Exhibit 3.37

INDIANA SECRETARY OF STATE

BUSINESS SERVICES DIVISION

CORPORATIONS CERTIFIED COPIES

INDIANA SECRETARY OF STATE

BUSINESS SERVICES DIVISION

302 West Washington Street, Room E018

Indianapolis, IN 46204

http://www.sos.in.gov

April 22, 2015

| | |

| Company Requested: | | THE MATRIXX GROUP, INCORPORATED |

| Control Number: | | 198412-300 |

| | | | |

| Date | | Transaction | | # Pages |

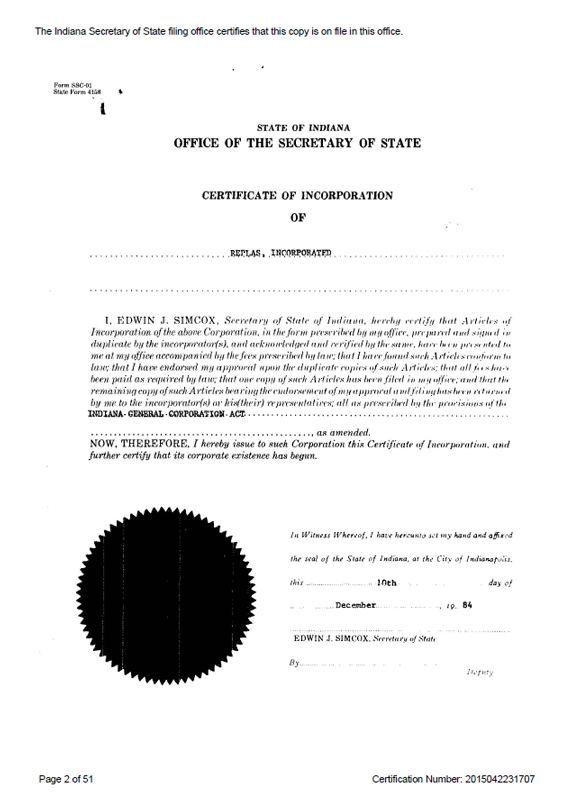

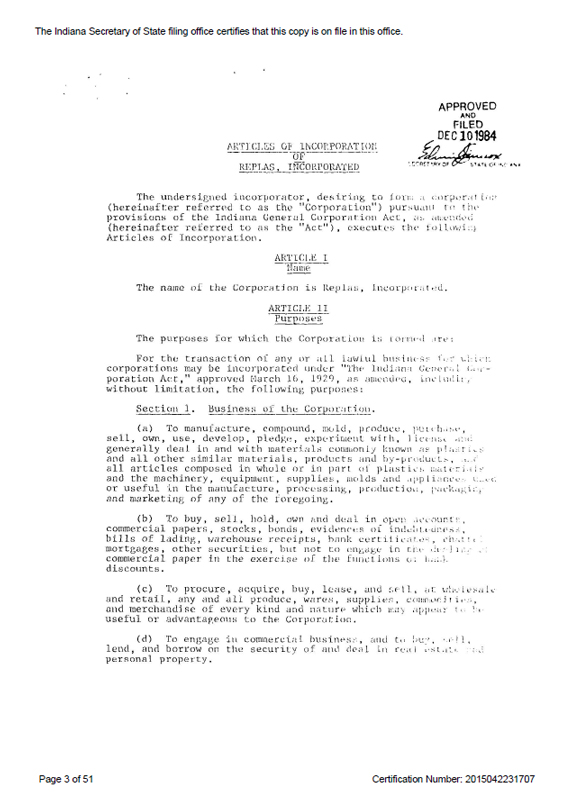

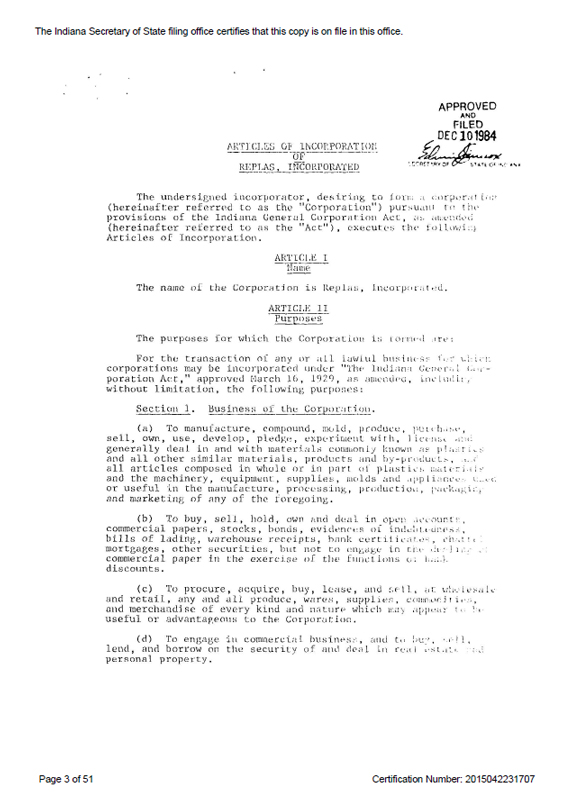

| 12/10/1984 | | Articles of Incorporation | | 9 |

| 04/16/1997 | | Articles of Amendment | | 3 |

| 03/09/2007 | | Articles of Merger | | 15 |

| 12/21/2010 | | Articles of Merger | | 8 |

| 12/28/2011 | | Articles of Merger | | 4 |

| 01/06/2012 | | Articles of Correction | | 7 |

| 05/08/2014 | | Certificate of Assumed Business Name | | 2 |

| 05/08/2014 | | Certificate of Assumed Business Name | | 2 |

| | |

| | State of Indiana Office of the Secretary of State I hereby certify that this is a true and complete copy of this 50 page document filed in this office. Dated: April 22, 2015 Certification Number: 2015042231707 |

| |

| |

| Connie Lawson | | |

| Secretary of State | | |

| | |

| Page 1 of 51 | | Certification Number: 2015042231707 |

The Indiana Secretary of State filing office certifies that this copy is on file in this office.

| | | | |

| Replas, Incorporated | | - 3 - | | Articles of Incorporation |

indemnification shall not be deemed exclusive of any other rights to which those indemnified may be entitled under any provision of the Articles of Incorporation, By-Laws, resolution, or other authorization heretofore or hereafter adopted, after notice, by a majority vote of all the voting shares then issued and outstanding; and provided further that expenses incurred in defending any action, suit, or proceeding, civil or criminal, may be paid by the Corporation in advance of the final disposition of such action, suit, or proceeding notwithstanding any provisions of this article to the contrary upon receipt of an undertaking by or on behalf of the director, officer, employee, or agent to repay the amount paid by the Corporation if it shall ultimately be determined that the director, officer, employee, or agent is not entitled to indemnification as provided in this section;

(j) To purchase and maintain insurance on behalf of any person who is or was a director, officer, employee or agent of the Corporation, or is or was serving at the request of the Corporation as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise against any liability asserted against him and incurred by him in any such capacity, or arising out of his status as such, whether or not the Corporation would have the power to indemnify him against such liability under the provisions of this section;

(k) To pay pensions and establish pension plans, pension trusts, profit sharing and retirement plans, stock bonus plans, stock option plans and other incentive plans for any or all of its directors, officers and employees;

(1) To make By-Laws for the government and regulation of its affairs;

(m) To cease doing business and to dissolve and surrender its corporate franchise;

(n) To be a promotor, partner, member, associate, or manager of any partnership, joint venture, trust, or other enterprise;

(o) To do all acts and things necessary, convenient or expedient to carry out the purposes for which it is formed;

(p) To purchase, own and/or hold and to sell and transfer (but not to vote) shares of its own capital stock to the extent permitted by The Indiana General Corporation Act, and this power includes the power to purchase the Corporation’s own shares to the extent of unreserved and unrestricted capital surplus available thereof;

| | |

| Page 5 of 51 | | Certification Number: 2015042231707 |

The Indiana Secretary of State filing office certifies that this copy is on file in this office.

| | | | |

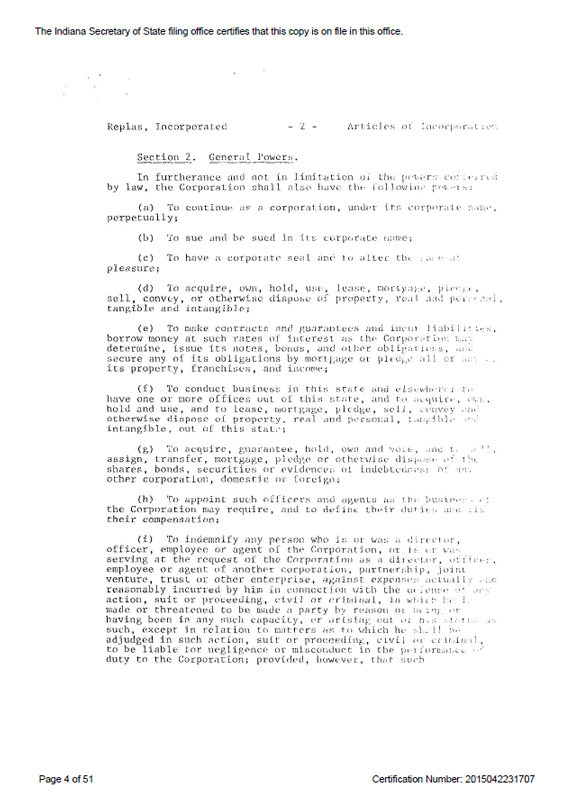

| Replas, Incorporated | | - 4 - | | Articles of Incorporation |

(q) To carry on, engage in and/or conduct any business or businesses or do any act or acts which a natural person or persons might do and which are necessary, convenient or expedient to accomplish the purposes for which this corporation is formed and such as are not repugnant to law; but this corporation shall not be deemed to possess the power of carrying on the business of receiving deposits of money, bullion or foreign coins, or of issuing bills, notes or other evidences of debts for circulation as money, and this corporation shall not engage in the business of rural loan and savings associations, credit unions nor conduct a banking, railroad, insurance, surety, trust, safe deposit, mortgage guarantee or building and loan business;

(r) The foregoing clauses shall be construed as powers as well as purposes, and the matters expressed in each clause shall, except if otherwise expressly provided, be in no wise limited by reference to or inference from the terms of any other clause, but shall be regarded as independent powers and purposes; and the enumeration of specific powers and purposes shall not be construed to limit or restrict in any manner the meaning of general terms or the general powers of the Corporation, nor shall the expression of any one thing be deemed to exclude another not expressed, although it be of like nature. The Corporation shall be authorized to exercise and enjoy all other powers, rights and privileges granted by an Act of the General Assembly of the State of Indiana, entitled “The Indiana General Corporation Act,” and all the powers conferred by all acts heretofore or hereafter amendatory of or supplemental to the said Act or the said laws; and the enumeration of certain powers as herein specified is not intended as exclusive of, or as a waiver of any of the powers, rights or privileges granted or conferred by the said Act or the said laws now or hereafter in force; provided, however, that the Corporation shall not in any state, territory, district, possession or county carry on any business or exercise any powers which a corporation organized under the laws thereof could not carry on or exercise.

ARTICLE III

Period of Existence

The period which the Corporation shall continue is perpetual.

ARTICLE IV

Resident Agent and Principal Office

Section 1.Resident Agent. The name and address of the Corporation’s Resident Agent for service of process is Raymond E. Wright, 719 Mels Drive, Evansville, Indiana 47722.

| | |

| Page 6 of 51 | | Certification Number: 2015042231707 |

The Indiana Secretary of State filing office certifies that this copy is on file in this office.

| | | | |

| Replas, Incorporated | | - 5 - | | Articles of Incorporation |

Section 2.Principal Office. The post office address of the principal office of the Corporation is 719 Mels Drive, Evansville, Indiana 47712.

ARTICLE V

Authorized Shares

Section 1.Number of Shares. The total number of shares which the Corporation is to have authority to issue is 1,000.

| | A. | The number of authorized shares which the Corporation designates as having par value is -0- with a par value of $-0-. |

| | B. | The number of authorized shares which the Corporation designates as without par value is 1,000. |

Section 2.Terms of Shares.

One Thousand (1,000) shares, without par value, of the capital stock of this corporation shall be known as common stock.

The One Thousand (1,000) shares of common stock shall have and possess full voting powers. The certificates of the common stock shall be in the form and language as authorized by law and as approved by the Board of Directors of this corporation.

Shares of the capital stock of this corporation may be issued by the Corporation for such an amount of consideration as may be fixed from time to time by the Board of Directors, and may be paid, in whole or in part, in money, in other property, tangible or intangible, or in labor actually performed for or services actually rendered to the Corporation, or for any other good and valid consideration.

ARTICLE VI

Requirements Prior to Doing Business

The Corporation will not commence business until consideration of the value of at least One Thousand Dollars ($1,000) has been received for the issuance of shares.

ARTICLE VII

Directors

Section 1.Number of Directors. The initial Board of Directors is composed of one member. The number of directors may be from time to time fixed by the By-Laws of the Corporation at any number. In the absence of a By-Law fixing the number of directors, the number shall be the lesser of three or its number of beneficial shareholders of record of the Corporation.

| | |

| Page 7 of 51 | | Certification Number: 2015042231707 |

The Indiana Secretary of State filing office certifies that this copy is on file in this office.

| | | | |

| Replas, Incorporated | | - 6 - | | Articles of Incorporation |

Section 2.Names and Post Office Addresses of the Directors. The name and post office address of the initial Board of Directors of the Corporation are:

| | | | | | | | |

Name | | Number and Street | | City | | State | | ZIP |

| | | | |

Raymond E. Wright | | 719 Mels Drive | | Evansville | | IN | | 47712 |

Section 3.Qualifications of Directors (if any).

Directors need not be shareholders of the Corporation.

A majority of the Directors at any time shall be citizens of the United States.

All Directors shall be of lawful age.

ARTICLE VIII

Incorporator

The name and post office address of the incorporator of the Corporation are:

| | | | | | | | |

Name | | Number and Street | | City | | State | | ZIP |

| | | | |

Raymond E. Wright | | 719 Mels Drive | | Evansville | | IN | | 47712 |

ARTICLE IX

Provisions for Regulation of Business

and Conduct of Affairs of Corporation

(“Powers” of the Corporation, its directors, or shareholders)

Section 1.Meetings of Shareholders. Meetings of the shareholders of the Corporation shall be held at such place within or without the State of Indiana as may be specified in the respective notices or waivers of notice thereof.

Section 2.Action Without Shareholders Meeting. Any action required to be taken at a meeting of the shareholders of the Corporation, or any action which may be taken at a meeting of the shareholders, may be taken without a meeting if, prior to such action, a consent in writing setting forth the action so taken shall be signed by all of the shareholders entitled to vote with respect to the subject matter thereof and such written consent is filed with the minutes of the proceedings of the shareholders. Such consent shall have the same effect as a unanimous vote of shareholders and may be stated as such in any articles or documents filed with the Secretary of State under the Act.

| | |

| Page 8 of 51 | | Certification Number: 2015042231707 |

The Indiana Secretary of State filing office certifies that this copy is on file in this office.

| | | | |

| Replas, Incorporated | | - 7 - | | Articles of Incorporation |

Section 3.Meetings of Directors. Meetings of the Directors of the Corporation shall be held at such place within or without the State of Indiana as may be specified in the respective notices or waivers of notice thereof.

Section 4.Action Without Board Meeting. Any action required or permitted to be taken at any meeting of the Board of Directors, or of any committee thereof, may be taken without a meeting if, prior to such action, a written consent thereto is signed by all members of the Board or of such committee, as the case may be, and such written consent is filed with the minutes of the proceedings of the Board or committee.

Section 5.Code of By-Laws. The Board of Directors of the Corporation shall have the power, without assent or vote of the shareholders, to make, alter, amend or repeal the Code of By-Laws of the Corporation, but the affirmative vote of a majority of the members of the Board of Directors for the time being shall be necessary to make such Code or to effect any alteration, amendment or repeal thereof.

Section 6.Additional Powers of Directors. In addition to the powers and authorities hereinabove or by statute expressly conferred, the Board of Directors is hereby authorized to exercise all such powers and do all such acts and things as may be exercised or done by a corporation organized and existing under the provisions of the Act.

Section 7.Amendment of Articles of Incorporation. The Corporation reserves the right to alter, amend or repeal any provision contained in these Articles of Incorporation in the manner now or hereafter prescribed by the provisions of the Act, or any other pertinent enactment of the General Assembly of the State of Indiana, and all rights and powers conferred hereby on shareholders, directors, and officers of the Corporation are subject to such reserved rights.

Section 8.Wasting Assets. In the event the Corporation may at any time or from time to time own wasting assets intended for sale in the ordinary course of business, such as coal or ore mines or oil or gas wells, or holds property having a limited life, such as a lease for a term of years, or patents, the depletion of such assets by sale or lapse of time need not be deducted in the computation of earned surplus available for dividends, and the Corporation may pay dividends without deduction of such depletion, subject, however, to the rights of shareholders of different classes and subject to the rights of creditors.

IN WITNESS WHEREOF, The undersigned, being the sole incorporator designated in Article VIII, executes these Articles of Incorporation and certifies to the truth of the facts stated this 5th day of December, 1984.

| | |

| Page 9 of 51 | | Certification Number: 2015042231707 |

The Indiana Secretary of State filing office certifies that this copy is on file in this office.

| | | | |

| Replas, Incorporated | | - 8 - | | Articles of Incorporation |

|

|

|

Raymond E. Wright |

| | | | | | |

STATE OF INDIANA | | ) | | | | |

| | ) | | SS: | | |

COUNTY OF VANDERBURGH | | ) | | | | |

I, the undersigned, a Notary Public duly commissioned to take acknowledgments and administer oaths in the State of Indiana, certify that Raymond E. Wright, being the sole incorporator referred to in Article VIII of the foregoing Articles of Incorporation, personally appeared before me; acknowledged the execution thereof; and swore to the truth of the facts therein stated.

WITNESS My hand and Notarial Seal this 5th day of December, 1984.

| | | | |

| | | |  |

| | | | |

| | | | Notary Public |

| | |

| My commission expires: | | | | Alan N. Shovers |

May 2, 1985 | | | | (Printed Signature) |

My county of residence is: Vanderburgh County, Indiana. | | | | |

THIS INSTRUMENT Was prepared by Alan N. Shovers, Attorney at Law, 305 Union Federal Building, Post Office Box 3646, Evansville, Indiana 47735-3646.

| | |

| Page 10 of 51 | | Certification Number: 2015042231707 |

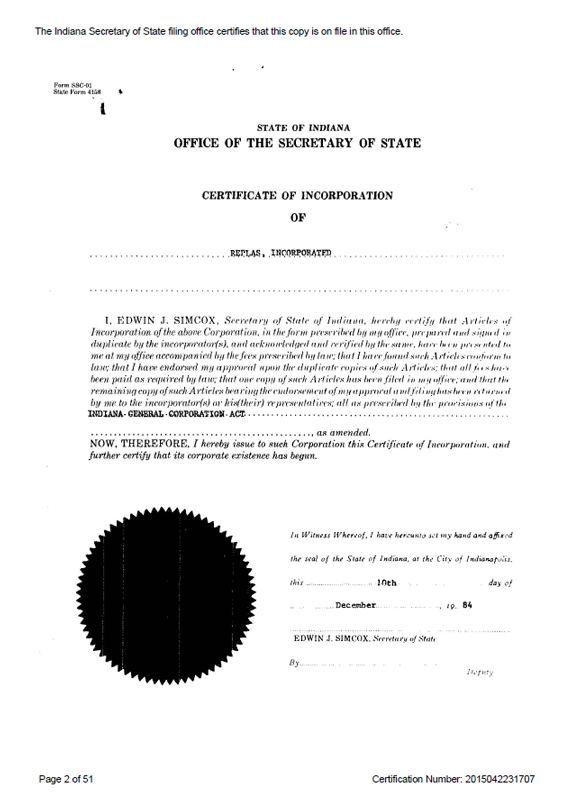

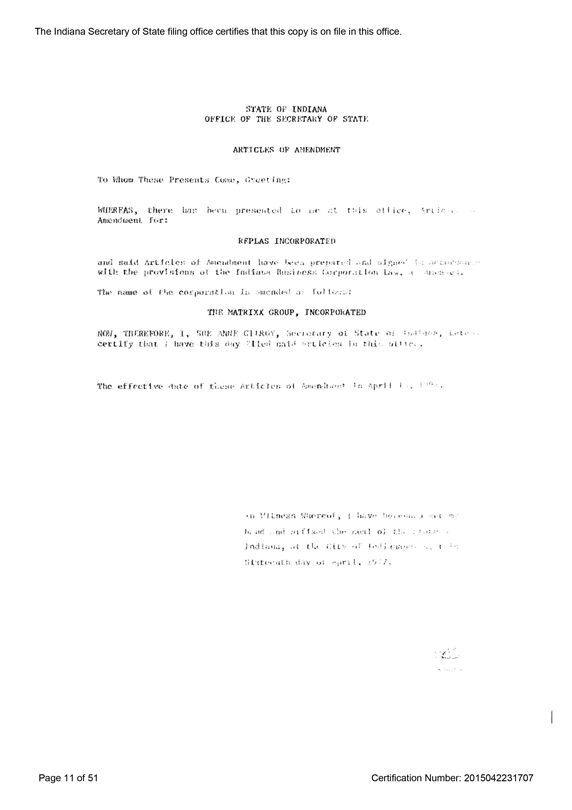

The Indiana Secretary of State filing office certifies that this copy is on file in this office.

198412 - 300

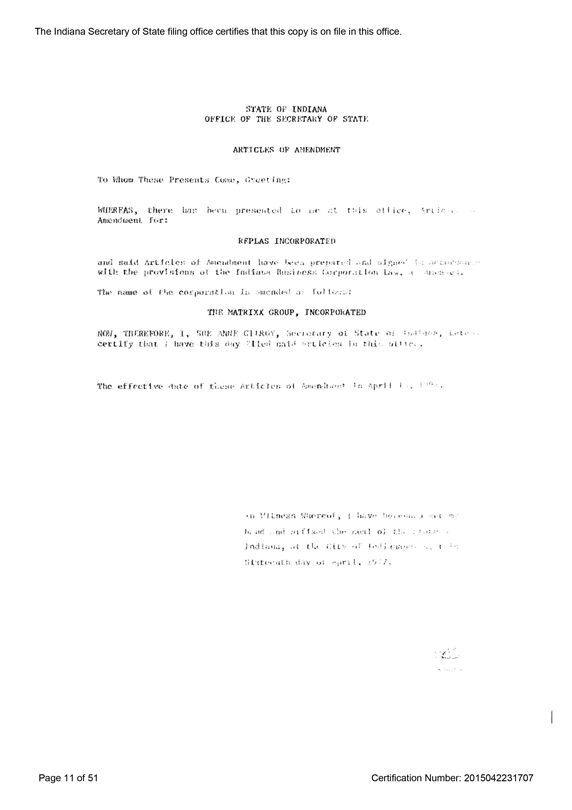

ARTICLES OF AMENDMENT

OF THE

ARTICLES OF INCORPORATION

OF

REPLAS, INCORPORATED

The undersigned officers of Replas, Incorporated (hereinafter referred to as the “Corporation”) existing pursuant to the provisions of the Indiana Business Corporation Law desiring to give notice of corporate action effectuating amendment of certain provisions of its Articles of Incorporation, certify the following facts:

ARTICLE I

Amendment

Section 1.Date of Incorporation. The date of incorporation of the Corporation is December 10, 1984.

Section 2.Name. The name of the Corporation following this amendment to the Articles of Incorporation is The Matrixx Group, Incorporated.

Section 3.Amendment Text. The exact text of Article I of the Articles of Incorporation is now as follows:

The name of the Corporation is The Matrixx Group, Incorporated.

Furthermore, the Corporation will conduct business as The Matrixx Group,

Replas and Matrixx Performance Resins.

Section 4.Date of Adoption. The date of adoption of this Article of Amendment is April 1, 1997.

ARTICLE II

Manner of Adoption and Vote

Section 1.Board Approval. This amendment was approved by the Board of Directors and shareholder action was not required.

ARTICLE III

Compliance with Legal Requirements

The manner of the adoption of the Articles of Amendment and the vote by which they were adopted constitute full legal compliance with the provisions of the Act, the Articles of Incorporated, and By-Law of the Corporation.

| | |

| Page 12 of 51 | | Certification Number: 2015042231707 |

The Indiana Secretary of State filing office certifies that this copy is on file in this office.

| | | | |

| Replas, Incorporated | | - 2 - | | Articles of Amendment |

IN WITNESS WHEREOF, The undersigned, being duly sworn officers of the Corporation, executes these Articles of Amendment to the Articles of Incorporation and certify to the truth of the facts stated this 1st day of April, 1997.

| | | | |

| | | |  |

| | | | |

| Raymond E. Wright | | | | Michael E. Wright |

| President | | | | Treasurer |

| | | | | | |

| STATE OF INDIANA | | ) | | | | |

| | ) | | SS: | | |

| COUNTY OF VANDERBURGH | | ) | | | | |

I, the undersigned, a Notary Public duly commissioned to take acknowledgments and administer oaths in the State of Indiana, certify that Raymond E. Wright and Michael E. Wright. duly sworn officers of the Corporation, personally appeared before me; acknowledged the execution thereof; and swore to the truth of the facts therein stated.

WITNESS My hand and Notarial Seal this 1st day of April, 1997.

| | | | |

| | | |

|

| | | | |

| | | | Notary Public |

| | |

| My Commission expires: | | | | Sonia L. Townsend |

Oct. 24, 1998 | | | | (Printed Signature) |

| My county of residence is: Vanderburgh County, Indiana | | | | |

| | |

| Page 13 of 51 | | Certification Number: 2015042231707 |

The Indiana Secretary of State filing office certifies that this copy is on file in this office.

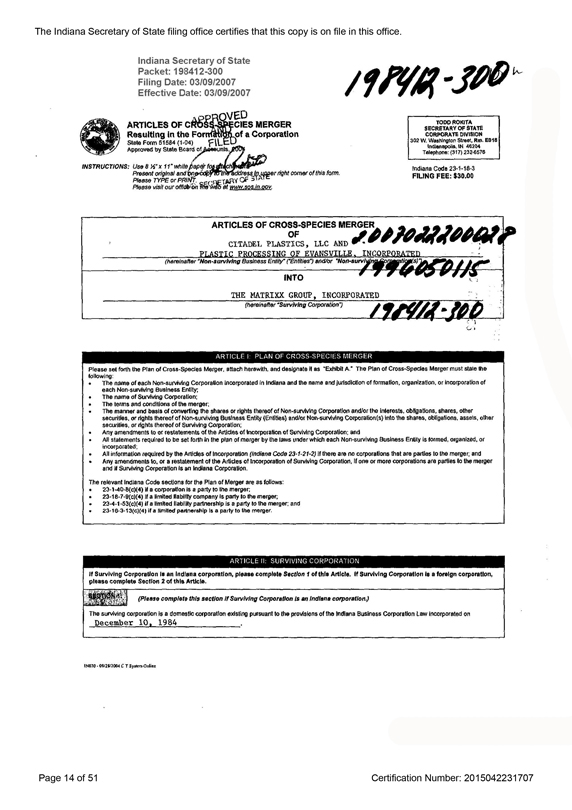

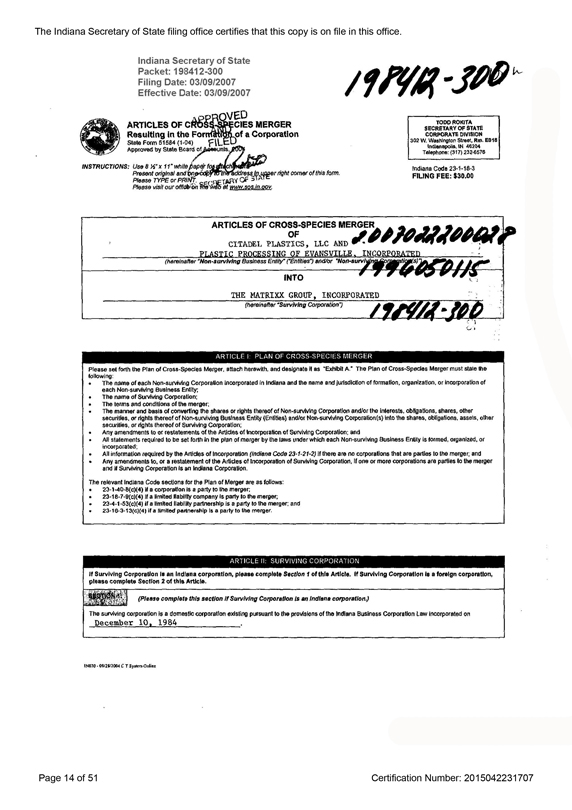

Indiana Secretary of State Packet: 198412-300 Filing Date: 03/09/2007 Effective Date: 03/09/2007

ARTICLES OF CROSS-SPECIES MERGER

Resulting in the Formation of a Corporation

State Form 51584 (1-04) Approved by State Board of Accounts, 2007

INSTRUCTIONS: Use 8 1/2“ by 11” white paper for attachments Present original and one copy to the address in upper right corner of this form. Please TYPE or PRINT.

Please visit Our office on the web at www.sos.in.gov.

TODD ROKITA

SECRETARY OF STATE CORPORATE DIVISION 302 W. Washington Street, Rm. E018 Indianapolis, IN 46204 Telephone: (317)232 6576

Indiana Code 23-1-18-3 FILING FEE: $30.00

ARTICLES OF CROSS-SPECIES MERGER OF

CITADEL PLASTICS, LLC AND PLASTIC PROCESSING OF EVANSVILLE, INCORPORATED 2.007022200028

(hereinafter “Non-surviving Business Entity” (“Entities”) and/or “Non-surviving Corporation(s)”)

INTO

THE MATRIXX. GROUP, INCORPORATED

1996050115

(hereinafter “Surviving Corporation”)

198412-300

ARTICLE I: PLAN OF CROSS-SPECIES MERGER

Please set forth the Plan of Cross-Species Merger, attach herewith, and designate it as “Exhibit A.” The Plan of Cross-Species Merger must state the

following:

. The name of each Non-surviving Corporation Incorporated In Indiana and the name and jurisdiction of formation, organization, or incorporation of each Non-surviving Business Entity;

The name of Surviving Corporation;

The terms and conditions of the merger;

. The manner and basis of converting the shares or rights thereof of Non-surviving Corporation and/or the interests, obligations, shares, other

securities, or rights thereof of Non-surviving Business Entity (Entities) and/or Non-surviving Corporations) into the shares, obligations, assets, other securities, or rights thereof of Surviving Corporation;

Any amendments to or restatements of the Articles of Incorporation of Surviving Corporation; and

All statements required to be set forth in the plan of merger by the laws under which each Non-surviving Business Entity is formed, organized, or incorporated;

All information required by the Articles of Incorporation (Indiana Code 23-1-21-2) if there are no corporations that are parties to the merger; and

Any amendments to, or a restatement of the Articles of Incorporation of Surviving Corporation, If one or more corporations are parties to the merger and if Surviving Corporation is an Indiana Corporation

The relevant Indiana Code sections for the Plan of Merger are as follows;

23-1-40-8(c)(4) If a corporation Is a party to the merger;

23-18-7-9(c)(4) If a limited liability company Is party to the merger;

23-4-1-53(c)(4) if a limited liability partnership is a party to the merger; and

• 23-16-3-13(c)(4) if a limited partnership is a party to the merger.

ARTICLE II; SURVIVING CORPORATION

If Surviving Corporation is an Indiana corporation, please complete Section 1 of this Article. If Surviving Corporation is a foreign corporation, please complete Section 2 of this Article.

(Please complete this section If Surviving Corporation Is an Indiana corporation.)

The surviving corporation is a domestic corporation existing pursuant to the provisions of the Indiana Business Corporation Law Incorporated on December 10, 1984

Page 14 of 51 Certification Number: 2015042231707

The Indiana Secretary of State filing office certifies that this copy is on file in this office.

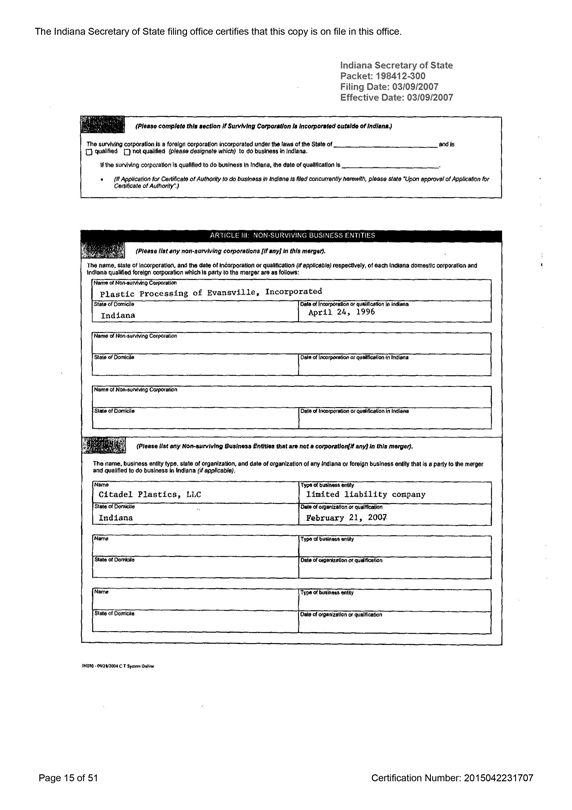

Indiana Secretary of State Packet: 198412-300 Filing Date: 03/09/2007 Effective Date: 03/09/2007

(Please complete this section if Surviving Corporation is Incorporated outside of Indiana.)

The surviving corporation is a foreign corporation Incorporated under the laws of the State of and Is [] qualified [] not qualified (please designate which) to do business in Indiana.

If the surviving corporation is qualified to do business In Indiana, the date of qualification Is

(If Application for Certificate of Authority to do business In Indiana is filed concurrently herewith, please state “Upon approval of Application for Certificate of Authority”.)

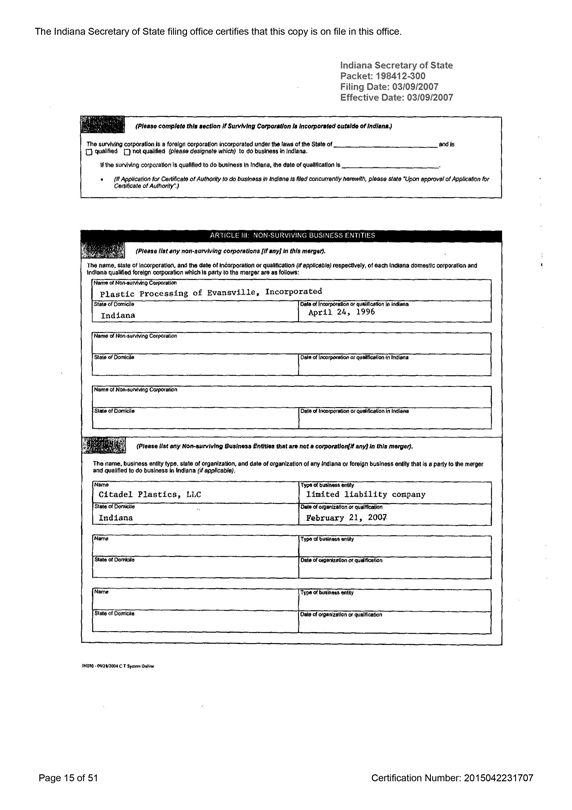

ARTICLE III: NON-SURVIVING BUSINESS ENTITIES

(Please list any non-surviving corporations [If any] In this merger).

The name, state of Incorporation, and the date of Incorporation or qualification (If applicable) respectively, of each Indiana domestic corporation and Indiana qualified foreign corporation which is party to the merger are as follows:

Name of Non-surviving Corporation

Plastic Processing of Evansville,

Incorporated

State of Domicile

Date of incorporation or qualification in Indiana

Indiana

April 24, 1996

Name of Non-surviving Corporation

State of Domicile

Date of incorporation or qualification In Indiana

Name of Non-surviving Corporation

State of Domicile

Date of incorporation or qualification in Indiana

(Please list my Non-surviving Business Entities that are not a corporation[if any] in this merger).

The name, business entity type, state of organization, and date of organization of any Indiana or foreign business entity that is a party to the merger and qualified to do business In Indiana (if applicable).

Name

Citadel Plastics, LLC

Type of business entity

limited liability company

State of Domicile

Indiana

Date of organization or qualification

February 21, 2007

Name

Type of business entity

State of Domicile

Date of organization or qualification

Name

Type of business entity

State of Domicile

Date of organization or qualification

Page 15 of 51

Certification Number: 2015042231707

The Indiana Secretary of State filing office certifies that this copy is on file in this office.

Indiana Secretary of State Packet: 198412-300 Filing Date: 03/09/2007 Effective Date: 03/09/2007

ARTICLE IV: MANNER OF ADOPTION AND VOTE OF SURVIVING CORPORATION

(Please complete either Section 1 or Section 2).

[] Shareholder vote not required.

The merger / share exchange was adopted by the Incorporators or board of directors without shareholder action and shareholder action was not required.

Vote of shareholders is required (Please select either A or B)

The designation (i.e. common, preferred, or any classification where different classes of stack exist), number of outstanding shares, number of votes entitled to be cast by each voting group entitled to vote separately on the merger / share exchange, and the number votes each voting group represented at the meeting are set forth below:

A.

Unanimous written consent executed on March 8,

2007 and signed by all shareholders entitled to vote.

B. Vote of shareholders during a meeting called by the Board of Directors.

TOTAL

A

B

C

DESIGNATION OF EACH VOTING GROUP (i.e. preferred and common)

NUMBER OF OUTSTANDING SHARES

NUMBER OF VOTES ENTITLED TO BE CAST

NUMBER OF VOTES REPRESENTED AT MEETING

SHARES VOTED IN FAVOR

SHARES VOTED AGAINST

ARTICLE V: MANNER OF ADOPTION AND VOTE OF NON-SURVIVING CORPORATION (if applicable)

Please complete this Article if a corporation is party to the merger. (Select either A or B):

The designation (i.e. common, preferred, or any classification where different classes of stock exist), number of outstanding shares, number of votes entitled to be cast by each voting group entitled to vote separately on the merger / share exchange, and the number of votes of each voting group represented at the meeting is set forth below:

A [x] Unanimous consent executed on March 8, 2007 and signed by all shareholders entitled to vote. B Vote of shareholders during a meeting called by the Board of Directors.

TOTAL

A

B

C

DESIGNATION OF EACH VOTING GROUP (i. e. preferred and common)

NUMBER OF OUTSTANDING SHARES

NUMBER OF VOTES ENTITLED TO BE CAST

NUMBER OF VOTES REPRESENTED AT MEETING

SHARES VOTED IN FAVOR

SHARES VOTED AGAINST

Page 16 of 51

Certification Number: 2015042231707

The Indiana Secretary of State filing office certifies that this copy is on file in this office.

Indiana Secretary of State

Packet: 198412-300

Filing Date: 03/09/2007

Effective Date: 03/09/2007

ARTICLE VI: SIGNATURE

In Witness Whereof, the undersigned, being a duly authorized representative of Surviving Corporation, executes these Articles of Cross-Species Merger and

verifies, subject to penalty of perjury, that the statements contained herein are true, and that each business entity that is a party to this merger has approved

the plan of merger according to Indiana law or according to the laws of the State In which the business entity was organized or incorporated, this

8th day of March, 2007.

Signature

Printed name

Paul Peterson

Title

Secretary

Page 17 of 51

Certification Number: 2015042231707

The Indiana Secretary of State filing office certifies that this copy is on file in this office.

| | |

| | Indiana Secretary of State |

| | Packet: 198412-300 |

| | Filing Date: 03/09/2007 |

| | Effective Date: 03/09/2007 |

PLAN OF MERGER

This Plan of Merger (“Plan of Merger”) is made and entered into this 8th day of March, 2007 by and among The Matrixx Group, Incorporated, an Indiana corporation (the “Surviving Company”), Citadel Plastics, LLC, an Indiana limited liability company (“Citadel Plastics”) and Plastic Processing of Evansville, Inc., an Indiana corporation (“Plastic Processing” and together with Citadel Plastics the “Merged Companies”).

WHEREAS, the Board of Directors and the sole Shareholder of the Surviving Company, the Board of Directors and sole Shareholder of Plastic Processing and the sole Member of Citadel Plastics deem it advisable and in the best interests of the parties hereto, that the Merged Companies be merged into the Surviving Company under the laws of the State of Indiana pursuant to the provisions of Section 23-1-40-8 of the Indiana Business Corporation Law.

NOW, THEREFORE, in consideration of the promises and of the mutual agreements contained herein, the parties hereto agree to merge upon the terms and conditions stated below:

1. The parties hereto agree that the Merged Companies will be merged into the Surviving Company (the “Merger”). The separate existence of the Merged Companies will cease, and the existence of the Surviving Company will continue unaffected and unimpaired by the Merger, with all rights, privileges, immunities and powers, and subject to all the duties and liabilities, of a corporation formed under the laws of the State of Indiana.

2. The mode of effecting the Merger will be as follows:

(a) At the Effective Date (as defined below), each membership unit of Citadel Plastics which is issued and outstanding on the Effective Date of the Merger, and all rights in respect thereof, shall be converted into the right to receive one (1) share of common stock, no par value, of the Surviving Company.

(b) At the Effective Date, each issued and outstanding share of common stock of Plastic Processing which is issued and outstanding on the Effective Date of the Merger, and all rights in respect thereof, shall be converted into the right to receive one (1) share of common stock, no par value, of the Surviving Company.

(c) At the Effective Date, each issued and outstanding share of common stock, no par value, of the Surviving Company shall remain outstanding and unchanged as a result of the Merger.

(d) The Merger will become effective upon the filing of Articles of Cross Species Merger with the Secretary of State of the State of Indiana (the “Effective Date”).

| | |

| Page 18 of 51 | | Certification Number: 2015042231707 |

The Indiana Secretary of State filing office certifies that this copy is on file in this office.

| | |

| | Indiana Secretary of State |

| | Packet: 198412-300 |

| | Filing Date: 03/09/2007 |

| | Effective Date: 03/09/2007 |

(e) Upon the Effective Date of the Merger, all the property, rights, privileges, franchises, patents, trademarks, licenses, registrations and other assets of every kind and description of the Merged Companies shall be transferred to, vested in, and devolve upon, the Surviving Company without further act or deed and all property, rights, and every other interest of the Surviving Company and the Merged Companies shall be as effectively the property of the Surviving Company as they were of the Surviving Company and the Merged Companies, respectively. The Merged Companies hereby agree from time to time, as and when requested by the Surviving Company or by its successors or assigns, to execute and deliver or cause to be executed and delivered all such deeds and instruments and to take or cause to be taken such further or other action as the Surviving Company may deem necessary or desirable in order to vest in and confirm to the Surviving Company title to and possession of any property of the Merged Companies acquired or to be acquired by reason of or as a result of the Merger herein provided for and otherwise to carry out the intent and purposes hereof and the proper Member and Board of Directors of the Merged Companies and the Board of Directors of the Surviving Company are fully authorized in the name of the Merged Companies and the Surviving Company, respectively to take any and all such action.

(f) All debts, liabilities and duties of the Surviving Company and Merged Companies will attach to the Surviving Company, and may be enforced against the Surviving Company to the same extent as if said debts, liabilities and duties had been incurred or contracted by Surviving Company.

3. The By-Laws of the Surviving Company as they exist on the Effective Date of this Plan of Merger shall be amended and restated to read as set forth onExhibit A attached hereto.

4. The Articles of Incorporation of the Surviving Company as they exist on the Effective Date of this Plan of Merger shall be and remain the Articles of Incorporation of the Surviving Company until the same shall be altered, amended or repealed as therein provided.

5. The Board of Directors of the Surviving Company and the Board of Directors and Member of the Merged Companies shall have the power in their discretion to abandon the Merger provided for herein prior to the filing of the Articles of Cross-Species Merger or other appropriate certificate with the office of the Secretary of State of the State of Indiana.

2

| | |

| Page 19 of 51 | | Certification Number: 2015042231707 |

The Indiana Secretary of State filing office certifies that this copy is on file in this office.

| | |

| | Indiana Secretary of State |

| | Packet: 198412-300 |

| | Filing Date: 03/09/2007 |

| | Effective Date: 03/09/2007 |

6. This Plan of Merger will be governed by and construed in accordance with the internal laws of the State of Indiana.

IN WITNESS WHEREOF, the parties hereto have caused their respective names to be signed hereto by their officers, duly authorized by their respective Board of Directors, Shareholders and Member, as the case may be.

| | |

| THE MATRIXX GROUP, INCORPORATED |

| (Surviving Company) |

| |

| By: | |  |

| | |

| | Paul Peterson, Secretary |

|

| CITADEL PLASTICS, LLC |

| (Merged Company) |

| |

| By: | | CITADEL PLASTICS HOLDINGS, INC., |

| Member |

| |

| By: | |  |

| | |

| | Paul Peterson, Secretary |

|

| PLASTIC PROCESSING OF EVANSVILLE, INCORPORATED |

| (Merged Company) |

| |

| By: | |  |

| | |

| | Paul Peterson, Secretary |

3

| | |

| Page 20 of 51 | | Certification Number: 2015042231707 |

The Indiana Secretary of State filing office certifies that this copy is on file in this office.

| | |

| | Indiana Secretary of State |

| | Packet: 198412-300 |

| | Filing Date: 03/09/2007 |

| | Effective Date: 03/09/2007 |

EXHIBIT A

AMENDED AND RESTATED

BY-LAWS

OF

THE MATRIXX GROUP, INCORPORATED

ARTICLE 1

Identification

Section 1.01Name. The name of the corporation is The Matrixx Group, Incorporated (hereinafter referred to as the “corporation”).

Section 1.02Principal Office and Resident Agent. The post-office address of the principal office of the corporation is 719 Mels Avenue, Evansville, Indiana 47712; and the name and post-office address of its Resident Agent in charge of such office is Raymond E. Wright, 719 Mels Avenue, Evansville, Indiana 47712. The corporation may also have offices at such other places both within and without the State of Indiana as the Board of Directors may from time to time determine or the business of the corporation may require.

Section 1.03Seal. The seal of the corporation shall be circular in form and mounted upon a metal die, suitable for impressing the same upon paper. About the upper periphery of the seal shall appear the words “The Matrixx Group, Incorporated” and about the lower periphery thereof, the word “Indiana.” In the center of the seal shall appear the words “Corporate Seal.”

Section 1.04Fiscal Year. The fiscal year of the corporation shall be fixed by resolution of the Board of Directors.

ARTICLE 2

Shares of Stock

Section 2.01Consideration for Shares. The Board of Directors shall cause the corporation to issue the shares of stock of the corporation for such consideration as has been fixed by such Board pursuant to the provisions of the Articles of Incorporation.

Section 2.02Payment for Shares. Subject to the provisions of the Articles of Incorporation, the consideration for the issuance of shares of stock of the corporation may be paid, in whole or in part, in money, in other property, tangible or intangible, or in labor actually performed for, or services actually rendered to, the corporations provided, however, that the part of the surplus of the corporation which is transferred to stated capital upon the issuance of shares as a share dividend shall be deemed to be the consideration for the issuance of such shares. When payment of the consideration for which a share was authorized to be issued shall have been received by the corporation, or when surplus shall have been transferred to stated capital upon the issuance of a share dividend, such share shall be declared and taken to be fully paid and not liable to any further call or assessment, and the holder thereof shall not be liable for any further transaction. The judgment of the Board of Directors as to the value of such property, labor or services received as consideration, or the value placed by the Board of Directors upon the corporate assets in the event of a share dividend, shall be conclusive. Promissory notes, uncertified checks, or future services shall not be accepted in payment or part payment of any of the shares of the corporation.

| | |

| Page 21 of 51 | | Certification Number: 2015042231707 |

The Indiana Secretary of State filing office certifies that this copy is on file in this office.

| | |

| | Indiana Secretary of State |

| | Packet: 198412-300 |

| | Filing Date: 03/09/2007 |

| | Effective Date: 03/09/2007 |

Section 2.03Certificates for Shares. Each holder of shares of stock of the corporation shall be entitled to a certificate signed by the president or vice president and the secretary of the corporation with the seal of the corporation thereunto affixed, certifying the number of shares owned by him in the corporation, The stock certificates to represent the shares of the capital stock of this corporation shall be in such form, not inconsistent with the laws of the State of Indiana, as may be adopted by the Board of Directors.

Section 2.04Transfer of Shares. The shares of the corporation shall be transferable on the books of the corporation upon surrender of the certificate or certificates representing the same, properly endorsed by the registered holder or by his duly authorized attorney, such endorsement or endorsements to be witnessed by one witness. The requirement for witnessing may be waived in writing upon the form of endorsement by the president of the corporation.

Section 2.05Equitable Interests in Shares Need Not Be Recognized. The corporation and its officers shall be entitled to treat the holder of record of any share or shares of stock of the corporation as the holder in fact thereof and accordingly shall not be required to recognize any equitable or other claim to or interest in such shares or shares on the part of any other person or persons, whether or not express notice thereof shall have been given the corporation, save as expressly provided to the contrary by the laws of the State of Indiana, the Articles of Incorporation of the corporation, or these By-Laws.

ARTICLE 3

Meetings of Shareholders

Section 3.01Place of Meetings. All meetings of shareholders of the corporation shall be held at such place, within or without the State of Indiana, as may be specified in the respective notices, or waivers of notice thereof, or proxies to represent shareholders thereat.

Section 3.02Annual Meeting. The annual meeting of the shareholders for the election of directors, and for the transaction of such other business as may properly come before the meeting, shall be held in the month of April of each year on such day, place and time as may be fixed by the Board of Directors. If for any reason the annual meeting of the shareholders shall not be held at a time and place herein provided, the same may be held at any time thereafter, or the business to be transacted at such annual meeting may be transacted at any special meeting called for that purpose.

Section 3.03Special Meetings. Special meetings of the shareholders may be called by the president, by the Board of Directors, or by shareholders holding not less than one-fourth (1/4) of all the shares of stock outstanding.

Section 3.04Notice of Meetings. A written or printed notice, stating the place, day and hour of the meeting, and, in case of a special meeting, the purpose or purposes for which the meeting is called, shall be delivered or mailed by the secretary, or by the officers or persons calling the meeting, to each holder of the shares of the corporation at the time entitled to vote at such address as appears upon the records of the corporation at least ten days before the date of the meeting. Notice of any such meeting may be waived in writing by any shareholder if the waiver sets forth in reasonable detail the purpose or purposes for which the meeting is called and the time and place thereof. Attendance at any meeting, in person or by proxy, shall constitute a waiver of notice of such meeting.

2

| | |

| Page 22 of 51 | | Certification Number: 2015042231707 |

The Indiana Secretary of State filing office certifies that this copy is on file in this office.

| | |

| | Indiana Secretary of State |

| | Packet: 198412-300 |

| | Filing Date: 03/09/2007 |

| | Effective Date: 03/09/2007 |

Section 3.05Vote by Consent in Writing. Any action required by the Indiana General Corporation Act, as amended, to be taken at a meeting of the shareholders of the corporation, or any action which may be taken at a meeting of the shareholders, may be taken without a meeting if, prior to such action, a consent in writing, setting forth the action so taken, shall be signed by all of the shareholders entitled to vote with respect to the subject matter thereof and such written consent is filed with the minutes of the proceedings of the shareholders.

Section 3.06Voting at Meetings.

(a)Voting Rights. Except as otherwise provided by law or by the provisions of the Articles of Incorporation, every holder of the shares of stock of the corporation shall have the right at all meetings of the shareholders of the corporation to one vote for each share of stock standing in his name on the books of the corporation.

(b) Proxies. A shareholder may vote either in person, by proxy executed in writing by the shareholder, or by a duly authorized attorney-in-fact. No proxy shall be valid after eleven months from the date of its execution unless a longer time is expressly provided therein.

(c)Quorum. Unless otherwise provided by the Articles of Incorporation, at any meeting of shareholders a majority of the shares of stock outstanding and entitled to vote, represented in person or by proxy, shall constitute a quorum.

ARTICLE 4

Board of Directors

Section 4.01Number. The number of directors which shall constitute the whole board shall not be less than one (1) and not more than ten (10). Thereafter, within the limits above specified, the number of directors shall be determined by resolution of the Board of Directors, or by the shareholders at the annual meeting. The directors shall be elected at the annual meeting of shareholders, and each director elected shall hold office until his successor is elected and qualified. The first Board of Directors shall hold office until the next annual meeting of shareholders.

Section 4.02Annual Meeting. The Board of Directors shall meet each year immediately after the annual meeting of the shareholders at the place where such meeting of the shareholders has been held for the purpose of organization, election of officers, and consideration of any business that may be brought before the meeting. No notice shall be necessary for the holding of this annual meeting of the Board specifically called in the manner provided in Section 4.03 of this Article.

Section 4.03Other Meetings. Other meetings of the Board of Directors may be held upon the call of the president, or of two or more members of the Board of Directors, at any place within or without the State of Indiana upon 48 hours notice, specifying the time, place, and general purposes of the meeting, given to each director, either personally, by mailing or by telegram. At any meeting at which all directors are present, notice of the time, place, and purposes thereof shall be deemed waived; and similar notice may likewise be waived by absent directors, either by written instrument or by telegram.

3

| | |

| Page 23 of 51 | | Certification Number: 2015042231707 |

The Indiana Secretary of State filing office certifies that this copy is on file in this office.

| | |

| | Indiana Secretary of State |

| | Packet: 198412-300 |

| | Filing Date: 03/09/2007 |

| | Effective Date: 03/09/2007 |

Section 4.04Vote by Consent in Writing. Any action required or permitted to be taken at any meeting of the Board of Directors, or any committee thereof, may be taken without a meeting if prior to such action a written consent to such action is signed by all members of the Board or of such committee, as the case may be, and such written consent is filed with the minutes of proceedings of the Board or committee.

Section 4.05Quorum. At any meeting of the Board of Directors, the presence of a majority of the members of the Board of Directors then qualified and acting shall constitute a quorum for the transaction of any business, except the filling of vacancies in the Board of Directors.

Section 4.06Vacancies. In case of any vacancy in the Board of Directors through death, resignation, removal or other cause, the remaining directors, by the affirmative vote of a majority thereof, may elect a successor to fill such vacancy until the next annual meeting of stockholders and until his successor is elected and qualified.

ARTICLE 5

The Officers of the Corporation

Section 5.01Officers. The officers of the corporation shall consist of a president, a vice president, a secretary and a treasurer. Any two or more offices may be held by the same person, except that the duties of the president and secretary shall not be performed by the same person. The Board of Directors, by resolution, may create and define the duties of other offices in the corporation and may elect or appoint persons to fill such offices.

Section 5.02Vacancies. Whenever any vacancies shall occur in any office by death, resignation, increase in the number of offices of the corporation, or otherwise, the same shall be filled by the Board of Directors, and the officer so elected shall hold office until his successor is chosen and qualified.

Section 5.03The President. The president shall preside at all meetings of shareholders and directors; discharge all the duties which devolve upon a presiding officer; and perform such other duties as these By-Laws provide or the Board of Directors may prescribe.

The president shall have full authority to execute proxies on behalf of the corporation; to vote stock owned by it in any other corporation; and to execute, with the secretary, powers of attorney to appoint other corporations, partnerships, or individuals the agent of the corporation, all subject to the provisions of the Indiana General Corporation Act of 1929, as amended, the Articles of Incorporation and these By-Laws.

Section 5.04The Vice President. The vice president shall perform all duties incumbent upon the president during the absence or disability of the president and perform such other duties as these By-Laws may require or the Board of Directors may prescribe.

Section 5.05The Secretary. The secretary shall have the custody and care of the corporate seal, records, minutes and stock books of the corporation. He or she shall attend all

4

| | |

| Page 24 of 51 | | Certification Number: 2015042231707 |

The Indiana Secretary of State filing office certifies that this copy is on file in this office.

| | |

| | Indiana Secretary of State |

| | Packet: 198412-300 |

| | Filing Date: 03/09/2007 |

| | Effective Date: 03/09/2007 |

meetings of the shareholders and of the Board of Directors; shall keep, or cause to be kept in a book provided for the purpose, a true and complete record of the proceedings of such meetings; and shall perform a like duty for all standing committees appointed by the Board of Directors when required. He or she shall attend to the giving and serving all notices of the corporation; shall file and take charge of all papers and documents belonging to the corporation; and shall perform such other duties as these By-Laws may require or the Board of Directors may prescribe.

Section 5.06The Treasurer. The treasurer shall keep correct and complete records of account, showing accurately at all times the financial condition of the corporation. He or she shall be the legal custodian of all monies, notes, securities and other valuables which may from time to time come into the possession of the corporation. He or she shall immediately deposit all funds of the corporation coming into his or her hands in some reliable bank or other depository to be designated by the Board of Directors and shall keep such bank account in the name of the corporation. He or she shall furnish at meetings of the Board of Directors, or whenever requested, a statement of the financial condition of the corporation and shall perform such other duties as these By-Laws may require or the Board of Directors may prescribe. The treasurer may be required to furnish bond in such amount as shall be determined by the Board of Directors.

Section 5.07Delegation of Authority. In case of the absence of any officer of the corporation, or for any other reason that the Board of Directors may deem sufficient, the Board of Directors may delegate the powers or duties of such officer to any other officer or to any director, for the time being, provided a majority of the entire Board of Directors concurs therein.

ARTICLE 6

Executive Committee

Section 6.01Committees. The Board of Directors, by resolution adopted by a majority of the number of directors fixed by these By-laws or otherwise, may create one or more committees and appoint members of the board to serve on them. Each committee may have one or more members, who serve at the pleasure of the Board of Directors. Such committee shall have and exercise all of the authority of the Board of Directors in the management of the corporation, except as otherwise required by law. Vacancies in the membership of committee shall be filled by the Board of Directors at a regular or special meeting of the Board of Directors. The executive committee shall keep regular minutes of its proceedings and report the same to the board when required.

ARTICLE 7

Notices

Section 7.01Notice Required. Whenever, under the provisions of the statutes or of the Articles of Incorporation or of these By-Laws, notice is required to be given to any director or shareholder, it shall not be construed to mean personal notice, but such notice may be given in writing, by mail, addressed to such director or shareholder, at his address as it appears on the records of the corporation, with postage thereon prepaid, and such notice shall be deemed to be given at the time when the same shall be deposited in the United States mail. Notice to directors may also be given by telegram.

5

| | |

| Page 25 of 51 | | Certification Number: 2015042231707 |

The Indiana Secretary of State filing office certifies that this copy is on file in this office.

| | |

| | Indiana Secretary of State |

| | Packet: 198412-300 |

| | Filing Date: 03/09/2007 |

| | Effective Date: 03/09/2007 |

Section 7.02Waiver of Notice. Whenever any notice whatever is required to be given under the provisions of the statutes or under the provisions of the Articles of Incorporation or these By-Laws, a waiver thereof in writing signed by the person or persons entitled to such notice, whether before or after the time stated therein, shall be deemed equivalent to the giving of such notice.

ARTICLE 8

Corporate Books

Section 8.01Place of Keeping, In General. Except as otherwise provided by the laws of the State of Indiana, by the Articles of Incorporation of the corporation, or by these By-Laws, the books and records of the corporation may be kept at such place or places, within or without the State of Indiana, as the Board of Directors may from time to time by resolution determine.

Section 8.02Stock Register or Transfer Book. The original or duplicate stock register or transfer book or, in case a stock registrar or transfer agent shall be employed by the corporation, either within or without the State of Indiana, a complete and accurate shareholders list, alphabetically arranged, giving the names and addresses of all shareholders and the number of shares held by each, shall be kept at the principal office of the corporation in the State of Indiana.

ARTICLE 9

Contracts, Checks, Notes, Dividends, Etc.

Section 9.01In General. All contracts and agreements authorized by the Board of Directors, and all checks, drafts, notes, bonds, bills of exchange, land orders for the payment of money, shall, unless otherwise directed by the Board of Directors or unless otherwise required by law, be signed by any two of the following officers who are different persons: president, vice president, treasurer, secretary, or assistant secretary. The Board of Directors may, however, authorize any one of such officers to sign checks, drafts, and orders for the payment of money singly and without necessity of countersignature, and may designate employees of the corporation, other than those named above, who may execute drafts, checks and orders for the payment of money in the name of the corporation in its behalf.

Section 9.02Dividends. Subject to the provisions of the Articles of Incorporation relating thereto, if any, dividends may be declared by the Board of Directors at any regular or special meeting, pursuant to law. Dividends may be paid in cash, in property or in shares of stock, subject to any provisions of the Articles of Incorporation. Before payment of any dividend, there may be set aside out of any funds of the corporation available for dividends such sum or sums as the directors, from time to time, in their absolute discretion, think proper as a reserve fund to meet contingencies, or for equalizing dividends, or for repairing or maintaining any property of the corporation, or for such other purpose as the directors shall think conducive to the interest of the corporation, and the directors may modify or abolish any such reserve in the manner in which it was created.

6

| | |

| Page 26 of 51 | | Certification Number: 2015042231707 |

The Indiana Secretary of State filing office certifies that this copy is on file in this office.

| | |

| | Indiana Secretary of State |

| | Packet: 198412-300 |

| | Filing Date: 03/09/2007 |

| | Effective Date: 03/09/2007 |

ARTICLE 10

Indemnification of Directors and Officers

Section 10.01Indemnification. In General. The corporation shall indemnify any person made a party to any action, suit or proceeding by reason of the fact that he or she, his or her testator or intestate, is or was a director, officer or employee of the corporation, or of any corporation which he or she served as such at the request of the corporation, against the reasonable expenses, including attorneys’ fees actually and reasonably incurred by him or her in connection with the defense of such action, suit or proceedings, or in connection with any appeal therein, to the fullest extent provided by Indiana law. The corporation may also reimburse to any such director, officer or employee the reasonable costs of settlement of any such action, suit or proceeding, if it shall be found by a majority of a committee composed of the directors not involved in the matter in controversy (whether or not a quorum) that it is to the interests of the corporation that such settlement be made and that such director, officer or employee was not guilty of negligence or misconduct. Such rights of indemnification and reimbursement shall not be deemed exclusive of any other rights to which such director, officer or employee may be entitled apart from the provisions of this Article.

ARTICLE 11

Disallowed Salary, Etc.

Section 11.01In General. Any payments made to an officer of the corporation, such as a salary, commission, bonus, interest, rent or travel and entertainment expense incurred by such officer, which shall be disallowed, in whole or in part, as a deductible corporate expense by the Internal Revenue Service, shall be reimbursed by such officer to the corporation to the full extent of such disallowance. The Board of Directors shall have the duty to enforce payment of such amount disallowed. Reimbursement may take the form of proportionate amounts being withheld from future compensation of such officer in lieu of a lump sum payment at the discretion of the Board of Directors.

ARTICLE 12

Amendments

Section 12.01In General. These By-Laws may be altered, amended, or repealed or new By-Laws may be adopted only by the affirmative vote of a majority of the Board of Directors at any regular or special meeting of the board, unless otherwise provided by the Articles of Incorporation or By-Laws.

7

| | |

| Page 27 of 51 | | Certification Number: 2015042231707 |

The Indiana Secretary of State filing office certifies that this copy is on file in this office.

| | |

| | Indiana Secretary of State |

| | Packet: 198412-300 |

| | Filing Date: 03/09/2007 |

| | Effective Date: 03/09/2007 |

State of Indiana

Office of the Secretary of State

CERTIFICATE OF MERGER

of

THE MATRIXX GROUP, INCORPORATED

I, TODD ROKITA, Secretary of State of Indiana, hereby certify that Articles of Merger of the above For-Profit Domestic Corporation have been presented to me at my office, accompanied by the fees prescribed by law and that the documentation presented conforms to law as prescribed by the provisions of the Indiana Business Corporation Law.

The following non-surviving entity(s):

CITADEL PLASTICS, LLC

a(n) Domestic Limited Liability Company (LLC)

PLASTIC PROCESSING OF EVANSVILLE, INCORPORATED

a(n) For-Profit Domestic Corporation

merged with and into the surviving entity:

THE MATRIXX GROUP, INCORPORATED

NOW, THEREFORE, with this document I certify that said transaction will become effective Friday, March 09, 2007.

| | |

| | In Witness Whereof, I have caused to be affixed my signature and the seal of the State of Indiana, at the City of Indianapolis, March 9, 2007.

TODD ROKITA, SECRETARY OF STATE 198412-300 / 2007030929919 |

| | |

| Page 28 of 51 | | Certification Number: 2015042231707 |

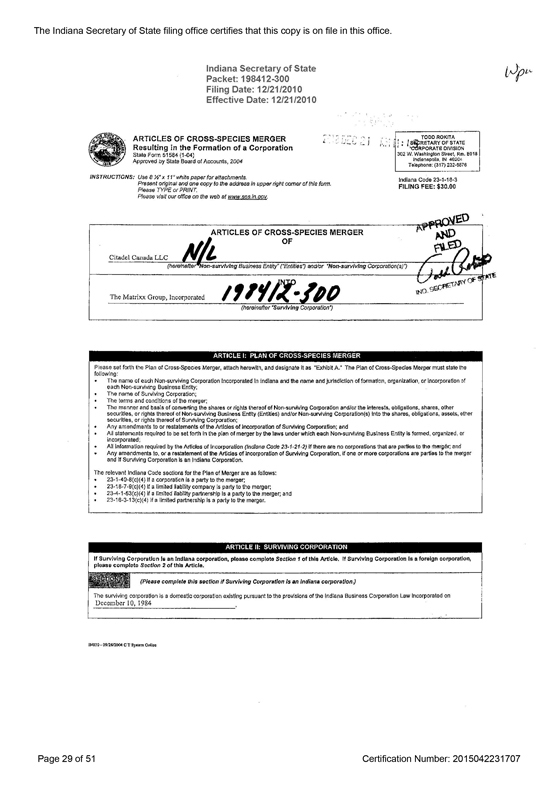

The Indiana Secretary of State filing office certifies that this copy is on file in this office.

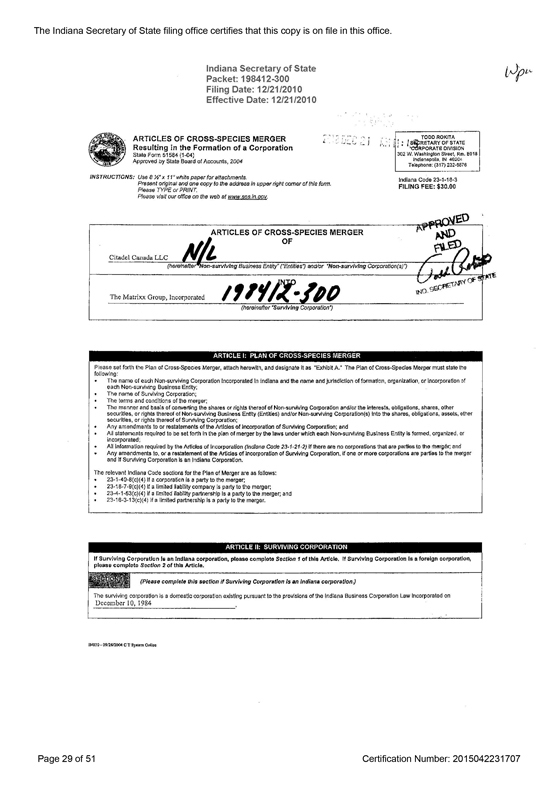

Indiana Secretary of State Packet: 198412-300 Filing Date: 12/21/2010 Effective Date: 12/21/2010

ARTICLES OF CROSS-SPECIES MERGER Resulting in the Formation of a Corporation

State Form 51584 (1-04)

Approved by State Board of Accounts, 2004

INSTRUCTIONS: Use 8 1/2” x 11” white paper for attachments.

Present original and one copy to the address in upper right corner of this form. Please TYPE or PRINT.

Please visit our office on the web at www.sos.In.gov.

TODD ROKITA SECRETARY OF STATE CORPORATE DIVISION 302 W. Washington Street Rm. E018 Indianapolis, IN 46204 Telephone: (317) 232-6676

Indiana Code 23-1-18-3 FILING FEE: $30.00

Citadel Canada LLC

ARTICLES OF CROSS-SPECIES MERGER OF

(hereinafter Non-surviving Business Entity” (“Entities”) and/or “Non-surviving Corporation(s)”)

INTO

The Matrixx Group, Incorporated

(hereinafter “Surviving Corporation”)

ARTICLE I: PLAN OF CROSS-SPECIES MERGER

Please set forth the Plan of Cross-Species Merger, attach herewith, and designate it as “Exhibit A.” The Plan of Cross-Species Merger must state the following:

| | • | | The name of each Non-surviving Corporation incorporated In Indiana and the name and jurisdiction of formation, organization, or incorporation of each Non-surviving Business Entity; |

| | • | | The name of Surviving Corporation; |

| | • | | The terms and conditions of the merger; |

| | • | | The manner and basis of converting the shares or rights thereof of Non-surviving Corporation and/or the interests, obligations, shares, other securities, or rights thereof of Non-surviving Business Entity (Entities) and/or Non-surviving Corporation(s) into the shares, obligations, assets, other securities, or rights thereof of Surviving Corporation; |

| | • | | Any amendments to or restatements of the Articles of Incorporation of Surviving Corporation; and |

| | • | | All statements required to be set forth in the plan of merger by the laws under which each Non-surviving Business Entity is formed, organized, or incorporated; |

| | • | | All information required by the Articles of Incorporation (Indiana Code 23-1-21-2) if there are no corporations that are parties to the merger; and |

| | • | | Any amendments to, or a restatement of the Articles of Incorporation of Surviving Corporation, if one or more corporations are parties to the merger and if Surviving Corporation is an Indiana Corporation. |

The relevant Indiana Code sections for the Plan of Merger are as follows:

| | • | | 23-1-40-8(c)(4) if a corporation is a party to the merger; |

| | • | | 23-18-7-9(c)(4) if a limited liability company is party to the merger; |

| | • | | 23-4-1-53(c)(4) if a limited liability partnership is a party to the merger; and |

| | • | | 23-16-3-13(c)(4) if a limited partnership is a party to the merger. |

ARTICLE II: SURVIVING CORPORATION

If Surviving Corporation is an Indiana corporation, please complete Section 1 of this Article. If Surviving Corporation is a foreign corporation, please complete Section 2 of this Article.

(Please complete this section if Surviving Corporation is an Indiana corporation.)

The surviving corporation is a domestic corporation existing pursuant to the provisions of the Indiana Business Corporation Law Incorporated on December 10, 1984.

Page 29 of 51

Certification Number: 2015042231707

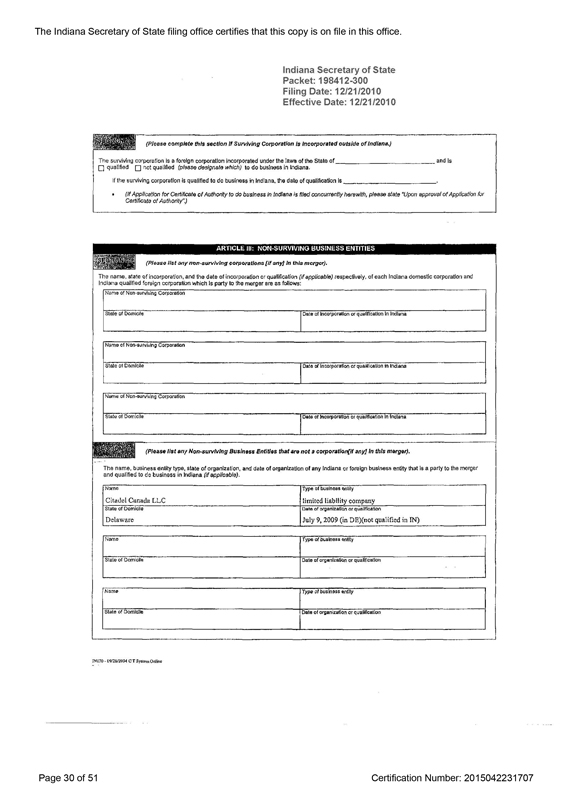

The Indiana Secretary of State filing office certifies that this copy is on file in this office.

Indiana Secretary of State Packet: 198412-300 Filing Date: 12/21/2010 Effective Date: 12/21/2010

(Please complete this section if Surviving Corporation is incorporated outside of Indiana.)

The surviving corporation is a foreign corporation incorporated under the laws of the State of and is ☐ qualified ☐ not qualified (please designate which) to do business in Indiana.

If the surviving corporation is qualified to do business in Indiana, the date of qualification is.

| | • | | (If Application for Certificate of Authority to do business in Indiana is filed concurrently herewith, please state “Upon approval of Application for Certificate of Authority”.) |

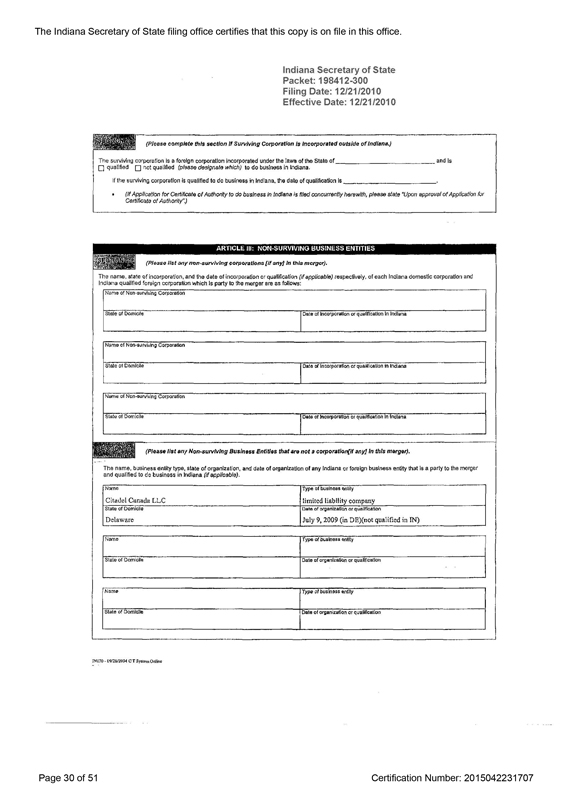

ARTICLE III: NON-SURVIVING BUSINESS ENTITIES

(Please list any non-surviving corporations [If any] in this merger).

The name, state of incorporation, and the date of incorporation or qualification (if applicable) respectively, of each Indiana domestic corporation and Indiana qualified foreign corporation which is party to the merger are as follows:

Name of Non-surviving Corporation

State of Domicile

Date of Incorporation or qualification in Indiana

Name of Non-surviving Corporation

State of Domicile

Date of Incorporation or qualification in Indiana

Name of Non-surviving Corporation

State of Domicile

Date of Incorporation or qualification in Indiana

(Please list any Non-surviving Business Entities that are not a corporation[If any] in this merger).

The name, business entity type, state of organization, and date of organization of any Indiana or foreign business entity that is a party to the merger and qualified to do business in Indiana (if applicable).

Name

Type of business entity

Citadel Canada LLC

limited liability company

State of Domicile

Date of organization or qualification

Delaware

July 9, 2009 (in DE)(not qualified in IN)

Name

Type of business entity

State of Domicile

Date of organization or qualification

Name

Type of business entity

State of Domicile

Date of organization or qualification

Page 30 of 51

Certification Number: 2015042231707

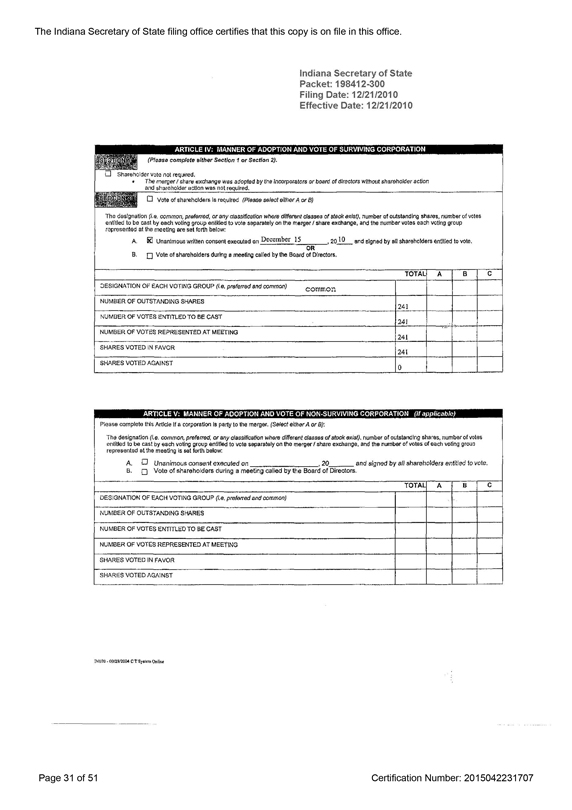

The Indiana Secretary of State filing office certifies that this copy is on file in this office.

Indiana Secretary of State Packet: 198412-300 Filing Date: 12/21/2010 Effective Date: 12/21/2010

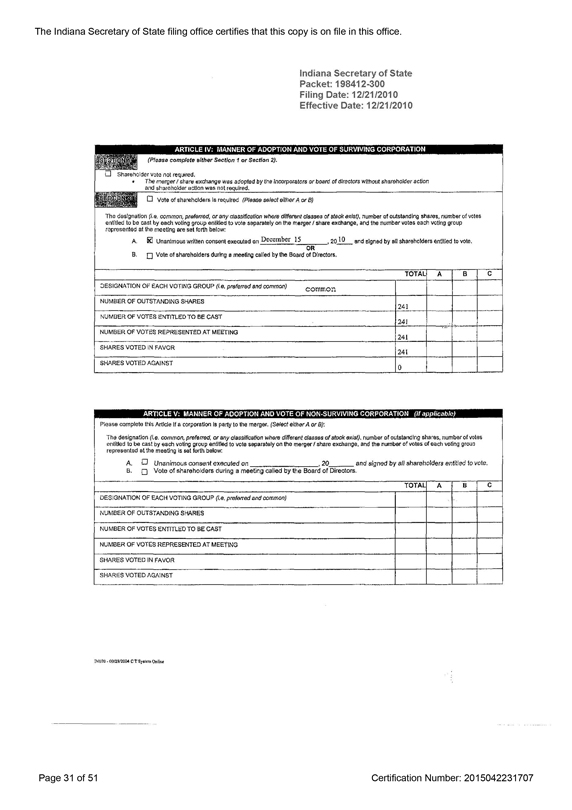

ARTICLE IV: MANNER OF ADOPTION AND VOTE OF SURVIVING CORPORATION

(Please complete either Section 1 or Section 2).

☐ Shareholder vote not required.

• The merger / share exchange was adopted by the incorporators or board of directors without shareholder action and shareholder action was not required.

☐ Vote of shareholders is required (Please select either A or B)

The designation (i.e. common, preferred, or any classification where different classes of stock exist), number of outstanding shares, number of votes entitled to be cast by each voting group entitled to vote separately on the merger / share exchange, and the number votes each voting group represented at the meeting are set forth below:

A. ☒ Unanimous written consent executed on December 15, 2010 and signed by all shareholders entitled to vote.

OR

B. ☐ Vote of shareholders during a meeting called by the Board of Directors.

TOTAL A B C

DESIGNATION OF EACH VOTING GROUP (i.e. preferred and common) common

NUMBER OF OUTSTANDING SHARES 241

NUMBER OF VOTES ENTITLED TO BE CAST 241

NUMBER OF VOTES REPRESENTED AT MEETING 241

SHARES VOTED IN FAVOR 241

SHARES VOTED AGAINST 0

ARTICLE V: MANNER OF ADOPTION AND VOTE OF NON-SURVIVING CORPORATION (If applicable)

Please complete this Article If a corporation is party to the merger. (Select either A or B)

The designation (i.e. common, preferred, or any classification where different classes of stock exist), number of outstanding shares, number of votes entitled to be cast by each voting group entitled to vote separately on the merger / share exchange, and the number of votes of each voting group represented at the meeting is set forth below:

A. ☐ Unanimous consent executed on , 20 and signed by all shareholders entitled to vote.

B. ☐ Vote of shareholders during a meeting called by the Board of Directors.

TOTAL A B C

DESIGNATION OF EACH VOTING GROUP (i.e. preferred and common)

NUMBER OF OUTSTANDING SHARES

NUMBER OF VOTES ENTITLED TO BE CAST

NUMBER OF VOTES REPRESENTED AT MEETING

SHARES VOTED IN FAVOR

SHARES VOTED AGAINST

Page 31 of 51

Certification Number: 2015042231707

The Indiana Secretary of State filing office certifies that this copy is on file in this office.

Indiana Secretary of State Packet: 198412-300 Filing Date: 12/21/2010 Effective Date: 12/21/2010

ARTICLE VI: SIGNATURE

In Witness Whereof, the undersigned, being a duly authorized representative of Surviving Corporation, executes these Articles of Cross-Species Merger and verifies, subject to penalty of perjury, that the statements contained herein are true, and that each business entity that is a party to this merger has approved the plan of merger according to Indiana law or according to the laws of the State in which the business entity was organized or incorporated, this

15th day of Dec. , 2010.

Signature

Printed name

Matthew D. McDonald

Title

Vice President

Page 32 of 51

Certification Number: 2015042231707

The Indiana Secretary of State filing office certifies that this copy is on file in this office.

| | |

| | Indiana Secretary of State |

| | Packet: 198412-300 |

| | Filing Date: 12/21/2010 |

| | Effective Date: 12/21/2010 |

AGREEMENT AND PLAN OF PLAN OF MERGER

This Agreement and Plan of Merger (“Plan of Merger”) is made and entered into this 15th day of December 2010, by and among The Matrixx Group, Incorporated, an Indiana corporation (the “Surviving Company”) and Citadel Canada LLC, a Delaware limited liability company (the “Merged Company”).

WHEREAS, the Board of Directors and the sole shareholder of the Surviving Company and the sole Member and Board of Managers of the Merged Company deem it advisable and in the best interests of the parties hereto, that the Merged Company be merged into the Surviving Company under the laws of the State of Indiana pursuant to the provision of Section 23-1-40-8 of the Indiana Business Corporation Law.

NOW, THEREFORE, in consideration of the promises of the mutual agreements contained herein, the Parties here to agree to merge upon the terms and conditions stated below:

1. The parties hereto agree that the Merged Company will be merged into the Surviving Company (the “Merger”). The separate existence of the Merged Company will cease, and the existence of the Surviving Company will continue unaffected and unimpaired by the Merger, with all rights, privileges, immunities and powers, and subject to all the duties and liabilities, of a corporation formed under the laws of the State of Indiana.

2. The mode of effecting the Merger will be as follows:

(a) At the Effective Date (as defined below), each membership unit of the Merged Company which is issued and outstanding on the Effective Date of the Merger, and all rights in respect thereof, shall be converted into the right to receive one (1) share of common stock, no par value, of the Surviving Company.

(b) At the Effective Date, each issued and outstanding share of common stock, no par value, of the Surviving Company shall remain outstanding and unchanged as a result of the Merger.

(c) The Merger will become effective upon filing of the Articles of Cross-Species Merger with the Secretary of State of the State of Indiana and the Certificate of Merger with the Secretary of State of the State of Delaware (the “Effective Date”).

(d) Upon the Effective Date of the Merger, all the property, rights, privileges, franchises, patents, trademarks, licenses, registrations and other assets of every kind and description of the Merged Company shall be transferred to, vested and devolve upon, the Surviving Company without further acct or deed and all property, rights and every other interest of the Surviving Company and the Merged Company shall be as effectively the property of the Surviving Company as they were of the Surviving Company and the Merged Company, respectively. The Merged Company hereby agrees from time to time, as and when requested by the Surviving Company or by its successors or assigns, to execute and deliver or cause to be executed and delivered all such deeds and instruments and to take a cause to be taken such further or other action as the Surviving Company title to and possession of any property of the Merged Company acquired or to be acquired by reason of or as a result of the Merger herein

| | |

| Page 33 of 51 | | Certification Number: 2015042231707 |

The Indiana Secretary of State filing office certifies that this copy is on file in this office.

| | |

| | Indiana Secretary of State |

| | Packet: 198412-300 |

| | Filing Date: 12/21/2010 |

| | Effective Date: 12/21/2010 |

provided for and otherwise to carry out the intent and purposes hereof and the proper Member and Board of Managers of the Merged Company and the Board of Directors of the Surviving Company are fully authorized in the name of the Merged Company and the Surviving Company, respectively to take any and all such action.

(e) All debts, liabilities and duties of the Surviving Company and Merged Company will attach to the Surviving Company, and may be enforced against the Surviving Company to the same extent as if said debts, liabilities and duties had been incurred or contracted by Surviving Company.

3. The By-Laws of the Surviving Company as they exist on the Effective Date of this Plan of Merger shall and remain the By-Laws of the Surviving Company until the same shall be altered, amended or repealed as therein provided.

4. The Articles of Incorporation of the Surviving Company as they exist on the Effective Date of this Plan of Merger shall be and remain the Articles of Incorporation of the Surviving Company until the same shall be altered, amended or repeated as therein provided.

5. The Board of Directors of the Surviving Company and the Board of Managers and Member of the Merged Company shall have the power in their discretion to abandon the Merger provided for herein prior to the filing of the Articles of Cross-Species Merger or other appropriate certificate with the office of the Secretary of State of the State of Indiana and the Certificate of Merger of other appropriate certificate with the office of the Secretary of State of the State of Delaware.

6. This Plan of Merger will be governed by and construed in accordance with the internal laws of the State of Indiana.

- 2 -

| | |

| Page 34 of 51 | | Certification Number: 2015042231707 |

The Indiana Secretary of State filing office certifies that this copy is on file in this office.

| | |

| | Indiana Secretary of State |

| | Packet: 198412-300 |

| | Filing Date: 12/21/2010 |

| | Effective Date: 12/21/2010 |

IN WITNESS WHEREOF, the parties hereto have caused their respective names to be signed hereto by their officer, duly authorized by their respective Board of Directors, Shareholders, Member or Board of Managers, as the case may be.

| | |

| THE MATRIXX GROUP, INCORPORATED |

| (Surviving Company) |

| |

| By: | |  |

| | |

| | Matthew D. McDonald, Vice President |

|

| CITADEL CANADA LLC |

| (Merged Company) |

| |

| By: | |  |

| | |

| | Matthew D. McDonald, Chief Financial Officer and a Manager |

- 3 -

| | |

| Page 35 of 51 | | Certification Number: 2015042231707 |

The Indiana Secretary of State filing office certifies that this copy is on file in this office.

State of Indiana

Office of the Secretary of State

CERTIFICATE OF MERGER

of

THE MATRIXX GROUP, INCORPORATED

I, TODD ROKITA, Secretary of State of Indiana, hereby certify that Articles of Merger of the above For-Profit Domestic Corporation have been presented to me at my office, accompanied by the fees prescribed by law and that the documentation presented conforms to law as prescribed by the provisions of the Indiana Business Corporation Law.

The following non-surviving entity(s):

CITADEL CANADA LLC

a(n) Delaware Non-Qualified Foreign Corporation

merged with and into the surviving entity:

THE MATRIXX GROUP, INCORPORATED

| | |

| | Indiana Secretary of State |

| | Packet: 198412-300 |

| | Filing Date: 12/21/2010 |

| | Effective Date: 12/21/2010 |

NOW, THEREFORE, with this document I certify that said transaction will become effective Tuesday, December 21, 2010.

| | |

| | In Witness Whereof, I have caused to be affixed my signature and the seal of the State of Indiana, at the City of Indianapolis, December 21, 2010.

TODD ROKITA, SECRETARY OF STATE 198412-300 / 20101 22255956 |

| | |

| Page 36 of 51 | | Certification Number: 2015042231707 |

The Indiana Secretary of State filing office certifies that this copy is on file in this office.

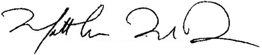

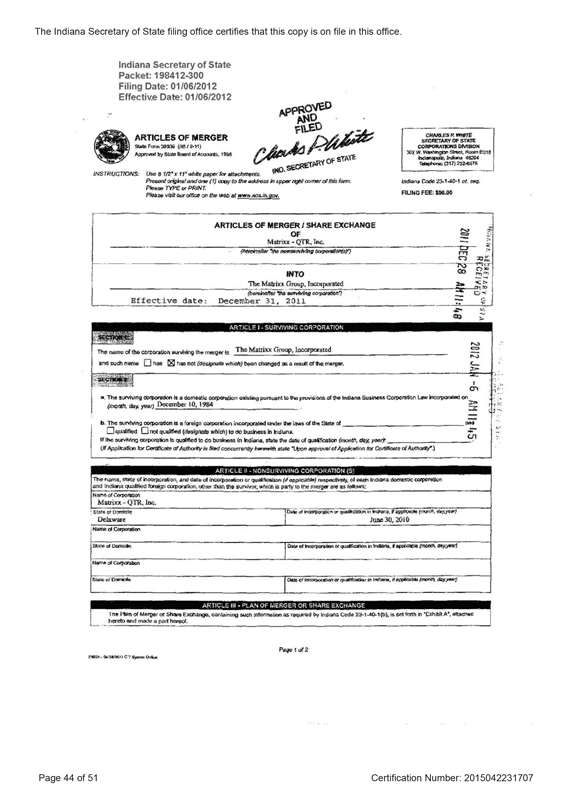

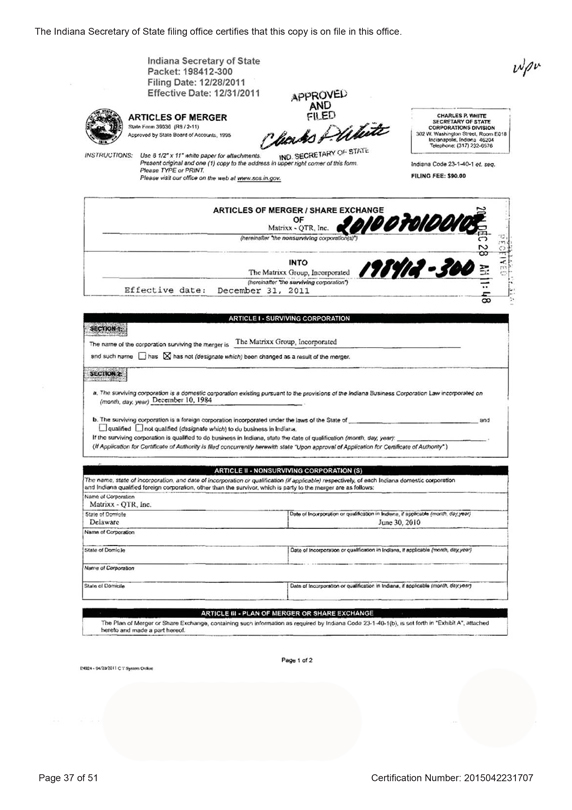

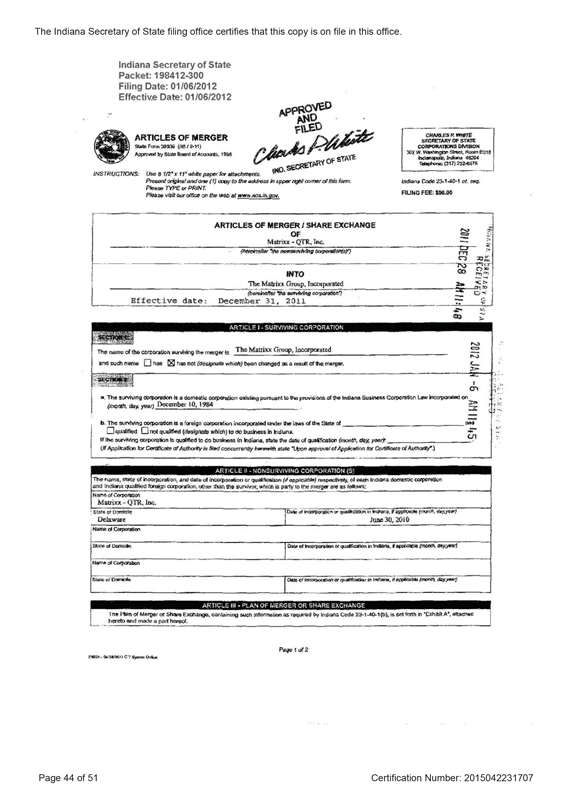

Indiana Secretary of State Packet: 198412-300 Filing Date: 12/28/2011 Effective Date: 12/31/2011

ARTICLES OF MERGER

State Form 39036 (R8/2-11)

Approved by State Board of Accounts, 1995

APPROVED

AND

FILED

IND. SECRETARY OF STATE

INSTRUCTIONS: Use 8 1/2” x 11” white paper for attachments.

Present original and one (1) copy to the address in upper right corner of this form. Please TYPE or PRINT.

Please visit our office on the web at www.sos.in.gov.

CHARLES P. WHITE SECRETARY OF STATE CORPORATIONS DIVISION

302 W. Washington Street, Room E018 Indianapolis, Indiana 46204 Telephone: (317) 232-6576

Indiana Code 23-1-40-1 et. seq. FILING FEE: $90.00

ARTICLES OF MERGER / SHARE EXCHANGE

OF

Matrixx - QTR, Inc.

(hereinafter “the nonsurviving corporation(s)”)

INTO

The Matrixx Group, Incorporated

(hereinafter “the surviving corporation”)

Effective date: December 31, 2011

ARTICLE I - SURVIVING CORPORATION

SECTION 1:

The name of the corporation surviving the merger is The Matrixx Group, Incorporated

and such name ☐ has ☒ has not (designate which) been changed as a result of the merger,

SECTION 2:

a. The surviving corporation is a domestic corporation existing pursuant to the provisions of the Indiana Business Corporation law incorporated on (month, day, year) December 10, 1984

b. The surviving corporation is a foreign corporation incorporated under the laws of the State of and

☐ qualified ☐ not qualified (designate which) to do business in Indiana.

If the surviving corporation is qualified to do business in Indiana, state the date of qualification (month, day, year):

(If Application for Certificate of Authority is filed concurrently herewith state “Upon approval of Application for Certificate of Authority”)

ARTICLE II - NONSURVIVING CORPORATION (S)