Exhibit (a)(2)

POSITION STATEMENT

of

D.E Master Blenders 1753 N.V.

regarding the recommended cash offer by Oak Leaf B.V. for all issued and outstanding ordinary shares with a nominal value of EUR 0.12 in the capital of D.E MASTER BLENDERS 1753 N.V.

19 June 2013

This document does not constitute an offer to sell, or any solicitation of any offer to buy or subscribe for any securities in D.E MASTER BLENDERS 1753 N.V.

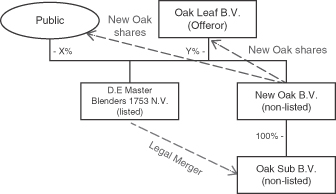

This Position Statement has been published by D.E MASTER BLENDERS 1753 N.V. (DEMBor the Company) for the sole purpose of providing information to its Shareholders on the recommended public offer by Oak Leaf B.V. (theOfferor), a newly incorporated company that is wholly owned by a Joh. A. Benckiser led investor group (JAB), for all issued and outstanding ordinary shares in the capital of DEMB at an offer price of EUR 12.50 (cum dividend) in cash for each DEMB ordinary share (theOffer), as required pursuant to Article 18, paragraph 2, and Annex G of the Dutch Public Offers Decree (Besluit openbare biedingen Wft).

DEMB has filed a Solicitation/Recommendation Statement on Schedule 14D-9 (together with the Position Statement and any other exhibits and annexes attached thereto, theSchedule 14D-9) with the U.S. Securities and Exchange Commission (theSEC). The Shareholders are strongly advised to read the Schedule 14D-9 because it contains important information that the Shareholders should consider before tendering their Shares. Shareholders may obtain a copy of the Schedule 14D-9 at no charge at the SEC’s website at www.sec.gov. In addition, the Offeror has filed a Tender Offer Statement on Schedule TO (together with the Offer Memorandum and any other exhibits and annexes attached thereto, theSchedule TO) with the SEC. The Shareholders are strongly advised to read the Schedule TO because it contains important information that the Shareholders should consider before tendering their Shares. Shareholders may obtain a copy of the Schedule TO at no charge at the SEC’s website atwww.sec.gov.

In relation to the Offer, an extraordinary general meeting of shareholders of DEMB (theEGM) will be held at 14:00 hours CET on 31 July 2013 at Beurs van Berlage located at Damrak 243, 1012 ZJ Amsterdam, the Netherlands.

Copies of this Position Statement can be obtained free of charge via the website of DEMB (www.demasterblenders1753.com).

The information included in this Position Statement reflects the situation as of the date of this Position Statement. DEMB does not undertake any obligation to publicly release any revisions to this information to reflect events or circumstances after the date of this document, except as may be required by applicable securities laws or by any appropriate regulatory authority. DEMB accepts responsibility for the information contained in this Position

1

Statement provided that the only responsibility that is accepted for information concerning the Offeror, JAB and the Offer is the assurance that such information is properly reported and reproduced from the Offer Memorandum.

The Position Statement may include “forward-looking statements” and language indicating trends, such as “expects,” “anticipates,” “projects” or “believes.” DEMB has based these forward-looking statements on its management’s current view with respect to future events and financial performance. These forward-looking statements are based on currently available competitive, financial and economic data, as well as management’s views and assumptions regarding future events, and are inherently uncertain. Although DEMB believes that the assumptions upon which its respective financial information and its respective forward-looking statements are based are reasonable, it can give no assurance that these assumptions will prove to be correct. By their nature, forward-looking statements involve risk and uncertainty because they relate to events and depend on circumstances that will occur in the future. These statements are subject to risks, uncertainties, assumptions and other important factors, many of which may be beyond DEMB’s control (such as political, economic or legal changes in the markets and environments in which DEMB does business), and could cause actual results to differ materially from those expressed or implied in these forward-looking statements. Factors that could cause actual results to differ from such statements include, but are not limited to: the occurrence of any event, change or other circumstances that could give rise to the termination of the Offer, the failure to receive, on a timely basis or otherwise, the required approvals by government or regulatory agencies, the risk that an Offer Condition may not be satisfied, the ability of DEMB to retain and hire key personnel and maintain relationships with customers, suppliers and other business partners pending the completion of the Offer, and other factors described in “Risk Factors” and “Forward Looking Statements” in DEMB’s Annual Report on Form 20-F for the fiscal year ended 30 June 2012 or reports on Form 6-K thereafter. Neither DEMB nor any of its advisers accept any responsibility for any financial information contained in this Position Statement relating to the business or operations or results or financial condition of DEMB or the DEMB group.

This Position Statement will be governed by and construed in accordance with the laws of the Netherlands, without prejudice to any applicable provisions of prevailing mandatorily applicable law, including the U.S. federal securities laws.

The Court of First Instance (Rechtbank) in Amsterdam, the Netherlands, shall have exclusive jurisdiction to settle any disputes which might arise out of or in connection with this Position Statement, without prejudice to the rights of appeal (hoger beroep) and cassation (cassatie) or to the jurisdiction of any other competent court pursuant to applicable prevailing mandatorily applicable law, including the U.S. federal securities laws.

Any capitalised terms in this Position Statement (other than in paragraph 9 (Fairness opinion Lazard), paragraph 10 (Fairness opinion Goldman Sachs) and paragraph 11 (Agenda Extraordinary General Meeting of Shareholders)) shall, unless otherwise defined in this Position Statement, have the meaning attributed to them in Section 4 (Definitions and interpretation) of the Offer Memorandum. Any reference in this Position Statement to defined terms in plural form shall constitute a reference to such defined terms in singular form, and vice versa. All grammatical and other changes required by the use of a definition in singular form shall be deemed to have been made herein and the provisions hereof shall be applied as if such changes have been made.

2

CONTENTS

Dear Shareholder,

The EGM to be held at 14:00 hours CET on 31 July 2013 at Beurs van Berlage located at Damrak 243, 1012 ZJ Amsterdam, the Netherlands, is an important event for DEMB and its Shareholders. During this meeting you will, among other things, be informed about the Offer and be able to vote, among other things, on the resolution to complete the Legal Merger, which merger is part of the Post-Closing Merger and Liquidation (see also paragraph 7).

On 12 April 2013, the Offeror and DEMB jointly announced that they reached conditional agreement in connection with a public offer by the Offeror for all issued and outstanding ordinary shares in the capital of DEMB (theShares,and each a Share) at an offer price of EUR 12.50 (cum dividend) in cash for each Share.

In this Position Statement, the board of directors of DEMB (theBoard) would like to address the background of the proposed transaction as well as its merits. As you will notice from the process described herein, the Board has given the Offer due and careful consideration.

| 2. | DECISION-MAKING PROCESS BY THE BOARD |

This paragraph contains a description of certain important considerations for the Board’s decision-making process, including a description of material contacts between representatives of the Offeror and representatives of DEMB that resulted in the signing of the Merger Protocol. As a listed company, DEMB has regular contacts with its Shareholders. In that context, representatives of DEMB and representatives of JAB have been in regular contact as of July 2012.

On 12 June 2012, the Shares began trading on Euronext Amsterdam on an “if-and-when-issued” basis.

On 2 July 2012, Mr Peter Harf, a partner of JAB, contacted Mr Jan Bennink, the then-Chairman of the Board and currently CEOad interim and non-executive member of the Board, and notified him that JAB, through its subsidiary JAB Forest B.V. (Forest), had acquired a stake in DEMB and that the acquisition of such stake would become public the following trading day.

On 3 July 2012, the AFM register of substantial shareholdings identified JAB as holding an indirect stake in DEMB totalling 12.19%.

3

Between 3 July 2012 and 6 July 2012, DEMB consulted Lazard B.V. (Lazard), DEMB’s lead financial advisor, and Goldman Sachs International (Goldman Sachs), DEMB’s financial adviser, and its legal advisor, Allen & Overy LLP (Allen & Overy) on JAB’s stakebuilding.

On 6 July 2012, Mr Bennink and Mr Michiel Herkemij, the then-CEO of DEMB, met in person with Messrs Harf and Olivier Goudet, partner of JAB. At the meeting, Messrs Harf and Goudet discussed JAB’s investment in DEMB. In addition, they stated that JAB would not increase its total holding above 20% and JAB was not seeking a board seat at DEMB. Messrs Bennink and Herkemij expressed that the Board considered a standstill agreement to be important. The JAB representatives responded that JAB was not willing to sign a standstill agreement as it preferred flexibility as to its shareholding. The parties agreed to schedule a call for the following week, after the DEMB representatives had consulted with the full Board.

On 11 July 2012, Mr Bennink and Mr Goudet had a call, during which they discussed the opening of a dialogue between the Company and its Shareholder in order to clarify JAB’s intentions and agreed the timing of the follow-up meeting in person the next day.

On 12 July 2012, Messrs Bennink and Herkemij had a scheduled teleconference meeting with Mr Goudet. Mr Goudet indicated that JAB’s investment in DEMB was financial and confirmed that no additional Shares had been acquired. Furthermore, Mr Goudet stated that JAB had currently no intention to bid for or otherwise acquire the whole of DEMB. The representatives of DEMB again proposed that JAB and DEMB would enter into a standstill agreement, but the representatives of JAB reiterated that JAB did not intend to sign a standstill agreement although it would be transparent about its intentions going forward. The parties agreed to schedule a face-to-face meeting on 24 July 2012 to try to formulate a plan for future interaction between the Company and its Shareholder, and allow JAB – as a large Shareholder – to get to know DEMB’s management.

On 22 July 2012, Mr Goudet called Mr Bennink to inform him that JAB had agreed to acquire the U.S.-listed company, Peet’s Coffee & Tea Inc. (Peet’s Coffee).

On 24 July 2012, Mr Michiel Quarles van Ufford, a DEMB spokesperson, responded to the announcement of JAB’s acquisition of Peet’s Coffee, stating that there was no direct relationship between JAB’s minority stake in DEMB and the Peet’s Coffee acquisition. Ms Elke Neujahr, a JAB spokesperson, confirmed that there were no plans to combine the products or services of the two companies.

On 24 July 2012, Mr Herkemij, Mr Michel Cup, CFO of DEMB, and Goudet met in person. During this meeting, the representative of JAB, among other things, confirmed that JAB had no intention to increase its stake in DEMB at that point in time, but that JAB would like to remain flexible in respect of increasing and decreasing its stake in DEMB. Furthermore, Mr Goudet requested that DEMB management give a shareholders’ presentation to JAB after the announcement of DEMB’s 2012 fiscal year end results. DEMB agreed to hold a meeting to give this shareholders’ presentation in autumn 2012.

On 3 August 2012, Mr Goudet called Mr Bennink to inform him that JAB had increased its stake in DEMB to 13.1%.

On 20 August 2012, Mr Bennink met in person with Mr Goudet. During which meeting Mr Goudet confirmed that JAB considered its shareholding in DEMB of a financial nature and that JAB had no intention to launch a bid for JAB.

On 12 October 2012, Mr Goudet called Mr Bennink to inform him that JAB had increased its stake in DEMB to 14.46%.

Speculation in European (including Dutch) media on JAB’s role in DEMB’s future lead to DEMB receiving many requests for information from inside and outside the Company. Noting this desire for information and also

4

to ensure a proper development of the DEMB share price, DEMB began drafting a press release on 13 October 2012.

On 13 and 14 October 2012, Messrs Herkemij, Cup and Goudet held calls to ensure that the correct factual information was included in the press release and to make sure that JAB’s intentions regarding its shareholding in DEMB were accurately represented.

On 17 October 2012, JAB informed DEMB that JAB had increased its stake in DEMB to 15.05%.

On 18 October 2012, DEMB issued a press release announcing that it had noticed that JAB’s stake in DEMB had increased to 15.05%.

On 15 November 2012, representatives of JAB, including Messrs Harf, Goudet, and Bart Becht, a partner of JAB, attended a shareholders’ presentation on DEMB based on publicly available information conducted by members of DEMB’s senior management including Messrs Bennink, Herkemij, Cup, Tom Hansson, then consultant to DEMB and currently Head of Strategy of DEMB, and Robin Jansen, Vice President Investor Relations of DEMB.

As of January 2013, JAB determined to explore the possibility of a transaction to acquire 100% of the Shares and had preliminary discussions with potential equity sources to determine the feasibility of such a transaction.

Over the course of the following months, up to execution of the Merger Protocol, JAB engaged from time to time in discussions with the representatives of the Investors with respect to the terms of potential equity financing with respect to a possible transaction involving DEMB. In addition, as of mid-March 2013, representatives of JAB engaged in discussions with potential lenders regarding debt financing of a possible transaction involving DEMB and eventually entered into negotiations with respect to a senior facilities agreement to provide debt financing for the transaction (theSFA).

On 31 January 2013, Messrs Goudet and Bennink held a call during which they discussed a possible transaction in which JAB would acquire 100% of the Shares. During that call Mr Bennink expressed concerns regarding such a transaction and stated that DEMB’s preference was to remain independent, but at the same time noted that the Board would act in conformity with its fiduciary duties vis-à-vis all stakeholders of DEMB, including its Shareholders.

On 6 February 2013, Mr Goudet met with Mr Bennink, during which meeting Mr Goudet conveyed JAB’s interest in exploring a possible acquisition of all of the Shares at a price in the range of EUR 10.75 to EUR 11.25 per Share in cash on a fully diluted basis. Mr Bennink stated that, in his opinion, the Board would conclude that the indicated price range undervalued DEMB. The parties agreed to hold a follow-up meeting on 8 March 2013.

On 16 February 2013, Mr Goudet had a telephone conversation with Messrs Bennink and Norman Sorensen, non-executive member of the Board, during which Messrs Bennink and Sorensen stated that DEMB’s preference was to remain independent, but that at the same time the Board would act in conformity with its fiduciary duties vis-à-vis DEMB’s stakeholders, including its Shareholders. Mr Goudet indicated that JAB could offer a higher price than was suggested during the meeting on 6 February 2013. Messrs Bennink and Sorensen responded that they would consult with the Board. Mr Goudet notified the representatives of DEMB that JAB anyway intended to send a written proposal on 8 March 2013, if it had not received a response from DEMB by that time.

On 2 March 2013, Mr Goudet had a brief telephone conversation with Mr Bennink in which Mr Goudet asked for the status of the inquiries with the Board. Mr Bennink responded that the Board required more time to consider JAB’s proposal and respond adequately.

On 7 March 2013, Messrs Becht and Goudet had a telephone conversation with Messrs Bennink and Sorensen during which Messrs Becht and Goudet discussed JAB’s interest in exploring a possible acquisition of DEMB.

5

Messrs Bennink and Sorensen stated that DEMB’s preference was to remain independent, and furthermore communicated that DEMB was cancelling the meeting which had been scheduled for 8 March 2013. Messrs Becht and Goudet stated that JAB still intended to press ahead with a proposal on a possible acquisition of DEMB, which proposal JAB expected to provide to DEMB the following day.

On 8 March 2013, representatives of JAB submitted a written non-binding unsolicited indication of interest to DEMB with respect to the acquisition of all of the Shares for a cash consideration of EUR 12.50 per Share on a fully diluted basis.

On 8 March 2013, the Board authorized the formation of a transaction committee consisting of Messrs Sorensen, Rob Zwartendijk, non-executive member of the Board, Bennink, Cup, Hansson, and Onno van Klinken, General Counsel and Corporate Secretary of DEMB (theTransaction Committee). The Transaction Committee was supplemented and supported by Lazard, Goldman Sachs and Allen & Overy.

On 10 March 2013, the Transaction Committee met in person to discuss the non-binding unsolicited indication of interest and next steps. The meeting was also attended by PricewaterhouseCoopers (PwC), DEMB’s tax advisor, Allen & Overy and Lazard.

On 10 March 2013, the full Board was updated on the recent developments regarding JAB’s non-binding proposal.

On 13 March 2013, in response to requests for clarifications from representatives of DEMB on the terms and conditions of this indication of interest, JAB submitted a written supplement to its 8 March 2013 indication of interest providing certain additional information regarding the proposed financing for the transaction and plans to maintain DEMB’s presence in the Netherlands following consummation of the proposed transaction. In this supplement, JAB reconfirmed its interest in proceeding with a transaction at a price of EUR 12.50 per Share. Following receipt of this supplement, representatives of DEMB indicated to representatives of JAB that DEMB would prefer a higher price.

On 14 March 2013, the full Board met in person to discuss the non-binding proposal and next steps. The meeting was also attended by PwC, Allen & Overy, Lazard and Goldman Sachs. JP Morgan, DEMB’s financial adviser, participated by telephone.

On 16 March 2013, after negotiations with DEMB, representatives of JAB indicated that, subject to the results of a due diligence review of DEMB, JAB would be willing to consider pursuing a transaction at a cash price of EUR 12.75 per Share. Subsequently, DEMB informed JAB that, on the basis of its most recent discussions with respect to price and non-financial terms and conditions and JAB’s supplemented written indication of interest, it was prepared to engage in negotiations with JAB on a potential recommended public offer for 100% of the Shares. However, any negotiations and a due diligence review of DEMB would be subject to JAB executing a customary confidentiality and standstill agreement.

On 17 March 2013, Allen & Overy provided a draft confidentiality and standstill agreement to Stibbe N.V. (Stibbe) and Skadden, Arps, Slate, Meagher & Flom LLP (Skadden). During the course of 18 and 19 March 2013, representatives of JAB and DEMB and their respective legal counsel negotiated the terms of the confidentiality and standstill agreement. On 20 March 2013, DEMB and Forest executed the confidentiality and standstill agreement.

From 20 March 2013 through 11 April 2013, representatives of JAB, Stibbe, Skadden and Ernst & Young LLP (E&Y), JAB’s accounting and tax adviser, as well as representatives of certain of the Investors, met in Amsterdam and New York, to conduct a due diligence review of DEMB.

Beginning on 20 March 2013, DEMB provided representatives of JAB, Stibbe, Skadden, E&Y and certain of the Investors with access to an electronic data room populated with various documents containing information

6

regarding DEMB. Lazard also organized a series of meetings where information regarding DEMB was provided to representatives of JAB and their advisors and these representatives were provided an opportunity to ask questions to representatives of DEMB and its advisors. Review of information included in the data room, as well as information provided by DEMB during the meetings and through other means, continued until the execution of the Merger Protocol.

On 22 March 2013, Stibbe sent a draft merger protocol to Allen & Overy containing proposed terms and conditions for a public offer by JAB on DEMB.

On 26 March 2013, the Board held a telephone meeting to discuss recent developments.

On 27 March 2013, Allen & Overy sent a revised draft merger protocol to Stibbe, reflecting DEMB’s responses to JAB’s proposed terms and conditions. Over the course of the following weeks until 12 April 2013, representatives of JAB and DEMB and their respective legal counsel negotiated the terms and conditions of the draft merger protocol.

On the morning of 28 March 2013, DEMB announced publicly that DEMB was in negotiations with an investor group led by JAB regarding a potential public offer by such investor group for DEMB at a cash price of EUR 12.75 per Share.

On 28 March 2013, the Transaction Committee held a telephone meeting to discuss current developments, including the reactions on the DEMB’s press release dated 28 March 2013.

Later in the day on 28 March 2013, representatives of DEMB, JAB, Lazard, Allen & Overy, Leonardo & Co B.V. (Leonardo), the Offeror’s financial adviser, and Stibbe met to discuss the material terms of the draft merger protocol.

On 1 April 2013, representatives of DEMB, including Messrs Bennink, Cup, Van Klinken, Rogier Rijnja, DEMB’s Senior Vice President of Human Resources, Luc Volatier, Senior Vice President of Operations for DEMB and Hansson, gave a management presentation on several topics, including DEMB’s strategy, marketing, innovations, pricing, promotions, human resources, company culture and supply chain to representatives of JAB.

On 2 April 2013, representatives of DEMB continued the management presentation.

On 2 April 2013, DEMB received from JAB a draft of the SFA along with draft equity and preferred equity commitment letters.

On 4 April 2013, representatives of JAB, including Mr Goudet, contacted Messrs Bennink and Cup to advise them that, based upon the results of JAB’s due diligence investigation to date, JAB was not able to proceed on the basis of the proposed purchase price of EUR 12.75 per Share. During the course of their discussion, Mr Goudet indicated that JAB would be willing to proceed at a price of EUR 12.25 per Share. In addition, Messrs Goudet and Bennink discussed JAB’s requirement that USPP Notes previously issued by subsidiaries of DEMB be redeemed prior to consummation of any acquisition and that DEMB should obtain agreements from all of the holders of USPP Notes irrevocably committing prior to execution of the Merger Protocol to the transfer of such USPP Notes. The representatives of DEMB responded that they would consult the full Board and its advisers on the implications of this development. Subsequently, the Transaction Committee (consisting of Messrs Sorensen, Zwartendijk, Bennink, Cup, Hansson and Van Klinken) held a telephone meeting to discuss the recent developments and decided (i) to suspend transaction related discussions and (ii) to request JAB to provide DEMB with the revised terms and conditions of their non-binding proposal, which could be presented to the Board on 5 April 2013.

On 4 April 2013, representatives of DEMB had a meeting with the DEMB Works Council, in order to provide them with a status update on the negotiations with JAB.

7

In the evening of 4 April 2013, Leonardo contacted Lazard via telephone in order to communicate that JAB increased its purchase price to EUR 12.50 per Share.

On 5 April 2013, the Board and representatives of Allen & Overy, Lazard and Goldman Sachs met telephonically to discuss the recent developments and in particular the revised terms and conditions of JAB’s non-binding proposal. The Board decided that any further decision would be postponed until the Board’s meeting on 7 April 2013, and that in the meantime DEMB’s advisers would request that JAB provide further clarification on the terms and conditions of its revised non-binding proposal.

Also on 5 April 2013, representatives of Lazard, Allen & Overy, Leonardo and Stibbe met to discuss some of the material terms of the draft merger protocol.

Early on 7 April 2013, representatives of JAB sent to representatives of DEMB a revised draft merger protocol reflecting JAB’s position on various open points thereunder, as well as the draft SFA, which the Offeror was in the process of negotiating with its prospective lenders.

On 7 April 2013, the Board and representatives of Allen & Overy, Lazard and Goldman Sachs met in person to discuss the status of the negotiations with JAB. During the discussions, the Board discussed and considered among other matters: (i) the valuation of DEMB, (ii) the price per Share offered by JAB, (iii) the financing of the potential public Offer, including the terms and conditions of the debt and equity financing, and the process regarding the holders of USPP Notes, (iv) the terms and conditions of the draft merger protocol, including the (enforcement of) the non-financial terms included in the draft merger protocol, and (v) the process with JAB going forward. At the end of the meeting the Board (a) mandated the Transaction Committee and its advisers to continue discussions with JAB and (b) decided to authorize management to seek transfer agreements from holders of all of the USPP Notes prior to execution of the Merger Protocol. The outcome of this Board meeting was communicated to JAB.

From 8 April through 12 April 2013, representatives of JAB and DEMB and their respective legal counsel negotiated the outstanding items on the draft merger protocol, representatives of JAB completed negotiations with respect to the draft SFA (on certain aspects of which DEMB was requested to provide comments), representatives of JAB and the Investors completed negotiations of the equity commitment letters and representatives of DEMB obtained executed transfer agreements from the holders of all of the USPP Notes.

On 10 April 2013, the Board held a telephonic meeting during which the status of the discussions regarding the draft SFA, the draft merger protocol, the equity commitment letters, and the USPP Notes process were evaluated. The Board considered the terms and conditions of the draft SFA and the draft merger protocol, and defined what would be an acceptable compromise on the outstanding issues. At the end of the meeting, the Board unanimously decided to mandate Messrs Sorensen, Zwartendijk, Bennink, Cup, Hansson and Van Klinken to negotiate the final outstanding issues and execute the Merger Protocol and provide final input on the terms and conditions of the draft SFA.

In the evening of 11 April 2013, the Transaction Committee held a telephonic meeting to discuss the status of the outstanding points in the negotiations regarding the draft debt financing documentation and the draft merger protocol.

In the early morning of 12 April 2013, the Transaction Committee (including Messrs Sorensen, Zwartendijk, Bennink, Cup, Hansson and Van Klinken) and representatives of Allen & Overy, Lazard and Goldman Sachs held a telephonic meeting to discuss the final draft of the SFA and the final draft of the merger protocol. During this meeting the Transaction Committee concluded that the terms and conditions as included in these final drafts were (i) in accordance with the mandate given by the Board, and (ii) in the best interest of DEMB and all of its stakeholders (including its Shareholders). By this time, all holders of the USPP Notes had entered into USPP Transfer Agreements.

8

In the morning of 12 April 2013, the Offeror approved and authorized the execution of the Merger Protocol and, together with certain of its affiliates entered into the SFA and equity commitment letters with the Investors.

That same morning, the merger protocol was executed by representatives of DEMB and the Offeror, which was publicly announced immediately thereafter.

Beginning on 6 May 2013, discussions have taken place between representatives of the Offeror and DEMB and their respective advisers with respect to a proposed post-closing merger and liquidation and the resulting amendments to the merger protocol.

On 13 May 2013, Stibbe provided Allen & Overy with a summary description of the intended post-closing merger and liquidation.

On 14 May 2013, Allen & Overy and PwC provided the Board with an explanation of the intended post-closing merger and liquidation.

On 26 May 2013, the Board held a telephonic meeting during which the proposed post-closing merger and liquidation was discussed and the Board agreed to continue to explore the possibility of a post-closing merger and liquidation.

On 28 May 2013, Stibbe provided Allen & Overy with a draft amended and restated merger protocol. Between 28 May 2013 and 6 June 2013, Stibbe and Allen & Overy had a number of telephone discussions on the draft amended and restated merger protocol and exchanged drafts thereof.

On 6 June 2013, the amended and restated merger protocol was executed by representatives of DEMB and the Offeror.

On 19 June 2013, the Offeror announced that this Offer Memorandum is publicly available and the Acceptance Period begins at 09:00 hours CET (03:00 hours EST) on 20 June 2013.

As part of the decision-making process the Board considered the strategic, financial and non-financial merits of the Offer. Each of those aspects is described below.

| 3.1 | The Board’s assessment of the strategic fit |

The Board is of the opinion that the strategic rationale of the proposed transaction is compelling and will provide significant benefits to DEMB for the following reasons:

| | • | | The Offer is driven by the significant growth opportunities that JAB sees in the global coffee and tea category and the strategy DEMB has set out to become a leading pure play coffee and tea company. |

| | • | | In JAB’s view, DEMB represents an ideal platform to grow in the coffee and tea categories. Accordingly, DEMB will act as the growth platform for further growth organically and through acquisitions in the fast moving consumer goods coffee and tea sector. |

| | • | | JAB supports the key aspects of DEMB’s strategic business plan. In line with this strategy, JAB believes DEMB can drive above industry average growth by investing in product quality and innovation of DEMB’s key brands. |

| | • | | The Board believes that it is challenging for DEMB to achieve a sustainable trading price for the Shares in excess of the EUR 12.50 per Share within the foreseeable future given DEMB’s projected near-term financial performance (including growth rates), and its long-term business plan and prospects if it were to remain a public company. |

9

| | • | | The new ownership structure will provide additional opportunities to expand DEMB’s product portfolio, enhance its competitive position and create new opportunities for its employees. |

| | • | | JAB and DEMB share a similar philosophy of long-term investments in premium quality consumer brand companies. |

| 3.2 | The Board’s financial assessment of the Offer |

The Offer values 100% of the Shares at approximately EUR 7.5 billion (on a fully diluted basis). The Offeror will finance the Offer through a combination of debt and equity.

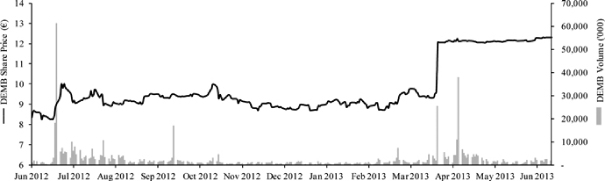

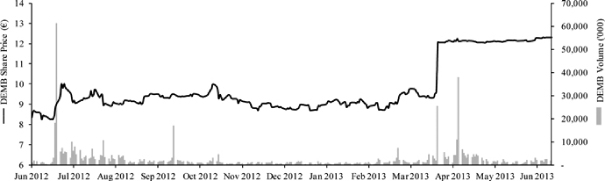

The Offer Price of EUR 12.50 (cum dividend) in cash per Share represents:

| | • | | a premium of 30.1% to the closing price per Share on 27 March 2013 (theReference Date); |

| | • | | a premium of 31.7% to the average closing price per Share for the one month period prior to and including the Reference Date; |

| | • | | a premium of 36.7% to the average closing price per Share for the three month period prior to and including the Reference Date; |

| | • | | a premium of 36.7% to the average closing price per Share for the six month period prior to and including the Reference Date; |

| | • | | a premium of 36.6% to the average closing price per Share since the Shares were firstly traded on Euronext Amsterdam on 12 June 2012 up to and including the Reference Date1; |

| | • | | based on net financial debt (adjusted for net pension liabilities and equity method investments) as of 31 December 2012 of EUR 335 million, an enterprise value for DEMB of 16.2x earnings before interest, taxes, depreciation and amortization (EBITDA) (based on an adjusted EBITDA forecast of EUR 483 million for the calendar year ending 31 December 2013); and |

| | • | | an equity value for DEMB of 26.5x net profit (based on an adjusted net profit forecast of EUR 282 million for the calendar year ending 31 December 2013).2 |

The chart below shows the development of the Share price of DEMB on Euronext Amsterdam in the period from admission to listing on Euronext Amsterdam on 12 June 2012 up to and including 18 June 2013.

| 1 | Taking into account that the Shares were firstly traded on Euronext Amsterdam on 12 June 2012, it is not possible to calculate the bid premium for the full year preceding the Reference Date, as required by Annex B, paragraph 1, sub-paragraph 4.2 of the Decree. |

| 2 | EBITDA and net profit forecasts for DEMB are based on broker reports issued post release of DEMB’s H1 2013 results and before 27 March, and that adjust forecasted financial results to exclude certain non-recurring items identified in DEMB’s disclosure. Forecasted data is calendarized to December year-end. |

10

The Board has thoroughly discussed and considered all strategic alternatives available to DEMB, including but not limited to a stand alone scenario. In its evaluation, it has among other things considered the (financial) impact of each alternative for all DEMB’s stakeholders, including its Shareholders. Based on its evaluation, the Board concluded that, taking into account the current circumstances, the Offer Price is fair to the Shareholders from a financial point of view.

In addition to the foregoing, the Board has also considered the following in its financial assessment of the Offer:

| | • | | That Lazard issued a fairness opinion to the Board to the effect that – based upon and subject to the procedures followed, assumptions made, matters considered and qualifications and limitations on the review undertaken in connection with such fairness opinion and as set forth therein – as of 12 April 2013, the amount in cash equal to EUR 12.50 per Share to be paid in connection with the Offer was fair, from a financial point of view, to the holders of the Shares other than the Offeror or any of its affiliates (see also paragraph 9). |

| | • | | That Goldman Sachs issued a fairness opinion to the Board to the effect that – based upon and subject to the procedures followed, assumptions made, matters considered and qualifications and limitations on the review undertaken in connection with such fairness opinion and as set forth therein – as of 12 April 2013, the EUR 12.50 per Share in cash to be paid to the holders (other than the Offeror and its affiliates) of Shares pursuant to the merger protocol was fair from a financial point of view to such holders of Shares (see also paragraph 10). |

| | • | | The Offeror’s confirmation on 12 April 2013 of its ability to fulfil its obligations under the Offer through a combination of approximately EUR 3 billion of debt and approximately EUR 4.9 billion of equity. In this respect, the Offeror has, subject to customary conditions, secured fully committed debt financing from its arrangers Banc of America Securities Limited, Citibank, N.A., London Branch, Rabobank International, London Branch, and Morgan Stanley Bank International Limited, and has entered into binding documentation with such arrangers. In addition, the Offeror has secured fully committed equity financing from JAB Forest B.V. (an affiliate of JAB), BDT Oak Acquisition Vehicle, L.P. (an affiliate of BDT Capital Partners), Colufa S.A. (an affiliate of Société Familiale d’Investissements S.A. who is in turn an affiliate of Patrinvest SCA) and Aguila Ltd. (or affiliates thereof, entities advised by Quadrant Capital Advisors, Inc.), and has entered into binding equity commitment letters with such members or their affiliates. |

| | • | | Binding commitments have been obtained from all holders of USPP Notes to transfer the USPP Notes to an affiliate of DEMB subject to Settlement taking place and certain pre-agreed terms with such holders, following which the USPP Notes shall be cancelled. |

| | • | | The form of consideration to be paid to the holders of Shares in the Offer is cash, which will provide certainty of value and liquidity to Shareholders. |

| | • | | At the time of this Position Statement, there are no competing offers. |

| | • | | The possibility of third parties making a competing offer if certain market conform thresholds (as set out in paragraph 3.3 under Certain arrangements) are met. |

Based on all the above considerations, the Board’s experience and on advice obtained from its financial advisors, the Board has concluded that, taking into account the current circumstances, the Offer Price is fair to the Shareholders from a financial point of view.

| 3.3 | The Board’s non-financial assessment of the Offer |

The Board considered a number of significant non-financial aspects and potential benefits and advantages associated with the Offer. Please refer to Sections 6.12 up to and including 6.14 of the Offer Memorandum for a detailed overview of non-financial arrangements and agreements between the Offeror and DEMB. In summary,

11

the Offeror and DEMB have agreed to the following key principles, as well as two specific arrangements in respect of the enforcement of certain key principles (as set out in the sub paragraph Enforcement below):

Organisation

| (1) | The DEMB group will have an operating structure as a separate division within the Offeror’s group; DEMB will remain a separate legal entity, the holding company of DEMB’s current and future subsidiaries and operations. |

| (2) | The DEMB group will act as the growth platform for relevant acquisitions in the fast moving consumer goods segment of the coffee and tea business in the world. |

| (3) | DEMB’s headquarters, relevant head office functions and the centre of management of the DEMB group will remain in Amsterdam, the Netherlands. |

| (4) | DEMB’s global R&D centre will – in form and substance – remain in the Netherlands. |

| (5) | The Offeror will keep the business of the DEMB group intact and it shall not sell and/or transfer the majority of the DEMB group or sell and/or transfer the majority of the assets of companies belonging to the DEMB group. |

| (6) | The Offeror will not require or cause the DEMB group to close any of the manufacturing facilities of the DEMB Group in the Netherlands. |

| (7) | The Offeror will allow the DEMB group to maintain its corporate identity and culture, albeit as a separate division of the Offeror. |

| (8) | The Offeror will allow the DEMB group to maintain its commitment to sustainable development and sustainable sourcing. The Douwe Egberts Foundation (or its successor) and its activities will remain in form and substance intact. |

Employees

| (9) | The employee consultation procedures of DEMB will be respected. |

| (10) | The existing rights and benefits of the employees of the DEMB group will be respected, including existing rights and benefits under their individual employment agreements, collective labour agreements, and including existing rights and benefits under existing covenants made to the works council and trade unions. |

| (11) | Subject to DEMB’s current and future review of the existing pension arrangements, the pension rights of current and former employees of the DEMB group will be respected. |

Financing

| (12) | The DEMB group will remain properly financed to safeguard business continuity. |

Minority Shareholders

| (13) | Any proposed Post-Closing Restructuring Measure which could reasonably be expected to disproportionally prejudice the value of, or the rights relating to the minority’s shareholding, will require an affirmative vote of an Independent Non-Executive. |

| (14) | In the effectuation of any Post-Closing Restructuring Measure, due consideration will be given to the interests of minority Shareholders. |

12

Composition of the Board

| (15) | As from the Settlement Date until the later of (i) the date on which the listing of DEMB on Euronext Amsterdam is terminated, and (ii) the earlier of (a) the submission by the Offeror of the writ of summons in a squeeze-out procedure (uitkoopprocedure) in accordance with article 2:92a of the Dutch Civil Code or a takeover buy-out procedure in accordance with article 2:359c of the Dutch Civil Code and (b) the date on which the Offeror has directly or indirectly otherwise acquired 100% of the shares in DEMB or any legal successor of DEMB, the Board will consist of: |

| | (a) | two non-executive members who are independent from the Offeror, its affiliates or any of its advisers as specified in the Dutch Corporate Governance Code (each anIndependent Non-Executive); and |

| | (b) | a number of executive and non-executive members, appointed upon nomination of the Offeror by the General Meeting of Shareholders. |

| (16) | The members of the Board to be appointed upon nomination by the Offeror effective as from the Settlement Date will be (i) Mr Becht, Mr Harf, Mr Goudet, Mr Van Damme, Mr Trott and Mr Santo Domingo as non-executive members and (ii) Mr Cup as executive member. |

| (17) | As from the Settlement Date, the initial chairman of the Board will be Mr Becht. |

| (18) | As per the Settlement Date, all current members of the Board shall resign with the exception of Mr Illy and Mr Zwartendijk who will continue as Independent Non-Executives. |

Enforcement

The Board may deviate from the arrangements set forth in numbers (1) up to and including (12) above if the Board is of the opinion that this is in the best interest of DEMB or the DEMB group taking into account the interest of all stakeholders, without prejudice to the terms of the covenant between DEMB, Koninklijke Douwe Egberts B.V. and the works council of Koninklijke Douwe Egberts B.V. dated 11 December 2012.

In the merger protocol dated 12 April 2013, it was agreed that, notwithstanding the previous paragraph, any deviation from the arrangements set forth in numbers (3), (4) and (6) will until the fourth anniversary of the merger protocol require the written prior approval of the supervisory board of Koninklijke Douwe Egberts B.V. The relevant wording in the merger protocol constitutes an irrevocable third party stipulation for no consideration (onherroepelijk derdenbeding om niet) for the benefit of the supervisory board of Koninklijke Douwe Egberts B.V. Following completion of the works council consultation process the above arrangements have been amended to the effect that any deviation from the arrangements set forth in numbers (3), (4) and (6) will until 12 April 2018 require the written prior approval of the supervisory board of Koninklijke Douwe Egberts B.V. with at least four out of five supervisory board members voting in favour of such deviation.

Certain arrangements

Further, in the negotiations resulting in the announcement on 12 April 2013 that conditional agreement had been reached between the Offeror and DEMB in connection with a public offer, DEMB identified certain core process points in order to be able to safeguard the interests of all its stakeholders. In particular DEMB agreed with the Offeror that:

| | • | | if in the reasonable opinion of the Board a written bona fide Alternative Proposal by a third party could reasonably be expected to qualify as (but does not yet constitute) a Superior Offer (aPotential Superior Offer) and DEMB has notified the Offeror promptly (and in any event within 48 hours) thereof, DEMB may engage in discussions or negotiations in relation to the Potential Superior Offer with such third party and disclose confidential information to such third party for a period of no longer than ten Business Days following the receipt of the written proposal. |

13

“Superior Offer” is a written and binding unsolicited proposal by a bona fide third party which, in the reasonable opinion of the Board, is a more beneficial offer than the Offer taking into account all economic and non-economic terms and conditions of such proposal, including expected timing, the nature and amount of consideration for the Outstanding Shares, and the likelihood of consummation, provided that such proposal shall only be considered to be a Superior Offer if the consideration per Outstanding Share exceeds the Offer Price by 7.5%. The full definition of Superior Offer is included in Section 4 of the Offer Memorandum;

| | • | | within ten Business Days after the receipt of a Potential Superior Offer by a third party, DEMB must either give written notice to the Offeror that (i) the Potential Superior Offer has evolved or led to a Superior Offer or (ii) the Potential Superior Offer did not evolve or lead to a Superior Offer, in which case DEMB must immediately confirm to the Offeror that (a) it continues to support the Offer, (b) the Board will continue to support and recommend the Offer, (c) it discontinued considering such Potential Superior Offer and (d) it has terminated any discussions and negotiations regarding that Potential Superior Offer and any Alternative Proposal from such third party. |

| | • | | in the event that a third party makes or announces its intention to make a Superior Offer, DEMB shall inform the Offeror promptly (and in any event within 24 hours) and the Offeror may submit in writing to the Board a revised offer within a period of ten Business Days thereafter (theRevised Offer Period) or, alternatively, terminate the Merger Protocol. |

| | • | | if such binding revised offer is on terms and conditions which, in the reasonable opinion of the Board, having consulted their financial and legal advisors and acting in good faith and observing their obligations under Dutch law, more beneficial to DEMB and its stakeholders than the Superior Offer (aRevised Offer), the Offeror and DEMB shall continue to be bound by the Merger Protocol and the Offeror may require the Board to reaffirm the Recommendation. Such revised offer shall in any event be deemed a Revised Offer unless confirmed otherwise to the Offeror in writing by the Board within two Business Days after expiry of the Revised Offer Period. Further, if the Board fails to reaffirm the Recommendation within two Business Days after having received the relevant request from the Offeror, the Offeror may terminate the Merger Protocol. |

| | • | | to induce the Offeror to enter into the Merger Protocol and to pursue and make the Offer, the Offeror and DEMB have agreed that upon a termination of the Merger Protocol by the Offeror: |

| | (a) | in the event DEMB accepts a Superior Offer or, in the event DEMB fails to reaffirm the Recommendation if the Offeror has submitted a Revised Offer; |

| | (b) | a material breach of the Merger Protocol by DEMB which material breach is not waived by the Offeror or timely remedied by or on behalf of DEMB; |

| | (c) | a revocation or change of the Recommendation of the Board other than in accordance with the Merger Protocol; or |

| | (d) | a material breach by DEMB of its obligations under the Merger Protocol relating to (i) the exclusivity arrangements set out in Section 6.14.1 (Exclusivity) of the Offer Memorandum or DEMB’s conduct with respect to a Superior Offer, |

DEMB will forfeit a termination fee to the Offeror equal to an amount of EUR 50 million (theTermination Fee).

The payment by DEMB of the Termination Fee shall not limit the Offeror’s rights to seek remedy or claim for damages for breach of the Merger Protocol on any other basis;

| | • | | to induce DEMB to enter into the Merger Protocol and to pursue the Offer, the Offeror and DEMB have agreed that upon a termination of the Merger Protocol by DEMB: |

| | (a) | due to the Offer Condition in Section 6.2.1(b) of the Offer Memorandum not being satisfied or waived; |

14

| | (b) | due to a material breach of the Merger Protocol by the Offeror which material breach is not waived by DEMB or timely remedied by or on behalf of the Offeror; |

| | (c) | if (i) all Offer Conditions have been satisfied or waived and Settlement has not taken place on the Settlement Date or (ii) if, notwithstanding the Offeror’s obligation under the Merger Protocol to (a) use its reasonable best efforts to take or cause to be taken, and do or cause to be done all things necessary, proper or advisable to arrange and obtain the proceeds of the SFA, satisfy all conditions and comply with its obligations under the SFA, and consummate the SFA at Settlement and (b) enforce its rights under the SFA (including through litigation), in each case under (a) and (b) in accordance with the terms of the SFA, the Offeror is unable to obtain sufficient debt financing to comply with its financial obligations pursuant to the Merger Protocol (assuming the Offer Price), |

the Offeror will forfeit a reversed termination fee to DEMB equal to an amount of EUR 150 million (theReversed Termination Fee).

The payment by the Offeror of the Reversed Termination Fee shall be the sole remedy and sole recourse for DEMB in the event of:

| | (a) | a termination of the Merger Protocol due to the Offer Condition set out in Section 6.2.1(b) of the Offer Memorandum not being satisfied or waived; and |

| | (b) | a breach by the Offeror of the Merger Protocol arising in connection with, or as a result of, the Offeror being unable to obtain sufficient debt financing to comply with its financial obligations pursuant to the Merger Protocol (assuming the Offer Price). |

Subject to the previous sentence, the payment by the Offeror of the Reversed Termination Fee shall not limit DEMB’s rights to seek remedy or claim for damages for breach of the Merger Protocol on any other basis; and

| | • | | a waiver of the Acceptance Level Offer Condition (as defined below) by the Offeror requires the prior express written approval of the Board if on the Tender Closing Date the number of Shares (i) that are tendered in the Offer, (ii) the Shares that are directly or indirectly held at that time by the Offeror or any of its Affiliates and (iii) the Shares that are unconditionally and irrevocably committed to the Offeror or any of its Affiliates would represent less than 66.67% of the Shares on a fully diluted basis. |

| 3.4 | Risks Associated with the Offer |

The Board considered a number of uncertainties, risks and other potentially negative factors of the Offer, including the following:

No Shareholder Participation in Future Growth or Earnings

| | • | | Shareholders will receive cash for their Shares in the Offer and, as a result, Shareholders will cease to participate in any future earnings or growth of DEMB and will cease to benefit from any potential future appreciation in the value of the Shares, including any value that could be achieved if DEMB engages in future strategic or other transactions or as a result of improvements to DEMB’s operations. |

Dividend policy

| | • | | DEMB may or may not make any Distributions in the future. Future Distributions may be of a one-off nature only and the amount of any Distribution will depend on a number of factors associated with the Offeror’s tax and financial preferences from time to time. Any Distribution made in respect of Shares after the date of the Offer Memorandum will be deducted for the purpose of establishing the value per Share in any statutory merger, Statutory Buy-Out or other measure contemplated by Section 6.9 of the Offer Memorandum. |

15

Business Disruption Resulting from Offer

| | • | | The possible effect of the public announcement of the Offer on DEMB’s operations, its ability to attract and retain key personnel, and the resulting distraction of the attention of DEMB’s management. |

Effect of Failure to Consummate the Offer

| | • | | If the Offer is not consummated, then (i) the market value of the Shares could be adversely affected, (ii) DEMB will have incurred significant transaction and opportunity costs associated with attempting to consummate the Offer, (iii) DEMB’s business may be subject to significant disruption, (iv) the market’s perceptions of DEMB’s prospects could be adversely affected, and (v) the Board and DEMB’s employees will have expended considerable time and effort to consummate the Offer. |

Interim Restrictions on Business

| | • | | The Merger Protocol restricts the conduct of DEMB’s business prior to the earlier of the Settlement Date or the date on which the Merger Protocol is terminated, and such restrictions (i) require DEMB, and its group companies, to conduct their business as a going concern in the ordinary course, consistent with past practice and (ii) prevent DEMB, or its group companies, from taking certain specified actions, unless otherwise consented to in writing by the Offeror. |

Taxable Consideration

| | • | | The fact that gains from sales of Shares may be taxable to Shareholders under the laws of the United States, the Netherlands, or any other jurisdiction, as applicable. |

Termination Fee

| | • | | The requirement that DEMB pays the Termination Fee if the Merger Protocol is terminated as described in paragraph 3.3. |

Post- Closing Restructuring Measures

| | • | | Subject to the Offer being declared unconditional, the Offeror shall be entitled to effect or cause to effect any other restructuring of DEMB’s group for the purpose of achieving an optimal operational, legal, financial or fiscal structure in accordance with the Bidding Rules and Dutch law in general, some of which may have the effect of diluting the interest of any remaining minority Shareholders. |

| | • | | Shareholders who do not tender their Shares under the Offer should carefully review paragraph 7. |

Taking into account all of the factors set forth above, as well as others, the Board determined that the benefits for the Shareholders and all other stakeholders in DEMB that arise from the Offer outweigh the benefits of any possible alternative. Based on these analyses, the Board, after having received extensive legal and financial advice and having given due and careful consideration to the strategic, financial and social aspects and consequences of the proposed transaction has unanimously reached the conclusion that the Offer is in the best interests of DEMB, its Shareholders and all other stakeholders in DEMB.

Reference is made to Part II, Section 1 (Selected consolidated/combined financial information of DEMB) and Section Part II, Section 2 (Financial statements 2012 of DEMB) of the Offer Memorandum.

16

| 4.2 | Prospective financial information |

In connection with the evaluation of a potential Offer, DEMB provided JAB in March 2013 with certain prospective financial information concerning the performance of DEMB, including revenue forecasts and forecasts regarding certain profitability metrics. Updated prospective financial information (theProjections), which superseded the initially furnished information, was later provided to JAB, Lazard and Goldman Sachs and was utilized by the Board in its deliberations with respect to the Offer.

A summary of such Projections is included herein solely to give Shareholders access to the information that was made available to JAB, Lazard, Goldman Sachs and the Board, and is not included in this Position Statement in order to influence any Shareholder to make any investment decision with respect to the Offer, including whether to tender Shares pursuant to the Offer, or because we believe it is material or because we believe it is a reliable prediction of actual future results.

The Projections were prepared by DEMB solely for internal use and were not prepared with a view toward public disclosure and, accordingly, do not necessarily comply with the published guidelines of the SEC regarding prospective financial information or the use of measures other than generally accepted accounting principles based on IFRS. Neither DEMB’s independent registered public accounting firm, nor any other independent accountants, have compiled, examined or performed any procedures with respect to the Projections, nor have they expressed any opinion or any other form of assurance on such information or its achievability, and they assume no responsibility for, and disclaim any association with, the Projections.

The Projections, while presented with numerical specificity necessarily were based on numerous variables and assumptions, including, but not limited to, those relating to industry performance, general business, economic, regulatory, competitive, market and financial conditions and other future events, as well as matters specific to DEMB’s business, and the various risks set forth in DEMB’s reports filed with the SEC and AFM, all of which are difficult to predict and many of which are beyond DEMB’s control. The Projections are subjective in many respects, were prepared for high strategic level planning purposes rather than reflecting an attempt to predict future results with accuracy and are susceptible to multiple interpretations. There can be no assurance that the projected results will be realized or that actual results will not be significantly higher or lower than projected. The inclusion of the Projections in this Position Statement should not be relied on as necessarily predictive of actual future events, because, among other things, the Projections (i) cover multiple years and such information by its nature becomes less predictive with each successive year, and (ii) reflect assumptions as to certain business decisions that are subject to change.

The inclusion of this information should not be regarded as an indication that DEMB, the Offeror, or any of their respective financial advisors or anyone who received this information then considered, or now considers, it to be necessarily predictive of actual future events, and this information should not be relied upon as such. None of DEMB, the Offeror, or any of their financial advisors, any of their respective affiliates or any other person assumes any responsibility for the validity, reasonableness, accuracy or completeness of the Projections. None of DEMB, the Offeror or any of their financial advisors or any of their respective affiliates intends to, and each of them disclaims any obligation to, update, revise or correct such Projections if they are or become inaccurate (even in the short term).

Underlying the Projections are certain key assumptions (any of which could turn out to be incorrect), including certain expansion plans for the capsules business, roll-out plans for the key innovations, reintroduction and repositioning of certain existing product lines, certain restructuring plans and cost saving plans. Overall the Projections are also based on certain planned innovations which are supported by significant capital expenditures. The Projections do not include any material acquisitions or divestitures.

The Projections do not take into account any circumstances or events occurring after the date they were prepared, including the transactions contemplated by the Merger Protocol. Further, the Projections do not take into account the effect of any failure of the Offer and should not be viewed as accurate or continuing in that context.

17

The Projections should be evaluated, if at all, in conjunction with the historical consolidated financial statements and other information regarding DEMB contained in DEMB’s public filings with the SEC and the AFM. In light of the foregoing factors and the uncertainties inherent in the Projections, readers of this Position Statement are cautioned not to place undue, if any, reliance on the Projections.

Projections(1)

| | | | | | | | | | | | | | | | |

| | | 2013E | | | 2014E | | | 2015E | | | 2016E | |

| | | (in millions EUR) | |

Sales | | | 2,757 | | | | 2,909 | | | | 3,106 | | | | 3,361 | |

| | | | |

Underlying EBITDA(2) | | | 474 | | | | 524 | | | | 583 | | | | 660 | |

| | | | |

Underlying EBIT(3) | | | 389 | | | | 429 | | | | 479 | | | | 545 | |

| | | | |

Normalized Net Income(4) | | | 304 | | | | 313 | | | | 350 | | | | 402 | |

| (1) | Figures in this table are for periods ending in December and exclude any contribution from green coffee exports. DEMB also provided certain forecast assumptions for the preparation of extrapolations of these Projections for calendar years 2017 through 2022, including, among other things, a gradual decline towards an annual growth rate of 2%, an EBITDA margin that increases to 20.5% in 2018 and is constant thereafter and an EBIT margin that increases to 17% in 2018 and is constant thereafter. The extrapolations of these Projections for calendar years 2017 through 2022 were approved for each of Lazard’s and Goldman Sachs’ use by senior management of DEMB. |

| (2) | Underlying EBITDA is a non-IFRS financial measure that DEMB defines for the Projections as profit for the period before income taxes, finance income, finance costs, depreciation and amortization, and unusual income and expenses. |

| (3) | Underlying EBIT is a non-IFRS financial measure that DEMB defines for the Projections as profit for the period before finance income, finance costs and income taxes, and unusual income and expenses. |

| (4) | Normalized Net Income is a non-IFRS financial measure that DEMB defines for the Projections as net income for the period adjusted to exclude (i) income or charges that management believes are unrelated to its core operating results and that are excluded in determining segment profits as well as items that DEMB deems to be non-recurring and (ii) unusual finance income and unusual tax expense. |

No representation is made by DEMB or any other person to any Shareholder or any other person regarding the ultimate performance of DEMB compared to the information included in the above Projections. DEMB does not intend to, and disclaims any obligation to, update, revise or correct the above Projections to reflect circumstances existing after the date when made or to reflect the occurrence of future events.

The Projections include forward looking statements. Reference is made to the cautionary statement regarding forward looking statements included on the first page of this Position Statement.

The relevant and applicable employee consultation procedure with the works council of Koninklijke Douwe Egberts B.V. has been completed. The works council of Koninklijke Douwe Egberts B.V. rendered positive advice in respect of (i) the Offer and the financing thereof and (ii) the Post-Closing Merger and Liquidation. The European Works Council of D.E MASTER BLENDERS 1753 has been informed about the Offer in accordance with the applicable consultation procedure and has shared its view with DEMB, which view supports the Offer. In addition, the Social Economic Council and the relevant trade unions have been notified of the Offer in accordance with the Dutch Merger Code (SER Fusiegedragsregels 2000).

Although the Offeror does not expect that there will be any material adverse social consequences for the employees of DEMB as a direct result of the Offer, the Board has given the impact of the Offer on the DEMB

18

group’s employees due consideration. To mitigate any consequences that the Offer might have and to safeguard the interests of the DEMB group’s employees in the future, DEMB and the Offeror have agreed to certain covenants which are described in paragraph 3.3.

| 6. | OVERVIEW OF SHARES HELD, SHARE TRANSACTIONS AND INCENTIVE PLANS |

Outlined below are relationships, agreements or arrangements that certain members of the Board have that provide them with interests in the proposed transaction with the Offeror that may be in addition to or different from the interests of DEMB generally in the Offer. The members of the Board were aware of these relationships, agreements and arrangements during their respective deliberations on the merits of the Offer and addressed such interests as appropriate under applicable Dutch law relating to conflicts of interests.

| 6.1 | Shares held by members of the Board |

At the date of the Offer Memorandum the members of the Board jointly hold a total of 707,814 Shares. No member of the Board holds any options on Shares.

| | | | |

Name | | Shares | |

Jan Bennink | | | 619,376 | 1,2 |

Norman Sorensen | | | 77,938 | 3 |

Rob Zwartendijk | | | 10,500 | 4 |

Total | | | 707,814 | |

| 1. | Jan Bennink acquired these Shares as follows: (i) Upon completion of the spin-off from Sara Lee Corporation the holders of Sara Lee shares received 1 DEMB Share for each Sara Lee share that they held on 14 June 2012. As a result 235,650 shares in Sara Lee Corporation held by Jan Bennink were converted into 235,650 DEMB Shares. (ii) 121,492 DEMB Shares relate to the vesting of incentive awards by Sara Lee Corporation. (iii) On 4 September 2012 Jan Bennink purchased 262,234 DEMB Shares. |

| 2. | Not including 2,422 DEMB Shares held by Jan Bennink for the benefit of his minor children. |

| 3. | Norman Sorensen acquired these Shares as follows: (i) Upon completion of the spin-off from Sara Lee Corporation the holders of Sara Lee shares received 1 DEMB Share for each Sara Lee share that they held on 14 June 2012. As a result 20,562 shares in Sara Lee Corporation held by Norman Sorensen were converted into 20,562 DEMB Shares. (ii) 53,376 DEMB Shares relate to the vesting of incentive awards by Sara Lee Corporation (see also paragraph 6.3). (iii) On 4 September 2012 Norman Sorensen purchased 4,000 DEMB Shares. |

| 4. | On 10 September 2012 Rob Zwartendijk purchased 10,500 DEMB Shares. |

To the knowledge of DEMB, after making reasonable inquiry, all of the Company’s executive officers and members of the Board currently intend to tender all Shares held of record or beneficially by such persons for purchase pursuant to the Offer.

The following transactions were performed by the members of the Board during the year preceding the date of the Offer Memorandum:

| | | | | | | | | | | | |

Name | | Buy/Sell | | Number of

Shares | | | Date of Trade | | Price per Share in

EUR | |

Jan Bennink | | Buy | | | 262,234 | 1,2 | | 4 September 2012 | | | 9.51 (w. average | )1,2 |

Norman Sorensen | | Buy | | | 4,000 | | | 4 September 2012 | | | 9.51 | |

Rob Zwartendijk | | Buy | | | 10,500 | | | 10 September 2012 | | | 9.49 | |

19

| 1. | These Shares were acquired with 68 different purchase orders executed on 4 September 2012. The table shows the average weighted purchase price. The lowest price paid per Share was EUR 9.42 and the highest price per Share was EUR 9.59. |

| 2. | Not including 722 Shares purchased by Jan Bennink for the benefit of his minor children on 4 September 2012 for an average weighted purchase price of EUR 9,51 (see also footnote 1). |

During the 60 days prior to publication of the Position Statement, none of the Company’s executive officers performed any transactions in the Shares.

2012 LTIP awards

In 2012 DEMB introduced a Long-Term Incentive Share Plan (the2012 LTIP). Under the 2012 LTIP, an award of Performance Share Units (PSUs) may be granted to certain key employees of the Group. The vesting of PSUs is dependent on (i) the participant’s continued service with the Group during a specified vesting period set out in the relevant grant notice (time based vesting) and (ii) the total shareholder return (theTSR) of DEMB relative to a predefined comparative group of companies (performance based vesting). The number of Shares that will be issued in exchange for a vested PSU depends on the variables stated in the previous sentence and ranges from 0% to 200% times the number of awarded PSUs.

As a result of the Offer, there will be 100% time-based vesting for all PSU awards granted with respect to the financial/calendar year 2012. The performance-based vesting will depend on the applicable TSR of DEMB upon award compared to the TSR of the peer group over the three month period ending on the last day prior to the Settlement Date. All vested PSUs will be settled in cash. See Section 7.11.2 of the Offer Memorandum for a description of the 2012 LTIP.

Under the 2012 LTIP, which applies to the PSUs granted to Mr Bennink, he is entitled to a maximum of 377,650 PSUs. This number of PSUs will be adjusted downwards if the applicable TSR of DEMB upon award compared to the TSR of the peer group over the three month period ending on the last day prior to the Settlement Date will not be at least at upper decile.

Subject to the Offer being declared unconditional, the table below indicates themaximum cash payment that Mr Bennink may receive for his PSUs to which the 2012 LTIP applies. As set out above, the final cash payment can be adjusted downwards depending on the TSR of DEMB compared to the TSR of the peer group.

| | | | | | | | |

Name | | Maximum number of PSUs

that may vest | | | Total maximum value of

PSUs in EUR | |

Jan Bennink | | | 377,650 | 1 | | | 4,720,625 | |

| 1. | The maximum number of PSUs that may vest (i.e. 200%) is included in the table. The number of PSUs that will actually vest will depend on the achievement of the performance based vesting criteria (i.e. TSR performance). This grant with an underlying grant value of EUR 1,750,000 was awarded by Sara Lee and documented after the spin-off. The terms of the 2012 LTIP apply to these PSUs. |

Awards that were settled in Shares

At the time of the spin off from Sara Lee, DEMB and Sara Lee concluded anEmployee Matters Agreement to address the treatment of equity-based compensation. Pursuant to the Employee Matters Agreement, Mr Sorensen received an award of 53,376 restricted share units (i.e. rights to acquire ordinary Shares in the capital of DEMB for no consideration,RSUs) to compensate him for the decrease in value of his existing Sara Lee restricted share units.

20

Combined overview of awards

The following awards were made to members of the Board during the year preceding the date of the Offer Memorandum:

| | | | | | |

Name | | Number of RSUs/PSUs | | | Date |

Jan Bennink | | | 377,650 PSUs | 1 | | 6 September 2012 |

Norman Sorensen | | | 53,376 RSUs | 2 | | 3 July 2012 |

| 1. | The maximum number of PSUs that may vest (i.e. 200%) is included in the table. The number of PSUs that will actually vest will depend on the achievement of the performance based vesting criteria (i.e. TSR performance). This grant with an underlying grant value of EUR 1,750,000 was awarded by Sara Lee and documented after the spin-off. The terms of the 2012 LTIP apply to these PSUs. |

| 2. | These RSUs vested on 28 December 2012. |

| 7. | POST-CLOSING MERGER AND LIQUIDATION |

| 7.1 | Filing of the Merger Proposal |

The Offeror and DEMB have agreed that prior to the Initial Acceptance Closing Date DEMB (i) will ensure that the Board will unanimously resolve to adopt and will sign the merger proposal with respect to the Legal Merger, substantially in the form as included in Part IV (Merger Proposal) of the Offer Memorandum (theMergerProposal), (ii) will file the Merger Proposal with the Trade Register and (iii) will have the Shareholders discuss and vote on the Merger Proposal at the EGM.

At the EGM the General Meeting of Shareholders will be asked to discuss and vote on the resolution of the General Meeting of Shareholders to complete the Legal Merger (theMerger Resolution).

It is expected that the Merger Proposal will be filed with the Trade Register on 20 June 2013 and in any event no later than 28 June 2013.

The Board unanimously recommends the Shareholders to vote in favor of the Merger Resolution.

| 7.2 | Waiver of the acceptance level Offer Condition |

The obligation of the Offeror to declare the Offer unconditional is subject to the Offer Conditions (see Section 6.2.1 of the Offer Memorandum) being satisfied or waived, as the case may be on the Acceptance Closing Date. One of the Offer Conditions is that: (i) the number of Tendered Shares, (ii) the Shares that are directly or indirectly held by the Offeror or any of its Affiliates and (iii) the Shares that are unconditionally and irrevocably committed to the Offeror or any of its Affiliates (theAcceptance Level) shall represent at least 95% of all Shares at the Acceptance Closing Date on a fully diluted basis (theAcceptance Level Offer Condition);

The Offeror will waive the Acceptance Level Offer Condition, if on the Acceptance Closing Date:

| | (a) | the Acceptance Level represents at least 80% of all Shares on a fully diluted basis; |

| | (b) | the Merger Resolution shall have been adopted by the EGM and be in full force and effect; |

| | (c) | the condition included in the SFA that the Offeror shall not declare the Offer unconditional unless the Acceptance Level represents at least 95% of all Shares at the Acceptance Closing Date on a fully diluted basis shall have been waived in accordance with the provisions of the SFA without any change to the terms or conditions of the SFA and without supplemental terms or conditions (other than such waiver); and |

21

| | (d) | nothing shall have occurred that will prevent or delay, or is reasonably expected to prevent or delay in any material respect, the completion of the Post-Closing Merger and Liquidation in accordance with its contemplated terms, which shall for the avoidance of doubt include that the Merger Proposal shall not have been withdrawn, and no non-frivolous claim or non-frivolous objection based on law or contract is made that will materially adversely affect or is reasonably likely to materially adversely affect the implementation of the Post-Closing Merger and Liquidation in accordance with its contemplated terms (including the transfer of all assets and liabilities of the Company to Oak Sub). |

If, immediately after the Post-Closing Acceptance Period, the Offeror and its Affiliates holdat least 95% of DEMB’s aggregated issued share capital, the Offeror will commence a Statutory Buy-Out in order to acquire the remaining Shares not held by the Offeror or its Affiliates.

No Dutch dividend withholding tax (dividendbelasting) is due upon a disposal of the Shares under the Statutory Buy-out. The Dutch income tax consequences of the Statutory Buy-Out are the same as the Dutch income tax consequences of the Offer. Reference is made to Section 10.1.5 of the Offer Memorandum.

| 7.4 | Post-Closing Merger and Liquidation |

Highlights

| | • | | Post-Closing Merger and Liquidation mayonly be implemented after the Post-Closing Acceptance Period and hence after the Offeror has declared the Offer unconditional. |

| | • | | Post-Closing Merger and Liquidationnot implemented if Acceptance Level is equal to or exceeds 95%. |

| | • | | Merger isproposal of Board to General Meeting of Shareholders. |

| | • | | General Meeting of Shareholdersdecides upon Merger. |

| | • | | Merger must be proposedat this stage to increase the likelihood of the Offer being declared unconditional (e.g. Offeror waiving the 95% acceptance level condition) |

| | • | | The Board is of the genuine opinion that it is itsfiduciary duty to propose the Merger to the Shareholders as it allows the possibility of a cash exit under the Offer if the vast majority of Shareholders so desires. |

| | • | | Minority Shareholders are offered acash exit equal to the Offer Price, without interest and subject to withholding taxes and other taxes. |

| | • | | The works council has rendered apositive advice on the Post-Closing Merger and Liquidation as they see the merits of the Offer being successfully consummated. |

| | • | | Fulltransparency to the Shareholders is important to the Board, hence the detailed information in the Offer Memorandum, the Position Statement and the documentation on the Post-Closing Merger and Liquidation. |

| | • | | The Post-Closing Merger and Liquidation will lead tominimal disruption of the Company’s business and operations. |

| | • | | Transactions withsimilar effect have been proposed/implemented in the past (Super de Boer/Jumbo, Crucell/Johnson & Johnson, New Skies Satellites/Blackstone). |

22

General

If (i) the Offer is declared unconditional, (ii) the Merger Resolution is adopted and in full force and effect and (iii) the Acceptance Level immediately after the Post-Closing Acceptance Period isless than 95% of all Shares on a fully diluted basis, the Offeror intends to pursue the Post-Closing Merger and Liquidation.

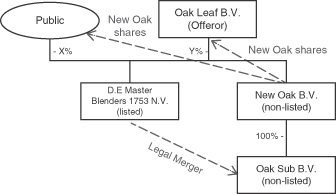

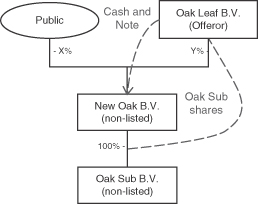

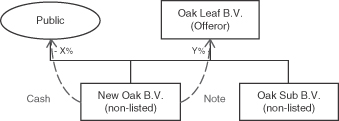

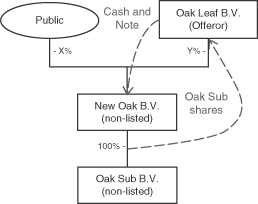

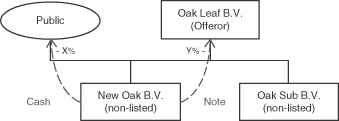

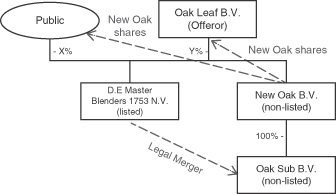

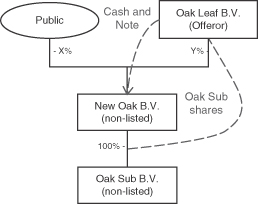

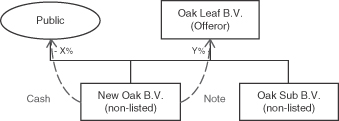

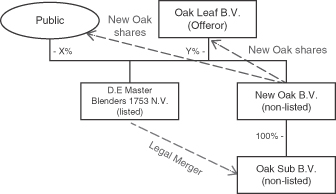

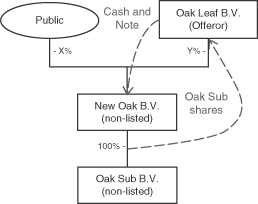

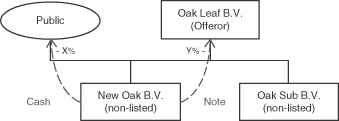

For the purposes of this Position Statement,Post-Closing Merger and Liquidation shall mean the post-closing restructuring consisting, in summary, of the following steps:

| | • | | the Merger Proposal being unanimously adopted by the Board and the managing boards of New Oak and Oak Sub and the adopting of the Merger Resolution by the EGM and the general meeting of shareholders of New Oak and Oak Sub; |

| | • | | the execution of the notarial deed with respect to the Legal Merger, which Legal Merger will become effective on the next day; |