Exhibit 99.1

TRILOGY METALS INC.

Arctic Project,

Northwest Alaska, USA

NI 43-101 Technical Report on Pre-Feasibility Study

| Report Prepared For: | Trilogy Metals Inc. 609 Granville Street, Suite 1150 Vancouver, BC V7Y 1G5 Canada Tel: 604-638-8088

Fax: 604-638-0644

www.trilogymetals.com |

| | |

| Report Prepared By: | Paul Staples, P.Eng., Ausenco Engineering Canada Inc. Justin Hannon, P.Eng., Ausenco Engineering Canada Inc. Antonio Peralta Romero, PhD, P.Eng., Amec Foster Wheeler Americas Ltd. Bruce Davis, FAusIMM, BD Resource Consulting, Inc. John J. DiMarchi, CPG, Core Geoscience Inc. |

| | Jeffrey B. Austin, P.Eng., International Metallurgical & Environmental Inc. Robert Sim, P.Geo., SIM Geological Inc. Calvin Boese, P.Eng., M.Sc., SRK Consulting (Canada) Inc. Bruce Murphy, P.Eng., SRK Consulting (Canada) Inc. Tom Sharp, PhD, P.Eng., SRK Consulting (Canada) Inc. |

| | |

| Effective Date: | February 20, 2018 |

| Release Date: | April 6, 2018 |

| Trilogy Metals Inc. | | |

| NI 43-101 Technical Report on the Arctic Project, | | |

| Northwest Alaska | | |

| | | |

Important Notice

This report was prepared as National Instrument 43-101 Technical Report for Trilogy Metals Inc. (Trilogy Metals or Trilogy) by Ausenco Engineering Canada Inc., Core Geoscience Inc., Amec Foster Wheeler Americas Limited, BD Resource Consulting, Inc., International Metallurgical & Environmental Inc., SIM Geological Inc., and SRK Consulting (Canada) Inc., collectively the “Report Authors”. The quality of information, conclusions, and estimates contained herein is consistent with the level of effort involved in the Report Authors’ services, based on i) information available at the time of preparation, ii) data supplied by outside sources, and iii) the assumptions, conditions, and qualifications set forth in this report. This report is intended for use by Trilogy Metals subject to the respective terms and conditions of its contracts with the individual Report Authors. Except for the purposes legislated under Canadian provincial securities law, any other uses of this report by any third party is at that party’s sole risk.

| Trilogy Metals Inc. | i | |

| NI 43-101 Technical Report on the Arctic Project, | | |

| Northwest Alaska | | |

| | | |

Table of Contents

| 1.0 | Summary | 1-16 |

| | | |

| | 1.1 | Introduction | 1-16 |

| | 1.2 | Management Property Description and Location | 1-16 |

| | 1.3 | Geology and Mineralization | 1-17 |

| | 1.4 | Drilling and Sampling | 1-18 |

| | 1.5 | Mineral Processing and Metallurgical Testing | 1-19 |

| | 1.6 | Mineral Resource Estimate | 1-21 |

| | 1.7 | Mining Reserves and Mining Methods | 1-22 |

| | 1.8 | Recovery Methods | 1-23 |

| | 1.9 | Project Infrastructure | 1-24 |

| | 1.10 | Market Studies | 1-26 |

| | 1.11 | Environmental, Permitting, Social and Closure Considerations | 1-27 |

| | | 1.11.1 | Environmental Considerations | 1-27 |

| | | 1.11.2 | Permitting Considerations | 1-27 |

| | | 1.11.3 | Social Considerations | 1-28 |

| | | 1.11.4 | Closure Planning | 1-29 |

| | 1.12 | Capital Costs | 1-29 |

| | 1.13 | Operating Costs | 1-30 |

| | 1.14 | Economic Analysis | 1-31 |

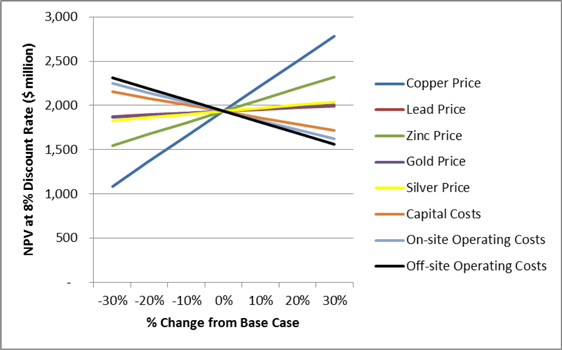

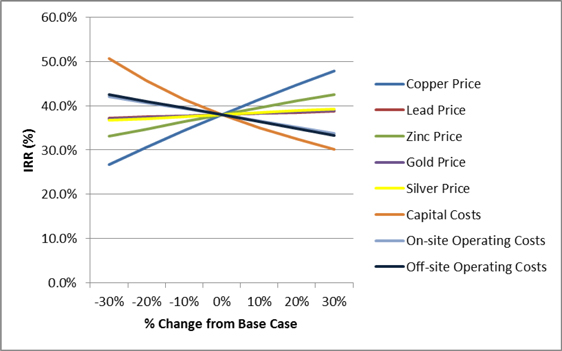

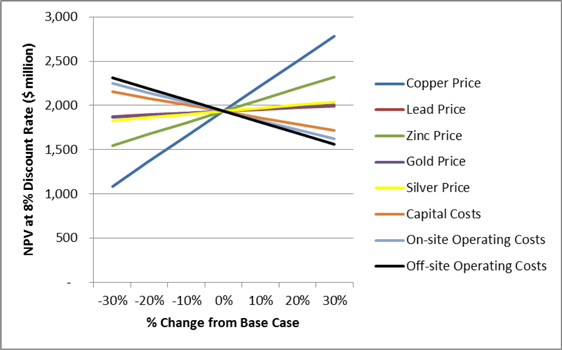

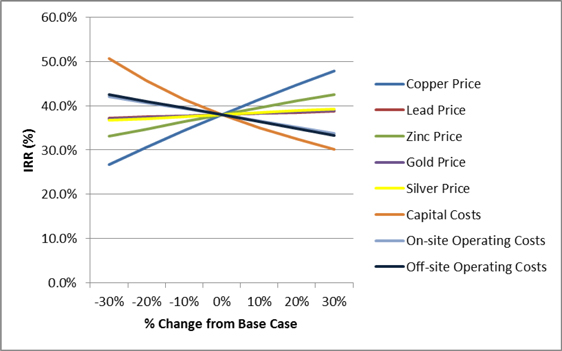

| | 1.15 | Sensitivity Analysis | 1-32 |

| | 1.16 | Interpretations and Conclusions | 1-32 |

| | 1.17 | Recommendations | 1-32 |

| | | |

| 2.0 | Introduction | 2-1 |

| | | |

| | 2.1 | Terms of Reference | 2-1 |

| | 2.2 | Units of Measurement | 2-2 |

| | 2.3 | Qualified Persons | 2-2 |

| | 2.4 | Site Visit | 2-2 |

| | 2.5 | Effective Dates | 2-3 |

| | 2.6 | Information Sources | 2-4 |

| | 2.7 | Previous Technical Reports | 2-4 |

| | | |

| 3.0 | Reliance on Other Experts | 3-1 |

| | | |

| | 3.1 | Introduction | 3-1 |

| | 3.2 | Mineral Tenure, Surface Rights, Royalties, Property Agreements | 3-1 |

| | 3.3 | Legal Considerations | 3-1 |

| | 3.4 | Taxation | 3-2 |

| | 3.5 | Marketing and Contracts | 3-2 |

| | 3.6 | Metal Prices and Exchange Rates | 3-2 |

| | | |

| 4.0 | Property Description and Location | 4-1 |

| | | |

| | 4.1 | Location | 4-1 |

| | 4.2 | Ownership | 4-1 |

| | 4.3 | Mineral Tenure | 4-1 |

| | 4.4 | Royalties, Agreements and Encumbrances | 4-6 |

| | | 4.4.1 | Kennecott Agreements | 4-6 |

| | | 4.4.2 | NANA Agreement | 4-6 |

| Trilogy Metals Inc. | ii | |

| NI 43-101 Technical Report on the Arctic Project, | | |

| Northwest Alaska | | |

| | | |

| | | 4.4.3 | South32 Agreement | 4-8 |

| | | 4.4.4 | State Royalty | 4-8 |

| | 4.5 | Surface Rights | 4-8 |

| | 4.6 | Environmental Considerations | 4-8 |

| | 4.7 | Permits | 4-9 |

| | 4.8 | Social Considerations | 4-9 |

| | 4.9 | Comment on Section 4 | 4-9 |

| | | |

| 5.0 | Accessibility, Climate, Local Resources, Infrastructure and Physiography | 5-1 |

| | | |

| | 5.1 | Accessibility | 5-1 |

| | | 5.1.1 | Air | 5-1 |

| | | 5.1.2 | Road | 5-1 |

| | | 5.1.3 | Water | 5-1 |

| | 5.2 | Climate | 5-1 |

| | 5.3 | Local Resources and Infrastructure | 5-2 |

| | 5.4 | Physiography | 5-2 |

| | 5.5 | Comment on Section 5 | 5-3 |

| | | |

| 6.0 | History | 6-1 |

| | | |

| | 6.1 | Prior Ownership and Ownership Changes – Arctic Deposit and the Ambler Lands | 6-2 |

| | 6.2 | Previous Exploration and Development Results – Arctic Deposit | 6-3 |

| | | 6.2.1 | Introduction | 6-3 |

| | | 6.2.2 | Geochemistry | 6-9 |

| | | 6.2.3 | Geophysics | 6-9 |

| | | 6.2.4 | Drilling | 6-10 |

| | | 6.2.5 | Specific Gravity | 6-10 |

| | | 6.2.6 | Petrology, Mineralogy, and Research Studies | 6-10 |

| | | 6.2.7 | Geotechnical, Hydrological and Acid-Base Accounting Studies | 6-11 |

| | | 6.2.8 | Metallurgical Studies | 6-12 |

| | 6.3 | Development Studies | 6-12 |

| | | |

| 7.0 | Geological setting and mineralization | 7-1 |

| | | |

| | 7.1 | Regional Geology – Southern Brooks Range | 7-1 |

| | | 7.1.1 | Terrane Descriptions | 7-1 |

| | | 7.1.2 | Regional Tectonic Setting | 7-3 |

| | 7.2 | Ambler Sequence Geology | 7-4 |

| | | 7.2.1 | General Stratigraphy of the Ambler Sequence | 7-5 |

| | | 7.2.2 | Structural Framework of the Ambler District | 7-9 |

| | 7.3 | Arctic Deposit Geology | 7-10 |

| | | 7.3.1 | Lithologies and Lithologic Domain Descriptions | 7-11 |

| | | 7.3.2 | Structure | 7-13 |

| | | 7.3.3 | Alteration | 7-14 |

| | 7.4 | Arctic Deposit Mineralization | 7-15 |

| | 7.5 | Genesis | 7-16 |

| | 7.6 | Deposits and Prospects | 7-17 |

| | | |

| 8.0 | Deposit Types | 8-1 |

| | | |

| 9.0 | Exploration | 9-1 |

| | | |

| | 9.1 | Grids and Surveys | 9-3 |

| | 9.2 | Geological Mapping | 9-3 |

| | 9.3 | Geochemistry | 9-6 |

| | 9.4 | Geophysics | 9-9 |

| | 9.5 | Bulk Density | 9-11 |

| Trilogy Metals Inc. | iii | |

| NI 43-101 Technical Report on the Arctic Project, | | |

| Northwest Alaska | | |

| | | |

| | 9.6 | Petrology, Mineralogy and Research Studies | 9-11 |

| | 9.7 | Geotechnical, Hydrogeological and Acid Base Accounting Studies | 9-11 |

| | | 9.7.1 | Geotechnical and Hydrogeological Assessments | 9-11 |

| | | 9.7.2 | Acid-Base Accounting Studies | 9-19 |

| | | 9.7.3 | Geochemical Kinetic Studies | 9-20 |

| | | |

| 10.0 | Drilling | 10-1 |

| | | |

| | 10.1 | Introduction | 10-1 |

| | 10.2 | Drill Companies | 10-3 |

| | 10.3 | Drill Core Procedures | 10-5 |

| | | 10.3.1 | Kennecott | 10-5 |

| | | 10.3.2 | NovaGold/Trilogy Metals | 10-5 |

| | 10.4 | Geotechnical Drill Hole Procedures | 10-6 |

| | 10.5 | Collar Surveys | 10-7 |

| | | 10.5.1 | Kennecott | 10-7 |

| | | 10.5.2 | NovaGold/Trilogy Metals | 10-7 |

| | 10.6 | Downhole Surveys | 10-7 |

| | 10.7 | Recovery | 10-8 |

| | | 10.7.1 | Kennecott | 10-8 |

| | | 10.7.2 | NovaGold/Trilogy Metals | 10-8 |

| | 10.8 | Drill Intercepts | 10-8 |

| | 10.9 | Prospect Drilling | 10-9 |

| | | |

| 11.0 | Sample Preparation, Analyses, and Security | 11-1 |

| | | |

| | 11.1 | Sample Preparation | 11-1 |

| | 11.2 | Core | 11-1 |

| | | 11.2.1 | Kennecott and BCMC | 11-1 |

| | | 11.2.2 | NovaGold/Trilogy Metals | 11-1 |

| | 11.3 | Acid-Base Accounting Sampling | 11-3 |

| | 11.4 | Density Determinations | 11-3 |

| | 11.5 | Security | 11-4 |

| | 11.6 | Assaying and Analytical Procedures | 11-4 |

| | 11.7 | Quality Assurance/Quality Control | 11-5 |

| | | 11.7.1 | Core Drilling Sampling QA/QC | 11-5 |

| | | 11.7.2 | Acid-Base Accounting Sampling QA/QC | 11-15 |

| | | 11.7.3 | Density Determinations QA/QC | 11-15 |

| | 11.8 | QP’s Opinion | 11-18 |

| | | |

| 12.0 | Data Verification | 12-1 |

| | | |

| | 12.1 | Drill Hole Collar Verification | 12-1 |

| | 12.2 | Topography Verification | 12-1 |

| | 12.3 | Core Logging Verification | 12-2 |

| | 12.4 | Database Verification | 12-2 |

| | 12.5 | QA/QC Review | 12-2 |

| | 12.6 | QP Opinion | 12-12 |

| | | |

| 13.0 | Mineral Processing and Metallurgical Testing | 13-1 |

| | | |

| | 13.1 | Metallurgical Test Work Review | 13-1 |

| | | 13.1.1 | Introduction | 13-1 |

| | | 13.1.2 | Historical Test Work Review | 13-3 |

| | | 13.1.3 | Mineralogical and Metallurgical Test Work – 2012 to 2017 | 13-8 |

| | 13.2 | Recommended Test Work | 13-25 |

| Trilogy Metals Inc. | iv | |

| NI 43-101 Technical Report on the Arctic Project, | | |

| Northwest Alaska | | |

| | | |

| 14.0 | Mineral Resource Estimate | 14-1 |

| | | |

| | 14.1 | Introduction | 14-1 |

| | 14.2 | Sample Database and Other Available Data | 14-1 |

| | | 14.2.1 | ABA Data | 14-4 |

| | 14.3 | Geologic Model | 14-6 |

| | | 14.3.1 | Summary of Geologic Domains | 14-9 |

| | 14.4 | Compositing | 14-10 |

| | 14.5 | Exploratory Data Analysis | 14-11 |

| | | 14.5.1 | As-Logged Geology and Domain Statistics | 14-11 |

| | | 14.5.2 | Interpreted Lithology and MinZone Domain Statistics | 14-13 |

| | | 14.5.3 | Contact Profiles | 14-19 |

| | | 14.5.4 | Modeling Implications | 14-21 |

| | 14.6 | Treatment of Outlier Grades | 14-22 |

| | 14.7 | Specific Gravity Data | 14-23 |

| | 14.8 | Variography | 14-24 |

| | 14.9 | Model Setup and Limits | 14-28 |

| | 14.10 | Interpolation Parameters | 14-29 |

| | 14.11 | Block Model Validation | 14-32 |

| | | 14.11.1 | Visual Inspection | 14-32 |

| | | 14.11.2 | Model Checks for Change of Support | 14-33 |

| | | 14.11.3 | Comparison of Interpolation Methods | 14-35 |

| | | 14.11.4 | Swath Plots (Drift Analysis) | 14-38 |

| | 14.12 | Resource Classification | 14-42 |

| | 14.13 | Mineral Resource Estimate | 14-43 |

| | 14.14 | Grade Sensitivity Analysis | 14-46 |

| | | |

| 15.0 | Mineral Reserve Estimates | 15-1 |

| | | |

| | 15.1 | Overview | 15-1 |

| | 15.2 | Pit Optimization | 15-1 |

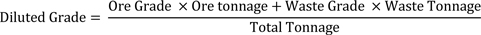

| | 15.3 | Dilution and Ore Losses | 15-4 |

| | 15.4 | Mineral Reserve Statement | 15-5 |

| | 15.5 | Factors Affecting Mineral Reserves | 15-6 |

| | | |

| 16.0 | Mining Methods | 16-1 |

| | | |

| | 16.1 | Overview | 16-1 |

| | 16.2 | Mine Design | 16-1 |

| | 16.3 | Waste Rock Facilities and Stockpile Designs | 16-3 |

| | 16.4 | Production Schedule | 16-5 |

| | 16.5 | Waste Material Handling | 16-7 |

| | 16.6 | Operating Schedule | 16-8 |

| | 16.7 | Mining Equipment | 16-9 |

| | | 16.7.1 | Blasting | 16-10 |

| | | 16.7.2 | Drilling | 16-11 |

| | | 16.7.3 | Loading | 16-13 |

| | | 16.7.4 | Hauling | 16-13 |

| | | 16.7.5 | Support | 16-14 |

| | | 16.7.6 | Auxiliary | 16-16 |

| | 16.8 | Open Pit Water Management | 16-17 |

| | 16.9 | Geotechnical Review | 16-17 |

| | | |

| 17.0 | Recovery methods | 17-1 |

| | | |

| | 17.1 | Mineral Processing | 17-1 |

| | | 17.1.1 | Flowsheet Development | 17-1 |

| | | 17.1.2 | Process Plant Description | 17-4 |

| | | 17.1.3 | Coarse Material Storage | 17-5 |

| Trilogy Metals Inc. | v | |

| NI 43-101 Technical Report on the Arctic Project, | | |

| Northwest Alaska | | |

| | | |

| | | 17.1.4 | Grinding and Classification | 17-5 |

| | | 17.1.5 | Flotation | 17-6 |

| | 17.2 | Plant Process Control | 17-14 |

| | | 17.2.1 | Overview | 17-14 |

| | | |

| 18.0 | Project InfrastrUcture | 18-1 |

| | | |

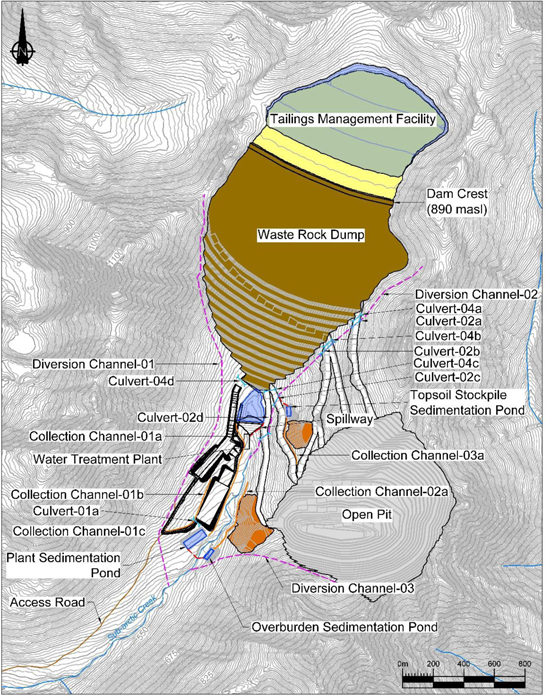

| | 18.1 | Introduction | 18-1 |

| | 18.2 | Access Roads | 18-4 |

| | | 18.2.1 | Ambler Mining District Industrial Access Project Road | 18-4 |

| | | 18.2.2 | Arctic Access Road | 18-5 |

| | 18.3 | Airstrip | 18-5 |

| | 18.4 | Camps | 18-6 |

| | | 18.4.1 | Bornite Exploration Camp | 18-6 |

| | | 18.4.2 | Temporary Construction Camp | 18-6 |

| | | 18.4.3 | Construction / Operations Permanent Camp | 18-6 |

| | 18.5 | Fuel Supply, Storage and Distribution | 18-6 |

| | 18.6 | Power Generation | 18-7 |

| | 18.7 | Electrical System | 18-7 |

| | 18.8 | Surface Water Management | 18-7 |

| | | 18.8.1 | Process Water Supply | 18-9 |

| | | 18.8.2 | Water Management Infrastructure | 18-9 |

| | | 18.8.3 | Waste Rock Collection Pond | 18-10 |

| | | 18.8.4 | Site Water and Load Balance | 18-10 |

| | 18.9 | Water Treatment Plant | 18-11 |

| | 18.10 | Tailings Management Facility | 18-11 |

| | | 18.10.1 | General Description | 18-11 |

| | | 18.10.2 | Design Criteria | 18-12 |

| | | 18.10.3 | Overburden Geotechnical Investigation | 18-13 |

| | | 18.10.4 | Site Selection | 18-13 |

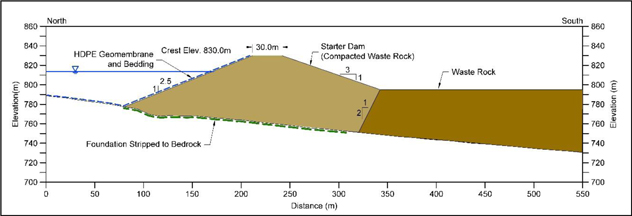

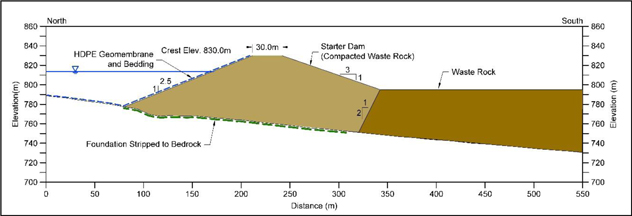

| | | 18.10.5 | Starter Dam | 18-13 |

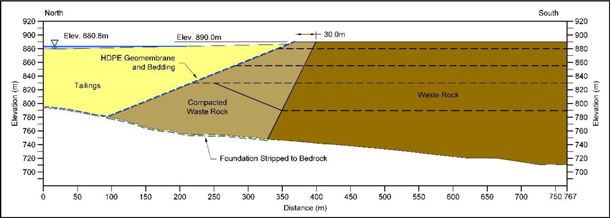

| | | 18.10.6 | Dam Raises and Final Dam | 18-14 |

| | | 18.10.7 | TMF Water Pool and Water Return | 18-15 |

| | 18.11 | Tailings Delivery and Return System | 18-15 |

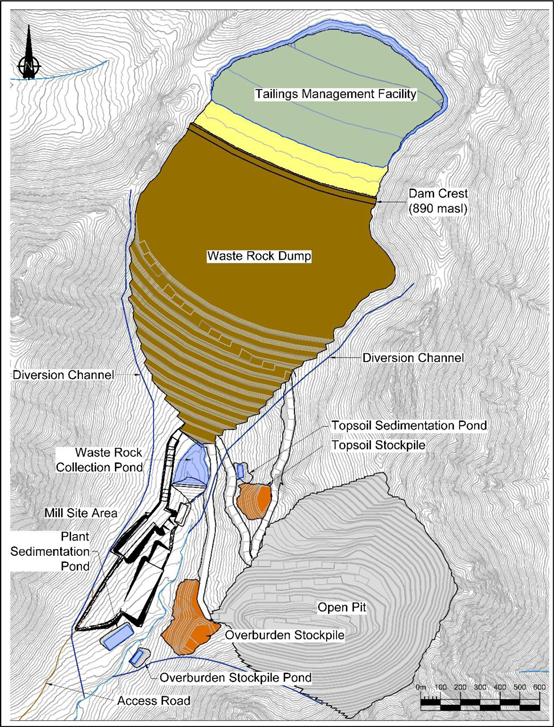

| | 18.12 | Waste Rock Dump and Overburden Stockpiles | 18-15 |

| | | 18.12.1 | Waste Rock Dump | 18-17 |

| | | 18.12.2 | Overburden and Topsoil Stockpiles | 18-17 |

| | 18.13 | Compressed Air Supply | 18-17 |

| | 18.14 | Site Communications | 18-18 |

| | 18.15 | Fire Protection | 18-18 |

| | 18.16 | Plant Buildings | 18-18 |

| | | 18.16.1 | Gatehouse | 18-18 |

| | | 18.16.2 | Mine Infrastructure Area | 18-18 |

| | | 18.16.3 | Laboratory | 18-19 |

| | | 18.16.4 | Administration Building | 18-19 |

| | | 18.16.5 | Mill Dry Facility | 18-19 |

| | | 18.16.6 | Plant Workshop and Warehouse | 18-19 |

| | | 18.16.7 | Primary Crushing | 18-19 |

| | | 18.16.8 | Fine Ore Stockpile | 18-19 |

| | | 18.16.9 | Process Plant | 18-20 |

| | | 18.16.10 | Concentrate Loadout | 18-20 |

| | | 18.16.11 | Reagent Storage and Handling | 18-20 |

| | | 18.16.12 | Raw Water Supply | 18-20 |

| | 18.17 | Concentrate Transportation | 18-20 |

| Trilogy Metals Inc. | vi | |

| NI 43-101 Technical Report on the Arctic Project, | | |

| Northwest Alaska | | |

| | | |

| 19.0 | Market Studies and Contracts | 19-1 |

| | | |

| | 19.1 | Metal Prices | 19-1 |

| | 19.2 | Markets and Contracts | 19-1 |

| | 19.3 | Smelter Term Assumptions | 19-2 |

| | 19.4 | Transportation and Logistics | 19-3 |

| | 19.5 | Insurance | 19-3 |

| | 19.6 | Representation and Marketing | 19-3 |

| | 19.7 | QP’s Opinion | 19-4 |

| | | |

| 20.0 | Environmental Studies, permitting and social or community Impact | 20-1 |

| | | |

| | 20.1 | Environmental Studies | 20-1 |

| | | 20.1.1 | Hydrology | 20-1 |

| | | 20.1.2 | Water Quality | 20-3 |

| | | 20.1.3 | Wetlands Data | 20-3 |

| | | 20.1.4 | Aquatic Life Data | 20-4 |

| | | 20.1.5 | Hydrogeology Data | 20-6 |

| | | 20.1.6 | Cultural Resources Data | 20-7 |

| | | 20.1.7 | Subsistence Data | 20-8 |

| | | 20.1.8 | Endangered Species, Migratory Birds, and Bald and Golden Eagle protection | 20-9 |

| | | 20.1.9 | Acid Base Accounting Data | 20-10 |

| | | 20.1.10 | Additional Baseline Data requirements | 20-10 |

| | 20.2 | Permitting | 20-11 |

| | | 20.2.1 | Exploration Permits | 20-11 |

| | | 20.2.2 | Major Mine Permits | 20-11 |

| | 20.3 | Social or Community Considerations | 20-13 |

| | 20.4 | Mine Reclamation and Closure | 20-15 |

| | | 20.4.1 | Reclamation and Closure Plan | 20-15 |

| | | 20.4.2 | Reclamation and Closure Financial Assurance | 20-20 |

| | | |

| 21.0 | Capital and Operating Costs | 21-1 |

| | | |

| | 21.1 | Capital Cost Summary | 21-1 |

| | | 21.1.1 | Capital Cost Introduction | 21-1 |

| | | 21.1.2 | Project Execution | 21-2 |

| | | 21.1.3 | Work Breakdown Structure | 21-2 |

| | | 21.1.4 | Estimate Summary | 21-2 |

| | | 21.1.5 | Definition | 21-4 |

| | | 21.1.6 | Road Construction | 21-5 |

| | | 21.1.7 | Basis of Mining Capital Cost Estimate | 21-6 |

| | | 21.1.8 | Mining Capital and Sustaining Capital Costs | 21-6 |

| | | 21.1.9 | Tailings Management Facility | 21-7 |

| | | 21.1.10 | Water Treatment Plant | 21-7 |

| | | 21.1.11 | Sustaining Capital and Closure Costs Summary | 21-8 |

| | 21.2 | Operating Cost Estimate | 21-8 |

| | | 21.2.1 | Operating Cost Summary | 21-8 |

| | | 21.2.2 | Mining Operating Cost Estimate | 21-9 |

| | | 21.2.3 | Processing Operating Cost Estimate | 21-10 |

| | | 21.2.4 | General and Administrative and Surface Services Cost Estimates | 21-10 |

| | | 21.2.5 | Road Toll Cost Estimate | 21-12 |

| | | |

| 22.0 | Economic Analysis | 22-1 |

| | | |

| | 22.1 | Introduction | 22-1 |

| | 22.2 | Cautionary Statement and Forward Looking Information | 22-1 |

| | 22.3 | Inputs to the Cash Flow Model | 22-1 |

| Trilogy Metals Inc. | vii | |

| NI 43-101 Technical Report on the Arctic Project, | | |

| Northwest Alaska | | |

| | | |

| | 22.4 | Basis of Pre-Tax Financial Evaluation | 22-3 |

| | 22.5 | Pre-Tax Financial Results | 22-4 |

| | 22.6 | Post-Tax Financial Analysis | 22-6 |

| | | 22.6.1 | US Federal Tax | 22-6 |

| | | 22.6.2 | Alaska State Tax | 22-6 |

| | | 22.6.3 | Alaska Mining License Tax | 22-7 |

| | | 22.6.4 | Post-Tax Financial Results | 22-7 |

| | 22.7 | Cash Flow | 22-8 |

| | 22.8 | Sensitivity Analysis | 22-9 |

| | 22.9 | Copper and Zinc Metal Price Scenarios | 22-13 |

| | | |

| 23.0 | Adjacent Properties | 23-1 |

| | | |

| 24.0 | Other Relevant Data and Information | 24-1 |

| | | |

| 25.0 | Interpretation and Conclusions | 25-1 |

| | | |

| | 25.1 | Introduction | 25-1 |

| | 25.2 | Mineral Tenure, Surface Rights, Royalties and Agreements | 25-1 |

| | 25.3 | Geology and Mineralization | 25-2 |

| | 25.4 | Exploration, Drilling and Analytical Data Collection in Support of Mineral Resource Estimation | 25-2 |

| | 25.5 | Metallurgical Testwork | 25-2 |

| | 25.6 | Mineral Resource Estimates | 25-3 |

| | 25.7 | Mineral Reserves and Mine Planning | 25-3 |

| | 25.8 | Recovery Plan | 25-3 |

| | 25.9 | Project Infrastructure | 25-4 |

| | 25.10 | Environmental, Permitting and Social | 25-4 |

| | 25.11 | Markets and Contracts | 25-4 |

| | 25.12 | Capital Costs | 25-4 |

| | 25.13 | Operating Costs | 25-5 |

| | 25.14 | Economic Analysis | 25-5 |

| | 25.15 | Conclusions | 25-5 |

| | | |

| 26.0 | Recommendations | 26-1 |

| | | |

| | 26.1 | Introduction | 26-1 |

| | 26.2 | Work Program | 26-1 |

| | | |

| 27.0 | References | 27-1 |

| | | |

| 28.0 | Certificates of Qualified Persons | 28-1 |

| | | |

| | 28.1 | Paul Staples, P.Eng. | 28-1 |

| | 28.2 | Justin Hannon, P.Eng. | 28-2 |

| | 28.3 | Antonio Peralta Romero, P.Eng. | 28-3 |

| | 28.4 | Bruce M. Davis, FAusIMM | 28-4 |

| | 28.5 | John Joseph DiMarchi, CPG | 28-5 |

| | 28.6 | Jeffery B. Austin, P.Eng. | 28-6 |

| | 28.7 | Robert Sim, P.Geo. | 28-7 |

| | 28.8 | Calvin Boese, PEng. | 28-8 |

| | 28.9 | Bruce Murphy, PEng. | 28-9 |

| | 28.10 | Tom Sharp, PEng. | 28-10 |

| Trilogy Metals Inc. | viii | |

| NI 43-101 Technical Report on the Arctic Project, | | |

| Northwest Alaska | | |

| | | |

Appendix A – List of Claims

| Table 1-1 | Summary of Overall Metal Recovery – Arctic Project | 1-21 |

| Table 1-2 | Mineral Resource Estimate for the Arctic Deposit | 1-22 |

| Table 1-3 | Mineral Reserve Estimates for the Arctic Deposit | 1-22 |

| Table 1-4 | Initial Capital Costs | 1-29 |

| Table 1-5 | Sustaining Capital and Closure Costs | 1-30 |

| Table 1-6 | Sustaining Capital and Closure Costs | 1-30 |

| Table 6-1 | Known Mapping, Geochemical, and Geophysical Programs Targeting VMS Prospects in the Ambler Mining District | 6-4 |

| Table 6-2 | Mining and Technical Studies | 6-12 |

| Table 9-1 | Summary of Trilogy/NovaGold Exploration Activities Targeting VMS-style Mineralization in the Ambler Sequence Stratigraphy and the Arctic Deposit | 9-2 |

| Table 9-2 | TDEM Loops and Locations | 9-9 |

| Table 9-3 | Summary of derived rock mass parameter values per rock mass domain. | 9-15 |

| Table 9-4 | Selected acceptance criteria | 9-17 |

| Table 9-5 | Summary of slope modelling results | 9-18 |

| Table 10-1 | Companies, Campaigns, Drill Holes and Metres Drilled at the Arctic Deposit | 10-1 |

| Table 10-2 | Summary of Trilogy/NovaGold Drilling | 10-2 |

| Table 10-3 | Drill Contractors, Drill Holes, Meterage and Core Sizes by Drill Campaign at the Arctic Deposit | 10-4 |

| Table 10-4 | Recovery and RQD 2004 to 2008 Arctic Drill Campaigns | 10-8 |

| Table 10-5 | Drill, Meterage and Average Drill Depth for Trilogy Ambler Sequence VMS Targets | 10-9 |

| Table 10-6 | Trilogy Metals Exploration Drilling – Ambler Schist Belt | 10-11 |

| Table 11-1 | Analytical Laboratories Used by Operators of the Arctic Project | 11-5 |

| Table 13-1 | Metallurgical Test Work Programs | 13-1 |

| Table 13-2 | Metallic Mineral Identified in Arctic Project Samples | 13-3 |

| Table 13-3 | Bond Ball Mill Work Index | 13-5 |

| Table 13-4 | Head Analyses | 13-6 |

| Table 13-5 | Flotation Test on Ambler Low Talc Composite | 13-7 |

| Table 13-6 | Head Grades – Composite Samples – 2012 | 13-9 |

| Table 13-7 | Head Grade 2017 Variability Samples and Pilot Plant Composite | 13-10 |

| Table 13-8 | Mineral Modal Abundance for Composite Samples – 2012 | 13-11 |

| Table 13-9 | Bond Ball Mill Grindability and Abrasion Index Test Results | 13-13 |

| Table 13-10 | Locked Cycle Metallurgical Test Results | 13-17 |

| Table 13-11 | SGS Open Circuit Copper and Lead Separation Test Results | 13-20 |

| Table 13-12 | ALS Metallurgy Locked Cycle Copper-Lead Separation Test Results | 13-22 |

| Table 13-13 | Summary of Overall Metal Recovery – Arctic Deposit | 13-23 |

| Trilogy Metals Inc. | ix | |

| NI 43-101 Technical Report on the Arctic Project, | | |

| Northwest Alaska | | |

| | | |

| Table 13-14 | Multi-element Assay Results –Lead Concentrate and Copper Concentrate | 13-24 |

| Table 13-15 | Multi-element Assay Results – Zinc Concentrate | 13-24 |

| Table 14-1 | Summary of Sample Data Used to Develop the Resource Block Model | 14-6 |

| Table 14-2 | Summary of Lithology Domains | 14-9 |

| Table 14-3 | Summary of Mineralized Zone (MinZone) Domains | 14-10 |

| Table 14-4 | Summary of Geotech, Alteration, Talc and Weathering Domains | 14-10 |

| Table 14-5 | Summary of Estimation Domains | 14-22 |

| Table 14-6 | Summary of Treatment of Outlier Sample Data | 14-23 |

| Table 14-7 | Copper Correlogram Parameters | 14-24 |

| Table 14-8 | Lead Correlogram Parameters | 14-25 |

| Table 14-9 | Zinc Correlogram Parameters | 14-25 |

| Table 14-10 | Gold Correlogram Parameters | 14-26 |

| Table 14-11 | Silver Correlogram Parameters | 14-26 |

| Table 14-12 | Sulphur Correlogram Parameters | 14-27 |

| Table 14-13 | AP Correlogram Parameters | 14-27 |

| Table 14-14 | NP Correlogram Parameters | 14-28 |

| Table 14-15 | Block Model Limits | 14-28 |

| Table 14-16 | Interpolation Parameters for Copper | 14-29 |

| Table 14-17 | Interpolation Parameters for Lead | 14-29 |

| Table 14-18 | Interpolation Parameters for Zinc | 14-30 |

| Table 14-19 | Interpolation Parameters for Gold | 14-30 |

| Table 14-20 | Interpolation Parameters for Silver | 14-30 |

| Table 14-21 | Interpolation Parameters for Sulphur | 14-31 |

| Table 14-22 | Interpolation Parameters for AP | 14-31 |

| Table 14-23 | Interpolation Parameters for NP | 14-31 |

| Table 14-24 | Interpolation Parameters for Specific Gravity | 14-32 |

| Table 14-25 | Parameters Used to Generate a Resource-Limiting Pit Shell | 14-44 |

| Table 14-26 | Mineral Resource Estimate for the Arctic Deposit | 14-45 |

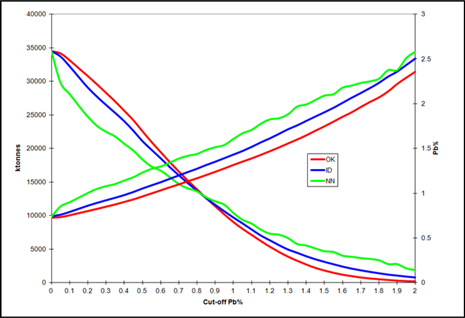

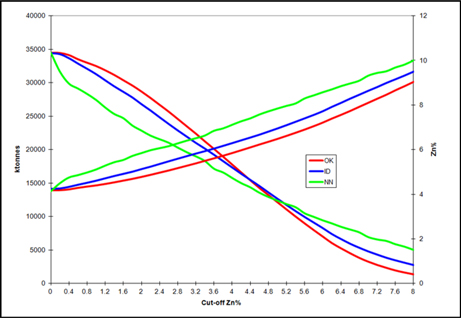

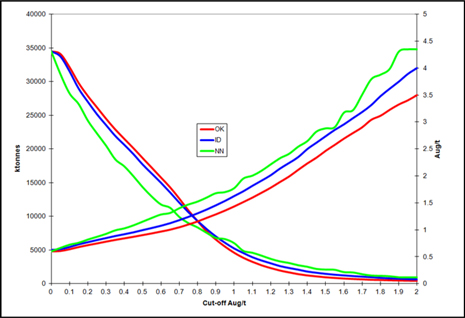

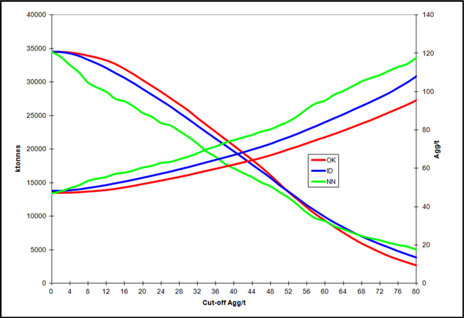

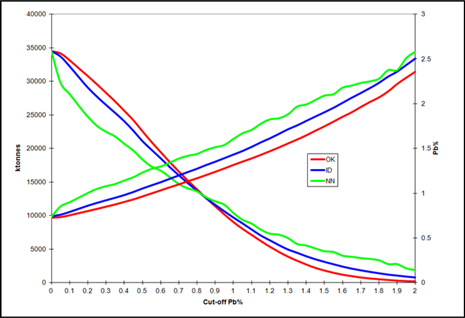

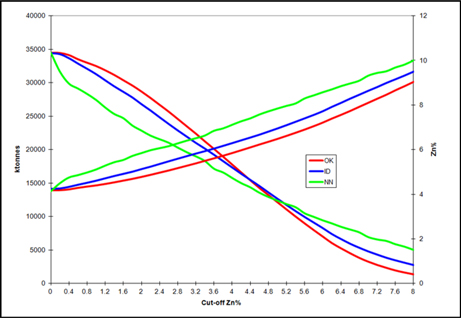

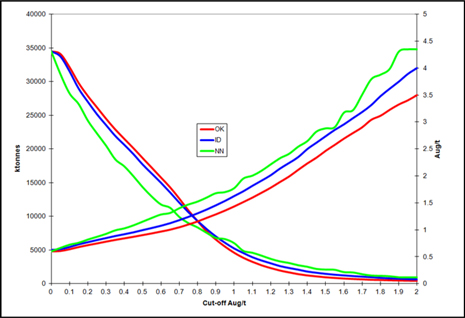

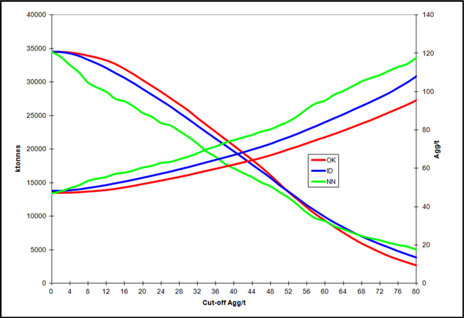

| Table 14-27 | Sensitivity of Mineral Resource to Cut-off Grade | 14-47 |

| Table 15-1 | Optimization Inputs | 15-2 |

| Table 15-2 | Mineral Reserve Statement | 15-5 |

| Table 16-1 | Mine Design Parameters | 16-1 |

| Table 16-2 | Production Schedule | 16-6 |

| Table 16-3 | Gross Operating Hours per Year | 16-8 |

| Table 16-4 | Productive Utilization Ramp-up | 16-9 |

| Table 16-5 | Availability and Productive Utilization Post Ramp-up | 16-9 |

| Table 16-6 | Blasting Design Input | 16-10 |

| Table 16-7 | Blast Designs | 16-11 |

| Table 16-8 | Rock Type Weight and UCS | 16-11 |

| Table 16-9 | PV271 Drill Penetration Rates | 16-12 |

| Table 16-10 | Drill Requirements and Performance | 16-12 |

| Table 16-11 | Truck Requirements & Productivity Statistics | 16-14 |

| Table 16-12 | Support Equipment | 16-16 |

| Table 16-13 | Auxiliary Equipment | 16-16 |

| Table 17-1 | Processing Facility Design Criteria | 17-4 |

| Table 18-1 | TMF Design Parameters and Design Criteria | 18-12 |

| Table 18-2 | Mode of Transport and Distances for Concentrate Shipping | 18-21 |

| Table 19-1 | Concentrate Transport Costs | 19-3 |

| Table 20-1 | Major Mine Permits Required for the Arctic Project | 20-13 |

| Table 20-2 | Summary of Closure and Reclamation Costs | 20-19 |

| Table 21-1 | Estimate Summary Level 1 Major Facility | 21-3 |

| Table 21-2 | Initial Estimate by Major Discipline | 21-4 |

| Table 21-3 | Estimate Exchange Rates | 21-5 |

| Table 21-4 | Mine Capital Costs | 21-7 |

| Trilogy Metals Inc. | x | |

| NI 43-101 Technical Report on the Arctic Project, | | |

| Northwest Alaska | | |

| | | |

| Table 21-5 | Sustaining Capital and Closure Costs | 21-8 |

| Table 21-6 | Overall Operating Cost Estimate | 21-9 |

| Table 21-7 | Life of Mine Mining Cost | 21-9 |

| Table 21-8 | Summary of Processing Operating Cost Estimates | 21-10 |

| Table 21-9 | G&A Cost Estimates | 21-11 |

| Table 21-10 | Surface Services Cost Estimates | 21-12 |

| Table 22-1 | Mine and Payable Metal Production for the Arctic Mine | 22-3 |

| Table 22-2 | Summary of Pre-Tax Financial Results | 22-5 |

| Table 22-3 | Summary of Post-Tax Financial Results | 22-8 |

| Table 22-4 | Pre and Post-Tax Arctic Project Production and Cash Flow Forecast | 22-9 |

| Table 22-5 | Pre-tax Copper Price Scenarios | 22-13 |

| Table 22-6 | Pre-tax Zinc Price Scenarios | 22-13 |

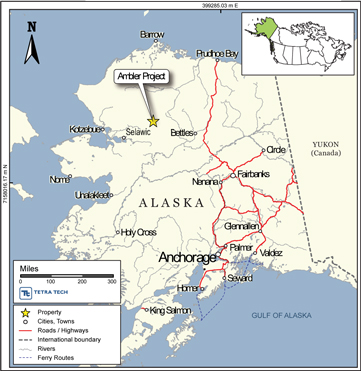

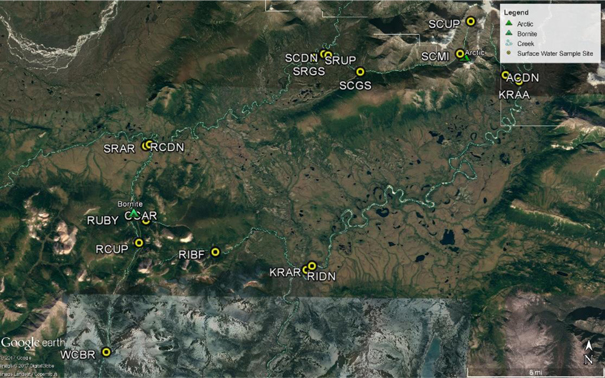

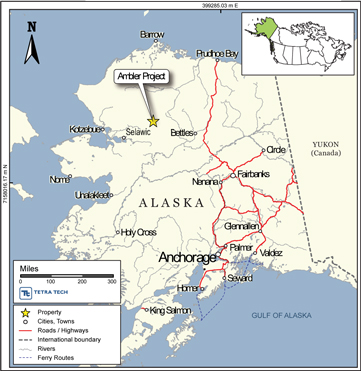

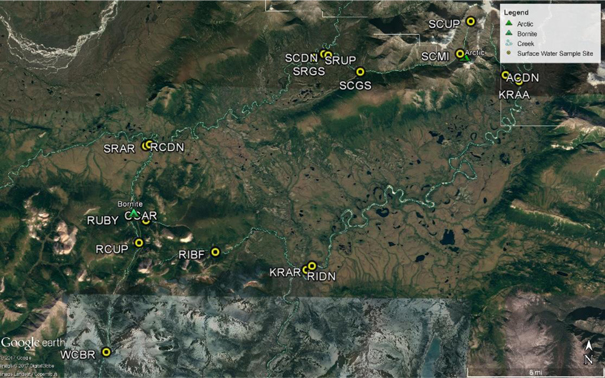

| Figure 2-1 | Property Location Map (Tetra Tech, 2013) | 2-1 |

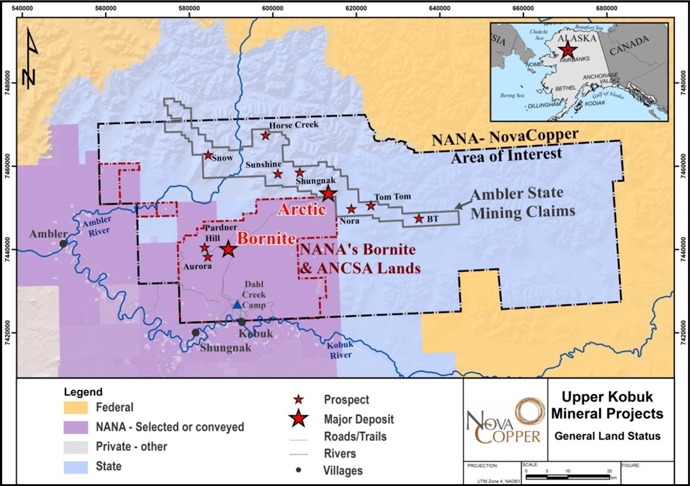

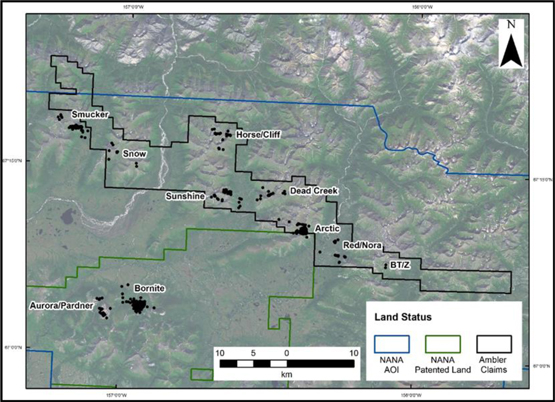

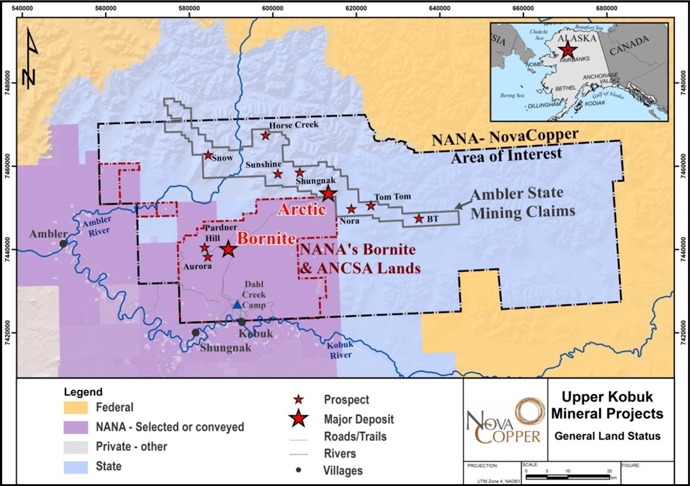

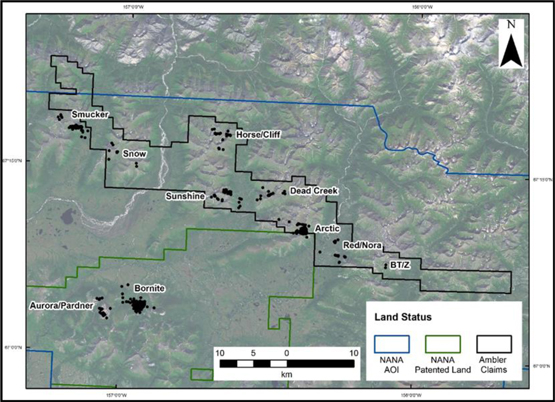

| Figure 4-1 | Upper Kobuk Mineral Projects Lands (Trilogy Metals, 2017) | 4-2 |

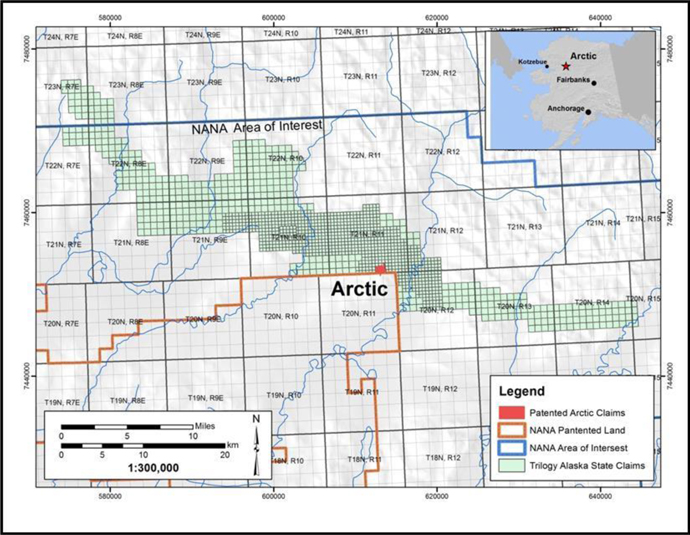

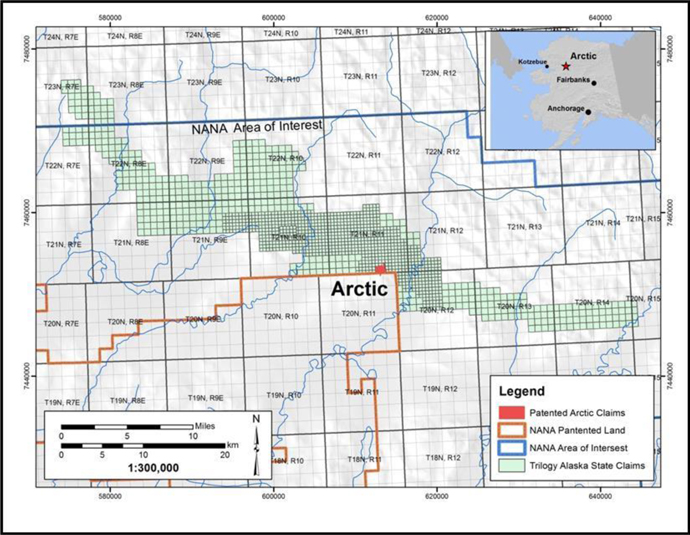

| Figure 4-2 | Arctic Project Mineral Tenure Plan (Trilogy Metals, 2017) | 4-3 |

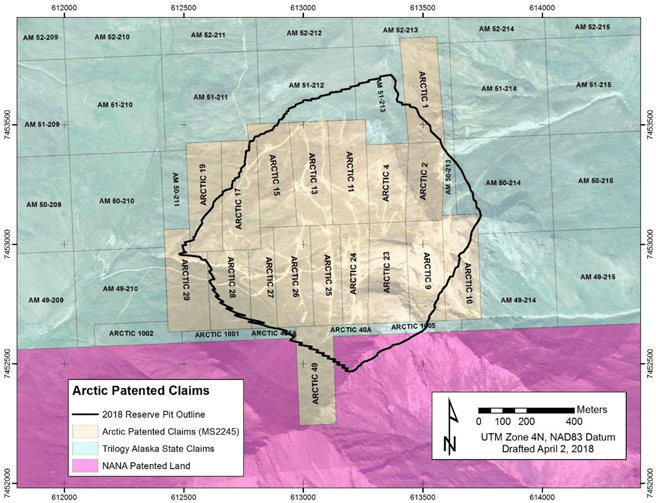

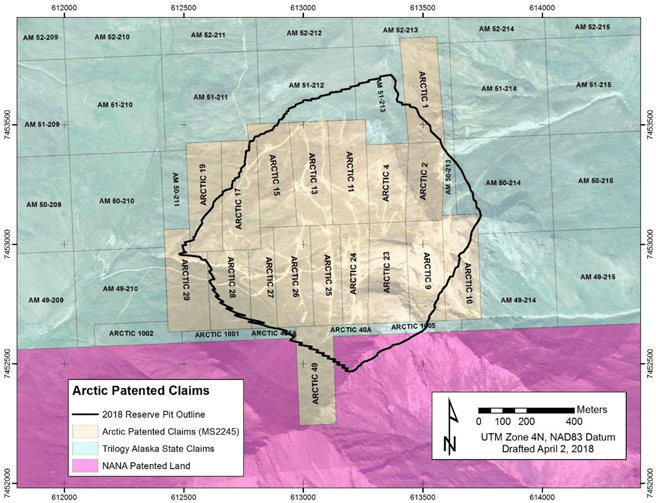

| Figure 4-3 | Mineral Tenure Layout Plan (Trilogy Metals, 2018) | 4-4 |

| Figure 4-4 | Arctic Deposit Location (Trilogy Metals, 2018) | 4-5 |

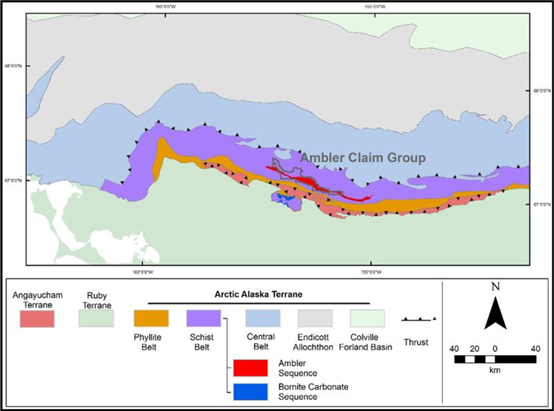

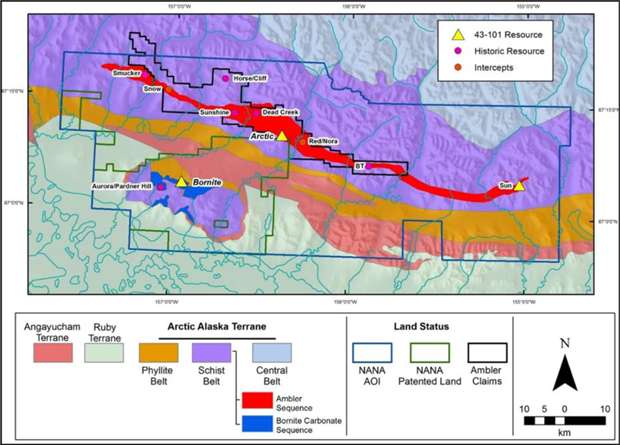

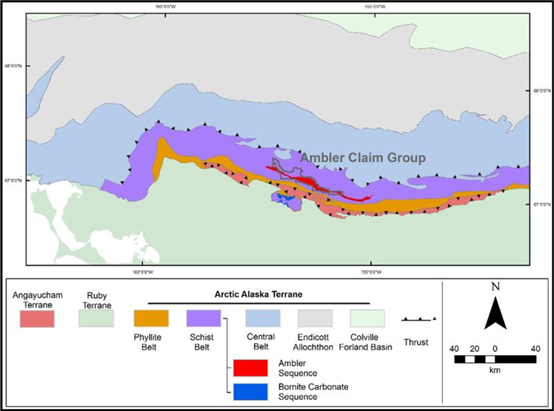

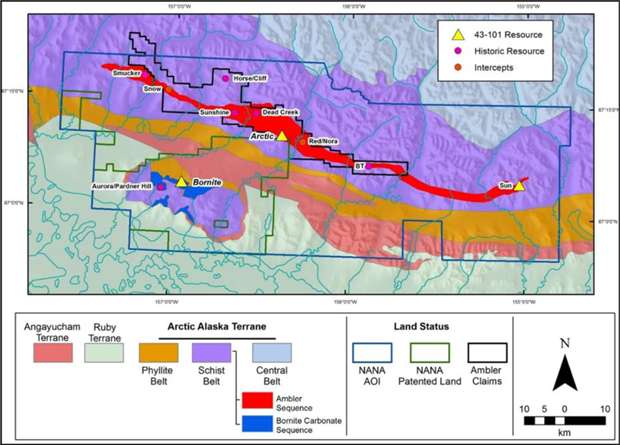

| Figure 7-1 | Geologic Terranes of the Southern Brooks Range (Trilogy Metals, 2017) | 7-2 |

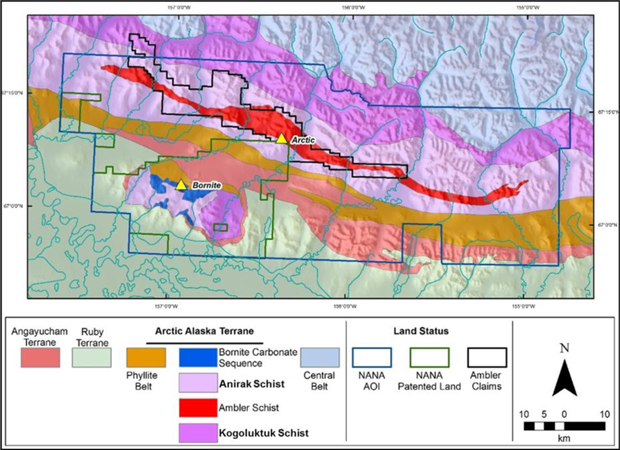

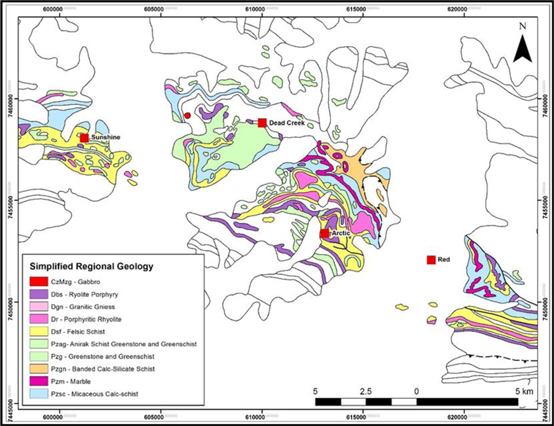

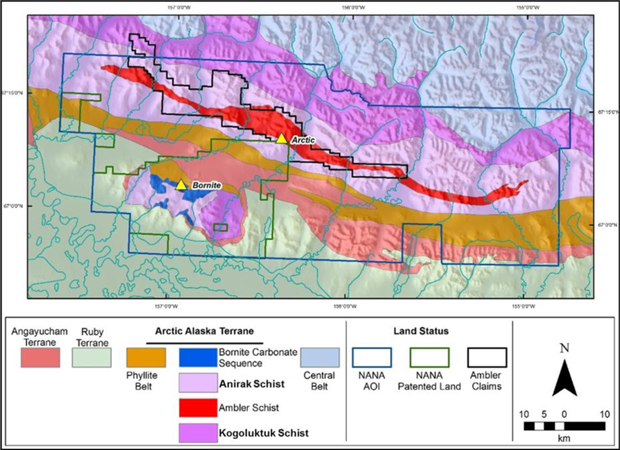

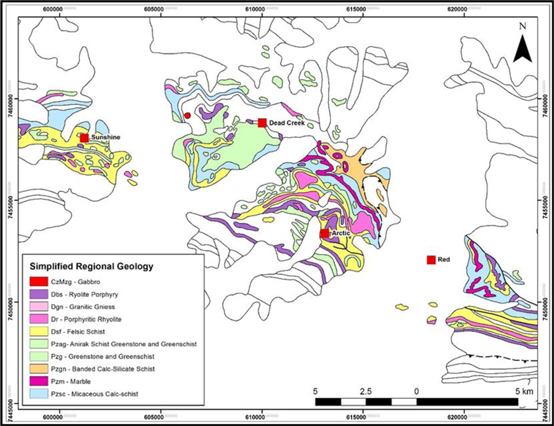

| Figure 7-2 | Geology of the Ambler Mining District (Trilogy Metals, 2017) | 7-5 |

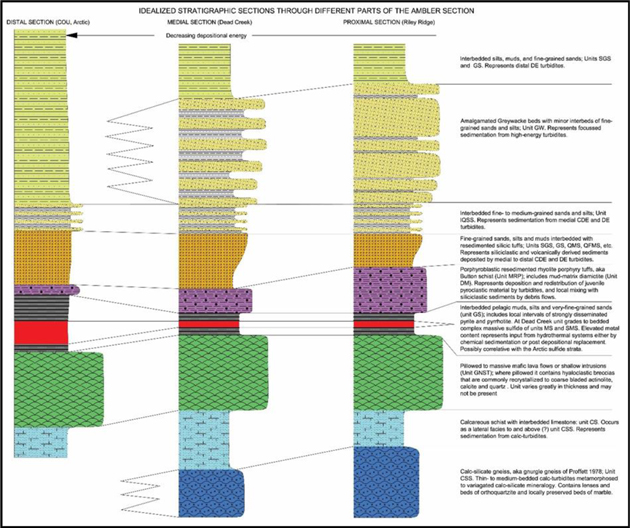

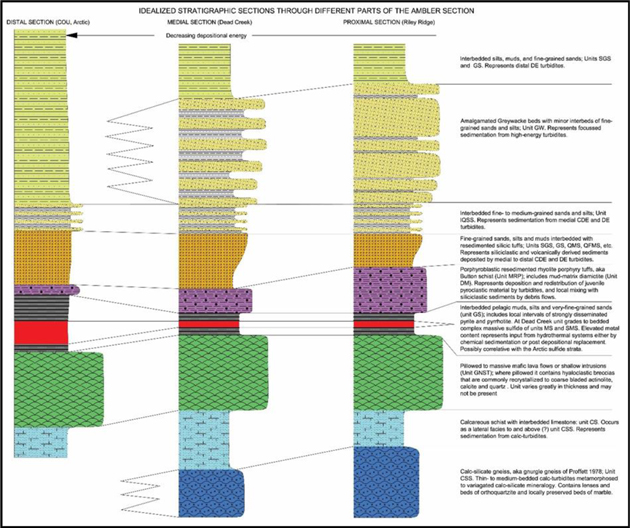

| Figure 7-3 | Ambler Sequence Stratigraphy in the Arctic Deposit Area (Trilogy Metals, 2017) | 7-7 |

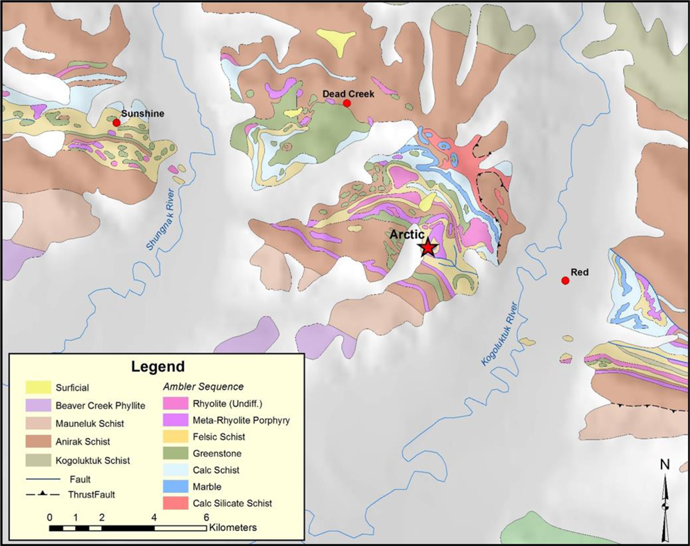

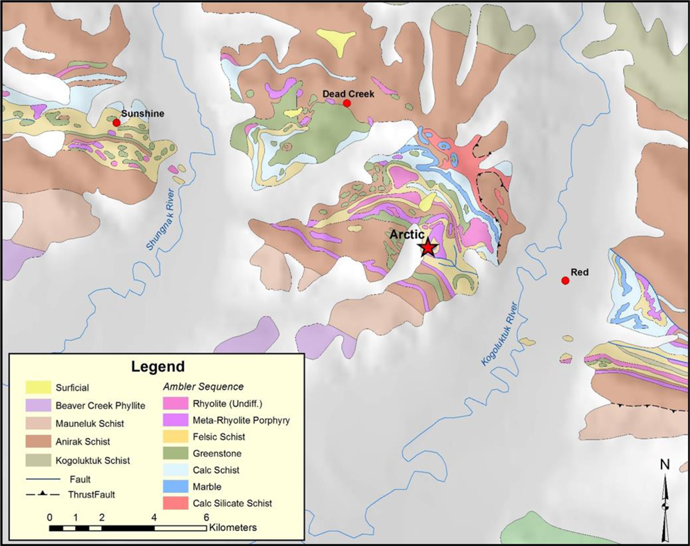

| Figure 7-4 | Generalized Geology of the Central Ambler District (Trilogy Metals, 2017) | 7-8 |

| Figure 7-5 | Typical F1 Isoclinal Folds Developed in Calcareous Gnurgle Gneiss | 7-9 |

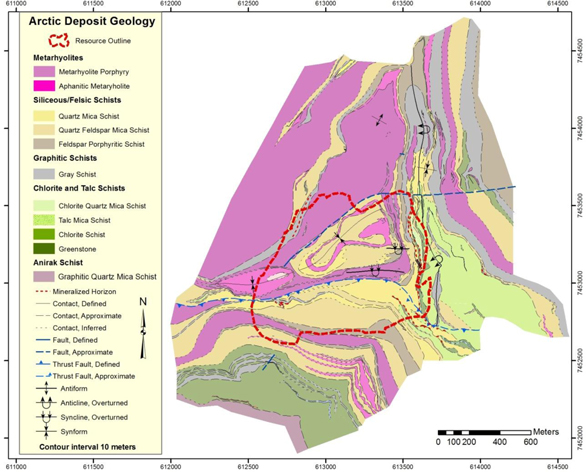

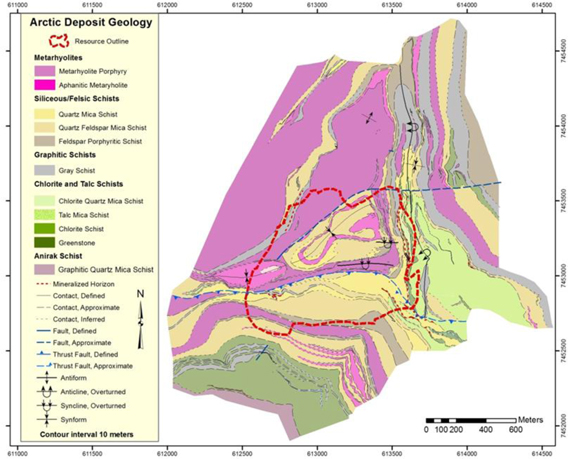

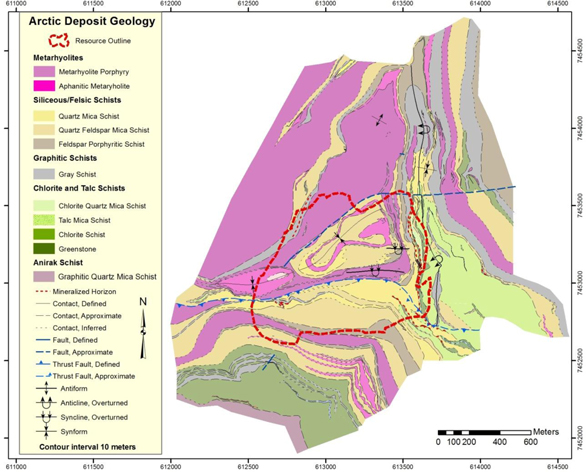

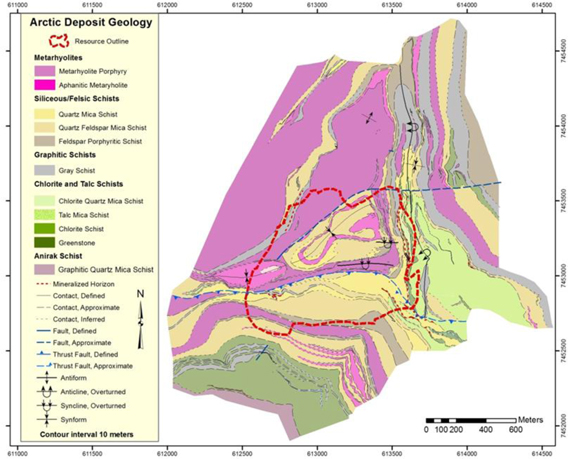

| Figure 7-6 | Generalized Geologic Map of the Arctic Deposit (Trilogy Metals, 2017) | 7-11 |

| Figure 7-7 | Typical Massive Sulphide Mineralization at the Arctic Deposit | 7-16 |

| Figure 7-8 | Major Prospects of the Ambler Mining District (Trilogy Metals, 2017) | 7-17 |

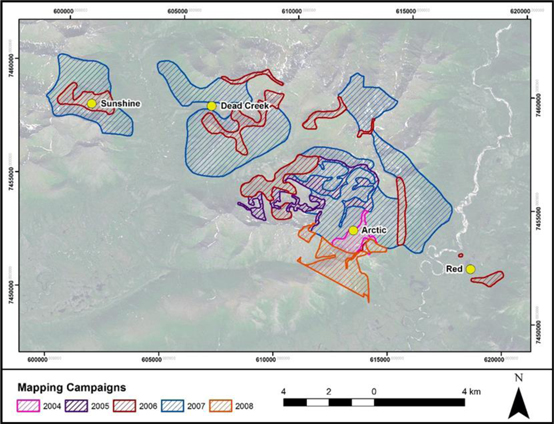

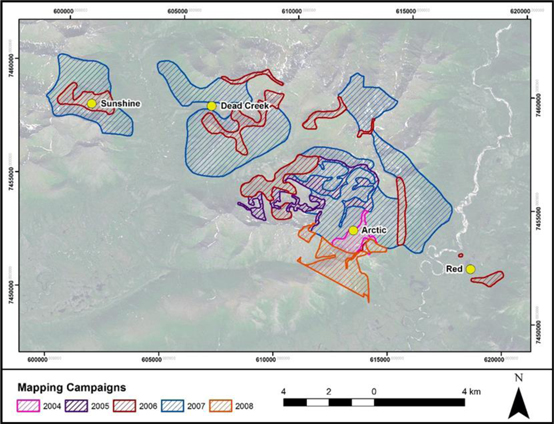

| Figure 9-1 | Mapping Campaigns in and around the Arctic Deposit (Trilogy Metals, 2017) | 9-4 |

| Figure 9-2 | Arctic Deposit Area Geology (Trilogy Metals, 2017) | 9-5 |

| Figure 9-3 | 2016 Updated Arctic Surface Geology Map (Trilogy Metals, 2017) | 9-6 |

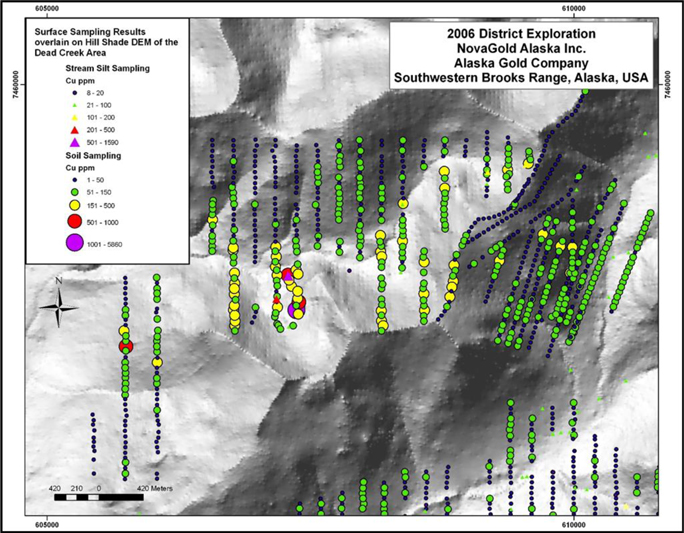

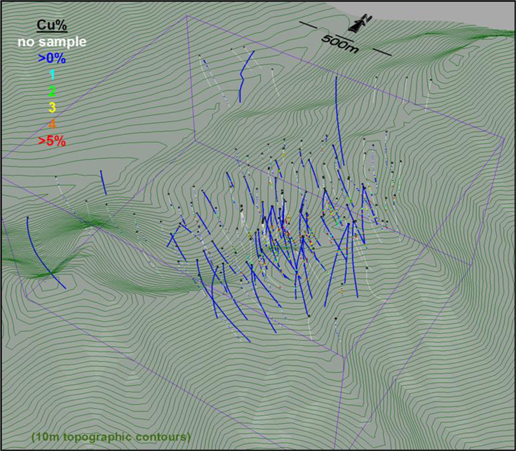

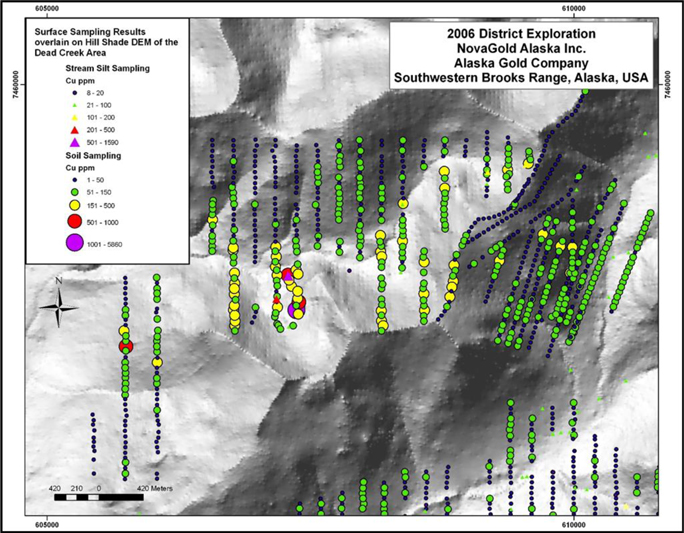

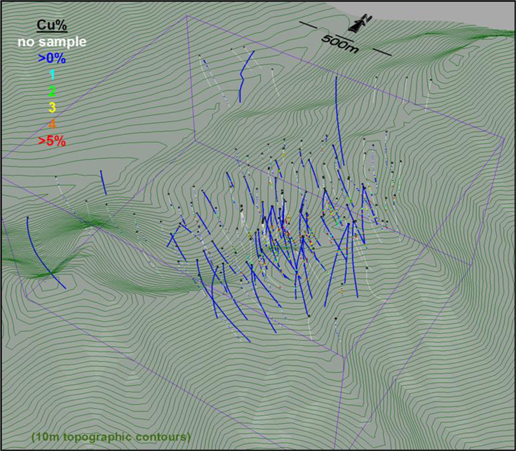

| Figure 9-4 | Copper Distribution in Silt and Soil Samples in the Dead Creek Area | 9-7 |

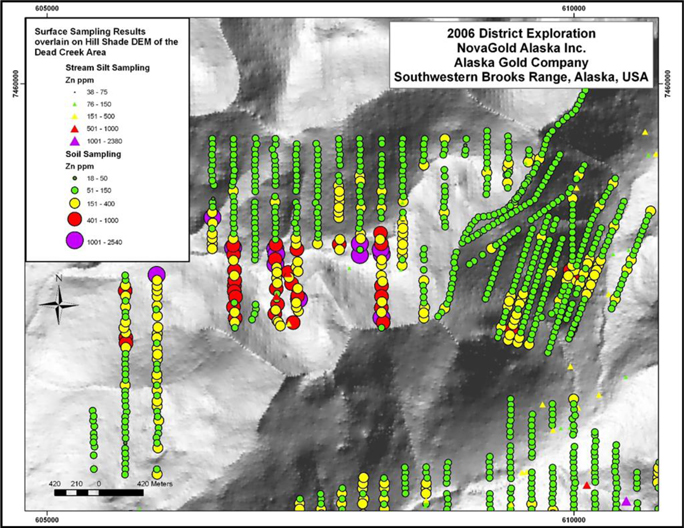

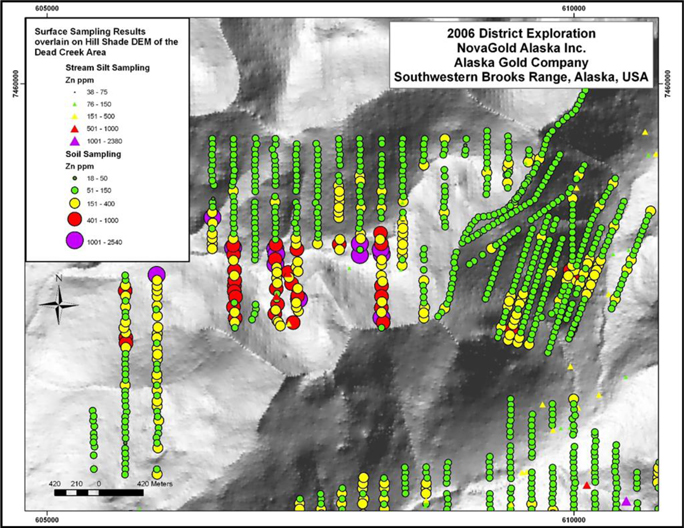

| Figure 9-5 | Zinc Distribution in Silt and Soil Samples in the Dead Creek Deposit Area | 9-8 |

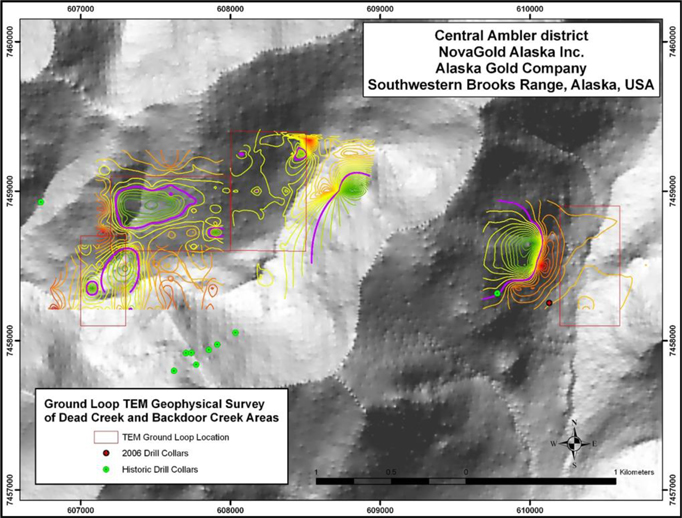

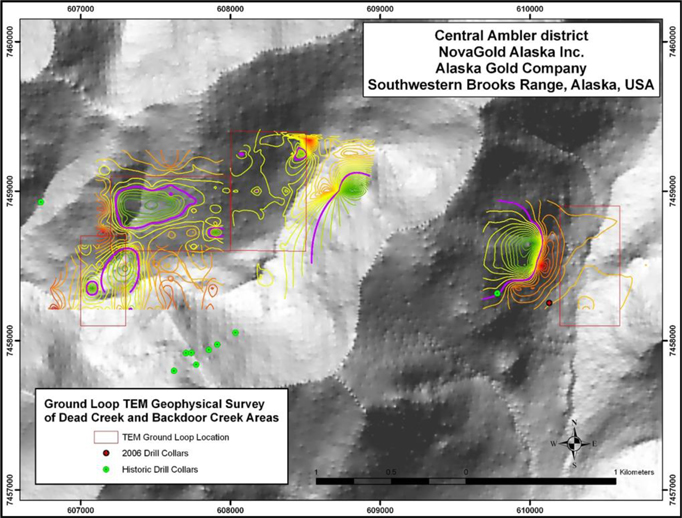

| Figure 9-6 | TDEM Loops and Contoured Resistivity – Dead Creek Prospect | 9-10 |

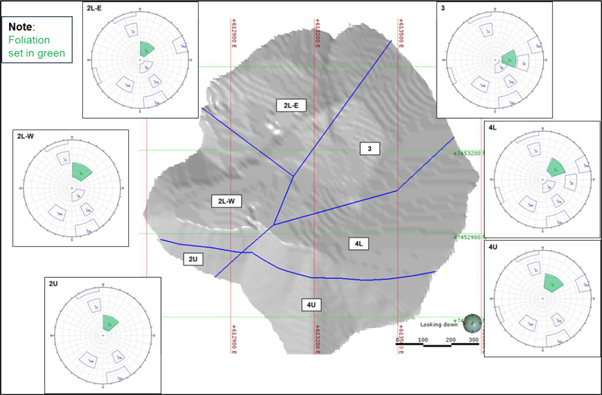

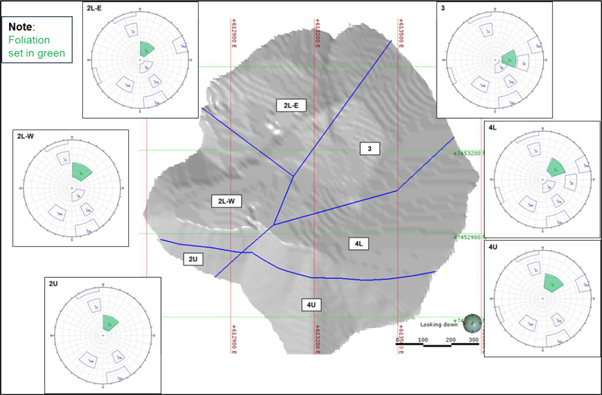

| Figure 9-7 | SRK Structural Model used in the Slope Stability Analysis | 9-13 |

| Figure 9-8 | Six structural and geomechanical domains were identified. | 9-14 |

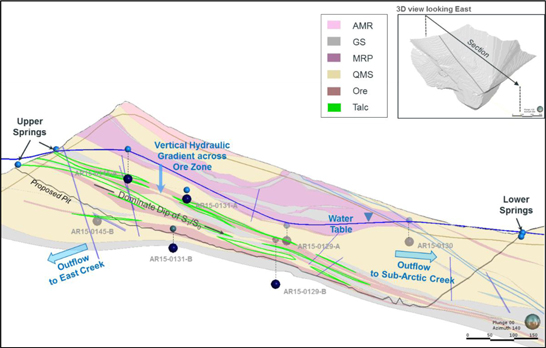

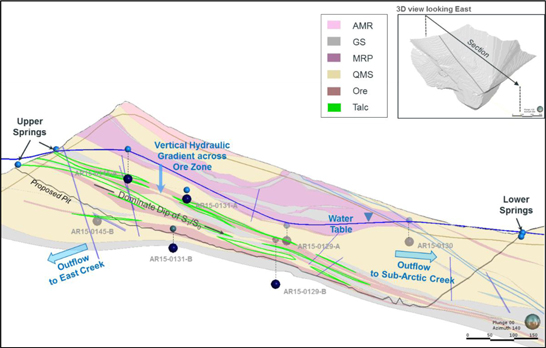

| Figure 9-9 | SRK Preliminary Hydrology Model – talc Confinement Model | 9-16 |

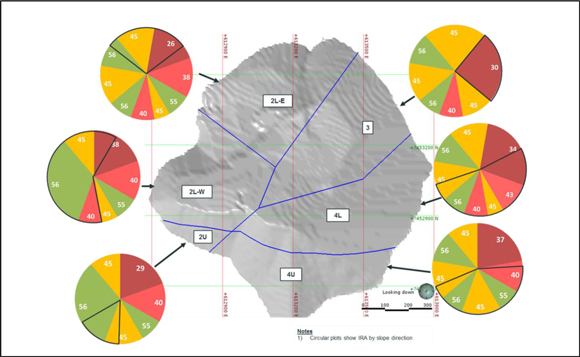

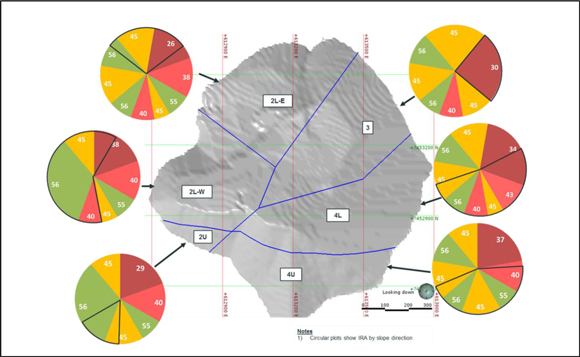

| Figure 9-10 | SRK Design Sectors and the Recommended Range of Inter-Ramp Angles to be used in the Slope Design | 9-19 |

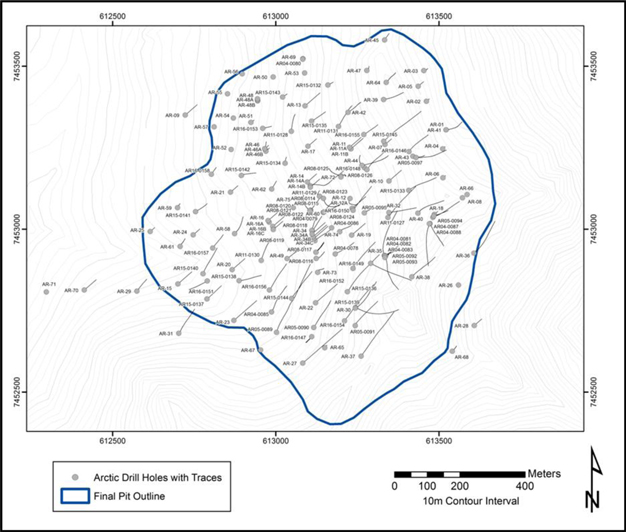

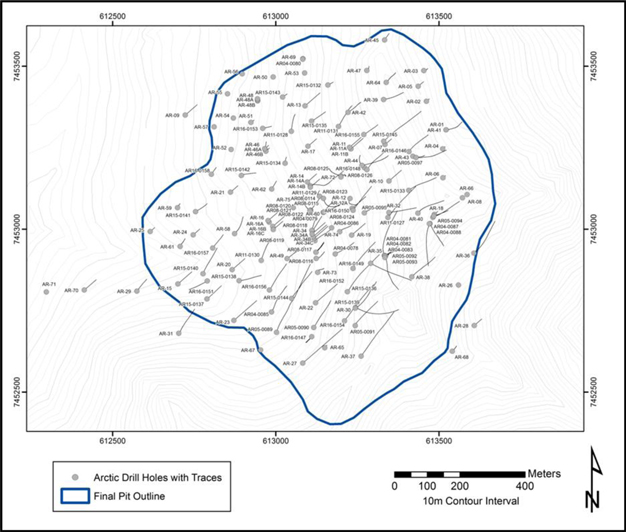

| Figure 10-1 | Plan Map of Drill Holes in the Vicinity of the Arctic Deposit (Trilogy Metals, 2017) | 10-3 |

| Figure 10-2 | Collar Locations and Principal Target Areas – Ambler District (Trilogy Metals, 2017) | 10-10 |

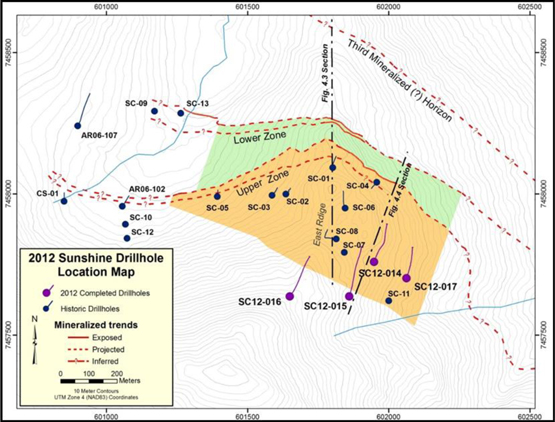

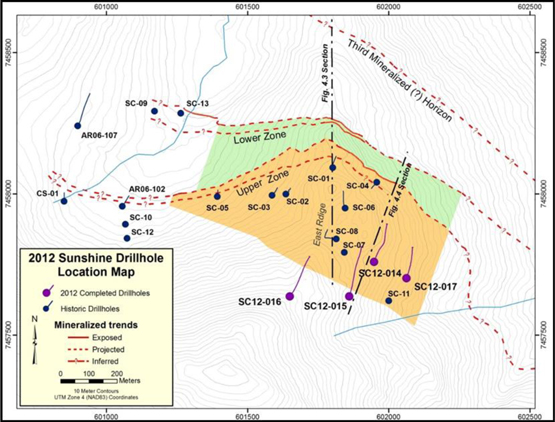

| Figure 10-3 | Sunshine Prospect and Drill Hole Locations (Trilogy Metals, 2017) | 10-11 |

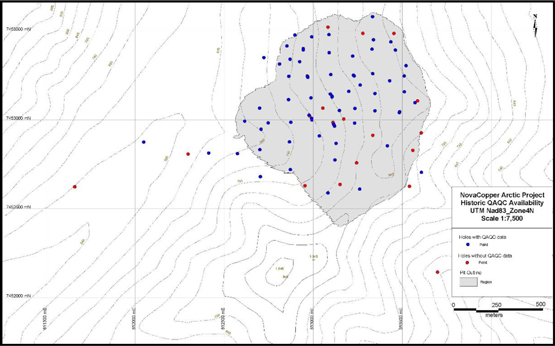

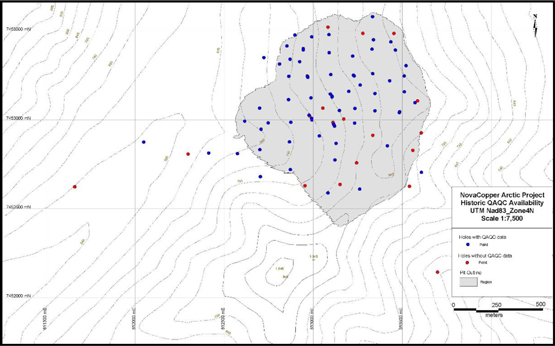

| Figure 11-1 | Spatial Availability of QA/QC Data (Trilogy Metals, 2017) | 11-6 |

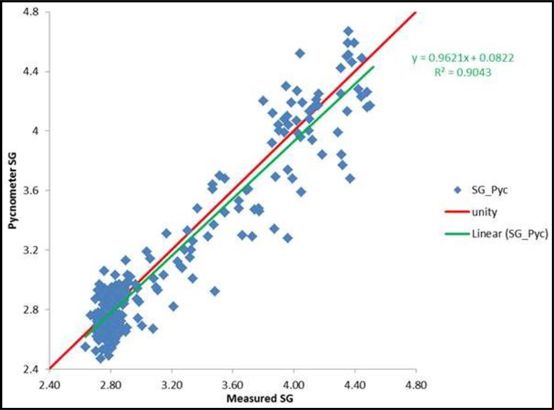

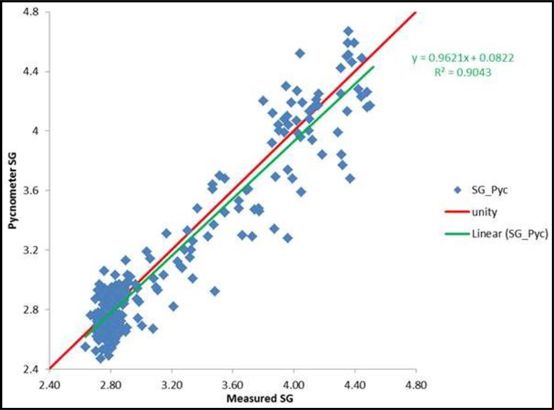

| Figure 11-2 | Graph Showing Good Agreement between Wet-dry Measured Specific Gravity and Pycnometer Measured Specific Gravity | 11-16 |

| Trilogy Metals Inc. | xi | |

| NI 43-101 Technical Report on the Arctic Project, | | |

| Northwest Alaska | | |

| | | |

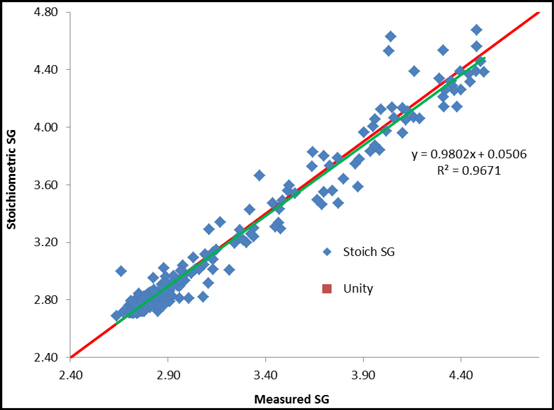

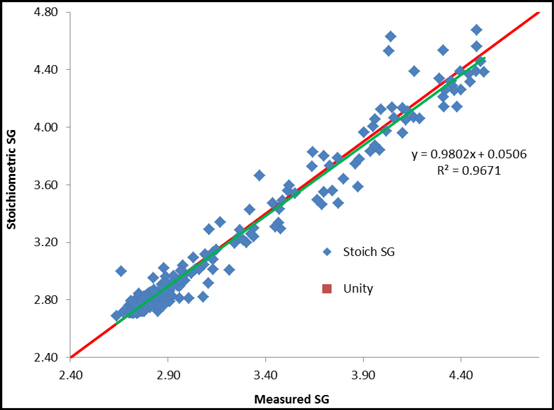

| Figure 11-3 | Measured versus Stoichiometric Specific Gravities | 11-17 |

| Figure 11-4 | Scatter Plot Showing the Measured Specific Gravity versus Multiple (Copper, Iron, Zinc, Barium) Regression Estimate | 11-18 |

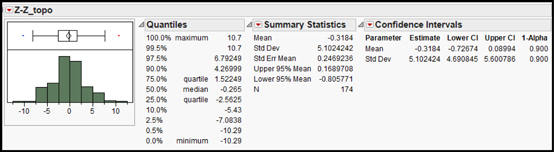

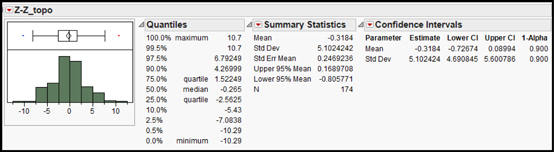

| Figure 12-1 | Distribution of the Differences Between GPS Elevations and the DTM | 12-1 |

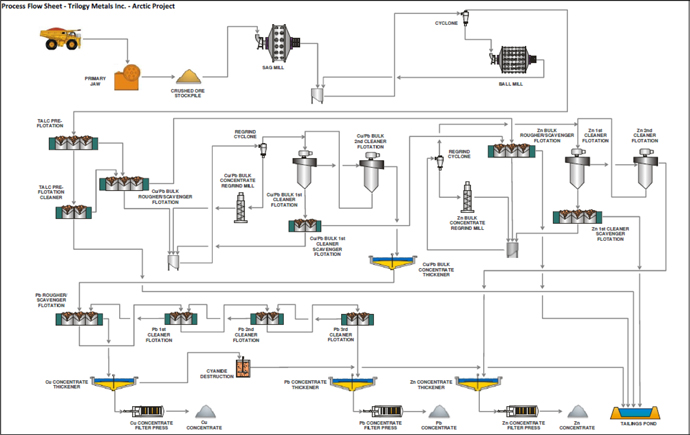

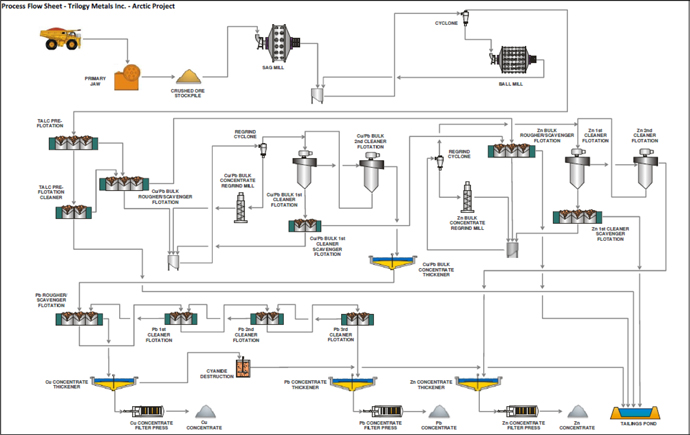

| Figure 13-1 | Proposed Copper-Lead-Zinc Flowsheet Showing Talc Pre-float | 13-2 |

| Figure 14-1 | Isometric View of Copper Grades in Drill Holes (Sim, 2017) | 14-3 |

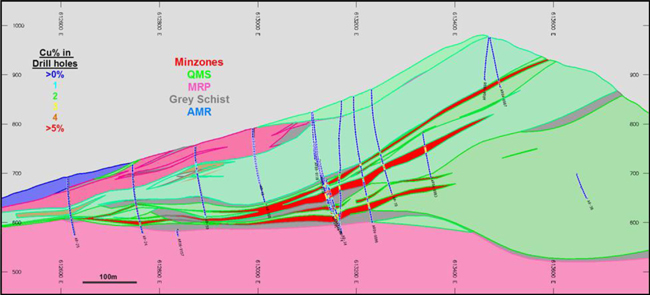

| Figure 14-2 | Isometric View of Copper Grades in Drill Holes (Sim, 2017) | 14-4 |

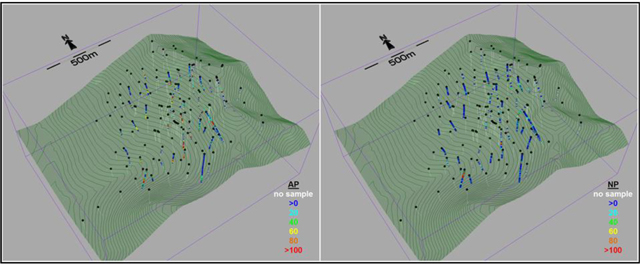

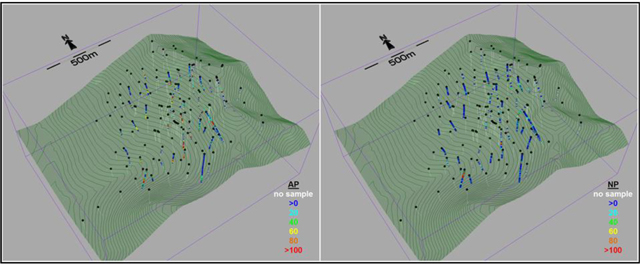

| Figure 14-3 | Isometric Views of Available AP and NP Data (Sim, 2017) | 14-5 |

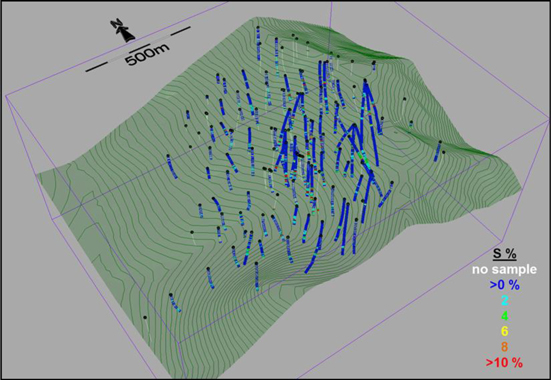

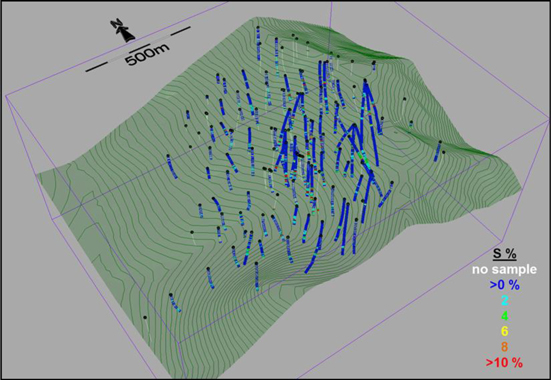

| Figure 14-4 | Isometric View of Available Sulphur Data (Sim,2017) | 14-5 |

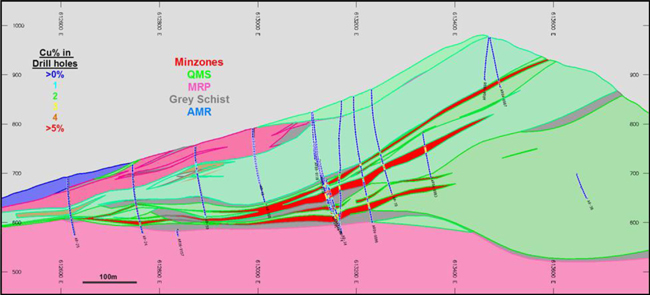

| Figure 14-5 | Cross Section 613250E Showing Lithology Domains at Arctic (Sim, 2017) | 14-7 |

| Figure 14-6 | Cross Section 7453000N Showing Lithology Domains at Arctic (Sim, 2017) | 14-7 |

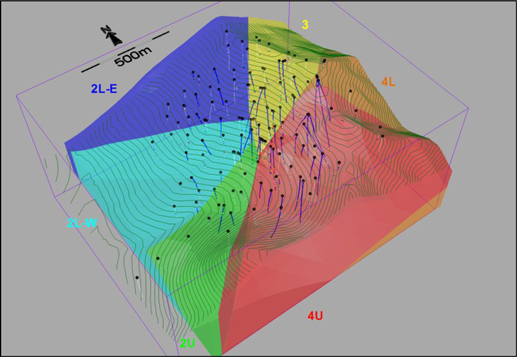

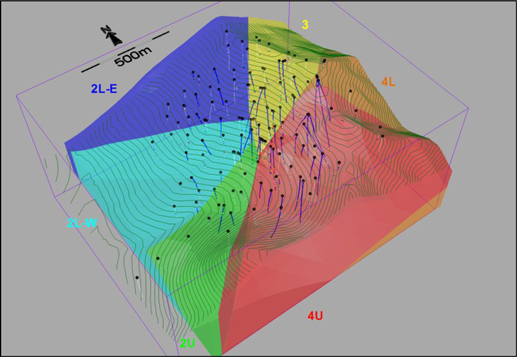

| Figure 14-7 | Isometric View of Geotechnical Domains (Sim, 2017) | 14-8 |

| Figure 14-8 | Isometric Views of Talc Domains (Sim, 2017) | 14-8 |

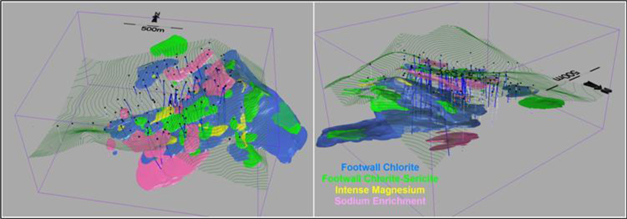

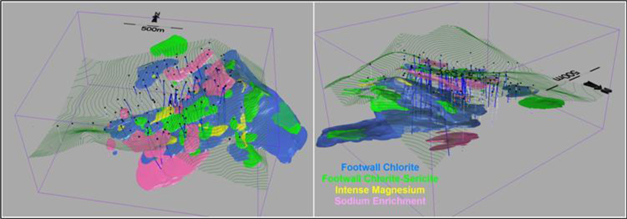

| Figure 14-9 | Isometric Views of Alteration Domains (Sim, 2017) | 14-9 |

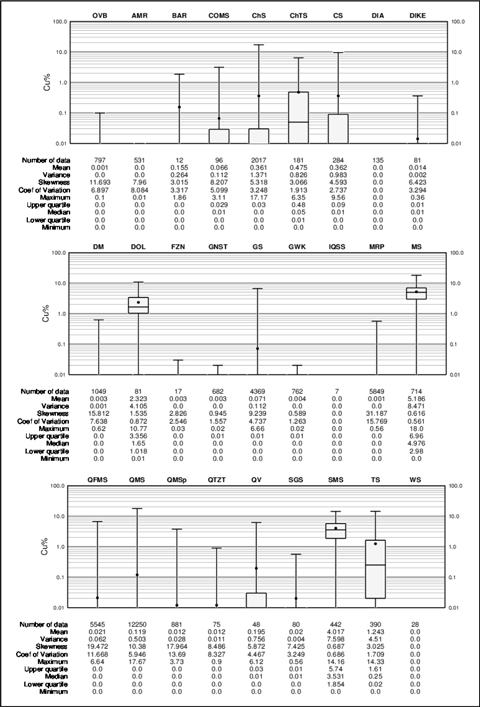

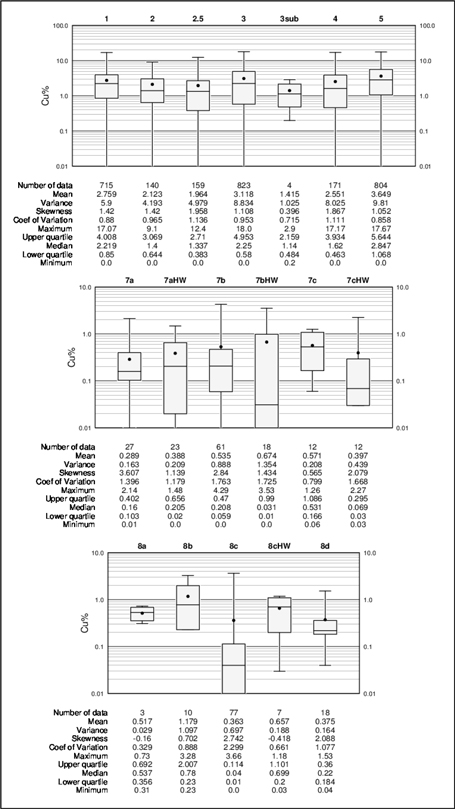

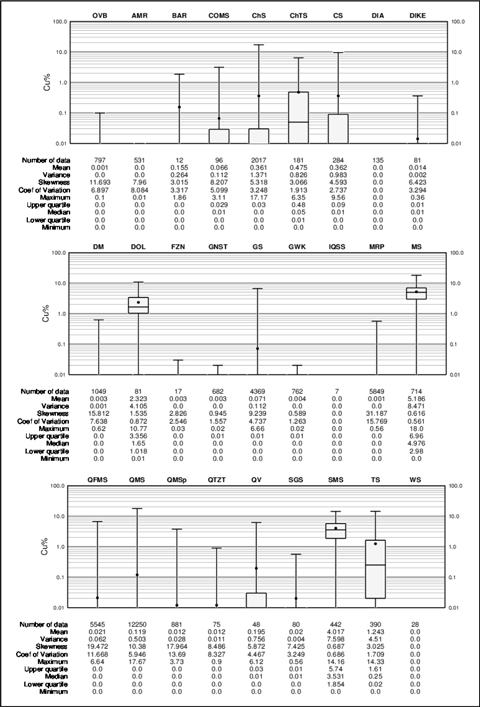

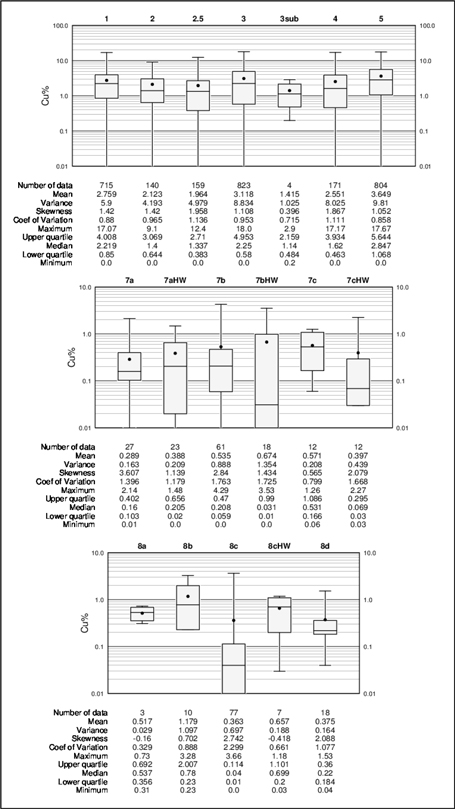

| Figure 14-10 | Boxplots of Copper by Logged Lithology Type (Sim, 2017) | 14-12 |

| Figure 14-11 | Boxplots of Copper by Lithology Domain (Sim, 2017) | 14-13 |

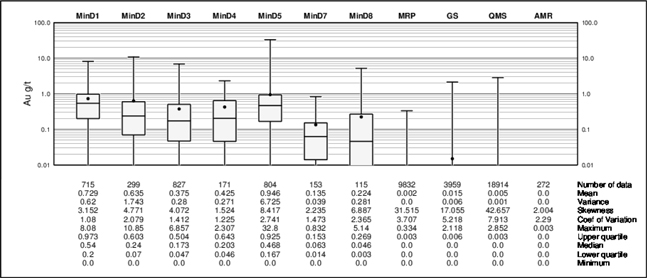

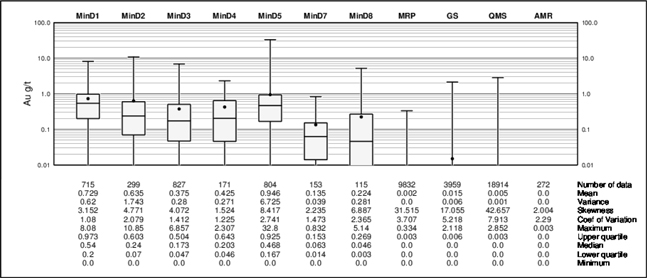

| Figure 14-12 | Boxplots of Gold by Lithology Domain (Sim, 2017) | 14-14 |

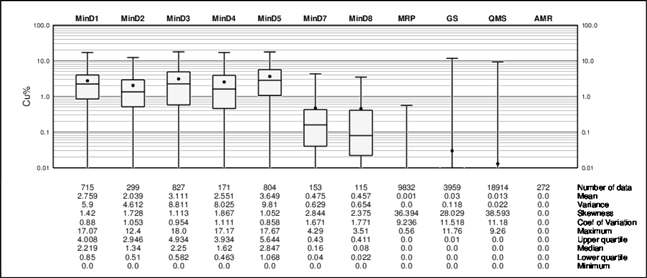

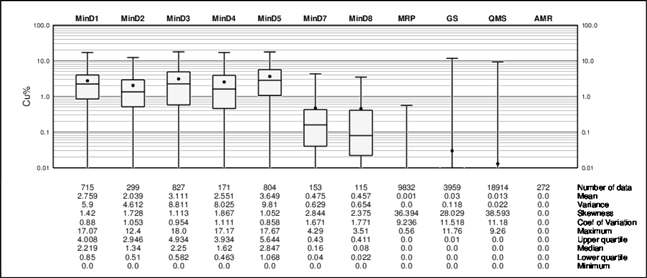

| Figure 14-13 | Boxplots of Copper by MinZone Domain (Sim, 2017) | 14-15 |

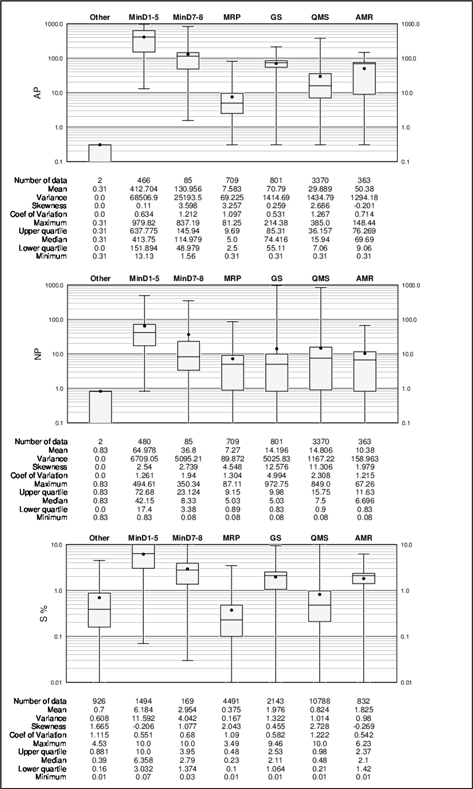

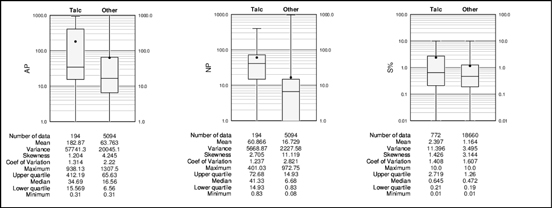

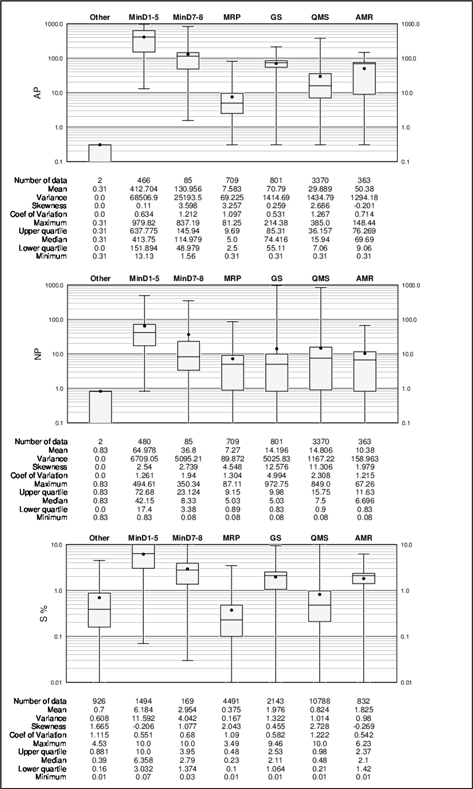

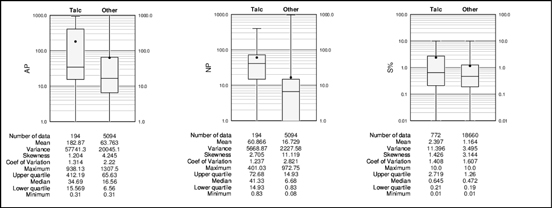

| Figure 14-14 | Boxplots of AP, NP and Sulphur by Lithology Domain (Sim, 2017) | 14-17 |

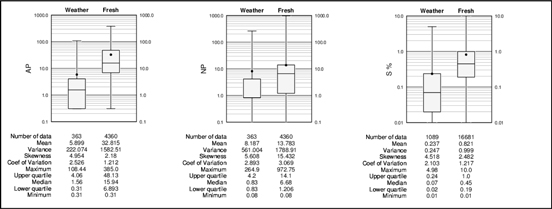

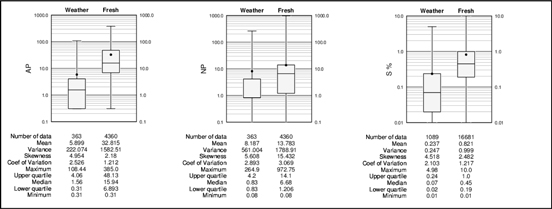

| Figure 14-15 | Boxplots of AP, NP and Sulphur by Talc Domain (Sim, 2017) | 14-18 |

| Figure 14-16 | Boxplots of AP, NP and Sulphur by Weathered Domain (Sim, 2017) | 14-18 |

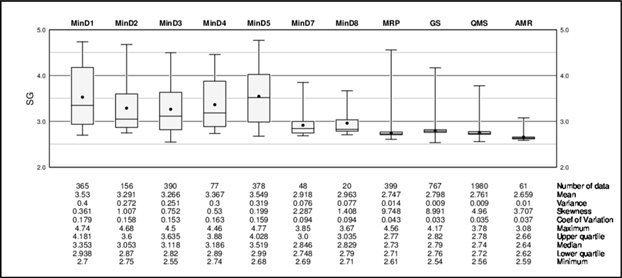

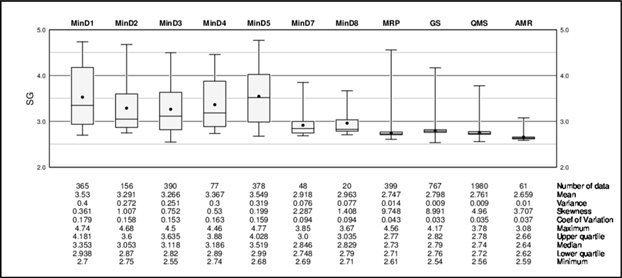

| Figure 14-17 | Boxplots of SG by MinZone and Lithology Group Domains (Sim, 2017) | 14-19 |

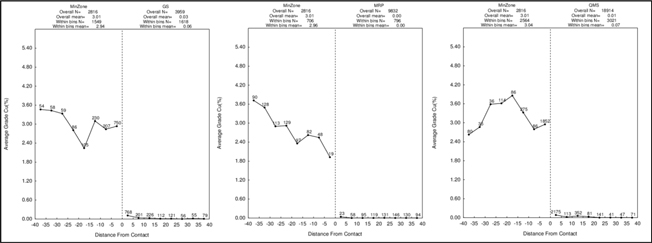

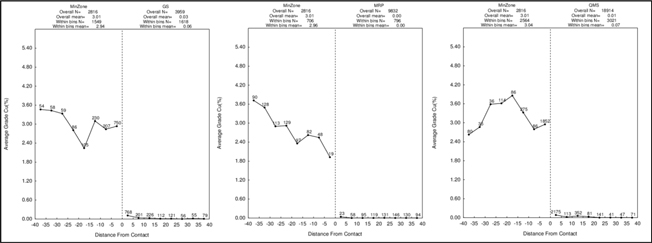

| Figure 14-18 | Contact Profiles of Copper Between MinZone and other Lithology Domain Groups (Sim, 2017) | 14-20 |

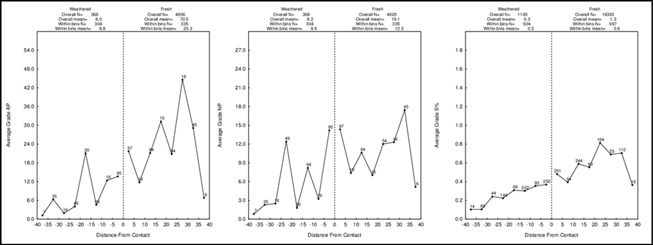

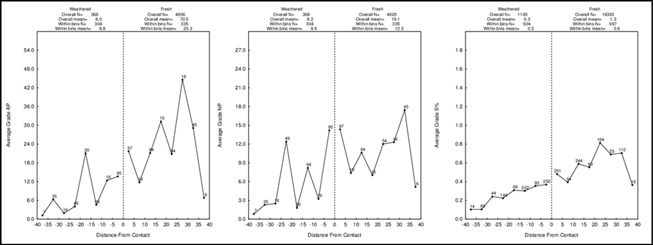

| Figure 14-19 | Contact Profile of AP, NP and Sulphur Between Weathered and Fresh Rocks (Sim, 2017) | 14-20 |

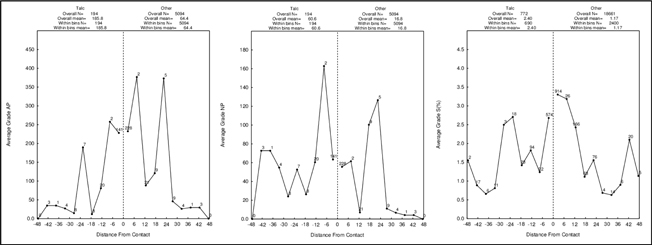

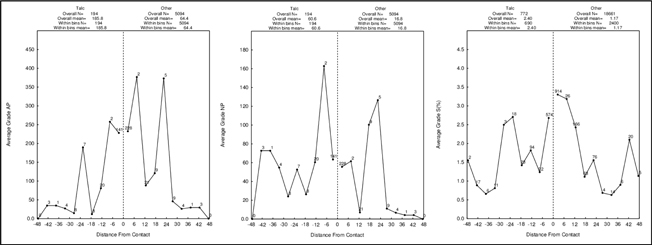

| Figure 14-20 | Contact Profile of AP, NP and Sulphur Inside / Outside of the Talc Domains (Sim, 2017) | 14-21 |

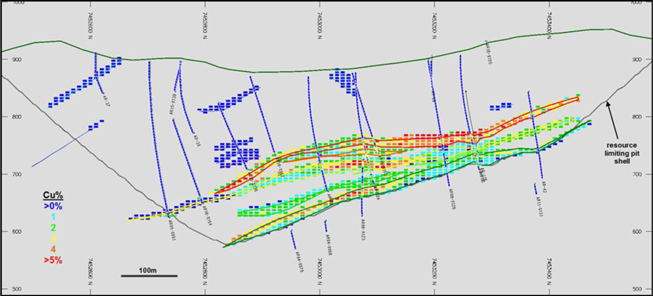

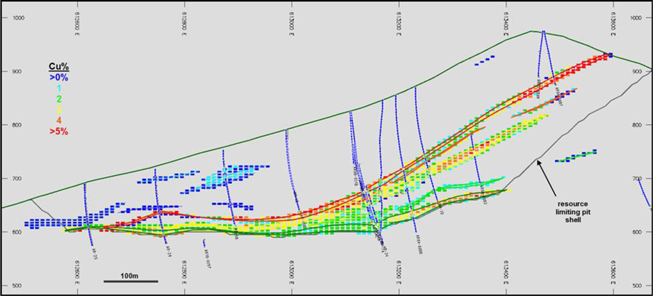

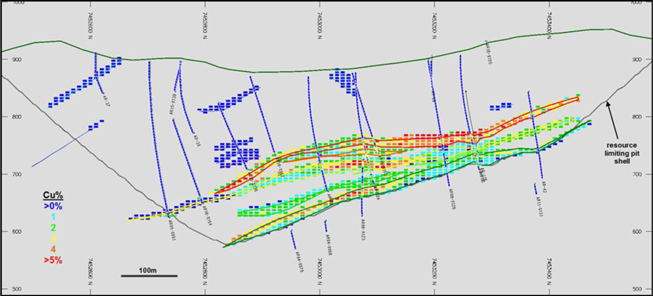

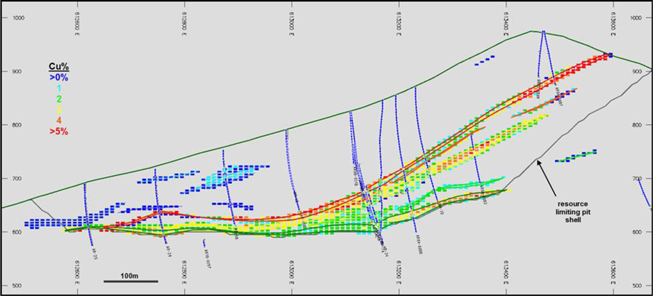

| Figure 14-21 | North-South Vertical Section of Copper Estimates in the Block Model (Section 613250E) (Sim, 2017) | 14-32 |

| Figure 14-22 | West-East Vertical Section of Copper Estimates in the Block Model (Section 7453000N) (Sim, 2017) | 14-33 |

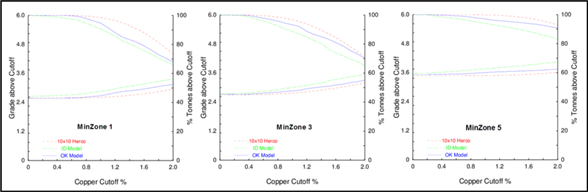

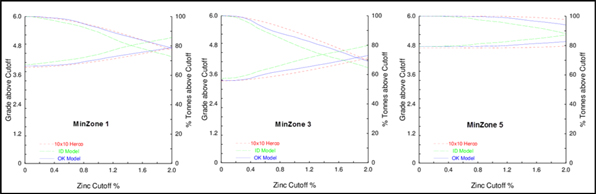

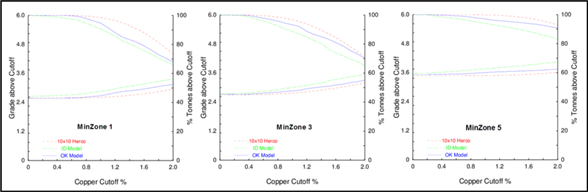

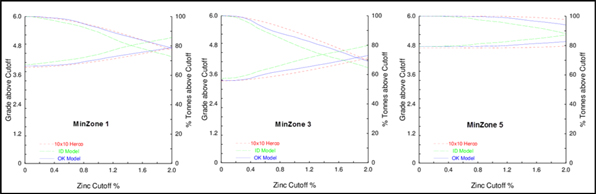

| Figure 14-23 | Herco and Model Grade / Tonnage Plots for Copper in MinZone Domains 1, 3 and 5 (Sim, 2017) | 14-34 |

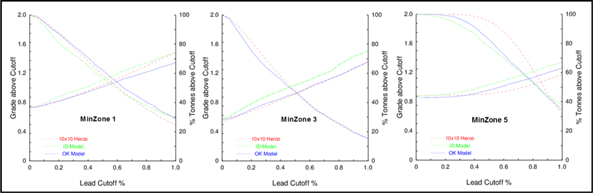

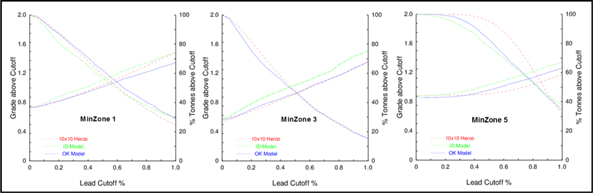

| Figure 14-24 | Herco and Model Grade / Tonnage Plots for Lead in MinZone Domains 1, 3 and 5 (Sim, 2017) | 14-34 |

| Figure 14-25 | Herco and Model Grade / Tonnage Plots for Zinc in MinZone Domains 1, 3 and 5 (Sim, 2017) | 14-34 |

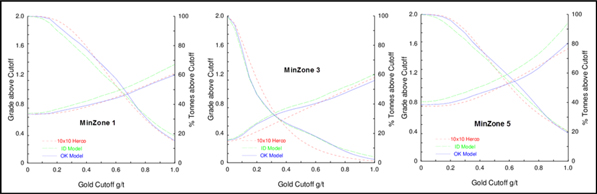

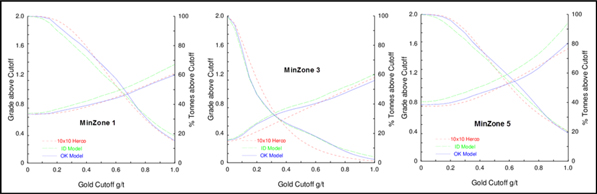

| Figure 14-26 | Herco and Model Grade / Tonnage Plots for Gold in MinZone Domains 1, 3 and 5 (Sim, 2017) | 14-35 |

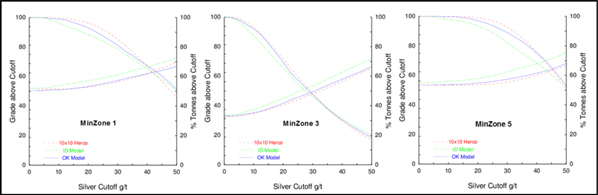

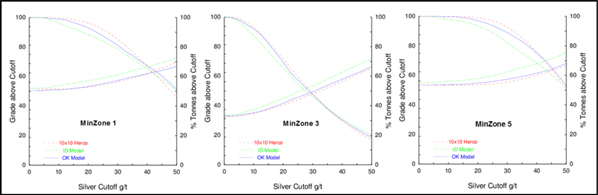

| Figure 14-27 | Herco and Model Grade / Tonnage Plots for Silver in MinZone Domains 1, 3 and 5 (Sim, 2017) | 14-35 |

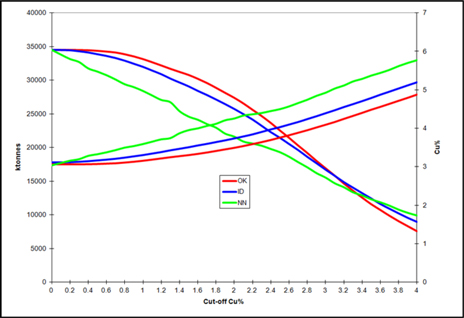

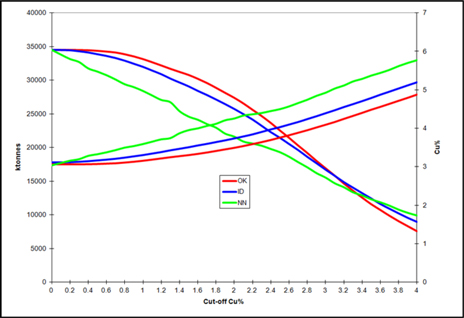

| Figure 14-28 | Comparison of Copper Model Types in MinZone Domains 1, 3 and 5 (Sim, 2017) | 14-36 |

| Figure 14-29 | Comparison of Lead Model Types in MinZone Domains 1, 3 and 5 (Sim, 2017) | 14-36 |

| Figure 14-30 | Comparison of Zinc Model Types in MinZone Domains 1, 3 and 5 (Sim, 2017) | 14-37 |

| Figure 14-31 | Comparison of Gold Model Types in MinZone Domains 1, 3 and 5 (Sim, 2017) | 14-37 |

| Figure 14-32 | Comparison of Silver Model Types in MinZone Domains 1, 3 and 5 (Sim, 2017) | 14-38 |

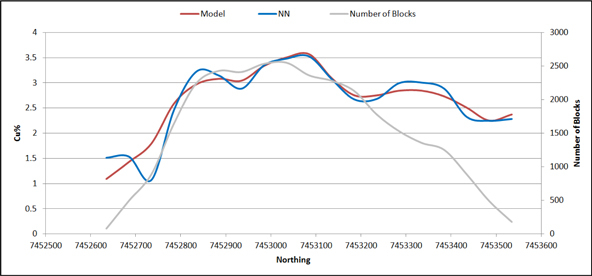

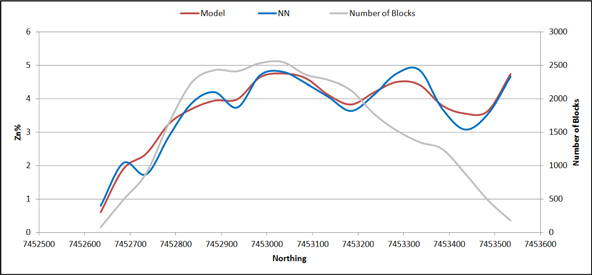

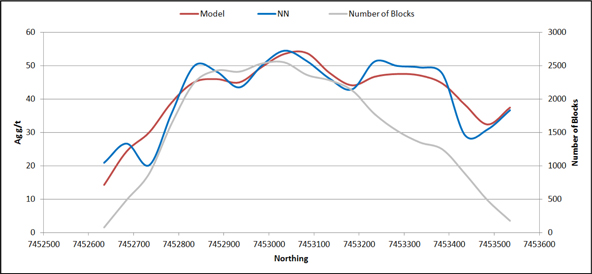

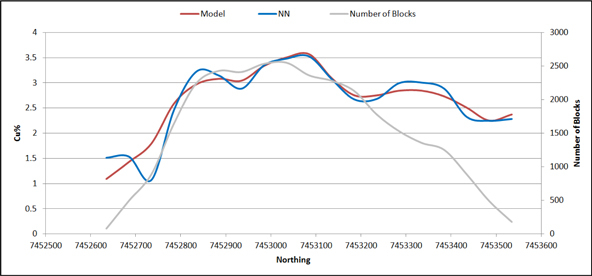

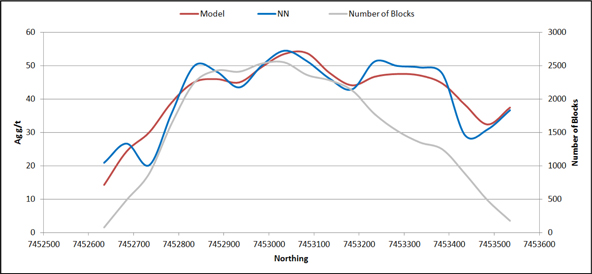

| Figure 14-33 | Swath Plot of Copper in MinZone Domains 1, 3 and 5 (Sim, 2017) | 14-39 |

| Trilogy Metals Inc. | xii | |

| NI 43-101 Technical Report on the Arctic Project, | | |

| Northwest Alaska | | |

| | | |

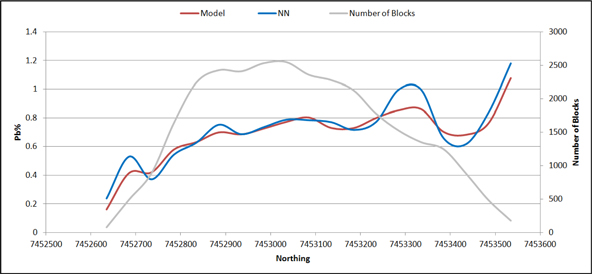

| Figure 14-34 | Swath Plot of Lead in MinZone Domains 1, 3 and 5 (Sim, 2017) | 14-39 |

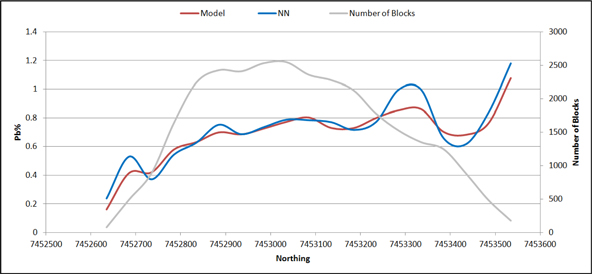

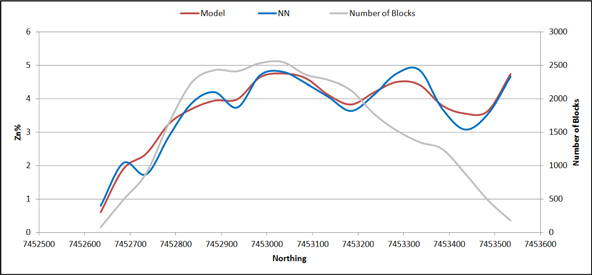

| Figure 14-35 | Swath Plot of Zinc in MinZone Domains 1, 3 and 5 (Sim, 2017) | 14-40 |

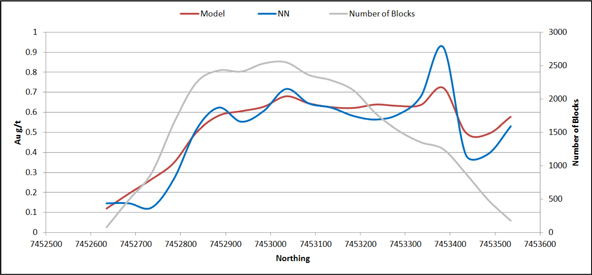

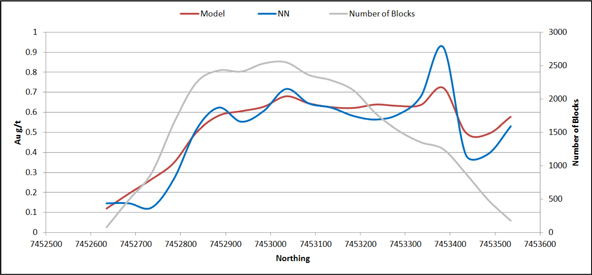

| Figure 14-36 | Swath Plot of Gold in MinZone Domains 1, 3 and 5 (Sim, 2017) | 14-40 |

| Figure 14-37 | Swath Plot of Silver in MinZone Domains 1, 3 and 5 (Sim, 2017) | 14-41 |

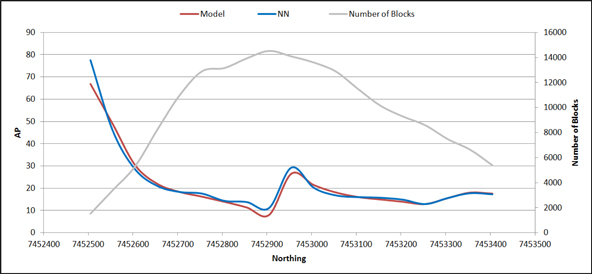

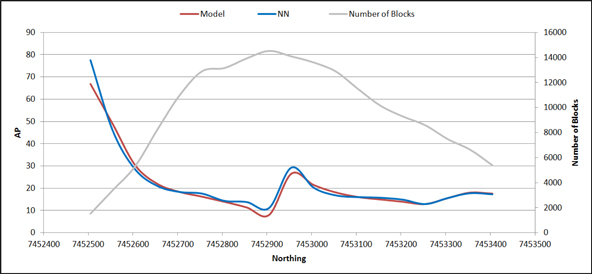

| Figure 14-38 | Swath Plot of AP in Rocks Outside of the MinZone Domains (Sim, 2017) | 14-41 |

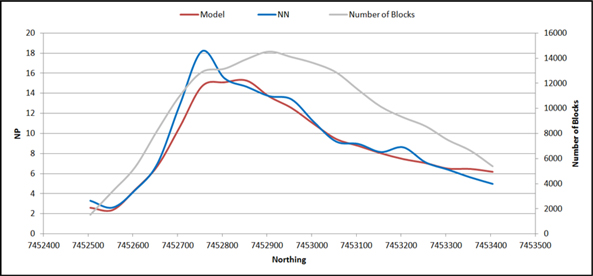

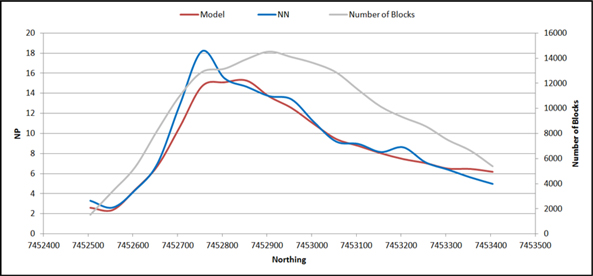

| Figure 14-39 | Swath Plot of NP in Rocks Outside of the MinZone Domains (Sim, 2017) | 14-42 |

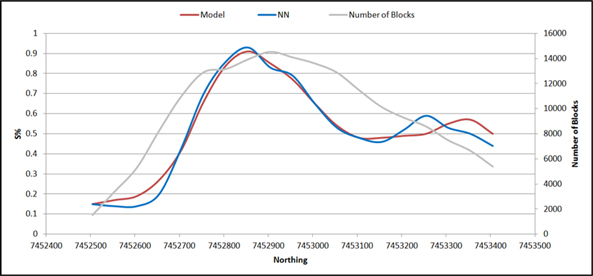

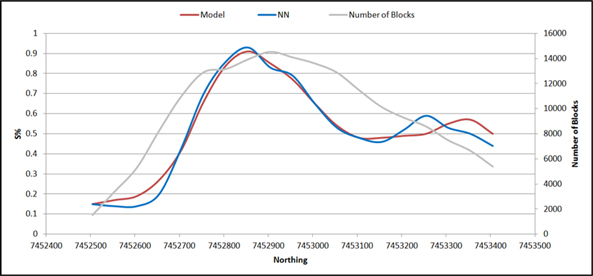

| Figure 14-40 | Swath Plot of Sulphur Rocks Outside of the MinZone Domains (Sim, 2017) | 14-42 |

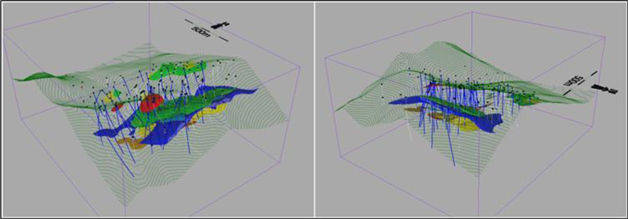

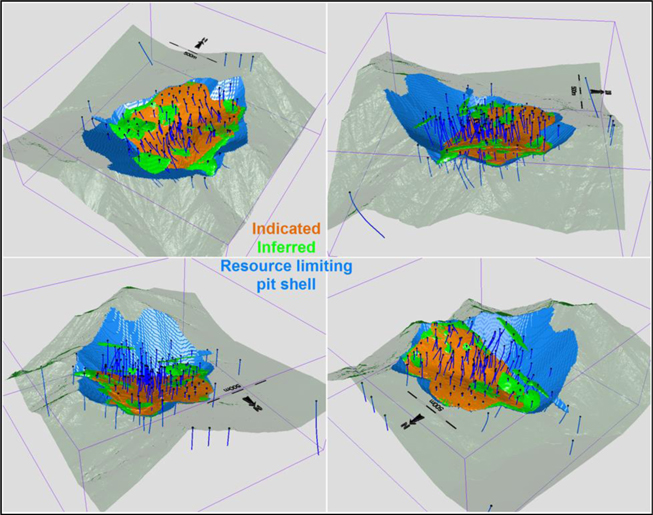

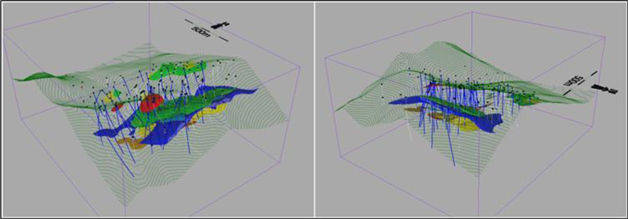

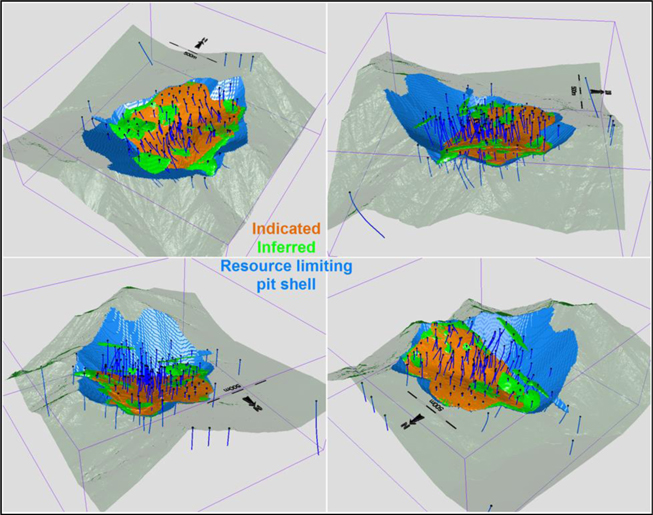

| Figure 14-41 | Isometric Views of Arctic Mineral Resource (Sim, 2017) | 14-46 |

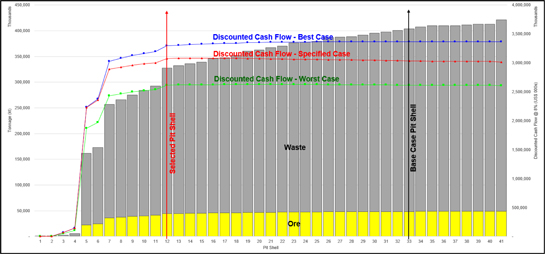

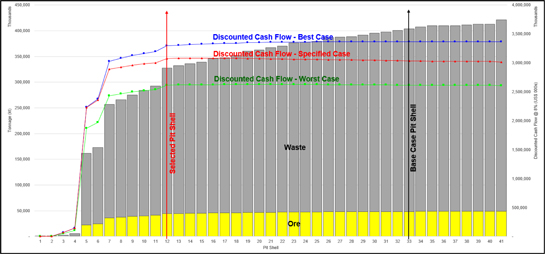

| Figure 15-1 | Pit-by-Pit Analysis | 15-3 |

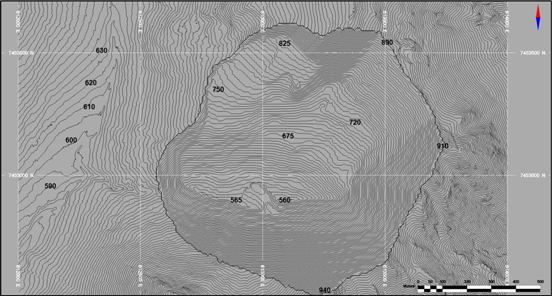

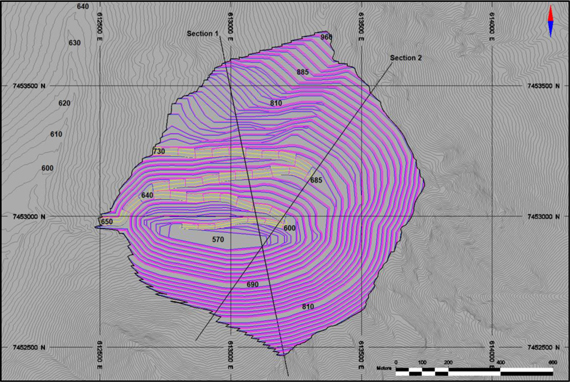

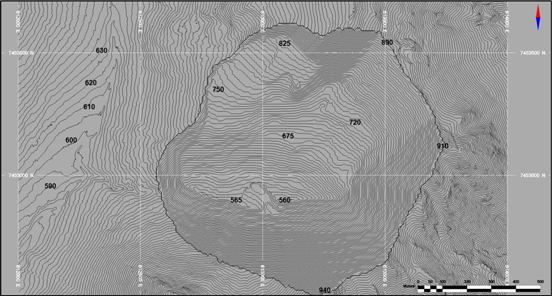

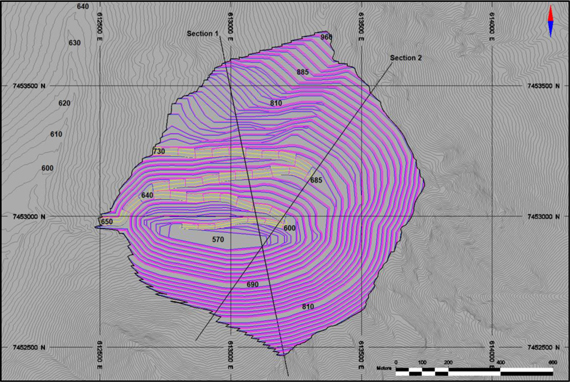

| Figure 15-2 | Selected Pit Shell | 15-4 |

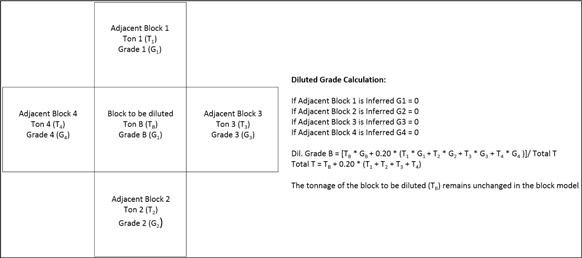

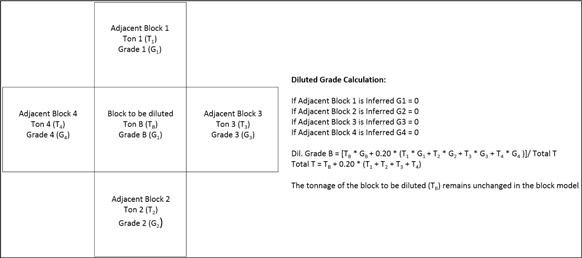

| Figure 15-3 | Contact Dilution Estimation Procedure | 15-5 |

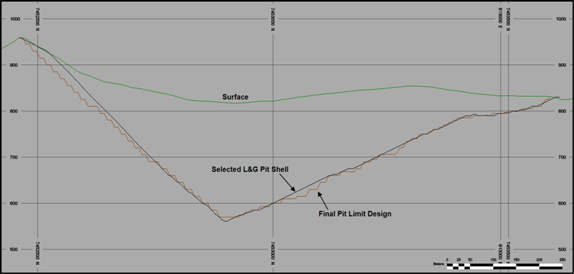

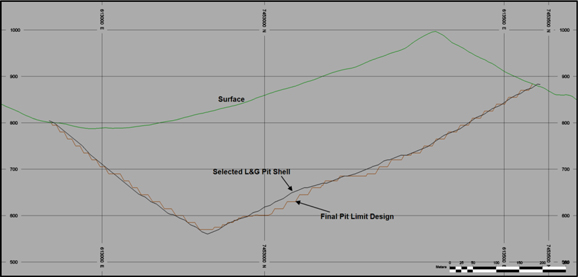

| Figure 16-1 | Ultimate Pit Design | 16-2 |

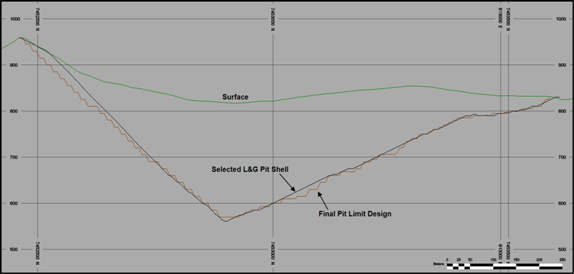

| Figure 16-2 | Section 1 Showing Mine Design and Selected Pit Shell (looking West) | 16-2 |

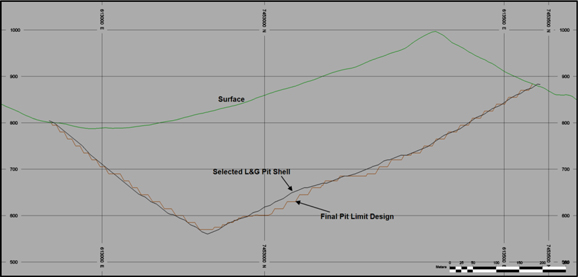

| Figure 16-3 | Section 2 Showing Mine Design and Selected Pit Shell (looking North-West) | 16-3 |

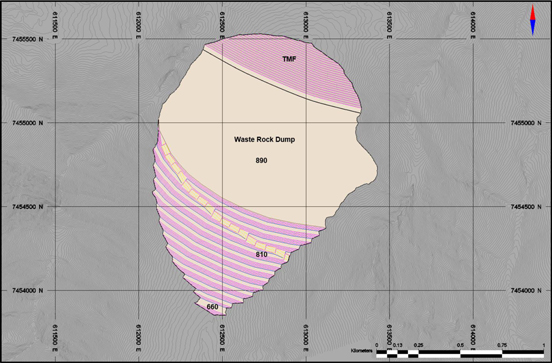

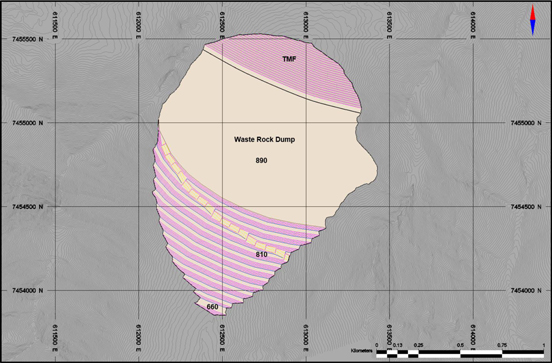

| Figure 16-4 | Waste Rock Dump | 16-4 |

| Figure 16-5 | Ore Stockpile | 16-5 |

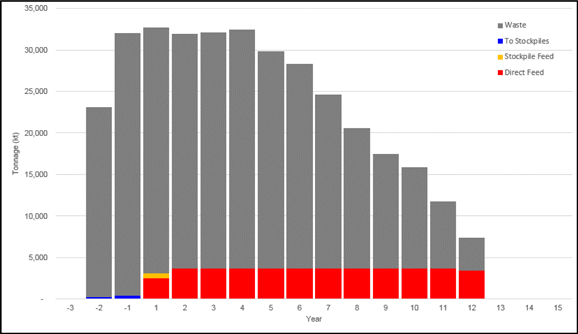

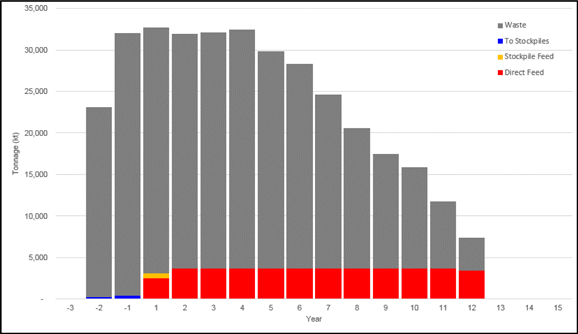

| Figure 16-6 | Production Schedule | 16-6 |

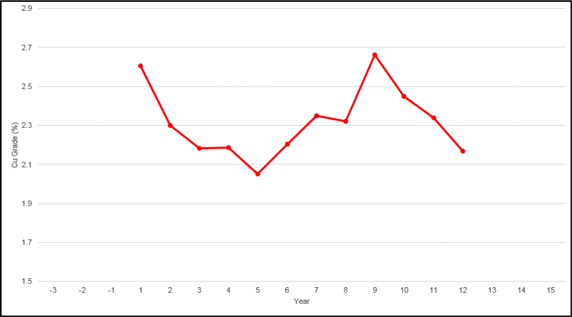

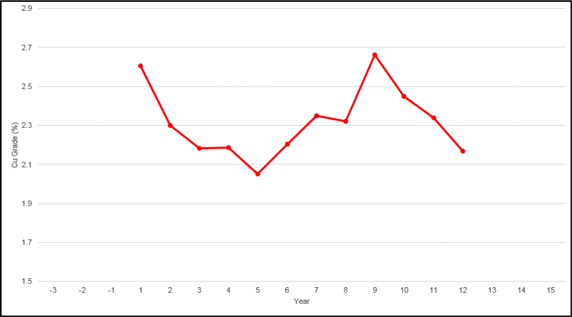

| Figure 16-7 | Scheduled Cu Feed Grade | 16-7 |

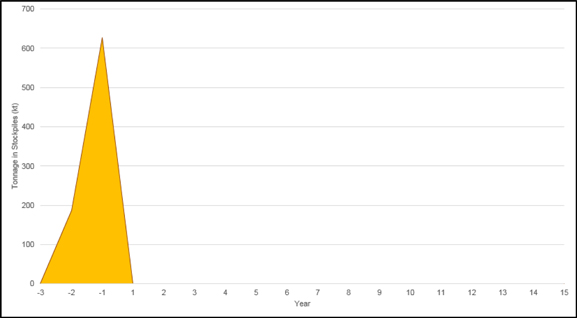

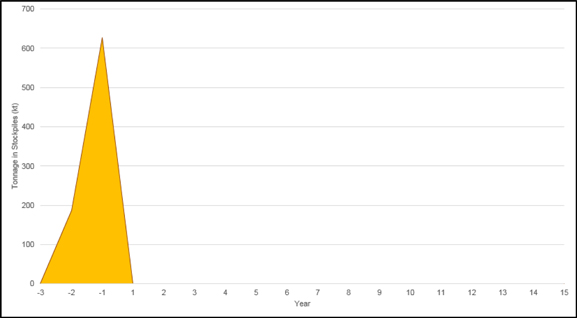

| Figure 16-8 | Stockpile Balance | 16-7 |

| Figure 17-1 | Simplified Process Flowsheet | 17-3 |

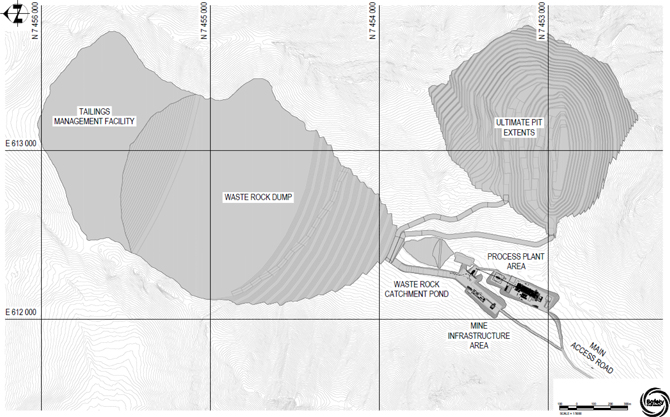

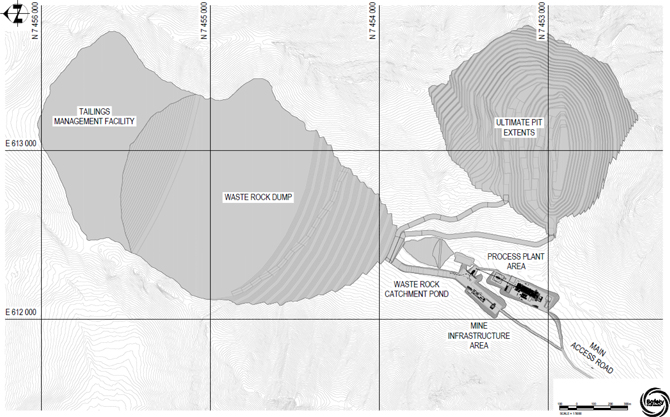

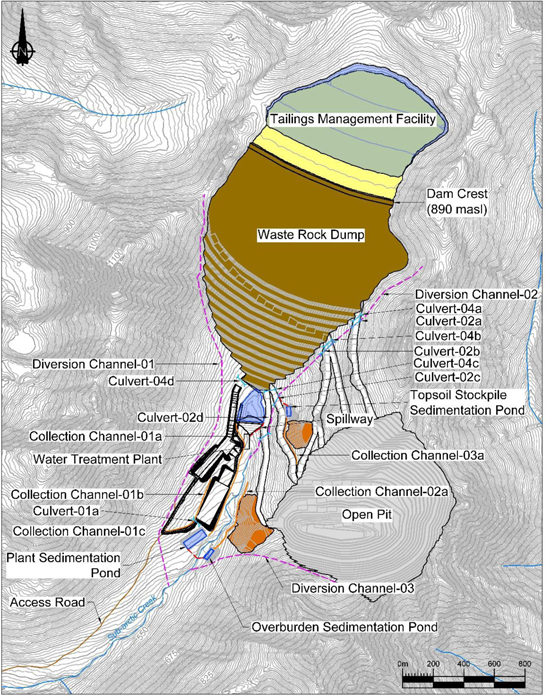

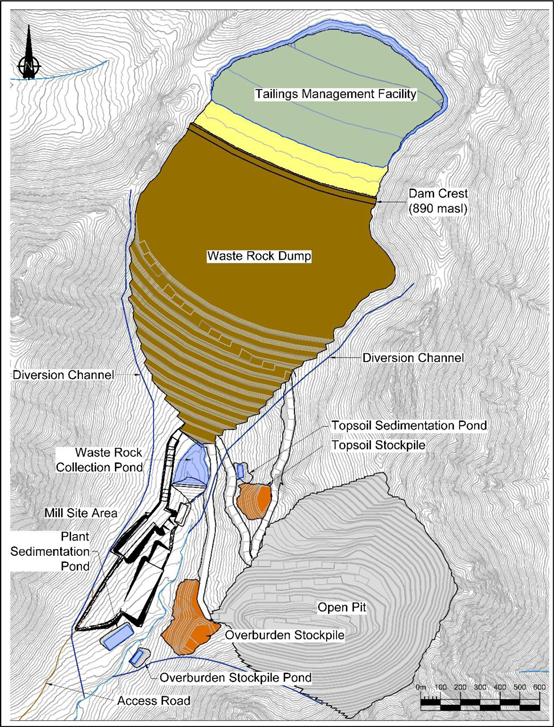

| Figure 18-1 | Proposed Location of the Processing Plant and Other Buildings (Ausenco, 2018) | 18-2 |

| Figure 18-2 | Proposed Site Layout (Ausenco, 2018) | 18-3 |

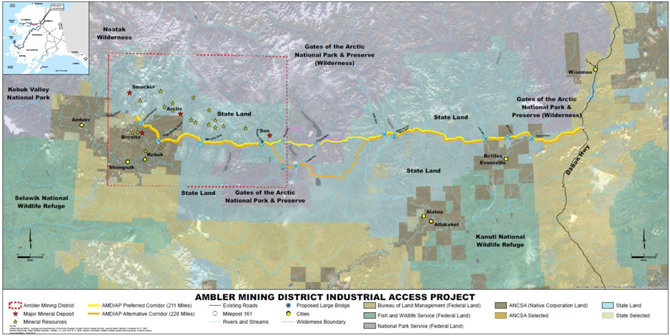

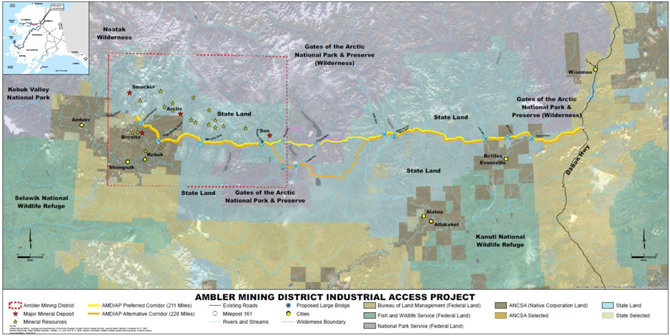

| Figure 18-3 | Proposed Route of AMDIAP Road (Ambler Access Website 2018) | 18-4 |

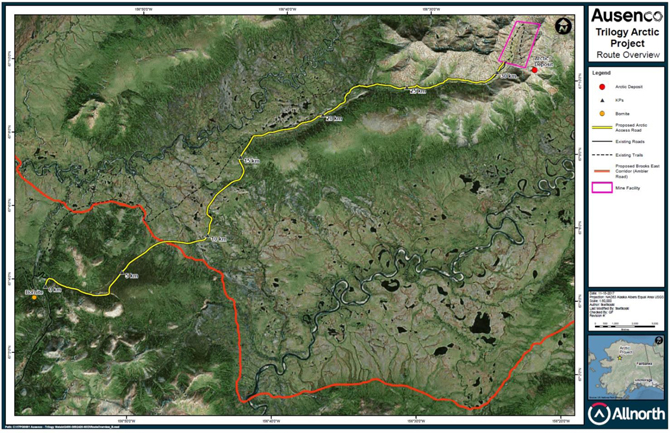

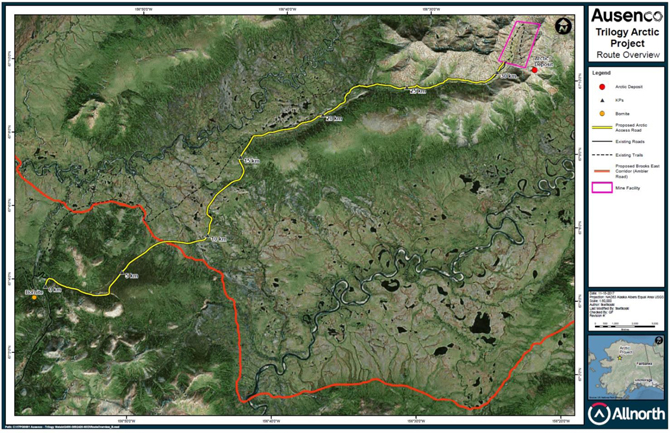

| Figure 18-4 | Arctic Access Road (AllNorth 2017) | 18-5 |

| Figure 18-5 | Surface Water Management Plan during Operations | 18-8 |

| Figure 18-6 | Cross Section through the TMF Starter Dam to Elevation 830 m | 18-14 |

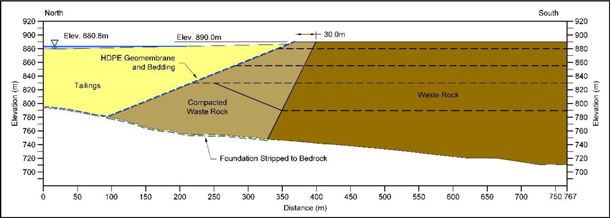

| Figure 18-7 | Cross Section of the TMF and WRD at Final Design Elevation | 18-15 |

| Figure 18-8 | General Location of WRD and Stockpiles | 18-16 |

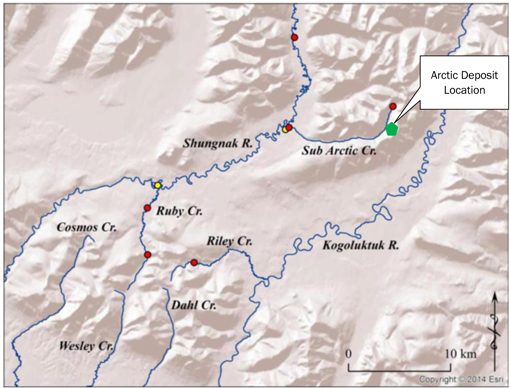

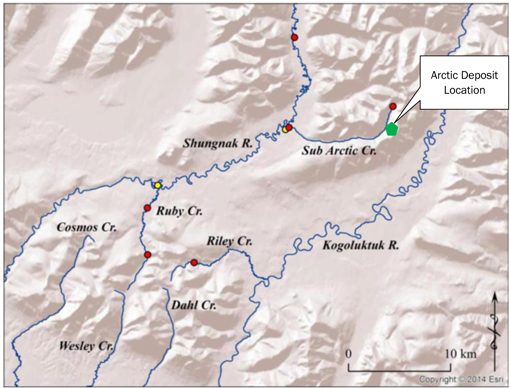

| Figure 20-1 | Current Water Quality and Hydrology Stations Location Map | 20-6 |

| Figure 20-2 | 2016 Aquatics Survey Sample Sites | 20-10 |

| Figure 22-1 | Pre-tax NPV Sensitivity Analysis (Ausenco, 2018) | 22-2 |

| Figure 22-2 | Pre-tax IRR Sensitivity Analysis (Ausenco, 2018) | 22-2 |

| Acme Analytical Laboratories Ltd. | AcmeLabs |

| Alaska Department of Environmental Conservation | ADEC |

| Alaska Department of Fish and Game | ADF&G |

| Alaska Department of Natural Resources | ADNR |

| Alaska Department of Transportation | ADOT |

| Alaska Industrial Development and Export Authority | AIDEA |

| Alaska Native Claims Settlement Act | ANCSA |

| Alaska Native Regional Corporations | ANCSA Corporations |

| Ambler Mining District Industrial Access Project | AMDIAP |

| Trilogy Metals Inc. | xiii | |

| NI 43-101 Technical Report on the Arctic Project, | | |

| Northwest Alaska | | |

| | | |

| Andover Mining Corp. | Andover |

| Annual Hardrock Exploration Activity | AHEA |

| atomic absorption | AA |

| atomic absorption spectroscopy | AAS |

| atomic emission spectroscopy | ICP_AES |

| Audio-Frequency Magneto-Telluric | AMT |

| BD Resource Consulting, Inc. | BDRC |

| Bear Creek Mining Corporation | BCMC |

| Arctic Property | the Property |

| Canadian Institute of Mining, Metallurgy, and Petroleum | CIM |

| Circular corrugated steel pipes | CSP |

| complex resistivity induced polarization | CRIP |

| Controlled Source Audio-frequency Magneto-Telluric | CSAMT |

| Electromagnetic | EM |

| Environmental Impact Statement | EIS |

| Environmental Protection Agency | EPA |

| Exploration Agreement and Option to Lease | NANA Agreement |

| Fugro Airborne Surveys | Fugro |

| GeoSpark Consulting Inc. | GeoSpark |

| General and Administrative. | G&A |

| High density sludge | HDS |

| inductively coupled plasma | ICP |

| inductively coupled plasma-mass | ICP-MS |

| Internal Rate of Return | IRR |

| International Organization for Standardization | ISO |

| Kennecott Exploration Company and Kennecott Arctic Company | Kennecott |

| Kennecott Research Centre | KRC |

| LiDAR | Light Detection and Ranging |

| liquefied natural gas | LNG |

| life of mine | LOM |

| Mine Development Associates | MDA |

| meters above sea level | masl |

| NANA Regional Corporation, Inc. | NANA |

| National Environmental Policy Act | NEPA |

| National Instrument 43-101 | NI 43-101 |

| natural source audio-magnetotelluric | NSAMT |

| naturally occurring asbestos | NOA |

| net present value | NPV |

| net smelter return | NSR |

| North American Datum | NAD |

| Northern Land Use Research Inc. | NLUR Inc. |

| Northwest Arctic Borough | NWAB |

| Trilogy Metals Inc. | Trilogy Metals |

| NovaGold Resources Inc. | NovaGold |

| Polarized Light Microscopy | PLM |

| Quality Assurance/Quality Control | QA/QC |

| Trilogy Metals Inc. | xiv | |

| NI 43-101 Technical Report on the Arctic Project, | | |

| Northwest Alaska | | |

| | | |

| SIM Geological Inc. | SGI |

| single point | SP |

| Teck Resources Ltd. | Teck |

| Tailings management facility | TMF |

| Universal Transverse Mercator | UTM |

| US Army Corps of Engineers | USACE |

| US Geological Survey | USGS |

| volcanogenic massive sulphide | VMS |

| WH Pacific, Inc. | WHPacific |

| Waste rock collection pond | WCRP |

| Waste rock dump | WRD |

| Water treatment plant | WTP |

| Zonge International Inc. | Zonge |

| Trilogy Metals Inc. | xv | |

| NI 43-101 Technical Report on the Arctic Project, | | |

| Northwest Alaska | | |

| | | |

Trilogy Metals Inc. (Trilogy Metals or Trilogy) commissioned Ausenco Engineering Canada Inc. (Ausenco) to compile a Technical Report (the Report) on the results of a Pre-Feasibility Study on the Arctic Deposit, part of the Arctic Project (the Project) in the Ambler Mining District of Northwest Alaska

The Report supports disclosure by Trilogy Metals in the news release dated 20 February 2018, entitled “Trilogy Metals Announces Pre-Feasibility Study Results and Reserves for the Arctic Project, Alaska”.

The firms and consultants who are providing Qualified Persons (QPs) responsible for the content of this Report, which is based on the Pre-Feasibility Study completed in 2018 (the 2018 PFS) and supporting documents prepared for the 2018 PFS, are, in alphabetical order, Amec Foster Wheeler Americas Ltd. (Amec Foster Wheeler); BD Resource Consulting, Inc., (BDRC); SRK Consulting (Canada) Inc. (SRK), and SIM Geological Inc. (SIM).

All amounts are in US dollars unless otherwise stated.

| 1.2 | Management Property Description and Location |

The Arctic Project (Property or Project) is located in the Ambler mining district (Ambler District) of the southern Brooks Range, in the NWAB of Alaska. The Property is geographically isolated with no current road access or nearby power infrastructure. The Project is located 270 km east of the town of Kotzebue, 36 km north of the village of Kobuk, and 260 km west of the Dalton Highway, an all-weather state-maintained highway.

NovaGold Resources Inc. (NovaGold) acquired the Arctic Project from Kennecott Exploration Company and Kennecott Arctic Company (collectively, Kennecott) in 2004. In 2012, NovaGold transferred all copper projects to NovaCopper Inc. NovaCopper Inc. subsequently underwent a name change to Trilogy Metals Inc. in 2016. The Project comprises approximately 46,336 ha of State of Alaska mining claims and US Federal patented mining claims in the Kotzebue Recording District. The Arctic Project land tenure consists of 1,386 contiguous claims, including 883 40-acre State claims, 503 160-acre State claims, and eighteen Federal patented claims comprising 272 acres (110 ha) held in the name of NovaCopper US Inc., a wholly owned subsidiary of Trilogy Metals.

Surface use of the private land held as Federal patented claims is limited only by reservations in the patents and by generally-applicable environmental laws. Surface use of State claims allows the owner of the mining claim to make such use of the surface as is “necessary for prospecting for, extraction of, or basic processing of minerals.”

| Trilogy Metals Inc. | 1-16 | |

| NI 43-101 Technical Report on the Arctic Project, | | |

| Northwest Alaska | | |

| | | |

Under the Kennecott Purchase and Termination Agreement, Kennecott retained a 1% net smelter return (NSR) royalty that is purchasable at any time by Trilogy Metals for a one-time payment of $10 million.

The NANA Regional Corporation, Inc. (NANA) controls lands granted under the Alaska Native Claims Settlement Act (ANCSA) to the south of the Project boundary. Trilogy Metals and NANA have entered into an agreement (the NANA Agreement) that consolidates Trilogy Metals’ and NANA’s land holdings into an approximately 142,831 ha land package and provides a framework for the exploration and development of the area. The NANA Agreement has a term of 20 years, with an option in favour of Trilogy Metals to extend the term for an additional 10 years. If, following receipt of a feasibility study and the release for public comment of a related draft environmental impact statement, Trilogy Metals decides to proceed with construction of a mine on the lands subject to the NANA Agreement, NANA will have 120 days to elect to either (a) exercise a non-transferrable back-in-right to acquire between 16% and 25% (as specified by NANA) of that specific project; or (b) not exercise its back-in-right, and instead receive a net proceeds royalty equal to 15% of the net proceeds realized by Trilogy Metals from such project. In the event that NANA elects to exercise its back-in-right, the parties will, as soon as reasonably practicable, form a joint venture with NANA electing to participate between 16% to 25%, and Trilogy Metals owning the balance of the interest in the joint venture. If Trilogy Metals decides to proceed with construction of a mine on its own lands subject to the NANA Agreement, NANA will enter into a surface use agreement with Trilogy Metals which will afford Trilogy Metals access to the project along routes approved by NANA. In consideration for the grant of such surface use rights, Trilogy Metals will grant NANA a 1% net smelter royalty on production and provide an annual payment on a per acre basis.

Trilogy Metals has entered into an option agreement with South32 Limited (South32) whereby South32 has the right to form a 50/50 Joint Venture with respect to the Trilogy Metals’ Alaskan assets including the Arctic Project. Upon exercise of the option, Trilogy Metals will transfer its Alaskan assets, including the Arctic Project, and South32 will contribute a minimum of $150 million, to a newly formed joint venture.

| 1.3 | Geology and Mineralization |

The Arctic Deposit is considered to be a volcanogenic massive sulphide (VMS) deposit.

The Ambler mining district is located on the southern margin of the Brooks Range. Within the VMS belt, several deposits and prospects (including the Arctic Deposit) are hosted in the Ambler Sequence, a group of Middle Devonian to Early Mississippian, metamorphosed, bimodal volcanic rocks with interbedded tuffaceous, graphitic, and calcareous volcaniclastic metasediments. The Ambler sequence occurs in the upper part of the regional Anirak Schist. VMS-style mineralization is found along the entire 110 km strike length of the district.

| Trilogy Metals Inc. | 1-17 | |

| NI 43-101 Technical Report on the Arctic Project, | | |

| Northwest Alaska | | |

| | | |

Stratigraphically, the Ambler Sequence consists of variably metamorphosed calc-turbidites, overlain by calcareous schists with irregularly distributed mafic sills and pillow lavas. These are overlain by the Arctic-sulphide host section which consists mainly of fine-grained, carbonaceous siliciclastic rocks which are in turn overlain by reworked silicic volcanic rocks, including meta-rhyolite porphyries and most notably the regionally extensive Button Schist with its characteristically large relic phenocrysts. Greywacke sandstones, interpreted to be turbidites, occur throughout the section but are concentrated higher in the stratigraphy. Several rock units within the stratigraphy show substantial variation in local thickness as a consequence of basin morphology at the time of deposition.

Alteration at the Arctic Deposit is characterized by magnesium alteration, primarily as talc, chlorite, and phengite alteration products associated with the sulphide-bearing horizons and continuing in the footwall. Stratigraphically above the sulphide-bearing horizons, significant muscovite as paragonite is developed and results in a marked shift in Na/Mg (sodium/magnesium) ratios across the sulphide bearing horizons.

Mineralization occurs as stratiform semi-massive sulphide (SMS) to massive sulphide (MS) beds within primarily graphitic chlorite schists and fine-grained quartz sandstones. The sulphide beds average 4 m in thickness but vary from less than 1 m up to as much as 18 m in thickness.

The bulk of the mineralization occurs within eight modelled SMS and MS zones lying along the upper and lower limbs of the Arctic isoclinal anticline. All of the zones are within an area of roughly 1 km2 with mineralization extending to a depth of approximately 250 m below the surface. Mineralization is predominately coarse-grained sulphides consisting mainly of chalcopyrite, sphalerite, galena, tetrahedrite-tennantite, pyrite, arsenopyrite, and pyrrhotite. Trace amounts of electrum are also present.

Drilling at the Arctic Deposit and within the Ambler District has been ongoing since its initial discovery in 1967. Approximately 56,480 m of drilling has been completed within the Ambler District, including 39,323 m of drilling in 174 drill holes at the Arctic deposit or on potential extensions in 27 campaigns spanning 50 years. Drill programs were completed by Kennecott and its subsidiaries, Anaconda, and Trilogy Metals and its predecessor companies.

Core recoveries are acceptable. Geological and geotechnical logging is in line with industry generally-accepted practices. Drill collar and downhole survey data were collected using industry-recognised instrumentation and methods.

Between 2004 and 2006, NovaGold conducted a systematic drill core re-logging and re-sampling campaign of Kennecott and BCMC era drill holes. NovaGold either took 1 to 2 m samples every 10 m, or sampled entire lengths of previously unsampled core within a minimum of 1 m and a maximum or 3 m intervals. During the Trilogy Metals campaigns, sample intervals were determined by the geological relationships observed in the core and limited to a 3 m maximum length and 1 m minimum length. An attempt was made to terminate sample intervals at lithological and mineralization boundaries. Sampling was generally continuous from the top to the bottom of the drill hole. When the hole was in unmineralized rock, the sample length was generally 3 m, whereas in mineralized units, the sample length was shortened to 1 to 2 m.

| Trilogy Metals Inc. | 1-18 | |

| NI 43-101 Technical Report on the Arctic Project, | | |

| Northwest Alaska | | |

| | | |

Gold assays were determined using fire analysis followed by an atomic absorption spectroscopy (AAS) finish. An additional 49-element suite was assayed by inductively coupled plasma-mass spectroscopy (ICP-MS) methodology, following nitric acid aqua regia digestion. The copper, zinc, lead, and silver analyses were completed by atomic absorption (AA), following a triple acid digest, when overlimits.

Standard reference materials, blanks, duplicates and check samples have been regularly submitted at a combined level of 20% of sampling submissions for all NovaGold/NovaCopper/Trilogy Metals era campaigns. BDRC reviewed the QA/QC dataset and reports and found the sample insertion rate and the timeliness of results analysis meets or exceeds industry best practices.

Specific gravity (SG) measurements have been conducted on 3,023 samples in the database and range from a minimum of 2.43 to a maximum of 4.99 and average 3.08. The distribution of SG data is considered sufficient to support estimation in the resource model.

An aerial LiDAR survey was completed to support pre-feasibility level resource estimation, engineering design, environmental studies, and infrastructure layout evaluations. Agreement between surveyed drill hole collar elevations and a LIDAR topographic surface verifies the correctness of the digital topography for use in estimation.

It was concluded that the drill database and topographic surface for the Arctic Deposit is reliable and sufficient to support the current estimate of mineral resources.

| 1.5 | Mineral Processing and Metallurgical Testing |

Since 1970, metallurgical test work has been conducted to determine the flotation response of various samples extracted from the Arctic Deposit. In general, the samples tested produced similar metallurgical performances. In 2012, SGS Mineral Services (SGS) conducted a metallurgical test program to further study metallurgical responses of the samples produced from Zones 1, 2, 3, and 5 of the Arctic Deposit. The flotation test procedures used talc pre-flotation, conventional copper-lead bulk flotation and zinc flotation, followed by copper and lead separation. In general, the 2012 test results indicated that the samples responded well to the flowsheet tested. The average results of the locked cycle tests (without copper and lead separation) were as follows:

| · | The copper recoveries to the bulk copper-lead concentrates ranged from 89 to 93% excluding the Zone 1 & 2 composite which produced a copper recovery of approximately 84%; the copper grades of the bulk concentrates were 24 to 28%. |

| Trilogy Metals Inc. | 1-19 | |

| NI 43-101 Technical Report on the Arctic Project, | | |

| Northwest Alaska | | |

| | | |

| · | Approximately 92 to 94% of the lead was recovered to the bulk copper-lead concentrates containing 9 to 13% lead. |

| · | The zinc recovery was 84.2% from Composite Zone 1 & 2, 93.0% from Composite Zone 3 and 90.5% from Composite Zone 5. On average, the zinc grades of the concentrates produced were higher than 55%, excluding the concentrate generated from Composite Zone 1 & 2, which contained only 44.5% zinc. |

| · | Gold and silver were predominantly recovered into the bulk copper-lead concentrates. Gold recoveries to this concentrate ranged from 65 to 80%, and silver recoveries ranged from 80 to 86%. |

Using an open circuit procedure, the copper and lead separation tests on the bulk copper-lead concentrate produced from the locked cycle tests generated reasonable copper and lead separation. The copper concentrates produced contained approximately 28 to 31% copper, while the grades of the lead concentrates were in the range of 41% to 67% lead. In this test work program, it appeared that most of the gold reported to the copper concentrate and on average the silver was equally recovered into the copper and lead concentrates. Subsequent test work to better define the copper and lead separation process was conducted in 2017, including a more detailed evaluation of the precious metal deportment in the copper and lead separation process.

The 2012 grindability test results showed that the Bond ball millwork index (BWi) tests ranged from 6.5 to 11 kWh/t and abrasion index (Ai) tests fluctuated from 0.017 to 0.072 g for the mineralized samples. The data indicate that the samples are neither resistant nor abrasive to ball mill grinding. The materials are considered to be soft or very soft in terms of grinding requirements.

In 2017, ALS Metallurgy conducted detailed copper and lead separation flotation test work using a bulk sample of copper-lead concentrate produced from the operation of a pilot plant. This test work confirmed high lead recoveries in locked cycle testing of the copper-lead separation process and confirmed precious metal recoveries into the representative copper and lead concentrates. This test work indicated a clear tendency of the gold values to follow the lead concentrate, giving it a significant gold grade and value.

The conclusions of test work conducted both in 2012 and 2017 indicate that the Arctic materials are well-suited to the production of high-quality copper and zinc concentrates using flotation techniques which are industry standard. Copper and zinc recovery data is reported in the range of 91 to 89% respectively, which reflects the high grade nature of the deposit as well as the coarse grained nature of these minerals. Lead concentrates have the potential to be of high quality and can also be impacted by zones of very high talc contents which has the potential to dilute lead concentrate grades. The lead concentrate is also shown to be rich in precious metals, which has some advantages in terms of marketability of this material.

An overall metallurgical balance for the project is summarized in Table 1-1. This table of metal recoveries is based on an expected average recovery over the entire resource based on grades and detailed results of metallurgical test work conducted in 2012 and 2017.

| Trilogy Metals Inc. | 1-20 | |

| NI 43-101 Technical Report on the Arctic Project, | | |

| Northwest Alaska | | |

| | | |

Table 1-1 Summary of Overall Metal Recovery – Arctic Project

| | | Concentrate Grade | Metal Recoveries |

| Process stream | Mass

% | Cu

% | Pb

% | Zn

% | Au

g/t | Ag

g/t | Cu

% | Pb

% | Zn

% | Au

% | Ag

% |

| Process Feed | 100.0 | 2.31 | 0.59 | 3.22 | 0.49 | 38 | | | | | |

| Copper Conc | 7.15 | 29.5 | 0.75 | 3.0 | 0.35 | 240 | 91.2 | 8.7 | 5.7 | 5.2 | 45.1 |

| Lead Conc | 1.02 | 1.7 | 50.0 | 0.9 | 28.0 | 1300 | 0.7 | 80.0 | 0.3 | 58.9 | 34.9 |

| Zinc Conc | 4.85 | 1.7 | 0.5 | 59.2 | 0.55 | 49.6 | 3.6 | 4.0 | 91.0 | 5.5 | 6.3 |

| Process Tailings | 86.98 | 0.12 | 0.05 | 0.15 | 0.17 | 6 | 4.5 | 7.3 | 3.0 | 30.5 | 13.7 |

| 1.6 | Mineral Resource Estimate |

The mineral resource estimate has been prepared by Robert Sim, P.Geo. SIM Geological Inc. and Bruce M. Davis, FAusIMM, BD Resource Consulting, Inc.

Mineral resource estimates are made from a 3D block model based on geostatistical applications using commercial mine planning software (MineSight® v11.60-2). The block model has a nominal block size measuring 10 x 10 x 5 m and utilizes data derived from 152 drill holes in the vicinity of the Arctic deposit. The resource estimate was generated using drill hole sample assay results and the interpretation of a geological model which relates to the spatial distribution of copper, lead, zinc, gold and silver. Interpolation characteristics were defined based on the geology, drill hole spacing, and geostatistical analysis of the data. The effects of potentially anomalous high-grade sample data, composited to two metre intervals, are controlled by limiting the distance of influence during block grade interpolation. The grade models have been validated using a combination of visual and statistical methods. The resources were classified according to their proximity to the sample data locations and are reported, as required by NI 43-101, according to the CIM Definition Standards for Mineral Resources and Mineral Reserves. Model blocks estimated by three or more drill holes spaced at a maximum distance of 100 metres are included in the Indicated category. Inferred blocks are within a maximum distance of 150 metres from a drill hole. The estimate of Indicated and Inferred mineral resources is within a limiting pit shell derived using projected technical and economic parameters.

The mineral resource estimate is listed in Table 1-2.

| Trilogy Metals Inc. | 1-21 | |

| NI 43-101 Technical Report on the Arctic Project, | | |

| Northwest Alaska | | |

| | | |

Table 1-2 Mineral Resource Estimate for the Arctic Deposit

| | | Average Grade: | Contained metal: |

| Class | M tonnes | Cu % | Pb% | Zn% | Au g/t | Ag g/t | Cu Mlbs | Pb Mlbs | Zn Mlbs | Au koz | Ag Moz |

| Indicated | 36.0 | 3.07 | 0.73 | 4.23 | 0.63 | 47.6 | 2441 | 581 | 3356 | 728 | 55 |

| Inferred | 3.5 | 1.71 | 0.60 | 2.72 | 0.36 | 28.7 | 131 | 47 | 210 | 40 | 3 |

| (1) | Resources stated as contained within a pit shell developed using metal prices of US$3.00/lb Cu, $0.90/lb Pb, $1.00/lb Zn, $1300/oz Au and $18/oz Ag and metallurgical recoveries of 92% Cu, 77% Pb, 88% Zn, 63% Au and 56% Ag and operating costs of $3/t mining and $35/t process and G&A. The average pit slope is 43 degrees. |

| (2) | The base case cut-off grade is 0.5% copper equivalent. CuEq = (Cu%x0.92)+(Zn%x0.290)+(Pb%x0.231)+(Augptx0.398)+(Aggptx0.005). |

| (3) | The Mineral Resource Estimate is reported on a 100% basis without adjustments for metallurgical recoveries. |

| (4) | The Estimate of Mineral Resources is inclusive of Mineral Reserves. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the Mineral Resources will be converted into Mineral Reserves. |

| (5) | Inferred resources have a great amount of uncertainty as to whether they can be mined legally or economically. It is reasonably expected that a majority of Inferred resources will be converted to Indicated resources with additional exploration. |

| (6) | Effective date of the Mineral Resource Estimate is April 25, 2017. |

| 1.7 | Mining Reserves and Mining Methods |

The Arctic Project is designed as a conventional truck-shovel operation assuming 131 t trucks for waste and 91 t trucks for ore, as well as 17 m3 and 12 m3 shovels for waste and ore respectively. The pit design includes three nested phases to balance stripping requirements while satisfying the concentrator requirements.

The design parameters include a ramp width of 28.5 m, in-pit road grades of 8% and out-pit road grades of 10%, bench height of 5 m, targeted mining width between 70 and 100 m, berm interval of 15 m, variable slope angles by sector and a minimum mining width of 30 m.

The smoothed final pit design contains approximately 43 Mt of ore and 296 Mt of waste for a resulting stripping ratio of 6.9:1. Within the 43 Mt of ore, the average grades are 2.32% Cu, 3.24% Zn, 0.57 % Pb, 0.49 g/t Au and 36.0 g/t Ag.

The Mineral Reserve estimates are shown in Table 1-3.

Table 1-3 Mineral Reserve Estimates for the Arctic Deposit

| | Tonnage | Grades |

| Class | t x 1000 | Cu (%) | Zn (%) | Pb (%) | Au (g/t) | Ag (g/t) |

| Proven Mineral Reserves | - | - | - | - | - | - |

| Probable Mineral Reserves | 43,038 | 2.32 | 3.24 | 0.57 | 0.49 | 36.0 |

| Proven & Probable Mineral Reserves | 43,038 | 2.32 | 3.24 | 0.57 | 0.49 | 36.0 |

| | | | | | | |

| Waste within Designed Pit | 296,444 | | | | | |

| Total Tonnage within Designed Pit | 339,482 | | | | | |

| Trilogy Metals Inc. | 1-22 | |

| NI 43-101 Technical Report on the Arctic Project, | | |

| Northwest Alaska | | |

| | | |

Notes:

| (1) | Mineral Reserves are estimated assuming open pit mining methods and include a combination of planned and contact dilution. |

| (2) | Mineral Reserves are based on prices of $2.90/lb Cu, $0.90/lb Pb, $1.10/lb Zn, $1250/oz Au and $18/oz Ag Fixed process recoveries of 90.0% Cu, 89.9% Pb, 91.7% Zn, 61.1% Au and 49.7% Ag |

| (3) | Mining costs: $3.00/t incremented at $0.02/t/15 m and $0.015/t/15 m below and above 710 m elevation respectively. |

| (4) | Processing costs: $36.55/t. Include process cost: $19.86/t, G&A: $8.92/t, sustaining capital: $4.11/t closure cost: $1.00/t, and road toll: $2.66/t. |

| (5) | Treatment costs of $70/t Cu concentrate, $180/t Pb concentrate and $300/t Zn concentrate. Refining costs of $0.07/lb Cu, $10/oz Au, $0.60/oz Ag. Transport cost of $149.96/t concentrate. |

| (6) | Fixed royalty percentage of 1%. |

| (7) | The Qualified Person for the Mineral Reserves is Antonio Peralta Romero P.Eng., an Amec Foster Wheeler employee who visited the project site in July 25, 2017 as part of the data verification process. |

| (8) | The effective date of mineral reserves estimate is October 10, 2017. |

The scheduling constraints set the maximum mining capacity at 32 Mt/year and the maximum process capacity at 10 kt/day. The production schedule results in a life of mine (LOM) of 12 years. The mine will require two years of pre-production before the start of operations in the processing plant.

The 10,000 t/d process plant design is conventional for the industry, will operate two 12 hour shifts per day, 365 d/a with an overall plant availability of 92%. The process plant will produce three concentrates: 1) copper concentrate, 2) zinc concentrate, and 3) lead concentrate. Gold and silver are expected to be payable at a smelter and are recovered in both the copper and lead concentrates.

The mill feed will be hauled from the open pit to a primary crushing facility where the material will be crushed by a jaw crusher to a particle size of 80% passing 125 mm.

The crushed material will be ground by two stages of grinding, consisting of one SAG mill and one ball mill in closed circuit with hydrocyclones (SAB circuit). The hydrocyclone overflow with a grind size of approximately 80% passing 70 μm will first undergo talc pre-flotation, and then be processed by conventional bulk flotation (to recover copper, lead, and associated gold and silver), followed by zinc flotation. The rougher bulk concentrate will be cleaned and followed by copper and lead separation to produce a lead concentrate and a copper concentrate. The final tailings from the zinc flotation circuit will be pumped to a tailings management facility (TMF). Copper, lead, and zinc concentrates will be thickened and pressure-filtered before being transported by truck to a port and shipped to smelters.

The LOM average mill feed is expected to contain 2.32% Cu, 3.24% Zn, 0.57% Pb, 0.49 g/t Au, and 35.98 g/t Ag. Based on the mine plan developed for the PFS and metallurgical testwork results, the life—of-mine (LOM) average metal recoveries and concentrate grades will be:

| Trilogy Metals Inc. | 1-23 | |

| NI 43-101 Technical Report on the Arctic Project, | | |

| Northwest Alaska | | |

| | | |

| o | recovery: 90.0% copper; 11.8% gold; 35.0% silver |

| o | recovery: 80.0% lead; 61.1% gold; 49.7% silver |

The average annual dry concentrate production is estimated as follows:

| · | Copper concentrate: 246,723 t/a |

| · | Lead concentrate: 29,493 t/a |

| · | Zinc concentrate: 180,219 t/a. |

| 1.9 | Project Infrastructure |

The Arctic project site is a remote, greenfields site that requires construction of its own infrastructure to support the mining operation.

The Project site will be accessed through a combination of State of Alaska owned highways (existing), an Alaska Industrial Development and Export Authority (AIDEA) owned private road (proposed) and Trilogy owned access roads (proposed). The Ambler Mining District Industrial Access Project (AMDIAP) road is proposed by AIDEA to connect the Ambler mining district to the Dalton Highway. The AMDIAP road is being permitted as a private road with restricted access for industrial use. To connect the Arctic Project site and the existing exploration camp to the proposed AMDIAP road a 30.7 km access road (the Arctic access road) will need to be built.

The State of Alaska owned public Dahl Creek Airport will require upgrades to support the planned regular transportation of crews to and from Fairbanks. Power generation will be by six Liquefied Natural Gas (LNG) generators, producing a supply voltage of 4.16 kV. The total connected load will be 17.5 MW with an average power draw of 12.6 MW. Liquid natural gas (LNG) will be supplied via existing fuel supply networks near Port Mackenzie, Alaska.

The Project will require three different self-contained camps, equipped with their own power and heat generation capabilities, water treatment plant, sewage treatment plant, and garbage incinerator. The existing exploration camp will be used to start the construction of the Arctic access road. A construction camp will be constructed at the intersection of the AMDIAP road and Arctic access road, and will be decommissioned once construction is complete. The permanent camp will be constructed along the Arctic access road, closer to the planned processing facility. The permanent camp will be constructed ahead of operations to support the peak accommodation requirements during construction.

| Trilogy Metals Inc. | 1-24 | |

| NI 43-101 Technical Report on the Arctic Project, | | |

| Northwest Alaska | | |

| | | |

Infrastructure that will be required for the mining and processing operations will include:

| · | Stockpiles and waste rock facilities |

| · | Truck workshop, truck wash, mine offices, mine dry facility and warehouse |

| · | Plant workshop and warehouse |

| · | Primary crushing building |

| · | Fine ore stockpile building |

| · | Process plant and laboratory |

| · | Concentrate loadout building |

| · | Reagent storage and handling building |

| · | Raw water supply building. |

| · | Tailings management facility |

| · | Diversion and collection channels, culverts, and containment structures |

| · | Waste rock collection pond |

On-site communications comprise of inter-connected mobile and fixed systems, including landline telephone network, radios and internet.

Compressed air will be supplied by screw compressors and a duty plant air receiver. Fire protection will be supported by a firewater distribution network and standpipe systems, water mist systems, sprinkler systems, and portable fire extinguishers. Gas detection will be provided to detect dangerous levels of LNG gas within the generator room.

A large waste rock dump (WRD) will be developed north of the Arctic pit in the upper part of the Arctic Valley. The waste rock storage facility will be designed to store both waste rock and tailings in adjacent footprints. . The total volume of waste rock is expected to be 145.6 Mm3 (296 Mt), however there is potential for expanded volume in the waste if placement density is less than 2.0 t/m3. The dump will have a final height of 245 m to an elevation of 890 masl and is planned to be constructed in 20 m lifts with intermediary bench widths at 23.5 m on average at the dump face, to achieve an overall slope of 2.7H:1V. Most of the waste rock is anticipated to be potentially acid-generating (PAG) and there will be no separation of waste based on acid generation potential. Rather, seepage from the WRD will be collected and treated.

| Trilogy Metals Inc. | 1-25 | |

| NI 43-101 Technical Report on the Arctic Project, | | |

| Northwest Alaska | | |

| | | |

There will also be two small overburden stockpiles to store the stripped topsoil and overburden from the TMF footprint. The topsoil stockpile will be placed in between the haul roads and will store up to 225,000 m3 of material while the overburden stockpile will be located below the lower haul road between the pit and the mill site with storage capacity up to 650,000 m3.

The tailings management facility (TMF) will be located at the headwaters of the Sub-Arctic Creek, in the upper-most portion of the creek valley. The 58.6 ha footprint of the TMF will be fully lined with an impermeable liner (HDPE). Tailings containment will be provided by an engineered dam that will be buttressed by the WRD constructed immediately downstream of the TMF and the natural topography on the valley sides. A starter dam will be constructed to elevation 830 m. Three subsequent raises will bring the final dam crest elevation to 890 m, which is the same as the final elevation of the waste rock dump. The TMF is designed to store approximately 27.3 Mm3 (38.7 Mt) of tailings plus 3.0 Mm3 of water produced over the 12 year mine life as well as the PMF and still provide 2m of freeboard.

The tailings delivery system pipeline will transport slurried tailings from processing plant to the TMF. The delivery system will be sized initially on the basis of a 10 kt/d operation. This pipeline will transport 1,050 m3/h of tailings to the TMF. The return water delivery system for recycle water from the TMF has been sized on the basis of 770 m3/h of water being pumped from the TMF to the process water pond, for the 10 kt/d operation.

The proposed mine development is located in valley of Sub-Arctic Creek, a tributary to the Shungnak River. A surface water management system will be constructed to segregate contact and non-contact water. Non-contact water will be diverted around mine infrastructure to Sub-Arctic Creek. Contact water will be conveyed to treatment facilities prior to discharge to the receiving environment.

Trilogy Metals provided Ausenco with the metal price projections for use in the Pre-Feasibility Study on which the Technical Report is based. Trilogy Metals established the pricing using a combination of two year trailing actual metal prices, and market research and bank analyst forward price projections, prepared in early 2018 by Jim Vice of StoneHouse Consulting Inc.

The long-term consensus metal price assumptions to be used in the Pre-Feasibility Study are:

| Trilogy Metals Inc. | 1-26 | |

| NI 43-101 Technical Report on the Arctic Project, | | |

| Northwest Alaska | | |

| | | |

Smelter terms were applied for the delivery of copper, zinc and lead concentrate. It was assumed that delivery of all concentrates would be to an East Asian smelter at currently available freight rates. These terms are considered to be in line with current market conditions. Total transport costs for the concentrate are estimated at $270.37/dmt.

| 1.11 | Environmental, Permitting, Social and Closure Considerations |

| 1.11.1 | Environmental Considerations |

The Arctic Project area includes the Ambler lowlands and Subarctic Creek within the Shungnak River drainage. To date, a moderate amount of baseline environmental data collection has occurred in the area including surface water quality sampling, surface hydrology monitoring, wetlands mapping, stream flow monitoring, aquatic life surveys, avian and mammal habitat surveys, cultural resource surveys, hydrogeology studies, meteorological monitoring, and acid base accounting studies.

| 1.11.2 | Permitting Considerations |

Trilogy performs mineral exploration at the Arctic Deposit under State of Alaska and Northwest Arctic Borough (NWAB) permits. Trilogy is presently operating under a State of Alaska Miscellaneous Land Use Permit (APMA permit) that expires at 2017 year-end, and an application to renew was submitted by Trilogy to the Alaska Department of Natural Resources (ADNR) in February 2018.

Mine development permitting will be largely driven by the underlying land ownership; regulatory authorities vary depending on land ownership. The Arctic Project area includes patented mining claims (private land under separate ownership by Trilogy and NANA), State of Alaska land, and NANA land (private land). The open pit would situate mostly on patented land while the mill, tailings and waste rock facilities would be largely on State land. Other facilities, such as the camps, would be on NANA land. Federal land would likely be part of any access road between the Dalton Highway and the Arctic Project area. Permits associated with such an access road are being investigated in a separate action by the State of Alaska.

Because the Arctic Project is situated to a large extent on State land, it will likely be necessary to obtain a Plan of Operation Approval (which includes the Reclamation Plan) from the ADNR. The Project will also require certificates to construct and then operate a dam(s) (tailings and water storage) from the ADNR (Dam Safety Unit) as well as water use authorizations, an upland mining lease and a mill site lease, as well as several minor permits including those that authorize access to construction material sites from ADNR.

The Alaska Department of Environmental Conservation (ADEC) would authorize waste management under an integrated waste management permit, air emissions during construction and then operations under an air permit, and require an APDES permit for any wastewater discharges to surface waters, and a Multi-Sector General Permit for stormwater discharges. The ADEC would also be required to review the USACE Section 404 permit to certify that it complies with Section 401 of the CWA.

| Trilogy Metals Inc. | 1-27 | |

| NI 43-101 Technical Report on the Arctic Project, | | |

| Northwest Alaska | | |

| | | |

The Alaska Department of Fish and Game (ADFG) would have to authorize any culverts or bridges that are required to cross fish-bearing streams or other impacts to fish-bearing streams that result in the loss of fish habitat.

US Army Corps of Engineers (USACE) would require a CWA Section 404 permit for dredging and filling activities in Waters of the United States (WOTUS) including jurisdictional wetlands. The USACE Section 404 permitting action would require the USACE to comply with the Natural Environmental Policy Act (NEPA) and, for a project of this magnitude, the development of an Environmental Impact Statement (EIS). The USACE would likely be the lead federal agency for the NEPA process. As part of the Section 404 permitting process, the Arctic Project will have to meet USACE wetlands guidelines to avoid, minimize and mitigate impacts to wetlands.

The Arctic Project will also have to obtain approval for a Master Plan from the NWAB. In addition, actions will have to be taken to change the borough zoning for the Arctic Project area from Subsistence Conservation to Resource Development.

The overall timeline required for permitting would be largely driven by the time required for the NEPA process, which is triggered by the submission of the 404 permit application to the US Army Corp of Engineers (ACOE). The timeline includes the development and publication of a draft and final EIS and ends with a Record of Decision, and 404-permit issuance. In Alaska, the EIS and other State and Federal permitting processes are generally coordinated so that permitting and environmental review occurs in parallel. The NEPA process could require between 1.5 to three years to complete, and could potentially take longer.

| 1.11.3 | Social Considerations |

The Arctic Project is located approximately 40 km northeast of the native villages of Shungnak and Kobuk, and 64 km east-northeast of the native village of Ambler. The population in these villages range from 156 in Kobuk (2016 Census) to 262 in Shungnak (2016 Census). Residents live a largely subsistence lifestyle with incomes supplemented by trapping, guiding, local development projects, government aid and other work in, and outside of, the villages.