- TMQ Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

FWP Filing

Trilogy Metals (TMQ) FWPFree writing prospectus

Filed: 19 Feb 14, 12:00am

Free Writing Prospectus

Filed pursuant to Rule 433

To the Prospectus Supplement dated February 19, 2014 and

Prospectus dated March 14, 2013

Registration Statement No. 333-185127

Dated February 19, 2014

A final base shelf prospectus containing important information relating to the securities described in this document was filed with the securities regulatory authorities in each of the provinces of Canada on March 11, 2013. A copy of the final base shelf prospectus, any amendment to the final base shelf prospectus and any applicable shelf prospectus supplement that has been filed, is required to be delivered with this document.

This document does not provide full disclosure of all material facts relating to the securities offered. Investors should read the final base shelf prospectus, any amendment and any applicable shelf prospectus supplement for disclosure of those facts, especially risk factors relating to the securities offered, before making an investment decision.

The Company has filed a registration statement on Form S-3 and a preliminary prospectus supplement with the SEC for the Offering to which this communication relates. Before you invest, you should read the preliminary prospectus supplement and other documents the Company has filed with the SEC for more complete information about the Company and this Offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the Company, any underwriter or any dealer participating in the Offering will arrange to send you the prospectus or you may request it from RBC Capital Markets at RBC Capital Markets, Attention: Distribution Centre, 180 Wellington St. W., 8th Floor, Toronto, Ontario M5J OC2 fax: 416-313-6066, email: distribution@rbccm.com or in the U.S., Attention: RBC Capital Markets, LLC, 3 World Financial Center, 200 Vesey Street, 8th Floor, New York, NY 10281-8098; Attention: Equity Syndicate; Phone: 877-822-4089; Fax: 212-428-6260 or from Cormark Securities, Attention: Susan Samila-Moroz, Suite 2800, South Tower, Royal Bank Plaza, Toronto, Ontario M6J 2J2 Fax: 416-943-6496 Phone: 416-943-6405.

Corporate Presentation - February 19, 2014

Rick Van Nieuwenhuyse, CEO

Elaine Sanders, CFO

Cautionary Note Regarding Forward-Looking Statements

This presentation includes certain Forward-Looking Statements and Forward-Looking Information (collectively, “forward-looking statements”) within the meaning of applicable securities laws, including the United States Private Securities Litigation Reform Act of 1995. All statements, other than statements of historical fact, included herein including, without limitation, statements relating to program objectives and future plans for the project, are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as “expects”, “anticipates”, “believes”, “intends”, “estimates”, “potential”, “possible” and similar expressions, or statements that events, conditions or results “will”, “may”, “could”, or “should” occur or be achieved. These forward-looking statements are set forth principally under the slides pertaining to the Arctic PEA, as defined below, permitting process and timeline for the Ambler access road, future milestones, and elsewhere in this presentation, and may include statements regarding perceived merit of properties; exploration results and budgets; mineral reserves and resource estimates; work programs; capital expenditures; timelines; strategic plans; completion of transactions; market price of precious base metals; or other statements that are not statements of fact. Forward-looking statements involve various risks and uncertainties. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. Important factors that could cause actual results to differ materially from NovaCopper’s expectations include the uncertainties involving the need for additional financing to explore and develop properties and availability of financing in the debt and capital markets; uncertainties involved in the interpretation of drilling results and geological tests and the estimation of resources; the need for cooperation of government agencies and native groups in the development and operation of properties; the need to obtain permits and governmental approvals; risks of mining projects such as accidents, equipment breakdowns, bad weather, non-compliance with environmental and permit requirements and unanticipated variation in geological structures, ore grades or recovery rates; unexpected cost increases; fluctuations in metal prices and currency exchange rates; and other risks and uncertainties disclosed in NovaCopper’s annual report on Form 10-K filed with the United States Securities and Exchange Commission and with the Canadian securities regulatory authorities and NovaCopper’s reports and documents filed with applicable securities regulatory authorities from time to time. Forward-looking statements reflect the beliefs, opinions and projections of management on the date the statements are made and are based on various assumptions, such as that permits required for NovaCopper’s operations will be obtained in a timely basis in order to permit NovaCopper to proceed on schedule with its planned exploration and development programs, that skilled personnel and contractors will be available as NovaCopper’s operations continue to grow, that that price of copper and other metals will be at levels that render NovaCopper’s mineral projects economic, that NovaCopper will be able to continue raising the necessary capital to finance its operations and realize on mineral resource estimates, and that the assumptions contained in the Arctic PEA, as defined below, are accurate and complete. NovaCopper assumes no obligation to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by law.

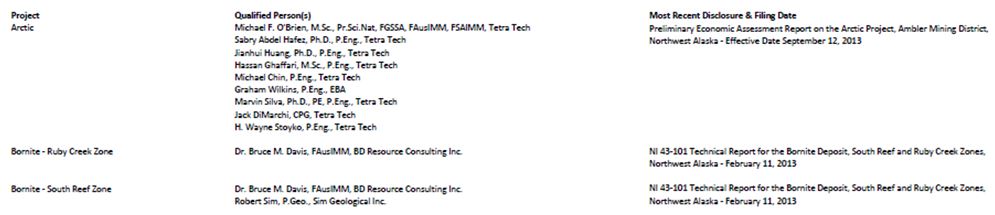

Certain technical data in this presentation was taken from the technical report entitled “Preliminary Economic Assessment Report on the Arctic Project, Ambler Mining District, Northwest Alaska” dated September 12, 2013 (the “Arctic PEA”) and the technical report entitled “NI 43-101 Technical Report for the Bornite Deposit, South Reef and Ruby Creek Zones, Northwest Alaska” dated February 11, 2013, and is subject to all of the assumptions, qualifications and procedures described therein. The Arctic PEA is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that that the results of the Arctic PEA will be realized. See “Disclosure Regarding Scientific and Technical Information” on Page 13 of this presentation and Cautionary Note Concerning Resource Estimates” on Page 14 of this presentation.

Scott Petsel, UKMP Project Manager is the Qualified Person who supervised the preparation of the technical information in this presentation.

NovaCopper Share Capitalization

| Issued and | Options | Fully diluted1 | ||

| outstanding | ||||

| 53.5 M | 0.16 M | 54.8 M |

| Key Facts | Major Shareholders | |||

| • | Trades on TSX and NYSE- MKT under symbol NCQ | • | Electrum Strategic Resources LP | |

| • | Issued & outstanding shares: 53.5M | • | Paulson & Co. Inc. | |

| • | US$5.4M in cash & cash equivalents (Jan 29, 2014) | • | Baupost Group LLC | |

| 1) | Fully diluted shares include 431,840 Restricted Share Units and 750,000 Deferred Share Units and does not include 100,000 NovaGold PSUs, 20,688 NovaGold DSUS and 1,497,428 NovaGold Arrangement Options |

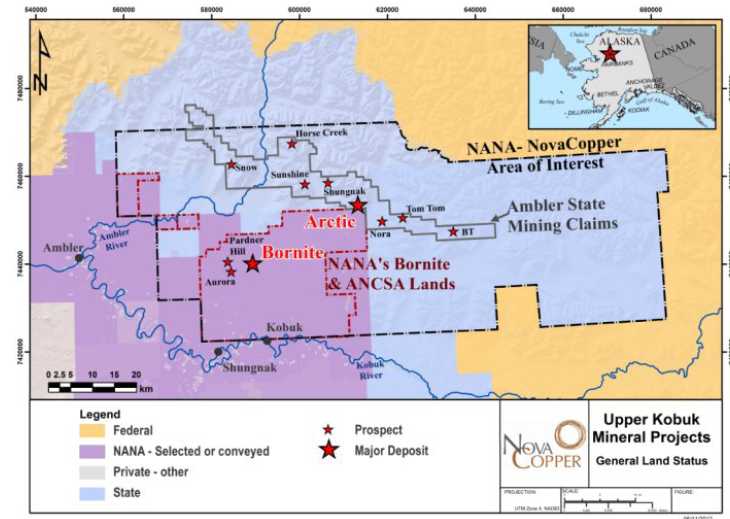

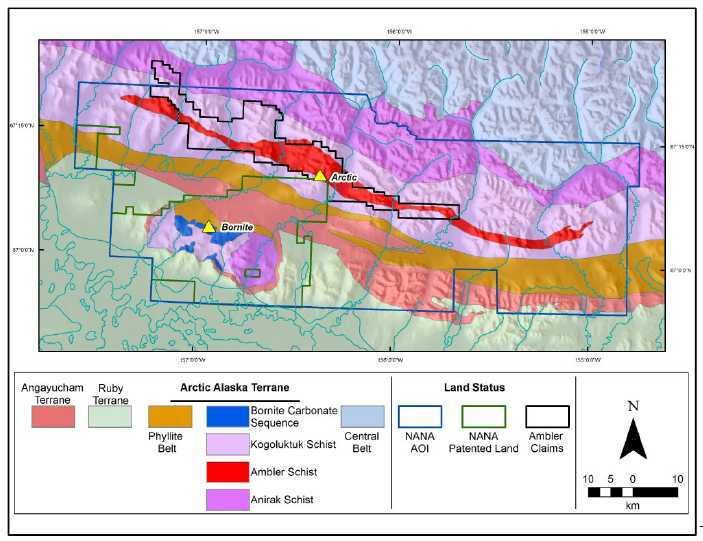

Ambler Mining District

|

Ambler District – NANA/NovaCopper Lands

Land Status

NANA Agreement

A Strong Partnership to Develop the Ambler Mining District

| • | Creates an area of interest within which land acquired by either party will form part of the Agreement |  | |

| • | NANA to receive Net Smelter Royalty (1% to 2.5% based on the particular area of land from which production originates) | ||

| • | Option for NANA to participate as an equity partner (16% to 25%) or receive a net proceeds royalty (15% NPI) upon decision to proceed with construction of a mine | ||

| • | Commitment on behalf of NovaCopper to promote employment for NANA shareholders | ||

| • | NovaCopper to make payments to NANA for scholarship fund to promote education for youth in the region | ||

| • | Oversight committee created which includes three sub-committees | ||

| - | Subsistence, Workforce Development and Communications | ||

Ambler Mining District

World-class mining district with potential multiple discoveries ~65 km long belt

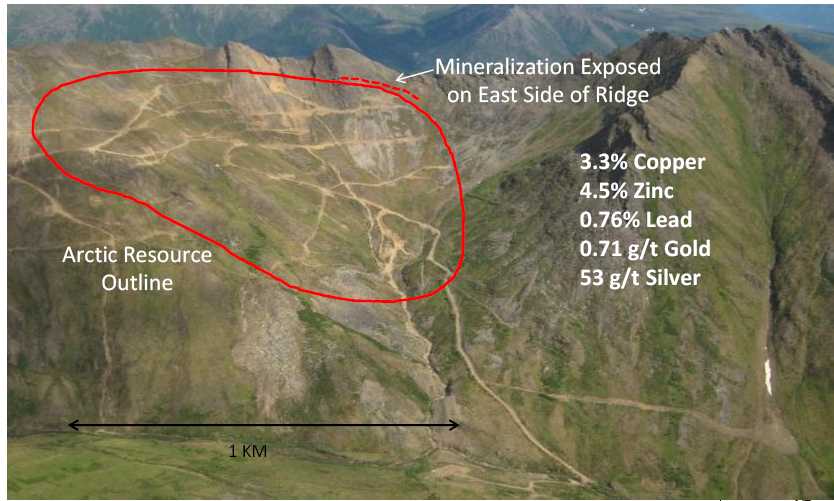

Arctic Deposit Looking East

A shallow dipping, high-grade copper deposit

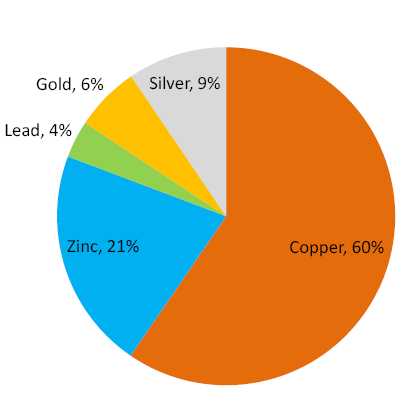

Highlights of the Arctic PEA (100% Basis)

| • | 12 year mine production at 10,000 tonnes per day | |

| • | Annual Payable Metal Production | |

| • | 130Mlbs payable Copper per year | |

| • | 177Mlbs payable Zinc per year | |

| • | 25Mlbs payable Lead per year | |

| • | 31,000oz payable Gold per year | |

| • | 2.8Moz payable Silver per year | |

| • | Average operating cash costs of US$63.93/tonne milled | |

| • | Capital costs (Q2 2013): US$717.7 million startup, US$164.4 million sustaining | |

| • | Post-Tax NPV8%of US$537.2 million | |

| • | IRR of 17.9% | |

| • | Payback of start up capital costs in 5.0 years using base case metal prices* | |

* | Base case metal prices: Copper US$2.90/lb, Zinc US$0.85/lb, Lead US$0.90/lb, Silver US$22.70/oz, and Gold US$1,300/oz. |

Net Revenues by Metal

Significant value in precious metals

| 3 Separate Concentrates |

| Copper 29% | |

| Zinc 56% | |

| Lead 50% | |

| Concentrate Recoveries | |

| Copper 87.1% | |

| Gold to copper concentrate - 57.9% | |

| Silver to copper concentrate - 40.2% | |

| Zinc 86.8% | |

| Lead 74% | |

| Gold to lead concentrate - 6.8% | |

| Silver to lead concentrate - 40.2% |

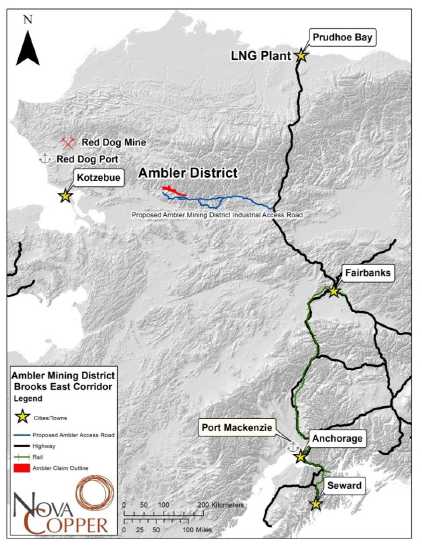

Ambler Mining District Industrial Access Road (“AMDIAR”)

Significant state support for infrastructure development

| ||

| 2009-2013 | ||

| • | State of Alaska has already expended approximately US$10M to identify proposed access routes and initiate environmental baseline studies | |

| ||

| • | Working Group consists of ADOT, ADNR, Alaska Governor’s Office, AIDEA, NANA and NovaCopper | |

| ||

| • | Signed MOU with AIDEA | |

| ADOT: Alaska Department of Transportation | ||

| AIDEA: Alaska Industrial Development and Export Authority | ||

| ADNR: Alaska Department of Natural Resources | ||

Total Resources for the Upper Kobuk Mineral Projects

| 1) | Base Case is 1.0% Cu cut-off grade. |

| 2) | Mineral resources at a 1.0% cut-off are considered as potentially economically viable in an underground mining scenario based on an assumed projected copper price of US$2.75 per lb and total site operating costs of US$60 per tonne. |

| 3) | Mineral Resources for Arctic have been estimated using a constant NSR cut-off of $35.01/tonne milled. The $35.01/tonne milled cutoff is calculated based on a process operating cost of $19.03/t, G&A of $7.22/t and Site Services of $8.76/t. NSR equals payable metal values, based on the metal prices outlined in Note 7 below, less applicable treatment, smelting, refining costs, penalties, concentrate transportation costs, insurance and losses and royalties. |

| 4) | NSR calculation is based on assumed metal prices of US$2.90/lb for copper, US$1,300/oz for gold, US$22.70/oz for silver, US$0.85/lb for zinc and US$0.90/lb for lead. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources will be converted into Mineral Reserves. |

| 5) | Mineral resource tonnage and contained metal have been rounded to reflect the accuracy of the estimate, and numbers may not add due to rounding. |

| 6) | The above table refers to “inferred resources”. We advise United States investors that this term is not recognized by the SEC. The estimation of inferred resources involves far greater uncertainty as to their existence and economic viability than the estimation of other categories of resources. United States investors are cautioned not to assume that estimates of inferred mineral resources exist, are economically minable, or will be upgraded into measured or indicated mineral resources. See “Disclosure Regarding Scientific and Technical Information” on Page 13 of this presentation and “Cautionary Note Regarding Resource Estimates” on Page 14 of this presentation. |

| 7) | The Arctic copper-equivalent resource is calculated using the following metals price assumptions: (in USD) $2.90/lb Cu, $1,300/oz Au, $22.70/oz Ag, $0.85/lb Zn, and $0.90/lb Pb |

DISCLOSURE REGARDING SCIENTIFIC AND

TECHNICAL INFORMATION

Unless otherwise indicated, all reserve and resource estimates included in this presentation have been prepared in accordance with Canadian National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy and Petroleum Definition Standards for Mineral Resources and Mineral Reserves (“CIM Definition Standards”). Canadian standards, including NI 43-101, differ significantly from the requirements of the United States Securities and Exchange Commission (“SEC”), and reserve and resource information in this presentation may not be comparable to similar information disclosed by U.S. companies. In particular, and without limiting the generality of the foregoing, the term “resource” does not equate to the term “‘reserves”. Under U.S. standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. The SEC’s disclosure standards normally do not permit the inclusion of information concerning “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources” or other descriptions of the amount of mineralization in mineral deposits that do not constitute “reserves” by U.S. standards in documents filed with the SEC. U.S. investors should also understand that “inferred mineral resources” have a great amount of uncertainty as to their existence and great uncertainty as to their economic and legal feasibility. It cannot be assumed that all or any part of an “inferred mineral resource” will ever be upgraded to a higher category. Under Canadian rules, estimated “inferred mineral resources” may not form the basis of feasibility or pre-feasibility studies except in rare cases. Investors are cautioned not to assume that all or any part of an “inferred mineral resource” exists or is economically or legally mineable. Disclosure of “contained ounces” in a resource is permitted disclosure under Canadian regulations; however, the SEC normally only permits issuers to report mineralization that does not constitute “reserves” by SEC standards as in-place tonnage and grade without reference to unit measures. The requirements of NI 43-101 for identification of “reserves” are also not the same as those of the SEC, and reserves reported in compliance with NI 43-101 may not qualify as “reserves” under SEC standards. Accordingly, information concerning mineral deposits set forth herein may not be comparable to information made public by companies that report in accordance with United States standards.

NovaCopper NI 43-101-Compliant Resources

Cautionary Note Concerning Resource Estimates

The summary tables may use the term “resources”, “measured resources”, “indicated resources” and “inferred resources”. United States investors are advised that, while such terms are recognized and required by Canadian securities laws, the United States Securities and Exchange Commission (the “SEC”) does not recognize them. Under United States standards, mineralization may not be classified as a “reserve” unless the determination has been made that the mineralization could be economically and legally produced or extracted at the time the reserve determination is made. Mineral resources that are not mineral reserves do not have demonstrated economic viability. United States investors are cautioned not to assume that all or any part of measured or indicated resources will ever be converted into reserves. Further, inferred resources have a great amount of uncertainty as to their existence and as to whether they can be mined legally or economically. It cannot be assumed that all or any part of the inferred resources will ever be upgraded to a higher category. Therefore, United States investors are also cautioned not to assume that all or any part of the inferred resources exist, or that they can be mined legally or economically. Disclosure of “contained ounces” is permitted disclosure under Canadian regulations, however, the SEC normally only permits issuers to report “resources” as in place tonnage and grade without reference to unit measures. Accordingly, information concerning descriptions of mineralization and resources contained in this release may not be comparable to information made public by United States companies subject to the reporting and disclosure requirements of the SEC.

NI 43-101 is a rule developed by the Canadian Securities Administrators, which established standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. Unless otherwise indicated, all resource estimates contained in this circular have been prepared in accordance with NI 43-101 and the CIM Definition Standards.