UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22671

AB MULTI-MANAGER ALTERNATIVE FUND, INC.

(Exact name of registrant as specified in charter)

1345 Avenue of the Americas, New York, New York 10105

(Address of principal executive offices) (Zip code)

Stephen M. Woetzel

AllianceBernstein L.P.

1345 Avenue of the Americas

New York, New York 10105

(Name and address of agent for service)

Registrant’s telephone number, including area code: (800) 221-5672

Date of fiscal year end: March 31, 2024

Date of reporting period: September 30, 2023

ITEM 1. REPORTS TO STOCKHOLDERS.

SEP 09.30.23

SEMI-ANNUAL REPORT

AB MULTI-MANAGER ALTERNATIVE FUND

| | |

| |

| Investment Products Offered | | • Are Not FDIC Insured • May Lose Value • Are Not Bank Guaranteed |

You may obtain a description of the Fund’s proxy voting policies and procedures, and information regarding how the Fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, without charge. Simply visit AB’s website at www.abfunds.com, or go to the Securities and Exchange Commission’s (the “Commission”) website at www.sec.gov, or call AB at (800) 227 4618.

The Fund files its complete schedule of portfolio holdings with the Commission for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the Commission’s website at www.sec.gov.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

SEMI-ANNUAL REPORT

November 15, 2023

This report provides certain performance data for the AB Multi-Manager Alternative Fund (the “Fund”) for the semi-annual reporting period ended September 30, 2023.

The Fund’s investment objective is to seek long-term capital appreciation.

RETURNS AS OF SEPTEMBER 30, 2023 (unaudited)

| | | | | | | | |

| | |

| | | 6 Months | | | 12 Months | |

| | |

| AB MULTI-MANAGER ALTERNATIVE FUND | | | 1.61% | | | | 3.32% | |

| | |

| Benchmark: HFRI FOF Composite Index | | | 2.22% | | | | 4.77% | |

| | |

| MSCI World Index (net) | | | 3.13% | | | | 21.95% | |

| | |

| Bloomberg US Aggregate Bond Index | | | -4.05% | | | | 0.64% | |

INVESTMENT RESULTS

The table above provides performance data for the Fund and its benchmark, the HFRI Fund of Funds Composite Index (“HFRI FOF”), for the six- and 12-month periods ended September 30, 2023. The table also includes the performance of the Morgan Stanley Capital International (“MSCI”) World Index (net) and the Bloomberg US Aggregate Bond Index.

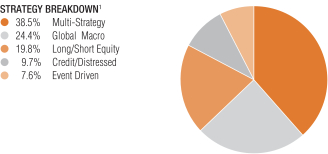

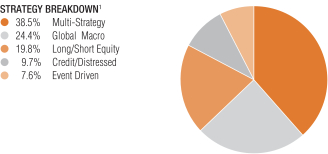

For the six-month period, the Fund underperformed the HFRI FOF and the MSCI World Index (net) but outperformed the Bloomberg US Aggregate Bond Index. The Fund’s underperformance, relative to the benchmark, was driven by Event Driven allocation. Event Driven Underlying Portfolios was the primary detractor, as a result of losses from an underlying portfolio’s positions in event equity and distressed credit. The Credit/Distressed strategy also negatively impacted performance, while Multi-Strategy and Long/Short Equity allocations contributed to performance.

For the 12-month period, the Fund underperformed the HFRI FOF and the MSCI World Index (net) but outperformed the Bloomberg US Aggregate Bond Index. Underperformance was a result of an allocation to Event Driven strategy, which was impacted by heightened regulatory risks around the completion of mergers and acquisitions. The largest contributors were Multi-Strategy and Long/Short Equity funds, which benefited from a strong bull market for global equities in general and exposures to emerging markets in particular, such as India and China, as well as global TMT stocks.

The Fund used currency forwards for hedging purposes, which had no material impact during either period. Total return swaps were used for investment purposes, which detracted from absolute performance for both periods.

| | |

| |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 1 |

MARKET REVIEW AND INVESTMENT STRATEGY

US and international stocks rose and emerging-market stocks declined during the six-month period ended September 30, 2023. Global markets rallied but experienced bouts of volatility, as central banks—led by the US Federal Reserve (the “Fed”)—began to pause or lower rate hikes. Lingering concerns from the collapse of select US regional banks and the threat of a US government default weighed on results early in the period. China’s reopening impulse initially benefited equity markets, but its effect quickly deteriorated—especially in emerging markets—as China’s economic recovery stalled. Toward the end of the period, equity markets pulled back as investors reacted to rising bond yields and hawkish commentary from the Fed that emphasized its intention to hold interest rates higher for longer, given mostly resilient economic growth and sticky inflation. Concern over a broadening United Auto Workers strike, the looming risk of a US government shutdown later in the year and some signs of weaker consumer spending also weighed on sentiment. Within large-cap markets, both growth- and value-oriented stocks rose, but growth significantly outperformed value, led by a technology-sector rally—especially among companies closely related to artificial intelligence technologies. Large-cap stocks rose in absolute terms and outperformed small-cap stocks, which declined.

Fixed-income government bond market yields were volatile as investors adjusted their expectations for inflation and economic growth. US Treasury yields jumped higher at the end of the period after the Fed adjusted its quarterly expectations of interest rates to be higher for longer. Other developed-market treasury yields rose in tandem. Most major developed-market central banks started to reduce the size of interest-rate hikes and pause future hikes. Headline inflation slowed, indicating that the end of the developed-market hiking cycle is clearly in sight. Government bond returns fell overall—with losses in all major markets except Japan. In corporate credit risk sectors, investment-grade corporate bonds outperformed the returns of global developed-market treasuries—with US and eurozone investment-grade corporates outperforming their respective treasury markets. Developed-market high-yield corporate bonds had positive returns and outperformed government bonds by a substantial margin. High-yield corporates significantly outperformed respective treasury markets in the US and eurozone. Emerging-market local-currency bonds outperformed developed-market treasuries even as the US dollar gained on most currencies during the period. Hard-currency sovereign bonds hedged to the US dollar posted a minor decline, while emerging-market corporate bonds had positive results overall.

During this period the Fund’s Senior Investment Management Team (the “Team”) selectively added exposure expected to benefit from a backdrop of higher interest rates and increased dispersion within equity markets. These new underlying fund investments were made across our allocations

| | |

| |

2 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

to Equity Long Short, Credit and Global Macro. In each case the funds selected have displayed asymmetric return profiles while also exhibiting downside preservation over their long-term track records. The Team simultaneously reduced exposure to underlying funds exhibiting declining levels of alpha (a measure of how the [Fund] is performing on a risk-adjusted basis versus its benchmark) production while being more susceptible to market volatility.

INVESTMENT POLICIES

There can be no assurance that the Fund will achieve its investment objective, be able to structure its investments as anticipated, or that its returns will be positive over any period of time. The Fund is not intended as a complete investment program for investors.

The Fund seeks to achieve its investment objective primarily by allocating its assets among investments in a diversified portfolio of private investment vehicles commonly referred to as hedge funds (“Underlying Portfolios”). The Fund will invest primarily in Underlying Portfolios pursuing the following strategies: Long/Short Equity, Event Driven, Credit/Distressed, Global Macro and Multi-Strategy. For more information on these strategies, please see “Consolidated Portfolio of Investments” on pages 9-14. As a secondary strategy, the Fund will generally also make direct investments in securities and other financial instruments. For more information regarding the Fund’s risks, please see “Disclosures and Risks” on pages 4-6 and “Note E—Risks Involved in Investing in the Fund” of the Notes to Consolidated Financial Statements on pages 33-37.

| | |

| |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 3 |

DISCLOSURES AND RISKS

Benchmark Disclosure

All indices are unmanaged and do not reflect fees and expenses associated with the active management of a mutual fund portfolio. The HFRI FOF Composite Index is an equal-weighted performance index that includes over 650 constituent funds of hedge funds that report their monthly net-of-fee returns to Hedge Fund Research, have at least $50 million under management and have been actively trading for at least 12 months. Returns of the Index are subject to subsequent revision. The MSCI World Index (net, free float-adjusted, market capitalization weighted) represents the equity market performance of developed markets. The Bloomberg US Aggregate Bond Index represents the performance of securities within the US investment-grade fixed-rate bond market, with index components for government and corporate securities, mortgage pass-through securities, asset-backed securities and commercial mortgage-backed securities. MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein. The MSCI data may not be further redistributed or used as a basis for other indices, any securities or financial products. This report is not approved, reviewed or produced by MSCI. Net returns include the reinvestment of dividends after deduction of non-US withholding tax. An investor cannot invest directly in an index, and its results are not indicative of the performance for any specific investment, including the Fund.

A Word about Risk

An investment in the Fund’s shares involves a high degree of risk and should not constitute a complete investment program. Before making an investment decision, you should carefully consider the following risk factors, together with the other information contained in the prospectus. At any point in time, an investment in the Fund’s shares may be worth less than the original amount invested, even after taking into account the distributions paid, if any, and the ability of shareholders to reinvest distributions. If any of the risks discussed below occurs, the Fund’s results of operations could be materially and adversely affected. If this were to happen, the price of Fund shares could decline significantly and you could lose all or a part of your investment.

Investment in this Fund is highly speculative and involves substantial risk, including loss of principal, and therefore may not be suitable for all investors.

General Risk Factors: Underlying Portfolios and the Fund’s direct investments may exhibit high volatility, and investors may lose all or substantially all of their investment. Investments by Underlying Portfolios and the Fund in illiquid assets and foreign markets and the use of short sales,

| | |

| |

4 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

DISCLOSURES AND RISKS (continued)

options, leverage, futures, swaps and other derivative instruments may create special risks and substantially increase the impact and likelihood of adverse price movements. Interests in Underlying Portfolios are subject to limitations on transferability and are illiquid, and no secondary market for interests typically exists or is likely to develop. Underlying Portfolios are typically not registered with securities regulators and are therefore generally subject to little or no regulatory oversight. Performance compensation payable to an Underlying Portfolio investment advisor may create an incentive to make riskier or more speculative investments. Underlying Portfolios typically charge higher fees than many other types of investments, which can offset trading profits, if any. There can be no assurance that any Underlying Portfolio will achieve its investment objectives.

Market Risk: The value of the Fund’s assets will fluctuate as the bond or stock market fluctuates. The value of its investments may decline, sometimes rapidly and unpredictably, simply because of economic changes or other events, including public health crises (including the occurrence of a contagious disease or illness) and regional and global conflicts, that affect large portions of the market.

Tax Risks: The Fund intends to be treated as a regulated investment company (“RIC”) under the Internal Revenue Code. However, in order to qualify as a RIC and also to avoid having to pay an “excise tax,” the Fund will be subject to certain limitations on its investments and operations, including a requirement that a specified proportion of its income come from qualifying sources, an asset diversification requirement and minimum distribution requirements. Satisfaction of the various requirements requires significant support and information from the Underlying Portfolios, and such support and information may not be available, sufficient, verifiable, or provided on a timely basis.

Limited Liquidity: The Fund’s shares are not listed on any securities exchange or traded in any other market, and are subject to substantial restrictions on transfer. Although the Fund has offered to repurchase shares on a quarterly basis, such periodic repurchase offers are at the sole discretion of the Fund’s Board of Trustees, and there is no assurance that these repurchase offers will continue. It will normally be four to six months between the time an investor tenders shares for repurchase (i.e., requests that the Fund repurchase shares as part of a repurchase offer) and the investor’s receipt of any cash proceeds associated with the repurchase.

Fund of Funds Considerations: The Fund will have no control rights over and limited transparency into the investment programs of the Underlying Portfolios in which it invests. In valuing the Fund’s holdings, the Investment Manager will generally rely on financial information provided by

| | |

| |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 5 |

DISCLOSURES AND RISKS (continued)

Underlying Portfolios, which may be unaudited, estimated and/or may not involve third parties. The Fund’s investment opportunities may be limited as a result of withdrawal terms or anticipated liquidity needs (e.g., withdrawal restrictions imposed by underlying hedge funds may delay, preclude or involve expense in connection with portfolio adjustments by the Investment Manager).

These risks are fully discussed in the Fund’s prospectus. As with all investments, you may lose money by investing in the Fund.

An Important Note About Historical Performance

The performance shown in this report represents past performance and does not guarantee future results. Current performance may be lower or higher than the performance information shown. All fees and expenses related to the operation of the Fund have been deducted. Performance assumes reinvestment of distributions and does not account for taxes.

| | |

| |

6 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

HISTORICAL PERFORMANCE

AVERAGE ANNUAL RETURNS AS OF SEPTEMBER 30, 2023 (unaudited)

| | | | |

| |

| | | NAV Returns | |

| |

| 1 Year | | | 3.32% | |

| |

| 5 Years | | | 3.62% | |

| |

| 10 Years | | | 2.78% | |

Performance assumes the reinvestment of dividends and capital gains distributions at prices obtained pursuant to the Fund’s dividend reinvestment plan.

| | |

| |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 7 |

PORTFOLIO SUMMARY

September 30, 2023 (unaudited)

Net Assets ($mil): $1,153.8

| 1 | The Fund’s portfolio strategy breakdown is based on the Investment Manager’s internal classification and is expressed as a percentage of total investment exposure, including exposure from derivatives (see “Consolidated Portfolio of Investments” section of the report for additional details). |

| | |

| |

8 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

CONSOLIDATED PORTFOLIO OF INVESTMENTS

September 30, 2023 (unaudited)

| | | | | | | | | | | | | | |

Underlying

Portfolios | | Shares | | | Fair Value ($) | | | % Net Assets | | | Liquidity* |

|

Multi-Strategy |

Atlas Enhanced Fund, Ltd. | | | 48,500 | | | $ | 49,425,086 | | | | 4.3 | % | | Quarterly |

Elliott International Limited | | | 48,815 | | | | 101,662,511 | | | | 8.8 | | | Quarterly |

Hudson Bay International Fund, Ltd. | | | 54,803 | | | | 59,133,421 | | | | 5.1 | | | Quarterly |

LMR Multi-Strategy Fund Limited | | | 206,673 | | | | 50,888,927 | | | | 4.4 | | | Quarterly |

Millennium International, Ltd. | | | 34,595 | | | | 38,886,949 | | | | 3.4 | | | Quarterly |

Point72 Capital International, Ltd. | | | 581,138 | | | | 84,194,428 | | | | 7.3 | | | Quarterly |

Schonfeld Strategic Partners Offshore Fund, Ltd. | | | 39,700 | | | | 55,469,903 | | | | 4.8 | | | Monthly |

| | | | | | | | | | | | | | |

Total | | | | | | | 439,661,225 | | | | 38.1 | | | |

| | | | | | | | | | | | | | |

|

Global Macro |

Alphadyne International Fund, Ltd. | | | 34,559 | | | | 52,630,371 | | | | 4.6 | | | Quarterly |

Brevan Howard Alpha Strategies Fund Limited | | | 481,178 | | | | 58,540,124 | | | | 5.1 | | | Quarterly |

Capula Tactical Macro Fund Limited | | | 255,246 | | | | 28,493,923 | | | | 2.5 | | | Monthly |

GreshamQuant – ACAR Fund, Ltd. | | | 13,000 | | | | 12,017,827 | | | | 1.0 | | | Quarterly |

John Street Systematic Fund Limited | | | 121,016 | | | | 26,073,214 | | | | 2.3 | | | Monthly |

LMR Alpha Rates Trading Fund Limited | | | 230,000 | | | | 23,069,460 | | | | 2.0 | | | Quarterly |

The Tudor BVI Global Fund, Ltd. | | | 347 | | | | 77,954,959 | | | | 6.7 | | | Quarterly |

| | | | | | | | | | | | | | |

Total | | | | | | | 278,779,878 | | | | 24.2 | | | |

| | | | | | | | | | | | | | |

|

Long/Short Equity |

Coatue Offshore Fund, Ltd. | | | 34,325 | | | | 5,127,368 | | | | 0.4 | | | Quarterly |

Janchor Partners Pan-Asian Fund | | | 174,396 | | | | 24,870,302 | | | | 2.2 | | | Triennially |

JAT Capital Offshore Fund, Ltd. | | | 23,000 | | | | 22,796,627 | | | | 2.0 | | | Quarterly |

Nokota LC, LLC | | | 1,138 | | | | 193,305 | | | | 0.0 | | | At Fund’s Discretion |

PFM Healthcare Offshore Fund, Ltd. | | | 344 | | | | 228,701 | | | | 0.0 | | | At Fund’s Discretion |

| | |

| |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 9 |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | | | |

Underlying

Portfolios | | Shares | | | Fair Value ($) | | | % Net Assets | | | Liquidity* |

|

Schonfeld Fundamental Equity Offshore Fund, Ltd. | | | 24,927 | | | $ | 34,222,701 | | | | 3.0 | % | | Quarterly |

TCIM Offshore Fund, Ltd. | | | 22,000 | | | | 21,465,850 | | | | 1.9 | | | Monthly |

The Children’s Investment Fund | | | 104,651 | | | | 23,598,818 | | | | 2.0 | | | Biennial |

Think Investments Offshore Ltd. | | | 11,660 | | | | 35,025,133 | | | | 3.0 | | | Semi-Annual |

Two Creeks Capital Offshore Fund, Ltd. | | | 20,060 | | | | 34,266,062 | | | | 3.0 | | | Quarterly |

| | | | | | | | | | | | | | |

Total | | | | | | | 201,794,867 | | | | 17.5 | | | |

| | | | | | | | | | | | | | |

|

Credit/Distressed |

Claren Road Credit Fund, Ltd. | | | 43,894 | | | | 45,256,282 | | | | 3.9 | | | Quarterly |

Cross Ocean GSS Offshore Feeder LP | | | 23,000 | | | | 23,345,828 | | | | 2.0 | | | Quarterly |

King Street Capital, Ltd. | | | 15,659 | | | | 1,807,070 | | | | 0.2 | | | At Fund’s Discretion |

LMR CCSA Fund Limited | | | 185,763 | | | | 22,690,632 | | | | 2.0 | | | Quarterly |

Readystate Offshore Fund, Ltd. | | | 23,000 | | | | 23,490,593 | | | | 2.0 | | | Quarterly |

Theorem Prime+ Yield Fund Offshore LP | | | 20,000 | | | | 17,944,625 | | | | 1.6 | | | Quarterly |

| | | | | | | | | | | | | | |

Total | | | | | | | 134,535,030 | | | | 11.7 | | | |

| | | | | | | | | | | | | | |

|

Event Driven |

Antara Capital Offshore Fund, Ltd. | | | 37,848 | | | | 28,634,255 | | | | 2.5 | | | Quarterly |

Lion Point International, Ltd. | | | 2,024 | | | | 4,533,582 | | | | 0.4 | | | Semi-Annual |

Luxor Capital Partners Offshore Liquidating SPV, Ltd. | | | 2,317 | | | | 2,253,530 | | | | 0.2 | | | At Fund’s Discretion |

Senator Global Opportunity Offshore Fund, Ltd. | | | 4,726 | | | | 5,518,244 | | | | 0.5 | | | Quarterly |

Senator Global Opportunity Offshore Fund II, Ltd. | | | 7,031 | | | | 8,743,656 | | | | 0.7 | | | Quarterly |

| | | | | | | | | | | | | | |

Total | | | | | | | 49,683,267 | | | | 4.3 | | | |

| | | | | | | | | | | | | | |

| | | | |

Total Underlying Portfolios

(cost $892,861,811) | | | | | | | 1,104,454,267 | | | | 95.8 | | | |

| | | | | | | | | | | | | | |

| | |

| |

10 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | |

Company | | Shares | | | Fair Value ($) | | | % Net Assets | |

| |

Common Stocks | | | | | | | | | | | | |

Merger Arbitrage | |

Abcam PLC (Sponsored ADR)(a) | | | 78,902 | | | $ | 1,785,552 | | | | 0.1 | % |

Activision Blizzard, Inc.(a) | | | 23,531 | | | | 2,203,208 | | | | 0.2 | |

Albertsons Companies, Inc. – Class A(a) | | | 81,976 | | | | 1,864,954 | | | | 0.2 | |

Amedisys, Inc.(a) | | | 10,926 | | | | 1,020,488 | | | | 0.1 | |

American National Bankshares, Inc.(a) | | | 9,363 | | | | 355,232 | | | | 0.0 | |

Avantax, Inc.(a) | | | 3,575 | | | | 91,448 | | | | 0.0 | |

Avid Technology(a) | | | 6,614 | | | | 177,718 | | | | 0.0 | |

Cambridge Bancorp(a) | | | 2,948 | | | | 183,631 | | | | 0.0 | |

Capri Holdings, Ltd.(a) | | | 31,905 | | | | 1,678,522 | | | | 0.1 | |

Chase Corp.(a) | | | 61 | | | | 7,761 | | | | 0.0 | |

Contra Chinook Therape(a)(b)(c) | | | 37,922 | | | | 4 | | | | 0.0 | |

Denbury, Inc.(a) | | | 19,888 | | | | 1,949,223 | | | | 0.2 | |

Gresham House PLC(a) | | | 3,869 | | | | 50,293 | | | | 0.0 | |

Heritage-Cystal Clean, Inc.(a) | | | 2,829 | | | | 128,295 | | | | 0.0 | |

Horizon Pharma PLC(a) | | | 16,079 | | | | 1,860,179 | | | | 0.2 | |

Hostess Brands, Inc.(a) | | | 21,915 | | | | 729,989 | | | | 0.1 | |

Intercept Pharmaceuticals, Inc.(a) | | | 64,803 | | | | 1,201,448 | | | | 0.1 | |

iRobot Corp.(a) | | | 11,960 | | | | 453,284 | | | | 0.0 | |

Lakeland Bancorp., Inc.(a) | | | 19,683 | | | | 248,399 | | | | 0.0 | |

National Instruments Corp.(a) | | | 33,148 | | | | 1,976,284 | | | | 0.2 | |

New Relic, Inc.(a) | | | 6,559 | | | | 561,582 | | | | 0.0 | |

PNM Resources, Inc.(a) | | | 42,304 | | | | 1,887,181 | | | | 0.2 | |

Seagen, Inc.(a) | | | 8,530 | | | | 1,809,639 | | | | 0.2 | |

Sovos Brands, Inc.(a) | | | 27,627 | | | | 622,989 | | | | 0.1 | |

Spirit Airlines, Inc.(a) | | | 68,383 | | | | 1,128,319 | | | | 0.1 | |

Splunk, Inc.(a) | | | 11,995 | | | | 1,754,269 | | | | 0.1 | |

Triton International, Ltd.(a)(b)(c) | | | 11,938 | | | | 982,600 | | | | 0.1 | |

Veritiv Corp.(a) | | | 1,629 | | | | 275,138 | | | | 0.0 | |

VMWare Inc. – Class A(a) | | | 13,093 | | | | 2,179,723 | | | | 0.2 | |

Westrock Co.(a) | | | 39,797 | | | | 1,424,733 | | | | 0.1 | |

| | | | | | | | | | | | |

| | | |

Total Common Stocks

(cost $29,399,282) | | | | | | | 30,592,085 | | | | 2.6 | |

| | | | | | | | | | | | |

| | | |

Total Investments

(cost $922,261,093) | | | | | | | 1,135,046,352 | | | | 98.4 | |

Other assets less liabilities | | | | | | | 18,733,976 | | | | 1.6 | |

| | | | | | | | | | | | |

| | | |

Net Assets | | | | | | $ | 1,153,780,328 | | | | 100.0 | % |

| | | | | | | | | | | | |

| | |

| |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 11 |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

FORWARD CURRENCY EXCHANGE CONTRACTS (see Note C)

| | | | | | | | | | | | | | | | | | | | |

| Counterparty | | Contracts to

Deliver

(000) | | | In Exchange

For

(000) | | | Settlement

Date | | | Unrealized

Appreciation

(Depreciation) | |

State Street Bank & Trust Co. | | CAD | 1,323 | | | | USD | | | | 972 | | | | 10/27/2023 | | | $ | 7,003 | |

State Street Bank & Trust Co. | | USD | 980 | | | | CAD | | | | 1,327 | | | | 10/27/2023 | | | | (1,818 | ) |

| | | | | | | | | | | | | | | | | | | | |

| | | $ | 5,185 | |

| | | | | | | | | | | | | | | | | | | | |

TOTAL RETURN SWAPS (see Note C)

| | | | | | | | | | | | | | | | | | | | |

Counterparty &

Referenced Obligation | | Rate Paid/

Received | | | Payment

Frequency | | Current

Notional

(000) | | | Maturity

Date | | | Unrealized

Appreciation

(Depreciation) | |

Receive Total Return on Reference Obligation | |

Bank of America, NA | | | | |

New Relic, Inc. | |

| OBFR plus

0.40% |

| | Maturity | | USD | | | 7 | | | | 05/20/2027 | | | $ | 4,424 | |

Goldman Sachs International | | | | | | | |

Amedisys, Inc. | |

| SOFR plus

0.35% |

| | Maturity | | USD | | | 132 | | | | 07/15/2025 | | | | 121,804 | |

Dechra Pharmaceuticals PLC | |

| SONIA plus

0.35% |

| | Maturity | | GBP | | | 42 | | | | 07/15/2025 | | | | 51,837 | |

Emis Group PLC | |

| SONIA plus

0.35% |

| | Maturity | | GBP | | | 66 | | | | 07/15/2025 | | | | 81,043 | |

Majorel Group Luxembourg SA | |

| ESTR plus

0.35% |

| | Maturity | | EUR | | | 14 | | | | 07/15/2025 | | | | 10,659 | |

NeoGames SA | |

| SOFR plus

0.35% |

| | Maturity | | USD | | | 3 | | | | 07/15/2025 | | | | (3,663 | ) |

Network International Holdings PLC | |

| SONIA plus

0.35% |

| | Maturity | | GBP | | | 8 | | | | 07/15/2025 | | | | 9,528 | |

Morgan Stanley Capital Services LLC | | | | | | | |

American Equity Investment Life Holding Co. | |

| FedFundEffective

plus 0.38% |

| | Maturity | | USD | | | 5 | | | | 10/18/2023 | | | | (2,134 | ) |

Christian Hansen Holding | | | 1 Month CIBOR | | | Maturity | | DKK | | | 1,895 | | | | 10/18/2023 | | | | (269,039 | ) |

Lakeland Bancorp, Inc. | |

| FedFundEffective

plus 0.38% |

| | Maturity | | USD | | | 75 | | | | 10/18/2023 | | | | (86,092 | ) |

|

Pay Total Return on Reference Obligation | |

Bank of America, NA | | | | |

Atlantic Union Bankshares Corp. | |

| OBFR minus

1.25% |

| | Maturity | | USD | | | 8 | | | | 05/20/2027 | | | | 9,496 | |

Eastern Bankshares, Inc. | |

| OBFR minus

0.29% |

| | Maturity | | USD | | | 1 | | | | 05/20/2027 | | | | (606 | ) |

Exxon Mobil Corp. | |

| OBFR minus

0.30% |

| | Maturity | | USD | | | 186 | | | | 05/20/2027 | | | | (176,537 | ) |

Goldman Sachs International | | | | | | | |

J.M. Smucker Co. (The) | |

| SOFR minus

0.31% |

| | Maturity | | USD | | | 6 | | | | 07/15/2025 | | | | 5,826 | |

Smurfit Kappa Group PLC | |

| SOFR minus

0.45% |

| | Maturity | | USD | | | 64 | | | | 07/15/2025 | | | | 65,949 | |

| | |

| |

12 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

| | | | | | | | | | | | | | | | | | | | | | | | |

Counterparty &

Referenced Obligation | | Rate Paid/

Received | | | Payment

Frequency | | | Current

Notional

(000) | | | Maturity

Date | | | Unrealized

Appreciation

(Depreciation) | |

JPMorgan Chase Bank, NA | | | | | | | | |

Provident Financial Services | |

| OBFR minus

0.29% |

| | | Maturity | | | | USD | | | | 167 | | | | 08/12/2024 | | | $ | 182,495 | |

Morgan Stanley Capital Services LLC | | | | | | | | |

Broadcom, Inc. | |

| FedFundEffective

minus 0.29% |

| | | Maturity | | | | USD | | | | 329 | | | | 10/18/2023 | | | | (307,792 | ) |

Brookfield Asset Management, Ltd. | |

| FedFundEffective

minus 5.03% |

| | | Maturity | | | | USD | | | | 0 | ** | | | 10/18/2023 | | | | 549 | |

Brookfield Infrastructure Partners LP | |

| FedFundEffective

minus 5.03% |

| | | Maturity | | | | USD | | | | 29 | | | | 10/18/2023 | | | | 35,512 | |

Novozymes A/S | |

| 1 Month CIBOR

minus 0.40% |

| | | Maturity | | | | DKK | | | | 2,034 | | | | 10/18/2023 | | | | 286,835 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | $ | 20,094 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| ** | Notional amount less than 500. |

| (a) | Non-income producing security. |

| (b) | Security in which significant unobservable inputs (Level 3) were used in determining fair value. |

| (c) | Fair valued by the Adviser. |

| * | The investment strategies and liquidity of the Underlying Portfolios in which the Fund invests are as follows: |

Multi-Strategy Underlying Portfolios invest across multiple strategies, including long/short equity, event driven, global macro, credit/distressed and emerging markets, in which the investment process is predicated on movements in underlying economic variables and the impact these variables have on equity, fixed income, currency, commodity and other financial instrument markets. Underlying Portfolios within this strategy are generally subject to 45 – 90 day redemption notice periods. Certain Underlying Portfolios may have lock up periods of two years.

Global Macro Underlying Portfolios aim to identify and exploit imbalances in global economics and asset classes, typically utilizing macroeconomic and technical market factors rather than “bottom-up” individual security analysis. The Underlying Portfolios within this strategy are subject to 30 – 90 day redemption notice periods. Certain Underlying Portfolios have lock up periods of up to one year.

Long/Short Equity Underlying Portfolios seek to buy securities with the expectation that they will increase in value (“going long”) and sell securities short in the expectation that they will decrease in value (“going short”). Underlying Portfolios within this strategy are generally subject to 45 – 120 day redemption notice periods. The majority of the Underlying Portfolios are no longer subject to initial lockups. Certain Underlying Portfolios have lock up periods of up to three years.

Credit/Distressed Underlying Portfolios invest in a variety of fixed income and other securities, including bonds (corporate and government), bank debt, asset-backed financial instruments, mortgage-backed securities and mezzanine and distressed securities, as well as securities of distressed companies and high yield securities. Underlying Portfolios within this strategy are generally subject to 30 – 90 day redemption notice periods. The majority of the Underlying Portfolios are no longer subject to initial lockups. Certain Underlying Portfolios have lock up periods of up to 18 months.

Event Driven Underlying Portfolios seek to take advantage of information inefficiencies resulting from a particular corporate event, such as a takeover, liquidation, bankruptcy, tender offer, buyback, spin off, exchange offer, merger or other type of corporate reorganization. Underlying Portfolios within this strategy are generally subject to 60 – 90 day redemption notice periods. The majority of the Underlying Portfolios are no longer subject to initial lockups. Certain Underlying Portfolios have lock up periods of up to one year.

| | |

| |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 13 |

CONSOLIDATED PORTFOLIO OF INVESTMENTS (continued)

The Fund may also make direct investments in securities (other than securities of Underlying Portfolios), options, futures, options on futures, swap contracts, or other derivative or financial instruments.

Currency Abbreviations:

CAD – Canadian Dollar

DKK – Danish Krona

EUR – Euro

GBP – Great British Pound

USD – United States Dollar

Glossary:

CIBOR – Copenhagen Interbank Offered Rate

ESTR – Euro Short Term Rate

FedFundEffective – Federal Funds Effective Rate

OBFR – Overnight Bank Funding Rate

SOFR – Secured Overnight Financing Rate

SONIA – Sterling Overnight Index Average

See notes to consolidated financial statements.

| | |

| |

14 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

CONSOLIDATED STATEMENT OF ASSETS & LIABILITIES

September 30, 2023 (unaudited)

| | | | |

| Assets | |

Investments in securities, at value (cost $922,261,093) | | $ | 1,135,046,352 | |

Cash | | | 17,520,198 | |

Cash collateral due from broker | | | 906,108 | |

Foreign currencies, at value (cost $29,536) | | | 27,862 | |

Investments in Underlying Portfolios paid in advance (see Note A2) | | | 22,000,000 | |

Receivable for investments sold | | | 1,256,104 | |

Unrealized appreciation on total return swaps | | | 865,957 | |

Affiliated dividends receivable | | | 16,309 | |

Unrealized appreciation on forward currency exchange contracts | | | 7,003 | |

Other assets | | | 454,884 | |

| | | | |

Total assets | | | 1,178,100,777 | |

| | | | |

| Liabilities | |

Payable for shares of beneficial interest redeemed | | | 12,249,458 | |

Subscriptions received in advance | | | 7,474,000 | |

Credit facility payable | | | 2,191,052 | |

Management fee payable | | | 967,393 | |

Unrealized depreciation on total return swaps | | | 845,863 | |

Administrative fee payable | | | 199,253 | |

Transfer Agent fee payable | | | 19,357 | |

Directors’ fees payable | | | 11,278 | |

Unrealized depreciation on forward currency exchange contracts | | | 1,818 | |

Accrued expenses | | | 360,977 | |

| | | | |

Total liabilities | | | 24,320,449 | |

| | | | |

Net Assets | | $ | 1,153,780,328 | |

| | | | |

| Composition of Net Assets | |

Shares of beneficial interest, at par | | $ | 101,810 | |

Additional paid-in capital | | | 1,115,900,276 | |

Distributable earnings | | | 37,778,242 | |

| | | | |

Net Assets | | $ | 1,153,780,328 | |

| | | | |

Shares of beneficial interest outstanding—unlimited shares authorized, with par value of $.001 (based on 101,810,444 shares outstanding) | | $ | 11.33 | |

| | | | |

See notes to consolidated financial statements.

| | |

| |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 15 |

CONSOLIDATED STATEMENT OF OPERATIONS

Six Months Ended September 30, 2023 (unaudited)

| | | | | | | | |

| Investment Income | | | | | | | | |

Dividends—Affiliated issuers | | | | | | $ | 907,944 | |

| | | | | | | | |

| Expenses | | | | | | | | |

Management fee (see Note B) | | $ | 5,704,427 | | | | | |

Custody and accounting | | | 244,518 | | | | | |

Administrative | | | 187,325 | | | | | |

Registration fees | | | 126,161 | | | | | |

Transfer agency | | | 114,089 | | | | | |

Credit facility fees | | | 85,740 | | | | | |

Audit and tax | | | 66,848 | | | | | |

Legal | | | 54,173 | | | | | |

Trustees’ fees | | | 39,548 | | | | | |

Printing | | | 15,073 | | | | | |

Miscellaneous | | | 166,042 | | | | | |

| | | | | | | | |

Total expenses before interest expense | | | 6,803,944 | | | | | |

Interest expense | | | 285 | | | | | |

| | | | | | | | |

Total expenses | | | 6,804,229 | | | | | |

Less: expenses waived and reimbursed by the Investment Manager (see Note B) | | | (16,149 | ) | | | | |

| | | | | | | | |

Net expenses | | | | | | | 6,788,080 | |

| | | | | | | | |

Net investment loss | | | | | | | (5,880,136 | ) |

| | | | | | | | |

| Realized and Unrealized Gain (Loss) on Investment and Foreign Currency Transactions | | | | | | | | |

Net realized gain (loss) on: | | | | | | | | |

Investment transactions | | | | | | | 30,062,676 | |

Forward currency exchange contracts | | | | | | | (3,982 | ) |

Swaps | | | | | | | (2,282,551 | ) |

Foreign currency transactions | | | | | | | 4,153 | |

Net change in unrealized appreciation (depreciation) of: | | | | | | | | |

Investments | | | | | | | (6,717,584 | ) |

Forward currency exchange contracts | | | | | | | 5,185 | |

Swaps | | | | | | | 2,430,284 | |

Foreign currency denominated assets and liabilities | | | | | | | (1,713 | ) |

| | | | | | | | |

Net gain on investment and foreign currency transactions | | | | | | | 23,496,468 | |

| | | | | | | | |

Net Increase in Net Assets from Operations | | | | | | $ | 17,616,332 | |

| | | | | | | | |

See notes to consolidated financial statements.

| | |

| |

16 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

CONSOLIDATED STATEMENT OF CHANGES IN NET ASSETS

| | | | | | | | |

| | | Six Months Ended

September 30, 2023

(unaudited) | | | Year Ended

March 31,

2023 | |

| Increase (Decrease) in Net Assets from Operations | | | | | | | | |

Net investment loss | | $ | (5,880,136 | ) | | $ | (11,178,492 | ) |

Net realized gain on investment and foreign currency transactions | | | 27,780,296 | | | | 26,019,249 | |

Net change in unrealized appreciation (depreciation) of investments and foreign currency denominated assets and liabilities | | | (4,283,828 | ) | | | (2,654,594 | ) |

Contributions from Affiliates (see Note B) | | | – 0 | – | | | 756 | |

| | | | | | | | |

Net increase in net assets from operations | | | 17,616,332 | | | | 12,186,919 | |

Distribution to Shareholders | | | – 0 | – | | | (58,579,561 | ) |

| Transactions in Shares of Beneficial Interest | | | | | | | | |

Net increase (see Note D) | | | 26,739,768 | | | | 106,512,193 | |

| | | | | | | | |

Total increase | | | 44,356,100 | | | | 60,119,551 | |

| Net Assets | | | | | | | | |

Beginning of period | | | 1,109,424,228 | | | | 1,049,304,677 | |

| | | | | | | | |

End of period | | $ | 1,153,780,328 | | | $ | 1,109,424,228 | |

| | | | | | | | |

See notes to consolidated financial statements.

| | |

| |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 17 |

CONSOLIDATED STATEMENT OF CASH FLOWS

For the six months ended September 30, 2023 (unaudited)

| | | | | | | | |

| Cash flows from operating activities | | | | | | | | |

Net increase in net assets from operations | | | | | | $ | 17,616,332 | |

| Reconciliation of net increase in net assets from operations to net decrease in cash from operating activities | | | | | | | | |

Purchases of Underlying Portfolio shares | | $ | (191,516,821 | ) | | | | |

Purchases of short-term investments | | | (119,460,496 | ) | | | | |

Sales of Underlying Portfolio shares | | | 143,443,170 | | | | | |

Proceeds from disposition of short-term investments | | | 130,034,832 | | | | | |

Net realized gain on investment transactions and foreign currency transactions | | | (27,780,296 | ) | | | | |

Net realized loss on forward currency exchange contracts | | | (3,982 | ) | | | | |

Net change in unrealized appreciation (depreciation) of investments and foreign currency denominated assets and liabilities | | | 4,283,828 | | | | | |

Increase in receivable for investments sold | | | (113,251 | ) | | | | |

Decrease in affiliated dividends receivable | �� | | 27,491 | | | | | |

Increase in investments in Underlying Portfolios paid in advance | | | (12,500,000 | ) | | | | |

Increase in other assets | | | (454,884 | ) | | | | |

Decrease in cash collateral due from broker | | | 8,706,892 | | | | | |

Decrease in cash collateral due to broker | | | (338,730 | ) | | | | |

Increase in credit facility payable | | | 2,191,052 | | | | | |

Increase in management fee payable | | | 28,279 | | | | | |

Increase in administrative fee payable | | | 14,890 | | | | | |

Decrease in Transfer Agent fee payable | | | (17,715 | ) | | | | |

Increase in Directors’ fee payable | | | 11,278 | | | | | |

Increase in accrued expenses | | | 92,830 | | | | | |

Payments on swaps, net | | | (2,277,818 | ) | | | | |

| | | | | | | | |

Total adjustments | | | | | | | (65,629,451 | ) |

| | | | | | | | |

Net cash provided by (used in) operating activities | | | | | | | (48,013,119 | ) |

| Cash flows from financing activities | | | | | | | | |

Subscriptions, including change in subscriptions received in advance | | | 55,363,145 | | | | | |

Redemptions, net of payable for shares of beneficial interest redeemed | | | (34,208,490 | ) | | | | |

| | | | | | | | |

Net cash provided by (used in) financing activities | | | | | | | 21,154,655 | |

Effect of exchange rate on cash | | | | | | | 2,440 | |

| | | | | | | | |

Net decrease in cash | | | | | | | (26,856,024 | ) |

Cash at beginning of period | | | | | | | 44,404,084 | |

| | | | | | | | |

Cash at end of period | | | | | | $ | 17,548,060 | |

| | | | | | | | |

| Supplemental disclosure of cash flow information | | | | | | | | |

Interest expense paid during the period | | $ | 285 | | | | | |

See notes to consolidated financial statements.

| | |

| |

18 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

September 30, 2023 (unaudited)

NOTE A

Significant Accounting Policies

AB Multi-Manager Alternative Fund (the “Fund”) is a statutory trust formed under the laws of the State of Delaware and registered under the Investment Company Act of 1940 as a diversified, closed-end management investment company. The Fund’s investment objective is to seek long-term capital appreciation. There can be no assurance that the Fund will achieve its investment objective, be able to structure its investments as anticipated, or that its returns will be positive over any period of time. The Fund is not intended as a complete investment program for investors. The Fund seeks to achieve its investment objective primarily by allocating its assets among investments in private investment vehicles (“Underlying Portfolios”), commonly referred to as hedge funds, that are managed by unaffiliated asset managers that employ a broad range of investment strategies. As a secondary strategy, the Fund will generally also make direct investments in securities and other financial instruments. As part of the Fund’s investment strategy, the Fund may seek to gain exposure to commodities and commodities-related instruments and derivatives through investments in AB Multi-Manager Alternative Fund (Cayman), Ltd., a wholly-owned subsidiary of the Fund organized under the laws of the Cayman Islands (the “Subsidiary”). The Subsidiary commenced operations on September 21, 2018. The Fund is the sole shareholder of the Subsidiary and it is intended that the Fund will remain the sole shareholder and will continue to control the Subsidiary. As of September 30, 2023, net assets of the Fund were $1,153,780,328, of which $160,501, or less than 1%, represented the Fund’s ownership of all issued shares and voting rights of the Subsidiary. This report presents the consolidated financial statements of the Fund and the Subsidiary. All intercompany transactions and balances have been eliminated in consolidation. The consolidated financial statements have been prepared in conformity with U.S. generally accepted accounting principles (“U.S. GAAP”), which require management to make certain estimates and assumptions that affect the reported amounts of assets and liabilities in the consolidated financial statements and amounts of income and expenses during the reporting period. Actual results could differ from those estimates. The Fund is an investment company under U.S. GAAP and follows the accounting and reporting guidance applicable to investment companies. The following is a summary of significant accounting policies followed by the Fund.

1. Valuation of Investments

The Fund’s Board of Trustees (the “Board”) has approved pricing and valuation policies and procedures pursuant to which the Fund’s investments in Underlying Portfolios are valued at fair value (the “Valuation Procedures”). Among other matters, the Valuation Procedures set forth the

| | |

| |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 19 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

Fund’s valuation policies and the mechanisms and processes to be employed on a monthly basis to implement such policies. In accordance with the Valuation Procedures, fair value of an Underlying Portfolio as of each valuation time ordinarily is the value determined as of such month-end for each Underlying Portfolio in accordance with the Underlying Portfolio’s valuation policies and reported at the time of the Fund’s valuation.

On a monthly basis, the Fund generally uses the net asset value (“NAV”), provided by the Underlying Portfolios, to determine the fair value of all Underlying Portfolios which (a) do not have readily determinable fair values and (b) either have the attributes of an investment company or prepare their financial statements consistent with measurement principles of an investment company. As a general matter, the fair value of the Fund’s interest in an Underlying Portfolio represents the amount that the Fund could reasonably expect to receive from an Underlying Portfolio if its interest were redeemed at the time of valuation. In the unlikely event that an Underlying Portfolio does not report a month-end value to the Fund on a timely basis, the Fund would determine the fair value of such Underlying Portfolio based on the most recent value reported by the Underlying Portfolio, and any other relevant information available at the time the Fund values its portfolio. In making a fair value determination, the Fund will consider all appropriate information reasonably available to it at the time and that AllianceBernstein L.P. (the “Investment Manager”) believes to be reliable. The Fund may consider factors such as, among others: (i) the price at which recent subscriptions for or redemptions of the Underlying Portfolio’s interests were effected; (ii) information provided to the Fund by the manager of an Underlying Portfolio, or the failure to provide such information as the Underlying Portfolio manager agreed to provide in the Underlying Portfolio’s offering materials or other agreements with the Fund; (iii) relevant news and other sources; and (iv) market events. In addition, when an Underlying Portfolio imposes extraordinary restrictions on redemptions, or when there have been no recent subscriptions for Underlying Portfolio interests, the Fund may determine that it is appropriate to apply a discount to the NAV reported by the Underlying Portfolio. The use of different factors and estimation methodologies could have a significant effect on the estimated fair value and could be material to the consolidated financial statements.

The Investment Manager has established a Valuation Committee (the “Committee”) made up of representatives of portfolio management, fund accounting, compliance and risk management which operates under the Valuation Procedures and is responsible for overseeing the pricing and valuation of all securities held in the Fund. The Committee’s responsibilities include: 1) fair value determinations (and oversight of any third parties to

| | |

| |

20 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

whom any responsibility for fair value determinations is delegated), and 2) regular monitoring of the Valuation Procedures and modification or enhancement of the Valuation Procedures (or recommendation of the modification of the Valuation Procedures) as the Committee believes appropriate. Prior to investing in any Underlying Portfolio, and periodically thereafter, the Investment Manager will conduct a due diligence review of the valuation methodology utilized by the Underlying Portfolio. In addition, there are several processes outside of the pricing process that are used to monitor valuation issues including: 1) performance and performance attribution reports are monitored for anomalous impacts based upon benchmark performance, and 2) portfolio managers review all portfolios for performance and analytics.

Portfolio securities are valued at market value determined on the basis of market quotations or, if market quotations are not readily available or are unreliable, at “fair value” as determined in accordance with procedures approved by and under the oversight of the Board. Pursuant to these procedures, the Investment Manager serves as the Fund’s valuation designee pursuant to Rule 2a-5 of the 1940 Act. In this capacity, the Investment Manager is responsible, among other things, for making all fair value determinations relating to the Fund’s portfolio investments, subject to the Board’s oversight.

In general, the market values of securities which are readily available and deemed reliable are determined as follows: securities listed on a national securities exchange (other than securities listed on the NASDAQ Stock Market, Inc. (“NASDAQ”)) or on a foreign securities exchange are valued at the last sale price at the close of the exchange or foreign securities exchange. If there has been no sale on such day, the securities are valued at the last traded price from the previous day. Securities listed on more than one exchange are valued by reference to the principal exchange on which the securities are traded; securities listed only on NASDAQ are valued in accordance with the NASDAQ Official Closing Price; listed or over the counter (“OTC”) market put or call options are valued at the mid level between the current bid and ask prices. If either a current bid or current ask price is unavailable, the Investment Manager will have discretion to determine the best valuation (e.g., last trade price in the case of listed options); open futures are valued using the closing settlement price or, in the absence of such a price, the most recent quoted bid price. If there are no quotations available for the day of valuation, the last available closing settlement price is used; U.S. Government securities and any other debt instruments having 60 days or less remaining until maturity are generally valued at market by an independent pricing vendor, if a market price is available. If a market price is not available, the securities are valued at amortized cost. This methodology is commonly used for short term

| | |

| |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 21 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

securities that have an original maturity of 60 days or less, as well as short term securities that had an original term to maturity that exceeded 60 days. In instances when amortized cost is utilized, the Committee must reasonably conclude that the utilization of amortized cost is approximately the same as the fair value of the security. Factors the Committee will consider include, but are not limited to, an impairment of the creditworthiness of the issuer or material changes in interest rates. Fixed-income securities, including mortgage-backed and asset-backed securities, may be valued on the basis of prices provided by a pricing service or at a price obtained from one or more of the major broker-dealers. In cases where broker-dealer quotes are obtained, the Investment Manager may establish procedures whereby changes in market yields or spreads are used to adjust, on a daily basis, a recently obtained quoted price on a security. Swaps and other derivatives are valued daily, primarily using independent pricing services, independent pricing models using market inputs, as well as third party broker-dealers or counterparties. Open-end mutual funds are valued at the closing net asset value per share, while exchange traded funds are valued at the closing market price per share.

Securities for which market quotations are not readily available (including restricted securities) or are deemed unreliable are valued at fair value as deemed appropriate by the Investment Manager. Factors considered in making this determination may include, but are not limited to, information obtained by contacting the issuer, analysts, analysis of the issuer’s financial statements or other available documents. In addition, the Fund may use fair value pricing for securities primarily traded in non-U.S. markets because most foreign markets close well before the Fund values its securities at 4:00 p.m., Eastern Time. The earlier close of these foreign markets gives rise to the possibility that significant events, including broad market moves, may have occurred in the interim and may materially affect the value of those securities. To account for this, the Fund generally values many of its foreign equity securities using fair value prices based on third party vendor modeling tools to the extent available.

U.S. GAAP establishes a framework for measuring fair value, and a three-level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund’s own assumptions about the assumptions that market participants would use in pricing the asset or liability based on the best information available in the circumstances. Each investment is assigned a level based upon the observability of the inputs

| | |

| |

22 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

which are significant to the overall valuation. The three-tier hierarchy of inputs is summarized below.

| | • | | Level 1—quoted prices in active markets for identical investments |

| | • | | Level 2—other significant observable inputs |

| | • | | Level 3—significant unobservable inputs |

The fair value of debt instruments, such as bonds, and over-the-counter derivatives is generally based on market price quotations, recently executed market transactions (where observable) or industry recognized modeling techniques and are generally classified as Level 2. Pricing vendor inputs to Level 2 valuations may include quoted prices for similar investments in active markets, interest rate curves, coupon rates, currency rates, yield curves, option adjusted spreads, default rates, credit spreads and other unique security features in order to estimate the relevant cash flows which is then discounted to calculate fair values. If these inputs are unobservable and significant to the fair value, these investments will be classified as Level 3.

Where readily available market prices or relevant bid prices are not available for certain equity investments, such investments may be valued based on similar publicly traded investments, movements in relevant indices since last available prices or based upon underlying company fundamentals and comparable company data (such as multiples to earnings or other multiples to equity). Where an investment is valued using an observable input, such as another publicly traded security, the investment will be classified as Level 2. If management determines that an adjustment is appropriate based on restrictions on resale, illiquidity or uncertainty, and such adjustment is a significant component of the valuation, the investment will be classified as Level 3. An investment will also be classified as Level 3 where management uses company fundamentals and other significant inputs to determine the valuation.

Valuations reflected in this report are as of the report date. As a result, changes in valuation due to market events and/or issuer related events after the report date and prior to issuance of the report are not reflected herein.

| | |

| |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 23 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

The following table summarizes the valuation of the Fund’s investments by the above fair value hierarchy levels as of September 30, 2023:

| | | | | | | | | | | | | | | | |

Investments in

Securities: | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

Assets: | |

Common Stocks | | $ | 29,609,481 | | | $ | – 0 | – | | $ | 982,604 | | | $ | 30,592,085 | |

Investments valued at NAV | | | | | | | | | | | | | | | 1,104,454,267 | |

| | | | | | | | | | | | | | | | |

Total Investments in Securities | | | 29,609,481 | | | | – 0 | – | | | 982,604 | | | | 1,135,046,352 | |

Other Financial Instruments(a): | | | | | | | | | | | | | | | | |

Assets: | |

Forward Currency Exchange Contracts | | | – 0 | – | | | 7,003 | | | | – 0 | – | | | 7,003 | |

Total Return Swaps | | | – 0 | – | | | 865,957 | | | | – 0 | – | | | 865,957 | |

Liabilities: | |

Forward Currency Exchange Contracts | | | – 0 | – | | | (1,818 | ) | | | – 0 | – | | | (1,818 | ) |

Total Return Swaps | | | – 0 | – | | | (845,863 | ) | | | – 0 | – | | | (845,863 | ) |

| | | | | | | | | | | | | | | | |

Total | | $ | 29,609,481 | | | $ | 25,279 | | | $ | 982,604 | | | $ | 1,135,071,631 | |

| | | | | | | | | | | | | | | | |

| (a) | Other financial instruments are derivative instruments, such as futures, forwards and swaps, which are valued at the unrealized appreciation (depreciation) on the instrument. Other financial instruments may also include swaps with upfront premiums, written options and written swaptions which are valued at market value. |

2. Cash Committed

As of September 30, 2023, the Fund has committed to purchase the following Underlying Portfolios for effective date October 1, 2023:

| | | | |

Underlying Portfolios | | Amount Committed | |

TCIM Offshore Fund Ltd. | | $ | 4,000,000 | |

Cross Ocean GSS Offshore Feeder LP. | | | 6,000,000 | |

JAT Capital Offshore Fund, Ltd. | | | 6,000,000 | |

Readystate Offshore Fund, Ltd. | | | 6,000,000 | |

| | | | |

| | $ | 22,000,000 | |

3. Currency Translation

Assets and liabilities denominated in foreign currencies and commitments under forward currency exchange contracts are translated into U.S. dollars at the mean of the quoted bid and ask prices of such currencies against the U.S. dollar. Purchases and sales of portfolio securities are translated into U.S. dollars at the rates of exchange prevailing when such securities were acquired or sold. Income and expenses are translated into U.S. dollars at rates of exchange prevailing when accrued.

| | |

| |

24 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

Net realized gain or loss on foreign currency transactions represents foreign exchange gains and losses from sales and maturities of foreign fixed income investments, holding of foreign currencies, currency gains or losses realized between the trade and settlement dates on foreign investment transactions, and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent amounts actually received or paid. Net unrealized currency gains and losses from valuing foreign currency denominated assets and liabilities at period end exchange rates are reflected as a component of net unrealized appreciation or depreciation of foreign currency denominated assets and liabilities.

4. Taxes

It is the Fund’s policy to meet the requirements of the Internal Revenue Code applicable to regulated investment companies and to distribute all of its investment company taxable income and net realized gains, if any, to shareholders. Therefore, no provisions for federal income or excise taxes are required. The Fund intends to continue to comply with the requirements of Subchapter M of the Internal Revenue Code of 1986 as they apply to regulated investment companies. By so complying, the Fund will not be subject to federal and state income taxes to the extent that all of its income is distributed.

For federal tax purposes, taxable income for the Fund and its Subsidiary are calculated separately. The Subsidiary is classified as a controlled foreign corporation (“CFC”) under the Code and its taxable income is included in the calculation of the Fund’s taxable income. Net losses of the Subsidiary are not deductible by the Fund either in the current period or future periods. The CFC has a taxable fiscal year end of March 31st.

In accordance with U.S. GAAP requirements regarding accounting for uncertainties in income taxes, management has analyzed the Fund’s tax positions taken or expected to be taken on federal and state income tax returns for all open tax years (the current and the prior three tax years) and has concluded that no provision for income tax is required in the Fund’s consolidated financial statements.

5. Investment Income and Investment Transactions

Income and capital gain distributions, if any, are recorded on the ex-dividend date. Investment transactions are accounted for on the trade date or effective date. Investment gains and losses are determined on the identified cost basis. Non-cash dividends, if any, are recorded on the ex-dividend date at the fair value of the securities received. The Fund accounts for distributions received from REIT investments or from regulated investment companies as dividend income, realized gain, or return of capital based on information provided by the REIT or the investment company.

| | |

| |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 25 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

6. Expenses

Expenses included in the accompanying consolidated statement of operations do not include any expenses of the Underlying Portfolios.

7. Dividends and Distributions

Dividends and distributions to shareholders, if any, are recorded on the ex-dividend date. Income dividends and capital gains distributions are determined in accordance with federal tax regulations and may differ from those determined in accordance with U.S. GAAP. To the extent these differences are permanent, such amounts are reclassified within the capital accounts based on their federal tax basis treatment; temporary differences do not require such reclassification.

NOTE B

Management Fee and Other Transactions with Affiliates

Under the terms of the investment advisory agreement, the Fund pays the Investment Manager a management fee at an annual rate of 1.00% of an aggregate of the Fund’s net assets determined as of the last day of a calendar month and adjusted for subscriptions and repurchases accepted as of the first day of the subsequent month (the “Management Fee”). The Management Fee is payable in arrears as of the last day of the subsequent month.

Under a separate Administrative Reimbursement Agreement, the Fund may use the Investment Manager and its personnel to provide certain administrative services to the Fund and, in such event, the services and payments will be subject to approval by the Fund’s Board. For the six months ended September 30, 2023, the Fund reimbursed the Investment Manager under the Administrative Reimbursement Agreement in the amount of $187,325.

The Fund may engage one or more distributors to solicit investments in the Fund. Sanford C. Bernstein & Company LLC (“Bernstein”) and AllianceBernstein Investments, Inc. (“ABI”), each an affiliate of the Investment Manager, have been selected as distributors of the Fund under Distribution Services Agreements. The Distribution Services Agreements do not call for any payments to be made to Bernstein or ABI by the Fund.

The Fund compensates AllianceBernstein Investor Services, Inc. (“ABIS”), a wholly-owned subsidiary of the Investment Manager, under a Transfer Agency Agreement for providing personnel and facilities to perform transfer agency services for the Fund. Such compensation paid to ABIS amounted to $114,089 for the six months ended September 30, 2023.

The Fund may invest in AB Government Money Market Portfolio (the “Government Money Market Portfolio”) which has a contractual annual

| | |

| |

26 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

advisory fee rate of .20% of the portfolio’s average daily net assets and bears its own expenses. The Investment Manager had contractually agreed to waive .10% of the advisory fee of Government Money Market Portfolio (resulting in a net advisory fee of .10%) until August 31, 2023. Effective September 1, 2023, the Adviser has contractually agreed to waive .05% of the advisory fee of Government Money Market Portfolio (resulting in a net advisory fee of .15%) until August 31, 2024. In connection with the investment by the Fund in Government Money Market Portfolio, the Investment Manager has contractually agreed to waive its advisory fee from the Fund in an amount equal to the Fund’s pro rata share of the effective advisory fee of Government Money Market Portfolio, as borne indirectly by the Fund as an acquired fund fee and expense. For the six months ended September 30, 2023, such waiver amounted to $16,149.

A summary of the Fund’s transactions in AB mutual funds for the six months ended September 30, 2023 is as follows:

| | | | | | | | | | | | | | | | | | | | |

Fund | | Market Value

3/31/23

(000) | | | Purchases

at Cost

(000) | | | Sales

Proceeds

(000) | | | Market Value

9/30/23

(000) | | | Dividend

Income

(000) | |

Government Money Market Portfolio | | $ | 10,574 | | | $ | 119,460 | | | $ | 130,034 | | | $ | – 0 | – | | $ | 908 | |

During the year ended March 31, 2023, the Investment Manager reimbursed the Fund $756 for trading losses incurred due to a trade entry error.

NOTE C

Investment Transactions

1. Purchases and Sales

Purchases and sales of investment securities (excluding short-term investments) for the six months ended September 30, 2023 were as follows:

| | | | | | | | |

| | | Purchases | | | Sales | |

Investment securities (excluding U.S. government securities) | | $ | 191,516,821 | | | $ | 143,498,324 | |

U.S. government securities | | | – 0 | – | | | – 0 | – |

The cost of investments for federal income tax purposes was substantially the same as the cost for financial reporting purposes. Accordingly, gross unrealized appreciation and unrealized depreciation are as follows:

| | | | |

Gross unrealized appreciation | | $ | 228,518,132 | |

Gross unrealized depreciation | | | (15,707,594 | ) |

| | | | |

Net unrealized appreciation | | $ | 212,810,538 | |

| | | | |

| | |

| |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 27 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

2. Derivative Financial Instruments

The Fund may use derivatives in an effort to earn income and enhance returns, to replace more traditional direct investments, to obtain exposure to otherwise inaccessible markets (collectively, “investment purposes”), or to hedge or adjust the risk profile of its portfolio.

The principal type of derivative utilized by the Fund, as well as the methods in which they may be used are:

| | • | | Forward Currency Exchange Contracts |

The Fund may enter into forward currency exchange contracts in order to hedge its exposure to changes in foreign currency exchange rates on its foreign portfolio holdings, to hedge certain firm purchase and sale commitments denominated in foreign currencies and for non-hedging purposes as a means of making direct investments in foreign currencies, as described below under “Currency Transactions”.

A forward currency exchange contract is a commitment to purchase or sell a foreign currency at a future date at a negotiated forward rate. The gain or loss arising from the difference between the original contract and the closing of such contract would be included in net realized gain or loss on forward currency exchange contracts. Fluctuations in the value of open forward currency exchange contracts are recorded for financial reporting purposes as unrealized appreciation and/or depreciation by the Fund. Risks may arise from the potential inability of a counterparty to meet the terms of a contract and from unanticipated movements in the value of a foreign currency relative to the U.S. dollar.

During the six months ended September 30, 2023, the Fund held forward currency exchange contracts for hedging purposes.

The Fund may enter into swaps to hedge its exposure to interest rates, credit risk, equity markets or currencies. The Fund may also enter into swaps for non-hedging purposes as a means of gaining market exposures, making direct investments in foreign currencies, as described below under “Currency Transactions” or in order to take a “long” or “short” position with respect to an underlying referenced asset described below under “Total Return Swaps”. A swap is an agreement that obligates two parties to exchange a series of cash flows at specified intervals based upon or calculated by reference to changes in specified prices or rates for a specified amount of an underlying asset. The payment flows are usually netted against each other, with the difference being paid by one party to the other. In addition, collateral may be pledged or received by the Fund in accordance with the terms of the respective swaps to provide value

| | |

| |

28 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

and recourse to the Fund or its counterparties in the event of default, bankruptcy or insolvency by one of the parties to the swap.

Risks may arise as a result of the failure of the counterparty to the swap to comply with the terms of the swap. The loss incurred by the failure of a counterparty is generally limited to the net interim payment to be received by the Fund, and/or the termination value at the end of the contract. Therefore, the Fund considers the creditworthiness of each counterparty to a swap in evaluating potential counterparty risk. This risk is mitigated by having a netting arrangement between the Fund and the counterparty and by the posting of collateral by the counterparty to the Fund to cover the Fund’s exposure to the counterparty. Additionally, risks may arise from unanticipated movements in interest rates or in the value of the underlying securities. The Fund accrues for the interim payments on swaps on a daily basis, with the net amount recorded within unrealized appreciation/depreciation of swaps on the consolidated statement of assets and liabilities, where applicable. Once the interim payments are settled in cash, the net amount is recorded as realized gain/(loss) on swaps on the consolidated statement of operations, in addition to any realized gain/(loss) recorded upon the termination of swaps. Upfront premiums paid or received for swaps are recognized as cost or proceeds on the consolidated statement of assets and liabilities and are amortized on a straight line basis over the life of the contract. Amortized upfront premiums are included in net realized gain/(loss) from swaps on the consolidated statement of operations. Fluctuations in the value of swaps are recorded as a component of net change in unrealized appreciation/depreciation of swaps on the consolidated statement of operations.

Total Return Swaps:

The Fund may enter into total return swaps in order to take a “long” or “short” position with respect to an underlying referenced asset. The Fund is subject to market price volatility of the underlying referenced asset. A total return swap involves commitments to pay interest in exchange for a market linked return based on a notional amount. To the extent that the total return of the security, group of securities or index underlying the transaction exceeds or falls short of the offsetting interest obligation, the Fund will receive a payment from or make a payment to the counterparty.

During the six months ended September 30, 2023, the Fund held total return swaps for non-hedging purposes.

The Fund and the Subsidiary typically enter into International Swaps and Derivatives Association, Inc. Master Agreements (“ISDA Master Agreement”) with their OTC derivative contract counterparties in order to, among other

| | |

| |

| abfunds.com | | AB MULTI-MANAGER ALTERNATIVE FUND | 29 |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

things, reduce their credit risk to OTC counterparties. ISDA Master Agreements include provisions for general obligations, representations, collateral and events of default or termination. Under an ISDA Master Agreement, the Fund and the Subsidiary typically may offset with the OTC counterparty certain derivative financial instruments’ payables and/or receivables with collateral held and/or posted and create one single net payment (close-out netting) in the event of default or termination. In the event of a default by an OTC counterparty, the return of collateral with market value in excess of the Fund’s and the Subsidiary’s net liability, held by the defaulting party, may be delayed or denied.

The Fund’s and Subsidiary’s ISDA Master Agreements may contain provisions for early termination of OTC derivative transactions in the event the net assets of the Fund or the Subsidiary decline below specific levels (“net asset contingent features”). If these levels are triggered, the Fund’s and the Subsidiary’s OTC counterparty has the right to terminate such transaction and require the Fund or the Subsidiary to pay or receive a settlement amount in connection with the terminated transaction. For additional details, please refer to netting arrangements by the OTC counterparty tables below.

During the six months ended September 30, 2023, the Fund had entered into the following derivatives:

| | | | | | | | | | | | |

| | | Asset Derivatives | | | Liability Derivatives | |

Derivative Type | | Consolidated Statement of Assets and Liabilities Location | | Fair Value | | | Consolidated Statement of Assets and Liabilities Location | | Fair Value | |

Foreign currency contracts | |

Unrealized appreciation on forward currency exchange contracts | |

$ |

7,003 |

| |

Unrealized depreciation on forward currency exchange contracts | |

$ |

1,818 |

|

| | | | |

Equity contracts | | Unrealized appreciation on total return swaps | | | 865,957 | | | Unrealized depreciation on total return swaps | | | 845,863 | |

| | | | | | | | | | | | |

Total | | | | $ | 872,960 | | | | | $ | 847,681 | |

| | | | | | | | | | | | |

| | |

| |

30 | AB MULTI-MANAGER ALTERNATIVE FUND | | abfunds.com |

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (continued)

| | | | | | | | | | | | |

Derivative Type | | Location of Gain or (Loss) on Derivatives Within Consolidated Statement of Operations | | Realized Gain

or (Loss) on

Derivatives | | | Change in

Unrealized

Appreciation or

(Depreciation) | |

Foreign currency contracts | |

Net realized gain (loss) on forward currency exchange contracts; Net change in unrealized appreciation (depreciation) of forward currency exchange contracts | |

$ |

(3,982 |

) | |

$ |

5,185 |

|

| | | |

Equity contracts | | Net realized gain (loss) on swaps; Net change in unrealized appreciation (depreciation) of swaps | | | (2,282,551 | ) | | | 2,430,284 | |

| | | | | | | | | | |

Total | | | | $ | (2,286,533 | ) | | $ | 2,435,469 | |

| | | | | | | | | | |

The following table represents the average monthly volume of the Fund’s derivative transactions during the six months ended September 30, 2023:

| | | | |

Forward Currency Exchange Contracts: | | | | |

Average principal amount of buy contracts | | $ | 605,365 | (a) |

Average principal amount of sale contracts | | $ | 1,142,546 | |

Total Return Swaps: | | | | |

Average notional amount | | $ | 26,069,055 | |

| (a) | Positions were open for two months during the period. |

For financial reporting purposes, the Fund does not offset derivative assets and derivative liabilities that are subject to netting arrangements in the consolidated statement of assets and liabilities.