |

| | | Maturity | | | | USD | | | | 1,406 | | | | 07/15/2025 | | | $ | (10,449 | ) |

II-VI, Inc. | |

| 1 Month SOFR Minus

0.31% |

| | | Maturity | | | | USD | | | | 1,250 | | | | 01/05/2023 | | | | (88,390 | ) |

M&T Bank Corp. | |

| 1 Month SOFR Minus

0.32% |

| | | Maturity | | | | USD | | | | 4,733 | | | | 07/15/2025 | | | | (404,634 | ) |

New York Community Bancorp, Inc. | |

| 1 Month SOFR Minus

0.32% |

| | | Maturity | | | | USD | | | | 4,690 | | | | 07/15/2025 | | | | 710,895 | |

Quidel Corp. | |

| 1 Month SOFR Minus

0.33% |

| | | Maturity | | | | USD | | | | 1,162 | | | | 07/15/2025 | | | | (125,160 | ) |

JPMorgan Chase Bank, NA | | | | | | | | | | | | | | | | | | | | | | | | |

GXO Logistics, Inc. | |

| 1 Month OBFR

Minus 0.30% |

| | | Maturity | | | | USD | | | | 256 | | | | 08/12/2022 | | | | 15,386 | |

Healthcare Realty Trust, Inc. | |

| 1 Month OBFR

Minus 0.30% |

| | | Maturity | | | | USD | | | | 2,761 | | | | 08/12/2022 | | | | (75,038 | ) |

MKS Instuments, Inc. | |

| 1 Month OBFR

Minus 0.40% |

| | | Maturity | | | | USD | | | | 1,228 | | | | 08/12/2022 | | | | 126,025 | |

NortonLifeLock, Inc. | |

| 1 Month OBFR

Minus 0.30% |

| | | Maturity | | | | USD | | | | 440 | | | | 08/12/2022 | | | | 30,725 | |

Raymond James Financial, Inc. | |

| 1 Month OBFR

Minus 0.30% |

| | | Maturity | | | | USD | | | | 2,562 | | | | 08/12/2022 | | | | (231,110 | ) |

Take-Two Interactive Software | |

| 1 Month OBFR

Minus 0.30% |

| | | Maturity | | | | USD | | | | 1,836 | | | | 08/12/2022 | | | | (143,306 | ) |

Morgan Stanley Capital Services, LLC | | | | | | | | | | | | | | | | | | | | | | | | |

Citizens Financial Group | |

| 1 Month

FedFundEffective

Minus 0.29% |

| | | Maturity | | | | USD | | | | 3,987 | | | | 10/18/2023 | | | | 54,779 | |

DraftKings, Inc. | |

| 1 Month

FedFundEffective

Minus 0.21% |

| | | Maturity | | | | USD | | | | 345 | | | | 10/18/2023 | | | | 577,186 | |

Frontier Group Holdings, Inc. | |

| 1 Month

FedFundEffective

Minus 1.57% |

| | | Maturity | | | | USD | | | | 690 | | | | 10/18/2023 | | | | 116,292 | |

Rentokil Initial PLC | |

| 1 Month

FedFundEffective

Minus 0.26% |

| | | Maturity | | | | USD | | | | 1,141 | | | | 10/18/2023 | | | | 65,943 | |

VICI Properties, Inc. | |

| 1 Month

FedFundEffective

Minus 0.20% |

| | | Maturity | | | | USD | | | | 32 | | | | 10/18/2023 | | | | 1,585 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | $ | 2,930,669 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| ** | Notional amount less than 500. |

| (a) | Non-income producing security. |

| (b) | Affiliated investments. |

| (c) | The rate shown represents the 7-day yield as of period end. |

| (d) | To obtain a copy of the fund’s shareholder report, please go to the Securities and Exchange Commission’s website at www.sec.gov, or call AB at (800) 227-4618. |

| | |

| |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 17 |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| * | The investment strategies and liquidity of the Underlying Portfolios in which the Fund invests are as follows: |

Multi-Strategy Underlying Portfolios invest across multiple strategies, including long/short equity, event driven, global macro, credit/distressed and emerging markets, in which the investment process is predicated on movements in underlying economic variables and the impact these variables have on equity, fixed income, currency, commodity and other financial instrument markets. Underlying Portfolios within this strategy are generally subject to 45 – 90 day redemption notice periods. Certain Underlying Portfolios may have lock up periods of two years.

Global Macro Underlying Portfolios aim to identify and exploit imbalances in global economics and asset classes, typically utilizing macroeconomic and technical market factors rather than “bottom-up” individual security analysis. The Underlying Portfolios within this strategy are subject to 30 – 90 day redemption notice periods. The Underlying Portfolios are no longer subject to initial lockups.

Long/Short Equity Underlying Portfolios seek to buy securities with the expectation that they will increase in value (“going long”) and sell securities short in the expectation that they will decrease in value (“going short”). Underlying Portfolios within this strategy are generally subject to 45 – 120 day redemption notice periods. The majority of the Underlying Portfolios are no longer subject to initial lockups. Certain Underlying Portfolios have lock up periods of up to three years.

Event Driven Underlying Portfolios seek to take advantage of information inefficiencies resulting from a particular corporate event, such as a takeover, liquidation, bankruptcy, tender offer, buyback, spin off, exchange offer, merger or other type of corporate reorganization. Underlying Portfolios within this strategy are generally subject to 60 – 90 day redemption notice periods. The majority of the Underlying Portfolios are no longer subject to initial lockups. Certain Underlying Portfolios have lock up periods of up to one year.

Credit/Distressed Underlying Portfolios invest in a variety of fixed income and other securities, including bonds (corporate and government), bank debt, asset-backed financial instruments, mortgage-backed securities and mezzanine and distressed securities, as well as securities of distressed companies and high yield securities. Underlying Portfolios within this strategy are generally subject to 90 day redemption notice periods. The majority of the Underlying Portfolios are no longer subject to initial lockups.

The Fund may also make direct investments in securities (other than securities of Underlying Portfolios), options, futures, options on futures, swap contracts, or other derivative or financial instruments.

Currency Abbreviations:

CAD – Canadian Dollar

EUR – Euro

GBP – Great British Pound

USD – United States Dollar

Glossary:

CDOR – Canadian Dealer Offered Rate

ESTR – Euro Short-Term Rate

EURIBOR – Euro Interbank Offered Rate

FedFundEffective – Federal Funds Effective Rate

OBFR – Overnight Bank Funding Rate

SOFR – Secured Overnight Financing Rate

SONIA – Sterling Overnight Index Average

See notes to consolidated financial statements.

| | |

| |

18 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

CONSOLIDATED STATEMENT OF ASSETS & LIABILITIES

March 31, 2022

| | | | |

| Assets | |

Investments in securities, at value | |

Unaffiliated issuers (cost $712,148,804) | | $ | 928,965,489 | |

Affiliated issuers (cost $110,999,000) | | | 110,999,000 | |

Cash | | | 15,854,364 | |

Cash collateral due from broker | | | 12,053,140 | |

Foreign currencies, at value (cost $123,697) | | | 123,686 | |

Unrealized appreciation on total return swaps | | | 7,388,069 | |

Investments in Underlying Portfolios paid in advance (see Note A2) | | | 3,700,000 | |

Receivable for investments sold | | | 1,222,765 | |

Receivable for terminated total return swaps | | | 16,962 | |

Affiliated dividends receivable | | | 8,060 | |

| | | | |

Total assets | | | 1,080,331,535 | |

| | | | |

| Liabilities | |

Payable for shares of beneficial interest redeemed | | | 18,488,921 | |

Subscriptions received in advance | | | 5,213,429 | |

Unrealized depreciation on total return swaps | | | 4,457,400 | |

Payable for terminated total return swaps | | | 32,422 | |

Distributions payable | | | 906,183 | |

Management fee payable | | | 876,242 | |

Cash collateral due to broker | | | 398,000 | |

Administrative fee payable | | | 139,609 | |

Transfer Agent fee payable | | | 17,654 | |

Accrued expenses | | | 496,998 | |

| | | | |

Total liabilities | | | 31,026,858 | |

| | | | |

Net Assets | | $ | 1,049,304,677 | |

| | | | |

| Composition of Net Assets | |

Shares of beneficial interest, at par | | $ | 90,008 | |

Additional paid-in capital | | | 982,696,838 | |

Distributable earnings | | | 66,517,831 | |

| | | | |

Net Assets | | $ | 1,049,304,677 | |

| | | | |

Shares of beneficial interest outstanding—unlimited shares authorized, with par value of $.001 (based on 90,007,720 shares outstanding) | | $ | 11.66 | |

| | | | |

See notes to consolidated financial statements.

| | |

| |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 19 |

CONSOLIDATED STATEMENT OF OPERATIONS

Year Ended March 31, 2022

| | | | | | | | |

| Investment Income | | | | | | | | |

Dividends—Affiliated issuers | | | | | | $ | 13,137 | |

| | | | | | | | |

| Expenses | | | | | | | | |

Management fee (see Note B) | | $ | 10,661,596 | | | | | |

Custody and accounting | | | 402,827 | | | | | |

Administrative | | | 284,299 | | | | | |

Transfer agency | | | 213,232 | | | | | |

Audit and tax | | | 166,301 | | | | | |

Credit facility fees | | | 135,764 | | | | | |

Registration fees | | | 88,462 | | | | | |

Legal | | | 74,767 | | | | | |

Printing | | | 50,631 | | | | | |

Trustees’ fees | | | 40,528 | | | | | |

Miscellaneous | | | 300,604 | | | | | |

| | | | | | | | |

Total expenses before interest expense | | | 12,419,011 | | | | | |

Interest expense | | | 591 | | | | | |

| | | | | | | | |

Total expenses | | | 12,419,602 | | | | | |

Less: expenses waived and reimbursed by the Investment Manager (see Note B) | | | (33,488 | ) | | | | |

| | | | | | | | |

Net expenses | | | | | | | 12,386,114 | |

| | | | | | | | |

Net investment loss | | | | | | | (12,372,977 | ) |

| | | | | | | | |

| Realized and Unrealized Gain (Loss) on Investment and Foreign Currency Transactions | | | | | | | | |

Net realized gain on: | | | | | | | | |

Investment transactions | | | | | | | 28,113,146 | |

Swaps | | | | | | | 569,740 | |

Foreign currency transactions | | | | | | | 17,688 | |

Net change in unrealized appreciation/depreciation of: | | | | | | | | |

Investments | | | | | | | (5,562,539 | ) |

Swaps | | | | | | | 1,946,241 | |

Foreign currency denominated assets and liabilities | | | | | | | (164 | ) |

| | | | | | | | |

Net gain on investment and foreign currency transactions | | | | | | | 25,084,112 | |

| | | | | | | | |

Contributions from Affiliates (see Note B) | | | | | | | 7,719 | |

| | | | | | | | |

Net Increase in Net Assets from Operations | | | | | | $ | 12,718,854 | |

| | | | | | | | |

See notes to consolidated financial statements.

| | |

| |

20 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

CONSOLIDATED STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | Year Ended

March 31,

2022 | | | Year Ended

March 31,

2021 | |

| Increase (Decrease) in Net Assets from Operations | | | | | | | | |

Net investment loss | | $ | (12,372,977 | ) | | $ | (11,536,705 | ) |

Net realized gain on investment and foreign currency transactions | | | 28,700,574 | | | | 22,456,876 | |

Net change in unrealized appreciation/depreciation of investments and foreign currency denominated assets and liabilities | | | (3,616,462 | ) | | | 169,160,328 | |

Contributions from Affiliates (see Note B) | | | 7,719 | | | | 6,897 | |

| | | | | | | | |

Net increase in net assets from operations | | | 12,718,854 | | | | 180,087,396 | |

Distribution to Shareholders | | | (44,015,030 | ) | | | (60,506,939 | ) |

| Transactions in Shares of Beneficial Interest | | | | | | | | |

Net increase (see Note D) | | | 42,587,624 | | | | 14,103,696 | |

| | | | | | | | |

Total increase | | | 11,291,448 | | | | 133,684,153 | |

| Net Assets | | | | | | | | |

Beginning of period | | | 1,038,013,229 | | | | 904,329,076 | |

| | | | | | | | |

End of period | | $ | 1,049,304,677 | | | $ | 1,038,013,229 | |

| | | | | | | | |

See notes to consolidated financial statements.

| | |

| |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 21 |

CONSOLIDATED STATEMENT OF CASH FLOWS

For the year ended March 31, 2022

| | | | | | | | |

| Cash flows from operating activities | | | | | | | | |

Net increase in net assets from operations | | | | | | $ | 12,718,854 | |

| Reconciliation of net increase in net assets from operations to net decrease in cash from operating activities | | | | | | | | |

Purchases of Underlying Portfolio shares | | $ | (143,935,731 | ) | | | | |

Purchases of short-term investments | | | (207,200,000 | ) | | | | |

Sales of Underlying Portfolio shares | | | 205,139,611 | | | | | |

Proceeds from disposition of short-term investments | | | 124,600,000 | | | | | |

Net realized gain on investment transactions and foreign currency transactions | | | (28,700,574 | ) | | | | |

Net change in unrealized appreciation/depreciation of investments and foreign currency denominated assets and liabilities | | | 3,616,462 | | | | | |

Decrease in receivable for investments sold | | | 399,974 | | | | | |

Increase in affiliated dividends receivable | | | (7,779 | ) | | | | |

Decrease in investments in Underlying Portfolios paid in advance | | | 3,300,000 | | | | | |

Decrease in cash collateral due from broker | | | 16,522,860 | | | | | |

Increase in cash collateral due to broker | | | 398,000 | | | | | |

Decrease in management fee payable | | | (5,098 | ) | | | | |

Decrease in administrative fee payable | | | (3,971 | ) | | | | |

Decrease in Transfer Agent fee payable | | | (5 | ) | | | | |

Decrease in accrued expenses | | | (406,617 | ) | | | | |

Proceeds on swaps, net | | | 653,573 | | | | | |

| | | | | | | | |

Total adjustments | | | | | | | (25,629,295 | ) |

| | | | | | | | |

Net cash provided by (used in) operating activities | | | | | | | (12,910,441 | ) |

| Cash flows from financing activities | | | | | | | | |

Subscriptions, including change in subscriptions received in advance | | | 78,463,365 | | | | | |

Redemptions, net of payable for shares of beneficial interest redeemed | | | (81,393,839 | ) | | | | |

Cash dividends paid (net of dividend reinvestments and distribution payable)† | | | (3,802,595 | ) | | | | |

| | | | | | | | |

Net cash provided by (used in) financing activities | | | | | | | (6,733,069 | ) |

Effect of exchange rate on cash | | | | | | | 17,524 | |

| | | | | | | | |

Net decrease in cash | | | | | | | (19,625,986 | ) |

Cash at beginning of year | | | | | | | 35,604,036 | |

| | | | | | | | |

Cash at end of year | | | | | | $ | 15,978,050 | |

| | | | | | | | |

| Supplemental disclosure of cash flow information | | | | | | | | |

† Reinvestment of dividends | | $ | 39,306,252 | | | | | |

Interest expense paid during the year | | $ | 591 | | | | | |

See notes to consolidated financial statements.

| | |

| |

22 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

March 31, 2022

NOTE A

Significant Accounting Policies

AB Multi-Manager Alternative Fund (the “Fund”) is a statutory trust formed under the laws of the State of Delaware and registered under the Investment Company Act of 1940 as a diversified, closed-end management investment company. The Fund commenced operations on October 1, 2012. The Fund’s investment objective is to seek long-term capital appreciation. There can be no assurance that the Fund will achieve its investment objective, be able to structure its investments as anticipated, or that its returns will be positive over any period of time. The Fund is not intended as a complete investment program for investors. The Fund seeks to achieve its investment objective primarily by allocating its assets among investments in private investment vehicles (“Underlying Portfolios”), commonly referred to as hedge funds, that are managed by unaffiliated asset managers that employ a broad range of investment strategies. As a secondary strategy, the Fund will generally also make direct investments in securities and other financial instruments. As part of the Fund’s investment strategy, the Fund may seek exposure to commodities and commodities-related instruments and derivatives primarily through investments in AB Multi-Manager Alternative Fund (Cayman), Ltd., a wholly-owned subsidiary of the Fund organized under the laws of the Cayman Islands (the “Subsidiary”). The Subsidiary commenced operations on September 21, 2018. The Fund is the sole shareholder of the Subsidiary and it is intended that the Fund will remain the sole shareholder and will continue to control the Subsidiary. As of March 31, 2022, net assets of the Fund were $1,049,304,677, of which $177,678, or less than 1%, represented the Fund’s ownership of all issued shares and voting rights of the Subsidiary. This report presents the consolidated financial statements of the Fund and the Subsidiary. All intercompany transactions and balances have been eliminated in consolidation. The consolidated financial statements have been prepared in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”), which require management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities in the consolidated financial statements and amounts of income and expenses during the reporting period. Actual results could differ from those estimates. The Fund is an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies. The following is a summary of significant accounting policies followed by the Fund.

1. Valuation of Investments

The Fund’s Board of Trustees (the “Board”) has approved pricing and valuation policies and procedures pursuant to which the Fund’s investments in Underlying Portfolios are valued at fair value (the “Valuation

| | |

| |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 23 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

Procedures”). Among other matters, the Valuation Procedures set forth the Fund’s valuation policies and the mechanisms and processes to be employed on a monthly basis to implement such policies. In accordance with the Valuation Procedures, fair value of an Underlying Portfolio as of each valuation time ordinarily is the value determined as of such month-end for each Underlying Portfolio in accordance with the Underlying Portfolio’s valuation policies and reported at the time of the Fund’s valuation.

On a monthly basis, the Fund generally uses the net asset value (“NAV”), provided by the Underlying Portfolios, to determine the fair value of all Underlying Portfolios which (a) do not have readily determinable fair values and (b) either have the attributes of an investment company or prepare their financial statements consistent with measurement principles of an investment company. As a general matter, the fair value of the Fund’s interest in an Underlying Portfolio represents the amount that the Fund could reasonably expect to receive from an Underlying Portfolio if its interest were redeemed at the time of valuation. In the unlikely event that an Underlying Portfolio does not report a month-end value to the Fund on a timely basis, the Fund would determine the fair value of such Underlying Portfolio based on the most recent value reported by the Underlying Portfolio, and any other relevant information available at the time the Fund values its portfolio. In making a fair value determination, the Fund will consider all appropriate information reasonably available to it at the time and that AllianceBernstein L.P. (the “Investment Manager”) believes to be reliable. The Fund may consider factors such as, among others: (i) the price at which recent subscriptions for or redemptions of the Underlying Portfolio’s interests were effected; (ii) information provided to the Fund by the manager of an Underlying Portfolio, or the failure to provide such information as the Underlying Portfolio manager agreed to provide in the Underlying Portfolio’s offering materials or other agreements with the Fund; (iii) relevant news and other sources; and (iv) market events. In addition, when an Underlying Portfolio imposes extraordinary restrictions on redemptions, or when there have been no recent subscriptions for Underlying Portfolio interests, the Fund may determine that it is appropriate to apply a discount to the NAV reported by the Underlying Portfolio. The use of different factors and estimation methodologies could have a significant effect on the estimated fair value and could be material to the consolidated financial statements.

The Investment Manager has established a Valuation Committee (the “Committee”) made up of representatives of portfolio management, fund accounting, compliance and risk management which operates under the Valuation Procedures and is responsible for overseeing the pricing and valuation of all securities held in the Fund. The Committee’s responsibilities

| | |

| |

24 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

include: 1) fair value determinations (and oversight of any third parties to whom any responsibility for fair value determinations is delegated), and 2) regular monitoring of the Valuation Procedures and modification or enhancement of the Valuation Procedures (or recommendation of the modification of the Valuation Procedures) as the Committee believes appropriate. Prior to investing in any Underlying Portfolio, and periodically thereafter, the Investment Manager will conduct a due diligence review of the valuation methodology utilized by the Underlying Portfolio. In addition, there are several processes outside of the pricing process that are used to monitor valuation issues including: 1) performance and performance attribution reports are monitored for anomalous impacts based upon benchmark performance, and 2) portfolio managers review all portfolios for performance and analytics.

Portfolio securities are valued at their current market value determined on the basis of market quotations or, if market quotations are not readily available or are deemed unreliable, at “fair value” as determined in accordance with procedures established by and under the general supervision of the Board.

In general, the market values of securities which are readily available and deemed reliable are determined as follows: securities listed on a national securities exchange (other than securities listed on the NASDAQ Stock Market, Inc. (“NASDAQ”)) or on a foreign securities exchange are valued at the last sale price at the close of the exchange or foreign securities exchange. If there has been no sale on such day, the securities are valued at the last traded price from the previous day. Securities listed on more than one exchange are valued by reference to the principal exchange on which the securities are traded; securities listed only on NASDAQ are valued in accordance with the NASDAQ Official Closing Price; listed or over the counter (“OTC”) market put or call options are valued at the mid level between the current bid and ask prices. If either a current bid or current ask price is unavailable, the Investment Manager will have discretion to determine the best valuation (e.g., last trade price in the case of listed options); open futures are valued using the closing settlement price or, in the absence of such a price, the most recent quoted bid price. If there are no quotations available for the day of valuation, the last available closing settlement price is used; U.S. Government securities and any other debt instruments having 60 days or less remaining until maturity are generally valued at market by an independent pricing vendor, if a market price is available. If a market price is not available, the securities are valued at amortized cost. This methodology is commonly used for short term securities that have an original maturity of 60 days or less, as well as short term securities that had an original term to maturity that exceeded 60 days. In instances when amortized cost is utilized, the Committee must reasonably

| | |

| |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 25 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

conclude that the utilization of amortized cost is approximately the same as the fair value of the security. Factors the Committee will consider include, but are not limited to, an impairment of the creditworthiness of the issuer or material changes in interest rates. Fixed-income securities, including mortgage-backed and asset-backed securities, may be valued on the basis of prices provided by a pricing service or at a price obtained from one or more of the major broker-dealers. In cases where broker-dealer quotes are obtained, the Investment Manager may establish procedures whereby changes in market yields or spreads are used to adjust, on a daily basis, a recently obtained quoted price on a security. Swaps and other derivatives are valued daily, primarily using independent pricing services, independent pricing models using market inputs, as well as third party broker-dealers or counterparties. Open-end mutual funds are valued at the closing net asset value per share, while exchange traded funds are valued at the closing market price per share.

Securities for which market quotations are not readily available (including restricted securities) or are deemed unreliable are valued at fair value as deemed appropriate by the Investment Manager. Factors considered in making this determination may include, but are not limited to, information obtained by contacting the issuer, analysts, analysis of the issuer’s financial statements or other available documents. In addition, the Fund may use fair value pricing for securities primarily traded in non-U.S. markets because most foreign markets close well before the Fund values its securities at 4:00 p.m., Eastern Time. The earlier close of these foreign markets gives rise to the possibility that significant events, including broad market moves, may have occurred in the interim and may materially affect the value of those securities. To account for this, the Fund generally values many of its foreign equity securities using fair value prices based on third party vendor modeling tools to the extent available.

U.S. GAAP establishes a framework for measuring fair value, and a three-level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund’s own assumptions about the assumptions that market participants would use in pricing the asset or liability based on the best information available in the circumstances. Each

| | |

| |

26 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

investment is assigned a level based upon the observability of the inputs which are significant to the overall valuation. The three-tier hierarchy of inputs is summarized below.

| | • | | Level 1—quoted prices in active markets for identical investments |

| | • | | Level 2—other significant observable inputs |

| | • | | Level 3—significant unobservable inputs |

The fair value of debt instruments, such as bonds, and over-the-counter derivatives is generally based on market price quotations, recently executed market transactions (where observable) or industry recognized modeling techniques and are generally classified as Level 2. Pricing vendor inputs to Level 2 valuations may include quoted prices for similar investments in active markets, interest rate curves, coupon rates, currency rates, yield curves, option adjusted spreads, default rates, credit spreads and other unique security features in order to estimate the relevant cash flows which is then discounted to calculate fair values. If these inputs are unobservable and significant to the fair value, these investments will be classified as Level 3.

Where readily available market prices or relevant bid prices are not available for certain equity investments, such investments may be valued based on similar publicly traded investments, movements in relevant indices since last available prices or based upon underlying company fundamentals and comparable company data (such as multiples to earnings or other multiples to equity). Where an investment is valued using an observable input, such as another publicly traded security, the investment will be classified as Level 2. If management determines that an adjustment is appropriate based on restrictions on resale, illiquidity or uncertainty, and such adjustment is a significant component of the valuation, the investment will be classified as Level 3. An investment will also be classified as Level 3 where management uses company fundamentals and other significant inputs to determine the valuation.

Valuations reflected in this report are as of the report date. As a result, changes in valuation due to market events and/or issuer related events after the report date and prior to issuance of the report are not reflected herein.

| | |

| |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 27 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

The following table summarizes the valuation of the Fund’s investments by the above fair value hierarchy levels as of March 31, 2022:

| | | | | | | | | | | | | | | | |

Investments in

Securities: | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets: | |

Common Stocks | | $ | 16,996,413 | | | $ | – 0 | – | | $ | – 0 | – | | $ | 16,996,413 | |

Warrants | | | 207,839 | | | | – 0 | – | | | – 0 | – | | | 207,839 | |

Short-Term Investments | | | 110,999,000 | | | | – 0 | – | | | – 0 | – | | | 110,999,000 | |

Investments valued at NAV | | | | | | | | | | | | | | | 911,761,237 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | | 128,203,252 | | | | – 0 | – | | | – 0 | – | | | 1,039,964,489 | |

Other Financial Instruments(a): | | | | | | | | | | | | | | | | |

Assets: | |

Total Return Swaps | | | – 0 | – | | | 7,388,069 | | | | – 0 | – | | | 7,388,069 | |

Liabilities: | |

Total Return Swaps | | | – 0 | – | | | (4,457,400 | ) | | | – 0 | – | | | (4,457,400 | ) |

| | | | | | | | | | | | | | | | |

Total | | $ | 128,203,252 | | | $ | 2,930,669 | | | $ | – 0 | – | | $ | 1,042,895,158 | |

| | | | | | | | | | | | | | | | |

| (a) | Other financial instruments are derivative instruments, such as futures, forwards and swaps, which are valued at the unrealized appreciation/(depreciation) on the instrument. Other financial instruments may also include swaps with upfront premiums, options written and swaptions written which are valued at market value. |

2. Cash Committed

As of March 31, 2022, the Fund has committed to purchase the following Underlying Portfolios for effective date April 1, 2022:

| | | | |

Underlying Portfolios | | Amount Committed | |

John Street Systematic Fund Limited | | $ | 1,100,000 | |

Brevan Howard Alpha Strategies Fund Limited | | | 2,600,000 | |

| | | | |

| | $ | 3,700,000 | |

3. Currency Translation

Assets and liabilities denominated in foreign currencies and commitments under forward currency exchange contracts are translated into U.S. dollars at the mean of the quoted bid and ask prices of such currencies against the U.S. dollar. Purchases and sales of portfolio securities are translated into U.S. dollars at the rates of exchange prevailing when such securities were acquired or sold. Income and expenses are translated into U.S. dollars at rates of exchange prevailing when accrued.

Net realized gain or loss on foreign currency transactions represents foreign exchange gains and losses from sales and maturities of foreign fixed income investments, holding of foreign currencies, currency gains or losses realized between the trade and settlement dates on foreign investment transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Fund’s books and

| | |

| |

28 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

the U.S. dollar equivalent amounts actually received or paid. Net unrealized currency gains and losses from valuing foreign currency denominated assets and liabilities at period end exchange rates are reflected as a component of net unrealized appreciation or depreciation of foreign currency denominated assets and liabilities.

4. Taxes

It is the Fund’s policy to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its investment company taxable income and net realized gains, if any, to shareholders. Therefore, no provisions for federal income or excise taxes are required. The Fund intends to continue to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986 as they apply to regulated investment companies. By so complying, the Fund will not be subject to federal and state income taxes to the extent that all of its income is distributed.

For federal tax purposes, taxable income for the Fund and its Subsidiary are calculated separately. The Subsidiary is classified as a controlled foreign corporation (“CFC”) under the Code and its taxable income is included in the calculation of the Fund’s taxable income. Net losses of the Subsidiary are not deductible by the Fund either in the current period or future periods. The CFC has a taxable fiscal year end of March 31st.

In accordance with U.S. GAAP requirements regarding accounting for uncertainties in income taxes, management has analyzed the Fund’s tax positions taken or expected to be taken on federal and state income tax returns for all open tax years (the current and the prior three tax years) and has concluded that no provision for income tax is required in the Fund’s consolidated financial statements.

5. Investment Income and Investment Transactions

Income and capital gain distributions, if any, are recorded on the ex-dividend date. Investment transactions are accounted for on the trade date or effective date. Investment gains and losses are determined on the identified cost basis. The Fund accounts for distributions received from REIT investments or from regulated investment companies as dividend income, realized gain, or return of capital based on information provided by the REIT or the investment company.

6. Expenses

Expenses included in the accompanying consolidated statement of operations do not include any expenses of the Underlying Portfolios.

| | |

| |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 29 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

7. Dividends and Distributions

Dividends and distributions to shareholders, if any, are recorded on the ex-dividend date. Income dividends and capital gains distributions are determined in accordance with federal tax regulations and may differ from those determined in accordance with U.S. GAAP. To the extent these differences are permanent, such amounts are reclassified within the capital accounts based on their federal tax basis treatment; temporary differences do not require such reclassification.

NOTE B

Management Fee and Other Transactions with Affiliates

Under the terms of the investment advisory agreement, the Fund pays the Investment Manager a management fee at an annual rate of 1.00% of an aggregate of the Fund’s net assets determined as of the last day of a calendar month and adjusted for subscriptions and repurchases accepted as of the first day of the subsequent month (the “Management Fee”). The Management Fee is payable in arrears as of the last day of the subsequent month.

Under a separate Administrative Reimbursement Agreement, the Fund may use the Investment Manager and its personnel to provide certain administrative services to the Fund and, in such event, the services and payments will be subject to approval by the Fund’s Board. For the year ended March 31, 2022, the reimbursement for such fees amounted to $284,299.

The Fund may engage one or more distributors to solicit investments in the Fund. Sanford C. Bernstein & Company LLC (“Bernstein”) and AllianceBernstein Investments, Inc. (“ABI”), each an affiliate of the Investment Manager, have been selected as distributors of the Fund under Distribution Services Agreements. The Distribution Services Agreements do not call for any payments to be made to Bernstein or ABI by the Fund.

The Fund compensates AllianceBernstein Investor Services, Inc. (“ABIS”), a wholly-owned subsidiary of the Investment Manager, under a Transfer Agency Agreement for providing personnel and facilities to perform transfer agency services for the Fund. Such compensation paid to ABIS amounted to $213,232 for the year ended March 31, 2022.

The Fund may invest in AB Government Money Market Portfolio (the “Government Money Market Portfolio”) which has a contractual annual advisory fee rate of .20% of the portfolio’s average daily net assets and bears its own expenses. The Investment Manager has contractually agreed to waive .10% of the advisory fee of Government Money Market Portfolio (resulting in a net advisory fee of .10%) until August 31, 2022. In connection with the investment by the Fund in Government Money

| | |

| |

30 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

Market Portfolio, the Investment Manager has contractually agreed to waive its advisory fee from the Fund in an amount equal to the Fund’s pro rata share of the effective advisory fee of Government Money Market Portfolio, as borne indirectly by the Fund as an acquired fund fee and expense. For the year ended March 31, 2022, such waiver amounted to $33,488.

A summary of the Fund’s transactions in AB mutual funds for the year ended March 31, 2022 is as follows:

| | | | | | | | | | | | | | | | | | | | |

Fund | | Market Value

3/31/21

(000) | | | Purchases

at Cost

(000) | | | Sales

Proceeds

(000) | | | Market Value

3/31/22

(000) | | | Dividend

Income

(000) | |

Government Money

Market Portfolio | | $ | 28,399 | | | $ | 207,200 | | | $ | 124,600 | | | $ | 110,999 | | | $ | 13 | |

During the year ended March 31, 2022 and the year ended March 31, 2021, the Investment Manager reimbursed the Fund $7,719 and $6,897, respectively, for trading losses incurred due to a trade entry error.

NOTE C

Investment Transactions

1. Purchases and Sales

Purchases and sales of investment securities (excluding short-term investments) for the year ended March 31, 2022 were as follows:

| | | | | | | | |

| | | Purchases | | | Sales | |