- TMQ Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

S-3 Filing

Trilogy Metals (TMQ) S-3Shelf registration

Filed: 23 Nov 12, 12:00am

| As filed with the Securities and Exchange Commission on November 23, 2012 |

| Registration No. 333-_______ |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

NOVACOPPER INC.

(Exact name of registrant as specified in its charter)

| British Columbia | Not Applicable |

| (State or other jurisdiction of | (I.R.S. Employer |

| incorporation or organization) | Identification Number) |

Suite 2300, 200 Granville Street

Vancouver, British Columbia

Canada, V6C 1S4

(604) 638-8088

(Address, including zip code, and telephone number, including area code of registrant’s principal executive offices)

DL Services, Inc.

Columbia Center

701 Fifth Avenue, Suite 6100

Seattle, Washington 98104-7043

(206) 903-8800

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| Christopher J. Barry and | Peter Kalbfleisch and | Riccardo Leofanti |

| Kimberley R. Anderson | Trisha Robertson | Skadden, Arps, Slate, Meagher & Flom |

| Dorsey & Whitney LLP | 595 Burrard Street | LLP |

| 701 5th Avenue, Suite 6100 | P.O. Box 49314 | 222 Bay Street, Suite 1750 |

| Seattle, Washington 98104 | Suite 2600, Three Bentall Centre | Toronto, Ontario, Canada |

| (206) 903-8800 | Vancouver, British Columbia, Canada | M5K 1J5 |

| V7X 1L3 | (416) 777-4700 | |

| (604) 631-3300 |

From time to time after the effective date of this Registration Statement

(Approximate date of commencement of proposed sale to the public)

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. [ ]

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. [X]

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. [ ]

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. [ ]

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. [ ]

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer [ ] | Accelerated filer [X] | Non-accelerated filer [ ] | Smaller Reporting Company [ ] |

| (Do not check if a smaller | |||

| reporting company) |

CALCULATION OF REGISTRATION FEE

| Proposed | Proposed | |||||||||||

| Maximum | Maximum | |||||||||||

| Title of Each Class of | Amount to be | Aggregate Price | Aggregate Offering | Amount of | ||||||||

| Securities To Be Registered(1) | Registered(1) (2) | Per Unit(2) | Price (2) (3) | Registration Fee (4) | ||||||||

| Common Shares, no par value | ||||||||||||

| Warrants to Purchase Common Stock | ||||||||||||

| Share Purchase Contracts | ||||||||||||

| Share Purchase or Equity Units | ||||||||||||

| Total | $ | 100,000,000 | $ | 13,640 | ||||||||

| 1. | There are being registered hereunder such indeterminate number of shares of common shares, such indeterminate number of warrants to purchase common shares, such indeterminate amount of share purchase contracts and such indeterminate amount of share purchase or equity units as will have an aggregate initial offering price not to exceed $100,000,000. Any securities registered hereunder may be sold separately or as units with other securities registered hereunder. The securities registered also include such indeterminate amounts and numbers of shares of common stock as may be issued upon exercise of warrants or pursuant to anti-dilution provisions of any such securities. The securities registered also include, pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), such additional number of shares of common shares that may become issuable as a result of any stock split, stock dividends or similar event. |

| 2. | Not applicable pursuant to Form S-3 General Instruction II.D. |

| 3. | The Registrant is hereby registering an indeterminate amount and number of each identified class of the identified securities up to a proposed maximum aggregate offering price of $100,000,000, which may be offered from time to time at indeterminate prices, including securities that may be purchased by underwriters. The Registrant has estimated the proposed maximum aggregate offering price solely for the purpose of calculating the registration fee pursuant to Rule 457(o) under the Securities Act. |

| 4. | The registration fee has been calculated in accordance with Rule 457(o) under the Securities Act. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act, or until the registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

EXPLANATORY NOTE

This Registration Statement contains a prospectus relating to an offering of our securities in the United States, together with separate prospectus pages relating to an offering of our securities in Canada. The U.S. prospectus and the Canadian prospectus will be substantially identical. The complete U.S. prospectus is included herein and is followed by those pages to be used solely in the Canadian prospectus. Each of the alternate pages for the Canadian prospectus included in this registration statement has been labeled "[Alternate Page for Canadian Prospectus.]"

(cover page continues on next page)

The information in this prospectus is not complete and may be changed. We may not sell these securities or accept an offer tobuy these securities until the registration statement filed with the Securities and Exchange Commission is effective. Thisprospectus is not an offer to sell these securities, and it is not soliciting offers to buy these securities in any state where suchoffer or sale is not permitted. |

| SUBJECT TO COMPLETION, DATED NOVEMBER 21, 2012 |

$100,000,000

Common Shares

Warrants to Purchase Common Shares

Share Purchase Contracts

Share Purchase or Equity Units

We may offer and issue from time to time common shares (the “Common Shares”), warrants to purchase Common Shares (the “Warrants”), share purchase contracts and share purchase or equity units (all of the foregoing, collectively, the “Securities”) or any combination thereof up to an aggregate initial offering price of $100,000,000 in one or more transactions under this shelf prospectus (which we refer to as the “Prospectus”). Securities may be offered separately or together, in amounts, at prices and on terms to be determined based on market conditions at the time of sale and set forth in an accompanying shelf prospectus supplement (a “Prospectus Supplement”).

This Prospectus provides you with a general description of the Securities that we may offer. Each time we offer Securities, we will provide you with a Prospectus Supplement that describes specific information about the particular Securities being offered and may add, update or change information contained or incorporated by reference in this Prospectus. You should read both this Prospectus and the Prospectus Supplement, together with the additional information which is incorporated by reference into this Prospectus and the Prospectus Supplement.

Our outstanding common shares are listed and posted for trading on the Toronto Stock Exchange (“TSX”) and the NYSE-MKT LLC (“NYSE-MKT”), previously NYSE-AMEX, under the symbol “NCQ”. On November 20, 2012, the last reported sale price of the Common Shares on the NYSE-MKT was $2.07 per Common Share and on the TSX was Cdn$2.03 per Common Share. Unless otherwise specified in the applicable Prospectus Supplement, Securities other than the Common Shares will not be listed on any securities exchange.There is currently no market through which the Securities, other than the Common Shares, may be sold and you may not be able to resell such Securities purchased under this Prospectus and any applicable Prospectus Supplement. This may affect the pricing of such Securities in the secondary market, the transparency and availability of trading prices, the liquidity of the securities, and the extent of issuer regulation. See “Risk Factors”. The offering of Securities hereunder is subject to approval of certain legal matters on our behalf by Blake, Cassels & Graydon LLP, with respect to Canadian legal matters, and Dorsey & Whitney LLP, with respect to U.S. legal matters.

Investing in our securities involves a high degree of risk. You should carefully read the‘‘Risk Factors’’ section beginning on page 4 of this Prospectus.

These Securities have not been approved or disapproved by the U.S. Securities and Exchange Commission (“SEC”) or any state securities commission nor has the SEC or any state securities commission passed upon the accuracy or adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

The date of this Prospectus is November 21, 2012.

ii

TABLE OF CONTENTS

1

ABOUT THIS PROSPECTUS

This Prospectus is a part of a registration statement that we have filed with the SEC utilizing a “shelf” registration process. Under this shelf registration process, we may sell any combination of the Securities described in this Prospectus in one or more offerings up to an aggregate initial offering price of $100,000,000. The specific terms of the Securities with respect to a particular offering will be set out in the applicable Prospectus Supplement and may include, where applicable: (i) in the case of Common Shares, the designation of the particular class and series, the number of common shares offered, the issue price, dividend rate, if any, and any other terms specific to the Common Shares being offered; (ii) in the case of Warrants, the designation, terms, number of Common Shares issuable upon exercise of the Warrants, any procedures that will result in the adjustment of these numbers, the exercise price, dates and periods of exercise, the currency in which the Warrants are issued and any other specific terms; (iii) in the case of share purchase contracts, the designation, number and terms of the Common Shares to be purchased under the share purchase contract, any procedures that will result in the adjustment of these numbers, the purchase price and purchase date or dates of the Common Shares, any requirements of the purchaser to secure its obligations under the share purchase contract and any other specific terms; and (iv) in the case of share purchase or equity units, the terms of the share purchase contract or third party obligations and any other specific terms. Where required by statute, regulation or policy, and where Securities are offered in currencies other than Canadian dollars, appropriate disclosure of foreign exchange rates applicable to such Securities will be included in the Prospectus Supplement describing such Securities.

We may offer and sell Securities to or through underwriting syndicates or dealers, through agents or directly to purchasers. The Prospectus Supplement for each offering of Securities will describe in detail the plan of distribution for that offering.

In connection with any offering of the Securities (unless otherwise specified in a Prospectus Supplement), the underwriters or agents may over-allot or effect transactions which stabilize or maintain the market price of the Securities offered at a higher level than that which might exist in the open market. Such transactions, if commenced, may be interrupted or discontinued at any time. See “Plan of Distribution.”

Please carefully read both this Prospectus and any Prospectus Supplement together with the documents incorporated herein by reference under “Documents Incorporated by Reference” and the additional information described below under “Additional Information.”

Prospective investors should be aware that all mineral resource estimates, and any future reserve estimates, included or incorporated by reference in this Prospectus and any accompanying Prospectus Supplement have been and will be prepared in accordance with applicable Canadian standards, which differ from U.S. standards. See “Cautionary Note to United States Investors” and “Glossary”. This Prospectus and the documents incorporated by reference in this Prospectus contain forward-looking statements and forward-looking information within the meaning of applicable U.S. and Canadian securities laws. See “Cautionary Statement Regarding Forward-Looking Statements.”

Prospective investors should be aware that the acquisition of the Securities described herein may have tax consequences. This Prospectus and the applicable Prospectus Supplement may not describe these tax consequences fully. You should read the tax discussion contained in the applicable Prospectus Supplement and consult your tax advisor with respect to your own particular circumstances. See “Certain Canadian Federal Income Tax Considerations” and “U.S. Federal Income Tax Considerations” in this Prospectus.

You should rely only on the information contained or incorporated by reference in this Prospectus and any Prospectus Supplement. We have not authorized anyone to provide you with different information. The distribution or possession of this Prospectus in or from certain jurisdictions may be restricted by law. This Prospectus is not an offer to sell these Securities and is not soliciting an offer to buy these Securities in any jurisdiction where the offer or sale is not permitted or where the person making the offer or sale is not qualified to do so or to any person to whom it is not permitted to make such offer or sale. The information contained in this Prospectus is accurate only as of the date of this Prospectus and any information incorporated by reference is accurate as of the date of the applicable document incorporated by reference, regardless of the time of delivery of this Prospectus or of any sale of the Securities. Our business, financial condition, results of operations and prospects may have changed since that date.

In this Prospectus and in any Prospectus Supplement, unless the context otherwise requires, references to “NovaCopper”, the “Company”, “we”, “us” and “our” refer to NovaCopper Inc., either alone or together with our subsidiaries as the context requires.

2

Unless stated otherwise or as the context otherwise requires, all references to dollar amounts in this Prospectus and any Prospectus Supplement are references to United States dollars. References to “$” or “US$” are to United States dollars and references to “Cdn$” are to Canadian dollars. See “Exchange Rate Information”. Our interim financial statements for interim periods ended in 2012 that are incorporated by reference into this Prospectus and any Prospectus Supplement have been prepared in accordance with accounting principles generally accepted in the United States.

3

RISK FACTORS

Investing in the Securities is speculative and involves a high degree of risk due to the nature of our business and the present stage of exploration of our mineral properties. The following risk factors, as well as risks currently unknown to us, could materially adversely affect our future business, operations and financial condition and could cause them to differ materially from the estimates described in forward-looking information relating to NovaCopper, or our business, property or financial results, each of which could cause purchasers of Securities to lose all or part of their investments. Before deciding to invest in any Securities, investors should consider carefully the risks included herein and incorporated by reference in this Prospectus and those described in any Prospectus Supplement.

Risks Related to the Our Business

We have not defined any proven or probable reserves and none of our mineral properties are in production or under development.

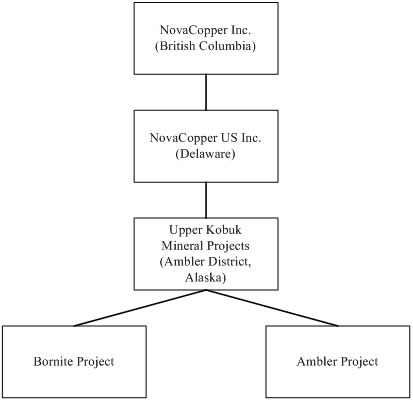

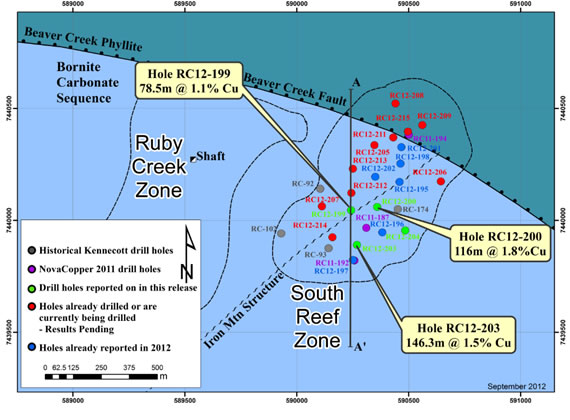

We have no history of commercially producing precious or base metals and all of our properties are in the exploration stage. We have not defined or delineated any measured resources or proven or probable reserves on our two projects located in Northwest Alaska, our property within the Ambler schist belt (the “Ambler Project”) and our property within the Bornite carbonate sequence (the “Bornite Project,” and together with the Ambler Project, the “Upper Kobuk Mineral Projects”). Mineral exploration involves significant risk, since few properties that are explored contain bodies of ore that would be commercially economic to develop into producing mines. We cannot assure you that we will establish the presence of any measured resources, or proven or probable reserves at the Upper Kobuk Mineral Projects or any other properties. The failure to establish measured resources, or proven or probable reserves, would severely restrict our ability to implement our strategies for long-term growth.

Even if one of our mineral projects is determined to be economically viable to develop into a mine, such development may not be successful.

If the development of one of our projects is found to be economically feasible and approved by our board of directors (the “Board”), such development will require obtaining permits and financing, the construction and operation of mines, processing plants and related infrastructure, including road access. As a result, we are and will continue to be subject to all of the risks associated with establishing new mining operations, including:

the timing and cost, which can be considerable, of the construction of mining and processing facilities and related infrastructure;

the availability and cost of skilled labour and mining equipment;

the availability and cost of appropriate smelting and refining arrangements;

the need to obtain necessary environmental and other governmental approvals and permits and the timing of the receipt of those approvals and permits;

the availability of funds to finance construction and development activities;

potential opposition from non-governmental organizations, environmental groups or local groups which may delay or prevent development activities; and

potential increases in construction and operating costs due to changes in the cost of fuel, power, materials and supplies.

The costs, timing and complexities of developing our projects may be greater than anticipated because our property interests are not located in developed areas, and, as a result, our property interests are not currently served by appropriate road access, water and power supply and other support infrastructure. Cost estimates may increase significantly as more detailed engineering work is completed on a project. It is common in new mining operations to experience unexpected costs, problems and delays during construction, development and mine start-up. In addition, delays in the early stages of mineral production often occur. Accordingly, we cannot provide assurance that we will ever achieve or that our activities will result in profitable mining operations at our mineral properties.

4

In addition, there can be no assurance that our mineral exploration activities will result in any discoveries of new mineralization. If further mineralization is discovered there is also no assurance that the mineralization would be economical for commercial production. Discovery of mineral deposits is dependent upon a number of factors and significantly influenced by the technical skill of the exploration personnel involved. The commercial viability of a mineral deposit is also dependent upon a number of factors which are beyond our control, including the attributes of the deposit, commodity prices, government policies and regulation and environmental protection.

We have no history of production and no revenue from operations.

We have a very limited history of operations and to date have generated no revenue from operations. As such, we are subject to many risks common to such enterprises, including under-capitalization, cash shortages, limitations with respect to personnel, financial and other resources and lack of revenues. There is no assurance that the Upper Kobuk Mineral Projects or any other projects will be commercially mineable, and we may never generate revenues from our operations.

We may not have sufficient funds to develop our mineral projects or to complete further exploration programs.

We have limited financial resources. We currently generate no operating revenue, and must primarily finance exploration activity and the development of mineral projects by other means. In the future, our ability to continue exploration, and development and production activities, if any, will depend on our ability to obtain additional external financing. Any unexpected costs, problems or delays could severely impact our ability to continue exploration and development activities. The failure to meet ongoing obligations on a timely basis could result in a loss or a substantial dilution of our interests in projects.

The sources of external financing that we may use for these purposes include project or bank financing, or public or private offerings of equity and debt. In addition, we may enter into one or more strategic alliances or joint ventures, decide to sell certain property interests, or utilize one or a combination of all of these alternatives. The financing alternative we chose may not be available on acceptable terms, or at all. If additional financing is not available, we may have to postpone further exploration or development of, or sell, one or more of our principal properties.

Changes in the market price of copper and other metals, which in the past have fluctuated widely, will affect our ability to finance continued exploration and development of our projects and affect our operations and financial condition.

Our long-term viability will depend, in large part, on the market price of copper and other metals. The market prices for these metals are volatile and are affected by numerous factors beyond our control, including:

global or regional consumption patterns;

the supply of, and demand for, these metals;

speculative activities;

the availability and costs of metal substitutes;

expectations for inflation; and

political and economic conditions, including interest rates and currency values.

We cannot predict the effect of these factors on metal prices. A decrease in the market price of copper and other metals could affect our ability to raise funds to finance the exploration and development of any of our mineral projects, which would have a material adverse effect on our financial condition and results of operations. The market price of copper and other metals may not remain at current levels. In particular, an increase in worldwide supply, and consequent downward pressure on prices, may result over the longer term from increased copper production from mines developed or expanded as a result of current metal price levels. There is no assurance that a profitable market may exist or continue to exist.

5

Actual capital costs, operating costs, production and economic returns may differ significantly from those described in the technical report for the Ambler Project.

The technical report titled “NI 43-101 Preliminary Economic Assessment, Ambler Project, Kobuk, AK” dated effective February 1, 2012 (the “PEA”) is an early stage study that is preliminary in nature. There can be no assurance that the results described in the PEA will be realized. The capital costs to take our projects into production may be significantly higher than anticipated.

None of our mineral properties have an operating history upon which we can base estimates of future operating costs. Decisions about the development of the Ambler Project (or the Bornite Project) will ultimately be based upon feasibility studies. Feasibility studies derive estimates of cash operating costs based upon, among other things:

anticipated tonnage, grades and metallurgical characteristics of the ore to be mined and processed;

anticipated recovery rates of metals from the ore;

cash operating costs of comparable facilities and equipment; and

anticipated climatic conditions.

Cash operating costs, production and economic returns, and other estimates contained in studies or estimates prepared by or for us may differ significantly from those anticipated by the PEA and there can be no assurance that our actual operating costs will not be higher than currently anticipated.

The Upper Kobuk Mineral Projects are located in a remote area of Alaska, and access to them is limited. Exploration and any future development or production activities may be limited and delayed by infrastructure challenges, inclement weather and a shortened exploration season.

The Upper Kobuk Mineral Projects are in a remote area of Alaska. Access to the Upper Kobuk Mineral Projects is limited and there is currently no infrastructure in the area.

We cannot provide assurances that the proposed road that would provide access to the Ambler District will be built, that it will be built in a timely manner or that the cost of accessing the proposed road will be reasonable, that it will be built in the manner contemplated, or that it will sufficiently satisfy the requirements of the Upper Kobuk Mineral Projects. In addition, successful development of the Upper Kobuk Mineral Projects will require the development of the necessary infrastructure. If adequate infrastructure is not available in a timely manner, there can be no assurance that:

the development of the Upper Kobuk Mineral Projects will be commenced or completed on a timely basis, if at all;

the resulting operations will achieve the anticipated production volume; or

the construction costs and operating costs associated with the development of the Upper Kobuk Mineral Projects will not be higher than anticipated.

As the Upper Kobuk Mineral Projects are located in a remote area of Alaska, exploration, development and production activities may be limited and delayed by inclement weather and a shortened exploration season.

6

We will incur losses for the foreseeable future.

We expect to incur losses unless and until such time as our mineral projects generate sufficient revenues to fund continuing operations. The exploration and development of our mineral properties will require the commitment of substantial financial resources that may not be available.

The amount and timing of expenditures will depend on a number of factors, including the progress of ongoing exploration and development, the results of consultants’ analyses and recommendations, the rate at which operating losses are incurred, the execution of any joint venture agreements with strategic partners and the acquisition of additional property interests, some of which are beyond our control. We cannot provide assurance that we will ever achieve profitability.

Mineral resource and reserve calculations are only estimates.

Any figures presented for mineral resources in this Prospectus and in our other filings with securities regulatory authorities and those which may be presented in the future or any figures for mineral reserves that may be presented by us in the future are and will only be estimates. There is a degree of uncertainty attributable to the calculation of mineral reserves and mineral resources. Until mineral reserves or mineral resources are actually mined and processed, the quantity of metal and grades must be considered as estimates only and no assurances can be given that the indicated levels of metals will be produced. In making determinations about whether to advance any of our projects to development, we must rely upon estimated calculations as to the mineral resources and grades of mineralization on our properties.

The estimating of mineral reserves and mineral resources is a subjective process that relies on the judgment of the persons preparing the estimates. The process relies on the quantity and quality of available data and is based on knowledge, mining experience, analysis of drilling results and industry practices. Valid estimates made at a given time may significantly change when new information becomes available. While we believe that the mineral resource estimates included in this Prospectus for the Upper Kobuk Mineral Projects are well established and reflect management’s best estimates, by their nature mineral resource estimates are imprecise and depend, to a certain extent, upon analysis of drilling results and statistical inferences that may ultimately prove to be inaccurate. There can be no assurances that actual results will meet the estimates contained in feasibility studies. As well, further studies are required.

Estimated mineral reserves or mineral resources may have to be recalculated based on changes in metal prices, further exploration or development activity or actual production experience. This could materially and adversely affect estimates of the volume or grade of mineralization, estimated recovery rates or other important factors that influence mineral reserve or mineral resource estimates. The extent to which mineral resources may ultimately be reclassified as mineral reserves is dependent upon the demonstration of their profitable recovery. Any material changes in mineral resource estimates and grades of mineralization will affect the economic viability of placing a property into production and a property’s return on capital. We cannot provide assurance that mineralization can be mined or processed profitably.

Our mineral resource estimates have been determined and valued based on assumed future metal prices, cut-off grades and operating costs that may prove to be inaccurate. Extended declines in market prices for copper, zinc, lead, gold and silver may render portions of our mineralization uneconomic and result in reduced reported mineral resources, which in turn could have a material adverse effect on our results of operations or financial condition. We cannot provide assurance that mineral recovery rates achieved in small scale tests will be duplicated in large scale tests under on-site conditions or in production scale.

A reduction in any mineral reserves that may be estimated by us in the future could have an adverse impact on our future cash flows, earnings, results of operations and financial condition. No assurances can be given that any mineral resource estimates for the Upper Kobuk Mineral Projects will ultimately be reclassified as mineral reserves. See “Cautionary Note to United States Investors.”

7

Significant uncertainty exists related to inferred mineral resources.

There is a risk that inferred mineral resources referred to in this Prospectus cannot be converted into measured or indicated mineral resources as there may be limited ability to assess geological continuity. Due to the uncertainty that may attach to inferred mineral resources, there is no assurance that inferred mineral resources will be upgraded to resources with sufficient geological continuity to constitute proven and probable mineral reserves as a result of continued exploration. See “Cautionary Note to United States Investors.”

Mining is inherently risky and subject to conditions or events beyond our control.

The development and operation of a mine is inherently dangerous and involves many risks that even a combination of experience, knowledge and careful evaluation may not be able to overcome, including:

unusual or unexpected geological formations;

metallurgical and other processing problems;

metal losses;

environmental hazards;

power outages;

labour disruptions;

industrial accidents;

periodic interruptions due to inclement or hazardous weather conditions;

flooding, explosions, fire, rockbursts, cave-ins and landslides;

mechanical equipment and facility performance problems; and

the availability of materials and equipment.

These risks could result in damage to, or destruction of, mineral properties, production facilities or other properties, personal injury or death, including to our employees, environmental damage, delays in mining, increased production costs, asset write downs, monetary losses and possible legal liability. We may not be able to obtain insurance to cover these risks at economically feasible premiums, or at all. Insurance against certain environmental risks, including potential liability for pollution and other hazards associated with mineral exploration and production, is not generally available to companies within the mining industry. We may suffer a material adverse effect on our business if we incur losses related to any significant events that are not covered by our insurance policies.

General economic conditions may adversely affect our growth, future profitability and ability to finance.

The unprecedented events in global financial markets in the past several years have had a profound impact on the global economy. Many industries, including the copper mining industry, are impacted by these market conditions. Some of the key impacts of the current financial market turmoil include contraction in credit markets resulting in a widening of credit risk, devaluations, high volatility in global equity, commodity, foreign exchange and precious metal markets and a lack of market liquidity. A worsening or slowdown in the financial markets or other economic conditions, including but not limited to, consumer spending, employment rates, business conditions, inflation, fuel and energy costs, consumer debt levels, lack of available credit, the state of the financial markets, interest rates and tax rates, may adversely affect our growth and ability to finance. Specifically:

8

the global credit/liquidity crisis could impact the cost and availability of financing and our overall liquidity;

the volatility of copper and other metal prices would impact our estimates of mineral resources, revenues, profits, losses and cash flow, and the feasibility of our projects;

negative economic pressures could adversely impact demand for our future production, if any;

construction related costs could increase and adversely affect the economics of any project in the Ambler District;

volatile energy, commodity and consumables prices and currency exchange rates would impact our estimated production costs; and

the devaluation and volatility of global stock markets would impact the valuation of our equity and other securities.

We cannot provide assurance that we will successfully acquire commercially mineable mineral rights.

Exploration for and development of copper properties involves significant financial risks which even a combination of careful evaluation, experience and knowledge may not eliminate. While the discovery of an ore body may result in substantial rewards, few properties which are explored are ultimately developed into producing mines. Major expenses may be required to establish reserves by drilling, constructing mining and processing facilities at a site, developing metallurgical processes and extracting metals from ore. We cannot ensure that our current exploration and development programs will result in profitable commercial mining operations.

The economic feasibility of development projects is based upon many factors, including the accuracy of mineral resource estimates; metallurgical recoveries; capital and operating costs; government regulations relating to prices, taxes, royalties, land tenure, land use, importing and exporting and environmental protection; and metal prices, which are highly volatile. Development projects are also subject to the successful completion of feasibility studies, issuance of necessary governmental permits and availability of adequate financing.

Most exploration projects do not result in the discovery of commercially mineable ore deposits, and no assurance can be given that any anticipated level of recovery of ore reserves, if any, will be realized or that any identified mineral deposit will ever qualify as a commercially mineable (or viable) ore body which can be legally and economically exploited. Estimates of mineral reserves, mineral resources, mineral deposits and production costs can also be affected by such factors as environmental permitting regulations and requirements, weather, environmental factors, unforeseen technical difficulties, the metallurgy of the mineralization forming the mineral deposit, unusual or unexpected geological formations and work interruptions. If current exploration programs do not result in the discovery of commercial ore, we may need to write-off part or all of our investment in our existing exploration stage properties, and may need to acquire additional properties.

Material changes in mineral reserves, if any, grades, stripping ratios or recovery rates may affect the economic viability of any project. Our future growth and productivity will depend, in part, on our ability to develop commercially mineable mineral rights at our existing properties or identify and acquire other commercially mineable mineral rights, and on the costs and results of continued exploration and potential development programs. Mineral exploration is highly speculative in nature and is frequently non-productive. Substantial expenditures are required to:

establish mineral reserves through drilling and metallurgical and other testing techniques;

determine metal content and metallurgical recovery processes to extract metal from the ore; and

construct, renovate or expand mining and processing facilities.

9

In addition, if we discover ore, it would take several years from the initial phases of exploration until production is possible. During this time, the economic feasibility of production may change. As a result of these uncertainties, there can be no assurance that we will successfully acquire commercially mineable (or viable) mineral rights.

We are subject to significant governmental regulations.

Our exploration activities are subject to extensive federal, state, provincial and local laws and regulations governing various matters, including:

environmental protection;

the management and use of toxic substances and explosives;

the management of natural resources;

the exploration and development of mineral properties, including reclamation;

exports;

price controls;

taxation and mining royalties;

management of tailing and other waste generated by operations;

labour standards and occupational health and safety, including mine safety; and

historic and cultural preservation.

Failure to comply with applicable laws and regulations may result in civil or criminal fines or penalties or enforcement actions, including orders issued by regulatory or judicial authorities enjoining, curtailing or closing operations or requiring corrective measures, installation of additional equipment or remedial actions, any of which could result in significant expenditures. We may also be required to compensate private parties suffering loss or damage by reason of a breach of such laws, regulations or permitting requirements. It is also possible that future laws and regulations, or more stringent enforcement of current laws and regulations by governmental authorities, could cause us to incur additional expense or capital expenditure restrictions, suspensions or closing of our activities and delays in the exploration and development of our properties.

We require further permits in order to conduct current and anticipated future operations, and delays in obtaining or failure to obtain such permits, or a failure to comply with the terms of any such permits that we have obtained, would adversely affect our business.

Our current and anticipated future operations, including further exploration, development and commencement of production on our mineral properties, require permits from various governmental authorities. Obtaining or renewing governmental permits is a complex and time-consuming process. The duration and success of efforts to obtain and renew permits are contingent upon many variables not within our control. Due to the preliminary stages of the Upper Kobuk Mineral Projects, it is difficult to assess what specific permitting requirements will ultimately apply.

Shortage of qualified and experienced personnel in the U.S. federal and Alaskan State agencies to coordinate a federally led joint environmental impact statement process could result in delays or inefficiencies. Backlog within the permitting agencies could affect the permitting timeline of the Upper Kobuk Mineral Projects. Other factors that could affect the permitting timeline include (i) the number of other large-scale projects currently in a more advanced stage of development which could slow down the review process for the Upper Kobuk Mineral Projects and (ii) significant public response regarding the Upper Kobuk Mineral Projects.

10

We cannot provide assurance that all permits that we require for our operations, including any for construction of mining facilities or conduct of mining, will be obtainable or renewable on reasonable terms, or at all. Delays or a failure to obtain such required permits, or the expiry, revocation or failure to comply with the terms of any such permits that we have obtained, would adversely affect our business.

Our activities are subject to environmental laws and regulations that may increase our costs and restrict our operations.

All of our exploration, potential development and production activities are subject to regulation by governmental agencies under various environmental laws. These laws address emissions into the air, discharges into water, management of waste, management of hazardous substances, protection of natural resources, antiquities and endangered species and reclamation of lands disturbed by mining operations. Environmental legislation is evolving and the general trend has been towards stricter standards and enforcement, increased fines and penalties for noncompliance, more stringent environmental assessments of proposed projects and increasing responsibility for companies and their officers, directors and employees. Compliance with environmental laws and regulations may require significant capital outlays on our behalf and may cause material changes or delays in our intended activities. Several regulatory initiatives are currently ongoing within the State of Alaska that have the potential to influence the permitting process for the Upper Kobuk Mineral Projects. These include a revision of the Alaska Mixing Zone Regulations which may be required in order to permit a mixing zone for discharge in Subarctic Creek. Future changes in these laws or regulations could have a significant adverse impact on some portion of our business, requiring us to re-evaluate those activities at that time.

Environmental hazards may exist on our properties that are unknown to us at the present time and that have been caused by previous owners or operators or that may have occurred naturally. We may be liable for remediating such damage.

Failure to comply with applicable environmental laws, regulations and permitting requirements may result in enforcement actions thereunder, including orders issued by regulatory or judicial authorities, causing operations to cease or to be curtailed, and may include corrective measures requiring capital expenditures, installation of additional equipment or remedial actions.

Land reclamation requirements for our exploration properties may be burdensome.

Land reclamation requirements are generally imposed on mineral exploration companies (as well as companies with mining operations) in order to minimize long term effects of land disturbance. Reclamation may include requirements to:

treat ground and surface water to drinking water standards;

control dispersion of potentially deleterious effluents; and

reasonably re-establish pre-disturbance land forms and vegetation.

In order to carry out reclamation obligations imposed on us in connection with exploration, potential development and production activities, we must allocate financial resources that might otherwise be spent on further exploration and development programs. In addition, regulatory changes could increase our obligations to perform reclamation and mine closing activities. If we are required to carry out unanticipated reclamation work, our financial position could be adversely affected.

Title and other rights to our properties may be subject to challenge.

We cannot provide assurance that title to our properties will not be challenged. We own mineral claims which constitute our property holdings. We may not have, or may not be able to obtain, all necessary surface rights to develop a property. Title insurance is generally not available for mineral properties and our ability to ensure that we have obtained a secure claim to individual mining properties may be severely constrained. Our mineral properties may be subject to prior unregistered agreements, transfers or claims, and title may be affected by, among other things, undetected defects. We have not conducted surveys of all of the claims in which we hold direct or indirect interests. A successful claim contesting our title to a property will cause us to lose our rights to explore and, if warranted, develop that property or undertake or continue production thereon. This could result in our not being compensated for our prior expenditures relating to the property. In addition, our ability to continue to explore and develop the property may be subject to agreements with other third parties including agreements with native corporations and first nations groups, for instance, the lands at the Upper Kobuk Mineral Projects are subject to an Exploration Agreement and Option to Lease between NANA Regional Corporation, Inc. (“NANA”), an Alaska Native Corporation headquartered in Kotzebue, Alaska, and NovaCopper US Inc. (“NovaCopper US”), our wholly-owned subsidiary, dated October 19, 2011 (the “NANA Agreement”) (as more particularly described under “History of NovaCopper – Agreement with NANA Regional Corporation”).

11

Risks inherent in acquisitions of new properties.

We may actively pursue the acquisition of exploration, development and production assets consistent with our acquisition and growth strategy. From time to time, we may also acquire securities of or other interests in companies with respect to which we may enter into acquisitions or other transactions. Acquisition transactions involve inherent risks, including but not limited to:

accurately assessing the value, strengths, weaknesses, contingent and other liabilities and potential profitability of acquisition candidates;

ability to achieve identified and anticipated operating and financial synergies;

unanticipated costs;

diversion of management attention from existing business;

potential loss of our key employees or key employees of any business acquired;

unanticipated changes in business, industry or general economic conditions that affect the assumptions underlying the acquisition;

decline in the value of acquired properties, companies or securities;

assimilating the operations of an acquired business or property in a timely and efficient manner;

maintaining our financial and strategic focus while integrating the acquired business or property;

implementing uniform standards, controls, procedures and policies at the acquired business, as appropriate; and

to the extent that we make an acquisition outside of markets in which it has previously operated, conducting and managing operations in a new operating environment.

Acquiring additional businesses or properties could place increased pressure on our cash flow if such acquisitions involve a cash consideration. The integration of our existing operations with any acquired business will require significant expenditures of time, attention and funds. Achievement of the benefits expected from consolidation would require us to incur significant costs in connection with, among other things, implementing financial and planning systems. We may not be able to integrate the operations of a recently acquired business or restructure our previously existing business operations without encountering difficulties and delays. In addition, this integration may require significant attention from our management team, which may detract attention from our day-to-day operations. Over the short-term, difficulties associated with integration could have a material adverse effect on our business, operating results, financial condition and the price of our common shares. In addition, the acquisition of mineral properties may subject us to unforeseen liabilities, including environmental liabilities, which could have a material adverse effect on us. There can be no assurance that any future acquisitions will be successfully integrated into our existing operations.

12

Any one or more of these factors or other risks could cause us not to realize the anticipated benefits of an acquisition of properties or companies, and could have a material adverse effect on our financial condition.

High metal prices in recent years have encouraged increased mining exploration, development and construction activity, which has increased demand for, and cost of, exploration, development and construction services and equipment.

The relative strength of metal prices in recent years has encouraged increases in mining exploration, development and construction activities around the world, which has resulted in increased demand for, and cost of, exploration, development and construction services and equipment. While recent market conditions have had a moderating effect on the costs of such services and equipment, increases in such costs may continue with the resumption of an upward trend in metal prices. Increased demand for and cost of services and equipment could result in delays if services or equipment cannot be obtained in a timely manner due to inadequate availability, and may cause scheduling difficulties due to the need to coordinate the availability of services or equipment, any of which could materially increase project exploration, development and/or construction costs.

We face industry competition in the acquisition of exploration properties and the recruitment and retention of qualified personnel.

We compete with other exploration and producing companies, many of which are better capitalized, have greater financial resources, operational experience and technical capabilities or are further advanced in their development or are significantly larger and have access to greater mineral reserves, for the acquisition of mineral claims, leases and other mineral interests as well as for the recruitment and retention of qualified employees and other personnel. If we require and are unsuccessful in acquiring additional mineral properties or in recruiting and retaining qualified personnel, we will not be able to grow at the rate we desire, or at all.

Some of our directors and officers have conflicts of interest as a result of their involvement with other natural resource companies.

Certain of our directors and officers also serve as directors or officers, or have significant shareholdings in, other companies involved in natural resource exploration and development or mining-related activities, including, in particular, NovaGold Resources Inc. (“NovaGold”). To the extent that such other companies may participate in ventures in which we may participate in, or in ventures which we may seek to participate in, our directors and officers may have a conflict of interest in negotiating and concluding terms respecting the extent of such participation. In all cases where our directors and officers have an interest in other companies, such other companies may also compete with us for the acquisition of mineral property investments. Such conflicts of our directors and officers may result in a material and adverse effect on our profitability, results of operation and financial condition. As a result of these conflicts of interest, we may miss the opportunity to participate in certain transactions, which may have a material adverse effect on our financial position.

We may experience difficulty attracting and retaining qualified management and technical personnel to grow our business.

We are dependent on the services of key executives and other highly skilled and experienced personnel to advance our corporate objectives as well as the identification of new opportunities for growth and funding. Mr. Van Nieuwenhuyse, Ms. Sanders, and Mr. Piekenbrock are currently our only executive officers. It will be necessary for us to recruit additional skilled and experienced executives. Our inability to do so, or the loss of any of these persons or our inability to attract and retain suitable replacements for them, or additional highly skilled employees required for our activities, would have a material adverse effect on our business and financial condition.

13

In the future we may be subject to legal proceedings.

Due to the nature of our business, we may be subject to numerous regulatory investigations, claims, lawsuits and other proceedings in the ordinary course of our business. The results of these legal proceedings cannot be predicted with certainty due to the uncertainty inherent in litigation, including the effects of discovery of new evidence or advancement of new legal theories, the difficulty of predicting decisions of judges and juries and the possibility that decisions may be reversed on appeal. There can be no assurances that these matters will not have a material adverse effect on our business.

Our largest shareholder has significant influence over us and may also affect the market price and liquidity of the Securities.

Electrum Strategic Resources LLC (“Electrum”) is our single largest shareholder, controlling approximately 19% of the outstanding voting securities and warrants exercisable for 5,222,879 Common Shares which, if exercised would increase its holdings to 27.2% if no other shares were issued. Accordingly, Electrum will have significant influence in determining the outcome of any corporate transaction or other matter submitted to the shareholders for approval, including mergers, consolidations and the sale of all or substantially all of our assets and other significant corporate actions. Unless significant participation of other shareholders takes place in such shareholder meetings, Electrum may be able to approve such matters itself. The concentration of ownership of the shares by Electrum may: (i) delay or deter a change of control of the Company; (ii) deprive shareholders of an opportunity to receive a premium for their shares as part of a sale of the Company; and (iii) affect the market price and liquidity of the shares. Without the consent of Electrum, we could be prevented from entering into transactions that are otherwise beneficial to us. The interests of Electrum may differ from or be adverse to the interests of our other shareholders. The effect of these rights and Electrum’s influence may impact the price that investors are willing to pay for securities. If Electrum sells a substantial number of shares in the public market, the market price of the shares could fall. The perception among the public that these sales will occur could also contribute to a decline in the market price of the shares.

Global climate change is an international concern, and could impact our ability to conduct future operations.

Global climate change is an international issue and receives an enormous amount of publicity. We would expect that the imposition of international treaties or U.S. or Canadian federal, state, provincial or local laws or regulations pertaining to mandatory reductions in energy consumption or emissions of greenhouse gasses could affect the feasibility of our mining projects and increase our operating costs.

Adverse publicity from non-governmental organizations could have a material adverse effect on us.

There is an increasing level of public concern relating to the effect of mining production on our surroundings, communities and environment. Non-governmental organizations (“NGOs”), some of which oppose resource development, are often vocal critics of the mining industry. While we seek to operate in a socially responsible manner, adverse publicity generated by such NGOs related to extractive industries, or our operations specifically, could have an adverse effect on our reputation and financial condition or our relationship with the communities in which we operate.

We may fail to achieve and maintain the adequacy of our internal control over financial reporting as per the requirements of the Sarbanes-Oxley Act.

We are required to document and test our internal control procedures in order to satisfy the requirements of Section 404 of the Sarbanes-Oxley Act (“SOX”). SOX requires an annual assessment by management of the effectiveness of our internal control over financial reporting and an attestation report by our independent auditors addressing this assessment. We may in the future fail to achieve and maintain the adequacy of our internal control over financial reporting, as such standards are modified, supplemented or amended from time to time, and we may not be able to ensure that we can conclude on an ongoing basis that we have effective internal control over financial reporting in accordance with Section 404 of SOX. Our failure to satisfy the requirements of Section 404 of SOX on an ongoing, timely basis could result in the loss of investor confidence in the reliability of our financial statements, which in turn could harm our business and negatively impact the trading price of our common shares. In addition, any failure to implement required new or improved controls, or difficulties encountered in their implementation, could harm our operating results or cause us to fail to meet our reporting obligations. Future acquisitions of companies may provide us with challenges in implementing the required processes, procedures and controls in our acquired operations. Acquired companies may not have disclosure control and procedures or internal control over financial reporting that are as thorough or effective as those required by securities laws currently applicable to us.

Our business is subject to evolving corporate governance and public disclosure regulations that have increased both our compliance costs and the risk of noncompliance, which could have an adverse effect on our stock price.

We are subject to changing rules and regulations promulgated by a number of United States and Canadian governmental and self-regulated organizations, including the SEC, the Canadian Securities Administrators, the NYSE MKT, the TSX, and the Financial Accounting Standards Board. These rules and regulations continue to evolve in scope and complexity and many new requirements have been created in response to laws enacted by the United States Congress, making compliance more difficult and uncertain. For example, on July 21, 2010, the United States Congress passed the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank”), which resulted in the SEC adopting rules that will require us to disclose on an annual basis, beginning in 2014, certain payments made by us, our subsidiaries or entities we control, to the U.S. government and foreign governments, including sub-national governments. Our efforts to comply with the Dodd-Frank act, the rules and regulations promulgated thereunder, and other new rules and regulations have resulted in, and are likely to continue to result in, increased general and administrative expenses and a diversion of management time and attention from revenue-generating activities to compliance activities.

14

Market for securities.

There is no market through which Share Purchase Contracts, Share Purchase or Equity Units (terms as defined below in “Description of Share Purchase Contracts and Share Purchase or Equity Units”) or Warrants to purchase Common Shares may be sold. There can be no assurance that an active trading market will develop for the aforementioned securities, or if developed, that such a market will be sustained at the price level at which it was offered. The liquidity of the trading market in those securities, and the market price quoted for those securities, may be adversely affected by, among other things:

changes in the overall market for those securities;

changes in our financial performance or prospects;

changes or perceived changes in our creditworthiness;

the prospects for companies in the industry generally;

the number of holders of those securities;

the interest of securities dealers in making a market for those securities; and

prevaling interest rates.

There can be no assurance that fluctuations in the trading price will not materially adversely impact on our ability to raise equity funding without significant dilution to our existing shareholders, or at all.

Future sales or issuances of equity securities could decrease the value of any existing common shares, dilute investors’ voting power and reduce our earnings per share.

We may sell additional equity securities (including through the sale of securities convertible into Common Shares) and may issue additional equity securities to finance our operations, exploration, development, acquisitions or other projects. We are authorized to issue an unlimited number of Common Shares. We cannot predict the size of future sales and issuances of equity securities or the effect, if any, that future sales and issuances of equity securities will have on the market price of the Common Shares. Sales or issuances of a substantial number of equity securities, or the perception that such sales could occur, may adversely affect prevailing market prices for the Common Shares. With any additional sale or issuance of equity securities, investors will suffer dilution of their voting power and may experience dilution in our earnings per share.

Our Common Shares are subject to various factors that have historically made share prices volatile.

The market price of our Common Shares may be subject to large fluctuations, which may result in losses to investors. The market price of the Common Shares may increase or decrease in response to a number of events and factors, including: our operating performance and the performance of competitors and other similar companies; volatility in metal prices; the arrival or departure of key personnel; the number of Common Shares to be publicly traded after an offering pursuant to any Prospectus Supplement; the public’s reaction to our press releases, material change reports, other public announcements and our filings with the various securities regulatory authorities; changes in earnings estimates or recommendations by research analysts who track the Common Shares or the shares of other companies in the resource sector; changes in general economic and/or political conditions; the number of Common Shares to be publicly traded after any equity offering; the arrival or departure of key personnel; acquisitions, strategic alliances or joint ventures involving us or our competitors; and the factors listed under the heading “CautionaryStatement Regarding Forward-Looking Information”.

15

The market price of the Common Shares may be affected by many other variables which are not directly related to our success and are, therefore, not within our control, including other developments that affect the market for all resource sector securities, the breadth of the public market for the Common Shares and the attractiveness of alternative investments.

We do not intend to pay any cash dividends in the foreseeable future.

We have not declared or paid any dividends on our Common Shares. We intend to retain future earnings, if any, to finance the growth and development of our business and do not intend to pay cash dividends on the Common Shares in the foreseeable future. Any return on an investment in the Common Shares will come from the appreciation, if any, in the value of the Common Shares. The payment of future cash dividends, if any, will be reviewed periodically by the Board and will depend upon, among other things, conditions then existing including earnings, financial condition and capital requirements, restrictions in financing agreements, business opportunities and conditions and other factors. See “Dividend Policy”.

We may be a “passive foreign investment company” in future periods, which will likely have adverse U.S. federal income tax consequences for U.S. shareholders.

U.S. investors in the Company should be aware that based on current business plans and financial expectations, we currently expect that we will not be a passive foreign investment company (“PFIC”) for the year ending November 30, 2012 but may be a PFIC in future tax years. If we are a PFIC for any year during a U.S. shareholder’s holding period, then such U.S. shareholder generally will be required to treat any gain realized upon a disposition of Common Shares, Warrants and Common Shares received on an exercise of Warrants (“Warrant Shares”), and any so-called “excess distribution” received on its Common Shares and Warrant Shares as ordinary income, and to pay an interest charge on a portion of such gain or distributions, unless the shareholder makes a timely and effective “qualified electing fund” election (“QEF Election”) with regard to its Common Shares, Warrants and Warrant Shares or a “mark-to-market” election with respect to the Common Shares and Warrant Shares. A U.S. shareholder who makes a QEF Election generally must report on a current basis its share of our net capital gain and ordinary earnings for any year in which we are a PFIC, whether or not we distribute any amounts to its shareholders. For each tax year that we qualify as a PFIC, we intend to: (a) make available to U.S. shareholders, upon their written request, a “PFIC Annual Information Statement” as described in Treasury Regulation Section 1.1295 -1(g) (or any successor Treasury Regulation) and (b) upon written request, use commercially reasonable efforts to provide all additional information that such U.S. shareholder is required to obtain in connection with maintaining such QEF Election with regard to the Company. We may elect to provide such information on our website. A U.S. shareholder who makes the mark-to-market election generally must include as ordinary income each year the excess of the fair market value of the Common Shares and Warrant Shares over the taxpayer’s basis therein. Each U.S. shareholder should consult its own tax advisor regarding the PFIC rules and the U.S. federal income tax consequences of the acquisition, ownership, and disposition of Common Shares, Warrants and Warrant Shares.

We will lose our status as a foreign private issuer under U.S. federal securities laws, resulting in additional expenses associated with compliance with the U.S. securities laws applicable to U.S. domestic issuers.

As a foreign private issuer, we are exempt from certain of the provisions of the U.S. federal securities laws. For example, the U.S. proxy rules and the Section 16 reporting and “short swing” profit rules do not apply to foreign private issuers. However, we will lose our status as a foreign private issuer effective December 1, 2012. When we lose our status as a foreign private issuer the aforementioned regulations would apply and we will also be required to commence reporting on forms required of U.S. companies, such as Forms 10-K, 10-Q and 8-K, rather than the forms currently available to us, such as Forms 40-F and 6-K. Compliance with these additional disclosure and timing requirements under these securities laws will likely result in increased expenses and would require our management to devote substantial time and resources to comply with new regulatory requirements following a loss of our foreign private issuer status. Further, to the extent that we were to offer or sell our securities outside of the United States, other than pursuant to this Prospectus, we will have to comply with the more restrictive Regulation S requirements that apply to U.S. companies, which could limit our ability to access the capital markets in the future.

16

CAUTIONARY NOTE TO UNITED STATES INVESTORS

Unless otherwise indicated, all resource estimates, and any future reserve estimates, included or incorporated by reference in this Prospectus and any Prospectus Supplement have been, and will be, prepared in accordance with Canadian National Instrument 43-101Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards for Mineral Resources and Mineral Reserves (“CIM Definition Standards”). NI 43-101 is a rule developed by the Canadian Securities Administrators which establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. NI 43-101 permits the disclosure of an historical estimate made prior to the adoption of NI 43-101 that does not comply with NI 43-101 to be disclosed using the historical terminology if the disclosure: (a) identifies the source and date of the historical estimate; (b) comments on the relevance and reliability of the historical estimate; (c) to the extent known, provides the key assumptions, parameters and methods used to prepare the historical estimate; (d) states whether the historical estimate uses categories other than those prescribed by NI 43-101; and (e) includes any more recent estimates or data available.

Canadian standards, including NI 43-101, differ significantly from the requirements of the SEC, and reserve and resource information contained or incorporated by reference into this Prospectus and any Prospectus Supplement may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, the term “resource” does not equate to the term “‘reserves”. Under SEC Industry Guide 7, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. SEC Industry Guide 7 does not define and the SEC’s disclosure standards normally do not permit the inclusion of information concerning “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute “reserves” by U.S. standards in documents filed with the SEC. U.S. investors should also understand that “inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral resource” will ever be upgraded to a higher category. Under Canadian rules, estimated “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies except in rare cases. Investors are cautioned not to assume that all or any part of an “inferred mineral resource” exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in-place tonnage and grade without reference to unit measures. The requirements of NI 43-101 for identification of “reserves” are also not the same as those of the SEC, and any reserves reported by us in the future in compliance with NI 43-101 may not qualify as “reserves” under SEC standards. Accordingly, information concerning mineral deposits set forth herein may not be comparable to information made public by companies that report in accordance with United States standards.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This Prospectus and the documents incorporated by reference into this Prospectus contain statements of forward-looking information. These forward-looking statements may include statements regarding perceived merit of properties, exploration results and budgets, mineral reserves and resource estimates, work programs, capital expenditures, operating costs, cash flow estimates, production estimates and similar statements relating to the economic viability of a project, timelines, strategic plans, including our plans and expectations relating to the Upper Kobuk Mineral Projects, completion of transactions, market prices for precious and base metals, or other statements that are not statements of fact. These statements relate to analyses and other information that are based on forecasts of future results, estimates of amounts not yet determinable and assumptions of management.

Statements concerning mineral resource estimates may also be deemed to constitute “forward-looking statements” to the extent that they involve estimates of the mineralization that will be encountered if the property is developed. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance (often, but not always, identified by words or phrases such as “expects”, “is expected”, “anticipates”, “believes”, “plans”, “projects”, “estimates”, “assumes”, “intends”, “strategy”, “goals”, “objectives”, “potential”, “possible” or variations thereof or stating that certain actions, events, conditions or results “may”, “could”, “would”, “should”, “might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions) are not statements of historical fact and may be forward-looking statements. Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation:

17

uncertainty of whether there will ever be production at our Ambler or Bornite Projects;

uncertainty of estimates of capital costs, operating costs, production and economic returns;

uncertainties relating to the assumptions underlying our resource and reserve estimates, such as metal pricing, metallurgy, mineability, marketability and operating and capital costs;

risks related to our ability to commence production and generate material revenues or obtain adequate financing for our planned exploration and development activities;

risks related to our ability to finance the development of our mineral properties through external financing, strategic alliances, the sale of property interests or otherwise;

risks related to market events and general economic conditions;

uncertainty related to inferred mineral resources;

uncertainty related to the economic projections contained herein derived from the PEA;

risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of our mineral deposits;

risks related to lack of infrastructure;

mining and development risks, including risks related to infrastructure, accidents, equipment breakdowns, labor disputes or other unanticipated difficulties with or interruptions in development, construction or production;

the risk that permits and governmental approvals necessary to develop and operate mines on our properties will not be available on a timely basis or at all;

commodity price fluctuations;

risks related to governmental regulation and permits, including environmental regulation;

risks related to the need for reclamation activities on our properties and uncertainty of cost estimates related thereto;

uncertainty related to title to our mineral properties;

our history of losses and expectation of future losses;

18

risks related to our majority shareholder;

risks inherent in the acquisition of new properties;

risks related to increases in demand for equipment, skilled labor and services needed for exploration and development of mineral properties, and related cost increases;

increased competition in the mining industry;

our need to attract and retain qualified management and technical personnel;

risks related to conflicts of interests of some of our directors;

risks related to global climate change;

risks related to adverse publicity from non-governmental organizations;